|

|

市場調査レポート

商品コード

1609379

ガス絶縁開閉装置の世界市場:構成別、エンドユーザー別、設置場所別、絶縁タイプ別、定格電圧別、地域別 - 2029年までの予測Gas Insulated Switchgear Market by Installation (Indoor, Outdoor), Insulation Type (SF6, SF6 free), Voltage Rating, Configuration ( Hybrid, Isolated Phase, Integrated three phase, Compact GIS), End-User, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ガス絶縁開閉装置の世界市場:構成別、エンドユーザー別、設置場所別、絶縁タイプ別、定格電圧別、地域別 - 2029年までの予測 |

|

出版日: 2024年12月03日

発行: MarketsandMarkets

ページ情報: 英文 324 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のガス絶縁開閉装置の市場規模は、2024年~2029年の予測期間に6.1%のCAGRで拡大し、2024年の249億3,000万米ドルから、2029年末には335億3,000万米ドルに達すると予測されています。

このようなガス絶縁開閉装置市場の継続的な成長は、近年のエネルギー消費の増加による世界のエネルギー需要の増加と密接に関連しており、電力需要の急増の主な触媒を形成しています。主要な促進要因の中では、産業部門が需要増加の最大の原動力となるとみられていますが、商業、サービス、住宅部門も大きな貢献をしています。エネルギー源に対する旺盛な需要は、エネルギー需給の変動を生み出し、エネルギー市場に価格変動をもたらします。この価格変動は主に、良好な経済状況、十分なエネルギー資源の存在、電力消費の増加など、複合的な要因によるものです。また、特にモノのインターネット(IoT)ホームオートメーションやビルオートメーションの開発において、発見されたシナリオを適切に管理するための方法に焦点を当てたエネルギー管理への懸念があります。したがって、これらの要因は、エネルギー使用の監視と最適化を促進するガス絶縁開閉装置に対する緊急の需要が高まるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 対象台数 | 金額(100万米ドル)および数量(台) |

| セグメント別 | 構成別、エンドユーザー別、設置場所別、絶縁タイプ別、定格電圧別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

六フッ化硫黄(SF6)ガスは、GIS変電所内の電流を流すすべてのコンポーネントの絶縁およびアーク消弧媒体として機能する、タイトガス金属筐体の中に設置されます。SF6は不燃性で、乾燥した不活性ガスであるため劣化しません。しかし、SF6はフッ素化ガスであり、温室効果ガス(GHG)の中で最も地球温暖化を促進する可能性が高いです。そのため、SF6の排出量が減少すれば、米国環境保護庁のSF6に対する審査に影響を与えることになります。その結果、SF6の使用がさらに厳しく制限されることになると思われます。SF6の使用に適用される可能性のある規制のほとんどは、Fガスとして知られる化学的に類似したフッ素系ガス群に関するものです。Fガスの規制がより厳しくなれば、SF6の使用量への影響も大きくなり、ガス絶縁開閉装置の市場に影響を与えることになります。

電気インフラでは、定格電圧16~27kVのGISが、そのコンパクトな設計、信頼性の高い性能、最小限のメンテナンス要件により、配電および産業環境の両方で普及しています。さらに、一般的に使用されている絶縁体である六フッ化硫黄(SF6)に対する環境問題の高まりから、持続可能で環境に優しい代替絶縁体に関する研究が盛んに行われており、グリーンGIS技術に対する業界の傾向が高まっています。さらに、国際エネルギー機関(IEA)によると、2022年の世界のエネルギー消費量は4.6%増加しました。こうした開発により、トランスミッションインフラへの大規模な投資が誘発されています。インド、中国、アラブ首長国連邦、アルゼンチンは、こうした取り組みを推進する新興の経済大国です。このことは、この特定分野におけるガス絶縁開閉装置市場の成長と統合に大きな展望を開くものです。

当レポートでは、世界のガス絶縁開閉装置市場について調査し、構成別、エンドユーザー別、設置場所別、絶縁タイプ別、定格電圧別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- バリューチェーン分析

- 投資と資金調達のシナリオ

- 技術分析

- 2024年~2025年の主な会議とイベント

- エコシステムマッピング

- 特許分析

- ケーススタディ分析

- 貿易分析

- 価格分析

- 関税と規制状況

- 顧客ビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

- 生成AI/ガス絶縁開閉装置市場におけるAIの影響

- ガス絶縁開閉装置市場のマクロ経済見通し

第6章 ガス絶縁開閉装置市場(構成別)

- イントロダクション

- ハイブリッド

- 分離相

- 統合型三相

- コンパクト型

第7章 ガス絶縁開閉装置市場(エンドユーザー別)

- イントロダクション

- 工業

- 商業・機関

- 電力会社

- データセンター

- アフターマーケット

第8章 ガス絶縁開閉装置市場(設置場所別)

- イントロダクション

- 屋内

- 屋外

第9章 ガス絶縁開閉装置市場(絶縁タイプ別)

- イントロダクション

- SF6

- SF6フリー

第10章 ガス絶縁開閉装置市場(定格電圧別)

- イントロダクション

- 5KV以下

- 6~15KV

- 16~27KV

- 28~40.5KV

- 40.6~73KV

- 74~220KV

- 220KV以上

第11章 ガス絶縁開閉装置市場(地域別)

- イントロダクション

- アジア太平洋

- 欧州

- 中東・アフリカ

- 北米

- 南米

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2023年

- 収益分析、2019年~2023年

- 企業価値評価と財務指標

- 製品タイプ/地理的プレゼンスの比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ABB

- SCHNEIDER ELECTRIC

- HITACHI, LTD.

- SIEMENS

- EATON

- GENERAL ELECTRIC COMPANY

- MITSUBISHI ELECTRIC CORPORATION

- HD HYUNDAI ELECTRIC CO., LTD.

- FUJI ELECTRIC CO., LTD.

- CG POWER AND INDUSTRIAL SOLUTIONS LTD.

- NISSIN ELECTRIC CO., LTD.

- MEIDENSHA CORPORATION

- POWELL INDUSTRIES

- HYOSUNG HEAVY INDUSTRIES

- TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- G&W ELECTRIC

- HENAN PINGGAO ELECTRIC CO., LTD.

- XIAN XD SWITCHGEAR ELECTRIC CO., LTD

- SWITCHGEAR COMPANY

- SIEYUAN ELECTRIC CO., LTD.

- その他の企業

- ELECKTROBUDOWA SP. Z O.O.

- CHINT GROUP

- SEL S.P.A.

- ILJIN ELECTRIC

- ZHEJIANG VOLCANO ELECTRICAL TECHNOLOGY CO., LTD

第14章 付録

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 GAS-INSULATED SWITCHGEAR MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- TABLE 3 GAS-INSULATED SWITCHGEAR MARKET: RISK ANALYSIS

- TABLE 4 GAS-INSULATED SWITCHGEAR MARKET: SNAPSHOT

- TABLE 5 GLOBAL WARMING POTENTIAL OF GREENHOUSE GASES (100-YEAR HORIZON)

- TABLE 6 GAS-INSULATED SWITCHGEAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 GAS-INSULATED SWITCHGEAR MARKET: KEY CONFERENCES AND EVENTS

- TABLE 8 ROLE OF PARTICIPANTS IN ECOSYSTEM

- TABLE 9 GAS-INSULATED SWITCHGEAR MARKET: KEY PATENTS, MAY 2019-JULY 2023

- TABLE 10 IMPORT SCENARIO FOR PRODUCTS UNDER HS CODE 853590, BY COUNTRY, 2021-2023 (USD)

- TABLE 11 EXPORT SCENARIO FOR PRODUCTS UNDER HS CODE 853590, BY COUNTRY, 2021-2023 (USD)

- TABLE 12 IMPORT SCENARIO FOR PRODUCTS UNDER HS CODE 853690, BY COUNTRY, 2021-2023 (USD)

- TABLE 13 EXPORT SCENARIO FOR PRODUCTS UNDER HS CODE 853690, BY COUNTRY, 2021-2023 (USD)

- TABLE 14 AVERAGE SELLING PRICE OF GAS-INSULATED SWITCHGEAR OFFERED, BY REGION, 2023-2029

- TABLE 15 INDICATIVE PRICING ANALYSIS OF GAS-INSULATED SWITCHGEAR, BY VOLTAGE RATING, 2023

- TABLE 16 IMPORT VALUES FOR LOW-VOLTAGE PROTECTION EQUIPMENT UNDER HS CODE 853690, 2022

- TABLE 17 IMPORT VALUES FOR HIGH-VOLTAGE PROTECTION EQUIPMENT UNDER HS CODE 853590, 2022

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 GAS-INSULATED SWITCHGEAR MARKET: CODES AND REGULATIONS

- TABLE 23 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 25 GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2021-2023 (USD MILLION)

- TABLE 26 GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2024-2029 (USD MILLION)

- TABLE 27 HYBRID GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 28 HYBRID GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 ISOLATED-PHASE GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 30 ISOLATED-PHASE GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

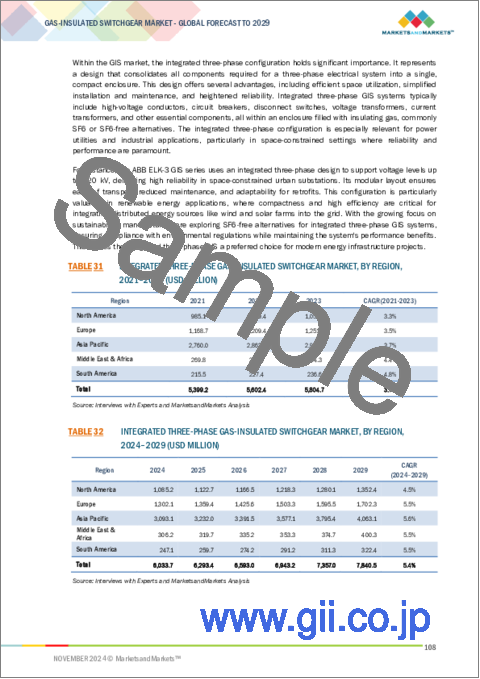

- TABLE 31 INTEGRATED THREE-PHASE GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 32 INTEGRATED THREE-PHASE GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 COMPACT GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 34 COMPACT GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 36 GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 37 INDUSTRIAL: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 38 INDUSTRIAL: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 INDUSTRIAL: GAS-INSULATED SWITCHGEAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 40 INDUSTRIAL: GAS-INSULATED SWITCHGEAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 41 COMMERCIAL & INSTITUTIONAL: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 42 COMMERCIAL & INSTITUTIONAL: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 COMMERCIAL & INSTITUTIONAL: GAS-INSULATED SWITCHGEAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 44 COMMERCIAL & INSTITUTIONAL: GAS-INSULATED SWITCHGEAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 45 ELECTRICAL UTILITIES: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 46 ELECTRICAL UTILITIES: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 ELECTRICAL UTILITIES: GAS-INSULATED SWITCHGEAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 48 ELECTRICAL UTILITIES: GAS-INSULATED SWITCHGEAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 49 DATA CENTERS: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 50 DATA CENTERS: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 DATA CENTERS: GAS-INSULATED SWITCHGEAR MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 52 DATA CENTERS: GAS-INSULATED SWITCHGEAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 53 AFTERMARKET: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 54 AFTERMARKET: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2021-2023 (USD MILLION)

- TABLE 56 GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 57 INDOOR: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 58 INDOOR: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 OUTDOOR: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 60 OUTDOOR: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2021-2023 (USD MILLION)

- TABLE 62 GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 63 SF6: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 64 SF6: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 SF6-FREE: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 66 SF6-FREE: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2021-2023 (USD MILLION)

- TABLE 68 GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 69 UP TO 5 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 70 UP TO 5 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 71 6 TO 15 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 72 6 TO 15 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 16 TO 27 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 74 16 TO 27 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 28 TO 40.5 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 76 28 TO 40.5 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 40.6 TO 73 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 78 40.6 TO 73 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 74 TO 220 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 80 74 TO 220 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 ABOVE 220 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 82 ABOVE 220 KV: GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 84 GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 85 GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2021-2023 (UNITS)

- TABLE 86 GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 87 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2021-2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2021-2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2021-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2021-2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2024-2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 CHINA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 100 CHINA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 101 INDIA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 102 INDIA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 103 JAPAN: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 104 JAPAN: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 105 SOUTH KOREA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 106 SOUTH KOREA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 107 AUSTRALIA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 108 AUSTRALIA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 111 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2021-2023 (USD MILLION)

- TABLE 112 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 113 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2021-2023 (USD MILLION)

- TABLE 114 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 115 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2021-2023 (USD MILLION)

- TABLE 116 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 117 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2021-2023 (USD MILLION)

- TABLE 118 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2024-2029 (USD MILLION)

- TABLE 119 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 120 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 121 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2021-2023(USD MILLION)

- TABLE 122 EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 123 GERMANY: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 124 GERMANY: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 125 UK: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 126 UK: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 127 ITALY: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023(USD MILLION)

- TABLE 128 ITALY: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 129 SPAIN: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 130 SPAIN: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 131 FRANCE: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 132 FRANCE: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 133 REST OF EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023(USD MILLION)

- TABLE 134 REST OF EUROPE: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2021-2023 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2021-2023 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2021-2023 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2021-2023 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2024-2029 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023(USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 147 GCC: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 148 GCC: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 149 SAUDI ARABIA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 150 SAUDI ARABIA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 151 UAE: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 152 UAE: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 153 KUWAIT: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023(USD MILLION)

- TABLE 154 KUWAIT: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 155 REST OF GCC: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 156 REST OF GCC: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 157 SOUTH AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 158 SOUTH AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 161 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2021-2023 (USD MILLION)

- TABLE 162 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 163 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2021-2023 (USD MILLION)

- TABLE 164 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 165 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2021-2023 (USD MILLION)

- TABLE 166 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 167 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2021-2023 (USD MILLION)

- TABLE 168 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2024-2029 (USD MILLION)

- TABLE 169 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 170 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 171 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 172 NORTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 173 US: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 174 US: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 175 CANADA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 176 CANADA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 177 MEXICO: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 178 MEXICO: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 179 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2021-2023 (USD MILLION)

- TABLE 180 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2024-2029 (USD MILLION)

- TABLE 181 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2021-2023 (USD MILLION)

- TABLE 182 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2024-2029 (USD MILLION)

- TABLE 183 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2021-2023 (USD MILLION)

- TABLE 184 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2024-2029 (USD MILLION)

- TABLE 185 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2021-2023 (USD MILLION)

- TABLE 186 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2024-2029 (USD MILLION)

- TABLE 187 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 188 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 189 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 190 SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 191 BRAZIL: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 192 BRAZIL: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 193 ARGENTINA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 194 ARGENTINA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 195 REST OF SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 196 REST OF SOUTH AMERICA: GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 197 GAS-INSULATED SWITCHGEAR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 198 GAS-INSULATED SWITCHGEAR MARKET: DEGREE OF COMPETITION, 2023

- TABLE 199 GAS-INSULATED SWITCHGEAR MARKET: REGION FOOTPRINT

- TABLE 200 GAS INSULATED SWITCHGEAR MARKET: INSTALLATION FOOTPRINT

- TABLE 201 GAS-INSULATED SWITCHGEAR MARKET: INSULATION TYPE FOOTPRINT

- TABLE 202 GAS-INSULATED SWITCHGEAR MARKET: CONFIGURATION TYPE FOOTPRINT

- TABLE 203 GAS-INSULATED SWITCHGEAR MARKET: VOLTAGE RATING FOOTPRINT

- TABLE 204 GAS-INSULATED SWITCHGEAR MARKET: END USER FOOTPRINT

- TABLE 205 GAS-INSULATED SWITCHGEAR MARKET: KEY STARTUPS/SMES

- TABLE 206 GAS-INSULATED SWITCHGEAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 207 GAS-INSULATED SWITCHGEAR MARKET: PRODUCT LAUNCHES, OCTOBER 2020-OCTOBER 2024

- TABLE 208 GAS-INSULATED SWITCHGEAR MARKET: DEALS, OCTOBER 2020-OCTOBER 2024

- TABLE 209 GAS-INSULATED SWITCHGEAR MARKET: EXPANSIONS, OCTOBER 2020-OCTOBER 2024

- TABLE 210 GAS-INSULATED SWITCHGEAR MARKET: OTHER DEVELOPMENTS, OCTOBER 2020-OCTOBER 2024

- TABLE 211 ABB: COMPANY OVERVIEW

- TABLE 212 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 ABB: PRODUCT LAUNCHES

- TABLE 214 ABB: DEALS

- TABLE 215 ABB: EXPANSIONS

- TABLE 216 ABB: OTHER DEVELOPMENTS

- TABLE 217 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 218 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 220 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 221 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 222 HITACHI, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 HITACHI, LTD.: DEALS

- TABLE 224 SIEMENS: COMPANY OVERVIEW

- TABLE 225 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 SIEMENS: DEALS

- TABLE 227 SIEMENS: OTHER DEVELOPMENTS

- TABLE 228 EATON: COMPANY OVERVIEW

- TABLE 229 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 EATON: PRODUCT LAUNCHES

- TABLE 231 EATON: DEALS

- TABLE 232 EATON: EXPANSIONS

- TABLE 233 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 234 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 GENERAL ELECTRIC COMPANY: PRODUCT LAUNCHES

- TABLE 236 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 237 GENERAL ELECTRIC COMPANY: OTHER DEVELOPMENTS

- TABLE 238 GENERAL ELECTRIC COMPANY: EXPANSIONS

- TABLE 239 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 240 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 241 MITSUBISHI ELECTRIC CORPORATION: EXPANSIONS

- TABLE 242 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 243 HD HYUNDAI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 HD HYUNDAI ELECTRIC CO., LTD: DEALS

- TABLE 245 FUJI ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 246 FUJI ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 FUJI ELECTRIC CO., LTD: EXPANSIONS

- TABLE 248 FUJI ELECTRIC CO., LTD: OTHER DEVELOPMENTS

- TABLE 249 CG POWER AND INDUSTRIAL SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 250 CG POWER AND INDUSTRIAL SOLUTIONS LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 251 CG POWER AND INDUSTRIAL SOLUTIONS LTD: DEALS

- TABLE 252 NISSIN ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 253 NISSIN ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 NISSIN ELECTRIC CO., LTD: EXPANSIONS

- TABLE 255 MEIDENSHA CORPORATION: COMPANY OVERVIEW

- TABLE 256 MEIDENSHA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 POWELL INDUSTRIES: COMPANY OVERVIEW

- TABLE 258 POWELL INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 HYOSUNG HEAVY INDUSTRIES: COMPANY OVERVIEW

- TABLE 260 HYOSUNG HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 HYOSUNG HEAVY INDUSTRIES: PRODUCT LAUNCHES

- TABLE 262 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 263 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: OTHER DEVELOPMENTS

- TABLE 265 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: EXPANSIONS

- TABLE 266 G&W ELECTRIC: COMPANY OVERVIEW

- TABLE 267 G&W ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 G&W ELECTRIC: DEALS

- TABLE 269 HENAN PINGGAO ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 270 HENAN PINGGAO ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 XIAN XD SWITCHGEAR ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 272 XIAN XD SWITCHGEAR ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 273 SWITCHGEAR COMPANY: COMPANY OVERVIEW

- TABLE 274 SWITCHGEAR COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 SIEYUAN ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 276 SIEYUAN ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 GAS-INSULATED SWITCHGEAR MARKET: SEGMENTATION

- FIGURE 2 GAS-INSULATED SWITCHGEAR MARKET: RESEARCH DESIGN

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR GAS-INSULATED SWITCHGEAR

- FIGURE 4 GAS-INSULATED SWITCHGEAR MARKET: BOTTOM-UP APPROACH

- FIGURE 5 GAS-INSULATED SWITCHGEAR MARKET: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF GAS-INSULATED SWITCHGEAR

- FIGURE 7 GAS-INSULATED SWITCHGEAR MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 8 GAS-INSULATED SWITCHGEAR MARKET: DATA TRIANGULATION

- FIGURE 9 ASIA PACIFIC DOMINATED GAS-INSULATED SWITCHGEAR MARKET IN 2023

- FIGURE 10 OUTDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2029

- FIGURE 11 SF6-FREE SEGMENT TO BE DOMINANT INSULATION TYPE BY 2029

- FIGURE 12 ABOVE 220 KV SEGMENT TO LEAD MARKET BY VOLTAGE RATING

- FIGURE 13 HYBRID GAS-INSULATED SWITCHGEAR TO BE KEY CONFIGURATION SEGMENT BY 2029

- FIGURE 14 ELECTRICAL UTILITIES SEGMENT TO LEAD GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2029

- FIGURE 15 ENHANCED ELECTRICAL SAFETY AND EFFICIENCY TO DRIVE GAS-INSULATED SWITCHGEAR MARKET

- FIGURE 16 GAS-INSULATED SWITCHGEAR MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 OUTDOOR SEGMENT AND CHINA DOMINATED GAS-INSULATED SWITCHGEAR MARKET IN ASIA PACIFIC IN 2023

- FIGURE 18 OUTDOOR SEGMENT TO HOLD LARGER SHARE OF GAS-INSULATED SWITCHGEAR MARKET BY 2029

- FIGURE 19 SF6 SEGMENT TO COMMAND MAJOR SHARE BY 2029

- FIGURE 20 ABOVE 220 KV SEGMENT TO DOMINATE MARKET BY 2029

- FIGURE 21 HYBRID SEGMENT TO LEAD MARKET BY 2029

- FIGURE 22 ELECTRIC UTILITIES TO HOLD MAJOR SHARE BY 2029

- FIGURE 23 GAS-INSULATED SWITCHGEAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 RENEWABLE ELECTRICITY CAPACITY GROWTH BY COUNTRY/REGION, 2005-2028

- FIGURE 25 INVESTMENT SPENDING ON ELECTRICITY GRIDS, 2015-2022

- FIGURE 26 GAS-INSULATED SWITCHGEAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 GAS-INSULATED SWITCHGEAR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 MAJOR PATENTS RELATED TO GAS-INSULATED SWITCHGEAR

- FIGURE 30 IMPORT SCENARIO FOR PRODUCTS UNDER HS CODE 853590, BY COUNTRY, 2021-2023 (USD)

- FIGURE 31 EXPORT SCENARIO FOR PRODUCTS UNDER HS CODE 853590, BY COUNTRY, 2021-2023 (USD)

- FIGURE 32 IMPORT SCENARIO FOR PRODUCTS UNDER HS CODE 853690, BY COUNTRY, 2021-2023 (USD)

- FIGURE 33 EXPORT SCENARIO FOR PRODUCTS UNDER HS CODE 853690, BY COUNTRY, 2021-2023 (USD)

- FIGURE 34 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2029

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 37 BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 38 IMPACT OF GENERATIVE AI/AI IN END USER

- FIGURE 39 GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION, 2023

- FIGURE 40 GAS-INSULATED SWITCHGEAR MARKET, BY END USER, 2023

- FIGURE 41 GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION, 2023

- FIGURE 42 GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE, 2023

- FIGURE 43 GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING, 2023

- FIGURE 44 GAS-INSULATED SWITCHGEAR MARKET, BY REGION, 2023

- FIGURE 45 GAS-INSULATED SWITCHGEAR MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 46 ASIA PACIFIC: GAS-INSULATED SWITCHGEAR MARKET SNAPSHOT

- FIGURE 47 EUROPE: GAS-INSULATED SWITCHGEAR MARKET SNAPSHOT

- FIGURE 48 GAS-INSULATED SWITCHGEAR MARKET SHARE ANALYSIS OF PLAYERS, 2023

- FIGURE 49 GAS-INSULATED SWITCHGEAR MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023

- FIGURE 50 COMPANY VALUATION

- FIGURE 51 FINANCIAL METRICS

- FIGURE 52 PRODUCT TYPE-/GEOGRAPHIC PRESENCE-WISE COMPARISON

- FIGURE 53 GAS-INSULATED SWITCHGEAR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 54 GAS-INSULATED SWITCHGEAR MARKET: COMPANY FOOTPRINT

- FIGURE 55 GAS-INSULATED SWITCHGEAR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 56 ABB: COMPANY SNAPSHOT

- FIGURE 57 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 58 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 59 SIEMENS: COMPANY SNAPSHOT

- FIGURE 60 EATON: COMPANY SNAPSHOT

- FIGURE 61 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 62 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 64 FUJI ELECTRIC CO., LTD: COMPANY SNAPSHOT

- FIGURE 65 CG POWER AND INDUSTRIAL SOLUTIONS LTD.: COMPANY SNAPSHOT

- FIGURE 66 NISSIN ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 67 MEIDENSHA CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 POWELL INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 69 HYOSUNG HEAVY INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 70 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY SNAPSHOT

The global gas insulated switchgear market is on a growth curve, projected to reach USD 33.53 billion by the end of 2029 in comparison to the estimated USD 24.93 billion in 2024, at a steady CAGR of 6.1% within the forecast period of 2024 to 2029. This continuous growth in the gas insulated switchgear market is closely associated with the incremental increase in global energy demand due to the increased consumption of energy within the recent years and forms the primary catalyst for the rise in the surge of electricity demand. Among the major drivers, the industrial sector is poised to be the biggest driver of the increased demand, although the commercial, service, and residential sectors also play major significant contributions. The vigorous demand for energy sources creates fluctuations of energy supply and demand, bringing about changes in prices in the energy market. This price variability is mainly due to a combination of factors, such as the presence of good economic conditions, enough energy resources, and increased electrical power consumption. Also, there is the concern for energy management focusing on ways in order to properly manage the scenarios found, especially in the development of the Internet of Things (IoT) home and building automation applications. Hence, these factors highlight the urgent demand for gas-insulated switchgear that would facilitate monitoring and optimization of energy usage.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) and Volume (Units) |

| Segments | Gas-Insulated Switchgear Market by installation, insulation type, configuration, voltage rating, and end- user |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa and South America |

Sulfur hexafluoride (SF6) gas is placed in gas-tight metallic enclosures, where it acts as both an insulating and arc-quenching medium for all components carrying electrical current inside GIS substations. SF6 is non-flammable and does not deteriorate because it is a dry, inert gas. However, SF6 is fluorinated gases and classified as "greenhouse gases" (GHGs) with the highest potential for fueling global warming among all GHGs. Decreased SF6 emissions will hence affect how the Environmental Protection Agency of the United States examines SF6 in that country. This will lead to even stricter restrictions on SF6 use. Most of the regulations that may be applied to SF6 use are concerning the family of chemically similar fluorinated gases known as F-gases. More pronounced stringent regulations of F-gas will have a greater effect on SF6 usage, thereby affecting the market for gas-insulated switchgear.

"16 to 27 kV segment, by voltage rating, to be fastest growing market from 2024 to 2029."

In the electrical infrastructure, GIS with a voltage rating of 16 to 27 kV has been popularized both in the distribution and industrial environment for their compact design, reliable performance, and minimum maintenance requirement. In addition, the increasing environmental concerns about sulfur hexafluoride (SF6), which is the insulator typically used, have garnered significant study over sustainable and more environmentally friendly alternatives for insulation, thus representing a growing industry tendency toward green GIS technology. In addition, according to the International Energy Agency, global energy consumption rose by an impressive 4.6% in 2022. These developments have induced extensive investment in the transmission infrastructure: India, China, the UAE, and Argentina are a few emerging economic giants driving such initiatives. This throws open wide prospects for the growth and consolidation of the market for gas-insulated switchgear in this particular sector.

"SF6 segment, by insulation type, to be the largest market from 2024 to 2029."

Gas-insulated switchgear (GIS) uses sulfur hexafluoride (SF6) gas, which is a dielectric at moderate pressure, for insulation among phases as well as to the ground. All the high-voltage units such as conductors, circuit breaker, switches, voltage transformers, and current transformers are fitted within a metal casing that is full of SF6 gas. SF6-filled GIS systems have an enormous advantage in space-constrained environments where air-insulated systems would have delivered similar insulating attributes in much greater volume. SF6 is a non-toxic, inert, colorless, tasteless, odorless, and non-flammable gas with superior insulating and arcinterruption properties, making it the preferred choice for modern high-voltage circuit interruption, replacing older mediums like oil and air.

"Asia Pacific to be largest and fastest growing region in gas insulated switchgear market."

The Asia Pacific is expected to lead the global market for gas insulated switchgear and is expected to achieve the highest Compound Annual Growth Rate (CAGR) in this region during 2023-2028. This can be attributed to the strong economic development and rapid growth of big Asian economies. Gas insulated switchgear is primarily used among the following end-users: industrial, commercial & institutional, electrical utilities, data centers and aftermarkets. The manufacturing sector in this region is expected to continue its market growth due to lower capital and labor costs. With the increased population both in China and India, the electricity generation requirement is escalating. Clean energy sources are widely adopted to efficiently meet the region's expanding energy requirements. These nations are actively modernizing their aging infrastructure to facilitate the integration of renewable energy sources into the national grid. Subsequently, the demand for gas insulated switchgear for electrical regulation and fault protection is expected to experience rapid growth is pushing the gas insulated switchgear market in Asia Pacific.

Breakdown of Primaries:

In-depth interviews with key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, were conducted to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The primary interviews were distributed as follows:

By Company Type: Tier 1-30%, Tier 2-55%, and Tier 3-15%

By Designation: C-Level-30%, D-Level-20%, and Others-50%

By Region: North America-18%, Europe-8%, Asia Pacific-60%, Middle East & Africa-10%, and South America-4%

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2023: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

The gas insulated switchgear market is largely dominated by well established global players. Major industrial control transformer market participants are ABB (Switzerland), Siemens (Germany), General Electric (US), Schneider Electric (France), Eaton (Ireland), Mitsubishi Electric (Japan), Nissin Electric (Japan), CG Power and Industrial Solutions (India), Fuji Electric (Japan), Powell Industries (US), Hyundai Electric & Energy Systems (South Korea), Hitachi (Japan), and many others.

Research Coverage:

The report provides a comprehensive definition, description, and forecast of the gas insulated switchgear market based on various parameters, including Insulation Type (SF6, SF6 Free), Installation (Indoor, Outdoor), Voltage Rating (Up to 5 kV, 6 to 15 kV, 16 to 27 kV, 28 to 40.5 kV, 40.6 to 73 kV, 74 to 220 kV, Above 220 kV), Configuration (Hybrid, Compact GIS, Integrated Three Phase, Isolated Phase), End-User (Industrial, Commercial & Institutional, Electrical Utilities, Data Centers, Aftermarket), and region (Asia Pacific, North America, Europe, Middle East and Africa, South America). The report provides an in-depth qualitative and quantitative analysis of the gas insulated switchgear market, including detailed thoroughness about the important market drivers, limitations, opportunities, and challenges. It also includes critical elements of the market like a competitive landscape study, market dynamics analysis, value-based market estimates, and future trends of the gas insulated switchgear market.

Key Benefits of Buying the Report

The report has been well-thought out to assist established industry leaders as well as newcomers who are emerging in the gas insulated switchgear market. It offers reliable revenue forecasts for the overall market and its individual sub-segments. This data is helpful for stakeholders as it allows them to gain a comprehensive understanding of the competitive landscape and go on to formulate effective market strategies for the businesses they are involved with. The report also acts as a medium of expression for the stakeholders to understand the prevailing market state. This is achieved by relating the market through the manifest insights that underline market drivers, limitations, challenges, and opportunities for growth. By embedding these insights, stakeholders make well-informed choices and remain updated about the evolving gas insulated switchgear industry dynamics.

- Analysis of key drivers (Adoption of SF6-free solutions, Transition toward Renewable Energy, Enhanced electrical safety and efficiency offered by gas insulated switchgear), restraints (High Procurement Costs affecting the growth of the gas-insulated switchgear, Regulatory restrictions on SF6 gas emissions), opportunities (Increasing urbanization and industrialization, Expansion of Smart Grid Networks), and challenges (Operational Challenges Associated with Gas Insulated Switchgear, Competition from the Unorganized Sector) influencing the growth of the gas insulated switchgear market.

- Product Development/ Innovation: The gas insulated switchgear market is in a constant state of evolution, with a major focus on product development and innovation. Some major industry players such as ABB, Siemens, Schneider Electric, and General Electric are moving ahead with a focus on broadening their product offerings to satisfy changing demands and environmental considerations. With growing environmental concerns related to sulfur hexafluoride (SF6), big strides in research and development are being implemented to usher in the creation and deployment of SF6-free alternatives. The aim is to retain all the performance aspects of SF6 while mitigating its adverse environmental footprint. There is also a marked trend toward increasing the 'intelligence' of gas insulated switchgear by using digital technology and IoT. It will integrate into complete remote monitoring, diagnostics, and even predictive maintenance. All these developments will take the reliability and efficiency to new levels in the equipment. Some other important developments in the market are hybrid gas insulated switchgears. Such switchgears combine the advantages of both gas and solid insulation. This offers an innovative solution toward higher reliability while simultaneously reducing environmental impact.

- Market Development: The gas insulated switchgear market is witnessing tremendous growth and evolution under the impetus of different factors. The thirst for electricity, primarily to satisfy global energy consumption trends, has led to the increasing renewable energy capacity; this has necessitated efficient and reliable distribution power solutions, where gas insulated switchgear is a clear favorite. It is compact in size and has fewer maintenance requirements, making it a more desirable choice for applications in constrained spaces. Besides, the eco-friendly types of insulating gases are increasing rapidly while trying to overcome the environmental issues created by sulfur hexafluoride (SF6). Moreover, the growth in the transmission infrastructure, especially in fast-developing economies, where enormous generation, distribution, and integration of clean energy sources are required to power escalated electricity needs. This market is poised for significant growth, especially in the Asia Pacific region, and is also responsive to new trends in energy as well as environmental issues.

- Market Diversification: As there are many diversifying factors, the gas insulated switchgear market is highly diversified. The market players are now focusing on developing and adopting environment-friendly, SF6-free insulation alternatives for environmental concerns. Thus, the market is diversifying across various kinds of insulations, ranging from traditional SF6 types to newer, emerging SF6-free options. Also, there is installation diversity as both indoor and outdoor GIS systems are establishing an increasing presence to cater to diverse application requirements. Voltage ratings are expanding to meet the range of diverse electrical infrastructure requirements. Configuration choices, such as hybrid, compact GIS, and isolated phase designs, offer end users diversity. This further diversification across the various end-user sectors-from industrial to commercial, institutional, electrical utilities, data centers, and aftermarket-strongly reflects the widespread utility of gas-insulated switchgear across divergent industries. Market diversification reflects industry efforts in response to evolving demands, sustainability objectives, and technological advancements.

- Competitive Assessment: A detailed analysis was carried out to examine the market penetration, growth patterns, and service offering of major players in the gas-insulated switchgear market. Key companies involved are: Eaton (Ireland), ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Hitachi Ltd. (Japan), and many more. This analysis provides in-depth insights into the competitive position of the major players, approaches they apply to drive market growth, and services offered within the gas insulated switchgear segment.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.3.1 Gas-insulated switchgear market: Inclusions and exclusions, by installation

- 1.3.3.2 Gas-insulated switchgear market: Inclusions and exclusions, by insulation type

- 1.3.3.3 Gas-insulated switchgear market: Inclusions and exclusions, by voltage rating

- 1.3.3.4 Gas-insulated switchgear market: Inclusions and exclusions, by configuration

- 1.3.3.5 Gas-insulated switchgear market: Inclusions and exclusions, by end user

- 1.3.3.6 Gas-insulated switchgear market: Inclusions and exclusions, by region

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GAS-INSULATED SWITCHGEAR MARKET

- 4.2 GAS-INSULATED SWITCHGEAR MARKET, BY REGION

- 4.3 GAS-INSULATED SWITCHGEAR MARKET IN ASIA PACIFIC, BY INSTALLATION AND COUNTRY, 2023

- 4.4 GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION

- 4.5 GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE

- 4.6 GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING

- 4.7 GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION

- 4.8 GAS-INSULATED SWITCHGEAR MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of SF6-free solutions

- 5.2.1.2 Transition toward renewable energy

- 5.2.1.3 Enhanced electrical safety and efficiency

- 5.2.2 RESTRAINTS

- 5.2.2.1 High procurement costs

- 5.2.2.2 Regulatory restrictions on SF6 gas emissions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing urbanization and industrialization

- 5.2.3.2 Expansion of smart grid networks

- 5.2.4 CHALLENGES

- 5.2.4.1 Operational challenges associated with gas-insulated switchgear

- 5.2.4.2 Competition from unorganized sector

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.4.2 COMPONENT MANUFACTURERS

- 5.4.3 GAS-INSULATED SWITCHGEAR MANUFACTURERS/ASSEMBLERS

- 5.4.4 DISTRIBUTORS

- 5.4.5 POST-SALE SERVICES

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 SF6-free technology

- 5.6.1.2 Digital monitoring and control systems

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Modular switchgear

- 5.6.1 KEY TECHNOLOGIES

- 5.7 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.8 ECOSYSTEM MAPPING

- 5.9 PATENT ANALYSIS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 NORTHERN POWERGRID COMPANY USES ABB'S SF6-FREE SWITCHGEAR FOR ELECTRICAL NETWORK

- 5.10.2 RETROFITTING IMPROVES PERFORMANCE AND MONITORING CAPABILITIES

- 5.10.3 SCHNEIDER ELECTRIC DEVELOPS SF6-FREE GREEN GIS SOLUTIONS

- 5.10.4 220 KV GIS DESIGN FOR GENERATION PLANT IN ULAANBAATAR, MONGOLIA

- 5.11 TRADE ANALYSIS

- 5.11.1 TRADE ANALYSIS OF ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS WITH VOLTAGE EXCEEDING 1,000 VOLTS

- 5.11.1.1 Import scenario

- 5.11.1.2 Export scenario

- 5.11.2 TRADE ANALYSIS RELATED TO ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS WITH VOLTAGE LOWER THAN 1,000 VOLTS

- 5.11.2.1 Import scenario

- 5.11.2.2 Export scenario

- 5.11.1 TRADE ANALYSIS OF ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS WITH VOLTAGE EXCEEDING 1,000 VOLTS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.12.2 INDICATIVE PRICING ANALYSIS, BY VOLTAGE RATING

- 5.13 TARIFFS AND REGULATORY LANDSCAPE

- 5.13.1 TARIFFS RELATED TO GAS-INSULATED SWITCHGEAR

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 CODES AND REGULATIONS RELATED TO GAS-INSULATED SWITCHGEAR

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GENERATIVE AI/AI IN GAS-INSULATED SWITCHGEAR MARKET

- 5.16.1 ADOPTION OF GENERATIVE AI/AI APPLICATIONS IN GAS-INSULATED SWITCHGEAR MARKET

- 5.16.2 IMPACT OF GENERATIVE AI/AI BY END USER

- 5.16.3 IMPACT OF AI IN GAS-INSULATED SWITCHGEAR MARKET, BY REGION

- 5.17 MACROECONOMIC OUTLOOK FOR GAS-INSULATED SWITCHGEAR MARKET

6 GAS-INSULATED SWITCHGEAR MARKET, BY CONFIGURATION

- 6.1 INTRODUCTION

- 6.2 HYBRID

- 6.2.1 SUSTAINABLE POWER TRANSMISSION TO BOOST SEGMENT

- 6.3 ISOLATED-PHASE

- 6.3.1 REDUCTION IN ELECTRICAL LOSSES - KEY DRIVER

- 6.4 INTEGRATED THREE-PHASE

- 6.4.1 RENEWABLE ENERGY INTEGRATION TO DRIVE SEGMENT

- 6.5 COMPACT GIS

- 6.5.1 DEMAND FOR SPACE-EFFICIENT, RELIABLE, AND HIGH-PERFORMANCE SOLUTIONS TO BOOST SEGMENT

7 GAS-INSULATED SWITCHGEAR MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 INDUSTRIAL

- 7.2.1 PROCESS

- 7.2.1.1 Energy efficiency in high-demand process industries to boost segment

- 7.2.2 DISCRETE

- 7.2.2.1 Precision in automotive assembly to drive segment

- 7.2.3 OIL & GAS

- 7.2.3.1 Facilitation of hybrid energy systems in oilfields to boost growth

- 7.2.4 OTHER INDUSTRIAL END USERS

- 7.2.1 PROCESS

- 7.3 COMMERCIAL & INSTITUTIONAL

- 7.3.1 COMMERCIAL

- 7.3.1.1 Reliable power supply for high-demand commercial facilities to fuel segment

- 7.3.2 INSTITUTIONAL

- 7.3.2.1 Centralized power management for large educational campuses - key driver

- 7.3.3 INFRASTRUCTURE

- 7.3.3.1 Enhancement of Smart City utilities with compact GIS to drive segment

- 7.3.4 GOVERNMENT

- 7.3.4.1 Use of smart utilities in public sector projects to boost demand

- 7.3.1 COMMERCIAL

- 7.4 ELECTRICAL UTILITIES

- 7.4.1 GENERATION

- 7.4.1.1 Renewable energy integration in power plants to boost segment growth

- 7.4.2 TRANSMISSION & DISTRIBUTION

- 7.4.2.1 Minimal energy loss in long-distance transmission to fuel growth

- 7.4.1 GENERATION

- 7.5 DATA CENTERS

- 7.5.1 NON-HYPERSCALE

- 7.5.1.1 Help overcome regulatory challenges

- 7.5.2 HYPERSCALE

- 7.5.2.1 Offer advanced monitoring capabilities

- 7.5.1 NON-HYPERSCALE

- 7.6 AFTERMARKET

- 7.6.1 ENSURES LONG-TERM PERFORMANCE OF SYSTEMS

8 GAS-INSULATED SWITCHGEAR MARKET, BY INSTALLATION

- 8.1 INTRODUCTION

- 8.2 INDOOR

- 8.2.1 SUSTAINABLE ENERGY INTEGRATION TO BOOST DEMAND

- 8.3 OUTDOOR

- 8.3.1 INCREASING APPLICATION IN SUBSTATIONS AND SWITCHYARDS TO PROPEL GROWTH

9 GAS-INSULATED SWITCHGEAR MARKET, BY INSULATION TYPE

- 9.1 INTRODUCTION

- 9.2 SF6

- 9.2.1 OPERATIONAL BENEFITS IN POWER TRANSMISSION AND DISTRIBUTION TO BOOST SEGMENT

- 9.3 SF6-FREE

- 9.3.1 GROWING AWARENESS FOR ADOPTION IN UTILITIES TO DRIVE SEGMENT

10 GAS-INSULATED SWITCHGEAR MARKET, BY VOLTAGE RATING

- 10.1 INTRODUCTION

- 10.2 UP TO 5 KV

- 10.2.1 WIDE-SCALE ADOPTION IN URBAN INFRASTRUCTURE PROJECTS TO FUEL GROWTH

- 10.3 6 TO 15 KV

- 10.3.1 PLAY CRUCIAL ROLE IN UTILITY SUBSTATION MODERNIZATION

- 10.4 16 TO 27 KV

- 10.4.1 INTEGRATION WITH RENEWABLE ENERGY FOR EFFICIENT GRID CONNECTION - KEY DRIVER

- 10.5 28 TO 40.5 KV

- 10.5.1 ADAPTABILITY TO HARSH ENVIRONMENTAL CONDITIONS TO BOOST SEGMENT

- 10.6 40.6 TO 73 KV

- 10.6.1 SEGMENT DRIVEN BY ENHANCED OPERATIONAL SAFETY IN HIGH-VOLTAGE SYSTEMS

- 10.7 74 TO 220 KV

- 10.7.1 INTEGRATION OF RENEWABLE ENERGY WITH HIGH-VOLTAGE GIS TO BOOST MARKET

- 10.8 ABOVE 220 KV

- 10.8.1 MINIMAL ENERGY LOSS IN LONG-DISTANCE POWER TRANSMISSION

11 GAS-INSULATED SWITCHGEAR MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 BY INSTALLATION

- 11.2.2 BY INSULATION TYPE

- 11.2.3 BY VOLTAGE RATING

- 11.2.4 BY CONFIGURATION

- 11.2.5 BY END USER

- 11.2.6 BY COUNTRY

- 11.2.6.1 China

- 11.2.6.1.1 Expansion of charging infrastructure to boost market

- 11.2.6.2 India

- 11.2.6.2.1 Scaling of renewable energy with GIS-integrated smart grids to drive market

- 11.2.6.3 Japan

- 11.2.6.3.1 Critical enabler of smart community projects and energy storage solutions

- 11.2.6.4 South Korea

- 11.2.6.4.1 Transition to low-carbon economy to drive market

- 11.2.6.5 Australia

- 11.2.6.5.1 Modernization of aging energy infrastructure to boost market

- 11.2.6.6 Rest of Asia Pacific

- 11.2.6.1 China

- 11.3 EUROPE

- 11.3.1 BY INSTALLATION

- 11.3.2 BY INSULATION TYPE

- 11.3.3 BY VOLTAGE RATING

- 11.3.4 BY CONFIGURATION

- 11.3.5 BY END USER

- 11.3.6 BY COUNTRY

- 11.3.6.1 Germany

- 11.3.6.1.1 Energy transition efforts to drive market

- 11.3.6.2 UK

- 11.3.6.2.1 Urban development projects and government infrastructure initiatives to boost market

- 11.3.6.3 Italy

- 11.3.6.3.1 Market driven by growing industrial sector

- 11.3.6.4 Spain

- 11.3.6.4.1 Utilization of GIS for energy transition to generate demand

- 11.3.6.5 France

- 11.3.6.5.1 Energy transition and industrial modernization - key drivers

- 11.3.6.6 Rest of Europe

- 11.3.6.1 Germany

- 11.4 MIDDLE EAST & AFRICA

- 11.4.1 BY INSTALLATION

- 11.4.2 BY INSULATION TYPE

- 11.4.3 BY VOLTAGE RATING

- 11.4.4 BY CONFIGURATION

- 11.4.5 BY END USER

- 11.4.6 BY COUNTRY

- 11.4.6.1 GCC

- 11.4.6.1.1 Saudi Arabia

- 11.4.6.1.1.1 Increased adoption in public and private sectors to boost market

- 11.4.6.1.2 UAE

- 11.4.6.1.2.1 Rapid growth in commercial and institutional projects boost demand

- 11.4.6.1.3 Kuwait

- 11.4.6.1.3.1 Need for reliable, space-efficient power distribution systems to drive demand

- 11.4.6.1.4 Rest of GCC

- 11.4.6.1.1 Saudi Arabia

- 11.4.6.2 South Africa

- 11.4.6.2.1 Rise in number of power generation projects to boost market

- 11.4.6.3 Rest of Middle East & Africa

- 11.4.6.1 GCC

- 11.5 NORTH AMERICA

- 11.5.1 BY INSTALLATION

- 11.5.2 BY INSULATION TYPE

- 11.5.3 BY VOLTAGE RATING

- 11.5.4 BY CONFIGURATION

- 11.5.5 BY END USER

- 11.5.6 BY COUNTRY

- 11.5.6.1 US

- 11.5.6.1.1 Modernization of power grid to boost market

- 11.5.6.2 Canada

- 11.5.6.2.1 Infrastructure upgrades across major cities to drive market

- 11.5.6.3 Mexico

- 11.5.6.3.1 Government initiatives to develop urban centers with GIS to boost growth

- 11.5.6.1 US

- 11.6 SOUTH AMERICA

- 11.6.1 BY INSTALLATION

- 11.6.2 BY INSULATION TYPE

- 11.6.3 BY VOLTAGE RATING

- 11.6.4 BY CONFIGURATION

- 11.6.5 BY END USER

- 11.6.6 BY COUNTRY

- 11.6.6.1 Brazil

- 11.6.6.1.1 Sustainability and carbon reduction goals to boost market

- 11.6.6.2 Argentina

- 11.6.6.2.1 Focus on expansion of electricity grid to drive market

- 11.6.6.3 Rest of South America

- 11.6.6.1 Brazil

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 MARKET SHARE ANALYSIS, 2023

- 12.4 REVENUE ANALYSIS, 2019-2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 PRODUCT TYPE-/GEOGRAPHIC PRESENCE-WISE COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Installation footprint

- 12.7.5.4 Insulation type footprint

- 12.7.5.5 Configuration type footprint

- 12.7.5.6 Voltage rating footprint

- 12.7.5.7 End user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABB

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.3.4 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 SCHNEIDER ELECTRIC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 HITACHI, LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 SIEMENS

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 EATON

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 GENERAL ELECTRIC COMPANY

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Other developments

- 13.1.6.3.4 Expansions

- 13.1.7 MITSUBISHI ELECTRIC CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.8 HD HYUNDAI ELECTRIC CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 FUJI ELECTRIC CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Expansions

- 13.1.9.3.2 Other developments

- 13.1.10 CG POWER AND INDUSTRIAL SOLUTIONS LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 NISSIN ELECTRIC CO., LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Expansions

- 13.1.12 MEIDENSHA CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 POWELL INDUSTRIES

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 HYOSUNG HEAVY INDUSTRIES

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.15 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Other developments

- 13.1.15.3.2 Expansions

- 13.1.16 G&W ELECTRIC

- 13.1.16.1 Products/Solutions/Services offered

- 13.1.16.2 Recent developments

- 13.1.16.2.1 Deals

- 13.1.17 HENAN PINGGAO ELECTRIC CO., LTD.

- 13.1.17.1 Products/Solutions/Services offered

- 13.1.18 XIAN XD SWITCHGEAR ELECTRIC CO., LTD

- 13.1.18.1 Products/Solutions/Services offered

- 13.1.19 SWITCHGEAR COMPANY

- 13.1.19.1 Products/Solutions/Services offered

- 13.1.20 SIEYUAN ELECTRIC CO., LTD.

- 13.1.20.1 Products/Solutions/Services offered

- 13.1.1 ABB

- 13.2 OTHER PLAYERS

- 13.2.1 ELECKTROBUDOWA SP. Z O.O.

- 13.2.2 CHINT GROUP

- 13.2.3 SEL S.P.A.

- 13.2.4 ILJIN ELECTRIC

- 13.2.5 ZHEJIANG VOLCANO ELECTRICAL TECHNOLOGY CO., LTD

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS