|

|

市場調査レポート

商品コード

1788515

スイッチギアモニタリングシステムの世界市場:スイッチギアタイプ別、電圧別、サービス別、コンポーネント別、エンドユーザー別、地域別 - 2030年までの予測Switchgear Monitoring System Market by Switchgear Type (Gas-insulated, Air-insulated), Voltage (Low, Medium, and High and Extra High), End User (Utilities, Industrial, Commercial, Residential), Component, Service, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| スイッチギアモニタリングシステムの世界市場:スイッチギアタイプ別、電圧別、サービス別、コンポーネント別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月06日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

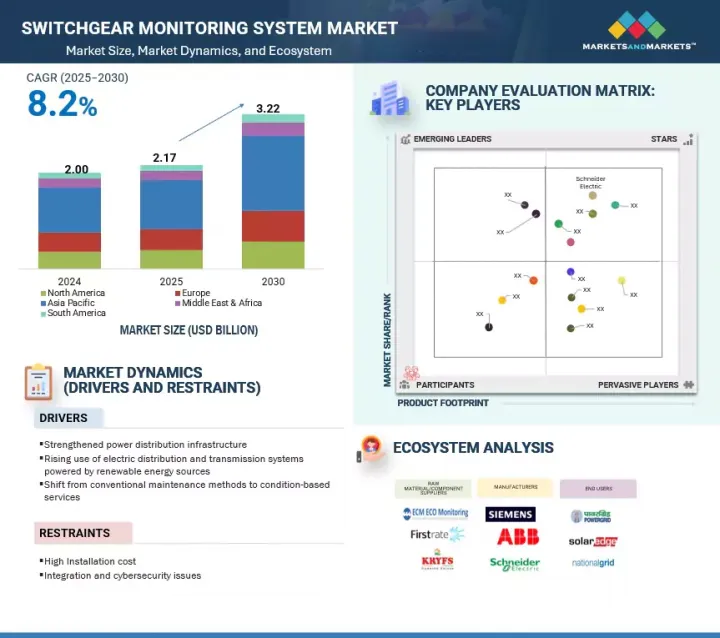

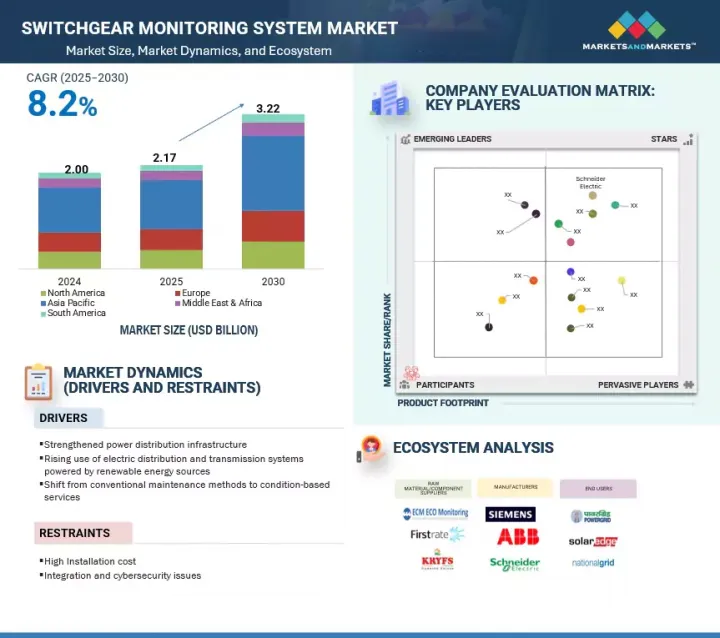

世界のスイッチギアモニタリングシステムの市場規模は、2025年の21億7,000万米ドルから2030年には32億2,000万米ドルに成長し、CAGRは8.2%になると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象台数 | 金額(100万米ドル)および数量(台) |

| セグメント | スイッチギアタイプ別、電圧別、サービス別、コンポーネント別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

信頼性の高い配電システム、送電網の近代化、予知保全に対する需要の高まりが、スイッチギアモニタリングシステム市場の拡大に拍車をかけています。また、技術の進歩やエネルギー効率化政策の実施により、スイッチギアモニタリングシステムは産業用ユーザーの間でも勢いを増しています。

予測期間を通じて変電所や送配電網で構成される重要なインフラで先進的なスイッチギアモニタリングシステムの採用が増加しているため、スイッチギアモニタリングシステム市場で最も大きな割合を占めるのは公益事業セグメントです。スイッチギアモニタリングシステムは、リアルタイム診断、信頼性の向上、メンテナンス要件の削減などの機能を備えているため、公益事業運営に適しています。送電網の安定性、停電防止、エネルギー効率に対する関心の高まりにより、これらのシステムの採用は着実に増加しています。さらに、スマート・モニタリング技術の導入とスマート・グリッドへの移行を奨励する政府の政策が、これらのシステムの導入をさらに後押しし、加速させています。

欧州は、産業オートメーションシステムにおけるスイッチギアモニタリングシステムの大規模な普及、再生可能エネルギー源の採用増加、スマートグリッドの開拓により、スイッチギアモニタリングシステム市場で第2位の市場になると見られています。同地域は、すでに確立された産業、エネルギー効率の高い技術への深い設備投資、クリーンエネルギーと電化に関する有利な政府政策を誇っています。さらに、ドイツやフランスなどの主要な電力会社や製造企業は、より高い信頼性と持続可能性を実現するために、開閉器モニタリングシステムシステムの統合への取り組みを強化しています。こうした積極的な取り組みが、この地域の需要をさらに押し上げています。重要な定性的・定量的情報を入手・検証し、将来の市場展望を評価するために、さまざまな主要市場参入企業、専門家、主要市場参入企業のCレベル幹部、業界コンサルタントなどの専門家に詳細なインタビューを実施しました。

当レポートでは、世界のスイッチギアモニタリングシステム市場を、スイッチギアのタイプ、コンポーネント、サービス、電圧、エンドユーザー、地域別に定義、記述、予測しています。また、市場の詳細な質的・量的分析も行っています。主な市場促進要因・抑制要因・機会・課題を包括的にレビューしています。また、市場の様々な重要な側面もカバーしています。これらには、競合情勢、市場力学、金額ベースの市場推定、スイッチギアモニタリングシステム市場の将来動向などの分析が含まれます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- バリューチェーン分析

- 技術分析

- 価格分析

- 関税と規制状況

- 貿易分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 生成AI/AIがスイッチギアモニタリングシステム市場に与える影響

- 2025年の米国関税の影響- 概要

第6章 スイッチギアモニタリングシステム市場(スイッチギアタイプ別)

- イントロダクション

- 空気断熱

- ガス断熱

第7章 スイッチギアモニタリングシステム市場(電圧別)

- イントロダクション

- 低電圧

- 中電圧

- 高電圧、超高電圧

第8章 スイッチギアモニタリングシステム市場(サービス別)

- イントロダクション

- 部分放電モニタリングシステム

- ガスモニタリングシステム

- 温度モニタリングシステム

- その他

第9章 スイッチギアモニタリングシステム市場(コンポーネント別)

- イントロダクション

- ハードウェア

- ソフトウェア

第10章 スイッチギアモニタリングシステム市場(エンドユーザー別)

- イントロダクション

- ユーティリティ

- 工業

- 商業

- その他

第11章 スイッチギアモニタリングシステム市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- GCC

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- SIEMENS

- ABB

- SCHNEIDER ELECTRIC

- EATON

- GE VERNOVA

- MITSUBISHI ELECTRIC CORPORATION

- EMERSON ELECTRIC CO.

- HITACHI, LTD.

- PT. TIARA VIBRASINDO PRATAMA

- SENSEOR-WIKA GROUP

- BLUE JAY TECHNOLOGY CO. LTD.

- DYNAMIC RATINGS

- OSENSA INNOVATIONS

- MEGGER

- IPEC LTD.

- その他の企業

- MONITRA LTD.

- RUGGED MONITORING

- PDS

- DOBLE ENGINEERING COMPANY

- NUVENTURA

第14章 付録

List of Tables

- TABLE 1 SWITCHGEAR MONITORING SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS, BY SWITCHGEAR TYPE

- TABLE 2 SWITCHGEAR MONITORING SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS, BY COMPONENT

- TABLE 3 SWITCHGEAR MONITORING SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS, BY VOLTAGE

- TABLE 4 SWITCHGEAR MONITORING SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS, BY SERVICE

- TABLE 5 SWITCHGEAR MONITORING SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS, BY END USER

- TABLE 6 SWITCHGEAR MONITORING SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS, BY REGION

- TABLE 7 SWITCHGEAR MONITORING SYSTEM MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- TABLE 8 SWITCHGEAR MONITORING SYSTEM MARKET: RISK ANALYSIS

- TABLE 9 SWITCHGEAR MONITORING SYSTEM MARKET SNAPSHOT

- TABLE 10 PROJECTS/REGULATIONS BY DIFFERENT COUNTRIES FOR ENERGY TRANSITION

- TABLE 11 ENERGY TRANSITION SCORES, BY COUNTRY, 2024

- TABLE 12 ROLE OF COMPANIES IN SWITCHGEAR MONITORING SYSTEM ECOSYSTEM

- TABLE 13 AVERAGE SELLING PRICE TREND OF SWITCHGEAR TYPES, 2021-2024 (USD/UNIT)

- TABLE 14 AVERAGE SELLING PRICE TREND OF SWITCHGEAR MONITORING SYSTEMS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 15 IMPORT DATA FOR HS CODE 853590-COMPLIANT PRODUCTS, 2024

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 SWITCHGEAR MONITORING SYSTEM MARKET: LIST OF PATENTS, 2021-2023

- TABLE 22 IMPORT DATA FOR HS CODE-853590 COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 23 EXPORT DATA FOR HS CODE-853590 COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 24 SWITCHGEAR MONITORING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- TABLE 26 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 27 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 28 ANTICIPATED CHANGE IN PRICES AND POTENTIAL IMPACT ON END USERS DUE TO TARIFF ENFORCEMENT

- TABLE 29 SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 30 SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 31 AIR-INSULATED: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 AIR-INSULATED: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 GAS-INSULATED: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 GAS-INSULATED: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 36 SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 37 LOW: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 LOW: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 MEDIUM: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 MEDIUM: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 HIGH AND EXTRA HIGH: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 HIGH AND EXTRA HIGH: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 44 SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 45 PARTIAL DISCHARGE MONITORING: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 PARTIAL DISCHARGE MONITORING: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 GAS MONITORING: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 GAS MONITORING: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 TEMPERATURE MONITORING: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 TEMPERATURE MONITORING: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 OTHER SERVICES: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 OTHER SERVICES: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 54 SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 55 HARDWARE: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 HARDWARE: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 SOFTWARE: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 SOFTWARE: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 60 SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 61 UTILITIES: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 UTILITIES: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 INDUSTRIAL: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 INDUSTRIAL: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 COMMERCIAL: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION 2021-2024 (USD MILLION)

- TABLE 66 COMMERCIAL: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION 2025-2030 (USD MILLION)

- TABLE 67 OTHER END USERS: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 OTHER END USERS: SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 72 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 73 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 74 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 75 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 76 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 78 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 82 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 CHINA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 86 CHINA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 87 JAPAN: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 88 JAPAN: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 89 INDIA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 90 INDIA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 91 SOUTH KOREA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 92 SOUTH KOREA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 93 AUSTRALIA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 94 AUSTRALIA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 100 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 102 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 GERMANY: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 110 GERMANY: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 111 UK: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 112 UK: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 113 FRANCE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 114 FRANCE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 115 ITALY: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 116 ITALY: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 117 RUSSIA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 118 RUSSIA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 120 REST OF EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 122 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 126 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 130 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 US: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 134 US: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 135 CANADA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 136 CANADA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 137 MEXICO: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 138 MEXICO: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 GCC: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 GCC: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 SAUDI ARABIA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 154 SAUDI ARABIA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 155 UAE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 156 UAE: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 157 KUWAIT: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 158 KUWAIT: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 159 REST OF GCC: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 160 REST OF GCC: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 162 SOUTH AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 167 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 168 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 169 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 170 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 171 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 172 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 174 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 175 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 BRAZIL: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 178 BRAZIL: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 179 ARGENTINA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 180 ARGENTINA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2021-2024 (USD MILLION)

- TABLE 182 REST OF SOUTH AMERICA: SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE, 2025-2030 (USD MILLION)

- TABLE 183 SWITCHGEAR MONITORING SYSTEM MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, MARCH 2021-JUNE 2025

- TABLE 184 SWITCHGEAR MONITORING SYSTEM MARKET: DEGREE OF COMPETITION, 2024

- TABLE 185 SWITCHGEAR MONITORING SYSTEM MARKET: REGION FOOTPRINT

- TABLE 186 SWITCHGEAR MONITORING SYSTEM MARKET: SWITCHGEAR TYPE FOOTPRINT

- TABLE 187 SWITCHGEAR MONITORING SYSTEM MARKET: VOLTAGE FOOTPRINT

- TABLE 188 SWITCHGEAR MONITORING SYSTEM MARKET: END USER FOOTPRINT

- TABLE 189 SWITCHGEAR MONITORING SYSTEM MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 190 SWITCHGEAR MONITORING SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 191 SWITCHGEAR MONITORING SYSTEM MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 192 SWITCHGEAR MONITORING SYSTEM MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 193 SWITCHGEAR MONITORING SYSTEM MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 194 SWITCHGEAR MONITORING SYSTEM MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 195 SIEMENS: COMPANY OVERVIEW

- TABLE 196 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SIEMENS: PRODUCT LAUNCHES

- TABLE 198 SIEMENS: DEALS

- TABLE 199 SIEMENS: EXPANSIONS

- TABLE 200 SIEMENS: OTHER DEVELOPMENTS

- TABLE 201 ABB: COMPANY OVERVIEW

- TABLE 202 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 ABB: PRODUCT LAUNCHES

- TABLE 204 ABB: EXPANSIONS

- TABLE 205 ABB: OTHER DEVELOPMENTS

- TABLE 206 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 207 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 209 SCHNEIDER ELECTRIC: DEALS

- TABLE 210 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

- TABLE 211 EATON: COMPANY OVERVIEW

- TABLE 212 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 EATON: PRODUCT LAUNCHES

- TABLE 214 EATON: EXPANSIONS

- TABLE 215 EATON: OTHER DEVELOPMENTS

- TABLE 216 GE VERNOVA: COMPANY OVERVIEW

- TABLE 217 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 GE VERNOVA: PRODUCT LAUNCHES

- TABLE 219 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 220 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 221 MITSUBISHI ELECTRIC CORPORATION: EXPANSIONS

- TABLE 222 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 223 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 224 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 226 HITACHI, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 HITACHI, LTD.: DEALS

- TABLE 228 HITACHI, LTD.: EXPANSIONS

- TABLE 229 PT. TIARA VIBRASINDO PRATAMA: COMPANY OVERVIEW

- TABLE 230 PT. TIARA VIBRASINDO PRATAMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SENSEOR - WIKA GROUP: COMPANY OVERVIEW

- TABLE 232 SENSEOR - WIKA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 BLUE JAY TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

- TABLE 234 BLUE JAY TECHNOLOGY CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 DYNAMIC RATINGS: COMPANY OVERVIEW

- TABLE 236 DYNAMIC RATINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 DYNAMIC RATINGS: DEALS

- TABLE 238 DYNAMIC RATINGS: EXPANSIONS

- TABLE 239 OSENSA INNOVATIONS: COMPANY OVERVIEW

- TABLE 240 OSENSA INNOVATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 OSENSA INNOVATIONS: PRODUCT LAUNCHES

- TABLE 242 MEGGER: COMPANY OVERVIEW

- TABLE 243 MEGGER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 MEGGER: EXPANSIONS

- TABLE 245 IPEC LTD.: COMPANY OVERVIEW

- TABLE 246 IPEC LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 IPEC LTD.: PRODUCT LAUNCHES

- TABLE 248 IPEC LTD.: EXPANSIONS

List of Figures

- FIGURE 1 SWITCHGEAR MONITORING SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR SWITCHGEAR MONITORING SYSTEMS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 SWITCHGEAR MONITORING SYSTEM MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED IN ASSESSING SUPPLY OF SWITCHGEAR MONITORING SYSTEMS

- FIGURE 7 SWITCHGEAR MONITORING SYSTEM MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWTHING MARKET FOR SWITCHGEAR MONITORING SYSTEMS DURING FORECAST PERIOD

- FIGURE 10 GAS-INSULATED SEGMENT HELD MAJORITY OF MARKET SHARE IN 2024

- FIGURE 11 SOFTWARE SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 HIGH AND EXTRA HIGH SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 TEMPERATURE MONITORING SEGMENT TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 14 UTILITIES SEGMENT LED MARKET IN 2024

- FIGURE 15 GROWING DEPLOYMENT OF SMART GRIDS GLOBALLY TO DRIVE MARKET

- FIGURE 16 ASIA PACIFIC TO WITNESS HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 17 UTILITIES SEGMENT AND CHINA HELD LARGEST SHARE OF ASIA PACIFIC SWITCHGEAR MONITORING SYSTEM MARKET IN 2024

- FIGURE 18 GAS-INSULATED SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2030

- FIGURE 19 HARDWARE COMPONENTS TO SECURE PROMINENT MARKET SHARE IN 2030

- FIGURE 20 HIGH AND EXTRA HIGH SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 21 TEMPERATURE MONITORING SEGMENT TO LEAD MARKET IN 2030

- FIGURE 22 UTILITIES SEGMENT TO COMMAND MARKET IN 2030

- FIGURE 23 SWITCHGEAR MONITORING SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 ANNUAL CLEAN ENERGY INVESTMENTS, 2019-2024

- FIGURE 25 GLOBAL ENERGY TRANSITION INVESTMENT, 2013-2023

- FIGURE 26 INVESTMENT IN POWER GRIDS AND STORAGE INFRASTRUCTURE, BY REGION, 2019-2024

- FIGURE 27 GLOBAL RENEWABLE ELECTRICITY GENERATION, 2013-2023

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 SWITCHGEAR MONITORING SYSTEM ECOSYSTEM PLAYERS

- FIGURE 30 SYSTEM MANUFACTURERS AND ASSEMBLERS SERVICE PROVIDERS TO ADD MAXIMUM VALUE TO OVERALL PRODUCT

- FIGURE 31 AVERAGE SELLING PRICE TREND OF DIFFERENT TYPE OF SWITCHGEAR DEPLOYED IN SWITCHGEAR MONITORING SYSTEMS, 2021-2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF SWITCHGEAR MONITORING SYSTEMS, BY REGION, 2021-2024

- FIGURE 33 PATENT ANALYSIS, 2014-2024

- FIGURE 34 IMPORT SCENARIO FOR HS CODE-853590 COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2022-2024

- FIGURE 35 EXPORT SCENARIO FOR HS CODE-853590 COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2022-2024

- FIGURE 36 SWITCHGEAR MONITORING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 38 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 39 IMPACT OF GENERATIVE AI/AI ON END USERS, BY REGION

- FIGURE 40 SWITCHGEAR MONITORING SYSTEM MARKET SHARE, BY SWITCHGEAR TYPE, 2024

- FIGURE 41 SWITCHGEAR MONITORING SYSTEM MARKET SHARE, BY VOLTAGE, 2024

- FIGURE 42 SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE, 2024

- FIGURE 43 SWITCHGEAR MONITORING SYSTEM MARKET SHARE, BY COMPONENT, 2024

- FIGURE 44 SWITCHGEAR MONITORING SYSTEM MARKET SHARE, BY END USER, 2024

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN SWITCHGEAR MONITORING SYSTEM MARKET FROM 2025 TO 2030

- FIGURE 46 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION, 2024

- FIGURE 47 ASIA PACIFIC: SWITCHGEAR MONITORING SYSTEM MARKET SNAPSHOT

- FIGURE 48 EUROPE: SWITCHGEAR MONITORING SYSTEM MARKET SNAPSHOT

- FIGURE 49 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SWITCHGEAR MONITORING SYSTEMS, 2024

- FIGURE 50 SWITCHGEAR MONITORING SYSTEM MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 51 SWITCHGEAR MONITORING SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 SWITCHGEAR MONITORING SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 53 SWITCHGEAR MONITORING SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 SIEMENS: COMPANY SNAPSHOT

- FIGURE 55 ABB: COMPANY SNAPSHOT

- FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 57 EATON: COMPANY SNAPSHOT

- FIGURE 58 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 59 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 61 HITACHI, LTD.: COMPANY SNAPSHOT

The global switchgear monitoring system market is estimated to grow from USD 2.17 billion in 2025 to USD 3.22 billion by 2030, at a CAGR of 8.2%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Units) |

| Segments | Switchgear Type, Voltage, Component, Service, and End User |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The growing demand for highly reliable power distribution systems, grid modernization, and predictive maintenance is fueling the expansion of the switchgear monitoring system market. Switchgear monitoring systems are also gaining momentum across industrial users due to ongoing technological advancements and the implementation of energy efficiency policies.

"By end user, utilities segment to capture most significant share of switchgear monitoring system

market throughout forecast period"

The utilities segment accounts for the most significant portion of the switchgear monitoring system market, due to the rising adoption of advanced switchgear monitoring systems in critical infrastructure consisting of substations, and transmission and distribution networks. Switchgear monitoring systems are well-suited for utility operations due to their capabilities in real-time diagnostics, enhanced reliability, and reduced maintenance requirements. Growing interest in grid stability, outage prevention, and energy efficiency has led to a steady rise in the adoption of these systems. Additionally, government policies that encourage the implementation of smart monitoring technologies and the transition to smart grids further support and accelerate their deployment.

"Europe to be second-largest market during forecast period"

Europe is set to become the second-largest switchgear monitoring system market because of the massive penetration of these systems in industrial automation systems, the rising adoption of renewable energy sources, and smart grid development. The region already boasts established industry, deep capital investment into energy-efficient technology, and advantageous government policies regarding clean energy and electrification. Moreover, leading utility and manufacturing companies in countries such as Germany and France are intensifying their efforts to integrate switchgear monitoring systems to achieve greater reliability and sustainability. This proactive approach is further driving regional demand. In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects.

The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 30%, Tier 2 - 55%, and Tier 3 - 15%

By Designation: C-level Executives - 30%, Directors - 20%, and Others - 50%

By Region: North America - 20%, Europe - 8%, Asia Pacific - 55%, Middle East & Africa - 13%, and South America - 4%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million. Other designations include sales managers, engineers, and regional managers.

Schneider Electric, ABB, Siemens, GE Vernova, and Mitsubishi Electric Corporation are some major players in the switchgear monitoring system market. The study includes an in-depth competitive analysis of these key players, including their company profiles, recent developments, and key market strategies.

Research Coverage

The report defines, describes, and forecasts the global switchgear monitoring system market, by switchgear type, component, service, voltage, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the switchgear monitoring system market.

Key Benefits of Buying the Report

- Key drivers (strengthened power distribution infrastructure), restraints (high installation cost), opportunities (growing deployment of smart grids), and challenges (inadequate data storage and management concerns) influence the growth of the switchgear monitoring system market.

- Market Development: In May 2024, ABB introduced digital, low-voltage switchgear, which allows users to access data on electrical distribution in real time. This enables users to be Industry 4.0 ready and explore the potential of intelligent devices, IoT, and cloud technology. The company will apply this technology to its low-voltage switchgear range.

- Product Innovation/Development: Significant product innovation existed in the switchgear monitoring system market. However, the innovation of IoT-enabled diagnostics and predictive maintenance capabilities of the most advanced systems is notable. These trends are geared toward improving reliability, minimizing downtime, and increasing efficiency standards among end users.

- Market Diversification: In June 2024, IPEC Ltd. entered Asia by establishing a regional office in Kuala Lumpur. This growth acted as a platform to collaborate, assist, and interact with customers in the area. This business decision helped the company serve its clients, establish new relationships, and become more market-informed to propel innovations.

- Competitive Assessment: The report includes an in-depth assessment of market shares, growth strategies, and service offerings of leading market players, such as ABB (Switzerland), Siemens (Germany), Schneider Electric (France), GE Vernova (US), and Mitsubishi Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Key primary insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET DATA TRIANGULATION

- 2.3.1 FORECAST

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SWITCHGEAR MONITORING SYSTEM MARKET

- 4.2 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION

- 4.3 SWITCHGEAR MONITORING SYSTEM MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- 4.4 SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE

- 4.5 SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT

- 4.6 SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE

- 4.7 SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE

- 4.8 SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Shift from conventional maintenance methods to condition-based services

- 5.2.1.2 Strengthened power distribution infrastructure

- 5.2.1.3 Rising use of electric distribution and transmission systems powered by renewable energy sources

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation cost

- 5.2.2.2 Integration- and cybersecurity-related challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing deployment of smart grids

- 5.2.3.2 Expansion of renewable energy infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate data storage and management concerns

- 5.2.4.2 Susceptibility of switchgear monitoring systems to cyber threats

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.2 ADJACENT TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF SWITCHGEAR TYPES, 2021-2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF SWITCHGEAR MONITORING SYSTEMS, BY REGION, 2021-2024

- 5.8 TARIFFS AND REGULATORY LANDSCAPE

- 5.8.1 TARIFF ANALYSIS (HS 853590)

- 5.8.2 REGULATORY LANDSCAPE

- 5.8.3 GLOBAL STANDARDS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE-853590)

- 5.9.2 EXPORT SCENARIO (HS CODE-853590)

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF SUBSTITUTES

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 MAINTAINING OPERATIONAL INTEGRITY AND REDUCING UNPLANNED DOWNTIME ACROSS GRID BY DEPLOYING DYNAMIC RATINGS' PARTIAL DISCHARGE MONITORING SYSTEM

- 5.12.2 ENHANCING GRID RELIABILITY AND MINIMIZING SF6 EMISSIONS THROUGH WIKA'S IOT-BASED GIS MONITORING SYSTEM

- 5.12.3 REDUCING THERMAL-RELATED FAILURES AND ENHANCING PLANT RESILIENCE WITH MARTEC'S IOT-BASED MONITORING SOLUTION

- 5.13 IMPACT OF GENERATIVE AI/AI ON SWITCHGEAR MONITORING SYSTEM MARKET

- 5.13.1 ADOPTION OF GENERATIVE AI/AI BY SWITCHGEAR MONITORING SYSTEM MANUFACTURERS

- 5.13.2 IMPACT OF GENERATIVE AI/AI ON KEY END USERS, BY REGION

- 5.13.3 IMPACT OF AI ON SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION

- 5.14 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 IMPACT ON COUNTRIES/REGIONS

- 5.14.3.1 North America

- 5.14.3.2 Europe

- 5.14.3.3 Asia Pacific

- 5.14.3.4 South America

- 5.14.3.5 Middle East & Africa

- 5.14.4 IMPACT ON END USERS

6 SWITCHGEAR MONITORING SYSTEM MARKET, BY SWITCHGEAR TYPE

- 6.1 INTRODUCTION

- 6.2 AIR-INSULATED

- 6.2.1 DESIGN SIMPLICITY, AFFORDABILITY, EASY MAINTENANCE TO ACCELERATE DEMAND

- 6.3 GAS-INSULATED

- 6.3.1 SURGING UTILIZATION IN HIGH-VOLTAGE APPLICATIONS TO AUGMENT MARKET GROWTH

7 SWITCHGEAR MONITORING SYSTEM MARKET, BY VOLTAGE

- 7.1 INTRODUCTION

- 7.2 LOW

- 7.2.1 RISING DEMAND FOR HOME AUTOMATION AND ENERGY MANAGEMENT SOLUTIONS TO PROPEL SEGMENTAL GROWTH

- 7.3 MEDIUM

- 7.3.1 INCLINATION TOWARD DEPLOYMENT OF SMART GRIDS AND DIGITAL SUBSTATIONS TO SPUR DEMAND

- 7.4 HIGH AND EXTRA HIGH

- 7.4.1 RAPID DEVELOPMENT OF POWER TRANSMISSION NETWORKS IN DEVELOPING COUNTRIES TO BOOST DEMAND

8 SWITCHGEAR MONITORING SYSTEM MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.2 PARTIAL DISCHARGE MONITORING

- 8.2.1 INCREASING REQUIREMENT FOR HIGH-PERFORMANCE AND RELIABLE ELECTRICAL ASSETS TO ACCELERATE ADOPTION

- 8.3 GAS MONITORING

- 8.3.1 OPERATIONAL NECESSITY TO DETECT SF6 LEAKAGE TO ELEVATE DEMAND

- 8.4 TEMPERATURE MONITORING

- 8.4.1 EMPHASIS ON EARLY FAULT DETECTION TO FOSTER SEGMENTAL GROWTH

- 8.5 OTHER SERVICES

9 SWITCHGEAR MONITORING SYSTEM MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 RISING DEMAND FOR REAL-TIME MONITORING OF TEMPERATURE, INSULATION INTEGRITY AND VOLTAGE LEVELS TO DRIVE MARKET

- 9.2.2 INTELLIGENT EQUIPMENT DEVICES

- 9.2.3 DISTRIBUTION NETWORK FEEDERS

- 9.2.4 OTHER HARDWARE COMPONENTS

- 9.3 SOFTWARE

- 9.3.1 PRESSING NEED TO HANDLE DATA PROCESSING AND EXECUTION TO BOOST DEMAND FOR SECURE AND EMBEDDED SOFTWARE

10 SWITCHGEAR MONITORING SYSTEM MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 UTILITIES

- 10.2.1 SURGING ADOPTION OF ML-INTEGRATED SWITCHGEAR MONITORING SYSTEMS TO GET REAL-TIME INSIGHTS TO FOSTER MARKET GROWTH

- 10.3 INDUSTRIAL

- 10.3.1 FOCUS ON PREVENTING FINANCIAL LOSSES DUE TO POWER DISRUPTIONS AND EQUIPMENT DAMAGE TO BOOST DEMAND

- 10.4 COMMERCIAL

- 10.4.1 ONGOING INFRASTRUCTURAL DEVELOPMENTS DUE TO RAPID URBANIZATION IN DEVELOPING COUNTRIES TO STIMULATE DEMAND

- 10.5 OTHER END USERS

11 SWITCHGEAR MONITORING SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Increasing investments in renewable energy projects to support market growth

- 11.2.2 JAPAN

- 11.2.2.1 Surging microgrid deployments to fuel market growth

- 11.2.3 INDIA

- 11.2.3.1 Emphasis on electrification projects to elevate demand

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Commitment to carbon neutrality to create growth opportunities

- 11.2.5 AUSTRALIA

- 11.2.5.1 Deployment of hybrid solar-wind microgrids to elevate demand

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Increasing government investment in expanding wind and solar infrastructure to fuel demand

- 11.3.2 UK

- 11.3.2.1 AI-driven maintenance and offshore wind projects to escalate demand

- 11.3.3 FRANCE

- 11.3.3.1 Greater emphasis on grid modernization to contribute to market growth

- 11.3.4 ITALY

- 11.3.4.1 Increasing green energy projects to augment adoption

- 11.3.5 RUSSIA

- 11.3.5.1 Rising investments in hydrogen energy projects to support market growth

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Strong focus on increasing renewable energy output to support market growth

- 11.4.2 CANADA

- 11.4.2.1 Rising investments in wind energy projects to foster market growth

- 11.4.3 MEXICO

- 11.4.3.1 Expansion of power generation, transmission, and distribution networks to contribute to market growth

- 11.4.1 US

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 SAUDI ARABIA

- 11.5.1.1.1 Pressing need to upgrade power infrastructure to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Growing emphasis on improving onshore power grids to accelerate market growth

- 11.5.1.3 Kuwait

- 11.5.1.3.1 Increasing transition toward clean energy to boost adoption

- 11.5.1.4 Rest of GCC

- 11.5.1.1 SAUDI ARABIA

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Northern Cape solar initiative and innovations in power monitoring to fuel market growth

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Surging power demand and need for electrification to propel market

- 11.6.2 ARGENTINA

- 11.6.2.1 Increasing government investments in offshore gas production projects to contribute to market growth

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.1.1 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.1.2 MARKET SHARE ANALYSIS, 2024

- 12.1.3 REVENUE ANALYSIS, 2020-2024

- 12.2 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.2.1 STARS

- 12.2.2 EMERGING LEADERS

- 12.2.3 PERVASIVE PLAYERS

- 12.2.4 PARTICIPANTS

- 12.2.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.2.5.1 Company footprint

- 12.2.5.2 Region footprint

- 12.2.5.3 Switchgear type footprint

- 12.2.5.4 Voltage footprint

- 12.2.5.5 End user footprint

- 12.3 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.3.1 PROGRESSIVE COMPANIES

- 12.3.2 RESPONSIVE COMPANIES

- 12.3.3 DYNAMIC COMPANIES

- 12.3.4 STARTING BLOCKS

- 12.3.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.3.5.1 Detailed list of key startups/SMEs

- 12.3.5.2 Competitive benchmarking of key startups/SMEs

- 12.4 COMPETITIVE SCENARIO

- 12.4.1 PRODUCT LAUNCHES

- 12.4.2 DEALS

- 12.4.3 EXPANSIONS

- 12.4.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SIEMENS

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.3.4 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 ABB

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Expansions

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 SCHNEIDER ELECTRIC

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 EATON

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Expansions

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 GE VERNOVA

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 MITSUBISHI ELECTRIC CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.6.3.2 Other developments

- 13.1.7 EMERSON ELECTRIC CO.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 HITACHI, LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.9 PT. TIARA VIBRASINDO PRATAMA

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 SENSEOR - WIKA GROUP

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 BLUE JAY TECHNOLOGY CO. LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 DYNAMIC RATINGS

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Expansions

- 13.1.13 OSENSA INNOVATIONS

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches

- 13.1.14 MEGGER

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Expansions

- 13.1.15 IPEC LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Expansions

- 13.1.1 SIEMENS

- 13.2 OTHER PLAYERS

- 13.2.1 MONITRA LTD.

- 13.2.2 RUGGED MONITORING

- 13.2.3 PDS

- 13.2.4 DOBLE ENGINEERING COMPANY

- 13.2.5 NUVENTURA

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS