|

|

市場調査レポート

商品コード

1430106

ヘルニア修復の世界市場:製品別、臨床適応別、手術タイプ別、エンドユーザー別- 2029年までの予測Hernia Repair Market by Product (Mesh (Synthetic, Biologic), Suture (Absorbable, Non-Absorbable), Tack, Glue Applicator), Indication (Inguinal, Incisional, Umbilical, Epigastric, Femoral, Hiatal), Surgery, End-user - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ヘルニア修復の世界市場:製品別、臨床適応別、手術タイプ別、エンドユーザー別- 2029年までの予測 |

|

出版日: 2024年02月15日

発行: MarketsandMarkets

ページ情報: 英文 223 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のヘルニア修復の市場規模は、2024年の41億米ドルから2029年には51億米ドルに達し、予測期間中のCAGRは4.2%で成長すると予測されています。

ヘルニア修復手術件数の増加は、予測数年間の市場成長を後押しすると予測される主な要因の1つです。さらに、メッシュの高コストがヘルニア修復市場の成長に影響を与えています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、臨床適応別、手術タイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

予測期間中、ヘルニア修復市場はメッシュセグメントが独占的となる見込みです。メッシュは他のヘルニア製品と比較して高価格であるため、推進すると予想されます。

鼠径ヘルニア分野は予測期間中、ヘルニア修復市場を独占すると予想されます。鼠径ヘルニア修復手術の件数が多いため、この市場セグメントの成長につながります。

開腹手術セグメントは、予測期間中、ヘルニア修復市場で最大の市場シェアを占めると予測されています。開腹手術は再発率が低いため、ヘルニア修復手術への採用が増加しています。

病院・クリニックは、予測期間中の2023年に世界のヘルニア修復市場で最大のシェアを占めました。これは、この医療環境における患者の流入が多いことに起因しています。病院と診療所のみが、特別に重症な症例で必要とされるケアとモニタリングを提供することができ、これが市場における優位性の理由でもあります。

2023年、ヘルニア修復の大きな市場シェアは米国とカナダからなる北米地域が占めています。米国におけるヘルニア修復に対する強い需要と採用が、同地域のヘルニア修復市場の成長につながっています。

当レポートでは、世界のヘルニア修復市場について調査し、製品別、臨床適応別、手術タイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 規制シナリオ

- 償還シナリオ

- バリューチェーン分析

- サプライチェーン分析

- 生態系市場/マップ

- ポーターのファイブフォース分析

- 貿易データ分析

- 特許分析

- 価格分析

- 技術分析

- 2023年から2024年の主要な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- アンメットニーズと主要な問題点

第6章 ヘルニア修復市場、製品別

- イントロダクション

- メッシュ

- 縫合糸

- メッシュ固定具

- その他

第7章 ヘルニア修復市場、臨床適応別

- イントロダクション

- 鼠径ヘルニア

- 腹部ヘルニア

- 裂孔ヘルニア

- 大腿ヘルニア

- その他

第8章 ヘルニア修復市場、手術タイプ別

- イントロダクション

- 開腹手術

- 腹腔鏡手術

- ロボット手術

第9章 ヘルニア修復市場、エンドユーザー別

- イントロダクション

- 病院・クリニック

- 外来手術センター

- その他

第10章 ヘルニア修復市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益シェア分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- ETHICON INC.(PART OF JOHNSON & JOHNSON)

- ABBVIE INC.

- MEDTRONIC PLC

- BECTON, DICKINSON AND COMPANY

- BAXTER INTERNATIONAL INC.

- B. BRAUN SE

- W. L. GORE & ASSOCIATES

- COOK GROUP INC.

- INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- THE COOPER COMPANIES, INC.

- その他の企業

- H.B. FULLER COMPANY

- ADVANCED MEDICAL SOLUTIONS GROUP PLC

- TELEFLEX MEDICAL OEM

- TRANSEASY MEDICAL TECH

- FEG TEXTILTECHNIK MBH

- DIPROMED SRL

- HERNIAMESH S.R.L

- GEM SRL

- MERIL LIFE SCIENCES PVT. LTD.

- TELA BIO, INC.

- ASSUT EUROPE S.P.A.

- ARAN BIOMEDICAL

- DOLPHIN SUTURES

- BG MEDICAL LLC

- COUSIN SURGERY

- TI MEDICAL PRIVATE LIMITED

- VITREX MEDICAL A/S

- DEMETECH CORPORATION

第13章 付録

The global hernia repair market is projected to reach USD 5.1 billion by 2029 from USD 4.1 billion in 2024, growing at a CAGR of 4.2% during the forecast period. The increasing number of hernia repair procedures is one of the major factors anticipated to boost market growth in the forecasting years. Additionally, the high cost of meshes affects the growth of the Hernia repair market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) Billion |

| Segments | Product, Clinical indication, Surgery type, End user, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

"The mesh segment to hold the largest share of the market in 2024."

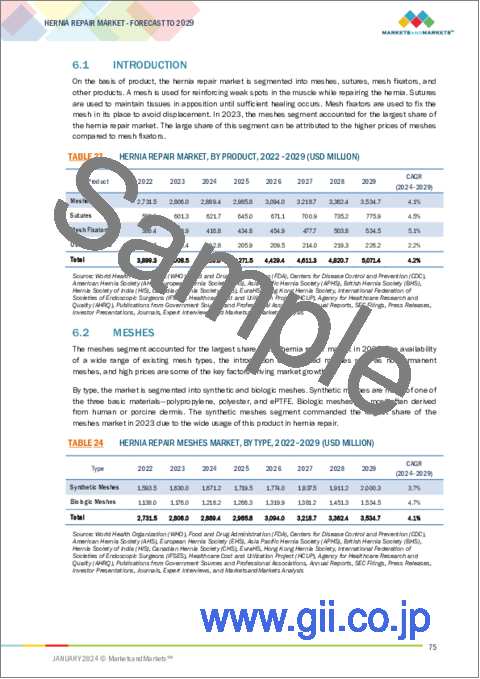

Based on product, the hernia repair market is segmented into mesh, sutures, mesh fixator, and other products. The mesh is segmented into synthetic and biologic mesh, while the mesh fixator is further segmented into tack applicators and glue applicators. The hernia repair market is expected to be dominated by mesh segment during the forecast period. The meshes are expected to propel due to their high prices as compared to other hernia products.

"The inguinal hernia segment to hold the largest share of the market in 2024."

Based on clinical indication, hernia repair is segmented into inguinal hernia, ventral hernia, femoral hernia, hiatial hernia and other clinical indications. Inguinal hernia segment is expected to dominate the hernia repair market during the forecast period. With the high number of inguinal hernia repair surgeries performed leading to the growth of this market segment.

"The open surgery segment to hold the largest share of the market in 2024."

Based on the surgery type, the hernia repair market is segmented into laparoscopic surgery, open surgery

and robotic surgery. The open surgery segment is estimated to hold the largest market share of the hernia repair market during the forecast period. Less recurrence rate by the open surgery type leads to the increasing adoption of surgery method for hernia repair.

"The hospitals & clinics segment to hold the largest share of the market in 2024."

The end user market is segmented into hospitals & clinics, ambulatory surgical centers, and other end users. Hospitals & clinics accounted for the largest share of the global hernia repair market in 2023 during the forecasted years. This can be attributed to the high patient inflow in this care setting. Only hospitals and clinics can provide the care and monitoring required in exceptionally severe cases, which also accounts for their dominance in the market.

"The market in the North America region is expected to hold a significant market share for hernia repair in 2022."

The hernia repair market covers five key geographies-North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2023, a significant market share for hernia repair was held by the market in the North American region, comprising the US and Canada. The strong demand for and adoption of hernia repair in the US led to the growth of the Hernia repair market in this region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 31%, Tier 2- 49%, and Tier 3- 28%

- By Designation: C-level- 28%, Directors- 19%, and Others- 53%

- By Region: North America- 34%, Europe- 36%, Asia Pacific- 22%, Latin America- 6%, MEA- 2%

The prominent players in the hernia repair market are Ethicon Inc. (US), AbbVie Inc. (US), Medtronic plc (Ireland), Becton Dickinson and Company (US), Baxter International Inc. (US), B. Braun SE (Germany), W. L. Gore & Associates (US), Cook Group Inc (US) and Integra Lifesciences Holdings Corporation (US), among others.

Research Coverage

This report studies the hernia repair market based on product, clinical indication, surgery type, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (increasing hernia prevalence, effectiveness of mesh repair, availability of reimbursement, technological advancement), restraints (hernia mesh recall and market withdrawals, high costs of mesh repair and availability of less-expensive approaches, long waiting times in developed countries), opportunities (growth potential offered by emerging markets), and challenges (increasing pricing pressure on market players in developed markets, dearth of expertise in laparoscopic surgery) influencing the growth of the hernia repair market

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the hernia repair market

- Service Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and service developments in the hernia repair market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new services, growing geographies, and recent developments in the hernia repair market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and services of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.4.4 CURRENCY CONSIDERED

- 1.5 KEY STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT: HERNIA REPAIR MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Indicative list of secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2023)

- 2.2.2 END USER-BASED MARKET ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION FOR HERNIA REPAIR MARKET

- FIGURE 6 EPIDEMIOLOGY-BASED APPROACH: HERNIA MESH MARKET ESTIMATION, BY SURGERY

- FIGURE 7 EPIDEMIOLOGY-BASED APPROACH: HERNIA MESH FIXATOR MARKET ESTIMATION

- 2.2.3 PRIMARY RESEARCH VALIDATION

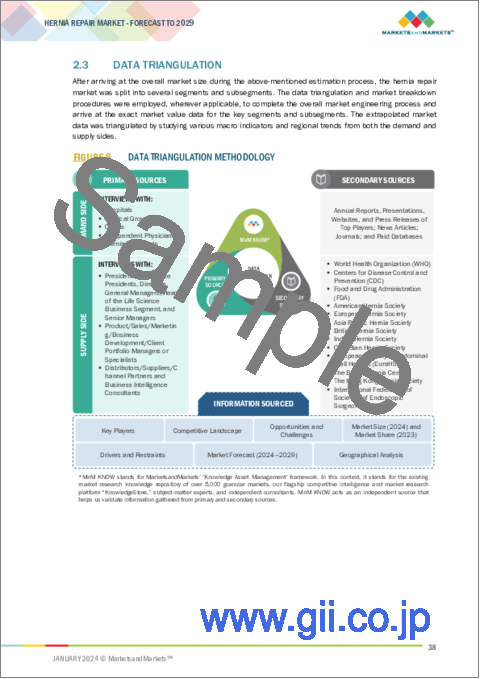

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.4 STUDY ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.7 IMPACT OF RECESSION ON HERNIA REPAIR MARKET

3 EXECUTIVE SUMMARY

- FIGURE 9 HERNIA REPAIR MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- FIGURE 10 HERNIA REPAIR MARKET, BY CLINICAL INDICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 HERNIA REPAIR MARKET SHARE, BY SURGERY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 HERNIA REPAIR MARKET SHARE, BY END USER, 2024 VS. 2029

- FIGURE 13 GEOGRAPHICAL SNAPSHOT OF HERNIA REPAIR MARKET

4 PREMIUM INSIGHTS

- 4.1 HERNIA REPAIR MARKET OVERVIEW

- FIGURE 14 INCREASING NUMBER OF HERNIA REPAIR PROCEDURES TO DRIVE MARKET

- 4.2 ASIA PACIFIC: HERNIA REPAIR MARKET, BY PRODUCT AND COUNTRY (2023)

- FIGURE 15 MESHES SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2023

- 4.3 HERNIA REPAIR MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 16 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 HERNIA REPAIR MARKET: REGIONAL MIX, 2022-2029 (USD MILLION)

- FIGURE 17 NORTH AMERICA WILL CONTINUE TO DOMINATE HERNIA REPAIR MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: HERNIA REPAIR MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of hernia in geriatric population

- 5.2.1.2 Superiority and effectiveness of mesh repair over conventional repair approaches

- 5.2.1.3 Availability of government and private reimbursement schemes in developed economies

- TABLE 1 REIMBURSEMENT FOR HERNIA REPAIR PROCEDURES IN US

- 5.2.1.4 Technological advancements and availability of advanced meshes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Market withdrawals of hernia meshes

- TABLE 2 MARKET RECALLS OF HERNIA MESHES, 2006-2021

- 5.2.2.2 High costs of mesh repair and availability of less-expensive approaches

- 5.2.2.3 Long waiting times for hernia mesh repair in developed countries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased growth potential in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing pricing pressure in developed economies

- 5.2.4.2 Dearth of expertise in laparoscopic surgery

- 5.3 REGULATORY SCENARIO

- 5.3.1 REGULATORY ANALYSIS

- 5.3.1.1 North America

- 5.3.1.1.1 US

- 5.3.1.1.2 Canada

- 5.3.1.1 North America

- TABLE 3 CANADA: RISK LEVELS OF INVASIVE MEDICAL DEVICES

- 5.3.1.2 Europe

- 5.3.1.3 Asia Pacific

- 5.3.1.3.1 China

- 5.3.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.1 REGULATORY ANALYSIS

- 5.4 REIMBURSEMENT SCENARIO

- TABLE 9 REIMBURSEMENT CODES FOR HERNIA REPAIR PROCEDURES, 2023

- 5.4.1 REIMBURSEMENT RATES FOR HERNIA REPAIR PROCEDURES IN US

- 5.4.1.1 Reimbursement rates for physicians, hospital outpatient departments, and ambulatory surgery centers

- TABLE 10 REIMBURSEMENT RATES FOR HERNIA REPAIR PROCEDURES FOR PHYSICIANS

- TABLE 11 REIMBURSEMENT RATES FOR HERNIA REPAIR PROCEDURES FOR HOSPITAL OUTPATIENT DEPARTMENTS

- TABLE 12 REIMBURSEMENT RATES FOR HERNIA REPAIR PROCEDURES FOR AMBULATORY SURGERY CENTERS

- 5.4.1.2 Hospital inpatient reimbursement rates

- TABLE 13 REIMBURSEMENT RATES FOR HERNIA REPAIR PROCEDURES FOR HOSPITAL INPATIENT DEPARTMENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 TECHNOLOGY INNOVATION

- 5.5.2 PROCUREMENT AND PRODUCT DEVELOPMENT

- 5.5.3 MARKETING, SALES, AND DISTRIBUTION AND POST-SALES SERVICES

- FIGURE 19 VALUE CHAIN ANALYSIS: HERNIA REPAIR MARKET

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- FIGURE 20 SUPPLY CHAIN ANALYSIS: HERNIA REPAIR MARKET

- 5.7 ECOSYSTEM MARKET/MAP

- FIGURE 21 HERNIA REPAIR MARKET ECOSYSTEM

- FIGURE 22 HERNIA REPAIR MARKET MAP

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 PORTER'S FIVE FORCES ANALYSIS: HERNIA REPAIR MARKET

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF BUYERS

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 THREAT OF NEW ENTRANTS

- 5.8.5 THREAT OF SUBSTITUTES

- 5.9 TRADE DATA ANALYSIS

- TABLE 15 IMPORT DATA FOR HERNIA MESHES (HS CODE 902190), BY COUNTRY, 2018-2022 (USD)

- TABLE 16 EXPORT DATA FOR HERNIA MESHES (HS CODE 902190), BY COUNTRY, 2018-2022 (USD)

- 5.10 PATENT ANALYSIS

- 5.10.1 TOP PATENT APPLICANTS (COMPANIES) FOR HERNIA REPAIR PRODUCTS

- FIGURE 23 TOP PATENT APPLICANTS FOR HERNIA REPAIR PRODUCTS, 2011-2023

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 17 HERNIA REPAIR PRICING ANALYSIS, BY REGION, 2023 (USD)

- 5.11.2 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- TABLE 18 HERNIA REPAIR PRICING ANALYSIS, BY KEY PLAYER, 2023 (USD)

- 5.12 TECHNOLOGY ANALYSIS

- 5.13 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 19 LIST OF MAJOR CONFERENCES & EVENTS IN HERNIA REPAIR MARKET, 2023-2024

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 EMERGING TRENDS AND OPPORTUNITIES AFFECTING FUTURE REVENUE MIX

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS

- FIGURE 25 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS

- TABLE 20 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS (%)

- 5.15.2 KEY BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR HERNIA REPAIR PRODUCTS

- TABLE 21 KEY BUYING CRITERIA FOR HERNIA REPAIR PRODUCTS

- 5.16 UNMET NEEDS AND KEY PAIN POINTS

- TABLE 22 HERNIA REPAIR MARKET: UNMET CUSTOMER NEEDS AND KEY PAIN POINTS

6 HERNIA REPAIR MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 23 HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- 6.2 MESHES

- TABLE 24 HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 25 HERNIA REPAIR MESHES MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 26 HERNIA REPAIR MESHES MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 27 HERNIA REPAIR MESHES MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 28 HERNIA REPAIR MESHES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.1 SYNTHETIC MESHES

- 6.2.1.1 Low cost to drive adoption

- TABLE 29 TYPES OF SYNTHETIC MESHES

- TABLE 30 FACTORS AFFECTING RESULTS OF MESH FIXATION

- TABLE 31 SYNTHETIC MESHES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.2.2 BIOLOGIC MESHES

- 6.2.2.1 Higher chance of hernia recurrence to hamper market growth

- TABLE 32 EXAMPLES OF BIOLOGIC MESHES

- TABLE 33 BIOLOGIC MESHES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.3 SUTURES

- TABLE 34 HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 35 HERNIA REPAIR SUTURES MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 36 HERNIA REPAIR SUTURES MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 37 HERNIA REPAIR SUTURES MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 38 HERNIA REPAIR SUTURES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.3.1 ABSORBABLE SUTURES

- 6.3.1.1 High absorbability to boost demand

- TABLE 39 ABSORBABLE SUTURES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.3.2 NON-ABSORBABLE SUTURES

- 6.3.2.1 Ability of non-absorbable sutures to retain strength indefinitely in body to support adoption

- TABLE 40 NON-ABSORBABLE SUTURES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.4 MESH FIXATORS

- TABLE 41 HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 42 HERNIA REPAIR MESH FIXATORS MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 43 HERNIA REPAIR MESH FIXATORS MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 44 HERNIA REPAIR MESH FIXATORS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 45 HERNIA REPAIR MESH FIXATORS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.4.1 TACK APPLICATORS

- 6.4.1.1 Easier and faster application of tacks to drive adoption

- TABLE 46 EXAMPLES OF TACK APPLICATORS

- TABLE 47 TACK APPLICATORS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.4.2 GLUE APPLICATORS

- 6.4.2.1 Significantly lower pain associated with glue fixation to drive market

- TABLE 48 GLUE APPLICATORS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.5 OTHER PRODUCTS

- TABLE 49 HERNIA REPAIR MARKET FOR OTHER PRODUCTS, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 50 HERNIA REPAIR MARKET FOR OTHER PRODUCTS, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 51 HERNIA REPAIR MARKET FOR OTHER PRODUCTS, BY END USER, 2022-2029 (USD MILLION)

- TABLE 52 HERNIA REPAIR MARKET FOR OTHER PRODUCTS, BY REGION, 2022-2029 (USD MILLION)

7 HERNIA REPAIR MARKET, BY CLINICAL INDICATION

- 7.1 INTRODUCTION

- TABLE 53 HERNIA REPAIR MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- 7.2 INGUINAL HERNIA

- 7.2.1 HIGH NUMBER OF INGUINAL HERNIA REPAIR SURGERIES PERFORMED WORLDWIDE TO DRIVE MARKET

- TABLE 54 INGUINAL HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3 VENTRAL HERNIA

- TABLE 55 VENTRAL HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 56 VENTRAL HERNIA REPAIR MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 7.3.1 INCISIONAL HERNIA

- 7.3.1.1 Ability to treat incisional hernias through surgery using sutures or meshes to drive growth

- TABLE 57 INCISIONAL HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3.2 UMBILICAL HERNIA

- 7.3.2.1 Lifting heavy weights and pressure inside abdomen-major contributors to occurrence of umbilical hernia

- TABLE 58 UMBILICAL HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3.3 EPIGASTRIC HERNIA

- 7.3.3.1 High prevalence among women to drive market

- TABLE 59 EPIGASTRIC HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.4 HIATAL HERNIA

- 7.4.1 HIGH RECURRENCE RATE TO SUPPORT MARKET GROWTH

- TABLE 60 HIATAL HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.5 FEMORAL HERNIA

- 7.5.1 FREQUENT OCCURRENCE IN WOMEN TO DRIVE DEMAND

- TABLE 61 FEMORAL HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.6 OTHER CLINICAL INDICATIONS

- TABLE 62 HERNIA REPAIR MARKET FOR OTHER CLINICAL INDICATIONS, BY REGION, 2022-2029 (USD MILLION)

8 HERNIA REPAIR MARKET, BY SURGERY TYPE

- 8.1 INTRODUCTION

- TABLE 63 HERNIA REPAIR MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- 8.2 OPEN SURGERY

- 8.2.1 PREFERRED TECHNIQUE FOR PRIMARY INGUINAL HERNIA REPAIR

- TABLE 64 OPEN HERNIA REPAIR SURGERY MARKET, BY REGION, 2022-2029 (USD MILLION)

- 8.3 LAPAROSCOPIC SURGERY

- 8.3.1 LESS POSTOPERATIVE PAIN AND EARLY RECOVERY TO DRIVE ADOPTION

- TABLE 65 LAPAROSCOPIC HERNIA REPAIR SURGERY MARKET, BY REGION, 2022-2029 (USD MILLION)

- 8.4 ROBOTIC SURGERY

- 8.4.1 INCREASED PRECISION AND VISIBILITY TO SUPPORT MARKET GROWTH

- TABLE 66 ROBOTIC HERNIA REPAIR SURGERY MARKET, BY REGION, 2022-2029 (USD MILLION)

9 HERNIA REPAIR MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 67 HERNIA REPAIR MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.2 HOSPITALS & CLINICS

- 9.2.1 LARGEST END-USER SEGMENT DUE TO HIGH PATIENT INFLOW

- TABLE 68 HERNIA REPAIR MARKET FOR HOSPITALS & CLINICS, BY REGION, 2022-2029 (USD MILLION)

- 9.3 AMBULATORY SURGERY CENTERS

- 9.3.1 FASTER PATIENT FLOW, REDUCED PATIENT STRESS, AND LOWER OVERALL COST-KEY FACTORS DRIVING MARKET GROWTH

- TABLE 69 HERNIA REPAIR MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2022-2029 (USD MILLION)

- 9.4 OTHER END USERS

- TABLE 70 HERNIA REPAIR MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

10 HERNIA REPAIR MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 71 HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 27 NORTH AMERICA: HERNIA REPAIR MARKET SNAPSHOT

- TABLE 72 NORTH AMERICA: HERNIA REPAIR MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 73 NORTH AMERICA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 75 NORTH AMERICA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: HERNIA REPAIR MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: HERNIA REPAIR MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: HERNIA REPAIR MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Government initiatives and investment plans for environmental protection to drive market

- TABLE 80 US: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 81 US: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 82 US: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 83 US: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Rising geriatric population to drive market

- TABLE 84 CANADA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 85 CANADA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 86 CANADA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 87 CANADA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 88 EUROPE: HERNIA REPAIR MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 89 EUROPE: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 90 EUROPE: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 91 EUROPE: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 92 EUROPE: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 93 EUROPE: HERNIA REPAIR MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 94 EUROPE: HERNIA REPAIR MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 95 EUROPE: HERNIA REPAIR MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Water pollution management and depleting air quality to drive demand for hernia repair products

- TABLE 96 GERMANY: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 97 GERMANY: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 98 GERMANY: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 99 GERMANY: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 High use of analytical techniques in food testing and stringent government regulations to drive market

- TABLE 100 UK: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 101 UK: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 102 UK: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 103 UK: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Rising industrial contaminant levels and pollution in drinking water bodies to drive market

- TABLE 104 FRANCE: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 105 FRANCE: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 106 FRANCE: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 107 FRANCE: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Favorable healthcare system and insurance to support growth

- TABLE 108 ITALY: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 109 ITALY: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 110 ITALY: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 111 ITALY: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Growing geriatric population & increasing life expectancies to aid market growth

- TABLE 112 SPAIN: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 113 SPAIN: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 114 SPAIN: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 115 SPAIN: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 116 REST OF EUROPE: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 117 REST OF EUROPE: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 118 REST OF EUROPE: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 119 REST OF EUROPE: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 28 ASIA PACIFIC: HERNIA REPAIR MARKET SNAPSHOT

- TABLE 120 ASIA PACIFIC: HERNIA REPAIR MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 121 ASIA PACIFIC: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 122 ASIA PACIFIC: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 123 ASIA PACIFIC: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 124 ASIA PACIFIC: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 125 ASIA PACIFIC: HERNIA REPAIR MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 126 ASIA PACIFIC: HERNIA REPAIR MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 127 ASIA PACIFIC: HERNIA REPAIR MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Japan to hold largest share of APAC market

- TABLE 128 JAPAN: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 129 JAPAN: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 130 JAPAN: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 131 JAPAN: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 High procedural volume and rising disposable income to favor market growth

- TABLE 132 CHINA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 133 CHINA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 134 CHINA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 135 CHINA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Rising geriatric population and infrastructural improvements to drive market

- TABLE 136 INDIA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 137 INDIA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 138 INDIA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 139 INDIA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Growing awareness of hernia management to support adoption and development of hernia repair procedures

- TABLE 140 AUSTRALIA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 141 AUSTRALIA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 142 AUSTRALIA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 143 AUSTRALIA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Growing awareness to drive market growth

- TABLE 144 SOUTH KOREA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 145 SOUTH KOREA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 146 SOUTH KOREA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 147 SOUTH KOREA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 148 REST OF ASIA PACIFIC: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICA: RECESSION IMPACT

- TABLE 152 LATIN AMERICA: HERNIA REPAIR MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 153 LATIN AMERICA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 154 LATIN AMERICA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 155 LATIN AMERICA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 156 LATIN AMERICA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 157 LATIN AMERICA: HERNIA REPAIR MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 158 LATIN AMERICA: HERNIA REPAIR MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 159 LATIN AMERICA: HERNIA REPAIR MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Growing medical tourism to support demand growth

- TABLE 160 BRAZIL: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 161 BRAZIL: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 162 BRAZIL: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 163 BRAZIL: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.5.3 MEXICO

- 10.5.3.1 Slow adoption of advanced technologies to hinder growth

- TABLE 164 MEXICO: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 165 MEXICO: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 166 MEXICO: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 167 MEXICO: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.5.4 REST OF LATIN AMERICA

- TABLE 168 REST OF LATIN AMERICA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 172 MIDDLE EAST & AFRICA: HERNIA REPAIR MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: HERNIA REPAIR MARKET, BY CLINICAL INDICATION, 2022-2029 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: HERNIA REPAIR MARKET, BY SURGERY TYPE, 2022-2029 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: HERNIA REPAIR MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Lack of regulations for PFAS substances to restrict growth

- TABLE 180 GCC COUNTRIES: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 181 GCC COUNTRIES: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 182 GCC COUNTRIES: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 183 GCC COUNTRIES: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 184 REST OF MIDDLE EAST & AFRICA: HERNIA REPAIR MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: HERNIA REPAIR MESHES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: HERNIA REPAIR SUTURES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: HERNIA REPAIR MESH FIXATORS MARKET, BY TYPE, 2022-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- FIGURE 29 KEY DEVELOPMENTS BY MAJOR PLAYERS IN HERNIA REPAIR MARKET, 2017-2024

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 30 REVENUE SHARE ANALYSIS OF KEY PLAYERS (2020-2023)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 31 HERNIA REPAIR MARKET SHARE, BY KEY PLAYER, 2023

- TABLE 188 DEGREE OF COMPETITION: HERNIA REPAIR MARKET

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 32 HERNIA REPAIR MARKET: COMPANY EVALUATION MATRIX, 2023

- 11.5.5 COMPANY FOOTPRINT

- TABLE 189 PRODUCT FOOTPRINT

- TABLE 190 CLINICAL INDICATION FOOTPRINT

- 11.6 START-UP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 33 HERNIA REPAIR MARKET: START-UP/SME EVALUATION MATRIX, 2023

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 191 HERNIA REPAIR MARKET: DETAILED LIST OF KEY START-UPS/SMES

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 192 HERNIA REPAIR MARKET: PRODUCT LAUNCHES & APPROVALS, JUNE 2020-DECEMBER 2023

- 11.7.2 DEALS

- TABLE 193 HERNIA REPAIR MARKET: DEALS, JUNE 2020-DECEMBER 2023

- 11.7.3 OTHER DEVELOPMENTS

- TABLE 194 HERNIA REPAIR MARKET: OTHER DEVELOPMENTS, JUNE 2020-DECEMBER 2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 12.1.1 ETHICON INC. (PART OF JOHNSON & JOHNSON)

- TABLE 195 ETHICON INC.: COMPANY OVERVIEW

- FIGURE 34 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2022)

- 12.1.2 ABBVIE INC.

- TABLE 196 ABBVIE INC.: COMPANY OVERVIEW

- FIGURE 35 ABBVIE INC.: COMPANY SNAPSHOT (2022)

- 12.1.3 MEDTRONIC PLC

- TABLE 197 MEDTRONIC PLC: COMPANY OVERVIEW

- FIGURE 36 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- 12.1.4 BECTON, DICKINSON AND COMPANY

- TABLE 198 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- FIGURE 37 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2023)

- 12.1.5 BAXTER INTERNATIONAL INC.

- TABLE 199 BAXTER INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 38 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT (2022)

- 12.1.6 B. BRAUN SE

- TABLE 200 B. BRAUN SE: COMPANY OVERVIEW

- FIGURE 39 B. BRAUN SE: COMPANY SNAPSHOT (2022)

- 12.1.7 W. L. GORE & ASSOCIATES

- TABLE 201 W. L. GORE & ASSOCIATES: COMPANY OVERVIEW

- 12.1.8 COOK GROUP INC.

- TABLE 202 COOK GROUP INC.: COMPANY OVERVIEW

- 12.1.9 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

- TABLE 203 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 40 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.10 THE COOPER COMPANIES, INC.

- TABLE 204 THE COOPER COMPANIES, INC.: COMPANY OVERVIEW

- FIGURE 41 THE COOPER COMPANIES, INC.: COMPANY SNAPSHOT (2022)

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 H.B. FULLER COMPANY

- 12.2.2 ADVANCED MEDICAL SOLUTIONS GROUP PLC

- 12.2.3 TELEFLEX MEDICAL OEM

- 12.2.4 TRANSEASY MEDICAL TECH

- 12.2.5 FEG TEXTILTECHNIK MBH

- 12.2.6 DIPROMED SRL

- 12.2.7 HERNIAMESH S.R.L

- 12.2.8 GEM SRL

- 12.2.9 MERIL LIFE SCIENCES PVT. LTD.

- 12.2.10 TELA BIO, INC.

- 12.2.11 ASSUT EUROPE S.P.A.

- 12.2.12 ARAN BIOMEDICAL

- 12.2.13 DOLPHIN SUTURES

- 12.2.14 BG MEDICAL LLC

- 12.2.15 COUSIN SURGERY

- 12.2.16 TI MEDICAL PRIVATE LIMITED

- 12.2.17 VITREX MEDICAL A/S

- 12.2.18 DEMETECH CORPORATION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS