|

|

市場調査レポート

商品コード

1869550

セキュリティソリューションの世界市場:システム別、サービス別、業界別、地域別 - 2030年までの予測Security Solutions Market by System (Fire Protection, Video Surveillance, Multi-technology Reader, Biometric Reader, Electronic Lock, Entrance Control, Intruder Alarm, Thermal Imaging), Service (Remote Monitoring, VSaaS, ACaaS) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| セキュリティソリューションの世界市場:システム別、サービス別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年10月16日

発行: MarketsandMarkets

ページ情報: 英文 286 Pages

納期: 即納可能

|

概要

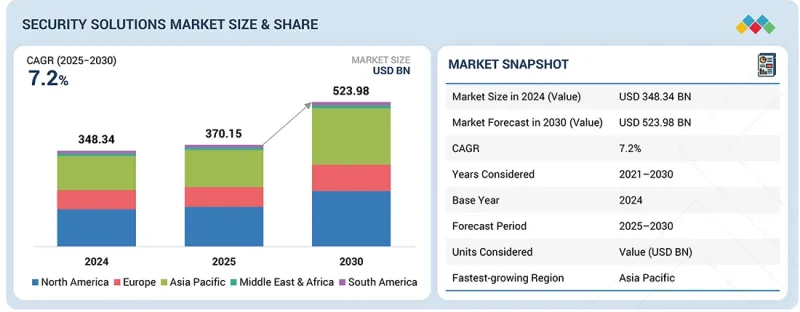

世界のセキュリティソリューションの市場規模は、2025年の3,701億5,000万米ドルから2030年までに5,239億8,000万米ドルへ、CAGR7.2%で成長すると予測されています。

AIを活用した監視システムや生体認証アクセス制御の急速な普及が、セキュリティシステムの精度・効率・信頼性を大幅に向上させることで成長を牽引しています。AIはリアルタイム映像解析、顔認識、行動検知を可能にし、脅威の迅速な特定と対応を実現すると同時に誤警報を低減します。指紋・虹彩・顔スキャンを用いた生体認証アクセス制御は、偽造や回避が困難な高セキュリティかつ利便性の高い認証方法を提供します。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 金額(10億米ドル) |

| セグメント | システム別、サービス別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他地域 |

これらの技術は相まって、商業施設と住宅の両方で高まる高度な保護ニーズに応える、よりスマートで自動化されたセキュリティソリューションを提供し、広範な導入を促進するとともに市場全体を拡大しています。

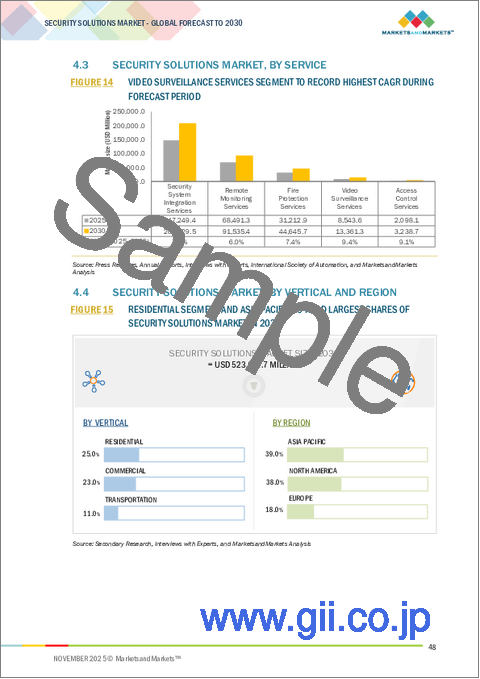

ビデオ監視サービスは、様々な分野において継続的なリアルタイム監視と強化されたセキュリティを提供できることから、最も急速に成長しています。クラウドベースのプラットフォームは、リモートアクセス、容易な拡張性、初期費用の低減を可能にし、企業と一般家庭の双方がこれらのサービスを利用できるようにしています。AI駆動型分析、顔認識、自動アラートなどの先進技術は、脅威検出の精度を向上させ、誤報を減らすことで、より迅速な対応を実現します。規制要件の強化や捜査における信頼性の高い証拠の必要性も、これらのサービスの需要を後押ししています。さらに、サブスクリプション型や管理型ビデオ監視モデルの台頭は、最小限の初期投資で済む費用対効果の高いソリューションを提供し、あらゆる規模の組織に魅力的です。安全性と資産保護への懸念が高まる中、ビデオ監視サービスは柔軟で効率的、かつ拡張性のある資産監視・保護手段を提供し、セキュリティ市場における急速な成長に寄与しています。

従業員、機密データ、貴重な資産の保護に対する懸念の高まりにより、商業セグメントはセキュリティソリューションにおいて最も急速な成長を遂げています。オフィスでは、不正アクセスを防止し安全な職場環境を維持するため、アクセス制御、映像監視、侵入検知などの高度なセキュリティ対策が求められます。規制要件や業界コンプライアンス基準の強化も、企業が包括的なセキュリティシステムへの投資を迫る要因となっています。スマートビルの普及とIoT統合により、遠隔監視が可能な効率的で自動化されたセキュリティソリューションの導入が進み、複数拠点での運用を支えています。さらに、小売、医療、金融、物流などオフィス空間が重要なセクターの成長が、拡張性とカスタマイズ性を備えたセキュリティ技術の需要を牽引しています。組織がリスク管理と事業継続性を優先する中、商業セグメントでは革新的で統合されたセキュリティソリューションの採用が継続し、セキュリティ市場全体における急速な拡大を促進しています。

米国は、先進的な技術インフラ、高いセキュリティ意識、および様々な分野における多額の投資により、北米セキュリティソリューション市場を独占しています。同国には、アクセス制御、映像監視、統合セキュリティシステムにおけるイノベーションを推進する多くの主要セキュリティ企業が拠点を置いています。金融、医療、政府などの業界における厳格な規制枠組みとコンプライアンス要件も、組織が堅牢なセキュリティ対策を導入する要因となっています。さらに、都市化の進展、大規模な商業用不動産セクター、職場や住宅の安全に対する関心の高まりが、需要の堅調な伸びに寄与しています。米国市場では、AI、クラウドベースのソリューション、生体認証などの新興技術を早期に導入しており、これが同地域のセキュリティソリューション市場における主導的立場をさらに強化しています。

当レポートでは、世界のセキュリティソリューション市場について調査し、システム別、サービス別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 購買プロセスにおける主要な利害関係者

- 購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2025年~2027年の主な会議とイベント

- 関税分析

- 基準と規制状況

- AI/生成AIがセキュリティソリューション市場に与える影響

- 2025年の米国関税がセキュリティソリューション市場に与える影響

第6章 物理的セキュリティの未来

- イントロダクション

- 次世代セキュリティにおけるAI、ドローン、ロボットの役割

- スマートシティの出現

- 物理セキュリティとサイバーセキュリティの融合

- 脅威防止のための予測分析の動向

第7章 セキュリティソリューション市場(システム別)

- イントロダクション

- 防火システム

- ビデオ監視システム

- アクセス制御システム

- 入場制御システム

- 侵入者警報システム

- 熱画像システム

第8章 セキュリティソリューション市場(サービス別)

- イントロダクション

- 防火サービス

- ビデオ監視サービス

- アクセス制御サービス

- セキュリティシステム統合サービス

- リモートモニタリングサービス

第9章 セキュリティソリューション市場(業界別)

- イントロダクション

- 住宅

- 商業

- 政府

- 輸送

- 小売

- 銀行・金融

- 教育

- 工業用

- エネルギー・公益事業

- スポーツとレジャー

- 健康管理

- 軍事・防衛

第10章 セキュリティソリューション市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- 南米

- アフリカ

- 南アフリカ

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- JOHNSON CONTROLS

- HONEYWELL INTERNATIONAL INC.

- ROBERT BOSCH GMBH

- ADT SECURITY SERVICES

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

- AXIS COMMUNICATIONS AB

- DAHUA TECHNOLOGY CO., LTD

- SECOM CO., LTD

- SIEMENS

- ASSA ABLOY

- KEENFINITY

- その他の企業

- HALMA PLC

- HOCHIKI CORPORATION

- DORMAKABA GROUP

- TELEDYNE FLIR LLC

- ALLEGION PLC

- NICE S.P.A.

- GODREJ GROUP

- ALARM.COM

- MOTOROLA SOLUTIONS, INC.

- DALLMEIER ELECTRONIC GMBH & CO KG

- SECURITAS TECHNOLOGY

- GUNNEBO AB

- BRIVO SYSTEMS, LLC

- BRINKS HOME

- VERKADA INC.