|

|

市場調査レポート

商品コード

1453087

デジタルリスク保護の世界市場:提供区分・ソリューションタイプ (自動脅威軽減・フィッシング対策・インシデント対応)・セキュリティタイプ・組織規模・展開モード・産業・地域別 - 予測(~2028年)Digital Risk Protection Market by Offering, Solution Type (Automated Threat Mitigation, Phishing Protection, Incident Response), Security Type, Organization Size, Deployment Mode, Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| デジタルリスク保護の世界市場:提供区分・ソリューションタイプ (自動脅威軽減・フィッシング対策・インシデント対応)・セキュリティタイプ・組織規模・展開モード・産業・地域別 - 予測(~2028年) |

|

出版日: 2024年03月11日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

デジタルリスク保護の市場規模は、予測期間中に19.6%のCAGRで推移し、2023年の644億米ドルから、2028年には1,578億米ドルの規模に成長すると予測されています。

同市場の成長は、電子メールやクラウドベースのサービスの普及と複雑化するデジタルリスク攻撃が交錯する、進化するデジタルコミュニケーション環境と密接に結びついています。サイバー犯罪者は絶えず脆弱性を悪用し、高度なソーシャルエンジニアリングの手口を用いてくるため、先進的なデジタルリスク保護ソリューションへのニーズが高まっています。デジタルプラットフォーム上のリスクの増大から、組織は機密データや金融資産を保護するための最先端の保護対策に投資する必要があり、これはさらにステークホルダーからの信頼を維持するのにも役立ちます。技術の進歩、攻撃対象の拡大、厳格なデータ保護規制により、革新的なデジタルリスク保護戦略の需要がさらに高まると予想されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | 提供区分・ソリューションタイプ・セキュリティタイプ・組織規模・展開モード・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

提供区分別では、サービス部門が予測期間中に高い成長率を達成する見込み:

デジタルリスク保護サービスの拡大は、デジタル脅威からの防御に向けた徹底した保護の重要性に対する組織の理解に支えられています。リスク評価・分析、導入・統合、コンプライアンス管理、インシデント対応、脅威検知などのマネージドサービスや専門サービスは、デジタル脅威と効果的に戦うためにカスタマイズされた柔軟なソリューションを提供することで、絶えず進化するサイバーセキュリティ環境に対処する組織の支援において重要な役割を果たしています。包括的な保護戦略を優先することで、組織のデジタル資産や機密情報を潜在的なリスクや攻撃から確実に保護することができるため、デジタルリスク保護市場の成長を促進するサービスセグメントの重要性が顕著となっています。

展開モード別では、クラウド部門が予測期間中に市場を独占する見込み:

クラウドベースのソリューションは、アクセシビリティとリモート管理を提供するため、デジタルリスク保護に非常に有益です。従業員がどこにいても、インターネット接続さえあればソリューションにアクセスできます。これは、今日のリモートワーク環境において特に有用であり、組織はデジタル資産と機密情報を効果的に保護することができます。また、クラウド導入により、オンサイトでのインストールに伴う複雑な作業を行うことなく、デジタルリスク保護ソリューションを迅速に導入することができます。さらに、クラウドベースのソリューションは、頻繁にアップデートやパッチを自動で受け取ることができるため、大幅なダウンタイムを経験したり、手動による介入を必要とすることなく、企業は常に最新のセキュリティ機能にアクセスすることができます。

予測期間中、北米地域が市場を独占:

北米のデジタルリスク保護市場は、企業や業界全体でデジタル導入が広まっており、デジタルリスク保護ソリューションに対する旺盛な需要を生み出していること、同地域ではサイバー攻撃、データ漏洩、システム障害の件数が増加しており、組織がオンラインブランドの評判やデータセキュリティを優先するよう促していることなど、いくつかの要因によって推進されています。脅威検出のためのAIや機械学習、包括的な監視のためのビッグデータアナリティクス、拡張性と費用対効果のためのクラウドベースのソリューションなどの技術的進歩が、市場成長の可能性をさらに高めています。ソーシャルメディアやダークウェブモニタリングなどの新たな脅威は、サードパーティによるリスク管理の重視に加え、市場のレジリエンスとイノベーションにも寄与しています。また、厳格なデータプライバシー規制、コンプライアンス重視の高まり、マネージドサービスに対する需要の高まりなどの要因も北米のデジタルリスク保護市場を推進し、企業が進化するサイバー脅威を効果的に乗り切るための十分な体制を確保するものと期待されています。

当レポートでは、世界の デジタルリスク保護の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ

- バリューチェーン分析

- エコシステムマッピング

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 顧客のビジネスに影響を与える動向とディスラプション

- 規制状況

- 主要なステークホルダーと購入基準

- 主要な会議とイベント

- ビジネスモデル分析

- 投資と資金調達のシナリオ

第6章 デジタルリスク保護市場:提供区分別

- ソリューション

- サービス

第7章 デジタルリスク保護市場:ソリューションタイプ別

- ブランド保護

- フィッシング対策

- インシデント対応

- アプリ保護

- ダークウェブインテリジェンス

- 自動脅威軽減

- その他

第8章 デジタルリスク保護市場:セキュリティタイプ別

- ネットワークセキュリティ

- エンドポイント&IoTセキュリティ

- クラウドセキュリティ

- アプリケーションセキュリティ

第9章 デジタルリスク保護市場:組織規模別

- 中小企業

- 大企業

第10章 デジタルリスク保護市場:展開モード別

- クラウド

- オンプレミス

第11章 デジタルリスク保護市場:産業別

- BFSI

- IT・ITES

- 政府

- ヘルスケア

- 小売・eコマース

- メディア・エンターテイメント

- その他

第12章 デジタルリスク保護市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第13章 競合情勢

- 概要

- 主要企業の採用戦略

- 収益分析

- 市場シェア分析

- 評価と財務指標

- 製品/ブランドの比較

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- MICROSOFT

- CISCO

- BROADCOM

- PALO ALTO NETWORKS

- KASPERSKY

- RAPID7

- PROOFPOINT

- TREND MICRO

- FORTINET

- RSA SECURITY

- CYBERARK

- CROWDSTRIKE

- DARKTRACE

- FORCEPOINT

- その他の企業

- DIGITAL SHADOWS

- ZEROFOX

- BRANDSHIELD

- PHISHLABS

- DEEPWATCH

- CYBERINT

- CYBELANGEL

- SAFEGUARD CYBER

- AXUR

- F-SECURE

- COFENSE

- EXABEAM

- DTEX SYSTEMS

- MENLO SECURITY

第15章 隣接市場

第16章 付録

The global digital risk protection market is estimated to be valued at USD 64.4 billion in 2023 and is expected to grow to USD 157.8 billion by 2028, with a compound annual growth rate (CAGR) of 19.6%. The DRP market growth is closely tied to the evolving digital communication landscape, where the widespread use of email and cloud-based services intersects with increasingly complex digital risk attacks. Cybercriminals continuously exploit vulnerabilities and employ sophisticated social engineering tactics, underscoring the need for advanced digital risk protection solutions. Due to increasing risk on digital platforms, organizations must invest in cutting-edge protection measures to safeguard sensitive data and financial assets, which further helps them to maintain their stakeholder trust. Technological advancements, expanding attack surfaces, and strict data protection regulations are expected to drive further demand for innovative digital risk protection strategies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By offering, solution type, security type, organization size, deployment mode, vertical and region. |

| Regions covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

"By offering, the services segment to register is expected to achieve a high growth rate during the forecast period."

The expansion of digital risk protection services is backed by organizations understanding the significance of having thorough protection to defend against digital threats. These managed and professional services such as risk assessment and analysis, implementation a nd integration, compliance management, incident response, threat detection play a vital role in assisting organizations in dealing with the constantly evolving cybersecurity environment by providing customized and flexible solutions to combat digital threats effectively. Prioritizing comprehensive protection strategies highlights the importance of the services segment in propelling the growth of the digital risk protection market, as it ensures organizations are well-equipped to safeguard their digital assets and sensitive information from potential risks and attacks.

"By deployment mode, the cloud segment is expected to dominate the digital risk protection market during the forecast period."

Cloud-based solutions are highly beneficial for digital risk protection because they offer accessibility and remote management. This means that regardless of where employees are located, they can access these solutions as long as they have an internet connection. This is especially useful in today's remote work setup, allowing organizations to safeguard their digital assets and sensitive information effectively. Moreover, cloud deployment enables rapid deployment of digital risk protection solutions without the complexities associated with on-site installations. Additionally, cloud-based solutions receive frequent updates and patches automatically, ensuring organizations always have access to the latest security features without experiencing significant downtime or needing manual intervention.

"The North America region to dominate the digital risk protection market during the forecast period."

The North American digital risk protection market is propelled by several positive factors such as there is a widespread digital adoption across businesses and industries, creating a robust demand for digital risk protection solutions, the region experiences a rising number of cyberattacks, data breaches, and system failures, driving organizations to prioritize their online brand reputation and data security. Technological advancements, including AI and machine learning for threat detection, big data analytics for comprehensive monitoring, and cloud-based solutions for scalability and cost-effectiveness, further enhance the market's growth potential. Emerging threats such as social media and dark web monitoring, along with the emphasis on third-party risk management, contribute to the market's resilience and innovation. And factors like stringent data privacy regulations, growing compliance focus, and the increasing demand for managed services are expected to sustain the North American digital risk protection market , ensuring businesses are well-equipped to navigate evolving cyber threats effectively.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primaries is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 57%, and Tier 3 - 33%

- By Designation: C-level - 40%, Managers and Others - 60%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 45%.

The major players in the digital risk protection market are Microsoft(US), CISCO (US), Broadcom (US), Palo Alto Networks (US), Kaspersky (Russia), Rapid7 (US), Proofpoint (US), Trend Micro (Japan), Fortinet (US), RSA Security (US), Cyberark (US), Crowdstrike (US), Darktrace (UK), Forcepoint (US), Digital Shadows (US), Zerofox (US), Brandshield (US), Phishlabs (US), Deepwatch (US), CyberInt (Israel), Cybelangel (France) Safeguard Cyber (US), Axur (US), F-secure (Finland), Cofense (US), Exabeam (US), Dtex Systems (France), Menlo Security (US). The study includes an in-depth competitive analysis of these key players in the digital risk protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The research encompasses the digital risk protection market's size across various segments. It seeks to gauge its market size and growth potential within different categories by offering sub-types, organization sizes, deployment modes, verticals, and regions. Additionally, the study provides a comprehensive competitive analysis of major market players, delving into their company profiles, significant observations regarding product and business offerings, recent advancements, and key market strategies.

Reasons to buy this report

The report aims to assist market leaders and new entrants by providing near-accurate revenue estimates for the overall digital risk protection market and its subsegments. It offers insights into the competitive landscape, enabling stakeholders to gain a deeper understanding and better position their businesses while also aiding in developing appropriate go-to-market strategies. Furthermore, the report aids stakeholders in grasping the market dynamics, offering information on significant market drivers, constraints, challenges, and opportunities.

The report provides insights on the following pointers:

- The report offers insights into various aspects: As businesses increasingly recognize the critical importance of digital risk protection, there is a growing demand for comprehensive solutions and services in this domain. These encompass a range of tools that enable organizations to achieve secure and authentic connectivity. While challenges such as the need for alignment and technology integration are acknowledged, the report emphasizes the dynamic nature of digital risk protection technologies and evolving market trends. Additionally, it provides valuable insights into the future direction of the digital risk protection market.

- Product Development/Innovation: The report provides detailed insights into emerging technologies, research and development activities, and product and solution launches within the digital risk protection market.

- Market Development: The report offers extensive details regarding profitable markets, analyzing the digital risk protection market across diverse regions.

- Market Diversification: The report provides thorough information on newly developed products and solutions, unexplored geographical areas, recent advancements, and investments in the digital risk protection market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Microsoft(US), CISCO (US), Broadcom (US), Palo Alto Networks (US), Kaspersky (Russia), Rapid7 (US), Proofpoint (US), Trend Micro (Japan), Fortinet (US), RSA Security (US), Cyberark (US), Crowdstrike (US), Darktrace (UK), Forcepoint (US), Digital Shadows (US), Zerofox (US), Brandshield (US), Phishlabs (US), Lookingglass cyber solutions (US), CyberInt (Israel), Cybelangel (France) Safeguard Cyber (US), Axur (US), F-secure (Finland), Cofense (US), Exabeam (US), Dtex Systems (France), Menlo Security (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 PRIMARY DATA

- 2.1.1.1 Breakdown of primary interviews

- 2.1.1.2 Key insights from industry experts

- 2.1.2 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 2 APPROACH 1 (TOP-DOWN; SUPPLY SIDE): REVENUE FROM SOLUTIONS AND SERVICES IN DIGITAL RISK PROTECTION MARKET

- FIGURE 3 APPROACH 1 (TOP-DOWN; SUPPLY SIDE): MARKET ESTIMATION FLOWCHART AND CORRESPONDING SOURCES INVOLVED

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 4 APPROACH 2 (BOTTOM-UP; DEMAND SIDE): SHARE OF VERTICALS THROUGH OVERALL DIGITAL RISK PROTECTION SPENDING

- 2.3 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RECESSION IMPACT ANALYSIS

- FIGURE 6 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 7 DIGITAL RISK PROTECTION MARKET TO WITNESS FAST GROWTH DURING FORECAST PERIOD

- FIGURE 8 DIGITAL RISK PROTECTION MARKET: FASTEST-GROWING SEGMENTS, 2023-2028

- FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

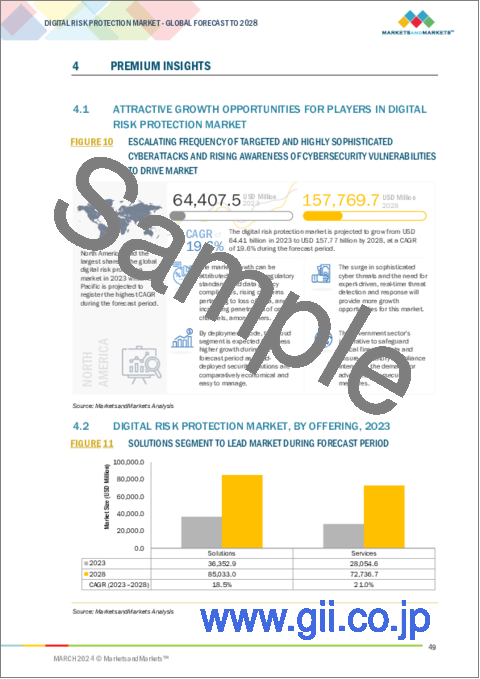

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DIGITAL RISK PROTECTION MARKET

- FIGURE 10 ESCALATING FREQUENCY OF TARGETED AND HIGHLY SOPHISTICATED CYBERATTACKS AND RISING AWARENESS OF CYBERSECURITY VULNERABILITIES TO DRIVE MARKET

- 4.2 DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023

- FIGURE 11 SOLUTIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023

- FIGURE 12 INCIDENT RESPONSE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023

- FIGURE 13 CLOUD SECURITY SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- 4.5 DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023

- FIGURE 14 LARGE ENTERPRISES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023

- FIGURE 15 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 4.7 DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023

- FIGURE 16 IT & ITES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.8 DIGITAL RISK PROTECTION MARKET, BY REGION

- FIGURE 17 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DIGITAL RISK PROTECTION MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing awareness of digital risk and compliance requirements

- 5.2.1.2 Automation and advanced threat detection capabilities

- 5.2.1.3 Adoption of cloud and remote work models

- 5.2.1.4 Expansion of digital footprint and attack surface

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical complexities and implementation challenges

- 5.2.2.2 Indifferent cost allocation and pricing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Continuous innovation and growth incorporating AI

- 5.2.3.2 Emerging market events

- 5.2.4 CHALLENGES

- 5.2.4.1 Limitations associated with seamless integration of digital risk protection solutions

- 5.2.4.2 Data privacy concerns prompting ethical considerations

- 5.2.4.3 Standard outcomes due to shortage of skilled professionals

- 5.3 CASE STUDIES

- 5.3.1 INNOVATIVE EMAIL ENCRYPTION SOLUTION BY SECLORE PROVIDES AMERICAN EXPRESS WITH ENHANCED SECURITY AND COMPLIANCE

- 5.3.2 GLOBAL BANK DEPLOYS VIRTUALIZATION SOLUTION OF SYSCOM TO STRENGTHEN EMAIL ENCRYPTION

- 5.3.3 ZEVA AND MICROSOFT INTRODUCE DECRYPTNABOX TO OVERCOME TRADITIONAL EMAIL ENCRYPTION CHALLENGES

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- 5.4.1 DIGITAL RISK PROTECTION PROVIDERS

- 5.4.2 TECHNOLOGY PROVIDERS

- 5.4.3 CONSULTANTS AND INTEGRATORS

- 5.4.4 REGULATORY BODIES AND COMPLIANCE STANDARDS ORGANIZATIONS

- 5.4.5 SECURITY RESEARCHERS AND COMMUNITIES

- 5.5 ECOSYSTEM MAPPING

- FIGURE 20 ECOSYSTEM MAPPING

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 PORTER'S FIVE FORCE ANALYSIS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING ANALYSIS, BY SOLUTION

- TABLE 5 INDICATIVE PRICING ANALYSIS, BY SOLUTION

- 5.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING TYPE

- FIGURE 22 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING TYPE

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGY

- 5.8.1.1 Incident response tools

- 5.8.1.2 Brand monitoring and protection

- 5.8.2 COMPLEMENTARY TECHNOLOGY

- 5.8.2.1 Data loss prevention

- 5.8.2.2 Security information and event management

- 5.8.3 ADJACENT TECHNOLOGY

- 5.8.3.1 Threat intelligence

- 5.8.1 KEY TECHNOLOGY

- 5.9 PATENT ANALYSIS

- FIGURE 23 PATENT ANALYSIS, 2013-2023

- FIGURE 24 PATENTS GRANTED, BY COUNTRY, 2013-2023

- TABLE 6 PATENT ANALYSIS, 2013-2023

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.13 KEY CONFERENCES AND EVENTS, 2024

- TABLE 14 KEY CONFERENCES AND EVENTS, 2024

- 5.14 BUSINESS MODEL ANALYSIS

- 5.14.1 SAAS-BASED INTEGRATED PLATFORM

- 5.14.2 THREAT-AS-A-SERVICE MODEL

- 5.14.3 API-DRIVEN INTEGRATION MODEL

- 5.14.4 OUTCOME-BASED PRICING MODEL

- 5.14.5 HYPER- SPECIALIZATION MODEL

- 5.15 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO

6 DIGITAL RISK PROTECTION MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 29 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 6.1.1 OFFERING: DIGITAL RISK PROTECTION MARKET DRIVERS

- TABLE 15 DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 16 DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 GROWING COMPLEXITY OF CYBER THREATS TO DRIVE DEMAND

- TABLE 17 SOLUTIONS: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 18 SOLUTIONS: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 RISING NEED FOR SPECIALIZED SERVICES TO COUNTER DIVERSE DIGITAL THREATS TO DRIVE MARKET

- TABLE 19 DIGITAL RISK PROTECTION MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 20 DIGITAL RISK PROTECTION MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 21 SERVICES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 SERVICES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

7 DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE

- 7.1 INTRODUCTION

- FIGURE 30 DARK WEB INTELLIGENCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 7.1.1 SOLUTION TYPE: DIGITAL RISK PROTECTION MARKET DRIVERS

- TABLE 23 DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 24 DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- 7.2 BRAND PROTECTION

- 7.2.1 SURGE IN ONLINE BRAND IMPERSONATION AND COUNTERFEIT ACTIVITIES TO DRIVE MARKET

- TABLE 25 BRAND PROTECTION: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 BRAND PROTECTION: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PHISHING PROTECTION

- 7.3.1 INCREASING SOPHISTICATION IN PHISHING ATTACKS TO DRIVE MARKET

- TABLE 27 PHISHING PROTECTION: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 PHISHING PROTECTION: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 INCIDENT RESPONSE

- 7.4.1 INCREASING COMPLEXITY AND FREQUENCY OF CYBER THREATS TO DRIVE MARKET

- TABLE 29 INCIDENT RESPONSE: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 INCIDENT RESPONSE: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 APP PROTECTION

- 7.5.1 RISE OF MOBILE BANKING, E-COMMERCE, AND ENTERPRISE APPLICATIONS TO DRIVE MARKET

- TABLE 31 APP PROTECTION: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 APP PROTECTION: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 DARK WEB INTELLIGENCE

- 7.6.1 NEED FOR EARLY DETECTION AND MITIGATION OF CYBER THREATS ORIGINATING FROM DARK WEB TO DRIVE MARKET

- TABLE 33 DARK WEB INTELLIGENCE: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 DARK WEB INTELLIGENCE: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 AUTOMATED THREAT MITIGATION

- 7.7.1 NEED FOR REAL-TIME RESPONSE TO CYBER THREATS AND VULNERABILITIES TO DRIVE MARKET

- TABLE 35 AUTOMATED THREAT MITIGATION: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 AUTOMATED THREAT MITIGATION: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.8 SUPPLY CHAIN SECURITY

- 7.8.1 INCREASING COMPLEXITY AND GLOBALIZATION OF SUPPLY CHAINS TO DRIVE MARKET

- TABLE 37 SUPPLY CHAIN SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 SUPPLY CHAIN SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.9 OTHER SOLUTION TYPES

- TABLE 39 OTHER SOLUTION TYPES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 OTHER SOLUTION TYPES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE

- 8.1 INTRODUCTION

- FIGURE 31 ENDPOINT & IOT SECURITY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 8.1.1 SECURITY TYPE: DIGITAL RISK PROTECTION MARKET DRIVERS

- TABLE 41 DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 42 DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

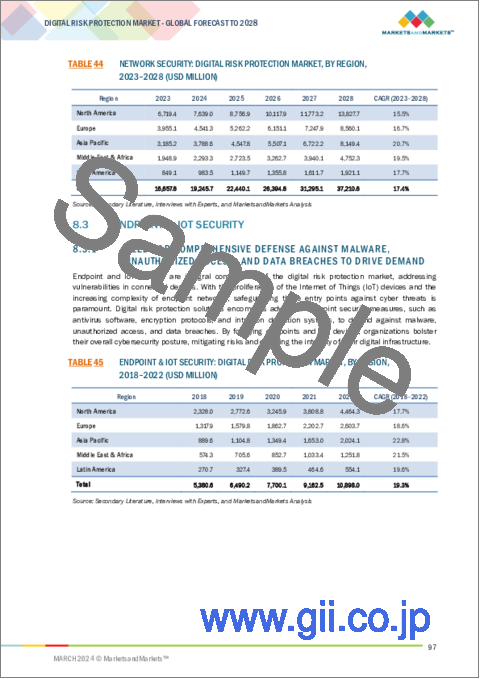

- 8.2 NETWORK SECURITY

- 8.2.1 INCREASING SOPHISTICATION OF CYBERATTACKS AND EXPANDING ATTACK SURFACE OF NETWORK INFRASTRUCTURE TO DRIVE MARKET

- TABLE 43 NETWORK SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 NETWORK SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 ENDPOINT & IOT SECURITY

- 8.3.1 NEED FOR COMPREHENSIVE DEFENSE AGAINST MALWARE, UNAUTHORIZED ACCESS, AND DATA BREACHES TO DRIVE DEMAND

- TABLE 45 ENDPOINT & IOT SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 ENDPOINT & IOT SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 CLOUD SECURITY

- 8.4.1 RAPID ADOPTION OF CLOUD SERVICES AND INCREASING NEED TO SECURE SENSITIVE DATA TO DRIVE MARKET

- TABLE 47 CLOUD SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 CLOUD SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 APPLICATION SECURITY

- 8.5.1 DEMAND FOR ROBUST APPLICATION SECURITY MEASURES TO DRIVE MARKET

- TABLE 49 APPLICATION SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 APPLICATION SECURITY: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- FIGURE 32 SMES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 9.1.1 ORGANIZATION SIZE: DIGITAL RISK PROTECTION MARKET DRIVERS

- TABLE 51 DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 52 DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 9.2 SMALL & MEDIUM-SIZED ENTERPRISES (SMES)

- 9.2.1 GROWING AWARENESS OF CYBERSECURITY RISKS TO DRIVE MARKET

- TABLE 53 SMES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 SMES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 LARGE ENTERPRISES

- 9.3.1 LARGE ENTERPRISES TO ADOPT COMPREHENSIVE DIGITAL RISK PROTECTION STRATEGY

- TABLE 55 LARGE ENTERPRISES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 LARGE ENTERPRISES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

10 DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE

- 10.1 INTRODUCTION

- FIGURE 33 ON-PREMISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 10.1.1 DEPLOYMENT MODE: DIGITAL RISK PROTECTION MARKET DRIVERS

- TABLE 57 DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 58 DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 10.2 CLOUD

- 10.2.1 INCREASING MIGRATION TO CLOUD-BASED INFRASTRUCTURE AND SERVICES TO DRIVE MARKET

- TABLE 59 CLOUD: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 CLOUD: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 ON-PREMISES

- 10.3.1 NEED FOR LOCALIZED CONTROL OVER SENSITIVE DATA AND COMPLIANCE REQUIREMENTS TO DRIVE MARKET

- TABLE 61 ON-PREMISES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 ON-PREMISES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

11 DIGITAL RISK PROTECTION MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 34 GOVERNMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 11.1.1 VERTICAL: DIGITAL RISK PROTECTION MARKET DRIVERS

- TABLE 63 DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 64 DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 BFSI

- 11.2.1 STRINGENCY REGULATORY ENVIRONMENT AND GROWING SUSCEPTIBILITY TO FINANCIAL CYBER THREATS TO DRIVE MARKET

- TABLE 65 BFSI: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 BFSI: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 IT & ITES

- 11.3.1 RAPID DIGITAL TRANSFORMATION AND INCREASING RELIANCE ON TECHNOLOGY INFRASTRUCTURE TO DRIVE MARKET

- TABLE 67 IT & ITES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 IT & ITES: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 GOVERNMENT

- 11.4.1 ESCALATING FREQUENCY AND SOPHISTICATION OF CYBERATTACKS TARGETING GOVERNMENT INSTITUTIONS TO DRIVE MARKET

- TABLE 69 GOVERNMENT: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 GOVERNMENT: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 HEALTHCARE

- 11.5.1 NEED TO SECURE SENSITIVE PATIENT DATA TO DRIVE MARKET

- TABLE 71 HEALTHCARE: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 HEALTHCARE: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 RETAIL & E-COMMERCE

- 11.6.1 EXPONENTIAL GROWTH OF ONLINE TRANSACTIONS AND HEIGHTENED RISK OF DATA BREACHES TO DRIVE MARKET

- TABLE 73 RETAIL & E-COMMERCE: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 RETAIL & E-COMMERCE: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.7 MEDIA & ENTERTAINMENT

- 11.7.1 RISING INSTANCES OF PIRACY, DEEPFAKES, AND DATA BREACHES TO DRIVE MARKET

- TABLE 75 MEDIA & ENTERTAINMENT: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 MEDIA & ENTERTAINMENT: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8 OTHER VERTICALS

- TABLE 77 OTHER VERTICALS: DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 OTHER VERTICALS: DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

12 DIGITAL RISK PROTECTION MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 35 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 79 DIGITAL RISK PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 DIGITAL RISK PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET DRIVERS

- 12.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 36 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET SNAPSHOT

- TABLE 81 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Rapid digitalization, escalating cyber threats, and evolving data privacy regulations to drive market

- TABLE 95 US: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 96 US: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 97 US: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 98 US: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 99 US: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 100 US: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 US: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 102 US: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 103 US: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 104 US: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 105 US: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 106 US: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.4 CANADA

- 12.2.4.1 Rapid digitalization, rising cyber threats, and evolving regulations to drive market

- TABLE 107 CANADA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 108 CANADA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 109 CANADA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 110 CANADA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 111 CANADA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 112 CANADA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 113 CANADA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 114 CANADA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 115 CANADA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 116 CANADA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 117 CANADA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 118 CANADA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: DIGITAL RISK PROTECTION MARKET DRIVERS

- 12.3.2 EUROPE: RECESSION IMPACT

- TABLE 119 EUROPE: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 120 EUROPE: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 121 EUROPE: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 122 EUROPE: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 123 EUROPE: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 124 EUROPE: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 125 EUROPE: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 126 EUROPE: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 127 EUROPE: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 128 EUROPE: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 129 EUROPE: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 130 EUROPE: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 131 EUROPE: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 132 EUROPE: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Increasing digitalization, heightened cyber threats, and evolving regulations to drive market

- TABLE 133 UK: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 134 UK: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 135 UK: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 136 UK: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 137 UK: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 138 UK: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 139 UK: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 140 UK: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 141 UK: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 142 UK: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 143 UK: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 144 UK: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Increasing reliance of businesses on digital technologies to drive market

- TABLE 145 GERMANY: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 146 GERMANY: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 147 GERMANY: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 148 GERMANY: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 149 GERMANY: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 150 GERMANY: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 151 GERMANY: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 152 GERMANY: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 153 GERMANY: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 154 GERMANY: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 155 GERMANY: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 156 GERMANY: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.5 FRANCE

- 12.3.5.1 Increasing adoption of digital technologies by businesses and proliferation of cyber threats to drive market

- TABLE 157 FRANCE: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 158 FRANCE: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 159 FRANCE: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 160 FRANCE: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 161 FRANCE: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 162 FRANCE: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 163 FRANCE: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 164 FRANCE: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 165 FRANCE: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 166 FRANCE: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 167 FRANCE: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 168 FRANCE: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Increasing awareness of digital threats and rising demand for compliance-focused solutions to drive market

- TABLE 169 ITALY: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 170 ITALY: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 171 ITALY: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 172 ITALY: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 173 ITALY: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 174 ITALY: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 175 ITALY: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 176 ITALY: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 177 ITALY: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 178 ITALY: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 179 ITALY: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 180 ITALY: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET DRIVERS

- 12.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 37 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET SNAPSHOT

- TABLE 181 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 188 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 189 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 190 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 192 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 193 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 194 ASIA PACIFIC: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 Continuous digitization and government cybersecurity initiatives to drive market

- TABLE 195 CHINA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 196 CHINA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 197 CHINA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 198 CHINA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 199 CHINA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 200 CHINA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 201 CHINA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 202 CHINA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 203 CHINA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 204 CHINA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 205 CHINA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 206 CHINA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Rising adoption of digital technologies to drive market

- TABLE 207 JAPAN: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 208 JAPAN: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 209 JAPAN: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 210 JAPAN: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 211 JAPAN: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 212 JAPAN: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 213 JAPAN: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 214 JAPAN: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 215 JAPAN: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 216 JAPAN: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 217 JAPAN: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 218 JAPAN: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.5 INDIA

- 12.4.5.1 Rising adoption of digital technologies across diverse sectors to drive market

- TABLE 219 INDIA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 220 INDIA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 221 INDIA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 222 INDIA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 223 INDIA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 224 INDIA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 225 INDIA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 226 INDIA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 227 INDIA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 228 INDIA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 229 INDIA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 230 INDIA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET DRIVERS

- 12.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 231 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.5.3 KSA

- 12.5.3.1 Increasing digitization of businesses and government services and rising cybersecurity concerns to drive market

- TABLE 245 KSA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 246 KSA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 247 KSA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 248 KSA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 249 KSA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 250 KSA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 251 KSA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 252 KSA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 253 KSA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 254 KSA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 255 KSA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 256 KSA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.5.4 UAE

- 12.5.4.1 Rapid digital transformation across industries and growing sophistication of cyber threats to drive market

- TABLE 257 UAE: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 258 UAE: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 259 UAE: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 260 UAE: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 261 UAE: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 262 UAE: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 263 UAE: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 264 UAE: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 265 UAE: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 266 UAE: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 267 UAE: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 268 UAE: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.5.5 SOUTH AFRICA

- 12.5.5.1 Growing adoption of cybersecurity measures by financial institutions to drive market

- TABLE 269 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 270 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 271 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 272 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 273 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 274 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 275 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 276 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 277 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 278 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 279 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 280 SOUTH AFRICA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.5.6 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET DRIVERS

- 12.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 281 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 282 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 283 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 284 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 285 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 286 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 287 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 288 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 289 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 290 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 291 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 292 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 293 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 294 LATIN AMERICA: DIGITAL RISK PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.6.3 BRAZIL

- 12.6.3.1 Strict data protection regulations to drive market

- TABLE 295 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 296 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 297 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 298 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 299 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 300 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 301 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 302 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 303 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 304 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 305 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 306 BRAZIL: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.6.4 MEXICO

- 12.6.4.1 Rapid digitization across several key sectors to drive market

- TABLE 307 MEXICO: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 308 MEXICO: DIGITAL RISK PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 309 MEXICO: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 310 MEXICO: DIGITAL RISK PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 311 MEXICO: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 312 MEXICO: DIGITAL RISK PROTECTION MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 313 MEXICO: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 314 MEXICO: DIGITAL RISK PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 315 MEXICO: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 316 MEXICO: DIGITAL RISK PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 317 MEXICO: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 318 MEXICO: DIGITAL RISK PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 319 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 REVENUE ANALYSIS, 2020-2022

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD MILLION)

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 39 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- TABLE 320 DIGITAL RISK PROTECTION MARKET: DEGREE OF COMPETITION

- 13.5 VALUATION AND FINANCIAL METRICS

- FIGURE 40 VALUATION AND FINANCIAL METRICS OF KEY DIGITAL RISK PROTECTION VENDORS, 2022

- 13.6 PRODUCT/BRAND COMPARISON

- FIGURE 41 PRODUCT/BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- FIGURE 42 COMPANY EVALUATION MATRIX, 2022

- 13.7.5 COMPANY FOOTPRINT

- TABLE 321 OFFERING FOOTPRINT

- TABLE 322 SOLUTION TYPE FOOTPRINT

- TABLE 323 VERTICAL FOOTPRINT

- TABLE 324 REGION FOOTPRINT

- FIGURE 43 COMPANY FOOTPRINT

- 13.8 START-UP/SME EVALUATION MATRIX

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- FIGURE 44 START-UP/SME EVALUATION MATRIX, 2022

- 13.8.5 COMPETITIVE BENCHMARKING

- TABLE 325 KEY START-UPS/SMES

- TABLE 326 OFFERING FOOTPRINT FOR KEY START-UPS/SMES

- TABLE 327 VERTICAL FOOTPRINT FOR KEY START-UPS/SMES

- TABLE 328 REGION FOOTPRINT FOR KEY START-UPS/SMES

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 329 DIGITAL RISK PROTECTION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2024

- 13.9.2 DEALS

- TABLE 330 DIGITAL RISK PROTECTION MARKET: DEALS, JANUARY 2021-FEBRUARY 2024

14 COMPANY PROFILES

- 14.1 MAJOR PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats)**

- 14.1.1 MICROSOFT

- TABLE 331 MICROSOFT: COMPANY OVERVIEW

- FIGURE 45 MICROSOFT: COMPANY SNAPSHOT

- TABLE 332 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 MICROSOFT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 334 MICROSOFT: DEALS

- 14.1.2 CISCO

- TABLE 335 CISCO: COMPANY OVERVIEW

- FIGURE 46 CISCO: COMPANY SNAPSHOT

- TABLE 336 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 CISCO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 338 CISCO: DEALS

- 14.1.3 BROADCOM

- TABLE 339 BROADCOM: COMPANY OVERVIEW

- FIGURE 47 BROADCOM: COMPANY SNAPSHOT

- TABLE 340 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 BROADCOM: DEALS

- 14.1.4 PALO ALTO NETWORKS

- TABLE 342 PALO ALTO NETWORKS: COMPANY OVERVIEW

- FIGURE 48 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- TABLE 343 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 PALO ALTO NETWORKS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 345 PALO ALTO NETWORKS: DEALS

- 14.1.5 KASPERSKY

- TABLE 346 KASPERSKY: COMPANY OVERVIEW

- TABLE 347 KASPERSKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 KASPERSKY: PRODUCT LAUNCHES/DEVELOPMENTS

- 14.1.6 RAPID7

- TABLE 349 RAPID7: COMPANY OVERVIEW

- FIGURE 49 RAPID7: COMPANY SNAPSHOT

- TABLE 350 RAPID7: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 351 RAPID7: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 352 RAPID7: DEALS

- 14.1.7 PROOFPOINT

- TABLE 353 PROOFPOINT: COMPANY OVERVIEW

- TABLE 354 PROOFPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 PROOFPOINT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 356 PROOFPOINT: DEALS

- 14.1.8 TREND MICRO

- TABLE 357 TREND MICRO: COMPANY OVERVIEW

- TABLE 358 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 TREND MICRO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 360 TREND MICRO: DEALS

- 14.1.9 FORTINET

- TABLE 361 FORTINET: COMPANY OVERVIEW

- FIGURE 50 FORTINET: COMPANY SNAPSHOT

- TABLE 362 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.10 RSA SECURITY

- TABLE 363 RSA SECURITY: COMPANY OVERVIEW

- TABLE 364 RSA SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 RSA SECURITY: PRODUCT LAUNCHES/DEVELOPMENTS

- 14.1.11 CYBERARK

- TABLE 366 CYBERARK: COMPANY OVERVIEW

- FIGURE 51 CYBERARK: COMPANY SNAPSHOT

- TABLE 367 CYBERARK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 368 CYBERARK: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 369 CYBERARK: DEALS

- 14.1.12 CROWDSTRIKE

- TABLE 370 CROWDSTRIKE: COMPANY OVERVIEW

- FIGURE 52 CROWDSTRIKE: COMPANY SNAPSHOT

- TABLE 371 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 372 CROWDSTRIKE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 373 CROWDSTRIKE: DEALS

- 14.1.13 DARKTRACE

- TABLE 374 DARKTRACE: COMPANY OVERVIEW

- TABLE 375 DARKTRACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 376 DARKTRACE: PRODUCT LAUNCHES/DEVELOPMENTS

- 14.1.14 FORCEPOINT

- TABLE 377 FORCEPOINT: COMPANY OVERVIEW

- TABLE 378 FORCEPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2 OTHER PLAYERS

- 14.2.1 DIGITAL SHADOWS

- 14.2.2 ZEROFOX

- 14.2.3 BRANDSHIELD

- 14.2.4 PHISHLABS

- 14.2.5 DEEPWATCH

- 14.2.6 CYBERINT

- 14.2.7 CYBELANGEL

- 14.2.8 SAFEGUARD CYBER

- 14.2.9 AXUR

- 14.2.10 F-SECURE

- 14.2.11 COFENSE

- 14.2.12 EXABEAM

- 14.2.13 DTEX SYSTEMS

- 14.2.14 MENLO SECURITY

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

15 ADJACENT MARKETS

- 15.1 INTRODUCTION

- TABLE 379 ADJACENT MARKETS

- 15.1.1 LIMITATIONS

- 15.2 PHISHING PROTECTION MARKET

- TABLE 380 PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 381 PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 382 PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 383 PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 15.3 AUTHENTICATION AND BRAND PROTECTION MARKET

- TABLE 384 AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 385 AUTHENTICATION AND BRAND PROTECTION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 386 AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 387 AUTHENTICATION AND BRAND PROTECTION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS