|

市場調査レポート

商品コード

1415417

フルフラール市場:原料、プロセス、用途、最終用途産業別-2024-2030年の世界予測Furfural Market by Raw Material (Corncobs, Cotton Hulls, Rice Hulls), Process (Chinese Batch Process, Quaker Batch Process, Rosenlew Continuous Process), Application, End-Use Industry - Global Forecast 2024-2030 |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| フルフラール市場:原料、プロセス、用途、最終用途産業別-2024-2030年の世界予測 |

|

出版日: 2024年01月15日

発行: 360iResearch

ページ情報: 英文 198 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

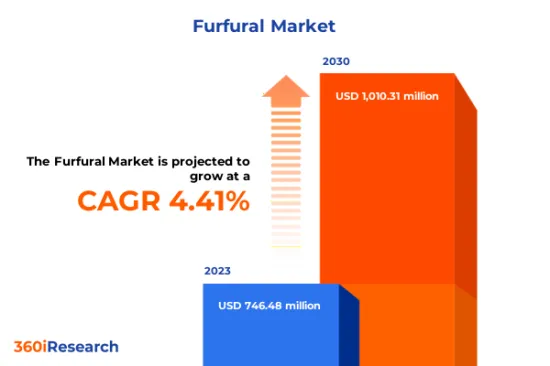

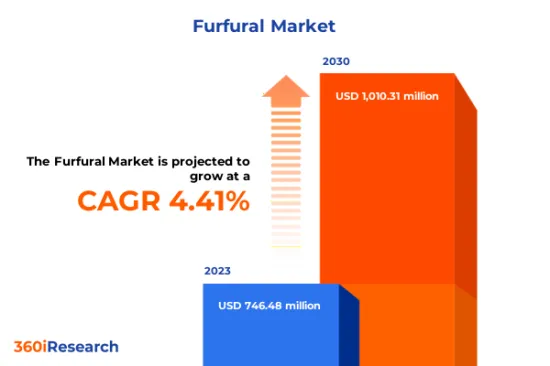

フルフラール市場規模は2023年に7億4,648万米ドルと推定され、2024年には7億7,896万米ドルに達すると予測され、CAGR 4.41%で2030年には10億1,031万米ドルに達すると予測されます。

フルフラールの世界市場

| 主な市場の統計 | |

|---|---|

| 基準年[2023] | 7億4,648万米ドル |

| 予測年 [2024] | 7億7,896万米ドル |

| 予測年 [2030] | 10億1,031万米ドル |

| CAGR(%) | 4.41% |

フルフラール市場は、主にトウモロコシの穂軸、燕麦の籾殻、籾殻、バガス、おがくずなどの農業製品別から得られる有機化合物であるフルフラールの世界の生産、流通、取引を網羅しています。農業セクターの発展への投資の増加と肥料の必要性により、フルフラール製品の需要が増加しています。バイオベースのプラスチックや塗料の需要の急増が、フルフラール製品の採用を促進しています。フルフラールの食品香料としての利用やパーソナルケア製品の香料としての利用は、フルフラール製品の需要に貢献しています。しかし、フルフラール製品の製造工程が複雑であるため、製品需要が制限される可能性があります。フルフラールの毒性や人体への悪影響も、市場採用の懸念材料となっています。フルフラール製品の応用範囲を拡大するための継続的な研究や、製造のための新技術の開発は、市場に大きな成長の可能性をもたらすと予想されます。

地域別の洞察

南北アメリカでは、米国が重要なフルフラール市場です。これは、プラスチックに使用されるフルフラール-アルコール樹脂の生産や製薬業界の溶剤としての用途によるものです。南北アメリカ地域では、バイオベースの化学薬品に対する需要が増加しており、フルフラール市場の成長を牽引すると予想されます。欧州では、持続可能な化学物質への注目が非常に高く、厳しい環境規制がフルフラール市場を牽引しています。欧州諸国は、化学産業における循環型経済とカーボンフットプリント削減のイニシアチブの最前線にあり、フルフラール市場の成長を支えています。アジア太平洋地域は、フルフラール製品の製造および消費者基盤が強く、中国、日本、インドなどの国々の旺盛な市場需要に牽引されています。アジア太平洋地域は競争市場であり、顧客の購買行動は持続可能で環境に優しい製品に傾いています。

FPNVポジショニング・マトリックス

FPNVポジショニングマトリックスは、フルフラール市場の評価において極めて重要です。事業戦略や製品満足度に関連する主要指標を調査し、ベンダーの包括的な評価を提供します。この綿密な分析により、ユーザーは各自の要件に沿った十分な情報に基づいた意思決定を行うことができます。評価に基づき、ベンダーは成功の度合いが異なる4つの象限に分類されます:フォアフロント(F)、パスファインダー(P)、ニッチ(N)、バイタル(V)です。

市場シェア分析

市場シェア分析は、フルフラール市場におけるベンダーの現状について、洞察に満ちた詳細な調査を提供する包括的なツールです。全体的な収益、顧客基盤、その他の主要指標についてベンダーの貢献度を綿密に比較・分析することで、企業の業績や市場シェア争いの際に直面する課題について理解を深めることができます。さらに、この分析により、調査対象基準年に観察された累積、断片化の優位性、合併の特徴などの要因を含む、この分野の競合特性に関する貴重な考察が得られます。このような詳細レベルの拡大により、ベンダーはより多くの情報に基づいた意思決定を行い、市場で競争優位に立つための効果的な戦略を考案することができます。

本レポートは、以下の側面に関する貴重な洞察を提供しています:

1-市場の浸透度:主要企業が提供する市場に関する包括的な情報を提示しています。

2-市場の開拓度:有利な新興市場を深く掘り下げ、成熟市場セグメントにおける浸透度を分析しています。

3-市場の多様化:新製品の発売、未開拓の地域、最近の開発、投資に関する詳細な情報を提供します。

4-競合の評価と情報:市場シェア、戦略、製品、認証、規制状況、特許状況、主要企業の製造能力などを網羅的に評価します。

5-製品開発およびイノベーション:将来の技術、研究開発活動、画期的な製品開発に関する知的洞察を提供します。

本レポートは、以下のような主要な質問に対応しています:

1-フルフラール市場の市場規模および予測は?

2-フルフラール市場の予測期間中に投資を検討すべき製品、セグメント、用途、分野は何か?

3-フルフラール市場における技術動向と規制の枠組みは?

4-フルフラール市場における主要ベンダーの市場シェアは?

5-フルフラール市場への参入に適した形態や戦略的手段は?

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 再生可能およびバイオベースの化学物質への注目の高まり

- 製薬と農業におけるフルフラールの需要の増加

- フレーバー・フレグランス産業の可能性を広げる

- 抑制要因

- 原材料の変動と調達の複雑さ

- 機会

- 新しい用途や配合を探索するための継続的な研究開発の取り組み

- フルフラールの生産拡大と加工技術開発への投資

- 課題

- フルフラールの毒性に関連する問題

- 促進要因

- 市場セグメンテーション分析

- 原材料:生産工程でのサトウキビバガスの利用率が上昇

- プロセス:ローゼンルー連続プロセスの進歩

- アプリケーション:溶媒としてのフルフラールの多様なアプリケーション

- 市場動向分析

- 高インフレの累積的影響

- ポーターのファイブフォース分析

- バリューチェーンとクリティカルパス分析

- 規制の枠組み

第6章 フルフラール市場:原材料別

- トウモロコシの穂軸

- 綿の殻

- もみ殻

- サトウキビバガス

第7章 フルフラール市場:プロセス別

- 中国語のバッチプロセス

- クエーカー教徒のバッチプロセス

- ローゼンルー連続プロセス

第8章 フルフラール市場:用途別

- フルフリルアルコール

- 中級

- 溶媒

第9章 フルフラール市場:最終用途産業別

- 農業

- 食品・飲料

- ペイントとコーティング

- 医薬品

- 製油所

第10章 南北アメリカのフルフラール市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第11章 アジア太平洋地域のフルフラール市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第12章 欧州・中東・アフリカのフルフラール市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第13章 競合情勢

- FPNVポジショニングマトリクス

- 市場シェア分析:主要企業別

- 競合シナリオ主要企業別の分析

- 新製品発売と機能強化

- 受賞・表彰・拡大

第14章 競争力のあるポートフォリオ

- 主要な企業プロファイル

- Associated British Foods PLC

- BASF SE

- Central Drug House(P)Ltd.

- Central Romana Corporation

- DalinYebo Trading and Development(Pty)Ltd.

- GoodRich Sugar

- Gravitas Chemical, LLC

- Hefei TNJ Chemical Industry Co., Ltd.

- Illovo Sugar Africa(Pty)Ltd.

- International Furan Chemicals B.V.

- Jinan Future Chemical Co., Ltd

- Junsei Chemical Co.,Ltd

- Kanto Chemical Co., Inc.

- Kishida Chemical Co.,Ltd.

- KRBL Ltd.

- Kunshan Odowell Co., Ltd.

- Lenzing AG

- Linzi Organic Chemical Inc. Ltd.

- Merck KGaA

- Origin Materials, Inc.

- Otto Chemie Pvt. Ltd.

- Pennakem, LLC

- Sappi Group

- Silvateam S.p.a.

- Spectrum Chemical Mfg. Corp.

- TCI America

- Thermo Fisher Scientific, Inc.

- TransFurans Chemicals bvba

- Vigon International, LLC

- Vizag Chemicals International

- 主要な製品ポートフォリオ

第15章 付録

- ディスカッションガイド

- ライセンスと価格について

LIST OF FIGURES

- FIGURE 1. FURFURAL MARKET RESEARCH PROCESS

- FIGURE 2. FURFURAL MARKET SIZE, 2023 VS 2030

- FIGURE 3. FURFURAL MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. FURFURAL MARKET SIZE, BY REGION, 2023 VS 2030 (%)

- FIGURE 5. FURFURAL MARKET SIZE, BY REGION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 6. FURFURAL MARKET DYNAMICS

- FIGURE 7. FURFURAL MARKET SIZE, BY RAW MATERIAL, 2023 VS 2030 (%)

- FIGURE 8. FURFURAL MARKET SIZE, BY RAW MATERIAL, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 9. FURFURAL MARKET SIZE, BY PROCESS, 2023 VS 2030 (%)

- FIGURE 10. FURFURAL MARKET SIZE, BY PROCESS, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 11. FURFURAL MARKET SIZE, BY APPLICATION, 2023 VS 2030 (%)

- FIGURE 12. FURFURAL MARKET SIZE, BY APPLICATION, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 13. FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2023 VS 2030 (%)

- FIGURE 14. FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 15. AMERICAS FURFURAL MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 16. AMERICAS FURFURAL MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 17. UNITED STATES FURFURAL MARKET SIZE, BY STATE, 2023 VS 2030 (%)

- FIGURE 18. UNITED STATES FURFURAL MARKET SIZE, BY STATE, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC FURFURAL MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC FURFURAL MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 21. EUROPE, MIDDLE EAST & AFRICA FURFURAL MARKET SIZE, BY COUNTRY, 2023 VS 2030 (%)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA FURFURAL MARKET SIZE, BY COUNTRY, 2023 VS 2024 VS 2030 (USD MILLION)

- FIGURE 23. FURFURAL MARKET, FPNV POSITIONING MATRIX, 2023

- FIGURE 24. FURFURAL MARKET SHARE, BY KEY PLAYER, 2023

LIST OF TABLES

- TABLE 1. FURFURAL MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2023

- TABLE 3. FURFURAL MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL FURFURAL MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 6. FURFURAL MARKET SIZE, BY CORNCOBS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. FURFURAL MARKET SIZE, BY COTTON HULLS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 8. FURFURAL MARKET SIZE, BY RICE HULLS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. FURFURAL MARKET SIZE, BY SUGARCANE BAGASSE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 11. FURFURAL MARKET SIZE, BY CHINESE BATCH PROCESS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. FURFURAL MARKET SIZE, BY QUAKER BATCH PROCESS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. FURFURAL MARKET SIZE, BY ROSENLEW CONTINUOUS PROCESS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 15. FURFURAL MARKET SIZE, BY FURFURYL ALCOHOL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. FURFURAL MARKET SIZE, BY INTERMEDIATE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. FURFURAL MARKET SIZE, BY SOLVENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 19. FURFURAL MARKET SIZE, BY AGRICULTURE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. FURFURAL MARKET SIZE, BY FOOD & BEVERAGES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. FURFURAL MARKET SIZE, BY PAINT & COATINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. FURFURAL MARKET SIZE, BY PHARMACEUTICALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. FURFURAL MARKET SIZE, BY REFINERIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. AMERICAS FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 25. AMERICAS FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 26. AMERICAS FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 27. AMERICAS FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 28. AMERICAS FURFURAL MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 29. ARGENTINA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 30. ARGENTINA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 31. ARGENTINA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 32. ARGENTINA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 33. BRAZIL FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 34. BRAZIL FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 35. BRAZIL FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 36. BRAZIL FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 37. CANADA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 38. CANADA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 39. CANADA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 40. CANADA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 41. MEXICO FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 42. MEXICO FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 43. MEXICO FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 44. MEXICO FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 45. UNITED STATES FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 46. UNITED STATES FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 47. UNITED STATES FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 48. UNITED STATES FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 49. UNITED STATES FURFURAL MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 50. ASIA-PACIFIC FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 51. ASIA-PACIFIC FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 52. ASIA-PACIFIC FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 53. ASIA-PACIFIC FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 54. ASIA-PACIFIC FURFURAL MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 55. AUSTRALIA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 56. AUSTRALIA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 57. AUSTRALIA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 58. AUSTRALIA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 59. CHINA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 60. CHINA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 61. CHINA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 62. CHINA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 63. INDIA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 64. INDIA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 65. INDIA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 66. INDIA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 67. INDONESIA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 68. INDONESIA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 69. INDONESIA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 70. INDONESIA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 71. JAPAN FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 72. JAPAN FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 73. JAPAN FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 74. JAPAN FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 75. MALAYSIA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 76. MALAYSIA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 77. MALAYSIA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 78. MALAYSIA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 79. PHILIPPINES FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 80. PHILIPPINES FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 81. PHILIPPINES FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 82. PHILIPPINES FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 83. SINGAPORE FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 84. SINGAPORE FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 85. SINGAPORE FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 86. SINGAPORE FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 87. SOUTH KOREA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 88. SOUTH KOREA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 89. SOUTH KOREA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 90. SOUTH KOREA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 91. TAIWAN FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 92. TAIWAN FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 93. TAIWAN FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 94. TAIWAN FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 95. THAILAND FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 96. THAILAND FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 97. THAILAND FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 98. THAILAND FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 99. VIETNAM FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 100. VIETNAM FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 101. VIETNAM FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 102. VIETNAM FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 103. EUROPE, MIDDLE EAST & AFRICA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 104. EUROPE, MIDDLE EAST & AFRICA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 105. EUROPE, MIDDLE EAST & AFRICA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 106. EUROPE, MIDDLE EAST & AFRICA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 107. EUROPE, MIDDLE EAST & AFRICA FURFURAL MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 108. DENMARK FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 109. DENMARK FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 110. DENMARK FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 111. DENMARK FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 112. EGYPT FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 113. EGYPT FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 114. EGYPT FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 115. EGYPT FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 116. FINLAND FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 117. FINLAND FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 118. FINLAND FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 119. FINLAND FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 120. FRANCE FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 121. FRANCE FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 122. FRANCE FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 123. FRANCE FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 124. GERMANY FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 125. GERMANY FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 126. GERMANY FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 127. GERMANY FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 128. ISRAEL FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 129. ISRAEL FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 130. ISRAEL FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 131. ISRAEL FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 132. ITALY FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 133. ITALY FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 134. ITALY FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 135. ITALY FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 136. NETHERLANDS FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 137. NETHERLANDS FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 138. NETHERLANDS FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 139. NETHERLANDS FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 140. NIGERIA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 141. NIGERIA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 142. NIGERIA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 143. NIGERIA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 144. NORWAY FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 145. NORWAY FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 146. NORWAY FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 147. NORWAY FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 148. POLAND FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 149. POLAND FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 150. POLAND FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 151. POLAND FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 152. QATAR FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 153. QATAR FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 154. QATAR FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 155. QATAR FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 156. RUSSIA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 157. RUSSIA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 158. RUSSIA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 159. RUSSIA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 160. SAUDI ARABIA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 161. SAUDI ARABIA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 162. SAUDI ARABIA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 163. SAUDI ARABIA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 164. SOUTH AFRICA FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 165. SOUTH AFRICA FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 166. SOUTH AFRICA FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 167. SOUTH AFRICA FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 168. SPAIN FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 169. SPAIN FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 170. SPAIN FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 171. SPAIN FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 172. SWEDEN FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 173. SWEDEN FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 174. SWEDEN FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 175. SWEDEN FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 176. SWITZERLAND FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 177. SWITZERLAND FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 178. SWITZERLAND FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 179. SWITZERLAND FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 180. TURKEY FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 181. TURKEY FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 182. TURKEY FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 183. TURKEY FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 184. UNITED ARAB EMIRATES FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 185. UNITED ARAB EMIRATES FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 186. UNITED ARAB EMIRATES FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 187. UNITED ARAB EMIRATES FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 188. UNITED KINGDOM FURFURAL MARKET SIZE, BY RAW MATERIAL, 2018-2030 (USD MILLION)

- TABLE 189. UNITED KINGDOM FURFURAL MARKET SIZE, BY PROCESS, 2018-2030 (USD MILLION)

- TABLE 190. UNITED KINGDOM FURFURAL MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 191. UNITED KINGDOM FURFURAL MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 192. FURFURAL MARKET, FPNV POSITIONING MATRIX, 2023

- TABLE 193. FURFURAL MARKET SHARE, BY KEY PLAYER, 2023

- TABLE 194. FURFURAL MARKET LICENSE & PRICING

[198 Pages Report] The Furfural Market size was estimated at USD 746.48 million in 2023 and expected to reach USD 778.96 million in 2024, at a CAGR 4.41% to reach USD 1,010.31 million by 2030.

Global Furfural Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2023] | USD 746.48 million |

| Estimated Year [2024] | USD 778.96 million |

| Forecast Year [2030] | USD 1,010.31 million |

| CAGR (%) | 4.41% |

The furfural market encompasses the global production, distribution, and trade of furfural, an organic compound primarily derived from agricultural byproducts such as corncobs, oat hulls, rice husk, bagasse, and sawdust. The increasing investments made in the development of the agriculture sector and the need for fertilizers have increased the demand for furfural products. The surging demand for bio-based plastics and paints enhances the adoption of furfural products. The utilization of furfural as a food flavoring and fragrance in personal care products contributes to the demand for furfural products. However, the complexity of the manufacturing process of furfural products may limit the product demand. The toxic nature of furfural and its adverse effects on human health are also factors of concern for market adoption. The ongoing research to expand the application scope of furfural products and the development of new technologies for production is anticipated to generate significant growth potential for the market.

Regional Insights

In the Americas, the United States is a significant furfural market due to its application in producing furfural-alcohol resins used in plastics and as a solvent for the pharmaceutical industry. The Americas region shows an increase in demand for bio-based chemicals, which is expected to drive furfural market growth. In Europe, the focus on sustainable chemicals is very pronounced, with stringent environmental regulations driving the market for furfural. European countries are at the forefront of initiatives for circular economies and reducing carbon footprints within the chemical industry, which supports the growth of the furfural market. The Asia Pacific region has a strong manufacturing and consumer base for furfural products, driven by strong market demand in countries such as China, Japan, and India. The APAC region presents a competitive market with customer purchasing behavior inclined towards sustainable and environmentally friendly products.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the Furfural Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Furfural Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Furfural Market, highlighting leading vendors and their innovative profiles. These include Associated British Foods PLC, BASF SE, Central Drug House (P) Ltd., Central Romana Corporation, DalinYebo Trading and Development (Pty) Ltd., GoodRich Sugar, Gravitas Chemical, LLC, Hefei TNJ Chemical Industry Co., Ltd., Illovo Sugar Africa (Pty) Ltd., International Furan Chemicals B.V., Jinan Future Chemical Co., Ltd, Junsei Chemical Co.,Ltd, Kanto Chemical Co., Inc., Kishida Chemical Co.,Ltd., KRBL Ltd., Kunshan Odowell Co., Ltd., Lenzing AG, Linzi Organic Chemical Inc. Ltd., Merck KGaA, Origin Materials, Inc., Otto Chemie Pvt. Ltd., Pennakem, LLC, Sappi Group, Silvateam S.p.a., Spectrum Chemical Mfg. Corp., TCI America, Thermo Fisher Scientific, Inc., TransFurans Chemicals bvba, Vigon International, LLC, and Vizag Chemicals International.

Market Segmentation & Coverage

This research report categorizes the Furfural Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Raw Material

- Corncobs

- Cotton Hulls

- Rice Hulls

- Sugarcane Bagasse

- Process

- Chinese Batch Process

- Quaker Batch Process

- Rosenlew Continuous Process

- Application

- Furfuryl Alcohol

- Intermediate

- Solvent

- End-Use Industry

- Agriculture

- Food & Beverages

- Paint & Coatings

- Pharmaceuticals

- Refineries

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Florida

- Illinois

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects:

1. Market Penetration: It presents comprehensive information on the market provided by key players.

2. Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

3. Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

4. Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

5. Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast of the Furfural Market?

2. Which products, segments, applications, and areas should one consider investing in over the forecast period in the Furfural Market?

3. What are the technology trends and regulatory frameworks in the Furfural Market?

4. What is the market share of the leading vendors in the Furfural Market?

5. Which modes and strategic moves are suitable for entering the Furfural Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Furfural Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Rising focus on renewable and bio-based chemicals

- 5.1.1.2. Increasing demand for furfural in pharmaceuticals and agriculture

- 5.1.1.3. Expanding potential in flavor and fragrance industries

- 5.1.2. Restraints

- 5.1.2.1. Fluctuation in the raw materials and sourcing complexity

- 5.1.3. Opportunities

- 5.1.3.1. Ongoing R&D efforts to explore new applications and formulations

- 5.1.3.2. Investment in furfural production expansion and processing technology development

- 5.1.4. Challenges

- 5.1.4.1. Issues associated with the toxicity of furfural

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Raw Material: Rising utilization of sugarcane bagasse for production process

- 5.2.2. Process: Advancements in rosenlew continuous process

- 5.2.3. Application: Diverse applications of furfural as solvent

- 5.3. Market Trend Analysis

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Furfural Market, by Raw Material

- 6.1. Introduction

- 6.2. Corncobs

- 6.3. Cotton Hulls

- 6.4. Rice Hulls

- 6.5. Sugarcane Bagasse

7. Furfural Market, by Process

- 7.1. Introduction

- 7.2. Chinese Batch Process

- 7.3. Quaker Batch Process

- 7.4. Rosenlew Continuous Process

8. Furfural Market, by Application

- 8.1. Introduction

- 8.2. Furfuryl Alcohol

- 8.3. Intermediate

- 8.4. Solvent

9. Furfural Market, by End-Use Industry

- 9.1. Introduction

- 9.2. Agriculture

- 9.3. Food & Beverages

- 9.4. Paint & Coatings

- 9.5. Pharmaceuticals

- 9.6. Refineries

10. Americas Furfural Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Furfural Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Furfural Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. FPNV Positioning Matrix

- 13.2. Market Share Analysis, By Key Player

- 13.3. Competitive Scenario Analysis, By Key Player

- 13.3.1. New Product Launch & Enhancement

- 13.3.1.1. FurBio Project Develops New Furfural-derived Resins and Biobased Biocomposites Reinforced with Natural Fibres

- 13.3.2. Award, Recognition, & Expansion

- 13.3.2.1. Origin Materials Announces Startup of Origin 1, World's First Commercial CMF Plant

- 13.3.2.2. Planning New Plants For Manufacturing New Fluoro Advance Intermediates

- 13.3.1. New Product Launch & Enhancement

14. Competitive Portfolio

- 14.1. Key Company Profiles

- 14.1.1. Associated British Foods PLC

- 14.1.2. BASF SE

- 14.1.3. Central Drug House (P) Ltd.

- 14.1.4. Central Romana Corporation

- 14.1.5. DalinYebo Trading and Development (Pty) Ltd.

- 14.1.6. GoodRich Sugar

- 14.1.7. Gravitas Chemical, LLC

- 14.1.8. Hefei TNJ Chemical Industry Co., Ltd.

- 14.1.9. Illovo Sugar Africa (Pty) Ltd.

- 14.1.10. International Furan Chemicals B.V.

- 14.1.11. Jinan Future Chemical Co., Ltd

- 14.1.12. Junsei Chemical Co.,Ltd

- 14.1.13. Kanto Chemical Co., Inc.

- 14.1.14. Kishida Chemical Co.,Ltd.

- 14.1.15. KRBL Ltd.

- 14.1.16. Kunshan Odowell Co., Ltd.

- 14.1.17. Lenzing AG

- 14.1.18. Linzi Organic Chemical Inc. Ltd.

- 14.1.19. Merck KGaA

- 14.1.20. Origin Materials, Inc.

- 14.1.21. Otto Chemie Pvt. Ltd.

- 14.1.22. Pennakem, LLC

- 14.1.23. Sappi Group

- 14.1.24. Silvateam S.p.a.

- 14.1.25. Spectrum Chemical Mfg. Corp.

- 14.1.26. TCI America

- 14.1.27. Thermo Fisher Scientific, Inc.

- 14.1.28. TransFurans Chemicals bvba

- 14.1.29. Vigon International, LLC

- 14.1.30. Vizag Chemicals International

- 14.2. Key Product Portfolio

15. Appendix

- 15.1. Discussion Guide

- 15.2. License & Pricing