|

|

市場調査レポート

商品コード

1398380

テーブルウェア用デジタル印刷の世界市場:用途別、インクタイプ別、地域別-2029年までの予測Digital Printing for Tableware Market by Application (Ceramic & Porcelain, Glass, Plastic, Bone China, Earthenware, Stoneware), Ink type (Ceramic ink, UV ink, Solvent-based ink) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| テーブルウェア用デジタル印刷の世界市場:用途別、インクタイプ別、地域別-2029年までの予測 |

|

出版日: 2023年12月01日

発行: MarketsandMarkets

ページ情報: 英文 209 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 用途別、インクタイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

テーブルウェア用デジタル印刷の市場規模は、2024年の3億2,600万米ドルから2029年には4億5,200万米ドルに達すると予測され、2024年から2029年までのCAGRは6.8%と見込まれています。

技術の進歩と、パーソナライズされたユニークなテーブルウェア製品に対する消費者の需要の高まりが、この成長軌道に拍車をかけています。この市場の楽観的な見通しにはいくつかの要因が寄与しています。まず、テーブルウェア業界におけるデジタル印刷技術へのシフトは、比類のないカスタマイズ能力を提供し、様々なテーブルウェアアイテムに複雑なデザイン、パターン、パーソナライズを可能にします。この動向は、個性的でオーダーメイドの食体験を求める消費者に強く響いています。さらに、製造業における持続可能な慣行に対する意識の高まりと重視が、テーブルウェア用デジタル印刷の採用を後押ししています。この技術は、資源の効率的な利用を可能にし、廃棄物を減らし、環境に優しい素材の利用をサポートし、環境意識の高い消費者の嗜好に合致しています。

持続可能な印刷は、環境への悪影響を減らすのに役立ちます。例えば、揮発性化合物を排除するために、コールドプレス版のようなプロセスフリーの版を使用します。デジタル印刷の採用は、従来の印刷方法との乖離により増加傾向にあります。従来の印刷とは異なり、デジタル印刷ではフィルム版や写真薬品を使用しないため、デジタル文書ファイルと最終的な印刷出力との間のプリプレス段階が合理化されます。版の交換が不要になるため、時間と資源の大幅な節約につながります。デジタル印刷機の活用は、業務効率を高めるだけでなく、企業の環境フットプリントにもプラスに働きます。さらに、デジタル印刷機は有害物質を排出しないため、オフセット印刷機で必要な換気システムが不要になり、環境に優しいという特長が際立っています。その結果、全体的なエネルギー消費量が削減されます。さらに、リサイクル材料の使用を提唱する持続可能な印刷の原則に沿い、デジタル印刷機は、印刷目的のためにリサイクルされたさまざまな基材に対応することで、多様性を示しています。

当レポートでは、世界のテーブルウェア用デジタル印刷市場について調査し、用途別、インクタイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価値/サプライチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 生態系/市場マップ

- 価格分析

- 技術動向

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2023年~2024年の主要な会議とイベント

- 規制状況

第6章 テーブルウェア用デジタル印刷市場、インクタイプ別

- イントロダクション

- セラミックインク

- UVインク

- 溶剤系インク

- その他

第7章 テーブルウェア用デジタル印刷市場、用途別

- イントロダクション

- セラミックと磁器

- ガラス

- その他

第8章 テーブルウェア用デジタル印刷市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第9章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 市場シェア分析、2022年

- 5年間の企業収益分析、2018~2022年

- 企業評価マトリックス

- 競争シナリオと動向

第10章 企業プロファイル

- デジタル印刷インクジェットプリンタープロバイダー

- SACMI

- ELECTRONICS FOR IMAGING, INC.

- MIMAKI ENGINEERING CO., LTD.

- KERAJET

- INX INTERNATIONAL INK CO.

- INKCUPS NOW

- BOSTON INDUSTRIAL SOLUTIONS, INC.

- PROJECTA ENGINEERING S.R.L.

- ENGINEERED PRINTING SOLUTIONS

- DIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.

- デジタルインクプロバイダー

- VIBRANTZ

- SICER S.P.A.

- SCF COLORIFICIO CERAMICO

- MARABU GMBH & CO. KG

- COLOROBBIA HOLDING S.P.A

- SPINKS WORLD

- RUCOINX DRUCKFARBEN

- KAO COLLINS CORPORATION

- SIEGWERK DRUCKFARBEN AG & CO. KGAA

- SUN CHEMICAL

- ENCRES DUBUIT

- NEEDHAM INKS LTD.

- SILPO

- T&K TOKA CORPORATION

- TECGLASS

第11章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Application, Ink type and Region |

| Regions covered | North America, Europe, APAC, RoW |

The Digital Printing For Tableware market is projected to reach USD 452 million by 2029 from USD 326 million in 2024; it is expected to grow at a CAGR of 6.8% from 2024 to 2029. The convergence of technological advancements and increasing consumer demand for personalized and unique tableware products is fueling this growth trajectory. Several factors contribute to the optimistic outlook for this market. Firstly, the shift toward digital printing techniques in the tableware industry offers unparalleled customization capabilities, allowing for intricate designs, patterns, and personalization on various tableware items. This trend resonates strongly with consumers seeking distinctive and bespoke dining experiences. Furthermore, the growing awareness and emphasis on sustainable practices in manufacturing are driving the adoption of digital printing for tableware. This technology enables efficient use of resources, reduces waste, and supports the utilization of eco-friendly materials, aligning with the preferences of environmentally conscious consumers.

"Increased demand for sustainable printing to drive the growth of Digital Printing For Tableware market."

Sustainable printing helps reduce the adverse impact on the environment. It uses recycled and renewable resources, e.g., process-free plates, such as cold press plates, to help eliminate volatile compounds. The adoption of digital printing has been on the rise due to its divergence from traditional printing methods. Unlike conventional printing, digital printing operates without film plates or photo chemicals, streamlining the pre-press stages between the digital document file and the final printed output. This elimination of plate replacement leads to significant time and resource savings. The utilization of digital printers not only enhances operational efficiency but also contributes positively to a company's environmental footprint. Moreover, digital presses stand out for their eco-friendly attributes as they don't emit harmful substances, thus obviating the need for the ventilation systems required by offset presses. Consequently, this results in reduced overall energy consumption. Furthermore, aligning with the principles of sustainable printing that advocate for the use of recycled materials, digital presses demonstrate versatility by accommodating a wide array of recycled substrates for printing purposes.

Digital printing for tableware is more sustainable than traditional methods, such as screen printing and decaling, because it uses less water and energy and it produces less waste. Screen printing and decaling both require the use of large amounts of water for rinsing and cleaning. Digital printing, on the other hand, does not require any water for cleaning. This is because digital printers use inkjet technology to print directly onto the tableware surface. Also, screen printing and decaling are both energy-intensive processes. Digital printing is more energy-efficient because it does not require the use of heat or chemicals to transfer the design onto the tableware. Furthermore, screen printing and decaling both produce a significant amount of waste, including printing plates, inks, and adhesives. Digital printing produces very little waste, as the inkjet printer only prints the design that is needed.

"The Ceramic and porcelain segment holds the largest market in 2023."

Digital printing for ceramic and porcelain tableware involves leveraging advanced printing techniques to intricately apply high-quality designs onto surfaces made of these materials. This contemporary method has gained significant traction in the tableware sector due to its capacity for customization, intricate graphics, and streamlined production processes. Employing inkjet printing technology, digital printing for ceramic and porcelain tableware ensures precise and elaborate images directly onto the items' surfaces. Specially crafted inks, often UV-curable, enable rapid drying and hardening upon exposure to ultraviolet light. This swift curing process is pivotal for maintaining efficiency along the production line. Digital printing caters to a range of ceramic and porcelain materials commonly used in crafting tableware, encompassing plates, bowls, mugs, and various other items.

"The UV ink segment, of Digital printing for tableware market by ink type is expected to hold largest market share during the forecast period."

UV ink formulated for digital printing on tableware denotes a specialized ink tailored for use in digital printing procedures, leveraging ultraviolet (UV) light to swiftly cure or dry the ink. Widely embraced in the customization and embellishment of diverse tableware categories like plates, bowls, mugs, and items crafted from materials such as ceramics, glass, and porcelain, this technology boasts rapid curative properties upon UV light exposure. The swift curing mechanism ensures immediate ink drying and solidification, streamlining production timelines significantly. Characterized by robust adhesion capabilities, these inks effectively bond with tableware surfaces, yielding resilient prints against regular use and washing. Renowned for their capacity to yield vivid and top-tier colors, UV inks empower the replication of intricate, finely detailed designs marked by exceptional color richness and saturation.

"Asia Pacific to hold grow at the highest CAGR during the forecast period."

The Asia Pacific region holds substantial potential for growth within the digital printing for tableware market. Factors driving this anticipated expansion include burgeoning industrialization, a rising population with increasing disposable income, and a growing appreciation for customized and aesthetically pleasing tableware. Countries like China, Japan, India, and South Korea are witnessing heightened adoption of digital printing technologies across various industries, including tableware production. Moreover, the region's robust manufacturing infrastructure and technological advancements position it favorably for further innovation and adoption of digital printing methods. The cultural significance of tableware in Asia Pacific societies, combined with the demand for unique and personalized designs, fuels the market's growth prospects. Additionally, the region's focus on eco-friendly practices aligns well with the sustainable aspects often associated with digital printing technologies. This convergence of factors suggests a promising trajectory for the Asia Pacific digital printing for the tableware market, presenting opportunities for manufacturers and stakeholders to tap into this burgeoning market segment.

Breakdown of profiles of primary participants:

- By Company Type: Tier 1 = 40%, Tier 2 = 25%, and Tier 3 = 35%

- By Designation: C-level Executives = 35%, Directors = 40%, and Others = 25%

- By Region: North America = 30%, Europe = 35%, Asia Pacific = 20%, and Rest of the World = 15%

Major players profiled in this report:

The digital printing for tableware market is dominated by established players such as SACMI (Italy), Electronics for Imaging, Inc. (US), Inkcups Now (US), and Mimaki Engineering Co., ltd. (Japan), Boston Industrial Solutions, Inc. (US), PROJECTA ENGINEERING S.R.L. (Italy), Engineered Printing Solutions (US), INX International Ink Co. (US), KERAjet (Spain), Dip-Tech Digital Printing Technologies Ltd. (Israel).

Research Coverage

This report offers detailed insights into the digital printing for tableware market based on Ink Type (Ceramic Ink, UV Ink, Solvent-based Ink, And Other Ink Types), By Application (Ceramic and porcelain, Glass, And Others), and Region (North America, Europe, Asia Pacific, and Rest of the World)- Global Forecast to 2029

The report also comprehensively reviews market drivers, restraints, opportunities, and challenges in the digital printing for tableware market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reasons to buy the report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the digital printing for the tableware market's pulse and provides information on key market drivers, restraints, challenges, and opportunities. This report includes statistics pertaining to digital printing for the tableware market based on ink type, application, and region. Major drivers, restraints, opportunities, and challenges for digital printing for the tableware market have been provided in detail in this report. The report includes illustrative segmentation, analysis, and forecast for the digital printing for tableware market based on its segments.

The report provides insights on the following pointers:

Analysis of key drivers (Increased demand for sustainable printing, growing demand from the food service industry, Rapid technological advancements in digital printers, Rapid prototyping and testing of new designs), restraints (High initial investment costs, Technological limitations in digital printing), opportunities (Increasing demand from the in-plant market, investment in R&D activities, Reduction in per unit cost of printing with digital printers) and challenges (Compatibility with limited materials, competition with traditional printing methods, Lack of standardization and regulatory compliance).

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the digital printing for tableware market

Market Development: Comprehensive information about lucrative markets - the report analyses the digital printing for tableware market across varied regions.

Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the digital printing for tableware market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like SACMI (Italy), Electronics for Imaging, Inc. (US), Inkcups Now (US), Mimaki Engineering Co., ltd. (Japan), Boston Industrial Solutions, Inc. (US), PROJECTA ENGINEERING S.R.L. (Italy), Engineered Printing Solutions (US), INX International Ink Co. (US), KERAjet (Spain), Dip-Tech Digital Printing Technologies Ltd. (Israel).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DIGITAL PRINTING FOR TABLEWARE MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DIGITAL PRINTING FOR TABLEWARE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of key interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach to estimate market size using top-down analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS IN DIGITAL PRINTING FOR TABLEWARE MARKET

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to estimate market size using bottom-up analysis

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIDE): BOTTOM-UP APPROACH, BY REGION

- 2.3 MARKET SHARE ESTIMATION

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.5.1 RESEARCH ASSUMPTIONS

- 2.5.2 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.6.1 RISK FACTOR ANALYSIS

- 2.6.2 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 9 CERAMIC & PORCELAIN SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 10 UV INK SEGMENT TO ACQUIRE LARGEST MARKET SHARE IN 2029

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL PRINTING FOR TABLEWARE MARKET

- FIGURE 12 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR DIGITALLY PRINTED TABLEWARE PRODUCTS

- 4.2 DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE

- FIGURE 13 UV INK SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- 4.3 DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION

- FIGURE 14 CERAMIC & PORCELAIN SEGMENT TO LEAD DIGITAL PRINTING FOR TABLEWARE MARKET FROM 2024 TO 2029

- 4.4 DIGITAL PRINTING FOR TABLEWARE MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- FIGURE 15 CERAMIC & PORCELAIN SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2029

- 4.5 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION

- FIGURE 16 MEXICO TO RECORD HIGHEST CAGR IN GLOBAL DIGITAL PRINTING FOR TABLEWARE FROM 2024 TO 2029

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DIGITAL PRINTING FOR TABLEWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing trend of sustainable practices in digital printing on tableware

- 5.2.1.2 High demand for digitally printed tableware from food service industry

- 5.2.1.3 Significant technological advancements in digital printing

- 5.2.1.4 Faster product development cycle due to rapid prototyping and quick testing of new designs

- FIGURE 18 DRIVERS: IMPACT ANALYSIS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Need for substantial upfront investment

- 5.2.2.2 Limited color gamut, susceptibility to fading, and lack of standardization

- FIGURE 19 RESTRAINTS: IMPACT ANALYSIS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising focus on in-plant printing in tableware industry

- 5.2.3.2 Increasing investments in R&D of newer digital printing technologies

- 5.2.3.3 Potential of digital printers to reduce per unit cost of printing

- FIGURE 20 OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.4 CHALLENGES

- 5.2.4.1 Compatibility with limited materials

- 5.2.4.2 Competition from traditional printing methods

- 5.2.4.3 Difficulties in regulatory compliance management

- FIGURE 21 CHALLENGES: IMPACT ANALYSIS

- 5.3 VALUE/SUPPLY CHAIN ANALYSIS

- FIGURE 22 VALUE/SUPPLY CHAIN ANALYSIS: DIGITAL PRINTING FOR TABLEWARE MARKET

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM/MARKET MAP

- TABLE 1 DIGITAL PRINTING FOR TABLEWARE MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- FIGURE 24 KEY PLAYERS IN DIGITAL PRINTING FOR TABLEWARE MARKET

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE (ASP) TREND

- FIGURE 25 ASP TREND OF DIGITAL INKJET PRINTERS USED IN TABLEWARE INDUSTRY, 2020-2029

- 5.6.2 INDICATIVE PRICE OF DIGITAL INKJET PRINTERS PROVIDED BY MAJOR COMPANIES, BY APPLICATION

- FIGURE 26 INDICATIVE PRICE OF DIGITAL INKJET PRINTERS OFFERED BY KEY PLAYERS, BY APPLICATION

- TABLE 2 INDICATIVE PRICE RANGE OF DIGITAL INKJET PRINTERS OFFERED BY KEY PLAYERS, BY APPLICATION (USD THOUSAND)

- 5.6.3 AVERAGE SELLING PRICE TREND FOR DIGITAL INKJET PRINTERS, BY REGION

- FIGURE 27 AVERAGE SELLING PRICE TREND OF DIGITAL INKJET PRINTERS, BY REGION

- 5.7 TECHNOLOGY TRENDS

- 5.7.1 RELEASE OF ADVANCED PRINTING TECHNOLOGIES

- 5.7.2 DEVELOPMENT OF NEW PRINTING HEADS

- 5.7.3 ELEVATED USE OF FOOD-SAFE INKS

- 5.7.4 INCREASED SUSTAINABILITY INITIATIVES

- 5.7.5 AI IN DIGITAL PRINTING FOR TABLEWARE

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES ON DIGITAL PRINTING FOR TABLEWARE MARKET

- FIGURE 28 DIGITAL PRINTING FOR TABLEWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA, BY APPLICATION

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 APULUM PARTNERED WITH SACMI TO PRODUCE PORCELAIN/STONEWARE TABLEWARE USING RECYCLED MATERIAL

- 5.10.2 BOTTLED GOOSE COLLABORATED WITH INKCUPS TO DEVELOP PERSONALIZED MODULE FOR CUSTOMIZED OFFERINGS

- 5.10.3 MITEC ENGINY ADOPTED INKJET PRINTING SOLUTION TO PRINT HIGH-QUALITY DESIGNS AND REDUCE PRODUCTION TIME AND COSTS

- 5.10.4 EFI VUTEK Q5R ROLL-TO-ROLL LED PRINTER HELPED DECOADER ACHIEVE FASTER TURNAROUND TIMES

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- FIGURE 31 COUNTRY-WISE IMPORT DATA FOR HS CODE 844339-COMPLIANT PRODUCTS, 2018-2022 (USD MILLION)

- TABLE 6 IMPORT DATA FOR HS CODE 844339-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

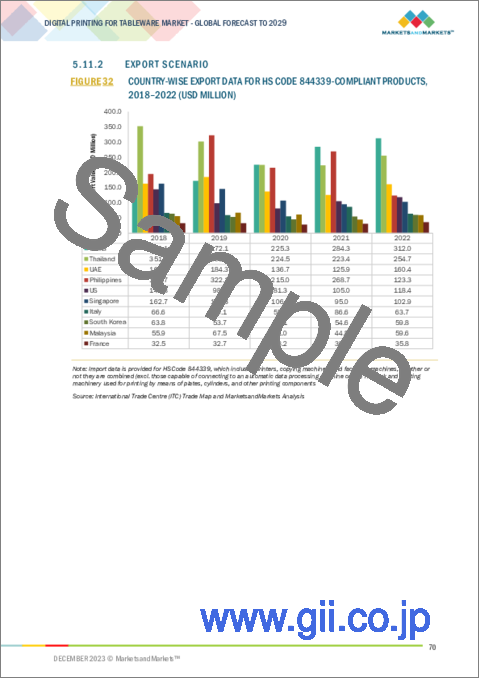

- 5.11.2 EXPORT SCENARIO

- FIGURE 32 COUNTRY-WISE EXPORT DATA FOR HS CODE 844339-COMPLIANT PRODUCTS, 2018-2022 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 844339-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- 5.12.1 TOP PATENT OWNERS

- FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- 5.12.2 GLOBAL PATENT TRENDS

- FIGURE 34 NUMBER OF PATENTS GRANTED PER YEAR, 2013-2022

- TABLE 8 NUMBER OF PATENTS GRANTED IN DIGITAL PRINTING FOR TABLEWARE MARKET IN LAST 10 YEARS

- TABLE 9 LIST OF KEY PATENTS IN DIGITAL PRINTING FOR TABLEWARE MARKET, 2022-2023

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS IN DIGITAL PRINTING FOR TABLEWARE MARKET, 2023-2024

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 ISO STANDARDS

- 5.14.1.1 Multicolor testing

- 5.14.1.2 Color richness testing

- 5.14.2 REGION-WISE REGULATORY ANALYSIS

- 5.14.3 NORTH AMERICA

- 5.14.3.1 US

- 5.14.3.2 Canada

- 5.14.3.3 Mexico

- 5.14.4 EUROPE

- 5.14.5 ASIA PACIFIC

- 5.14.5.1 China

- 5.14.5.2 Japan

- 5.14.5.3 South Korea

- 5.14.6 ROW

- 5.14.6.1 Middle East

- 5.14.6.2 Africa

- 5.14.6.3 South America

- 5.14.1 ISO STANDARDS

6 DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE

- 6.1 INTRODUCTION

- FIGURE 35 UV INK TO HOLD LARGEST MARKET SHARE IN 2024

- TABLE 11 DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 12 DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 6.2 CERAMIC INK

- 6.2.1 INCREASING USE IN PRINTING INTRICATE DESIGNS ON CERAMIC SURFACES TO FUEL SEGMENTAL GROWTH

- TABLE 13 CERAMIC INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 14 CERAMIC INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 UV INK

- 6.3.1 SURGING DEMAND FOR UV INK TO PRODUCE VIVID AND HIGH-RESOLUTION PRINTS TO DRIVE MARKET

- TABLE 15 UV INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 16 UV INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.4 SOLVENT-BASED INK

- 6.4.1 COMPATIBILITY WITH NUMEROUS SUBSTRATES AND EXCEPTIONAL DURABILITY TO DRIVE DEMAND

- TABLE 17 SOLVENT-BASED INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 18 SOLVENT-BASED INK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.5 OTHER INK TYPES

- TABLE 19 OTHER INK TYPES: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 20 OTHER INK TYPES: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

7 DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 36 CERAMIC & PORCELAIN SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 21 DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 22 DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 7.2 CERAMIC & PORCELAIN

- 7.2.1 GROWING TREND TO PRODUCE INTRICATE AND COLORFUL DESIGNS ON CERAMICS AND PORCELAIN TO DRIVE MARKET

- TABLE 23 CERAMIC & PORCELAIN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 CERAMIC & PORCELAIN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 GLASS

- 7.3.1 UNPARALLELED CUSTOMIZATION, DURABILITY, AND COST-EFFECTIVENESS OF DIGITAL PRINTING ON GLASS TABLEWARE TO DRIVE MARKET

- TABLE 25 GLASS: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 GLASS: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.4 OTHER APPLICATIONS

- TABLE 27 OTHER APPLICATIONS: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 OTHER APPLICATIONS: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

8 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 37 DIGITAL PRINTING FOR TABLEWARE MARKET: REGIONAL SNAPSHOT

- TABLE 29 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- FIGURE 38 DIGITAL PRINTING FOR TABLEWARE MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- TABLE 30 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2020-2023 (UNITS)

- TABLE 32 DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (UNITS)

- 8.2 NORTH AMERICA

- FIGURE 39 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET SNAPSHOT

- TABLE 33 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 34 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 35 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 36 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- TABLE 37 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 38 NORTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 8.2.1 US

- 8.2.1.1 Significant demand for personalized tableware products to drive market

- TABLE 39 US: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 40 US: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 41 US: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 42 US: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.2.2 CANADA

- 8.2.2.1 Increasing adoption of sustainable technology to fuel market growth

- TABLE 43 CANADA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 44 CANADA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 CANADA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 46 CANADA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.2.3 MEXICO

- 8.2.3.1 Rising focus on creation of tableware featuring popular festivals to accelerate market growth

- TABLE 47 MEXICO: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 48 MEXICO: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 49 MEXICO: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 50 MEXICO: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.2.4 IMPACT OF RECESSION ON MARKET IN NORTH AMERICA

- 8.3 EUROPE

- FIGURE 40 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET SNAPSHOT

- TABLE 51 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 52 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 53 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 54 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- TABLE 55 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 56 EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 8.3.1 UK

- 8.3.1.1 Growing use of digital inkjet printers by ceramic plate manufacturers to support market growth

- TABLE 57 UK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 58 UK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 59 UK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 60 UK: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.3.2 GERMANY

- 8.3.2.1 Significant presence of premium and craft beverage providers to stimulate market growth

- TABLE 61 GERMANY: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 62 GERMANY: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 63 GERMANY: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 64 GERMANY: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.3.3 FRANCE

- 8.3.3.1 Wine and dine culture and booming tourism market to boost demand

- TABLE 65 FRANCE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 66 FRANCE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 67 FRANCE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 68 FRANCE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.3.4 REST OF EUROPE

- TABLE 69 REST OF EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 70 REST OF EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 71 REST OF EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 72 REST OF EUROPE: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.3.5 IMPACT OF RECESSION ON MARKET IN EUROPE

- 8.4 ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET SNAPSHOT

- TABLE 73 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 74 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 75 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 76 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- TABLE 77 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 8.4.1 JAPAN

- 8.4.1.1 Rising demand for theme- and festive-based tableware to drive market

- TABLE 79 JAPAN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 80 JAPAN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 81 JAPAN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 82 JAPAN: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.4.2 CHINA

- 8.4.2.1 Surging demand for personalized and visually distinctive tableware products to create opportunities

- TABLE 83 CHINA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 84 CHINA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 85 CHINA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 86 CHINA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.4.3 SOUTH KOREA

- 8.4.3.1 Growing preference for customized and aesthetically unique tableware products to foster market growth

- TABLE 87 SOUTH KOREA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 88 SOUTH KOREA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 89 SOUTH KOREA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 90 SOUTH KOREA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.4.4 REST OF ASIA PACIFIC

- TABLE 91 REST OF ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.4.5 IMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

- 8.5 REST OF THE WORLD (ROW)

- TABLE 95 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 96 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 97 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 98 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- TABLE 99 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- FIGURE 42 MIDDLE EAST TO ACCOUNT FOR LARGEST SHARE OF DIGITAL PRINTING FOR TABLEWARE MARKET IN ROW IN 2029

- TABLE 100 ROW: DIGITAL PRINTING FOR TABLEWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.5.1 SOUTH AMERICA

- 8.5.1.1 Increasing demand for contemporary and innovative tableware designs to fuel market growth

- TABLE 101 SOUTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 102 SOUTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 103 SOUTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 104 SOUTH AMERICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.5.2 MIDDLE EAST

- 8.5.2.1 Rising demand for customized tableware from hospitality sector to foster market growth

- 8.5.2.2 GCC countries

- 8.5.2.3 Rest of Middle East

- TABLE 105 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 106 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 107 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 108 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- TABLE 109 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 MIDDLE EAST: DIGITAL PRINTING FOR TABLEWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 8.5.3 AFRICA

- 8.5.3.1 Regional arts and traditional craftsmanship to boost demand

- TABLE 111 AFRICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 112 AFRICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 AFRICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2020-2023 (USD MILLION)

- TABLE 114 AFRICA: DIGITAL PRINTING FOR TABLEWARE MARKET, BY INK TYPE, 2024-2029 (USD MILLION)

- 8.5.4 IMPACT OF RECESSION ON MARKET IN REST OF THE WORLD

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 115 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

- 9.2.1 PRODUCT PORTFOLIO

- 9.2.2 REGIONAL FOCUS

- 9.2.3 MANUFACTURING FOOTPRINT

- 9.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

- 9.3 MARKET SHARE ANALYSIS, 2022

- TABLE 116 DIGITAL PRINTING FOR TABLEWARE MARKET: DEGREE OF COMPETITION, 2022

- 9.4 FIVE-YEAR COMPANY REVENUE ANALYSIS, 2018-2022

- FIGURE 43 FIVE-YEAR COMPANY REVENUE ANALYSIS OF KEY MARKET PLAYERS

- 9.5 COMPANY EVALUATION MATRIX

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- FIGURE 44 DIGITAL PRINTING FOR TABLEWARE MARKET: COMPANY EVALUATION MATRIX, 2022

- 9.5.5 COMPANY FOOTPRINT

- TABLE 117 OVERALL COMPANY FOOTPRINT (10 COMPANIES)

- TABLE 118 COMPANY APPLICATION FOOTPRINT (10 COMPANIES)

- TABLE 119 COMPANY REGION FOOTPRINT (10 COMPANIES)

- 9.6 COMPETITIVE SCENARIOS AND TRENDS

- 9.6.1 PRODUCT LAUNCHES

- TABLE 120 PRODUCT LAUNCHES, 2020-2023

- 9.6.2 DEALS

- TABLE 121 DEALS, 2020-2023

10 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 10.1 DIGITAL INKJET PRINTER PROVIDERS

- 10.1.1 SACMI

- TABLE 122 SACMI: COMPANY OVERVIEW

- FIGURE 45 SACMI: COMPANY SNAPSHOT

- TABLE 123 SACMI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 SACMI: DEALS

- 10.1.2 ELECTRONICS FOR IMAGING, INC.

- TABLE 125 ELECTRONICS FOR IMAGING, INC.: COMPANY OVERVIEW

- TABLE 126 ELECTRONICS FOR IMAGING, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 ELECTRONICS FOR IMAGING, INC.: DEALS

- 10.1.3 MIMAKI ENGINEERING CO., LTD.

- TABLE 128 MIMAKI ENGINEERING CO., LTD.: COMPANY OVERVIEW

- FIGURE 46 MIMAKI ENGINEERING CO., LTD.: COMPANY SNAPSHOT

- TABLE 129 MIMAKI ENGINEERING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 MIMAKI ENGINEERING CO., LTD.: PRODUCT LAUNCHES

- TABLE 131 MIMAKI ENGINEERING CO., LTD.: DEALS

- 10.1.4 KERAJET

- TABLE 132 KERAJET: COMPANY OVERVIEW

- TABLE 133 KERAJET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 KERAJET: PRODUCT LAUNCHES

- TABLE 135 KERAJET: DEALS

- 10.1.5 INX INTERNATIONAL INK CO.

- TABLE 136 INX INTERNATIONAL INK CO.: COMPANY OVERVIEW

- TABLE 137 INX INTERNATIONAL INK CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 INX INTERNATIONAL INK CO.: DEALS

- TABLE 139 INX INTERNATIONAL INK CO.: OTHERS

- 10.1.6 INKCUPS NOW

- TABLE 140 INKCUPS NOW: COMPANY OVERVIEW

- TABLE 141 INKCUPS NOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 INKCUPS NOW: PRODUCT LAUNCHES

- TABLE 143 INKCUPS NOW: DEALS

- 10.1.7 BOSTON INDUSTRIAL SOLUTIONS, INC.

- TABLE 144 BOSTON INDUSTRIAL SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 145 BOSTON INDUSTRIAL SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 BOSTON INDUSTRIAL SOLUTIONS, INC.: PRODUCT LAUNCHES

- 10.1.8 PROJECTA ENGINEERING S.R.L.

- TABLE 147 PROJECTA ENGINEERING S.R.L.: COMPANY OVERVIEW

- TABLE 148 PROJECTA ENGINEERING S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.9 ENGINEERED PRINTING SOLUTIONS

- TABLE 149 ENGINEERED PRINTING SOLUTIONS: COMPANY OVERVIEW

- TABLE 150 ENGINEERED PRINTING SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 ENGINEERED PRINTING SOLUTIONS: PRODUCT LAUNCHES

- 10.1.10 DIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.

- TABLE 152 DIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 153 DIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 DIP-TECH DIGITAL PRINTING TECHNOLOGIES LTD.: DEALS

- 10.2 DIGITAL INK PROVIDERS

- 10.2.1 VIBRANTZ

- 10.2.2 SICER S.P.A.

- 10.2.3 SCF COLORIFICIO CERAMICO

- 10.2.4 MARABU GMBH & CO. KG

- 10.2.5 COLOROBBIA HOLDING S.P.A

- 10.2.6 SPINKS WORLD

- 10.2.7 RUCOINX DRUCKFARBEN

- 10.2.8 KAO COLLINS CORPORATION

- 10.2.9 SIEGWERK DRUCKFARBEN AG & CO. KGAA

- 10.2.10 SUN CHEMICAL

- 10.2.11 ENCRES DUBUIT

- 10.2.12 NEEDHAM INKS LTD.

- 10.2.13 SILPO

- 10.2.14 T&K TOKA CORPORATION

- 10.2.15 TECGLASS

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS