|

|

市場調査レポート

商品コード

1415814

SOI(Silicon on Insulator)およびその他の基板市場:基板タイプ別(半絶縁性SiC基板、導電性SiC基板)、ウエハサイズ別(100mm、150mm、200mm)、用途別(パワーデバイス、RFデバイス)、地域別 - 2029年までの予測SiC-On-Insulator and Other Substrates Market by Substrate Type (Semi-insulating SiC Substrates, Conductive SiC Substrates), Wafer Size (100mm, 150mm and 200mm), Application (Power Devices, RF Devices) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| SOI(Silicon on Insulator)およびその他の基板市場:基板タイプ別(半絶縁性SiC基板、導電性SiC基板)、ウエハサイズ別(100mm、150mm、200mm)、用途別(パワーデバイス、RFデバイス)、地域別 - 2029年までの予測 |

|

出版日: 2024年01月16日

発行: MarketsandMarkets

ページ情報: 英文 135 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 基板タイプ別、ウエハサイズ別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

SOI(Silicon on Insulator)およびその他の基板の市場規模は、2024年の9,900万米ドルから2029年には1億4,900万米ドルに達すると予測され、2024年から2029年までのCAGRは8.5%になるとみられています。

同市場の成長を促進する主な要因には、5G技術におけるSiC基板の展開の増加、電気自動車におけるSiC基板の採用加速などがあります。さらに、SOI基板のバイオメディカル機器への導入が増加しており、市場の参入企業にいくつかの成長の機会を提供すると期待されています。

パワーデバイスは、予測期間中、SOI(Silicon on Insulator)およびその他の基板市場で最大の市場シェアを占めると予想されます。

SiCの優れた熱伝導率はSiの3倍以上であり、同じ温度上昇であれば小さなダイを使用できます。そのため、パワーデバイスへのSiCオンインシュレータ基板の採用が増加しているのは、より高い電力密度、過酷な環境に対する耐性、電力損失の低減、効率の向上、優れた熱伝導率が得られるためです。その結果、SiC-on-Insulatorはパワーデバイス用途に非常に好まれており、パワーデバイスが最大の市場シェアを占めると予想されています。

当レポートでは、世界のSOI(Silicon on Insulator)およびその他の基板市場について調査し、基板タイプ別、ウエハサイズ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 生態系/市場マップ

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 特許分析

- ポーターのファイブフォース分析

- 基準と規制状況

- 2024年~2025年の主要な会議とイベント

第6章 SOI(Silicon on Insulator)およびその他の基板材料

- イントロダクション

- SI

- SIO2

- その他

第7章 SOI(Silicon on Insulator)およびその他の基板市場、ウエハサイズ別

- イントロダクション

- 100mm

- 150mm

- 200mm

第8章 SOI(Silicon on Insulator)およびその他の基板市場、基板タイプ別

- イントロダクション

- 半絶縁性SIC基板

- 導電性SIC基板

第9章 SOI(Silicon on Insulator)およびその他の基板市場、用途別

- イントロダクション

- パワーデバイス

- RFデバイス

- その他

第10章 SOI(Silicon on Insulator)およびその他の基板市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- イントロダクション

- 主要企業が採用した戦略、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス、2023年

- 競合シナリオと動向

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- WOLFSPEED, INC.

- SICC CO., LTD.

- SOITEC

- COHERENT CORP.

- GLOBALWAFERS

- XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.

- CERAMICFORUM CO., LTD.

- HOMRAY MATERIAL TECHNOLOGY

- SHANGHAI ZHONGYINGRONG INNOVATIVE MATERIAL TECHNOLOGY CO., LTD

- PRECISION MICRO-OPTICS INC.

- SICRYSTAL GMBH

- SYNLIGHT

- TANKEBLUE CO,. LTD.

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Substrate Type, Wafer Size, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

The SiC-on-insulator and other substrates market is projected to reach USD 149 million by 2029 from USD 99 million in 2024, at a CAGR of 8.5% from 2024 to 2029. The major factors driving the market growth of the SiC-on-insulator and other substrates include the increasing deployment of SiC substrates in 5G technology and the accelerating adoption of SiC substrates in electric vehicles. Moreover, the growing implementation of SiC-on-insulator substrates in biomedical devices is expected to provide several growth opportunities for market players in the SiC-on-insulator and other substrates market.

Power devices are expected to account for the largest market share in the SiC-on-insulator and other substrates market during the forecast period.

The superior thermal conductivity of SiC, is more than three times better than Si, which allows the use of a small die for the same temperature rise. Therefore, the growing implementation of SiC-on-Insulator substrates in power devices is attributed to gaining higher power density, tolerance for harsh environments, reduced power losses, enhanced efficiency, and superior thermal conductivity. As a result, SiC-on-insulator is highly preferred for power device applications due to which power devices are expected to account for the largest market share in the SiC-on-insulator and other substrates.

Conductive SiC substrates are expected to account for the largest market size in the SiC-on-insulator and other substrates market during the forecast period.

In comparison to traditional silicon devices, power devices based on conductive SiC substrates offer several advantages such as faster switching speeds, higher voltages, lower parasitic resistances, compact sizes, and reduced cooling requirements. The capability of these devices to withstand high temperatures positions them as robust solutions for applications where traditional silicon counterparts may face limitations. Therefore, conductive SiC substrates are expected to account for the largest market size in the SiC-on-insulator and other substrates market.

Asia Pacific is expected to account for the highest CAGR during the forecast period.

The growing number of developments related to SiC-on-insulator and other substrates, surging demand for electric vehicles, the growing number of initiatives and schemes, the presence of key players and the availability of cost-efficiency resources fuel the market growth of SiC-on-insulator and other substrates. Therefore, the market growth of SiC-on-insulator and other substrates in Asia Pacific is expected to account for the highest CAGR during the forecast period.

The break-up of profile of primary participants in the SiC-on-insulator and other substrates market-

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, Tier 3 - 20%

- By Designation Type: C Level - 25%, Director Level - 35%, Others - 40%

- By Region Type: North America - 30%, Europe - 25%, Asia Pacific - 35%, Rest of the World (RoW) - 10%

The major players of the SiC-on-insulator and other substrates market are Wolfspeed, Inc. (US), SICC Co., Ltd. (China), SOITEC (France), Coherent Corp. (US), GlobalWafers Co., Ltd. (Taiwan)

Research Coverage

The report segments the SiC-on-insulator and other substrates market and forecasts its size based on substrate type, application, and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall SiC-on-insulator and other substrates market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing deployment of SiC substrates in 5G technology and accelerating adoption of SiC substrates in electric vehicles), restraints (High costs of SiC substrates), opportunities (Growing implementation of SiC-on-insulator substrates in biomedical devices and growing attention towards SiC-on-insulator substrates in photonics industry), and challenges (Process complexities related to SiC-on-insulator and other substrates) influencing the growth of the SiC-on-insulator and other substrates market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the SiC-on-insulator and other substrates market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the SiC-on-insulator and other substrates market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the SiC-on-insulator and other substrates market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Wolfspeed, Inc. (US), SICC Co., Ltd. (China), SOITEC (France), Coherent Corp. (US), GlobalWafers Co. Ltd. (Taiwan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.3.1 By company

- 1.3.3.2 By substrate type

- 1.3.3.3 By application

- 1.3.3.4 By region

- 1.3.4 YEARS CONSIDERED

- 1.3.5 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.2.5 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- FIGURE 3 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- FIGURE 4 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 1)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 2)

- 2.3.2 GROWTH FORECAST ASSUMPTIONS

- TABLE 1 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET GROWTH ASSUMPTIONS

- 2.4 RECESSION IMPACT

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- TABLE 2 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- TABLE 3 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET SIZE, 2020-2029

- FIGURE 9 CONDUCTIVE SIC SUBSTRATES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 10 POWER DEVICES APPLICATION TO DOMINATE SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC HELD LARGEST SHARE OF SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET

- FIGURE 12 BURGEONING DEMAND FOR ELECTRIC VEHICLES TO FOSTER SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET GROWTH

- 4.2 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY APPLICATION

- FIGURE 13 POWER DEVICES APPLICATION TO ACCOUNT FOR LARGEST SHARE OF SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET IN 2029

- 4.3 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY SUBSTRATE TYPE

- FIGURE 14 CONDUCTIVE SIC SUBSTRATES TO HOLD LARGER MARKET SHARE IN 2029

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Mounting demand for power and thermal management devices

- 5.2.1.2 Increasing use of SiC substrates to boost performance efficiency of telecom devices

- 5.2.1.3 Rising preference for sustainable mobility solutions

- FIGURE 16 SALES OF ELECTRIC VEHICLES IN US, 2019-2021

- FIGURE 17 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: DRIVERS AND THEIR IMPACT

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production costs

- FIGURE 18 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: RESTRAINTS AND THEIR IMPACT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for SiC substrates in photonics industry

- 5.2.3.2 Increasing R&D of SiC-on-insulator substrates for biomedical devices

- FIGURE 19 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: OPPORTUNITIES AND THEIR IMPACT

- 5.2.4 CHALLENGES

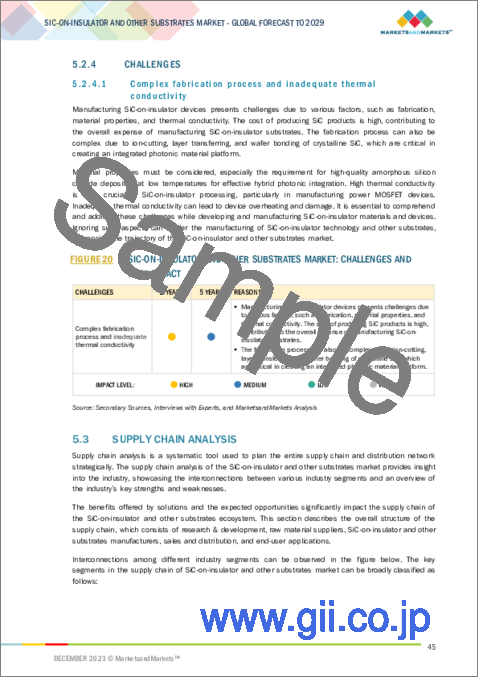

- 5.2.4.1 Complex fabrication process and inadequate thermal conductivity

- FIGURE 20 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: CHALLENGES AND THEIR IMPACT

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 21 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM/MARKET MAP

- FIGURE 22 SIC-ON-INSULATOR AND OTHER SUBSTRATES ECOSYSTEM

- TABLE 4 COMPANIES AND THEIR ROLES IN SIC-ON-INSULATOR AND OTHER SUBSTRATES ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 ADVANCED SIC-ON-INSULATOR AND SIC-BASED PLATFORMS

- 5.6.2 AMORPHOUS SIC SUBSTRATES

- 5.7 PATENT ANALYSIS

- TABLE 5 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: PATENTS FILED BETWEEN JANUARY AND DECEMBER, 2023

- FIGURE 23 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: NUMBER OF PATENTS GRANTED, 2013-2023

- FIGURE 24 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013-2023

- TABLE 6 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: TOP 20 PATENT OWNERS, 2013-2023

- TABLE 7 KEY PATENTS RELATED TO SIC-ON-INSULATOR AND OTHER SUBSTRATES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 8 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 STANDARDS AND REGULATORY LANDSCAPE

- 5.9.1 STANDARDS

- 5.9.2 REGULATIONS

- 5.9.2.1 Asia Pacific

- 5.9.2.2 North America

- 5.9.2.3 Europe

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

6 SIC-ON-INSULATOR AND OTHER SUBSTRATE MATERIALS

- 6.1 INTRODUCTION

- 6.2 SI

- 6.3 SIO2

- 6.4 OTHER MATERIALS

7 SIC-ON-INSULATOR AND OTHER SUBSTRATE WAFER SIZES

- 7.1 INTRODUCTION

- 7.2 100 MM

- 7.3 150 MM

- 7.4 200 MM

8 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY SUBSTRATE TYPE

- 8.1 INTRODUCTION

- TABLE 10 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY SUBSTRATE TYPE, 2020-2023 (USD MILLION)

- TABLE 11 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY SUBSTRATE TYPE, 2024-2029 (USD MILLION)

- FIGURE 27 CONDUCTIVE SIC SUBSTRATES TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- 8.2 SEMI-INSULATING SIC SUBSTRATES

- 8.2.1 GROWING ADOPTION OF HIGH-PURITY SEMI-INSULATING SIC SUBSTRATES IN RF DEVICES TO DRIVE MARKET

- 8.3 CONDUCTIVE SIC SUBSTRATES

- 8.3.1 INCREASING DEVELOPMENT OF SIC POWER ELECTRONICS TO FUEL SEGMENTAL GROWTH

9 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 12 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 13 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- FIGURE 28 POWER DEVICES APPLICATION TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- 9.2 POWER DEVICES

- 9.2.1 USE OF CONDUCTIVE SIC-ON-INSULATOR SUBSTRATES IN ELECTRONIC DEVICES TO FOSTER SEGMENTAL GROWTH

- 9.3 RF DEVICES

- 9.3.1 WIDE BANDGAP AND LOW LEAKAGE CURRENT TO AUGMENT DEMAND

- 9.4 OTHER APPLICATIONS

10 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 14 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 15 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET, BY REGION, 2024-2029 (USD MILLION)

- FIGURE 29 ASIA PACIFIC TO DOMINATE SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET DURING FORECAST PERIOD

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- 10.2.2 US

- 10.2.3 CANADA

- 10.2.4 MEXICO

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- 10.3.2 GERMANY

- 10.3.3 UK

- 10.3.4 FRANCE

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.3 JAPAN

- 10.4.4 INDIA

- 10.4.5 SOUTH KOREA

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 RECESSION IMPACT ON MARKET IN ROW

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 GCC

- 10.5.2.2 Rest of Middle East & Africa

- 10.5.3 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2023

- TABLE 16 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2023

- FIGURE 30 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: ORGANIC AND INORGANIC STRATEGIES ADOPTED BY PLAYERS, 2019-2023

- 11.2.1 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.2.1.1 Product portfolio expansion

- 11.2.1.2 Geographic footprint expansion

- 11.2.1.3 Manufacturing footprint expansion

- 11.3 MARKET SHARE ANALYSIS, 2023

- TABLE 17 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: DEGREE OF COMPETITION

- 11.4 COMPANY EVALUATION MATRIX, 2023

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 31 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: COMPANY EVALUATION MATRIX, 2023

- 11.4.5 COMPANY FOOTPRINT

- TABLE 18 COMPANY OVERALL FOOTPRINT (12 KEY COMPANIES)

- TABLE 19 COMPANY SUBSTRATE TYPE FOOTPRINT (12 KEY COMPANIES)

- TABLE 20 COMPANY APPLICATION FOOTPRINT (12 KEY COMPANIES)

- TABLE 21 COMPANY REGION FOOTPRINT (12 KEY COMPANIES)

- 11.5 COMPETITIVE SCENARIOS AND TRENDS

- 11.5.1 PRODUCT LAUNCHES

- TABLE 22 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: PRODUCT LAUNCHES, 2019-2023

- 11.5.2 DEALS

- TABLE 23 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: DEALS, 2020-2023

- 11.5.3 OTHERS

- TABLE 24 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: OTHERS, 2021-2023

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 WOLFSPEED, INC.

- TABLE 25 WOLFSPEED, INC.: COMPANY OVERVIEW

- FIGURE 32 WOLFSPEED, INC.: COMPANY SNAPSHOT

- TABLE 26 WOLFSPEED, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 27 WOLFSPEED, INC.: DEALS

- TABLE 28 WOLFSPEED, INC.: OTHERS

- 12.2.2 SICC CO., LTD.

- TABLE 29 SICC CO., LTD.: COMPANY OVERVIEW

- TABLE 30 SICC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 31 SICC CO., LTD.: DEALS

- TABLE 32 SICC CO., LTD.: OTHERS

- 12.2.3 SOITEC

- TABLE 33 SOITEC: COMPANY OVERVIEW

- FIGURE 33 SOITEC: COMPANY SNAPSHOT

- TABLE 34 SOITEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 35 SOITEC: PRODUCT LAUNCHES

- TABLE 36 SOITEC: DEALS

- TABLE 37 SOITEC: OTHERS

- 12.2.4 COHERENT CORP.

- TABLE 38 COHERENT CORP.: COMPANY OVERVIEW

- FIGURE 34 COHERENT CORP.: COMPANY SNAPSHOT

- TABLE 39 COHERENT CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 40 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 41 COHERENT CORP.: DEALS

- TABLE 42 COHERENT CORP.: OTHERS

- 12.2.5 GLOBALWAFERS

- TABLE 43 GLOBALWAFERS: COMPANY OVERVIEW

- FIGURE 35 GLOBALWAFERS: COMPANY SNAPSHOT

- TABLE 44 GLOBALWAFERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 45 GLOBALWAFERS: DEALS

- 12.2.6 XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.

- TABLE 46 XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 47 XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 48 XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.: PRODUCT LAUNCHES

- 12.2.7 CERAMICFORUM CO., LTD.

- TABLE 49 CERAMICFORUM CO., LTD.: COMPANY OVERVIEW

- TABLE 50 CERAMICFORUM CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.8 HOMRAY MATERIAL TECHNOLOGY

- TABLE 51 HOMRAY MATERIAL TECHNOLOGY: COMPANY OVERVIEW

- TABLE 52 HOMRAY MATERIAL TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 53 HOMRAY MATERIAL TECHNOLOGY: PRODUCT LAUNCHES

- 12.2.9 SHANGHAI ZHONGYINGRONG INNOVATIVE MATERIAL TECHNOLOGY CO., LTD

- TABLE 54 SHANGHAI ZHONGYINGRONG INNOVATIVE MATERIAL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 55 SHANGHAI ZHONGYINGRONG INNOVATIVE MATERIAL TECHNOLOGY CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.10 PRECISION MICRO-OPTICS INC.

- TABLE 56 PRECISION MICRO-OPTICS INC.: COMPANY OVERVIEW

- TABLE 57 PRECISION MICRO-OPTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.11 SICRYSTAL GMBH

- TABLE 58 SICRYSTAL GMBH: COMPANY OVERVIEW

- TABLE 59 SICRYSTAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 60 SICRYSTAL GMBH: DEALS

- 12.2.12 SYNLIGHT

- TABLE 61 SYNLIGHT: COMPANY OVERVIEW

- TABLE 62 SYNLIGHT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.13 TANKEBLUE CO,. LTD.

- TABLE 63 TANKEBLUE CO,. LTD.: COMPANY OVERVIEW

- TABLE 64 TANKEBLUE CO,. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 65 TANKEBLUE CO,. LTD.: DEALS

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS