|

|

市場調査レポート

商品コード

1458540

防衛向け電子機器陳腐化の世界市場:システム別、タイプ別、地域別 - 予測(~2028年)Defense Electronics Obsolescence Market by System (Communication System; Navigation System; Human Machine Interface; Flight Control System; Targeting System; Electronic Warfare System; and Sensors), Type & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 防衛向け電子機器陳腐化の世界市場:システム別、タイプ別、地域別 - 予測(~2028年) |

|

出版日: 2024年03月20日

発行: MarketsandMarkets

ページ情報: 英文 230 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の防衛向け電子機器陳腐化の市場規模は、2023年の25億米ドルから2028年までに37億米ドルに達し、2023年~2028年にCAGRで8.2%の成長が予測されています。

Raytheon Technologies Corporation(米国)、BAE Systems(英国)、L3Harris Technologies, Inc.(イスラエル)は、防衛向け電子機器陳腐化市場で活動する主要企業です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 100万米ドル |

| セグメント | システム別、タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

防衛部門は、技術革新と必要性の交差点に位置する独特な位置にあり、技術の進歩の急速なペースは成長のカタリストであると同時にライフサイクル管理の課題でもあります。AI、量子コンピューティング、サイバー能力の飛躍的進歩によって定義される時代において、防衛向け電子機器システムは常に進化を迫られています。この絶え間ない進歩は、戦争や防衛戦略において可能なことの限界を押し広げるだけでなく、陳腐化を防ぐための既存システムの厳格な更新、交換サイクルを義務付けています。

「通信セグメントが予測期間に防衛向け電子機器陳腐化市場でもっとも高い成長となります。」

防衛向け電子機器陳腐化市場は、センサー、飛行制御、電子戦、ヒューマンマシンインターフェース、通信システム、ナビゲーションシステムの6つのセグメントに分けられています。急速な技術の進歩は、通信プロトコルや規格の陳腐化を早める可能性があり、互換性と性能を保証するために頻繁なアップグレードや機器の交換が必要となります。結果として、通信技術はますます古くなっていきます。

「航空セグメントが予測期間に防衛向け電子機器陳腐化市場で最大の市場シェアを占めます。」

プラットフォームに基づき、防衛向け電子機器陳腐化市場は陸上、海上、航空に区分されます。軍用航空機は、レーダー、通信システム、ヘルメットマウントディスプレイ(HMD)、パレット積載システム(PLS)、航空輸送システムなどの複雑な電子機器を使用しており、陳腐化するリスクが高いため、航空プラットフォームが市場を独占する見込みです。

「予測期間に北米市場が市場をリードすると見込まれます。」

北米がこの市場をリードしているのは、その多額の防衛費、革新的な技術、強力な産業基盤のためです。北米企業は、特に陸上、海上、航空システムに重点を置き、さまざまなプラットフォームの明確なニーズに適した精巧な陳腐化管理技術を生み出す最前線にいます。北米地域の企業は陳腐化管理における技術革新を促進し、軍隊が技術的優位性と作戦準備態勢を維持できるようにしています。これは、戦略的に研究開発と共同研究に投資することによって実現されます。防衛向け電子機器陳腐化産業をリードする北米は、複雑化する地政学的環境において安定性を維持し、国家安全保障上の利益を守るために不可欠です。

当レポートでは、世界の防衛向け電子機器陳腐化市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 防衛向け電子機器陳腐化市場における企業にとって魅力的な機会

- 防衛向け電子機器陳腐化市場:システム別

- 防衛向け電子機器陳腐化市場:プラットフォーム別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- 研究開発

- 原材料

- コンポーネント/製品メーカー(OEM)

- インテグレーターとシステムプロバイダー

- エンドユーザー

- 価格分析

- 平均販売価格の動向の分析:システム別

- 参考価格の動向の分析

- 運用データ

- エコシステムマッピング

- 著名企業

- 民間企業、中小企業

- エンドユーザー

- 技術分析

- 貿易分析

- ユースケース分析

- 主な会議とイベント

- 規制情勢

- 北米の規制機関、政府機関、その他の組織

- 欧州の規制機関、政府機関、その他の組織

- アジア太平洋の規制機関、政府機関、その他の組織

- 中東の規制機関、政府機関、その他の組織

- その他の地域の規制機関、政府機関、その他の組織

- 主なステークホルダーと購入基準

- 主要市場企業のビジネスモデル

第6章 産業動向

- イントロダクション

- 技術動向

- 先進のコンポーネント陳腐化管理ツール

- モジュラーオープンシステムアプローチ

- デジタルツイン

- 積層造形

- ブロックチェーン

- メガトレンドの影響

- サプライチェーン分析

- イノベーションと特許登録

- 総所有コスト

- 技術ロードマップ

第7章 防衛向け電子機器陳腐化市場:システム別

- イントロダクション

- 通信

- トランスポンダー

- トランシーバー

- アンテナ

- 送信機

- 受信機

- ナビゲーション

- 慣性航法システム

- GPS

- ナビゲーションコンピューター

- ヒューマンマシンインターフェース

- ナビゲーションディスプレイ

- プライマリフライトディスプレイ

- 多機能ディスプレイ

- フライトコントロール

- ターゲッティング

- レーダー

- 電気光学・赤外線

- 電子戦

- ジャマー

- センサー

- 赤外線

- モーション

- LiDAR

- 圧力

- 放射線

- 磁気

- 生体認証

- 湿度/温度

- 近接

第8章 防衛向け電子機器陳腐化市場:プラットフォーム別

- イントロダクション

- 陸上

- 戦闘車両

- 戦闘支援車両

- 海上

- 空母

- 駆逐艦

- フリゲート

- コルベット

- 潜水艦

- 巡視船

- 機雷対策船

- 航空

- 戦闘機

- 輸送機

- 特殊任務航空機

- 戦闘ヘリコプター

第9章 防衛向け電子機器陳腐化の種類

- イントロダクション

- ロジスティクスの陳腐化

- 機能の陳腐化

- 技術の陳腐化

第10章 地域の分析

- イントロダクション

- 景気後退の影響の分析:地域別

- 北米

- 北米に対する不況の影響

- 北米のPESTLE分析

- 米国

- カナダ

- 欧州

- 欧州に対する不況の影響

- 欧州のPESTLE分析

- 英国

- フランス

- アジア太平洋

- アジア太平洋に対する不況の影響

- アジア太平洋のPESTLE分析

- インド

- オーストラリア

- 中東

- 中東に対する不況の影響

- 中東のPESTLE分析

- サウジアラビア

- アラブ首長国連邦

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- ランキング分析

- 収益分析

- 市場シェア分析

- 企業の評価マトリクス(2022年)

- 企業のフットプリント

- スタートアップ/中小企業の評価マトリクス(2022年)

- 競合シナリオと動向

- 財務指標と評価

第12章 企業プロファイル

- イントロダクション

- 主要企業

- RAYTHEON TECHNOLOGIES CORPORATION

- BAE SYSTEMS

- THALES

- L3HARRIS TECHNOLOGIES, INC.

- ELBIT SYSTEMS LTD.

- HEXAGON AB

- LEONARDO S.P.A.

- CURTISS-WRIGHT CORPORATION

- BHARAT ELECTRONICS LTD

- ULTRA ELECTRONICS

- HINDUSTAN AERONAUTICS LTD

- LOCKHEED MARTIN CORPORATION

- TT ELECTRONICS

- SIEMENS AG

- MEL SYSTEMS AND SERVICES LTD.

- その他の企業

- ACTIA

- LARSEN & TOUBRO LIMITED

- DEFENCE RESEARCH & DEVELOPMENT ORGANIZATION (DRDO)

- CYIENT LIMITED

- RADEL ADVANCED TECHNOLOGY PVT. LTD.

- ALL TECH ELECTRONICS

- CONVERGE

- EINFOCHIPS

- A2 GLOBAL ELECTRONICS+SOLUTIONS

- FERMIONX

第13章 付録

The global defense electronics obsolescence market size is projected to grow from USD 2.5 billion in 2023 to USD 3.7 billion by 2028, at a CAGR of 8.2% from 2023 to 2028. Raytheon Technologies Corporation (US), BAE Systems (UK), L3Harris Technologies, Inc. (US), Thales (US) and Elbit Systems Ltd. (Israel) are some of the leading players operating in the Defense electronics obsolescence market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By System, Type & Region |

| Regions covered | North America, Europe, APAC, RoW |

The defense sector is uniquely positioned at the intersection of innovation and necessity, where the rapid pace of technological advancements serves as both a catalyst for growth and a challenge for lifecycle management. In an era defined by breakthroughs in artificial intelligence, quantum computing, and cyber capabilities, defense electronics systems are under constant pressure to evolve. This relentless progression not only pushes the boundaries of what's possible in warfare and defense strategies but also mandates a rigorous update and replacement cycle for existing systems to prevent obsolescence.

"The communication segment to account for highest growth in the defense electronics obsolescence market during the forecast period."

The market for defense electronics obsolescence has been divided into six segments: sensors, flight control, electronic warfare, human-machine interface, communication systems, and navigation systems. Rapid technological advancements can lead to the quick obsolescence of communication protocols and standards, necessitating frequent upgrades and equipment replacements to guarantee compatibility and performance. The communication techniques grow increasingly antiquated as a result.

"The airborne segment to account for largest market share in the defense electronics obsolescence market during the forecast period."

Based on platform, the defense electronics obsolescence market has been segmented into Land, Naval, and Airborne. The Airborne platform will have the largest market share in the market as military aircrafts uses complex electronics like Radars, Communication system, Helmet-Mounted Displays (HMDs), palletized loading systems (PLS) and aerial delivery systems which have high risk of getting obsolete resulting in airborne segment to dominate the market.

"The North America market is projected to lead the market during the forecast period."

North America takes the lead in this market because of its significant defense spending, innovative technology, and strong industrial foundation. North American corporations are at the forefront of creating sophisticated obsolescence management techniques that are suited to the distinct needs of different platforms, with a particular emphasis on land, naval, and aerial systems. Companies in the North American area foster innovation in obsolescence management, enabling military forces to preserve technological superiority and operational preparedness. They do this by strategically investing in research, development, and collaboration. North America, which leads the defense electronics obsolescence industry, is essential to maintaining stability in an increasingly complex geopolitical environment and defending national security interests.

Raytheon Technologies Corporation (US), BAE Systems (UK), L3Harris Technologies, Inc. (US), Thales (US) and Elbit Systems Ltd. (Israel) are some of the leading players operating in the defense electronics obsolescence market.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-35%; Europe-25%; Asia Pacific-30%; and Middle East-10%

Research Coverage

The study covers the defense electronics obsolescence market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on system, platform, type and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall defense electronics obsolescence market and its subsegments. The report covers the entire ecosystem of the defense electronics obsolescence market . It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Leveraging Rapid Technological Advancements, Adhering to Stringent Regulatory Requirements and Standards, Navigating Supply Chain Disruptions, and Counteracting Evolving Threat Landscapes), restraints (High Costs of System Upgrades and Replacement, Intellectual Property Barriers in Defense Electronics Upgrades), opportunities (Strategic Adaptation through Remanufacturing and Reverse Engineering, , and Embracing Modularity to Future-Proof Defense Electronics), and challenges (Synchronizing System Upgrades and Operational Readiness in Defense Forces) influencing the growth in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the defense electronics obsolescence market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the defense electronics obsolescence market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in defense electronics obsolescence market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Raytheon Technologies Corporation (US), BAE Systems (UK), L3Harris Technologies, Inc. (US), Thales (US) and Elbit Systems Ltd. (Israel) among others in the defense electronics obsolescence market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- TABLE 3 MARKET ESTIMATION PROCEDURE

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE INDICATORS

- 2.3.2.1 Increasing complexity of defense systems

- 2.3.2.2 Upgrades and modernization programs

- 2.3.2.3 Regulatory compliance and standards

- 2.3.2.4 End-of-life management

- 2.3.2.5 Cybersecurity threats

- 2.3.3 SUPPLY-SIDE INDICATORS

- 2.3.3.1 Advancements in electronics manufacturing technology

- 2.3.3.2 Technological innovations and R&D investments

- 2.3.4 RECESSION IMPACT ANALYSIS

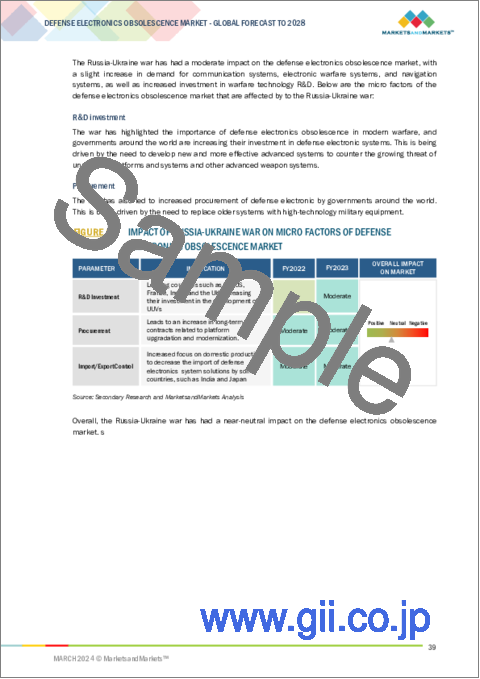

- 2.3.5 IMPACT OF RUSSIA-UKRAINE WAR

- 2.3.5.1 Impact of Russia-Ukraine war on macro factors of defense electronics obsolescence market

- FIGURE 5 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF DEFENSE ELECTRONICS OBSOLESCENCE MARKET

- 2.3.5.2 Impact of Russia-Ukraine war on micro factors of defense electronics obsolescence market

- TABLE 4 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF DEFENSE ELECTRONICS OBSOLESCENCE MARKET

- FIGURE 6 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF DEFENSE ELECTRONICS OBSOLESCENCE MARKET

- 2.4 SELECTION CRITERIA FOR DEFENSE FLEET MANAGEMENT AND MODERNIZATION

- TABLE 5 SELECTION CRITERIA FOR DEFENSE FLEET MANAGEMENT AND MODERNIZATION, BY COUNTRY

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 TARGETING TO BE LARGEST SEGMENT OF MARKET DURING FORECAST PERIOD

- FIGURE 9 AIRBORNE PLATFORM TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DEFENSE ELECTRONICS OBSOLESCENCE MARKET

- FIGURE 11 MISMATCH BETWEEN LIFESPAN OF MILITARY PLATFORMS AND THEIR COMPONENTS TO DRIVE MARKET

- 4.2 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY SYSTEM

- FIGURE 12 TARGETING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM

- FIGURE 13 AIRBORNE SEGMENT HELD LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid technological advancements leading to challenges in lifecycle management

- TABLE 6 RAPID TECHNOLOGICAL ADVANCEMENTS IN DEFENSE PLATFORMS IN LAST 5 YEARS

- 5.2.1.2 Stringent regulatory requirements and standards

- TABLE 7 REGULATORY REQUIREMENTS AND STANDARDS FOR DEFENSE PLATFORMS

- 5.2.1.3 Potential supply chain disruptions

- TABLE 8 GLOBAL CHALLENGES IN DEFENSE ELECTRONICS SUPPLY CHAIN

- 5.2.1.4 Evolving threat landscape

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of system upgrades and replacements

- 5.2.2.2 Intellectual property barriers in defense electronics upgrades

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Strategic adaptation through remanufacturing and reverse engineering

- 5.2.3.2 Adoption of modular designs to future-proof defense electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 Synchronizing system upgrades and operational readiness in defense forces

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 NEW REVENUE SHIFTS AND REVENUE POCKETS IN DEFENSE ELECTRONICS OBSOLESCENCE MARKET

- FIGURE 15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 RAW MATERIALS

- 5.4.3 COMPONENT/PRODUCT MANUFACTURERS (OEMS)

- 5.4.4 INTEGRATORS AND SYSTEM PROVIDERS

- 5.4.5 END USERS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND ANALYSIS, BY SYSTEM

- FIGURE 17 AVERAGE SELLING PRICE TREND FOR LAND PLATFORM, BY SYSTEM, 2023

- TABLE 9 AVERAGE SELLING PRICE TREND FOR LAND PLATFORM, BY SYSTEM, 2021-2028

- FIGURE 18 AVERAGE SELLING PRICE TREND FOR NAVAL PLATFORM, BY SYSTEM, 2023

- TABLE 10 AVERAGE SELLING PRICE TREND FOR NAVAL PLATFORM, BY SYSTEM, 2021-2028

- FIGURE 19 AVERAGE SELLING PRICE TREND FOR AIRBORNE PLATFORM, BY SYSTEM, 2023

- TABLE 11 AVERAGE SELLING PRICE TREND FOR AIRBORNE PLATFORM, BY SYSTEM, 2021-2028

- 5.5.2 INDICATIVE PRICE TREND ANALYSIS

- TABLE 12 COST METRICS FOR OBSOLESCENCE (USD)

- 5.6 OPERATIONAL DATA

- TABLE 13 LAND FLEET, BY COUNTRY, 2023

- TABLE 14 NAVAL FLEET, BY COUNTRY, 2023

- TABLE 15 AIRBORNE FLEET, BY COUNTRY, 2023

- 5.7 ECOSYSTEM MAPPING

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- FIGURE 20 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: ECOSYSTEM MAPPING

- TABLE 16 ROLE OF COMPANIES IN ECOSYSTEM

- 5.8 TECHNOLOGY ANALYSIS

- TABLE 17 TECHNOLOGY ANALYSIS FOR DEFENSE ELECTRONICS OBSOLESCENCE MARKET

- 5.9 TRADE ANALYSIS

- FIGURE 21 IMPORT DATA OF TOP 8 COUNTRIES

- TABLE 18 COUNTRY-WISE IMPORTS, 2019-2022 (USD THOUSAND)

- FIGURE 22 EXPORT DATA OF TOP 8 COUNTRIES

- TABLE 19 COUNTRY-WISE EXPORTS, 2019-2022 (USD THOUSAND)

- 5.10 USE CASE ANALYSIS

- 5.10.1 USE CASE 1: EARLY WARNING AND CONTROL SYSTEM UPGRADE BY INDIAN AIR FORCE FOR ENHANCED DETECTION CAPABILITIES

- 5.10.2 USE CASE 2: MILITARY COMMUNICATIONS SYSTEM UPGRADE BY US DEFENSE FORCES FOR IMPROVED SECURITY AND RELIABILITY

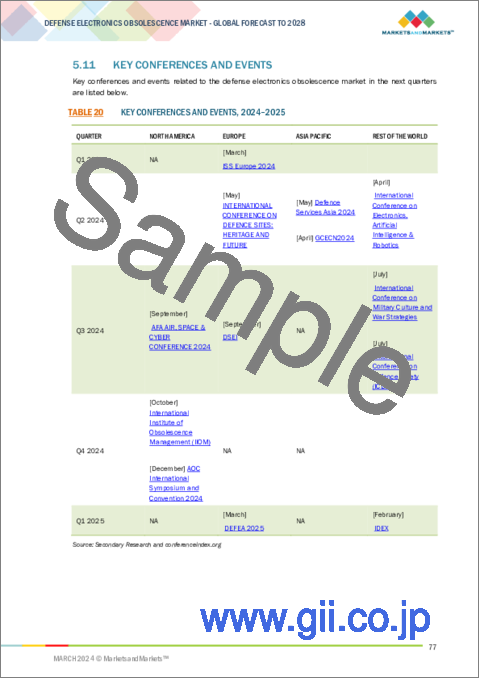

- 5.11 KEY CONFERENCES AND EVENTS

- TABLE 20 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.4 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.5 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR 3 PLATFORMS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR 3 PLATFORMS

- 5.13.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR 3 PLATFORMS

- TABLE 22 KEY BUYING CRITERIA FOR 3 PLATFORMS

- 5.14 BUSINESS MODEL OF KEY MARKET PLAYERS

- FIGURE 25 BUSINESS MODEL OF KEY MARKET PLAYERS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- FIGURE 26 TECHNOLOGY TRENDS IN DEFENSE ELECTRONICS OBSOLESCENCE MARKET

- 6.2.1 ADVANCED COMPONENT OBSOLESCENCE MANAGEMENT TOOLS

- 6.2.2 MODULAR OPEN SYSTEMS APPROACH

- 6.2.3 DIGITAL TWINS

- 6.2.4 ADDITIVE MANUFACTURING

- 6.2.5 BLOCKCHAIN

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 MANAGING ACCELERATED COMPONENT OBSOLESCENCE

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 27 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- FIGURE 28 TOP 10 PATENT OWNERS

- TABLE 23 INNOVATIONS AND PATENT REGISTRATIONS, 2019-2022

- 6.6 TOTAL COST OF OWNERSHIP

- FIGURE 29 TOTAL COST OF OWNERSHIP ASSOCIATED WITH ACQUISITION OF SPECIFIC MILITARY ASSETS

- FIGURE 30 AIRCRAFT LIFECYCLE PHASES

- FIGURE 31 AVERAGE BREAKDOWN OF MAJOR COST CATEGORIES AS PERCENTAGE OF TOTAL LIFECYCLE COST

- TABLE 24 TOTAL COST OF OWNERSHIP FOR INDIVIDUAL AIRCRAFT

- FIGURE 32 FIGHTER AIRCRAFT TOTAL THROUGH-LIFE COST (USD MILLION)

- FIGURE 33 FIGHTER AIRCRAFT OPERATIONS AND MAINTENANCE COST, PER TAIL PER YEAR (USD MILLION)

- 6.7 TECHNOLOGY ROADMAP

- FIGURE 34 TECHNOLOGY TRENDS, 2000-2050

- FIGURE 35 TECHNOLOGY ROADMAP, 1970-2028

- FIGURE 36 EMERGING TRENDS IN DEFENSE ELECTRONICS OBSOLESCENCE MARKET

7 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- FIGURE 37 TARGETING TO BE LARGEST SEGMENT OF MARKET DURING FORECAST PERIOD

- TABLE 25 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY SYSTEM, 2020-2022 (USD MILLION)

- TABLE 26 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- 7.2 COMMUNICATIONS

- 7.2.1 TRANSPONDER

- 7.2.1.1 Advancements in Mode 5 IFF technology to drive segment growth

- 7.2.2 TRANSCEIVER

- 7.2.2.1 Evolving threat landscape and need for secure and reliable transmission to propel segment

- 7.2.3 ANTENNA

- 7.2.3.1 Enhanced capability of advanced antennas to boost segment growth

- 7.2.4 TRANSMITTER

- 7.2.4.1 Need for advanced military transmitter to drive innovation in segment

- 7.2.5 RECEIVER

- 7.2.5.1 Innovation-driven advancements to drive segment

- 7.2.1 TRANSPONDER

- 7.3 NAVIGATION

- 7.3.1 INERTIAL NAVIGATION SYSTEM

- 7.3.1.1 Development of miniaturized and cost-effective systems to drive segment growth

- 7.3.1.2 Altimeter

- 7.3.1.3 Magnetometer

- 7.3.1.4 Gyroscope

- 7.3.2 GLOBAL POSITIONING SYSTEM

- 7.3.2.1 Advancements in anti-jam and anti-spoof capabilities in GPS technology to boost demand

- 7.3.3 NAVIGATION COMPUTER

- 7.3.3.1 Enhanced real-time data processing capabilities to drive segment growth

- 7.3.1 INERTIAL NAVIGATION SYSTEM

- 7.4 HUMAN MACHINE INTERFACE

- 7.4.1 NAVIGATION DISPLAY

- 7.4.1.1 Integration with emerging technologies to boost segment growth

- 7.4.2 PRIMARY FLIGHT DISPLAY

- 7.4.2.1 Development of new and advanced displays to boost demand

- 7.4.3 MULTI-FUNCTION DISPLAY

- 7.4.3.1 Evolving requirements from military sector to lead to increased demand

- 7.4.1 NAVIGATION DISPLAY

- 7.5 FLIGHT CONTROL

- 7.5.1 DIGITAL FLIGHT CONTROL COMPUTER

- 7.5.1.1 Enhanced precision and adaptability of digital systems to propel segment growth

- 7.5.1 DIGITAL FLIGHT CONTROL COMPUTER

- 7.6 TARGETING

- 7.6.1 RADAR

- 7.6.1.1 Shift in military requirements and tactics to drive segment

- 7.6.1.2 Antenna

- 7.6.1.3 Transmitter

- 7.6.1.4 Receiver

- 7.6.1.5 Digital signal processor

- 7.6.1.6 Power amplifier

- 7.6.1.7 Duplexer

- 7.6.2 ELECTRO-OPTIC & INFRARED

- 7.6.2.1 Limited service life for EO/IR systems leading to costly maintenance drives segment growth

- 7.6.2.2 Transmitter

- 7.6.2.3 Receiver

- 7.6.2.4 Beam expander

- 7.6.2.5 Optical sensor

- 7.6.2.6 Detector

- 7.6.2.7 Signal processor

- 7.6.1 RADAR

- 7.7 ELECTRONIC WARFARE

- 7.7.1 JAMMER

- 7.7.1.1 Advancements in jamming techniques and countermeasure technology to propel segment growth

- 7.7.1.2 Transmitter

- 7.7.1.3 Receiver

- 7.7.1.4 Control unit

- 7.7.1.5 Display

- 7.7.1 JAMMER

- 7.8 SENSOR

- 7.8.1 INFRARED

- 7.8.1.1 Evolving operational needs and requirement for outdated sensors to boost segment growth

- 7.8.2 MOTION

- 7.8.2.1 Costly maintenance of aging sensors to drive segment growth

- 7.8.3 LIDAR

- 7.8.3.1 Need for sensors that help counter emerging threats to boost segment growth

- 7.8.4 PRESSURE

- 7.8.4.1 Trend towards miniaturization to boost segment growth

- 7.8.5 RADIATION

- 7.8.5.1 Advancements in alternative sensing technologies to drive segment

- 7.8.6 MAGNETIC

- 7.8.6.1 Need for sensors that meet specialized requirements to propel segment

- 7.8.7 BIOMETRIC

- 7.8.7.1 Focus on development of tamper-resistant sensors to boost segment growth

- 7.8.8 HUMIDITY/TEMPERATURE

- 7.8.8.1 Demand for sensors that provide enhanced performance and flexibility to drive segment

- 7.8.9 PROXIMITY

- 7.8.9.1 Requirement of sensors that facilitate seamless integration with interconnected defense networks to propel segment

- 7.8.1 INFRARED

8 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- FIGURE 38 AIRBORNE PLATFORM TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 27 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 28 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 8.2 LAND

- 8.2.1 COMBAT VEHICLE

- 8.2.1.1 Increasing demand for electronics in asymmetric warfare to drive segment

- 8.2.1.2 Main battle tank

- 8.2.1.3 Infantry fighting vehicle

- 8.2.1.4 Armored personnel carrier

- 8.2.1.5 Light armored vehicle

- 8.2.2 COMBAT SUPPORT VEHICLE

- 8.2.2.1 Requirement for interoperability with various platforms and systems to boost segment growth

- 8.2.2.2 Armored combat support vehicle

- 8.2.2.3 Mine-resistant ambush-protected

- 8.2.1 COMBAT VEHICLE

- 8.3 NAVAL

- 8.3.1 AIRCRAFT CARRIER

- 8.3.1.1 Development of more efficient and advanced launch and recovery systems to propel segment

- 8.3.2 DESTROYER

- 8.3.2.1 Rapid advancements in sensor, communications, and weapon technologies to boost segment growth

- 8.3.3 FRIGATE

- 8.3.3.1 Evolving mission requirements to drive segment

- 8.3.4 CORVETTE

- 8.3.4.1 Need to achieve operational effectiveness in designated environments to propel segment

- 8.3.5 SUBMARINE

- 8.3.5.1 Evolution of anti-submarine warfare to boost segment growth

- 8.3.6 PATROL VESSEL

- 8.3.6.1 Growing requirement for substitution of outdated and ineffective electronics to drive segment

- 8.3.7 MINE COUNTERMEASURES SHIP

- 8.3.7.1 Development of more sensitive and accurate systems to boost segment growth

- 8.3.1 AIRCRAFT CARRIER

- 8.4 AIRBORNE

- 8.4.1 COMBAT AIRCRAFT

- 8.4.1.1 Rising need for interoperability and integration to boost drive segment

- 8.4.2 TRANSPORT AIRCRAFT

- 8.4.2.1 Growing requirement for maintenance and support of aging systems to propel segment

- 8.4.3 SPECIAL MISSION AIRCRAFT

- 8.4.3.1 Increasing production of aircraft that support wide range of specialized missions to drive market

- 8.4.4 COMBAT HELICOPTER

- 8.4.4.1 Rise in need for continuous upgrades to adapt to new emerging tactics will boost segment

- 8.4.1 COMBAT AIRCRAFT

9 TYPES OF DEFENSE ELECTRONICS OBSOLESCENCE

- 9.1 INTRODUCTION

- 9.2 LOGISTICS OBSOLESCENCE

- 9.3 FUNCTIONAL OBSOLESCENCE

- 9.4 TECHNOLOGY OBSOLESCENCE

10 REGIONAL ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 39 NORTH AMERICA TO DOMINATE MARKET FROM 2023 TO 2028

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 29 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 30 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 31 DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 NORTH AMERICA: RECESSION IMPACT

- 10.3.2 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 40 NORTH AMERICA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET SNAPSHOT

- TABLE 32 NORTH AMERICA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.3.3 US

- 10.3.3.1 Focus of DOD on mitigation of obsolescence risks to drive market

- TABLE 36 US: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 37 US: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.3.4 CANADA

- 10.3.4.1 Significant government support for defense infrastructure modernization to propel market

- TABLE 38 CANADA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 39 CANADA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 EUROPE: RECESSION IMPACT

- 10.4.2 EUROPE: PESTLE ANALYSIS

- FIGURE 41 EUROPE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET SNAPSHOT

- TABLE 40 EUROPE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 41 EUROPE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 42 EUROPE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 43 EUROPE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4.3 UK

- 10.4.3.1 Increasing need to improve operational readiness of defense systems to boost market growth

- TABLE 44 UK: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 45 UK: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.4.4 FRANCE

- 10.4.4.1 Evolving defense needs to fuel market growth

- TABLE 46 FRANCE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 47 FRANCE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5 ASIA PACIFIC

- 10.5.1 ASIA PACIFIC: RECESSION IMPACT

- 10.5.2 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 42 ASIA PACIFIC: DEFENSE ELECTRONICS OBSOLESCENCE MARKET SNAPSHOT

- TABLE 48 ASIA PACIFIC: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 51 ASIA PACIFIC: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5.3 INDIA

- 10.5.3.1 Focus on modernization of aging electronic components and systems to drive market

- TABLE 52 INDIA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 53 INDIA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.5.4 AUSTRALIA

- 10.5.4.1 Growing efforts to upgrade military aircraft to boost market growth

- TABLE 54 AUSTRALIA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 55 AUSTRALIA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.6 MIDDLE EAST

- 10.6.1 MIDDLE EAST: RECESSION IMPACT

- 10.6.2 MIDDLE EAST: PESTLE ANALYSIS

- FIGURE 43 MIDDLE EAST: DEFENSE ELECTRONICS OBSOLESCENCE MARKET SNAPSHOT

- TABLE 56 MIDDLE EAST: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 57 MIDDLE EAST: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 58 MIDDLE EAST: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 59 MIDDLE EAST: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.6.3 SAUDI ARABIA

- 10.6.3.1 Rise in need to upgrade airborne surveillance system aircraft to drive market

- TABLE 60 SAUDI ARABIA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 61 SAUDI ARABIA: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.6.4 UAE

- 10.6.4.1 Increasing demand for advanced border defense systems to boost market growth

- TABLE 62 UAE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 63 UAE: DEFENSE ELECTRONICS OBSOLESCENCE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 64 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2023

- 11.3 RANKING ANALYSIS

- FIGURE 44 MARKET RANKING OF KEY PLAYERS, 2022

- 11.4 REVENUE ANALYSIS

- FIGURE 45 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2023

- 11.5 MARKET SHARE ANALYSIS

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- TABLE 65 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: DEGREE OF COMPETITION

- 11.6 COMPANY EVALUATION MATRIX, 2022

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 47 COMPANY EVALUATION MATRIX, 2022

- 11.7 COMPANY FOOTPRINT

- FIGURE 48 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: COMPANY FOOTPRINT

- TABLE 66 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: COMPANY FOOTPRINT, BY PLATFORM

- TABLE 67 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: COMPANY FOOTPRINT, BY TYPE

- TABLE 68 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: COMPANY FOOTPRINT, BY REGION

- 11.8 START-UP/SME EVALUATION MATRIX, 2022

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 49 START-UP/SME EVALUATION MATRIX, 2022

- 11.8.5 COMPETITIVE BENCHMARKING

- TABLE 69 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: LIST OF KEY START-UPS/SMES

- TABLE 70 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

- 11.9.1 DEALS

- TABLE 71 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: DEALS, OCTOBER 2022- DECEMBER 2023

- 11.9.2 OTHER DEVELOPMENTS

- TABLE 72 DEFENSE ELECTRONICS OBSOLESCENCE MARKET: OTHER DEVELOPMENTS, JULY 2020-JANUARY 2024

- 11.10 FINANCIAL METRICS AND VALUATION

- FIGURE 50 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 51 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 73 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- FIGURE 52 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 74 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 75 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 76 RAYTHEON TECHNOLOGIES CORPORATION: OTHER DEVELOPMENTS

- 12.2.2 BAE SYSTEMS

- TABLE 77 BAE SYSTEMS: COMPANY OVERVIEW

- FIGURE 53 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 78 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 79 BAE SYSTEMS: OTHER DEVELOPMENTS

- 12.2.3 THALES

- TABLE 80 THALES: COMPANY OVERVIEW

- FIGURE 54 THALES: COMPANY SNAPSHOT

- TABLE 81 THALES: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 82 THALES: OTHER DEVELOPMENTS

- 12.2.4 L3HARRIS TECHNOLOGIES, INC.

- TABLE 83 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 55 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 84 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 85 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 86 L3HARRIS TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- 12.2.5 ELBIT SYSTEMS LTD.

- TABLE 87 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 56 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 88 ELBIT SYSTEMS LTD.: PRODUCTS/SERVICES/SOLUTIONS

- 12.2.6 HEXAGON AB

- TABLE 89 HEXAGON AB: COMPANY OVERVIEW

- FIGURE 57 HEXAGON AB: COMPANY SNAPSHOT

- TABLE 90 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES

- 12.2.7 LEONARDO S.P.A.

- TABLE 91 LEONARDO S.P.A.: COMPANY OVERVIEW

- FIGURE 58 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 92 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 93 LEONARDO S.P.A.: OTHER DEVELOPMENTS

- 12.2.8 CURTISS-WRIGHT CORPORATION

- TABLE 94 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- FIGURE 59 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- TABLE 95 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 96 CURTISS-WRIGHT CORPORATION: OTHER DEVELOPMENTS

- 12.2.9 BHARAT ELECTRONICS LTD

- TABLE 97 BHARAT ELECTRONICS LTD: COMPANY OVERVIEW

- FIGURE 60 BHARAT ELECTRONICS LTD: COMPANY SNAPSHOT

- TABLE 98 BHARAT ELECTRONICS LTD: PRODUCTS/SOLUTIONS/SERVICES

- 12.2.10 ULTRA ELECTRONICS

- TABLE 99 ULTRA ELECTRONICS: COMPANY OVERVIEW

- TABLE 100 ULTRA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 101 ULTRA ELECTRONICS: OTHER DEVELOPMENTS

- 12.2.11 HINDUSTAN AERONAUTICS LTD

- TABLE 102 HINDUSTAN AERONAUTICS LTD: COMPANY OVERVIEW

- FIGURE 61 HINDUSTAN AERONAUTICS LTD: COMPANY SNAPSHOT

- TABLE 103 HINDUSTAN AERONAUTICS LTD: PRODUCTS/SOLUTIONS/SERVICES

- 12.2.12 LOCKHEED MARTIN CORPORATION

- TABLE 104 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- FIGURE 62 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 105 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS

- 12.2.13 TT ELECTRONICS

- TABLE 106 TT ELECTRONICS: COMPANY OVERVIEW

- FIGURE 63 TT ELECTRONICS: COMPANY SNAPSHOT

- TABLE 107 TT ELECTRONICS.: PRODUCTS/SOLUTIONS/SERVICES

- TABLE 108 TTF ELECTRONICS: OTHER DEVELOPMENTS

- 12.2.14 SIEMENS AG

- TABLE 109 SIEMENS AG: COMPANY OVERVIEW

- FIGURE 64 SIEMENS AG: COMPANY SNAPSHOT

- TABLE 110 SIEMENS AG: PRODUCTS/SERVICES/SOLUTIONS

- 12.2.15 MEL SYSTEMS AND SERVICES LTD.

- TABLE 111 MEL SYSTEMS AND SERVICES LTD.: COMPANY OVERVIEW

- TABLE 112 MEL SYSTEMS AND SERVICES LTD.: PRODUCTS/SOLUTIONS/SERVICES

- 12.3 OTHER PLAYERS

- 12.3.1 ACTIA

- TABLE 113 ACTIA: COMPANY OVERVIEW

- 12.3.2 LARSEN & TOUBRO LIMITED

- TABLE 114 LARSEN & TURBO LIMITED: COMPANY OVERVIEW

- 12.3.3 DEFENCE RESEARCH & DEVELOPMENT ORGANIZATION (DRDO)

- TABLE 115 DEFENCE RESEARCH & DEVELOPMENT ORGANIZATION (DRDO): COMPANY OVERVIEW

- 12.3.4 CYIENT LIMITED

- TABLE 116 CYIENT LIMITED: COMPANY OVERVIEW

- 12.3.5 RADEL ADVANCED TECHNOLOGY PVT. LTD.

- TABLE 117 RADEL ADVANCED TECHNOLOGY PVT. LTD.: COMPANY OVERVIEW

- 12.3.6 ALL TECH ELECTRONICS

- TABLE 118 ALL TECH ELECTRONICS: COMPANY OVERVIEW

- 12.3.7 CONVERGE

- TABLE 119 CONVERGE: COMPANY OVERVIEW

- 12.3.8 EINFOCHIPS

- TABLE 120 EINFOCHIPS: COMPANY OVERVIEW

- 12.3.9 A2 GLOBAL ELECTRONICS + SOLUTIONS

- TABLE 121 A2 GLOBAL ELECTRONICS + SOLUTIONS: COMPANY OVERVIEW

- 12.3.10 FERMIONX

- TABLE 122 FERMIONX: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS