|

|

市場調査レポート

商品コード

1432258

CVデポ充電市場の今後:車両タイプ別(eLCV、eMCV、eHCV、eバス)、充電器タイプ別(AC、DC)、地域別(アジア太平洋、北米、欧州)- 2030年までの予測Future of CV Depot Charging Market by Vehicle Type (eLCV, eMCV, eHCV and eBuses), Charger Type (AC and DC), and Region (Asia Pacific, North America, Europe) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| CVデポ充電市場の今後:車両タイプ別(eLCV、eMCV、eHCV、eバス)、充電器タイプ別(AC、DC)、地域別(アジア太平洋、北米、欧州)- 2030年までの予測 |

|

出版日: 2024年02月16日

発行: MarketsandMarkets

ページ情報: 英文 93 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

新車用充電器のCVデポ充電の市場規模は2023年に47億米ドル、2030年には307億米ドルに達すると予測されており、2024年から2030年までのCAGRは28.2%になるとみられています。

CVデポ充電市場は、様々な要因によって成長が見込まれています。CVデポ充電業界は現在、技術の進歩やエンドユーザーの嗜好による新たな変化への適応を常に迫られています。電気商用車の採用は、CVデポ充電業界の急速な変化を目の当たりにした重要な要因です。EVセクターと同様に、顧客のための高速・超高速充電ポイントの設置とともに充電ポートの開発と製造は、OEMとEVソリューション提供企業の最重要課題です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 車両タイプ別(eLCV、eMCV、eHCV、eバス)、充電器タイプ別(AC、DC)、地域別(アジア太平洋、北米、欧州) |

| 対象地域 | 北米、欧州、アジア太平洋 |

さらに、さまざまな運用、ビジネス、財務モデルのイントロダクションが、CVデポ充電市場の動向を変化させています。さらに、OEMは、ワイヤレス、バッテリー交換、パンタグラフ充電技術を採用することで、車両のダウンタイムを減らすことに注力しています。

EVセグメントは、クリーンな交通機関への嗜好の高まりとインセンティブによる政府の支援により、2023年には30~40%の力強い成長を遂げました。加えて、ノルウェー、ドイツ、英国、米国、インド、中国などの政府は、公共交通機関のバス車両をICEからEVに転換する目標を掲げています。さらに、商用車のフリートオペレーターもECVを採用しています。このため、ECVデポ充電市場は世界中で成長しています。しかし、商用車の電動化は、航続距離の制限、不十分な充電インフラ、車両のダウンタイムといった課題があります。

EV充電インフラは、消費者のニーズに応えるために著しく成長しています。2023年には、世界中で100万以上のEV充電ポイントが新たに設置されました。これらの充電ポイントは、低速充電器と急速充電器の両方で構成されています。例えば、2023年には英国で1万6,000カ所近くの充電ポイントが設置され、充電ポイントの総数は5万3,000カ所を超えました。さらに、日本、中国、ドイツ、米国、その他の欧州諸国でも、ワイヤレス充電ポイントのパイロット・プロジェクトが成功しました。政府とEV充電ソリューション・プロバイダーは、2023年に総額500億米ドル以上の資金拠出を発表しました。この総額は、世界各地に充電ポイントを設置するために徐々に投資される予定です。

当レポートでは、世界のCVデポ充電市場について調査し、車両タイプ別、充電器タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

第2章 調査範囲、目的、調査手法および定義

第3章 世界のB2Bデポ充電市場規模

第4章 エコシステムとビジネスおよび財務モデル

- デポ充電エコシステム

- デポ充電エコシステムの利害関係者

- デポ充電:さまざまなタイプの利害関係者および市場参入企業へのサービス

- ビジネスモデル

- 財務モデル:ビジネスモデルの重要な要素

- ビジネスメトリクスの推定値(典型的な範囲)

- 典型的な財務上の前提

- デポ充電の価格モデル

第5章 充電テクノロジーとオプション

- ECV:充電オプション

- ECV:充電オプションとバッテリー交換の比較分析

- 充電技術

- 充電動向:バスの例、国別

- 消費者行動:車種別

- デポの料金オプション:設備投資、運用コスト、実行可能性

第6章 主要参入企業

- B2Bデポ充電市場の主要企業

- ソリューション、ビジネスモデル、世界のプレゼンス

- B2Bの追加比較

- B2Bデポ充電市場の競合情勢における主な動向

- 最近の合併と買収

第7章 デジタルへの取り組み

- デジタルプラットフォーム

- 商用車両の充電

第8章 最終的なポイントと提言

第9章 付録

The CV depot charging market size for chargers of new vehicles was 4.7 $billion in 2023 and is projected to reach 30.7 $billion in 2030, witnessing a CAGR of 28.2% from 2024 to 2030. The CV depot charging market is expected to experience growth driven by various factors. The CV depot charging industry is currently under constant pressure to adapt to new changes due to technological advancements and end-user preferences. Adoption of electric commercial vehicle fleet is the key factor that has witnessed a rapid change in the CV depot charging industry. In line with the EV sector, development and manufacturing of charging ports along with installation of fast and ultra-fast charging points for customers is the foremost agenda of the OEMs and EV solution providing companies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Vehicle Type (eLCV, eMCV, eHCV and eBuses), Charger Type (AC and DC), and Region (Asia Pacific, North America, Europe) |

| Regions covered | North America, Europe and Asia Pacific |

Further, the introduction of different operational, business and financial models is shifting the trends in the CV depot charging market. Moreover, OEMs are focused on reducing the downtime of the vehicles by adopting wireless, battery swapping and pantograpy charging technology.

"Depot charging stations will grow rapidly till 2030."

The EV segment registered a strong growth of 30-40% in 2023 due growing preference towards clean transportation and government support through incentives. In addition, the governments in Norway, Germany, UK, US, India, China and other countries have set goals to convert their public transportation buses fleets in electric from ICE. Moreover, the fleet operators of commercial vehicles are adopting the ECV. This has led to growth of ECV depot charging market across the globe. However, the electrification in commercial vehicles is challenged by factors such as range limitations, inadequate charging infrastructure and vehicle downtime.

The EV charging infrastructure is significantly growing to cater the needs of the consumers. In 2023, over a million new EV charging points were installed around the world. These charging points consisted of both slow chargers as well as fast chargers. For instance, in 2023, close to 16,000 charging points were installed in the UK, taking the number of total charging points over 53,000; wherein, more than 4,500 were fast charging points. In addition, successful pilot projects were carried out for wireless charging points in Japan, China, Germany, US and other countries in Europe. A collective of over $50 billion was announced by the governments and EV charging solution providers in 2023. The sum of the money will be gradually invested to setup charging points across the world.

"Fast and ultra-fast chargers are anticipated to witness significant growth till 2030."

The years 2022 and 2023 saw change in charging technology of cars wherein ultra-fast chargers have been introduced in the market to enhance the speed of charging the electric vehicles. OEMs such as Ford and Tesla have partnered with the charging infrastructure solution providers to cater the ultra-fast charging needs. Moreover, the hardware and software manufacturers have come up with different business models to monetize the commercial electric vehicles depot charging market.

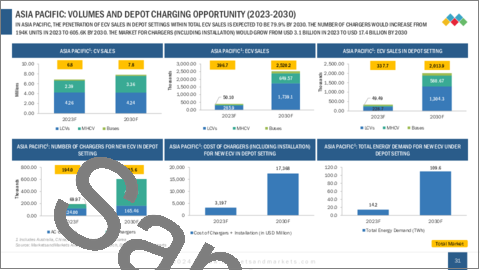

"Asia Pacific holds the largest market share"

With over 50% of the market for new EV sales, the Asia Pacific region dominates the industry. The primary cause of this is China's extensive automobile production and export industry. The greatest market in the world for both automobile production and sales is China. Furthermore, after the COVID suspension, the Chinese market has expanded dramatically. The manufacturing sector has intensified as a result of China's economy's recovery. The development of EV sales into the European market is a primary strategy employed by Chinese electric vehicle manufacturers. Moreover, nations like South Korea, Singapore, and Indian make major contributions to the expansion of the ECV industry in the Asian region. .

Research Coverage:

The market analysis encompasses the CV depot charging market, focusing on the sales volume of electric commercial vehicles, energy requirement for charging, AC & DC charging market for CV depot charging. Additionally, it examines the developments that occurred in the CV depot charging industry in 2023. The report delves into the trends propelling the depot charging sector, analyzing factors that influence the industry till 2030. The study encompasses a broad range, including depot charging operational models, business models, financial models, government targeted related to electrification and Zero Emission Vehicles (ZEV). Geographically, the report covers North America, Europe and Asia Pacific.

Report Scope

The report will help the market leaders/new entrants in this market with information on the closest approximations of the sales numbers for the CV depot charging market in 2023 and their subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key Trends in 2023 to 2030 (electric commercial vehicles, energy requirement, cost of chargers, etc).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the CV depot charging market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the CV depot charging market across varied regions

- Market Diversification: Exhaustive information about diversification of supply chains, untapped geographies, recent developments, and investments in the CV depot charging market

- Competitive Assessment: Assessment of market shares, growth strategies and service offerings of leading players like across commercial vehicle segments which are then dirther divided into eLCV, eMHCV and eBuses in the CV depot charging market setup. The report also helps stakeholders understand the pulse of the CV depot charging market and provides them information on key market drivers, challenges, and opportunities.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. ECV VOLUMES AND NUMBER OF DEPOT CHARGING

- 1.2. CHARGER MARKET SIZE, ENERGY DEMAND, AND COST OF ENERGY

- 1.3. DEPOT CHARGING ECOSYSTEM

- 1.4. EMERGING BUSINESS AND PRICING MODELS

2. RESEARCH SCOPE, OBJECTIVES, METHODOLOGY AND DEFINITIONS

- 2.1. STUDY OBJECTIVES AND METHODOLOGY

- 2.2. STUDY SCOPE

- 2.3. VEHICLE SEGMENT IN STUDY SCOPE

- 2.4. TYPE OF DEPOT CHARGERS IN STUDY SCOPE

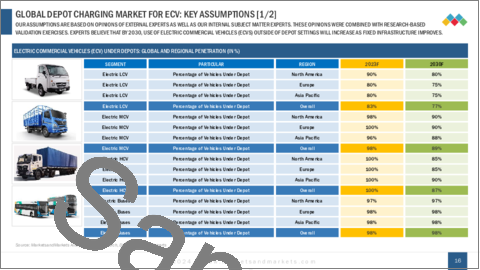

- 2.5. MARKET SIZING & FORECASTING METHODOLOGY

- 2.6. KEY ASSUMPTIONS

3. GLOBAL B2B DEPOT CHARGING MARKET SIZE

- 3.1. COMMERCIAL VEHICLE SALES (2023-2030)

- 3.2. ELECTRIC COMMERCIAL VEHICLE SALES (2023-2030)

- 3.3. ELECTRIC COMMERCIAL VEHICLE PARC (2023-2030)

- 3.4. NEW ECV UNDER DEPOT SETTING (2023-2030)

- 3.5. ECV PARC UNDER DEPOT SETTING (2023-2030)

- 3.6. NUMBER OF CHARGERS FOR NEW ECV IN DEPOT SETTING (2023-2030)

- 3.7. NUMBER OF CHARGERS FOR ECV PARC IN DEPOT SETTING (2023-2030)

- 3.8. TOTAL COST OF CHARGERS AND INSTALLATION COST FOR NEW ECV UNDER DEPOT SETTING (2023-2030)

- 3.9. TOTAL ENERGY DEMAND AND COST OF ENERGY FOR NEW ECV UNDER DEPOT SETTING (2023-2030)

- 3.10. TOTAL ENERGY DEMAND AND COST OF ENERGY FOR ECV PARC UNDER DEPOT SETTING (2023-2030)

- 3.11. NORTH AMERICA: VOLUME AND DEPOT CHARGING OPPORTUNITY (2023-2030)

- 3.12. EUROPE: VOLUME AND DEPOT CHARGING OPPORTUNITY (2023-2030)

- 3.13. ASIA PACIFIC: VOLUME AND DEPOT CHARGING OPPORTUNITY (2023-2030)

4. ECOSYSTEM AND BUSINESS & FINANCIAL MODELS

- 4.1. DEPOT CHARGING ECOSYSTEM

- 4.2. STAKEHOLDERS IN THE DEPOT CHARGING ECOSYSTEM

- 4.3. DEPOT CHARGING: OFFERINGS OF DIFFERENT TYPES OF STAKEHOLDERS AND MARKET PARTICIPANTS

- 4.4. BUSINESS MODELS

- 4.5. FINANCIAL MODEL: KEY ELEMENTS OF BUSINESS MODEL

- 4.6. BUSINESS METRICS ESTIMATES (TYPICAL RANGE)

- 4.7. TYPICAL FINANCIAL ASSUMPTIONS

- 4.8. DEPOT CHARGING PRICING MODELS

5. CHARGING TECHNOLOGIES & OPTIONS

- 5.1. ECV: CHARGING OPTIONS

- 5.2. ECV: COMPARATIVE ANALYSIS OF CHARGING OPTIONS AND BATTERY SWAPPING

- 5.3. CHARGING TECHNOLOGY

- 5.4. CHARGING TRENDS: EXAMPLE OF BUSES, BY COUNTRY

- 5.5. CONSUMER BEHAVIOR: BY TYPE OF VEHICLE

- 5.6. CHARGING OPTIONS FOR DEPOT: CAPEX, OPEX AND VIABILITY

6. KEY PLAYERS

- 6.1. KEY PLAYERS IN THE B2B DEPOT CHARGING MARKET

- 6.2. SOLUTIONS, BUSINESS MODEL AND GLOBAL PRESENCE

- 6.3. B2B ADDITIONAL COMPARISONS

- 6.4. KEY TRENDS IN COMPETITIVE LANDSCAPE OF B2B DEPOT CHARGING MARKET

- 6.5. RECENT MERGERS & ACQUISITIONS

7. DIGITAL INITIATIVE

- 7.1. DIGITAL PLATFORMS

- 7.2. ELECTRIC COMMERCIAL FLEET CHARGING

8. FINAL TAKEAWAY & RECOMMENDATIONS

- 8.1. FINAL TAKEAWAY

- 8.2. STRATEGIC RECOMMENDATIONS

9. APPENDIX

- 9.1. ELCV: VOLUME AND DEPOT CHARGING OPPORTUNITY

- 9.2. EMCV: VOLUME AND DEPOT CHARGING OPPORTUNITY

- 9.3. EHCV: VOLUME AND DEPOT CHARGING OPPORTUNITY

- 9.4. EBUSES: VOLUME AND DEPOT CHARGING OPPORTUNITY

- 9.5. TOTAL COST OF OWNERSHIP: ICE VS ELCV

- 9.6. ICE BUS VS EBUS: TCO ANALYSIS

- 9.7. ZERO EMISSION VEHICLES (ZEV) & CHARGING INFRASTRUCTURE TARGETS

- 9.8. NORTH AMERICA: PENETRATION OF ECV IN FLEET (UTILITIES SECTOR)

- 10. ABOUT MARKETANDMARKETS

- 11. LEGAL DISCLAIMER