|

|

市場調査レポート

商品コード

1452896

ケーブルモデム終端システム (CTMS) および統合ケーブルアクセスプラットフォーム (CCAP) の世界市場:タイプ (CMTS (従来型・仮想)・CCAP)・DOCSIS規格 (DOCSIS 3.1・DOCSIS 3.0以下)・地域別 - 予測(~2029年)Cable Modem Termination System (CTMS) and Converged Cable Access Platform (CCAP) Market by Type (CMTS (traditional CMTS, Virtual CMTS) and CCAP), DOCSIS Standard (DOCSIS 3.1 and DOCSIS 3.0 and Below) and Geography- Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ケーブルモデム終端システム (CTMS) および統合ケーブルアクセスプラットフォーム (CCAP) の世界市場:タイプ (CMTS (従来型・仮想)・CCAP)・DOCSIS規格 (DOCSIS 3.1・DOCSIS 3.0以下)・地域別 - 予測(~2029年) |

|

出版日: 2024年03月13日

発行: MarketsandMarkets

ページ情報: 英文 190 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

ケーブルモデム終端システム (CTMS) および統合ケーブルアクセスプラットフォーム (CCAP) の市場規模は、予測期間中に9.3%のCAGRで推移し、2024年の67億米ドルから、2029年には104億米ドルの規模に成長すると予測されています。

仮想CMTSは、クラウドまたは仮想化インフラ内の標準サーバーで実行することにより、機能を仮想化します。これにより、需要に応じたCMTSリソースの迅速な展開と拡張が可能になり、変化するトラフィックパターンへの迅速なネットワーク適応が促進されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | タイプ・DOCSIS規格・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

仮想CMTSの採用の増加がCMTS市場を牽引する主要因の一つです。スマートホームデバイスやIoT用途は、広帯域、低遅延ネットワークの需要を生み出しています。CMTSはこれらの用途に必要なインフラを提供できます。光ファイバーネットワークはさらに高速ですが、まだ普及していません。CMTSは、多くのケーブル事業者にとって、速度と信頼性の面で光ファイバーに対抗できる費用対効果の高いソリューションです。

規格別では、DOCSIS 3.1の部門が予測期間中に高い成長率を示す見通し:

高速インターネット需要の急増により、消費者は高解像度コンテンツのストリーミング、オンラインゲーム、リモートワークなどのアクティビティのために、より高速で信頼性の高いインターネット接続を求めるようになっています。DOCSIS 3.1は、従来のものと比べて格段に高速であるため、ケーブル事業者にとって、こうした需要に応えるための重要なアップグレードとなっています。

予測期間中、米国が北米地域で最大の市場規模を維持する見込み:

2023年の北米市場では米国が最大のシェアを占めており、予測期間中も同様の傾向が見られると予想されています。この地域には、CommScope (米国)、Cisco Systems (米国)、Casa Systems (米国)、Harmonic (米国) などの大手企業が存在し、市場を牽引しています。さらに、ブロードバンドアクセスを拡大し、サービスが行き届いていない地域のインターネット接続を改善するために、政府のイニシアティブが導入されており、これが高度なケーブルブロードバンド技術への投資の増加に寄与しています。

当レポートでは、世界のケーブルモデム終端システム (CTMS) および統合ケーブルアクセスプラットフォーム (CCAP) の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 市場参入企業のビジネスに影響を与える動向/ディスラプション

- エコシステム分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ

- 投資と資金調達のシナリオ

- 技術分析

- 貿易分析

- 特許分析

- 規制と基準

- 主要な会議とイベント

- 価格分析

第6章 CMTSおよびCCAPソリューションの主な用途

- 消費者

- 企業

第7章 CMTSおよびCCAP市場:タイプ別

- CMTS

- 従来型CMTS

- 仮想CMTS

- CCAP

第8章 CMTSおよびCCAP市場:DOCSIS規格別

- DOCSIS 3.0 以下

- DOCSIS 3.1

第9章 CMTSおよびCCAP市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 概要

- 主要企業の採用戦略

- 上位5社の収益分析

- CMTSとCCAPの市場シェア分析

- 企業評価と財務指標

- CMTSおよびCCAP市場:財務指標

- CMTSおよびCCAP市場:ブランド/製品の比較分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- COMMSCOPE

- CISCO SYSTEMS, INC.

- CASA SYSTEMS

- HARMONIC INC.

- HUAWEI TECHNOLOGIES CO., LTD.

- NOKIA

- BROADCOM

- JUNIPER NETWORKS, INC.

- JINGHONG V & T TECHNOLOGY CO., LTD.

- SUMAVISION

- その他の企業

- BLONDER TONGUE LABORATORIES, INC.

- VERSA TECHNOLOGY, INC.

- C9 NETWORKS INC.

- VECIMA NETWORKS INC.

- TELESTE

- GENXCOMM, INC.

- THE VOLPE FIRM

- CREONIC GMBH

- INANGO SYSTEMS LTD.

- INFINERA CORPORATION

- CABLELABS

- LEADMAN ELECTRONICS USA, INC.

- ZCOURM

- CALIX

- AUSTRALIA'S NATIONAL BROADBAND NETWORK (NBN AUSTRALIA)

第12章 付録

The CMTS and CCAP market is projected to grow from USD 6.7 billion in 2024 and is expected to reach USD 10.4 billion by 2029, growing at a CAGR of 9.3% from 2024 to 2029. Virtual CMTS, virtualizes the functionalities by running them on standard servers within a cloud or virtualized infrastructure. These enable faster deployment and scaling of CMTS resources based on demand, facilitating rapid network adaptation to changing traffic patterns.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, DOCSIS Standard, and Geography |

| Regions covered | North America, Europe, APAC, RoW |

"Cable Modem Termination System segment in the CMTS and CCAP market to witness higher growth rate during the forecast period."

The increasing adoption Virtual CMTS is one of the major factor driving the market for CMTS. Smart home devices and IoT applications is creating demand for high-bandwidth, low-latency networks. CMTS can provide the necessary infrastructure for these applications. While fiber optic networks offer even faster speeds, they are not yet widely available. CMTS remains a cost-effective solution for many cable operators to compete with fiber in terms of speed and reliability.

"Market for DOCSIS 3.1 in the CMTS and CCAP market to witness higher growth rate during the forecast period."

Due to the surging demand of high speed internet consumers are increasingly demanding faster and more reliable internet connections for activities like streaming high-definition content, online gaming, and working remotely. DOCSIS 3.1 offers significantly higher speeds compared to its predecessors, making it a crucial upgrade for cable operators to meet these demands.

"The US is expected to hold the largest market size in the North American region during the forecast period."

The US accounted for the largest share of the North American CMTS and CCAP market in 2023, and a similar trend is expected to be witnessed during the forecast period. The presence of major players in this region such as CommScope (US), Cisco Systems, Inc. (US), Casa Systems (US), and Harmonic Inc. (US), is driving the market. Moreover, Government initiatives are being introduced to expand broadband access and improve internet connectivity in underserved areas contributing to increased investments in advanced cable broadband technologies. For example, presence of Broadband Equity Access and Deployment Program (BEAD).

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: C-level Executives - 55%, Directors -30%, and Others - 15%

- By Region: North America -60%, Europe - 20%, Asia Pacific- 15%, and RoW - 5%

The report profiles key players in the CMTS and CCAP market with their respective market ranking analysis. Prominent players profiled in this report include CommScope (US), Cisco Systems, Inc. (US), Casa Systems (US), Harmonic Inc. (US), Nokia (Finland), Huawei Technologies Co., Ltd. (China), Broadcom (US), Juniper Networks, Inc. (US), Jinghong V & T technology Co., Ltd. (China), Sumavision (China), Blonder Tongue Laboratories (US), Versa Technology Inc. (US), C9 Networks Inc. (US), Vecima Networks Inc. (Canada), Teleste (Finland), Gennexcomm, Inc (US), The Volpe Firm (US), Creonic GmbH (Germany), Inango Systems Ltd. (Israel), Infinera Corporation (US), CableLabs (US), Leadman Electronics USA, Inc. (US), ZCorum (US), Calix (US), Australia's National Broadband Network. (Australia) are among a few other key companies in the CMTS and CCAP market.

Report Coverage

The report defines, describes, and forecasts the CMTS and CCAP market based on type, DOCSIS Standards, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the CMTS and CCAP market. It also analyzes competitive developments such as product launches, acquisitions, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall CMTS and CCAP market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (Increasing adoption of virtual CMTS), restraints (High deployment costs), opportunities (Government focus on cable digitalization as an opportunity for CMTS and CCAP market), and challenges (Bandwidth sharing issue) of the CMTS and CCAP market.

- Product development /Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the CMTS and CCAP market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the CMTS and CCAP market across various regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the CMTS and CCAP market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and services, offering of leading players like CommScope (US), Cisco Systems, Inc. (US), Casa Systems (US), Harmonic Inc. (US), Nokia (Finland), among others in the CMTS and CCAP market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 CMTS AND CCAP MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- FIGURE 2 CMTS AND CCAP MARKET: REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.10 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 CMTS AND CCAP MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 4 RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key data from secondary sources

- 2.1.2.2 List of major secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE): REVENUE GENERATED THROUGH SALES OF CMTS AND CCAP

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (supply side)

- FIGURE 6 CMTS AND CCAP MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (demand side)

- FIGURE 7 CMTS AND CCAP MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON CMTS AND CCAP MARKET

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 CCAP TO ACCOUNT FOR MAJORITY OF MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 10 CMTS MARKET, BY TYPE, 2024 VS. 2029

- FIGURE 11 DOCSIS 3.1 SEGMENT TO DOMINATE CMTS AND CCAP MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CMTS AND CCAP MARKET

- FIGURE 13 INCREASING INVESTMENT IN EXPANDING BROADBAND INFRASTRUCTURE TO DRIVE MARKET

- 4.2 CMTS AND CCAP MARKET, BY TYPE

- FIGURE 14 CMTS SEGMENT TO REGISTER HIGHER CAGR IN CMTS AND CCAP MARKET DURING FORECAST PERIOD

- 4.3 CMTS AND CCAP MARKET, BY DOCSIS STANDARD

- FIGURE 15 DOCSIS 3.1 SEGMENT TO HOLD LARGER SHARE OF CMTS AND CCAP MARKET IN 2029

- 4.4 CMTS MARKET, BY TYPE

- FIGURE 16 VIRTUAL CMTS SEGMENT TO HOLD LARGER SHARE OF CMTS MARKET IN 2029

- 4.5 CMTS AND CCAP MARKET IN NORTH AMERICA, BY TYPE AND COUNTRY

- FIGURE 17 CCAP SEGMENT AND US HELD LARGEST SHARES OF NORTH AMERICAN CMTS AND CCAP MARKET IN 2023

- 4.6 CMTS AND CCAP MARKET, BY COUNTRY

- FIGURE 18 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL CMTS AND CCAP MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 CMTS AND CCAP MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 20 CMTS AND CCAP MARKET: IMPACT OF DRIVERS

- 5.2.1.1 Increasing investment in expanding broadband infrastructure

- 5.2.1.2 Advent of OTT platforms such as Netflix, Amazon Prime, Hulu

- 5.2.1.3 Emergence of DOCSIS 4.0

- 5.2.1.4 Rising adoption of virtual CMTS by internet service providers

- 5.2.2 RESTRAINTS

- FIGURE 21 CMTS AND CCAP MARKET: IMPACT OF RESTRAINTS

- 5.2.2.1 High costs of infrastructure modification

- 5.2.3 OPPORTUNITIES

- FIGURE 22 CMTS AND CCAP MARKET: IMPACT OF OPPORTUNITIES

- 5.2.3.1 Government focus on digitalization of cable networks

- 5.2.3.2 Integration of edge computing into CMTS and CCAP solutions

- 5.2.4 CHALLENGES

- FIGURE 23 CMTS AND CCAP MARKET: IMPACT OF CHALLENGES

- 5.2.4.1 Challenges associated with mature market

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 CMTS AND CCAP VALUE CHAIN

- 5.4 TRENDS/DISRUPTIONS IMPACTING BUSINESSES OF MARKET PLAYERS

- 5.4.1 TRENDS IMPACTING BUSINESSES OF MARKET PLAYERS

- FIGURE 25 TRENDS IMPACTING CMTS AND CCAP BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 26 KEY PLAYERS IN ECOSYSTEM

- TABLE 2 ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 CMTS AND CCAP MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- 5.8 CASE STUDY

- 5.8.1 USE OF DISAGGREGATED ROUTING IN 5G AND DATA TRANSPORT NETWORKS TO REDUCE CAPEX AND OPEX

- 5.8.2 ADOPTION OF DOCSIS 4.0 TECHNOLOGY TO MAXIMIZE UPSTREAM CAPACITY

- 5.8.3 DEPLOYMENT OF CCAP IN CREATING INTELLIGENT NETWORK TO HANDLE DATA AND UNICAST GROWING TRAFFIC

- 5.9 INVESTMENT AND FUNDING SCENARIO

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO FOR STARTUP COMPANIES

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGY

- 5.10.1.1 Distributed access architecture

- 5.10.1.2 Distributed power over ethernet

- 5.10.2 COMPLEMENTARY TECHNOLOGY

- 5.10.2.1 Network function virtualization (NFV)and software-defined networking (SDN)

- 5.10.3 ADJACENT TECHNOLOGY

- 5.10.3.1 DOCSIS 4.0

- 5.10.1 KEY TECHNOLOGY

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA

- FIGURE 31 IMPORT SCENARIO FOR HS CODE 851769-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022

- TABLE 6 IMPORT SCENARIO FOR HS CODE 851769-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11.2 EXPORT DATA

- FIGURE 32 EXPORT SCENARIO FOR HS CODE 851769-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022

- TABLE 7 EXPORT SCENARIO FOR HS CODE 851769-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11.3 TARIFF ANALYSIS

- TABLE 8 MFN TARIFF FOR HS CODE 851769-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2022

- TABLE 9 MFN TARIFF FOR HS CODE 851769-COMPLIANT PRODUCTS EXPORTED BY US, 2022

- TABLE 10 MFN TARIFF FOR HS CODE 851769-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2022

- TABLE 11 MFN TARIFF FOR HS CODE 851769-COMPLIANT PRODUCTS EXPORTED BY UK, 2022

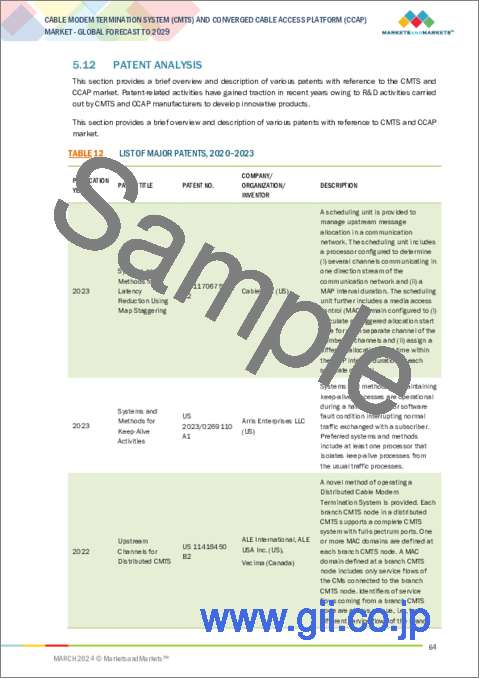

- 5.12 PATENT ANALYSIS

- TABLE 12 LIST OF MAJOR PATENTS, 2020-2023

- FIGURE 33 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2023

- TABLE 13 TOP 30 PATENT OWNERS DURING 2013-2023

- FIGURE 34 TOP 10 COMPANIES WITH MAXIMUM NUMBER OF PATENT APPLICATIONS DURING 2013-2023

- 5.13 REGULATIONS AND STANDARDS

- 5.13.1 GOVERNMENT REGULATIONS

- 5.13.1.1 Canada

- 5.13.1.2 Europe

- 5.13.1.3 India

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.13.2.1 DOCSIS 3.1

- 5.13.2.2 ITU-T J.122

- 5.13.2.3 ISO/IEC 8802-3 Ethernet standard

- 5.13.1 GOVERNMENT REGULATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 18 CMTS AND CCAP MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE OF CMTS OFFERED BY KEY PLAYERS

- FIGURE 35 AVERAGE SELLING PRICE OF CMTS, BY KEY PLAYER (USD)

- TABLE 19 AVERAGE SELLING PRICE OF CMTS OFFERED BY KEY PLAYERS (USD)

- 5.15.2 AVERAGE SELLING PRICE TREND OF CMTS AND CCAP, BY REGION, 2020-2029

- FIGURE 36 AVERAGE SELLING PRICE TREND OF CMTS AND CCAP, BY REGION, 2020-2029 (USD)

6 KEY APPLICATIONS OF CMTS AND CCAP SOLUTIONS

- 6.1 INTRODUCTION

- 6.2 CONSUMER

- 6.3 BUSINESS

7 CMTS AND CCAP MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 20 CMTS AND CCAP MARKET, VALUE AND VOLUME, 2020-2023

- TABLE 21 CMTS AND CCAP MARKET, VALUE AND VOLUME, 2024-2029

- FIGURE 37 CCAP SEGMENT TO HOLD LARGER MARKET SHARE THROUGHOUT FORECAST PERIOD

- TABLE 22 CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 23 CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.2 CMTS

- 7.2.1 TRADITIONAL CMTS

- 7.2.1.1 Surging demand for high-speed internet access to drive market

- 7.2.2 VIRTUAL CMTS

- 7.2.2.1 Increasing need for network flexibility, scalability, and agility in delivering high-speed broadband services to fuel segmental growth

- TABLE 24 CMTS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 25 CMTS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 26 CMTS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 CMTS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.2.1 TRADITIONAL CMTS

- 7.3 CCAP

- 7.3.1 FOCUS OF OTT SERVICE PROVIDERS ON DELIVERING CONTENT WITH HIGH RELIABILITY, LOW LATENCY, AND MINIMAL BUFFERING TO DRIVE MARKET

- FIGURE 38 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR CCAP BETWEEN 2024 AND 2029

- TABLE 28 CCAP MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 29 CCAP MARKET, BY REGION, 2024-2029 (USD MILLION)

8 CMTS AND CCAP MARKET, BY DOCSIS STANDARD

- 8.1 INTRODUCTION

- FIGURE 39 DOCSIS 3.1 SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 30 CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 31 CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 8.2 DOCSIS 3.0 & BELOW

- 8.2.1 GROWING TREND OF HIGH-SPEED INTERNET ACCESS OVER CABLE NETWORKS TO DRIVE MARKET

- TABLE 32 DOCSIS 3.0 & BELOW: CMTS AND CCAP MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 DOCSIS 3.0 & BELOW: CMTS AND CCAP MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 DOCSIS 3.1

- 8.3.1 INCREASING DEMAND FOR SUPERIOR BROADBAND SERVICES TO DRIVE MARKET

- TABLE 34 DOCSIS 3.1: CMTS AND CCAP MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 DOCSIS 3.1: CMTS AND CCAP MARKET, BY REGION, 2024-2029 (USD MILLION)

9 CMTS AND CCAP MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 40 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 36 CMTS AND CCAP MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 CMTS AND CCAP MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- FIGURE 41 NORTH AMERICA: CMTS AND CCAP MARKET SNAPSHOT

- TABLE 38 NORTH AMERICA: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 39 NORTH AMERICA: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 40 NORTH AMERICA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 41 NORTH AMERICA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- TABLE 42 NORTH AMERICA: CMTS AND CCAP MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 43 NORTH AMERICA: CMTS AND CCAP MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Prominent presence of CMTS and CCAP technology providers to drive market

- TABLE 44 US: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 45 US: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 46 US: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 47 US: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Government initiatives to improve networking capabilities to fuel market growth

- TABLE 48 CANADA: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 49 CANADA: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 50 CANADA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 51 CANADA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.2.4 MEXICO

- 9.2.4.1 Significant demand for networking services to accelerate market growth

- TABLE 52 MEXICO: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 53 MEXICO: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 54 MEXICO: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 55 MEXICO: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- FIGURE 42 EUROPE: CMTS AND CCAP MARKET SNAPSHOT

- TABLE 56 EUROPE: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 57 EUROPE: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 58 EUROPE: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 59 EUROPE: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- TABLE 60 EUROPE: CMTS AND CCAP MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 61 EUROPE: CMTS AND CCAP MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Booming consumer electronics industry to boost demand

- TABLE 62 GERMANY: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 63 GERMANY: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 64 GERMANY: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 65 GERMANY: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Growing need for high-speed data transmission in datacom and telecom industries to drive market

- TABLE 66 FRANCE: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 67 FRANCE: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 68 FRANCE: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 69 FRANCE: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.3.4 UK

- 9.3.4.1 Rising demand for cloud-based services to drive market

- TABLE 70 UK: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 71 UK: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 72 UK: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 73 UK: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Increasing adoption of digital technology to foster market growth

- TABLE 74 ITALY: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 75 ITALY: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 76 ITALY: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 77 ITALY: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 78 REST OF EUROPE: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 79 REST OF EUROPE: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 80 REST OF EUROPE: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 81 REST OF EUROPE: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: CMTS AND CCAP MARKET SNAPSHOT

- TABLE 82 ASIA PACIFIC: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 83 ASIA PACIFIC: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 84 ASIA PACIFIC: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CMTS AND CCAP MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CMTS AND CCAP MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Elevating demand for consumer electronic products to accelerate market growth

- TABLE 88 CHINA: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 CHINA: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 90 CHINA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 91 CHINA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Increasing adoption of IoT and automation to drive market

- TABLE 92 JAPAN: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 93 JAPAN: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 94 JAPAN: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 95 JAPAN: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Thriving consumer electronics and automotive industries to drive market

- TABLE 96 SOUTH KOREA: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 97 SOUTH KOREA: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 98 SOUTH KOREA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 99 SOUTH KOREA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.4.5 INDIA

- 9.4.5.1 Rising number of data centers to fuel market growth

- TABLE 100 INDIA: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 101 INDIA: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 102 INDIA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 103 INDIA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 104 REST OF ASIA PACIFIC: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.5 REST OF THE WORLD (ROW)

- 9.5.1 RECESSION IMPACT ON MARKET IN ROW

- TABLE 108 ROW: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 109 ROW: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 110 ROW: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 111 ROW: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- TABLE 112 ROW: CMTS AND CCAP MARKET, BY GEOGRAPHY, 2020-2023 (USD MILLION)

- TABLE 113 ROW: CMTS AND CCAP MARKET, BY GEOGRAPHY, 2024-2029 (USD MILLION)

- 9.5.2 GCC COUNTRIES

- 9.5.2.1 Rising adoption of 5G, AI, and IoT technologies to create growth opportunities

- TABLE 114 GCC COUNTRIES: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 115 GCC COUNTRIES: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 116 GCC COUNTRIES: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 117 GCC COUNTRIES: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Increasing use of smartphones and mobile networks to foster market growth

- TABLE 118 SOUTH AMERICA: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 119 SOUTH AMERICA: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 120 SOUTH AMERICA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 121 SOUTH AMERICA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

- 9.5.4 REST OF MEA

- TABLE 122 REST OF MEA: CMTS AND CCAP MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 123 REST OF MEA: CMTS AND CCAP MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 124 REST OF MEA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2020-2023 (USD MILLION)

- TABLE 125 REST OF MEA: CMTS AND CCAP MARKET, BY CABLE STANDARD, 2024-2029 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 126 CMTS AND CCAP MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018-2022

- FIGURE 44 CMTS AND CCAP MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018-2022

- 10.4 CMTS AND CCAP MARKET SHARE ANALYSIS, 2023

- FIGURE 45 CMTS AND CCAP MARKET SHARE ANALYSIS, 2023

- TABLE 127 CMTS AND CCAP MARKET: DEGREE OF COMPETITION, 2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 46 CMTS AND CCAP MARKET MAP

- 10.6 CMTS AND CCAP MARKET: FINANCIAL METRICS

- FIGURE 47 FINANCIAL METRICS

- 10.7 CMTS AND CCAP MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 48 TOP TRENDING BRANDS/PRODUCTS

- 10.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.8.1 STARS

- 10.8.2 EMERGING LEADERS

- 10.8.3 PERVASIVE PLAYERS

- 10.8.4 PARTICIPANTS

- FIGURE 49 CMTS AND CCAP MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 10.8.5 COMPANY FOOTPRINT

- 10.8.5.1 Company footprint

- FIGURE 50 CMTS AND CCAP MARKET: COMPANY FOOTPRINT

- 10.8.5.2 Type footprint

- TABLE 128 CMTS AND CCAP MARKET: TYPE FOOTPRINT

- 10.8.5.3 DOCSIS standard footprint

- TABLE 129 CMTS AND CCAP MARKET: DOCSIS STANDARD FOOTPRINT

- 10.8.5.4 Regional footprint

- TABLE 130 CMTS AND CCAP MARKET: REGIONAL FOOTPRINT

- 10.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- FIGURE 51 CMTS AND CCAP MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 10.9.5 COMPETITIVE BENCHMARKING

- 10.9.5.1 Detailed list of key startups/SMEs

- TABLE 131 CMTS AND CCAP MARKET: LIST OF KEY STARTUPS/SMES

- 10.9.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 132 CMTS AND CCAP MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.10 COMPETITIVE SCENARIO AND TRENDS

- 10.10.1 PRODUCT LAUNCHES

- TABLE 133 CMTS AND CCAP MARKET: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2024

- 10.10.2 DEALS

- TABLE 134 CMTS AND CCAP MARKET: DEALS, JANUARY 2020-FEBRUARY 2024

- 10.10.3 OTHERS

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 COMMSCOPE

- TABLE 135 COMMSCOPE: COMPANY OVERVIEW

- FIGURE 52 COMMSCOPE: COMPANY SNAPSHOT

- TABLE 136 COMMSCOPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 COMMSCOPE: PRODUCT LAUNCHES

- 11.1.2 CISCO SYSTEMS, INC.

- TABLE 138 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 53 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- TABLE 139 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 CISCO SYSTEMS, INC.: DEALS

- 11.1.3 CASA SYSTEMS

- TABLE 141 CASA SYSTEMS: COMPANY OVERVIEW

- FIGURE 54 CASA SYSTEMS: COMPANY SNAPSHOT

- TABLE 142 CASA SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 CASA SYSTEMS: PRODUCT LAUNCHES

- TABLE 144 CASA SYSTEMS: DEALS

- 11.1.4 HARMONIC INC.

- TABLE 145 HARMONIC INC.: COMPANY OVERVIEW

- FIGURE 55 HARMONIC INC.: COMPANY SNAPSHOT

- TABLE 146 HARMONIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 HARMONIC INC.: PRODUCT LAUNCHES

- TABLE 148 HARMONIC INC.: DEALS

- TABLE 149 HARMONIC INC.: EXPANSIONS

- 11.1.5 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 150 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 151 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 153 HUAWEI TECHNOLOGIES CO., LTD.: EXPANSIONS

- 11.1.6 NOKIA

- TABLE 154 NOKIA: COMPANY OVERVIEW

- FIGURE 56 NOKIA: COMPANY SNAPSHOT

- TABLE 155 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 NOKIA: PRODUCT LAUNCHES

- TABLE 157 NOKIA: DEALS

- TABLE 158 NOKIA: OTHERS

- 11.1.7 BROADCOM

- TABLE 159 BROADCOM: COMPANY OVERVIEW

- FIGURE 57 BROADCOM: COMPANY SNAPSHOT

- TABLE 160 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 BROADCOM: PRODUCT LAUNCHES

- 11.1.8 JUNIPER NETWORKS, INC.

- TABLE 162 JUNIPER NETWORKS, INC.: COMPANY OVERVIEW

- FIGURE 58 JUNIPER NETWORKS, INC.: COMPANY SNAPSHOT

- TABLE 163 JUNIPER NETWORKS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 JUNIPER NETWORKS, INC.: PRODUCT LAUNCHES

- TABLE 165 JUNIPER NETWORKS, INC.: EXPANSIONS

- 11.1.9 JINGHONG V & T TECHNOLOGY CO., LTD.

- TABLE 166 JINGHONG V & T TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 167 JINGHONG V & T TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.10 SUMAVISION

- TABLE 168 SUMAVISION: COMPANY OVERVIEW

- TABLE 169 SUMAVISION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER KEY PLAYERS

- 11.2.1 BLONDER TONGUE LABORATORIES, INC.

- 11.2.2 VERSA TECHNOLOGY, INC.

- 11.2.3 C9 NETWORKS INC.

- 11.2.4 VECIMA NETWORKS INC.

- 11.2.5 TELESTE

- 11.2.6 GENXCOMM, INC.

- 11.2.7 THE VOLPE FIRM

- 11.2.8 CREONIC GMBH

- 11.2.9 INANGO SYSTEMS LTD.

- 11.2.10 INFINERA CORPORATION

- 11.2.11 CABLELABS

- 11.2.12 LEADMAN ELECTRONICS USA, INC.

- 11.2.13 ZCOURM

- 11.2.14 CALIX

- 11.2.15 AUSTRALIA'S NATIONAL BROADBAND NETWORK (NBN AUSTRALIA)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS