|

|

市場調査レポート

商品コード

1423545

フィッシング対策の世界市場:提供別、サブタイプ別、組織規模別、展開方式別、業界別、地域別 - 予測(~2028年)Phishing Protection Market by Offering (Solutions, Services), Subtype (Email-based Phishing, Non-email-based Phishing), Organization Size, Deployment Mode, Vertical (BFSI, IT & ITeS, Government) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| フィッシング対策の世界市場:提供別、サブタイプ別、組織規模別、展開方式別、業界別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月01日

発行: MarketsandMarkets

ページ情報: 英文 298 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

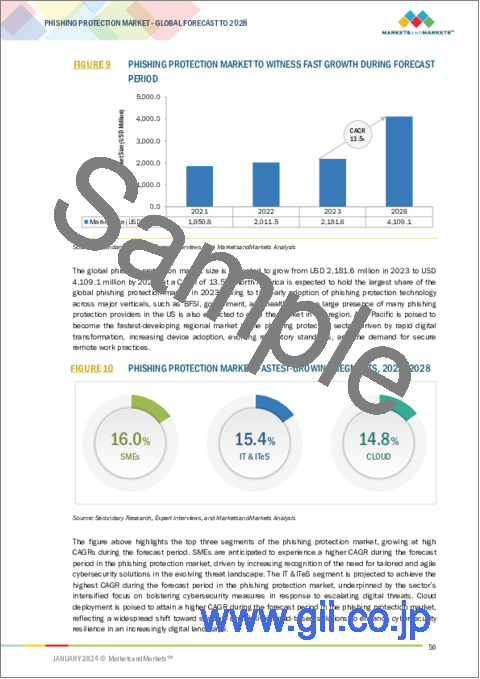

世界のフィッシング対策の市場規模は、2023年までに22億米ドル、2028年までに41億米ドルに達し、予測期間にCAGRで13.5%の成長が見込まれています。

フィッシング対策市場の推進力は、電子メールやクラウドベースのサービスが広く普及し、フィッシング攻撃がますます複雑化している、進化するデジタル通信の状況と密接に結びついています。脆弱性を悪用しようとするサイバー犯罪者の執拗な追跡と、精巧なソーシャルエンジニアリングの手口の増加により、先進のサイバーセキュリティソリューションの重要性が浮き彫りになっています。複雑なフィッシング詐欺の手口やリスクの高まりから、企業は機密データや金融資産、ステークホルダーからの信頼を守るため、最先端の対策に多額の投資を余儀なくされています。技術の進歩、攻撃対象の拡大、厳格なデータ保護規制が相まって、革新的なフィッシング対策への需要が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 100万米ドル、10億米ドル |

| セグメント | 提供別、サブタイプ別、組織規模別、展開方式別、業界別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「提供別では、サービスセグメントが予測期間にもっとも高い成長率を占めます。」

サービスセグメントが予測期間にフィッシング対策市場でもっとも高い成長率を示す見込みです。この傾向は、フィッシングの脅威に対する防御を強化するための包括的なサービスの必要性が組織内で認識されつつあることに起因しています。フィッシング攻撃の複雑性と多様性が進化し続ける中、専用品への需要が高まっています。サービスセグメントは、組織がサイバーセキュリティの動的な情勢を行くことを支援し、フィッシングの試みに効果的に対抗するためにカスタマイズされた適応性のあるソリューションを提供する上で極めて重要な役割を果たしています。包括的な対策戦略への重視により、サービスセグメントはフィッシング対策市場の重要な成長促進要因として位置づけられています。

「展開方式別では、クラウドセグメントが予測期間にもっとも高い成長率を占めます。」

展開方式別では、クラウドセグメントが予測期間にフィッシング対策市場でもっとも高い成長率を占めす見込みです。この急成長はクラウドベースソリューションの採用の急増に起因しており、クラウド展開によって提供される利点に対する組織の認識の高まりを反映しています。クラウドベースのフィッシング対策ソリューションは、拡張性、柔軟性、集中管理を提供し、先進のフィッシングの脅威に対抗するための企業の進化するニーズによく合致しています。リモートワークの増加やクラウドサービスへの依存の高まりが、クラウドネイティブなフィッシング対策技術への需要をさらに高めています。組織がサイバーセキュリティ戦略において俊敏性と効率性を優先するにつれ、クラウドセグメントはフィッシング対策市場においてダイナミックな成長の焦点として浮上しています。

「アジア太平洋が予測期間にもっとも高い成長率を占めます。」

アジア太平洋が予測期間にフィッシング対策市場においてもっとも高い成長率を占めすと見込まれています。この成長加速は、各産業における急速なデジタル化や、サイバー脅威の増加、サイバーセキュリティ対策の重視の高まりなど、多くの要因によるものです。アジア太平洋の企業や政府がデジタル技術を受け入れ続けるにつれ、フィッシング攻撃のリスクはより顕著になり、強固な対策ソリューションへの需要が高まっています。サイバー脅威の経済的影響や風評被害に対する意識の高まりや、規制への取り組みが、同地域におけるフィッシング対策の急速な普及に寄与しています。サイバー脅威情勢の動的な性質により、アジア太平洋市場はフィッシング対策セグメントの重要な成長促進要因として位置づけられています。

当レポートでは、世界のフィッシング対策市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- フィッシング対策市場の概要

- フィッシング対策市場:提供別(2023年)

- フィッシング対策市場:ソリューション別(2023年)

- フィッシング対策市場:サブタイプ別(2023年)

- フィッシング対策市場:組織規模別(2023年)

- フィッシング対策市場:展開方式別(2023年)

- フィッシング対策市場:業界別(2023年)

- 市場投資シナリオ

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- フィッシング対策の略歴

- ケーススタディ分析

- バリューチェーン分析

- フィッシング対策ソリューションプロバイダー

- クラウドプロバイダー

- サービスプロバイダー

- 政府、規制機関

- エンドユーザー

- エコシステム

- ポーターのファイブフォース分析

- 価格分析

- 主要企業の平均販売価格の動向:提供別

- 参考価格分析:ソリューション別

- 技術分析

- 主な技術

- 関連技術

- フィッシング攻撃の種類

- QRコードフィッシング

- 電子メールフィッシング、スパム

- スピアフィッシング

- クローンフィッシング

- ホエーリング、CEO詐欺

- 欺瞞的フィッシング

- ビッシング、スミッシング

- DNSベースフィッシング

- その他のフィッシング攻撃

- 特許分析

- 顧客のビジネスに影響を与える動向と混乱

- フィッシング対策ツール、フレームワーク、技術

- 技術ロードマップ

- 関税と規制情勢

- 主なステークホルダーと購入基準

- 主な会議とイベント

- フィッシング対策市場におけるベストプラクティス

- 現在と新興のビジネスモデル

第6章 フィッシング対策市場:提供別

- イントロダクション

- ソリューション

- フィッシング攻撃の増加により、堅牢なフィッシング対策ソリューションへの需要が高まる

- 電子メールセキュリティソリューション

- トレーニング・シミュレーションソリューション

- 先進脅威インテリジェンス

- サービス

- 専門家のサービスによる包括的なフィッシング対策の実装、市場成長を促進する継続的なセキュリティサポート

- プロフェッショナルサービス

- マネージドセキュリティサービス

第7章 フィッシング対策市場:ソリューションタイプ別

- イントロダクション

- フィッシング対策フィルター

- 電子メール認証ツール

- サンドボックス化、脅威分析

- その他のソリューションタイプ

第8章 フィッシング対策市場:サブタイプ別

- イントロダクション

- 電子メールベースのフィッシング

- 非電子メールベースのフィッシング

第9章 フィッシング対策市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第10章 フィッシング対策市場:展開方式別

- イントロダクション

- クラウド

- オンプレミス

第11章 フィッシング対策市場:業界別

- イントロダクション

- BFSI

- IT・ITES

- 政府

- 医療

- 小売・eコマース

- メディア・エンターテインメント

- その他の業界

第12章 フィッシング対策市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 北米のフィッシング対策市場の促進要因

- 米国

- カナダ

- 欧州

- 欧州の不況の影響

- 欧州のフィッシング対策市場の促進要因

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋の不況の影響

- アジア太平洋のフィッシング対策市場の促進要因

- 中国

- 日本

- インド

- シンガポール

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカの不況の影響

- 中東・アフリカのフィッシング対策市場の促進要因

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカの不況の影響

- ラテンアメリカのフィッシング対策市場の促進要因

- ブラジル

- メキシコ

- その他のラテンアメリカ

第13章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業

- 収益分析

- 上位市場企業の市場シェア分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオ

- フィッシング対策製品のベンチマーク

- 主なフィッシング対策ベンダーの評価と財務指標

第14章 企業プロファイル

- 主要企業

- MICROSOFT

- OPENTEXT

- TWILIO

- TREND MICRO

- PROOFPOINT

- MIMECAST

- BARRACUDA

- TRUSTWAVE

- COFENSE

- SOPHOS

- IRONSCALES

- VIRTRU

- PAUBOX

- DUOCIRCLE

- TRUSTIFI

- スタートアップ/中小企業

- ABNORMAL SECURITY

- SPYCLOUD

- ZEROFOX

- INKY

- DEEPWATCH

- GUARDZ

- REDSIFT

- VADE

- GREATHORN

- AGARI

- VALIMAIL

- APPGUARD

- IMMUNIWEB

第15章 隣接市場

- 隣接市場のイントロダクション

- 電子メール暗号化市場

- セキュリティオートメーション市場

第16章 付録

The global phishing protection market is estimated to be worth USD 2.2 billion in 2023 and is projected to reach USD 4.1 billion by 2028, at a CAGR of 13.5% during the forecast period. The propulsion of the phishing protection market is intricately tied to the evolving digital communication landscape, where the widespread adoption of email and cloud-based services converges with the increasing intricacy of phishing attacks. The relentless pursuit of cybercriminals to exploit vulnerabilities and the rising instances of sophisticated social engineering tactics underscore the criticality of advanced cybersecurity solutions. Marked by intricate phishing schemes and a heightened risk landscape, organizations are compelled to invest significantly in cutting-edge protection measures to safeguard sensitive data, financial assets, and stakeholders' trust. The intersection of technological advancement, expanding attack surfaces, and stringent data protection regulations collectively propel the demand for innovative phishing protection strategies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By offering, sub-types, organization size, deployment mode, and vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"By offering, the services segment to register the highest growth rate during the forecast period."

The forecast indicates that, by offering, the services segment is anticipated to exhibit the highest growth rate in the phishing protection market during the forecast period. This trajectory can be attributed to the increasing recognition among organizations of the need for comprehensive services to fortify their defenses against phishing threats. As the complexity and diversity of phishing attacks continue to evolve, there is a growing demand for specialized. The services segment plays a pivotal role in assisting organizations to navigate the dynamic landscape of cybersecurity, offering tailored and adaptive solutions to combat phishing attempts effectively. The emphasis on holistic protection strategies positions the services segment as a key driver for growth in the phishing protection market.

"By deployment mode, the cloud segment to register the highest growth rate during the forecast period."

The forecast indicates that, by deployment mode, the cloud segment is poised to register the highest growth rate in the phishing protection market during the forecast period. This surge can be attributed to the escalating adoption of cloud-based solutions, reflecting the growing recognition among organizations of the advantages offered by cloud deployment. Cloud-based phishing protection solutions provide scalability, flexibility, and centralized management, aligning well with the evolving needs of businesses to counter sophisticated phishing threats. The rise in remote work scenarios and the increasing reliance on cloud services further accentuate the demand for cloud-native phishing protection technologies. As organizations prioritize agility and efficiency in their cybersecurity strategies, the cloud segment emerges as a focal point for dynamic growth within the phishing protection market.

"Asia Pacific to register the highest growth rate during the forecast period."

The Asia Pacific region is expected to register the highest growth rate in the phishing protection market during the forecast period. This accelerated growth is driven by many factors, including rapid digitization across industries, increased cyber threats, and a growing emphasis on cybersecurity measures. As businesses and governments in the Asia Pacific continue to embrace digital technologies, the risk of phishing attacks becomes more pronounced, fueling the demand for robust protection solutions. The heightened awareness of the economic and reputational consequences of cyber threats and regulatory initiatives contributes to the rapid adoption of phishing protection measures in the region. The dynamic nature of the cyber threat landscape positions the Asia Pacific market as a key driver for growth in the phishing protection sector.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primaries is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 57%, and Tier 3 - 33%

- By Designation: C-level - 40%, Managers and Others - 60%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 45%.

The major players in the phishing protection market are Barracuda (US), Cofense (US), Duocircle (US), Ironscales (Israel), Microsoft (US), Mimecast (UK), OpenText (Canada), Paubox (US), Proofpoint (US), Sophos (UK), Trend Micro (Japan), Trustwave (US), Twilio (US), Virtru (US), Abnormal Security (US), AGARI (US), AppGuard (US), Deepwatch (US), GreatHorn (US), Guardz (US), ImmuniWeb (Switzerland), Inky (US), Redsift (UK), SpyCloud (US), Trustifi (US), Vade (France), Valimail (US), ZeroFOX (US). The study includes an in-depth competitive analysis of these key players in the phishing protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the phishing protection market size across segments. It aims to estimate the market size and growth potential of this market across different segments by offering sub-types, organization sizes, deployment modes, verticals, and regions. The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall phishing protection market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- As businesses recognize the pivotal role of phishing protection, there is a mounting demand for comprehensive phishing protection solutions and services. These encompass a range of tools enabling organizations to achieve authentic and secure connectivity. While challenges like the need for alignment and technology integration are acknowledged, the report underscores the dynamic landscape of phishing protection-centric technologies and evolving market trends; the report also offers valuable insights into the future trajectory of the phishing protection market.

- Product Development/Innovation: Detailed insights on coming technologies, R&D activities, and product & solution launches in the phishing protection market

- Market Development: Comprehensive information about lucrative markets - the report analyses the phishing protection market across varied regions.

- Market Diversification: Exhaustive information about new products & solutions being developed, untapped geographies, recent developments, and investments in the phishing protection market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Barracuda (US), Cofense (US), Duocircle (US), Ironscales (Israel), Microsoft (US), Mimecast (UK), OpenText (Canada), Paubox (US), Proofpoint (US), Sophos (UK), Trend Micro (Japan), Trustwave (US), Twilio (US), Virtru (US), Abnormal Security (US), AGARI (US), AppGuard (US), Deepwatch (US), GreatHorn (US), Guardz (US), ImmuniWeb (Switzerland), Inky (US), Redsift (UK), SpyCloud (US), Trustifi (US), Vade (France), Valimail (US), ZeroFOX (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PHISHING PROTECTION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 3 PHISHING PROTECTION MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN PHISHING PROTECTION MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1-BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF SOLUTIONS AND SERVICES IN PHISHING PROTECTION MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2-BOTTOM-UP (DEMAND SIDE) VERTICALS

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 RECESSION IMPACT

- FIGURE 8 PHISHING PROTECTION MARKET: RECESSION IMPACT

- FIGURE 9 PHISHING PROTECTION MARKET TO WITNESS FAST GROWTH DURING FORECAST PERIOD

- FIGURE 10 PHISHING PROTECTION MARKET: FASTEST-GROWING SEGMENTS, 2023-2028

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF PHISHING PROTECTION MARKET

- FIGURE 12 ESCALATING FREQUENCY OF TARGETED AND HIGHLY SOPHISTICATED PHISHING ATTACKS TO DRIVE MARKET GROWTH

- 4.2 PHISHING PROTECTION MARKET, BY OFFERING, 2023

- FIGURE 13 SOLUTIONS SEGMENT TO HOLD LARGER SHARE DURING FORECAST PERIOD

- 4.3 PHISHING PROTECTION MARKET, BY SOLUTION, 2023

- FIGURE 14 EMAIL SECURITY SOLUTIONS TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- 4.4 PHISHING PROTECTION MARKET, BY SUBTYPE, 2023

- FIGURE 15 EMAIL-BASED PHISHING SEGMENT TO HOLD LARGER SHARE DURING FORECAST PERIOD

- 4.5 PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023

- FIGURE 16 LARGE ENTERPRISES TO HOLD LARGER SHARE DURING FORECAST PERIOD

- 4.6 PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023

- FIGURE 17 CLOUD SEGMENT TO HOLD LARGER SHARE DURING FORECAST PERIOD

- 4.7 PHISHING PROTECTION MARKET, BY VERTICAL, 2023

- FIGURE 18 IT & ITES SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- 4.8 MARKET INVESTMENT SCENARIO

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 PHISHING PROTECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising instances of phishing attacks

- 5.2.1.2 Surge in mobile phishing

- 5.2.1.3 Rise in stringent data protection regulations and compliance

- 5.2.2 RESTRAINTS

- 5.2.2.1 Resource constraints

- 5.2.2.2 Increase in false positives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing cloud adoption

- 5.2.3.2 Global awareness campaigns

- 5.2.4 CHALLENGES

- 5.2.4.1 Human factor challenging phishing protection

- 5.2.4.2 Adapting to new threat vectors

- 5.3 BRIEF HISTORY OF PHISHING PROTECTION

- FIGURE 21 BRIEF HISTORY OF PHISHING PROTECTION

- 5.3.1 1990-2000

- 5.3.2 2000-2010

- 5.3.3 2010-2020

- 5.3.4 2020-PRESENT

- 5.4 CASE STUDY ANALYSIS

- 5.4.1 SECLORE'S INNOVATIVE EMAIL ENCRYPTION SOLUTION EMPOWERED AMERICAN EXPRESS WITH ENHANCED SECURITY AND COMPLIANCE

- 5.4.2 GLOBAL BANK DEPLOYED SYSCOM'S IN-HOUSE VIRTUAL APPLIANCE TO STRENGTHEN EMAIL ENCRYPTION

- 5.4.3 ZEVA AND MICROSOFT COLLABORATED AND INTRODUCED DECRYPTNABOX TO OVERCOME CHALLENGES OF TRADITIONAL EMAIL ENCRYPTION

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS

- 5.5.1 PHISHING PROTECTION SOLUTION PROVIDERS

- 5.5.2 CLOUD PROVIDERS

- 5.5.3 SERVICE PROVIDERS

- 5.5.4 GOVERNMENT AND REGULATORY BODIES

- 5.5.5 END USERS

- 5.6 ECOSYSTEM

- FIGURE 23 ECOSYSTEM MAP

- TABLE 3 ROLE IN ECOSYSTEM

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PORTER'S FIVE FORCES MODEL: IMPACT ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 BARGAINING POWER OF SUPPLIERS

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 THREAT OF SUBSTITUTES

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- FIGURE 25 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- TABLE 5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- 5.8.2 INDICATIVE PRICING ANALYSIS, BY SOLUTION

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY SOLUTION

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Email filtering and authentication

- 5.9.1.2 Artificial intelligence and machine learning

- 5.9.1.3 Web filtering

- 5.9.1.4 Multi-factor authentication

- 5.9.1.5 Endpoint security

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Blockchain

- 5.9.2.2 Cloud security

- 5.9.2.3 Zero-trust security

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PHISHING ATTACK TYPES

- 5.10.1 QR CODE PHISHING

- 5.10.2 EMAIL PHISHING AND SPAM

- 5.10.3 SPEAR PHISHING

- 5.10.4 CLONE PHISHING

- 5.10.5 WHALING AND CEO FRAUD

- 5.10.6 DECEPTIVE PHISHING

- 5.10.7 VISHING AND SMISHING

- 5.10.8 DNS-BASED PHISHING

- 5.10.9 OTHER PHISHING ATTACKS

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- FIGURE 26 LIST OF MAJOR PATENTS FOR PHISHING PROTECTION

- TABLE 7 LIST OF MAJOR PATENTS

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 PHISHING PROTECTION TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.14 TECHNOLOGY ROADMAP

- 5.14.1 PHISHING PROTECTION TECHNOLOGY ROADMAP TILL 2030

- 5.14.1.1 Short-term roadmap (2023-2025)

- 5.14.1.2 Mid-term roadmap (2026-2028)

- 5.14.1.3 Long-term roadmap (2029-2030)

- 5.14.1 PHISHING PROTECTION TECHNOLOGY ROADMAP TILL 2030

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.1.1 North America

- 5.15.1.1.1 US

- 5.15.1.2 Europe

- 5.15.1.3 Asia Pacific

- 5.15.1.3.1 India

- 5.15.1.3.2 China

- 5.15.1.4 Middle East & Africa

- 5.15.1.4.1 UAE

- 5.15.1.5 Latin America

- 5.15.1.5.1 Brazil

- 5.15.1.5.2 Mexico

- 5.15.1.1 North America

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING CRITERIA

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.16.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.17 KEY CONFERENCES & EVENTS

- TABLE 11 KEY CONFERENCES & EVENTS, 2023-2024

- 5.18 BEST PRACTICES IN PHISHING PROTECTION MARKET

- 5.18.1 USER EDUCATION AND AWARENESS

- 5.18.2 EMAIL FILTERING

- 5.18.3 MULTI-FACTOR AUTHENTICATION (MFA)

- 5.18.4 REGULAR SOFTWARE UPDATES

- 5.18.5 URL INSPECTION

- 5.18.6 SECURE WEBSITE CONNECTION (HTTPS)

- 5.18.7 INCIDENT RESPONSE PLAN

- 5.18.8 PHISHING SIMULATION EXERCISES

- 5.18.9 EMAIL AUTHENTICATION PROTOCOLS

- 5.18.10 SECURITY SOFTWARE

- 5.18.11 REPORTING MECHANISMS

- 5.19 CURRENT AND EMERGING BUSINESS MODELS

6 PHISHING PROTECTION MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 30 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 6.1.1 OFFERING: PHISHING PROTECTION MARKET DRIVERS

- TABLE 12 PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 13 PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 RISING PHISHING ATTACKS TO BOOST DEMAND FOR ROBUST PHISHING PROTECTION SOLUTIONS

- TABLE 14 SOLUTIONS: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 15 SOLUTIONS: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 EMAIL SECURITY SOLUTIONS

- TABLE 16 EMAIL SECURITY SOLUTIONS: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 17 EMAIL SECURITY SOLUTIONS: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 TRAINING & SIMULATION SOLUTIONS

- TABLE 18 TRAINING & SIMULATION SOLUTIONS: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 TRAINING & SIMULATION SOLUTIONS: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4 ADVANCED THREAT INTELLIGENCE

- TABLE 20 ADVANCED THREAT INTELLIGENCE: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 ADVANCED THREAT INTELLIGENCE: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 IMPLEMENTING COMPREHENSIVE PHISHING PROTECTION THROUGH EXPERT SERVICES AND ONGOING SECURITY SUPPORT TO FUEL MARKET GROWTH

- TABLE 22 PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 23 PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 24 SERVICES: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 SERVICES: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- TABLE 26 PROFESSIONAL SERVICES: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 PROFESSIONAL SERVICES: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 MANAGED SECURITY SERVICES

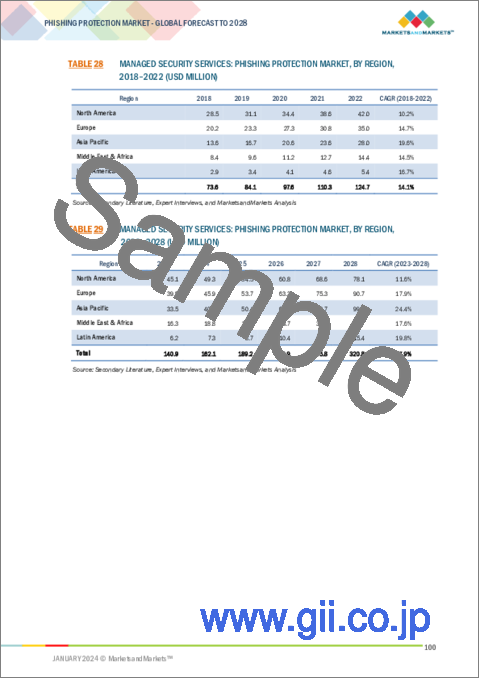

- TABLE 28 MANAGED SECURITY SERVICES: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 MANAGED SECURITY SERVICES: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

7 PHISHING PROTECTION MARKET, BY SOLUTION TYPE

- 7.1 INTRODUCTION

- 7.1.1 SOLUTION TYPE: PHISHING PROTECTION MARKET DRIVERS

- 7.2 ANTI-PHISHING FILTERS

- 7.2.1 ENHANCED SECURITY WITH MODERN ANTI-PHISHING FILTERS TO FUEL MARKET GROWTH

- 7.3 EMAIL AUTHENTICATION TOOLS

- 7.3.1 PHISHING DEFENSES THROUGH AUTHENTICATION POLICIES TO CONTRIBUTE TO MARKET GROWTH

- 7.4 SANDBOXING AND THREAT ANALYSIS

- 7.4.1 ENHANCED PHISHING DEFENSE WITH SANDBOXING AND THREAT ANALYSIS SERVICE TO DRIVE MARKET GROWTH

- 7.5 OTHER SOLUTION TYPES

8 PHISHING PROTECTION MARKET, BY SUBTYPE

- 8.1 INTRODUCTION

- FIGURE 31 EMAIL-BASED PHISHING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 8.1.1 SUBTYPE: PHISHING PROTECTION MARKET DRIVERS

- TABLE 30 PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 31 PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 8.2 EMAIL-BASED PHISHING

- 8.2.1 STRATEGIES SUCH AS ADVANCED EMAIL FILTERING SYSTEMS FOR EMAIL PHISHING RESILIENCE TO DRIVE MARKET GROWTH

- TABLE 32 EMAIL-BASED PHISHING: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 EMAIL-BASED PHISHING: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 NON-EMAIL-BASED PHISHING

- 8.3.1 COMPREHENSIVE DEFENSE AGAINST NON-EMAIL-BASED PHISHING THREATS TO DRIVE MARKET GROWTH

- TABLE 34 NON-EMAIL-BASED PHISHING: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 NON-EMAIL-BASED PHISHING: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- FIGURE 32 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 9.1.1 ORGANIZATION SIZE: PHISHING PROTECTION MARKET DRIVERS

- TABLE 36 PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 37 PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 9.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 9.2.1 SMES TO NAVIGATE PHISHING RISKS THROUGH COST-EFFECTIVE SOLUTIONS

- TABLE 38 SMES: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 SMES: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 LARGE ENTERPRISES

- 9.3.1 LARGE ENTERPRISES TO INVEST IN COMPREHENSIVE DEFENSE AGAINST PHISHING ATTACKS

- TABLE 40 LARGE ENTERPRISES: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 LARGE ENTERPRISES: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

10 PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE

- 10.1 INTRODUCTION

- FIGURE 33 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 10.1.1 DEPLOYMENT MODE: PHISHING PROTECTION MARKET DRIVERS

- TABLE 42 PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 43 PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 10.2 CLOUD

- 10.2.1 ENHANCED SECURITY AGAINST PHISHING ATTACKS WITH CLOUD SOLUTIONS TO DRIVE MARKET GROWTH

- TABLE 44 CLOUD: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 CLOUD: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 ON-PREMISES

- 10.3.1 SIGNIFICANT LEVEL OF CONTROL OVER SECURITY CONFIGURATIONS AND SENSITIVE DATA WITH ON-PREMISES DEPLOYMENT TO CONTRIBUTE TO MARKET GROWTH

- TABLE 46 ON-PREMISES: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 ON-PREMISES: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

11 PHISHING PROTECTION MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 34 RETAIL & E-COMMERCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 11.1.1 VERTICAL: PHISHING PROTECTION MARKET DRIVERS

- TABLE 48 PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 49 PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 BFSI

- 11.2.1 CRITICAL NEED TO SECURE FINANCIAL TRANSACTIONS AND ENSURE COMPLIANCE WITH STRINGENT REGULATORY STANDARDS TO DRIVE MARKET GROWTH

- TABLE 50 BFSI: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 BFSI: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 IT & ITES

- 11.3.1 SIGNIFICANCE OF ADVANCED PHISHING PROTECTION SOLUTIONS IN IT & ITES TO AUGMENT DEMAND

- TABLE 52 IT & ITES: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 IT & ITES: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 GOVERNMENT

- 11.4.1 GOVERNMENTS' VIGILANCE AGAINST RISING PHISHING ATTACKS TO CONTRIBUTE TO MARKET GROWTH

- TABLE 54 GOVERNMENT: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 GOVERNMENT: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 HEALTHCARE

- 11.5.1 PHISHING PROTECTION SOLUTIONS TO HELP SECURE PATIENT DATA

- TABLE 56 HEALTHCARE: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 HEALTHCARE: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 RETAIL & E-COMMERCE

- 11.6.1 PHISHING PROTECTION TO HELP ENHANCE CUSTOMER TRUST WITH PROTECTION OF DIGITAL DATA

- TABLE 58 RETAIL & E-COMMERCE: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 RETAIL & E-COMMERCE: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.7 MEDIA & ENTERTAINMENT

- 11.7.1 ROBUST PHISHING SOLUTIONS TO SAFEGUARD INTELLECTUAL PROPERTY, CONTENT ASSETS, AND USER CREDENTIALS

- TABLE 60 MEDIA & ENTERTAINMENT: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 MEDIA & ENTERTAINMENT: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8 OTHER VERTICALS

- TABLE 62 OTHER VERTICALS: PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 OTHER VERTICALS: PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

12 PHISHING PROTECTION MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 35 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 64 PHISHING PROTECTION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 PHISHING PROTECTION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT

- 12.2.2 NORTH AMERICA: PHISHING PROTECTION MARKET DRIVERS

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 66 NORTH AMERICA: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: PHISHING PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: PHISHING PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Regulatory mandates and rising phishing attacks to propel adoption of phishing protection solutions in US

- TABLE 82 US: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 83 US: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 84 US: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 85 US: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 86 US: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 87 US: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 88 US: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 89 US: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 90 US: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 91 US: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 92 US: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 93 US: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 94 US: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 95 US: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.4 CANADA

- 12.2.4.1 Rising government initiatives to drive Canadian phishing protection market

- TABLE 96 CANADA: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 97 CANADA: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 98 CANADA: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 99 CANADA: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 100 CANADA: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 101 CANADA: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 102 CANADA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 103 CANADA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 104 CANADA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 105 CANADA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 106 CANADA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 107 CANADA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 108 CANADA: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 109 CANADA: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT

- 12.3.2 EUROPE: PHISHING PROTECTION MARKET DRIVERS

- TABLE 110 EUROPE: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 111 EUROPE: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 112 EUROPE: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 113 EUROPE: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 114 EUROPE: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 115 EUROPE: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 116 EUROPE: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 117 EUROPE: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 118 EUROPE: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 119 EUROPE: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 120 EUROPE: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 121 EUROPE: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 123 EUROPE: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 124 EUROPE: PHISHING PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 125 EUROPE: PHISHING PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Growing awareness about phishing threats in UK to drive market growth

- TABLE 126 UK: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 127 UK: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 128 UK: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 129 UK: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 130 UK: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 131 UK: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 132 UK: PHISHING PROTECTION MARKET, BY SOLUTION TYPE, 2018-2022 (USD MILLION)

- TABLE 133 UK: PHISHING PROTECTION MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 134 UK: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 135 UK: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 136 UK: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 137 UK: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 138 UK: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 139 UK: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 140 UK: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 141 UK: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Government initiatives to promote awareness and education regarding phishing in Germany

- TABLE 142 GERMANY: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 143 GERMANY: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 144 GERMANY: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 145 GERMANY: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 146 GERMANY: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 147 GERMANY: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 148 GERMANY: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 149 GERMANY: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 150 GERMANY: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 151 GERMANY: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 152 GERMANY: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 153 GERMANY: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 154 GERMANY: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 155 GERMANY: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.5 FRANCE

- 12.3.5.1 Rising phishing awareness campaigns in France to propel market growth

- TABLE 156 FRANCE: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 157 FRANCE: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 158 FRANCE: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 159 FRANCE: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 160 FRANCE: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 161 FRANCE: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 162 FRANCE: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 163 FRANCE: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 164 FRANCE: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 165 FRANCE: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 166 FRANCE: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 167 FRANCE: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 168 FRANCE: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 169 FRANCE: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Rising awareness and government initiatives regarding phishing protection in Italy to drive market growth

- TABLE 170 ITALY: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 171 ITALY: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 172 ITALY: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 173 ITALY: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 174 ITALY: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 175 ITALY: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 176 ITALY: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 177 ITALY: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 178 ITALY: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 179 ITALY: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 180 ITALY: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 181 ITALY: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 182 ITALY: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 183 ITALY: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT

- 12.4.2 ASIA PACIFIC: PHISHING PROTECTION MARKET DRIVERS

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 184 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 191 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 194 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 195 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 196 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 197 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 198 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 199 ASIA PACIFIC: PHISHING PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 China's rapid transformation in cybersecurity to drive phishing protection market

- TABLE 200 CHINA: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 201 CHINA: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 202 CHINA: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 203 CHINA: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 204 CHINA: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 205 CHINA: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 206 CHINA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 207 CHINA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 208 CHINA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 209 CHINA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 210 CHINA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 211 CHINA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 212 CHINA: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 213 CHINA: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Strict regulatory measures by Japanese government regarding cybersecurity to fuel market growth

- TABLE 214 JAPAN: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 215 JAPAN: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 216 JAPAN: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 217 JAPAN: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 218 JAPAN: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 219 JAPAN: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 220 JAPAN: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 221 JAPAN: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 222 JAPAN: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 223 JAPAN: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 224 JAPAN: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 225 JAPAN: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 226 JAPAN: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 227 JAPAN: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.5 INDIA

- 12.4.5.1 Government initiatives concerning phishing protection in India to augment market growth

- TABLE 228 INDIA: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 229 INDIA: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 230 INDIA: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 231 INDIA: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 232 INDIA: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 233 INDIA: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 234 INDIA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 235 INDIA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 236 INDIA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 237 INDIA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 238 INDIA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 239 INDIA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 240 INDIA: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 241 INDIA: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.6 SINGAPORE

- 12.4.6.1 Navigating phishing protection in tech-savvy landscape in Singapore to drive market growth

- TABLE 242 SINGAPORE: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 243 SINGAPORE: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 244 SINGAPORE: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 245 SINGAPORE: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 246 SINGAPORE: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 247 SINGAPORE: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 248 SINGAPORE: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 249 SINGAPORE: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 250 SINGAPORE: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 251 SINGAPORE: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 252 SINGAPORE: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 253 SINGAPORE: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 254 SINGAPORE: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 255 SINGAPORE: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 12.5.2 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET DRIVERS

- TABLE 256 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: PHISHING PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.5.3 GCC COUNTRIES

- 12.5.3.1 Technological advancements and government initiatives for cybersecurity in region to drive market growth

- 12.5.3.2 KSA

- TABLE 272 KSA: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 273 KSA: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 274 KSA: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 275 KSA: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 276 KSA: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 277 KSA: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 278 KSA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 279 KSA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 280 KSA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 281 KSA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 282 KSA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 283 KSA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 284 KSA: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 285 KSA: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.5.3.3 UAE

- TABLE 286 UAE: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 287 UAE: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 288 UAE: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 289 UAE: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 290 UAE: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 291 UAE: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 292 UAE: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 293 UAE: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 294 UAE: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 295 UAE: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 296 UAE: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 297 UAE: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 298 UAE: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 299 UAE: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.5.3.4 Rest of GCC Countries

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Adoption of cybersecurity measures by financial institutions in South Africa to drive market growth

- TABLE 300 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 301 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 302 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 303 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 304 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 305 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 306 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 307 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 308 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 309 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 310 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 311 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 312 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 313 SOUTH AFRICA: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: RECESSION IMPACT

- 12.6.2 LATIN AMERICA: PHISHING PROTECTION MARKET DRIVERS

- TABLE 314 LATIN AMERICA: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 315 LATIN AMERICA: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 316 LATIN AMERICA: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 317 LATIN AMERICA: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 318 LATIN AMERICA: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 319 LATIN AMERICA: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 320 LATIN AMERICA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 321 LATIN AMERICA: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 322 LATIN AMERICA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 323 LATIN AMERICA: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 324 LATIN AMERICA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 325 LATIN AMERICA: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 326 LATIN AMERICA: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 327 LATIN AMERICA: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 328 LATIN AMERICA: PHISHING PROTECTION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 329 LATIN AMERICA: PHISHING PROTECTION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.6.3 BRAZIL

- 12.6.3.1 Strict data protection regulations in Brazil to promote adoption of phishing protection solutions

- TABLE 330 BRAZIL: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 331 BRAZIL: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 332 BRAZIL: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 333 BRAZIL: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 334 BRAZIL: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 335 BRAZIL: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 336 BRAZIL: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 337 BRAZIL: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 338 BRAZIL: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 339 BRAZIL: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 340 BRAZIL: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 341 BRAZIL: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 342 BRAZIL: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 343 BRAZIL: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.6.4 MEXICO

- 12.6.4.1 Adoption of phishing protection in nascent stage in Mexico

- TABLE 344 MEXICO: PHISHING PROTECTION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 345 MEXICO: PHISHING PROTECTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 346 MEXICO: PHISHING PROTECTION MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 347 MEXICO: PHISHING PROTECTION MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 348 MEXICO: PHISHING PROTECTION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 349 MEXICO: PHISHING PROTECTION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 350 MEXICO: PHISHING PROTECTION MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 351 MEXICO: PHISHING PROTECTION MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- TABLE 352 MEXICO: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 353 MEXICO: PHISHING PROTECTION MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 354 MEXICO: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 355 MEXICO: PHISHING PROTECTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 356 MEXICO: PHISHING PROTECTION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 357 MEXICO: PHISHING PROTECTION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 358 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PHISHING PROTECTION MARKET

- 13.3 REVENUE ANALYSIS

- FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

- 13.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 39 PHISHING PROTECTION MARKET: MARKET SHARE ANALYSIS

- TABLE 359 PHISHING PROTECTION MARKET: DEGREE OF COMPETITION

- 13.5 COMPANY EVALUATION MATRIX

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 40 GLOBAL PHISHING PROTECTION MARKET: COMPANY EVALUATION MATRIX, 2023

- 13.5.5 COMPANY FOOTPRINT

- TABLE 360 SOLUTION FOOTPRINT

- TABLE 361 VERTICAL FOOTPRINT

- TABLE 362 REGIONAL FOOTPRINT

- TABLE 363 COMPANY FOOTPRINT

- 13.6 STARTUP/SME EVALUATION MATRIX

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 41 GLOBAL PHISHING PROTECTION MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 364 PHISHING PROTECTION MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 365 PHISHING PROTECTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.7 COMPETITIVE SCENARIO

- 13.7.1 PRODUCT LAUNCHES

- TABLE 366 PHISHING PROTECTION MARKET: PRODUCT LAUNCHES, JULY 2021-SEPTEMBER 2023

- 13.7.2 DEALS

- TABLE 367 PHISHING PROTECTION MARKET: DEALS, MAY 2021-JANUARY 2024

- 13.8 PHISHING PROTECTION PRODUCT BENCHMARKING

- 13.8.1 PROMINENT PHISHING PROTECTION PROVIDERS

- TABLE 368 COMPARATIVE ANALYSIS OF PROMINENT PHISHING PROTECTION PROVIDERS

- 13.8.1.1 Microsoft defender 365

- 13.8.1.2 OpenText security suite

- 13.8.1.3 Twilio sendgrid email security

- 13.8.1.4 Trend micro cloud one email security

- 13.8.1.5 Proofpoint ETAP

- 13.9 VALUATION AND FINANCIAL METRICS OF KEY PHISHING PROTECTION VENDORS

- FIGURE 42 VALUATION AND FINANCIAL METRICS OF KEY PHISHING PROTECTION VENDORS

14 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 MAJOR PLAYERS

- 14.1.1 MICROSOFT

- TABLE 369 MICROSOFT: COMPANY OVERVIEW

- FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

- TABLE 370 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 371 MICROSOFT: DEALS

- 14.1.2 OPENTEXT

- TABLE 372 OPENTEXT: BUSINESS OVERVIEW

- FIGURE 44 OPENTEXT: COMPANY SNAPSHOT

- TABLE 373 OPENTEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 OPENTEXT: DEALS

- 14.1.3 TWILIO

- TABLE 375 TWILIO: BUSINESS OVERVIEW

- FIGURE 45 TWILIO: COMPANY SNAPSHOT

- TABLE 376 TWILIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 377 TWILIO: PRODUCT LAUNCHES

- TABLE 378 TWILIO: DEALS

- 14.1.4 TREND MICRO

- TABLE 379 TREND MICRO: BUSINESS OVERVIEW

- FIGURE 46 TREND MICRO: COMPANY SNAPSHOT

- TABLE 380 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 381 TREND MICRO: PRODUCT LAUNCHES

- TABLE 382 TREND MICRO: DEALS

- 14.1.5 PROOFPOINT

- TABLE 383 PROOFPOINT: BUSINESS OVERVIEW

- TABLE 384 PROOFPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 PROOFPOINT: PRODUCT LAUNCHES

- TABLE 386 PROOFPOINT: DEALS

- 14.1.6 MIMECAST

- TABLE 387 MIMECAST: BUSINESS OVERVIEW

- TABLE 388 MIMECAST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 MIMECAST: PRODUCT LAUNCHES

- TABLE 390 MIMECAST: DEALS

- 14.1.7 BARRACUDA

- TABLE 391 BARRACUDA: BUSINESS OVERVIEW

- TABLE 392 BARRACUDA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 393 BARRACUDA: PRODUCT LAUNCHES

- TABLE 394 BARRACUDA: DEALS

- 14.1.8 TRUSTWAVE

- TABLE 395 TRUSTWAVE: BUSINESS OVERVIEW

- TABLE 396 TRUSTWAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 397 TRUSTWAVE: PRODUCT LAUNCHES

- TABLE 398 TRUSTWAVE: DEALS

- 14.1.9 COFENSE

- TABLE 399 COFENSE: BUSINESS OVERVIEW

- TABLE 400 COFENSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 401 COFENSE: PRODUCT LAUNCHES

- 14.1.10 SOPHOS

- TABLE 402 SOPHOS: BUSINESS OVERVIEW

- TABLE 403 SOPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 404 SOPHOS: PRODUCT LAUNCHES

- 14.1.11 IRONSCALES

- 14.1.12 VIRTRU

- 14.1.13 PAUBOX

- 14.1.14 DUOCIRCLE

- 14.1.15 TRUSTIFI

- TABLE 405 TRUSTIFI: BUSINESS OVERVIEW

- TABLE 406 TUSTIFI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 407 TRUSTIFI: DEALS

- 14.2 STARTUPS/SMES

- 14.2.1 ABNORMAL SECURITY

- 14.2.2 SPYCLOUD

- 14.2.3 ZEROFOX

- 14.2.4 INKY

- 14.2.5 DEEPWATCH

- 14.2.6 GUARDZ

- 14.2.7 REDSIFT

- 14.2.8 VADE

- 14.2.9 GREATHORN

- 14.2.10 AGARI

- 14.2.11 VALIMAIL

- 14.2.12 APPGUARD

- 14.2.13 IMMUNIWEB

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 ADJACENT MARKETS

- 15.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 408 ADJACENT MARKETS AND FORECASTS

- 15.1.1 LIMITATIONS

- 15.2 EMAIL ENCRYPTION MARKET

- TABLE 409 EMAIL ENCRYPTION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 410 EMAIL ENCRYPTION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 411 EMAIL ENCRYPTION MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 412 EMAIL ENCRYPTION MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 15.3 SECURITY AUTOMATION MARKET

- TABLE 413 SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 414 SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 415 SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2017-2022 (USD MILLION)

- TABLE 416 SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2023-2028 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS