|

|

市場調査レポート

商品コード

1572792

レーザー加工の世界市場 - 産業規模、シェア、動向、機会、予測:タイプ別、レーザータイプ別、用途別、地域別、競合、2019-2029年Laser Processing Market - Global Industry Size, Share, Trends, Opportunity, and Forecast Segmented By Type, By Laser Type, By Application, By Region & Competition, 2019-2029F |

||||||

カスタマイズ可能

|

|||||||

| レーザー加工の世界市場 - 産業規模、シェア、動向、機会、予測:タイプ別、レーザータイプ別、用途別、地域別、競合、2019-2029年 |

|

出版日: 2024年10月18日

発行: TechSci Research

ページ情報: 英文 185 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

レーザー加工の世界市場は、2023年に1,258億米ドルとなり、2029年までのCAGRは9.8%で、予測期間に力強い成長が予測されています。

レーザー加工は、切断、溶接、マーキング、彫刻、表面治療など様々な産業用途でのレーザー技術の利用を指します。この汎用性の高い技術は、集光されたレーザービームの強力なエネルギーを利用し、物理的な接触なしに材料を正確に操作するもので、従来の機械的な方法よりも大きな利点を提供します。レーザー加工の特徴は、高精度、複雑なディテール、最小限の熱歪みを達成する能力であり、微調整された制御と一貫した品質を必要とする製造業に理想的です。レーザー加工の市場は、いくつかの重要な要因により成長する見込みです。ファイバーレーザーや固体レーザーなど、より強力で効率的なレーザー光源の開発など、レーザー技術の絶え間ない進歩は、加工可能な材料の範囲を広げ、加工速度を向上させる。これらの進歩により、メーカーは生産性を向上させ、生産コストを削減することができます。インダストリー4.0の原則に後押しされた製造業の自動化とデジタル化の動向は、自動化された生産ラインにシームレスに統合され、リアルタイムの監視と制御を提供できるレーザー加工システムの採用を後押ししています。自動車、航空宇宙、エレクトロニクス、ヘルスケア、消費財など、さまざまな分野での用途が拡大しており、需要を牽引しています。レーザー加工は、精密な医療機器製造から自動車部品の高速切断まで、各業界特有の要件に合わせたソリューションを提供しています。さらに、厳しい規制基準や環境への配慮から、産業界はよりクリーンで効率的な製造プロセスを採用するよう求められており、レーザー加工は、従来の方法に比べて廃棄物の発生やエネルギー消費を最小限に抑えることができる点が大きな特徴です。技術が進化し続け、産業界が持続可能性と業務効率をますます優先するようになるにつれ、レーザー加工市場は、その汎用性、精密能力、現代の製造動向との整合性により、さらに拡大すると予想されます。

| 市場概要 | |

|---|---|

| 予測期間 | 2025-2029 |

| 市場規模:2023年 | 1,258億米ドル |

| 市場規模:2029年 | 2,224億3,000万米ドル |

| CAGR:2024年~2029年 | 9.8% |

| 急成長セグメント | ハイブリッドビーム |

| 最大市場 | アジア太平洋 |

市場促進要因

レーザー技術の進歩

自動車および航空宇宙産業における採用の増加

インダストリー4.0とスマートマニュファクチャリングへのシフト

主な市場課題

技術の複雑さと統合の課題

コストと投資収益率(ROI)への配慮

主な市場動向

人工知能(AI)と機械学習の統合

積層造形(AM)技術の採用拡大

新素材と用途への拡大

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 VOC (顧客の声)

第5章 世界のレーザー加工市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別(ガスレーザー、固体レーザー、ファイバーレーザー、その他)

- レーザータイプ別(固定ビーム、ムービングビーム、ハイブリッドビーム)

- 用途別(切断、製造、溶接、穴あけ、彫刻、積層造形、その他)

- 地域別

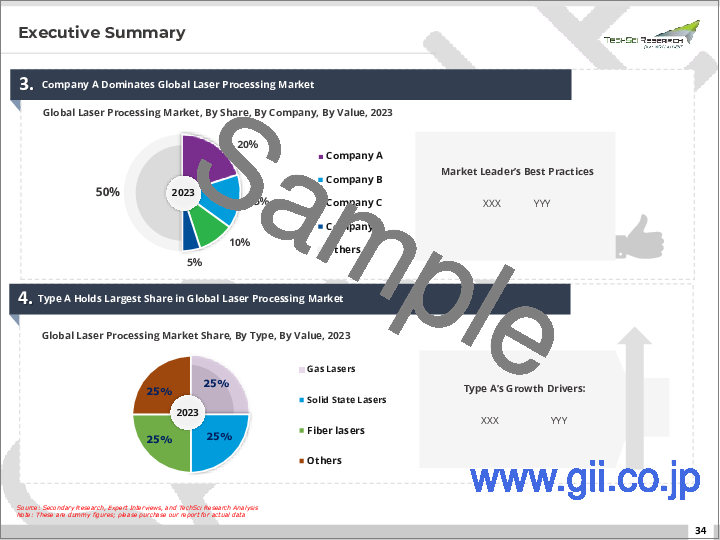

- 企業別(2023)

- 市場マップ

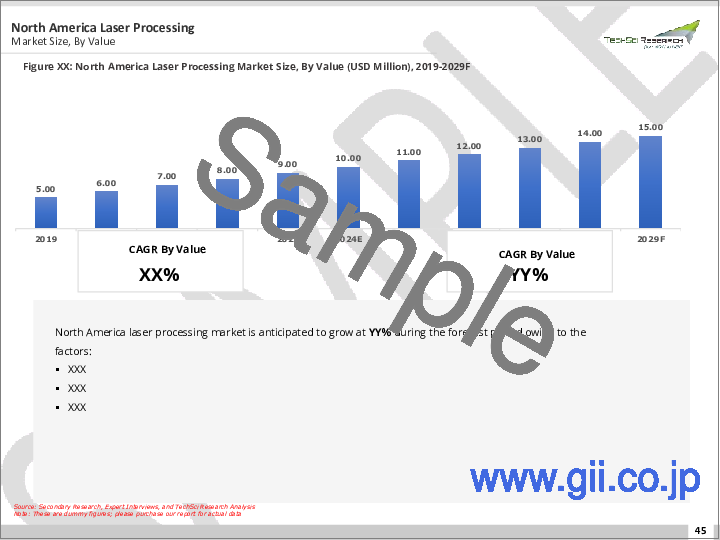

第6章 北米のレーザー加工市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- レーザータイプ別

- 用途別

- 国別

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 アジア太平洋地域のレーザー加工市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- レーザータイプ別

- 用途別

- 国別

- アジア太平洋地域:国別分析

- 中国

- インド

- 日本

- 韓国

- インドネシア

第8章 欧州のレーザー加工市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- レーザータイプ別

- 用途別

- 国別

- 欧州:国別分析

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

第9章 南米のレーザー加工市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- レーザータイプ別

- 用途別

- 国別

- 南米:国別分析

- ブラジル

- アルゼンチン

第10章 中東・アフリカのレーザー加工市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- レーザータイプ別

- 用途別

- 国別

- 中東・アフリカ:国別分析

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- イスラエル

- エジプト

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

第13章 企業プロファイル

- Altec GmbH.

- TRUMPF, INC.

- Amada Co. Ltd

- Bystronic Laser AG

- Epilog Corporation

- eurolaser GmbH

- Han's Laser Technology Industry Group Co. Ltd

- IPG Photonics Corporation

- Coherent, Inc.

- Jenoptik AG

第14章 戦略的提言

第15章 調査会社について・免責事項

Global Laser Processing Market was valued at USD 125.8 Billion in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 9.8% through 2029. Laser processing refers to the utilization of laser technology for various industrial applications such as cutting, welding, marking, engraving, and surface treatment. This versatile technology harnesses the intense energy of focused laser beams to precisely manipulate materials without physical contact, offering significant advantages over traditional mechanical methods. Laser processing is characterized by its ability to achieve high precision, intricate details, and minimal thermal distortion, making it ideal for manufacturing industries that require fine-tuned control and consistent quality. The market for laser processing is poised for growth due to several key factors. Continuous advancements in laser technology, including the development of more powerful and efficient laser sources such as fiber lasers and solid-state lasers, expand the range of materials that can be processed and increase processing speeds. These advancements enable manufacturers to enhance productivity and reduce production costs. Increasing automation and digitalization trends in manufacturing, driven by Industry 4.0 principles, favor the adoption of laser processing systems for their ability to integrate seamlessly into automated production lines and provide real-time monitoring and control. Gfrowing applications across diverse sectors such as automotive, aerospace, electronics, healthcare, and consumer goods are driving demand. Laser processing offers tailored solutions for each industry's unique requirements, from precise medical device manufacturing to high-speed cutting of automotive components. Moreover, stringent regulatory standards and environmental concerns push industries to adopt cleaner and more efficient manufacturing processes, where laser processing stands out for its minimal waste generation and energy consumption compared to traditional methods. As technology continues to evolve and industries increasingly prioritize sustainability and operational efficiency, the laser processing market is expected to expand further, driven by its versatility, precision capabilities, and alignment with modern manufacturing trends.

| Market Overview | |

|---|---|

| Forecast Period | 2025-2029 |

| Market Size 2023 | USD 125.8 Billion |

| Market Size 2029 | USD 222.43 Billion |

| CAGR 2024-2029 | 9.8% |

| Fastest Growing Segment | Hybrid beam |

| Largest Market | Asia Pacific |

Key Market Drivers

Advancements in Laser Technology

One of the primary drivers propelling the Laser Processing Market is continuous advancements in laser technology. Over the years, significant progress has been made in improving the power, efficiency, and versatility of laser sources used in industrial applications. The development of fiber lasers, for instance, has revolutionized laser processing by offering higher beam quality, enhanced reliability, and lower maintenance requirements compared to traditional CO2 lasers. Solid-state lasers have also gained prominence for their ability to deliver precise and consistent performance across a wide range of materials, from metals and plastics to ceramics and composites. These advancements in laser technology have expanded the scope of laser processing applications, enabling manufacturers to achieve higher cutting speeds, improved edge quality, and greater flexibility in design and customization. Furthermore, the integration of nanosecond, picosecond, and femtosecond lasers has opened up new possibilities in micromachining, ultrafast laser processing, and delicate material processing tasks like thin-film ablation and semiconductor processing. As laser technology continues to evolve, with ongoing research and development focused on increasing power densities, refining beam delivery systems, and enhancing process control through advanced monitoring and feedback mechanisms, the Laser Processing Market is poised to experience sustained growth. Manufacturers across various industries are increasingly adopting laser processing solutions to stay competitive, capitalize on these technological advancements, and meet evolving consumer demands for precision, quality, and innovation.

Increasing Adoption in Automotive and Aerospace Industries

The growing adoption of laser processing technologies in the automotive and aerospace industries represents another significant driver for market expansion. These sectors demand high levels of precision, reliability, and efficiency in manufacturing processes to meet stringent safety standards and regulatory requirements. Laser processing offers several advantages over traditional methods in these industries, including the ability to cut complex shapes with minimal heat-affected zones, weld dissimilar materials, and mark components with permanent, high-contrast identifiers. In automotive manufacturing, lasers are widely used for cutting sheet metal for body panels, welding components like exhaust systems and battery packs, and engraving part numbers and logos. The shift towards electric vehicles (EVs) further drives demand for laser welding of battery cells and assembly of lightweight components made from advanced materials like aluminum and carbon fiber-reinforced polymers. Similarly, in aerospace applications, lasers play a critical role in manufacturing turbine blades, fuselage panels, and intricate components for aircraft engines and structures. Laser drilling and cutting enable precise machining of aerospace alloys such as titanium and Inconel, while laser marking ensures traceability and compliance with aerospace quality standards. As automotive and aerospace manufacturers continue to invest in automation and digitalization to improve production efficiency and reduce costs, laser processing technologies will remain indispensable tools for achieving these objectives. The increasing complexity of vehicle designs, coupled with the trend towards lightweight materials and electric propulsion systems, further underscores the importance of laser processing in shaping the future of these industries.

Shift Towards Industry 4.0 and Smart Manufacturing

The global shift towards Industry 4.0 and smart manufacturing practices is driving significant growth in the Laser Processing Market. Industry 4.0 represents the integration of digital technologies, automation, and data exchange in manufacturing processes to create smart factories that are more efficient, flexible, and responsive to market demands. Laser processing technologies play a pivotal role in this transformation by enabling real-time monitoring, adaptive control, and predictive maintenance of production processes. Advanced laser systems equipped with sensors and actuators can dynamically adjust parameters such as power, focus, and feed rate to optimize cutting, welding, and marking operations based on real-time data analysis. This capability not only enhances process reliability and product quality but also reduces downtime and material waste, resulting in improved overall equipment effectiveness (OEE) and lower production costs. Moreover, lasers are integral to additive manufacturing processes such as selective laser melting (SLM) and laser powder bed fusion (LPBF), which are key components of Industry 4.0-driven initiatives for rapid prototyping and on-demand production of complex geometries. As manufacturers across industries embrace digital twins, artificial intelligence (AI), and cloud-based analytics to create interconnected production ecosystems, the demand for laser processing technologies that can seamlessly integrate into these environments continues to grow. Laser systems capable of supporting remote monitoring, predictive maintenance algorithms, and adaptive process control are essential for achieving the scalability, agility, and sustainability goals of Industry 4.0. By harnessing the power of laser processing within smart factories, manufacturers can achieve higher levels of operational efficiency, product customization, and competitiveness in the global marketplace

Key Market Challenges

Technological Complexity and Integration Challenges

One of the significant challenges facing the Laser Processing Market is the inherent technological complexity of laser systems and the associated integration challenges. Laser processing technologies encompass a wide range of applications, including cutting, welding, marking, engraving, and surface treatment, each requiring specific laser sources, optics, and control systems tailored to the material and application requirements. As laser technology continues to advance with innovations such as fiber lasers, solid-state lasers, and ultrafast lasers, manufacturers face the daunting task of selecting the right technology and configuring it to meet their precise needs. This complexity is compounded by the diverse materials being processed, from metals and alloys to plastics, ceramics, and composites, each with unique thermal, optical, and mechanical properties that impact laser processing outcomes. Integrating laser systems into existing production lines can also be challenging, requiring careful planning, customization of equipment, and often substantial modifications to infrastructure and workflow processes.

Moreover, ensuring seamless integration of laser processing equipment with other automated systems, such as robotic arms, CNC machines, and quality control devices, is crucial for maximizing efficiency and productivity. Compatibility issues between different components and software platforms can hinder workflow optimization and data exchange, leading to inefficiencies and delays. Manufacturers must invest in comprehensive training programs for operators and maintenance personnel to ensure they have the necessary skills to operate and troubleshoot advanced laser systems effectively. Additionally, the rapid pace of technological evolution means that companies must continuously upgrade their equipment and software to stay competitive, further adding to the complexity and cost of integration. Addressing these challenges requires close collaboration between laser technology providers, automation experts, and end-users to develop standardized interfaces, streamline integration processes, and provide robust technical support throughout the equipment lifecycle.

Cost Considerations and Return on Investment (ROI)

Another significant challenge for the Laser Processing Market is the upfront cost associated with acquiring and implementing advanced laser processing systems, coupled with the need to demonstrate a compelling return on investment (ROI). Laser processing equipment, particularly high-power fiber lasers and multi-axis laser systems capable of handling complex tasks, represents a significant capital investment for manufacturers. The initial cost includes not only the purchase of laser sources, optics, and control software but also installation, training, and ongoing maintenance expenses. Small and medium-sized enterprises (SMEs) may find these costs prohibitive, limiting their ability to adopt laser processing technologies and compete effectively in the market.

Furthermore, while laser processing offers numerous benefits such as high precision, speed, and versatility, quantifying the tangible ROI can be challenging for some applications and industries. Manufacturers must carefully assess factors such as labor savings, scrap reduction, improved product quality, and faster time-to-market to justify the investment in laser technology. The complexity of ROI calculations is further compounded by variables such as material costs, energy consumption, regulatory compliance, and market demand fluctuations. Industries with low-volume, high-mix production environments may struggle to achieve economies of scale with laser processing, making it difficult to achieve a favorable ROI within a reasonable timeframe.

Moreover, ongoing operational costs, including energy consumption and consumables such as gases and optics, contribute to the total cost of ownership over the equipment's lifecycle. Manufacturers must carefully evaluate these costs and develop comprehensive cost-benefit analyses to make informed decisions about investing in laser processing technology. Addressing cost considerations and demonstrating clear ROI metrics requires collaboration between laser manufacturers, industry associations, financial institutions, and government agencies to develop financing options, incentives, and support programs that facilitate broader adoption of laser processing technologies across diverse industrial sectors

Key Market Trends

Integration of Artificial Intelligence (AI) and Machine Learning

One prominent trend shaping the Laser Processing Market is the integration of artificial intelligence (AI) and machine learning (ML) technologies into laser systems and processes. AI and ML algorithms are increasingly being utilized to optimize laser parameters, predict and prevent process deviations, and automate quality control in real-time. For instance, AI-powered systems can analyze sensor data from laser processes to adjust parameters such as power, speed, and focal length dynamically, optimizing cutting, welding, and engraving operations for maximum efficiency and quality. ML algorithms can also learn from historical data to predict potential defects or anomalies in laser processing, enabling proactive maintenance and minimizing downtime. This trend not only enhances the precision and reliability of laser processing but also supports the industry's shift towards smart manufacturing practices by enabling adaptive manufacturing processes that respond intelligently to changing production conditions and customer demands.

Increased Adoption of Additive Manufacturing (AM) Techniques

Another significant trend in the Laser Processing Market is the increased adoption of additive manufacturing (AM) techniques, such as laser powder bed fusion (LPBF) and direct energy deposition (DED). AM processes leverage laser technology to build three-dimensional objects layer by layer from digital designs, offering advantages in terms of design freedom, material efficiency, and rapid prototyping capabilities. Laser-based AM processes enable the production of complex geometries with high precision and repeatability, making them ideal for applications in aerospace, medical devices, automotive components, and consumer goods. The integration of advanced laser sources and scanning systems enhances AM processes by improving resolution, surface finish, and build speed. As industries seek to reduce lead times, customize products, and optimize supply chains, the demand for laser-based AM solutions is expected to grow, driving innovation and investment in laser processing technologies.

Expansion into New Materials and Applications

A notable trend driving the Laser Processing Market is the continuous expansion into new materials and applications beyond traditional metals. Laser processing technologies are increasingly being applied to a diverse range of materials, including ceramics, composites, polymers, and even biological tissues. For example, lasers are used for cutting and drilling ceramics in electronics manufacturing, welding thermoplastics in automotive components, and engraving glass in consumer electronics. The development of specialized laser sources and processing techniques tailored to these materials has expanded the potential applications of laser processing across various industries. Additionally, advancements in hybrid laser processing, which combines laser technology with other manufacturing processes such as machining and 3D printing, further broaden the scope of laser applications. As industries explore sustainable materials and lightweight alternatives, laser processing technologies play a crucial role in enabling precise, efficient, and environmentally friendly manufacturing solutions. The trend towards exploring new materials and applications underscores the versatility and adaptability of laser processing technologies in meeting evolving market needs and driving innovation across diverse industrial sectors.

Segmental Insights

Application Insights

In 2023, the cutting application segment dominated the Laser Processing Market and is expected to maintain its dominance during the forecast period. Cutting operations utilize laser technology to precisely cut through materials such as metals, plastics, ceramics, and composites with high accuracy and minimal heat-affected zones. This capability makes laser cutting ideal for industries requiring intricate shapes, tight tolerances, and efficient material utilization, such as automotive, aerospace, and electronics. Laser cutting systems offer advantages over traditional mechanical methods by enabling faster production speeds, reduced tool wear, and the ability to process a wide range of thicknesses and material types. The automotive industry, for example, relies on laser cutting for fabricating body panels, chassis components, and interior trim with superior edge quality and minimal distortion. In aerospace, laser cutting plays a critical role in manufacturing turbine blades, structural components, and complex geometries for aircraft structures. Moreover, advancements in laser sources, including fiber lasers and ultrafast lasers, continue to enhance cutting capabilities by improving power efficiency, beam quality, and cutting speed. As industries increasingly emphasize precision manufacturing, customization, and operational efficiency, laser cutting applications are poised to expand further. The versatility of laser cutting across multiple materials and its integration with automation and digital manufacturing trends reinforce its dominance in the Laser Processing Market, driving continued adoption and innovation in laser cutting technologies.

Regional Insights

In 2023, the Asia Pacific region emerged as the dominant force in the Laser Processing Market and is poised to maintain its leadership throughout the forecast period. Several factors contribute to Asia Pacific's dominance in this market segment. Firstly, the region is home to some of the world's largest manufacturing economies, including China, Japan, South Korea, and Taiwan, which collectively drive significant demand for laser processing technologies across diverse industries such as automotive, electronics, semiconductor manufacturing, and consumer goods. These industries leverage laser cutting, welding, marking, and additive manufacturing processes to achieve higher production efficiency, precision, and customization capabilities. Moreover, the rapid industrialization and technological advancement in Asia Pacific countries have accelerated the adoption of laser processing solutions to meet growing domestic and international market demands. The region's robust infrastructure development, supportive government policies, and investments in research and development further foster innovation and technological advancements in laser technology applications. Additionally, Asia Pacific benefits from a strong ecosystem of laser equipment manufacturers, research institutions, and skilled workforce, which collectively drive the development and deployment of advanced laser processing solutions tailored to local market needs. Furthermore, the increasing focus on sustainable manufacturing practices and environmental regulations in countries like China and Japan incentivizes industries to adopt laser processing technologies that offer higher energy efficiency and reduced material waste compared to traditional manufacturing methods. As Asia Pacific continues to lead in manufacturing output and technological innovation, coupled with rising investments in automation and digitalization initiatives, the demand for laser processing solutions is expected to expand across new applications and industries. This growth trajectory positions Asia Pacific as a pivotal region shaping the future of the global Laser Processing Market, driving innovation, efficiency, and competitiveness in industrial manufacturing on a global scale.

Key Market Players

- Altec GmbH

- TRUMPF, INC.

- Amada Co. Ltd

- Bystronic Laser AG

- Epilog Corporation

- eurolaser GmbH

- Han's Laser Technology Industry Group Co. Ltd

- IPG Photonics Corporation

- Jenoptik AG

- Coherent, Inc.

Report Scope:

In this report, the Global Laser Processing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Laser Processing Market, By Type:

- Gas Lasers

- Solid State Lasers

- Fiber lasers

- Others

Laser Processing Market, By Laser Type:

- Fixed Beam

- Moving Beam

- Hybrid Beam

Laser Processing Market, By Application:

- Cutting

- Making

- Welding

- Drilling

- Engraving

- Additive Manufacturing

- Others

Laser Processing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Laser Processing Market.

Available Customizations:

Global Laser Processing Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.3. Markets Covered

- 1.4. Years Considered for Study

- 1.5. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Key Industry Partners

- 2.4. Major Association and Secondary Sources

- 2.5. Forecasting Methodology

- 2.6. Data Triangulation & Validation

- 2.7. Assumptions and Limitations

3. Executive Summary

4. Voice of Customers

5. Global Laser Processing Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Type (Gas Lasers, Solid State Lasers, Fiber lasers, and Others)

- 5.2.2. By Laser Type (Fixed Beam, Moving Beam and Hybrid Beam)

- 5.2.3. By Application (Cutting, Making, Welding, Drilling, Engraving, Additive Manufacturing, and Others)

- 5.2.4. By Region

- 5.3. By Company (2023)

- 5.4. Market Map

6. North America Laser Processing Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Type

- 6.2.2. By Laser Type

- 6.2.3. By Application

- 6.2.4. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Laser Processing Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Type

- 6.3.1.2.2. By Laser Type

- 6.3.1.2.3. By Application

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Laser Processing Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Type

- 6.3.2.2.2. By Laser Type

- 6.3.2.2.3. By Application

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Laser Processing Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Type

- 6.3.3.2.2. By Laser Type

- 6.3.3.2.3. By Application

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Laser Processing Market Outlook

7. Asia-Pacific Laser Processing Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Type

- 7.2.2. By Laser Type

- 7.2.3. By Application

- 7.2.4. By Country

- 7.3. Asia-Pacific: Country Analysis

- 7.3.1. China Laser Processing Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Type

- 7.3.1.2.2. By Laser Type

- 7.3.1.2.3. By Application

- 7.3.1.1. Market Size & Forecast

- 7.3.2. India Laser Processing Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Type

- 7.3.2.2.2. By Laser Type

- 7.3.2.2.3. By Application

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Japan Laser Processing Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Type

- 7.3.3.2.2. By Laser Type

- 7.3.3.2.3. By Application

- 7.3.3.1. Market Size & Forecast

- 7.3.4. South Korea Laser Processing Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Type

- 7.3.4.2.2. By Laser Type

- 7.3.4.2.3. By Application

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Indonesia Laser Processing Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Type

- 7.3.5.2.2. By Laser Type

- 7.3.5.2.3. By Application

- 7.3.5.1. Market Size & Forecast

- 7.3.1. China Laser Processing Market Outlook

8. Europe Laser Processing Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Type

- 8.2.2. By Laser Type

- 8.2.3. By Application

- 8.2.4. By Country

- 8.3. Europe: Country Analysis

- 8.3.1. Germany Laser Processing Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Type

- 8.3.1.2.2. By Laser Type

- 8.3.1.2.3. By Application

- 8.3.1.1. Market Size & Forecast

- 8.3.2. United Kingdom Laser Processing Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Type

- 8.3.2.2.2. By Laser Type

- 8.3.2.2.3. By Application

- 8.3.2.1. Market Size & Forecast

- 8.3.3. France Laser Processing Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Type

- 8.3.3.2.2. By Laser Type

- 8.3.3.2.3. By Application

- 8.3.3.1. Market Size & Forecast

- 8.3.4. Russia Laser Processing Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Type

- 8.3.4.2.2. By Laser Type

- 8.3.4.2.3. By Application

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Spain Laser Processing Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Type

- 8.3.5.2.2. By Laser Type

- 8.3.5.2.3. By Application

- 8.3.5.1. Market Size & Forecast

- 8.3.1. Germany Laser Processing Market Outlook

9. South America Laser Processing Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Type

- 9.2.2. By Laser Type

- 9.2.3. By Application

- 9.2.4. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Laser Processing Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Type

- 9.3.1.2.2. By Laser Type

- 9.3.1.2.3. By Application

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Laser Processing Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Type

- 9.3.2.2.2. By Laser Type

- 9.3.2.2.3. By Application

- 9.3.2.1. Market Size & Forecast

- 9.3.1. Brazil Laser Processing Market Outlook

10. Middle East & Africa Laser Processing Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Type

- 10.2.2. By Laser Type

- 10.2.3. By Application

- 10.2.4. By Country

- 10.3. Middle East & Africa: Country Analysis

- 10.3.1. Saudi Arabia Laser Processing Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Type

- 10.3.1.2.2. By Laser Type

- 10.3.1.2.3. By Application

- 10.3.1.1. Market Size & Forecast

- 10.3.2. South Africa Laser Processing Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Type

- 10.3.2.2.2. By Laser Type

- 10.3.2.2.3. By Application

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE Laser Processing Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Type

- 10.3.3.2.2. By Laser Type

- 10.3.3.2.3. By Application

- 10.3.3.1. Market Size & Forecast

- 10.3.4. Israel Laser Processing Market Outlook

- 10.3.4.1. Market Size & Forecast

- 10.3.4.1.1. By Value

- 10.3.4.2. Market Share & Forecast

- 10.3.4.2.1. By Type

- 10.3.4.2.2. By Laser Type

- 10.3.4.2.3. By Application

- 10.3.4.1. Market Size & Forecast

- 10.3.5. Egypt Laser Processing Market Outlook

- 10.3.5.1. Market Size & Forecast

- 10.3.5.1.1. By Value

- 10.3.5.2. Market Share & Forecast

- 10.3.5.2.1. By Type

- 10.3.5.2.2. By Laser Type

- 10.3.5.2.3. By Application

- 10.3.5.1. Market Size & Forecast

- 10.3.1. Saudi Arabia Laser Processing Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenge

12. Market Trends & Developments

13. Company Profiles

- 13.1. Altec GmbH.

- 13.1.1. Business Overview

- 13.1.2. Key Revenue and Financials

- 13.1.3. Recent Developments

- 13.1.4. Key Personnel

- 13.1.5. Key Product/Services

- 13.2. TRUMPF, INC.

- 13.2.1. Business Overview

- 13.2.2. Key Revenue and Financials

- 13.2.3. Recent Developments

- 13.2.4. Key Personnel

- 13.2.5. Key Product/Services

- 13.3. Amada Co. Ltd

- 13.3.1. Business Overview

- 13.3.2. Key Revenue and Financials

- 13.3.3. Recent Developments

- 13.3.4. Key Personnel

- 13.3.5. Key Product/Services

- 13.4. Bystronic Laser AG

- 13.4.1. Business Overview

- 13.4.2. Key Revenue and Financials

- 13.4.3. Recent Developments

- 13.4.4. Key Personnel

- 13.4.5. Key Product/Services

- 13.5. Epilog Corporation

- 13.5.1. Business Overview

- 13.5.2. Key Revenue and Financials

- 13.5.3. Recent Developments

- 13.5.4. Key Personnel

- 13.5.5. Key Product/Services

- 13.6. eurolaser GmbH

- 13.6.1. Business Overview

- 13.6.2. Key Revenue and Financials

- 13.6.3. Recent Developments

- 13.6.4. Key Personnel

- 13.6.5. Key Product/Services

- 13.7. Han's Laser Technology Industry Group Co. Ltd

- 13.7.1. Business Overview

- 13.7.2. Key Revenue and Financials

- 13.7.3. Recent Developments

- 13.7.4. Key Personnel

- 13.7.5. Key Product/Services

- 13.8. IPG Photonics Corporation

- 13.8.1. Business Overview

- 13.8.2. Key Revenue and Financials

- 13.8.3. Recent Developments

- 13.8.4. Key Personnel

- 13.8.5. Key Product/Services

- 13.9. Coherent, Inc.

- 13.9.1. Business Overview

- 13.9.2. Key Revenue and Financials

- 13.9.3. Recent Developments

- 13.9.4. Key Personnel

- 13.9.5. Key Product/Services

- 13.10. Jenoptik AG

- 13.10.1. Business Overview

- 13.10.2. Key Revenue and Financials

- 13.10.3. Recent Developments

- 13.10.4. Key Personnel

- 13.10.5. Key Product/Services