|

|

市場調査レポート

商品コード

1426166

IoTセンサーの世界市場:センサータイプ別、ネットワーク技術別、業界別、地域別 - 予測(~2029年)IoT Sensors Market by Sensor Type (Pressure, Temperature, Humidity, Image, Inertial, Gyroscope, Touch), Network Technology (Wired and Wireless), Vertical (Commercial IoT and Industrial IoT) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| IoTセンサーの世界市場:センサータイプ別、ネットワーク技術別、業界別、地域別 - 予測(~2029年) |

|

出版日: 2024年02月12日

発行: MarketsandMarkets

ページ情報: 英文 262 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

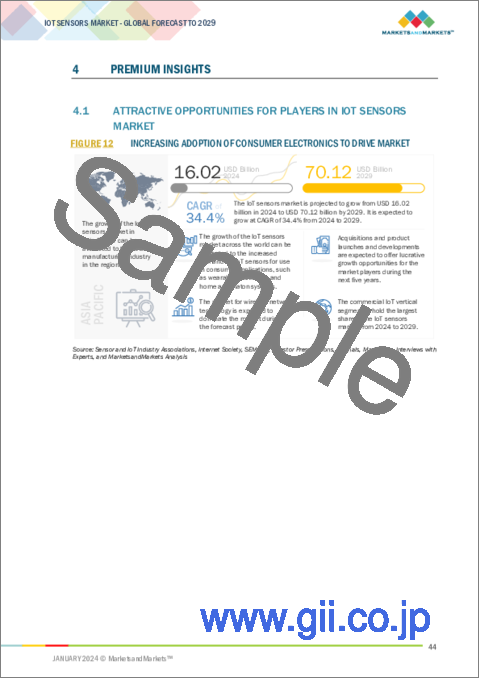

世界のIoTセンサーの市場規模は、2024年に160億米ドル、2029年までに701億米ドルに達し、2024年~2029年にCAGRで34.4%の成長が予測されています。

IoTは、技術動向やイノベーションに適応する組織や企業に飛躍的な成長機会を提供します。IoTの可能性を最大限に実現し、IoT市場で成功するためには、領域を超えた提携と新しいビジネスモデルがもっとも重要です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 1,000/100万/10億 |

| セグメント | センサータイプ別、ネットワーク技術別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「センサータイプ別では、ジャイロスコープが予測期間にもっとも高いCAGRで成長する見込みです。」

ジャイロスコープは角速度の測定に使用されます。主に3Dマウス、ゲーム、アスリートのトレーニング用途で使用されます。ジャイロスコープには、リングレーザージャイロや光ファイバージャイロなどのさまざまなクラスがあります。これらは、製品に関する正確な情報を提供する信頼性の高いセンサーです。これらのセンサーは、GPSなどの外部位置測定に依存することなく、デバイスのモーショントラッキングを可能にするため、ポータブルデバイスにおいて重要なツールです。ジャイロスコープは、加速度センサーよりも消費電力が小さいです。

「有線ネットワーク技術が2023年に大きな市場規模を占めます。」

有線ネットワーク技術は、コンピューターのOSのインストール、トラブルシューティング、設定を行うための基盤です。このネットワーク技術は、バス、スター、トークンリング、メッシュトポロジーで動作します。ネットワークは距離によって、ローカルエリアネットワーク(LAN)、メトロポリタンエリアネットワーク(MAN)、ワイドエリアネットワーク(WAN)に分類されます。ネットワーク技術は、3GやWi-Fiを使用せず、長距離や低消費電力などの利点を持つLoRaWANを使用してIoTに接続される可能性もあります。

「北米のIoTセンサー市場が予測期間に2番目に大きな市場規模を占めます。」

北米の企業は、新しい技術を業務に取り入れることで、生産活動を強化し、流通網を広げています。IoTセンサーのメーカーは、最小限のエラーと高品質な生産を確実にするとともに、プロセスを自動化することが可能になっています。北米のIoTセンサー市場の主要企業には、Texas Instruments(米国)、Broadcom(米国)、Analog Devices(米国)、SmartThings(米国)などがあります。

当レポートでは、世界のIoTセンサー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- IoTセンサー市場の企業にとって魅力的な機会

- IoTセンサー市場:センサータイプ別

- IoTセンサー市場:ネットワーク技術別

- IoTセンサー市場:業界別

- IoTセンサー市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- IoTセンサーの平均販売価格:主要企業別

- 平均販売価格:センサータイプ別

- バリューチェーン分析

- チップ設計者

- コンポーネントメーカー

- 技術プロバイダー

- インテグレーター

- 最終用途

- エコシステム分析

- 技術分析

- 主な技術

- 補完技術

- 関連技術

- 特許分析

- 貿易データアナリティクス

- イメージセンサーの輸入シナリオ

- イメージセンサーの輸出シナリオ

- 関税と規制情勢

- IoTセンサー市場に関連する関税

- 規制機関、政府機関、その他の組織

- 規制基準

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 主な会議とイベント

第6章 IoTセンサー市場:センサータイプ別

- イントロダクション

- 温度センサー

- 圧力センサー

- 湿度センサー

- フローセンサー

- 加速度計

- 磁力計

- ジャイロスコープ

- 慣性センサー

- イメージセンサー

- タッチセンサー

- 近接センサー

- 音響センサー

- モーションセンサー

- 人感センサー

- 画像処理人感センサー

- インテリジェント人感センサー

- CO2センサー

- その他のセンサー

- 光センサー

- レーダーセンサー

第7章 ネットワークIoTセンサー市場:技術別

- イントロダクション

- 有線

- KNX

- LONWORKS

- イーサネット

- Modbus

- DALI

- 無線

- Wi-Fi

- Bluetooth

- ZigBee

- Z-WAVE

- NFC

- RFID

- EnOcean

- Thread

- 6LoWPAN

- WirelessHART(WHART)

- Process Field Bus

- DECT-ULE

- その他の無線技術

第8章 IoTセンサー市場:業界別

- イントロダクション

- 消費者向けIoT

- 商業用IoT

- スマートシティ

- 小売

- 航空宇宙・防衛

- ロジスティクス、サプライチェーン、輸送

- エンターテインメント

- 金融機関

- 企業オフィス

- 産業用IoT

- エネルギー

- 産業オートメーション

- 医療

- スマート農業

第9章 IoTセンサー市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 北米の不況の影響の分析

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- 欧州の不況の影響の分析

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他のアジア太平洋

- アジア太平洋の不況の影響の分析

- その他の地域

- GCC

- その他の中東・アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 主要企業の戦略

- 市場の収益分析

- 市場シェア分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- TEXAS INSTRUMENTS

- TE CONNECTIVITY

- BROADCOM

- NXP SEMICONDUCTORS

- STMICROELECTRONICS NV

- BOSCH SENSORTEC

- TDK CORPORATION

- INFINEON TECHNOLOGIES AG

- ANALOG DEVICES

- OMRON CORPORATION

- その他の企業

- SENSIRION

- HONEYWELL INTERNATIONAL

- SIEMENS AG

- KNOWLES CORPORATION

- ABB LTD.

- SENSATA TECHNOLOGIES

- EMERSON ELECTRIC CO.

- TELEDYNE TECHNOLOGIES INCORPORATED

- SMARTTHINGS INC.

- MONNIT CORPORATION

- MURATA MANUFACTURING CO., LTD.

- FIGARO ENGINEERING INC.

- TRAFAG AG

- NIDEC COPAL ELECTRONICS

- KITA SENSOR TECH. CO., LTD.

第12章 付録

IoT sensors market size is valued at USD 16.0 billion in 2024 and is anticipated to be USD 70.1 billion by 2029; growing at a CAGR of 34.4% from 2024 to 2029. IoT offers an exponential growth opportunity for organizations and businesses to adapt to technological trends and innovations. To realize the full potential of IoT and to become successful in the IoT market, cross-domain collaborations and new business models are of utmost importance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Thousand/Million/Billion |

| Segments | By Sensors Type, By Network Technology, By Vertical and By Region |

| Regions covered | North America, Europe, APAC, RoW |

"Gyroscopes is expected to grow with highest CAGR in terms of sensors type during the forecast period"

Gyroscopes are used to measure angular velocity. They are mainly used in 3D mouse, game, and athlete training applications. Gyroscopes come in various classes, such as ring laser gyro and fiber-optic gyro. These are reliable sensors that provide accurate information about the product. These sensors are important tools in portable instruments as they allow device motion tracking, independent of GPS or other external location measurements. Gyroscopes are more frugal with respect to power consumption than accelerometers.

"Wired network technology to account for significant market size in 2023"

Wired network technology is a base to install, troubleshoot, and configure computer operating systems. The network technology works on bus, star, token ring, and mesh topologies. The networks can be characterized based on the distance into local area networks (LANs), metropolitan area networks (MANs), and wide area networks (WANs). The network technologies can also be connected to IoT without using 3G or Wi-Fi and instead by using LoRaWAN, which offers advantages including long-range and low power consumption.

"The IoT sensors market in North America to have second largest market size during the forecast period"

Companies in North America are enhancing their production activities and widening their distribution networks by incorporating new technologies into their operations. Manufacturers of IoT sensors have been enabled to automate their processes, along with ensuring minimal errors and high-quality production. Some of the leading players in the IoT sensors market in North America are Texas Instruments (US), Broadcom (US), Analog Devices (US), and SmartThings (US).

The breakup of primaries conducted during the study is depicted below:

- By Company Type: Tier 1 - 15%, Tier 2 - 50%, and Tier 3 - 35%

- By Designation: C-Level Executives -40%, Directors - 35%, and Others - 25%

- By Region: North America - 45%, Europe - 35%, Asia Pacific - 12%, South America- 3% and Middle East and Africa - 5%

The key players operating in the IoT sensors market are Texas Instruments (US), TE Connectivity (Switzerland), Broadcom (US), NXP Semiconductors (Netherlands), STMicroelectronics NV (Switzerland), Bosch Sensortec (Germany), TDK Corporation (Japan), Infineon Technologies (Germany), Analog Devices (US), Omron Corporation (Japan), Sensirion (Switzerland), Honeywell International (US), Siemens AG (Germany), Knowles Corporation (US), ABB Ltd. (Switzerland), Sensata Technologies (US), Emerson Electric Co. (US), Teledyne Technologies (US), SmartThings Inc. (US), Monnit Corporation (US), Murata Manufacturing Co., (Japan), Figaro Engineering Inc. (Japan), Trafag AG (Switzerland), NIDEC COPAL ELECTRONICS (Japan), and KITA SENSOR TECH. CO., LTD. (Taiwan).

The report defines, describes, and forecasts the IoT sensors market based on sensors type, network technology, vertical and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the IoT sensors market. It also analyzes competitive developments such as product launches, acquisitions, expansion contracts, partnerships and actions carried out by the key players to grow the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall IoT sensors market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (Increasing use of sensors in IoT applications), restraints (Data security concerns), opportunities (Favorable government initiatives and funds for IoT projects), and challenges (Shortage of technical know how)

- Product development /Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the IoT sensors market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the IoT sensors market across various regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the IoT sensors market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and services, offering of leading players Texas Instruments (US), TE Connectivity (Switzerland), Broadcom (US), NXP Semiconductors (Netherlands), STMicroelectronics NV (Switzerland), among others in IoT sensors market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.1.1 Key industry insights

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primary interviews

- 2.1.3.2 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.7 RECESSION IMPACT ANALYSIS

- FIGURE 7 IMPACT OF RECESSION ON IOT SENSORS MARKET, 2020-2029 (USD MILLION)

- 2.7.1 PARAMETERS TO ANALYZE RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 8 PRESSURE SENSORS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 WIRELESS NETWORK TECHNOLOGY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 COMMERCIAL IOT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IOT SENSORS MARKET

- FIGURE 12 INCREASING ADOPTION OF CONSUMER ELECTRONICS TO DRIVE MARKET

- 4.2 IOT SENSORS MARKET, BY SENSOR TYPE

- FIGURE 13 PRESSURE SENSORS TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.3 IOT SENSORS MARKET, BY NETWORK TECHNOLOGY

- FIGURE 14 WIRELESS SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 IOT SENSORS MARKET, BY VERTICAL

- FIGURE 15 COMMERCIAL IOT TO DISPLAY HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 IOT SENSORS MARKET, BY COUNTRY

- FIGURE 16 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 IOT SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 18 IOT SENSORS MARKET: DRIVERS AND THEIR IMPACT

- 5.2.1.1 Increasing development of technologically advanced and low-cost sensors

- 5.2.1.2 Introduction of 3GPP Release 13 and 14 specifications

- 5.2.1.3 Growth in internet penetration rate

- FIGURE 19 REGION-WISE INTERNET USERS TILL JUNE 2022

- 5.2.1.4 Rising demand for connected and wearable devices

- 5.2.1.5 Higher adoption of IPv6

- FIGURE 20 WORLDWIDE ADOPTION OF IPV6, 2023

- 5.2.1.6 Growing IoT applications in real-time computing

- 5.2.2 RESTRAINTS

- FIGURE 21 IOT SENSORS MARKET: RESTRAINTS AND THEIR IMPACT

- 5.2.2.1 Data security concerns

- 5.2.3 OPPORTUNITIES

- FIGURE 22 IOT SENSORS MARKET: OPPORTUNITIES AND THEIR IMPACT

- 5.2.3.1 Favorable government initiatives and funds for IoT projects

- 5.2.3.2 Implementation of predictive maintenance programs for IoT

- 5.2.3.3 Cross-domain collaborations across businesses

- 5.2.3.4 Inclination of small- and medium-sized businesses toward IoT

- 5.2.4 CHALLENGES

- FIGURE 23 IOT SENSORS MARKET: CHALLENGES AND THEIR IMPACT

- 5.2.4.1 Lack of common protocols and communication standards

- 5.2.4.2 Shortage of technical know-how

- 5.2.4.3 High power consumption by connected devices

- 5.2.4.4 Limited bandwidth and latency issues

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN IOT SENSORS MARKET

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF IOT SENSORS, BY KEY PLAYERS

- FIGURE 25 AVERAGE SELLING PRICE OF IOT SENSORS, BY KEY PLAYERS (USD)

- 5.4.2 AVERAGE SELLING PRICE, BY SENSOR TYPE

- FIGURE 26 AVERAGE SELLING PRICE, BY SENSOR TYPE, 2020 VS. 2029 (USD)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 27 VALUE CHAIN ANALYSIS

- 5.5.1 CHIP DESIGNERS

- 5.5.2 COMPONENT MANUFACTURERS

- 5.5.3 TECHNOLOGY PROVIDERS

- 5.5.4 INTEGRATORS

- 5.5.5 END USE APPLICATIONS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 28 ECOSYSTEM MAPPING

- TABLE 1 ROLE OF COMPANIES IN ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 5G

- 5.7.1.2 Low-power wide area networks (LPWAN)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Quantum dot CMOS technology

- 5.7.2.2 Multipixel technology (MPT)

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Thermal imaging

- 5.7.3.2 Electronic nose (e-nose)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 2 TOP 10 PATENT OWNERS IN US, 2013-2023

- FIGURE 30 PATENT PUBLICATION TREND, 2013-2023

- TABLE 3 INNOVATIONS AND PATENT REGISTRATIONS, 2020-2023

- 5.9 TRADE DATA ANALYSIS

- 5.9.1 IMPORT SCENARIO OF IMAGE SENSORS

- FIGURE 31 IMPORT DATA FOR IMAGE SENSORS FOR TOP FIVE COUNTRIES, 2019-2022 (THOUSAND UNITS)

- 5.9.2 EXPORT SCENARIO OF IMAGE SENSORS

- FIGURE 32 EXPORT DATA FOR IMAGE SENSORS FOR TOP FIVE COUNTRIES, 2019-2022 (THOUSAND UNITS)

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 TARIFFS RELATED TO IOT SENSORS MARKET

- TABLE 4 MFN TARIFFS FOR GAS OR SMOKE ANALYSIS APPARATUS EXPORTED BY US

- TABLE 5 MFN TARIFFS FOR GAS OR SMOKE ANALYSIS APPARATUS IMPORTS BY CHINA

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.3 REGULATORY STANDARDS

- TABLE 10 NORTH AMERICA: SAFETY STANDARDS FOR IOT SENSORS

- TABLE 11 EUROPE: SAFETY STANDARDS FOR IOT SENSORS

- TABLE 12 ASIA PACIFIC: SAFETY STANDARDS FOR IOT SENSORS

- TABLE 13 REST OF THE WORLD: SAFETY STANDARDS FOR IOT SENSORS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 IMPACT OF PORTER'S FIVE FORCES

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA, BY VERTICAL

- TABLE 16 KEY BUYING CRITERIA, BY VERTICAL

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 REMOTE MONITORING SYSTEMS FOR MANAGING HVAC SETUP

- 5.13.2 MAINTAINING WATER QUALITY FOR PISCICULTURE

- 5.13.3 WATER QUALITY MONITORING SYSTEM FOR IRRIGATION DAM

- 5.13.4 HUMAN CONDITION SAFETY SENSORS TO MINIMIZE JOB SITE RISKS

- 5.13.5 SMART CONSTRUCTION USING IOT SENSORS

- 5.13.6 TEMPERATURE AND HUMIDITY TRACKING IN DATA CENTERS

- 5.14 KEY CONFERENCES AND EVENTS

- TABLE 17 KEY CONFERENCES AND EVENTS, 2024-2025

6 IOT SENSORS MARKET, BY SENSOR TYPE

- 6.1 INTRODUCTION

- FIGURE 36 IOT SENSORS MARKET, BY SENSOR TYPE

- TABLE 18 IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 19 IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

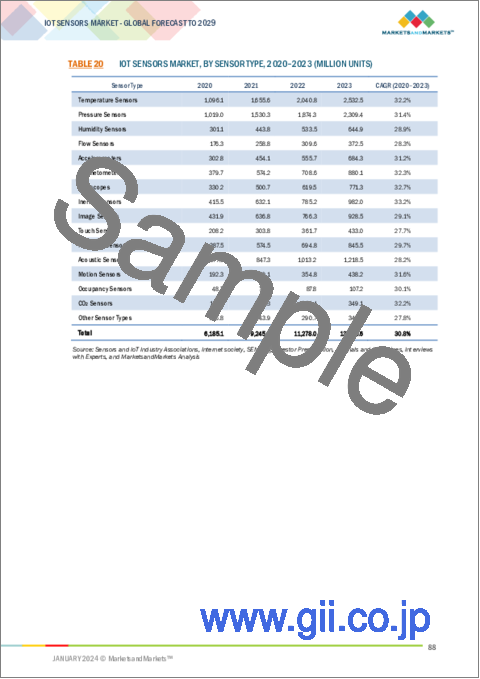

- TABLE 20 IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (MILLION UNITS)

- TABLE 21 IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (MILLION UNITS)

- 6.2 TEMPERATURE SENSORS

- 6.2.1 HIGHER OPERATIONAL LIFESPAN AND ENERGY EFFICIENCY TO DRIVE MARKET

- TABLE 22 TEMPERATURE SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 23 TEMPERATURE SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 24 TEMPERATURE SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 25 TEMPERATURE SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 PRESSURE SENSORS

- 6.3.1 UTILIZATION IN INTELLIGENT BUILDINGS TO DRIVE MARKET

- TABLE 26 PRESSURE SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 27 PRESSURE SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 28 PRESSURE SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 29 PRESSURE SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4 HUMIDITY SENSORS

- 6.4.1 EASY CONNECTIVITY WITH WI-FI-ENABLED DEVICES TO DRIVE MARKET

- TABLE 30 HUMIDITY SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 31 HUMIDITY SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- FIGURE 37 HUMIDITY IOT SENSORS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- TABLE 32 HUMIDITY SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 HUMIDITY SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.5 FLOW SENSORS

- 6.5.1 HIGH ADOPTION IN INDUSTRIAL MANUFACTURING AND HEALTHCARE TO DRIVE MARKET

- TABLE 34 FLOW SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 35 FLOW SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 36 FLOW SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 FLOW SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.6 ACCELEROMETERS

- 6.6.1 ABILITY TO MEASURE ACCELERATION, TILT, VIBRATION, AND SHOCK TO DRIVE MARKET

- TABLE 38 ACCELEROMETERS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 39 ACCELEROMETERS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 40 ACCELEROMETERS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 ACCELEROMETERS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.7 MAGNETOMETERS

- 6.7.1 INDUSTRIAL IOT AND SMART CITIES TO DRIVE MARKET

- TABLE 42 MAGNETOMETERS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 43 MAGNETOMETERS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 44 MAGNETOMETERS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 45 MAGNETOMETERS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.8 GYROSCOPES

- 6.8.1 INCREASING USE IN PORTABLE INSTRUMENTS TO DRIVE MARKET

- TABLE 46 GYROSCOPES: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 47 GYROSCOPES: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 48 GYROSCOPES: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 GYROSCOPES: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.9 INERTIAL SENSORS

- 6.9.1 GEOENGINEERING, CONDITION MONITORING, AND NAVIGATION APPLICATIONS TO DRIVE MARKET

- TABLE 50 INERTIAL SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 51 INERTIAL SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 52 INERTIAL SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 INERTIAL SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.10 IMAGE SENSORS

- 6.10.1 LOW POWER CONSUMPTION, COMPACTNESS, AND FAST PRODUCTION TO DRIVE MARKET

- TABLE 54 IMAGE SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 55 IMAGE SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 56 IMAGE SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 IMAGE SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.11 TOUCH SENSORS

- 6.11.1 ATTRACTIVE DESIGNS WITH AFFORDABLE MANUFACTURING TO DRIVE MARKET

- TABLE 58 TOUCH SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 59 TOUCH SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 60 TOUCH SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 TOUCH SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.12 PROXIMITY SENSORS

- 6.12.1 PROMINENT USE IN MOBILE PHONES, TABLETS, AND PERSONAL COMPUTERS TO DRIVE MARKET

- TABLE 62 PROXIMITY SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 63 PROXIMITY SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 64 PROXIMITY SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 PROXIMITY SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.13 ACOUSTIC SENSORS

- 6.13.1 UNDERWATER AND UNDERGROUND COMMUNICATION TO DRIVE MARKET

- TABLE 66 ACOUSTIC SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 67 ACOUSTIC SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 68 ACOUSTIC SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 69 ACOUSTIC SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.14 MOTION SENSORS

- 6.14.1 RISING USE IN CONSUMER APPLIANCES, MEDICAL DEVICES, AND INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- TABLE 70 MOTION SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 71 MOTION SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 72 MOTION SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 MOTION SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.15 OCCUPANCY SENSORS

- TABLE 74 OCCUPANCY SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 75 OCCUPANCY SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 76 OCCUPANCY SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 77 OCCUPANCY SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.15.1 IMAGE PROCESSING OCCUPANCY SENSORS

- 6.15.1.1 Improved performance than passive infrared sensors and ultrasonic sensors to drive market

- 6.15.2 INTELLIGENT OCCUPANCY SENSORS

- 6.15.2.1 Easy detection of human presence and adjustment of HVAC systems to drive market

- 6.16 CO2 SENSORS

- 6.16.1 INDOOR CLIMATE SENSING TO DRIVE MARKET

- TABLE 78 CO2 SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 79 CO2 SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 80 CO2 SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 CO2 SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.17 OTHER SENSORS

- 6.17.1 LIGHT SENSORS

- 6.17.2 RADAR SENSORS

- TABLE 82 OTHER SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 83 OTHER SENSORS: IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 84 OTHER SENSORS: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 85 OTHER SENSORS: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

7 IOT SENSORS MARKET, BY NETWORK TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 38 KEY NETWORK TECHNOLOGIES IN IOT SENSORS MARKET

- FIGURE 39 WIRELESS NETWORK TECHNOLOGY SEGMENT TO LEAD IOT SENSORS MARKET FROM 2024 TO 2029

- TABLE 86 IOT SENSORS MARKET, BY NETWORK TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 87 IOT SENSORS MARKET, BY NETWORK TECHNOLOGY, 2024-2029 (USD MILLION)

- 7.2 WIRED

- FIGURE 40 ETHERNET TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 88 WIRED: IOT SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 WIRED: IOT SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.2.1 KNX

- 7.2.1.1 Home and building control applications to drive market

- 7.2.2 LONWORKS

- 7.2.2.1 Standardized interface for sensors to drive market

- 7.2.3 ETHERNET

- 7.2.3.1 Mobile, cloud, and IoT network communication to drive market

- 7.2.4 MODBUS

- 7.2.4.1 High adoption in manufacturing industries to drive market

- 7.2.5 DIGITAL ADDRESSABLE LIGHTING INTERFACE (DALI)

- 7.2.5.1 Increasing prevalence of new lighting technologies to drive market

- 7.3 WIRELESS

- TABLE 90 WIRELESS: IOT SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 91 WIRELESS: IOT SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 7.3.1 WI-FI

- 7.3.1.1 3G-powered Wi-Fi connections in cars to drive market

- 7.3.2 BLUETOOTH

- 7.3.2.1 Bluetooth Smart

- 7.3.2.1.1 High adoption in wearable electronics to drive market

- 7.3.2.2 Wi-Fi/Bluetooth Smart

- 7.3.2.2.1 Seamless connectivity with wireless LAN networks to drive market

- 7.3.2.3 Bluetooth Smart/Ant+

- 7.3.2.3.1 SensRcore feature to drive market

- 7.3.2.4 Bluetooth 5

- 7.3.2.4.1 Location-based marketing to drive market

- 7.3.2.1 Bluetooth Smart

- 7.3.3 ZIGBEE

- 7.3.3.1 Personal area networks to drive market

- 7.3.4 Z-WAVE

- 7.3.4.1 Home automation trend to drive market

- 7.3.5 NEAR FIELD COMMUNICATION (NFC)

- 7.3.5.1 Need for cost-effective and easy interactions between electronic devices to drive market

- 7.3.6 RFID

- 7.3.6.1 Integration in supply chain, inventory control, and logistics to drive market

- 7.3.7 ENOCEAN

- 7.3.7.1 Interoperable standard promoting wireless technologies to drive market

- 7.3.8 THREAD

- 7.3.8.1 Higher speed than Wi-Fi to drive market

- 7.3.9 6LOWPAN

- 7.3.9.1 Scalability and self-healing properties to drive market

- 7.3.10 WIRELESS-HART (WHART)

- 7.3.10.1 Configuration, diagnostics, and data processing applications to drive market

- 7.3.11 PROCESS FIELD BUS

- 7.3.11.1 Standardized field bus communication to drive market

- 7.3.12 DECT-ULE

- 7.3.12.1 Low power consumption and long range to drive market

- 7.3.13 OTHER WIRELESS TECHNOLOGIES

- 7.3.13.1 ANT+

- 7.3.13.2 ISA100

- 7.3.13.3 GPS

- 7.3.13.4 Sub-Gig

- 7.3.13.5 Cellular

8 IOT SENSORS MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 41 CONSUMER IOT SENSORS MARKET TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 92 IOT SENSORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 93 IOT SENSORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 8.2 CONSUMER IOT

- 8.2.1 INSIGHTS INTO USAGE PATTERNS OF ELECTRONIC DEVICES BY CONSUMERS TO DRIVE MARKET

- TABLE 94 CONSUMER IOT: IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 95 CONSUMER IOT: IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- 8.3 COMMERCIAL IOT

- TABLE 96 COMMERCIAL IOT: IOT SENSORS MARKET, BY END USE APPLICATIONS, 2020-2023 (USD MILLION)

- TABLE 97 COMMERCIAL IOT: IOT SENSORS MARKET, BY END USE APPLICATIONS, 2024-2029 (USD MILLION)

- TABLE 98 COMMERCIAL IOT: IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 99 COMMERCIAL IOT: IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- 8.3.1 SMART CITIES

- 8.3.1.1 Traffic management and smart parking to drive market

- 8.3.2 RETAIL

- FIGURE 42 LOGISTICS, SUPPLY CHAIN, AND TRANSPORTATION SEGMENT TO HOLD LARGEST MARKET SHARE FOR RETAIL APPLICATIONS DURING FORECAST PERIOD

- TABLE 100 COMMERCIAL IOT: IOT SENSORS MARKET, BY RETAIL APPLICATIONS, 2020-2023 (USD MILLION)

- TABLE 101 COMMERCIAL IOT: IOT SENSORS MARKET, BY RETAIL APPLICATIONS, 2024-2029 (USD MILLION)

- 8.3.2.1 Advertising and marketing

- 8.3.2.1.1 Increased competition among retail stores to drive market

- 8.3.2.2 Digital signages

- 8.3.2.2.1 Product promotion and customer engagement to drive market

- 8.3.2.3 Energy optimization

- 8.3.2.3.1 Increasing use of smart meters to drive market

- 8.3.2.4 Intelligent payment solutions

- 8.3.2.4.1 Popularity of point-of-sale payment counters to drive market

- 8.3.2.5 Real-time/streaming analytics

- 8.3.2.5.1 Use of analytics for effective decision making to drive market

- 8.3.2.6 Resource management

- 8.3.2.6.1 Workforce training and productivity measurement to drive market

- 8.3.2.7 Safety & security

- 8.3.2.7.1 Threat of security breaches to drive market

- 8.3.2.8 Smart shelves and smart doors

- 8.3.2.8.1 Increasing use of radio frequency identification reader-equipped shelves to drive market

- 8.3.2.9 Smart vending machines

- 8.3.2.9.1 Growing preference for enhanced shopping experiences to drive market

- 8.3.2.1 Advertising and marketing

- 8.3.3 AEROSPACE & DEFENSE

- 8.3.3.1 Drones/unmanned aerial vehicles

- 8.3.3.1.1 Electronic warfare and strike missions to drive market

- 8.3.3.2 Predictive maintenance

- 8.3.3.2.1 Ability to identify first-stage equipment failure to drive market

- 8.3.3.1 Drones/unmanned aerial vehicles

- 8.3.4 LOGISTICS, SUPPLY CHAIN, AND TRANSPORTATION

- 8.3.4.1 Warehouse and inventory management and travel-centric applications and services to drive market

- 8.3.5 ENTERTAINMENT

- 8.3.5.1 Rising installation of IoT sensors in shopping malls and theme parks to drive market

- 8.3.6 FINANCIAL INSTITUTES

- 8.3.6.1 Booming Fintech sector to drive market

- 8.3.7 CORPORATE OFFICES

- 8.3.7.1 High adoption of occupancy sensors in corporate houses to drive market

- 8.4 INDUSTRIAL IOT

- FIGURE 43 INDUSTRIAL AUTOMATION TO DOMINATE INDUSTRIAL IOT SENSORS MARKET FROM 2024 TO 2029

- TABLE 102 INDUSTRIAL IOT: IOT SENSORS MARKET, BY END USE APPLICATIONS, 2020-2023 (USD MILLION)

- TABLE 103 INDUSTRIAL IOT: IOT SENSORS MARKET, BY END USE APPLICATIONS, 2024-2029 (USD MILLION)

- TABLE 104 INDUSTRIAL IOT: IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 105 INDUSTRIAL IOT: IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- 8.4.1 ENERGY

- 8.4.1.1 Implementation of smart grids to drive market

- 8.4.2 INDUSTRIAL AUTOMATION

- 8.4.2.1 Supply chain optimization and enhanced asset maintenance to drive market

- 8.4.3 HEALTHCARE

- FIGURE 44 INPATIENT MONITORING SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2029

- TABLE 106 INDUSTRIAL IOT: IOT SENSORS MARKET, BY HEALTHCARE APPLICATIONS, 2020-2023 (USD MILLION)

- TABLE 107 INDUSTRIAL IOT: IOT SENSORS MARKET, BY HEALTHCARE APPLICATIONS, 2024-2029 (USD MILLION)

- 8.4.3.1 Telemedicine

- 8.4.3.1.1 Need for accessible health facilities in rural areas to drive market

- 8.4.3.2 Clinical operations and workflow management

- 8.4.3.2.1 Improved medical equipment and inventory management to drive market

- 8.4.3.3 Connected imaging

- 8.4.3.3.1 High-quality healthcare and imaging services to drive market

- 8.4.3.4 Inpatient monitoring

- 8.4.3.4.1 Non-invasive monitoring of patients to drive market

- 8.4.3.5 Medication management

- 8.4.3.5.1 Accurate clinical trials and research to drive market

- 8.4.3.6 Other healthcare applications

- 8.4.3.1 Telemedicine

- 8.4.4 SMART AGRICULTURE

- TABLE 108 INDUSTRIAL IOT: IOT SENSORS MARKET, BY SMART AGRICULTURE APPLICATIONS, 2020-2023 (USD MILLION)

- TABLE 109 INDUSTRIAL IOT: IOT SENSORS MARKET, BY SMART AGRICULTURE APPLICATIONS, 2024-2029(USD MILLION)

- 8.4.4.1 Precision farming

- 8.4.4.1.1 Maximum yields with minimum input costs to drive market

- 8.4.4.2 Livestock monitoring

- 8.4.4.2.1 Monitoring livestock health to identify possible disease outbreaks and treatment plans to drive market

- 8.4.4.3 Smart fish farming

- 8.4.4.3.1 Efficient tracking of fish migration to drive market

- 8.4.4.4 Smart greenhouses

- 8.4.4.4.1 Cultivation of perishables in ideal environment to drive market

- 8.4.4.5 Other smart agriculture applications

- 8.4.4.1 Precision farming

9 IOT SENSORS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 45 GEOGRAPHIC SNAPSHOT OF IOT SENSORS MARKET

- TABLE 110 IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 111 IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: IOT SENSORS MARKET SNAPSHOT

- TABLE 112 NORTH AMERICA: IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 113 NORTH AMERICA: IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 114 NORTH AMERICA: IOT SENSORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 NORTH AMERICA: IOT SENSORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Growing demand for consumer electronics and presence of leading sensor manufacturers to drive market

- 9.2.2 CANADA

- 9.2.2.1 Setting up of data centers to drive market

- 9.2.3 MEXICO

- 9.2.3.1 Economic growth, political stability, and increased healthcare expenditure to drive market

- 9.2.4 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- 9.3 EUROPE

- FIGURE 47 EUROPE: IOT SENSORS MARKET SNAPSHOT

- TABLE 116 EUROPE: IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 117 EUROPE: IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 118 EUROPE: IOT SENSORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 119 EUROPE: IOT SENSORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Industry 4.0 initiative to drive market

- 9.3.2 UK

- 9.3.2.1 Robust digital infrastructure to drive market

- 9.3.3 FRANCE

- 9.3.3.1 Presence of industry-leading car companies to drive market

- 9.3.4 ITALY

- 9.3.4.1 Cloud computing and big data adoption in various industries to drive market

- 9.3.5 SPAIN

- 9.3.5.1 IoT sensor deployment in precision agriculture to drive market

- 9.3.6 REST OF EUROPE

- 9.3.7 EUROPE: RECESSION IMPACT ANALYSIS

- 9.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: IOT SENSORS MARKET SNAPSHOT

- TABLE 120 ASIA PACIFIC: IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 121 ASIA PACIFIC: IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 122 ASIA PACIFIC: IOT SENSORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 123 ASIA PACIFIC: IOT SENSORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Internet Plus strategy to drive market

- 9.4.2 JAPAN

- 9.4.2.1 Growing demand for sophisticated and expensive medical equipment to drive market

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Ministry of Trade, Industry, and Energy investments to drive market

- 9.4.4 INDIA

- 9.4.4.1 Development of government-backed digital payment systems to drive market

- 9.4.5 AUSTRALIA

- 9.4.5.1 Increased healthcare and agriculture expenditures to drive market

- 9.4.6 REST OF ASIA PACIFIC

- 9.4.7 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- 9.5 REST OF THE WORLD

- TABLE 124 REST OF THE WORLD: IOT SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 125 REST OF THE WORLD: IOT SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 126 REST OF THE WORLD: IOT SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 127 REST OF THE WORLD: IOT SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5.1 GCC

- 9.5.1.1 Strategic partnerships and collaborations between countries and global semiconductor companies to drive market

- 9.5.2 REST OF MIDDLE EAST & AFRICA

- 9.5.2.1 Oil & gas industry to drive market

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Easy availability of affordable electronic products and rising use of smartphones and handheld devices to drive market

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS' STRATEGIES

- TABLE 128 KEY PLAYERS' STRATEGIES

- 10.3 MARKET REVENUE ANALYSIS

- FIGURE 49 MARKET REVENUE ANALYSIS, 2020-2022

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 50 MARKET SHARE ANALYSIS, 2023

- TABLE 129 DEGREE OF COMPETITION

- TABLE 130 MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS

- 10.5 COMPANY EVALUATION MATRIX

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 51 COMPANY EVALUATION MATRIX

- 10.5.5 COMPANY FOOTPRINT

- TABLE 131 COMPANY FOOTPRINT

- TABLE 132 COMPANY FOOTPRINT, BY VERTICAL

- TABLE 133 COMPANY FOOTPRINT, BY REGION

- TABLE 134 COMPANY FOOTPRINT, BY SENSOR TYPE

- 10.6 STARTUP/SME EVALUATION MATRIX

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 52 STARTUP/SME EVALUATION MATRIX

- 10.6.5 COMPETITIVE BENCHMARKING

- TABLE 135 LIST OF KEY STARTUPS/SMES

- TABLE 136 COMPETITIVE BENCHMARKING

- TABLE 137 COMPETITIVE BENCHMARKING, BY REGION

- TABLE 138 COMPETITIVE BENCHMARKING, BY VERTICAL

- TABLE 139 COMPETITIVE BENCHMARKING, BY SENSOR TYPE

- 10.7 COMPETITIVE SCENARIOS AND TRENDS

- 10.7.1 PRODUCT LAUNCHES

- TABLE 140 PRODUCT LAUNCHES, 2019-2023

- 10.7.2 DEALS

- TABLE 141 DEALS, 2019-2023

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1.1 TEXAS INSTRUMENTS

- TABLE 142 TEXAS INSTRUMENTS: COMPANY OVERVIEW

- FIGURE 53 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

- TABLE 143 TEXAS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 TEXAS INSTRUMENTS: PRODUCT LAUNCHES

- TABLE 145 TEXAS INSTRUMENTS: DEALS

- 11.1.2 TE CONNECTIVITY

- TABLE 146 TE CONNECTIVITY: COMPANY OVERVIEW

- FIGURE 54 TE CONNECTIVITY: COMPANY SNAPSHOT

- TABLE 147 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 TE CONNECTIVITY: DEALS

- 11.1.3 BROADCOM

- TABLE 149 BROADCOM: COMPANY OVERVIEW

- FIGURE 55 BROADCOM: COMPANY SNAPSHOT

- TABLE 150 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 BROADCOM: PRODUCT LAUNCHES

- 11.1.4 NXP SEMICONDUCTORS

- TABLE 152 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- FIGURE 56 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 153 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 155 NXP SEMICONDUCTORS: DEALS

- 11.1.5 STMICROELECTRONICS NV

- TABLE 156 STMICROELECTRONICS NV: COMPANY OVERVIEW

- FIGURE 57 STMICROELECTRONICS NV: COMPANY SNAPSHOT

- TABLE 157 STMICROELECTRONICS NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 STMICROELECTRONICS NV: PRODUCT LAUNCHES

- TABLE 159 STMICROELECTRONICS NV: DEALS

- TABLE 160 STMICROELECTRONICS NV: EXPANSIONS

- 11.1.6 BOSCH SENSORTEC

- TABLE 161 BOSCH SENSORTEC: COMPANY OVERVIEW

- TABLE 162 BOSCH SENSORTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 BOSCH SENSORTEC: PRODUCT LAUNCHES

- TABLE 164 BOSCH SENSORTEC: DEALS

- 11.1.7 TDK CORPORATION

- TABLE 165 TDK CORPORATION: COMPANY OVERVIEW

- FIGURE 58 TDK CORPORATION: COMPANY SNAPSHOT

- TABLE 166 TDK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 TDK CORPORATION: PRODUCT LAUNCHES

- TABLE 168 TDK CORPORATION: DEALS

- 11.1.8 INFINEON TECHNOLOGIES AG

- TABLE 169 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 59 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 170 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 172 INFINEON TECHNOLOGIES AG: DEALS

- 11.1.9 ANALOG DEVICES

- TABLE 173 ANALOG DEVICES: COMPANY OVERVIEW

- FIGURE 60 ANALOG DEVICES: COMPANY SNAPSHOT

- TABLE 174 ANALOG DEVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 ANALOG DEVICES: DEALS

- TABLE 176 ANALOG DEVICES: OTHER DEVELOPMENTS

- 11.1.10 OMRON CORPORATION

- TABLE 177 OMRON CORPORATION: COMPANY OVERVIEW

- FIGURE 61 OMRON CORPORATION: COMPANY SNAPSHOT

- TABLE 178 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 180 OMRON CORPORATION: DEALS

- 11.2 OTHER PLAYERS

- 11.2.1 SENSIRION

- TABLE 181 SENSIRION: COMPANY OVERVIEW

- 11.2.2 HONEYWELL INTERNATIONAL

- TABLE 182 HONEYWELL INTERNATIONAL: COMPANY OVERVIEW

- 11.2.3 SIEMENS AG

- TABLE 183 SIEMENS AG: COMPANY OVERVIEW

- 11.2.4 KNOWLES CORPORATION

- TABLE 184 KNOWLES CORPORATION: COMPANY OVERVIEW

- 11.2.5 ABB LTD.

- TABLE 185 ABB LTD.: COMPANY OVERVIEW

- 11.2.6 SENSATA TECHNOLOGIES

- TABLE 186 SENSATA TECHNOLOGIES: COMPANY OVERVIEW

- 11.2.7 EMERSON ELECTRIC CO.

- TABLE 187 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- 11.2.8 TELEDYNE TECHNOLOGIES INCORPORATED

- TABLE 188 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- 11.2.9 SMARTTHINGS INC.

- TABLE 189 SMARTTHINGS INC.: COMPANY OVERVIEW

- 11.2.10 MONNIT CORPORATION

- TABLE 190 MONNIT CORPORATION: COMPANY OVERVIEW

- 11.2.11 MURATA MANUFACTURING CO., LTD.

- TABLE 191 MURATA MANUFACTURING CO. LTD.: COMPANY OVERVIEW

- 11.2.12 FIGARO ENGINEERING INC.

- TABLE 192 FIGARO ENGINEERING INC.: COMPANY OVERVIEW

- 11.2.13 TRAFAG AG

- TABLE 193 TRAFAG AG: COMPANY OVERVIEW

- 11.2.14 NIDEC COPAL ELECTRONICS

- TABLE 194 NIDEC COPAL ELECTRONICS: COMPANY OVERVIEW

- 11.2.15 KITA SENSOR TECH. CO., LTD.

- TABLE 195 KITA SENSOR TECH CO., LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS