|

|

市場調査レポート

商品コード

1384222

食品診断の世界市場:タイプ別、検査タイプ別、検査部位別、検査対象食品別、地域別-2028年までの予測Food Diagnostics Market by Type (Systems, Test Kits, and Consumables), Testing Type (Safety and Quality), Site (Outsourcing Facility and Inhouse), Food Tested (Meat, Poultry & Seafood, Dairy Products, Processed Food) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 食品診断の世界市場:タイプ別、検査タイプ別、検査部位別、検査対象食品別、地域別-2028年までの予測 |

|

出版日: 2023年11月01日

発行: MarketsandMarkets

ページ情報: 英文 408 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 対象単位 | 金額(米ドル)、数量(キロトン) |

| セグメント別 | タイプ別、検査タイプ別、検査部位別、検査対象食品別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、アフリカ、中東 |

世界の食品診断の市場規模は、2023年に162億米ドルになるとみられ、2028年には235億米ドルに達すると予測されており、予測期間中のCAGRは7.7%と見込まれています。

食品診断市場は、世界の食品安全への懸念につながっている食中毒やアウトブレイクの増加によって牽引されています。食中毒の発生は、汚染された食品の摂取に伴うリスクに対する意識を高めます。こうした集団発生に対応して、食品中の病原体や汚染物質を特定するための検査に対する需要が高まっています。政府や規制機関は、食中毒の発生に対して、より厳格な食品安全規制や要件を実施することで対応することが多いです。こうした規制には、食品のより厳格な検査とモニタリングが含まれる場合があります。食品企業は、こうした規制を遵守するために高度な診断ツールや技術に投資する必要があり、それによって食品診断市場が活性化しています。

食品診断におけるシステムとは、リアルタイムモニタリングが可能なさまざまなシステムによる微生物学的、化学的、物理的分析を指し、このように多様な検査を実施できるため、食品の安全性と品質保証に不可欠なものとなっています。システムには、ハイブリダイゼーションベース、クロマトグラフィベース、スペクトロメトリベース、イムノアッセイベース、バイオセンサー、その他多くのシステムがあります。クロマトグラフィは、食品サンプル中の農薬、マイコトキシン、重金属、食品添加物などの汚染物質を検出し、定量することができます。これは食品の安全性を確保し、規制基準を遵守するために不可欠です。また、アレルゲン化合物の検出や食品の栄養成分の測定にも使用されます。食品診断における高度なシステムの使用は、規制遵守を保証するだけでなく、透明性と食品の安全性が最も重要な関心事である時代において、消費者の信頼を醸成します。

食品診断は、製品の安全性、品質、真正性を確保するために、食肉、鶏肉、水産物産業において不可欠です。これらの産業は、製品の腐敗しやすい性質と汚染の可能性により、独自の課題に直面しています。食品診断学は、食肉、鶏肉、水産物からサルモネラ菌、大腸菌、リステリア菌、カンピロバクターなどの病原体を検出・定量するために用いられます。これらの検査は、食中毒を予防し、製品が安全基準を満たしていることを確認するのに役立ちます。食肉、鶏肉、魚介類の各企業は、製品の品質をモニターし、製品が味、食感、鮮度に関する望ましい仕様に適合していることを確認するために診断法を使用しています。また、腐敗菌、酸化、微生物活性などの要因をモニタリングすることで、食肉、鶏肉、水産物製品の保存期間を決定するのにも役立ちます。魚介類の不正は重要な問題であり、診断技術は魚介類の正確な種類を確認するために使用され、効果的に不当表示を防止し、製品の真正性を維持します。

欧州、特に欧州連合(EU)は、非常に厳しい食品安全規制を維持しています。これらの規制は、食品が厳格な安全・品質基準に適合していることを確認するために、集中的な検査と監視を義務付けています。その結果、規制遵守のための食品診断キットに対する大きな需要が生じています。欧州の食品サプライ・チェーンは、世界各地から供給される製品を包含する複雑さと世界化が顕著です。この複雑さゆえに、潜在的な汚染物質、アレルゲン、偽装表示を追跡・管理するための綿密な検査手順が必要となります。

当レポートでは、世界の食品診断市場について調査し、タイプ別、検査タイプ別、検査部位別、検査対象食品別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

第6章 業界の動向

- イントロダクション

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- マーケットマッピング

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 価格分析

- 規制の枠組み

- 北米:規制

- 欧州

- アジア太平洋

- その他の地域

- 主要な利害関係者と購入基準

- 2023年~2024年の主要な会議とイベント

第7章 食品診断市場、検査部位別

- イントロダクション

- インハウス

- アウトソーシング施設

第8章 食品診断市場、タイプ別

- イントロダクション

- システム

- テストキット

- 消耗品

第9章 食品診断市場、検査対象食品別

- イントロダクション

- 肉、鶏肉、魚介類

- 乳製品

- 加工食品

- 果物、野菜

- シリアル、穀物、豆類

- ナッツ、種子、スパイス

- その他

第10章 食品診断市場、検査タイプ別

- イントロダクション

- 品質

- 安全性

第11章 食品診断市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 市場シェア分析

- 主要企業のセグメント別収益分析

- 主要企業の年間収益VS.成長

- 主要企業のEBIT/EBITDA

- 主要参入企業の戦略/有力企業

- 主要な市場参入企業の世界スナップショット

- 主要企業の評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- THERMO FISHER SCIENTIFIC INC.

- BIO-RAD LABORATORIES, INC.

- MERCK KGAA

- NEOGEN CORPORATION

- SHIMADZU CORPORATION

- BIOMERIEUX

- AGILENT TECHNOLOGIES, INC.

- QIAGEN

- BRUKER

- DANAHER

- PERKINELMER INC.

- FOSS

- HYGIENA LLC

- R-BIOPHARM AG

- ROMER LABS DIVISION HOLDING

- スタートアップ/中小企業

- ENVIROLOGIX

- RANDOX FOOD DIAGNOSTICS

- PROMEGA CORPORATION

- PATHOGENDX CORPORATION

- ROKA BIO SCIENCE

- GOLD STANDARD DIAGNOSTICS

- CLEAR LABS, INC.

- RING BIOTECHNOLOGY CO LTD.

- NEMIS TECHNOLOGIES AG

- BIOREX FOOD DIAGNOSTICS

第14章 隣接市場および関連市場

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD), Volume (KT) |

| Segments | By Type, By Testing Type, By Site, By Food Tested, and By Region |

| Regions covered | North America, Europe, Asia Pacific, South America, Africa, and Middle East |

The global market for food diagnostics is estimated to be valued at USD 16.2 Billion in 2023 and is projected to reach USD 23.5 Billion by 2028, at a CAGR of 7.7% during the forecast period. The food diagnostic market is driven by the increasing number of foodborne illnesses and outbreaks, which has led to global food safety concerns. Foodborne illness outbreaks raise awareness about the risks associated with consuming contaminated food. In response to these outbreaks, there is an increased demand for testing to identify pathogens and contaminants in food products. Governments and regulatory bodies often respond to foodborne illness outbreaks by implementing stricter food safety regulations and requirements. These regulations may include more rigorous testing and monitoring of food products. Food companies must invest in advanced diagnostic tools and technologies to comply with these regulations, thereby boosting the food diagnostics market.

"By type, the systems segment is estimated to be growing at a significant CAGR of 7.9% in the food diagnostics market."

Systems in food diagnostics refer to microbiological, chemical, and physical analyses through different systems with real-time monitoring and can perform this diverse range of tests, thus becoming indispensable for the safety and quality assurance of food products. The systems can be hybridization-based, chromatography-based, spectrometry-based, immunoassay-based, biosensors, and many other systems. Chromatography can detect and quantify contaminants like pesticides, mycotoxins, heavy metals, and food additives in food samples. This is essential for ensuring food safety and compliance with regulatory standards. It is also used for the detection of allergenic compounds, and for determining the nutritional content of food. The use of advanced systems in food diagnostics not only ensures regulatory compliance but also fosters consumer trust in an era where transparency and food safety are paramount concerns.

"By food tested, the meat, poultry, and seafood segment is anticipated to be growing at a significant CAGR of 8.5% during the forecast period in the food diagnostics market."

Food diagnostics are essential in the meat, poultry, and seafood industry to ensure the safety, quality, and authenticity of products. These industries face unique challenges due to the perishable nature of their products and the potential for contamination. Food diagnostics are employed to detect and quantify pathogens such as Salmonella, E. coli, Listeria, and Campylobacter in meat, poultry, and seafood products. These tests help prevent foodborne illnesses and ensure that products meet safety standards. Meat, poultry, and seafood companies use diagnostics to monitor product quality, ensuring that the products meet desired specifications for taste, texture, and freshness. It also helps to determine the shelf life of meat, poultry, and seafood products by monitoring factors such as spoilage organisms, oxidation, and microbial activity. Seafood fraud is a significant issue, and diagnostic techniques are employed to ascertain the exact species of seafood, effectively preventing misrepresentation, and upholding the authenticity of the product.

"Among sites, the outsourcing facility segment is estimated to grow at a CAGR of 8.0% during the forecast period."

Outsourcing facilities frequently carry out regular testing across diverse parameters, encompassing microbiological, chemical, and physical aspects of food items. This can include the identification of pathogens, allergen screening, nutritional analysis, and more, and thus dominate the food diagnostics market. They provide advanced analytical services utilizing cutting-edge tools and methodologies, such as mass spectrometry, chromatography, and DNA sequencing. These services are instrumental in identifying contaminants, additives, and specific compounds present in food. These entities contribute to maintaining product quality and consistency by performing quality control tests. Their role is to ensure that food products meet defined standards and are devoid of defects or deviations. Outsourcing facilities often collaborate with food companies on research initiatives, aiding in the development and validation of new testing methods, the evaluation of product stability, and the execution of experiments to enhance food quality.

"Europe to grow at a significant CAGR during the forecast period in the food diagnostics market."

Europe, particularly the European Union (EU), upholds exceptionally stringent food safety regulations. These regulations mandate intensive testing and surveillance of food products to ensure their compliance with stringent safety and quality standards. Consequently, this has generated a substantial demand for food diagnostic kits for regulatory adherence. Europe's food supply chain is notably complex and globalized, encompassing products sourced from various parts of the world. This intricacy necessitates meticulous testing procedures to trace and manage potential contaminants, allergens, and deceptive labeling, all critical for safeguarding consumers.

The break-up of the profile of primary participants in the food diagnostics market:

- By Company: Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation: CXOs - 45%, Manager level - 30%, and C-Level- 25%

- By Region: North America - 34%, Europe -36%, Asia Pacific - 16%, South America - 8%, Africa - 4%, and Middle East - 2%

Major key players operating in the food diagnostics market include Bio-Rad Laboratories Inc. (US), Thermo Fisher Scientific Inc. (US), Shimadzu Corporation (Japan), Neogen Corporation (US), BioMerieux (France), Agilent Technologies Inc. (US), Merck KGaA (Germany), QIAGEN (Germany), Bruker (US), and Danaher (US).

Research Coverage:

This research report categorizes the food diagnostics market, by type (systems, test kits, and consumables), by test type (safety and quality), by site (outsourcing facility and inhouse), by food tested (Meat, Poultry, and Seafood, Dairy Products, Processed Food, Fruits & Vegetables, Cereals, Grains, and Pulses, Nuts, Seeds, and Spices and Other Food Tested), and region (North America, Europe, Asia Pacific, South America, Africa, and Middle East). The scope of this report encompasses a comprehensive examination of major factors, including drivers, restraints, challenges, and opportunities, that significantly influence the growth of the food diagnostics market. Extensive research has been conducted to analyze key industry players, offering valuable insights into their business overview, product offerings, key strategies, contracts, partnerships, new product launches, as well as mergers and acquisitions associated with the food diagnostics market. Furthermore, the report includes a competitive analysis of emerging startups in the food diagnostics market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall food diagnostics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing instances of foodborne illnesses, Initiatives by the regulatory bodies and governments to improve food safety across geographies, Increasing cases of food recalls), restraints (Lack of basic supporting infrastructure in developing countries), opportunities (Technological innovations in testing, Increased budget allocation and expenditure on food safety, Emerging economies to present high-growth opportunities), and challenges (High cost of rapid technologies (hybridization-based, spectrometry-based), Complexity in the quantification of test results, Standardization of testing protocols) influencing the growth of the food diagnostics market.

- New Product launch/Innovation: Detailed insights on research & development activities and new product launches in the food diagnostics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the food diagnostics market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the food diagnostics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Bio-Rad Laboratories Inc. (US), Thermo Fisher Scientific Inc. (US), Shimadzu Corporation (Japan), Neogen Corporation (US), BioMerieux (France), Agilent Technologies Inc. (US), Merck KGaA (Germany), QIAGEN (Germany), Bruker (US), and Danaher (US), and others in the food diagnostics market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- FIGURE 2 REGIONAL SEGMENTATION

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.5 YEARS CONSIDERED

- FIGURE 3 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.7 UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 FOOD DIAGNOSTICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 FOOD DIAGNOSTICS MARKET: BOTTOM-UP APPROACH

- FIGURE 6 FOOD DIAGNOSTICS MARKET: BOTTOM-UP APPROACH

- 2.2.2 FOOD DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- FIGURE 7 FOOD DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 MACROECONOMIC INDICATORS OF RECESSION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATE, 2012-2022

- FIGURE 11 GLOBAL GROSS DOMESTIC PRODUCT, 2012-2022 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON FOOD DIAGNOSTICS MARKET

- FIGURE 13 GLOBAL FOOD DIAGNOSTICS MARKET: CURRENT FORECAST VS. RECESSION IMPACT FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 FOOD DIAGNOSTICS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 14 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 FOOD DIAGNOSTICS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 FOOD DIAGNOSTICS MARKET, BY SITE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 FOOD DIAGNOSTICS MARKET, BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FOOD DIAGNOSTICS MARKET

- FIGURE 19 INCREASING INSTANCES OF FOODBORNE OUTBREAKS AND GLOBALIZATION OF FOOD TRADE TO DRIVE FOOD DIAGNOSTICS MARKET

- 4.2 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE AND KEY COUNTRY

- FIGURE 20 SYSTEMS SEGMENT AND GERMANY TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2022

- 4.3 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE

- FIGURE 21 SAFETY SEGMENT TO LEAD MARKET BY 2028

- 4.4 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED

- FIGURE 22 MEAT, POULTRY, AND SEAFOOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 FOOD DIAGNOSTICS MARKET, BY SITE

- FIGURE 23 OUTSOURCING FACILITY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 FOOD DIAGNOSTICS MARKET, BY TYPE AND REGION

- FIGURE 24 SYSTEMS SEGMENT AND EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.7 FOOD DIAGNOSTICS MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 25 US TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

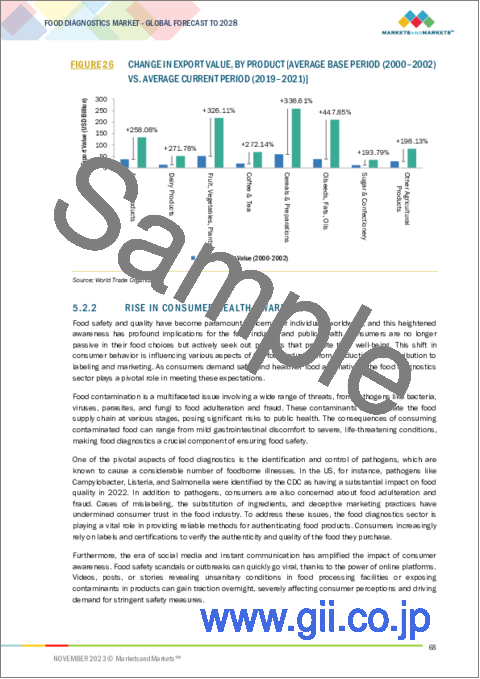

- 5.2.1 GLOBALIZATION OF FOOD TRADE

- FIGURE 26 CHANGE IN EXPORT VALUE, BY PRODUCT [AVERAGE BASE PERIOD (2000-2002) VS. AVERAGE CURRENT PERIOD (2019-2021)]

- 5.2.2 RISE IN CONSUMER HEALTH AWARENESS

- FIGURE 27 CONSUMER CHECKS FOR LABEL AND NUTRITIONAL INFORMATION PANEL (NIP) OF FOOD PRODUCTS (PERCENTAGE OF CONSUMERS), 2019

- 5.3 MARKET DYNAMICS

- FIGURE 28 FOOD DIAGNOSTICS MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in incidences of foodborne illnesses

- TABLE 3 US: FOODBORNE OUTBREAKS, 2021-2023

- 5.3.1.2 Initiatives by regulatory bodies and governments to improve food safety across regions

- 5.3.1.3 Increase in cases of food recalls

- FIGURE 29 AUSTRALIA: FOOD RECALLS COORDINATED BY FSANZ, 2013-2023

- 5.3.1.3.1 Food recalls in US

- FIGURE 30 US: FOOD RECALLS, 2013-2023

- 5.3.1.3.2 Growth in border rejection cases in Europe

- 5.3.2 RESTRAINTS

- 5.3.2.1 Lack of basic supporting infrastructure in emerging economies

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological innovations in testing

- 5.3.3.1.1 Demand for rapid test kits to rise for onsite testing

- 5.3.3.1.2 DNA-based test kits for pathogen testing

- 5.3.3.1.3 Multi-contaminant analyzing technology

- 5.3.3.2 Increase in budget allocation and expenditure on food safety

- 5.3.3.1 Technological innovations in testing

- FIGURE 31 USDA'S FSIS FEDERAL BUDGET FOR FOOD SAFETY, 2021-2023 (USD MILLION)

- 5.3.3.3 Growth in food trade and regulations to combat outbreaks in emerging economies

- 5.3.4 CHALLENGES

- 5.3.4.1 High cost of rapid technologies (hybridization-based, spectrometry-based)

- 5.3.4.1.1 Heavy duty on test kits

- 5.3.4.2 Complexity in quantification of test results

- 5.3.4.3 Standardization of testing protocols

- 5.3.4.1 High cost of rapid technologies (hybridization-based, spectrometry-based)

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 32 REVENUE SHIFT FOR FOOD DIAGNOSTICS MARKET

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 33 FOOD DIAGNOSTICS MARKET: VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIALS

- 6.3.2 FOOD MILLS

- 6.3.3 DISTRIBUTION

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 34 FOOD DIAGNOSTICS MARKET: SUPPLY CHAIN ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 UPCOMING TECHNOLOGIES IN FOOD DIAGNOSTICS MARKET

- 6.5.1.1 Microarray

- 6.5.1.2 Phages

- 6.5.1.3 Biochip

- 6.5.1.4 Biosensors

- 6.5.1.5 Flow Cytometry

- 6.5.1.6 NMR

- 6.5.1.7 NIRS

- 6.5.1.8 ICP

- 6.5.1 UPCOMING TECHNOLOGIES IN FOOD DIAGNOSTICS MARKET

- 6.6 MARKET MAPPING

- FIGURE 35 FOOD DIAGNOSTICS MARKET: ECOSYSTEM MAP

- FIGURE 36 FOOD DIAGNOSTICS MARKET: MARKET MAP

- TABLE 4 FOOD DIAGNOSTICS MARKET: ECOSYSTEM

- 6.7 TRADE ANALYSIS

- TABLE 5 TOP 10 EXPORTERS OF DIAGNOSTIC OR LABORATORY REAGENTS, 2022 (USD THOUSAND)

- TABLE 6 TOP 10 IMPORTERS OF DIAGNOSTIC OR LABORATORY REAGENTS, 2022 (USD THOUSAND)

- 6.8 PATENT ANALYSIS

- FIGURE 37 PATENTS GRANTED FOR FOOD DIAGNOSTICS MARKET, 2013-2022

- TABLE 7 KEY PATENTS ABOUT FOOD DIAGNOSTICS MARKET, 2021-2023

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 PORTER'S FIVE FORCES IMPACT ON FOOD DIAGNOSTICS MARKET

- 6.9.1 THREAT OF NEW ENTRANTS

- 6.9.2 THREAT OF SUBSTITUTES

- 6.9.3 BARGAINING POWER OF SUPPLIERS

- 6.9.4 BARGAINING POWER OF BUYERS

- 6.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.10 CASE STUDY ANALYSIS

- TABLE 9 BCN RESEARCH LABORATORIES IMPROVED PATHOGEN DETECTION WITH BIOMERIEUX'S GENE-UP

- TABLE 10 EUROFINS MICROBIOLOGY LABORATORY NETWORK IMPLEMENTED RHEONIX LISTERIA PATTERNALERT

- 6.11 PRICING ANALYSIS

- 6.11.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- FIGURE 39 AVERAGE SELLING PRICE OF KEY PLAYERS FOR FOOD DIAGNOSTIC TYPES

- 6.11.2 AVERAGE SELLING PRICE, BY TYPE

- TABLE 11 AVERAGE SELLING PRICES OF FOOD DIAGNOSTIC UNITS, BY TYPE, 2019-2023 (USD/UNIT)

- 6.11.3 AVERAGE SELLING PRICE, BY REGION

- TABLE 12 AVERAGE SELLING PRICES OF FOOD DIAGNOSTIC SYSTEMS, BY REGION, 2019-2023 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICES OF FOOD DIAGNOSTIC TEST KITS, BY REGION, 2019-2023 (USD/UNIT)

- TABLE 14 AVERAGE SELLING PRICES OF FOOD DIAGNOSTIC CONSUMABLES, BY REGION, 2019-2023 (USD/UNIT)

- 6.12 REGULATORY FRAMEWORK

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13 NORTH AMERICA: REGULATIONS

- 6.13.1 US REGULATIONS

- 6.13.1.1 Federal legislation

- 6.13.1.1.1 State Legislation

- 6.13.1.1.2 Food Safety in Retail Food

- 6.13.1.1.3 Food Safety in Trade

- 6.13.1.1.4 HACCP Regulation in US

- 6.13.1.1.5 US Regulations for Foodborne Pathogens in Poultry

- 6.13.1.1.6 Food Safety Regulations for Fruit & Vegetable Growers

- 6.13.1.1.7 GMO Regulations in US

- 6.13.1.1.8 FDA Food Safety Modernization Act (FSMA)

- 6.13.1.1.9 Labeling of GM Foods

- 6.13.1.1 Federal legislation

- TABLE 18 FEDERAL FOOD, DRUG, AND COSMETIC ACT, BY TOLERANCE OF RAW & PROCESSED FOOD

- 6.13.1.1.10 Regulatory Guidance by FDA for Aflatoxins

- TABLE 19 MAXIMUM ACCEPTED LEVELS OF AFLATOXIN, BY PRODUCT

- 6.13.1.1.11 Pesticide Regulations in US

- 6.13.2 CANADA

- 6.13.3 MEXICO

- TABLE 20 NORTH AMERICA: REGULATORY COMPLIANCE DATES

- 6.13.1 US REGULATIONS

- 6.14 EUROPE

- 6.14.1 EUROPEAN UNION REGULATIONS

- 6.14.1.1 Microbiological Criteria Regulation

- 6.14.1.2 Melamine Legislation

- TABLE 21 MAXIMUM LEVEL FOR MELAMINE & ITS STRUCTURAL ANALOGS

- 6.14.1.3 General Food Law for Food Safety

- 6.14.1.4 GMOs Regulation

- TABLE 22 GMOS: LABELING REQUIREMENT

- 6.14.1.5 Regulations on Toxins

- 6.14.1.5.1 Ochratoxin A

- 6.14.1.5 Regulations on Toxins

- TABLE 23 COMMISSION REGULATION FOR OCHRATOXIN A

- 6.14.1.5.2 Dioxin and PBCs

- 6.14.1.5.3 Fusarium Toxins

- 6.14.1.5.4 Aflatoxins

- 6.14.1.5.5 Polycyclic Aromatic Hydrocarbons (PAH)

- 6.14.2 GERMANY

- 6.14.3 UK

- 6.14.3.1 Mycotoxin Regulations in UK

- TABLE 24 MAXIMUM LEVELS OF MYCOTOXINS, BY FOODSTUFF

- 6.14.4 FRANCE

- 6.14.5 ITALY

- 6.14.6 POLAND

- 6.14.1 EUROPEAN UNION REGULATIONS

- 6.15 ASIA PACIFIC

- 6.15.1 CHINA

- 6.15.1.1 Regulating Bodies for Food Safety in China

- 6.15.1.2 Major Efforts of China to Standardize its Food Safety System

- 6.15.2 JAPAN

- 6.15.3 INDIA

- 6.15.3.1 Food Safety Standards Amendment Regulations, 2012

- 6.15.3.2 Food Safety and Standards Amendment Regulations, 2011

- 6.15.3.3 Food Safety and Standards Act, 2006

- 6.15.4 AUSTRALIA

- 6.15.4.1 Food Standards Australia and New Zealand

- 6.15.5 NEW ZEALAND

- 6.15.5.1 GMO Labeling Regulation in Asia Pacific

- TABLE 25 GMOS LABELING IN ASIA PACIFIC COUNTRIES

- 6.15.6 INDONESIA

- 6.15.6.1 General Law for Food Safety

- 6.15.7 REGULATIONS ON PESTICIDES

- 6.15.8 REGULATIONS ON MYCOTOXINS IN FOOD

- 6.15.9 CHEMICAL CONTAMINANTS

- 6.15.10 GENETICALLY ENGINEERED FOODS

- 6.15.11 REGULATIONS ON ALLERGEN LABELING IN FOOD

- 6.15.1 CHINA

- 6.16 REST OF THE WORLD

- 6.16.1 SOUTH AFRICA

- 6.16.1.1 International vs. Local Standards & Legislations

- 6.16.1.2 Private Standards in South Africa & Requirements for Product Testing

- 6.16.2 BRAZIL

- 6.16.2.1 Ministry of Agriculture, Livestock, and Food Supply (MAPA)

- 6.16.2.2 Ministry of Health (MS)

- 6.16.3 ARGENTINA

- 6.16.1 SOUTH AFRICA

- 6.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD DIAGNOSTIC TYPES

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD DIAGNOSTICS TYPES

- 6.17.2 BUYING CRITERIA

- TABLE 27 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 41 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- 6.18 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 28 FOOD DIAGNOSTICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

7 FOOD DIAGNOSTICS MARKET, BY SITE

- 7.1 INTRODUCTION

- FIGURE 42 FOOD DIAGNOSTICS MARKET, BY SITE, 2023 VS. 2028 (USD MILLION)

- TABLE 29 FOOD DIAGNOSTICS MARKET, BY SITE, 2019-2022 (USD MILLION)

- TABLE 30 FOOD DIAGNOSTICS MARKET, BY SITE, 2023-2028 (USD MILLION)

- 7.2 INHOUSE

- 7.2.1 IMPROVED QUALITY AND FASTER TURNAROUND TIMES OF TESTING TO DRIVE GROWTH OF INHOUSE FOOD DIAGNOSTICS LABORATORIES

- TABLE 31 INHOUSE FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 INHOUSE FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 OUTSOURCING FACILITY

- 7.3.1 REDUCED OPERATIONAL EXPENSES AND OVERHEAD COSTS TO FUEL DEMAND FOR OUTSOURCING FACILITIES

- TABLE 33 OUTSOURCING FACILITY-BASED FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 OUTSOURCING FACILITY-BASED FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 FOOD DIAGNOSTICS MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 43 FOOD DIAGNOSTICS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 35 FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 36 FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 37 FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

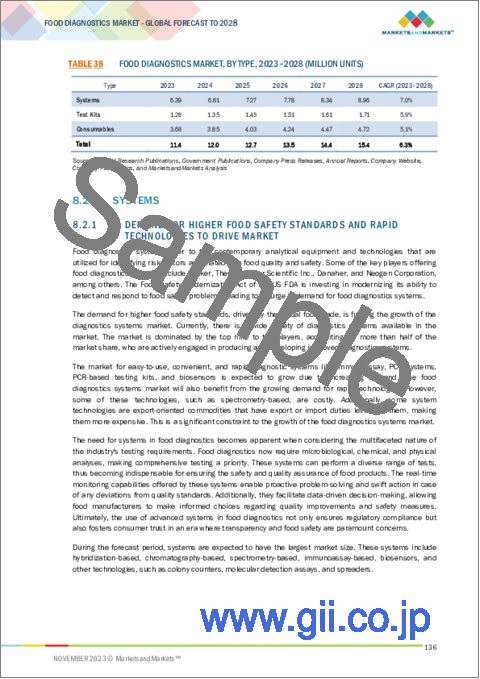

- TABLE 38 FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- 8.2 SYSTEMS

- 8.2.1 DEMAND FOR HIGHER FOOD SAFETY STANDARDS AND RAPID TECHNOLOGIES TO DRIVE MARKET

- TABLE 39 FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 40 FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 41 FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 44 FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 8.2.2 HYBRIDIZATION-BASED

- 8.2.2.1 High level of accuracy and reliability of hybridization-based systems to drive its demand

- TABLE 45 HYBRIDIZATION-BASED FOOD DIAGNOSTICS SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 HYBRIDIZATION-BASED FOOD DIAGNOSTICS SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 HYBRIDIZATION-BASED FOOD DIAGNOSTICS SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 48 HYBRIDIZATION-BASED FOOD DIAGNOSTICS SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2.2.2 Polymerase Chain Reaction (PCR)

- 8.2.2.2.1 Need to provide accurate food testing results, good DNA-based reproducibility, and affordability to drive demand

- 8.2.2.3 Microarrays

- 8.2.2.3.1 Need to trace GMOs, detect pathogens, and analyze food samples to boost demand

- 8.2.2.4 Gene amplifiers

- 8.2.2.4.1 Rapid detection capabilities and need for reduced decision-making in food production and safety to boost demand

- 8.2.2.5 Sequencers

- 8.2.2.5.1 Accuracy and fast results with high sensitivity and specificity to fuel demand

- 8.2.2.2 Polymerase Chain Reaction (PCR)

- 8.2.3 CHROMATOGRAPHY-BASED

- 8.2.3.1 Chromatography-based systems to detect broad range of analytes, including contaminants, pesticides, mycotoxins, and flavor compounds

- TABLE 49 CHROMATOGRAPHY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 CHROMATOGRAPHY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 51 CHROMATOGRAPHY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 52 CHROMATOGRAPHY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 8.2.3.2 High-Performance Liquid Chromatography (HPLC)

- 8.2.3.2.1 Need to analyze residues and contaminants, food additives, and natural ingredients to fuel demand

- 8.2.3.3 Liquid Chromatography (LC)

- 8.2.3.3.1 LC to detect amino acids and lipids in food products and analyze contaminants

- 8.2.3.4 Gas Chromatography (GC)

- 8.2.3.4.1 GC to identify current and past trends in food samples and predict future trends

- 8.2.3.5 Other Chromatography-based Technologies

- 8.2.3.2 High-Performance Liquid Chromatography (HPLC)

- 8.2.4 SPECTROMETRY-BASED

- 8.2.4.1 Spectrometry-based systems to provide non-destructive testing, minimal sample preparation, and reduce waste

- TABLE 53 SPECTROMETRY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 SPECTROMETRY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.5 IMMUNOASSAY-BASED

- 8.2.5.1 Growing demand for ELISA for food safety analysis to drive immunoassay-based systems

- TABLE 55 IMMUNOASSAY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 IMMUNOASSAY-BASED FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.6 BIOSENSORS

- 8.2.6.1 Ease of application and simple methodology for performing safety tests to drive growth

- TABLE 57 FOOD DIAGNOSTIC BIOSENSORS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 FOOD DIAGNOSTIC BIOSENSORS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.7 OTHER SYSTEMS

- TABLE 59 OTHER FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 OTHER FOOD DIAGNOSTIC SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 TEST KITS

- 8.3.1 ACCESSIBILITY, COST-EFFICIENCY, AND EASE OF USE IN TESTING KITS TO DRIVE MARKET

- TABLE 61 FOOD DIAGNOSTIC TEST KITS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 62 FOOD DIAGNOSTIC TEST KITS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 63 FOOD DIAGNOSTIC TEST KITS MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 64 FOOD DIAGNOSTIC TEST KITS MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 8.4 CONSUMABLES

- 8.4.1 NEED TO MAINTAIN STERILITY AND PROVIDE PRECISION & EFFICIENCY IN FOOD DIAGNOSTICS PROCESS TO DRIVE MARKET

- TABLE 65 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 66 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 67 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 69 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 70 FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 8.4.2 REAGENTS

- 8.4.2.1 Rise in use of reagents alongside diagnostic systems to drive demand for testing food samples

- TABLE 71 FOOD DIAGNOSTIC REAGENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 FOOD DIAGNOSTIC REAGENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.3 TEST ACCESSORIES

- 8.4.3.1 Need for precision and efficiency in testing processes to drive growth for test accessories

- TABLE 73 FOOD DIAGNOSTIC TEST ACCESSORIES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 FOOD DIAGNOSTIC TEST ACCESSORIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.4 DISINFECTANTS

- 8.4.4.1 Need to maintain sterile and hygienic environments during food safety tests to drive demand for disinfectants

- TABLE 75 FOOD DIAGNOSTIC DISINFECTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 FOOD DIAGNOSTIC DISINFECTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.5 OTHER CONSUMABLES

- TABLE 77 OTHER FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 78 OTHER FOOD DIAGNOSTIC CONSUMABLES MARKET, BY REGION, 2023-2028 (USD MILLION)

9 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED

- 9.1 INTRODUCTION

- FIGURE 44 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023 VS. 2028 (USD MILLION)

- TABLE 79 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019-2022 (USD MILLION)

- TABLE 80 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 9.2 MEAT, POULTRY, AND SEAFOOD

- 9.2.1 RISING GLOBAL CONSUMPTION OF MEAT, POULTRY, AND SEAFOOD AND INCREASING CONTAMINATION TO DRIVE MARKET

- TABLE 81 PRODUCTION OF MEAT, BY REGION, 2000-2020 (THOUSAND TONS)

- TABLE 82 MEAT, POULTRY, AND SEAFOOD: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 83 MEAT, POULTRY, AND SEAFOOD: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 DAIRY PRODUCTS

- 9.3.1 RISING FOODBORNE ILLNESSES AND NEED TO FILTER ADDITIVES TO FUEL DEMAND FOR FOOD DIAGNOSTICS IN DAIRY PRODUCTS

- TABLE 84 DAIRY PRODUCTS: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 DAIRY PRODUCTS: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 PROCESSED FOOD

- 9.4.1 MICROBIAL CONTAMINATION AND NEED TO PREVENT ILLNESSES AND CHEMICAL HAZARDS TO DRIVE MARKET

- TABLE 86 PROCESSED FOOD: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 PROCESSED FOOD: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 FRUITS & VEGETABLES

- 9.5.1 NEED TO PREVENT RECALLS DUE TO CONTAMINATION AND HARMFUL PESTICIDES TO FUEL DEMAND IN FRUITS AND VEGETABLES

- TABLE 88 FRUITS & VEGETABLES: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 FRUITS & VEGETABLES: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 CEREALS, GRAINS, AND PULSES

- 9.6.1 HIGH RISK OF CONTAMINATION RELATED TO PESTICIDES AND MYCOTOXINS TO DRIVE DEMAND FOR FOOD DIAGNOSTICS

- TABLE 90 CEREALS, GRAINS, AND PULSES: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 91 CEREALS, GRAINS, AND PULSES: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 NUTS, SEEDS, AND SPICES

- 9.7.1 NEED TO FILTER HARMFUL SUBSTANCES AND CONTAMINANTS FROM NUTS, SEEDS, AND SPICES TO DRIVE MARKET

- TABLE 92 NUTS, SEEDS, AND SPICES: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 93 NUTS, SEEDS, AND SPICES: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHER FOOD TESTED

- TABLE 94 OTHER FOOD TESTED: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 95 OTHER FOOD TESTED: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE

- 10.1 INTRODUCTION

- FIGURE 45 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 96 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 97 FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- 10.2 QUALITY

- 10.2.1 INCREASED EMPHASIS ON PRODUCT LABELING AND TRANSPARENCY TO DRIVE MARKET FOR FOOD QUALITY TESTING SOLUTIONS

- TABLE 98 QUALITY: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 99 QUALITY: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 100 QUALITY: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 101 QUALITY: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- 10.2.2 SHELF-LIFE TESTING

- 10.2.2.1 Need to prevent food spoilage, reduce waste, and safeguard consumer health to drive demand for shelf-life testing

- TABLE 102 SHELF-LIFE TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 103 SHELF-LIFE TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.3 NUTRITIONAL ANALYSIS

- 10.2.3.1 Consumer health awareness and regulatory compliance to propel growth of food diagnostics solutions for nutritional analysis

- TABLE 104 NUTRITIONAL ANALYSIS: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 105 NUTRITIONAL ANALYSIS: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.4 FLAVOR AND AROMA ANALYSIS

- 10.2.4.1 Flavor and aroma analysis to ensure quality of food products

- TABLE 106 FLAVOR & AROMA ANALYSIS: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 107 FLAVOR & AROMA ANALYSIS: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.5 TEXTURE AND VISCOSITY TESTING

- 10.2.5.1 Ability to enhance sensory satisfaction to drive demand for food diagnostics solutions for texture and viscosity testing

- TABLE 108 TEXTURE & VISCOSITY TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 109 TEXTURE & VISCOSITY TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 SAFETY

- 10.3.1 GROWING PREVALENCE OF FOODBORNE ILLNESSES TO DRIVE MARKET FOR FOOD SAFETY TESTING SOLUTIONS

- TABLE 110 SAFETY: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 111 SAFETY: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 112 SAFETY: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 113 SAFETY: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023-2028 (USD MILLION)

- 10.3.2 PATHOGEN TESTING

- 10.3.2.1 Need to identify harmful microorganisms and prevent foodborne illnesses to drive demand for pathogen testing

- TABLE 114 PATHOGEN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 115 PATHOGEN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.3 ALLERGEN TESTING

- 10.3.3.1 Growth in awareness of food allergies to drive demand for food diagnostics solutions

- TABLE 116 ALLERGEN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 117 ALLERGEN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.4 TOXIN TESTING

- 10.3.4.1 Consumer awareness and demand for toxin-free products to spur demand for food diagnostics solutions for toxin testing

- TABLE 118 TOXIN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 119 TOXIN TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.5 PESTICIDE RESIDUE TESTING

- 10.3.5.1 Global trade and export compliance to drive demand for food diagnostics solutions for pesticide residue testing

- TABLE 120 PESTICIDE RESIDUE TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 121 PESTICIDE RESIDUE TESTING: FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 FOOD DIAGNOSTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 46 FOOD DIAGNOSTICS MARKET: GEOGRAPHIC SNAPSHOT, 2023-2028 (USD MILLION)

- TABLE 122 FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 123 FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 124 FOOD DIAGNOSTICS MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 125 FOOD DIAGNOSTICS MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 47 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 48 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 126 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 127 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 129 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 130 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 133 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- TABLE 134 NORTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2019-2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019-2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Stringent food safety regulations and technological advancements in US to drive market

- TABLE 148 US: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 149 US: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 150 US: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 151 US: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Growing food industry and government initiatives to prevent potential food risks in Canada to propel market growth

- TABLE 152 CANADA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 153 CANADA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 154 CANADA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 155 CANADA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Strong agricultural trade partnership with US to lead to increased demand for better food diagnostics systems in Mexico

- FIGURE 49 TOP 10 COMMODITIES IMPORTED BY MEXICO FROM US, 2022 (USD BILLION)

- TABLE 156 MEXICO: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 157 MEXICO: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 MEXICO: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 159 MEXICO: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- FIGURE 50 EUROPE: FOOD DIAGNOSTICS MARKET SNAPSHOT

- 11.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 51 EUROPE: COUNTRY-LEVEL INFLATION DATA, 2017-2022

- FIGURE 52 EUROPE: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 160 EUROPE: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 161 EUROPE: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 162 EUROPE: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 163 EUROPE: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 164 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 165 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 166 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 167 EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- TABLE 168 EUROPE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 169 EUROPE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 170 EUROPE: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 171 EUROPE: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 172 EUROPE: FOOD DIAGNOSTICS MARKET, BY SITE, 2019-2022 (USD MILLION)

- TABLE 173 EUROPE: FOOD DIAGNOSTICS MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 174 EUROPE: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 175 EUROPE: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 176 EUROPE: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 177 EUROPE: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 178 EUROPE: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 179 EUROPE: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 180 EUROPE: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019-2022 (USD MILLION)

- TABLE 181 EUROPE: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Multiple foodborne illness outbreaks and environmental factors to fuel market growth in Germany

- TABLE 182 GERMANY: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 183 GERMANY: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 184 GERMANY: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 185 GERMANY: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Government commitment to food safety and combating food crime to drive UK's food diagnostics market

- TABLE 186 UK: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 187 UK: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 188 UK: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 189 UK: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Food recall incidents and consumer awareness to drive surge in French food diagnostics market

- TABLE 190 FRANCE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 191 FRANCE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 192 FRANCE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 193 FRANCE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Substantial investments and stringent regulations to propel growth of food diagnostics market in Italy

- TABLE 194 ITALY: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 195 ITALY: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 196 ITALY: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 197 ITALY: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.6 SPAIN

- 11.3.6.1 Rise in Salmonella and Yersinia outbreaks in Spain to drive food diagnostics market

- TABLE 198 SPAIN: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 199 SPAIN: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 200 SPAIN: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 201 SPAIN: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.7 POLAND

- 11.3.7.1 Rise in poultry production and exports to drive Poland's food diagnostics market

- TABLE 202 POLAND: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 203 POLAND: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 204 POLAND: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 205 POLAND: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.8 REST OF EUROPE

- TABLE 206 REST OF EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 207 REST OF EUROPE: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 208 REST OF EUROPE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 209 REST OF EUROPE: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 53 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET SNAPSHOT

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 54 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 55 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 210 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 211 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 213 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 214 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 215 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 217 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- TABLE 218 ASIA PACIFIC: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 221 ASIA PACIFIC: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY SITE, 2019-2022 (USD MILLION)

- TABLE 223 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 224 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 225 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 226 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 227 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 228 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 229 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 230 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019-2022 (USD MILLION)

- TABLE 231 ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Shift from wet markets to supermarkets or eCommerce channels to cause food diagnostics to play major role in China

- TABLE 232 CHINA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 233 CHINA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 234 CHINA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 235 CHINA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Export rejections and government initiatives to drive growth of food diagnostics market in India

- TABLE 236 INDIA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 237 INDIA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 238 INDIA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 239 INDIA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Safety concerns in seafood industry to propel adoption of food diagnostics

- TABLE 240 JAPAN: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 241 JAPAN: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 242 JAPAN: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 243 JAPAN: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Allergen mitigation and proactive initiatives to drive food diagnostics market in Australia and New Zealand

- TABLE 244 AUSTRALIA & NEW ZEALAND: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 245 AUSTRALIA & NEW ZEALAND: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 246 AUSTRALIA & NEW ZEALAND: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 247 AUSTRALIA & NEW ZEALAND: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Heavy reliance on food imports to augment South Korea's food diagnostics adoption

- TABLE 248 SOUTH KOREA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 249 SOUTH KOREA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 250 SOUTH KOREA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 251 SOUTH KOREA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- TABLE 252 REST OF ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 56 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2022

- FIGURE 57 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 256 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 257 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 258 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 259 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 260 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 261 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 262 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 263 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- TABLE 264 SOUTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 265 SOUTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 266 SOUTH AMERICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 267 SOUTH AMERICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 268 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2019-2022 (USD MILLION)

- TABLE 269 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 270 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 271 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 272 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 273 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 274 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 275 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 276 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019-2022 (USD MILLION)

- TABLE 277 SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 International trade disputes and global food safety standards to drive growth of food diagnostics market in Brazil

- TABLE 278 BRAZIL: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 279 BRAZIL: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 280 BRAZIL: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 281 BRAZIL: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Rise in foodborne illnesses to lead to increase in food testing practices and diagnostics in Argentina

- TABLE 282 ARGENTINA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 283 ARGENTINA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 284 ARGENTINA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 285 ARGENTINA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 286 REST OF SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 287 REST OF SOUTH AMERICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 288 REST OF SOUTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 289 REST OF SOUTH AMERICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6 MIDDLE EAST

- 11.6.1 RELIANCE IN FOOD IMPORTS AND GROWTH IN EXPORTS TO FUEL FOOD DIAGNOSTICS MARKET IN MIDDLE EAST

- TABLE 290 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 291 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 292 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 293 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- TABLE 294 MIDDLE EAST: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 295 MIDDLE EAST: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 296 MIDDLE EAST: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 297 MIDDLE EAST: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 298 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY SITE, 2019-2022 (USD MILLION)

- TABLE 299 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 300 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 301 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 302 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 303 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 304 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 305 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 306 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019-2022 (USD MILLION)

- TABLE 307 MIDDLE EAST: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 11.7 AFRICA

- 11.7.1 AFRICA: RECESSION IMPACT ANALYSIS

- FIGURE 58 AFRICA: INFLATION RATES, BY KEY COUNTRY, 2018-2022

- FIGURE 59 AFRICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- TABLE 308 AFRICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 309 AFRICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 310 AFRICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 311 AFRICA: FOOD DIAGNOSTICS MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 312 AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 313 AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 314 AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (MILLION UNITS)

- TABLE 315 AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (MILLION UNITS)

- TABLE 316 AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 317 AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 318 AFRICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 319 AFRICA: FOOD DIAGNOSTIC CONSUMABLES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 320 AFRICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2019-2022 (USD MILLION)

- TABLE 321 AFRICA: FOOD DIAGNOSTICS MARKET, BY SITE, 2023-2028 (USD MILLION)

- TABLE 322 AFRICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 323 AFRICA: FOOD DIAGNOSTICS MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 324 AFRICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 325 AFRICA: FOOD DIAGNOSTICS MARKET, BY SAFETY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 326 AFRICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2019-2022 (USD MILLION)

- TABLE 327 AFRICA: FOOD DIAGNOSTICS MARKET, BY QUALITY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 328 AFRICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2019-2022 (USD MILLION)

- TABLE 329 AFRICA: FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2023-2028 (USD MILLION)

- 11.7.2 SOUTH AFRICA

- 11.7.2.1 History of listeriosis outbreak to drive surge of South African food diagnostics market

- TABLE 330 SOUTH AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 331 SOUTH AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 332 SOUTH AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 333 SOUTH AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.7.3 REST OF AFRICA

- TABLE 334 REST OF AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 335 REST OF AFRICA: FOOD DIAGNOSTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 336 REST OF AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 337 REST OF AFRICA: FOOD DIAGNOSTIC SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- TABLE 338 FOOD DIAGNOSTICS MARKET: DEGREE OF COMPETITION, 2022

- 12.3 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 60 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018-2022 (USD BILLION)

- 12.4 KEY PLAYER ANNUAL REVENUE VS. GROWTH

- FIGURE 61 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 12.5 KEY PLAYERS EBIT/EBITDA

- FIGURE 62 EBITDA, 2022 (USD BILLION)

- 12.6 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 339 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 63 FOOD DIAGNOSTICS MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- 12.8 KEY COMPANY EVALUATION MATRIX

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- FIGURE 64 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 12.8.5 COMPANY FOOTPRINT

- TABLE 340 COMPANY FOOTPRINT, BY TYPE

- TABLE 341 COMPANY FOOTPRINT, BY TESTING TYPE

- TABLE 342 COMPANY FOOTPRINT, BY REGION

- TABLE 343 OVERALL COMPANY FOOTPRINT

- 12.9 STARTUP/SME EVALUATION MATRIX

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- FIGURE 65 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 12.9.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 344 FOOD DIAGNOSTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 345 FOOD DIAGNOSTICS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- TABLE 346 PRODUCT LAUNCHES, 2020-2022

- 12.10.2 DEALS

- TABLE 347 DEALS, 2019-2022

- 12.10.3 OTHERS

- TABLE 348 OTHERS, 2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1.1 THERMO FISHER SCIENTIFIC INC.

- TABLE 349 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- FIGURE 66 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- TABLE 350 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES

- TABLE 351 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 352 THERMO FISHER SCIENTIFIC INC.: OTHERS

- 13.1.2 BIO-RAD LABORATORIES, INC.

- TABLE 353 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 67 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- TABLE 354 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES

- 13.1.3 MERCK KGAA

- TABLE 355 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 68 MERCK KGAA: COMPANY SNAPSHOT

- TABLE 356 MERCK KGAA: DEALS

- 13.1.4 NEOGEN CORPORATION

- TABLE 357 NEOGEN CORPORATION: BUSINESS OVERVIEW

- FIGURE 69 NEOGEN CORPORATION: COMPANY SNAPSHOT

- TABLE 358 NEOGEN CORPORATION: PRODUCT LAUNCHES

- TABLE 359 NEOGEN CORPORATION: DEALS

- 13.1.5 SHIMADZU CORPORATION

- TABLE 360 SHIMADZU CORPORATION: BUSINESS OVERVIEW

- FIGURE 70 SHIMADZU CORPORATION: COMPANY SNAPSHOT

- 13.1.6 BIOMERIEUX

- TABLE 361 BIOMERIEUX: BUSINESS OVERVIEW

- FIGURE 71 BIOMERIEUX: COMPANY SNAPSHOT

- TABLE 362 BIOMERIEUX: PRODUCT LAUNCHES

- TABLE 363 BIOMERIEUX: DEALS

- TABLE 364 BIOMERIEUX: OTHERS

- 13.1.7 AGILENT TECHNOLOGIES, INC.

- TABLE 365 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 72 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 366 AGILENT TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 367 AGILENT TECHNOLOGIES, INC.: OTHERS

- 13.1.8 QIAGEN

- TABLE 368 QIAGEN: BUSINESS OVERVIEW

- FIGURE 73 QIAGEN: COMPANY SNAPSHOT

- 13.1.9 BRUKER

- TABLE 369 BRUKER: BUSINESS OVERVIEW

- FIGURE 74 BRUKER: COMPANY SNAPSHOT

- TABLE 370 BRUKER: PRODUCT LAUNCHES

- 13.1.10 DANAHER

- TABLE 371 DANAHER: BUSINESS OVERVIEW

- FIGURE 75 DANAHER: COMPANY SNAPSHOT

- 13.1.11 PERKINELMER INC.

- TABLE 372 PERKINELMER INC.: BUSINESS OVERVIEW

- TABLE 373 PERKINELMER INC.: PRODUCT LAUNCHES

- TABLE 374 PERKINELMER INC.: DEALS

- 13.1.12 FOSS

- TABLE 375 FOSS: BUSINESS OVERVIEW

- 13.1.13 HYGIENA LLC

- TABLE 376 HYGIENA LLC: BUSINESS OVERVIEW

- 13.1.14 R-BIOPHARM AG

- TABLE 377 R-BIOPHARM AG: BUSINESS OVERVIEW

- TABLE 378 R-BIOPHARM AG: DEALS

- 13.1.15 ROMER LABS DIVISION HOLDING

- TABLE 379 ROMER LABS DIVISION HOLDING: BUSINESS OVERVIEW

- 13.2 STARTUPS/SMES

- 13.2.1 ENVIROLOGIX

- TABLE 380 ENVIROLOGIX: BUSINESS OVERVIEW

- 13.2.2 RANDOX FOOD DIAGNOSTICS

- TABLE 381 RANDOX FOOD DIAGNOSTICS: BUSINESS OVERVIEW

- 13.2.3 PROMEGA CORPORATION

- TABLE 382 PROMEGA CORPORATION: BUSINESS OVERVIEW

- 13.2.4 PATHOGENDX CORPORATION

- TABLE 383 PATHOGENDX CORPORATION: BUSINESS OVERVIEW

- 13.2.5 ROKA BIO SCIENCE

- TABLE 384 ROKA BIO SCIENCE: BUSINESS OVERVIEW

- 13.2.6 GOLD STANDARD DIAGNOSTICS

- TABLE 385 GOLD STANDARD DIAGNOSTICS: BUSINESS OVERVIEW

- 13.2.7 CLEAR LABS, INC.

- TABLE 386 CLEAR LABS, INC.: BUSINESS OVERVIEW

- 13.2.8 RING BIOTECHNOLOGY CO LTD.

- TABLE 387 RING BIOTECHNOLOGY CO LTD.: BUSINESS OVERVIEW

- 13.2.9 NEMIS TECHNOLOGIES AG

- TABLE 388 NEMIS TECHNOLOGIES AG: BUSINESS OVERVIEW

- 13.2.10 BIOREX FOOD DIAGNOSTICS

- TABLE 389 BIOREX FOOD DIAGNOSTICS: BUSINESS OVERVIEW

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 390 ADJACENT MARKETS

- 14.2 RESEARCH LIMITATIONS

- 14.3 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE

- TABLE 391 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2018-2022 (USD MILLION)

- TABLE 392 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY SITE, 2023-2028 (USD MILLION)

- 14.3.4 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION

- TABLE 393 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 394 FOOD PATHOGEN SAFETY TESTING EQUIPMENT AND SUPPLIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.4 FOOD SAFETY TESTING MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY

- TABLE 395 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2017-2021 (USD MILLION)

- TABLE 396 FOOD SAFETY TESTING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 14.4.4 FOOD SAFETY TESTING MARKET, BY REGION

- TABLE 397 FOOD SAFETY TESTING MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 398 FOOD SAFETY TESTING MARKET, BY REGION, 2022-2027 (USD MILLION)

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS