|

|

市場調査レポート

商品コード

1410951

自己粘着ラベルの世界市場 (~2028年):構成 (フェイスストック・接着剤・剥離ライナー)・性質 (永久・剥離可能・再貼付可能)・タイプ (剥離ライナー・ライナーレス)・印刷技術・用途・地域別Self-Adhesive Labels Market by Composition (Facestock, Adhesive, Release Liner), Nature (Permanent, Removable, Repositionable), Type (Release Liner, Linerless), Printing Technology, Application, and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自己粘着ラベルの世界市場 (~2028年):構成 (フェイスストック・接着剤・剥離ライナー)・性質 (永久・剥離可能・再貼付可能)・タイプ (剥離ライナー・ライナーレス)・印刷技術・用途・地域別 |

|

出版日: 2024年01月11日

発行: MarketsandMarkets

ページ情報: 英文 191 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) ・数量 (平方メートル) |

| セグメント | 構成・性質・タイプ・印刷技術・用途・地域 |

| 対象地域 | 北米・アジア太平洋・欧州・南米・中東&アフリカ |

自己粘着ラベルの市場規模は、2023年の532億米ドルから、予測期間中は5.4%のCAGRで推移し、2028年には692億米ドルの規模に成長すると予測されています。

自己粘着ラベル市場は、製品の識別とブランディングに対する需要の増加、印刷技術の進歩、持続可能性への注目、偽造防止対策の必要性によって推進されています。産業が進化し続け、消費者の期待も変化する中、自己粘着性ラベル市場は、さまざまな分野のダイナミックなニーズに応えるべく、成長と多様化が見込まれています。

タイプ別では、剥離ライナーの部門が最大の規模を示す見通しです。剥離ライナーは可変情報やバーコードのキャリアとして機能し、自動ラベリングシステムとのシームレスな統合を容易にします。これは、効率的で正確なラベリング工程が不可欠な食品・飲料や物流など、大量生産ラインを持つ業界では特に重要です。剥離ライナーラベルの自動化システムとの互換性は、スピードと精度が最重要視される環境での迅速な導入に貢献しています。

性質別では、永久ラベルの部門がもっとも急成長する見通しです。eコマースとグローバルなサプライチェーンの台頭から、永久ラベルが特に選ばれています。製品は製造から配送まで長い旅程をたどることが多く、永久ラベルは、バーコードや追跡情報などの重要な情報が、物流プロセスを通じてそのまま維持されることを保証します。永久ラベルの耐久性は、サプライチェーンの完全性を維持し、輸送や保管中のデータ損失のリスクを最小限に抑える上で極めて重要です。

地域別では、アジア太平洋地域が最大の規模を示しています。印刷技術と材料の進歩が同地域の市場成長に重要な役割を果たしています。同地域のメーカーは、コスト効率の良い小ロット、短納期、高品質のグラフィックを可能にするデジタル印刷などの最先端の印刷技術を採用しています。これにより、さまざまな産業で自己粘着ラベルの採用が促進され、市場全体の成長に寄与しています。

当レポートでは、世界の自己粘着ラベルの市場を調査し、市場概要、市場影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- ポーターのファイブフォース分析

第7章 粘着ラベル市場:構成別

- フェイスストック

- 接着剤

- ホットメルト

- アクリル

- 剥離ライナーまたは裏地

第8章 粘着ラベル市場:性質別

- 永久

- 剥離可能

- 再貼付可能

第9章 粘着ラベル市場:タイプ別

- 剥離ライナー

- ライナーレス

第10章 粘着ラベル市場:印刷技術別

- フレキソグラフィ

- スクリーン印刷

- デジタル印刷

- グラビア

- オフセット

- リソグラフィ

- 活版印刷

第11章 粘着ラベル市場:用途別

- 食品・飲料

- 耐久消費財

- ホーム&パーソナルケア

- 医薬品

- 小売ラベル

- eコマース

- その他

第12章 粘着ラベル市場:地域別

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要企業の戦略

- 市場ランキング

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- CCL INDUSTRIES

- AVERY DENNISON CORPORATION

- MULTI-COLOR CORPORATION

- HUHTAMAKI OYJ

- COVERIS

- SATO HOLDINGS CORPORATION

- LINTEC CORPORATION

- LECTA ADESTOR

- FUJI SEAL INTERNATIONAL, INC.

- ALL4LABELS

- その他の企業

- SKANEM

- BSP LABELS LTD.

- INLAND

- CS LABELS

- SECURA LABELS

- TERRAGENE

- LABEL CRAFT

- REFLEX LABELS LTD.

- ETIQUETTE LABELS LTD.

- ROYSTON LABELS

- AZTEC LABEL

- SVS SPOL. S R.O.

- MAXIM LABEL AND PACKAGING

- DURALABEL GRAPHICS PVT. LTD.

- PROPRINT GROUP

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion/Million), Volume (Million Square Meter) |

| Segments | Composition, Nature, Type, Printing, Technology, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

The self-adhesive labels market is projected to grow from USD 53.2 billion in 2023 to USD 69.2 billion by 2028, at a CAGR of 5.4% from 2023 to 2028. The self-adhesive labels market is propelled by the increasing demand for product identification and branding, advancements in printing technologies, a focus on sustainability, and the need for anti-counterfeiting measures. As industries continue to evolve and consumer expectations shift, the self-adhesive labels market is expected to grow and diversify to meet the dynamic needs of various sectors.

"Release Liner to be the largest type used in self-adhesive labels market"

The release liner serves as a carrier for variable information and barcodes, facilitating seamless integration with automated labeling systems. This is particularly crucial in industries with high-volume production lines, such as food and beverage and logistics, where efficient and accurate labeling processes are essential. The compatibility of release liner labels with automated systems contributes to their faster adoption in environments where speed and precision are paramount.

"Permanent labels to be the fastest growing labels in the self-adhesive labels market."

The rise of e-commerce and the global supply chain has contributed to the preference for permanent labels. Products often undergo long journeys from manufacturing to delivery, and permanent labels ensure that essential information, such as barcodes and tracking details, remains intact throughout the logistics process. The durability of permanent labels is crucial in maintaining the integrity of the supply chain and minimizing the risk of data loss during transportation and storage.

"The Flexography holds the largest market share in the self-adhesive labels market"

The cost-effectiveness of flexography plays a significant role in its prominence. Flexo printing plates are relatively affordable compared to other printing technologies, and the simplicity of the flexo process contributes to lower setup and operational costs. As a result, businesses can achieve high-quality printing at a competitive cost per label, making flexography an attractive option for companies looking to balance quality and affordability in their labeling processes.

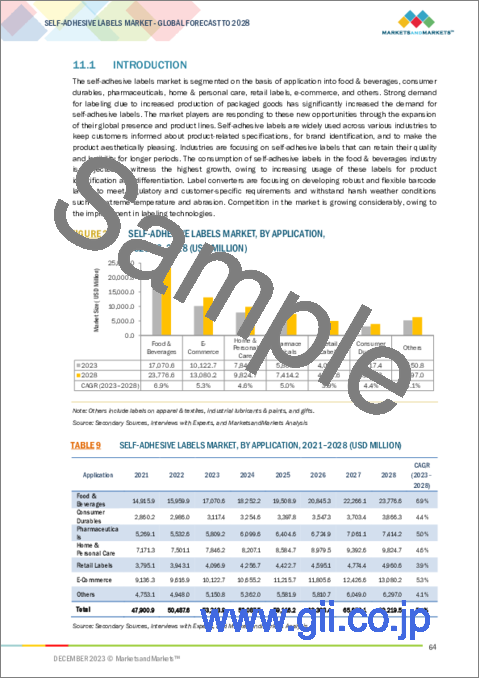

"Food & Beverages application holds the largest market share in self-adhesive labels market."

The convenience and efficiency of self-adhesive labels play a pivotal role in their widespread adoption in the food and beverage sector. These labels are easy to apply, allowing for seamless integration into high-speed production lines. The quick application process ensures that manufacturers can meet the demands of fast-paced production environments while maintaining product quality and consistency. This efficiency is particularly important in an industry where rapid product turnover and timely labeling are essential.

"Asia Pacific is the biggest market for self-adhesive labels market."

Advancements in printing technologies and materials have played a crucial role in the expansion of the self-adhesive labels market in the Asia Pacific. Manufacturers in the region are adopting cutting-edge printing techniques such as digital printing, which allows for cost-effective short runs, quick turnaround times, and high-quality graphics. This has fueled the adoption of self-adhesive labels across various industries, contributing to the overall market growth.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and information was gathered through secondary research.

The break-up of primary interviews is given below:

- By Department - Sales/Export/Marketing: 62%, Production: 26%, and R&D: 12%

- By Designation - Managers: 55%, CXOs: 15%, and Executives: 30%

- By Region - North America: 18%, Europe: 14%, Asia Pacific: 43%, Middle East & Africa: 21%, and South America: 4%

Companies Covered: The companies profiled in this market research report include CCL Industries (Canada), Avery Dennison Corporation (US), Multi-Color Corporation(US), Huhtamaki OYJ (Finland), and Coveris (Austria), and others.

Research Coverage:

The market study covers self-adhesive labels across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on composition, nature, type, printing technology, application, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the self-adhesive labels market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall self-adhesive labels market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing urban population, strong demand from end-use industries, growth of parent industry), restraints (advantages of wet-glue labels over self-adhesive labels, printing on package) opportunities (emerging economies, forward integrations in value chain), and challenges (varying environmental mandates across regions) influencing the growth of the self-adhesive labels market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the self-adhesive labels market

- Market Development: Comprehensive information about lucrative markets - the report analyses the self-adhesive labels market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the self-adhesive labels market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as CCL Industries (Canada), Avery Dennison Corporation (US), Multi-Color Corporation(US), Huhtamaki OYJ (Finland), and Coveris (Austria), and others in the self-adhesive labels market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- FIGURE 1 SELF-ADHESIVE LABELS MARKET SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 SELF-ADHESIVE LABELS MARKET, BY REGION

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 SELF-ADHESIVE LABELS MARKET: RESEARCH DESIGN

- 2.2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.2 PRIMARY DATA

- FIGURE 4 DATA TRIANGULATION

- 2.3 KEY MARKET INSIGHTS

- FIGURE 5 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF INTERVIEWS WITH EXPERTS

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 6 APPROACH 1: BOTTOM-UP APPROACH (BASED ON LINERLESS LABELS MARKET)

- 2.4.1 APPROACH - 2

- FIGURE 7 SELF-ADHESIVE LABELS MARKET: BOTTOM-UP APPROACH (BASED ON RELEASE LINER LABELS MARKET)

- 2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

- 2.5.1 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 RISK ASSESSMENT

- TABLE 1 LIMITATIONS & ASSOCIATED RISKS

- 2.7 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 RELEASE LINER TO BE LARGER MARKET DURING FORECAST PERIOD

- FIGURE 9 PERMANENT LABELS SEGMENT TO BE LARGER MARKET DURING FORECAST PERIOD

- FIGURE 10 FLEXOGRAPHY TO BE FASTEST-GROWING PRINTING TECHNOLOGY SEGMENT

- FIGURE 11 FOOD & BEVERAGES TO BE FASTEST-GROWING APPLICATION

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING SELF-ADHESIVE LABELS MARKET FROM 2023 TO 2028

4 PREMIUM INSIGHTS

- 4.1 ASIA PACIFIC TO GROW FAST DUE TO RAPID INDUSTRIALIZATION AND INCREASING END-USE INDUSTRIES

- FIGURE 13 INCREASING DEMAND FROM FOOD & BEVERAGE INDUSTRY TO DRIVE DEMAND FOR SELF-ADHESIVE LABELS

- 4.2 SELF-ADHESIVE LABELS MARKET, BY TYPE

- FIGURE 14 RELEASE LINER TO BE FASTER-GROWING SEGMENT

- 4.3 SELF-ADHESIVE LABELS MARKET, BY NATURE

- FIGURE 15 PERMANENT LABELS TO BE FASTEST-GROWING SEGMENT

- 4.4 SELF-ADHESIVE LABELS MARKET, BY PRINTING TECHNOLOGY

- FIGURE 16 FLEXOGRAPHY TO BE FASTEST-GROWING SEGMENT

- 4.5 SELF-ADHESIVE LABELS MARKET, BY APPLICATION

- FIGURE 17 FOOD & BEVERAGES SEGMENT TO LEAD SELF-ADHESIVE LABELS MARKET

- 4.6 ASIA PACIFIC SELF-ADHESIVE LABELS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 18 FOOD & BEVERAGES AND CHINA LED SELF-ADHESIVE LABELS MARKET IN 2022

- 4.7 SELF-ADHESIVE LABELS MARKET, BY REGION

- FIGURE 19 CHINA TO BE FASTEST-GROWING MARKET BY VOLUME DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SELF-ADHESIVE LABELS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing urban population

- FIGURE 21 URBAN AND RURAL POPULATION 1950-2050

- 5.2.1.2 Strong demand from end-use industries

- 5.2.1.3 Growth of parent industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Advantages of wet-glue labels over self-adhesive labels

- 5.2.2.2 Printing on package

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging economies

- 5.2.3.2 Forward integrations in value chain

- 5.2.3.3 New product development

- 5.2.4 CHALLENGES

- 5.2.4.1 Varying environmental mandates across regions

- TABLE 2 ACTS AND REGULATIONS REGARDING LABELLING

- 5.2.4.2 Cost-to-benefit ratio concern for small manufacturers

- 5.2.4.3 High R&D investments

- 5.2.4.4 Management of packaging supply chain

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 SELF-ADHESIVE LABELS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF SUBSTITUTES

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 BARGAINING POWER OF BUYERS

- 6.1.4 THREAT OF NEW ENTRANTS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

7 SELF-ADHESIVE LABELS MARKET, BY COMPOSITION

- 7.1 INTRODUCTION

- 7.2 FACESTOCK

- 7.3 ADHESIVE

- 7.3.1 HOT-MELT

- 7.3.2 ACRYLIC

- 7.4 RELEASE LINER OR BACKING

8 SELF-ADHESIVE LABELS MARKET, BY NATURE

- 8.1 INTRODUCTION

- FIGURE 23 SELF-ADHESIVE LABELS MARKET SIZE, BY NATURE, 2023 VS. 2028 (USD MILLION)

- TABLE 3 SELF-ADHESIVE LABELS MARKET SIZE, BY NATURE, 2021-2028 (USD MILLION)

- TABLE 4 SELF-ADHESIVE LABELS MARKET SIZE, BY NATURE, 2021-2028 (MILLION SQUARE METER)

- 8.2 PERMANENT

- 8.2.1 COST-EFFECTIVE LABELS WITH SEVERAL APPLICATIONS TO DRIVE MARKET

- 8.3 REMOVABLE

- 8.3.1 INCREASING APPLICATION IN RETAIL SECTOR TO DRIVE SEGMENT

- 8.4 REPOSITIONABLE

- 8.4.1 MULTIPLE REAPPLICATION TO DRIVE MARKET

9 SELF-ADHESIVE LABELS MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 24 SELF-ADHESIVE LABELS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 5 SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 6 SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- 9.2 RELEASE LINER

- 9.2.1 AVAILABILITY IN DIFFERENT SHAPES AND SIZES TO DRIVE MARKET

- 9.3 LINERLESS

- 9.3.1 LOW COST AND MORE DURABILITY OF LINERLESS LABELS TO DRIVE MARKET

10 SELF-ADHESIVE LABELS MARKET, BY PRINTING TECHNOLOGY

- 10.1 INTRODUCTION

- FIGURE 25 SELF-ADHESIVE LABELS MARKET, BY PRINTING TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- TABLE 7 SELF-ADHESIVE LABELS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 8 SELF-ADHESIVE LABELS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (MILLION SQUARE METER)

- 10.2 FLEXOGRAPHY

- 10.2.1 COST-EFFECTIVENESS AND EFFICIENT PRINTING TO DRIVE SEGMENT

- 10.3 SCREEN PRINTING

- 10.3.1 INCREASING DEMAND IN DIFFERENT APPLICATIONS TO DRIVE SEGMENT

- 10.4 DIGITAL PRINTING

- 10.4.1 HIGH QUALITY AND LESS PRODUCT WASTAGE TO INCREASE DEMAND

- 10.5 GRAVURE

- 10.5.1 RISING DEMAND FOR VARIOUS APPLICATIONS TO DRIVE MARKET

- 10.6 OFFSET

- 10.6.1 HIGH AND CONSISTENT IMAGE QUALITY TO DRIVE DEMAND

- 10.7 LITHOGRAPHY

- 10.7.1 SEVERAL ADVANTAGES OVER OTHER TECHNOLOGIES TO DRIVE MARKET

- 10.8 LETTERPRESS

- 10.8.1 TIME-CONSUMING PROCESS TO HAMPER DEMAND

11 SELF-ADHESIVE LABELS MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 26 SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 9 SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 10 SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 11.2 FOOD & BEVERAGES

- 11.2.1 FOOD & BEVERAGES SEGMENT TO DOMINATE SELF-ADHESIVE LABELS MARKET

- 11.3 CONSUMER DURABLES

- 11.3.1 INCREASING APPLICATIONS OF SELF-ADHESIVE LABELS TO PROPEL MARKET GROWTH

- 11.4 HOME & PERSONAL CARE

- 11.4.1 IMPROVED LIVING STANDARDS AND RISING DISPOSABLE INCOME TO DRIVE SEGMENT

- 11.5 PHARMACEUTICALS

- 11.5.1 GOVERNMENT REGULATIONS, SAFETY STANDARDS, CERTIFICATIONS, AND DRUG-RELATED LAWS TO DRIVE SEGMENT

- 11.6 RETAIL LABELS

- 11.6.1 RISING CONSUMER DEMAND TO DRIVE MARKET

- 11.7 E-COMMERCE

- 11.7.1 GROWING INVESTMENTS IN LOGISTICS AND WAREHOUSES TO SUPPORT MARKET GROWTH

- 11.8 OTHERS

12 SELF-ADHESIVE LABELS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 27 CHINA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 11 SELF-ADHESIVE LABELS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 12 SELF-ADHESIVE LABELS MARKET, BY REGION, 2021-2028 (MILLION SQUARE METER)

- 12.2 ASIA PACIFIC

- 12.2.1 RECESSION IMPACT

- FIGURE 28 ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET SNAPSHOT

- TABLE 13 ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 14 ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 15 ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 16 ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 17 ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 18 ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.2.2 CHINA

- 12.2.2.1 Increasing industrial activities and high growth of food sector to boost market

- TABLE 19 CHINA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 20 CHINA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 21 CHINA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 22 CHINA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.2.3 INDIA

- 12.2.3.1 Growing demand for FMCG and convenience products to drive market

- TABLE 23 INDIA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 24 INDIA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 25 INDIA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 26 INDIA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.2.4 JAPAN

- 12.2.4.1 Increasing demand from pharmaceutical industry to drive market

- TABLE 27 JAPAN: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 28 JAPAN: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 29 JAPAN: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 30 JAPAN: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Increasing government investments in R&D to drive market

- TABLE 31 SOUTH KOREA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 32 SOUTH KOREA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 33 SOUTH KOREA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 34 SOUTH KOREA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.2.6 AUSTRALIA

- 12.2.6.1 High demand from food & beverage industry to drive market

- TABLE 35 AUSTRALIA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 36 AUSTRALIA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 37 AUSTRALIA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 38 AUSTRALIA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.2.7 THAILAND

- 12.2.7.1 Growing manufacturing and processing industries to drive market

- TABLE 39 THAILAND: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 40 THAILAND: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 41 THAILAND: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 42 THAILAND: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.2.8 REST OF ASIA PACIFIC

- TABLE 43 REST OF ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 44 REST OF ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 45 REST OF ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 46 REST OF ASIA PACIFIC: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.3 EUROPE

- 12.3.1 RECESSION IMPACT

- FIGURE 29 EUROPE: SELF-ADHESIVE LABELS MARKET SNAPSHOT

- TABLE 47 EUROPE: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 48 EUROPE: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 49 EUROPE: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 50 EUROPE: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 51 EUROPE: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 52 EUROPE: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.3.2 GERMANY

- 12.3.2.1 Expanding e-commerce industry to increase demand

- TABLE 53 GERMANY: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 54 GERMANY: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 55 GERMANY: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 56 GERMANY: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.3.3 UK

- 12.3.3.1 Growing food industry to boost market

- TABLE 57 UK: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 58 UK: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 59 UK: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 60 UK: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.3.4 ITALY

- 12.3.4.1 Rising food retail sales to drive demand for self-adhesive labels

- TABLE 61 ITALY: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 62 ITALY: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 63 ITALY: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 64 ITALY: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.3.5 FRANCE

- 12.3.5.1 Growing cosmetics and perfume industry to drive market

- TABLE 65 FRANCE: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 FRANCE: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 67 FRANCE: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 68 FRANCE: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.3.6 SPAIN

- 12.3.6.1 Upward food & beverages industry to drive market

- TABLE 69 SPAIN: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 SPAIN: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 71 SPAIN: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 72 SPAIN: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.3.7 RUSSIA

- 12.3.7.1 Increasing online sales of FMCG products to boost market

- TABLE 73 RUSSIA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 RUSSIA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 75 RUSSIA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 76 RUSSIA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.3.8 REST OF EUROPE

- TABLE 77 REST OF EUROPE: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 79 REST OF EUROPE: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 80 REST OF EUROPE: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.4 NORTH AMERICA

- 12.4.1 RECESSION IMPACT

- FIGURE 30 NORTH AMERICA: SELF-ADHESIVE LABELS MARKET SNAPSHOT

- TABLE 81 NORTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 83 NORTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 85 NORTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.4.2 US

- 12.4.2.1 Stringent rules and regulations related to labeling to drive market

- TABLE 87 US: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 US: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 89 US: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 90 US: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.4.3 CANADA

- 12.4.3.1 Growth in food and beverage industry to significantly drive to market

- TABLE 91 CANADA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 CANADA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 93 CANADA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 94 CANADA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.4.4 MEXICO

- 12.4.4.1 Increasing demand for packed food to drive market

- TABLE 95 MEXICO SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 MEXICO: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 97 MEXICO: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 98 MEXICO: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 RECESSION IMPACT

- TABLE 99 MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2019-2026 (MILLION SQUARE METER)

- TABLE 101 MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 103 MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.5.2 TURKEY

- 12.5.2.1 Rapid industrialization and urbanization to drive market

- TABLE 105 TURKEY: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 TURKEY: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 107 TURKEY: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 108 TURKEY: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.5.3 SAUDI ARABIA

- 12.5.3.1 Increasing manufacturing activities to boost market growth

- TABLE 109 SAUDI ARABIA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 SAUDI ARABIA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 111 SAUDI ARABIA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 112 SAUDI ARABIA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 High demand from retail food outlets to drive market

- TABLE 113 SOUTH AFRICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 SOUTH AFRICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 115 SOUTH AFRICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 116 SOUTH AFRICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.5.5 UAE

- 12.5.5.1 Growing pharmaceutical industry to fuel market

- TABLE 117 UAE: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 118 UAE: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 119 UAE: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 120 UAE: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 121 REST OF MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 REST OF MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.6 SOUTH AMERICA

- 12.6.1 RECESSION IMPACT

- TABLE 125 SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 126 SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METER)

- TABLE 127 SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 129 SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 130 SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.6.2 BRAZIL

- 12.6.2.1 Growing agricultural and food processing sector to drive market

- TABLE 131 BRAZIL: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 BRAZIL: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 133 BRAZIL: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 134 BRAZIL: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.6.3 ARGENTINA

- 12.6.3.1 Growing online retail sales to boost market

- TABLE 135 ARGENTINA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 ARGENTINA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 137 ARGENTINA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 138 ARGENTINA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

- 12.6.4 REST OF SOUTH AMERICA

- TABLE 139 REST OF SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 REST OF SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY TYPE, 2021-2028 (MILLION SQUARE METER)

- TABLE 141 REST OF SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 142 REST OF SOUTH AMERICA: SELF-ADHESIVE LABELS MARKET, BY APPLICATION, 2021-2028 (MILLION SQUARE METER)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- FIGURE 31 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY, 2019-2023

- 13.3 MARKET RANKING

- FIGURE 32 MARKET RANKING OF KEY PLAYERS, 2022

- 13.3.1 CCL INDUSTRIES

- 13.3.2 AVERY DENNISON CORPORATION

- 13.3.3 MULTI-COLOR CORPORATION

- 13.3.4 HUHTAMAKI OYJ

- 13.3.5 COVERIS

- 13.4 COMPANY EVALUATION MATRIX

- FIGURE 33 SELF-ADHESIVE LABELS MARKET: COMPANY EVALUATION MATRIX, 2022

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE COMPANIES

- 13.4.4 PARTICIPANTS

- 13.5 START-UPS/SMES EVALUATION MATRIX, 2022

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- FIGURE 34 START-UPS/SMES EVALUATION MATRIX: SELF-ADHESIVE LABELS MARKET, 2022

- 13.6 COMPETITIVE SCENARIO AND TRENDS

- 13.6.1 DEALS

- TABLE 143 SELF-ADHESIVE LABELS MARKET: DEALS, 2019-2023

- 13.6.2 OTHERS

- TABLE 144 SELF-ADHESIVE LABELS MARKET: OTHERS, 2019-2023

14 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 14.1 KEY COMPANIES

- 14.1.1 CCL INDUSTRIES

- TABLE 145 CCL INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 35 CCL INDUSTRIES: COMPANY SNAPSHOT

- 14.1.2 AVERY DENNISON CORPORATION

- TABLE 146 AVERY DENNISON CORPORATION: BUSINESS OVERVIEW

- FIGURE 36 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- TABLE 147 AVERY DENNISON CORPORATION: OTHERS

- 14.1.3 MULTI-COLOR CORPORATION

- TABLE 148 MULTI-COLOR CORPORATION: BUSINESS OVERVIEW

- TABLE 149 MULTI-COLOR CORPORATION: OTHERS

- 14.1.4 HUHTAMAKI OYJ

- TABLE 150 HUHTAMAKI OYJ: BUSINESS OVERVIEW

- FIGURE 37 HUHTAMAKI OYJ: COMPANY SNAPSHOT

- TABLE 151 HUHTAMAKI OYJ: OTHERS

- 14.1.5 COVERIS

- TABLE 152 COVERIS: BUSINESS OVERVIEW

- TABLE 153 COVERIS: OTHERS

- 14.1.6 SATO HOLDINGS CORPORATION

- TABLE 154 SATO HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 38 SATO HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 155 SATO HOLDING CORPORATION: OTHERS

- 14.1.7 LINTEC CORPORATION

- TABLE 156 LINTEC CORPORATION: BUSINESS OVERVIEW

- FIGURE 39 LINTEC CORPORATION: COMPANY SNAPSHOT

- 14.1.8 LECTA ADESTOR

- TABLE 157 LECTA ADESTOR: BUSINESS OVERVIEW

- TABLE 158 LECTA ADESTOR: OTHERS

- 14.1.9 FUJI SEAL INTERNATIONAL, INC.

- TABLE 159 FUJI SEAL INTERNATIONAL, INC.: BUSINESS OVERVIEW

- FIGURE 40 FUJI SEAL INTERNATIONAL, INC.: COMPANY SNAPSHOT

- 14.1.10 ALL4LABELS

- TABLE 160 ALL4LABELS: BUSINESS OVERVIEW

- TABLE 161 ALL4LABELS: OTHERS

- 14.2 OTHER PLAYERS

- 14.2.1 SKANEM

- TABLE 162 SKANEM: COMPANY OVERVIEW

- 14.2.2 BSP LABELS LTD.

- TABLE 163 BSP LABELS LTD.: COMPANY OVERVIEW

- 14.2.3 INLAND

- TABLE 164 INLAND: COMPANY OVERVIEW

- 14.2.4 CS LABELS

- TABLE 165 CS LABELS: COMPANY OVERVIEW

- 14.2.5 SECURA LABELS

- TABLE 166 SECURA LABELS: COMPANY OVERVIEW

- 14.2.6 TERRAGENE

- TABLE 167 TERRAGENE: COMPANY OVERVIEW

- 14.2.7 LABEL CRAFT

- TABLE 168 LABEL CRAFT: COMPANY OVERVIEW

- 14.2.8 REFLEX LABELS LTD.

- TABLE 169 REFLEX LABELS LTD.: COMPANY OVERVIEW

- 14.2.9 ETIQUETTE LABELS LTD.

- TABLE 170 ETIQUETTE LABELS LTD.: COMPANY OVERVIEW

- 14.2.10 ROYSTON LABELS

- TABLE 171 ROYSTON LABELS: COMPANY OVERVIEW

- 14.2.11 AZTEC LABEL

- TABLE 172 AZTEC LABEL: COMPANY OVERVIEW

- 14.2.12 SVS SPOL. S R.O.

- TABLE 173 SVS SPOL. S R.O.: COMPANY OVERVIEW

- 14.2.13 MAXIM LABEL AND PACKAGING

- TABLE 174 MAXIM LABEL AND PACKAGING: COMPANY OVERVIEW

- 14.2.14 DURALABEL GRAPHICS PVT. LTD.

- TABLE 175 DURALABEL GRAPHICS PVT. LTD.: COMPANY OVERVIEW

- 14.2.15 PROPRINT GROUP

- TABLE 176 PROPRINT GROUP: COMPANY OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS