|

|

市場調査レポート

商品コード

1745109

レーザー加工の世界市場 (~2032年):レーザータイプ (ファイバー・ルビー・YAG・半導体・薄ディスク・CO2・エキシマ・ヘリウムネオン・アルゴン・化学・液体・X線・フォトニック結晶・短パルス )・構成 (固定・移動・ハイブリッド)・コンポーネント別Laser Processing Market by Laser type (Fiber, Ruby, YAG, Semiconductor, Thin-disk, CO2, Excimer, Helium-neon, Argon, Chemical, Liquid, X-ray, Photonic Crystal, Short-pulse), Configuration (Fixed, Moving, Hybrid), Component - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| レーザー加工の世界市場 (~2032年):レーザータイプ (ファイバー・ルビー・YAG・半導体・薄ディスク・CO2・エキシマ・ヘリウムネオン・アルゴン・化学・液体・X線・フォトニック結晶・短パルス )・構成 (固定・移動・ハイブリッド)・コンポーネント別 |

|

出版日: 2025年06月04日

発行: MarketsandMarkets

ページ情報: 英文 325 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

レーザ加工の市場規模は、2025年の71億7,000万米ドルから、予測期間中はCAGR 8.5%で推移し、2032年には118億9,000万米ドルに達すると予測されています。

レーザー加工は、表面の処理や彫刻に用いられる非常に高精度で、多用途かつ効率的な方法であり、さまざまな産業で使用されています。自動車分野においては、レーザー表面処理技術は、塗装のための表面準備、接着性の向上、腐食や摩耗耐性といった機能的特性の向上に使用されます。レーザー彫刻は、エンジン部品、シャーシ部品、内装トリムなどの部品を識別・ブランド化・カスタマイズするために使用され、恒久的で高コントラストのマーキングを提供します。エレクトロニクス電子機器産業においては、レーザー表面処理技術は、基板の微細構造化やテクスチャリングに適用され、回路基板や半導体部品などのデバイスにおいて接着性や電気的特性を向上させます。また、マイクロチップや電子機器筐体などの精密部品のマーキングや切断にも利用されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2032年 |

| 単位 | 金額 (米ドル) |

| 部門別 | コンポーネント、レーザータイプ、構成、用途、エンドユーザー、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

"ガスレーザー部門は、予測期間中に2番目に大きな市場シェアを占める見込み"

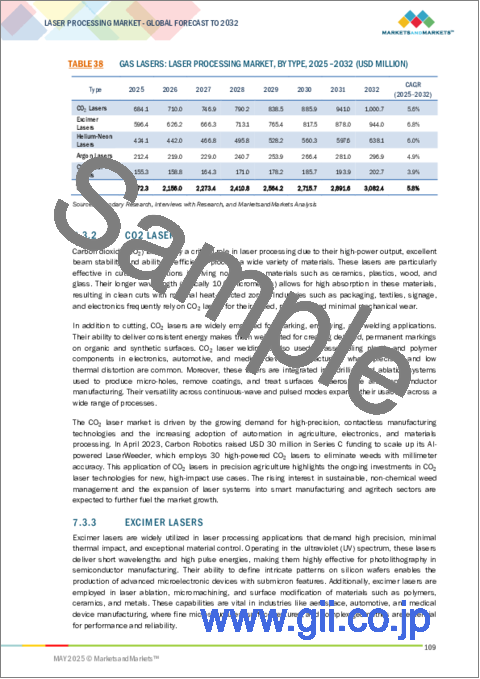

ガスレーザーは、レーザー媒質として気体化合物を使用し、その安定した性能、優れたビーム品質、幅広い精密用途への適合性で知られています。一般的なタイプには、CO2レーザー、エキシマレーザー、ヘリウムネオンレーザー、アルゴンレーザー、化学レーザーがあります。それぞれは、産業、医療、科学の分野で異なる役割を果たします。CO2レーザーは、高効率で非金属材料の加工が可能なため、切断、溶接、彫刻などの材料加工で広く使用されています。エキシマレーザーは紫外線領域で動作し、フォトリソグラフィー、マイクロマシニング、眼科手術において好まれています。ヘリウムネオンレーザーは出力は低いものの、非常に安定した赤色レーザービームを提供し、光学アライメント、干渉計測、計量などに理想的です。アルゴンレーザーは高出力かつ狭帯域の青および緑の光を発し、医療処置、蛍光イメージング、分光分析に使用されます。一方、化学レーザーは化学反応によって強力なエネルギーバーストを発生させる高エネルギーシステムであり、防衛や航空宇宙分野で使用されます。

"エンドユーザー別では、自動車部門が2番目に高いCAGRで成長する見込み"

レーザー加工は、高精度製造、生産速度の向上、材料効率の改善を可能にすることで、自動車産業の発展に重要な役割を果たしています。自動車用途において、レーザーは金属および複合材料の切断、溶接、彫刻、表面処理に広く使用されており、ボディパネル、パワートレインシステム、バッテリー筐体などの車両部品の製造に不可欠です。EVの採用拡大、公的支援の増加、技術革新の相乗効果により、レーザー加工は現代の自動車製造における基盤技術となりつつあります。サプライヤーやOEMが進化するEVの要求に応じて業務を拡大する中、レーザーソリューションの需要は大幅に増加すると予想されます。これにより、特に高速かつスケーラブルで効率的なEV製造プロセスに適したソリューションを提供するレーザー加工プロバイダーにとって、新たな成長機会が創出されるでしょう。

当レポートでは、世界のレーザー加工の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客の事業に影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 貿易分析

- 価格分析

- 特許分析

- 主な会議とイベント

- 規制状況

- 主要なステークホルダーと購入基準

- AIの影響

- 2025年の米国関税の影響

第6章 レーザー加工の構成要素

- レーザー

- レーザーシステム

第7章 レーザー加工市場:レーザータイプ別

- 固体レーザー

- ファイバーレーザー

- ルビーレーザー

- YAGレーザー

- 半導体レーザー

- 薄ディスクレーザー

- ガスレーザー

- CO2レーザー

- エキシマレーザー

- ヘリウムネオンレーザー

- アルゴンレーザー

- 化学レーザー

- 液体レーザー

- その他

第8章 レーザー加工市場:構成別

- 固定ビーム

- 可動ビーム

- ハイブリッドビーム

第9章 レーザー加工市場:用途別

- 切断

- 溶接

- 掘削

- マーキングと彫刻

- 高度な処理

- その他

第10章 レーザー加工市場:エンドユーザー別

- マイクロエレクトロニクスおよび半導体

- PCBの穴あけと切断

- ウエハーダイシング

- OLEDディスプレイのパターニング

- 自動車

- ボディパネル溶接

- バッテリー溶接

- プラスチック部品のマーキング

- 医療・ライフサイエンス

- 医療機器製造

- ステント用レーザー微細加工

- DNAと細胞の操作

- 航空宇宙

- 航空機部品の溶接

- 複合材料加工

- レーザー距離計・照準システム

- アーキテクチャ・建設

- 装飾レーザー切断

- インテリアとファサードの彫刻

- その他

第11章 レーザー加工市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- スイス

- ポーランド

- 北欧

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- 世界のその他の地域

- マクロ経済見通し

- 中東

- 南米

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- COHERENT CORP.

- TRUMPF

- HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD.

- IPG PHOTONICS CORPORATION

- JENOPTIK AG

- FIVES

- AXBIS

- LUMENTUM OPERATIONS LLC

- GRAVOTECH, INC.

- LASER STAR TECHNOLOGIES

- LUMIBIRD

- EPILOG LASER

- MKS INSTRUMENTS

- NOVANTA INC.

- EUROLASER GMBH

- 600 GROUP PLC

- BYSTRONIC GROUP

- その他の地域

- ALPHALAS GMBH

- APPLIED LASER TECHNOLOGY, INC.

- ARIMA LASERS CORP.

- FOCUSLIGHT TECHNOLOGIES INC.

- INNO LASER TECHNOLOGY CO., LTD.

- NKT PHOTONICS A/S

- PHOTONICS INDUSTRIES INTERNATIONAL. INC.

- SFX

- TOPTICA PHOTONICS AG

- UNIVERSAL LASER SYSTEMS, INC.

第14章 付録

List of Tables

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 LASER PROCESSING MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 LASER PROCESSING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 ENHANCING COPPER LASER WELDING WITH CANUNDA-HP AT INSTITUT MAUPERTUIS

- TABLE 5 TRANSITIONING FROM GRIT BLASTING TO LASER TEXTURING WITH LASERAX

- TABLE 6 UNIVERSITY OF MANCHESTER ENHANCES ENGINEERING EDUCATION WITH HPC LASER CUTTER

- TABLE 7 ENHANCING CHIMNEY & BOILER MANUFACTURING WITH LASER ISSE'S FULLY AUTOMATED LASER WELDING LINE

- TABLE 8 VORTRAN LASERS ENHANCE BIOMEDICAL RESEARCH WITH LIFE CANVAS TECHNOLOGIES

- TABLE 9 MEETING CUSTOM MACHINE TOOL DEMAND OF DAWN MACHINERY WITH REINSHAW PLC LASER PRECISION

- TABLE 10 ENHANCING CNC MACHINE TOOL ACCURACY OF HEAKE WITH RENISHAW PLC LASER CALIBRATION TECHNOLOGY

- TABLE 11 BOOSTING HVAC FABRICATION EFFICIENCY OF KAVANAGH INDUSTRIES WITH AMADA HIGH-SPEED FIBER LASER TECHNOLOGY

- TABLE 12 IMPORT SCENARIO FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT SCENARIO FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 AVERAGE SELLING PRICE TREND, BY LASER TYPE, 2022-2024

- TABLE 15 AVERAGE SELLING PRICE OF LASERS OFFERED BY KEY PLAYERS, BY LASER TYPE (USD)

- TABLE 16 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- TABLE 17 LASER PROCESSING MARKET: LIST OF MAJOR PATENTS, 2021-2024

- TABLE 18 LASER PROCESSING MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 25 ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 26 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFF

- TABLE 27 LASER PROCESSING MARKET, BY LASER TYPE, 2021-2024 (USD MILLION)

- TABLE 28 LASER PROCESSING MARKET, BY LASER TYPE, 2025-2032 (USD MILLION)

- TABLE 29 LASER PROCESSING MARKET, BY LASER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 30 LASER PROCESSING MARKET, BY LASER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 31 SOLID LASERS: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 SOLID LASERS: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 33 SOLID LASERS: LASER PROCESSING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 34 SOLID LASERS: LASER PROCESSING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 35 GAS LASERS: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 GAS LASERS: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 GAS LASERS: LASER PROCESSING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 38 GAS LASERS: LASER PROCESSING MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 39 LIQUID LASERS: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 LIQUID LASERS: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 41 OTHER LASER TYPES: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 OTHER LASER TYPES: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 LASER PROCESSING MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 44 LASER PROCESSING MARKET, BY CONFIGURATION, 2025-2032 (USD MILLION)

- TABLE 45 FIXED BEAMS: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 FIXED BEAMS: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 MOVING BEAMS: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 MOVING BEAMS: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 HYBRID BEAMS: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 HYBRID BEAMS: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 51 COMPARISON OF LASER PROCESSING CONFIGURATIONS

- TABLE 52 LASER PROCESSING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 53 LASER PROCESSING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 54 LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 55 LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 56 KEY COMPETITORS OF FIVES OFFERING LASER PROCESSING SYSTEMS

- TABLE 57 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 61 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 63 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 65 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 MICROELECTRONICS & SEMICONDUCTORS: LASER PROCESSING MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 ENHANCING WAFER DOWNSIZING WITH PRECISION LASER MICROJET TECHNOLOGY

- TABLE 68 PRECISION SINGULATION OF ULTRA-THIN SILICON WAFERS USING WATER-GUIDED LASERS

- TABLE 69 ENHANCING PRECISION AND EFFICIENCY IN DICING OF HIGH-DENSITY CIRCUITS

- TABLE 70 COST REDUCTION AND QUALITY IMPROVEMENT IN WAFER DICING

- TABLE 71 LIST OF CLIENTS IN MICROELECTRONICS & SEMICONDUCTORS INDUSTRY

- TABLE 72 AUTOMOTIVE: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 AUTOMOTIVE: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 74 AUTOMOTIVE: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 AUTOMOTIVE: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 76 AUTOMOTIVE: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 AUTOMOTIVE: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 78 AUTOMOTIVE: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 AUTOMOTIVE: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 80 AUTOMOTIVE: LASER PROCESSING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 AUTOMOTIVE: LASER PROCESSING MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 82 ENHANCING TRACEABILITY IN HARSH DIE CASTING ENVIRONMENTS WITH LASER MARKING

- TABLE 83 PRECISION E-COATING REMOVAL FOR AUTOMOTIVE SEAT RAIL WELDING

- TABLE 84 BOOSTING PRODUCTION EFFICIENCY IN NEV MANUFACTURING: BOJUN TECHNOLOGY'S SUCCESS WITH TRUMPF'S TRULASER SOLUTION

- TABLE 85 LIST OF CLIENTS IN AUTOMOTIVE INDUSTRY

- TABLE 86 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 88 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 90 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 92 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 94 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 MEDICAL & LIFE SCIENCES: LASER PROCESSING MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 PRECISION CUTTING OF SILICON BLADES FOR OPHTHALMIC SURGERY

- TABLE 97 ENHANCING STENT MANUFACTURING WITH LASER MICROJET TECHNOLOGY

- TABLE 98 ACHIEVING DURABLE AND PRECISE MARKINGS FOR MEDICAL DEVICES

- TABLE 99 PRECISION LASER MARKING AND CUTTING FOR NEUROSURGICAL IMPLANTS

- TABLE 100 LIST OF CLIENTS IN MEDICAL & LIFE SCIENCE INDUSTRY

- TABLE 101 AEROSPACE: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 AEROSPACE: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 103 AEROSPACE: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 AEROSPACE: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 105 AEROSPACE: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 AEROSPACE: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 107 AEROSPACE: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 AEROSPACE: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 109 AEROSPACE: LASER PROCESSING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 AEROSPACE: LASER PROCESSING MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 PRECISION DRILLING, MILLING, AND CUTTING OF AERO-ENGINE PARTS WITH LMJ TECHNOLOGY

- TABLE 112 ADVANCING CMC MACHINING WITH WATER-JET GUIDED LASER SOLUTIONS

- TABLE 113 PRECISION WELDING SOLUTIONS FOR COMPLEX AEROSPACE COMPONENTS

- TABLE 114 LIST OF CLIENTS IN AEROSPACE INDUSTRY

- TABLE 115 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 117 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 119 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 121 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 123 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 ARCHITECTURE & CONSTRUCTION: LASER PROCESSING MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 125 PRECISION MODELING FOR HIGH-COMPLEXITY INFRASTRUCTURE PROJECTS

- TABLE 126 LIST OF CLIENTS IN ARCHITECTURE & CONSTRUCTION INDUSTRY

- TABLE 127 OTHER END USERS: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 OTHER END USERS: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 129 OTHER END USERS: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 OTHER END USERS: LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 131 OTHER END USERS: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 OTHER END USERS: LASER PROCESSING MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 133 OTHER END USERS: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 OTHER END USERS: LASER PROCESSING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 135 OTHER END USERS: LASER PROCESSING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 136 OTHER END USERS: LASER PROCESSING MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 137 MEETING MILITARY MARKING STANDARDS WITH LASER TECHNOLOGY

- TABLE 138 ENHANCING TIME EFFICIENCY AND DESIGN PRECISION WITH LASER TECHNOLOGY

- TABLE 139 IMPLEMENTING SUSTAINABLE MARKING TECHNOLOGIES FOR FOOD PACKAGING

- TABLE 140 LIST OF CLIENTS IN OTHER END USERS

- TABLE 141 LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 143 NORTH AMERICA: LASER PROCESSING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 NORTH AMERICA: LASER PROCESSING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 145 NORTH AMERICA: LASER PROCESSING MARKET, BY LASER TYPE, 2021-2024 (USD MILLION)

- TABLE 146 NORTH AMERICA: LASER PROCESSING MARKET, BY LASER TYPE, 2025-2032 (USD MILLION)

- TABLE 147 NORTH AMERICA: LASER PROCESSING MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: LASER PROCESSING MARKET, BY CONFIGURATION, 2025-2032 (USD MILLION)

- TABLE 149 NORTH AMERICA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 151 US: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 152 US: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 153 CANADA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 154 CANADA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 155 MEXICO: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 156 MEXICO: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 157 EUROPE: LASER PROCESSING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 EUROPE: LASER PROCESSING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 159 EUROPE: LASER PROCESSING MARKET, BY LASER TYPE, 2021-2024 (USD MILLION)

- TABLE 160 EUROPE: LASER PROCESSING MARKET, BY LASER TYPE, 2025-2032 (USD MILLION)

- TABLE 161 EUROPE: LASER PROCESSING MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 162 EUROPE: LASER PROCESSING MARKET, BY CONFIGURATION, 2025-2032 (USD MILLION)

- TABLE 163 EUROPE: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 164 EUROPE: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 165 UK: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 166 UK: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 167 GERMANY: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 168 GERMANY: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 169 FRANCE: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 170 FRANCE: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 171 ITALY: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 172 ITALY: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 173 SPAIN: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 174 SPAIN: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 175 NETHERLANDS: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 176 NETHERLANDS: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 177 SWITZERLAND: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 178 SWITZERLAND: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 179 POLAND: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 180 POLAND: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 181 NORDICS: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 182 NORDICS: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 183 REST OF EUROPE: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 184 REST OF EUROPE: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 185 ASIA PACIFIC: LASER PROCESSING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 ASIA PACIFIC: LASER PROCESSING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 187 ASIA PACIFIC: LASER PROCESSING MARKET, BY LASER TYPE, 2021-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: LASER PROCESSING MARKET, BY LASER TYPE, 2025-2032 (USD MILLION)

- TABLE 189 ASIA PACIFIC: LASER PROCESSING MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 190 ASIA PACIFIC: LASER PROCESSING MARKET, BY CONFIGURATION, 2025-2032 (USD MILLION)

- TABLE 191 ASIA PACIFIC: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 192 ASIA PACIFIC: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 193 CHINA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 194 CHINA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 195 JAPAN: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 196 JAPAN: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 197 SOUTH KOREA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 198 SOUTH KOREA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 199 INDIA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 200 INDIA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 201 AUSTRALIA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 202 AUSTRALIA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 203 INDONESIA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 204 INDONESIA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 205 MALAYSIA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 206 MALAYSIA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 207 THAILAND: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 208 THAILAND: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 209 VIETNAM: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 210 VIETNAM: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 213 ROW: LASER PROCESSING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 214 ROW: LASER PROCESSING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 215 ROW: LASER PROCESSING MARKET, BY LASER TYPE, 2021-2024 (USD MILLION)

- TABLE 216 ROW: LASER PROCESSING MARKET, BY LASER TYPE, 2025-2032 (USD MILLION)

- TABLE 217 ROW: LASER PROCESSING MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 218 ROW: LASER PROCESSING MARKET, BY CONFIGURATION, 2025-2032 (USD MILLION)

- TABLE 219 ROW: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 220 ROW: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 221 MIDDLE EAST: LASER PROCESSING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 222 MIDDLE EAST: LASER PROCESSING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 223 MIDDLE EAST: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 224 MIDDLE EAST: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 225 SOUTH AMERICA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 226 SOUTH AMERICA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 227 AFRICA: LASER PROCESSING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 228 AFRICA: LASER PROCESSING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 229 AFRICA: LASER PROCESSING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 230 AFRICA: LASER PROCESSING MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 231 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR COMPANIES, JANUARY 2022-MAY 2025

- TABLE 232 LASER PROCESSING MARKET: DEGREE OF COMPETITION, 2024

- TABLE 233 LASER PROCESSING MARKET: REGION FOOTPRINT

- TABLE 234 LASER PROCESSING MARKET: LASER TYPE FOOTPRINT

- TABLE 235 LASER PROCESSING MARKET: APPLICATION FOOTPRINT

- TABLE 236 LASER PROCESSING MARKET: END USER FOOTPRINT

- TABLE 237 LASER PROCESSING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 238 LASER PROCESSING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 239 LASER PROCESSING MARKET: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 240 LASER PROCESSING MARKETS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 241 LASER PROCESSING MARKETS MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 242 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 243 COHERENT CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 245 TRUMPF: COMPANY OVERVIEW

- TABLE 246 TRUMPF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 TRUMPF: PRODUCT LAUNCHES

- TABLE 248 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 249 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD.: PRODUCT LAUNCHES

- TABLE 251 IPG PHOTONICS CORPORATION: COMPANY OVERVIEW

- TABLE 252 IPG PHOTONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 IPG PHOTONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 254 IPG PHOTONICS CORPORATION: DEALS

- TABLE 255 JENOPTIK AG: COMPANY OVERVIEW

- TABLE 256 JENOPTIK AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 JENOPTIK AG: PRODUCT LAUNCHES

- TABLE 258 FIVES: COMPANY OVERVIEW

- TABLE 259 FIVES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 FIVES: EXPANSIONS

- TABLE 261 AXBIS: COMPANY OVERVIEW

- TABLE 262 AXBIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 LUMENTUM OPERATIONS LLC: COMPANY OVERVIEW

- TABLE 264 LUMENTUM OPERATIONS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 LUMENTUM OPERATIONS LLC: DEALS

- TABLE 266 LUMENTUM OPERATIONS LLC: EXPANSIONS

- TABLE 267 GRAVOTECH, INC.: COMPANY OVERVIEW

- TABLE 268 GRAVOTECH, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 GRAVOTECH, INC.: PRODUCT LAUNCHES

- TABLE 270 LASER STAR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 271 LASER STAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 LUMIBIRD: COMPANY OVERVIEW

- TABLE 273 LUMIBIRD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 LUMIBIRD: DEALS

- TABLE 275 EPILOG LASER: COMPANY OVERVIEW

- TABLE 276 EPILOG LASER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 EPILOG LASER: PRODUCT LAUNCHES

- TABLE 278 MKS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 279 MKS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 MKS INSTRUMENTS: PRODUCT LAUNCHES

- TABLE 281 MKS INSTRUMENTS: DEALS

- TABLE 282 NOVANTA INC.: COMPANY OVERVIEW

- TABLE 283 NOVANTA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 NOVANTA INC.: PRODUCT LAUNCHES

- TABLE 285 EUROLASER GMBH: COMPANY OVERVIEW

- TABLE 286 EUROLASER GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 600 GROUP PLC: COMPANY OVERVIEW

- TABLE 288 600 GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 600 GROUP PLC: PRODUCT LAUNCHES

- TABLE 290 BYSTRONIC GROUP: COMPANY OVERVIEW

- TABLE 291 BYSTRONIC GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 BYSTRONIC GROUP: PRODUCT LAUNCHES

- TABLE 293 BYSTRONIC GROUP: EXPANSIONS

- TABLE 294 ALPHALAS GMBH: COMPANY OVERVIEW

- TABLE 295 APPLIED LASER TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 296 ARIMA LASERS CORP.: COMPANY OVERVIEW

- TABLE 297 FOCUSLIGHT TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 298 INNO LASER TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 299 NKT PHOTONICS A/S: COMPANY OVERVIEW

- TABLE 300 PHOTONICS INDUSTRIES INTERNATIONAL. INC.: COMPANY OVERVIEW

- TABLE 301 SFX: COMPANY OVERVIEW

- TABLE 302 TOPTICA PHOTONICS AG: COMPANY OVERVIEW

- TABLE 303 UNIVERSAL LASER SYSTEMS, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LASER PROCESSING MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1-SUPPLY-SIDE ANALYSIS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY-SIDE)-IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM SALES OF LASER PROCESSING SYSTEMS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 SOLID LASERS SEGMENT TO LEAD LASER PROCESSING MARKET FROM 2025 TO 2032

- FIGURE 8 CUTTING TO BE LARGEST APPLICATION OF PROCESSING DURING FORECAST PERIOD

- FIGURE 9 MICROELECTRONICS & SEMICONDUCTORS SEGMENT TO BE LARGEST END USER BETWEEN 2025 AND 2032

- FIGURE 10 ASIA PACIFC TO REGISTER HIGHEST CAGR IN LASER PROCESSING MARKET DURING FORECAST PERIOD

- FIGURE 11 RISING DEMAND FOR ADVANCED MANUFACTURING AUTOMATION AND PRECISION TO DRIVE MARKET GROWTH

- FIGURE 12 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICA LASER PROCESSING MARKET IN 2025

- FIGURE 13 MICROELECTRONICS & SEMICONDUCTORS TO ACCOUNT FOR LARGEST SHARE OF LASER PROCESSING MARKET IN ASIA PACIFIC

- FIGURE 14 INDIA TO BE FASTEST-GROWING LASER PROCESSING MARKET DURING FORECAST PERIOD

- FIGURE 15 LASER PROCESSING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 GLOBAL SEMICONDUCTOR SILICON MATERIAL SALES (MILLION SQUARE INCH), 2022-2024

- FIGURE 17 IMPACT ANALYSIS: DRIVERS

- FIGURE 18 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 19 GLOBAL AUTOMOTIVE SALES, BY VEHICLE TYPE, 2020-2023 (MILLION UNITS)

- FIGURE 20 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS: CHALLENGES

- FIGURE 22 LASER PROCESSING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 LASER PROCESSING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 LASER PROCESSING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 IMPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 28 EXPORT DATA FOR HS CODE 901320-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY LASER TYPE, 2022-2024

- FIGURE 30 AVERAGE SELLING PRICE OF LASERS OFFERED BY KEY PLAYERS, BY LASER TYPE, 2024

- FIGURE 31 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 35 KEY AI USE CASES IN LASER PROCESSING MARKET

- FIGURE 36 SOLID LASERS TO DOMINATE LASER PROCESSING MARKET DURING FORECAST PERIOD

- FIGURE 37 HYBRID BEAMS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF LASER PROCESSING MARKET DURING FORECAST PERIOD

- FIGURE 38 CUTTING APPLICATION TO ACCOUNT FOR LARGEST SHARE OF LASER PROCESSING MARKET IN 2032

- FIGURE 39 MICROELECTRONICS & SEMICONDUCTORS TO ACCOUNT FOR LARGEST SHARE OF LASER PROCESSING MARKET IN 2032

- FIGURE 40 LASER PROCESSING MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 41 NORTH AMERICA: LASER PROCESSING MARKET SNAPSHOT

- FIGURE 42 EUROPE: LASER PROCESSING MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: LASER PROCESSING MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS IN LASER PROCESSING MARKET, 2020-2024

- FIGURE 45 MARKET SHARE ANALYSIS OF MAJOR PLAYERS, 2024

- FIGURE 46 COMPANY VALUATION

- FIGURE 47 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 48 BRAND/PRODUCT COMPARISON

- FIGURE 49 LASER PROCESSING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 LASER PROCESSING MARKET: COMPANY FOOTPRINT

- FIGURE 51 LASER PROCESSING MARKET: COMPANY EVALUATION MATRIX (SMES/STARTUPS), 2024

- FIGURE 52 COHERENT CORP.: COMPANY SNAPSHOT

- FIGURE 53 TRUMPF: COMPANY SNAPSHOT

- FIGURE 54 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 55 IPG PHOTONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 JENOPTIK AG: COMPANY SNAPSHOT

- FIGURE 57 FIVES: COMPANY SNAPSHOT

- FIGURE 58 AXBIS: COMPANY SNAPSHOT

- FIGURE 59 LUMENTUM OPERATIONS LLC: COMPANY SNAPSHOT

- FIGURE 60 LUMIBIRD: COMPANY SNAPSHOT

- FIGURE 61 MKS INSTRUMENTS: COMPANY SNAPSHOT

- FIGURE 62 NOVANTA INC.: COMPANY SNAPSHOT

- FIGURE 63 600 GROUP PLC: COMPANY SNAPSHOT

- FIGURE 64 BYSTRONIC GROUP: COMPANY SNAPSHOT

The laser processing market is valued at USD 7.17 billion in 2025 and is projected to reach USD 11.89 billion by 2032, registering a CAGR of 8.5% during the forecast period. Laser processing is a highly precise, versatile, and efficient method used in various industries for surface treatment and engraving. In the automotive sector, laser surface treatment techniques prepare surfaces for painting, improve adhesion, and enhance functional properties, such as corrosion and wear resistance. Laser engraving identifies, brands, and customizes components, including engine parts, chassis components, and interior trim. This provides permanent and high-contrast markings. In the electronics industry, laser surface treatment techniques are applied for micro-structuring and texturing of substrates, improving adhesion and electrical properties in devices such as circuit boards and semiconductor components. It is also utilized for marking and cutting precision components, including microchips and electronic housings.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By component, laser type, configuration, application, end user, and by region |

| Regions covered | North America, Europe, APAC, RoW |

"Gas laser segment expected to account for second-largest market share during forecast period"

Gas lasers utilize gaseous compounds as their lasing medium and are recognized for their stable performance, excellent beam quality, and suitability across a broad range of precision applications. Common types include CO2 lasers, excimer lasers, helium-neon lasers, argon lasers, and chemical lasers. Each serves distinct roles in industrial, medical, and scientific sectors. CO2 lasers are widely used in material processing, such as cutting, welding, and engraving, due to their high efficiency and ability to process non-metallic materials. Excimer lasers operate in the ultraviolet spectrum and are favored in photolithography, micromachining, and ophthalmic surgery. Helium-neon lasers, although low in power, provide exceptionally stable red laser beams, making them ideal for optical alignment, interferometry, and metrology. Argon lasers emit blue and green light with high power and narrow spectral lines, finding use in medical treatments, fluorescence imaging, and spectroscopy. Chemical lasers, on the other hand, are high-energy systems employed in defense and aerospace for their capability to deliver intense energy bursts through chemical reactions.

"Automotive end user expected to grow at second-highest CAGR in laser processing market"

Laser processing plays a vital role in advancing the automotive industry by enabling high-precision manufacturing, enhanced production speed, and improved material efficiency. In automotive applications, lasers are widely used for cutting, welding, engraving, and surface treatment of metals and composites, which are essential for manufacturing vehicle components such as body panels, powertrain systems, and battery enclosures. The combined effect of rising EV adoption, supportive public funding, and technological advancements is positioning laser processing as a cornerstone of modern automotive manufacturing. As suppliers and OEMs scale up their operations to meet evolving EV requirements, demand for laser solutions is expected to rise significantly. This will create new growth opportunities for laser processing providers, particularly those offering solutions tailored for high-speed, scalable, and efficient EV manufacturing processes.

"Germany to dominate laser processing market in Europe"

Germany's laser processing market is driven by its strong industrial foundation, focus on innovation, and continued investment in advanced manufacturing technologies. The country's automotive, machinery, electronics, and medical sectors are increasingly integrating laser systems to improve precision, efficiency, and material handling in production processes. In the automotive industry, lasers are used for welding lightweight structures and processing electric vehicle components. The machinery & equipment sector depends on laser solutions for fabricating complex parts with high strength and accuracy. In electronics, laser systems are vital for micro-cutting, marking, and assembly of compact components. Meanwhile, the medical and photonics industries are leveraging advanced laser technologies for imaging, diagnostics, and surgical applications, supporting Germany's leadership in high-end research and healthcare technologies.

- By Company Type: Tier 1 - 25%, Tier 2 - 40%, and Tier 3 - 35%

- By Designation: Managers - 32%, Directors - 30%, and Others - 38%

- By Region: North America - 20%, Europe - 40%, Asia Pacific - 35%, and RoW - 5%

Coherent Corp. (US), TRUMPF (Germany), Han's Laser Technology Industry Group Co., Ltd. (China), IPG Photonics Corporation (US), JENOPTIK AG (Germany), Fives (France), AXBIS (South Korea), Lumentum Operations LLC (US), Gravotech, Inc. (France), and LaserStar Technologies (US) are some of the key players in the laser processing market.

The study includes an in-depth competitive analysis of these key players in the laser processing market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the laser processing market by component (Qualitative data regarding various components such as lasers and laser systems), laser type (Solid Lasers (Fiber, Ruby, YAG, Semiconductor, Thin-disk Lasers), Gas Lasers (CO2 Lasers, Excimer Lasers, Helium Neon Lasers, Argon Lasers, Chemical Lasers), Liquid Lasers, and Other Laser Types), configuration (Fixed Beam, Moving Beam, Hybrid), application (Cutting, Welding, Drilling, Marking & Engraving, Advanced Processing, and Other Applications), end user (Microelectronics & Semiconductor, Automotive, Medical & Life Sciences, Aerospace, Architecture & Construction, Other End Users), and by region (North America, Europe, Asia Pacific, and RoW). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the laser processing market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and products; key strategies; contracts, partnerships, agreements; new product launches; mergers & acquisitions; and other recent developments associated with the laser processing market. This report covers the competitive analysis of upcoming startups in the laser processing market ecosystem.

Reasons to buy this report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall laser processing market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

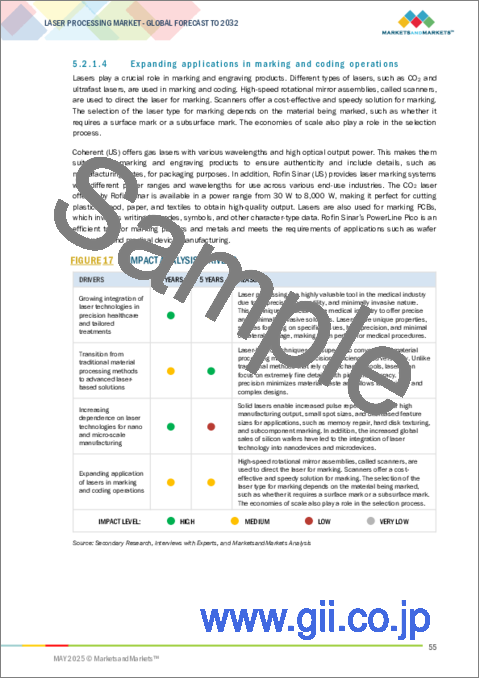

- Analysis of key drivers (Transition from traditional material processing methods to advanced laser-based solutions, Increasing dependence on laser technologies for nano and micro-scale manufacturing, and Expanding application of lasers in marking and coding operations), restraints (Significant R&D investments and high initial deployment costs), opportunities (Expanding use of laser technologies in automotive sector, Expanding role of laser technologies in scientific and research institutes), and challenges (Environmental concerns due to reliance on rare-earth elements in laser technologies) influencing the growth of the laser processing market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the laser processing market

- Market Development: Comprehensive information about lucrative markets-the report analyses the laser processing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the laser processing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Coherent Corp. (US), TRUMPF (Germany), Han's Laser Technology Industry Group Co., Ltd. (China), IPG Photonics Corporation (US), JENOPTIK AG (Germany), Fives (France), AXBIS (South Korea), Lumentum Operations LLC (US), Gravotech, Inc. (France), and LaserStar Technologies (US), among others, in the laser processing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants and key opinion leaders in primary interviews

- 2.1.2.2 List of major participants in primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.2.5 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LASER PROCESSING MARKET

- 4.2 LASER PROCESSING MARKET IN NORTH AMERICA, BY COUNTRY AND END USER

- 4.3 LASER PROCESSING MARKET IN ASIA PACIFIC, BY END USER

- 4.4 LASER PROCESSING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing integration of laser technologies in precision healthcare and tailored treatments

- 5.2.1.2 Transition from traditional material processing methods to advanced laser-based solutions

- 5.2.1.3 Increasing dependence on laser technologies for nano and micro-scale manufacturing

- 5.2.1.4 Expanding applications in marking and coding operations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Significant R&D investment and initial deployment costs

- 5.2.2.2 Limited availability of skilled laser technicians

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding use of laser technologies in automotive sector

- 5.2.3.2 Growing adoption to enhance design, functionality, and personalization of consumer goods

- 5.2.3.3 Expanding role in scientific research and innovation

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns due to reliance on rare-earth elements

- 5.2.4.2 Technical limitations in high-power laser integration

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Machine learning & artificial intelligence

- 5.7.1.2 Additive manufacturing

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 LiDAR

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Fiber optics

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 CASE STUDY ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 901320)

- 5.10.2 EXPORT SCENARIO (HS CODE 901320)

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY LASER TYPE, 2022-2024

- 5.11.2 AVERAGE SELLING PRICE OF LASERS OFFERED BY KEY PLAYERS, BY LASER TYPE, 2024

- 5.11.3 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- 5.14.2.1 IEC 60825-1:2014

- 5.14.2.2 ANSI Z136.1

- 5.14.2.3 Federal Laser Product Performance Standard (FLPPS)

- 5.14.2.4 International Commission on Non-ionizing Radiation Protection (ICNIRP) (2013)

- 5.14.2.5 EN 60825 - Safety of Laser Products

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT ON LASER PROCESSING MARKET

- 5.16.3 TOP USE CASES & MARKET POTENTIAL

- 5.17 2025 US TARIFF IMPACT ON LASER PROCESSING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 KEY IMPACTS ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 COMPONENTS OF LASER PROCESSING

- 6.1 INTRODUCTION

- 6.2 LASERS

- 6.3 LASER SYSTEMS

7 LASER PROCESSING MARKET, BY LASER TYPE

- 7.1 INTRODUCTION

- 7.2 SOLID LASERS

- 7.2.1 RISING DEMAND FOR PRECISION MANUFACTURING FUELING SEGMENTAL GROWTH

- 7.2.2 FIBER LASERS

- 7.2.3 RUBY LASERS

- 7.2.4 YAG LASERS

- 7.2.5 SEMICONDUCTOR LASERS

- 7.2.6 THIN-DISK LASERS

- 7.3 GAS LASERS

- 7.3.1 ADVANCEMENTS IN PHOTOLITHOGRAPHY AND LASER SURGERY DRIVING GROWTH

- 7.3.2 CO2 LASERS

- 7.3.3 EXCIMER LASERS

- 7.3.4 HELIUM-NEON LASERS

- 7.3.5 ARGON LASERS

- 7.3.6 CHEMICAL LASERS

- 7.4 LIQUID LASERS

- 7.4.1 RISING ADOPTION IN MEDICAL AND COSMETIC TREATMENTS TO SUPPORT MARKET GROWTH

- 7.5 OTHER LASER TYPES

- 7.5.1 INCREASING USE OF X-RAY LASERS IN ADVANCED MANUFACTURING TO FUEL MARKET GROWTH

8 LASER PROCESSING MARKET, BY CONFIGURATION

- 8.1 INTRODUCTION

- 8.2 FIXED BEAMS

- 8.2.1 ADVANCEMENTS IN MOTION CONTROL AND CNC SYSTEMS TO SUPPORT MARKET GROWTH

- 8.3 MOVING BEAMS

- 8.3.1 GOVERNMENT INVESTMENTS SUPPORTING SMART MANUFACTURING INITIATIVES TO FUEL MARKET GROWTH

- 8.4 HYBRID BEAMS

- 8.4.1 GROWING DEMAND FOR MULTIFUNCTIONAL MANUFACTURING SYSTEMS TO FUEL SEGMENTAL GROWTH

9 LASER PROCESSING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CUTTING

- 9.2.1 ADVANCEMENTS IN MANUFACTURING SECTOR DRIVING SEGMENTAL GROWTH

- 9.3 WELDING

- 9.3.1 GROWTH IN ELECTRIC VEHICLE AND BATTERY PRODUCTION TO DRIVE MARKET GROWTH

- 9.4 DRILLING

- 9.4.1 GROWING DEMAND FOR PRECISION MICROVIA AND HOLE DRILLING FUELING MARKET GROWTH

- 9.5 MARKING & ENGRAVING

- 9.5.1 RISING USE OF LASER ENGRAVING IN MEDICAL DEVICE PRODUCTION FOR PRECISION AND STERILITY DRIVING GROWTH

- 9.6 ADVANCED PROCESSING

- 9.6.1 ADVANCEMENTS IN ADDITIVE MANUFACTURING TECHNOLOGIES IN INDUSTRIAL AND HEALTHCARE SECTORS TO FUEL MARKET GROWTH

- 9.7 OTHER APPLICATIONS

- 9.7.1 ADVANCEMENTS IN LASER ABLATION AND LASER-BASED SURFACE STRUCTURING TECHNIQUES TO SUPPORT MARKET GROWTH

10 LASER PROCESSING MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 KEY COMPETITORS

- 10.2 MICROELECTRONICS & SEMICONDUCTORS

- 10.2.1 MINIATURIZATION OF ELECTRONIC COMPONENTS AND INCREASED CIRCUIT COMPLEXITY DRIVING DEMAND

- 10.2.2 CASE STUDY ANALYSIS

- 10.2.3 PCB DRILLING & CUTTING

- 10.2.4 WAFER DICING

- 10.2.5 OLED DISPLAY PATTERNING

- 10.2.5.1 List of clients in microelectronics & semiconductors industry

- 10.3 AUTOMOTIVE

- 10.3.1 RISING DEMAND FOR ELECTRIC VEHICLES DRIVING MARKET GROWTH

- 10.3.2 CASE STUDY ANALYSIS

- 10.3.3 BODY PANEL WELDING

- 10.3.4 BATTERY WELDING

- 10.3.5 PLASTIC COMPONENT MARKING

- 10.3.5.1 List of clients in automotive industry

- 10.4 MEDICAL & LIFE SCIENCES

- 10.4.1 RISING DEMAND FOR PRECISION AND MINIATURIZATION IN MEDICAL DEVICES FUELING MARKET GROWTH

- 10.4.2 CASE STUDY ANALYSIS

- 10.4.3 MEDICAL DEVICE MANUFACTURING

- 10.4.4 LASER MICROMACHINING FOR STENTS

- 10.4.5 DNA AND CELL MANIPULATION

- 10.4.5.1 List of clients in medical & life science industry

- 10.5 AEROSPACE

- 10.5.1 RISING USE OF COMPOSITE AND HIGH-PERFORMANCE MATERIALS TO FUEL DEMAND

- 10.5.2 CASE STUDY ANALYSIS

- 10.5.3 AIRCRAFT COMPONENT WELDING

- 10.5.4 COMPOSITE MATERIAL PROCESSING

- 10.5.5 LASER RANGE FINDERS & TARGETING SYSTEMS

- 10.5.5.1 List of clients in aerospace industry

- 10.6 ARCHITECTURE & CONSTRUCTION

- 10.6.1 NEED FOR ACCURATE CUTTING, WELDING, AND ENGRAVING IN COMPLEX ARCHITECTURAL DESIGNS TO DRIVE MARKET

- 10.6.2 CASE STUDY ANALYSIS

- 10.6.3 DECORATIVE LASER CUTTING

- 10.6.4 INTERIOR & FACADE ENGRAVING

- 10.6.4.1 List of clients in architecture & construction industry

- 10.7 OTHER END USERS

- 10.7.1 STRICT TRACEABILITY AND MARKING STANDARDS IN DEFENSE SECTOR SUPPORTING MARKET GROWTH

- 10.7.2 CASE STUDY ANALYSIS

- 10.7.2.1 List of clients in other end users

11 LASER PROCESSING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Growing need for micro-processing in electronics manufacturing to drive market growth

- 11.2.3 CANADA

- 11.2.3.1 Increased investment in laser technology startups and R&D to boost market growth

- 11.2.4 MEXICO

- 11.2.4.1 Development of smart manufacturing hubs to foster revenue growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 Rising investments in photonics and laser research and development propelling market growth

- 11.3.3 GERMANY

- 11.3.3.1 Presence of leading laser processing manufacturers and startups to complement revenue growth

- 11.3.4 FRANCE

- 11.3.4.1 Growing pharmaceutical and textile sectors adopting ultra-fast laser marking to propel market growth

- 11.3.5 ITALY

- 11.3.5.1 Expansion of local distribution through international laser technology partnerships driving market growth

- 11.3.6 SPAIN

- 11.3.6.1 EU recovery funds supporting high-tech industrial transformation initiatives driving market growth

- 11.3.7 NETHERLANDS

- 11.3.7.1 Growth in high-tech and precision manufacturing industries to support market growth

- 11.3.8 SWITZERLAND

- 11.3.8.1 Strong foundation in precision engineering and photonics innovation to contribute to market growth

- 11.3.9 POLAND

- 11.3.9.1 Growing demand for precision manufacturing in electronics and semiconductors to drive market growth

- 11.3.10 NORDICS

- 11.3.10.1 Expansion of battery manufacturing and clean energy industries to fuel demand

- 11.3.11 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Growth in electric vehicle battery manufacturing technologies to boost market growth

- 11.4.3 JAPAN

- 11.4.3.1 Presence of well-established manufacturing sector to offer lucrative growth opportunities

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Advancement in additive manufacturing and 3D printing technologies to anticipate positive market growth

- 11.4.5 INDIA

- 11.4.5.1 Growing presence of international laser technology providers boosting market growth

- 11.4.6 AUSTRALIA

- 11.4.6.1 Growing adoption in advanced manufacturing boosting market growth

- 11.4.7 INDONESIA

- 11.4.7.1 Government focus on semiconductor industry development to fuel market growth in near future

- 11.4.8 MALAYSIA

- 11.4.8.1 Presence of specialized local suppliers to create lucrative growth opportunities

- 11.4.9 THAILAND

- 11.4.9.1 Technology transfer from South Korean chipmaker to support market growth

- 11.4.10 VIETNAM

- 11.4.10.1 Expansion of battery manufacturing requiring precision laser processing solutions to fuel market growth

- 11.4.11 REST OF ASIA PACIFIC

- 11.5 REST OF THE WORLD

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Bahrain

- 11.5.2.1.1 Strategic focus on industrial modernization driving demand for laser processing

- 11.5.2.2 Kuwait

- 11.5.2.2.1 Policies under Kuwait Vision 2035 strategy to support market growth

- 11.5.2.3 Oman

- 11.5.2.3.1 Strategic investments to drive economic growth supporting market growth

- 11.5.2.4 Qatar

- 11.5.2.4.1 Investment in advanced manufacturing and clean energy transition to contribute to market growth

- 11.5.2.5 Saudi Arabia

- 11.5.2.5.1 Expansion of domestic manufacturing capabilities in advanced technologies to fuel market growth

- 11.5.2.6 UAE

- 11.5.2.6.1 Investment in advanced battery manufacturing technologies to fuel market growth

- 11.5.2.7 Rest of Middle East

- 11.5.2.7.1 Growth in aerospace, defense, and medical device industries to drive demand

- 11.5.2.1 Bahrain

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Major industrial trade fairs promoting technology awareness to support growth of laser processing

- 11.5.4 AFRICA

- 11.5.4.1 South Africa

- 11.5.4.1.1 Rising venture capital in ICT sector boosting technology adoption

- 11.5.4.2 Other African countries

- 11.5.4.2.1 Growing emphasis on industrial automation and smart manufacturing solutions to drive market

- 11.5.4.1 South Africa

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Laser type footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 End user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 COHERENT CORP.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 TRUMPF

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 HAN'S LASER TECHNOLOGY INDUSTRY GROUP CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 IPG PHOTONICS CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 JENOPTIK AG

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 FIVES

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 AXBIS

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Key strengths

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses and competitive threats

- 13.1.8 LUMENTUM OPERATIONS LLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.9 GRAVOTECH, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.10 LASER STAR TECHNOLOGIES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 LUMIBIRD

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 EPILOG LASER

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.13 MKS INSTRUMENTS

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches

- 13.1.13.3.2 Deals

- 13.1.14 NOVANTA INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.15 EUROLASER GMBH

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.16 600 GROUP PLC

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches

- 13.1.17 BYSTRONIC GROUP

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Product launches

- 13.1.17.3.2 Expansions

- 13.1.1 COHERENT CORP.

- 13.2 OTHER PLAYERS

- 13.2.1 ALPHALAS GMBH

- 13.2.2 APPLIED LASER TECHNOLOGY, INC.

- 13.2.3 ARIMA LASERS CORP.

- 13.2.4 FOCUSLIGHT TECHNOLOGIES INC.

- 13.2.5 INNO LASER TECHNOLOGY CO., LTD.

- 13.2.6 NKT PHOTONICS A/S

- 13.2.7 PHOTONICS INDUSTRIES INTERNATIONAL. INC.

- 13.2.8 SFX

- 13.2.9 TOPTICA PHOTONICS AG

- 13.2.10 UNIVERSAL LASER SYSTEMS, INC.

14 APPENDIX

- 14.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.2 CUSTOMIZATION OPTIONS

- 14.3 RELATED REPORTS

- 14.4 AUTHOR DETAILS