|

|

市場調査レポート

商品コード

1371237

光衛星の世界市場:サイズ別(小型、中型、大型)、用途別(地球観測、通信)、運用軌道別、コンポーネント別、エンドユーザー別、地域別-2028年までの予測Optical Satellite Market by Size (Small, Medium, Large), Application (Earth Observation, Communication), Operational Orbit, Component, End User and Region (North America, Europe, Asia Pacific, Rest of the world) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 光衛星の世界市場:サイズ別(小型、中型、大型)、用途別(地球観測、通信)、運用軌道別、コンポーネント別、エンドユーザー別、地域別-2028年までの予測 |

|

出版日: 2023年10月25日

発行: MarketsandMarkets

ページ情報: 英文 224 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

光衛星の市場規模は、2023年に20億米ドルになるとみられ、2023年~2028年のCAGRは15.1%と見込まれており、2028年には41億米ドルに達すると予測されています。

ここ数十年、光衛星産業は、使用事例の拡大、コスト効率の向上、衛星の新技術開発の影響が大きくなるなど、進化を続けてきました。光衛星市場は、農業、林業、都市計画、災害管理、防衛を含む複数の分野にわたる高解像度の地球観測とイメージング機能に対する通信と需要の増加によって成長を経験しています。技術の進歩、特に費用対効果の高いコンパクトな衛星プラットフォームが、市場アクセシビリティを向上させています。商業宇宙企業の関与の高まりと宇宙インフラへの政府投資は、競争と技術革新を刺激しています。

光衛星市場の地球観測セグメントは、進化する世界のセキュリティ力学が牽引しています。光衛星市場における地球観測セグメントは、農業、都市計画、環境モニタリングなどの分野にわたる高精度地理空間データに対する需要の増加によって推進されています。特に費用対効果の高い小型衛星プラットフォームにおける技術の進歩が、市場のアクセシビリティを拡大しています。環境問題への関心の高まりと、宇宙インフラへの政府および商業投資は、環境課題の監視と対処における光衛星の必要性を強調しています。この競合情勢が技術革新を促進し、市場全体の成長見通しを高めています。

光衛星市場における小型セグメントは、コスト効率と汎用性によって牽引されています。小型化とコスト効果の高い衛星技術の進歩が参入障壁を下げ、競争激化を促進しています。農業、ロジスティクス、環境モニタリングなどの分野では、精密な地球観測や画像サービスの需要が高まっており、狙ったデータを提供できる小型で機敏な衛星への要求が高まっています。この競合情勢が小型衛星セグメントの成長を後押ししています。

アジア太平洋は、主要ビジネス要因によって光衛星市場で力強い成長が見られます。この地域の繁栄する経済は、様々な産業で高解像度の地球観測とイメージングサービスの需要増を生み出しています。この地域の政府は、宇宙インフラと衛星技術に多額の投資を行っており、これが光衛星の開発と展開を加速しています。さらに、特に日本や中国のような国々で急速に拡大する商業宇宙セクターの存在が競争を激化させ、技術革新を促進し、市場拡大に寄与しています。

当レポートでは、世界の光衛星市場について調査し、サイズ別、用途別、運用軌道別、コンポーネント別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 景気後退の影響分析

- ポーターのファイブフォース分析

- バリューチェーン分析

- 生態系マッピング

- 顧客のビジネスに影響を与える動向と混乱

- 使用事例分析

- 貿易データ分析

- 規制状況

- 運用データ

- 価格分析

- 主要な利害関係者と購入基準

- 2023年~2024年の主要な会議とイベント

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- イノベーションと特許登録

- 光衛星市場への技術ロードマップ

第7章 光衛星市場、サイズ別

- イントロダクション

- 小型

- 中型

- 大型

第8章 光衛星市場、用途別

- イントロダクション

- 通信

- 地球観測

第9章 光衛星市場、運用軌道別

- イントロダクション

- LEO

- MEO/GEO

第10章 光衛星市場、エンドユーザー別

- イントロダクション

- 政府

- 商業

- 防衛

第11章 光衛星市場、コンポーネント別

- イントロダクション

- イメージングおよびセンシングシステム

- 光通信システム

第12章 光衛星市場、地域別

- イントロダクション

- 地域不況の影響分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- イントロダクション

- 市場ランキング分析、2022年

- 企業評価マトリックス、2022年

- 新興企業/中小企業評価マトリックス、2022年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- BALL CORPORATION

- LOCKHEED MARTIN CORPORATION

- SPACEX

- L3HARRIS TECHNOLOGIES, INC.

- AIRBUS DEFENCE AND SPACE

- MITSUBISHI ELECTRIC CORPORATION

- AAC CLYDE SPACE

- HONEYWELL INTERNATIONAL INC.

- THALES GROUP

- PLANET LABS PBC

- RAYTHEON TECHNOLOGIES CORPORATION

- MAXAR TECHNOLOGIES

- BAE SYSTEMS

- HENSOLDT

- IMAGESAT INTERNATIONAL

- OHB SE

- TERRAN ORBITAL CORPORATION

- SATELLOGIC

- その他の企業

- PIXXEL

- LASER TECHNOLOGY, INC.

- SITAEL S.P.A.

- TRANSCELESTIAL

- ALEN SPACE

- NANOAVIONICS

- WARPSPACE INC.

- GALAXEYE SPACE SOLUTIONS PVT LTD.

第15章 付録

The optical satellite market is valued at USD 2.0 billion in 2023 and is projected to reach USD 4.1 billion by 2028, at a CAGR of 15.1% from 2023 to 2028. Over the last few decades, the optical satellite industry has continued to evolve with expanding use cases, better cost efficiencies, and a more significant impact of new technological developments in the satellites. The optical satellite market is experiencing growth driven by increasing communication and demand for high-resolution earth observation and imaging capabilities across multiple sectors, including agriculture, forestry, urban planning, disaster management, and defense. Technological advancements, particularly in cost-effective, compact satellite platforms, are improving market accessibility. Growing involvement of commercial space enterprises and government investments in space infrastructure are stimulating competition and innovation.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Size, Application, Component, End User and Region |

| Regions covered | Asia Pacific, Europe, North America,APAC, RoW |

Based on application, the earth observation segment is estimated to have the second largest market share in 2023.

The earth observation segment in the optical satellite market is being driven by evolving global security dynamics. The Earth observation segment in the optical satellite market is being propelled by increasing demand for high-precision geospatial data across sectors like agriculture, urban planning, and environmental monitoring. Technological advancements, particularly in cost-effective small satellite platforms, are expanding market accessibility. Growing environmental concerns, along with government and commercial investments in space infrastructure, underscore the need for optical satellites in monitoring and addressing environmental challenges. This competitive landscape is driving innovation and enhancing the market's overall growth prospects.

Based on size, the small segment is estimated to have the second largest market share in 2023.

The small segment within the optical satellite market is being driven by cost-efficiency and versatility. The advancements in miniaturization and cost-effective satellite technology have lowered entry barriers, fostering heightened competition. The escalating demand for precise Earth observation and imaging services in sectors such as agriculture, logistics, and environmental monitoring is bolstering the requirement for compact, agile satellites capable of delivering targeted data. This competitive landscape is propelling growth in the small satellite segment.

Based on regions, the Asia Pacific region is estimated to have the second largest market share in 2023.

The Asia Pacific region is witnessing robust growth in the optical satellite market driven by key business factors. The region's thriving economies are generating increased demand for high-resolution Earth observation and imaging services across various industries. Governments in the region are making substantial investments in space infrastructure and satellite technology, which is accelerating the development and deployment of optical satellites. Additionally, the presence of a rapidly expanding commercial space sector, particularly in countries like Japan and China, is intensifying competition and driving innovation, contributing to market expansion.

The break-up of the profile of primary participants in the optical satellite market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 40%, Director Level - 25%, and Others - 35%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 25%, Rest of the World (RoW) - 10%

Major companies profiled in the report include SpaceX (US), Lockheed Martin Corporation (US), Ball Corporation (US), Airbus Defene & Space (Germany), and L3Harris Technologies, Inc. (US), among others.

Research Coverage:

This market study covers the optical satellite market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on size, operational orbits, application, component, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall optical satellite market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The optical satellite market is experiencing substantial growth, primarily driven by the exchange of real-time information. The increasing trend toward international cooperation and joint operations among nations is fostering demand for optical satellites, contributing to regional and global stability. The report provides insights on the following pointers:

- Market Drivers: Market Drivers such as the need for Earth observation imagery and analytics, Technological advancements in optical satellite communication, and other drivers covered in the report.

- Market Penetration: Comprehensive information on optical satellite offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the optical satellite market

- Market Development: Comprehensive information about lucrative markets - the report analyses the optical satellite market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the optical satellite market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the optical satellite market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 OPTICAL SATELLITE MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- FIGURE 5 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 COMMUNICATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 9 LARGE SATELLITES TO SECURE LEADING MARKET POSITION IN 2028

- FIGURE 10 COMMERCIAL TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

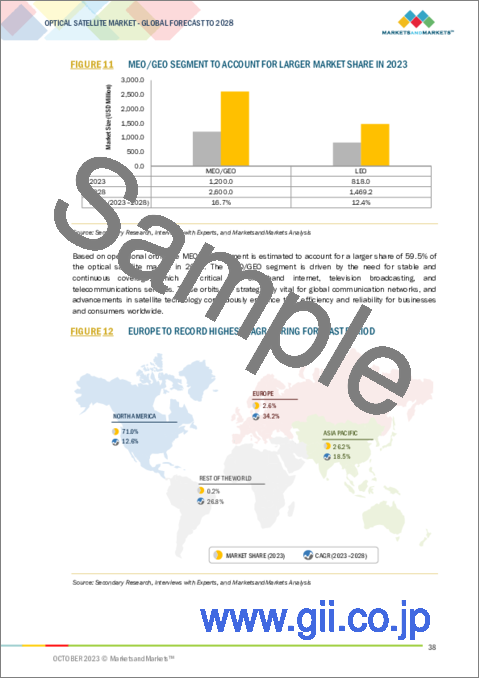

- FIGURE 11 MEO/GEO SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 12 EUROPE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OPTICAL SATELLITE MARKET

- FIGURE 13 INCREASE IN DEMAND FOR EARTH MONITORING AND REAL-TIME INFORMATION

- 4.2 OPTICAL SATELLITE MARKET, BY END USER

- FIGURE 14 COMMERCIAL SEGMENT TO ACQUIRE MAXIMUM MARKET SHARE IN 2023

- 4.3 OPTICAL SATELLITE MARKET, BY APPLICATION

- FIGURE 15 COMMUNICATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- 4.4 OPTICAL SATELLITE MARKET, BY COUNTRY

- FIGURE 16 RUSSIA TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 OPTICAL SATELLITE MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in optical satellite communication

- 5.2.1.2 Growing demand for multimedia services

- 5.2.1.3 Booming cloud computing market

- 5.2.1.4 Rapid development of new satellite constellations

- 5.2.1.5 Need for Earth observation imagery and analytics

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development cost of optical satellite systems

- 5.2.2.2 Lack of standardized communication protocols

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in adoption of cloud-based services

- 5.2.3.2 Increased government investments in space-based infrastructure and services

- 5.2.4 CHALLENGES

- 5.2.4.1 Implications of cloud cover

- 5.2.4.2 Operational limitations associated with harsh and remote environments

- 5.3 RECESSION IMPACT ANALYSIS

- FIGURE 18 RECESSION IMPACT ANALYSIS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM MAPPING

- FIGURE 21 ECOSYSTEM MAPPING

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.8 USE CASE ANALYSIS

- 5.8.1 OPTICAL INTER-SATELLITE DATA RELAY SERVICE

- 5.8.2 OPTICAL INTER-SATELLITE COMMUNICATION

- 5.9 TRADE DATA ANALYSIS

- TABLE 5 COUNTRY-WISE IMPORT DATA, 2019-2022

- TABLE 6 COUNTRY-WISE EXPORT DATA, 2019-2022

- 5.10 REGULATORY LANDSCAPE

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 OPERATIONAL DATA

- TABLE 11 OPTICAL SATELLITE LAUNCHES, BY APPLICATION, 2021-2023 (UNITS)

- 5.12 PRICING ANALYSIS

- TABLE 12 AVERAGE SELLING PRICE OF OPTICAL SATELLITES, BY COMMUNICATION APPLICATION (USD MILLION)

- TABLE 13 AVERAGE SELLING PRICE OF OPTICAL SATELLITES, BY EARTH OBSERVATION APPLICATION (USD MILLION)

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF OPTICAL SATELLITES, BY APPLICATION

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF OPTICAL SATELLITES, BY APPLICATION (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR OPTICAL SATELLITES, BY END USER

- TABLE 15 KEY BUYING CRITERIA FOR OPTICAL SATELLITES, BY END USER

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 KEY CONFERENCES AND EVENTS, 2023-2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 INTEGRATION OF ADVANCED TECHNOLOGIES

- 6.2.2 LASER COMMUNICATION RELAY SYSTEMS

- 6.2.3 CLOUD COMPUTING

- 6.2.4 5G

- 6.2.5 ATP TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 SATELLITE INTERNET OF THINGS

- 6.3.2 SATCOM-ON-THE-MOVE

- 6.3.3 INTELLIGENT OPTICAL SATELLITE COMMUNICATION

- 6.3.4 HYBRID SATELLITE-TERRESTRIAL RELAY NETWORK

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- FIGURE 26 TOP PATENT OWNERS

- TABLE 17 KEY PATENTS

- 6.6 TECHNOLOGICAL ROADMAP TO OPTICAL SATELLITE MARKET

- FIGURE 27 EVOLUTION OF OPTICAL SATELLITES

7 OPTICAL SATELLITE MARKET, BY SIZE

- 7.1 INTRODUCTION

- FIGURE 28 OPTICAL SATELLITE MARKET, BY SIZE, 2023-2028

- TABLE 18 OPTICAL SATELLITE MARKET, BY SIZE, 2020-2022 (USD MILLION)

- TABLE 19 OPTICAL SATELLITE MARKET, BY SIZE, 2023-2028 (USD MILLION)

- 7.2 SMALL

- 7.2.1 COST-EFFECTIVENESS AND ACCESSIBILITY TO DRIVE GROWTH

- 7.3 MEDIUM

- 7.3.1 RAPID ADVANCEMENTS IN TECHNOLOGY TO DRIVE GROWTH

- 7.4 LARGE

- 7.4.1 RISING DEMAND FOR ADVANCED IMAGING CAPABILITIES TO DRIVE GROWTH

8 OPTICAL SATELLITE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 29 OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028

- TABLE 20 OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 21 OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 COMMUNICATION

- 8.2.1 INCREASING POPULARITY OF STREAMING MEDIA TO DRIVE GROWTH

- 8.2.2 SATELLITE-TO-SATELLITE

- 8.2.3 SATELLITE-TO-GROUND

- 8.3 EARTH OBSERVATION

- 8.3.1 BOOST IN ENVIRONMENTAL MONITORING AND URBAN PLANNING TO DRIVE GROWTH

- 8.3.2 SURVEILLANCE AND MONITORING

- 8.3.3 SCIENTIFIC RESEARCH

- 8.3.4 WEATHER MONITORING

- 8.3.5 DISASTER MANAGEMENT

- 8.3.6 EARLY WARNING SYSTEMS

- 8.3.7 OTHER IMAGING AND VIDEO OPERATIONS

9 OPTICAL SATELLITE MARKET, BY OPERATIONAL ORBIT

- 9.1 INTRODUCTION

- FIGURE 30 OPTICAL SATELLITE MARKET, BY OPERATIONAL ORBIT, 2023-2028

- TABLE 22 OPTICAL SATELLITE MARKET, BY OPERATIONAL ORBIT, 2020-2022 (USD MILLION)

- TABLE 23 OPTICAL SATELLITE MARKET, BY OPERATIONAL ORBIT, 2023-2028 (USD MILLION)

- 9.2 LEO

- 9.2.1 NEED FOR INSTANT CONNECTIVITY AND LOW-LATENCY COVERAGE TO DRIVE GROWTH

- 9.3 MEO/GEO

- 9.3.1 RISING PREFERENCE FOR HIGH-SPEED DATA TRANSMISSION TO DRIVE GROWTH

10 OPTICAL SATELLITE MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 31 OPTICAL SATELLITE MARKET, BY END USER, 2023-2028

- TABLE 24 OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 25 OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.2 GOVERNMENT

- 10.2.1 SURGE IN NATIONAL SECURITY CONCERNS TO DRIVE GROWTH

- 10.3 COMMERCIAL

- 10.3.1 COMMERCIALIZATION OF OPTICAL SATELLITES TO DRIVE GROWTH

- 10.4 DEFENSE

- 10.4.1 ESCALATING DEMAND FOR REAL-TIME DATA AND IMAGING TO DRIVE GROWTH

11 OPTICAL SATELLITE MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 IMAGING AND SENSING SYSTEMS

- 11.2.1 VISIBLE SPECTRUM AND PANCHROMATIC

- 11.2.2 ULTRAVIOLET AND INFRARED

- 11.2.3 LASER-BASED

- 11.3 OPTICAL COMMUNICATION SYSTEMS

- 11.3.1 SATELLITE-TO-SATELLITE COMMUNICATION

- 11.3.2 SATELLITE-TO-GROUND COMMUNICATION

12 OPTICAL SATELLITE MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 32 OPTICAL SATELLITE MARKET, BY REGION, 2023-2028

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 26 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 27 OPTICAL SATELLITE MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 28 OPTICAL SATELLITE MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.3 NORTH AMERICA

- 12.3.1 PESTLE ANALYSIS

- 12.3.2 RECESSION IMPACT ANALYSIS

- FIGURE 33 NORTH AMERICA: OPTICAL SATELLITE MARKET SNAPSHOT

- TABLE 29 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.3 US

- 12.3.3.1 Increasing influx of small satellite launches to drive growth

- TABLE 35 US: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 36 US: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 37 US: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 38 US: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.4 CANADA

- 12.3.4.1 Rising deployment of optical satellites to drive growth

- TABLE 39 CANADA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 40 CANADA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 41 CANADA: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 42 CANADA: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4 EUROPE

- 12.4.1 PESTLE ANALYSIS

- 12.4.2 RECESSION IMPACT ANALYSIS

- FIGURE 34 EUROPE: OPTICAL SATELLITE MARKET SNAPSHOT

- TABLE 43 EUROPE: OPTICAL SATELLITE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 44 EUROPE: OPTICAL SATELLITE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 45 EUROPE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 46 EUROPE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 47 EUROPE: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 48 EUROPE: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.3 UK

- 12.4.3.1 Increasing demand for high-speed data transmission to drive growth

- TABLE 49 UK: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 50 UK: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 51 UK: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 52 UK: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.4 FRANCE

- 12.4.4.1 New satellite launches by domestic space companies to drive growth

- TABLE 53 FRANCE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 54 FRANCE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 55 FRANCE: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 56 FRANCE: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.5 GERMANY

- 12.4.5.1 Boost in government investments to drive growth

- TABLE 57 GERMANY: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 58 GERMANY: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 59 GERMANY: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 60 GERMANY: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.6 ITALY

- 12.4.6.1 Innovations in satellite technologies to drive growth

- TABLE 61 ITALY: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 62 ITALY: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 63 ITALY: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 64 ITALY: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.7 RUSSIA

- 12.4.7.1 Rising development of domestic space systems to drive growth

- TABLE 65 RUSSIA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 66 RUSSIA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 67 RUSSIA: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 68 RUSSIA: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.8 REST OF EUROPE

- TABLE 69 REST OF EUROPE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 70 REST OF EUROPE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 71 REST OF EUROPE: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 72 REST OF EUROPE: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5 ASIA PACIFIC

- 12.5.1 PESTLE ANALYSIS

- 12.5.2 RECESSION IMPACT ANALYSIS

- FIGURE 35 ASIA PACIFIC: OPTICAL SATELLITE MARKET SNAPSHOT

- TABLE 73 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.3 CHINA

- 12.5.3.1 Rapid development of new satellites to drive growth

- TABLE 79 CHINA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 80 CHINA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 81 CHINA: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 82 CHINA: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.4 JAPAN

- 12.5.4.1 Rise in launch of optical satellites to drive growth

- TABLE 83 JAPAN: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 84 JAPAN: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 85 JAPAN: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 86 JAPAN: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.5 INDIA

- 12.5.5.1 Domestic emphasis on space-based Earth observation to drive growth

- TABLE 87 INDIA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 88 INDIA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 89 INDIA: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 90 INDIA: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.6 SOUTH KOREA

- 12.5.6.1 Presence of key space technology companies to drive growth

- TABLE 91 SOUTH KOREA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 92 SOUTH KOREA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 93 SOUTH KOREA: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 94 SOUTH KOREA: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.7 REST OF ASIA PACIFIC

- TABLE 95 REST OF ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6 REST OF THE WORLD

- FIGURE 36 REST OF THE WORLD: OPTICAL SATELLITE MARKET SNAPSHOT

- 12.6.1 PESTLE ANALYSIS

- 12.6.2 RECESSION IMPACT ANALYSIS

- TABLE 99 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY REGION 2020-2022 (USD MILLION)

- TABLE 100 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 101 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 102 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 103 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 104 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6.3 MIDDLE EAST & AFRICA

- 12.6.3.1 Rising demand for high-definition video streaming and cloud computing applications to drive growth

- TABLE 105 MIDDLE EAST & AFRICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.6.4 LATIN AMERICA

- 12.6.4.1 Increasing focus on space development to drive growth

- TABLE 109 LATIN AMERICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 110 LATIN AMERICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 111 LATIN AMERICA: OPTICAL SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 112 LATIN AMERICA: OPTICAL SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- TABLE 113 STRATEGIES ADOPTED BY KEY PLAYERS IN OPTICAL SATELLITE MARKET

- 13.2 MARKET RANKING ANALYSIS, 2022

- FIGURE 37 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- 13.3 COMPANY EVALUATION MATRIX, 2022

- 13.3.1 STARS

- 13.3.2 EMERGING LEADERS

- 13.3.3 PERVASIVE PLAYERS

- 13.3.4 PARTICIPANTS

- FIGURE 38 COMPANY EVALUATION MATRIX, 2022

- 13.3.5 COMPANY FOOTPRINT

- TABLE 114 COMPANY FOOTPRINT

- TABLE 115 APPLICATION FOOTPRINT

- TABLE 116 REGION FOOTPRINT

- 13.4 START-UP/SME EVALUATION MATRIX, 2022

- 13.4.1 PROGRESSIVE COMPANIES

- 13.4.2 RESPONSIVE COMPANIES

- 13.4.3 DYNAMIC COMPANIES

- 13.4.4 STARTING BLOCKS

- FIGURE 39 START-UP/SME EVALUATION MATRIX, 2022

- TABLE 117 OPTICAL SATELLITE MARKET: KEY START-UPS/SMES

- 13.4.5 COMPETITIVE BENCHMARKING

- TABLE 118 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 13.5 COMPETITIVE SCENARIO

- 13.5.1 PRODUCT LAUNCHES

- TABLE 119 PRODUCT LAUNCHES, 2020-2023

- 13.5.2 DEALS

- TABLE 120 DEALS, 2020-2023

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 14.1.1 BALL CORPORATION

- TABLE 121 BALL CORPORATION: COMPANY OVERVIEW

- FIGURE 40 BALL CORPORATION: COMPANY SNAPSHOT

- TABLE 122 BALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 BALL CORPORATION: DEALS

- 14.1.2 LOCKHEED MARTIN CORPORATION

- TABLE 124 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- FIGURE 41 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 125 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 LOCKHEED MARTIN CORPORATION: DEALS

- 14.1.3 SPACEX

- TABLE 127 SPACEX: COMPANY OVERVIEW

- TABLE 128 SPACEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 SPACEX: DEALS

- 14.1.4 L3HARRIS TECHNOLOGIES, INC.

- TABLE 130 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 42 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 131 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 133 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- 14.1.5 AIRBUS DEFENCE AND SPACE

- TABLE 134 AIRBUS DEFENCE AND SPACE: COMPANY OVERVIEW

- FIGURE 43 AIRBUS DEFENCE AND SPACE: COMPANY SNAPSHOT

- TABLE 135 AIRBUS DEFENCE AND SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 AIRBUS DEFENCE AND SPACE: DEALS

- 14.1.6 MITSUBISHI ELECTRIC CORPORATION

- TABLE 137 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 44 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 138 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- 14.1.7 AAC CLYDE SPACE

- TABLE 140 AAC CLYDE SPACE: COMPANY OVERVIEW

- FIGURE 45 AAC CLYDE SPACE: COMPANY SNAPSHOT

- TABLE 141 AAC CLYDE SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 AAC CLYDE SPACE: PRODUCT LAUNCHES

- TABLE 143 AAC CLYDE SPACE: DEALS

- 14.1.8 HONEYWELL INTERNATIONAL INC.

- TABLE 144 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 46 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 145 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 HONEYWELL INTERNATIONAL INC: DEALS

- 14.1.9 THALES GROUP

- TABLE 147 THALES GROUP: COMPANY OVERVIEW

- FIGURE 47 THALES GROUP: COMPANY SNAPSHOT

- TABLE 148 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 THALES GROUP: DEALS

- 14.1.10 PLANET LABS PBC

- TABLE 150 PLANET LABS PBC: COMPANY OVERVIEW

- FIGURE 48 PLANET LABS PBC: COMPANY SNAPSHOT

- TABLE 151 PLANET LABS PBC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 PLANET LABS PBC: PRODUCT LAUNCHES

- TABLE 153 PLANET LABS PBC: DEALS

- 14.1.11 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 154 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- FIGURE 49 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 155 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 14.1.12 MAXAR TECHNOLOGIES

- TABLE 157 MAXAR TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 50 MAXAR TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 158 MAXAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.13 BAE SYSTEMS

- TABLE 159 BAE SYSTEMS: COMPANY OVERVIEW

- FIGURE 51 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 160 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 BAE SYSTEMS: DEALS

- 14.1.14 HENSOLDT

- TABLE 162 HENSOLDT: COMPANY OVERVIEW

- FIGURE 52 HENSOLDT: COMPANY SNAPSHOT

- TABLE 163 HENSOLDT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 HENSOLDT: DEALS

- 14.1.15 IMAGESAT INTERNATIONAL

- TABLE 165 IMAGESAT INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 53 IMAGESAT INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 166 IMAGESAT INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 IMAGESAT INTERNATIONAL: DEALS

- 14.1.16 OHB SE

- TABLE 168 OHB SE: COMPANY OVERVIEW

- FIGURE 54 OHB SE: COMPANY SNAPSHOT

- TABLE 169 OHB SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.17 TERRAN ORBITAL CORPORATION

- TABLE 170 TERRAN ORBITAL CORPORATION: COMPANY OVERVIEW

- FIGURE 55 TERRAN ORBITAL CORPORATION: COMPANY SNAPSHOT

- TABLE 171 TERRAN ORBITAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 TERRAN ORBITAL CORPORATION: PRODUCT LAUNCHES

- 14.1.18 SATELLOGIC

- TABLE 173 SATELLOGIC: COMPANY OVERVIEW

- FIGURE 56 SATELLOGIC: COMPANY SNAPSHOT

- TABLE 174 SATELLOGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 SATELLOGIC: DEALS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 PIXXEL

- TABLE 176 PIXXEL: COMPANY OVERVIEW

- 14.2.2 LASER TECHNOLOGY, INC.

- TABLE 177 LASER TECHNOLOGY, INC.: COMPANY OVERVIEW

- 14.2.3 SITAEL S.P.A.

- TABLE 178 SITAEL S.P.A.: COMPANY OVERVIEW

- 14.2.4 TRANSCELESTIAL

- TABLE 179 TRANSCELESTIAL: COMPANY OVERVIEW

- 14.2.5 ALEN SPACE

- TABLE 180 ALEN SPACE: COMPANY OVERVIEW

- 14.2.6 NANOAVIONICS

- TABLE 181 NANOAVIONICS: COMPANY OVERVIEW

- 14.2.7 WARPSPACE INC.

- TABLE 182 WARPSPACE INC.: COMPANY OVERVIEW

- 14.2.8 GALAXEYE SPACE SOLUTIONS PVT LTD.

- TABLE 183 GALAXEYE SPACE SOLUTIONS PVT LTD.: COMPANY OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS