|

|

市場調査レポート

商品コード

1451937

卵加工の世界市場:製品タイプ別、最終用途アプリケーション別、性質別、地域別 - 予測(~2029年)Egg Processing Market by product type (Dried Egg Products, Liquid Egg Products, Frozen Egg Products), End-use Application (Food Processing and Manufacturing, Food Service, Retail), Nature and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 卵加工の世界市場:製品タイプ別、最終用途アプリケーション別、性質別、地域別 - 予測(~2029年) |

|

出版日: 2024年03月07日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

卵加工の市場規模は、予測期間中に4.7%のCAGRで推移し、2024年の375億米ドルから、2029年には472億米ドルの規模に成長すると予測されています。

卵加工市場は、に成長し、予測期間中のCAGRは4.7%と予測されています。Taylor &Francis Onlineが2021年に提供した記事によると、ゆで卵や低温殺菌といった従来の卵加工方法では、新鮮な味、食感、栄養価が損なわれることが多いと言われています。これを克服するため、研究者は高圧、パルス電場、超音波などの非熱技術を模索しています。これらの技術は、食品の安全性や保存性を向上させ、さらには卵の生物活性化合物などの有益な特性を、新鮮な卵のような特性への影響を最小限に抑えながら保持することができます。消費者は健康的で加工度の低い食品をますます求めるようになっており、こうした非加熱技術は卵業界がその需要に応えるのに役立つ可能性があります。さらに、卵に含まれる生物活性化合物を保存できる可能性があるため、健康志向の消費者にとって卵がさらに魅力的なものになる可能性もあります。非加熱技術によって安全性と保存性が改善された、高品質で新鮮な卵製品の生産は、卵加工市場の成長と革新を大きく後押しする可能性を秘めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 検討単位 | 金額 (米ドル) |

| セグメント | 製品タイプ・最終用途アプリケーション・性質・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・南米・その他の地域 |

エンドユーザー別では、食品加工・製造の部門が予測期間中に最大のCAGRでもっとも急速な成長を示すと予測されています。食品加工・製造部門には、加工食品や調理済み食品、ベーカリーや菓子類、栄養補助食品などが含まれます。卵は膨張剤、粘結剤、乳化剤、軟化剤として働き、構造、食感、風味、色に寄与します。消費者はより健康的でバランスの取れた食生活を求めるようになっています。タンパク質や特定の機能性 (低脂肪、低炭水化物など) を付加した加工食品が人気を集めており、卵製品はそのような品質に貢献することが多いです。加工食品や惣菜における卵製品の使用の増加が卵加工市場の成長を牽引しています。

製品タイプ別では、液卵製品が優勢:

液卵は、卵を割ったり、分けたり、泡立てたりといった手間のかかる工程を省くことで、調理時間を大幅に短縮することができます。この時間短縮のメリットは、忙しい消費者や、効率的な食事準備のソリューションを必要とする外食産業関係者にとって特に価値があります。プレパックされた液卵は、あらかじめ計量された量が提供されるため、卵白や卵黄が使われずに廃棄されることが多い全卵を使用する場合と比べ、卵の無駄を最小限に抑えることができます。このような廃棄物の削減は、持続可能性に意識の高い消費者や、環境フットプリントを最小限に抑えたい企業にとって魅力的です。

当レポートでは、世界の卵加工の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- バリューチェーン分析

- 技術分析

- 特許分析

- エコシステム分析/市場マップ

- 貿易分析

- 価格分析

- 顧客のビジネスに影響を与える動向とディスラプション

- 主要な会議とイベント

- 関税と規制状況

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- 卵加工市場:投資と資金調達のシナリオ

第7章 卵加工市場:製品タイプ別

- 乾燥卵製品

- 液体卵製品

- 冷凍卵製品

第8章 卵加工市場:最終用途アプリケーション別

- 食品加工・製造

- 加工食品・調理済み食品

- ベーカリー・菓子類

- 栄養補助食品

- その他

- 食品サービス

- 小売

第9章 卵加工市場:性質別

- 有機卵製品

- 無機卵製品

第10章 卵加工市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第11章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の戦略/有力企業

- 収益分析

- 主要企業の年間収益・成長

- 主要企業のEBIT/EBITDA

- ブランド/製品の比較分析

- 卵加工会社の評価と財務指標

- 世界の主要参入企業のスナップショット

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- CAL-MAINE FOODS, INC.

- ROSE ACRE FARMS

- OVOBELFOODS.COM

- SKMEGG.COM

- INTEROVO EGG GROUP BV

- IGRECA

- WABASH VALLEY

- REMBRANDT FOODS

- AVRIL SCA

- EUROVO S.R.L.

- BOUWHUIS ENTHOVEN

- TAJ AGRO INTERNATIONAL (TAJ PHARMA GROUP)

- HILLANDALE FARMS

- VENKY'S INDIA

- KEWPIE EGG CORPORATION

- その他の企業

- OVOBEST EIPRODUKTE GMBH & CO. KG

- TAIYO INTERNATIONAL

- READY EGG PRODUCTS

- OVOVITA

- VERSOVA

第13章 隣接市場および関連市場

第14章 付録

The egg processing market is projected to grow from USD 37.5 Billion in 2024 to USD 47.2 Billion by 2029, at a CAGR of 4.7% during the forecast period. According to the article provided by Taylor & Francis Online in 2021, traditional methods of processing eggs, such as boiling or pasteurization, often damage their fresh taste, texture, and nutritional value. To overcome this, researchers are exploring non-thermal technologies such as high pressure, pulsed electric fields, and ultrasound. These technologies can improve food safety, and shelf life, and even retain the beneficial properties of eggs, such as their bioactive compounds, with minimal impact on their fresh-like characteristics. Consumers are increasingly demanding healthy, minimally processed foods, and these non-thermal technologies could help the egg industry meet that demand. Additionally, the potential to preserve the bioactive compounds in eggs could make them even more appealing to health-conscious consumers. The production of high-quality, fresh-like egg products with improved safety, and shelf life with non-thermal technologies has the potential to significantly boost the growth and innovation of the egg processing market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Product Type, End-Use Application, Nature, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

During the projected period, the food processing and manufacturing end-use application segment is anticipated to exhibit the most rapid growth, boasting the highest Compound Annual Growth Rate (CAGR).

The food processing and manufacturing segment includes processed foods and ready meals, bakery and confectionery, dietary supplements, and other products. From fluffy cakes to decadent custards, eggs play a significant role in the bakery and confectionery segment. They act as leaveners, binding agents, emulsifiers, and tenderizers, contributing to structure, texture, flavor, and color. Whole eggs, yolks, and whites each play specific roles, with whites whipping into airy foams for meringues and yolks adding richness to custards. Bakers turn to liquid, dried, and frozen options for convenience and long shelf life. Additionally, egg products find application in various processed foods like sauces, mayonnaise, dressings, and pasta. They contribute to texture, stability, and flavor, extending shelf life and improving mouthfeel. consumers are increasingly seeking healthier and more balanced diets. Processed foods with added protein and specific functionalities (e.g., low-fat, low-carb) are gaining traction, with egg products often contributing to those qualities. The increasing use of egg products in processed foods and ready meals is driving the growth of the egg processing market.

Manufacturers are constantly developing new and innovative processed food and ready-meal options incorporating egg products to cater to diverse consumer preferences and dietary needs. Major companies operating in the segment include Cal-Maine Foods Inc. (US), Rose Acre Farms (US), Ovobel Foods Limited (India), and others. They are offering liquid egg and dried egg products for their convenience and ease of use.

Liquid Egg Product is dominant within the product type segment of the market.

Liquid eggs have indeed seen a significant rise in popularity and are dominating certain segments of the egg market. Liquid eggs offer a significant reduction in preparation time by eliminating the need for several labor-intensive steps, such as cracking, separating, and whisking eggs. This time-saving benefit is especially valuable for busy consumers and food service professionals who require efficient meal preparation solutions. Pre-packaged liquid eggs provide pre-measured quantities, minimizing egg waste compared to using whole eggs, where leftover egg whites or yolks may often go unused and eventually discarded. This reduction in waste appeals to sustainability-conscious consumers and businesses seeking to minimize their environmental footprint.

Liquid eggs offer unparalleled versatility in culinary applications, seamlessly integrating into a wide range of dishes and recipes. From sauces and baked goods to fluffy omelets and perfectly textured batters, the adaptability of liquid eggs enhances culinary flexibility in both home and professional kitchens. This versatility allows chefs and cooks to experiment with various recipes and cooking techniques, creating diverse and flavorful dishes to cater to different tastes and preferences.

The break-up of the profile of primary participants in the egg processing market:

- By Company Type: Tier 1 - 50%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C Level - 44%, Director Level - 34%, Others-22%

- By Region: North America - 20%, Asia Pacific - 45%, Europe - 25%, South America - 5%, and Rest of the World -5%

Prominent companies are Cal-Maine Foods (US), Rose Acre Farms (US), Ovobel Foods.com (India), SKMEgg.com (India), and Interovo Egg Group BV (Gelerland) among others.

Research Coverage:

This research report categorizes the egg processing market by Product Type (Dried Egg Products, Liquid Egg Products, Frozen Egg Products), End-Use Application (Food Processing and Manufacturing, Food Service, Retail), Nature (Organic Egg Products, Inorganic Egg products), and Region (North America, Europe, Asia Pacific, South America, and RoW). The report covers information about the key factors, such as drivers, restraints, opportunities, and challenges impacting the growth of the egg processing market. It also provides a detailed analysis of the major players in the market including their business overview, products offered; key strategies; partnerships, new product launches, and acquisitions. Competitive benchmarking of upcoming startups in the egg processing market is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall egg processing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Rising health consciousness fuels demand for nutrient-rich processed egg products in the evolving consumer market, The expansion of the food and beverage industry catalyzes growth in the egg processing market, and Busy lifestyles drive demand for processed egg products), restraints (Egg price volatility impacts processing costs and consumer confidence and Consumer demands for ethical sourcing and animal welfare practices are rising), opportunity (Egg producers' sustainability efforts attract eco-conscious consumers, driving ethical demand and Cutting-edge technology enhances efficiency and market appeal in egg processing), and challenges (Consumer misconceptions regarding risks linked to both conventional and processed eggs and Plant-based egg substitutes challenge traditional egg products in diverse applications) influencing the growth of the egg processing market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the egg processing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the egg processing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the egg processing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Cal-Maine Foods, Inc. (US), Rose Acre Farms (US), Ovobel Foods Limited (India), SKMEgg.com (India), Interovo Egg Group BV (Netherlands), IGRECA (France), Avril SCA (France), Eurovo Srl (Italy), Rembrandt Foods (US), and Hillandale Farms (US) among others in the egg processing market strategies. The report also helps stakeholders understand the egg processing market and provides them with information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 EGG PROCESSING MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATE, 2019-2023

- 1.7 VOLUME UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 EGG PROCESSING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 EGG PROCESSING MARKET SIZE ESTIMATION, BY KEY PLAYER: SUPPLY SIDE

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 5 EGG PROCESSING MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 6 EGG PROCESSING MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (BASED ON GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 RECESSION MACROINDICATORS

- FIGURE 8 INDICATORS OF RECESSION

- FIGURE 9 GLOBAL INFLATION RATE, 2012-2022

- FIGURE 10 GLOBAL GROSS DOMESTIC PRODUCT, 2012-2022 (USD TRILLION)

- FIGURE 11 RECESSION INDICATORS AND THEIR IMPACT ON EGG PROCESSING MARKET

- FIGURE 12 GLOBAL EGG PROCESSING MARKET: CURRENT FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

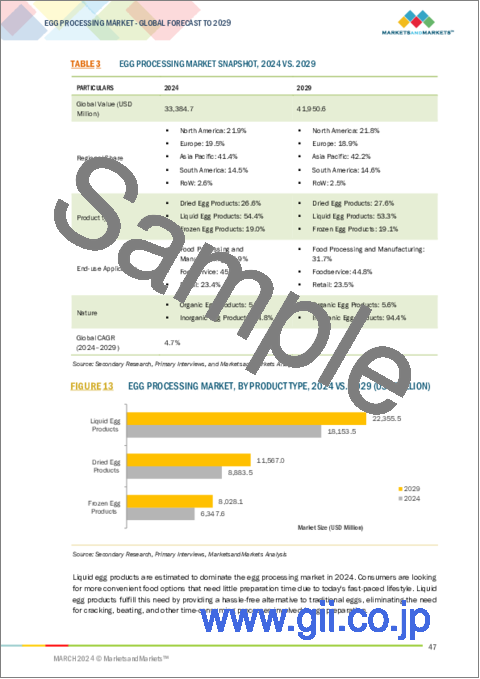

- TABLE 3 EGG PROCESSING MARKET SNAPSHOT, 2024 VS. 2029

- FIGURE 13 EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 EGG PROCESSING MARKET, BY NATURE, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 EGG PROCESSING MARKET SHARE (VALUE), BY REGION, 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN EGG PROCESSING MARKET

- FIGURE 17 EMERGING ECONOMIES TO PROVIDE ATTRACTIVE OPPORTUNITIES IN EGG PROCESSING MARKET

- 4.2 EGG PROCESSING MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 18 CHINA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: EGG PROCESSING MARKET, BY TYPE AND COUNTRY

- FIGURE 19 LIQUID EGG PRODUCTS SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2024

- 4.4 EGG PROCESSING MARKET, BY PRODUCT TYPE

- FIGURE 20 LIQUID EGG PRODUCTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 EGG PROCESSING MARKET, BY END-USE APPLICATION

- FIGURE 21 FOODSERVICE SEGMENT PROJECTED TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.6 EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING END-USE APPLICATION

- FIGURE 22 PROCESSED FOODS AND READY MEALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 EGG PROCESSING MARKET, BY NATURE

- FIGURE 23 INORGANIC EGG PRODUCTS TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN RETAIL SALES

- FIGURE 24 RETAIL & FOOD SERVICE SALES IN US, 2016-2023 (USD BILLION)

- 5.2.2 UPSWING IN EGG PROCESSING INDUSTRY ALIGNING WITH GLOBAL RISE IN POPULATION AND GDP

- FIGURE 25 GLOBAL POPULATION GROWTH, 1950-2050 (MILLION)

- FIGURE 26 GDP GROWTH, 2016-2022 (TRILLION)

- 5.3 MARKET DYNAMICS

- FIGURE 27 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rising health-consciousness among people

- 5.3.1.2 Widespread popularity of multi-functionality of egg products

- 5.3.1.3 Busy lifestyles leading to adoption of processed egg products

- 5.3.2 RESTRAINTS

- 5.3.2.1 High costs and low consumer confidence

- FIGURE 28 EGG PRODUCTION, EGG DEMAND, AND EGG PRICE FLUCTUATION, 2000-2022

- FIGURE 29 COST OF PRIMARY PRODUCTION IN ENRICHED CAGES IN EU (AVERAGE) AND CONVENTIONAL CAGES IN NON-EU COUNTRIES (USD PER KILOGRAM OF EGGS), 2021

- FIGURE 30 COST OF PRODUCTION OF WHOLE EGG POWDER IN NON-EU COUNTRIES (USD PER KILOGRAM OF EGG POWDER), 2021

- 5.3.2.2 Increase in consumer demand for ethical sourcing and animal welfare practices

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Egg producers' sustainability efforts to attract eco-conscious consumers

- 5.3.3.2 Use of cutting-edge technology in egg processing

- 5.3.4 CHALLENGES

- 5.3.4.1 Consumers' misconceptions regarding risks associated with conventional and processed eggs

- 5.3.4.2 Rapid adoption of plant-based egg substitutes in diverse applications

- FIGURE 31 PLANT-BASED EGG SALES GROWTH VS. CONVENTIONAL EGG SALES GROWTH, 2021

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH & DEVELOPMENT (R&D)

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 PROCESSING & MANUFACTURING

- 6.2.4 DISTRIBUTION

- 6.2.5 MARKETING & SALES

- FIGURE 32 VALUE CHAIN ANALYSIS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 KEY TECHNOLOGIES

- 6.3.1.1 Automation of egg separation technology to separate egg whites and yolks with high accuracy

- 6.3.2 COMPLEMENTARY TECHNOLOGIES

- 6.3.2.1 High-pressure processing (HPP) and pulsed electric fields (PEF) technologies use intense pressure to eliminate harmful bacteria

- 6.3.3 ADJACENT TECHNOLOGIES

- 6.3.3.1 Automation and robotics technologies improve efficiency, consistency, and safety

- 6.3.1 KEY TECHNOLOGIES

- 6.4 PATENT ANALYSIS

- FIGURE 33 LIST OF MAJOR PATENTS PERTAINING TO EGG PROCESSING MARKET, 2012-2024

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED, 2014-2023

- TABLE 4 LIST OF MAJOR PATENTS GRANTED, 2021-2023

- 6.5 ECOSYSTEM ANALYSIS/MARKET MAP

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- FIGURE 35 EGG PROCESSING MARKET: MARKET MAP

- TABLE 5 EGG PROCESSING MARKET: ECOSYSTEM ANALYSIS

- 6.6 TRADE ANALYSIS

- TABLE 6 TOP 10 IMPORTERS AND EXPORTERS OF SHELL, FRESH, PRESERVED, OR COOKED EGGS, 2022 (USD THOUSAND)

- TABLE 7 TOP 10 IMPORTERS AND EXPORTERS OF SHELL, FRESH, PRESERVED, OR COOKED EGGS, 2022 (USD TONS)

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE

- FIGURE 36 GLOBAL: AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE (USD/KG)

- 6.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT TYPE

- TABLE 8 EGG PROCESSING MARKET: AVERAGE SELLING PRICE (ASP), BY PRODUCT TYPE, 2019-2023 (USD/KG)

- 6.7.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY REGION

- TABLE 9 EGG PROCESSING MARKET: AVERAGE SELLING PRICE (ASP), BY REGION, 2019-2023 (USD/ KG)

- 6.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 37 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 KEY CONFERENCES & EVENTS

- TABLE 10 KEY CONFERENCES & EVENTS, 2024

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATORY LANDSCAPE

- 6.10.2.1 NORTH AMERICA

- 6.10.2.1.1 US

- 6.10.2.1.2 Canada

- 6.10.2.2 EUROPEAN UNION

- 6.10.2.3 ASIA PACIFIC

- 6.10.2.3.1 Japan

- 6.10.2.3.2 India

- 6.10.2.4 SOUTH AMERICA

- 6.10.2.4.1 Brazil

- 6.10.2.4.2 Argentina

- 6.10.2.1 NORTH AMERICA

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 CAL-MAINE FOODS COMMITTED TO SUSTAINABILITY FOR ETHICAL AND ENVIRONMENTAL ADVANCEMENT

- 6.11.2 SANOVO TECHNOLOGY GROUP OPTIMIZED PRODUCTION WITH DATA-DRIVEN INSIGHTS

- 6.11.3 GRANJA CAMPOMAYOR IMPLEMENTED ERP SOLUTION FOR ENHANCED INVENTORY CONTROL, LABELING ACCURACY, AND ORDER-HANDLING EFFICIENCY

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 EGG PROCESSING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 EGG PROCESSING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 DEGREE OF COMPETITION

- 6.12.2 THREAT OF NEW ENTRANTS

- 6.12.3 THREAT OF SUBSTITUTES

- 6.12.4 BARGAINING POWER OF SUPPLIERS

- 6.12.5 BARGAINING POWER OF BUYERS

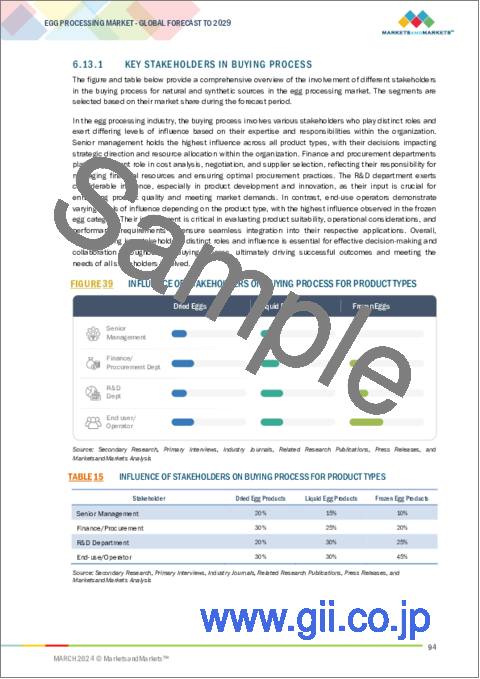

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRODUCT TYPES

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PRODUCT TYPES

- 6.13.2 BUYING CRITERIA

- TABLE 16 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 40 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- 6.14 EGG PROCESSING MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 41 INVESTOR DEALS AND FUNDING IN EGG PROCESSING MARKET

- FIGURE 42 KEY EGG PROCESSING FIRMS, 2022 (USD BILLION)

7 EGG PROCESSING MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- FIGURE 43 EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024 VS. 2029 (USD MILLION)

- TABLE 17 EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 18 EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 19 EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 20 EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 7.2 DRIED EGG PRODUCTS

- 7.2.1 DRIED EGG PRODUCTS TO WITNESS BOOM WITH INDUSTRY LEADERS MEETING HEALTH-CONSCIOUS DEMANDS OF GLOBAL CONSUMERS

- TABLE 21 DRIED EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 22 DRIED EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 23 DRIED EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 24 DRIED EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 7.3 LIQUID EGG PRODUCTS

- 7.3.1 WITH WIDE ADOPTION ACROSS SECTORS, LIQUID EGG PRODUCTS MARKET TO BE DRIVEN BY UNMATCHED CONVENIENCE, SAFETY, AND DIVERSE OFFERINGS

- TABLE 25 LIQUID EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 LIQUID EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 LIQUID EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 28 LIQUID EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 7.4 FROZEN EGG PRODUCTS

- 7.4.1 FROZEN EGG PRODUCTS MARKET TO BE PROPELLED WITH RISING DEMAND FOR CONVENIENT BREAKFASTS

- TABLE 29 FROZEN EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 FROZEN EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 FROZEN EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 32 FROZEN EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

8 EGG PROCESSING MARKET, BY END-USE APPLICATION

- 8.1 INTRODUCTION

- FIGURE 44 EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024 VS. 2029 (USD MILLION)

- TABLE 33 EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (USD MILLION)

- TABLE 34 EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- TABLE 35 EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (KT)

- TABLE 36 EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (KT)

- 8.2 FOOD PROCESSING AND MANUFACTURING

- 8.2.1 FOOD PROCESSING AND MANUFACTURING TO BOOM DUE TO INCREASING DEMAND FOR VERSATILE EGG PRODUCTS, DRIVEN BY THEIR ESSENTIAL ROLES IN ENHANCING TEXTURE OF CULINARY CREATIONS

- TABLE 37 FOOD PROCESSING AND MANUFACTURING: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 FOOD PROCESSING AND MANUFACTURING: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 FOOD PROCESSING AND MANUFACTURING: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 40 FOOD PROCESSING AND MANUFACTURING: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- TABLE 41 EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (USD MILLION)

- TABLE 42 EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (USD MILLION)

- TABLE 43 EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (KT)

- TABLE 44 EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (KT)

- 8.2.2 PROCESSED FOODS AND READY MEALS

- 8.2.2.1 Innovations in product offerings and market expansion to fuel egg processing industry for plant-based and conventional ready meals

- TABLE 45 PROCESSED FOOD AND READY MEALS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 PROCESSED FOOD AND READY MEALS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 PROCESSED FOOD AND READY MEALS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 48 PROCESSED FOOD AND READY MEALS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 8.2.3 BAKERY AND CONFECTIONERY

- 8.2.3.1 Leveraging egg processing innovations for superior quality and functionality to enhance growth in bakery and confectionery industry

- TABLE 49 BAKERY AND CONFECTIONERY: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 BAKERY AND CONFECTIONERY: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 BAKERY AND CONFECTIONERY: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 52 BAKERY AND CONFECTIONERY: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 8.2.4 DIETARY SUPPLEMENTS

- 8.2.4.1 Egg processing industry to witness growth by meeting rising demand for nutrient-rich dietary supplements

- TABLE 53 DIETARY SUPPLEMENTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 DIETARY SUPPLEMENTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 DIETARY SUPPLEMENTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 56 DIETARY SUPPLEMENTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 8.2.5 OTHERS

- TABLE 57 OTHERS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 OTHERS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 OTHERS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 60 OTHERS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 8.3 FOODSERVICE

- 8.3.1 FOODSERVICE MARKET GROWTH TO BE DRIVEN BY DIVERSE EGG PRODUCTS MEETING VARIED CULINARY NEEDS WITH FOCUS ON CONVENIENCE, SAFETY, AND QUALITY

- TABLE 61 FOODSERVICE: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 62 FOODSERVICE: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 FOODSERVICE: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 64 FOODSERVICE: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 8.4 RETAIL

- 8.4.1 RETAIL CHANNELS TO FUEL GLOBAL ADOPTION OF EGG-BASED INGREDIENTS IN HOME KITCHENS

- TABLE 65 RETAIL: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 RETAIL: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 RETAIL: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 68 RETAIL: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

9 EGG PROCESSING MARKET, BY NATURE

- 9.1 INTRODUCTION

- FIGURE 45 EGG PROCESSING MARKET, BY NATURE, 2024 VS. 2029 (USD MILLION)

- TABLE 69 EGG PROCESSING MARKET, BY NATURE, 2019-2023 (USD MILLION)

- TABLE 70 EGG PROCESSING MARKET, BY NATURE, 2024-2029 (USD MILLION)

- TABLE 71 EGG PROCESSING MARKET, BY NATURE, 2019-2023 (KT)

- TABLE 72 EGG PROCESSING MARKET, BY NATURE, 2024-2029 (KT)

- 9.2 ORGANIC EGG PRODUCTS

- 9.2.1 ORGANIC EGG PRODUCTS FUELED BY SUSTAINABLE FARMING PRACTICES, PROPELLING ORGANIC EGG PROCESSING MARKET AMID HEALTH-CONSCIOUS DEMAND

- TABLE 73 ORGANIC EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 ORGANIC EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 ORGANIC EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 76 ORGANIC EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 9.3 INORGANIC EGG PRODUCTS

- 9.3.1 INORGANIC EGG PRODUCTS TO FUEL GROWTH IN EGG PROCESSING MARKET, MEETING DIVERSE CONSUMER AND BUSINESS NEEDS WITH AFFORDABLE PROTEIN SOURCES

- TABLE 77 INORGANIC EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 INORGANIC EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 INORGANIC EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 80 INORGANIC EGG PRODUCTS: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

10 EGG PROCESSING MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 46 INDIA TO BE FASTEST-GROWING COUNTRY IN EGG PROCESSING MARKET

- TABLE 81 EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 84 EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- 10.2 NORTH AMERICA

- FIGURE 47 NORTH AMERICA: EGG PROCESSING MARKET SNAPSHOT, 2024

- TABLE 85 NORTH AMERICA: EGG PROCESSING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: EGG PROCESSING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: EGG PROCESSING MARKET, BY COUNTRY, 2019-2023 (KT)

- TABLE 88 NORTH AMERICA: EGG PROCESSING MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 89 NORTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 92 NORTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- TABLE 93 NORTH AMERICA: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (KT)

- TABLE 96 NORTH AMERICA: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (KT)

- TABLE 97 NORTH AMERICA: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (USD MILLION)

- TABLE 98 NORTH AMERICA: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (USD MILLION)

- TABLE 99 NORTH AMERICA: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (KT)

- TABLE 100 NORTH AMERICA: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (KT)

- TABLE 101 NORTH AMERICA: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (USD MILLION)

- TABLE 102 NORTH AMERICA: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (USD MILLION)

- TABLE 103 NORTH AMERICA: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (KT)

- TABLE 104 NORTH AMERICA: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (KT)

- 10.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 48 NORTH AMERICAN EGG PROCESSING MARKET: RECESSION IMPACT ANALYSIS

- 10.2.2 US

- 10.2.2.1 Consumer inclination toward protein-rich foods due to rising prevalence of health diseases to propel market growth

- TABLE 105 US: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 106 US: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 107 US: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 108 US: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.2.3 CANADA

- 10.2.3.1 Consumer preferences for convenience, safety, and nutrition to boost egg processing market

- TABLE 109 CANADA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 110 CANADA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 111 CANADA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 112 CANADA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.2.4 MEXICO

- 10.2.4.1 Growing foodservice industry to create high demand for pre-prepared egg products, thereby boosting market

- TABLE 113 MEXICO: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 114 MEXICO: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 115 MEXICO: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 116 MEXICO: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.3 EUROPE

- TABLE 117 EUROPE: EGG PROCESSING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 118 EUROPE: EGG PROCESSING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 119 EUROPE: EGG PROCESSING MARKET, BY COUNTRY, 2019-2023 (KT)

- TABLE 120 EUROPE: EGG PROCESSING MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 121 EUROPE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 122 EUROPE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 123 EUROPE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 124 EUROPE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- TABLE 125 EUROPE: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (USD MILLION)

- TABLE 126 EUROPE: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (KT)

- TABLE 128 EUROPE: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (KT)

- TABLE 129 EUROPE: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (USD MILLION)

- TABLE 130 EUROPE: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (USD MILLION)

- TABLE 131 EUROPE: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (KT)

- TABLE 132 EUROPE: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (KT)

- TABLE 133 EUROPE: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (USD MILLION)

- TABLE 134 EUROPE: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (USD MILLION)

- TABLE 135 EUROPE: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (KT)

- TABLE 136 EUROPE: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (KT)

- 10.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 49 EUROPEAN EGG PROCESSING MARKET: RECESSION IMPACT ANALYSIS

- 10.3.2 GERMANY

- 10.3.2.1 Free-range farming and diversification of egg production in Germany leading to growth in egg processing market

- TABLE 137 GERMANY: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 138 GERMANY: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 139 GERMANY: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 140 GERMANY: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.3.3 FRANCE

- 10.3.3.1 Increasing adoption of cage-free methods in response to changing consumer preferences to fuel market growth

- TABLE 141 FRANCE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 142 FRANCE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 143 FRANCE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 144 FRANCE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.3.4 UK

- 10.3.4.1 UK's egg processing market to thrive, demonstrating impressive growth and resilience

- TABLE 145 UK: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 146 UK: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 147 UK: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 148 UK: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.3.5 ITALY

- 10.3.5.1 Investments in advanced processing technology to enhance efficiency, safety, and product quality

- TABLE 149 ITALY: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 150 ITALY: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 151 ITALY: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 152 ITALY: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.3.6 SPAIN

- 10.3.6.1 Shift toward cage-free eggs to drive growth in Spain's egg processing industry

- TABLE 153 SPAIN: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 154 SPAIN: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 155 SPAIN: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 156 SPAIN: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.3.7 REST OF EUROPE

- TABLE 157 REST OF EUROPE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 158 REST OF EUROPE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 159 REST OF EUROPE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 160 REST OF EUROPE: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.4 ASIA PACIFIC

- FIGURE 50 ASIA PACIFIC: EGG PROCESSING MARKET SNAPSHOT, 2024

- TABLE 161 ASIA PACIFIC: EGG PROCESSING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 162 ASIA PACIFIC: EGG PROCESSING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 163 ASIA PACIFIC: EGG PROCESSING MARKET, BY COUNTRY, 2019-2023 (KT)

- TABLE 164 ASIA PACIFIC: EGG PROCESSING MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 165 ASIA PACIFIC: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 167 ASIA PACIFIC: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 168 ASIA PACIFIC: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- TABLE 169 ASIA PACIFIC: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (USD MILLION)

- TABLE 170 ASIA PACIFIC: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- TABLE 171 ASIA PACIFIC: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (KT)

- TABLE 172 ASIA PACIFIC: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (KT)

- TABLE 173 ASIA PACIFIC: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (USD MILLION)

- TABLE 174 ASIA PACIFIC: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (USD MILLION)

- TABLE 175 ASIA PACIFIC: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (KT)

- TABLE 176 ASIA PACIFIC: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (KT)

- TABLE 177 ASIA PACIFIC: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (USD MILLION)

- TABLE 178 ASIA PACIFIC: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (USD MILLION)

- TABLE 179 ASIA PACIFIC: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (KT)

- TABLE 180 ASIA PACIFIC: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (KT)

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 51 ASIA PACIFIC EGG PROCESSING MARKET: RECESSION IMPACT ANALYSIS

- 10.4.2 CHINA

- 10.4.2.1 Expansion of egg production variety in China to enhance growth outlook for egg processing market

- TABLE 181 CHINA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 182 CHINA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 183 CHINA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 184 CHINA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.4.3 JAPAN

- 10.4.3.1 Impact of import-export dynamics on Japan's egg processing market to fuel market growth

- TABLE 185 JAPAN: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 186 JAPAN: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 187 JAPAN: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 188 JAPAN: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.4.4 INDIA

- 10.4.4.1 Egg production capacity and export dominance fueling egg processing industry growth

- TABLE 189 INDIA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 190 INDIA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 191 INDIA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 192 INDIA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.4.5 AUSTRALIA & NEW ZEALAND

- 10.4.5.1 Scaling operations and regional research in Australia and New Zealand to promote egg industry

- FIGURE 52 AUSTRALIA: EGG CONSUMPTION PER CAPITA, PER PERSON, 2018-2023

- TABLE 193 AUSTRALIA & NEW ZEALAND: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 194 AUSTRALIA & NEW ZEALAND: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 195 AUSTRALIA & NEW ZEALAND: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 196 AUSTRALIA & NEW ZEALAND: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 197 REST OF ASIA PACIFIC: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 200 REST OF ASIA PACIFIC: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.5 SOUTH AMERICA

- TABLE 201 SOUTH AMERICA: EGG PROCESSING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 202 SOUTH AMERICA: EGG PROCESSING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 203 SOUTH AMERICA: EGG PROCESSING MARKET, BY COUNTRY, 2019-2023 (KT)

- TABLE 204 SOUTH AMERICA: EGG PROCESSING MARKET, BY COUNTRY, 2024-2029 (KT)

- TABLE 205 SOUTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 206 SOUTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 207 SOUTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 208 SOUTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- TABLE 209 SOUTH AMERICA: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (USD MILLION)

- TABLE 210 SOUTH AMERICA: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- TABLE 211 SOUTH AMERICA: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (KT)

- TABLE 212 SOUTH AMERICA: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (KT)

- TABLE 213 SOUTH AMERICA: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (USD MILLION)

- TABLE 214 SOUTH AMERICA: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (USD MILLION)

- TABLE 215 SOUTH AMERICA: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (KT)

- TABLE 216 SOUTH AMERICA: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (KT)

- TABLE 217 SOUTH AMERICA: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (USD MILLION)

- TABLE 218 SOUTH AMERICA: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (USD MILLION)

- TABLE 219 SOUTH AMERICA: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (KT)

- TABLE 220 SOUTH AMERICA: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (KT)

- 10.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 53 SOUTH AMERICAN EGG PROCESSING MARKET: RECESSION IMPACT ANALYSIS

- 10.5.2 BRAZIL

- 10.5.2.1 Expanding exports to open up new revenue streams for processors in Brazil

- TABLE 221 BRAZIL: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 222 BRAZIL: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 223 BRAZIL: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 224 BRAZIL: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.5.3 ARGENTINA

- 10.5.3.1 Capitalizing on health trends: Growing opportunities in Argentina's egg processing market

- TABLE 225 ARGENTINA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 226 ARGENTINA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 227 ARGENTINA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 228 ARGENTINA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.5.4 REST OF SOUTH AMERICA

- TABLE 229 REST OF SOUTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 230 REST OF SOUTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 231 REST OF SOUTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 232 REST OF SOUTH AMERICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.6 REST OF THE WORLD (ROW)

- TABLE 233 ROW: EGG PROCESSING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 234 ROW: EGG PROCESSING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 235 ROW: EGG PROCESSING MARKET, BY REGION, 2019-2023 (KT)

- TABLE 236 ROW: EGG PROCESSING MARKET, BY REGION, 2024-2029 (KT)

- TABLE 237 ROW: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 238 ROW: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 239 ROW: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 240 ROW: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- TABLE 241 ROW: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (USD MILLION)

- TABLE 242 ROW: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- TABLE 243 ROW: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2019-2023 (KT)

- TABLE 244 ROW: EGG PROCESSING MARKET, BY END-USE APPLICATION, 2024-2029 (KT)

- TABLE 245 ROW: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (USD MILLION)

- TABLE 246 ROW: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (USD MILLION)

- TABLE 247 ROW: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2019-2023 (KT)

- TABLE 248 ROW: EGG PROCESSING MARKET, BY FOOD PROCESSING AND MANUFACTURING, 2024-2029 (KT)

- TABLE 249 ROW: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (USD MILLION)

- TABLE 250 ROW: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (USD MILLION)

- TABLE 251 ROW: EGG PROCESSING MARKET, BY NATURE, 2019-2023 (KT)

- TABLE 252 ROW: EGG PROCESSING MARKET, BY NATURE, 2024-2029 (KT)

- 10.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 54 ROW EGG PROCESSING MARKET: RECESSION IMPACT ANALYSIS

- 10.6.2 AFRICA

- 10.6.2.1 FAO to invest in sustainable solutions for Rwanda's egg market

- 10.6.2.2 South Africa

- 10.6.2.3 Nigeria

- 10.6.2.4 Rest of Africa

- TABLE 253 AFRICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 254 AFRICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 255 AFRICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 256 AFRICA: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

- 10.6.3 MIDDLE EAST

- 10.6.3.1 Diversifying US egg product exports to meet growing demand in Middle East

- 10.6.3.2 UAE

- 10.6.3.3 Saudi Arabia

- 10.6.3.4 Iran

- 10.6.3.5 Rest of Middle East

- TABLE 257 MIDDLE EAST: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (USD MILLION)

- TABLE 258 MIDDLE EAST: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 259 MIDDLE EAST: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2019-2023 (KT)

- TABLE 260 MIDDLE EAST: EGG PROCESSING MARKET, BY PRODUCT TYPE, 2024-2029 (KT)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- TABLE 261 EGG PROCESSING MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 11.3 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 262 STRATEGIES ADOPTED BY KEY PLAYERS IN EGG PROCESSING MARKET

- 11.4 REVENUE ANALYSIS

- FIGURE 55 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018-2023 (USD BILLION)

- 11.5 KEY PLAYERS' ANNUAL REVENUE VS. GROWTH

- FIGURE 56 ANNUAL REVENUE, 2023 (USD BILLION) VS. REVENUE GROWTH, 2021-2023

- 11.6 KEY PLAYERS' EBIT/EBITDA

- FIGURE 57 EBIT/EBITDA, 2023 (USD BILLION)

- 11.7 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.7.1 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY PRODUCT TYPE

- FIGURE 58 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY PRODUCT TYPE

- 11.7.1.1 Le Naturelle

- 11.7.1.2 SKM Best Eggs

- 11.7.1.3 Ovostar

- 11.7.1.4 Sportprotein.Com

- 11.7.1.5 Eggland's Best

- 11.8 VALUATION AND FINANCIAL METRICS OF EGG PROCESSING COMPANIES

- FIGURE 59 EV/EBITDA OF EGG PROCESSING, 2023

- 11.9 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 60 EGG PROCESSING MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2023

- 11.10 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 11.10.1 STARS

- 11.10.2 EMERGING LEADERS

- 11.10.3 PERVASIVE PLAYERS

- 11.10.4 PARTICIPANTS

- FIGURE 61 EGG PROCESSING MARKET, COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 11.10.5 COMPANY FOOTPRINT

- TABLE 263 COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 264 COMPANY END-USE APPLICATION FOOTPRINT

- TABLE 265 COMPANY REGION FOOTPRINT

- TABLE 266 OVERALL COMPANY FOOTPRINT

- 11.11 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 11.11.1 PROGRESSIVE COMPANIES

- 11.11.2 RESPONSIVE COMPANIES

- 11.11.3 DYNAMIC COMPANIES

- 11.11.4 STARTING BLOCKS

- FIGURE 62 EGG PROCESSING MARKET, COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 11.11.5 COMPETITIVE BENCHMARKING

- 11.11.5.1 Detailed list of key startups/SMEs

- TABLE 267 EGG PROCESSING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 268 EGG PROCESSING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.12 COMPETITIVE SCENARIO

- 11.12.1 PRODUCT LAUNCHES

- TABLE 269 EGG PROCESSING MARKET: PRODUCT LAUNCHES, SEPTEMBER 2020

- 11.12.2 DEALS

- TABLE 270 EGG PROCESSING MARKET: DEALS, NOVEMBER 2019-JANUARY 2024

- 11.12.3 EXPANSIONS

- TABLE 271 EGG PROCESSING MARKET: EXPANSIONS, JUNE 2020-JANUARY 2024

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 CAL-MAINE FOODS, INC.

- TABLE 272 CAL-MAINE FOODS, INC.: BUSINESS OVERVIEW

- FIGURE 63 CAL-MAINE FOODS, INC.: COMPANY SNAPSHOT

- TABLE 273 CAL-MAINE FOODS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 CAL-MAINE FOODS, INC.: DEALS, NOVEMBER 2019-JANUARY 2024

- TABLE 275 CAL-MAINE FOODS, INC.: EXPANSION, JUNE 2020-DECEMBER 2023

- 12.1.2 ROSE ACRE FARMS

- TABLE 276 ROSE ACRE FARMS: BUSINESS OVERVIEW

- TABLE 277 ROSE ACRE FARMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 ROSE ACRE FARMS: DEALS, OCTOBER 2020-NOVEMBER 2023

- TABLE 279 ROSE ACRE FARMS: EXPANSIONS, MAY 2023

- 12.1.3 OVOBELFOODS.COM

- TABLE 280 OVOBELFOODS.COM: BUSINESS OVERVIEW

- FIGURE 64 OVOBELFOODS.COM: COMPANY SNAPSHOT

- TABLE 281 OVOBELFOODS.COM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.4 SKMEGG.COM

- TABLE 282 SKMEGG.COM: BUSINESS OVERVIEW

- FIGURE 65 SKMEGG.COM: COMPANY SNAPSHOT

- TABLE 283 SKMEGG.COM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 SKMEGG.COM: EXPANSIONS, MAY 2023

- 12.1.5 INTEROVO EGG GROUP BV

- TABLE 285 INTEROVO EGG GROUP BV: BUSINESS OVERVIEW

- TABLE 286 INTEROVO EGG GROUP BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.6 IGRECA

- TABLE 287 IGRECA: BUSINESS OVERVIEW

- TABLE 288 IGRECA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 WABASH VALLEY

- TABLE 289 WABASH VALLEY: BUSINESS OVERVIEW

- TABLE 290 WABASH VALLEY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 WABASH VALLEY: EXPANSIONS, FEBRUARY 2023

- 12.1.8 REMBRANDT FOODS

- TABLE 292 REMBRANDT FOODS: BUSINESS OVERVIEW

- TABLE 293 REMBRANDT FOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 AVRIL SCA

- TABLE 294 AVRIL SCA: BUSINESS OVERVIEW

- TABLE 295 AVRIL SCA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.10 EUROVO S.R.L.

- TABLE 296 EUROVO S.R.L.: BUSINESS OVERVIEW

- TABLE 297 EUROVO S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.11 BOUWHUIS ENTHOVEN

- TABLE 298 BOUWHUIS ENTHOVEN: BUSINESS OVERVIEW

- TABLE 299 BOUWHUIS ENTHOVEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 BOUWHUIS ENTHOVEN: PRODUCT LAUNCHES, SEPTEMBER 2020

- 12.1.12 TAJ AGRO INTERNATIONAL (TAJ PHARMA GROUP)

- TABLE 301 TAJ AGRO INTERNATIONAL (TAJ PHARMA GROUP): BUSINESS OVERVIEW

- TABLE 302 TAJ AGRO INTERNATIONAL (TAJ PHARMA GROUP): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.13 HILLANDALE FARMS

- TABLE 303 HILLANDALE FARMS: BUSINESS OVERVIEW

- TABLE 304 HILLANDALE FARMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.14 VENKY'S INDIA

- TABLE 305 VENKY'S INDIA: BUSINESS OVERVIEW

- FIGURE 66 VENKY'S INDIA: COMPANY SNAPSHOT

- TABLE 306 VENKY'S INDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 VENKY'S INDIA: EXPANSIONS, FEBRUARY 2023

- 12.1.15 KEWPIE EGG CORPORATION

- TABLE 308 KEWPIE EGG CORPORATION: BUSINESS OVERVIEW

- TABLE 309 KEWPIE EGG CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 KEWPIE EGG CORPORATION: EXPANSIONS, JULY 2023-JANUARY 2024

- 12.2 OTHER PLAYERS

- 12.2.1 OVOBEST EIPRODUKTE GMBH & CO. KG

- 12.2.2 TAIYO INTERNATIONAL

- 12.2.3 READY EGG PRODUCTS

- 12.2.4 OVOVITA

- 12.2.5 VERSOVA

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 311 MARKETS ADJACENT TO EGG PROCESSING MARKET

- 13.2 LIMITATIONS

- 13.3 LECITHIN AND PHOSPHOLIPIDS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 312 PHOSPHOLIPIDS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 313 PHOSPHOLIPIDS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.4 PROTEIN INGREDIENTS MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- TABLE 314 PROTEIN INGREDIENTS MARKET, BY SOURCE, 2019-2022 (USD MILLION)

- TABLE 315 PROTEIN INGREDIENTS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS