|

|

市場調査レポート

商品コード

1423547

水素コンプレッサーの世界市場:潤滑タイプ別、タイプ別、用途別、設計別、地域別 - 予測(~2028年)Hydrogen Compressors Market by Lubrication Type (Oil-based, Oil-free), Type (Mechanical, Non-mechanical), Application (Hydrogen Infrastructure, Industrial (Oil Refining, Chemicals & Petrochemicals)), Design Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 水素コンプレッサーの世界市場:潤滑タイプ別、タイプ別、用途別、設計別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月05日

発行: MarketsandMarkets

ページ情報: 英文 197 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の水素コンプレッサーの市場規模は、2023年の21億米ドルから2028年までに26億米ドルに達し、予測期間にCAGRで4.5%の成長が見込まれています。

官民セグメントによる水素関連インフラやプロジェクトへの投資拡大が、水素コンプレッサー産業の成長に寄与しています。こうした投資は、水素コンプレッサー技術の採用と商業化を加速します。クリーンエネルギー技術の促進を目的とした政府の補助金と規制枠組みが、水素コンプレッサー市場の成長をさらに後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 100万米ドル/10億米ドル、台 |

| セグメント | タイプ別、潤滑タイプ別、設計別、最終用途別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、南米、中東・アフリカ |

「オイルベースコンプレッサー:水素コンプレッサー市場の潤滑タイプ別で最大のセグメント。」

オイルベースコンプレッサーはオイルフリーコンプレッサーよりも効率が高いため、水素コンプレッサー産業で優位に立っています。オイルベースコンプレッサーは、オイルを冷却媒体として使用し、圧縮時にコンプレッサーで発生する熱の約80%を吸収するため、効率が高くなります。このコンプレッサーは、高圧縮を必要とするさまざまな産業用途に適していると考えられています。石油・ガス部門への投資の増加が、水素コンプレッサーの需要を高めると予測されます。

「最終用途別では、水素バリューチェーン/インフラが予測期間にもっとも急成長するセグメントとなる見込みです。」

水素バリューチェーン/インフラ向け水素コンプレッサー市場は、予測期間に市場シェアがもっとも急成長する見込みです。この市場には、政府と民間企業の両方により、多くの取り組みと数十億米ドルの投資が行われています。例えば、バイデン・ハリス政権は、米国内の7地域のクリーン水素ハブに総額70億米ドルの資金を提供すると発表しました。これらの拠点は、年間300万トン以上のクリーン水素を生産する計画で、米国が2030年までにクリーン水素の生産目標を達成することを支援します。新たな水素パイプラインネットワークの構築も進められており、パイプラインの材料やコンプレッサーの設計に水素の性質がもたらす特有の問題を克服することが重視されています。欧州における主な取り組みの1つとして、2026年までに約250か所の水素補給ステーションのネットワークを構築する、Phillips 66とH2 Energy Europeのパートナーシップがあります。

「北米が水素コンプレッサー市場で2番目に大きな成長地域になると予測されます。」

北米は持続可能なエネルギーを重視しており、水素燃料電池車の利用の増加も市場成長に寄与しています。さらに、米国エネルギー省による研究開発活動への融資と支援により、市場で複数の特許と新技術が生まれ、北米が水素コンプレッサー生産のパイオニアとしての地位を固めています。この地域における近年の契約の1つに、国立再生可能エネルギー研究所(NREL)とToyota Motor North Americaの1メガワット固体高分子形燃料電池システムの共同開発があり、これは水素コンプレッサーの必要性につながる水素燃料電池を使った大規模発電の進歩を示しています。米国の企業は、水素コンプレッサーセグメントでの市場シェアを拡大するために投資を行っています。これには、水素の生産、輸送、使用に特化した改良型コンプレッサー技術の開発が含まれます。

当レポートでは、世界の水素コンプレッサー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 水素コンプレッサー市場の企業にとって魅力的な機会

- 水素コンプレッサー市場:地域別

- 水素コンプレッサー市場:タイプ別

- 水素コンプレッサー市場:設計別

- 水素コンプレッサー市場:潤滑タイプ別

- 水素コンプレッサー市場:用途別

- アジア太平洋の水素コンプレッサー市場:用途別、国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 平均販売価格の動向:地域別

- 参考価格の動向:タイプ別

- サプライチェーン分析

- 原材料のサプライヤー

- コンポーネントプロバイダー

- 水素コンプレッサーメーカー

- エンドユーザー

- エコシステム/市場マップ

- 貿易分析

- 輸出シナリオ

- 輸入シナリオ

- 技術分析

- レシプロコンプレッサー

- ロータリーコンプレッサー

- イオンコンプレッサー

- 遠心コンプレッサー

- 非機械式コンプレッサー

- ケーススタディ分析

- 主な会議とイベント(2024年~2025年)

- 特許分析

- 関税と規制情勢

- 規制機関、政府機関、その他の組織

- 水素コンプレッサー市場:規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 水素コンプレッサー市場:タイプ別

- イントロダクション

- 機械式コンプレッサー

- 非機械式コンプレッサー

第7章 水素コンプレッサー市場:設計別

- イントロダクション

- 単段

- 多段

第8章 水素コンプレッサー市場:潤滑タイプ別

- イントロダクション

- オイルベースコンプレッサー

- オイルフリーコンプレッサー

第9章 水素コンプレッサー市場:用途別

- イントロダクション

- 水素インフラ

- 水素貯蔵・パイプライン輸送

- 水素補給ステーション

- 産業

- 石油精製

- 化学・石油化学

- その他の産業用途

第10章 水素コンプレッサー市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 潤滑タイプ別

- タイプ別

- 設計別

- 用途別

- アジア太平洋

- アジア太平洋の不況の影響

- 潤滑タイプ別

- タイプ別

- 設計別

- 用途別

- 国別

- 欧州

- 欧州の不況の影響

- 潤滑タイプ別

- タイプ別

- 設計別

- 用途別

- 国別

- 中東・アフリカ

- 中東・アフリカの不況の影響

- 潤滑タイプ別

- タイプ別

- 設計別

- 用途別

- 国別

- 南米

- 景気後退の影響:南米

- 潤滑タイプ別

- タイプ別

- 設計別

- 用途別

第11章 競合情勢

- 概要

- 主要企業が採用した戦略(2019年~2023年)

- 市場シェア分析(2022年)

- 収益分析(2020年~2022年)

- 競合シナリオと動向

- 企業の評価マトリクス:主要企業

- 企業の評価マトリクス:その他の企業

第12章 企業プロファイル

- 主要企業

- ATLAS COPCO AB

- LINDE PLC

- AIR PRODUCTS AND CHEMICALS, INC.

- INGERSOLL RAND

- SIEMENS ENERGY

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- KOBE STEEL, LTD.

- HITACHI INDUSTRIAL PRODUCTS, LTD.

- SUNDYNE

- HOWDEN GROUP

- NEUMAN & ESSER GROUP

- HAUG SAUER KOMPRESSOREN AG

- ARIEL CORPORATION

- INDIAN COMPRESSORS LTD

- ADICOMP S.R.L.

- その他の企業

- KEEPWIN TECHNOLOGY HEBEI CO., LTD

- PURE ENERGY CENTRE

- FLUITRON

- CYRUS S.A.

- AEROTECNICA COLTRI S.P.A.

- HYDRO-PAC, INC.

- SOLLANT

- IDEX INDIA

- MEHRER COMPRESSION GMBH

- GRUPPO SIAD

第13章 付録

The global hydrogen compressors market is estimated to grow from USD 2.1 billion in 2023 to USD 2.6 billion by 2028; it is expected to record a CAGR of 4.5% during the forecast period. Growing investments in hydrogen-related infrastructure and projects from both the public and private sectors contribute to the growth of the hydrogen compressor industry. These investments accelerate the adoption and commercialization of hydrogen compressor technology. Government subsidies and regulatory frameworks aimed at promoting clean energy technologies further drive the growth of the hydrogen compressor market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Segments | by Type, by lubrication type, by design, by end use application and Region |

| Regions covered | Asia Pacific, North America, Europe, South America, Middle East & Africa |

"Oil-based compressor: The largest segment of the hydrogen compressors market, by lubrication type. "

Based on lubrication type, the hydrogen compressors market is split into two segments: oil-based & oil-free. Oil-based compressors dominate the hydrogen compressor industry because they are more efficient than oil-free compressors. Oil-based compressors employ oil as a cooling medium, absorbing around 80% of the heat generated by the compressor during compression, resulting in higher efficiency. They are deemed appropriate for a variety of industrial applications that demand increased compression. The increased investment in the oil and gas sector is expected to raise demand for hydrogen compressors.

"The hydrogen value chain/infrastructure, by end-use application, is expected to be the fastest growing segment during the forecast period."

Based on end-use application, the hydrogen compressors market has been split into hydrogen value chain/infrastructure & Industrial application. The hydrogen compressors market for hydrogen value chain/infrastructure is anticipated to be the fastest growing market share over the forecast period. It is further divided into Hydrogen production & storage, Transportation, hydrogen refueling stations, hydrogen fuel cells. There are lot of initiatives & billions of dollars being invested in the market by both government & private companies. For example, The Biden-Harris Administration stated that seven regional clean hydrogen hubs in the United States will receive a total of USD 7 billion in funding. These centers are planned to produce more than three million metric tons of clean hydrogen per year, helping the United States meet its clean hydrogen production goal by 2030. Efforts are being made to construct new hydrogen pipeline networks, with an emphasis on overcoming the specific problems posed by hydrogen's characteristics to pipeline materials and compressor design. One of the major initiatives in Europe is a partnership between Phillips 66 and H2 Energy Europe to build a network of around 250 hydrogen refueling stations by 2026.

"North America is expected to be the second largest growing region in the hydrogen compressor market."

North America is expected to be the second largest region in the hydrogen compressors market during the forecast period. The region's emphasis on sustainable energy, as well as the increasing usage of hydrogen fuel cell vehicles, are all contributing to market growth. Furthermore, the United States Department of Energy's financing and support for R&D efforts has resulted in multiple patents and new technologies in the market, cementing North America's position as a pioneer in hydrogen compressor production. One of the recent contracts in the region includes collaboration between the National Renewable Energy Laboratory (NREL) and Toyota Motor North America in developing a one-megawatt proton exchange membrane fuel cell system showcases advancements in large-scale power production using hydrogen fuel cells which will lead to need in hydrogen compressors. Companies in the United States have been making investments to increase their market share in the hydrogen compressor sector. This includes the development of improved compressor technologies specifically designed for hydrogen production, transit, and use. Ariel Corporation, Atlas Copco Group, and Burckhardt Compression AG are among the prominent players in the region.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 60%, Tier 2- 25%, and Tier 3- 15%

By Designation: C-Level- 35%, Director Level- 25%, and Others- 40%

By Region: North America- 25%, Europe- 25%, Asia Pacific- 30%, South America - 10%, Middle East & Africa - 10%

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The hydrogen compressors market is dominated by a few major players that have a wide regional presence. The leading players in the hydrogen compressors market are Atlas Copco AB (Sweden), Linde plc (Ireland), Siemens Energy (Germany), Air Products and Chemicals, Inc. (US), Ingersoll Rand (US). The major strategy adopted by the players includes new product launches, contracts, agreements, partnerships, joint ventures, acquisitions, and investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global hydrogen compressors market by technology, lubrication type, by design, end-use application and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the hydrogen compressor market.

Key Benefits of Buying the Report

- Government initiatives at the national and international levels amplify the impact of investment on the electrolyzer market. Robust policy frameworks, often accompanied by financial incentives, subsidies, and regulatory support, encourage widespread adoption of hydrogen compressors for green hydrogen production. Factors such as high initial cost and lack of infrastructure restrain the growth of the market. The growing energy transition towards renewable energy sources and rapid urbanization are expected to present lucrative opportunities for the players operating in the hydrogen compressor market.

- Product Development/ Innovation: The new HAUG.Sirius NanoLoc compressor is the first compressor which combines J.P. Sauer & Sohn's high-pressure competence with HAUG Sauer Kompressoren AG's oil-free expertise. The machines are entirely dry-running and hermetically gas-tight and are intended for applications requiring absolute process safety and purity. The compressor, with an ultimate pressure of 450 bar, allows for oil-free compression of nearly any gas.

- Market Development: Atlas Copco Compressors is partnering with Hoffman & Hoffman to develop a new distributor agreement for Atlas Copco's whole line of industrial process cooling solutions. Hoffman & Hoffman will exclusively represent the product line throughout South Carolina, North Carolina, Virginia, and Tennessee.

- Market Diversification: Investments by Ingersoll Rand in India. Ingersoll Rand, a global leader in mission-critical flow creation and industrial technologies, is investing in its Indian operations to promote expanded technological innovation, hydrogen compressor manufacture and testing, and manufacturing capacity development. At its world-class manufacturing site in Naroda, Gujarat, it has introduced energy-efficient Heat-of-compression (HOC) dryers.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include as Atlas Copco AB (Sweden), Linde plc (Ireland), Siemens Energy (Germany), Air Products and Chemicals, Inc. (US), Ingersoll Rand (US), among others in the hydrogen compressor market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT ON HYDROGEN COMPRESSORS MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 HYDROGEN COMPRESSORS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- FIGURE 2 HYDROGEN COMPRESSORS MARKET: BREAKDOWN OF PRIMARIES

- 2.2 DATA TRIANGULATION

- FIGURE 3 HYDROGEN COMPRESSORS MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 HYDROGEN COMPRESSORS MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 HYDROGEN COMPRESSORS MARKET: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 6 HYDROGEN COMPRESSORS MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 7 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR HYDROGEN COMPRESSORS

- 2.3.3.1 Demand-side assumptions

- 2.3.3.2 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 8 KEY METRICS CONSIDERED TO ANALYZE SUPPLY OF HYDROGEN COMPRESSORS

- FIGURE 9 HYDROGEN COMPRESSORS MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side assumptions and calculations

- FIGURE 10 HYDROGEN COMPRESSORS MARKET: MARKET SHARE ANALYSIS, 2022

- 2.4 FORECAST

- 2.5 STUDY LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 1 HYDROGEN COMPRESSORS MARKET SNAPSHOT

- FIGURE 11 MECHANICAL COMPRESSORS SEGMENT TO DOMINATE HYDROGEN COMPRESSORS MARKET, BY TYPE, IN 2028

- FIGURE 12 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGER SHARE OF HYDROGEN COMPRESSORS MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 13 MULTI-STAGE SEGMENT TO LEAD HYDROGEN COMPRESSORS MARKET, BY DESIGN, IN 2028

- FIGURE 14 OIL-BASED SEGMENT TO ACCOUNT FOR LARGER SHARE OF HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE, DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC HELD LARGEST SHARE OF HYDROGEN COMPRESSORS MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROGEN COMPRESSORS MARKET

- FIGURE 16 INCREASING DEMAND FOR CLEAN ENERGY AND INDUSTRIAL GROWTH TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 HYDROGEN COMPRESSORS MARKET, BY REGION

- FIGURE 17 HYDROGEN COMPRESSORS MARKET TO WITNESS FASTEST GROWTH IN ASIA PACIFIC DURING FORECAST PERIOD

- 4.3 HYDROGEN COMPRESSORS MARKET, BY TYPE

- FIGURE 18 MECHANICAL COMPRESSORS SEGMENT DOMINATED HYDROGEN COMPRESSORS MARKET IN 2022

- 4.4 HYDROGEN COMPRESSORS MARKET, BY DESIGN

- FIGURE 19 MULTI-STAGE SEGMENT HELD LARGER SHARE OF HYDROGEN COMPRESSORS MARKET IN 2022

- 4.5 HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE

- FIGURE 20 OIL-BASED SEGMENT ACCOUNTED FOR LARGER SHARE OF HYDROGEN COMPRESSORS MARKET IN 2022

- 4.6 HYDROGEN COMPRESSORS MARKET, BY APPLICATION

- FIGURE 21 INDUSTRIAL SEGMENT ACCOUNTED FOR LARGER SHARE OF HYDROGEN COMPRESSORS MARKET IN 2022

- 4.7 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 22 INDUSTRIAL APPLICATION AND CHINA DOMINATED HYDROGEN COMPRESSORS MARKET IN ASIA PACIFIC IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 HYDROGEN COMPRESSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives and policies to curb greenhouse gas (GHG) emissions

- FIGURE 24 CUMULATIVE EMISSION REDUCTION, BY MITIGATION MEASURE, 2021-2050

- 5.2.1.2 Substantial clean energy investments in developing economies

- FIGURE 25 GLOBAL CLEAN ENERGY INVESTMENTS, 2015-2023

- 5.2.1.3 Rising demand for oil-free hydrogen compressors

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance cost of hydrogen compressors

- 5.2.2.2 Safety standards associated with hydrogen compressors

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing emphasis on net-zero carbon emission goals

- 5.2.3.2 Expansion of hydrogen refueling infrastructure

- 5.2.3.3 Increased demand for hydrogen compressors from oil & gas industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Underdeveloped hydrogen infrastructure

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4.2 INDICATIVE PRICING TREND, BY TYPE

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 27 HYDROGEN COMPRESSORS MARKET: SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 COMPONENT PROVIDERS

- 5.5.3 HYDROGEN COMPRESSOR MANUFACTURERS

- 5.5.4 END USERS

- TABLE 3 HYDROGEN COMPRESSORS MARKET: ROLE OF COMPANIES IN SUPPLY CHAIN

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 28 HYDROGEN COMPRESSORS MARKET: ECOSYSTEM/MARKET MAP

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT SCENARIO

- TABLE 4 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 280410, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.7.2 IMPORT SCENARIO

- TABLE 5 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 280410, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 30 IMPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 RECIPROCATING COMPRESSORS

- 5.8.2 ROTARY COMPRESSORS

- 5.8.3 IONIC COMPRESSORS

- 5.8.4 CENTRIFUGAL COMPRESSORS

- 5.8.5 NON-MECHANICAL COMPRESSORS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ADOPTION OF HYDROGEN COMPRESSION FOR FUELING STATIONS

- 5.9.1.1 Problem statement

- 5.9.1.2 Solution

- 5.9.2 HOWDEN AND PIONEER EPC CONTRACTOR PARTNERED TO INTEGRATE HYDROGEN COMPRESSORS IN REFINERIES

- 5.9.2.1 Problem statement

- 5.9.2.2 Solution

- 5.9.1 ADOPTION OF HYDROGEN COMPRESSION FOR FUELING STATIONS

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 6 HYDROGEN COMPRESSORS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 PATENT ANALYSIS

- FIGURE 31 HYDROGEN COMPRESSORS MARKET: PATENTS APPLIED AND GRANTED, 2013-2023

- 5.11.1 LIST OF MAJOR PATENTS

- TABLE 7 HYDROGEN COMPRESSORS: INNOVATIONS AND PATENT REGISTRATIONS, MARCH 2019-DECEMBER 2023

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

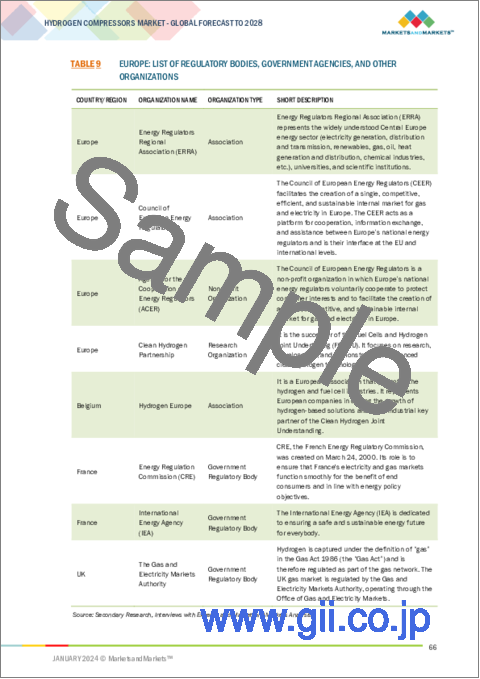

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 HYDROGEN COMPRESSORS MARKET: REGULATORY FRAMEWORK

- TABLE 11 REGULATORY FRAMEWORK: HYDROGEN COMPRESSORS MARKET, BY REGION

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 HYDROGEN COMPRESSORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 HYDROGEN COMPRESSORS MARKET: IMPACT OF PORTER'S FIVE FORCES, 2022

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 34 BUYING CRITERIA FOR TOP 3 APPLICATIONS

6 HYDROGEN COMPRESSORS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 35 HYDROGEN COMPRESSORS MARKET SHARE, IN TERMS OF VALUE, BY TYPE, 2022

- TABLE 14 HYDROGEN COMPRESSORS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 6.2 MECHANICAL COMPRESSORS

- 6.2.1 SUITABILITY FOR VARIOUS APPLICATIONS TO PROPEL DEMAND FOR MECHANICAL COMPRESSORS

- 6.2.1.1 Reciprocating compressors

- 6.2.1.2 Rotary compressors

- 6.2.1.3 Ionic compressors

- 6.2.1.4 Centrifugal compressors

- TABLE 15 MECHANICAL COMPRESSORS: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 6.2.1 SUITABILITY FOR VARIOUS APPLICATIONS TO PROPEL DEMAND FOR MECHANICAL COMPRESSORS

- 6.3 NON-MECHANICAL COMPRESSORS

- 6.3.1 ADVANTAGES SUCH AS LACK OF MOVING PARTS AND COMPACT SIZE TO INDUCE DEMAND FOR NON-MECHANICAL COMPRESSORS

- 6.3.1.1 Metal hydride compressors

- 6.3.1.2 Electrochemical hydrogen compressors (EHCs)

- 6.3.1.3 Adsorption-desorption compressors

- TABLE 16 NON-MECHANICAL COMPRESSORS: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 6.3.1 ADVANTAGES SUCH AS LACK OF MOVING PARTS AND COMPACT SIZE TO INDUCE DEMAND FOR NON-MECHANICAL COMPRESSORS

7 HYDROGEN COMPRESSORS MARKET, BY DESIGN

- 7.1 INTRODUCTION

- FIGURE 36 HYDROGEN COMPRESSORS MARKET SHARE, IN TERMS OF VALUE, BY DESIGN, 2022

- TABLE 17 HYDROGEN COMPRESSORS MARKET, BY DESIGN, 2022-2028 (USD MILLION)

- 7.2 SINGLE-STAGE

- 7.2.1 GROWING INVESTMENTS IN OIL REFINERIES TO PROPEL DEMAND FOR SINGLE-STAGE HYDROGEN COMPRESSORS

- TABLE 18 SINGLE-STAGE: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.3 MULTI-STAGE

- 7.3.1 USE OF MULTI-STAGE COMPRESSORS IN HEAVY-DUTY APPLICATIONS TO DRIVE SEGMENT

- TABLE 19 MULTI-STAGE: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

8 HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE

- 8.1 INTRODUCTION

- FIGURE 37 HYDROGEN COMPRESSORS MARKET SHARE, IN TERMS OF VALUE, BY LUBRICATION TYPE, 2022

- TABLE 20 HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE, 2022-2028 (USD MILLION)

- 8.2 OIL-BASED COMPRESSORS

- 8.2.1 RELIABILITY AND VERSATILE NATURE TO FUEL DEMAND FOR OIL-BASED COMPRESSORS

- TABLE 21 OIL-BASED COMPRESSORS: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 8.3 OIL-FREE COMPRESSORS

- 8.3.1 ABILITY TO PROVIDE HIGH-QUALITY AIR FREE FROM CONTAMINATION TO BOOST DEMAND FOR OIL-FREE COMPRESSORS

- TABLE 22 OIL-FREE COMPRESSORS: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

9 HYDROGEN COMPRESSORS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 38 HYDROGEN COMPRESSORS MARKET SHARE, IN TERMS OF VALUE, BY APPLICATION, 2022

- TABLE 23 HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 24 HYDROGEN COMPRESSORS MARKET, BY HYDROGEN INFRASTRUCTURE APPLICATION, 2022-2028 (USD MILLION)

- TABLE 25 HYDROGEN COMPRESSORS MARKET, BY INDUSTRIAL APPLICATION, 2022-2028 (USD MILLION)

- 9.2 HYDROGEN INFRASTRUCTURE

- TABLE 26 HYDROGEN INFRASTRUCTURE: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.2.1 HYDROGEN STORAGE & PIPELINE TRANSPORTATION

- 9.2.1.1 Need to increase storage density and minimize storage volume to boost adoption of hydrogen compressors

- TABLE 27 HYDROGEN STORAGE & PIPELINE TRANSPORTATION: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.2.2 HYDROGEN REFUELING STATIONS

- 9.2.2.1 Increased adoption of fuel cell vehicles to drive segment

- TABLE 28 HYDROGEN REFUELING STATIONS: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.3 INDUSTRIAL

- TABLE 29 INDUSTRIAL: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.3.1 OIL REFINING

- 9.3.1.1 Growing use of hydrogen in various oil refining processes to drive segment

- TABLE 30 OIL REFINING: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.3.2 CHEMICAL & PETROCHEMICAL

- 9.3.2.1 Increasing demand for chemical- and petrochemical-derived products to drive segment

- TABLE 31 CHEMICAL & PETROCHEMICAL: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.3.3 OTHER INDUSTRIAL APPLICATIONS

- TABLE 32 OTHER INDUSTRIAL APPLICATIONS: HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

10 HYDROGEN COMPRESSORS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 HYDROGEN COMPRESSORS MARKET SHARE, IN TERMS OF VALUE, BY REGION, 2022

- FIGURE 40 HYDROGEN COMPRESSORS MARKET TO REGISTER HIGHEST CAGR IN ASIA PACIFIC FROM 2023 TO 2028

- TABLE 33 HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 34 HYDROGEN COMPRESSORS MARKET, BY REGION, 2022-2028 (UNITS)

- 10.2 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: HYDROGEN COMPRESSORS MARKET SNAPSHOT

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 BY LUBRICATION TYPE

- TABLE 35 NORTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE, 2022-2028 (USD MILLION)

- 10.2.3 BY TYPE

- TABLE 36 NORTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.2.4 BY DESIGN

- TABLE 37 NORTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY DESIGN, 2022-2028 (USD MILLION)

- 10.2.5 BY APPLICATION

- TABLE 38 NORTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY HYDROGEN INFRASTRUCTURE APPLICATION, 2022-2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY INDUSTRIAL APPLICATION, 2022-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.2.5.1 US

- 10.2.5.1.1 Growing oil and gas exploration operations to boost demand for hydrogen compressors

- 10.2.5.1 US

- TABLE 42 US: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.2.5.2 Canada

- 10.2.5.2.1 Investment by key players in hydrogen compressors and new technologies to augment market growth

- 10.2.5.2 Canada

- TABLE 43 CANADA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET SNAPSHOT

- 10.3.1 ASIA PACIFIC: RECESSION IMPACT

- 10.3.2 BY LUBRICATION TYPE

- TABLE 44 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE, 2022-2028 (USD MILLION)

- 10.3.3 BY TYPE

- TABLE 45 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.3.4 BY DESIGN

- TABLE 46 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY DESIGN, 2022-2028 (USD MILLION)

- 10.3.5 BY APPLICATION

- TABLE 47 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY HYDROGEN INFRASTRUCTURE APPLICATION, 2022-2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY INDUSTRIAL APPLICATION, 2022-2028 (USD MILLION)

- 10.3.6 BY COUNTRY

- TABLE 50 ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.3.6.1 China

- 10.3.6.1.1 Focus on domestic production of hydrogen compressors to foster market growth

- 10.3.6.1 China

- TABLE 51 CHINA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.6.2 Japan

- 10.3.6.2.1 Government push toward carbon neutrality to boost adoption of hydrogen compressors

- 10.3.6.2 Japan

- TABLE 52 JAPAN: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.6.3 South Korea

- 10.3.6.3.1 Focus on developing hydrogen refueling stations in coming years to create opportunities for market players

- 10.3.6.3 South Korea

- TABLE 53 SOUTH KOREA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.6.4 India

- 10.3.6.4.1 Growing hydrogen exploration operations to drive market

- 10.3.6.4 India

- TABLE 54 INDIA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.6.5 Australia

- 10.3.6.5.1 Significant potential for hydrogen production and government focus on renewable energy to drive market

- 10.3.6.5 Australia

- TABLE 55 AUSTRALIA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.6.6 Rest of Asia Pacific

- TABLE 56 REST OF ASIA PACIFIC: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 EUROPE: RECESSION IMPACT

- 10.4.2 BY LUBRICATION TYPE

- TABLE 57 EUROPE: HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE, 2022-2028 (USD MILLION)

- 10.4.3 BY TYPE

- TABLE 58 EUROPE: HYDROGEN COMPRESSORS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.4.4 BY DESIGN

- TABLE 59 EUROPE: HYDROGEN COMPRESSORS MARKET, BY DESIGN, 2022-2028 (USD MILLION)

- 10.4.5 BY APPLICATION

- TABLE 60 EUROPE: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 61 EUROPE: HYDROGEN COMPRESSORS MARKET, BY HYDROGEN INFRASTRUCTURE APPLICATION, 2022-2028 (USD MILLION)

- TABLE 62 EUROPE: HYDROGEN COMPRESSORS MARKET, BY INDUSTRIAL APPLICATION, 2022-2028 (USD MILLION)

- 10.4.6 BY COUNTRY

- TABLE 63 EUROPE: HYDROGEN COMPRESSORS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.4.6.1 Germany

- 10.4.6.1.1 Efforts to advance hydrogen infrastructure and promote shift toward green energy to drive market

- 10.4.6.1 Germany

- TABLE 64 GERMANY: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.6.2 France

- 10.4.6.2.1 Investment by key players in hydrogen compressors to propel market

- 10.4.6.2 France

- TABLE 65 FRANCE: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.6.3 UK

- 10.4.6.3.1 Government focus on transitioning to low-carbon economy to favor market growth

- 10.4.6.3 UK

- TABLE 66 UK: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.6.4 Italy

- 10.4.6.4.1 Demand from refining and chemicals industries to underpin market growth

- 10.4.6.4 Italy

- TABLE 67 ITALY: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.6.5 Norway

- 10.4.6.5.1 Active participation in development of hydrogen compressors and storage systems to support market growth

- 10.4.6.5 Norway

- TABLE 68 NORWAY: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.6.6 Rest of Europe

- TABLE 69 REST OF EUROPE: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.2 BY LUBRICATION TYPE

- TABLE 70 MIDDLE EAST & AFRICA: HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE, 2022-2028 (USD MILLION)

- 10.5.3 BY TYPE

- TABLE 71 MIDDLE EAST & AFRICA: HYDROGEN COMPRESSORS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.5.4 BY DESIGN

- TABLE 72 MIDDLE EAST & AFRICA: HYDROGEN COMPRESSORS MARKET, BY DESIGN, 2022-2028 (USD MILLION)

- 10.5.5 BY APPLICATION

- TABLE 73 MIDDLE EAST & AFRICA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 74 MIDDLE EAST & AFRICA: HYDROGEN COMPRESSORS MARKET, BY HYDROGEN INFRASTRUCTURE APPLICATION, 2022-2028 (USD MILLION)

- TABLE 75 MIDDLE EAST & AFRICA: HYDROGEN COMPRESSORS MARKET, BY INDUSTRIAL APPLICATION, 2022-2028 (USD MILLION)

- 10.5.6 BY COUNTRY

- TABLE 76 MIDDLE EAST & AFRICA: HYDROGEN COMPRESSORS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 77 GCC COUNTRIES: HYDROGEN COMPRESSORS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.5.6.1 GCC Countries

- 10.5.6.1.1 Saudi Arabia

- 10.5.6.1.1.1 Substantial investments in hydrogen generation by government to drive market

- 10.5.6.1.1 Saudi Arabia

- 10.5.6.1 GCC Countries

- TABLE 78 SAUDI ARABIA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.6.1.2 UAE

- 10.5.6.1.2.1 Significant investments in hydrogen sector to drive market

- 10.5.6.1.2 UAE

- TABLE 79 UAE: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.6.1.3 Qatar

- 10.5.6.1.3.1 Investment by key players in R&D Activities to boost market growth

- 10.5.6.1.3 Qatar

- TABLE 80 QATAR: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.6.1.4 Rest of GCC

- TABLE 81 REST OF GCC: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.6.2 South Africa

- 10.5.6.2.1 Active government investments in hydrogen-related initiatives to drive market

- 10.5.6.2 South Africa

- TABLE 82 SOUTH AFRICA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.6.3 Rest of Middle East & Africa

- TABLE 83 REST OF MIDDLE EAST & AFRICA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT: SOUTH AMERICA

- 10.6.2 BY LUBRICATION TYPE

- TABLE 84 SOUTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY LUBRICATION TYPE, 2022-2028 (USD MILLION)

- 10.6.3 BY TYPE

- TABLE 85 SOUTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.6.4 BY DESIGN

- TABLE 86 SOUTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY DESIGN, 2022-2028 (USD MILLION)

- 10.6.5 BY APPLICATION

- TABLE 87 SOUTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 88 SOUTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY HYDROGEN INFRASTRUCTURE APPLICATION, 2022-2028 (USD MILLION)

- TABLE 89 SOUTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY INDUSTRIAL APPLICATION, 2022-2028 (USD MILLION)

- TABLE 90 SOUTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.6.5.1 Brazil

- 10.6.5.1.1 Collaborations and partnerships among key players and government bodies to drive market expansion

- 10.6.5.1 Brazil

- TABLE 91 BRAZIL: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.6.5.2 Argentina

- 10.6.5.2.1 Investment by key players in hydrogen compressors and new technologies to boost market

- 10.6.5.2 Argentina

- TABLE 92 ARGENTINA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.6.5.3 Rest of South America

- 10.6.5.4 By application

- TABLE 93 REST OF SOUTH AMERICA: HYDROGEN COMPRESSORS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2023

- 11.3 MARKET SHARE ANALYSIS, 2022

- TABLE 94 HYDROGEN COMPRESSORS MARKET: DEGREE OF COMPETITION

- FIGURE 43 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2022

- 11.4 REVENUE ANALYSIS, 2020-2022

- FIGURE 44 REVENUE ANALYSIS, 2020-2022

- 11.5 COMPETITIVE SCENARIOS AND TRENDS

- 11.5.1 DEALS

- TABLE 95 HYDROGEN COMPRESSORS MARKET: DEALS, 2019-2023

- 11.5.2 OTHERS

- TABLE 96 HYDROGEN COMPRESSORS MARKET: OTHERS, NOVEMBER 2022

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 45 HYDROGEN COMPRESSORS MARKET: COMPANY EVALUATION MATRIX (KEY COMPANIES), 2022

- 11.6.5 COMPANY FOOTPRINT

- TABLE 97 HYDROGEN COMPRESSOR MARKET: MARKET FOOTPRINT

- TABLE 98 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 99 TYPE: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 100 LUBRICATION TYPE: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 101 DESIGN: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 102 APPLICATION: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 103 REGION: COMPANY FOOTPRINT (KEY PLAYERS)

- 11.7 COMPANY EVALUATION MATRIX: OTHER PLAYERS

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 46 HYDROGEN COMPRESSORS MARKET: COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2022

- 11.7.5 COMPETITIVE BENCHMARKING

- TABLE 104 HYDROGEN COMPRESSORS MARKET: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 105 PRODUCT: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 106 TYPE: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 107 LUBRICATION TYPE: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 108 DESIGN: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 109 APPLICATION: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 110 REGION: COMPANY FOOTPRINT (OTHER PLAYERS)

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1.1 ATLAS COPCO AB

- TABLE 111 ATLAS COPCO AB: COMPANY OVERVIEW

- FIGURE 47 ATLAS COPCO AB: COMPANY SNAPSHOT

- TABLE 112 ATLAS COPCO AB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 113 ATLAS COPCO AB: PRODUCT LAUNCHES

- TABLE 114 ATLAS COPCO AB: DEALS

- 12.1.2 LINDE PLC

- TABLE 115 LINDE PLC: COMPANY OVERVIEW

- FIGURE 48 LINDE PLC: COMPANY SNAPSHOT

- TABLE 116 LINDE PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 117 LINDE PLC: DEALS

- 12.1.3 AIR PRODUCTS AND CHEMICALS, INC.

- TABLE 118 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- FIGURE 49 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- TABLE 119 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 120 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

- TABLE 121 AIR PRODUCTS AND CHEMICALS, INC.: OTHERS

- 12.1.4 INGERSOLL RAND

- TABLE 122 INGERSOLL RAND: COMPANY OVERVIEW

- FIGURE 50 INGERSOLL RAND: COMPANY SNAPSHOT

- TABLE 123 INGERSOLL RAND: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 124 INGERSOLL RAND: DEALS

- TABLE 125 INGERSOLL RAND: OTHERS

- 12.1.5 SIEMENS ENERGY

- TABLE 126 SIEMENS ENERGY: COMPANY OVERVIEW

- FIGURE 51 SIEMENS ENERGY: COMPANY SNAPSHOT

- TABLE 127 SIEMENS ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.6 MITSUBISHI HEAVY INDUSTRIES, LTD.

- TABLE 128 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- FIGURE 52 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- TABLE 129 MITSUBISHI INDUSTRIES, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.7 KOBE STEEL, LTD.

- TABLE 130 KOBE STEEL, LTD.: COMPANY OVERVIEW

- FIGURE 53 KOBE STEEL, LTD.: COMPANY SNAPSHOT

- TABLE 131 KOBE STEEL, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.8 HITACHI INDUSTRIAL PRODUCTS, LTD.

- TABLE 132 HITACHI INDUSTRIAL PRODUCTS, LTD.: COMPANY OVERVIEW

- FIGURE 54 HITACHI INDUSTRIAL PRODUCTS, LTD.: COMPANY SNAPSHOT

- TABLE 133 HITACHI INDUSTRIAL PRODUCTS, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.9 SUNDYNE

- TABLE 134 SUNDYNE: COMPANY OVERVIEW

- TABLE 135 SUNDYNE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 136 SUNDYNE: PRODUCT LAUNCHES

- 12.1.10 HOWDEN GROUP

- TABLE 137 HOWDEN GROUP: COMPANY OVERVIEW

- TABLE 138 HOWDEN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 139 HOWDEN GROUP: DEALS

- 12.1.11 NEUMAN & ESSER GROUP

- TABLE 140 NEUMAN & ESSER GROUP: COMPANY OVERVIEW

- TABLE 141 NEUMAN & ESSER GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 142 NEUMAN & ESSER GROUP: DEALS

- 12.1.12 HAUG SAUER KOMPRESSOREN AG

- TABLE 143 HAUG SAUER KOMPRESSOREN AG: COMPANY OVERVIEW

- TABLE 144 HAUG SAUER KOMPRESSOREN AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 145 HAUG SAUER KOMPRESSOREN AG: PRODUCT LAUNCHES

- 12.1.13 ARIEL CORPORATION

- TABLE 146 ARIEL CORPORATION: COMPANY OVERVIEW

- TABLE 147 ARIEL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 148 ARIEL CORPORATION: DEALS

- 12.1.14 INDIAN COMPRESSORS LTD

- TABLE 149 INDIAN COMPRESSORS LTD: COMPANY OVERVIEW

- TABLE 150 INDIAN COMPRESSORS LTD : PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.15 ADICOMP S.R.L.

- TABLE 151 ADICOMP S.R.L: COMPANY OVERVIEW

- TABLE 152 ADICOMP S.R.L.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 KEEPWIN TECHNOLOGY HEBEI CO., LTD

- 12.2.2 PURE ENERGY CENTRE

- 12.2.3 FLUITRON

- 12.2.4 CYRUS S.A.

- 12.2.5 AEROTECNICA COLTRI S.P.A.

- 12.2.6 HYDRO-PAC, INC.

- 12.2.7 SOLLANT

- 12.2.8 IDEX INDIA

- 12.2.9 MEHRER COMPRESSION GMBH

- 12.2.10 GRUPPO SIAD

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS