|

|

市場調査レポート

商品コード

1424576

軟質フォームの世界市場:タイプ別、用途別、地域別 - 予測(~2028年)Flexible foam Market by Type (Polyurethane (PU), Polyethylene (PE), Polpropylene (PP)), Application (Furniture & Bedding, Transportation, Packaging), & Region (North America, Europe, APAC, Middle East & Africa, Latin America) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 軟質フォームの世界市場:タイプ別、用途別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月08日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の軟質フォームの市場規模は、2023年に427億米ドル、2028年までに568億米ドルに達し、CAGRで5.9%の成長が見込まれています。

軟質フォームの軽量特性は自動車全体の軽量化に役立ち、燃費を向上させます。そのため、自動車メーカーは自動車における軟質フォームの使用を増やすことに注力しています。無害で環境にやさしく持続可能な発泡体に対する需要の増加は、バイオベースの原材料を使用して製造された、環境にやさしい発泡体の需要を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 100万米ドル |

| セグメント | タイプ、用途、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「ポリエチレン(PE)は、予測期間に軟質フォーム市場において金額ベースで2番目に大きなタイプになると予測されます。」

軟質ポリエチレンフォームの特性は、耐久性、軽量、弾力性、非研磨性、柔軟性、無臭、費用対効果、独立気泡構造です。独立気泡構造であるためクッション性があり、包装や自動車用途に有用です。PEフォームの主用途は包装です。医療、電子、軍事、自動車業界における壊れやすい商品の包装に使用されています。振動減衰性や断熱性に優れ、化学品や湿気に対する耐性が高いため選好されています。この発泡体には耐火グレードもあり、繊細な種類の機械の包装に使用されています。

「輸送が金額ベースで2022年に軟質フォーム市場で第2位のシェアを占めています。」

輸送は軟質フォーム市場で2番目に大きな用途です。これには自動車、航空宇宙、鉄道の用途が含まれます。自動車業界は、金額、数量ともにもっとも急成長している業界の1つです。中国、インド、ブラジルなどの新興経済国では経済が成長し、商用車や高級車への支出が増加しているため、予測期間に輸送用途での軟質フォームの需要が増加する見込みです。軟質フォームの使用により、輸送業界の重量、安全性、耐久性、快適性が大幅に改善されています。軟質フォームは自動車用途で重要な役割を果たしています。

「南米が予測期間に軟質フォーム市場で金額ベースで2番目に急成長する地域となる見込みです。」

南米が経済的・社会的問題の解決に向けて前進するにつれ、この地域で成長と利益を求める企業は、成長中の広大な下層階級と中下層階級の消費者に再び焦点を当てると予測されます。Honda(日本)やGeneral Motors(米国)といった先進国の主要企業は、多くの労働力を確保できる南米に投資しています。為替レートが低く、ビジネス環境と安全衛生法が緩やかなことも、この地域の主要市場企業に機会をもたらしています。

当レポートでは、世界の軟質フォーム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 軟質フォーム市場における魅力的な機会

- 軟質フォーム市場:地域別

- アジア太平洋の軟質フォーム市場:タイプ別、国別(2022年)

- 軟質フォーム市場:用途別 vs. 地域別

- 軟質フォーム市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界の動向

- サプライチェーン分析

- 原材料

- 製造

- 流通ネットワーク

- 最終用途産業

- 主なステークホルダーと購入基準

- 価格分析

- 主要企業の平均販売価格の動向:用途別

- 平均販売価格の動向:地域別

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム/市場マップ

- 技術分析

- ケーススタディ

- 貿易データ統計

- 軟質フォームの輸入シナリオ

- 軟質フォームの輸出シナリオ

- 関税と規制情勢

- 軟質フォーム市場の規制

- 規制機関、政府機関、その他の組織

- 主な会議とイベント(2023年~2024年)

- 特許分析

第7章 軟質フォーム市場:用途別

- イントロダクション

- 家具・寝具

- 輸送

- 包装

- その他の用途

第8章 軟質フォーム市場:タイプ別

- イントロダクション

- ポリウレタン(PU)フォーム

- ポリエチレンフォーム

- ポリプロピレンフォーム

- その他のタイプ

第9章 軟質フォーム市場:地域別

- イントロダクション

- 欧州

- 欧州の景気後退の影響

- 欧州の軟質フォーム市場:タイプ別

- 欧州の軟質フォーム市場:用途別

- 欧州の軟質フォーム市場:国別

- 北米

- 北米の景気後退の影響

- 北米の軟質フォーム市場:タイプ別

- 北米の軟質フォーム市場:用途別

- 北米の軟質フォーム市場:国別

- アジア太平洋

- アジア太平洋の景気後退の影響

- アジア太平洋の軟質フォーム市場:タイプ別

- アジア太平洋の軟質フォーム市場:用途別

- アジア太平洋の軟質フォーム市場:国別

- 南米

- 南米の景気後退の影響

- 南米の軟質フォーム市場:タイプ別

- 南米の軟質フォーム市場:用途別

- 南米の軟質フォーム市場:国別

- 中東・アフリカ

- 中東・アフリカの景気後退の影響

- 中東・アフリカの軟質フォーム市場:タイプ別

- 中東・アフリカの軟質フォーム市場:用途別

- 中東・アフリカの軟質フォーム市場:国別

第10章 競合情勢

- イントロダクション

- 主要企業の戦略

- 主な市場企業のランキング(2022年)

- 市場シェア分析

- DOW INC.

- BASF SE

- HUNTSMAN INTERNATIONAL LLC

- COVESTRO AG

- 主要企業の収益の分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- BASF SE

- COVESTRO AG

- DOW INC.

- HUNTSMAN INTERNATIONAL LLC

- JSP CORPORATION

- ROGERS FOAM CORPORATION

- UBE CORPORATION

- RECTICEL GROUP

- ZOTEFOAMS PLC

- WOODBRIDGE

- その他の企業

- SEKISUI CHEMICAL CO., LTD.

- INOAC CORPORATION

- KANEKA CORPORATION

- AMERICAN EXCELSIOR COMPANY

- FOAMCRAFT, INC.

- ARMACELL

- FUTURE FOAM INC.

- NEVEON HOLDING GMBH

- AMERICAN FOAM PRODUCTS

- FXI

- CARPENTER CO.

- INTERFOAM LTD.

- HUEBACH CORPORATION

- INTERPLASP

- PREGIS LLC

第12章 隣接市場

- イントロダクション

- 制限事項

- ポリウレタンフォーム市場

- 市場の定義

- 市場の概要

- ポリウレタンフォーム市場:地域別

- アジア太平洋

- 欧州

- 北米

- 中東

- アフリカ

- 南米

第13章 付録

In terms of value, The market size of flexible foam is estimated at USD 42.7 billion in 2023 and is projected to reach USD 56.8 billion by 2028, at a CAGR of 5.9%. Flexible foams consist of different types of foam used for cushioning purposes. They are a type of polymeric foam produced using a combination of TDI, polyols, additives, and blowing agents. Flexible foam is used to render comfort, and support which makes it suitable for automotive applications (armrests, headrests, bumpers, side impact pads, energy-absorbing bumper inserts, side seat inserts, under floor inserts, panel stiffeners, and others). The lightweight property of flexible foam helps reduce the overall weight of a vehicle, which provides better fuel efficiency. Hence, automotive manufacturers are focusing on increasing the usage of flexible foam in vehicles. Increasing demand for non-hazardous, green, and sustainable foam drives the demand for eco-friendly foams manufactured using bio-based raw materials.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | Type, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Polyethylene (PE) is expected to be the second largest type of the flexible foam market, in terms of value, during the forecast period."

Properties of flexible polyethylene foam are durable, lightweight, resilient, non abrasive, flexible, odorless, and cost effective, and a closed-cell structure. The closed cell structure of this foam provides cushioning properties which makes it helpful in packaging and automotive applications. PE foam is largely used for packaging. It is used for the packaging of fragile goods in the medical, electronics, military, and automotive industries. It is preferred due to its excellent vibration dampening and insulation properties, and high resistance to chemicals and moisture. This foam is also available in fire retardant grades which is used in the packaging of sensitive types of machinery.

"Transportation accounted for the second largest share of the flexible foam market, in terms of value, in 2022."

Transportation is the second largest application of the flexible foam market. It includes automobile, aerospace, and railway applications. The automotive industry is one of the fastest-growing industries, in terms of value and volume. The growing economy and increasing expenditure on commercial and luxury vehicles in emerging economies such as China, India, and Brazil are expected to increase the demand for flexible foam in transportation applications during the forecast period. The use of flexible foam has resulted in significant improvements in weight, safety, durability, and comfort of the transportation industry. Flexible foam plays an important role in the automotive application.

"South America is projected to be the second fastest growing region, in terms of value, during the forecast period in the Flexible foam market."

As South America makes progress in solving its economic and social problems, companies seeking growth and profit in the region are expected to refocus on the vast and growing lower-class and lower-to-middle-class consumers. Major companies such as Honda (Japan) and General Motors (US) from developed countries are investing in South America where a large workforce is available. Low exchange rates and lenient business environment and health & safety laws are also presenting opportunities for major market players in the region.

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: C-Level - 23%, Director Level - 37%, and Others - 40%

- By Region: North America - 32%, Europe - 21%, Asia Pacific - 28%, South America - 7%, Middle East & Africa - 12%

The key players profiled in the report include BASF SE (Germany), Covestro AG (Germany), Dow Inc. (US), Huntsman International LLC (US), JSP Corporation (Japan), Rogers Foam Corporation (US), UBE Corporation (Japan), Recticel Group (Belgium), Zotefoams Plc (UK) and Woodbridge (Canada) and others.

Research Coverage

This report segments the market for flexible foam based on type, application and region and provides estimations of value (USD million) and volume (Kiloton) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, key strategies, associated with the market for flexible foam.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the flexible foam market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on flexible foam offered by top players in the global market

- Analysis of key drivers: (Versatility and unique physical properties, growing end-use applications), restraints (exposure risk and environmental impact due to restricted raw materials), opportunities (Development of bio-based and carbon dioxide-based polyols, high Growth Potential for flexible foam in emerging economies), and challenges (Volatility in raw material prices).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the flexible foam market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for flexible foam across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global flexible foam market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the flexible foam market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.3 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3 MARKET SCOPE

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Interviews with experts-Demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM UP APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)-COLLECTIVE SHARE OF MAJOR PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM UP (SUPPLY SIDE) - COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM UP (DEMAND SIDE): PRODUCTS SOLD

- 2.2.2 TOP DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP DOWN

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 7 MARKET GROWTH PROJECTIONS FROM SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- 2.5 IMPACT OF RECESSION

- 2.6 FACTOR ANALYSIS

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 POLYURETHANE (PU) SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 10 FURNITURE & BEDDING SEGMENT TO BE LARGEST APPLICATION OF FLEXIBLE FOAM MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN FLEXIBLE FOAM MARKET

- FIGURE 12 INCREASING DEMAND FOR VERSATILE FLEXIBLE FOAM IN FURNITURE AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET

- 4.2 FLEXIBLE FOAM MARKET, BY REGION

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC FLEXIBLE FOAM MARKET, BY TYPE AND COUNTRY, 2022

- FIGURE 14 POLYURETHANE (PU) SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE

- 4.4 FLEXIBLE FOAM MARKET, BY APPLICATION VS. REGION

- 4.5 FLEXIBLE FOAM MARKET, BY MAJOR COUNTRIES

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FLEXIBLE FOAM MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Versatility and unique physical properties

- 5.2.1.2 Growing end-use applications

- TABLE 1 MEGA PROJECTS IN INDIA THAT DRIVE FLEXIBLE FOAM MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risk of exposure and environmental impact due to use of restricted raw materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of bio-based and carbon dioxide-based polyols

- 5.2.3.2 High growth potential for flexible foam in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatility in raw material prices

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- TABLE 3 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020-2028 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 18 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIALS

- 6.1.2 MANUFACTURING

- 6.1.3 DISTRIBUTION NETWORK

- 6.1.4 END-USE INDUSTRIES

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 6.2.2 BUYING CRITERIA

- FIGURE 20 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- FIGURE 21 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- TABLE 6 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION (USD/KG)

- 6.3.2 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 22 AVERAGE SELLING PRICE TREND OF FLEXIBLE FOAM, BY REGION (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE TREND OF FLEXIBLE FOAM, BY REGION (USD/KG)

- 6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.4.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR FLEXIBLE FOAM MARKET

- FIGURE 23 REVENUE SHIFT FOR FLEXIBLE FOAM MARKET

- 6.5 ECOSYSTEM/MARKET MAP

- FIGURE 24 FLEXIBLE FOAM MARKET ECOSYSTEM/MARKET MAP

- TABLE 8 ROLE IN ECOSYSTEM

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 SLABSTOCK PRODUCTION OR MOLDED PROCESS

- TABLE 9 BENEFITS OF SLABSTOCK PRODUCTION OR MOLDED PROCESS

- 6.7 CASE STUDIES

- 6.7.1 SUSTAINABLE PU INSULATION BY COVESTRO AG AND RECTICEL

- 6.7.2 USE OF BAYSAFE POLYURETHANE FOAM IN DESIGNING CRASHBOX BY COVESTRO AG

- 6.7.3 SOFT, SPRINGY PISPRING MATTRESS TOPPER WITH DESMODUR WHITE BY COVESTRO AG

- 6.8 TRADE DATA STATISTICS

- 6.8.1 IMPORT SCENARIO OF FLEXIBLE FOAM

- FIGURE 25 IMPORT OF FLEXIBLE FOAM, BY KEY COUNTRY (2017-2022)

- TABLE 10 IMPORT OF FLEXIBLE FOAM, BY REGION, 2017-2022 (USD MILLION)

- 6.8.2 EXPORT SCENARIO OF FLEXIBLE FOAM

- FIGURE 26 EXPORT OF FLEXIBLE FOAM, BY KEY COUNTRY (2017-2022)

- TABLE 11 EXPORT OF FLEXIBLE FOAM, BY REGION, 2017-2022 (USD MILLION)

- 6.9 TARIFF AND REGULATORY LANDSCAPE

- 6.9.1 REGULATIONS FOR FLEXIBLE FOAM MARKET

- TABLE 12 NORTH AMERICA: REGULATIONS FOR FLEXIBLE FOAM

- TABLE 13 EUROPE: REGULATIONS FOR FLEXIBLE FOAM

- TABLE 14 ASIA PACIFIC: REGULATIONS FOR FLEXIBLE FOAM

- 6.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 15 KEY CONFERENCES & EVENTS, 2023-2024

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPE

- TABLE 16 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS

- FIGURE 27 FLEXIBLE FOAM PATENTS REGISTERED, 2013-2023

- FIGURE 28 LIST OF MAJOR PATENTS FOR FLEXIBLE FOAM

- 6.11.3 TOP APPLICANTS

- TABLE 17 LIST OF MAJOR PATENTS OF FLEXIBLE FOAM

- TABLE 18 PATENTS BY PROCTOR & GAMBLE COMPANY

- TABLE 19 PATENTS BY BASF SE

- TABLE 20 PATENTS BY 3M COMPANY

- TABLE 21 TOP 10 PATENT OWNERS IN US, 2013-2023

- FIGURE 29 LEGAL STATUS OF PATENTS FILED IN FLEXIBLE FOAM MARKET

- 6.11.4 JURISDICTION ANALYSIS

- FIGURE 30 MAXIMUM PATENTS FILED IN JURISDICTION OF US

7 FLEXIBLE FOAM MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 31 FURNITURE & BEDDING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 22 FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 23 FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 24 FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 25 FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 7.2 FURNITURE & BEDDING

- 7.2.1 RISING DEMAND FOR SLABSTOCK FOAM IN MATTRESSES AND SOFA SETS TO DRIVE MARKET

- TABLE 26 FURNITURE & BEDDING: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 27 FURNITURE & BEDDING: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 28 FURNITURE & BEDDING: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 29 FURNITURE & BEDDING: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

- 7.3 TRANSPORTATION

- 7.3.1 INCREASING EXPENDITURE ON COMMERCIAL AND LUXURY VEHICLES TO FUEL MARKET

- TABLE 30 TRANSPORTATION: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 31 TRANSPORTATION: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 32 TRANSPORTATION: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 33 TRANSPORTATION: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

- 7.4 PACKAGING

- 7.4.1 WIDE USE IN PACKAGING ELECTRONICS AND SEMICONDUCTOR DEVICES TO DRIVE MARKET

- TABLE 34 PACKAGING: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 35 PACKAGING: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 36 PACKAGING: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 37 PACKAGING: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

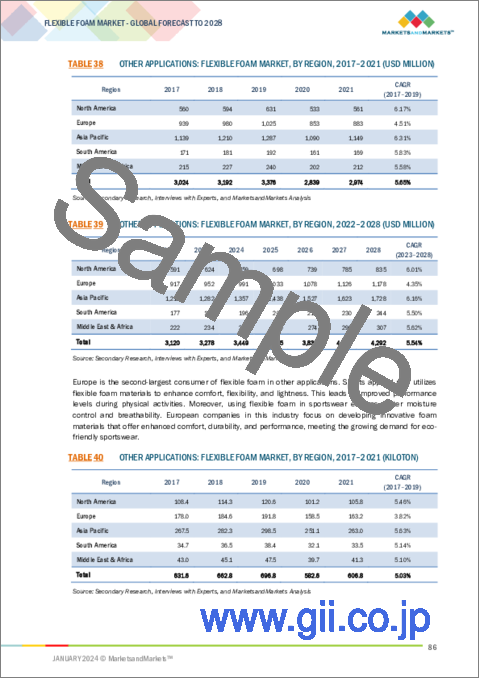

- 7.5 OTHER APPLICATIONS

- TABLE 38 OTHER APPLICATIONS: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 39 OTHER APPLICATIONS: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 40 OTHER APPLICATIONS: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 41 OTHER APPLICATIONS: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

8 FLEXIBLE FOAM MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 32 POLYURETHANE TYPE TO BE LARGEST SEGMENT OF FLEXIBLE FOAM MARKET DURING FORECAST PERIOD

- TABLE 42 FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 43 FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 44 FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (KILOTON)

- TABLE 45 FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (KILOTON)

- 8.2 POLYURETHANE (PU) FOAM

- 8.2.1 FLEXIBILITY, STRUCTURE, AND NON-REACTIVITY TO DRIVE MARKET

- TABLE 46 PU: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 47 PU: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 48 PU: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 49 PU: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

- 8.3 POLYETHYLENE FOAM

- 8.3.1 EXCELLENT VIBRATION DAMPING AND INSULATION PROPERTIES TO DRIVE MARKET

- TABLE 50 PE: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 51 PE: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 52 PE: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 53 PE: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

- 8.4 POLYPROPYLENE FOAM

- 8.4.1 INCREASING PER CAPITA INCOME AND DEMAND FOR AUTOMOBILES TO DRIVE MARKET

- TABLE 54 PP: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 55 PP: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 56 PP: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 57 PP: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

- 8.5 OTHER TYPES

- TABLE 58 OTHER TYPES: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 59 OTHER TYPES: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 60 OTHER TYPES: FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 61 OTHER TYPES: FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

9 FLEXIBLE FOAM MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING FLEXIBLE FOAM MARKET DURING FORECAST PERIOD

- TABLE 62 FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 63 FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 64 FLEXIBLE FOAM MARKET, BY REGION, 2017-2021 (KILOTON)

- TABLE 65 FLEXIBLE FOAM MARKET, BY REGION, 2022-2028 (KILOTON)

- 9.2 EUROPE

- FIGURE 34 EUROPE: FLEXIBLE FOAM MARKET SNAPSHOT

- 9.2.1 IMPACT OF RECESSION ON EUROPE

- 9.2.2 EUROPE FLEXIBLE FOAM MARKET, BY TYPE

- TABLE 66 EUROPE: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 67 EUROPE: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 68 EUROPE: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (KILOTON)

- TABLE 69 EUROPE: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (KILOTON)

- 9.2.3 EUROPE FLEXIBLE FOAM MARKET, BY APPLICATION

- TABLE 70 EUROPE: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 71 EUROPE: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 72 EUROPE: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 73 EUROPE: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.2.4 EUROPE FLEXIBLE FOAM MARKET, BY COUNTRY

- TABLE 74 EUROPE: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 75 EUROPE: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 76 EUROPE: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 77 EUROPE: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 9.2.4.1 Germany

- 9.2.4.1.1 Large automotive manufacturing base to drive market

- 9.2.4.1 Germany

- TABLE 78 GERMANY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 79 GERMANY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 80 GERMANY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 81 GERMANY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.2.4.2 Italy

- 9.2.4.2.1 Investments in packaging industry to drive market

- 9.2.4.2 Italy

- TABLE 82 ITALY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 83 ITALY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 84 ITALY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 85 ITALY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.2.4.3 France

- 9.2.4.3.1 Growing packaging and automotive sectors to drive market

- 9.2.4.3 France

- TABLE 86 FRANCE: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 87 FRANCE: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 88 FRANCE: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 89 FRANCE: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.2.4.4 Spain

- 9.2.4.4.1 Presence of major automobile manufacturers to drive market

- 9.2.4.4 Spain

- TABLE 90 SPAIN: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 91 SPAIN: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 92 SPAIN: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 93 SPAIN: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.2.4.5 UK

- 9.2.4.5.1 Rising investments in sustainable packaging to boost market

- 9.2.4.5 UK

- TABLE 94 UK: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 95 UK: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 96 UK: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 97 UK: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.2.4.6 Russia

- 9.2.4.6.1 Developing automotive sector to drive market

- 9.2.4.6 Russia

- TABLE 98 RUSSIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 99 RUSSIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 100 RUSSIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 101 RUSSIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.2.4.7 Turkey

- 9.2.4.7.1 Government policies attracting automotive spares and accessories manufacturers to boost market

- 9.2.4.7 Turkey

- TABLE 102 TURKEY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 103 TURKEY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 104 TURKEY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 105 TURKEY: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.2.4.8 Poland

- 9.2.4.8.1 Established furniture sector to drive market

- 9.2.4.8 Poland

- TABLE 106 POLAND: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 107 POLAND: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 108 POLAND: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 109 POLAND: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.3 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: FLEXIBLE FOAM MARKET SNAPSHOT

- 9.3.1 IMPACT OF RECESSION ON NORTH AMERICA

- 9.3.2 NORTH AMERICA FLEXIBLE FOAM MARKET, BY TYPE

- TABLE 110 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 111 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (KILOTON)

- TABLE 113 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (KILOTON)

- 9.3.3 NORTH AMERICA FLEXIBLE FOAM MARKET, BY APPLICATION

- TABLE 114 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 115 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 117 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.3.4 NORTH AMERICA FLEXIBLE FOAM MARKET, BY COUNTRY

- TABLE 118 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 119 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 121 NORTH AMERICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 9.3.4.1 US

- 9.3.4.1.1 Large automotive industry to drive market

- 9.3.4.1 US

- TABLE 122 US: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 123 US: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 124 US: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 125 US: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.3.4.2 Canada

- 9.3.4.2.1 Investment in research & development to fuel market

- 9.3.4.2 Canada

- TABLE 126 CANADA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 127 CANADA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 128 CANADA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 129 CANADA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.3.4.3 Mexico

- 9.3.4.3.1 Growing automotive sector to fuel market

- 9.3.4.3 Mexico

- TABLE 130 MEXICO: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 131 MEXICO: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 132 MEXICO: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 133 MEXICO: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.4 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: FLEXIBLE FOAM MARKET SNAPSHOT

- 9.4.1 IMPACT OF RECESSION ON ASIA PACIFIC

- 9.4.2 ASIA PACIFIC FLEXIBLE FOAM MARKET, BY TYPE

- TABLE 134 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 135 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (KILOTON)

- TABLE 137 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (KILOTON)

- 9.4.3 ASIA PACIFIC FLEXIBLE FOAM MARKET, BY APPLICATION

- TABLE 138 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 139 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 141 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.4.4 ASIA PACIFIC FLEXIBLE FOAM MARKET, BY COUNTRY

- TABLE 142 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 143 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 145 ASIA PACIFIC: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 9.4.4.1 China

- 9.4.4.1.1 Expanding manufacturing facilities to drive market

- 9.4.4.1 China

- TABLE 146 CHINA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 147 CHINA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 148 CHINA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 149 CHINA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.4.4.2 Japan

- 9.4.4.2.1 Furniture & bedding industry to drive market

- 9.4.4.2 Japan

- TABLE 150 JAPAN: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 151 JAPAN: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 152 JAPAN: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 153 JAPAN: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.4.4.3 Malaysia

- 9.4.4.3.1 Favorable investment policies in transport industry to fuel market

- 9.4.4.3 Malaysia

- TABLE 154 MALAYSIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 155 MALAYSIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 156 MALAYSIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 157 MALAYSIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.4.4.4 India

- 9.4.4.4.1 Improving socio-economic conditions and industrialization to promote market growth

- 9.4.4.4 India

- TABLE 158 INDIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 159 INDIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 160 INDIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 161 INDIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.4.4.5 South Korea

- 9.4.4.5.1 Ongoing industrialization to drive market

- 9.4.4.5 South Korea

- TABLE 162 SOUTH KOREA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 163 SOUTH KOREA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 164 SOUTH KOREA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 165 SOUTH KOREA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.4.4.6 Thailand

- 9.4.4.6.1 Growing furniture industry to drive market

- 9.4.4.6 Thailand

- TABLE 166 THAILAND: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 167 THAILAND: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 168 THAILAND: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 169 THAILAND: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.4.4.7 Indonesia

- 9.4.4.7.1 Surging demand for flexible foams in auto parts to contribute to market growth

- 9.4.4.7 Indonesia

- TABLE 170 INDONESIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 171 INDONESIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 172 INDONESIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 173 INDONESIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.5 SOUTH AMERICA

- 9.5.1 IMPACT OF RECESSION ON SOUTH AMERICA

- 9.5.2 SOUTH AMERICA FLEXIBLE FOAM MARKET, BY TYPE

- TABLE 174 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 175 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 176 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (KILOTON)

- TABLE 177 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (KILOTON)

- 9.5.3 SOUTH AMERICA FLEXIBLE FOAM MARKET, BY APPLICATION

- TABLE 178 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 179 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 180 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 181 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.5.4 SOUTH AMERICA FLEXIBLE FOAM MARKET, BY COUNTRY

- TABLE 182 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 183 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 184 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 185 SOUTH AMERICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 9.5.4.1 Brazil

- 9.5.4.1.1 Rising investments in automotive sector to boost market

- 9.5.4.1 Brazil

- TABLE 186 BRAZIL: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 187 BRAZIL: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 188 BRAZIL: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 189 BRAZIL: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.5.4.2 Argentina

- 9.5.4.2.1 Economic volatility to impact overall market growth

- 9.5.4.2 Argentina

- TABLE 190 ARGENTINA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 191 ARGENTINA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 192 ARGENTINA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 193 ARGENTINA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.5.4.3 Colombia

- 9.5.4.3.1 Policies to improve transportation sector to fuel market growth

- 9.5.4.3 Colombia

- TABLE 194 COLOMBIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 195 COLOMBIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 196 COLOMBIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 197 COLOMBIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 IMPACT OF RECESSION ON MIDDLE EAST & AFRICA

- 9.6.2 MIDDLE EAST & AFRICA FLEXIBLE FOAM MARKET, BY TYPE

- TABLE 198 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY TYPE, 2017-2021 (KILOTON)

- TABLE 201 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY TYPE, 2022-2028 (KILOTON)

- 9.6.3 MIDDLE EAST & AFRICA FLEXIBLE FOAM MARKET, BY APPLICATION

- TABLE 202 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 205 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.6.4 MIDDLE EAST & AFRICA FLEXIBLE FOAM MARKET, BY COUNTRY

- TABLE 206 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2017-2021 (KILOTON)

- TABLE 209 MIDDLE EAST & AFRICA: FLEXIBLE FOAM MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- 9.6.4.1 GCC

- 9.6.4.1.1 Emerging manufacturing hubs for automotive and furniture industries to drive market

- 9.6.4.2 Saudi Arabia

- 9.6.4.2.1 Rapid urbanization to boost market

- 9.6.4.1 GCC

- TABLE 210 SAUDI ARABIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 211 SAUDI ARABIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 212 SAUDI ARABIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 213 SAUDI ARABIA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.6.4.3 Egypt

- 9.6.4.3.1 Growing infrastructure sector to drive market

- 9.6.4.3 Egypt

- TABLE 214 EGYPT: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 215 EGYPT: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 216 EGYPT: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 217 EGYPT: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- 9.6.4.4 South Africa

- 9.6.4.4.1 Growing automotive manufacturing industry to fuel market

- 9.6.4.4 South Africa

- TABLE 218 SOUTH AFRICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 219 SOUTH AFRICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 220 SOUTH AFRICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2017-2021 (KILOTON)

- TABLE 221 SOUTH AFRICA: FLEXIBLE FOAM MARKET, BY APPLICATION, 2022-2028 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES

- TABLE 222 OVERVIEW OF STRATEGIES ADOPTED BY KEY FLEXIBLE FOAM MANUFACTURERS

- 10.3 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 37 RANKING OF TOP 4 PLAYERS IN FLEXIBLE FOAM MARKET, 2022

- 10.4 MARKET SHARE ANALYSIS

- TABLE 223 FLEXIBLE FOAM MARKET: DEGREE OF COMPETITION

- FIGURE 38 DOW INC. LED FLEXIBLE FOAM MARKET IN 2022

- 10.4.1 DOW INC.

- 10.4.2 BASF SE

- 10.4.3 HUNTSMAN INTERNATIONAL LLC

- 10.4.4 COVESTRO AG

- 10.5 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES IN LAST 5 YEARS

- 10.6 COMPANY EVALUATION MATRIX

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 40 FLEXIBLE FOAM MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.6.5 COMPANY FOOTPRINT

- FIGURE 41 FLEXIBLE FOAM MARKET: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 224 FLEXIBLE FOAM MARKET: TYPE FOOTPRINT (25 COMPANIES)

- TABLE 225 FLEXIBLE FOAM MARKET: APPLICATION FOOTPRINT (25 COMPANIES)

- TABLE 226 FLEXIBLE FOAM MARKET: COMPANY REGION FOOTPRINT (25 COMPANIES)

- 10.7 STARTUP/SME EVALUATION MATRIX

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 42 FLEXIBLE FOAM MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 10.7.5 COMPETITIVE BENCHMARKING

- 10.7.5.1 FLEXIBLE FOAM MARKET: KEY STARTUPS/SMES

- 10.7.5.2 FLEXIBLE FOAM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.8 COMPETITIVE SCENARIO AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 227 FLEXIBLE FOAM MARKET: PRODUCT LAUNCHES (2018-2023)

- 10.8.2 DEALS

- TABLE 228 FLEXIBLE FOAM MARKET: DEALS (2018-2023)

- 10.8.3 OTHER DEVELOPMENTS

- TABLE 229 FLEXIBLE FOAM MARKET: OTHER DEVELOPMENTS (2018-2023)

11 COMPANY PROFILES

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 11.1 KEY COMPANIES

- 11.1.1 BASF SE

- TABLE 230 BASF SE: COMPANY OVERVIEW

- FIGURE 43 BASF SE: COMPANY SNAPSHOT

- TABLE 231 BASF SE: PRODUCT LAUNCHES

- TABLE 232 BASF SE: DEALS

- TABLE 233 BASF SE: OTHER DEVELOPMENTS

- 11.1.2 COVESTRO AG

- TABLE 234 COVESTRO AG: COMPANY OVERVIEW

- FIGURE 44 COVESTRO AG: COMPANY SNAPSHOT

- TABLE 235 COVESTRO AG: PRODUCT LAUNCHES

- TABLE 236 COVESTRO AG: DEALS

- TABLE 237 COVESTRO AG: OTHER DEVELOPMENTS

- 11.1.3 DOW INC.

- TABLE 238 DOW INC.: COMPANY OVERVIEW

- FIGURE 45 DOW INC.: COMPANY SNAPSHOT

- TABLE 239 DOW INC.: PRODUCT LAUNCHES

- TABLE 240 DOW INC.: DEALS

- TABLE 241 DOW INC.: OTHER DEVELOPMENTS

- 11.1.4 HUNTSMAN INTERNATIONAL LLC

- TABLE 242 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- FIGURE 46 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- TABLE 243 HUNTSMAN INTERNATIONAL LLC: PRODUCT LAUNCHES

- TABLE 244 HUNTSMAN INTERNATIONAL LLC: DEALS

- 11.1.5 JSP CORPORATION

- TABLE 245 JSP CORPORATION: COMPANY OVERVIEW

- FIGURE 47 JSP CORPORATION: COMPANY SNAPSHOT

- 11.1.6 ROGERS FOAM CORPORATION

- TABLE 246 ROGERS FOAM CORPORATION: COMPANY OVERVIEW

- FIGURE 48 ROGERS FOAM CORPORATION: COMPANY SNAPSHOT

- 11.1.7 UBE CORPORATION

- TABLE 247 UBE CORPORATION: COMPANY OVERVIEW

- FIGURE 49 UBE CORPORATION: COMPANY SNAPSHOT

- 11.1.8 RECTICEL GROUP

- TABLE 248 RECTICEL GROUP: COMPANY OVERVIEW

- FIGURE 50 RECTICEL GROUP: COMPANY SNAPSHOT

- TABLE 249 RECTICEL GROUP: DEALS

- 11.1.9 ZOTEFOAMS PLC

- TABLE 250 ZOTEFOAMS PLC: COMPANY OVERVIEW

- FIGURE 51 ZOTEFOAMS PLC: COMPANY SNAPSHOT

- TABLE 251 ZOTEFOAMS PLC: PRODUCT LAUNCHES

- 11.1.10 WOODBRIDGE

- TABLE 252 WOODBRIDGE: COMPANY OVERVIEW

- TABLE 253 WOODBRIDGE: DEALS

- TABLE 254 WOODBRIDGE: OTHER DEVELOPMENTS

- 11.2 OTHER PLAYERS

- 11.2.1 SEKISUI CHEMICAL CO., LTD.

- TABLE 255 SEKISUI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 11.2.2 INOAC CORPORATION

- TABLE 256 INOAC CORPORATION: COMPANY OVERVIEW

- 11.2.3 KANEKA CORPORATION

- TABLE 257 KANEKA CORPORATION: COMPANY OVERVIEW

- 11.2.4 AMERICAN EXCELSIOR COMPANY

- TABLE 258 AMERICAN EXCELSIOR COMPANY: COMPANY OVERVIEW

- 11.2.5 FOAMCRAFT, INC.

- TABLE 259 FOAMCRAFT, INC.: COMPANY OVERVIEW

- 11.2.6 ARMACELL

- TABLE 260 ARMACELL: COMPANY OVERVIEW

- 11.2.7 FUTURE FOAM INC.

- TABLE 261 FUTURE FOAM INC.: COMPANY OVERVIEW

- 11.2.8 NEVEON HOLDING GMBH

- TABLE 262 NEVEON HOLDING GMBH: COMPANY OVERVIEW

- 11.2.9 AMERICAN FOAM PRODUCTS

- TABLE 263 AMERICAN FOAM PRODUCTS: COMPANY OVERVIEW

- 11.2.10 FXI

- TABLE 264 FXI: COMPANY OVERVIEW

- 11.2.11 CARPENTER CO.

- TABLE 265 CARPENTER CO.: COMPANY OVERVIEW

- 11.2.12 INTERFOAM LTD.

- TABLE 266 INTERFOAM LTD.: COMPANY OVERVIEW

- 11.2.13 HUEBACH CORPORATION

- TABLE 267 HUEBACH CORPORATION: COMPANY OVERVIEW

- 11.2.14 INTERPLASP

- TABLE 268 INTERPLASP: COMPANY OVERVIEW

- 11.2.15 PREGIS LLC

- TABLE 269 PREGIS LLC: COMPANY OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 POLYURETHANE FOAM MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.4 POLYURETHANE FOAM MARKET, BY REGION

- TABLE 270 POLYURETHANE FOAM MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 271 POLYURETHANE FOAM MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 272 POLYURETHANE FOAM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 273 POLYURETHANE FOAM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.4.1 ASIA PACIFIC

- TABLE 274 ASIA PACIFIC: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 275 ASIA PACIFIC: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 276 ASIA PACIFIC: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 277 ASIA PACIFIC: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.2 EUROPE

- TABLE 278 EUROPE: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 279 EUROPE: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 280 EUROPE: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 281 EUROPE: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.3 NORTH AMERICA

- TABLE 282 NORTH AMERICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 283 NORTH AMERICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 284 NORTH AMERICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 285 NORTH AMERICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.4 MIDDLE EAST

- TABLE 286 MIDDLE EAST: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 287 MIDDLE EAST: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 288 MIDDLE EAST: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 289 MIDDLE EAST: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.5 AFRICA

- TABLE 290 AFRICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 291 AFRICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 292 AFRICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 293 AFRICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.6 SOUTH AMERICA

- TABLE 294 SOUTH AMERICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 295 SOUTH AMERICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 296 SOUTH AMERICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 297 SOUTH AMERICA: POLYURETHANE FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS