|

|

市場調査レポート

商品コード

1667628

水晶発振器の世界市場:実装方式別、一般回路別、水晶カット別 - 予測(~2030年)Crystal Oscillator Market by Mounting Scheme (Surface Mount, Through Hole), General Circuitry (SPXO,VCXO (TCVCXO, OCVCXO), TCXO, OCXO (DOCXO, EMXO), FCXO), Crystal Cut (AT-cut, BT-cut, SC-cut) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 水晶発振器の世界市場:実装方式別、一般回路別、水晶カット別 - 予測(~2030年) |

|

出版日: 2025年02月26日

発行: MarketsandMarkets

ページ情報: 英文 249 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の水晶発振器の市場規模は、2025年の28億9,000万米ドルから2030年までに36億6,000万米ドルに拡大すると予測され、CAGRで4.8%の成長が見込まれます。

自動車産業における水晶発振器の使用の増加は、水晶発振器市場の主な促進要因です。水晶発振器は、自動車用途で一般的に見られる高い振動レベルにも耐えられるように設計されています。水晶発振器は、多くの自動車用途に不可欠な部品です。水晶発振器は、これらの重要な用途に必要な長期的な信頼性、高精度、安定性、温度範囲、耐振動性を提供します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | タイプ、実装方式、水晶カット、一般回路、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「ATカットセグメントが予測期間に最大の市場シェアを占める見込みです。」

このATカットセグメントの成長は、より多くの活動DIP、より高いドライブレベル感度、電界に対する鈍感さによるものと考えられます。さらに、製造工程が複雑でなく、生産コストも低いです。その結果、コンシューマーエレクトロニクス、通信、精密タイミング用途、汎用発振器で好まれています。その特徴としては、温度安定性、低周波数ドリフト、高精度、小型化可能性、低消費電力、高周波数範囲、信頼性、経済性などが挙げられます。これらが累積的に寄与し、ATカット水晶発振器は、精密で信頼性の高い周波数源が必要とされるコンシューマーエレクトロニクス、通信、その他の多くの産業で採用されています。

「コンシューマーエレクトロニクスセグメントの市場が予測期間に最大の市場シェアを占める見込みです。」

コンシューマーエレクトロニクスが2030年に水晶発振器市場でもっとも高いパーセンテージを占めました。このセグメントの成長は、スマートフォンやタブレットのような電子機器の需要が世界的に高まっていることで説明できます。水晶発振器は、センサーやその他の電子部品に正確なタイミングを提供するため、スマートウォッチやフィットネストラッカーなどのウェアラブル技術の主要部品となっています。水晶発振器の安定した周波数は、そのようなデバイスが正確な測定と一貫した機能を提供することを保証し、ユーザーエクスペリエンスとデータインテグリティにとってもっとも重要です。コンシューマーエレクトロニクス市場は、仮想現実や拡張現実、スマートスピーカー、ホームオートメーションシステム、ドローン技術、ロボット、5G対応スマートフォンの普及などの技術に後押しされ、すさまじい成長の勢いを見せています。

「中国が予測期間にアジア太平洋で最大の市場シェアを占める見込みです。」

中国は経済の40%が工業部門に依存していることから、主に先進の工業の開発に注力しています。同国の工業部門には主に半導体、自動車、コンシューマーエレクトロニクスが含まれ、これらは水晶発振器の大きな市場となっています。中国は世界最大の製造国です。そのため、業界では急速な技術の進歩や研究活動の活発化がみられます。そのため、中国は水晶発振器のエコシステムに関わる企業に複数の機会を提供すると予測されます。中国は工業化と都市化が急速に進んでおり、特にコンシューマーエレクトロニクス、IT・通信、ネットワーク部門が重視されています。特に、スピードと効率を高めるために、ネットワークの同期メカニズムに重点が置かれています。したがって、中国は今後も水晶発振器デバイスの最大の市場であり続ける見込みです。さらに、航空宇宙・防衛産業では、精巧なツール、システム、車両を作るために莫大な投資が行われています。こうした戦略的取り組みが、中国の水晶発振器市場の力強い成長の大きな促進要因となっています。

当レポートでは、世界の水晶発振器市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 市場参入企業にとって魅力的な機会

- 水晶発振器市場:実装方式別

- VCXO水晶発振器市場:タイプ別

- OCXO水晶発振器市場:タイプ別

- アジア太平洋の水晶発振器市場:用途別、国別

- 水晶発振器市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 一般回路水晶発振器製品の平均販売価格:主要企業別(2024年)

- 水晶発振器の平均販売価格の動向:一般回路別(2021年~2024年)

- 恒温槽付水晶発振器の平均販売価格の動向:地域別(2021年~2024年)

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 水晶発振器市場に対するAIの影響

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入データ(HSコード854160)

- 輸出データ(HSコード854160)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 標準

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年)

第6章 水晶発振器の種類

- イントロダクション

- ピアス水晶発振器

- コルピッツ水晶発振器

- ハートレー水晶発振器

- その他のタイプ

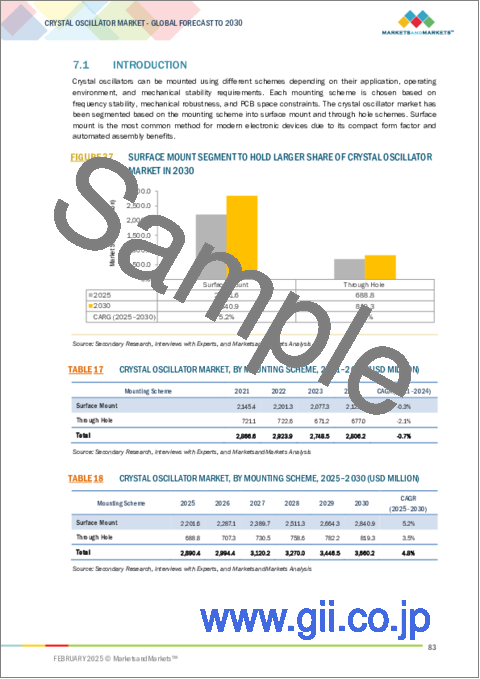

第7章 水晶発振器市場:実装方式別

- イントロダクション

- 表面実装

- スルーホール

第8章 水晶発振器市場:水晶カット別

- イントロダクション

- ATカット

- BTカット

- SCカット

- その他

第9章 水晶発振器市場:一般回路別

- イントロダクション

- SPXO

- TCXO

- VCXO

- FCXO

- OCXO

- その他の一般回路

第10章 水晶発振器市場:用途別

- イントロダクション

- 通信・ネットワーク

- コンシューマーエレクトロニクス

- 軍事・航空宇宙

- 研究・測定

- 工業

- 自動車

- 医療

第11章 水晶発振器市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2024年)

- 上位5社の収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標(2024年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- SEIKO EPSON CORPORATION

- NIHON DEMPA KOGYO CO., LTD.

- TXC CORPORATION

- KYOCERA CORPORATION

- DAISHINKU CORP.

- MICROCHIP TECHNOLOGY INC.

- MURATA MANUFACTURING CO., LTD.

- HOSONIC TECHNOLOGY (GROUP) CO., LTD.

- SITIME CORP.

- SIWARD CRYSTAL TECHNOLOGY CO., LTD.

- RAKON LIMITED

- RIVER ELETEC CORPORATION

- VISHAY INTERTECHNOLOGY, INC.

- その他の主要企業

- MERCURY INC.

- ABRACON

- GREENRAY INDUSTRIES, INC.

- MTI-MILLIREN TECHNOLOGIES, INC.

- QVS TECH, INC.

- SHENZHEN YANGXING TECHNOLOGY CO., LTD.

- BLILEY

- FUJI CRYSTAL (HONG KONG) ELECTRONICS CO., LTD.

- SHENZHEN CRYSTAL TECHNOLOGY INDUSTRIAL CO., LTD.

- AXTAL GMBH

- TAITIEN ELECTRONICS CO., LTD

- CRYSTEK CORPORATION

第14章 付録

List of Tables

- TABLE 1 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE OF OVEN-CONTROLLED CRYSTAL OSCILLATOR PRODUCTS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF CRYSTAL OSCILLATORS, BY GENERAL CIRCUITRY, 2021-2024 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF OVEN-CONTROLLED CRYSTAL OSCILLATORS, BY REGION, 2021-2024 (USD)

- TABLE 5 LIST OF MAJOR PATENTS, 2022-2024

- TABLE 6 IMPORT DATA FOR HS CODE 854160-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 854160-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 8 MFN TARIFFS FOR HS CODE 854160-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2024

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 CRYSTAL OSCILLATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 15 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 16 LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 17 CRYSTAL OSCILLATOR MARKET, BY MOUNTING SCHEME, 2021-2024 (USD MILLION)

- TABLE 18 CRYSTAL OSCILLATOR MARKET, BY MOUNTING SCHEME, 2025-2030 (USD MILLION)

- TABLE 19 CRYSTAL OSCILLATOR MARKET, BY CRYSTAL CUT, 2021-2024 (USD MILLION)

- TABLE 20 CRYSTAL OSCILLATOR MARKET, BY CRYSTAL CUT, 2025-2030 (USD MILLION)

- TABLE 21 CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 22 CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 23 CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (THOUSAND UNITS)

- TABLE 24 CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (THOUSAND UNITS)

- TABLE 25 SPXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 26 SPXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 SPXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 SPXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 SPXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 SPXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 SPXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 SPXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 SPXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 SPXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 TCXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 36 TCXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 TCXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 TCXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 TCXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 TCXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 TCXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 TCXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 TCXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 TCXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 VCXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 VCXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 VCXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 VCXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 VCXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 VCXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 VCXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 VCXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 VCXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 VCXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 VCXO: CRYSTAL OSCILLATOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 56 VCXO: CRYSTAL OSCILLATOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 57 FCXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 58 FCXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59 FCXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 FCXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 FCXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 FCXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 FCXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 FCXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 FCXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 FCXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 OCXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 68 OCXO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 OCXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 OCXO: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 OCXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 OCXO: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 OCXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 OCXO: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 OCXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 OCXO: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 OCXO: CRYSTAL OSCILLATOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 78 OCXO: CRYSTAL OSCILLATOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 79 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 80 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET FOR TELECOM & NETWORKING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 OTHER GENERAL CIRCUITRIES: CRYSTAL OSCILLATOR MARKET FOR AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 TELECOM & NETWORKING: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 92 TELECOM & NETWORKING: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 93 TELECOM & NETWORKING: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 TELECOM & NETWORKING: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 CONSUMER ELECTRONICS: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 96 CONSUMER ELECTRONICS: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 97 CONSUMER ELECTRONICS: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 CONSUMER ELECTRONICS: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 MILITARY & AEROSPACE: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 100 MILITARY & AEROSPACE: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 101 MILITARY & AEROSPACE: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 MILITARY & AEROSPACE: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 RESEARCH & MEASUREMENT: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 104 RESEARCH & MEASUREMENT: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 105 RESEARCH & MEASUREMENT: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 RESEARCH & MEASUREMENT: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 INDUSTRIAL: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 108 INDUSTRIAL: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 109 INDUSTRIAL: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 INDUSTRIAL: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 AUTOMOTIVE: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 112 AUTOMOTIVE: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 113 AUTOMOTIVE: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 AUTOMOTIVE: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 HEALTHCARE: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 116 HEALTHCARE: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 117 HEALTHCARE: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 HEALTHCARE: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: CRYSTAL OSCILLATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 NORTH AMERICA: CRYSTAL OSCILLATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 126 NORTH AMERICA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 127 US: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 US: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 CANADA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 CANADA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 MEXICO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 132 MEXICO: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: CRYSTAL OSCILLATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 EUROPE: CRYSTAL OSCILLATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 136 EUROPE: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 EUROPE: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 139 UK: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 UK: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 GERMANY: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 GERMANY: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 FRANCE: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 FRANCE: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 ITALY: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 ITALY: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 REST OF EUROPE: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 148 REST OF EUROPE: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 CHINA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 CHINA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 JAPAN: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 158 JAPAN: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 SOUTH KOREA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 160 SOUTH KOREA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 ROW: CRYSTAL OSCILLATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 ROW: CRYSTAL OSCILLATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 165 ROW: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2021-2024 (USD MILLION)

- TABLE 166 ROW: CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY, 2025-2030 (USD MILLION)

- TABLE 167 ROW: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 168 ROW: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: CRYSTAL OSCILLATOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: CRYSTAL OSCILLATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AMERICA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 SOUTH AMERICA: CRYSTAL OSCILLATOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 CRYSTAL OSCILLATOR MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS, 2021-2024

- TABLE 176 CRYSTAL OSCILLATOR MARKET: DEGREE OF COMPETITION, 2023

- TABLE 177 CRYSTAL OSCILLATOR MARKET: REGION FOOTPRINT

- TABLE 178 CRYSTAL OSCILLATOR MARKET: MOUNTING SCHEME FOOTPRINT

- TABLE 179 CRYSTAL OSCILLATOR MARKET: APPLICATION FOOTPRINT

- TABLE 180 CRYSTAL OSCILLATOR MARKET: GENERAL CIRCUITRY FOOTPRINT

- TABLE 181 CRYSTAL OSCILLATOR MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 182 CRYSTAL OSCILLATOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 183 CRYSTAL OSCILLATOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 184 CRYSTAL OSCILLATOR MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 185 CRYSTAL OSCILLATOR MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 186 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 187 SEIKO EPSON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES

- TABLE 189 NIHON DEMPA KOGYO CO., LTD.: COMPANY OVERVIEW

- TABLE 190 NIHON DEMPA KOGYO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 NIHON DEMPA KOGYO CO., LTD.: PRODUCT LAUNCHES

- TABLE 192 NIHON DEMPA KOGYO CO., LTD.: DEALS

- TABLE 193 TXC CORPORATION: COMPANY OVERVIEW

- TABLE 194 TXC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 TXC CORPORATION: PRODUCT LAUNCHES

- TABLE 196 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 197 KYOCERA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 KYOCERA CORPORATION: PRODUCT LAUNCHES

- TABLE 199 DAISHINKU CORP.: COMPANY OVERVIEW

- TABLE 200 DAISHINKU CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 202 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 MICROCHIP TECHNOLOGY INC.: EXPANSIONS

- TABLE 204 MURATA MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 205 MURATA MANUFACTURING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 MURATA MANUFACTURING CO., LTD.: PRODUCT LAUNCHES

- TABLE 207 HOSONIC TECHNOLOGY (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 208 HOSONIC TECHNOLOGY (GROUP) CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 SITIME CORP.: COMPANY OVERVIEW

- TABLE 210 SITIME CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 SITIME CORP.: PRODUCT LAUNCHES

- TABLE 212 SITIME CORP.: DEALS

- TABLE 213 SIWARD CRYSTAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 214 SIWARD CRYSTAL TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 SIWARD CRYSTAL TECHNOLOGY CO., LTD.: DEALS

- TABLE 216 RAKON LIMITED: COMPANY OVERVIEW

- TABLE 217 RAKON LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 RIVER ELETEC CORPORATION: COMPANY OVERVIEW

- TABLE 219 RIVER ELETEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 VISHAY INTERTECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 221 VISHAY INTERTECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 CRYSTAL OSCILLATOR MARKET SEGMENTATION

- FIGURE 2 CRYSTAL OSCILLATOR MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 CRYSTAL OSCILLATOR MARKET ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 VCXO SEGMENT TO EXHIBIT HIGHEST CAGR IN CRYSTAL OSCILLATOR MARKET FROM 2025 TO 2030

- FIGURE 8 AT-CUT SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 CONSUMER ELECTRONICS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

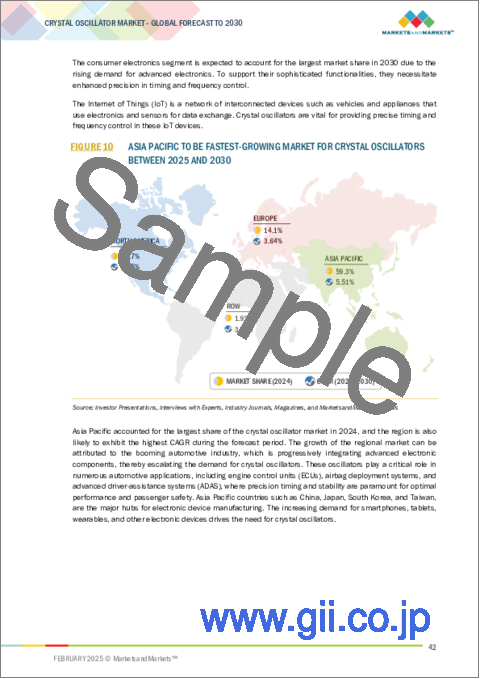

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR CRYSTAL OSCILLATORS BETWEEN 2025 AND 2030

- FIGURE 11 INCREASING DEMAND FOR MINIATURE ELECTRONIC DEVICES TO CREATE OPPORTUNITIES FOR CRYSTAL OSCILLATOR VENDORS

- FIGURE 12 SURFACE MOUNT SEGMENT TO LEAD CRYSTAL OSCILLATOR MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 13 OCVCXO SEGMENT TO REGISTER HIGHER CAGR IN CRYSTAL OSCILLATOR MARKET FOR VCXO FROM 2025 TO 2030

- FIGURE 14 DOCXO SEGMENT TO EXHIBIT HIGHER CAGR IN CRYSTAL OSCILLATOR MARKET FOR OCXO FROM 2025 TO 2030

- FIGURE 15 CONSUMER ELECTRONICS SEGMENT AND CHINA TO HOLD LARGEST SHARE OF CRYSTAL OSCILLATOR MARKET IN ASIA PACIFIC IN 2025

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL CRYSTAL OSCILLATOR MARKET DURING FORECAST PERIOD

- FIGURE 17 CRYSTAL OSCILLATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 CRYSTAL OSCILLATOR MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 19 GLOBAL VEHICLE PRODUCTION, 2020-2024 (MILLION UNITS)

- FIGURE 20 CRYSTAL OSCILLATOR MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 21 CRYSTAL OSCILLATOR MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 22 NUMBER OF CARS SOLD WORLDWIDE, 2020-2023 (MILLION UNITS)

- FIGURE 23 CRYSTAL OSCILLATOR MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 24 CRYSTAL OSCILLATOR VALUE CHAIN

- FIGURE 25 KEY PLAYERS IN CRYSTAL OSCILLATOR ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE OF OVEN-CONTROLLED CRYSTAL OSCILLATOR PRODUCTS OFFERED BY KEY PLAYERS, 2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF CRYSTAL OSCILLATORS BASED ON GENERAL CIRCUITRIES, 2021-2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF OVEN-CONTROLLED CRYSTAL OSCILLATORS, BY REGION, 2021-2024

- FIGURE 29 FUNDS RAISED BY MERCURY INC. IN CRYSTAL OSCILLATOR MARKET

- FIGURE 30 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 31 PATENTS APPLIED, OWNED, AND GRANTED, 2014-2024

- FIGURE 32 IMPORT DATA FOR HS CODE 854160-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023 (USD THOUSAND)

- FIGURE 33 EXPORT DATA FOR HS CODE 854160-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023 (USD THOUSAND)

- FIGURE 34 CRYSTAL OSCILLATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 37 SURFACE MOUNT SEGMENT TO HOLD LARGER SHARE OF CRYSTAL OSCILLATOR MARKET IN 2030

- FIGURE 38 AT-CUT SEGMENT TO DOMINATE CRYSTAL OSCILLATOR MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 39 TCXO SEGMENT TO HOLD PROMINENT MARKET SHARE IN 2030

- FIGURE 40 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 41 ASIA PACIFIC TO BE MOST LUCRATIVE MARKET FOR CRYSTAL OSCILLATORS THROUGHOUT FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: CRYSTAL OSCILLATOR MARKET SNAPSHOT

- FIGURE 43 EUROPE: CRYSTAL OSCILLATOR MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: CRYSTAL OSCILLATOR MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2019-2023

- FIGURE 46 CRYSTAL OSCILLATOR MARKET SHARE ANALYSIS, 2023

- FIGURE 47 COMPANY VALUATION, 2024

- FIGURE 48 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 49 BRAND/PRODUCT COMPARISON

- FIGURE 50 CRYSTAL OSCILLATOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 CRYSTAL OSCILLATOR MARKET: COMPANY FOOTPRINT

- FIGURE 52 CRYSTAL OSCILLATOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 NIHON DEMPA KOGYO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 55 TXC CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 DAISHINKU CORP.: COMPANY SNAPSHOT

- FIGURE 58 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 59 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 SITIME CORP.: COMPANY SNAPSHOT

- FIGURE 61 SIWARD CRYSTAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 RAKON LIMITED: COMPANY SNAPSHOT

- FIGURE 63 VISHAY INTERTECHNOLOGY, INC.: COMPANY SNAPSHOT

The global market for crystal oscillators is anticipated to increase from USD 2.89 billion in 2025 to USD 3.66 billion in 2030, at a CAGR of 4.8%. The increasing use of crystal oscillators in the automobile industry is the primary factor propelling the crystal oscillator market. Crystal oscillators are also designed to withstand high vibration levels, which are commonly found in automotive applications. When everything is said and done, crystal oscillators are essential components of numerous automobile applications. They provide the necessary long-term dependability, high accuracy, stability, temperature range, and vibration resistance in these vital applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Mounting scheme, Crystal cut, General circuitry, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Market for AT-cut segment is projected to account for largest market share during the forecast timeline"

This AT-cut segment's growth can be attributed to the greater number of activity dips, higher drive level sensitivity, and insensitivity to electric fields. Additionally, it has a less complicated manufacturing process and costs less to produce. As a result, it is favored in consumer electronics, telecommunications, precise timing applications, and general-purpose oscillators. Some of its characteristics are temperature stability, low frequency drift, high precision, possibility for downsizing, low power usage, high frequency range, reliability, and economy. Cumulatively, all these attributes contribute to making AT-cut crystal oscillators the go-to product in many industries such as consumer electronics, telecommunications, and many more where precision and reliable sources of frequency is required.

"Market for consumer electronics segment is projected to account for largest market share during the forecast timeline."

Consumer electronics represented the highest percentage of the crystal oscillator market in 2030. The growth of the segment can be explained by the rising demand for electronic devices worldwide, like smartphones and tablets. Crystal oscillators are a key component of wearable technology, such as smartwatches and fitness trackers, as they deliver accurate timing to sensors and other electronic components. Their capacity for stable frequencies guarantees that such devices provide precise measurements and consistent functionality, which is paramount to user experience and data integrity. The consumer electronics market is witnessing tremendous growth momentum fueled by technologies in virtual and augmented reality, smart speakers, home automation systems, drone technology, robots, and the spread of 5G-enabled smartphones.

"China is expected to account for largest market share in Asia Pacific during the forecast period."

China mainly focuses on advanced industrial development, as "40% of its economy depends on the industrial sector. The country's industrial sector primarily includes semiconductors, automotive, and consumer electronics, which are big markets for crystal oscillators. China is the biggest manufacturer in the world. Hence, rapid technological advancements and increased research activities take place in industries. Therefore, China is expected to offer several opportunities for the players involved in the crystal oscillator ecosystem. China is witnessing a rapid increase in industrialization and urbanization, with a particular emphasis on its consumer electronics, telecommunications, and networking sectors. Special emphasis is given to synchronization mechanisms of networks in order to boost speed and efficiency. Thus, China will continue to remain the largest market for crystal oscillator devices. Additionally, tremendous investments are incurred in the aerospace & defense industries to create sophisticated tools, systems, and vehicles. These strategic undertakings are major drivers for the strong growth of the crystal oscillator market in China.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the crystal oscillator marketplace. The break-up of the profile of primary participants in the crystal oscillator market:

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: Directors - 40%, C-level - 30%, Others-30%

- By Region: North America - 35%, Europe - 35%, Asia Pacific - 20%, ROW- 10%

Seiko Epson Corporation (Japan), NIHON DEMPA KOGYO CO., LTD. (Japan), TXC Corporation (Taiwan), KYOCERA Corporation (Japan), Daishinku Corp. (Japan), Microchip Technology Inc. (US), Murata Manufacturing Co., Ltd. (Japan), SiTime Corp. (US), SIWARD Crystal Technology Co., Ltd. (Taiwan), Rakon Limited (New Zealand), and Vishay Intertechnology, Inc. are few among the prominent players in the crystal oscillator industry.

The study includes an in-depth competitive analysis of these key players in the crystal oscillator market, with their company profiles, recent developments, and key market strategies.

Research Coverage: This research report categorizes the crystal oscillator market by mounting scheme (surface mount, through hole), by crystal cut(AT-cut, BT-cut, SC-cut, others), by general circuitry (SPXO, VCXO, TCXO, OCXO, FCXO, others), by application (consumer electronics, telecom & networking, automotive, military and aerospace, research & measurement, industrial, healthcare) and by region (North America, Europe, Asia Pacific, and RoW).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the crystal oscillator market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the crystal oscillator market have been covered in the report. This report covers a competitive analysis of upcoming startups in the crystal oscillator market ecosystem.

Reasons to buy this report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall crystal oscillator market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key benefits of buying the report:

- Analysis of key drivers (increasing adoption of crystal oscillators in aerospace & defense applications, growing use of crystal oscillators in automotive sector, surging implementation of crystal oscillators in consumer electronics, and rising deployment of crystal oscillators in 5G and 6G networks.), restraints (availability of cost-effective and more reliable alternative technologies), opportunities (growing demand for miniature electronic devices with improved performance and increasing adoption of advanced automotive electronics) and challenges (frequency drift issues in crystal oscillators after extended use) influencing the growth of the crystal oscillator market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the crystal oscillator.

- Market Development: Comprehensive information about lucrative markets - the report analysis the crystal oscillator market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the crystal oscillator market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading market players such as Seiko Epson Corporation (Japan), NIHON DEMPA KOGYO CO., LTD. (Japan), TXC Corporation (Taiwan), KYOCERA Corporation (Japan), Daishinku Corp. (Japan), Microchip Technology Inc. (US), Murata Manufacturing Co., Ltd. (Japan), SiTime Corp. (US), SIWARD Crystal Technology Co., Ltd. (Taiwan), Rakon Limited (New Zealand), and Vishay Intertechnology, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 CRYSTAL OSCILLATOR MARKET, BY MOUNTING SCHEME

- 4.3 CRYSTAL OSCILLATOR MARKET FOR VCXO, BY TYPE

- 4.4 CRYSTAL OSCILLATOR MARKET FOR OCXO, BY TYPE

- 4.5 CRYSTAL OSCILLATOR MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 4.6 CRYSTAL OSCILLATOR MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of crystal oscillators in aerospace & defense applications

- 5.2.1.2 Growing use of crystal oscillators in automotive sector

- 5.2.1.3 Surging implementation of crystal oscillators in consumer electronics

- 5.2.1.4 Rising deployment of crystal oscillators in 5G and 6G networks

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of cost-effective and more reliable alternative technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for miniature electronic devices with improved performance

- 5.2.3.2 Increasing adoption of advanced automotive electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 Frequency drift issues in crystal oscillators after extended use

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF GENERAL CIRCUITRY CRYSTAL OSCILLATOR PRODUCTS, BY KEY PLAYER, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF CRYSTAL OSCILLATORS, BY GENERAL CIRCUITRY, 2021-2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF OVEN-CONTROLLED CRYSTAL OSCILLATORS, BY REGION, 2021-2024

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 IMPACT OF AI ON CRYSTAL OSCILLATOR MARKET

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 MEMS-based oscillator

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Hybrid microcircuit technology

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Green crystal technology

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 854160)

- 5.11.2 EXPORT DATA (HS CODE 854160)

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 STANDARDS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 BARGAINING POWER OF SUPPLIERS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 THREAT OF NEW ENTRANTS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 KEY CONFERENCES AND EVENTS, 2025

6 DIFFERENT TYPES OF CRYSTAL OSCILLATORS

- 6.1 INTRODUCTION

- 6.2 PIERCE CRYSTAL OSCILLATORS

- 6.3 COLPITTS CRYSTAL OSCILLATORS

- 6.4 HARTLEY CRYSTAL OSCILLATORS

- 6.5 OTHER TYPES

7 CRYSTAL OSCILLATOR MARKET, BY MOUNTING SCHEME

- 7.1 INTRODUCTION

- 7.2 SURFACE MOUNT

- 7.2.1 HIGHER COMPONENT DENSITY PER UNIT AND LOWER COST OF UNIT ASSEMBLIES TO BOOST SEGMENTAL GROWTH

- 7.3 THROUGH HOLE

- 7.3.1 STRONG MECHANICAL CONNECTION AND STABILITY FEATURES TO DRIVE DEMAND

8 CRYSTAL OSCILLATOR MARKET, BY CRYSTAL CUT

- 8.1 INTRODUCTION

- 8.2 AT-CUT

- 8.2.1 DEPLOYMENT IN AUTOMOTIVE APPLICATIONS TO FUEL MARKET GROWTH

- 8.3 BT-CUT

- 8.3.1 ADOPTION IN HIGH-FREQUENCY APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

- 8.4 SC-CUT

- 8.4.1 UTILIZATION IN OCXO APPLICATIONS TO SUPPORT MARKET GROWTH

- 8.5 OTHERS

9 CRYSTAL OSCILLATOR MARKET, BY GENERAL CIRCUITRY

- 9.1 INTRODUCTION

- 9.2 SPXO

- 9.2.1 SUITABILITY FOR MODERN COMPACT ELECTRONIC DESIGNS TO BOOST DEMAND

- 9.3 TCXO

- 9.3.1 INCREASING DEMAND FOR COMMUNICATION DEVICES AND MEASURING INSTRUMENTS TO SUPPORT SEGMENTAL GROWTH

- 9.3.2 VCTCXO

- 9.4 VCXO

- 9.4.1 TCVCXO

- 9.4.1.1 Rising use in precision timing applications due to superior temperature stability to fuel segmental growth

- 9.4.2 OCVCXO

- 9.4.2.1 Minimal g-sensitivity, enhanced thermal stability, and reduced power consumption features to accelerate demand

- 9.4.1 TCVCXO

- 9.5 FCXO

- 9.5.1 GROWING UTILIZATION IN FIBER CHANNELS, HD VIDEO SYSTEMS, AND PON DEVICES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.6 OCXO

- 9.6.1 DOCXO

- 9.6.1.1 Fast warm-up time, low power consumption, and long-term frequency stability benefits to accelerate demand

- 9.6.2 EMXO

- 9.6.2.1 Escalated demand for crystal oscillators in spacecraft to support market growth

- 9.6.1 DOCXO

- 9.7 OTHER GENERAL CIRCUITRIES

10 CRYSTAL OSCILLATOR MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 TELECOM & NETWORKING

- 10.2.1 INCREASING DEPLOYMENT OF 5G NETWORKS TO FOSTER MARKET GROWTH

- 10.3 CONSUMER ELECTRONICS

- 10.3.1 SURGING DEMAND FOR MINIATURE ELECTRONIC DEVICES TO DRIVE MARKET

- 10.4 MILITARY & AEROSPACE

- 10.4.1 RISING REQUIREMENT FOR SOPHISTICATED MISSILES AND WEAPONS TO FUEL MARKET GROWTH

- 10.5 RESEARCH & MEASUREMENT

- 10.5.1 ESCALATING DEMAND FOR COMPACT AND PORTABLE INSTRUMENTS TO SUPPORT MARKET GROWTH

- 10.6 INDUSTRIAL

- 10.6.1 ELEVATING NEED FOR RELIABLE CRYSTAL OSCILLATORS WITH SUPERIOR TEMPERATURE STABILITY TO CONTRIBUTE TO MARKET GROWTH

- 10.7 AUTOMOTIVE

- 10.7.1 INTEGRATION OF ADVANCED SAFETY FEATURES IN AUTOMOBILES TO ACCELERATE DEMAND

- 10.8 HEALTHCARE

- 10.8.1 GROWING DEMAND FOR PORTABLE MEDICAL DEVICES TO DRIVE MARKET

11 CRYSTAL OSCILLATOR MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Transition of industrial sector toward automation to drive market

- 11.2.3 CANADA

- 11.2.3.1 Surging investments in R&D promoting technological advancements to contribute to market growth

- 11.2.4 MEXICO

- 11.2.4.1 Strong automotive and manufacturing base to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 Rising adoption of automation in aerospace, automotive, and consumer electronics industries to drive market

- 11.3.3 GERMANY

- 11.3.3.1 Flourishing automotive sector to augment market growth

- 11.3.4 FRANCE

- 11.3.4.1 Surging adoption of AI and ML in manufacturing firms to contribute to market growth

- 11.3.5 ITALY

- 11.3.5.1 Elevating use of advanced technologies in healthcare sector to foster market growth

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rapid urbanization and industrialization to fuel demand

- 11.4.3 JAPAN

- 11.4.3.1 Prominent presence of major crystal oscillator manufacturing firms to accelerate market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Growing focus on 5G infrastructure development to boost demand

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Booming consumer electronics industry to foster market growth

- 11.5.2.2 GCC

- 11.5.2.3 Rest of Middle East & Africa

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Flourishing electronics industry to stimulate demand

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.3 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2019-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Mounting scheme footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 General circuitry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of startups/SMEs

- 12.8.5.2 Competitive benchmarking of startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SEIKO EPSON CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 NIHON DEMPA KOGYO CO., LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 TXC CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 KYOCERA CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 DAISHINKU CORP.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 MICROCHIP TECHNOLOGY INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 MURATA MANUFACTURING CO., LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 HOSONIC TECHNOLOGY (GROUP) CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 SITIME CORP.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 SIWARD CRYSTAL TECHNOLOGY CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 RAKON LIMITED

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 RIVER ELETEC CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 VISHAY INTERTECHNOLOGY, INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.1 SEIKO EPSON CORPORATION

- 13.2 OTHER KEY PLAYERS

- 13.2.1 MERCURY INC.

- 13.2.2 ABRACON

- 13.2.3 GREENRAY INDUSTRIES, INC.

- 13.2.4 MTI-MILLIREN TECHNOLOGIES, INC.

- 13.2.5 QVS TECH, INC.

- 13.2.6 SHENZHEN YANGXING TECHNOLOGY CO., LTD.

- 13.2.7 BLILEY

- 13.2.8 FUJI CRYSTAL (HONG KONG) ELECTRONICS CO., LTD.

- 13.2.9 SHENZHEN CRYSTAL TECHNOLOGY INDUSTRIAL CO., LTD.

- 13.2.10 AXTAL GMBH

- 13.2.11 TAITIEN ELECTRONICS CO., LTD

- 13.2.12 CRYSTEK CORPORATION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS