|

|

市場調査レポート

商品コード

1371230

軍用車両維持の世界市場:車両タイプ別、サービス別、エンドユーザー別、地域別 - 2028年までの予測Military Vehicle Sustainment Market by Vehicle Type, Service (Maintenance, Repair, & Overhaul, Training & Support, Parts and Components Supply, Upgrades & Modernization), End User & Region- Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 軍用車両維持の世界市場:車両タイプ別、サービス別、エンドユーザー別、地域別 - 2028年までの予測 |

|

出版日: 2023年10月04日

発行: MarketsandMarkets

ページ情報: 英文 201 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

軍用車両維持の市場規模は、予測期間中に7.0%のCAGRで拡大し、2023年の168億米ドルから2028年には235億米ドルに成長すると予測されています。

技術の進歩と世界の軍用車両の需要増加が市場の成長を促進しています。

装甲兵員輸送車分野が予測期間中に最も高いシェアを占めると予測されます。装甲兵員輸送車(APC)は軍で広く使用されている車両です。APCは人員や軍事装備の輸送に定期的に使用されます。APCは定期的に使用されるため、適切かつ日常的なメンテナンスと修理が、APCを大量に稼働させ続けるために極めて重要です。

陸軍セグメントは予測期間中に最も高い成長率を示すと予測されています。軍用車両は陸軍で広く使用されています。輸送、監視、情報収集、救助任務、戦闘任務、その他多くの目的で陸軍は軍用車両を使用しています。軍用車両は陸軍で幅広く使用されているため、維持サービスの必要性が生じています。軍用車両を任務遂行可能な状態に維持するためには、メンテナンス、修理、アップグレード、近代化が必要です。

アジア太平洋は軍用車両維持の最大市場シェアを占めています。アジア太平洋は予測期間中にCAGR 5.3%で成長すると予測されます。同地域ではインドが市場をリードしており、多くの企業や新興企業がこの業界で事業を展開しています。同国は軍用車両維持の進歩とサービスにおいて重要な役割を果たしています。インドは軍用車両の維持サービスの民営化を計画しています。

当レポートでは、世界の軍用車両維持市場について調査し、車両タイプ別、サービス別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 市場エコシステム

- ポーターのファイブフォース分析

- 価格分析

- 関税と規制状況

- 貿易分析

- 主要な利害関係者と購入基準

- 2023年~2024年の主要な会議とイベント

- ケーススタディ分析

第6章 業界の動向

- イントロダクション

- 主要な技術動向

- メガトレンドの影響

- サプライチェーン分析

第7章 軍用車両維持市場、車両タイプ別

- イントロダクション

- 装甲車両

- 軍用トラック

第8章 軍用車両維持市場、サービス別

- イントロダクション

- メンテナンス、修理、オーバーホール(MRO)

- トレーニングとサポート

- 部品およびコンポーネントの供給

- アップグレードと最新化

第9章 軍用車両維持市場、エンドユーザー別

- イントロダクション

- 陸軍

- 海軍

- 空軍

第10章 軍用車両維持市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- イントロダクション

- 市場ランキング分析

- 市場シェア分析

- 収益分析

- 競合ベンチマーキング

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 米国の補給所整備場所

- 主要参入企業

- BAE SYSTEMS

- RHEINMETALL AG

- ELBIT SYSTEMS LTD.

- GENERAL DYNAMICS CORPORATION

- OSHKOSH CORPORATION

- MOOG INC.

- THALES

- SAIC

- LEONARDO S.P.A.

- SAAB AB

- ST ENGINEERING

- KBR INC.

- VSE CORPORATION

- KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

- CUMMINS INC.

- GM DEFENSE LLC

- MAHINDRA & MAHINDRA LTD.

- MANTECH INTERNATIONAL CORPORATION

- AMENTUM SERVICES INC.

- NAVISTAR DEFENSE LLC

- その他の企業

- AM GENERAL

- GORIZIANE

- DGC INTERNATIONAL

- EDGE GROUP PJSC

- EXCALIBUR ARMY SPOL. S R.O.

第13章 付録

The Military Vehicle Sustainment market is projected to grow from USD 16.8 Billion in 2023 to USD 23.5 Billion by 2028, at a CAGR of 7.0% during the forecast period. Technological advancements and increasing demand for military vehicles across the globe are driving the growth of the market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Type, Pressure, Technology, Aircraft Type, End Use |

| Regions covered | North America, Europe, APAC, RoW |

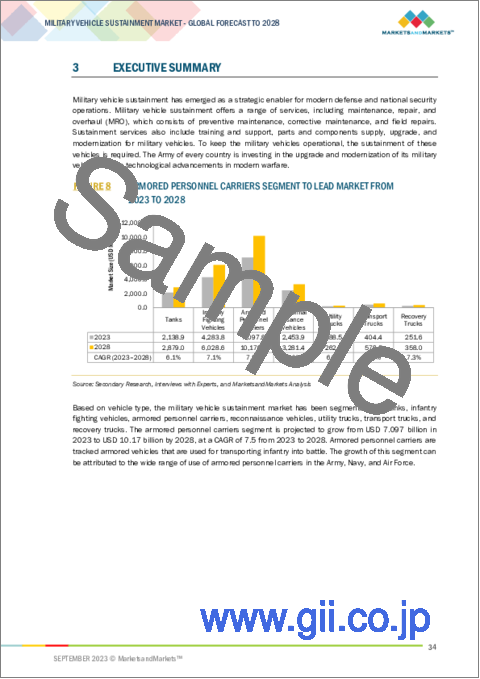

The Armored Personnel Carrier is projected to hold highest share of the market by Vehicle type during the forecast period.

Based on Vehicle type, the armored personnel carrier segment of the Military Vehicle Sustainment market is projected to hold the highest share during the forecast period. The Armored Personnel Carrier (APC) are widely used vehicle in military. The APCs are used on regular basis for the transportation of personnel and military equipments. Due to its regular use proper and daily maintenance and repair is crucial to keep the APCs operational in high amount.

The Army segment is projected to grow at highest rate by End User Type.

Based on End User type, the Army segment is projected to grow at highest rate during the forecast period. Military Vehicles are widely used by Army. For Transportation, Surveillance, Information Gathering, Rescue Mission, Combat Missions and many for many other purpose Army uses the military vehicles. Due to wide use case of military vehicle in Army the need of sustainment services arises. To keep the military vehicle mission- ready maintenance, repair, upgradation and modernization is required.

Asia Pacific is expected to account for the largest market share in 2023.

The Military Vehicle Sustainment market industry has been studied in North America, Europe, Asia Pacific, and Rest of the World. Asia Pacific accounted for the largest market share for Military Vehicle Sustainment. Asia Pacific is estimated to grow at CAGR of 5.3 % during the forecast period. India leads the market in Asia Pacific with a large number of companies and startups operating in the industry. The country is playing a vital role in the advancement and services of Military Vehicle Sustainment. India is planning to privatize the sustainment services for military vehicles.

The break-up of the profile of primary participants in the MILITARY VEHICLE SUSTAINMENT market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Managers - 25%, Others-40%

- By Region: North America -30%, Europe - 20%, Asia Pacific - 40%, Rest of the World - 10%

- Prominent companies include Rheinmetall AG (Germany), BAE Systems (UK), General Dynamic Corporation (US), Elbit Systems Ltd (Israel), and Oshkosh Corporation (US) and among others.

Research Coverage:

This research report categorizes the Military Vehicle Sustainment market by Vehicle Type (Armored Vehicles, Military Trucks), by Service (Maintenance, Repair and Overhaul (MRO), Training and Support, Parts and Components Supply, Upgrades and Modernization) , by End User (Army, Navy, Air Force), and by region (North America, Europe, Asia Pacific, Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Military Vehicle Sustainment market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services; key strategies; Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the Military Vehicle Sustainment System market. Competitive analysis of upcoming startups in the Military Vehicle Sustainment market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Military Vehicle Sustainment Service market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising technology integration and upgrades in military vehicles, Increased adoption of data-driven and predictive maintenance, Growing focus on lifecycle management strategy), restraints (High cost and maintenance time for Fleet modernization, Technology gaps in military vehicle sustainment market, Limited utilization of data for sustainment), opportunities (Use of autonomous systems, Rising adoption of Lifecycle optimization strategy for sustainment, Supply chain efficiency enhancement), and challenges (Lack in resource allocation,Lack of cost optimization for sustainment ) influencing the growth of the authentication and brand protection market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Military Vehicle Sustainment market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Military Vehicle Sustainment market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Military Vehicle Sustainment market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the Military Vehicle Sustainment market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MILITARY VEHICLE SUSTAINMENT MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 INCLUSIONS AND EXCLUSIONS

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 RESEARCH APPROACH & METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- TABLE 2 MILITARY VEHICLE SUSTAINMENT MARKET ESTIMATION PROCEDURE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 ARMORED PERSONNEL CARRIERS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 9 ARMY END USER SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 10 ASIA PACIFIC TO CAPTURE LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MILITARY VEHICLE SUSTAINMENT MARKET

- FIGURE 11 RISE IN DEMAND TO INCREASE FLEET SIZE OF MILITARY VEHICLES TO DRIVE MARKET

- 4.2 MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE

- FIGURE 12 ARMORED PERSONNEL CARRIERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER

- FIGURE 13 ARMY SEGMENT TO ACCOUNT FOR MAXIMUM MARKET SHARE DURING FORECAST PERIOD

- 4.4 MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION

- FIGURE 14 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY/REGION

- FIGURE 15 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING MARKET FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 MILITARY VEHICLE SUSTAINMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising technology integration and upgrades in military vehicles

- 5.2.1.2 Increased adoption of data-driven and predictive maintenance techniques

- 5.2.1.3 Growing focus on lifecycle management strategies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity and high cost of fleet modernization

- 5.2.2.2 Technology gaps in military vehicle sustainment market

- 5.2.2.3 Limited utilization of data for sustainment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of autonomous systems

- 5.2.3.2 Rising adoption of lifecycle optimization strategies for sustainment

- 5.2.3.3 Supply chain efficiency enhancement

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of resource allocation

- 5.2.4.2 Lack of cost optimization for sustainment

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 REVENUE SHIFT IN MILITARY VEHICLE SUSTAINMENT MARKET

- 5.5 MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 19 ECOSYSTEM MAPPING

- TABLE 3 ROLE OF KEY PLAYERS IN ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PORTER'S FIVE FORCE ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF MAIN BATTLE TANKS (USD MILLION)

- TABLE 6 AVERAGE SELLING PRICE OF INFANTRY FIGHTING VEHICLES (USD MILLION)

- TABLE 7 AVERAGE SELLING PRICE OF ARMORED PERSONNEL CARRIERS (USD MILLION)

- TABLE 8 AVERAGE SELLING PRICE OF MINE-RESISTANT AMBUSH-PROTECTED VEHICLES (USD MILLION)

- TABLE 9 AVERAGE SELLING PRICE OF LIGHT PROTECTED VEHICLES (USD MILLION)

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 TRADE ANALYSIS

- TABLE 15 COUNTRY-WISE IMPORTS, 2019-2022 (USD THOUSAND)

- TABLE 16 COUNTRY-WISE EXPORTS, 2019-2022 (USD THOUSAND)

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MILITARY VEHICLE SUSTAINMENT SERVICES, BY END USER

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MILITARY VEHICLE SUSTAINMENT SERVICES, BY END USER

- 5.10.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR MILITARY VEHICLE SUSTAINMENT SERVICES, BY END USER

- TABLE 18 KEY BUYING CRITERIA FOR MILITARY VEHICLE SUSTAINMENT SERVICES, BY END USER

- 5.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 19 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 PREDICTIVE MAINTENANCE TO ENHANCE VEHICLE SUSTAINMENT

- 5.12.2 SOLUTIONS FOR INVENTORY MANAGEMENT

- 5.12.3 MODERNIZATION AND INFRASTRUCTURE DEVELOPMENT

- 5.12.4 ADVANCED TRAINING PROGRAMS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- FIGURE 22 TECHNOLOGY ROADMAP IN MILITARY VEHICLE SUSTAINMENT MARKET, 2000-2050

- 6.2 KEY TECHNOLOGY TRENDS

- FIGURE 23 TECHNOLOGY TRENDS IN MILITARY VEHICLE SUSTAINMENT MARKET

- 6.2.1 FLEET MANAGEMENT NETWORK SYSTEM

- 6.2.2 ENERGY INSTALLATIONS AND ENERGY RESILIENCE

- FIGURE 24 BENEFITS OF HYBRID ELECTRIC PROPULSION SYSTEMS FOR MILITARY VEHICLE SUSTAINMENT MARKET

- 6.2.3 CONNECTED VEHICLES AND AUTONOMY

- 6.2.4 3D PRINTING

- 6.2.5 ADVANCED MATERIALS

- 6.2.6 MODULAR PLATFORMS

- 6.2.7 CYBERSECURITY

- 6.2.8 PREDICTIVE MAINTENANCE

- FIGURE 25 PREDICTIVE MAINTENANCE AND ITS BENEFITS FOR MILITARY VEHICLE SUSTAINMENT MARKET

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 INTERNET OF THINGS (IOT)

- 6.3.2 ARTIFICIAL INTELLIGENCE (AI) AND ROBOTICS

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 26 MILITARY VEHICLE SUSTAINMENT MARKET: SUPPLY CHAIN ANALYSIS

7 MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- FIGURE 27 MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028

- TABLE 20 MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 21 MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 7.2 ARMORED VEHICLES

- 7.2.1 TANKS

- 7.2.1.1 Requirement of scheduled and regular maintenance to drive market

- 7.2.2 INFANTRY FIGHTING VEHICLES

- 7.2.2.1 Increasing demand in modern warfare to drive market

- 7.2.3 ARMORED PERSONNEL CARRIERS

- 7.2.3.1 Protective system maintenance to drive market

- 7.2.4 RECONNAISSANCE VEHICLES

- 7.2.4.1 Lifecycle management and repairs to drive market

- 7.2.1 TANKS

- 7.3 MILITARY TRUCKS

- 7.3.1 UTILITY TRUCKS

- 7.3.1.1 Sustainment activities to maximize utility truck reliability to drive market

- 7.3.2 TRANSPORT TRUCKS

- 7.3.2.1 Cost-effective sustainment solutions for longevity and fleet support to drive market

- 7.3.3 RECOVERY VEHICLES

- 7.3.3.1 Need for regular maintenance to drive market

- 7.3.1 UTILITY TRUCKS

8 MILITARY VEHICLE SUSTAINMENT MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.2 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)

- 8.2.1 PREVENTIVE MAINTENANCE

- 8.2.2 CORRECTIVE MAINTENANCE

- 8.2.3 FIELD REPAIR

- 8.3 TRAINING AND SUPPORT

- 8.4 PARTS AND COMPONENTS SUPPLY

- 8.5 UPGRADES AND MODERNIZATION

9 MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 28 MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2023-2028

- TABLE 22 MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 23 MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.2 ARMY

- 9.2.1 LARGEST END USER SEGMENT OF MARKET

- 9.3 NAVY

- 9.3.1 MAINTENANCE, REPAIR, AND UPGRADES OF MILITARY VEHICLES TO DRIVE MARKET

- 9.4 AIR FORCE

- 9.4.1 NEED FOR LOGISTICS SUPPORT ON AIRBASES TO DRIVE MARKET

10 MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 29 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE FROM 2023 TO 2028

- TABLE 24 MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 25 MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.1.1 Political

- 10.2.1.2 Economic

- 10.2.1.3 Social

- 10.2.1.4 Technological

- 10.2.1.5 Legal

- 10.2.1.6 Environmental

- FIGURE 30 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET SNAPSHOT

- TABLE 26 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2020-2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2023-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Continuous investment in military vehicle sustainment to drive market

- TABLE 34 US: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 35 US: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 36 US: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 37 US: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Modernizing military vehicle sustainment strategies to drive market

- TABLE 38 CANADA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 39 CANADA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 40 CANADA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 41 CANADA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.2.1 PESTLE ANALYSIS

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS

- 10.3.1.1 Political

- 10.3.1.2 Economic

- 10.3.1.3 Social

- 10.3.1.4 Technological

- 10.3.1.5 Legal

- 10.3.1.6 Environmental

- FIGURE 31 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET SNAPSHOT

- TABLE 42 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 43 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 44 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 45 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 46 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 47 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- TABLE 48 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2020-2022 (USD MILLION)

- TABLE 49 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2023-2028 (USD MILLION)

- 10.3.2 RUSSIA

- 10.3.2.1 Increase in demand for repair of military vehicles due to Russia-Ukraine war to drive market

- TABLE 50 RUSSIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 51 RUSSIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 52 RUSSIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 53 RUSSIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Presence of key players for military vehicle sustainment to drive market

- TABLE 54 UK: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 55 UK: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 56 UK: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 57 UK: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Increase in military spending to drive market

- TABLE 58 FRANCE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 59 FRANCE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 60 FRANCE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 61 FRANCE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.3.5 REST OF EUROPE

- TABLE 62 REST OF EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 63 REST OF EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 64 REST OF EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 65 REST OF EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.3.1 PESTLE ANALYSIS

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS

- 10.4.1.1 Political

- 10.4.1.2 Economic

- 10.4.1.3 Social

- 10.4.1.4 Technological

- 10.4.1.5 Legal

- 10.4.1.6 Environmental

- FIGURE 32 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET SNAPSHOT

- TABLE 66 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 67 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Rise in need of sustainment and support for extensive military vehicle fleet to drive market

- TABLE 74 CHINA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 75 CHINA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 76 CHINA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 77 CHINA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Privatization in military vehicle sustainment to drive market

- TABLE 78 INDIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 79 INDIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 80 INDIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 81 INDIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Increasing number of contracts for military vehicles with European countries to drive market

- TABLE 82 JAPAN: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 83 JAPAN: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 84 JAPAN: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 85 JAPAN: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Development of military vehicle sustainment centers to drive market

- TABLE 86 AUSTRALIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 87 AUSTRALIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 88 AUSTRALIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 89 AUSTRALIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 90 REST OF ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.4.1 PESTLE ANALYSIS

- 10.5 REST OF THE WORLD

- FIGURE 33 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET SNAPSHOT

- TABLE 94 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 95 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 96 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 97 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 98 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 99 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- TABLE 100 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2020-2022 (USD MILLION)

- TABLE 101 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2023-2028 (USD MILLION)

- 10.5.1 MIDDLE EAST & AFRICA

- 10.5.1.1 Border tensions and geopolitical competition to drive market

- TABLE 102 MIDDLE EAST & AFRICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

- 10.5.2 LATIN AMERICA

- 10.5.2.1 Increasing demand for military vehicles to drive market

- TABLE 106 LATIN AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020-2022 (USD MILLION)

- TABLE 107 LATIN AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 108 LATIN AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020-2022 (USD MILLION)

- TABLE 109 LATIN AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 MARKET RANKING ANALYSIS

- FIGURE 34 MARKET RANKING OF TOP 5 PLAYERS, 2023

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 35 MARKET SHARE ANALYSIS FOR TOP 5 PLAYERS, 2022

- TABLE 110 MILITARY VEHICLE SUSTAINMENT MARKET: DEGREE OF COMPETITION

- 11.4 REVENUE ANALYSIS

- FIGURE 36 REVENUE ANALYSIS FOR TOP 5 PLAYERS, 2022

- 11.5 COMPETITIVE BENCHMARKING

- TABLE 111 COMPANY PRODUCT FOOTPRINT

- TABLE 112 REGION FOOTPRINT ANALYSIS

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 37 MILITARY VEHICLE SUSTAINMENT MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.7 START-UP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 STARTING BLOCKS

- 11.7.4 DYNAMIC COMPANIES

- FIGURE 38 MILITARY VEHICLE SUSTAINMENT MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 MARKET EVALUATION FRAMEWORK

- 11.8.2 PRODUCT LAUNCHES

- TABLE 113 PRODUCT LAUNCHES, 2022-2023

- 11.8.3 DEALS

- TABLE 114 DEALS, 2020-2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 INTRODUCTION

- 12.2 DEPOT MAINTENANCE LOCATIONS IN US

- FIGURE 39 DEPOT MAINTENANCE LOCATIONS IN US: SNAPSHOT

- 12.3 KEY PLAYERS

- 12.3.1 BAE SYSTEMS

- TABLE 115 BAE SYSTEMS: COMPANY OVERVIEW

- FIGURE 40 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 116 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 BAE SYSTEMS: DEALS

- 12.3.2 RHEINMETALL AG

- TABLE 118 RHEINMETALL AG.: COMPANY OVERVIEW

- FIGURE 41 RHEINMETALL AG: COMPANY SNAPSHOT

- TABLE 119 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 121 RHEINMETALL AG: DEALS

- 12.3.3 ELBIT SYSTEMS LTD.

- TABLE 122 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 42 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 123 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 ELBIT SYSTEMS LTD.: DEALS

- 12.3.4 GENERAL DYNAMICS CORPORATION

- TABLE 125 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- FIGURE 43 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- TABLE 126 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 128 GENERAL DYNAMICS CORPORATION: DEALS

- 12.3.5 OSHKOSH CORPORATION

- TABLE 129 OSHKOSH CORPORATION: COMPANY OVERVIEW

- FIGURE 44 OSHKOSH CORPORATION: COMPANY SNAPSHOT

- TABLE 130 OSHKOSH CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 OSHKOSH CORPORATION: DEALS

- 12.3.6 MOOG INC.

- TABLE 132 MOOG INC.: COMPANY OVERVIEW

- FIGURE 45 MOOG INC.: COMPANY SNAPSHOT

- TABLE 133 MOOG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.7 THALES

- TABLE 134 THALES: COMPANY OVERVIEW

- FIGURE 46 THALES: COMPANY SNAPSHOT

- TABLE 135 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.8 SAIC

- TABLE 136 SAIC: COMPANY OVERVIEW

- FIGURE 47 SAIC: COMPANY SNAPSHOT

- TABLE 137 SAIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.9 LEONARDO S.P.A.

- TABLE 138 LEONARDO S.P.A.: COMPANY OVERVIEW

- FIGURE 48 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 139 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.10 SAAB AB

- TABLE 140 SAAB AB: COMPANY OVERVIEW

- FIGURE 49 SAAB AB: COMPANY SNAPSHOT

- TABLE 141 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.11 ST ENGINEERING

- TABLE 142 ST ENGINEERING: COMPANY OVERVIEW

- FIGURE 50 ST ENGINEERING: COMPANY SNAPSHOT

- TABLE 143 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 ST ENGINEERING: DEALS

- 12.3.12 KBR INC.

- TABLE 145 KBR INC.: COMPANY OVERVIEW

- FIGURE 51 KBR INC.: COMPANY SNAPSHOT

- TABLE 146 KBR INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.13 VSE CORPORATION

- TABLE 147 VSE CORPORATION: COMPANY OVERVIEW

- FIGURE 52 VSE CORPORATION: COMPANY SNAPSHOT

- TABLE 148 VSE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 VSE CORPORATION: DEALS

- 12.3.14 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

- TABLE 150 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY OVERVIEW

- FIGURE 53 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

- TABLE 151 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.15 CUMMINS INC.

- TABLE 152 CUMMINS INC.: COMPANY OVERVIEW

- FIGURE 54 CUMMINS INC.: COMPANY SNAPSHOT

- TABLE 153 CUMMINS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.16 GM DEFENSE LLC

- TABLE 154 GM DEFENSE LLC: COMPANY OVERVIEW

- TABLE 155 GM DEFENSE LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 GM DEFENSE LLC: DEALS

- 12.3.17 MAHINDRA & MAHINDRA LTD.

- TABLE 157 MAHINDRA & MAHINDRA LTD.: COMPANY OVERVIEW

- FIGURE 55 MAHINDRA & MAHINDRA LTD.: COMPANY SNAPSHOT

- TABLE 158 MAHINDRA & MAHINDRA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3.18 MANTECH INTERNATIONAL CORPORATION

- TABLE 159 MANTECH INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 160 MANTECH INTERNATIONAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 MANTECH INTERNATIONAL CORPORATION: DEALS

- 12.3.19 AMENTUM SERVICES INC.

- TABLE 162 AMENTUM SERVICES INC.: COMPANY OVERVIEW

- TABLE 163 AMENTUM SERVICES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 AMENTUM SERVICES INC.: DEALS

- 12.3.20 NAVISTAR DEFENSE LLC

- TABLE 165 NAVISTAR DEFENSE LLC: COMPANY OVERVIEW

- TABLE 166 NAVISTAR DEFENSE LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 NAVISTAR DEFENSE LLC: DEALS

- 12.4 OTHER PLAYERS

- 12.4.1 AM GENERAL

- TABLE 168 AM GENERAL: COMPANY OVERVIEW

- 12.4.2 GORIZIANE

- TABLE 169 GORIZIANE: COMPANY OVERVIEW

- 12.4.3 DGC INTERNATIONAL

- TABLE 170 DGC INTERNATIONAL: COMPANY OVERVIEW

- 12.4.4 EDGE GROUP PJSC

- TABLE 171 EDGE GROUP PJSC: COMPANY OVERVIEW

- 12.4.5 EXCALIBUR ARMY SPOL. S R.O.

- TABLE 172 EXCALIBUR ARMY SPOL. S R.O.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS