|

|

市場調査レポート

商品コード

1413703

CBRN防衛の世界市場 (~2028年):タイプ・エンドユーザー・機器 (防護ウェアラブル・呼吸システム・検知&監視システム・除染システム・シミュレータ・情報管理ソフトウェア)・地域別CBRN Defense Market by Type, End Use, Equipment (Protective Wearables, Respiratory Systems, Detection & Monitoring Systems, Decontamination Systems, Simulators, Information Management Software) & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| CBRN防衛の世界市場 (~2028年):タイプ・エンドユーザー・機器 (防護ウェアラブル・呼吸システム・検知&監視システム・除染システム・シミュレータ・情報管理ソフトウェア)・地域別 |

|

出版日: 2024年01月15日

発行: MarketsandMarkets

ページ情報: 英文 234 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | タイプ・エンドユーザー・機器・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東・その他の地域 |

CBRN防衛の市場規模は、2023年の161億米ドルから、予測期間中はCAGR 5.8%で推移し、2028年には214億米ドルの規模に成長すると予測されています。

政府、軍、ファーストレスポンダーは、化学、生物、放射線、核、高威力爆発物を含むCBRNの脅威に対する防衛戦略を採用しています。これらの戦略には、検知、識別、予防技術の使用が含まれます。地政学的緊張の高まりを受けて、CBRN防衛市場は大きな変貌を遂げています。特に供給サイドによる、仮想現実、拡張現実、IoTなどの最新技術の統合が顕著です。多様な産業におけるCBRN防衛機器に対する需要の大幅な急増が同市場の成長を推進すると予測されています。この成長の主な原動力は、世界の軍事支出の増加です。

タイプ別では、化学部門が2023年に最大のシェアを占めると推定されています。2023年9月に米国国防総省がSmiths Detectionの次世代AVCADなどの高度な化学検出システムを採用したことが、特に軍事用途で化学CBRN防衛能力を強化する促進要因となっています。

機器別では、防護ウェアラブルの部門が2023年に最大のシェアを占めると予測されています。CBRNの脅威から身を守る必要性が同部門の成長の主な要因であり、衣類、防毒マスク、脱出装置、靴、手袋などの防護ウェアラブルは、ファーストレスポンダー、危険物安全担当者、軍のCBRN対応チームにとって極めて重要であり、適切な防護ウェアラブルの決定は、汚染レベルや軍固有の任務指向防護姿勢 (MOPP) ガイドラインなどの要因によって導かれます。

エンドユーザー別では、防衛部門が予測期間中に最大のシェアを占めると推定されています。同部門の促進要因は、軍 (陸軍、海軍、空軍) と国土安全保障を包含する防衛・政府部門内のCBRN防衛能力に対する包括的なニーズであり、防護ウェアラブル、検出ツール、除染システムなどの不可欠な機器は、軍事ユーザーや、ファーストレスポンダー、警察、消防安全部門、危険物安全担当官を含む国土安全保障要員にとって不可欠です。

地域別では、アジア太平洋地域が予測期間中の市場をシェアでリードする見通しです。同地域でテロ攻撃が増加していることから、同地域の国々はCBRN防衛能力の強化を促しています。さらに、インドや中国などの国々における国防支出の増加と、新興経済圏における軍事司令部の拡大が、同地域におけるCBRN防衛に対する需要の高まりに拍車をかけています。

当レポートでは、世界のCBRN防衛の市場を調査し、市場概要、市場影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/ディスラプション

- バリューチェーン分析

- サプライチェーン分析

- 市場エコシステム

- 貿易分析

- CBRN防御ソリューションの平均販売価格

- 使用事例の分析

- ポーターのファイブフォース分析

- 関税と規制状況

- 主な会議とイベント

- 主なステークホルダーと購入基準

第6章 産業動向

- 技術動向

- 技術分析

- メガトレンドの影響

- イノベーションと特許登録

- 技術ロードマップ

第7章 CBRN防衛市場:タイプ別

- 化学

- 生物

- 放射線

- 核

- 爆発物

第8章 CBRN防衛市場:機器別

- 防護ウェアラブル

- 防護服

- 防護ガスマスク・フード

- 脱出装置/フード

- 保護靴

- 保護手袋

- 呼吸系

- 自給式呼吸装置 (SCBA)

- 電動空気清浄呼吸器 (PAPR)

- 検出・監視システム

- サーマルイメージャー

- センサー

- 固定・モバイル監視デバイス

- サンプリング装置

- スクリーニング検査キット

- 赤外分光分析

- ビーコン

- スタンドオフ検出器

- ガス検知器

- 生物学的脅威検出器

- 放射線脅威検出器

- 除染システム

- 汚染インジケーター除染保証システム

- スプレーユニット

- その他

- シミュレーター

- 情報管理ソフトウェア

第9章 CBRN防衛市場:エンドユーザー別

- 防衛・政府

- 軍

- 国土安全保障

- 民間・商業

- 重要インフラ

- 医療

- 産業

第10章 地域分析

- 地域的不況の影響分析

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

第11章 競合情勢

- 主要企業の戦略

- 主要企業の市場ランキング分析

- 主要企業の市場シェア

- トップ5社の収益分析

- 企業評価マトリックス

- 企業の製品フットプリント分析

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- RHEINMETALL DEFENCE

- THALES GROUP

- TELEDYNE FLIR LLC

- BRUKER CORPORATION

- SMITHS GROUP PLC

- CHEMRING GROUP PLC

- MSA SAFETY, INC.

- AVON PROTECTION PLC

- AIRBOSS DEFENSE GROUP INC.

- HDT GLOBAL

- LEIDOS

- INDRA

- QINETIQ

- SAAB AB

- KNDS N.V.

- その他の企業

- ENVIRONICS OY

- ARGON ELECTRONICS (UK) LTD.

- BLUCHER GMBH

- CRISTANINI SPA

- KARCHER FUTURETECH GMBH

- RAPISCAN SYSTEMS

- BIOQUELL

- ARKTIS RADIATION DETECTORS LTD

- BATTELLE MEMORIAL INSTITUTE

- BHARAT ELECTRONICS LIMITED

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, End Use, Equipment and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East, RoW |

CBRN Defense market is projected to grow from USD 16.1 billion in 2023 to USD 21.4 billion by 2028, at a CAGR of 5.8% during the forecast period. Governments, armed forces, and first responders employ defense strategies against CBRN threats, encompassing Chemical, Biological, Radiological, Nuclear, and high-yield explosives. These strategies involve the use of detection, identification, and prevention techniques. The CBRN defense market has undergone significant transformation in response to heightened geopolitical tensions. Notably, the supply side of the market has experienced the integration of modern technologies such as virtual reality, augmented reality, and the Internet of Things (IoT). Anticipated is exponential growth in this market, attributed to a substantial surge in demand for CBRN defense equipment across diverse industries. A major driving force behind this growth is the increased global military spending.

CBRN Defense market is dominated by a few globally established players such as Thales Group (France), Rheinmetall Defence (Germany), Smiths Group PLC (UK), Teledyne FLIR LLC (US), and Bruker Corporation (US), among others, are the key manufacturers that secured CBRN Defense contracts in the last few years. Significant attention has been directed toward contracts and the development of new products, driven by the rising demand for CBRN defense equipment. The growth of emerging markets has incentivized companies to embrace this strategy as a means of entering new markets.

Based on Type, chemical segment is estimated to witness the largest share of the CBRN Defense market in 2023.

Based on type, chemical segment of the CBRN Defense market is estimated to held the dominant market share in 2023. The adoption of advanced chemical detection systems, such as Smiths Detection's Next Generation AVCAD, by the US Department of Defense in September 2023, highlights the driving factor of enhancing chemical CBRN defense capabilities, especially in military applications.

Based on Equipment, protective wearables segment of the CBRN Defense market is projected to witness the largest share in 2023.

Based on equipment, protective wearables segment is projected to lead the CBRN Defense market during the forecast period. The driving factor for this segment lies in the necessity to safeguard against CBRN threats, with protective wearables, including clothing, gas masks, escape devices, shoes, and gloves, being crucial for first responders, hazmat safety officers, and military CBRN response teams, with the determination of the appropriate protective wearable guided by factors like contamination levels and military-specific Mission-Oriented Protective Posture (MOPP) guidelines.

Based on end use, defense segment is estimated to account for the largest share of the CBRN Defense market from 2023 to 2028.

Based on end use, defense segment is estimated to account for the largest share of the CBRN Defense during the forecast period. The defense segment includes military and homeland security. The driving factor for this segment is the comprehensive need for CBRN defense capabilities within the defense and government segment, encompassing the military (army, navy, and air force) and homeland security, where essential equipment such as protective wearables, detection tools, and decontamination systems are vital for military users and homeland security personnel, including first responders, police, fire safety departments, and hazmat safety officers.

The Asia Pacific market is projected to contribute the largest share from 2023 to 2028 in the CBRN Defense market

Based on region, Asia Pacific is expected to lead the CBRN Defense market from 2023 to 2028 in terms of market share. The rise in occurrences of terror attacks in the Asia Pacific region has prompted countries in the area to strengthen their CBRN defense capabilities. Furthermore, increased defense expenditures in nations such as India and China, coupled with the expansion of military commands in emerging economies, have spurred a heightened demand for CBRN Defense in the Asia Pacific region. The escalating need for CBRN defense solutions can be traced to countries' growing investments in the development and procurement of advanced CBRN defense measures, particularly for their armed forces, border protection, and biowarfare programs.

The break-up of the profile of primary participants in the CBRN Defense market:

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 45%, Middle East - 5%

Major companies profiled in the report include Thales Group (France), Rheinmetall Defence (Germany), Smiths Group PLC (UK), Teledyne FLIR LLC (US), and Bruker Corporation (US), among others.

Research Coverage:

This market study covers the CBRN Defense market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on type, equipment, end use, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall CBRN Defense market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on CBRN Defense offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the CBRN Defense market

- Market Development: Comprehensive information about lucrative markets - the report analyses the CBRN Defense market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the CBRN Defense market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the CBRN Defense market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 CBRN DEFENSE MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY & PRICING

- TABLE 1 USD EXCHANGE RATES

- 1.5 INCLUSIONS & EXCLUSIONS

- 1.6 MARKET STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 CBRN MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from primary sources

- 2.1.2.3 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 RECESSION IMPACT ANALYSIS

- 2.3 RUSSIA-UKRAINE WAR IMPACT ANALYSIS

- 2.3.1 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF DEFENSE INDUSTRY

- FIGURE 5 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF DEFENSE INDUSTRY

- 2.3.2 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF DEFENSE INDUSTRY

- 2.3.3 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF CBRN DEFENSE MARKET

- 2.3.3.1 R&D Investment

- 2.3.3.2 Procurement

- 2.3.3.3 Import/Export Control

- FIGURE 6 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF CBRN DEFENSE MARKET

- 2.4 FACTOR ANALYSIS

- 2.4.1 INTRODUCTION

- 2.4.2 DEMAND-SIDE INDICATORS

- 2.4.2.1 Political dissent and separatist movements

- 2.4.2.2 Adoption of cloud computing technologies in public safety industry

- 2.4.3 SUPPLY-SIDE INDICATORS

- 2.5 MARKET SIZE ESTIMATION

- 2.6 RESEARCH APPROACH & METHODOLOGY

- 2.6.1 BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.6.2 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.7 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RISK ANALYSIS

- 2.10 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 CHEMICAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 PROTECTIVE WEARABLES SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 12 DEFENSE & GOVERNMENT TO LEAD MARKET FOR CBRN DEFENSE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF CBRN DEFENSE MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN CBRN DEFENSE MARKET

- FIGURE 14 RISE IN USAGE OF PORTABLE SOLUTIONS ACROSS INDUSTRIES DRIVES MARKET GROWTH

- 4.2 CBRN DEFENSE MARKET, BY TYPE

- FIGURE 15 CHEMICAL SEGMENT TO GROW AT HIGHEST CAGR FROM 2023-2028

- 4.3 CBRN DEFENSE MARKET, BY EQUIPMENT

- FIGURE 16 PROTECTIVE WEARABLES SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 CBRN DEFENSE MARKET, BY END USER

- FIGURE 17 DEFENSE & GOVERNMENT SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 CBRN DEFENSE MARKET, BY COUNTRY

- FIGURE 18 CBRN DEFENSE MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 CBRN DEFENSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 70% of global defense expenditure contributed by top 8 defense spenders

- FIGURE 20 MILITARY SPENDING OF TOP 8 COUNTRIES, 2016-2022 (USD BILLION)

- 5.2.1.2 Growing technological innovations

- 5.2.1.3 Favorable regulations and international agreements

- 5.2.1.4 Easy availability of CBRN weapons

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited investment in research & development

- 5.2.2.2 Saturated market in developed countries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in use of CBRN safety measures by emergency medical services

- 5.2.3.2 Emerging markets

- 5.2.3.3 Lack of adequate training

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological complexities in CBRN defense equipment

- 5.2.4.2 Challenges in developing advanced, cost-effective prototypes for mass production

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CBRN DEFENSE MANUFACTURERS

- FIGURE 21 REVENUE SHIFT FOR CBRN DEFENSE MARKET PLAYERS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 23 SUPPLY CHAIN ANALYSIS

- 5.6 MARKET ECOSYSTEM

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- FIGURE 24 MARKET ECOSYSTEM MAP: CBRN DEFENSE MARKET

- TABLE 2 CBRN DEFENSE MARKET ECOSYSTEM

- FIGURE 25 KEY PLAYERS IN MARKET ECOSYSTEM

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA ANALYSIS

- 5.7.1.1 Import Scenario of Breathing Appliances and Gas Masks

- FIGURE 26 TOP FIVE IMPORTING COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 3 IMPORT VALUE OF BREATHING APPLIANCES AND GAS MASKS, EXCLUDING PROTECTIVE MASKS HAVING NEITHER MECHANICAL PARTS NOR REPLACEABLE FILTERS (PRODUCT HARMONIZED SYSTEM CODE: 902000), 2018-2022 (USD THOUSAND)

- 5.7.2 EXPORT DATA STATISTICS

- 5.7.2.1 Export Scenario of Breathing Appliances and Gas Masks

- FIGURE 27 TOP FIVE EXPORTING COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 4 EXPORT VALUE OF BREATHING APPLIANCES AND GAS MASKS, EXCLUDING PROTECTIVE MASKS HAVING NEITHER MECHANICAL PARTS NOR REPLACEABLE FILTERS (PRODUCT HARMONIZED SYSTEM CODE: 902000), 2018-2022 (USD THOUSAND)

- 5.7.1 IMPORT DATA ANALYSIS

- 5.8 AVERAGE SELLING PRICE OF CBRN DEFENSE SOLUTIONS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF CBRN DEFENSE SOLUTIONS, 2022

- TABLE 5 AVERAGE SELLING PRICE TRENDS OF CBRN DEFENSE SOLUTIONS, (2022)

- 5.9 USE CASE ANALYSIS

- 5.9.1 USE CASE: EU-SENSE SYSTEM FOR CBRN THREAT DETECTION

- 5.9.2 USE CASE: CBRN PROTECTION FOR CRITICAL INFRASTRUCTURE

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 CBRN DEFENSE: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 CBRN DEFENSE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 TARIFFS & REGULATORY LANDSCAPE

- 5.11.1 TARIFFS IN CBRN DEFENSE MARKET

- 5.11.1.1 Tariffs for breathing appliances and gas masks

- TABLE 7 TARIFFS FOR BREATHING APPLIANCES AND GAS MASKS, INCL. PARTS AND ACCESSORIES (EXCL. PROTECTIVE MASKS HAVING NEITHER MECHANICAL PARTS NOR REPLACEABLE FILTERS, AND ARTIFICIAL RESPIRATION OR OTHER THERAPEUTIC RESPIRATION APPARATUS), 2022

- 5.11.2 REGULATORY LANDSCAPE IN CBRN DEFENSE MARKET

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 TARIFFS IN CBRN DEFENSE MARKET

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 13 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE CBRN TYPES

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE CBRN TYPES (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE CBRN TYPES

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE CBRN TYPES

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 VIRTUAL REALITY AND AUGMENTED REALITY-BASED SIMULATION TRAINING

- 6.2.2 REMOTE SENSING FOR DETECTION AND IDENTIFICATION OF CBRN THREATS

- 6.2.3 WEARABLE TECHNOLOGY FOR DETECTION OF CBRN THREATS

- 6.2.4 ION-MOBILITY SPECTROMETRY

- 6.2.5 OTHER CHEMICAL DETECTION TECHNOLOGIES

- 6.3 TECHNOLOGY ANALYSIS

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 NANOTECHNOLOGY FOR CBRN DEFENSE

- 6.4.2 ARTIFICIAL INTELLIGENCE IN CBRN DETECTION AND IDENTIFICATION

- 6.4.3 UNMANNED AIR VEHICLES IN CBRN DEFENSE

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- FIGURE 32 NUMBER OF PATENTS GRANTED FOR CBRN DEFENSE MARKET, 2012-2022

- TABLE 16 INNOVATIONS AND PATENT REGISTRATIONS, 2020-2023

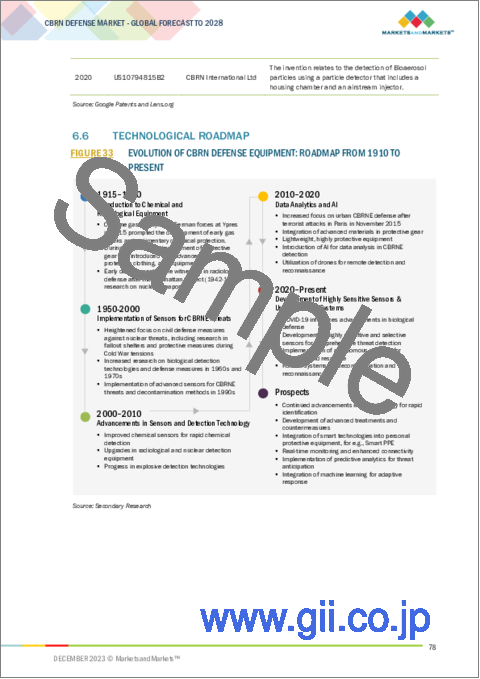

- 6.6 TECHNOLOGICAL ROADMAP

- FIGURE 33 EVOLUTION OF CBRN DEFENSE EQUIPMENT: ROADMAP FROM 1910 TO PRESENT

7 CBRN DEFENSE MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 34 CHEMICAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 17 CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 18 CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 CHEMICAL

- 7.2.1 STRATEGIC ACQUISITION BOOSTS US DOD'S CHEMICAL THREAT DETECTION CAPABILITIES

- 7.3 BIOLOGICAL

- 7.3.1 BIODEFENSE STRATEGY ENHANCES PROTECTION FROM BIOLOGICAL THREATS

- 7.4 RADIOLOGICAL

- 7.4.1 DEPLOYED BY ARMED FORCES AGAINST RADIOLOGICAL THREATS

- 7.5 NUCLEAR

- 7.5.1 GLOBAL NUCLEAR THREAT TO CREATE DEMAND FOR NUCLEAR DEFENSE SYSTEMS AND EQUIPMENT

- TABLE 19 NUCLEAR WEAPONS, BY COUNTRY (AS OF JANUARY 2023)

- 7.6 EXPLOSIVE

- 7.6.1 INTERNATIONAL MILITARY COLLABORATION STRENGTHENS EXPERTISE FOR EXPLOSIVE THREAT HANDLING

8 CBRN DEFENSE MARKET, BY EQUIPMENT

- 8.1 INTRODUCTION

- FIGURE 35 PROTECTIVE WEARABLES SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 20 CBRN DEFENSE MARKET, BY EQUIPMENT, 2020-2022 (USD MILLION)

- TABLE 21 CBRN DEFENSE MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- 8.2 PROTECTIVE WEARABLES

- 8.2.1 OSHA GUIDELINES ON USAGE OF PROTECTIVE WEARABLES

- TABLE 22 OSHA GUIDELINES

- 8.2.2 PROTECTIVE CLOTHING

- 8.2.2.1 Biological warfare threats drive segment

- 8.2.3 PROTECTIVE GAS MASKS AND HOODS

- 8.2.3.1 Modernization and enhancement of safety measures for aircrew personnel to fuel segment

- 8.2.4 ESCAPE DEVICES/HOODS

- 8.2.4.1 Adoption of fire escape hoods by firefighters to boost segment

- 8.2.5 PROTECTIVE SHOES

- 8.2.5.1 Civil and commercial applications drive demand for protective shoes

- 8.2.6 PROTECTIVE GLOVES

- 8.2.6.1 Significant NATO contract demonstrates rising demand for advanced CBRN protective shoes

- 8.3 RESPIRATORY SYSTEMS

- 8.3.1 SELF-CONTAINED BREATHING APPARATUS (SCBA)

- 8.3.1.1 Proactive commitment to public safety to drive segment

- 8.3.2 POWERED AIR-PURIFYING RESPIRATOR (PAPR)

- 8.3.2.1 Extensive applications for defense and civil end users to fuel growth of segment

- 8.3.1 SELF-CONTAINED BREATHING APPARATUS (SCBA)

- 8.4 DETECTION & MONITORING SYSTEMS

- 8.4.1 THERMAL IMAGERS

- 8.4.1.1 Advancements in thermal imagers in hazardous CBRN zones to drive segment

- 8.4.2 SENSORS

- 8.4.2.1 Changing geopolitical scenarios fuel segment growth

- 8.4.3 STATIONARY AND MOBILE MONITORING DEVICES

- 8.4.3.1 Testing of CBRN vehicles by armed forces to drive segment

- 8.4.4 SAMPLING EQUIPMENT

- 8.4.4.1 Increasing research & development drive segment

- 8.4.5 SCREENING TEST KIT

- 8.4.5.1 Importance of screening technologies to drive market segment

- 8.4.6 INFRARED SPECTROSCOPY

- 8.4.6.1 Reduced risks associated with infrared spectroscopy drive demand

- 8.4.7 BEACONS

- 8.4.7.1 Ensure swift responses and real-time insights in defense and security scenarios

- 8.4.8 STAND-OFF DETECTORS

- 8.4.8.1 South Korea's breakthrough tech drives CBRN market with advanced detection

- 8.4.9 GAS DETECTORS

- 8.4.9.1 Integration of gas detectors on robots and UAVs to drive market

- 8.4.10 BIOLOGICAL THREAT DETECTORS

- 8.4.10.1 Research for trial against bioterrorism to drive segment growth

- 8.4.11 RADIOLOGICAL THREAT DETECTORS

- 8.4.11.1 Importance of advanced radiological threat detection systems drives segment

- 8.4.1 THERMAL IMAGERS

- 8.5 DECONTAMINATION SYSTEMS

- 8.5.1 CONTAMINATION INDICATOR DECONTAMINATION ASSURANCE SYSTEMS

- 8.5.1.1 Military applications to drive segment

- 8.5.2 SPRAY UNITS

- 8.5.2.1 Requirement of portable spray units to spray disinfectants to drive segment

- 8.5.3 OTHERS

- 8.5.3.1 Demand for mobile decontamination systems to drive segment growth

- 8.5.1 CONTAMINATION INDICATOR DECONTAMINATION ASSURANCE SYSTEMS

- 8.6 SIMULATORS

- 8.6.1 US BACKS NATIONAL VIRTUAL TRAINING CENTER FOR PHILIPPINE CHEMICAL DEFENSE

- 8.7 INFORMATION MANAGEMENT SOFTWARE

- 8.7.1 GROWING DEMAND FOR CBRN INFORMATION MANAGEMENT SOFTWARE, MEETING NATO STANDARDS

9 CBRN DEFENSE MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 36 DEFENSE & GOVERNMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 23 CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 24 CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.2 DEFENSE & GOVERNMENT

- 9.2.1 ARMED FORCES

- 9.2.1.1 Air force

- 9.2.1.2 Army

- 9.2.1.3 Navy

- 9.2.1.4 Others

- 9.2.1.4.1 CBRN defense demand from special operation forces

- 9.2.2 HOMELAND SECURITY

- 9.2.2.1 Use for detection of CBRNE contamination drives segment

- 9.2.2.2 Police

- 9.2.2.3 Fire safety departments

- 9.2.1 ARMED FORCES

- 9.3 CIVIL & COMMERCIAL

- 9.3.1 CRITICAL INFRASTRUCTURE

- 9.3.1.1 Need for infrastructural protection from CBRNE attacks boosts segment

- 9.3.2 MEDICAL

- 9.3.2.1 Growing investments in equipment for protection from CBRN threats to drive segment

- 9.3.3 INDUSTRIAL

- 9.3.3.1 Increasing usage of protective equipment to fuel segment

- 9.3.1 CRITICAL INFRASTRUCTURE

10 REGIONAL ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 37 CBRN DEFENSE MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST RATE FROM 2023 TO 2028

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 25 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 26 CBRN DEFENSE MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 27 CBRN DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 PESTLE ANALYSIS: NORTH AMERICA

- 10.3.2 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 38 NORTH AMERICA: CBRN DEFENSE MARKET SNAPSHOT

- TABLE 28 NORTH AMERICA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: CBRN DEFENSE MARKET, BY EQUIPMENT, 2020-2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: CBRN DEFENSE MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: CBRN DEFENSE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: CBRN DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 US

- 10.3.3.1 Adoption of safety measures to protect armed forces and high military budget to drive market

- TABLE 36 US: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 37 US: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 38 US: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 39 US: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.3.4 CANADA

- 10.3.4.1 Equipment upgrades for CBRNE strategy to drive market

- TABLE 40 CANADA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 41 CANADA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 42 CANADA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 43 CANADA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 PESTLE ANALYSIS: EUROPE

- 10.4.2 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 39 EUROPE: CBRN DEFENSE MARKET SNAPSHOT

- TABLE 44 EUROPE: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 45 EUROPE: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 46 EUROPE: CBRN DEFENSE MARKET, BY EQUIPMENT, 2020-2022 (USD MILLION)

- TABLE 47 EUROPE: CBRN DEFENSE MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- TABLE 48 EUROPE: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 49 EUROPE: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 50 EUROPE: CBRN DEFENSE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 51 EUROPE: CBRN DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 UK

- 10.4.3.1 Spending on CBRN defense training and mitigation to drive market

- TABLE 52 UK: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 53 UK: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 54 UK: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 55 UK: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.4.4 FRANCE

- 10.4.4.1 Engagement with European Union to enhance preparedness for CBRN threats

- TABLE 56 FRANCE: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 57 FRANCE: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 58 FRANCE: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 59 FRANCE: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.4.5 GERMANY

- 10.4.5.1 Presence of major CBRN defense bodies and solution providers to drive market

- TABLE 60 GERMANY: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 61 GERMANY: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 62 GERMANY: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 63 GERMANY: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.4.6 RUSSIA

- 10.4.6.1 Revocation of Comprehensive Nuclear Test Ban Treaty (CTBT) to boost market

- TABLE 64 RUSSIA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 65 RUSSIA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 66 RUSSIA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 67 RUSSIA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.4.7 ITALY

- 10.4.7.1 Mapping CBRN preparedness with CBRN-Italy program to drive market

- TABLE 68 ITALY: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 69 ITALY: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 70 ITALY: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 71 ITALY: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.4.8 SPAIN

- 10.4.8.1 Procurement of mobile CBRN equipment to drive market

- TABLE 72 SPAIN: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 73 SPAIN: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 74 SPAIN: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 75 SPAIN: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.4.9 REST OF EUROPE

- 10.4.9.1 Rising border conflicts to fuel growth of market

- TABLE 76 REST OF EUROPE: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 77 REST OF EUROPE: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 79 REST OF EUROPE: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.5 ASIA PACIFIC

- 10.5.1 PESTLE ANALYSIS: ASIA PACIFIC

- 10.5.2 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 40 ASIA PACIFIC: CBRN DEFENSE MARKET SNAPSHOT

- TABLE 80 ASIA PACIFIC: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: CBRN DEFENSE MARKET, BY EQUIPMENT, 2020-2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: CBRN DEFENSE MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CBRN DEFENSE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CBRN DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 CHINA

- 10.5.3.1 Nuclear weapon expansion to drive market

- TABLE 88 CHINA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 89 CHINA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 90 CHINA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 91 CHINA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.5.4 INDIA

- 10.5.4.1 US special operation forces elevate CBRNE defense capabilities in joint training in India

- TABLE 92 INDIA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 93 INDIA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 94 INDIA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 95 INDIA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.5.5 JAPAN

- 10.5.5.1 Advanced aircrew protection study at Yokota Air Base enhances capabilities in CBRNE defense

- TABLE 96 JAPAN: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 97 JAPAN: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 98 JAPAN: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 99 JAPAN: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.5.6 SOUTH KOREA

- 10.5.6.1 Joint CBRN exercise shapes landscape for advancements in CBRN defense market

- TABLE 100 SOUTH KOREA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 101 SOUTH KOREA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 102 SOUTH KOREA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 103 SOUTH KOREA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.5.7 AUSTRALIA

- 10.5.7.1 Growing R&D activities improve market position

- TABLE 104 AUSTRALIA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 105 AUSTRALIA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 106 AUSTRALIA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 107 AUSTRALIA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.5.8 REST OF ASIA PACIFIC

- 10.5.8.1 US initiatives drive CBRN defense in region with training and equipment

- TABLE 108 REST OF ASIA PACIFIC: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.6 MIDDLE EAST

- 10.6.1 PESTLE ANALYSIS: MIDDLE EAST

- 10.6.2 MIDDLE EAST: RECESSION IMPACT ANALYSIS

- FIGURE 41 MIDDLE EAST: CBRN DEFENSE MARKET SNAPSHOT

- TABLE 112 MIDDLE EAST: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 113 MIDDLE EAST: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 114 MIDDLE EAST: CBRN DEFENSE MARKET, BY EQUIPMENT, 2020-2022 (USD MILLION)

- TABLE 115 MIDDLE EAST: CBRN DEFENSE MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- TABLE 116 MIDDLE EAST: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 117 MIDDLE EAST: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 118 MIDDLE EAST: CBRN DEFENSE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 119 MIDDLE EAST: CBRN DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 GCC

- 10.6.3.1 Saudi Arabia

- 10.6.3.1.1 CBRN initiatives, coupled with nuclear and petrochemical growth to drive market

- 10.6.3.1 Saudi Arabia

- TABLE 120 SAUDI ARABIA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 121 SAUDI ARABIA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 122 SAUDI ARABIA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 123 SAUDI ARABIA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.6.3.2 UAE

- 10.6.3.2.1 Strategic initiatives propel CBRN defense market advancements

- 10.6.3.2 UAE

- TABLE 124 UAE: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 125 UAE: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 126 UAE: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 127 UAE: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.6.4 ISRAEL

- 10.6.4.1 International collaboration to tackle regional disputes to drive market

- TABLE 128 ISRAEL: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 129 ISRAEL: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 130 ISRAEL: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 131 ISRAEL: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.6.5 TURKEY

- 10.6.5.1 Growth in domestic production of indigenous equipment to drive market

- TABLE 132 TURKEY: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 133 TURKEY: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 134 TURKEY: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 135 TURKEY: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.6.6 REST OF MIDDLE EAST

- TABLE 136 REST OF MIDDLE EAST: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 137 REST OF MIDDLE EAST: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 138 REST OF MIDDLE EAST: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.7 REST OF THE WORLD

- 10.7.1 PESTLE ANALYSIS: REST OF THE WORLD

- TABLE 140 REST OF THE WORLD: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 141 REST OF THE WORLD: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 142 REST OF THE WORLD: CBRN DEFENSE MARKET, BY EQUIPMENT, 2020-2022 (USD MILLION)

- TABLE 143 REST OF THE WORLD: CBRN DEFENSE MARKET, BY EQUIPMENT, 2023-2028 (USD MILLION)

- TABLE 144 REST OF THE WORLD: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 145 REST OF THE WORLD: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 146 REST OF THE WORLD: CBRN DEFENSE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 147 REST OF THE WORLD: CBRN DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.7.2 LATIN AMERICA

- 10.7.2.1 Brazil's robust initiatives propel regional CBRNE defense market advancements

- TABLE 148 LATIN AMERICA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 149 LATIN AMERICA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 150 LATIN AMERICA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 151 LATIN AMERICA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.7.3 AFRICA

- 10.7.3.1 7 Medical Battalion Group supports special and airborne forces in CBW scenarios

- TABLE 152 AFRICA: CBRN DEFENSE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 153 AFRICA: CBRN DEFENSE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 154 AFRICA: CBRN DEFENSE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 155 AFRICA: CBRN DEFENSE MARKET, BY END USER, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 156 STRATEGIES ADOPTED BY KEY PLAYERS IN CBRN DEFENSE MARKET

- 11.3 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 42 RANKING ANALYSIS OF TOP FIVE PLAYERS: CBRN DEFENSE MARKET, 2022

- 11.4 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 43 SHARE OF KEY PLAYERS IN CBRN DEFENSE MARKET, 2022

- TABLE 157 CBRN DEFENSE MARKET: DEGREE OF COMPETITION

- 11.5 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2018-2022 (USD MILLION)

- FIGURE 44 REVENUE ANALYSIS OF TOP FIVE PLAYERS: CBRN DEFENSE MARKET

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 45 CBRN DEFENSE MARKET (KEY PLAYERS) COMPETITIVE LEADERSHIP MAPPING, 2022

- 11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 46 COMPANY PRODUCT FOOTPRINT

- TABLE 158 COMPANY FOOTPRINT, BY TYPE

- TABLE 159 COMPANY FOOTPRINT, BY EQUIPMENT

- TABLE 160 COMPANY REGION FOOTPRINT

- 11.8 STARTUP/SME EVALUATION MATRIX

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 STARTING BLOCKS

- 11.8.4 DYNAMIC COMPANIES

- FIGURE 47 CBRN DEFENSE MARKET (STARTUPS) COMPETITIVE LEADERSHIP MAPPING, 2022

- 11.8.5 COMPETITIVE BENCHMARKING

- TABLE 161 CBRN DEFENSE MARKET: KEY STARTUP/SMES

- TABLE 162 CBRN DEFENSE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 MARKET EVALUATION FRAMEWORK

- 11.9.2 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 163 NEW PRODUCT LAUNCHES AND DEVELOPMENTS, 2019-2023

- 11.9.3 DEALS

- TABLE 164 DEALS, 2019-2023

- 11.9.4 OTHERS

- TABLE 165 OTHERS, 2019-2023

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.2 KEY PLAYERS

- 12.2.1 RHEINMETALL DEFENCE

- TABLE 166 RHEINMETALL DEFENCE: BUSINESS OVERVIEW

- FIGURE 48 RHEINMETALL DEFENCE: COMPANY SNAPSHOT

- TABLE 167 RHEINMETALL DEFENCE: DEALS

- 12.2.2 THALES GROUP

- TABLE 168 THALES GROUP: BUSINESS OVERVIEW

- FIGURE 49 THALES GROUP: COMPANY SNAPSHOT

- TABLE 169 THALES GROUP: PRODUCT DEVELOPMENT

- TABLE 170 THALES GROUP: DEALS

- 12.2.3 TELEDYNE FLIR LLC

- TABLE 171 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- FIGURE 50 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- TABLE 172 TELEDYNE FLIR LLC: DEALS

- 12.2.4 BRUKER CORPORATION

- TABLE 173 BRUKER CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 BRUKER CORPORATION: COMPANY SNAPSHOT

- TABLE 174 BRUKER CORPORATION: DEALS

- 12.2.5 SMITHS GROUP PLC

- TABLE 175 SMITHS GROUP PLC: BUSINESS OVERVIEW

- FIGURE 52 SMITHS GROUP PLC: COMPANY SNAPSHOT

- TABLE 176 SMITHS GROUP PLC: DEALS

- 12.2.6 CHEMRING GROUP PLC

- TABLE 177 CHEMRING GROUP PLC: BUSINESS OVERVIEW

- FIGURE 53 CHEMRING GROUP PLC: COMPANY SNAPSHOT

- TABLE 178 CHEMRING GROUP PLC: DEALS

- 12.2.7 MSA SAFETY, INC.

- TABLE 179 MSA SAFETY, INC.: BUSINESS OVERVIEW

- FIGURE 54 MSA SAFETY, INC: COMPANY SNAPSHOT

- TABLE 180 MSA SAFETY, INC: DEALS

- 12.2.8 AVON PROTECTION PLC

- TABLE 181 AVON PROTECTION PLC: BUSINESS OVERVIEW

- FIGURE 55 AVON PROTECTION PLC: COMPANY SNAPSHOT

- TABLE 182 AVON PROTECTION PLC: PRODUCT LAUNCH

- TABLE 183 AVON PROTECTION PLC: DEALS

- 12.2.9 AIRBOSS DEFENSE GROUP INC.

- TABLE 184 AIRBOSS DEFENSE GROUP, INC.: BUSINESS OVERVIEW

- FIGURE 56 AIRBOSS OF AMERICA CORP.: COMPANY SNAPSHOT

- TABLE 185 AIRBOSS DEFENSE GROUP, INC.: DEALS

- 12.2.10 HDT GLOBAL

- TABLE 186 HDT GLOBAL: BUSINESS OVERVIEW

- TABLE 187 HDT GLOBAL: DEALS

- 12.2.11 LEIDOS

- TABLE 188 LEIDOS: BUSINESS OVERVIEW

- FIGURE 57 LEIDOS: COMPANY SNAPSHOT

- 12.2.12 INDRA

- TABLE 189 INDRA: BUSINESS OVERVIEW

- FIGURE 58 INDRA: COMPANY SNAPSHOT

- TABLE 190 INDRA: DEALS

- 12.2.13 QINETIQ

- TABLE 191 QINETIQ: BUSINESS OVERVIEW

- FIGURE 59 QINETIQ: COMPANY SNAPSHOT

- TABLE 192 QINETIQ: DEALS

- 12.2.14 SAAB AB

- TABLE 193 SAAB AB: BUSINESS OVERVIEW

- FIGURE 60 SAAB AB: COMPANY SNAPSHOT

- 12.2.15 KNDS N.V.

- TABLE 194 KNDS N.V.: BUSINESS OVERVIEW

- TABLE 195 KNDS N.V.: DEALS

- 12.3 OTHER PLAYERS

- 12.3.1 ENVIRONICS OY

- TABLE 196 ENVIRONICS OY: COMPANY OVERVIEW

- 12.3.2 ARGON ELECTRONICS (UK) LTD.

- TABLE 197 ARGON ELECTRONICS (UK) LTD.: COMPANY OVERVIEW

- 12.3.3 BLUCHER GMBH

- TABLE 198 BLUCHER GMBH: COMPANY OVERVIEW

- 12.3.4 CRISTANINI SPA

- TABLE 199 CRISTANINI SPA: COMPANY OVERVIEW

- 12.3.5 KARCHER FUTURETECH GMBH

- TABLE 200 KARCHER FUTURETECH GMBH: COMPANY OVERVIEW

- 12.3.6 RAPISCAN SYSTEMS

- TABLE 201 RAPISCAN SYSTEMS: COMPANY OVERVIEW

- 12.3.7 BIOQUELL

- TABLE 202 BIOQUELL: COMPANY OVERVIEW

- 12.3.8 ARKTIS RADIATION DETECTORS LTD

- TABLE 203 ARKTIS RADIATION DETECTORS LTD: COMPANY OVERVIEW

- 12.3.9 BATTELLE MEMORIAL INSTITUTE

- TABLE 204 BATTELLE MEMORIAL INSTITUTE: COMPANY OVERVIEW

- 12.3.10 BHARAT ELECTRONICS LIMITED

- TABLE 205 BHARAT ELECTRONICS LIMITED: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.1.1 CBRN DEFENSE MARKET (2023-2028)

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS