|

|

市場調査レポート

商品コード

1394959

フルフラールの世界市場:触媒別、プロセス別、原料別、用途別、最終用途産業別、地域別-2028年までの予測Furfural Market by Raw Material (Sugarcane Bagasse, Corncob, Rice Husk), Application (Derivatives, Solvents), End-Use Industry (Agriculture, Paint & Coatings, Pharmaceuticals, Food & Beverages, Refineries), and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| フルフラールの世界市場:触媒別、プロセス別、原料別、用途別、最終用途産業別、地域別-2028年までの予測 |

|

出版日: 2023年12月08日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 対象単位 | 金額(1,000米ドル)および数量(トン) |

| セグメント | 触媒別、プロセス別、原料別、用途別、最終用途産業別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

世界のフルフラールの市場規模は、2023年の6億6,200万米ドルから2028年には7億6,700万米ドルに成長し、2023年から2028年までのCAGRは2.9%と予測されています。

フルフラールは、トウモロコシの穂軸やサトウキビのバガスなどの農業副産物から得られる適応性のある化学化合物で、世界市場で極めて重要な役割を果たしています。医薬品、農業、様々な化学プロセスにおけるその多様な用途は、その重要性を裏付けています。フルフラール市場は、生産から最終用途までを包括する総合的なエコシステムであり、多様な要因によって形成されています。重要な促進要因は、持続可能な代替物に対する需要の高まりであり、市場促進要因となっています。生産性の低さと原料の集中に関連する制約を克服することがハードルとなっています。より広範なバイオベース化学品の中で、フルフラール市場は、より環境に優しく持続可能な産業慣行への飛躍を意味しています。さらに、繊維産業が新たなビジネスチャンスとして浮上し、この分野でのフルフラールの潜在的な用途が示されています。

フルフラール生産に広く利用されていることから、コーンコブはフルフラール市場の主要原料セグメントとして際立っています。この普及は主に、合成中にフルフラールを得るために極めて重要な変換プロセスを経る必須成分であるキシロースとペントサンがコーンコブに多く含まれていることに起因しています。キシロースとペントサンの豊富な含有量は、コーンコブを好ましい原料として位置づけるだけでなく、市場におけるフルフラールの全体的な生産動態と入手可能性を形成する上で不可欠な役割を強調しています。

予測期間中に最も急成長するセグメントとして予測されるフルフラール市場の誘導体用途は、大幅な拡大を遂げると思われます。この成長の加速は、多様な最終用途産業からの旺盛な需要に起因しています。フルフリルアルコール(FA)は主要な誘導体として中心的な地位を占めており、世界のフルフラール生産量の大きなシェアを占めています。フルフリルアルコールの需要の高まりは、様々な分野で広く利用されていることを示しており、フルフラール市場全体の成長と誘導体用途の隆盛の主要な促進要因としての重要性を裏付けています。

農業は、フルフラール市場の最終用途産業として急成長しており、その多面的用途と農業セクターの進化し続けるニーズがその原動力となっています。汎用性の高い化合物であるフルフラールは、農薬や殺虫剤の合成に幅広く使用され、農作物の保護と収穫量の向上に大きく貢献しています。持続可能で環境に優しい農法が世界的に重視されるようになったことで、特にバイオベースの農薬や肥料の開発において、フルフラールベースの製品に対する需要が高まっています。農業界が生産性の課題に対処するための革新的な解決策を求めるようになるにつれ、フルフラールの多様な用途が成長の最前線に位置づけられ、フルフラール市場において農業が最も急成長している最終用途産業となっています。

当レポートでは、世界のフルフラール市場について調査し、触媒別、プロセス別、原料別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- バリューチェーン分析

- 生態系/市場マップ

- 技術分析

- 特許分析

- 貿易分析

- 2023年~2024年の主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- マクロ経済指標

第6章 フルフラール市場、触媒別

- イントロダクション

- 固体酸型触媒

- 液体酸型触媒

第7章 フルフラール市場、プロセス別

- イントロダクション

- クエーカーバッチプロセス

- チャイニーズバッチプロセス

第8章 フルフラール市場、原料別

- イントロダクション

- トウモロコシの穂軸

- サトウキビバガス(SCB)

- もみ殻

- その他

第9章 フルフラール市場、用途別

- イントロダクション

- 誘導体

- 溶媒

- その他

第10章 フルフラール市場、最終用途産業別

- イントロダクション

- 農業

- ペイントとコーティング

- 医薬品

- 食品・飲料

- 製油所

- その他

第11章 フルフラール市場、地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要市場参入企業の収益分析

- 市場シェア分析

- 企業評価マトリックス

- 企業のフットプリント

- スタートアップ/中小企業の評価マトリックス

- 競合ベンチマーキング

- 競合状況・動向

第13章 企業プロファイル

- 主要参入企業

- CENTRAL ROMANA CORPORATION

- LENZING AG

- PENNAKEM, LLC

- MERCK KGAA

- KRBL LIMITED

- ILLOVO SUGAR(SOUTH AFRICA)(PTY)LTD

- SILVATEAM

- HONGYE HOLDING GROUP CORPORATION LIMITED

- KANTO CHEMICAL CO., INC.

- TANIN

- その他の企業

- LAXMI FURALS PVT LTD

- HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

- FURNOVA POLYMERS LTD

- TOKYO CHEMICAL INDUSTRY CO., LTD.(TCI)

- SHANDONG XINHUA PHARMA

- JUNSEI CHEMICAL CO., LTD.

- A. B. ENTERPRISES

- SHANDONG YINO BIOLOGIC MATERIALS CO., LTD.

- RX CHEMICALS

- KUNSHAN ODOWELL CO., LTD.

- CENTRAL DRUG HOUSE(P)LTD.

- AECOCHEM

- BEIJING LYS CHEMICALS CO., LTD.

- ZHUCHENG TAISHENG CHEMICAL CO., LTD.

- XINGTAI CHUNLEI FURFURYL ALCOHOL CO., LTD.

第14章 隣接市場および関連市場

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD thousands) and Volume (Tons) |

| Segments | Raw material, Application, End-Use industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

The market size for Global Furfural Market size is projected to grow from USD 662 million in 2023 to USD 767 million by 2028, at a CAGR of 2.9% from 2023 to 2028.

Furfural, an adaptable chemical compound sourced from agricultural by-products like corncobs and sugarcane bagasse etc., plays a pivotal role in the global market. Its diverse applications in pharmaceuticals, agriculture, and various chemical processes underscore its significance. The furfural market, a holistic ecosystem encompassing production to end-use, is shaped by diverse factors. An essential driver is the escalating demand for sustainable alternatives, propelling market progression. Overcoming limitations related to low productivity and feedstock concentration presents a hurdle. In the broader spectrum of bio-based chemicals, the furfural market signifies a collective leap towards greener and more sustainable industrial practices. Moreover, the textile industry emerges as an additional opportunity, showcasing furfural's potential applications in this sector.

By Raw Material, corncob segment dominated the market in 2022.

The corncob stands out as the principal raw material segment within the furfural market, given its widespread utilization in furfural production. This prevalence is primarily attributed to the substantial presence of xylose and pentosan in corncob, essential components that undergo a pivotal conversion process to yield furfural during synthesis. The abundant content of xylose and pentosan not only positions corncob as the preferred raw material but also emphasizes its integral role in shaping the overall production dynamics and availability of furfural in the market.

By Application, derivatives segment to account for the highest CAGR during the forecast period

Anticipated as the fastest-growing segment in the forecast period, the derivatives application within the furfural market is set to undergo substantial expansion. This accelerated growth is attributed to the robust demand emanating from diverse end-use industries. Furfuryl Alcohol (FA) takes center stage as the major derivative, constituting a significant share of the global furfural production. The heightened demand for furfuryl alcohol is indicative of its widespread utilization across various sectors, underlining its importance as a key driver for the overall growth and prominence of the derivatives application within the furfural market.

By End Use Industry, Agriculture segment to account for the highest CAGR during the forecast period

Agriculture has emerged as the fastest-growing end-use industry in the furfural market, driven by its multifaceted applications and the ever-evolving needs of the agricultural sector. Furfural, a versatile chemical compound, finds extensive use in the synthesis of agrochemicals and pesticides, contributing significantly to crop protection and enhanced yield. The growing global emphasis on sustainable and eco-friendly agricultural practices has propelled the demand for furfural-based products, particularly in the development of bio-based pesticides and fertilizers. As the agricultural industry increasingly seeks innovative solutions to address productivity challenges, furfural's diverse applications position it at the forefront of growth, making agriculture the fastest-growing end-use industry within the furfural market.

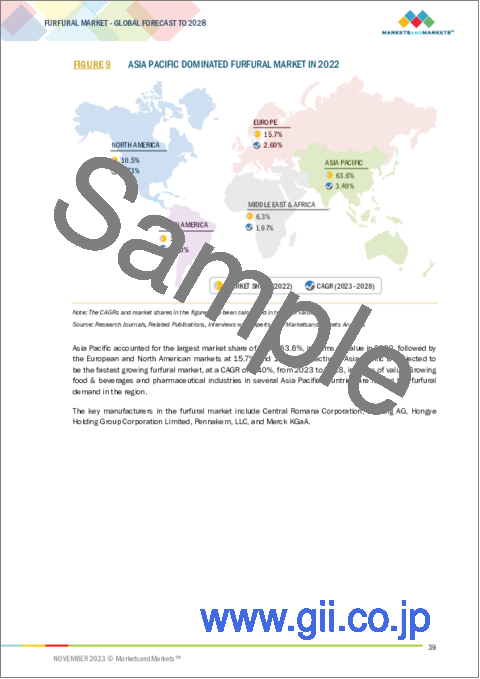

APAC to be the biggest region in the Furfural market.

In 2022, the Asia-Pacific (APAC) region emerged as the frontrunner in the global furfural market, with China playing a pivotal role as the primary driver of growth. China, boasting the majority share of both global production and consumption of furfural, significantly influenced the market dynamics. The surge in demand within the region was particularly fuelled by the expanding foundry and pharmaceutical industries in China. The robust growth in these sectors, marked by increasing production activities, contributed substantially to the heightened demand for furfural. Notably, beyond China, Thailand has also made significant strides, positioning itself as the major producer and exporter of furfural in the APAC region.

By Company: Tier1: 40%, Tier 2: 25%, Tier3: 4: 35%

By Designation: C-Level: 35%, Director Level: 30%, Others: 35%

By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, South America: 5%, and Middle East & Africa: 5%.

Companies Covered: Central Romana Corporation (Dominican Republic), Pennakem (US), Silvateam (Italy), Illovo Sugar (South Africa), Hongye Holding Group Corporation Limited (China), KRBL Limited (India), Lenzing AG(Austria), and Merck KGaA (Germany), and others are covered in the furfural market.

Research Coverage

The market study covers the furfural market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on raw material, applications, End-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the furfural market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall furfural market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Shift toward renewable chemicals & growing demand for furfuryl alcohol), restraints (Availability of crude oil-based alternatives), opportunities (Emerging demand from textile and fashion industry) and challenges (raw material price fluctuations) influencing the growth of the furfural market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the furfural market

- Market Development: Comprehensive information about lucrative markets - the report analyses the furfural market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the furfural market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Central Romana Corporation (Dominican Republic), Pennakem (US), Silvateam (Italy), Illovo Sugar (South Africa), Hongye Holding Group Corporation Limited (China), KRBL Limited (India), Lenzing AG(Austria), and Merck KGaA (Germany), and among others in the furfural market. The report also helps stakeholders understand the pulse of the furfural market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 FURFURAL MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 REGIONAL SCOPE

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 LIMITATIONS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 FURFURAL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 5 FURFURAL MARKET: DATA TRIANGULATION

- 2.4 RECESSION IMPACT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 6 CORNCOB SEGMENT TO LEAD FURFURAL MARKET DURING FORECAST PERIOD

- FIGURE 7 DERIVATIVES SEGMENT TO DOMINATE FURFURAL MARKET

- FIGURE 8 AGRICULTURE TO BE LARGEST END-USE INDUSTRY IN FURFURAL MARKET

- FIGURE 9 ASIA PACIFIC DOMINATED FURFURAL MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FURFURAL MARKET

- FIGURE 10 ASIAN ECONOMIES TO WITNESS RELATIVELY HIGHER GROWTH RATE FOR FURFURAL MARKET

- 4.2 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY AND COUNTRY, 2022

- FIGURE 11 CHINA ACCOUNTED FOR LARGEST SHARE IN TERMS OF VOLUME

- 4.3 FURFURAL MARKET, BY COUNTRY

- FIGURE 12 FURFURAL MARKET IN CHINA TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FURFURAL MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for furfuryl alcohol

- 5.2.1.2 Increase in utilization of furfural in agrochemicals and horticulture

- 5.2.1.3 Shift toward renewable chemicals

- TABLE 2 TOP 30 CHEMICALS THAT CAN BE OBTAINED FROM BIOMASS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of crude oil-based alternatives

- 5.2.2.2 Lack of technological advancement and production process framework

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging demand from textile and fashion industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuations in raw material prices

- 5.2.4.2 Low yield of furfural from traditional technology

- 5.3 TRENDS & DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 14 REVENUE SHIFT FOR FURFURAL MANUFACTURERS

- 5.4 PRICING ANALYSIS

- FIGURE 15 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 END-USE INDUSTRIES

- TABLE 3 AVERAGE PRICE TREND OF KEY PLAYERS, BY TOP 3 END-USE INDUSTRIES (USD/KG), 2022

- FIGURE 16 AVERAGE SELLING PRICE TREND, BY REGION (USD/KG)

- TABLE 4 AVERAGE PRICE TREND, BY REGION (USD/KG)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS OF FURFURAL MARKET

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 18 FURFURAL MARKET: ECOSYSTEM MAPPING

- TABLE 5 ECOSYSTEM OF FURFURAL MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 SUPRA YIELD TECHNOLOGY

- 5.7.2 FURFURAL-BASED BIOPLASTICS

- 5.7.3 FURFURAL'S CATALYTIC TRANSFORMATION INTO VALUE-ADDED CHEMICALS

- 5.7.4 FURFURAL IN COATINGS

- 5.8 PATENT ANALYSIS

- 5.8.1 INTRODUCTION

- 5.8.2 METHODOLOGY

- 5.8.3 FURFURAL MARKET, PATENT ANALYSIS (2013-2022)

- FIGURE 19 LIST OF MAJOR PATENTS FOR FURFURAL MARKET (2013-2022)

- TABLE 6 LIST OF PATENTS FOR FURFURAL

- 5.9 TRADE ANALYSIS

- FIGURE 20 EXPORT SCENARIO, HS CODE 293212 ENCOMPASSING FURFURAL OR 2-FURALDEHYDE "FURFURALDEHYDE" (USD MILLION)

- FIGURE 21 IMPORT SCENARIO, HS CODE 293212 ENCOMPASSING FURFURAL OR 2-FURALDEHYDE "FURFURALDEHYDE" (USD MILLION)

- 5.10 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 7 FURFURAL MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 AVERAGE TARIFF RATES

- TABLE 10 TARIFF RELATED TO FURFURAL

- 5.11.3 ENVIRONMENTAL STANDARD (CHINA)

- 5.11.4 REGULATION (EC) NO 1272/2008

- 5.11.5 REGULATION (EC) NO 1907/2006

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 FURFURAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 BARGAINING POWER OF SUPPLIERS

- 5.12.2 THREAT OF NEW ENTRANTS

- 5.12.3 THREAT OF SUBSTITUTES

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA

- TABLE 12 KEY BUYING CRITERIA FOR FURFURAL MARKET

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 USE OF PD-PDO/ZNSO4 CATALYST IN FURFURAL MANUFACTURING

- 5.14.2 CONVERSION OF FURFURAL INTO BIO-CHEMICALS THROUGH BIO-CATALYSIS

- 5.15 MACROECONOMIC INDICATORS

- 5.15.1 INTRODUCTION

- 5.15.2 GDP TRENDS AND FORECASTS

- TABLE 13 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- 5.15.3 TRENDS AND FORECAST OF OIL INDUSTRY AND ITS IMPACT ON FURFURAL MARKET

- FIGURE 25 GLOBAL OIL PRODUCTION, 2017-2021

6 FURFURAL MARKET, BY CATALYST

- 6.1 INTRODUCTION

- 6.2 SOLID ACID TYPE CATALYSTS

- 6.3 LIQUID ACID TYPE CATALYSTS

7 FURFURAL MARKET, BY PROCESS

- 7.1 INTRODUCTION

- 7.2 QUAKER BATCH PROCESS

- 7.3 CHINESE BATCH PROCESS

8 FURFURAL MARKET, BY RAW MATERIAL

- 8.1 INTRODUCTION

- TABLE 14 FURFURAL YIELD FROM DIFFERENT TYPES OF RAW MATERIALS

- FIGURE 26 CORNCOB SEGMENT TO DOMINATE FURFURAL MARKET DURING FORECAST PERIOD

- TABLE 15 FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (TON)

- TABLE 16 FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (USD THOUSAND)

- TABLE 17 FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (TON)

- TABLE 18 FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (USD THOUSAND)

- 8.2 CORNCOB

- 8.2.1 HIGHEST HEMICELLULOSE CONTENT OF ALL RAW MATERIALS FOR FURFURAL

- 8.3 SUGARCANE BAGASSE (SCB)

- 8.3.1 SUSTAINABLE SUGAR INDUSTRY BY-PRODUCT

- 8.4 RICE HUSK

- 8.4.1 LOWEST CONTENT OF HEMICELLULOSE

- 8.5 OTHER RAW MATERIALS

9 FURFURAL MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 27 DERIVATIVES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 19 FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 20 FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 21 FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 22 FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 23 FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 24 FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 9.2 DERIVATIVES

- 9.2.1 HIGH DEMAND IN FURFURYL ALCOHOL MANUFACTURING TO DRIVE MARKET

- 9.3 SOLVENT

- 9.3.1 NON-TOXICITY MAKES FURFURAL SUITABLE ALTERNATIVE TO PHENOLS

- 9.4 OTHER APPLICATIONS

10 FURFURAL MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 28 AGRICULTURE TO BE LARGEST APPLICATION OF FURFURAL DURING FORECAST PERIOD

- TABLE 25 FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (TON)

- TABLE 26 FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (USD THOUSAND)

- TABLE 27 FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (TON)

- TABLE 28 FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD THOUSAND)

- 10.2 AGRICULTURE

- 10.2.1 GROWING DEMAND FOR BIO-BASED PESTICIDES AND HERBICIDES TO DRIVE MARKET

- 10.3 PAINT & COATINGS

- 10.3.1 INCREASING DEMAND FOR HIGH-PERFORMANCE COATINGS TO DRIVE MARKET

- 10.4 PHARMACEUTICALS

- 10.4.1 ADVANCEMENT IN APPLICATIONS IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- 10.5 FOOD & BEVERAGES

- 10.5.1 GROWING DEMAND FOR NATURAL FLAVORS TO DRIVE MARKET

- 10.6 REFINERIES

- 10.6.1 EXPANDING APPLICATIONS IN SOLVENT EXTRACTION TO DRIVE MARKET

- 10.7 OTHER END-USE INDUSTRIES

11 FURFURAL MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 29 CHINA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC MARKET TO RECORD FASTEST-GROWTH DURING FORECAST PERIOD

- TABLE 29 FURFURAL MARKET, BY REGION, 2021-2028 (TON)

- TABLE 30 FURFURAL MARKET, BY REGION, 2021-2028 (USD THOUSAND)

- 11.2 ASIA PACIFIC

- 11.2.1 RECESSION IMPACT

- FIGURE 31 ASIA PACIFIC: FURFURAL MARKET SNAPSHOT

- TABLE 31 ASIA PACIFIC: FURFURAL MARKET, BY COUNTRY, 2021-2028 (TON)

- TABLE 32 ASIA PACIFIC: FURFURAL MARKET, BY COUNTRY, 2021-2028 (USD THOUSAND)

- TABLE 33 ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 34 ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 35 ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 36 ASIA PACIFIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 37 ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 38 ASIA PACIFIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 39 ASIA PACIFIC: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (TON)

- TABLE 40 ASIA PACIFIC: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (USD THOUSAND)

- TABLE 41 ASIA PACIFIC: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (TON)

- TABLE 42 ASIA PACIFIC: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (USD THOUSAND)

- TABLE 43 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (TON)

- TABLE 44 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (USD THOUSAND)

- TABLE 45 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (TON)

- TABLE 46 ASIA PACIFIC: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD THOUSAND)

- 11.2.2 CHINA

- 11.2.2.1 Largest producer of furfural in world

- TABLE 47 CHINA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 48 CHINA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 49 CHINA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 50 CHINA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 51 CHINA: FURFURAL MARKET SIZE, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 52 CHINA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.2.3 INDIA

- 11.2.3.1 Pharmaceutical industry to be major driver of market

- TABLE 53 INDIA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 54 INDIA: FURFURAL MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 55 INDIA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 56 INDIA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 57 INDIA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 58 INDIA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.2.4 JAPAN

- 11.2.4.1 Growing investment in chemical and pharmaceutical industries

- TABLE 59 JAPAN: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 60 JAPAN: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 61 JAPAN: FURFURAL MARKET SIZE, BY APPLICATION, 2021-2028 (TON)

- TABLE 62 JAPAN: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 63 JAPAN: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 64 JAPAN: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.2.5 THAILAND

- 11.2.5.1 Market to be driven by rising sportswear industry

- TABLE 65 THAILAND: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 66 THAILAND: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 67 THAILAND: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 68 THAILAND: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 69 THAILAND: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 70 THAILAND: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.2.6 REST OF ASIA PACIFIC

- TABLE 71 REST OF ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 72 REST OF ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 73 REST OF ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 74 REST OF ASIA PACIFIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 75 REST OF ASIA PACIFIC: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 76 REST OF ASIA PACIFIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT

- FIGURE 32 EUROPE: FURFURAL MARKET SNAPSHOT

- TABLE 77 EUROPE: FURFURAL MARKET, BY COUNTRY, 2021-2028 (TON)

- TABLE 78 EUROPE: FURFURAL MARKET, BY COUNTRY, 2021-2028 (USD THOUSAND)

- TABLE 79 EUROPE: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 80 EUROPE: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 81 EUROPE: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 82 EUROPE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 83 EUROPE: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 84 EUROPE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 85 EUROPE: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (TON)

- TABLE 86 EUROPE: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (USD THOUSAND)

- TABLE 87 EUROPE: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (TON)

- TABLE 88 EUROPE: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (USD THOUSAND)

- TABLE 89 EUROPE: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (TON)

- TABLE 90 EUROPE: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (USD THOUSAND)

- TABLE 91 EUROPE: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (TON)

- TABLE 92 EUROPE: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD THOUSAND)

- 11.3.2 GERMANY

- 11.3.2.1 Investments in chemical & petrochemical industry to drive market

- TABLE 93 GERMANY: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 94 GERMANY: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 95 GERMANY: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 96 GERMANY: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 97 GERMANY: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 98 GERMANY: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.3.3 FRANCE

- 11.3.3.1 Strong base of plastic industries to create growth opportunities

- TABLE 99 FRANCE: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 100 FRANCE: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 101 FRANCE: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 102 FRANCE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 103 FRANCE: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 104 FRANCE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.3.4 ITALY

- 11.3.4.1 Intensive horticulture activities to drive market

- TABLE 105 ITALY: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 106 ITALY: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 107 ITALY: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 108 ITALY: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 109 ITALY: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 110 ITALY: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.3.5 UK

- 11.3.5.1 Increasing focus on bioenergy to drive market

- TABLE 111 UK: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 112 UK: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 113 UK: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 114 UK: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 115 UK: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 116 UK: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.3.6 BELGIUM

- 11.3.6.1 Presence of one of largest furfuryl alcohol plants makes country major market

- TABLE 117 BELGIUM: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 118 BELGIUM: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 119 BELGIUM: FURFURAL MARKET SIZE, BY APPLICATION, 2021-2028 (TON)

- TABLE 120 BELGIUM: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 121 BELGIUM: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 122 BELGIUM: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.3.7 NETHERLANDS

- 11.3.7.1 Presence of major food & beverage companies to support market growth

- TABLE 123 NETHERLANDS: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 124 NETHERLANDS: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 125 NETHERLANDS: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 126 NETHERLANDS: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 127 NETHERLANDS: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 128 NETHERLANDS: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.3.8 REST OF EUROPE

- TABLE 129 REST OF EUROPE: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 130 REST OF EUROPE: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 131 REST OF EUROPE: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 132 REST OF EUROPE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 133 REST OF EUROPE: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 134 REST OF EUROPE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.4 NORTH AMERICA

- 11.4.1 RECESSION IMPACT

- TABLE 135 NORTH AMERICA: FURFURAL MARKET, BY COUNTRY, 2021-2028 (TON)

- TABLE 136 NORTH AMERICA: FURFURAL MARKET, BY COUNTRY, 2021-2028 (USD THOUSAND)

- TABLE 137 NORTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 138 NORTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 139 NORTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 140 NORTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 141 NORTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 142 NORTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 143 NORTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (TON)

- TABLE 144 NORTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (USD THOUSAND)

- TABLE 145 NORTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (TON)

- TABLE 146 NORTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (USD THOUSAND)

- TABLE 147 NORTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (TON)

- TABLE 148 NORTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (USD THOUSAND)

- TABLE 149 NORTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (TON)

- TABLE 150 NORTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD THOUSAND)

- 11.4.2 US

- 11.4.2.1 Growing sportswear market to fuel demand

- TABLE 151 US: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 152 US: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 153 US: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 154 US: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 155 US: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 156 US: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.4.3 CANADA

- 11.4.3.1 Growth in agrochemical market to boost demand

- TABLE 157 CANADA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 158 CANADA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 159 CANADA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 160 CANADA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 161 CANADA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 162 CANADA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.4.4 MEXICO

- 11.4.4.1 Increasing investments in pharmaceutical industry and growing food & beverage industry

- TABLE 163 MEXICO: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 164 MEXICO: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 165 MEXICO: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 166 MEXICO: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 167 MEXICO: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 168 MEXICO: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 RECESSION IMPACT

- TABLE 169 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY COUNTRY, 2021-2028 (TON)

- TABLE 170 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY COUNTRY, 2021-2028 (USD THOUSAND)

- TABLE 171 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 172 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 173 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 174 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 175 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 176 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 177 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (TON)

- TABLE 178 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (USD THOUSAND)

- TABLE 179 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (TON)

- TABLE 180 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (USD THOUSAND)

- TABLE 181 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (TON)

- TABLE 182 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (USD THOUSAND)

- TABLE 183 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (TON)

- TABLE 184 MIDDLE EAST & AFRICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD THOUSAND)

- 11.5.2 GCC COUNTRIES

- 11.5.2.1 Growth in end-use industries to propel market

- TABLE 185 GCC COUNTRIES: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 186 GCC COUNTRIES: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 187 GCC COUNTRIES: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 188 GCC COUNTRIES: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 189 GCC COUNTRIES: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 190 GCC COUNTRIES: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.5.2.2 Saudi Arabia

- 11.5.2.2.1 Increasing opportunities in end-use industries to drive market

- 11.5.2.2 Saudi Arabia

- TABLE 191 SAUDI ARABIA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 192 SAUDI ARABIA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 193 SAUDI ARABIA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 194 SAUDI ARABIA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 195 SAUDI ARABIA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 196 SAUDI ARABIA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.5.2.3 UAE

- 11.5.2.3.1 Increasing demand from food & beverage industry to drive market

- 11.5.2.3 UAE

- TABLE 197 UAE: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 198 UAE: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 199 UAE: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 200 UAE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 201 UAE: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 202 UAE: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.5.2.4 Rest of GCC

- TABLE 203 REST OF GCC: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 204 REST OF GCC: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 205 REST OF GCC: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 206 REST OF GCC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 207 REST OF GCC: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 208 REST OF GCC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Significant export of furfural to Asia Pacific and European countries

- TABLE 209 SOUTH AFRICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 210 SOUTH AFRICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 211 SOUTH AFRICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 212 SOUTH AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 213 SOUTH AFRICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 214 SOUTH AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.5.4 DOMINICAN REPUBLIC

- 11.5.4.1 Usage of furfural in agriculture and pharmaceutical industries to drive market

- TABLE 215 DOMINICAN REPUBLIC: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 216 DOMINICAN REPUBLIC: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 217 DOMINICAN REPUBLIC: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 218 DOMINICAN REPUBLIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 219 DOMINICAN REPUBLIC: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 220 DOMINICAN REPUBLIC: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 221 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 222 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 223 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 224 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 225 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.6 SOUTH AMERICA

- 11.6.1 RECESSION IMPACT

- TABLE 227 SOUTH AMERICA: FURFURAL MARKET, BY COUNTRY, 2021-2028 (TON)

- TABLE 228 SOUTH AMERICA: FURFURAL MARKET, BY COUNTRY, 2021-2028 (USD THOUSAND)

- TABLE 229 SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 230 SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 231 SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 232 SOUTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 233 SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 234 SOUTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 235 SOUTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (TON)

- TABLE 236 SOUTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2017-2020 (USD THOUSAND)

- TABLE 237 SOUTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (TON)

- TABLE 238 SOUTH AMERICA: FURFURAL MARKET, BY RAW MATERIAL, 2021-2028 (USD THOUSAND)

- TABLE 239 SOUTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (TON)

- TABLE 240 SOUTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2017-2020 (USD THOUSAND)

- TABLE 241 SOUTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (TON)

- TABLE 242 SOUTH AMERICA: FURFURAL MARKET, BY END-USE INDUSTRY, 2021-2028 (USD THOUSAND)

- 11.6.2 BRAZIL

- 11.6.2.1 Growing investments across end-use industries

- TABLE 243 BRAZIL: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 244 BRAZIL: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 245 BRAZIL: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 246 BRAZIL: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 247 BRAZIL: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 248 BRAZIL: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.6.3 ARGENTINA

- 11.6.3.1 Increasing investments in construction sector and growing chemical sector

- TABLE 249 ARGENTINA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 250 ARGENTINA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 251 ARGENTINA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 252 ARGENTINA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 253 ARGENTINA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 254 ARGENTINA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

- 11.6.4 REST OF SOUTH AMERICA

- TABLE 255 REST OF SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (TON)

- TABLE 256 REST OF SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 257 REST OF SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (TON)

- TABLE 258 REST OF SOUTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (TON)

- TABLE 259 REST OF SOUTH AMERICA: FURFURAL MARKET, BY APPLICATION, 2021-2028 (USD THOUSAND)

- TABLE 260 REST OF SOUTH AMERICA: FURFURAL MARKET, BY DERIVATIVE APPLICATION, 2021-2028 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- TABLE 261 OVERVIEW OF STRATEGIES ADOPTED BY KEY FURFURAL PLAYERS

- 12.2 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 33 REVENUE ANALYSIS OF KEY COMPANIES IN FURFURAL MARKET OVER LAST FIVE YEARS

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 34 SHARE OF LEADING COMPANIES IN FURFURAL MARKET

- TABLE 262 FURFURAL MARKET: DEGREE OF COMPETITION

- 12.4 COMPANY EVALUATION MATRIX

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 35 COMPANY EVALUATION MATRIX, 2022

- 12.5 COMPANY FOOTPRINT

- FIGURE 36 FURFURAL MARKET: PRODUCT FOOTPRINT (25 COMPANIES)

- TABLE 263 FURFURAL MARKET: APPLICATION FOOTPRINT (25 COMPANIES)

- TABLE 264 FURFURAL MARKET: REGIONAL FOOTPRINT (25 COMPANIES)

- TABLE 265 FURFURAL MARKET: COMPANY FOOTPRINT (25 COMPANIES)

- 12.6 START-UP/SME EVALUATION MATRIX

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 37 START-UP/SME EVALUATION MATRIX

- 12.7 COMPETITIVE BENCHMARKING

- TABLE 266 FURFURAL MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 267 FURFURAL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 12.8 COMPETITIVE SITUATIONS AND TRENDS

- 12.8.1 DEALS

- TABLE 268 DEALS, 2019-2023

- 12.8.2 OTHERS

- TABLE 269 OTHERS, 2019-2023

13 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 CENTRAL ROMANA CORPORATION

- TABLE 270 CENTRAL ROMANA CORPORATION: COMPANY OVERVIEW

- 13.1.2 LENZING AG

- TABLE 271 LENZING AG: COMPANY OVERVIEW

- FIGURE 38 LENZING AG: COMPANY SNAPSHOT

- TABLE 272 LENZING AG: OTHERS

- 13.1.3 PENNAKEM, LLC

- TABLE 273 PENNAKEM, LLC: COMPANY OVERVIEW

- TABLE 274 PENNAKEM, LLC: DEALS

- TABLE 275 PENNAKEM, LLC: OTHERS

- 13.1.4 MERCK KGAA

- TABLE 276 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 39 MERCK KGAA: COMPANY SNAPSHOT

- 13.1.5 KRBL LIMITED

- TABLE 277 KRBL LIMITED: COMPANY OVERVIEW

- FIGURE 40 KRBL LIMITED: COMPANY SNAPSHOT

- 13.1.6 ILLOVO SUGAR (SOUTH AFRICA) (PTY) LTD

- TABLE 278 ILLOVO SUGAR (SOUTH AFRICA) (PTY) LTD: COMPANY OVERVIEW

- TABLE 279 ILLOVO SUGAR (SOUTH AFRICA) (PTY) LTD: OTHERS

- 13.1.7 SILVATEAM

- TABLE 280 SILVATEAM: COMPANY OVERVIEW

- 13.1.8 HONGYE HOLDING GROUP CORPORATION LIMITED

- TABLE 281 HONGYE HOLDING GROUP CORPORATION LIMITED: COMPANY OVERVIEW

- 13.1.9 KANTO CHEMICAL CO., INC.

- TABLE 282 KANTO CHEMICAL CO., INC.: COMPANY OVERVIEW

- 13.1.10 TANIN

- TABLE 283 TANIN: COMPANY OVERVIEW

- 13.2 OTHER PLAYERS

- 13.2.1 LAXMI FURALS PVT LTD

- TABLE 284 LAXMI FURALS PVT LTD: COMPANY OVERVIEW

- 13.2.2 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

- TABLE 285 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- 13.2.3 FURNOVA POLYMERS LTD

- TABLE 286 FURNOVA POLYMERS LTD: COMPANY OVERVIEW

- 13.2.4 TOKYO CHEMICAL INDUSTRY CO., LTD. (TCI)

- TABLE 287 TOKYO CHEMICAL INDUSTRY CO., LTD. (TCI): COMPANY OVERVIEW

- 13.2.5 SHANDONG XINHUA PHARMA

- TABLE 288 SHANDONG XINHUA PHARMA: COMPANY OVERVIEW

- 13.2.6 JUNSEI CHEMICAL CO., LTD.

- TABLE 289 JUNSEI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 13.2.7 A. B. ENTERPRISES

- TABLE 290 A. B. ENTERPRISES: COMPANY OVERVIEW

- 13.2.8 SHANDONG YINO BIOLOGIC MATERIALS CO., LTD.

- TABLE 291 SHANDONG YINO BIOLOGIC MATERIALS CO., LTD.: COMPANY OVERVIEW

- 13.2.9 RX CHEMICALS

- TABLE 292 RX CHEMICALS: COMPANY OVERVIEW

- 13.2.10 KUNSHAN ODOWELL CO., LTD.

- TABLE 293 KUNSHAN ODOWELL CO., LTD.: COMPANY OVERVIEW

- 13.2.11 CENTRAL DRUG HOUSE (P) LTD.

- TABLE 294 CENTRAL DRUG HOUSE (P) LTD.: COMPANY OVERVIEW

- 13.2.12 AECOCHEM

- TABLE 295 AECOCHEM: COMPANY OVERVIEW

- 13.2.13 BEIJING LYS CHEMICALS CO., LTD.

- TABLE 296 BEIJING LYS CHEMICALS CO., LTD.: COMPANY OVERVIEW

- 13.2.14 ZHUCHENG TAISHENG CHEMICAL CO., LTD.

- TABLE 297 ZHUCHENG TAISHENG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 13.2.15 XINGTAI CHUNLEI FURFURYL ALCOHOL CO., LTD.

- TABLE 298 XINGTAI CHUNLEI FURFURYL ALCOHOL CO., LTD. NC.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKET

- 14.1 INTRODUCTION

- 14.2 TETRAHYDROFURAN (THF) MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.3 TETRAHYDROFURAN MAREKT, BY PROCESS TECHNOLOGY

- TABLE 299 THF MARKET, BY PROCESS TECHNOLOGY, 2015-2022 (KILOTON)

- TABLE 300 THF MARKET, BY PROCESS TECHNOLOGY, 2015-2022 (USD MILLION)

- 14.4 TETRAHYDROFURAN MAREKT, BY APPLICATION

- TABLE 301 THF MARKET, BY APPLICATION, 2015-2022 (KILOTON)

- TABLE 302 THF MARKET, BY APPLICATION, 2015-2022 (USD MILLION)

- 14.5 TETRAHYDROFURAN MARKET, BY REGION

- TABLE 303 THF MARKET, BY REGION, 2015-2022 (KILOTON)

- TABLE 304 THF MARKET, BY REGION, 2015-2022 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS