|

|

市場調査レポート

商品コード

1384221

高電圧および中電圧製品主要10品目市場:製品別、設置タイプ別、エンドユーザー別-2028年までの予測Top 10 High & Medium Voltage Products Market HV (Switchgear, HV Cables, Power Transformer), MV (Ring Main Unit, Recloser, MV Cables, Voltage Regulator, Surge Protection Device, Disconnect Switch), Installation Type End User - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 高電圧および中電圧製品主要10品目市場:製品別、設置タイプ別、エンドユーザー別-2028年までの予測 |

|

出版日: 2023年11月07日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、設置タイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

高電圧および中電圧製品主要10品目の市場規模は、2023年の2,641億米ドルから2028年には3,497億米ドルに成長すると予測され、予測期間中のCAGRは5.8%になると見込まれています。

高電圧および中電圧製品の需要は、エネルギー需要の増加、再生可能エネルギー源の統合、輸送などのセクターの電化、現在進行中の送電網近代化への取り組みなどにより高まっています。

タイプ別に見ると、高電圧の採用が拡大しており、2番目に速いセグメントとなる見込みです。これは、電力需要が増加している都市部や工業地帯での広範な使用、再生可能エネルギー源の統合における重要性、既存のインフラ内での効率的な配電を保証する送電網近代化における役割などによるものです。

産業分野は、重機械、製造プロセス、大規模操業の電力を中・高圧機器に依存しているため、これらの製品に対する大きな需要を牽引しており、第2位になると予想されます。

設置タイプ別では、屋内が最大セグメントとなる見込みです。屋内設置は、制御され保護された環境を提供し、安全性を確保し、高電圧および中電圧製品に関連する環境リスクを軽減します。また、スペース効率も高く、不動産が限られた都市部では重要な考慮事項です。屋内設置は保守点検のためのアクセスが容易で、信頼性の向上とダウンタイムの短縮につながります。

当レポートでは、世界の高電圧および中電圧製品主要10品目市場について調査し、製品別、設置タイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 生態系マッピング

- バリューチェーン分析

- 技術分析

- 価格分析

- 料金分析

- コードと規制状況

- 特許分析

- 貿易分析

- ポーターのファイブフォース分析

- ケーススタディ分析

- 2023年~2024年の主要な会議とイベント

- 主要な利害関係者と購入基準

第6章 高電圧および中電圧製品主要10品目市場、設置タイプ別

- イントロダクション

- 屋内

- 屋外

第7章 高電圧および中電圧製品主要10品目市場、製品別

- イントロダクション

- 高電圧

- 中電圧

第8章 高電圧および中電圧製品主要10品目市場、エンドユーザー別

- イントロダクション

- 送電・配電

- 工業

- 商業

- 住宅

第9章 高電圧および中電圧製品主要10品目市場、地域別

- イントロダクション

- 欧州

- 南米

- 北米

- 中東・アフリカ

- アジア太平洋

第10章 競合情勢

- 概要

- 大手企業が採用した主な戦略

- 市場シェア分析、2022年

- 収益分析、2018~2022年

- 企業評価マトリックス、2022年

- スタートアップ/中小企業の評価マトリックス、2022年

- 競合ベンチマーキング

- 企業のフットプリント

- 競争シナリオと動向

第11章 企業プロファイル

- 主要参入企業

- SIEMENS

- ABB LTD.

- HITACHI ENERGY LTD.

- SCHNEIDER ELECTRIC

- PRYSMIAN GROUP

- BHARAT HEAVY ELECTRICALS LIMITED

- GE

- LUCY ELECTRIC

- NEXANS

- SUMITOMO ELECTRIC INDUSTRIES, LTD.

- ORECCO

- MITSUBISHI ELECTRIC CORPORATION

- G&W ELECTRIC

- TOSHIBA CORPORATION

- HD HYUNDAI ELECTRIC

- ANCHOR ELECTRICALS PRIVATE LIMITED

- EATON

- NKT A/S

- KEI INDUSTRIES LIMITED

- HAVELLS INDIA LTD.

第12章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | Product, Installation type, end user, Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

The Top 10 high and medium voltage products market is estimated to grow from USD 264.1 Billion in 2023 to USD 349.7 Billion by 2028; it is expected to record a CAGR of 5.8% during the forecast period. The demand for high and medium voltage products is rising due to increasing energy needs, integration of renewable energy sources, electrification of sectors like transportation, and ongoing grid modernization efforts.

"Medium Voltage: The second-fastest segment of the top 10 high and medium voltage market, by product."

Based on product type, the Top 10 high and medium voltage products market has been split into two types: Medium voltage and High voltage. The adoption of high voltage is growing and is expected to be the second fastest segment. This is due to their extensive use in urban and industrial areas with growing electricity demand, their importance in integrating renewable energy sources, and their role in grid modernization, ensuring efficient power distribution within existing infrastructure.

"Industrial segment is expected to emerge as the second-largest segment based on end user."

Based on end users, the top 10 high and medium voltage products market has been segmented into transmission and distribution, industrial, residential, and commercial. The industrial segment is expected to be the second-largest segment owing to the dependence of industries on medium and high voltage equipment to power heavy machinery, manufacturing processes, and large-scale operations, driving a significant demand for these products. Additionally, the need for industrial infrastructure expansion and modernization further contributes to the prominence of the industrial segment in this market.

"Indoor is expected to emerge as largest segment based on Installation type."

By installation type, the top 10 high and medium voltage product market has been segmented into outdoor and indoor. Indoor is expected to emerge as largest segment based on installation type. These installations offer a controlled and protected environment, ensuring safety and mitigating environmental risks associated with high and medium voltage equipment. They are also more space-efficient, a vital consideration in urban areas with limited real estate. Indoor installations provide easy access for maintenance and inspection, resulting in increased reliability and reduced downtime.

"North America is expected to be the second-fastest region in the top 10 high and medium voltage product market."

North America is expected to be the second-fastest region in the top 10 high and medium voltage product markets between 2023-2028, preceded by Asia Pacific. The region has a well-established electrical infrastructure that requires continuous modernization and upgrades to ensure reliability and efficiency. Moreover, a growing emphasis on renewable energy integration and grid resilience drives demand for high and medium voltage products. Additionally, a thriving industrial sector and the adoption of electric vehicles in North America further contribute to the need for these products, solidifying the region's prominent position in the market. These are the key factors fostering the growth of the Top 10 high and medium voltage products market in the North America.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 27%, Asia Pacific- 33%, Europe- 20%, the Middle East & Africa- 12%, and South America- 8%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The Top 10 high and medium voltage products market is dominated by a few major players that have a wide regional presence. The leading players in the refinery and petrochemical filtration market are ABB (Switzerland), Prysmian SpA (Italy), Schneider Electric (France), Hitachi Global (Japan), and Siemens (Germany).

Research Coverage:

The report defines, describes, and forecasts the global Top 10 high and medium voltage products market, by product, installation type, end user and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the top 10 high and medium voltage products market.

Key Benefits of Buying the Report

- Rise in grid investments and growing demand for reliable and continuous power supply drive the demand. Factors such as delays in procurement and installation of electrical equipment due to complex regulatory and environment authorizations procedures and implementation of stringent regulations hinder market growth. Continuous increase in power generation capacity and increasing developments of smart grids and growing digitalization offer lucrative opportunities in this market. Supply-chain constraints and requirement for high technical expertise to develop and install power cables are major challenges faced by countries in this market.

- Product Development/ Innovation: The trends such as Intelligent switchgear are groundbreaking advancements in the industry, integrating advanced sensing capabilities and connectivity for improved control and data analysis. It enhances the monitoring and predictive analytics process by incorporating intelligent electronic devices (IEDs), including smart circuit breakers, sensors, and microprocessor-based relays and meters. Additional sensors like humidity, temperature, vibration, motion, noise, and light provide crucial data for assessing equipment health.

- Market Development: The development of smart grids is essential to achieve shared goals for energy security, economic development, and climate change mitigation. Smart grids enable increased demand response and energy efficiency, integration of variable renewable energy resources into the power grid infrastructure, and electric vehicle recharging services while reducing peak demand and stabilizing the electricity system.

- Market Diversification: ABB launched the latest and narrowest in their air-insulated (AIS) medium-voltage (MV) switchgear, UniGear ZS1, 500mm panel version, at ADIPEC 2023. The new 500 mm version of UniGear ZS1 is designed with higher sustainability targets and raises the bar for safety with its innovative design and carefully selected material mix.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), Prysmian SpA (Italy), Schneider Electric (France), Hitachi Global (Japan), and Siemens (Germany) among others in the Top 10 high and medium voltage products market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.1.1 Top 10 high and medium voltage products market: Inclusions and exclusions, by product

- 1.2.1.2 Top 10 high and medium voltage products market: Inclusions and exclusions, by installation type

- 1.2.1.3 Top 10 high and medium voltage products market: Inclusions and exclusions, by end user

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 DATA TRIANGULATION

- 2.3 PRIMARY AND SECONDARY RESEARCH

- 2.3.1 SECONDARY RESEARCH

- 2.3.1.1 Key data from secondary sources

- 2.3.2 PRIMARY RESEARCH

- 2.3.2.1 Key data from primary sources

- 2.3.2.2 Breakdown of primaries

- FIGURE 2 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: BREAKDOWN OF PRIMARIES

- 2.3.1 SECONDARY RESEARCH

- 2.4 SCOPE

- FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS

- 2.5 MARKET SIZE ESTIMATION

- 2.5.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5.3 DEMAND-SIDE ANALYSIS

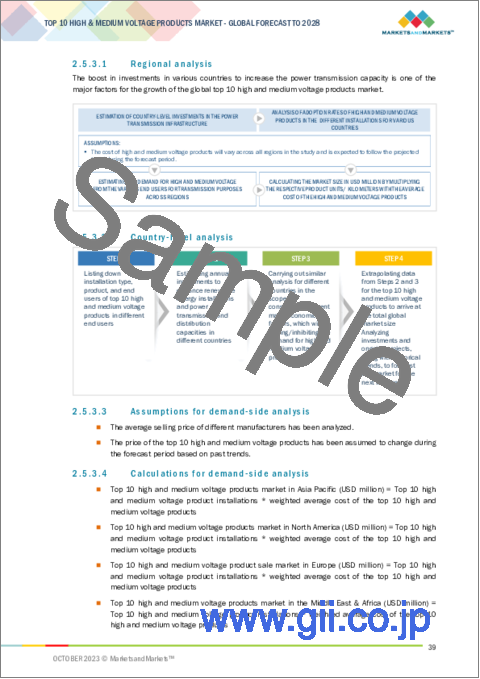

- 2.5.3.1 Regional analysis

- 2.5.3.2 Country-level analysis

- 2.5.3.3 Assumptions for demand-side analysis

- 2.5.3.4 Calculations for demand-side analysis

- 2.5.4 SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF HIGH AND MEDIUM VOLTAGE PRODUCTS

- FIGURE 7 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: SUPPLY-SIDE ANALYSIS

- 2.5.4.1 Calculations for supply-side analysis

- 2.5.4.2 Assumptions for supply-side analysis

- FIGURE 8 COMPANY REVENUE ANALYSIS, 2022

- 2.5.5 FORECAST

- 2.6 RISK ASSESSMENT

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 1 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: SNAPSHOT

- FIGURE 9 INDOOR SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 10 HIGH VOLTAGE SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 TRANSMISSION AND DISTRIBUTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET

- FIGURE 13 GROWING DEPLOYMENT OF SMART GRIDS AND INCREASING DIGITALIZATION

- 4.2 ASIA PACIFIC TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER AND COUNTRY

- FIGURE 14 TRANSMISSION AND DISTRIBUTION SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET IN 2022

- 4.3 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE

- FIGURE 15 INDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- 4.4 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT

- FIGURE 16 HIGH VOLTAGE SEGMENT TO HOLD LARGER MARKET SHARE IN 2028

- 4.5 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER

- FIGURE 17 TRANSMISSION AND DISTRIBUTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in grid investments to improve transmission and distribution infrastructure

- FIGURE 19 INVESTMENTS IN ELECTRICITY NETWORKS, BY REGION, 2015-2021

- TABLE 2 T&D INFRASTRUCTURE EXPANSION PLAN, BY REGION

- 5.2.1.2 Growing demand for reliable and continuous power supply with increasing urbanization and industrialization

- FIGURE 20 ELECTRICITY DEMAND, BY REGION, 2020 VS. 2021

- 5.2.2 RESTRAINTS

- 5.2.2.1 Delays in procurement and installation of electrical equipment attributed to complex regulatory and environmental authorization procedures

- 5.2.2.2 Implementation of stringent regulations to limit SF6 emissions from switchgears and ring main units

- TABLE 3 GLOBAL WARMING POTENTIAL OF GREENHOUSE GASES (100-YEAR TIME PERIOD)

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Continuous increase in power generation capacity

- FIGURE 21 GLOBAL ANNUAL RENEWABLE ELECTRICITY CAPACITY ADDITIONS, 2015-2026 (GW)

- 5.2.3.2 Increasing development of smart grids and growing digitalization

- 5.2.4 CHALLENGES

- 5.2.4.1 Requirement for high technical expertise to develop and install power cables

- 5.2.4.2 Supply chain disruptions

- FIGURE 22 GLOBAL NOMINAL PRICE OF ALUMINUM (USD/MT) AND COPPER (USD/MT), 2019-2022

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 ECOSYSTEM MAPPING

- TABLE 4 COMPANIES AND THEIR ROLE IN TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS ECOSYSTEM

- FIGURE 24 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: ECOSYSTEM MAPPING

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 25 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL/COMPONENT PROVIDERS

- 5.5.2 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCT MANUFACTURERS/ASSEMBLERS/INSTALLATION AND MAINTENANCE SERVICE PROVIDERS

- 5.5.3 END USERS/OPERATORS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 SF6-FREE RING MAIN UNIT

- 5.6.2 INTELLIGENT SWITCHGEAR

- 5.7 PRICING ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE POWER TRANSFORMERS, 2021, 2022, 2023, AND 2028 (USD MILLION/UNIT)

- FIGURE 27 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE SWITCHGEARS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 28 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE CABLES, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- FIGURE 29 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE PRODUCTS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 30 AVERAGE SELLING PRICE (ASP) OF HIGH AND MEDIUM VOLTAGE FAULT-CURRENT LIMITERS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 31 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE CABLES, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- TABLE 5 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE POWER TRANSFORMERS, 2021, 2022, 2023, AND 2028 (USD MILLION/UNIT)

- TABLE 6 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE SWITCHGEARS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 7 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE CABLES, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- TABLE 8 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE DISCONNECT SWITCHES, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 9 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE SURGE PROTECTION DEVICES, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 10 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE FAULT CURRENT LIMITERS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 11 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE REGULATORS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 12 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RECLOSERS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 13 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RING MAIN UNITS, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 14 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE CABLES, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- TABLE 15 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE POWER TRANSFORMERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/UNIT)

- TABLE 16 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE SWITCHGEARS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 17 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE CABLES, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- TABLE 18 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE DISCONNECT SWITCHES, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 19 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE SURGE PROTECTION DEVICES, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 20 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE FAULT CURRENT LIMITERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 21 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE REGULATORS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 22 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RECLOSERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 23 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RING MAIN UNITS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- TABLE 24 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE CABLES, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- FIGURE 32 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE POWER TRANSFORMERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/UNIT)

- FIGURE 33 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE SWITCHGEARS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 34 AVERAGE SELLING PRICE (ASP) OF HIGH VOLTAGE CABLES, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- FIGURE 35 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE DISCONNECT SWITCHES, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 36 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE FAULT CURRENT LIMITERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 37 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE REGULATORS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 38 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RECLOSERS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 39 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE RING MAIN UNITS, BY REGION, 2021, 2022, 2023, AND 2028 (USD/UNIT)

- FIGURE 40 AVERAGE SELLING PRICE (ASP) OF MEDIUM VOLTAGE CABLES, BY REGION, 2021, 2022, 2023, AND 2028 (USD MILLION/MILE)

- 5.8 TARIFF ANALYSIS

- 5.8.1 TARIFF RELATED TO HIGH AND MEDIUM VOLTAGE CABLE UNITS

- TABLE 25 TARIFF RELATED TO HIGH AND MEDIUM VOLTAGE CABLE UNITS

- 5.8.2 TARIFF RELATED TO RING MAIN UNITS

- TABLE 26 TARIFF RELATED TO RING MAIN UNITS

- 5.9 CODES AND REGULATORY LANDSCAPE

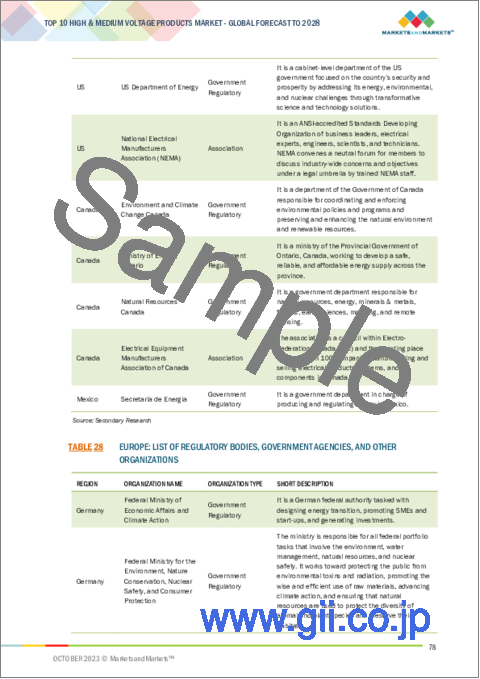

- 5.9.1 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 CODES RELATED TO HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 32 NORTH AMERICA: CODES

- TABLE 33 SOUTH AMERICA: CODES

- TABLE 34 GLOBAL: CODES

- 5.10 PATENT ANALYSIS

- TABLE 35 INNOVATIONS AND PATENT REGISTRATIONS, FEBRUARY 2021-JULY 2023

- 5.11 TRADE ANALYSIS

- 5.11.1 HIGH VOLTAGE PRODUCTS

- FIGURE 41 TRADE DATA FOR HIGH VOLTAGE PRODUCTS UNDER HS CODE 8544, 2018-2022 (USD THOUSAND)

- TABLE 36 TRADE DATA FOR HIGH VOLTAGE PRODUCTS UNDER HS CODE 8544, 2018-2022 (USD THOUSAND)

- 5.11.2 MEDIUM VOLTAGE PRODUCTS

- 5.11.2.1 Import scenario

- TABLE 37 IMPORT DATA FOR MEDIUM VOLTAGE PRODUCTS UNDER HS CODE 853590, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.11.2.2 Export scenario

- TABLE 38 EXPORT DATA FOR MEDIUM VOLTAGE PRODUCTS UNDER HS CODE 853590, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 39 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 42 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF SUBSTITUTES

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF NEW ENTRANTS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 AEGIS 36 RING MAIN UNIT WAS DEPLOYED IN RENEWABLE PROJECT TO ENSURE HASSLE-FREE OPERATION FOR EXTENDED PERIOD

- 5.13.1.1 Problem statement

- 5.13.1.2 Solution

- 5.13.2 AUSTRALIA-SINGAPORE INTERCONNECTOR PROJECT DEVELOPED VIABLE SOLUTION TO LINK RENEWABLE ENERGY FROM AUSTRALIA TO SINGAPORE'S POWER NETWORK

- 5.13.2.1 Problem statement

- 5.13.2.2 Solution

- 5.13.3 SUC COBURG DEPLOYED ABB'S SAFERING AIRPLUS RING MAIN UNITS TO INCREASE RELIABILITY OF POWER SUPPLY IN POWER DISTRIBUTION GRID

- 5.13.3.1 Problem statement

- 5.13.3.2 Solution

- 5.13.1 AEGIS 36 RING MAIN UNIT WAS DEPLOYED IN RENEWABLE PROJECT TO ENSURE HASSLE-FREE OPERATION FOR EXTENDED PERIOD

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 40 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: LIST OF CONFERENCES AND EVENTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 43 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 41 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.15.2 BUYING CRITERIA

- FIGURE 44 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 42 KEY BUYING CRITERIA FOR TOP THREE END USERS

6 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE

- 6.1 INTRODUCTION

- FIGURE 45 INDOOR SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- TABLE 43 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021-2028 (USD BILLION)

- 6.2 INDOOR

- 6.2.1 INCREASING INVESTMENTS IN RENEWABLE ENERGY INDUSTRY TO FUEL DEMAND

- TABLE 44 INDOOR: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 OUTDOOR

- 6.3.1 INCREASING ELECTRIFICATION AND GROWING NEED FOR HIGH-LOAD, LONG-DISTANCE ELECTRICITY TRANSMISSION TO DRIVE DEMAND

- TABLE 45 OUTDOOR: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD MILLION)

7 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- FIGURE 46 HIGH VOLTAGE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2022

- TABLE 46 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021-2028 (USD BILLION)

- TABLE 47 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 48 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021-2028 (USD BILLION)

- 7.2 HIGH VOLTAGE

- 7.2.1 CAPABILITY OF HIGH VOLTAGE PRODUCTS TO TRANSMIT ELECTRICITY EFFICIENTLY AND SAFELY OVER LONG DISTANCES TO DRIVE DEMAND

- 7.2.1.1 Power transformers

- 7.2.1.2 Switchgears

- 7.2.1.3 High voltage cables and accessories

- TABLE 49 HIGH VOLTAGE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD BILLION)

- 7.2.1 CAPABILITY OF HIGH VOLTAGE PRODUCTS TO TRANSMIT ELECTRICITY EFFICIENTLY AND SAFELY OVER LONG DISTANCES TO DRIVE DEMAND

- 7.3 MEDIUM VOLTAGE

- 7.3.1 POTENTIAL OF MEDIUM VOLTAGE PRODUCTS TO EFFICIENTLY DISTRIBUTE ELECTRICITY WITH REDUCED POWER LOSSES TO FUEL DEMAND

- 7.3.1.1 Disconnect switches

- 7.3.1.2 Surge protection devices

- 7.3.1.3 Fault current limiters

- 7.3.1.4 Voltage regulators

- 7.3.1.5 Reclosers

- 7.3.1.6 Ring main units

- 7.3.1.7 Medium voltage cables and accessories

- TABLE 50 MEDIUM VOLTAGE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD BILLION)

- 7.3.1 POTENTIAL OF MEDIUM VOLTAGE PRODUCTS TO EFFICIENTLY DISTRIBUTE ELECTRICITY WITH REDUCED POWER LOSSES TO FUEL DEMAND

8 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 47 TRANSMISSION AND DISTRIBUTION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- TABLE 51 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 8.2 TRANSMISSION AND DISTRIBUTION

- 8.2.1 GROWING NEED TO MAINTAIN STABLE FREQUENCY AND VOLTAGE AND DELIVER EFFICIENT POWER TO DRIVE MARKET

- TABLE 52 TRANSMISSION AND DISTRIBUTION: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD BILLION)

- 8.3 INDUSTRIAL

- 8.3.1 RISING USE OF HIGH AND MEDIUM VOLTAGE PRODUCTS TO ENSURE EFFICIENT POWER DISTRIBUTION WITHIN INDUSTRIAL FACILITIES AND EQUIPMENT PROTECTION TO DRIVE MARKET

- TABLE 53 INDUSTRIAL: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD BILLION)

- 8.4 COMMERCIAL

- 8.4.1 GROWING ADOPTION OF HIGH AND MEDIUM VOLTAGE PRODUCTS TO PROVIDE RELIABLE POWER SUPPLY TO VARIOUS CRITICAL EQUIPMENT TO FUEL SEGMENTAL GROWTH

- TABLE 54 COMMERCIAL: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD BILLION)

- 8.5 RESIDENTIAL

- 8.5.1 RISING DEMAND FOR HIGH AND MEDIUM VOLTAGE PRODUCTS TO OFFER STABLE POWER SUPPLY AND REDUCE RISK OF ELECTRICAL FAULTS AND FIRES TO BOOST MARKET GROWTH

- TABLE 55 RESIDENTIAL: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD BILLION)

9 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 48 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC DOMINATED TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET IN 2022

- TABLE 56 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY REGION, 2021-2028 (USD BILLION)

- TABLE 57 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021-2028 (THOUSAND UNITS/THOUSAND MILES)

- 9.2 EUROPE

- FIGURE 50 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET SNAPSHOT

- 9.2.1 EUROPE: RECESSION IMPACT

- TABLE 58 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021-2028 (USD BILLION)

- TABLE 59 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT TYPE, 2021-2028 (USD BILLION)

- TABLE 60 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 61 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 62 EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD BILLION)

- 9.2.1.1 UK

- 9.2.1.1.1 Growing integration of renewables into power mix and upgrading grid infrastructure to propel market

- 9.2.1.1 UK

- TABLE 63 UK: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.2.1.2 Germany

- 9.2.1.2.1 Increasing focus on enhancing energy efficiency and grid expansion to drive market

- 9.2.1.2 Germany

- TABLE 64 GERMANY: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.2.1.3 Italy

- 9.2.1.3.1 Rising interconnection of grids to drive demand

- 9.2.1.3 Italy

- TABLE 65 ITALY: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1.4 SPAIN

- 9.2.1.4.1 Increasing government focus on expansion of renewable installations to support market growth

- 9.2.1.4 SPAIN

- TABLE 66 SPAIN: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1.5 France

- 9.2.1.5.1 Growing emphasis on development of energy industry to drive market

- 9.2.1.5 France

- TABLE 67 FRANCE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1.6 Rest of Europe

- TABLE 68 REST OF EUROPE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3 SOUTH AMERICA

- 9.3.1 SOUTH AMERICA: RECESSION IMPACT

- TABLE 69 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021-2028 (USD BILLION)

- TABLE 70 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021-2028 (USD BILLION)

- TABLE 71 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 72 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 73 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 74 SOUTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3.1.1 Brazil

- 9.3.1.1.1 Rising need for electrification to drive market

- 9.3.1.1 Brazil

- TABLE 75 BRAZIL: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1.2 Argentina

- 9.3.1.2.1 Increasing government-led investments in renewable energy industry to drive market

- 9.3.1.2 Argentina

- TABLE 76 ARGENTINA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1.3 Chile

- 9.3.1.3.1 Increasing developments in renewable energy industry with focus on boosting clean and sustainable energy consumption to drive market

- 9.3.1.3 Chile

- TABLE 77 CHILE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1.4 Rest of South America

- TABLE 78 REST OF SOUTH AMERICA: TOP 10 HIGH & MEDIUM VOLTAGE MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4 NORTH AMERICA

- 9.4.1 NORTH AMERICA: RECESSION IMPACT

- TABLE 79 NORTH AMERICA TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021-2028 (USD BILLION)

- TABLE 80 NORTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021-2028 (USD BILLION)

- TABLE 81 NORTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 82 NORTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 83 NORTH AMERICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD BILLION)

- 9.4.2 US

- 9.4.2.1 Renewable energy development plans to generate demand

- TABLE 84 US: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.4.3 CANADA

- 9.4.3.1 Increasing investments in wind energy sector to foster market growth

- TABLE 85 CANADA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.4.4 MEXICO

- 9.4.4.1 Rising focus on renewable power generation to fuel market growth

- TABLE 86 MEXICO: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 87 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021-2028 (USD BILLION)

- TABLE 88 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021-2028 (USD BILLION)

- TABLE 89 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 90 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 91 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- TABLE 92 MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD BILLION)

- 9.5.2 SAUDI ARABIA

- 9.5.2.1 Government policies supporting utilization of renewables for power generation to drive market

- TABLE 93 SAUDI ARABIA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.5.3 UAE

- 9.5.3.1 Rising implementation of enhanced oil recovery (EOR) technique in oil fields to accelerate demand

- TABLE 94 UAE: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.5.4 EGYPT

- 9.5.4.1 Increasing energy demand and transformation of power generation infrastructure to control carbon emissions to accelerate market growth

- TABLE 95 EGYPT: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.5.5 SOUTH AFRICA

- 9.5.5.1 Rising adoption of renewable sources backed by government support to drive market

- TABLE 96 SOUTH AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 97 REST OF MIDDLE EAST & AFRICA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6 ASIA PACIFIC

- FIGURE 51 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET SNAPSHOT

- 9.6.1 ASIA PACIFIC: RECESSION IMPACT

- TABLE 98 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY INSTALLATION TYPE, 2021-2028 (USD BILLION)

- TABLE 99 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY PRODUCT, 2021-2028 (USD BILLION)

- TABLE 100 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY HIGH VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 101 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY MEDIUM VOLTAGE, 2021-2028 (USD BILLION)

- TABLE 102 ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD BILLION)

- 9.6.2 CHINA

- 9.6.2.1 Increasing investments in reducing carbon footprint to support market growth

- TABLE 103 CHINA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.6.3 JAPAN

- 9.6.3.1 Rising government-led initiatives to meet power demand to fuel market growth

- TABLE 104 JAPAN: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.6.4 INDIA

- 9.6.4.1 Rising electrification initiatives supported by government schemes in remote areas to propel market growth

- TABLE 105 INDIA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.6.5 SOUTH KOREA

- 9.6.5.1 Increasing developments in offshore wind sector to fuel market growth

- TABLE 106 SOUTH KOREA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.6.6 AUSTRALIA

- 9.6.6.1 Rising electrification of railway network to drive demand

- TABLE 107 AUSTRALIA: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

- 9.6.7 REST OF ASIA PACIFIC

- TABLE 108 REST OF ASIA PACIFIC: TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET, BY END USER, 2021-2028 (USD BILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 109 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS, 2022

- FIGURE 52 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET SHARE ANALYSIS, 2022

- TABLE 110 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: DEGREE OF COMPETITION

- FIGURE 53 INDUSTRY CONCENTRATION, 2022

- 10.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 54 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 10.5 COMPANY EVALUATION MATRIX, 2022

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- FIGURE 55 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.6 STARTUPS/SMES EVALUATION MATRIX, 2022

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 56 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 111 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 112 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.8 COMPANY FOOTPRINT

- TABLE 113 PRODUCT: COMPANY FOOTPRINT

- TABLE 114 END USER: COMPANY FOOTPRINT

- TABLE 115 REGION: COMPANY FOOTPRINT

- TABLE 116 OVERALL COMPANY FOOTPRINT

- 10.9 COMPETITIVE SCENARIOS AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- TABLE 117 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: PRODUCT LAUNCHES, 2021-2023

- 10.9.2 DEALS

- TABLE 118 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: DEALS, 2021-2023

- 10.9.3 OTHERS

- TABLE 119 TOP 10 HIGH AND MEDIUM VOLTAGE PRODUCTS MARKET: OTHERS, 2021-2023

11 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 SIEMENS

- TABLE 120 SIEMENS: COMPANY OVERVIEW

- FIGURE 57 SIEMENS: COMPANY SNAPSHOT

- TABLE 121 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 SIEMENS: DEALS

- 11.1.2 ABB LTD.

- TABLE 123 ABB LTD.: COMPANY OVERVIEW

- FIGURE 58 ABB LTD.: COMPANY SNAPSHOT

- TABLE 124 ABB LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 ABB LTD.: PRODUCT LAUNCHES

- TABLE 126 ABB LTD.: DEALS

- 11.1.3 HITACHI ENERGY LTD.

- TABLE 127 HITACHI ENERGY LTD.: COMPANY OVERVIEW

- FIGURE 59 HITACHI ENERGY LTD.: COMPANY SNAPSHOT

- TABLE 128 HITACHI ENERGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 HITACHI ENERGY LTD.: DEALS

- 11.1.4 SCHNEIDER ELECTRIC

- TABLE 130 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 60 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 131 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.5 PRYSMIAN GROUP

- TABLE 132 PRYSMIAN GROUP: COMPANY OVERVIEW

- FIGURE 61 PRYSMIAN GROUP: COMPANY SNAPSHOT

- TABLE 133 PRYSMIAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 PRYSMIAN GROUP: PRODUCT LAUNCHES

- TABLE 135 PRYSMIAN GROUP: DEALS

- TABLE 136 PRYSMIAN GROUP: OTHERS

- 11.1.6 BHARAT HEAVY ELECTRICALS LIMITED

- TABLE 137 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY OVERVIEW

- FIGURE 62 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT

- TABLE 138 BHARAT HEAVY ELECTRICALS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 BHARAT HEAVY ELECTRICALS LIMITED.: PRODUCT LAUNCHES

- 11.1.7 GE

- TABLE 140 GE: COMPANY OVERVIEW

- FIGURE 63 GE: COMPANY SNAPSHOT

- TABLE 141 GE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.8 LUCY ELECTRIC

- TABLE 142 LUCY ELECTRIC: COMPANY OVERVIEW

- TABLE 143 LUCY ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.9 NEXANS

- TABLE 144 NEXANS: COMPANY OVERVIEW

- FIGURE 64 NEXANS: COMPANY SNAPSHOT

- TABLE 145 NEXANS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 NEXANS: DEALS

- TABLE 147 NEXANS: OTHERS

- 11.1.10 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- TABLE 148 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- FIGURE 65 SUMITOMO ELECTRIC INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 149 SUMITOMO ELECTRIC INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 SUMITOMO ELECTRIC INDUSTRIES LTD.: DEALS

- TABLE 151 SUMITOMO ELECTRIC INDUSTRIES LTD.: OTHERS

- 11.1.11 ORECCO

- TABLE 152 ORECCO: COMPANY OVERVIEW

- TABLE 153 ORECCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.12 MITSUBISHI ELECTRIC CORPORATION

- TABLE 154 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 66 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 155 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 MITSUBISHI ELECTRIC CORPORATION: DEALS

- 11.1.13 G&W ELECTRIC

- TABLE 157 G&W ELECTRIC: COMPANY OVERVIEW

- TABLE 158 G&W ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.14 TOSHIBA CORPORATION

- TABLE 159 TOSHIBA CORPORATION: COMPANY OVERVIEW

- FIGURE 67 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- TABLE 160 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.15 HD HYUNDAI ELECTRIC

- TABLE 161 HD HYUNDAI ELECTRIC: COMPANY OVERVIEW

- FIGURE 68 HD HYUNDAI ELECTRIC: COMPANY SNAPSHOT

- TABLE 162 HD HYUNDAI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.16 ANCHOR ELECTRICALS PRIVATE LIMITED

- TABLE 163 ANCHOR ELECTRICALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 164 ANCHOR ELECTRICALS PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.17 EATON

- TABLE 165 EATON: COMPANY OVERVIEW

- FIGURE 69 EATON: COMPANY SNAPSHOT

- TABLE 166 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 EATON: DEALS

- 11.1.18 NKT A/S

- TABLE 168 NKT A/S: COMPANY OVERVIEW

- FIGURE 70 NKT A/S: COMPANY SNAPSHOT

- TABLE 169 NKT A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 NKT A/S: PRODUCT LAUNCHES

- TABLE 171 NKT A/S: DEALS

- TABLE 172 NKT A/S: OTHERS

- 11.1.19 KEI INDUSTRIES LIMITED

- TABLE 173 KEI INDUSTRIES LIMITED: COMPANY OVERVIEW

- FIGURE 71 KEI INDUSTRIES LIMITED: COMPANY SNAPSHOT

- TABLE 174 KEI INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 KEI INDUSTRIES LIMITED: DEALS

- 11.1.20 HAVELLS INDIA LTD.

- TABLE 176 HAVELLS INDIA LTD.: COMPANY OVERVIEW

- FIGURE 72 HAVELLS INDIA LTD.: COMPANY SNAPSHOT

- TABLE 177 HAVELLS INDIA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HAVELLS INDIA LTD.: DEALS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS