|

|

市場調査レポート

商品コード

1453086

航空機用ギアの世界市場:プラットフォーム・エンドユーザー・ギアタイプ・用途・地域別 - 予測(~2028年)Aircraft Gears Market by Platform (Commercial, Military), End User (OEM, Aftermarket), Gear Types (Spur, Helical, Bevel, Rack and Pinion), Application (APU, Actuators, Pumps, Air Conditioning Compressor) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 航空機用ギアの世界市場:プラットフォーム・エンドユーザー・ギアタイプ・用途・地域別 - 予測(~2028年) |

|

出版日: 2024年03月08日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

航空機用ギアの市場規模は、予測期間中に4.4%のCAGRで推移し、2023年の3億2,500万米ドルから、2028年には4億300万米ドルの規模に成長すると予測されています。

モジュール設計、歯形、複合材料など、ギアにおける絶え間ない技術革新が、民間航空と軍用航空におけるギアアップグレードの需要を推進しています。航空機のシームレスなオペレーションに対する需要の拡大が同市場を推進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | プラットフォーム・エンドユーザー・ギアタイプ・用途別 |

| 対象地域 | アジア太平洋・欧州・北米 |

エンドユーザー別では、OEMの部門が予測期間中に最大のCAGRを維持する見込み:

民間および軍用航空に対する世界の需要の増加がOEM部門の成長を牽引しています。航空機メーカーがより高い納入率と生産率を経験するにつれて、航空機用ギアの統合への需要が増加しています。航空会社は、全体的な運用効率を向上させ、航空機の信頼性を高め、オペレーターの経験を向上させるギアを求めています。航空機メーカーが競争力を維持するためには、このような操作性の向上を実現する航空機用ギアが不可欠となります。

プラットフォーム別では、民間航空の部門が2023年にもっとも高いシェアを示す:

主要な参入事業者は、この市場での新たな機会を模索するために、先進的な民間航空機用ギアの開発に積極的に従事しています。民間航空部門でのギアの需要は、主に燃料効率と排出量削減へのニーズの高まりによって牽引されています。より軽量で耐久性の高いギアを製造することを目的とした、材料と製造プロセスにおける技術的進歩は、航空機の性能と運用効率を高める上で極めて重要です。加えて、航空需要の増加による世界の航空機保有機数の増加は、強固なアフターマーケットサービスを必要とし、航空機用ギア市場をさらに活性化させています。

"ギアタイプ別では、 スパーギアセグメントが2023年にもっとも高い市場シェアを占める見込み"

ギアタイプに基づき、航空機用ギア市場はさらにスパーギア、ベベルギア、ヘリカルギア、ラック&ピニオンギア、その他に区分されます。航空機用ギア市場における平ギアセグメントの成長は、主に様々な航空機システムの効率的な動力伝達を確保する上で不可欠な役割によって牽引されています。平ギアはシンプルで信頼性が高く、製造が容易なため、航空業界にとって費用対効果の高いソリューションとして支持されています。飛行制御や推進などの重要なシステムでの使用には、高速運転に耐え、騒音レベルを最小化する精密工学が要求されます。

"北米が2023年にもっとも高い市場シェアを占める見込み"

北米の国防予算は軍の近代化努力を支援し、軍用機に先進システムを組み込むことにつながっています。戦闘機、偵察機、その他の軍事プラットフォーム用ギアの需要は、主要な促進要因の1つです。北米の航空業界は、既存の航空機が多いため、ギアのアップグレードや改修に大きな重点を置いています。航空会社や運航会社は、古い航空機の近代化ソリューションを求めており、性能と進化する規制への準拠を強化するための後付けギアの需要を牽引しています。北米は米国とカナダを市場分析対象としています。北米では、ボーイングのような大手航空機メーカーが次世代航空機プログラムに継続的に投資しています。ボーイング737 MAXやエアバスA320neoファミリーのような先進的なプラットフォームの開発は、強化された機能を持つ航空機用ギアの機会を生み出しています。ギアメーカーとボーイングやエアバスのような大手航空機メーカーとの戦略的パートナーシップや協力関係は、航空機用ギア市場の成長に貢献しています。共同イニシアチブは、特定の航空機モデルに合わせた革新的な航空機用ギアの開発につながることが多いです。

当レポートでは、世界の航空機用ギアの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向とディスラプション

- 航空機用ギア市場の技術ロードマップ

- エコシステムマッピング

- 航空機用ギアの総所有コスト

- ビジネスモデル

- 航空機用ギアの材料表

- 価格分析

- 技術分析

- 規制状況

- 貿易分析

- 主要なステークホルダーと購入基準

- 主要な会議とイベント

- 使用事例の分析

- 運用データ

第6章 業界の動向

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

第7章 航空機用ギア市場:エンドユーザー別

- OEM

- アフターマーケット

第8章 航空機用ギア市場:ギアタイプ別

- スパーギア

- ベベルギア

- ヘリカルギア

- ラックアンドピニオンギア

- その他

第9章 航空機用ギア市場:用途別

- 補助電源ユニット

- アクチュエーター

- 飛行制御システム

- スラストリバーサーアクチュエーション

- 燃料貯蔵・分配システム

- ペイロード管理システム

- 発電システム

- ポンプ

- 空調コンプレッサー

- その他

第10章 航空機用ギア市場:プラットフォーム別

- 民間航空

- ナローボディ機

- ワイドボディ機

- 地域輸送機

- 一般航空

- ビジネスジェット

- 商用ヘリコプター

- 軍用航空

- 戦闘機

- 輸送機

- 特別任務航空機

- 軍用ヘリコプター

第11章 航空機用ギア市場:地域別

- 地域不況の影響分析

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

第12章 競合情勢

- 主要企業の採用戦略

- 市場シェア分析

- ランキング分析

- 収益分析

- 企業評価マトリックス

- 新興企業/中小企業評価マトリックス

- ブランド/製品の比較

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ARROW GEAR

- PRECIPART

- BATOM CO., LTD.

- GEAR MOTIONS

- GIBBS GEARS

- STD PRECISION GEAR AND INSTRUMENT

- TRIUMPH GROUP

- DELTA GEAR

- SHANGHAI BELON MACHINERY CO., LTD.

- BMT AEROSPACE

- WM BERG INC.

- AMERICAN PRECISION GEAR CO., INC.

- RILEY GEAR CORP

- HANLOO CO., LTD.

- SCHAFER INDUSTRIES

- AMERICAN GEAR, INC.

- CIRCLE & GEAR MACHINE CO., INC.

- その他の企業

- XIAMEN KANGFUXIANG MACHINERY CO., LTD.

- BEVEL GEARS (INDIA) PVT. LTD.

- CURTIS MACHINE COMPANY

- THE ADAMS COMPANY

- SACHA TECHNOFORGE PVT. LTD.

- KOHARA GEAR INDUSTRY CO., LTD.

- ATLAS GEAR COMPANY

- COMPAX, INC.

第14章 付録

The aircraft gears market is estimated to grow from USD 325 million in 2023, to USD 403 million in 2028, at a CAGR of 4.4%. Constant innovation in gears, such as modular designs, tooth profiles, and composite materials fuels the demand for upgraded gears across both commercial and military aviation. The increasing demand for seamless operation in aircraft, driven by efficiency requirements, propels the market for aircraft gears.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform, End User, Gear Type and Application |

| Regions covered | Asia Pacific, Europe, and North America |

"OEM segment by end user is expected to hold the highest CAGR during the forecast period."

Based on end user, the aircraft gears market is categorized into OEM and aftermarket. The increasing global demand for commercial and military aviation drives the OEM aircraft gears market. As aircraft manufacturers experience higher delivery and production rates, the demand for integrated aircraft gears grows. Airlines seek gears that improve overall operational efficiency, increase aircraft reliability, and enhance operator's experience. Aircraft gears that offer such operational enhancements become crucial for aircraft manufacturers to remain competitive. Overall, both OEM and aftermarket segments are crucial for the sustainable growth of the aircraft gears market.

"Commercial Aviation segment by platform is estimated to hold the highest market share in 2023."

Based on Platform, the market is further divided into military aviation, and commercial aviation. Major industry players are actively engaged in developing advanced commercial aviation aircraft gears to explore emerging opportunities in this market. The commercial aviation sector's demand for aircraft gears is primarily driven by the growing need for fuel efficiency and reduced emissions. Technological advancements in materials and manufacturing processes, aimed at producing lighter and more durable gears, are crucial to enhancing aircraft performance and operational efficiency. Additionally, the growing global aircraft fleet size, driven by increased air travel demand, necessitates robust aftermarket services, further fueling the aircraft gears market.

"Spur gears by gear type segment is expected to hold the highest market share in 2023."

Based on gear type, the aircraft gears market is further segmented into spur gears, bevel gears, helical gears, rack and pinion gears, and others. The growth of the spur gears segment within the aircraft gears market is primarily driven by their essential role in ensuring efficient power transmission for various aircraft systems. Spur gears are favored for their simplicity, reliability, and ease of manufacture, making them a cost-effective solution for the aviation industry. Their application in critical systems, such as flight control and propulsion, demands precision engineering to withstand high-speed operations and minimize noise levels.

"North America is expected to hold the highest market share in 2023."

Defense budgets in North America support military modernization efforts, leading to the incorporation of advanced systems in military aircraft. The demand for gear for fighter jets, surveillance aircraft, and other military platforms is one of the major drivers. With a substantial existing fleet, the North American aviation industry places significant emphasis on gears upgrades and retrofits. Airlines and operators seek modernization solutions for older aircraft, driving the demand for retrofit gears to enhance performance and compliance with evolving regulations. North America covers the US and Canada for market analysis. In North America, major aircraft manufacturers like Boeing continually invest in next-generation aircraft programs. The development of advanced platforms, such as the Boeing 737 MAX and Airbus A320neo families, creates opportunities for aircraft gears with enhanced capabilities. The strategic partnerships and collaborations between gears manufacturers and major aircraft manufacturers like Boeing and Airbus contribute to the growth of the aircraft gears market. Joint initiatives often lead to the development of innovative aircraft gears tailored to specific aircraft models.

The break-up of the profile of primary participants in the Avionics market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 40%, Director Level - 25%, Others - 35%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 25%, & Rest of the World - 10%

Arrow Gear (US), Precipart (US), Batom Co. Ltd (Taiwan), Gear Motions (US), Gibbs Gears (UK). These key players offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America.

Research Coverage:

In terms of End User, the aircraft gears market is divided into OEM and Aftermarket. The end user segment of the aircraft gears market is OEM and Aftermarket.

The Platform based segmentation includes commercial aviation and military aviation.

Based on Gear type, the aircraft gears market is further segmented into Spur Gears, Helical Gears, Bevel Gears, Rack and Pinion Gears, and Others.

Based on Application, the aircraft gears market is further segmented into Auxiliary Power Unit, Actuators, Pumps, Air Conditioning Compressors, and Others

This report segments the Avionics market across six key regions: North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America, along with their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the aircraft gears market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, new product launches, contracts, expansions, acquisitions, and partnerships associated with the aircraft gears market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the aircraft gears market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights on the following pointers:

- Analysis of the key driver (Escalating Aircraft Production Driving aircraft gears market, Growing fleets of commercial and military aviation, restraint (Stringent Regulatory Compliance, Material supply chain vulnerabilities) opportunities (Economic growth provides new opportunities) and challenges (Complex design and integration of new materials and eenvironmental durability and corrosion) there are several factors that could contribute to an increase in the avionics market.

- Market Penetration: Comprehensive information on aircraft gears offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aircraft gears market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aircraft gears market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aircraft gears market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the aircraft gears market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AIRCRAFT GEARS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.2 RECESSION IMPACT ANALYSIS

- 2.2.1 DEMAND-SIDE ANALYSIS

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.3 FACTOR ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE INDICATORS

- 2.3.3 SUPPLY-SIDE INDICATORS

- 2.4 MARKET SIZE ESTIMATION AND METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 GROWTH RATE ASSUMPTIONS

- 2.6.2 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

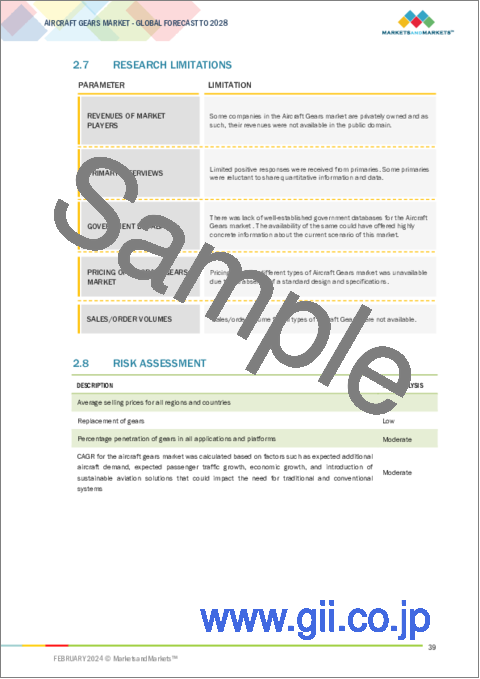

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 ORIGINAL EQUIPMENT MANUFACTURERS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 MILITARY AVIATION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 9 BEVEL GEARS SEGMENT TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 ACTUATORS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO BE LARGEST MARKET FOR AIRCRAFT GEARS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT GEARS MARKET

- FIGURE 12 INCREASING GLOBAL DEMAND FOR AIRCRAFT DELIVERIES AND GROWING PASSENGER TRAFFIC TO DRIVE MARKET

- 4.2 AIRCRAFT GEARS MARKET, BY END USER

- FIGURE 13 ORIGINAL EQUIPMENT MANUFACTURERS TO SURPASS AFTERMARKET DURING FORECAST PERIOD

- 4.3 AIRCRAFT GEARS MARKET, BY PLATFORM

- FIGURE 14 COMMERCIAL AVIATION TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- 4.4 AIRCRAFT GEARS MARKET, BY GEAR TYPE

- FIGURE 15 SPUR GEARS SEGMENT TO ACQUIRE MAXIMUM SHARE IN 2028

- 4.5 AIRCRAFT GEARS MARKET, BY COUNTRY

- FIGURE 16 SAUDI ARABIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 AIRCRAFT GEARS MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in global air travel demand

- FIGURE 18 AIRCRAFT DELIVERIES, BY BOEING AND AIRBUS, 2019-2023

- 5.2.1.2 Preference for enhanced aircraft performance

- 5.2.1.3 Technological advancements in aircraft gear manufacturing

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory and certification requirements

- 5.2.2.2 Supply chain vulnerabilities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapidly expanding global economy

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex design and integration of new materials

- 5.2.4.2 Environmental durability concerns

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIALS

- 5.3.2 R&D

- 5.3.3 COMPONENT MANUFACTURING

- 5.3.4 END USERS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 TECHNOLOGICAL ROADMAP OF AIRCRAFT GEARS MARKET

- FIGURE 21 INTRODUCTION TO TECHNOLOGY ROADMAP OF AIRCRAFT GEARS MARKET

- FIGURE 22 EVOLUTION OF KEY TECHNOLOGIES IN AIRCRAFT GEARS MARKET

- FIGURE 23 EMERGING TRENDS IN AIRCRAFT GEARS MARKET

- 5.6 ECOSYSTEM MAPPING

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- FIGURE 24 ECOSYSTEM MAPPING

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- 5.7 TOTAL COST OF OWNERSHIP OF AIRCRAFT GEARS

- FIGURE 25 TOTAL COST OF OWNERSHIP OF AIRCRAFT GEARS

- TABLE 4 TOTAL COST OF OWNERSHIP OF AIRCRAFT GEARS

- 5.8 BUSINESS MODELS

- 5.9 BILL OF MATERIALS OF AIRCRAFT GEARS

- FIGURE 26 BILL OF MATERIALS OF AIRCRAFT GEARS

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- TABLE 5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION (USD)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION (USD)

- 5.10.2 AVERAGE SELLING PRICE TREND, BY REGION (USD)

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY REGION, 2018-2023 (USD)

- 5.10.3 INDICATIVE PRICING ANALYSIS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 DATA ANALYTICS AND MANAGEMENT

- 5.11.2 GEAR GRINDING TECHNOLOGY

- 5.12 REGULATORY LANDSCAPE

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TRADE ANALYSIS

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 11 IMPORT DATA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 12 EXPORT DATA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT GEARS, BY PLATFORM

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT GEARS, BY PLATFORM (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR AIRCRAFT GEARS, BY PLATFORM

- TABLE 14 KEY BUYING CRITERIA FOR AIRCRAFT GEARS, BY PLATFORM

- 5.15 KEY CONFERENCES AND EVENTS, 2024

- TABLE 15 KEY CONFERENCES AND EVENTS, 2024

- 5.16 USE CASE ANALYSIS

- 5.16.1 INDUCTION CONTOUR HARDENING FOR GEAR WHEELS

- 5.16.2 USE OF COMPOSITE MATERIALS IN GEAR SYSTEMS

- 5.17 OPERATIONAL DATA

- 5.17.1 AIRCRAFT DELIVERIES, 2019-2028

- TABLE 16 GLOBAL AIRCRAFT DELIVERIES, BY PLATFORM (UNITS)

- TABLE 17 GLOBAL AIRCRAFT DELIVERIES, BY AIRCRAFT MODEL (UNITS)

- 5.17.2 ACTIVE AIRCRAFT FLEETS, 2019-2028

- TABLE 18 GLOBAL ACTIVE AIRCRAFT FLEETS, BY PLATFORM (UNITS)

- TABLE 19 REGIONAL ACTIVE AIRCRAFT FLEETS, BY PLATFORM (UNITS)

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 ADVANCED MATERIALS

- 6.2.2 ADDITIVE MANUFACTURING

- 6.2.3 GEAR TOOTH DESIGN

- 6.2.4 ADVANCED COATING AND SURFACE ANALYSIS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 INDUSTRY 4.0

- 6.3.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 33 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

- FIGURE 34 PATENT ANALYSIS

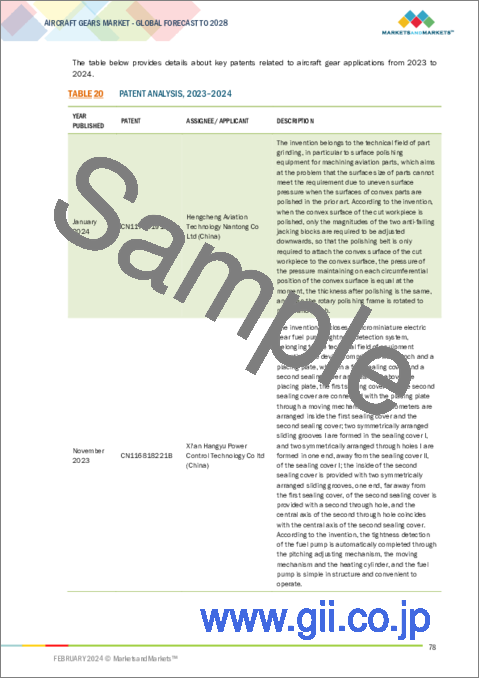

- TABLE 20 PATENT ANALYSIS, 2023-2024

7 AIRCRAFT GEARS MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 35 AIRCRAFT GEARS MARKET, BY END USER, 2023-2028

- TABLE 21 AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 22 AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 7.2 ORIGINAL EQUIPMENT MANUFACTURERS

- 7.2.1 GROWING STRATEGIC PARTNERSHIPS WITH TECHNOLOGY PROVIDERS TO DRIVE MARKET

- 7.3 AFTERMARKET

- 7.3.1 INCREASING AGE OF GLOBAL AIRCRAFT FLEET TO DRIVE MARKET

8 AIRCRAFT GEARS MARKET, BY GEAR TYPE

- 8.1 INTRODUCTION

- FIGURE 36 AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028

- TABLE 23 AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 24 AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- TABLE 25 AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (UNITS)

- TABLE 26 AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (UNITS)

- 8.2 SPUR GEARS

- 8.2.1 FOCUS ON FUEL EFFICIENCY AND NOISE REDUCTION TO DRIVE MARKET

- 8.3 BEVEL GEARS

- 8.3.1 ADVANCEMENTS IN MATERIAL SCIENCES TO DRIVE MARKET

- 8.4 HELICAL GEARS

- 8.4.1 INTRODUCTION OF NEXT-GENERATION AIRCRAFT TO DRIVE MARKET

- 8.5 RACK AND PINION GEARS

- 8.5.1 NEED FOR ACCURATE ACTUATION SYSTEMS TO DRIVE MARKET

- 8.6 OTHER GEARS

9 AIRCRAFT GEARS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 AIRCRAFT GEARS MARKET, BY APPLICATION, 2023-2028

- TABLE 27 AIRCRAFT GEARS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 28 AIRCRAFT GEARS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 AUXILIARY POWER UNITS

- 9.2.1 INCREASING DEMAND FOR ENHANCED OPERATIONAL EFFICIENCY AND REDUCED ENVIRONMENTAL IMPACT TO DRIVE MARKET

- 9.3 ACTUATORS

- TABLE 29 AIRCRAFT GEARS MARKET, BY ACTUATOR, 2019-2022 (USD MILLION)

- TABLE 30 AIRCRAFT GEARS MARKET, BY ACTUATOR, 2023-2028 (USD MILLION)

- 9.3.1 FLIGHT CONTROL SYSTEMS

- 9.3.1.1 Need for stabilization of aircraft to drive market

- 9.3.2 THRUST REVERSER ACTUATION

- 9.3.2.1 Innovations in materials and actuation mechanisms to drive market

- 9.3.3 FUEL STORAGE AND DISTRIBUTION SYSTEMS

- 9.3.3.1 Developments in lightweight actuators to drive market

- 9.3.4 PAYLOAD MANAGEMENT SYSTEMS

- 9.3.4.1 Aviation industry's focus on enhancing aircraft efficiency and operational flexibility to drive market

- 9.3.5 POWER GENERATION SYSTEMS

- 9.3.5.1 Rapid adoption of electric aircraft to drive market

- 9.4 PUMPS

- 9.4.1 GROWING EMPHASIS ON FUEL EFFICIENCY AND AIRCRAFT PERFORMANCE TO DRIVE MARKET

- 9.5 AIR CONDITIONING COMPRESSORS

- 9.5.1 RISING GLOBAL AIR TRAVEL TO DRIVE MARKET

- 9.6 OTHER APPLICATIONS

10 AIRCRAFT GEARS MARKET, BY PLATFORM

- 10.1 INTRODUCTION

- FIGURE 38 AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028

- TABLE 31 AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 32 AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 10.2 COMMERCIAL AVIATION

- TABLE 33 AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2019-2022 (USD MILLION)

- TABLE 34 AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2023-2028 (USD MILLION)

- 10.2.1 NARROW-BODY AIRCRAFT

- 10.2.1.1 Surge in long-haul flights to drive market

- 10.2.2 WIDE-BODY AIRCRAFT

- 10.2.2.1 High demand for enhanced features from pilots to drive market

- 10.2.3 REGIONAL TRANSPORT AIRCRAFT

- 10.2.3.1 Large-scale orders from regional airline operators to drive market

- 10.2.4 GENERAL AVIATION

- 10.2.4.1 Need to retrofit and upgrade existing aircraft with advanced gear systems to drive market

- 10.2.5 BUSINESS JETS

- 10.2.5.1 Expanding private aviation companies to drive market

- 10.2.6 COMMERCIAL HELICOPTERS

- 10.2.6.1 Air ambulances, cargo transportation, aerial photography applications to drive market

- 10.3 MILITARY AVIATION

- TABLE 35 AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2019-2022 (USD MILLION)

- TABLE 36 AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2023-2028 (USD MILLION)

- 10.3.1 FIGHTER AIRCRAFT

- 10.3.1.1 Rising geopolitical tensions worldwide to drive market

- 10.3.2 TRANSPORT AIRCRAFT

- 10.3.2.1 Increasing utilization in military operations to drive market

- 10.3.3 SPECIAL MISSION AIRCRAFT

- 10.3.3.1 Focus on disaster management and climate monitoring to drive market

- 10.3.4 MILITARY HELICOPTERS

- 10.3.4.1 Combat search and rescue, medical evacuation, and airborne command post operations to drive market

11 AIRCRAFT GEARS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 39 AIRCRAFT GEARS MARKET, BY REGION, 2023-2028

- TABLE 37 AIRCRAFT GEARS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 AIRCRAFT GEARS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 39 REGIONAL RECESSION IMPACT ANALYSIS

- 11.3 NORTH AMERICA

- 11.3.1 RECESSION IMPACT ANALYSIS

- 11.3.2 PESTLE ANALYSIS

- FIGURE 40 NORTH AMERICA: AIRCRAFT GEARS MARKET SNAPSHOT

- TABLE 40 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2019-2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2023-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2019-2022 (USD MILLION)

- TABLE 49 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2023-2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: AIRCRAFT GEARS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.3 US

- 11.3.3.1 Rising passenger traffic to drive market

- TABLE 54 US: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 55 US: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 56 US: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 57 US: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 58 US: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 59 US: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.3.4 CANADA

- 11.3.4.1 Growing business aviation demand to drive market

- TABLE 60 CANADA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 61 CANADA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 62 CANADA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 63 CANADA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 64 CANADA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 65 CANADA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 RECESSION IMPACT ANALYSIS

- 11.4.2 PESTLE ANALYSIS

- FIGURE 41 EUROPE: AIRCRAFT GEARS MARKET SNAPSHOT

- TABLE 66 EUROPE: AIRCRAFT GEARS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 67 EUROPE: AIRCRAFT GEARS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 68 EUROPE: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 69 EUROPE: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 70 EUROPE: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 71 EUROPE: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 72 EUROPE: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2019-2022 (USD MILLION)

- TABLE 73 EUROPE: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2023-2028 (USD MILLION)

- TABLE 74 EUROPE: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2019-2022 (USD MILLION)

- TABLE 75 EUROPE: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2023-2028 (USD MILLION)

- TABLE 76 EUROPE: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 77 EUROPE: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- TABLE 78 EUROPE: AIRCRAFT GEARS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 79 EUROPE: AIRCRAFT GEARS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.3 UK

- 11.4.3.1 Increasing purchases of new aircraft to drive market

- TABLE 80 UK: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 81 UK: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 82 UK: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 83 UK: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 84 UK: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 85 UK: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.4.4 FRANCE

- 11.4.4.1 Rising investments in development and production of new aircraft to drive market

- TABLE 86 FRANCE: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 87 FRANCE: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 88 FRANCE: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 89 FRANCE: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 90 FRANCE: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 91 FRANCE: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.4.5 GERMANY

- 11.4.5.1 Surge in equipment modernization programs to drive market

- TABLE 92 GERMANY: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 93 GERMANY: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 94 GERMANY: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 95 GERMANY: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 96 GERMANY: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 97 GERMANY: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.4.6 RUSSIA

- 11.4.6.1 Growing procurement of new military aircraft to drive market

- TABLE 98 RUSSIA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 99 RUSSIA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 100 RUSSIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 101 RUSSIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 102 RUSSIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 103 RUSSIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.4.7 REST OF EUROPE

- TABLE 104 REST OF EUROPE: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.5 ASIA PACIFIC

- 11.5.1 RECESSION IMPACT ANALYSIS

- 11.5.2 PESTLE ANALYSIS

- FIGURE 42 ASIA PACIFIC: AIRCRAFT GEARS MARKET SNAPSHOT

- TABLE 110 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2019-2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2023-2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2019-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2023-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.3 CHINA

- 11.5.3.1 Booming domestic airline business to drive market

- TABLE 124 CHINA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 125 CHINA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 126 CHINA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 127 CHINA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 128 CHINA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 129 CHINA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.5.4 INDIA

- 11.5.4.1 Indigenous manufacturing of aircraft to drive market

- TABLE 130 INDIA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 131 INDIA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 132 INDIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 133 INDIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 134 INDIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 135 INDIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.5.5 JAPAN

- 11.5.5.1 Development of new aircraft technologies to drive market

- TABLE 136 JAPAN: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 137 JAPAN: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 138 JAPAN: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 139 JAPAN: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 140 JAPAN: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 141 JAPAN: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.5.6 SOUTH KOREA

- 11.5.6.1 Rise in air cargo operations to drive market

- TABLE 142 SOUTH KOREA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 143 SOUTH KOREA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 144 SOUTH KOREA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 145 SOUTH KOREA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 146 SOUTH KOREA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 147 SOUTH KOREA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.5.7 AUSTRALIA

- 11.5.7.1 Ongoing replacement of older aircraft fleets to drive market

- TABLE 148 AUSTRALIA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 149 AUSTRALIA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 150 AUSTRALIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 151 AUSTRALIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 152 AUSTRALIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 153 AUSTRALIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.5.8 REST OF ASIA PACIFIC

- TABLE 154 REST OF ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.6 MIDDLE EAST

- 11.6.1 RECESSION IMPACT ANALYSIS

- 11.6.2 PESTLE ANALYSIS

- FIGURE 43 MIDDLE EAST: AIRCRAFT GEARS MARKET SNAPSHOT

- TABLE 160 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 163 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 164 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 165 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 166 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2019-2022 (USD MILLION)

- TABLE 167 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2023-2028 (USD MILLION)

- TABLE 168 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2019-2022 (USD MILLION)

- TABLE 169 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2023-2028 (USD MILLION)

- TABLE 170 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 171 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- TABLE 172 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 173 MIDDLE EAST: AIRCRAFT GEARS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.3 UAE

- 11.6.3.1 Growing export of aircraft equipment to drive market

- TABLE 174 UAE: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 175 UAE: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 176 UAE: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 177 UAE: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 178 UAE: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 179 UAE: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.6.4 SAUDI ARABIA

- 11.6.4.1 Increasing investments in domestic aviation industry to drive market

- TABLE 180 SAUDI ARABIA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 181 SAUDI ARABIA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 182 SAUDI ARABIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 183 SAUDI ARABIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 184 SAUDI ARABIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 185 SAUDI ARABIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.6.5 REST OF MIDDLE EAST

- TABLE 186 REST OF MIDDLE EAST: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 188 REST OF MIDDLE EAST: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 191 REST OF MIDDLE EAST: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.7 LATIN AMERICA

- 11.7.1 RECESSION IMPACT ANALYSIS

- 11.7.2 PESTLE ANALYSIS

- FIGURE 44 LATIN AMERICA: AIRCRAFT GEARS MARKET SNAPSHOT

- TABLE 192 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 195 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 197 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2019-2022 (USD MILLION)

- TABLE 199 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2023-2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2019-2022 (USD MILLION)

- TABLE 201 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2023-2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 203 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 205 LATIN AMERICA: AIRCRAFT GEARS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.7.3 BRAZIL

- 11.7.3.1 Expanding commercial fleets to drive market

- TABLE 206 BRAZIL: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 207 BRAZIL: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 208 BRAZIL: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 209 BRAZIL: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 210 BRAZIL: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 211 BRAZIL: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.7.4 MEXICO

- 11.7.4.1 Growth in aerospace manufacturing to drive market

- TABLE 212 MEXICO: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 213 MEXICO: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 214 MEXICO: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 215 MEXICO: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 216 MEXICO: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 217 MEXICO: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.7.5 REST OF LATIN AMERICA

- TABLE 218 REST OF LATIN AMERICA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 219 REST OF LATIN AMERICA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 220 REST OF LATIN AMERICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 221 REST OF LATIN AMERICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 222 REST OF LATIN AMERICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 223 REST OF LATIN AMERICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.8 AFRICA

- 11.8.1 RECESSION IMPACT ANALYSIS

- 11.8.2 PESTLE ANALYSIS

- FIGURE 45 AFRICA: AIRCRAFT GEARS MARKET SNAPSHOT

- TABLE 224 AFRICA: AIRCRAFT GEARS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 225 AFRICA: AIRCRAFT GEARS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 226 AFRICA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 227 AFRICA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 228 AFRICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 229 AFRICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 230 AFRICA: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2019-2022 (USD MILLION)

- TABLE 231 AFRICA: AIRCRAFT GEARS MARKET, BY COMMERCIAL AVIATION, 2023-2028 (USD MILLION)

- TABLE 232 AFRICA: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2019-2022 (USD MILLION)

- TABLE 233 AFRICA: AIRCRAFT GEARS MARKET, BY MILITARY AVIATION, 2023-2028 (USD MILLION)

- TABLE 234 AFRICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 235 AFRICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- TABLE 236 AFRICA: AIRCRAFT GEARS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 237 AFRICA: AIRCRAFT GEARS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.8.3 SOUTH AFRICA

- 11.8.3.1 Increasing use of private jets for business travel to drive market

- TABLE 238 SOUTH AFRICA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 239 SOUTH AFRICA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 240 SOUTH AFRICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 241 SOUTH AFRICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 242 SOUTH AFRICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 243 SOUTH AFRICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.8.4 NIGERIA

- 11.8.4.1 Growing commercial aviation industry to drive market

- TABLE 244 NIGERIA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 245 NIGERIA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 246 NIGERIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 247 NIGERIA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 248 NIGERIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 249 NIGERIA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

- 11.8.5 REST OF AFRICA

- TABLE 250 REST OF AFRICA: AIRCRAFT GEARS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 251 REST OF AFRICA: AIRCRAFT GEARS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 252 REST OF AFRICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 253 REST OF AFRICA: AIRCRAFT GEARS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 254 REST OF AFRICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2019-2022 (USD MILLION)

- TABLE 255 REST OF AFRICA: AIRCRAFT GEARS MARKET, BY GEAR TYPE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 256 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS, 2022

- FIGURE 46 MARKET SHARE OF KEY PLAYERS, 2022

- TABLE 257 AIRCRAFT GEARS MARKET: DEGREE OF COMPETITION

- 12.4 RANKING ANALYSIS, 2022

- FIGURE 47 MARKET RANKING OF KEY PLAYERS, 2022

- 12.5 REVENUE ANALYSIS, 2020-2022

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD MILLION)

- 12.6 COMPANY EVALUATION MATRIX, 2022

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- 12.6.5 COMPANY FOOTPRINT

- TABLE 258 COMPANY FOOTPRINT

- TABLE 259 PLATFORM FOOTPRINT

- TABLE 260 GEAR TYPE FOOTPRINT

- TABLE 261 REGION FOOTPRINT

- 12.7 START-UP/SME EVALUATION MATRIX, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 50 START-UP/SME EVALUATION MATRIX, 2022

- 12.7.5 COMPETITIVE BENCHMARKING

- TABLE 262 KEY START-UPS/SMES

- TABLE 263 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.8 BRAND/PRODUCT COMPARISON

- FIGURE 51 BRAND/PRODUCT COMPARISON, BY COMPANY

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 OTHERS

- TABLE 264 AIRCRAFT GEARS MARKET: OTHERS, 2020-2022

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 ARROW GEAR

- TABLE 265 ARROW GEAR: COMPANY OVERVIEW

- TABLE 266 ARROW GEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.2 PRECIPART

- TABLE 267 PRECIPART: COMPANY OVERVIEW

- TABLE 268 PRECIPART: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.3 BATOM CO., LTD.

- TABLE 269 BATOM CO., LTD.: COMPANY OVERVIEW

- TABLE 270 BATOM CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.4 GEAR MOTIONS

- TABLE 271 GEAR MOTIONS: COMPANY OVERVIEW

- TABLE 272 GEAR MOTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.5 GIBBS GEARS

- TABLE 273 GIBBS GEARS: COMPANY OVERVIEW

- TABLE 274 GIBBS GEARS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.6 STD PRECISION GEAR AND INSTRUMENT

- TABLE 275 STD PRECISION GEAR AND INSTRUMENT: COMPANY OVERVIEW

- TABLE 276 STD PRECISION GEAR AND INSTRUMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 TRIUMPH GROUP

- TABLE 277 TRIUMPH GROUP: COMPANY OVERVIEW

- FIGURE 52 TRIUMPH GROUP: COMPANY SNAPSHOT

- TABLE 278 TRIUMPH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 TRIUMPH GROUP: OTHERS

- 13.1.8 DELTA GEAR

- TABLE 280 DELTA GEAR: COMPANY OVERVIEW

- TABLE 281 DELTA GEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 SHANGHAI BELON MACHINERY CO., LTD.

- TABLE 282 SHANGHAI BELON MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 283 SHANGHAI BELON MACHINERY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.10 BMT AEROSPACE

- TABLE 284 BMT AEROSPACE: COMPANY OVERVIEW

- TABLE 285 BMT AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 WM BERG INC.

- TABLE 286 WM BERG INC.: COMPANY OVERVIEW

- TABLE 287 WM BERG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.12 AMERICAN PRECISION GEAR CO., INC.

- TABLE 288 AMERICAN PRECISION GEAR CO., INC.: COMPANY OVERVIEW

- TABLE 289 AMERICAN PRECISION GEAR CO., INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 RILEY GEAR CORP

- TABLE 290 RILEY GEAR CORP: COMPANY OVERVIEW

- TABLE 291 RILEY GEAR CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.14 HANLOO CO., LTD.

- TABLE 292 HANLOO CO., LTD.: COMPANY OVERVIEW

- TABLE 293 HANLOO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.15 SCHAFER INDUSTRIES

- TABLE 294 SCHAFER INDUSTRIES: COMPANY OVERVIEW

- TABLE 295 SCHAFER INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.16 AMERICAN GEAR, INC.

- TABLE 296 AMERICAN GEAR, INC.: COMPANY OVERVIEW

- TABLE 297 AMERICAN GEAR, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.17 CIRCLE & GEAR MACHINE CO., INC.

- TABLE 298 CIRCLE & GEAR MACHINE CO., INC.: COMPANY OVERVIEW

- TABLE 299 CIRCLE & GEAR MACHINE CO., INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 XIAMEN KANGFUXIANG MACHINERY CO., LTD.

- TABLE 300 XIAMEN KANGFUXIANG MACHINERY CO., LTD.: COMPANY OVERVIEW

- 13.2.2 BEVEL GEARS (INDIA) PVT. LTD.

- TABLE 301 BEVEL GEARS (INDIA) PVT. LTD.: COMPANY OVERVIEW

- 13.2.3 CURTIS MACHINE COMPANY

- TABLE 302 CURTIS MACHINE COMPANY: COMPANY OVERVIEW

- 13.2.4 THE ADAMS COMPANY

- TABLE 303 THE ADAMS COMPANY: COMPANY OVERVIEW

- 13.2.5 SACHA TECHNOFORGE PVT. LTD.

- TABLE 304 SACHA TECHNOFORGE PVT. LTD.: COMPANY OVERVIEW

- 13.2.6 KOHARA GEAR INDUSTRY CO., LTD.

- TABLE 305 KOHARA GEAR INDUSTRY CO., LTD.: COMPANY OVERVIEW

- 13.2.7 ATLAS GEAR COMPANY

- TABLE 306 ATLAS GEAR COMPANY: COMPANY OVERVIEW

- 13.2.8 COMPAX, INC.

- TABLE 307 COMPAX, INC.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS