|

|

市場調査レポート

商品コード

1364757

多要素認証(MFA)の世界市場:認証タイプ別、コンポーネント別、モデルタイプ別、最終用途産業別、地域別 - 予測(~2028年)Multi-Factor Authentication Market by Authentication Type (Password-Based Authentication, Passwordless Authentication), Component (Hardware, Software, Services), Model Type, End User Industry and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 多要素認証(MFA)の世界市場:認証タイプ別、コンポーネント別、モデルタイプ別、最終用途産業別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月10日

発行: MarketsandMarkets

ページ情報: 英文 286 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の多要素認証(MFA)の市場規模は、2023年に152億米ドル、2028年までに348億米ドルに達し、予測期間にCAGRで18.0%の成長が予測されています。

市場の成長軌道を形成する主な促進要因は、金銭的損失や評判の低下につながる、セキュリティ侵害や巧妙なサイバー攻撃の増加です。さらに、熟練したサイバーセキュリティ専門家の不足が市場成長を妨げる可能性があります。

「最終用途産業別では、BFSI産業が最大の市場規模を有します。」

BFSI産業は、顧客の財務データ、ユーザーID、パスワード、その他の個人情報など、機密性の高い情報を保持しているため、MFAに関連する最新技術の採用の最前線にいます。この産業は、機密性の高い金融データを保有しているため、最先端のMFAソリューションをいち早く採用しています。PIPEDA、GLBA、FFIECなどの政府の指令や、PCI DSS、SOXなどの基準により、金融機関はサイバー犯罪者から確実に保護することが求められています。こうした規制により、BFSI産業ではセキュリティを高めるためにMFAの使用が義務づけられています。さらに、オンラインバンキングサービスやeコマース活動の増加に伴うデジタル化のニーズの高まりと厳格な規制遵守が、市場の成長を促進すると予想されます。

「モデルタイプ別では、4要素認証セグメントが予測期間中にもっとも高いCAGRで成長します。」

4要素認証は、その精巧な認証と破られないセキュリティ設計により、もっとも有望な技術の1つになると予測されています。

「地域別では、北米が最大の市場規模を占めています。」

世界でもっとも多くのMFAベンダーが存在するという点で、北米が世界市場をリードしています。北米はセキュリティ技術の採用とインフラについて、もっとも進んだ地域です。この地域の主な成長要因は、データコンプライアンス規制の遵守とクラウド展開の普及です。北米地域では、さまざまなセキュリティ関連の規制が通信インフラ全体の保護を管理しています。さらに、北米ではクラウドベースアプリケーションの採用率が高いため、サイバー攻撃は増加し、巧妙化しています。そのため、同地域の産業では、大規模なMFAソリューションの導入が進んでいます。さらに北米には、Microsoft、Broadcom、OneSpan、OKTA、Micro Focusといった主要MFAベンダーが存在します。このような著名ベンダーのプレゼンスが、同地域におけるMFAソリューションとサービスの採用を後押ししています。

当レポートでは、世界の多要素認証(MFA)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 多要素認証(MFA)市場の概要

- 多要素認証(MFA)市場:認証タイプ別(2023年)

- 多要素認証(MFA)市場:コンポーネント別(2023年)

- 多要素認証(MFA)市場:モデルタイプ別(2023年)

- 多要素認証(MFA)の市場シェア:上位3つの最終用途産業と地域(2023年)

- 市場投資シナリオ

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- バリューチェーン分析

- エコシステム

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 顧客/クライアントのビジネスに影響を与える動向と混乱

- 技術ロードマップ

- ビジネスモデル分析

- 多要素認証(MFA)の進化

- 規制情勢

- HSコード

- 主なステークホルダーと購入基準

- 主な会議とイベント(2023年~2024年)

第6章 多要素認証(MFA)市場:認証タイプ別

- イントロダクション

- パスワードベースの認証

- パスワードレス認証

第7章 多要素認証(MFA)市場:コンポーネント別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第8章 多要素認証(MFA)市場:モデルタイプ別

- イントロダクション

- 2要素認証

- 3要素認証

- 4要素認証

- 5要素認証

第9章 多要素認証(MFA)市場:最終用途産業別

- イントロダクション

- BFSI

- 政府

- 旅行/入国管理

- 軍事・防衛

- 商業セキュリティ

- 医療

- IT・ITES

- 通信

- メディア・エンターテインメント

- その他の最終用途産業

第10章 多要素認証(MFA)市場:地域別

- イントロダクション

- 北米

- 北米の多要素認証(MFA)市場の促進要因

- 北米の不況の影響

- 北米の規制情勢

- 米国

- カナダ

- 欧州

- 欧州の多要素認証(MFA)市場の促進要因

- 欧州の不況の影響

- 欧州の規制情勢

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋の多要素認証(MFA)市場の促進要因

- アジア太平洋の不況の影響

- アジア太平洋の規制情勢

- オーストラリア

- インド

- 中国

- 日本

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカの多要素認証(MFA)市場の促進要因

- 中東・アフリカの不況の影響

- 中東・アフリカの規制情勢

- アラブ首長国連邦

- サウジアラビア

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカの多要素認証(MFA)市場の促進要因

- ラテンアメリカの不況の影響

- ラテンアメリカの規制情勢

- ブラジル

- メキシコ

- その他のラテンアメリカ

第11章 競合情勢

- 概要

- 主要企業の収益の分析

- 市場シェア分析

- 収益実績の分析

- 主要企業の市場ランキング

- 主要企業の評価マトリクス

- 主要企業の競合ベンチマーキング

- スタートアップ/中小企業の評価マトリクス

- 世界の主要市場企業とその本社のスナップショット

- ベンダーの評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- MICROSOFT

- THALES GROUP

- OKTA

- BROADCOM

- ONESPAN

- MICRO FOCUS

- HID GLOBAL

- CISCO

- PING IDENTITY

- RSA SECURITY

- ESET

- YUBICO

- FORGEROCK

- CYBERARK

- ONELOGIN

- SECUREAUTH

- ORACLE

- SALESFORCE

- その他の主要企業

- SECRET DOUBLE OCTOPUS

- SILVERFORT

- TRUSONA

- FUSIONAUTH

- HYPR

- KEYLESS

- LUXCHAIN

第13章 隣接市場

- 隣接市場のイントロダクション

- 制限事項

- 隣接市場

- ID・アクセス管理市場

- デジタルアイデンティティソリューション市場

第14章 付録

The global MFA market size is projected to grow from USD 15.2 billion in 2023 to USD 34.8 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 18.0% during the forecast period. The MFA market is propelled by key factors shaping its growth trajectory. These include rising security breaches and sophisticated cyberattacks leading to financial and reputational loss. Furthermore, the scarcity of skilled cybersecurity professionals may hinder market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Authentication type, components, model type, end users industry, and regions. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"By end-user industry, BFSI industry holds the largest market size."

The BFSI industry is at the forefront of adopting the latest technologies related to MFA as it holds highly confidential information, such as the financial data of customers, user IDs, passwords, and other personal information. The industry is an early adopter of cutting-edge MFA solutions as they possess highly sensitive financial data. Government mandates such as the Personal Information Protection and Electronic Documents Act (PIPEDA), Gramm-Leach-Bliley Act (GLBA), Federal Financial Institutions Examination Council (FFIEC), along with standards that include Payment Card Industry Data Security Standard (PCI DSS), and Sarbanes-Oxley Act (SOX), require financial institutions to ensure protection from cyber criminals. Such regulations mandate the use of MFA in the BFSI industry to increase security. Moreover, the increased need for digitalization with the rise in online banking services, eCommerce activities, and stringent regulatory compliance are expected to drive the MFA market growth.

"By model type, four-factor authentication segment to grow at highest CAGR during the forecast period."

An authentication system is highly secure when the user provides many identification factors. Earlier, single-factor authentication was usually accomplished by providing "something you know," such as a password or PIN. The fourth factor is most referred to as location (where you are) but could also be a matter of time, or in some people's opinion, even a performance, an exhibition, or even other people.

Four-factor authentication is achieved by requiring possession, location, a biometric, and a knowledge factor or by requiring location, a biometric, and two knowledge factors. Additional security parameters have encouraged companies to adopt such solutions to avoid cyberattacks. The four-factor authentication is expected to be one of the most promising technologies because of its sophisticated authentication and unbreakable security design.

"By region, North America holds the largest market size."

North America leads the global MFA market in terms of the presence of the world's most significant number of MFA vendors. North America is the most advanced region regarding security technology adoption and infrastructure. The major growth drivers for this region are the widespread adherence to data compliance regulations and cloud deployments. Various security-related regulatory compliances control the overall protection of the communication infrastructures in the North American region. Moreover, due to the high adoption of cloud-based applications in North America, cyberattacks are increasing and becoming more sophisticated. Hence, industries in the region are increasingly implementing extensive MFA solutions. Moreover, North America is home to major MFA vendors such as Microsoft, Broadcom, OneSpan, OKTA, and Micro Focus. The presence of such prominent vendors drives the adoption of MFA solutions and services in the region.

Breakdown of primaries

The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level - 40%, Director-35%, & other- 25%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 45%, rest of World-5%

Major vendors in the global MFA market include Microsoft (US), Thales (France), Okta (US), Broadcom (US), OneSpan (US), Micro Focus (UK), HID Global (US), Cisco (US), Ping Identity (US), RSA Security (US). The study includes an in-depth competitive analysis of the key players in the MFA market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the MFA market and forecasts its size by Authentication Type (Password-Based, Passwordless), Component (Hardware, Software, Services), by Model Type (Two-factor authentication, Three-factor authentication, Four-factor authentication, Five-factor authentication), by End-user Industry (BFSI, Government, Travel & Immigration, Military & Defense, Commercial Security, Healthcare, IT & ITeS, Telecom, Media & Entertainment, Other End-user Industry), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall MFA market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing adoption of BYOD, CYOD, and WFH trends, Rising security breaches and sophisticated cyberattacks leading to financial and reputational loss, Stringent government regulations to increase the adoption of MFA solutions, Rising instances of identity theft and fraud), restraints (High cost and technical complexities in implementing MFA solutions, Increasing response time in higher-order authentication model), opportunities (Proliferation of cloud-based MFA solutions and services, Rising adoption of interconnected devices in the IoT environment, High volume of online transactions) and challenges (Lack of awareness related to MFA among enterprises, Scarcity of skilled cybersecurity professionals)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the MFA market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the MFA market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the MFA market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Microsoft (US), Thales (France), Okta (US), Broadcom (US), OneSpan (US), Micro Focus (UK), HID Global (US), Cisco (US), Ping Identity (US), RSA Security (US) and among others in the MFA market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MULTI-FACTOR AUTHENTICATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary profiles

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION AND MARKET BREAKUP

- FIGURE 3 MULTI-FACTOR AUTHENTICATION MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 MULTI-FACTOR AUTHENTICATION MARKET ESTIMATION: RESEARCH FLOW

- 2.3.1 REVENUE ESTIMATES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, SUPPLY-SIDE ANALYSIS: REVENUE OF HARDWARE, SOLUTIONS, AND SERVICES FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL HARDWARE, SOLUTIONS, AND SERVICES OF VENDORS

- 2.3.2 DEMAND-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, TOP-DOWN (DEMAND SIDE)

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT AND ASSUMPTIONS

- 2.5.1 RECESSION IMPACT

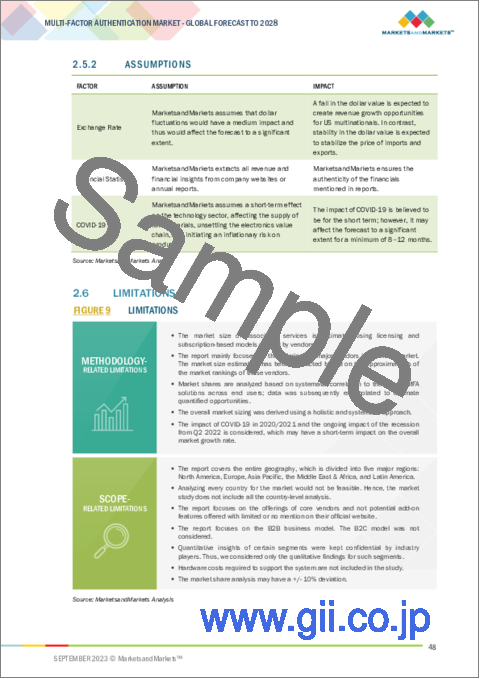

- 2.5.2 ASSUMPTIONS

- 2.6 LIMITATIONS

- FIGURE 9 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 MULTI-FACTOR AUTHENTICATION MARKET SIZE AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MULTI-FACTOR AUTHENTICATION MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y %)

- FIGURE 10 GLOBAL MULTI-FACTOR AUTHENTICATION MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 11 NORTH AMERICA TO DOMINATE MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF MULTI-FACTOR AUTHENTICATION MARKET

- FIGURE 12 GROWING INSTANCES OF DATA BREACHES, RISING ADOPTION OF BYOD TRENDS, AND STRINGENT REGULATIONS TO DRIVE MARKET

- 4.2 MULTI-FACTOR AUTHENTICATION MARKET: BY AUTHENTICATION TYPE, 2023

- FIGURE 13 PASSWORD-BASED AUTHENTICATION SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 MULTI-FACTOR AUTHENTICATION MARKET: BY COMPONENT, 2023

- FIGURE 14 SOFTWARE SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- 4.4 MULTI-FACTOR AUTHENTICATION MARKET: BY MODEL TYPE, 2023

- FIGURE 15 TWO-FACTOR AUTHENTICATION TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- 4.5 MULTI-FACTOR AUTHENTICATION MARKET SHARE: TOP THREE END-USE INDUSTRIES AND REGIONS, 2023

- FIGURE 16 BFSI END-USE INDUSTRY AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.6 MARKET INVESTMENT SCENARIO

- FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MULTI-FACTOR AUTHENTICATION MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of BYOD, CYOD, and WFH trends

- 5.2.1.2 Rising security breaches and sophisticated cyberattacks to lead to financial and reputational loss

- 5.2.1.3 Stringent government regulations to increase adoption of MFA solutions

- 5.2.1.4 Rising instances of identity theft and fraud

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and technical complexities

- 5.2.2.2 More time-consuming than two-factor authentication systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Proliferation of cloud-based MFA solutions and services

- 5.2.3.2 Growing adoption of interconnected devices in IoT environment

- 5.2.3.3 Increasing digital banking and online transactions

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness regarding MFA solutions

- 5.2.4.2 Scarcity of skilled cybersecurity professionals

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 PING IDENTITY IMPROVED BOOKING RECONCILIATION PROCESS OF PAMEIJER ACROSS ALL BUSINESS UNITS

- 5.3.2 AMERIGAS DEPLOYED DUO SECURITY'S MFA TO ACHIEVE PCI-DSS COMPLIANCE

- 5.3.3 BROWARD COLLEGE IMPLEMENTED ONELOGIN MULTI-FACTOR AUTHENTICATION TO OFFER ACCESS MANAGEMENT

- 5.3.4 OKTA DELIVERED BLACKHAWK NETWORK CENTRALIZED, SCALABLE PLATFORM AND SAFEGUARDED BACKEND BY EXTENDING SSO AND MFA

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 19 MULTI-FACTOR AUTHENTICATION MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM

- FIGURE 20 MULTI-FACTOR AUTHENTICATION MARKET: ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 MULTI-FACTOR AUTHENTICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 OKTA

- 5.7.2 ONELOGIN

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 OUT-OF-BAND AUTHENTICATION

- 5.8.2 BUILT-IN FINGERPRINT READERS

- 5.8.3 BAKED-IN AUTHENTICATION

- 5.9 PATENT ANALYSIS

- FIGURE 22 LIST OF MAJOR PATENTS FOR MULTI-FACTOR AUTHENTICATION MARKET

- TABLE 6 LIST OF PATENTS IN MULTI-FACTOR AUTHENTICATION MARKET, 2023

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS/CLIENTS' BUSINESSES

- FIGURE 23 MULTI-FACTOR AUTHENTICATION MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS/CLIENTS' BUSINESSES

- 5.11 TECHNOLOGY ROADMAP

- TABLE 7 MULTI-FACTOR AUTHENTICATION MARKET: TECHNOLOGY ROADMAP

- 5.12 BUSINESS MODEL ANALYSIS

- TABLE 8 MULTI-FACTOR AUTHENTICATION MARKET: BUSINESS MODEL ANALYSIS

- 5.13 EVOLUTION OF MULTI-FACTOR AUTHENTICATION

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 CRIMINAL JUSTICE INFORMATION SYSTEM SECURITY POLICY

- 5.14.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.14.4 FFIEC AUTHENTICATION IN AN INTERNET BANKING ENVIRONMENT

- 5.14.5 FAIR AND ACCURATE CREDIT TRANSACTION ACT

- 5.14.6 IDENTITY THEFT RED FLAGS

- 5.14.7 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.14.8 SARBANES-OXLEY ACT

- 5.14.9 GRAMM-LEACH-BLILEY ACT

- 5.15 HS CODES

- TABLE 10 EXPORT SCENARIO FOR HS CODE 8301, BY COUNTRY, 2022 (KG)

- TABLE 11 IMPORT SCENARIO FOR HS CODE 8301, BY COUNTRY, 2022 (KG)

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.16.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.17 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 14 MULTI-FACTOR AUTHENTICATION MARKET: LIST OF CONFERENCES AND EVENTS, 2023-2024

6 MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE

- 6.1 INTRODUCTION

- 6.1.1 AUTHENTICATION TYPE: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- FIGURE 26 PASSWORDLESS AUTHENTICATION SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 15 MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 16 MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- 6.2 PASSWORD-BASED AUTHENTICATION

- 6.2.1 EASY INTEGRATION OF PASSWORD-BASED AUTHENTICATION INTO VARIOUS SYSTEMS, APPLICATIONS, AND DEVICES TO DRIVE ITS ADOPTION

- TABLE 17 PASSWORD-BASED AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 18 PASSWORD-BASED AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 PASSWORDLESS AUTHENTICATION

- 6.3.1 PASSWORDLESS AUTHENTICATION TO USE UNIQUE BIOMETRIC ATTRIBUTES AND ELIMINATE ISSUE OF REMEMBERING PASSWORDS

- TABLE 19 PASSWORDLESS AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 20 PASSWORDLESS AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

7 MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.1.1 COMPONENT: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- FIGURE 27 SOFTWARE SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 21 MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 22 MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 7.2 HARDWARE

- 7.2.1 HARDWARE-BASED MFA METHODS TO PROVIDE ROBUST AUTHENTICATION AND SIGNIFICANTLY REDUCE RISK OF UNAUTHORIZED ACCESS

- TABLE 23 HARDWARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 24 HARDWARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 SOFTWARE

- 7.3.1 MFA SOFTWARE TO HELP BUSINESSES COMPLY WITH REGULATORY NORMS WHILE SECURING THEIR CONFIDENTIAL DATA

- TABLE 25 SOFTWARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 26 SOFTWARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 SERVICES

- 7.4.1 MFA SERVICES TO DEPLOY, EXECUTE, AND MAINTAIN MFA PLATFORMS IN ORGANIZATIONS

- TABLE 27 SERVICES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 SERVICES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE

- 8.1 INTRODUCTION

- 8.1.1 MODEL TYPE: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- FIGURE 28 TWO-FACTOR AUTHENTICATION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 29 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 30 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- 8.2 TWO-FACTOR AUTHENTICATION

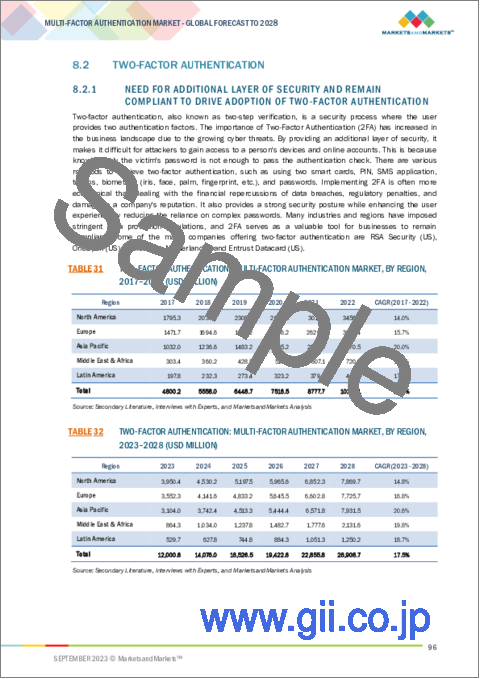

- 8.2.1 NEED FOR ADDITIONAL LAYER OF SECURITY AND REMAIN COMPLIANT TO DRIVE ADOPTION OF TWO-FACTOR AUTHENTICATION

- TABLE 31 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 32 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 33 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 34 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2.2 SMART CARD WITH PIN

- 8.2.2.1 Need for high level of security and protect sensitive consumer and company data with smart cards and PINs to drive market

- TABLE 35 TWO-FACTOR AUTHENTICATION: SMART CARD WITH PIN MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 TWO-FACTOR AUTHENTICATION: SMART CARD WITH PIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.3 SMART CARD WITH BIOMETRIC TECHNOLOGY

- 8.2.3.1 Smart cards with biometric technology to control access to buildings, secure areas, and IT systems

- TABLE 37 TWO-FACTOR AUTHENTICATION: SMART CARD WITH BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 38 TWO-FACTOR AUTHENTICATION: SMART CARD WITH BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.4 BIOMETRIC TECHNOLOGY WITH PIN

- 8.2.4.1 Biometric technology with PIN to be used for various financial applications

- TABLE 39 TWO-FACTOR AUTHENTICATION: BIOMETRIC TECHNOLOGY WITH PIN MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 TWO-FACTOR AUTHENTICATION: BIOMETRIC TECHNOLOGY WITH PIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.5 TWO-FACTOR BIOMETRIC TECHNOLOGY

- 8.2.5.1 Two-factor biometric technology to safeguard assets and maintain trust

- TABLE 41 TWO-FACTOR AUTHENTICATION: TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 TWO-FACTOR AUTHENTICATION: TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.6 ONE-TIME PASSWORD WITH PIN

- 8.2.6.1 OTP with PIN to secure access to corporate systems and mobile apps

- TABLE 43 TWO-FACTOR AUTHENTICATION: ONE-TIME PASSWORD WITH PIN MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 TWO-FACTOR AUTHENTICATION: ONE-TIME PASSWORD WITH PIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 THREE-FACTOR AUTHENTICATION

- 8.3.1 INCREASING CLOUD COMPUTING USAGE TO DRIVE ADOPTION OF THREE-FACTOR AUTHENTICATION

- TABLE 45 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 48 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.3.2 SMART CARD WITH PIN AND BIOMETRIC TECHNOLOGY

- 8.3.2.1 High resilience to various forms of attacks, including phishing, credential theft, and identity fraud, to drive market

- TABLE 49 THREE-FACTOR AUTHENTICATION: SMART CARD WITH PIN AND BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 THREE-FACTOR AUTHENTICATION: SMART CARD WITH PIN AND BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.3 SMART CARD WITH TWO-FACTOR BIOMETRIC TECHNOLOGY

- 8.3.3.1 Need for handling sensitive data in healthcare and finance and preventing data breaches to drive demand for smart card

- TABLE 51 THREE-FACTOR AUTHENTICATION: SMART CARD WITH TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 THREE-FACTOR AUTHENTICATION: SMART CARD WITH TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.4 PIN WITH TWO-FACTOR BIOMETRIC TECHNOLOGY

- 8.3.4.1 Need for superior security, compliance with legal requirements, and durability against online threats to drive market

- TABLE 53 THREE-FACTOR AUTHENTICATION: PIN WITH TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 THREE-FACTOR AUTHENTICATION: PIN WITH TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.5 THREE-FACTOR BIOMETRIC TECHNOLOGY

- 8.3.5.1 Three-factor biometric technology to impersonate legitimate users and reduce risk of identity theft

- TABLE 55 THREE-FACTOR AUTHENTICATION: THREE-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 THREE-FACTOR AUTHENTICATION: THREE-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 FOUR-FACTOR AUTHENTICATION

- 8.4.1 NEED TO LEVERAGE FOUR DISTINCT AUTHENTICATION FACTORS TO VERIFY USER IDENTITY AND ENHANCE SECURITY TO UNPRECEDENTED LEVELS

- TABLE 57 FOUR-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 FOUR-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 FIVE-FACTOR AUTHENTICATION

- 8.5.1 5FA TO OFFER HIGH LEVEL OF SECURITY TO SAFEGUARD DATA AND TECHNOLOGY

- TABLE 59 FIVE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 FIVE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.1.1 END-USE INDUSTRY: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- FIGURE 29 BFSI SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 61 MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 62 MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2 BFSI

- 9.2.1 NEED TO PROTECT HIGHLY CONFIDENTIAL INFORMATION AND HELP SECURE GOVERNMENT DATA TO DRIVE MARKET

- TABLE 63 BFSI: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 64 BFSI: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 GOVERNMENT

- 9.3.1 DIGITALIZATION OF GOVERNMENT AND DEFENSE PROCESSES AND SAFEGUARD GOVERNMENT DATA FROM BREACHES TO DRIVE MARKET

- TABLE 65 GOVERNMENT: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 GOVERNMENT: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 TRAVEL & IMMIGRATION

- 9.4.1 MULTI-FACTOR AUTHENTICATION TO CAPTURE, MANAGE, AND APPLY IDENTITY DATA ACROSS DIGITAL CHANNELS

- TABLE 67 TRAVEL & IMMIGRATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 TRAVEL & IMMIGRATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 MILITARY & DEFENSE

- 9.5.1 DEFENSE SEGMENT TO UTILIZE BIOMETRICS TO TACKLE CYBERATTACKS

- TABLE 69 MILITARY & DEFENSE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 70 MILITARY & DEFENSE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 COMMERCIAL SECURITY

- 9.6.1 ORGANIZATIONS TO SAFEGUARD CLIENT DATA AND ASSETS WITH MULTI-FACTOR AUTHENTICATION

- TABLE 71 COMMERCIAL SECURITY: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 72 COMMERCIAL SECURITY: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 HEALTHCARE

- 9.7.1 MULTI-FACTOR AUTHENTICATION SOLUTIONS TO ADDRESS DATA SECURITY, PATIENT SAFETY, AND PRODUCTIVITY

- TABLE 73 HEALTHCARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 74 HEALTHCARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 IT & ITES

- 9.8.1 RAPID ADOPTION IN WFH POLICY AND FOCUS ON MAINTAINING SECURITY OF HYBRID IT ENVIRONMENTS TO DRIVE MARKET

- TABLE 75 IT & ITES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 76 IT & ITES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9 TELECOM

- 9.9.1 ADVENT OF 5G TECHNOLOGY AND INTERNET OF THINGS TO DRIVE MARKET

- TABLE 77 TELECOM: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 78 TELECOM: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10 MEDIA & ENTERTAINMENT

- 9.10.1 MULTI-FACTOR AUTHENTICATION TO SECURE VALUABLE INTELLECTUAL PROPERTY

- TABLE 79 MEDIA & ENTERTAINMENT: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 80 MEDIA & ENTERTAINMENT: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.11 OTHER END-USE INDUSTRIES

- TABLE 81 OTHER END-USE INDUSTRIES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 82 OTHER END-USE INDUSTRIES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

10 MULTI-FACTOR AUTHENTICATION MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 30 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 83 MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 84 MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- 10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 85 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.4 US

- 10.2.4.1 Presence of stringent laws, growing internet penetration, and government initiatives to adopt MFA to drive market

- TABLE 99 US: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 100 US: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 101 US: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 102 US: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 103 US: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 104 US: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 105 US: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 106 US: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.5 CANADA

- 10.2.5.1 Increased occurrence of online fraud, terrorist attacks, and bad bot attacks to drive market

- TABLE 107 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 108 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 109 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 110 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 111 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 112 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 113 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 114 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- 10.3.3 EUROPE: REGULATORY LANDSCAPE

- TABLE 115 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 116 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 117 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 118 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 119 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 120 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 121 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 122 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 123 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 124 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 125 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 126 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 127 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 128 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Increasing identity fraud to boost adoption of MFA

- TABLE 129 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 130 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 131 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 132 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 133 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 134 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 135 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 136 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.5 GERMANY

- 10.3.5.1 Rising innovative technologies and need to combat financial crimes to drive market

- TABLE 137 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 138 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 139 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 140 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 141 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 142 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 143 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 144 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.6 FRANCE

- 10.3.6.1 Guidelines of French Data Protection Authority to adopt MFA to drive market

- TABLE 145 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 146 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 147 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 148 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 149 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 150 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 151 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 152 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.7 ITALY

- 10.3.7.1 Consistent growth in cybersecurity and need to comply with GDPR to drive market

- TABLE 153 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 154 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 155 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 156 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 157 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 158 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 159 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 160 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.8 REST OF EUROPE

- TABLE 161 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 162 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 163 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 164 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 165 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 166 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 168 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- 10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 169 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Need to safeguard data, websites, and mobile applications and focus of Australian TPB to enhance its online portal with MFA to drive market

- TABLE 183 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 184 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 185 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 186 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 187 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 188 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 189 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 190 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Personal Data Protection Act to strengthen data privacy across all FIs to drive demand for MFA

- TABLE 191 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 192 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 193 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 194 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 195 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 196 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 197 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 198 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.6 CHINA

- 10.4.6.1 Surge in mobile commerce and digital payment platforms to drive growth of MFA

- TABLE 199 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 200 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 201 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 202 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 203 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 204 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 205 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 206 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.7 JAPAN

- 10.4.7.1 Strong technological base and focus on data protection and government support to drive market

- TABLE 207 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 208 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 209 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 210 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 211 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 212 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 213 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 214 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.8 REST OF ASIA PACIFIC

- TABLE 215 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 220 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 221 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 223 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.4 UAE

- 10.5.4.1 Need to adopt modern low-friction authentication techniques to safeguard mixed workforces to drive market

- TABLE 237 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 238 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 239 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 240 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 241 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 242 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 243 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 244 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.5 KSA

- 10.5.5.1 Need to secure digital identities to fuel adoption of MFA solutions

- TABLE 245 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 246 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 247 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 248 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 249 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 250 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 251 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 252 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 253 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 254 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 255 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 256 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 260 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- 10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 261 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 262 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 264 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 266 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 267 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 268 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017-2022 (USD MILLION)

- TABLE 270 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023-2028 (USD MILLION)

- TABLE 271 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 272 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 273 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 274 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.4 BRAZIL

- 10.6.4.1 Rising adoption of digital penetration and social media to propel market

- TABLE 275 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 276 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 277 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 278 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 279 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 280 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 281 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 282 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.5 MEXICO

- 10.6.5.1 Rising social media and digital penetration to fuel demand for MFA solutions

- TABLE 283 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 284 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 285 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 286 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 287 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 288 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 289 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 290 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.6 REST OF LATIN AMERICA

- TABLE 291 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017-2022 (USD MILLION)

- TABLE 292 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023-2028 (USD MILLION)

- TABLE 293 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017-2022 (USD MILLION)

- TABLE 294 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 295 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017-2022 (USD MILLION)

- TABLE 296 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023-2028 (USD MILLION)

- TABLE 297 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 298 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS OF LEADING PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 33 MARKET SHARE ANALYSIS, 2022

- TABLE 299 INTENSITY OF COMPETITIVE RIVALRY

- 11.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 34 REVENUE ANALYSIS FOR KEY PLAYERS, 2020-2022 (USD BILLION)

- 11.5 MARKET RANKING OF KEY PLAYERS

- FIGURE 35 RANKING OF KEY PLAYERS

- 11.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 11.6.1 DEFINITION AND METHODOLOGY

- 11.6.2 STARS

- 11.6.3 EMERGING LEADERS

- 11.6.4 PERVASIVE PLAYERS

- 11.6.5 PARTICIPANTS

- 11.7 COMPETITIVE BENCHMARKING FOR KEY PLAYERS

- 11.7.1 OVERALL COMPANY FOOTPRINT

- FIGURE 36 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 11.8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- TABLE 300 LIST OF STARTUPS/SMES

- 11.8.1 DEFINITION AND METHODOLOGY

- 11.8.2 PROGRESSIVE COMPANIES

- 11.8.3 RESPONSIVE COMPANIES

- 11.8.4 DYNAMIC COMPANIES

- 11.8.5 STARTING BLOCKS

- FIGURE 37 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- 11.9 GLOBAL SNAPSHOTS OF KEY MARKET PLAYERS AND THEIR HEADQUARTERS

- FIGURE 38 REGIONAL SNAPSHOT

- 11.10 VALUATION AND FINANCIAL METRICS OF VENDORS

- FIGURE 39 VALUATION AND FINANCIAL METRICS OF MULTI-FACTOR AUTHENTICATION VENDORS

- 11.11 COMPETITIVE SCENARIO

- TABLE 301 MULTI-FACTOR AUTHENTICATION MARKET: PRODUCT LAUNCHES, 2021-2023

- TABLE 302 MULTI-FACTOR AUTHENTICATION MARKET: DEALS, 2021-2023

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 MICROSOFT

- TABLE 303 MICROSOFT: COMPANY OVERVIEW

- FIGURE 40 MICROSOFT: COMPANY SNAPSHOT

- TABLE 304 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 MICROSOFT: PRODUCT LAUNCHES

- TABLE 306 MICROSOFT: DEALS

- 12.1.2 THALES GROUP

- TABLE 307 THALES GROUP: COMPANY OVERVIEW

- FIGURE 41 THALES GROUP: COMPANY SNAPSHOT

- TABLE 308 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 THALES GROUP: PRODUCT LAUNCHES

- TABLE 310 THALES GROUP: DEALS

- 12.1.3 OKTA

- TABLE 311 OKTA: COMPANY OVERVIEW

- FIGURE 42 OKTA: COMPANY SNAPSHOT

- TABLE 312 OKTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 OKTA: PRODUCT LAUNCHES

- TABLE 314 OKTA: DEALS

- 12.1.4 BROADCOM

- TABLE 315 BROADCOM: COMPANY OVERVIEW

- FIGURE 43 BROADCOM: COMPANY SNAPSHOT

- TABLE 316 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 BROADCOM: DEALS

- 12.1.5 ONESPAN

- TABLE 318 ONESPAN: COMPANY OVERVIEW

- FIGURE 44 ONESPAN: COMPANY SNAPSHOT

- TABLE 319 ONESPAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 ONESPAN: PRODUCT LAUNCHES

- TABLE 321 ONESPAN: DEALS

- 12.1.6 MICRO FOCUS

- TABLE 322 MICRO FOCUS: COMPANY OVERVIEW

- TABLE 323 MICRO FOCUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 MICRO FOCUS: DEALS

- 12.1.7 HID GLOBAL

- TABLE 325 HID GLOBAL: COMPANY OVERVIEW

- TABLE 326 HID GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 HID GLOBAL: PRODUCT LAUNCHES

- TABLE 328 HID GLOBAL: DEALS

- 12.1.8 CISCO

- TABLE 329 CISCO: COMPANY OVERVIEW

- FIGURE 45 CISCO: COMPANY SNAPSHOT

- TABLE 330 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 CISCO: PRODUCT LAUNCHES

- TABLE 332 CISCO: DEALS

- 12.1.9 PING IDENTITY

- TABLE 333 PING IDENTITY: COMPANY OVERVIEW

- TABLE 334 PING IDENTITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 PING IDENTITY: PRODUCT LAUNCHES

- TABLE 336 PING IDENTITY: DEALS

- 12.1.10 RSA SECURITY

- TABLE 337 RSA SECURITY: COMPANY OVERVIEW

- TABLE 338 RSA SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 RSA SECURITY: DEALS

- 12.1.11 ESET

- 12.1.12 YUBICO

- 12.1.13 FORGEROCK

- 12.1.14 CYBERARK

- 12.1.15 ONELOGIN

- 12.1.16 SECUREAUTH

- 12.1.17 ORACLE

- 12.1.18 SALESFORCE

- 12.2 OTHER KEY PLAYERS

- 12.2.1 SECRET DOUBLE OCTOPUS

- 12.2.2 SILVERFORT

- 12.2.3 TRUSONA

- 12.2.4 FUSIONAUTH

- 12.2.5 HYPR

- 12.2.6 KEYLESS

- 12.2.7 LUXCHAIN

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 340 ADJACENT MARKETS AND FORECASTS

- 13.2 LIMITATIONS

- 13.3 ADJACENT MARKETS

- 13.3.1 IDENTITY AND ACCESS MANAGEMENT MARKET

- TABLE 341 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 342 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 343 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 344 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- 13.3.2 DIGITAL IDENTITY SOLUTIONS MARKET

- TABLE 345 DIGITAL IDENTITY SOLUTIONS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 346 DIGITAL IDENTITY SOLUTIONS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 347 DIGITAL IDENTITY SOLUTIONS MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 348 DIGITAL IDENTITY SOLUTIONS MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS