|

|

市場調査レポート

商品コード

1453782

籾殻灰の世界市場:用途別、シリカ含有率別、プロセス別、製品別、地域別-2028年までの予測Rice Husk Ash Market by Application (Building & Construction, Steel Industry, Silica, Ceramics & Refractory, Rubber), Silica Content (80-84%, 85-89%, 90-94%, and greater than 95%), Process, Product, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 籾殻灰の世界市場:用途別、シリカ含有率別、プロセス別、製品別、地域別-2028年までの予測 |

|

出版日: 2024年03月18日

発行: MarketsandMarkets

ページ情報: 英文 192 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

籾殻灰の市場規模は、2023年の26億米ドルから2028年には32億米ドルに成長すると予測されており、予測期間中のCAGRは4.5%になるとみられています。

籾殻灰の需要の高まりは、その多用途性と環境に優しい性質に後押しされています。建設、製造、農業、水処理セクターの各産業界は、コンクリートにおける補強特性、土壌強化の利点、水ろ過プロセスにおける効果的な使用のために籾殻灰を求めており、世界の採用の増加が籾殻灰市場を後押しする主要な要因の一つとなっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 対象単位 | 金額(10億米ドル/100万米ドル)、数量(キロトン) |

| セグメント別 | 製品別、シリカ含有率別、用途別、プロセス別、地域別 |

| 対象地域 | アジア太平洋、欧州、中東・アフリカ、南米、北米 |

シリカ含有率85%~89%の籾殻灰が籾殻灰市場で最大のシェアを占めると予測されています。この高いシリカ含有率により、建設、製造、農業、水処理など様々な産業用途で特に重宝されています。シリカは、コンクリートやセメントにおける補強特性や、セラミック、ガラス、耐火物の製造における使用で求められる主要成分です。また、農業における土壌改良材や水処理工程での利点も、市場での存在感を高めています。

建築と建設は、その顕著な特性により、籾殻灰の最も高い使用部門になると予想されています。ポゾラン材料として、籾殻灰はコンクリートの強度と耐久性を高め、セメントの必要性を減らし、持続可能な建設慣行に貢献します。また、軽量であるため断熱材としても理想的であり、建物のエネルギー効率を促進します。さらに、その豊富さと費用対効果の高さが、特に米の生産が盛んな地域での建設プロジェクトでの採用を後押ししています。そのため、建築・建設における籾殻灰の使用は増加し、籾殻灰市場を牽引すると予想されます。

籾殻灰市場におけるアジア太平洋の優位性は、いくつかの要因によるものです。この地域の大きなシェアは、特にインド、中国、タイ、ベトナム、インドネシアなどの国々における大規模な米生産産業が主な要因です。これらの国々は、精米プロセスの副産物として大量の籾殻灰を生成します。さらに、持続可能な慣行が重視されるようになり、環境に優しい建設資材の需要が高まっていることも、アジア太平洋の様々な用途における籾殻灰の利用をさらに後押ししています。さらに、中国やインドのような国々における工業化とインフラ開発活動の拡大は、この地域における籾殻灰市場の成長を助長する環境を作り出しています。

当レポートでは、世界の籾殻灰市場について調査し、用途別、シリカ含有率別、プロセス別、製品別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 規制状況

- バリューチェーン分析

- 生態系/市場マップ

- ケーススタディ

- 技術分析

- 主要な利害関係者と購入基準

- 主要な会議とイベント(2024年)

- 価格分析

- 貿易データ

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

第6章 籾殻灰市場、用途別

- イントロダクション

- 建築・建設

- シリカ

- 鋼鉄

- セラミックス・耐火物

- ゴム

- その他

第7章 籾殻灰市場、製品別

- イントロダクション

- 根粒

- 粉末

- 顆粒

第8章 籾殻灰市場、シリカ含有率別

- イントロダクション

- 80%~84%

- 85%~89%

- 90%~94%

- 95%以上

第9章 籾殻灰市場、プロセス別

- イントロダクション

- アルカリ抽出法

- 沈降シリカの抽出方法

- メソポーラスシリカの抽出方法

- シリカゲル抽出

第10章 籾殻灰市場、地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第11章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 収益分析

- 市場シェア分析

- ブランド/製品の比較

- 企業評価マトリックス(Tier 1)

- スタートアップ/中小企業の評価マトリックス

第12章 企業プロファイル

- 主要参入企業

- USHER AGRO LTD.

- KRBL LIMITED

- GURU METACHEM

- YIHAI KERRY ARAWANA HOLDINGS CO., LTD.

- JASORIYA RICE MILL

- RESCON INDIA PVT. LTD.

- ASTRRA CHEMICALS

- J.M. BIOTECH PVT. LTD.

- RICE HUSK ASH(THAILAND)

- REFSTEEL SOLUTIONS

- GLOBAL RECYCLING

- GIA GIA NGUYEN CO., LTD.

- KV METACHEM

- NK ENTERPRISES

- GELEX AGRO INDUSTRIAL CO., LTD.

- REFRATECHNIK

- その他の企業

- VENSPRA IMPEX

- GLOBAL SILICON

- STEELCON INDUSTRIES

- HARIPRIYA AGRO INDUSTRIES

第13章 隣接市場および関連市場

第14章 付録

The Rice Husk Ash Market is projected to grow from USD 2.6 billion in 2023 to USD 3.2 billion by 2028, at a CAGR of 4.5 % during the forecast period. The growing demand for rice husk ash in The growing demand for rice husk ash is propelled by its versatility and eco-friendly nature. Industries across construction, manufacturing, agriculture, and water treatment sectors seek it for its reinforcement properties in concrete, soil enrichment benefits, and effective use in water filtration processes, driving its increasing adoption globally is one of the key driver that is boosting the rice husk ash market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion/Million), Volume (Kilotons) |

| Segments | By Product, Silica Content, Application, Process and Region |

| Regions covered | Asia Pacific, Europe, Middle East & Africa, South and North America |

"By silica content,the silica content between 85-89% , is estimated to account for the largest share during the forecast period."

Rice husk ash with a silica content ranging from 85% to 89% is projected to hold the largest market share in the rice husk ash market. This high silica content makes it particularly valuable for various industrial applications, including construction, manufacturing, agriculture, and water treatment. Silica is a key component sought after for its reinforcing properties in concrete and cement, as well as its use in manufacturing ceramics, glass, and refractory materials. Additionally, its benefits in agriculture as a soil amendment and in water treatment processes further contribute to its prominence in the market.

"By application,building & construction segment is accounted for the largest share during the forecast period."

Building and construction are expected to be the highest-use sectors for rice husk ash due to its remarkable properties. As a pozzolanic material, rice husk ash enhances the strength and durability of concrete, reducing the need for cement and contributing to sustainable construction practices. Its lightweight nature also makes it ideal for use in insulating materials, promoting energy efficiency in buildings. Additionally, its abundance and cost-effectiveness further drive its adoption in construction projects, particularly in regions where rice production is prevalent. Therefore, the use of rice husk ash in building and construction will increase and it is expected to drive the Rice Husk Ash Market.

"Asia Pacific is estimated to account for the largest share during 2023-2028."

Asia Pacific's dominance in the rice husk ash market is attributed to several factors. The region's significant share is primarily driven by its large rice production industry, particularly in countries like India, China, Thailand, Vietnam, and Indonesia. These nations generate substantial volumes of rice husk ash as a byproduct of rice milling processes. Moreover, the increasing emphasis on sustainable practices and the rising demand for eco-friendly construction materials further boost the utilization of rice husk ash in various applications across the Asia Pacific region. Additionally, the expanding industrialization and infrastructure development activities in countries like China and India create a conducive environment for the growth of the rice husk ash market in the region.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 35%, Tier 2 - 35%, and Tier 3 - 30%

- By Designation: C-level- 25%, Director Level- 30%, and Others - 45%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, Middle East & Africa and South America -15%

Companies such as Usher Agro Limited (India), KRBL Ltd. (India), Guru Meta Chem (India), Yihai Kerry Investments (China), Jasoriya Rice Mill (India), Rescon India Pvt Ltd (India) are some of the major players operating in the rice husk ash market. These players have adopted strategies such as acquisitions, expansions, and partnerships, and expansions in order to increase their market share business revenue.

Research Coverage:

The report defines, segments, and projects the rice husk ash market based on Silica content, process, product, application, and region. It provides detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges. It strategically profiles, rice husk ash manufacturers and comprehensively analyses their market shares and core competencies as well as tracks and analyzes competitive developments, such as expansions, joint ventures, agreements, and acquisitions, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them the closest approximations of revenue numbers of the rice husk ash market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Low manufacturing and low raw material cost), restraints (highly dependency on rice paddy production), opportunities (increasing use of rice husk ash in building and construction), and challenges (limited awareness about rice husk ash) influencing the growth of the rice husk ash market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the Rice Husk Ash Market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Rice Husk Ash Market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the rice husk ash market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as Usher Agro Limited (India), Krbl Ltd (India),Guru Meta Chem (India),Yihai Kerry Investments (China), Jasoriya Rice Mill (India), Rescon India Pvt. Ltd. (India) and others in the rice husk ash market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 RICE HUSK ASH MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 RICE HUSK ASH MARKET SEGMENTATION

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RICE HUSK ASH MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Participating companies for primary research

- 2.1.2.3 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RICE HUSK ASH MARKET-1

- 2.4 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RICE HUSK ASH MARKET-2

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.4.2 FORECAST

- 2.4.3 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- FIGURE 5 RICE HUSK ASH MARKET: DATA TRIANGULATION

- 2.5.1 RESEARCH ASSUMPTIONS

- 2.5.2 RESEARCH LIMITATIONS

- 2.5.3 IMPACT OF RECESSION

- 2.5.4 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 2 RICE HUSK ASH MARKET SNAPSHOT: 2023 VS. 2028

- FIGURE 6 BUILDING & CONSTRUCTION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 7 ASIA PACIFIC DOMINATED RICE HUSK ASH MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RICE HUSK ASH MARKET

- FIGURE 8 RICE HUSK ASH MARKET TO WITNESS SIGNIFICANT GROWTH BETWEEN 2023 AND 2028

- 4.2 RICE HUSK ASH MARKET, BY SILICA CONTENT

- FIGURE 9 85-89% SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 RICE HUSK ASH MARKET, BY APPLICATION

- FIGURE 10 BUILDING & CONSTRUCTION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 RICE HUSK ASH MARKET, BY MAJOR COUNTRIES

- FIGURE 11 MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN RICE HUSK ASH MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Low manufacturing and raw material cost

- 5.2.1.2 Use of rice husk ash to produce high-purity silica

- FIGURE 13 RICE PRODUCTION, 2018 VS. 2021

- 5.2.2 RESTRAINTS

- 5.2.2.1 High dependence on production of rice paddy

- 5.2.2.2 Availability of various substitutes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of rice husk ash in production of rubber tires

- 5.2.3.2 Demand for rice husk ash in cement & construction industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited awareness and need for proper disposal of waste

- 5.2.4.2 Inefficient infrastructure and technology

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 14 RICE HUSK ASH MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 RICE HUSK ASH MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 REGULATORY LANDSCAPE

- 5.4.1 REGULATIONS RELATED TO RICE HUSK ASH MARKET

- 5.4.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 15 RICE HUSK ASH MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROCUREMENT

- 5.5.2 RICE HUSK PROCESSING

- 5.5.3 END-USE APPLICATIONS

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 16 RICE HUSK ASH MARKET: ECOSYSTEM MAPPING

- TABLE 7 RICE HUSK ASH MARKET: ROLE IN ECOSYSTEM

- 5.7 CASE STUDIES

- 5.7.1 PROBLEM STATEMENT

- 5.7.2 SOLUTION OFFERED

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.10 KEY CONFERENCES AND EVENTS (2024)

- TABLE 10 RICE HUSK ASH MARKET: KEY CONFERENCES AND EVENTS (2024)

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE FOR RICE HUSK ASH, BY APPLICATION

- FIGURE 19 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS

- 5.11.2 AVERAGE SELLING PRICE FOR RICE HUSK ASH, BY REGION

- FIGURE 20 AVERAGE SELLING PRICE IN TOP THREE REGIONS

- 5.12 TRADE DATA

- TABLE 11 IMPORT OF RICE HUSK (USD THOUSAND)

- TABLE 12 EXPORT OF RICE HUSK (USD THOUSAND)

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 PATENT ANALYSIS

- 5.14.1 METHODOLOGY

- FIGURE 22 LIST OF MAJOR PATENTS FOR RICE HUSK ASH

- 5.14.2 MAJOR PATENTS

6 RICE HUSK ASH MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 23 BUILDING & CONSTRUCTION APPLICATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 13 RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 14 RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 15 RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 16 RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 6.2 BUILDING & CONSTRUCTION

- 6.2.1 STRINGENT REGULATIONS AND SUSTAINABILITY TO DRIVE MARKET

- TABLE 17 BUILDING & CONSTRUCTION: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 18 BUILDING & CONSTRUCTION: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 19 BUILDING & CONSTRUCTION: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 BUILDING & CONSTRUCTION: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SILICA

- 6.3.1 RISING DEMAND IN FOOD & BEVERAGE, COSMETIC, AND CONSTRUCTION INDUSTRIES TO DRIVE MARKET

- TABLE 21 SILICA: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 22 SILICA: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 23 SILICA: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 SILICA: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (USD MILLION)

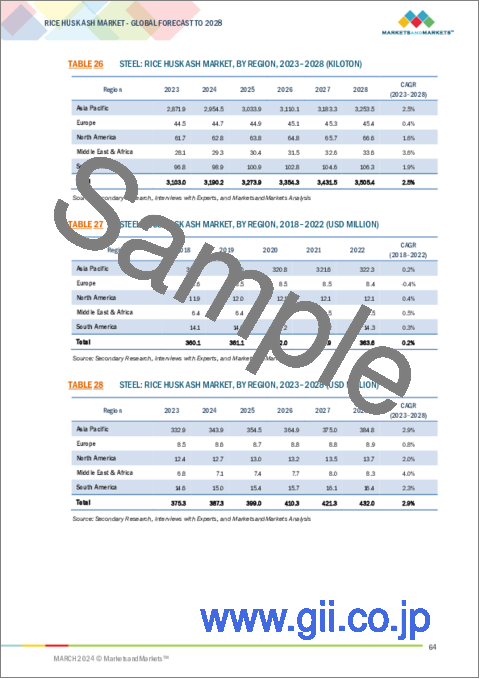

- 6.4 STEEL

- 6.4.1 WIDELY USED IN STEEL INDUSTRY TO PRODUCE HIGH-STEEL QUALITY

- TABLE 25 STEEL: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 26 STEEL: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 27 STEEL: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 STEEL: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 CERAMICS & REFRACTORY

- 6.5.1 INSULATION PROPERTIES AND RESISTANCE TO CHEMICAL CORROSION TO DRIVE MARKET

- TABLE 29 CERAMICS & REFRACTORY: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 30 CERAMICS & REFRACTORY: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 31 CERAMICS & REFRACTORY: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 CERAMICS & REFRACTORY: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.6 RUBBER

- 6.6.1 RICE HUSK ASH USED TO IMPROVE MECHANICAL PROPERTIES OF RUBBER PRODUCTS

- TABLE 33 RUBBER: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 34 RUBBER: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 35 RUBBER: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 RUBBER: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.7 OTHER APPLICATIONS

- TABLE 37 OTHER APPLICATIONS: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 38 OTHER APPLICATIONS: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 39 OTHER APPLICATIONS: RICE HUSK ASH MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 OTHER APPLICATIONS: RICE HUSK ASH MARKET, BY REGION, 2023-2028 (USD MILLION)

7 RICE HUSK ASH MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 NODULES

- 7.2.1 ENABLES DENSITY REDUCTION IN CONCRETE AND IMPROVING DURABILITY AND STRENGTH

- 7.3 POWDER

- 7.3.1 ABILITY TO INCREASE STRENGTH, DURABILITY, AND RESISTANCE TO CHEMICAL ATTACKS TO DRIVE MARKET

- 7.4 GRANULES

- 7.4.1 DEMAND FOR SUSTAINABLE AND EFFICIENT SOLUTION IN CONSTRUCTION SECTOR TO DRIVE MARKET

8 RICE HUSK ASH MARKET, BY SILICA CONTENT

- 8.1 INTRODUCTION

- FIGURE 24 85%-89% SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 41 RICE HUSK ASH MARKET, BY SILICA CONTENT, 2018-2022 (KILOTON)

- TABLE 42 RICE HUSK ASH MARKET, BY SILICA CONTENT, 2023-2028 (KILOTON)

- 8.2 80%-84%

- 8.2.1 REQUIREMENT FOR BALANCE BETWEEN COST AND SILICA CONTENT TO DRIVE MARKET

- 8.3 85%-89%

- 8.3.1 GROWING DEMAND IN BUILDING & CONSTRUCTION SECTOR TO DRIVE MARKET

- 8.4 90%-94

- 8.4.1 PRODUCTION OF HIGH-STRENGTH CONCRETE, CEMENT, AND OTHER ADVANCED MATERIALS TO DRIVE MARKET

- 8.5 MORE THAN OR EQUAL TO 95%

- 8.5.1 DEMAND FOR HIGH-PURITY SILICA FOR SPECIALIZED APPLICATIONS IN PHARMACEUTICAL SECTOR TO DRIVE MARKET

9 RICE HUSK ASH MARKET, BY PROCESS

- 9.1 INTRODUCTION

- 9.2 ALKALINE EXTRACTION METHOD

- 9.2.1 INTEGRAL PROCESS FOR MEETING DEMANDS FOR PURE SILICA GEL

- 9.3 PRECIPITATED SILICA EXTRACTION METHOD

- 9.3.1 WIDELY USED METHOD IN RICE HUSK ASH INDUSTRY FOR VARIOUS APPLICATIONS

- 9.4 MESOPOROUS SILICA EXTRACTION METHOD

- 9.4.1 OFFERS COST-EFFECTIVE METHOD FOR SILICA EXTRACTION

- 9.5 SILICA GEL EXTRACTION

- 9.5.1 OFFERS SUSTAINABLE ALTERNATIVE TO TRADITIONAL HEAT-BASED EXTRACTION METHODS

10 RICE HUSK ASH MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 25 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 43 RICE HUSK ASH MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 44 RICE HUSK ASH MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 45 RICE HUSK ASH MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 RICE HUSK ASH MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- 10.2.1 IMPACT OF RECESSION ON ASIA PACIFIC

- FIGURE 26 ASIA PACIFIC: RICE HUSK ASH MARKET SNAPSHOT

- TABLE 47 ASIA PACIFIC: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 48 ASIA PACIFIC: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 49 ASIA PACIFIC: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 50 ASIA PACIFIC: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 52 ASIA PACIFIC: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 53 ASIA PACIFIC: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 54 ASIA PACIFIC: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.2 CHINA

- 10.2.2.1 Government subsidies for increased rice production to drive market

- TABLE 55 CHINA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 56 CHINA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 57 CHINA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 58 CHINA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.3 SOUTH KOREA

- 10.2.3.1 Surge in rice production to drive market

- TABLE 59 SOUTH KOREA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 60 SOUTH KOREA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 61 SOUTH KOREA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 62 SOUTH KOREA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.4 JAPAN

- 10.2.4.1 Technological advancements and sustainability to drive market

- TABLE 63 JAPAN: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 64 JAPAN: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 65 JAPAN: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 66 JAPAN: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.5 INDIA

- 10.2.5.1 Government support for agricultural sector to drive market

- TABLE 67 INDIA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 68 INDIA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 69 INDIA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 70 INDIA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.6 VIETNAM

- 10.2.6.1 Technological advancements in rice production to drive market

- TABLE 71 VIETNAM: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 72 VIETNAM: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 73 VIETNAM: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 74 VIETNAM: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.7 THAILAND

- 10.2.7.1 Significant production of rice to drive market

- TABLE 75 THAILAND: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 76 THAILAND: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 77 THAILAND: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 78 THAILAND: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.8 REST OF ASIA PACIFIC

- TABLE 79 REST OF ASIA PACIFIC: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 80 REST OF ASIA PACIFIC: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 81 REST OF ASIA PACIFIC: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 IMPACT OF RECESSION ON NORTH AMERICA

- FIGURE 27 NORTH AMERICA: RICE HUSH ASH MARKET SNAPSHOT

- TABLE 83 NORTH AMERICA: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 84 NORTH AMERICA: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 85 NORTH AMERICA: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 88 NORTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 89 NORTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.2 US

- 10.3.2.1 Expanding rice production to drive market

- TABLE 91 US: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 92 US: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 93 US: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 94 US: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.3 CANADA

- 10.3.3.1 Emphasis on sustainable agriculture and innovation to drive market

- TABLE 95 CANADA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 96 CANADA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 97 CANADA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 98 CANADA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.4 MEXICO

- 10.3.4.1 Favorable climate, technological advancements, and supportive government policies to drive market

- TABLE 99 MEXICO: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 100 MEXICO: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 101 MEXICO: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 102 MEXICO: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 IMPACT OF RECESSION ON EUROPE

- FIGURE 28 EUROPE: RICE HUSK ASH MARKET SNAPSHOT

- TABLE 103 EUROPE: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 104 EUROPE: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 105 EUROPE: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 106 EUROPE: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 107 EUROPE: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 108 EUROPE: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 109 EUROPE: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 110 EUROPE: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.2 GERMANY

- 10.4.2.1 Growing construction sector to drive market

- TABLE 111 GERMANY: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 112 GERMANY: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 113 GERMANY: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 114 GERMANY: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.3 FRANCE

- 10.4.3.1 Construction and agriculture sectors to drive market

- TABLE 115 FRANCE: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 116 FRANCE: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 117 FRANCE: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 118 FRANCE: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.4 UK

- 10.4.4.1 Demand in construction sector to drive market

- TABLE 119 UK: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 120 UK: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 121 UK: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 122 UK: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.5 ITALY

- 10.4.5.1 Extensive growth of rice sector to drive market

- TABLE 123 ITALY: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 124 ITALY: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 125 ITALY: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 126 ITALY: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.6 SPAIN

- 10.4.6.1 Significant growth of ceramics & refractory sector to drive market

- TABLE 127 SPAIN: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 128 SPAIN: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 129 SPAIN: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 130 SPAIN: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.7 RUSSIA

- 10.4.7.1 Investments to increase self-sufficiency in rice production to drive market

- TABLE 131 RUSSIA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 132 RUSSIA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 133 RUSSIA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 134 RUSSIA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.8 REST OF EUROPE

- TABLE 135 REST OF EUROPE: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 136 REST OF EUROPE: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 137 REST OF EUROPE: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 138 REST OF EUROPE: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 IMPACT OF RECESSION ON MIDDLE EAST & AFRICA

- TABLE 139 MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 140 MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 141 MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 144 MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 145 MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.2 GCC COUNTRIES

- 10.5.2.1 Saudi Arabia

- 10.5.2.1.1 Growing steel industry to drive market

- 10.5.2.1 Saudi Arabia

- TABLE 147 SAUDI ARABIA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 148 SAUDI ARABIA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 149 SAUDI ARABIA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 150 SAUDI ARABIA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.2.2 UAE

- 10.5.2.2.1 Demand for sustainable building materials to drive market

- 10.5.2.2 UAE

- TABLE 151 UAE: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 152 UAE: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 153 UAE: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 154 UAE: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.2.3 Rest of GCC countries

- 10.5.3 IRAN

- 10.5.3.1 Modernization, technological advancements, and improved irrigation systems in rice production to drive market

- TABLE 155 IRAN: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 156 IRAN: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 157 IRAN: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 158 IRAN: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 159 REST OF MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 161 REST OF MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 162 REST OF MIDDLE EAST & AFRICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 IMPACT OF RECESSION

- TABLE 163 SOUTH AMERICA: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 164 SOUTH AMERICA: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 165 SOUTH AMERICA: RICE HUSK ASH MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 166 SOUTH AMERICA: RICE HUSK ASH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 167 SOUTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 168 SOUTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 169 SOUTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 170 SOUTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.2 BRAZIL

- 10.6.2.1 Government focus on promoting sustainable practices and reducing waste to drive market

- TABLE 171 BRAZIL: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 172 BRAZIL: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 173 BRAZIL: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 174 BRAZIL: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.3 ARGENTINA

- 10.6.3.1 Advanced farming techniques, improved seed varieties, and enhanced productivity of rice to drive market

- TABLE 175 ARGENTINA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 176 ARGENTINA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 177 ARGENTINA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 178 ARGENTINA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.4 COLOMBIA

- 10.6.4.1 Adoption of sustainable practices in construction to drive market

- TABLE 179 COLOMBIA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 180 COLOMBIA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 181 COLOMBIA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 182 COLOMBIA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.5 REST OF SOUTH AMERICA

- TABLE 183 REST OF SOUTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 184 REST OF SOUTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 185 REST OF SOUTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 186 REST OF SOUTH AMERICA: RICE HUSK ASH MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 11.3 REVENUE ANALYSIS

- FIGURE 29 REVENUE ANALYSIS OF KEY COMPANIES (2018-2022)

- 11.4 MARKET SHARE ANALYSIS

- 11.4.1 RANKING OF KEY MARKET PLAYERS

- FIGURE 30 RANKING OF TOP 5 PLAYERS IN RICE HUSK ASH MARKET, 2022

- 11.4.2 MARKET SHARE OF KEY PLAYERS

- FIGURE 31 RICE HUSK ASH MARKET SHARE ANALYSIS

- TABLE 187 DEGREE OF COMPETITION: RICE HUSK ASH MARKET

- 11.5 BRAND/PRODUCT COMPARISON

- 11.5.1 RICE HUSK ASH POWDER BY USHER AGRO LTD.

- 11.5.2 RICE HUSK ASH POWDER BY KRBL LTD.

- 11.5.3 RICE HUSK ASH POWDER BY GURU METACHEM

- 11.5.4 RICE HUSK ASH POWDER BY YIHAI KERRY ARAWANA HOLDINGS CO., LTD

- 11.5.5 RICE HUSK ASH POWDER BY JASORIYA RICE MILL

- 11.6 COMPANY EVALUATION MATRIX (TIER 1)

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 32 RICE HUSK ASH MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS)

- 11.6.5 COMPANY FOOTPRINT

- FIGURE 33 COMPANY OVERALL FOOTPRINT (16 COMPANIES)

- TABLE 188 COMPANY REGION FOOTPRINT (16 COMPANIES)

- TABLE 189 COMPANY PRODUCT FOOTPRINT (16 COMPANIES)

- TABLE 190 COMPANY APPLICATION FOOTPRINT (16 COMPANIES)

- 11.7 STARTUP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 34 RICE HUSK ASH MARKET: STARTUP/SME EVALUATION MATRIX

- 11.7.5 COMPETITIVE BENCHMARKING

- TABLE 191 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 192 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 USHER AGRO LTD.

- TABLE 193 USHER AGRO LTD.: COMPANY OVERVIEW

- TABLE 194 USHER AGRO LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.2 KRBL LIMITED

- TABLE 195 KRBL LTD.: COMPANY OVERVIEW

- FIGURE 35 KRBL LTD.: COMPANY SNAPSHOT

- TABLE 196 KRBL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.3 GURU METACHEM

- TABLE 197 GURU METACHEM: COMPANY OVERVIEW

- TABLE 198 GURU METACHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.4 YIHAI KERRY ARAWANA HOLDINGS CO., LTD.

- TABLE 199 YIHAI KERRY ARAWANA HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 200 YIHAI KERRY ARAWANA HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.5 JASORIYA RICE MILL

- TABLE 201 JASORIYA RICE MILL: COMPANY OVERVIEW

- TABLE 202 JASORIYA RICE MILL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.6 RESCON INDIA PVT. LTD.

- TABLE 203 RESCON INDIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 204 RESCON INDIA PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 ASTRRA CHEMICALS

- TABLE 205 ASTRRA CHEMICALS: COMPANY OVERVIEW

- TABLE 206 ASTRRA CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.8 J.M. BIOTECH PVT. LTD.

- TABLE 207 J.M. BIOTECH PVT. LTD.: COMPANY OVERVIEW

- TABLE 208 J.M. BIOTECH PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 RICE HUSK ASH (THAILAND)

- TABLE 209 RICE HUSK ASH (THAILAND): COMPANY OVERVIEW

- TABLE 210 RICE HUSK ASH (THAILAND): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.10 REFSTEEL SOLUTIONS

- TABLE 211 REFSTEEL SOLUTIONS: COMPANY OVERVIEW

- TABLE 212 REFSTEEL SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.11 GLOBAL RECYCLING

- TABLE 213 GLOBAL RECYCLING: COMPANY OVERVIEW

- TABLE 214 GLOBAL RECYCLING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.12 GIA GIA NGUYEN CO., LTD.

- TABLE 215 GIA GIA NGUYEN CO., LTD.: COMPANY OVERVIEW

- TABLE 216 GIA GIA NGUYEN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.13 KV METACHEM

- TABLE 217 KV METACHEM: COMPANY OVERVIEW

- TABLE 218 KV METACHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.14 NK ENTERPRISES

- TABLE 219 NK ENTERPRISES: COMPANY OVERVIEW

- TABLE 220 NK ENTERPRISES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.15 GELEX AGRO INDUSTRIAL CO., LTD.

- TABLE 221 GELEX AGRO INDUSTRIAL CO., LTD: COMPANY OVERVIEW

- TABLE 222 GELEX AGRO INDUSTRIAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.16 REFRATECHNIK

- TABLE 223 REFRATECHNIK: COMPANY OVERVIEW

- TABLE 224 REFRATECHNIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 VENSPRA IMPEX

- TABLE 225 VENSPRA IMPEX: COMPANY OVERVIEW

- 12.2.2 GLOBAL SILICON

- TABLE 226 GLOBAL SILICON: COMPANY OVERVIEW

- 12.2.3 STEELCON INDUSTRIES

- TABLE 227 STEELCON INDUSTRIES: COMPANY OVERVIEW

- 12.2.4 HARIPRIYA AGRO INDUSTRIES

- TABLE 228 HARIPRIYA AGRO INDUSTRIES: COMPANY OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 RICE HUSK ASH INTERCONNECTED MARKET

- 13.4 SEEDS MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 SEEDS MARKET, BY TYPE

- TABLE 229 SEEDS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 230 SEEDS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 13.4.3.1 Conventional seeds

- 13.4.3.2 Genetically modified seeds

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTOR DETAILS