|

|

市場調査レポート

商品コード

1396473

空港オートメーションの世界市場:システム別、用途別、空港サイド別、空港規模別、エンドマーケット別、自動化レベル別、地域別- 2028年までの予測Airport Automation Market by System (Data Acquisition and Communication, Automation and Control, Data Storage, Software and solution), Application, Airport Side, Airport Size, End Market, Automation level and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 空港オートメーションの世界市場:システム別、用途別、空港サイド別、空港規模別、エンドマーケット別、自動化レベル別、地域別- 2028年までの予測 |

|

出版日: 2023年12月11日

発行: MarketsandMarkets

ページ情報: 英文 287 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | システム・用途・空港サイド・空港規模・エンドマーケット・自動化レベル・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

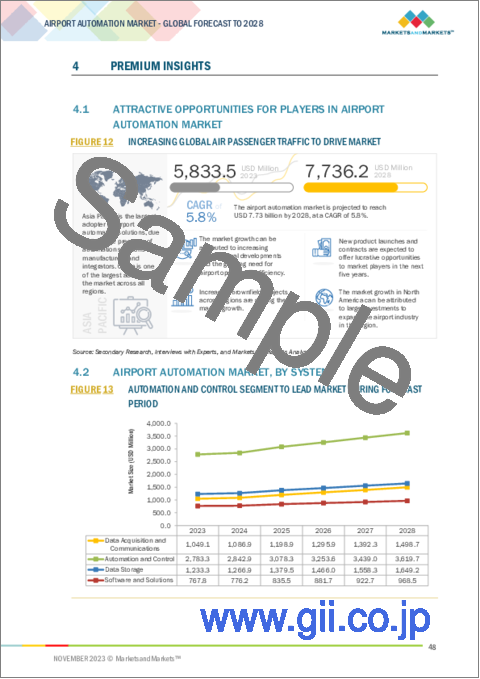

空港オートメーションの市場規模は、2023年の58億米ドルから、予測期間中は5.8%のCAGRで推移し、2028年には77億米ドルの規模に成長すると予測されています。

オートメーションは、空港の環境フットプリントを軽減する上で極めて重要な役割を果たします。例えば、最適化によって合理化された手荷物処理システムは、航空機の燃料節約につながります。また、オートメーションによって促進される全体的な効率改善は、より持続可能な空港運営の促進に寄与します。

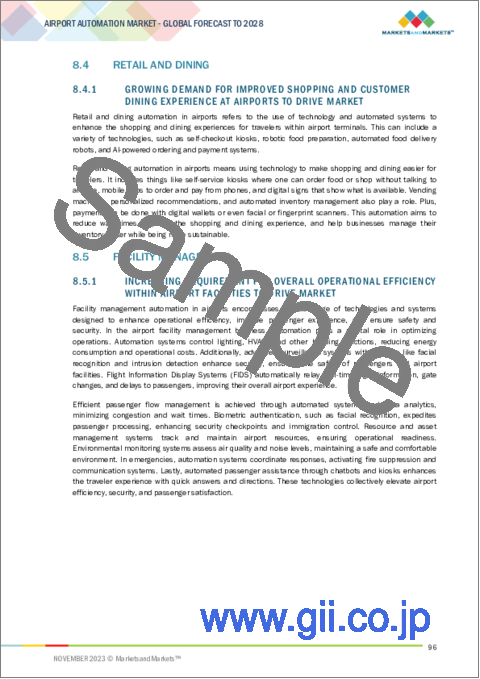

予測期間中、自動化・制御の部門が最大のシェアを占めると予想されています。産業オートメーション機器は、空港の進化するニーズに合わせて拡張性と適応性を持つように設計されています。エンドポイントデバイス、特にIoTとクラウド技術に基づくデバイスは、変化する乗客数と変化する運用要件に対応するための拡張性と柔軟性を提供します。産業用デバイスとエンドポイントデバイスの統合は、手作業を減らし、ミスを最小限に抑え、リソース配分を改善することで、コストの最適化に貢献します。自動化はリソースの効率的活用につながり、最終的には運用コストの削減につながります。

空港規模別では、中規模空港の部門が予測期間中の市場をリードする見通しです。自動化システムは、中規模空港の運営効率と旅客処理能力を大幅に向上させることができます。これらの空港では、手荷物処理、セキュリティ検査、旅客処理などの業務に自動化ソリューションを採用することができ、業務の合理化と待ち時間の短縮につながります。中規模空港では、多くの場合、シームレスでポジティブな旅客体験を提供することを目指しています。セルフサービスキオスク、自動チェックイン、生体認証などの自動化技術が、旅客の旅程の改善と効率化に貢献し、総合的な満足度を高めます。

自動化レベル別では、自動化レベル3.0の部門が市場をリードする見通しです。AIおよびML技術の導入により、空港システムはデータパターンに基づいて学習し、適応することができます。これらの技術は、意思決定プロセスを強化し、リソース配分を最適化し、メンテナンスと運用の予測分析に貢献します。高度なデータ解析の活用により、予知保全戦略が促進されます。AI主導のアルゴリズムは、さまざまな空港システムからの膨大なデータを分析し、機器の故障や潜在的な問題を事前に特定することを可能にし、運用の信頼性の向上につながります。

地域別では、北米地域が2023年に最大のシェアを占める見込みです。日本は空港オートメーション市場においてもっとも急成長している国の一つです。アジア太平洋地域の空港は、最先端の自動化ソリューションを導入するため、技術プロバイダーやソリューションベンダーと提携しています。

当レポートでは、世界の空港オートメーションの市場を調査し、市場概要、市場成長への各種影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 景気後退の影響分析

- バリューチェーン分析

- エコシステムマップ

- 顧客の事業に影響を与える動向とディスラプション

- ポーターのファイブフォース分析

- 価格分析

- 運用データ

- 貿易データ分析

- 関税と規制状況

- 主要な会議とイベント

- 使用事例分析

- 主要なステークホルダーと購入基準

第6章 業界の動向

- 技術動向

- ロボティクス・オートメーション

- 空港オートメーションにおけるAIツールの使用

- 空港運営を強化するための自律システム

- 高度なデータ分析とロケーションインテリジェンスによる空港での意思決定

- AR・VR

- クラウド技術

- 5G技術

- IoT

- メガトレンドの影響

- 特許分析

- 商業化のロードマップ

第7章 空港オートメーション市場:システム別

- データ取得・通信

- センサーネットワーク

- 通信インフラ

- 自動化・制御

- 産業オートメーションデバイス

- エンドポイントデバイス

- データストレージ

- クラウドストレージ

- オンプレミスストレージ

- ソフトウェア・ソリューション

- 空港運営管理システム

- 乗客および手荷物処理システム

- セキュリティ管理システム

第8章 空港オートメーション市場:用途別

- 手荷物の取り扱い・追跡

- 地上交通・駐車場

- 小売・飲食店

- 施設管理

- 乗客サービス・サポート

- 緊急対応・セーフティ

- 地上支援機材 (GSE)

- 航空交通管理

- 飛行場管理

- その他

第9章 空港オートメーション市場:空港サイド別

- ランドサイド

- カーブサイド

- ターミナルサイド

- エアサイド

- エプロンサイド

- ランウェイサイド

第10章 空港オートメーション市場:空港規模別

- 大規模

- 中規模

- 小規模

第11章 空港オートメーション市場:エンドマーケット別

- グリーンフィールド

- ブラウンフィールド

第12章 空港オートメーション市場:自動化レベル別

- レベル1.0

- レベル2.0

- レベル3.0

- レベル4.0

第13章 空港オートメーション市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

第14章 競合情勢

- 市場シェア分析

- 市場ランキング分析

- トップ5社の収益分析

- 企業評価マトリックス

- 新興企業/中小企業評価マトリックス

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- DAIFUKU CO., LTD.

- AMADEUS IT GROUP SA

- LEONARDO S.P.A.

- SIEMENS

- COLLINS AEROSPACE

- THALES

- VANDERLANDE INDUSTRIES B.V.

- SMITHS DETECTION GROUP LTD.

- LEIDOS

- NEC CORPORATION

- INDRA SISTEMAS S.A.

- MATERNA IPS GMBH

- ADB SAFEGATE

- HUAWEI TECHNOLOGIES CO., LTD.

- GUNNEBO ENTRANCE CONTROL LTD.

- その他の企業

- VISION-BOX

- BEUMER GROUP

- ALSTEF GROUP

- LENZE

- GORILLA TECHNOLOGY

- INK INNOVATION

- ATG AIRPORTS LIMITED

- NUCTECH COMPANY LIMITED

- SCARABEE AVIATION GROUP B.V.

- XOVIS AG

第16章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By System, Application, Airport Side, Airport Size, End Market, Automation level and Region |

| Regions covered | North America, Europe, APAC, RoW |

The Airport Automation Market size is projected to grow from USD 5.8 billion in 2023 to USD 7.7 billion by 2028, at a CAGR of 5.8% from 2023 to 2028. Automation plays a pivotal role in mitigating the environmental footprint of airports. Specifically, streamlined baggage handling systems, through optimization, can result in fuel savings for aircraft. Moreover, the overall improvements in efficiency fostered by automation contribute to the promotion of more sustainable airport operations. Automation can contribute to the reduction of the environmental impact of airports. For example, optimized baggage handling systems can lead to fuel savings for aircraft, and the overall efficiency improvements can contribute to more sustainable airport operations.

The Automation and Control segment is expected to have largest market share during the forecast period.

Industrial automation devices are designed to be scalable and adaptable to the evolving needs of airports. Endpoint devices, particularly those based on IoT and cloud technologies, offer scalability and flexibility for handling varying passenger volumes and changing operational requirements. The integration of industrial and endpoint devices contributes to cost optimization by reducing manual labor requirements, minimizing errors, and improving resource allocation. Automation leads to more efficient use of resources, ultimately lowering operational costs

The medium size airport is projected to lead the market during the forecast period.

Automation systems can significantly improve operational efficiency and passenger throughput at medium-sized airports. These airports can adopt automation solutions for tasks such as baggage handling, security screening, and passenger processing, leading to streamlined operations and reduced wait times. Medium-sized airports often aim to provide a seamless and positive passenger experience. Automation technologies, such as self-service kiosks, automated check-in, and biometric identification, contribute to an improved and efficient passenger journey, enhancing overall satisfaction.

The Automation level 3.0 is projected to lead Airport Automation Market during the forecast period.

The incorporation of AI and ML technologies allows airport systems to learn and adapt based on data patterns. These technologies enhance decision-making processes, optimize resource allocation, and contribute to predictive analytics for maintenance and operations. The utilization of advanced data analytics facilitates predictive maintenance strategies. AI-driven algorithms analyze vast amounts of data from various airport systems, enabling proactive identification of equipment failures and potential issues, leading to increased operational reliability.

North America is expected to account for the largest market share in 2023

The Airport Automation Market has been studied for the regions North America, Europe, Asia Pacific, Middle East and Rest of the World. Asia Pacific is expected to have the highest market share during the forecast period. Japan is one of the fastest-growing countries in the Airport Automation Market . Airports in the Asia-Pacific region are collaborating with technology providers and solution vendors to implement cutting-edge automation solutions. Partnerships and collaborations enable airports to access the latest technologies and benefit from expertise in implementing automation projects.

The break-up of the profile of primary participants in the Airport Automation Market :

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: C Level - 50%, Director Level - 25%, Others-25%

- By Region: North America - 47%, Europe - 21%, Asia Pacific - 21%, Rest of the World - 11%.

Prominent companies include Daifuku Co. Ltd. (Japan), Collins Aerospace (US), Siemens (Germany), and Amadeus IT Group (Spain) among others.

Research Coverage:

The report segments the Airport Automation Market By System (Data Acquisition and Communication, Automation and Control, Data Storage, Software and solution), Application, Airport Side, Airport Size, End Market, Automation level and by Region - Global Forecast to 2028. The Airport Automation Market has been studied in North America, Europe, Asia Pacific, Middle East and the Rest of the World. The scope of the report covers extensive information covering market overviews, such as drivers, restraints, challenges, and opportunities, that drive the growth in the market. Analysis of key players in the industry providing business overviews, products, solutions, and services, key strategies, recent developments, and new product & service launches associated with the Airport Automation Market is also covered in the report. An extensive competitive analysis of the Key players and the up-and-coming startups in the Marine Electric Vehicle Ecosystem is also covered in the report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Airport Automation Market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on Airport Automation offered by the top players in the market

- Market Drivers: Growing emphasis on customer centric strategies and increasing integration of advanced connectivity technologies is driving market growth

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Airport Automation Market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Airport Automation Market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Airport Automation Market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the Airport Automation Market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.6 INCLUSIONS AND EXCLUSIONS

- TABLE 2 AIRPORT AUTOMATION MARKET: INCLUSIONS AND EXCLUSIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.1.1 Breakdown of primary interviews

- 2.1.2.1 Primary sources

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Increasing demand for airport infrastructure development to facilitate seamless passenger experience

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Development of advanced airport automation technologies by manufacturers

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Evaluation of airport automation market

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY SIDE)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.5 RECESSION IMPACT ANALYSIS

- FIGURE 7 AIRPORT AUTOMATION SYSTEMS: AIR PASSENGER FOOTPRINT AND REVENUE PER KILOMETER (RPK) YOY GROWTH, 2022

- 2.5.1 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH ASSUMPTIONS

- FIGURE 8 PARAMETRIC ASSUMPTIONS FOR MARKET STUDY

- 2.7 RISKS ANALYSIS

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 LANDSIDE SEGMENT TO LEAD MARKET IN 2023

- FIGURE 10 BROWNFIELD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE THAN GREENFIELD SEGMENT IN 2023

- FIGURE 11 MIDDLE EAST TO BE FASTEST-GROWING REGIONAL MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRPORT AUTOMATION MARKET

- FIGURE 12 INCREASING GLOBAL AIR PASSENGER TRAFFIC TO DRIVE MARKET

- 4.2 AIRPORT AUTOMATION MARKET, BY SYSTEM

- FIGURE 13 AUTOMATION AND CONTROL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 AIRPORT AUTOMATION MARKET, BY APPLICATION

- FIGURE 14 AIR TRAFFIC MANAGEMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 AIRPORT AUTOMATION MARKET, BY COUNTRY

- FIGURE 15 GERMANY TO BE FASTEST-GROWING COUNTRY-LEVEL MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 AIRPORT AUTOMATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Escalating demand for real-time data

- 5.2.1.2 Growing emphasis on customer-centric strategies

- 5.2.1.3 Increasing adoption of automated vehicles within airport premises

- 5.2.1.4 Rising integration of advanced connectivity technologies in airport operations

- 5.2.1.5 Growing need to enhance air traffic management and optimize capacity

- 5.2.2 RESTRAINTS

- 5.2.2.1 High investment in cybersecurity measures

- 5.2.2.2 Securing robustness and reliability of automation solutions

- 5.2.2.3 Absence of standardized regulations governing blockchain technology

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing integration of automation solutions to improve airport operations

- 5.2.3.2 Rising utilization of data-backed decision-making

- 5.2.4 CHALLENGES

- 5.2.4.1 Slow integration of automation technologies due to requirement for high capital expenditures

- 5.2.4.2 Need for thorough understanding of passengers to efficiently adopt specific airport automation solutions

- 5.2.4.3 Simplifying automation system integration

- 5.3 RECESSION IMPACT ANALYSIS

- FIGURE 17 RECESSION IMPACT ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL

- 5.4.2 R&D

- 5.4.3 COMPONENT MANUFACTURING

- 5.4.4 OEM

- 5.4.5 END USER

- 5.4.6 AFTER-SALES SERVICE

- 5.5 ECOSYSTEM MAP

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 19 ECOSYSTEM MAP

- TABLE 3 ROLE OF KEY PLAYERS IN ECOSYSTEM

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 REVENUE SHIFT FOR PLAYERS IN AIRPORT AUTOMATION MARKET

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SYSTEM

- FIGURE 22 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SYSTEM

- TABLE 5 AVERAGE SELLING PRICE RANGE: AIRPORT AUTOMATION MARKET, BY SYSTEM (USD)

- 5.8.2 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 23 AVERAGE SELLING PRICE TREND, BY REGION, 2019-2022

- TABLE 6 AIRPORT AUTOMATION MARKET: AVERAGE SELLING PRICE RANGE, BY REGION (USD)

- 5.9 OPERATIONAL DATA

- TABLE 7 AIRPORT AUTOMATION MARKET: NUMBER OF AIRPORTS, BY REGION (UNITS)

- FIGURE 24 GLOBAL AIRPORT INVESTMENT VS. AIRPORT AUTOMATION INVESTMENT

- 5.10 TRADE DATA ANALYSIS

- TABLE 8 COUNTRY-WISE IMPORTS, 2020-2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORTS, 2020-2022 (USD THOUSAND)

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 NORTH AMERICA

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 EUROPE

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.3 ASIA PACIFIC

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.4 MIDDLE EAST & AFRICA

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.5 LATIN AMERICA

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 AIRPORT AUTOMATION MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.13 USE CASE ANALYSIS

- TABLE 16 AUTOMATED BAGGAGE HANDLING SYSTEMS

- TABLE 17 SELF-SERVICE CHECK-IN KIOSKS

- TABLE 18 AUTOMATED SECURITY SCREENING

- TABLE 19 FACIAL RECOGNITION BOARDING

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AIRPORT AUTOMATION SOLUTIONS, BY END USER

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AIRPORT AUTOMATION SOLUTIONS, BY END USER (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR AIRPORT AUTOMATION SOLUTIONS, BY END USER

- TABLE 21 KEY BUYING CRITERIA FOR AIRPORT AUTOMATION SOLUTIONS, BY END USER

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- FIGURE 27 TECHNOLOGY TRENDS IN AIRPORT AUTOMATION MARKET

- 6.2.1 ROBOTICS AND AUTOMATION

- 6.2.2 USE OF AI TOOLS IN AIRPORT AUTOMATION

- 6.2.3 AUTONOMOUS SYSTEMS FOR ENHANCED AIRPORT OPERATIONS

- 6.2.4 DECISION-MAKING IN AIRPORTS WITH ADVANCED DATA ANALYTICS AND LOCATION INTELLIGENCE

- 6.2.5 AUGMENTED REALITY AND VIRTUAL REALITY

- 6.2.6 CLOUD TECHNOLOGY

- 6.2.7 5G TECHNOLOGY

- 6.2.8 INTERNET OF THINGS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 ENHANCED FACILITY EFFICIENCY

- 6.3.2 BLOCKCHAIN APPLICATIONS IN AIRPORT OPERATIONS

- 6.3.3 CAPACITY EXPANSION

- 6.4 PATENT ANALYSIS

- FIGURE 28 PATENT ANALYSIS

- TABLE 22 PATENT REGISTRATIONS

- 6.5 ROADMAP FOR AIRPORT AUTOMATION COMMERCIALIZATION

- FIGURE 29 DEVELOPMENT POTENTIAL OF AIRPORT AUTOMATION MARKET FROM 2000 TO 2030

7 AIRPORT AUTOMATION MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- FIGURE 30 AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023 VS. 2028

- TABLE 23 AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 24 AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- 7.2 DATA ACQUISITION AND COMMUNICATIONS

- TABLE 25 AIRPORT AUTOMATION MARKET, BY DATA ACQUISITION AND COMMUNICATIONS, 2019-2022 (USD MILLION)

- TABLE 26 AIRPORT AUTOMATION MARKET, BY DATA ACQUISITION AND COMMUNICATIONS, 2023-2028 (USD MILLION)

- 7.2.1 SENSOR NETWORKS

- 7.2.1.1 Growing need for real-time data analysis in airports to drive market

- 7.2.2 COMMUNICATION INFRASTRUCTURE

- 7.2.2.1 Increasing demand for seamless and smooth data exchange to drive market

- 7.3 AUTOMATION AND CONTROL

- TABLE 27 AIRPORT AUTOMATION MARKET, BY AUTOMATION AND CONTROL, 2019-2022 (USD MILLION)

- TABLE 28 AIRPORT AUTOMATION MARKET, BY AUTOMATION AND CONTROL, 2023-2028 (USD MILLION)

- 7.3.1 INDUSTRIAL AUTOMATION DEVICES

- 7.3.1.1 Increasing demand for automated operations to drive market

- 7.3.2 END-POINT DEVICES

- 7.3.2.1 Growing need for self-service technology to enhance passenger experience to drive market

- 7.4 DATA STORAGE

- TABLE 29 AIRPORT AUTOMATION MARKET, BY DATA STORAGE, 2019-2022 (USD MILLION)

- TABLE 30 AIRPORT AUTOMATION MARKET, BY DATA STORAGE, 2023-2028 (USD MILLION)

- 7.4.1 CLOUD STORAGE

- 7.4.1.1 Rising demand for storage capacity with less CAPEX to drive market

- 7.4.2 ON-PREMISES STORAGE

- 7.4.2.1 Increasing need for cybersecurity and immediate accessibility to drive market

- 7.5 SOFTWARE AND SOLUTIONS

- TABLE 31 AIRPORT AUTOMATION MARKET, BY SOFTWARE AND SOLUTIONS, 2019-2022 (USD MILLION)

- TABLE 32 AIRPORT AUTOMATION MARKET, BY SOFTWARE AND SOLUTIONS, 2023-2028 (USD MILLION)

- 7.5.1 AIRPORT OPERATIONAL CONTROL SYSTEMS

- 7.5.1.1 Growing use of centralized platforms for efficient airport operation to drive market

- 7.5.2 PASSENGER AND BAGGAGE PROCESSING SYSTEMS

- 7.5.2.1 Growing need to optimize passenger journeys to drive market

- 7.5.3 SECURITY MANAGEMENT SYSTEMS

- 7.5.3.1 Increasing adoption of cognitive security systems to drive market

8 AIRPORT AUTOMATION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 31 AIRPORT AUTOMATION MARKET, BY APPLICATION, 2023 VS. 2028

- TABLE 33 AIRPORT AUTOMATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 34 AIRPORT AUTOMATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 BAGGAGE HANDLING AND TRACKING

- 8.2.1 IMPLEMENTATION OF RESOLUTION 753 TO DRIVE MARKET

- 8.3 GROUND TRANSPORTATION AND PARKING

- 8.3.1 NEED FOR REDUCED WAIT TIMES IN AIRPORT PARKING SYSTEMS TO DRIVE MARKET

- 8.4 RETAIL AND DINING

- 8.4.1 GROWING DEMAND FOR IMPROVED SHOPPING AND CUSTOMER DINING EXPERIENCE AT AIRPORTS TO DRIVE MARKET

- 8.5 FACILITY MANAGEMENT

- 8.5.1 INCREASING REQUIREMENT FOR OVERALL OPERATIONAL EFFICIENCY WITHIN AIRPORT FACILITIES TO DRIVE MARKET

- 8.6 PASSENGER SERVICES AND ASSISTANCE

- 8.6.1 NEED FOR EFFICIENT CAPACITY HANDLING WHILE MAINTAINING IMPROVED PASSENGER EXPERIENCE TO DRIVE MARKET

- 8.7 EMERGENCY RESPONSE AND SAFETY

- 8.7.1 RISING DEMAND FOR INFRASTRUCTURE SECURITY AND EMERGENCY RESPONSE TO DRIVE MARKET

- 8.8 GROUND SUPPORT EQUIPMENT (GSE)

- 8.8.1 GROWING NEED TO DECREASE WORKFORCE AND REDUCE ERRORS TO DRIVE MARKET

- 8.9 AIR TRAFFIC MANAGEMENT

- 8.9.1 INCREASING NEED TO AUTOMATE MANUAL TASKS IN AIR TRAFFIC MANAGEMENT SYSTEMS TO DRIVE MARKET

- 8.10 AIRFIELD MANAGEMENT

- 8.10.1 INCREASING REQUIREMENT FOR OPERATIONAL SAFETY AND EFFICIENCY AT AIRFIELDS AND RUNWAYS TO DRIVE MARKET

- 8.11 OTHERS

9 AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE

- 9.1 INTRODUCTION

- FIGURE 32 AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023 VS. 2028

- TABLE 35 AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 36 AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- 9.2 LANDSIDE

- TABLE 37 AIRPORT AUTOMATION MARKET, BY LANDSIDE, 2019-2022 (USD MILLION)

- TABLE 38 AIRPORT AUTOMATION MARKET, BY LANDSIDE, 2023-2028 (USD MILLION)

- 9.2.1 CURBSIDE

- 9.2.1.1 Growing demand for automated passenger service solutions in airports to drive market

- 9.2.2 TERMINAL SIDE

- 9.2.2.1 Rising demand for operations optimization in airports to drive market

- 9.3 AIRSIDE

- TABLE 39 AIRPORT AUTOMATION MARKET, BY AIRSIDE, 2019-2022 (USD MILLION)

- TABLE 40 AIRPORT AUTOMATION MARKET, BY AIRSIDE, 2023-2028 (USD MILLION)

- 9.3.1 APRON SIDE

- 9.3.1.1 Growing use of ground transportation and refueling equipment to drive market

- 9.3.2 RUNWAY SIDE

- 9.3.2.1 Growing use of advanced sensors and communication infrastructure to ensure safe and efficient aircraft turnaround to drive market

10 AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE

- 10.1 INTRODUCTION

- FIGURE 33 AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023 VS. 2028

- TABLE 41 AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 42 AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 10.2 LARGE

- 10.2.1 INCREASING REQUIREMENT FOR AUTOMATED OPERATION EQUIPMENT TO PROCESS HIGH PASSENGER TRAFFIC AND REDUCE AIRCRAFT TURNAROUND TO DRIVE MARKET

- 10.3 MEDIUM

- 10.3.1 INCREASING INVESTMENT IN MEDIUM AIRPORTS TO EXPAND CAPABILITIES TO DRIVE MARKET

- 10.4 SMALL

- 10.4.1 INCREASING REGIONAL/DOMESTIC AIR PASSENGER TRAFFIC TO DRIVE MARKET

11 AIRPORT AUTOMATION MARKET, BY END MARKET

- 11.1 INTRODUCTION

- FIGURE 34 AIRPORT AUTOMATION MARKET, BY END MARKET, 2023 VS. 2028

- TABLE 43 AIRPORT AUTOMATION MARKET, BY END MARKET, 2019-2022 (USD MILLION)

- TABLE 44 AIRPORT AUTOMATION MARKET, BY END MARKET, 2023-2028 (USD MILLION)

- 11.2 GREENFIELD

- 11.2.1 INCREASING CONSTRUCTION OF NEW AIRPORTS TO MEET RISING PASSENGER TRAFFIC TO DRIVE MARKET

- 11.3 BROWNFIELD

- 11.3.1 MODERNIZATION AND TECHNOLOGY UPGRADES OF AIRPORTS TO MEET GROWING AIR TRAFFIC DEMAND TO DRIVE MARKET

12 AIRPORT AUTOMATION MARKET, BY AUTOMATION LEVEL

- 12.1 INTRODUCTION

- FIGURE 35 AIRPORT AUTOMATION MARKET, BY AUTOMATION LEVEL, 2023 VS. 2028

- TABLE 45 AIRPORT AUTOMATION MARKET, BY AUTOMATION LEVEL, 2019-2022 (USD MILLION)

- TABLE 46 AIRPORT AUTOMATION MARKET, BY AUTOMATION LEVEL, 2023-2028 (USD MILLION)

- 12.2 LEVEL 1.0

- 12.2.1 REDUCED INVESTMENT COST AND DEPENDENCY ON LEGACY SYSTEMS TO DRIVE MARKET

- 12.3 LEVEL 2.0

- 12.3.1 INCREASING ADOPTION OF SELF-SERVICE TECHNOLOGY AND BASIC PASSENGER AND BAGGAGE PROCESSING TECHNOLOGY TO DRIVE MARKET

- 12.4 LEVEL 3.0

- 12.4.1 ADOPTION OF MORE ADVANCED SENSOR NETWORKS AND PROCESSING INFRASTRUCTURE TO DRIVE MARKET

- 12.5 LEVEL 4.0

- 12.5.1 INCREASING INTEGRATION OF COGNITIVE TECHNOLOGY AND AUTONOMOUS EQUIPMENT TO ENHANCE AIRPORT EFFICIENCY TO DRIVE MARKET

13 AIRPORT AUTOMATION MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 36 AIRPORT AUTOMATION MARKET, BY REGION, 2023-2028

- TABLE 47 AIRPORT AUTOMATION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 AIRPORT AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.2 NORTH AMERICA

- 13.2.1 RECESSION IMPACT ANALYSIS

- 13.2.2 PESTLE ANALYSIS

- FIGURE 37 NORTH AMERICA: AIRPORT AUTOMATION MARKET SNAPSHOT

- TABLE 49 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY END MARKET, 2019-2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: AIRPORT AUTOMATION MARKET, BY END MARKET, 2023-2028 (USD MILLION)

- 13.2.3 US

- 13.2.3.1 Continuous focus on improving operational efficiency of airports to drive market

- TABLE 59 US: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 60 US: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 61 US: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 62 US: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 63 US: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 64 US: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.2.4 CANADA

- 13.2.4.1 Increasing focus on deploying advanced automation technologies in airports to drive market

- TABLE 65 CANADA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 66 CANADA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 67 CANADA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 68 CANADA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 69 CANADA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 70 CANADA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.3 EUROPE

- 13.3.1 RECESSION IMPACT ANALYSIS

- 13.3.2 PESTLE ANALYSIS

- FIGURE 38 EUROPE: AIRPORT AUTOMATION MARKET SNAPSHOT

- TABLE 71 EUROPE: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 72 EUROPE: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 73 EUROPE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 74 EUROPE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 75 EUROPE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 76 EUROPE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 77 EUROPE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 78 EUROPE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- TABLE 79 EUROPE: AIRPORT AUTOMATION MARKET, BY END MARKET, 2019-2022 (USD MILLION)

- TABLE 80 EUROPE: AIRPORT AUTOMATION MARKET, BY END MARKET, 2023-2028 (USD MILLION)

- 13.3.3 UK

- 13.3.3.1 Growing initiatives toward enhancing passenger experience with advanced automation solutions to drive market

- TABLE 81 UK: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 82 UK: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 83 UK: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 84 UK: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 85 UK: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 86 UK: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.3.4 FRANCE

- 13.3.4.1 Increasing focus on upgrading automated systems to enhance passenger experience to drive market

- TABLE 87 FRANCE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 88 FRANCE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 89 FRANCE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 90 FRANCE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 91 FRANCE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 92 FRANCE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.3.5 GERMANY

- 13.3.5.1 Technological advancements and growing need for efficiency in airport operations to drive market

- TABLE 93 GERMANY: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 94 GERMANY: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 95 GERMANY: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 96 GERMANY: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 97 GERMANY: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 98 GERMANY: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.3.6 NETHERLANDS

- 13.3.6.1 Growing adoption of innovative automation technology to enhance operational efficiency of airports to drive market

- TABLE 99 NETHERLANDS: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 100 NETHERLANDS: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 101 NETHERLANDS: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 102 NETHERLANDS: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 103 NETHERLANDS: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 104 NETHERLANDS: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.3.7 REST OF EUROPE

- TABLE 105 REST OF EUROPE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 106 REST OF EUROPE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.4 ASIA PACIFIC

- 13.4.1 RECESSION IMPACT ANALYSIS

- 13.4.2 PESTLE ANALYSIS

- FIGURE 39 ASIA PACIFIC: AIRPORT AUTOMATION MARKET SNAPSHOT

- TABLE 111 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY END MARKET, 2019-2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY END MARKET, 2023-2028 (USD MILLION)

- 13.4.3 CHINA

- 13.4.3.1 Growing focus on adopting advanced automated air cargo facilities to drive market

- TABLE 121 CHINA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 122 CHINA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 123 CHINA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 124 CHINA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 125 CHINA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 126 CHINA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.4.4 INDIA

- 13.4.4.1 Increasing investment in indigenous automation solutions to drive market

- TABLE 127 INDIA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 128 INDIA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 129 INDIA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 130 INDIA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 131 INDIA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 132 INDIA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.4.5 JAPAN

- 13.4.5.1 Increasing investment in advanced passenger service technologies to drive market

- TABLE 133 JAPAN: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 134 JAPAN: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 135 JAPAN: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 136 JAPAN: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 137 JAPAN: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 138 JAPAN: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.4.6 SINGAPORE

- 13.4.6.1 Integration of diverse automation systems at Changi Airport to drive market

- TABLE 139 SINGAPORE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 140 SINGAPORE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 141 SINGAPORE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 142 SINGAPORE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 143 SINGAPORE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 144 SINGAPORE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.4.7 SOUTH KOREA

- 13.4.7.1 Increasing adoption of cognitive technology and presence of automation solution players to drive market

- TABLE 145 SOUTH KOREA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 146 SOUTH KOREA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 147 SOUTH KOREA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 148 SOUTH KOREA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 149 SOUTH KOREA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 150 SOUTH KOREA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.4.8 REST OF ASIA PACIFIC

- TABLE 151 REST OF ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.5 MIDDLE EAST

- 13.5.1 RECESSION IMPACT ANALYSIS

- 13.5.2 PESTLE ANALYSIS

- FIGURE 40 MIDDLE EAST: AIRPORT AUTOMATION MARKET SNAPSHOT

- TABLE 157 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 158 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 159 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 160 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 161 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 162 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 163 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 164 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- TABLE 165 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY END MARKET, 2019-2022 (USD MILLION)

- TABLE 166 MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY END MARKET, 2023-2028 (USD MILLION)

- 13.5.3 SAUDI ARABIA

- 13.5.3.1 Growing focus on increasing operational efficiency in airports to drive market

- TABLE 167 SAUDI ARABIA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 168 SAUDI ARABIA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 169 SAUDI ARABIA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 170 SAUDI ARABIA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 171 SAUDI ARABIA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 172 SAUDI ARABIA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.5.4 UAE

- 13.5.4.1 Growing focus on deploying advanced automation technologies in airports to drive market

- TABLE 173 UAE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 174 UAE: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 175 UAE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 176 UAE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 177 UAE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 178 UAE: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.5.5 REST OF MIDDLE EAST

- TABLE 179 REST OF MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.6 REST OF THE WORLD

- 13.6.1 RECESSION IMPACT ANALYSIS

- 13.6.2 PESTLE ANALYSIS

- FIGURE 41 REST OF THE WORLD: AIRPORT AUTOMATION MARKET SNAPSHOT

- TABLE 185 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 186 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 187 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 188 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 189 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 190 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 191 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 192 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- TABLE 193 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY END MARKET, 2019-2022 (USD MILLION)

- TABLE 194 REST OF THE WORLD: AIRPORT AUTOMATION MARKET, BY END MARKET, 2023-2028 (USD MILLION)

- 13.6.3 BRAZIL

- 13.6.3.1 Increasing investment in automation of various operations at airports to drive market

- TABLE 195 BRAZIL: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 196 BRAZIL: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 197 BRAZIL: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 198 BRAZIL: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 199 BRAZIL: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 200 BRAZIL: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.6.4 MEXICO

- 13.6.4.1 Rising focus on deploying advanced automation technologies in airports to drive market

- TABLE 201 MEXICO: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 202 MEXICO: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 203 MEXICO: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 204 MEXICO: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 205 MEXICO: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 206 MEXICO: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.6.5 SOUTH AFRICA

- 13.6.5.1 Increasing investment in data-driven decision-making and analytics solutions to support airport operational strategies to drive market

- TABLE 207 SOUTH AFRICA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 208 SOUTH AFRICA: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 209 SOUTH AFRICA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 210 SOUTH AFRICA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 211 SOUTH AFRICA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 212 SOUTH AFRICA: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

- 13.6.6 OTHERS

- TABLE 213 OTHERS: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 214 OTHERS: AIRPORT AUTOMATION MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- TABLE 215 OTHERS: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2019-2022 (USD MILLION)

- TABLE 216 OTHERS: AIRPORT AUTOMATION MARKET, BY AIRPORT SIDE, 2023-2028 (USD MILLION)

- TABLE 217 OTHERS: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2019-2022 (USD MILLION)

- TABLE 218 OTHERS: AIRPORT AUTOMATION MARKET, BY AIRPORT SIZE, 2023-2028 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 MARKET SHARE ANALYSIS, 2022

- TABLE 219 AIRPORT AUTOMATION MARKET: DEGREE OF COMPETITION

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2022

- TABLE 220 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRPORT AUTOMATION MARKET, 2022

- 14.3 MARKET RANKING ANALYSIS, 2022

- FIGURE 43 MARKET RANKING OF TOP 5 PLAYERS IN AIRPORT AUTOMATION MARKET, 2022

- 14.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2018-2022

- FIGURE 44 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2018-2022

- 14.5 COMPANY EVALUATION MATRIX

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- FIGURE 45 COMPANY EVALUATION MATRIX, 2022

- 14.5.5 COMPANY FOOTPRINT

- TABLE 221 PRODUCT FOOTPRINT

- TABLE 222 COMPANY FOOTPRINT

- TABLE 223 COMPANY REGION FOOTPRINT

- 14.6 START-UP/SME EVALUATION MATRIX

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- FIGURE 46 START-UP/SME EVALUATION MATRIX, 2022

- 14.6.5 COMPETITIVE BENCHMARKING

- TABLE 224 AIRPORT AUTOMATION MARKET: LIST OF KEY START-UPS/SMES

- 14.7 COMPETITIVE SCENARIO

- 14.7.1 MARKET EVALUATION FRAMEWORK

- 14.7.2 DEALS

- TABLE 225 DEALS, 2020-2023

- 14.7.3 OTHERS

- TABLE 226 OTHERS, 2020-2023

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 15.1.1 DAIFUKU CO., LTD.

- TABLE 227 DAIFUKU CO., LTD.: COMPANY OVERVIEW

- FIGURE 47 DAIFUKU CO., LTD.: COMPANY SNAPSHOT

- TABLE 228 DAIFUKU CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 DAIFUKU CO., LTD.: PRODUCT LAUNCHES

- TABLE 230 DAIFUKU CO., LTD.: DEALS

- 15.1.2 AMADEUS IT GROUP SA

- TABLE 231 AMADEUS IT GROUP SA: COMPANY OVERVIEW

- FIGURE 48 AMADEUS IT GROUP SA: COMPANY SNAPSHOT

- TABLE 232 AMADEUS IT GROUP SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 233 AMADEUS IT GROUP SA: DEALS

- 15.1.3 LEONARDO S.P.A.

- TABLE 234 LEONARDO S.P.A.: COMPANY OVERVIEW

- FIGURE 49 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 235 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 236 LEONARDO S.P.A.: DEALS

- 15.1.4 SIEMENS

- TABLE 237 SIEMENS: COMPANY OVERVIEW

- FIGURE 50 SIEMENS: COMPANY SNAPSHOT

- TABLE 238 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 239 SIEMENS: DEALS

- 15.1.5 COLLINS AEROSPACE

- TABLE 240 COLLINS AEROSPACE: COMPANY OVERVIEW

- FIGURE 51 COLLINS AEROSPACE: COMPANY SNAPSHOT

- TABLE 241 COLLINS AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 242 COLLINS AEROSPACE: OTHERS

- 15.1.6 THALES

- TABLE 243 THALES: COMPANY OVERVIEW

- FIGURE 52 THALES: COMPANY SNAPSHOT

- TABLE 244 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 245 THALES: DEALS

- 15.1.7 VANDERLANDE INDUSTRIES B.V.

- TABLE 246 VANDERLANDE INDUSTRIES B.V.: COMPANY OVERVIEW

- FIGURE 53 VANDERLANDE INDUSTRIES B.V.: COMPANY SNAPSHOT

- TABLE 247 VANDERLANDE INDUSTRIES B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 248 VANDERLANDE INDUSTRIES B.V.: DEALS

- 15.1.8 SMITHS DETECTION GROUP LTD.

- TABLE 249 SMITHS DETECTION GROUP LTD.: COMPANY OVERVIEW

- FIGURE 54 SMITHS DETECTION GROUP LTD.: COMPANY SNAPSHOT

- TABLE 250 SMITHS DETECTION GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- 15.1.9 LEIDOS

- TABLE 251 LEIDOS: COMPANY OVERVIEW

- FIGURE 55 LEIDOS: COMPANY SNAPSHOT

- TABLE 252 LEIDOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 253 LEIDOS: DEALS

- 15.1.10 NEC CORPORATION

- TABLE 254 NEC CORPORATION: COMPANY OVERVIEW

- FIGURE 56 NEC CORPORATION: COMPANY SNAPSHOT

- TABLE 255 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 256 NEC CORPORATION: DEALS

- 15.1.11 INDRA SISTEMAS S.A.

- TABLE 257 INDRA SISTEMAS S.A.: COMPANY OVERVIEW

- FIGURE 57 INDRA SISTEMAS S.A.: COMPANY SNAPSHOT

- TABLE 258 INDRA SISTEMAS S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 259 INDRA SISTEMAS S.A.: DEALS

- 15.1.12 MATERNA IPS GMBH

- TABLE 260 MATERNA IPS GMBH: COMPANY OVERVIEW

- TABLE 261 MATERNA IPS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 262 MATERNA IPS GMBH: DEALS

- 15.1.13 ADB SAFEGATE

- TABLE 263 ADB SAFEGATE: COMPANY OVERVIEW

- TABLE 264 ADB SAFEGATE: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 265 ADB SAFEGATE: DEALS

- 15.1.14 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 266 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 267 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- TABLE 268 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- 15.1.15 GUNNEBO ENTRANCE CONTROL LTD.

- TABLE 269 GUNNEBO ENTRANCE CONTROL LTD.: COMPANY OVERVIEW

- TABLE 270 GUNNEBO ENTRANCE CONTROL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED**

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 15.2 OTHER PLAYERS

- 15.2.1 VISION-BOX

- 15.2.2 BEUMER GROUP

- 15.2.3 ALSTEF GROUP

- 15.2.4 LENZE

- 15.2.5 GORILLA TECHNOLOGY

- 15.2.6 INK INNOVATION

- 15.2.7 ATG AIRPORTS LIMITED

- 15.2.8 NUCTECH COMPANY LIMITED

- 15.2.9 SCARABEE AVIATION GROUP B.V.

- 15.2.10 XOVIS AG

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS