|

|

市場調査レポート

商品コード

1394956

変圧器モニタリングの世界市場 (~2028年):コンポーネント・タイプ・サービス・電圧・地域別Transformer Monitoring Market by Component, Type, Services, Voltage & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 変圧器モニタリングの世界市場 (~2028年):コンポーネント・タイプ・サービス・電圧・地域別 |

|

出版日: 2023年12月07日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | コンポーネント・タイプ・サービス・電圧・用途・地域 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

変圧器モニタリングの市場規模は、2023年の24億米ドルから、予測期間中は9.1%のCAGRで推移し、2028年には37億米ドルの規模に成長する予測されています

安定した電力供給の必要性、インフラの老朽化、スマートグリッド技術の進歩から、変圧器モニタリングの需要の増加しており、変圧器モニタリングの市場は急成長を遂げています。

電圧別で見ると、高圧・超高圧の部門が最大の規模を示しています。同部門は、長距離送電に重要な役割を果たすため、変圧器市場を独占しています。電力需要の増加、送電網の拡張プロジェクト、再生可能エネルギー源の導入などの要因が高圧・超高圧変圧器の需要を増加させています。これらの変圧器は、効率的な配電において重要な役割を果たし、変化するエネルギー環境に対応し、信頼性の高い電力網を維持する上で重要なコンポーネントとなっています。

サービス別では、オイルモニタリングの部門が最も急成長する見込みです。変圧器オイルは診断媒体として重要な役割を果たしており、変圧器の状態のモニタリングにより、変圧器の健康状態を知ることができ、予防保全、ダウンタイムの最小化、性能の最適化が可能になります。

当レポートでは、世界の変圧器モニタリングの市場を調査し、市場概要、市場成長への各種影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- エコシステムマッピング

- バリューチェーン分析

- 技術分析

- 特許分析

- 貿易分析

- 価格分析

- 料金分析

- 基準と規制状況

- ポーターのファイブフォース分析

- ケーススタディ分析

- 主要なステークホルダーと購入基準

- 主要な会議とイベント

第6章 変圧器モニタリングシステム市場:電圧別

- 低圧

- 中圧

- 高圧・超高圧

第7章 変圧器モニタリングシステム市場:サービス別

- オイルモニタリング

- ブッシングモニタリング

- 部分放電 (PD) モニタリング

- オンロードタップチェンジャー (OLTC) モニタリング

- その他のサービス

第8章 変圧器モニタリングシステム市場:コンポーネント別

- ハードウェアソリューション

- ソフトウェアソリューション

第9章 変圧器モニタリングシステム市場:用途別

- 電源トランス

- 配電変圧器

- その他

第10章 変圧器モニタリングシステム市場:タイプ別

- 油入

- キャストレジン

- その他

第11章 変圧器モニタリングシステム市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要企業が採用した主な戦略

- 市場シェア分析、2022年

- 主要企業5社の収益分析

- 競争シナリオと動向

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

第13章 企業プロファイル

- 主要企業

- SIEMENS ENERGY AG

- ABB

- GE

- SCHNEIDER ELECTRIC

- EATON

- MISTRAS GROUP

- MITSUBISHI ELECTRIC CORPORATION

- VAISALA

- HITACHI ENERGY LTD

- KJ DYNATECH, INC.

- MASCHINENFABRIK REINHAUSEN GMBH

- QUALITROL

- GASERA

- DOBLE ENGINEERING COMPANY

- WILSON TRANSFORMERS

- その他の企業

- SAIELECTRICAL

- CAMLIN LTD

- TREETECH

- EMCO ELECTRONICS

- ADVANCED POWER TECHNOLOGIES LLC

- KONCAR-ELECTRICAL ENGINEERING INSTITUTE LTD.

- CMSGP

- UBICQUIA, INC

- AVL INDIA PRIVATE LTD

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | Component, Type, Services, Voltage, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The Transformer Monitoring market is estimated to grow from USD 2.4 Billion in 2023 to USD 3.7 Billion by 2028; it is expected to record a CAGR of 9.1% during the forecast period. The Transformer Monitoring market is witnessing rapid growth due to the need for stable power supply, aging infrastructure, and the advancement of smart grid technologies are driving rising demand for transformer monitoring.

"High & Extra High Voltage is the largest segment of the Transformer Monitoring market, by voltage"

Based on voltage, the Transformer Monitoring market has been split into three types: Low voltage, medium voltage and high & extra high voltage. The high and extra high voltage segment dominates the transformers market due to its vital role in power transmission across large distances. Rising electricity demand, grid expansion projects, and the incorporation of renewable energy sources all increase the demand for high and extra high voltage transformers. These transformers serve an important role in efficient power distribution, making them an important component in handling the changing energy landscape and maintaining reliable electrical grids.

"Oil Monitoring segment is expected to emerge as the fastest-growing segment based on services"

Based on services, the Transformer Monitoring market has been segmented into oil monitoring, bushing monitoring, partial discharge monitoring, OLTC monitoring and others. Due to its vital role as a diagnostic medium, transformer oil accounts for the greatest portion of the transformer monitoring market. Monitoring its state provides insights into the transformer's health, allowing for preventative maintenance, minimizing downtime, and optimising performance, all of which are important elements in assuring transformer reliability and lifetime.

"North America is expected to emerge as the second-largest region based on Transformer Monitoring market"

By region, the Transformer Monitoring market has been segmented into Asia Pacific, North America, South America, Europe, and Middle East & Africa. In the region, the transformer monitoring market is expanding in North America as a result of a push for power infrastructure modernization, a concentration on energy efficiency, and rigorous environmental requirements. Monitoring solutions are in high demand due to the integration of renewable energy sources and the requirement to optimize existing transformer assets to meet changing energy demands. Furthermore, a focus on smart grid projects, as well as increased knowledge of the economic and operational benefits of real-time monitoring, contribute to the increased implementation of transformer monitoring technology in the North America region.

Cast resin is expected to be the second-fastest segment based on the type

Retrofit is expected to be the second-fastest segment in the Transformer Monitoring market between 2023-2028 due to their eco-friendly and fire-resistant properties. As environmental concerns grow and safety becomes a priority, industries opt for cast resin transformers. The need for reliable monitoring solutions to ensure their efficient performance further contributes to the increasing demand.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 27%, Europe- 20%, Asia Pacific- 33%, the Middle East & Africa- 12%, and South America- 8%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The Transformer Monitoring market is dominated by a few major players that have a wide regional presence. The leading players in the Transformer Monitoring market are GE (US), ABB (Switzerland), Siemens Energy AG (Germany), Schneider Electric (France), and Eaton (Ireland).

Research Coverage:

The report defines, describes, and forecasts the Transformer Monitoring market, by component, type, services, voltage, application, and region. It also offers a detailed qualitative and quantitate ve analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the Transformer Monitoring market.

Key Benefits of Buying the Report

- Growing emphasis on ensuring a reliable and continuous power supply and need for monitoring to address the challenges of aging transformer infrastructure is likely to drive the demand. Factors such as cost barrier is hindering the growth of power transformers. Growth of big data analytic is creating opportunities in this market. Acceptance level among end users are major challenges faced by countries in this market.

- Product Development/ Innovation: The trends such as launching of continuous online monitors for transformers that uses UHF Partial Discharge monitoring, trending and classification technology.

- Market Development: The global scenario of transformer monitoring has developed due to digitalization of the utilities promoting use of power transformers, increased investments in renewable energy, and increased electricity consumption throughout the world.

- Market Diversification: ABB launched ABB Ability condition monitoring for belts which offers a complete overview of the assets' condition through continuous monitoring of belt health, generating alarms and warnings in the event of deterioration. By moving from preventative to predictive maintenance, it enables operators to avoid the costly failures that can occur between physical inspections and personnel can be removed from dangerous areas.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like GE (US), ABB (Switzerland), Siemens Energy AG (Germany), Schneider Electric (France), and Eaton (Ireland) among others in the Transformer Monitoring market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT: INCLUSIONS AND EXCLUSIONS

- 1.3.2 TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

- 1.3.3 TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES: INCLUSIONS AND EXCLUSIONS

- 1.3.4 TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE: INCLUSIONS AND EXCLUSIONS

- 1.3.5 TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.4.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 TRANSFORMER MONITORING SYSTEM MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key industry insights

- 2.2.2.2 Breakdown of primaries

- 2.3 SCOPE

- FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR TRANSFORMER MONITORING SYSTEMS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF TRANSFORMER MONITORING SYSTEMS

- FIGURE 7 TRANSFORMER MONITORING SYSTEM MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Calculations for supply-side analysis

- 2.4.4.2 Assumptions for supply-side analysis

- FIGURE 8 INDUSTRY CONCENTRATION, 2022

- 2.4.5 FORECAST

- 2.5 RISK ASSESSMENT

- 2.6 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 1 TRANSFORMER MONITORING SYSTEM MARKET SNAPSHOT

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN TRANSFORMER MONITORING SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 10 HARDWARE SOLUTIONS SEGMENT TO LEAD TRANSFORMER MONITORING SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 11 OIL-IMMERSED SEGMENT TO DOMINATE TRANSFORMER MONITORING SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 12 POWER TRANSFORMERS SEGMENT TO LEAD TRANSFORMER MONITORING SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 13 HIGH AND EXTRA HIGH VOLTAGE SEGMENT TO LEAD TRANSFORMER MONITORING SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 14 OIL MONITORING SEGMENT TO LEAD TRANSFORMER MONITORING SYSTEM MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TRANSFORMER MONITORING SYSTEM MARKET

- FIGURE 15 RISING ADOPTION OF EFFICIENT POWER DISTRIBUTION SYSTEMS

- 4.2 TRANSFORMER MONITORING SYSTEM MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES AND COUNTRY, 2022

- FIGURE 17 OIL MONITORING SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC TRANSFORMER MONITORING SYSTEM MARKET IN 2022

- 4.4 TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT

- FIGURE 18 HARDWARE SOLUTIONS SEGMENT TO DOMINATE TRANSFORMER MONITORING SYSTEM MARKET IN 2028

- 4.5 TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE

- FIGURE 19 OIL-IMMERSED SEGMENT TO ACCOUNT FOR LARGEST SHARE OF TRANSFORMER MONITORING SYSTEM MARKET IN 2028

- 4.6 TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION

- FIGURE 20 POWER TRANSFORMERS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF TRANSFORMER MONITORING SYSTEM MARKET IN 2028

- 4.7 TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE

- FIGURE 21 HIGH AND EXTRA HIGH VOLTAGE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF TRANSFORMER MONITORING SYSTEM MARKET IN 2028

- 4.8 TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES

- FIGURE 22 OIL MONITORING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF TRANSFORMER MONITORING SYSTEM MARKET IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 TRANSFORMER MONITORING SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing focus on digitalization of utilities

- TABLE 2 PROJECTS BY DIFFERENT COUNTRIES FOR ENERGY TRANSITION

- FIGURE 24 INVESTMENTS IN DIGITALIZATION OF TRANSFORMERS, 2015-2022 (USD BILLION)

- 5.2.1.2 Increased investments in renewable and clean energy generation

- FIGURE 25 GLOBAL CLEAN ENERGY INVESTMENTS, 2015-2023 (USD BILLION)

- FIGURE 26 ENERGY TRANSITION INVESTMENTS, BY TOP 10 COUNTRIES, 2021 (%)

- FIGURE 27 ENERGY TRANSITION INVESTMENTS, BY SECTOR, 2021 (USD BILLION)

- 5.2.1.3 Growing use of monitoring systems for transformers

- FIGURE 28 ELECTRICITY CONSUMPTION, BY COUNTRY, 2022 (TWH)

- 5.2.2 RESTRAINTS

- 5.2.2.1 High hardware, software, and installation costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of big data analytics in energy industry

- 5.2.3.2 Increased investments in offshore wind farms

- FIGURE 29 NEW OFFSHORE INSTALLATIONS, 2016-2022 (MW)

- 5.2.4 CHALLENGES

- 5.2.4.1 Low acceptance among end users

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 ECOSYSTEM MAPPING

- TABLE 3 COMPANIES AND THEIR ROLE IN TRANSFORMER MONITORING ECOSYSTEM

- FIGURE 31 TRANSFORMER MONITORING SYSTEM MARKET: ECOSYSTEM MAPPING

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 32 TRANSFORMER MONITORING SYSTEM MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS/COMPONENT MANUFACTURERS

- 5.5.2 TRANSFORMER MONITORING SYSTEM MANUFACTURERS/ASSEMBLERS

- 5.5.3 DISTRIBUTORS/RESELLERS

- 5.5.4 END USERS

- 5.5.5 MAINTENANCE/SERVICE PROVIDERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 SENSORS AND INTERNET OF THINGS (IOT)

- 5.6.2 DATA ANALYTICS AND ARTIFICIAL INTELLIGENCE (AI)

- 5.6.3 DIGITAL TWINS AND SIMULATION

- 5.6.4 CLOUD-BASED AND MOBILE SOLUTIONS

- 5.7 PATENT ANALYSIS

- FIGURE 33 TRANSFORMER MONITORING SYSTEM MARKET: PATENT REGISTRATIONS, 2012-2022

- TABLE 4 TRANSFORMER MONITORING SYSTEM MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2019-2023

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO FOR HS CODE 850423-COMPLIANT PRODUCTS

- TABLE 5 IMPORT DATA FOR HS CODE 850423-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 34 IMPORT DATA FOR HS CODE 850423-COMPLIANT PRODUCTS, BY TOP FIVE COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.8.2 EXPORT SCENARIO FOR HS CODE 850423-COMPLIANT PRODUCTS

- TABLE 6 EXPORT DATA FOR HS CODE 850423-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 35 EXPORT DATA FOR HS CODE 850423-COMPLIANT PRODUCTS, BY TOP FIVE COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.8.3 IMPORT SCENARIO FOR HS CODE 850421-COMPLIANT PRODUCTS

- TABLE 7 IMPORT DATA FOR HS CODE 850421-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 36 IMPORT SCENARIO FOR HS CODE 850421-COMPLIANT PRODUCTS, BY TOP FIVE COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.8.4 EXPORT SCENARIO FOR HS CODE 850421-COMPLIANT PRODUCTS

- TABLE 8 EXPORT DATA FOR HS CODE 850421-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 37 EXPORT DATA FOR HS CODE 850421-COMPLIANT PRODUCTS, BY TOP FIVE COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9 PRICING ANALYSIS

- FIGURE 38 AVERAGE SELLING PRICE (ASP) OF TRANSFORMER MONITORING SYSTEMS, BY APPLICATION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 9 AVERAGE SELLING PRICE (ASP) OF TRANSFORMER MONITORING SYSTEMS, BY APPLICATION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 10 AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2020, 2021, 2022, AND 2030 (USD/UNIT)

- FIGURE 39 AVERAGE SELLING PRICE (ASP) TREND, BY REGION, 2020, 2021, 2022, AND 2030 (USD/UNIT)

- 5.10 TARIFF ANALYSIS

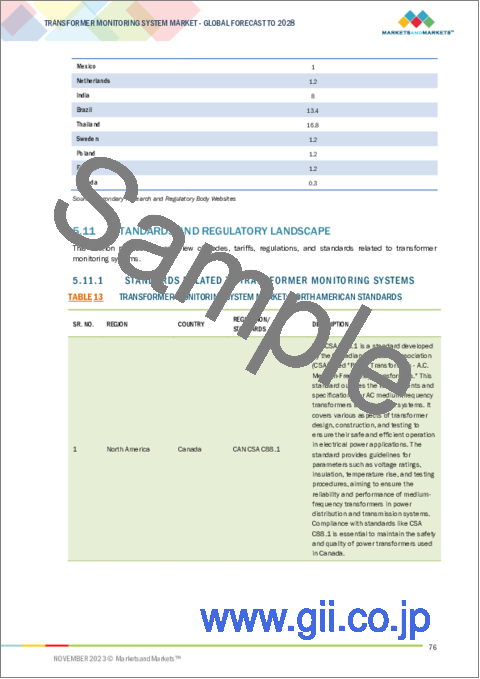

- TABLE 11 TARIFF LEVIED ON TRANSFORMER MONITORING SYSTEMS (HS CODE 850423), 2022

- TABLE 12 TARIFF LEVIED ON TRANSFORMER MONITORING SYSTEMS (HS CODE 850421), 2022

- 5.11 STANDARDS AND REGULATORY LANDSCAPE

- 5.11.1 STANDARDS RELATED TO TRANSFORMER MONITORING SYSTEMS

- TABLE 13 TRANSFORMER MONITORING SYSTEM MARKET: NORTH AMERICAN STANDARDS

- TABLE 14 TRANSFORMER MONITORING SYSTEM MARKET: EUROPEAN STANDARDS

- TABLE 15 TRANSFORMER MONITORING SYSTEM MARKET: ASIA PACIFIC STANDARDS

- TABLE 16 TRANSFORMER MONITORING SYSTEM MARKET: INTERNATIONAL STANDARDS

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 TRANSFORMER MONITORING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 21 TRANSFORMER MONITORING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF SUBSTITUTES

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF NEW ENTRANTS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 EARLY DETECTION OF TEMPERATURE, OIL QUALITY, GAS LEVELS, AND ELECTRICAL CHARACTERISTICS IN TRANSFORMERS BY CONDITION MONITORING

- 5.13.1.1 Problem statement

- 5.13.1.2 Solution

- 5.13.2 GUJARAT POWER RESEARCH & DEVELOPMENT (GPRD) DEPLOYED SYSTEM LEVEL SOLUTIONS (SLS)'S REAL-TIME TRANSFORMER MONITORING SYSTEM (TMS) FOR REAL-TIME TRANSFORMER MONITORING

- 5.13.2.1 Problem statement

- 5.13.2.2 Solution

- 5.13.3 OMICRON ELECTRONICS GMBH WAS CONTRACTED BY SUBSTATION BASED IN AUSTRIA TO RECTIFY PARTIAL DISCHARGE AND ENSURE OPERATIONAL SAFETY AND RELIABILITY

- 5.13.3.1 Problem statement

- 5.13.3.2 Solution

- 5.13.1 EARLY DETECTION OF TEMPERATURE, OIL QUALITY, GAS LEVELS, AND ELECTRICAL CHARACTERISTICS IN TRANSFORMERS BY CONDITION MONITORING

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 41 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SERVICES

- TABLE 22 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SERVICES

- 5.14.2 BUYING CRITERIA

- FIGURE 42 KEY BUYING CRITERIA FOR TOP THREE SERVICES

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE SERVICES

- 5.15 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 24 TRANSFORMER MONITORING SYSTEM MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2023-2024

6 TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE

- 6.1 INTRODUCTION

- FIGURE 43 TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE, 2022

- TABLE 25 TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 6.2 LOW VOLTAGE

- 6.2.1 HIGHLY USED TO POWER DEVICES AND SYSTEMS REQUIRING LOWER VOLTAGE

- TABLE 26 LOW VOLTAGE: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 MEDIUM VOLTAGE

- 6.3.1 USED TO STEP DOWN HIGHER VOLTAGES SUPPLIED BY GRID TO LEVELS APPROPRIATE FOR INDUSTRIAL OPERATIONS, ENSURING SAFE AND MANAGEABLE ELECTRICITY DISTRIBUTION

- TABLE 27 MEDIUM VOLTAGE: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 HIGH AND EXTRA HIGH VOLTAGE

- 6.4.1 FACILITATES EARLY FAULT DETECTION, COMPLIANCE ADHERENCE, AND REMOTE OVERSIGHT

- TABLE 28 HIGH VOLTAGE: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

7 TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES

- 7.1 INTRODUCTION

- FIGURE 44 TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2022

- TABLE 29 TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 7.2 OIL MONITORING

- 7.2.1 HELPS DETECT ISSUES EARLY AND EXTEND OPERATIONAL LIFE OF TRANSFORMERS

- TABLE 30 OIL MONITORING: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 BUSHING MONITORING

- 7.3.1 ENSURES INTEGRITY AND PREVENTS CRIPPLING OF TRANSFORMER, CIRCUIT BREAKER, OR SHUNT REACTOR BUSHING FAILURE

- TABLE 31 BUSHING MONITORING: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 PARTIAL DISCHARGE (PD) MONITORING

- 7.4.1 ENABLES EARLY PROBLEM IDENTIFICATION AND PREVENTATIVE MAINTENANCE

- TABLE 32 PARTIAL DISCHARGE (PD) MONITORING: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.5 ON-LOAD TAP CHANGER (OLTC) MONITORING

- 7.5.1 ENSURES PROPER FUNCTIONING BY MODIFYING TURN RATIO OF TRANSFORMERS AND ADJUSTING VOLTAGE UNDER VARIOUS LOAD SITUATIONS

- TABLE 33 ON-LOAD TAP CHANGER (OLTC) MONITORING: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.6 OTHER SERVICES

- TABLE 34 OTHER SERVICES: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

8 TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- FIGURE 45 TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT, 2022

- TABLE 35 TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- 8.2 HARDWARE SOLUTIONS

- 8.2.1 INCREASED EFFORTS TO IMPROVE EFFICIENCY, RELIABILITY, AND LONGEVITY OF POWER TRANSFORMERS TO DRIVE DEMAND

- TABLE 36 HARDWARE SOLUTIONS: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3 SOFTWARE SOLUTIONS

- 8.3.1 GROWING ADOPTION FOR PREVENTATIVE MAINTENANCE, IMPROVING POWER TRANSFORMER PERFORMANCE, AND TRANSFORMING RAW DATA INTO USABLE INSIGHTS TO DRIVE MARKET

- TABLE 37 SOFTWARE SOLUTIONS: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

9 TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 46 TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2022

- TABLE 38 TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 39 TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2021-2028 (UNITS)

- 9.2 POWER TRANSFORMERS

- 9.2.1 CAPABILITY TO DETECT ANOMALIES FOR INFORMED DECISION-MAKING TO DRIVE DEMAND

- TABLE 40 POWER TRANSFORMERS: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 41 POWER TRANSFORMERS: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (UNITS)

- 9.3 DISTRIBUTION TRANSFORMERS

- 9.3.1 ABILITY TO REMOTELY MONITOR AND CONTROL POWER DISTRIBUTION TO FUEL DEMAND

- TABLE 42 DISTRIBUTION TRANSFORMERS: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 DISTRIBUTION TRANSFORMERS: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (UNITS)

- 9.4 OTHER APPLICATIONS

- TABLE 44 OTHER APPLICATIONS: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 45 OTHER APPLICATIONS: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (UNITS)

10 TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 47 TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE, 2022

- TABLE 46 TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.2 OIL-IMMERSED

- 10.2.1 USED IN UTILITIES TO HANDLE POSSIBLE FAULTS, REDUCE UNPLANNED OUTAGES, AND OPTIMIZE TRANSFORMER PERFORMANCE

- TABLE 47 OIL-IMMERSED: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.3 CAST-RESIN

- 10.3.1 IDEAL FOR REAL-TIME ASSESSMENT OF SOLID INSULATION CONDITION

- TABLE 48 CAST-RESIN: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.4 OTHER TYPES

- TABLE 49 OTHER TYPES: TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

11 TRANSFORMER MONITORING SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 48 TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2022 (%)

- FIGURE 49 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 50 TRANSFORMER MONITORING SYSTEM MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 51 TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 52 TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- TABLE 53 TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 54 TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 55 TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICAN TRANSFORMER MONITORING SYSTEM MARKET: RECESSION IMPACT

- FIGURE 50 NORTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET SNAPSHOT

- TABLE 56 NORTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Growing electricity demand and need for reliable and efficient operation of power utilities

- TABLE 62 US: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Rising use to reduce operational risks and ensure reliability of power transformers in technologically evolving landscape

- TABLE 63 CANADA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Increasing use of renewable energy and growing emphasis on sustainability and grid resilience

- TABLE 64 MEXICO: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.3 EUROPE

- FIGURE 51 EUROPE: TRANSFORMER MONITORING SYSTEM MARKET SNAPSHOT

- 11.3.1 EUROPEAN TRANSFORMER MONITORING SYSTEM MARKET: RECESSION IMPACT

- TABLE 65 EUROPE: TRANSFORMER MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 66 EUROPE: TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- TABLE 68 EUROPE: TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 EUROPE: TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 70 EUROPE: TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Growing adoption of innovative monitoring systems

- TABLE 71 UK: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.3.3 GERMANY

- 11.3.3.1 Expansion of T&D network with shift from nuclear and fossil fuels to renewable energy

- TABLE 72 GERMANY: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Decommissioning of aging nuclear plants and growing importance of reliable and efficient power infrastructure

- TABLE 73 FRANCE: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Increased power consumption and use of renewable energy sources

- TABLE 74 ITALY: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.3.6 RUSSIA

- 11.3.6.1 Rising government-led investments in modernization of power grids

- TABLE 75 RUSSIA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 76 REST OF EUROPE: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 52 ASIA PACIFIC: TRANSFORMER MONITORING SYSTEM MARKET SNAPSHOT

- 11.4.1 ASIA PACIFIC TRANSFORMER MONITORING SYSTEM MARKET: RECESSION IMPACT

- TABLE 77 ASIA PACIFIC: TRANSFORMER MONITORING SYSTEM MARKET , BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Rising focus on grid stability and sustainability

- TABLE 83 CHINA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 Increasing need for modernized and resilient power grids

- TABLE 84 JAPAN: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.4.4 INDIA

- 11.4.4.1 Growing need for dependable and efficient power supply and aging transformer infrastructure

- TABLE 85 INDIA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Increased power consumption and adoption of renewable sources for electricity production

- TABLE 86 SOUTH KOREA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.4.6 AUSTRALIA

- 11.4.6.1 Increasing electricity demand, growing share of renewable energy sources, and rising adoption of distributed generation

- TABLE 87 AUSTRALIA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- TABLE 88 REST OF ASIA PACIFIC: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 SOUTH AMERICAN TRANSFORMER MONITORING SYSTEM MARKET: RECESSION IMPACT

- TABLE 89 SOUTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 90 SOUTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 91 SOUTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- TABLE 92 SOUTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 SOUTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 94 SOUTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Growing solar power generation

- TABLE 95 BRAZIL: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Increased hydroelectricity generation

- TABLE 96 ARGENTINA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.5.4 VENEZUELA

- 11.5.4.1 Presence of aging and underinvested power grids

- TABLE 97 VENEZUELA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.5.5 REST OF SOUTH AMERICA

- TABLE 98 REST OF SOUTH AMERICA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MIDDLE EASTERN & AFRICAN TRANSFORMER MONITORING SYSTEM MARKET: RECESSION IMPACT

- TABLE 99 MIDDLE EAST & AFRICA: TRANSFORMER MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: TRANSFORMER MONITORING SYSTEM MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: TRANSFORMER MONITORING SYSTEM MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: TRANSFORMER MONITORING SYSTEM MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: TRANSFORMER MONITORING SYSTEM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 High electricity demand in residential sector

- TABLE 105 UAE: TRANSFORMER MONITORING SYSTEM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 106 UAE: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6.2.2 UAE

- 11.6.2.2.1 Rising investments in solar energy generation

- 11.6.2.2 UAE

- TABLE 107 UAE: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6.2.3 SAUDI ARABIA

- 11.6.2.3.1 Expansion of grids and energy diversification

- 11.6.2.3 SAUDI ARABIA

- TABLE 108 SAUDI ARABIA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6.2.4 QATAR

- 11.6.2.4.1 Increased electricity generation capacity year-on-year

- 11.6.2.4 QATAR

- TABLE 109 QATAR: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6.2.5 REST OF GCC COUNTRIES

- TABLE 110 REST OF GCC COUNTRIES: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6.3 IRAN

- 11.6.3.1 Growing use of renewable energy sources and aging transformer infrastructure

- TABLE 111 IRAN: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6.4 ALGERIA

- 11.6.4.1 Growing deployment in power grids and oil & gas fields

- TABLE 112 ALGERIA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6.5 SOUTH AFRICA

- 11.6.5.1 Increased power generation using coal and growing use to improve transformer dependability and longevity by giving real-time data on performance and potential defects

- TABLE 113 SOUTH AFRICA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

- 11.6.6 REST OF MIDDLE EAST & AFRICA

- TABLE 114 REST OF MIDDLE EAST & AFRICA: TRANSFORMER MONITORING SYSTEM MARKET, BY SERVICES, 2021-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 53 TRANSFORMER MONITORING SYSTEM MARKET: MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, 2018-2023

- 12.3 MARKET SHARE ANALYSIS, 2022

- FIGURE 54 TRANSFORMER MONITORING SYSTEM MARKET SHARE ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018-2022

- FIGURE 55 TRANSFORMER MONITORING SYSTEM MARKET: ANNUAL REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018-2022

- 12.5 COMPETITIVE SCENARIOS AND TRENDS

- 12.5.1 DEALS

- TABLE 116 TRANSFORMER MONITORING SYSTEM MARKET: DEALS, 2018-2023

- 12.5.2 OTHERS

- TABLE 117 TRANSFORMER MONITORING SYSTEM MARKET: OTHERS, 2018-2023

- 12.6 COMPANY EVALUATION MATRIX, 2022

- FIGURE 56 TRANSFORMER MONITORING SYSTEM MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT

- TABLE 118 COMPONENT: COMPANY FOOTPRINT

- TABLE 119 TYPE: COMPANY FOOTPRINT

- TABLE 120 SERVICES: COMPANY FOOTPRINT

- TABLE 121 VOLTAGE: COMPANY FOOTPRINT

- TABLE 122 APPLICATION: COMPANY FOOTPRINT

- TABLE 123 REGION: COMPANY FOOTPRINT

- TABLE 124 COMPANY OVERALL FOOTPRINT

- 12.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- FIGURE 57 TRANSFORMER MONITORING SYSTEM MARKET: STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING

- TABLE 125 TRANSFORMER MONITORING SYSTEM MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 126 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY COMPONENT

- TABLE 127 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY TYPE

- TABLE 128 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY SERVICES

- TABLE 129 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY VOLTAGE

- TABLE 130 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 131 KEY STARTUPS/SMES OVERALL FOOTPRINT

13 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 SIEMENS ENERGY AG

- TABLE 132 SIEMENS ENERGY AG: COMPANY OVERVIEW

- FIGURE 58 SIEMENS ENERGY AG: COMPANY SNAPSHOT

- TABLE 133 SIEMENS ENERGY AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 SIEMENS ENERGY AG: PRODUCT LAUNCHES

- 13.1.2 ABB

- TABLE 135 ABB: COMPANY OVERVIEW

- FIGURE 59 ABB: COMPANY SNAPSHOT

- TABLE 136 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 ABB: PRODUCT LAUNCHES

- 13.1.3 GE

- TABLE 138 GE: COMPANY OVERVIEW

- FIGURE 60 GE: COMPANY SNAPSHOT

- TABLE 139 GE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 GE: DEALS

- 13.1.4 SCHNEIDER ELECTRIC

- TABLE 141 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 61 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 142 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 144 SCHNEIDER ELECTRIC: DEALS

- TABLE 145 SCHNEIDER ELECTRIC: OTHERS

- 13.1.5 EATON

- TABLE 146 EATON: COMPANY OVERVIEW

- FIGURE 62 EATON: COMPANY SNAPSHOT

- TABLE 147 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 EATON: OTHERS

- 13.1.6 MISTRAS GROUP

- TABLE 149 MISTRAS GROUP: COMPANY OVERVIEW

- FIGURE 63 MISTRAS GROUP: COMPANY SNAPSHOT

- TABLE 150 MISTRAS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 MITSUBISHI ELECTRIC CORPORATION

- TABLE 151 MITSUBISHI ELECTRICAL CORPORATION: COMPANY OVERVIEW

- FIGURE 64 MITSUBISHI ELECTRICAL CORPORATION: COMPANY SNAPSHOT

- TABLE 152 MITSUBISHI ELECTRICAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 MITSUBISHI ELECTRICAL CORPORATION: DEALS

- 13.1.8 VAISALA

- TABLE 154 VAISALA: COMPANY OVERVIEW

- FIGURE 65 VAISALA: COMPANY SNAPSHOT

- TABLE 155 VAISALA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 HITACHI ENERGY LTD

- TABLE 156 HITACHI ENERGY LTD: COMPANY OVERVIEW

- TABLE 157 HITACHI ENERGY LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.10 KJ DYNATECH, INC.

- TABLE 158 KJ DYNATECH, INC.: COMPANY OVERVIEW

- TABLE 159 KJ DYNATECH, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 MASCHINENFABRIK REINHAUSEN GMBH

- TABLE 160 MASCHINENFABRIK REINHAUSEN GMBH: COMPANY OVERVIEW

- TABLE 161 MASCHINENFABRIK REINHAUSEN GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 MASCHINENFABRIK REINHAUSEN GMBH: DEALS

- TABLE 163 MASCHINENFABRIK REINHAUSEN GMBH: OTHERS

- 13.1.12 QUALITROL

- TABLE 164 QUALITROL: COMPANY OVERVIEW

- TABLE 165 QUALITROL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 QUALITROL: PRODUCT LAUNCHES

- 13.1.13 GASERA

- TABLE 167 GASERA: COMPANY OVERVIEW

- TABLE 168 GASERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.14 DOBLE ENGINEERING COMPANY

- TABLE 169 DOBLE ENGINEERING COMPANY: COMPANY OVERVIEW

- TABLE 170 DOBLE ENGINEERING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 DOBLE ENGINEERING COMPANY: PRODUCT LAUNCHES

- TABLE 172 DOBLE ENGINEERING COMPANY: DEALS

- 13.1.15 WILSON TRANSFORMERS

- TABLE 173 WILSON TRANSFORMERS: COMPANY OVERVIEW

- TABLE 174 WILSON TRANSFORMERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 SAIELECTRICAL

- 13.2.2 CAMLIN LTD

- 13.2.3 TREETECH

- 13.2.4 EMCO ELECTRONICS

- 13.2.5 ADVANCED POWER TECHNOLOGIES LLC

- 13.2.6 KONCAR - ELECTRICAL ENGINEERING INSTITUTE LTD.

- 13.2.7 CMSGP

- 13.2.8 UBICQUIA, INC

- 13.2.9 AVL INDIA PRIVATE LTD

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS