|

|

市場調査レポート

商品コード

1362381

バイオ燃料の世界市場:燃料タイプ別(エタノール、バイオディーゼル、再生可能ディーゼル、バイオジェット)、世代別(第1世代、第2世代、第3世代)、最終用途別(運輸、航空)、地域別-2028年までの予測Biofuel Market by Fuel Type (Ethanol, Biodiesel, Renewable Diesel, and Biojets), Generation (First Generation, Second Generation, Third Generation), End-use, Application (Transportation, Aviation) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| バイオ燃料の世界市場:燃料タイプ別(エタノール、バイオディーゼル、再生可能ディーゼル、バイオジェット)、世代別(第1世代、第2世代、第3世代)、最終用途別(運輸、航空)、地域別-2028年までの予測 |

|

出版日: 2023年09月28日

発行: MarketsandMarkets

ページ情報: 英文 219 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のバイオ燃料の市場規模は、2023年の1,674億米ドルから2028年には2,259億米ドルに成長すると予測され、予測期間中のCAGRは6.2%となる見込みです。

この成長は、世界的によりクリーンな燃料に対する需要の高まりによるものです。世界がよりクリーンで持続可能なエネルギーへの移行を目指す中、この需要は今後も伸び続けると予想されます。さらに、税額控除や曲げ加工義務といった政府の支援政策も、バイオ燃料市場の成長を後押しする主な理由です。

| 調査範囲 | |

|---|---|

| 対象範囲 | 2019-2028 |

| 基準年 | 2022 |

| 予測期間 | 2023-2028 |

| 単位 | USD |

| セグメント | 燃料タイプ, 燃料タイプ, 最終用途, 地域 |

| 対象地域 | 北米, 欧州, アジア太平洋, その他の地域 |

バイオディーゼル分野は予測期間中、第2位の市場シェアを占めると予想されます。バイオディーゼルは一般に、植物油や動物性脂肪などの原料から生産されます。再生可能な原料を利用することで、有限な化石燃料資源への依存を減らすと同時に、エネルギー安全保障を強化することができます。運輸部門からの二酸化炭素排出を削減する取り組みが活発化していることも、バイオ燃料市場におけるバイオディーゼル分野の成長を促す重要な要因の一つです。

予測期間中、第1世代セグメントが最大の市場シェアを占めると予想されます。第1世代バイオ燃料は、トウモロコシ、サトウキビ、大豆などの食用作物から生産されます。これらの作物はデンプン、糖分、油分を多く含んでおり、発酵やその他の化学処理によってバイオ燃料に変換することができます。入手が容易な原材料と多くの国々でのバイオ燃料の広範な利用が、第1世代セグメントのバイオ燃料市場を押し上げると思われます。

予測期間中、輸送分野がバイオ燃料市場の最大セグメントとなる見込みです。バイオ燃料は、様々な方法で輸送用途に使用することができます。例えば、バイオディーゼルは純粋な形で使用することも、ディーゼル燃料と混合して使用することもできます。エタノールは、純粋な形で使用することも、ガソリンと混合して使用することもできます。バイオ燃料は、再生可能ディーゼルなど、他の種類の輸送用燃料の製造にも利用できます。

当レポートでは、世界のバイオ燃料市場について調査し、燃料タイプ別、世代別、最終用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 生態系/市場マップ

- 技術分析

- 特許分析

- 貿易分析

- 価格分析

- 関税、法規、規制機関

- ポーターのファイブフォース分析

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 2023年~2024年の主要な会議とイベント

第6章 さまざまな形態のバイオ燃料

- イントロダクション

- 液体

- ガス状

- 固体

第7章 バイオ燃料市場、燃料タイプ別

- イントロダクション

- エタノール

- バイオディーゼル

- 再生可能ディーゼル

- バイオジェット

第8章 バイオ燃料市場、最終用途別

- イントロダクション

- 輸送

- 航空

- その他

第9章 バイオ燃料市場、世代別

- イントロダクション

- 第1世代

- 第2世代

- 第3世代

第10章 バイオ燃料市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他

第11章 競合情勢

- 概要

- 市場シェア分析、2022年

- 市場評価フレームワーク、2019~2023年

- 収益分析、2018年~2022年

- 主要企業評価マトリックス、2022年

- 企業のフットプリント

- スタートアップ/中小企業(SMES)の評価マトリックス、2022年

- 競合ベンチマーキング

- 競争シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- ADM

- VALERO

- NESTE

- GREEN PLAINS INC.

- POET, LLC.

- CHEVRON CORPORATION(CHEVRON RENEWABLE ENERGY GROUP)

- CARGILL, INCORPORATED

- WILMAR INTERNATIONAL LTD

- THE ANDERSONS, INC.

- VERBIO AG

- BORREGAARD AS

- AEMETIS, INC.

- RAIZEN

- FUTUREFUEL CORPORATION

- その他の企業

- CROPENERGIES AG

- BP P.L.C.

- MUNZER BIOINDUSTRIE GMBH

- ALGENOL

- PANNONIA BIO ZRT.

- BLUE BIOFUELS, INC.

第13章 付録

The global biofuel market is estimated to grow from USD 167.4 Billion in 2023 to USD 225.9 Billion by 2028; it is expected to record a CAGR of 6.2% during the forecast period. The growth is attributed to the rising demand for cleaner fuels worldwide. This demand is expected to continue to grow in the coming years as the world seeks to transition to a cleaner and more sustainable energy future. In addition, supportive government policies such as tax credits and bending mandates are another key reason driving the growth of the biofuel market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Fuel Type, Generation, End Use, Region |

| Regions covered | North America, Europe, APAC, RoW |

"Biodiesel: The second-largest segment of the biofuel market, by fuel type. "

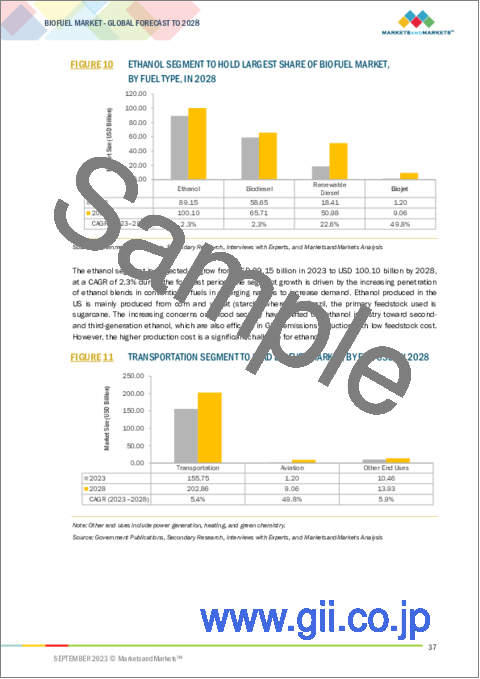

Based on fuel type, the biofuel market has been split into four types: ethanol, biodiesel, renewable diesel, and biojets. The biodiesel segment is expected to hold the second largest market share during the forecast period. Biodiesel is generally produced from feedstocks, such as vegetable oils and animal fats. The utilization of renewable feedstocks decreases reliance on finite fossil fuel resources while also enhancing energy security. The growing initiatives to reduce carbon emissions from the transport sector is one of the important factor driving the growth of the biodiesel segment in the biofuel market.

"First Generation segment is expected to be the largest segment during the forecast period based on generation."

By generation, the biofuel market has been segmented into the first-generation, second generation and third generation. The first generation segment is expected to hold the largest market share during the forecast period. First generation biofuels are produced from food crops, such as corn, sugarcane, and soybeans. These crops are high in starch, sugar, or oil, which can be converted into biofuels through fermentation or other chemical processes. Easily accessible raw materials and the extensive use of biofuel in many countries will boost the biofuel market in the first generation segment.

"By end use, the transportation segment is expected to be the largest segment during the forecast period."

Based on the end use, the biofuel market is segmented into transportation, aviation, and others. The transportation segment is expected to be the largest segment of the biofuel market during the forecast period. Biofuels can be used in transportation applications in a variety of ways. For example, biodiesel can be used in pure form or blended with diesel fuel. Ethanol can be used in pure form or blended with gasoline. Biofuels can also be used to produce other types of transportation fuels, such as renewable diesel. The mitigation of carbon emissions from the transport sector globally is one of the key factors accelerating the usage of biofuels in the transport sector.

"North America is expected to be the largest region in the biofuel market."

North America is expected to be the largest region in the biofuel market during the forecast period. Growth is attributed to the rising investments in deploying biorefineries and a highly optimistic outlook for the renewable energy industry in the region. Further, according to the BP Statistical Review of World Energy 2022, 38.5% of the total renewable biofuel produced in North America is consumed in the region. The majority of biofuel usage is in the form of a blend with refined petroleum products including gasoline, diesel fuel, heating oil and jet fuel. This shift from predominantly conventional fuels to biofuels is expected to drive the biofuel market in the region. Moreover, the favorable government policies and programs intended to promote the usage of biofuels are also expected to drive the biofuel market in North America.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: North America- 40%, Europe- 25%, Asia Pacific-25%, Rest of the World - 10%,

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The biofuel market is dominated by a few major players that have a wide regional presence. The leading players in the biofuel market are ADM (US), Chevron (US), Valero (US), Neste (Finland), and Cargill, Incorporated (US). The major strategy adopted by the players includes new product launches, contracts & agreements, partnerships, collaborations, joint ventures, mergers and acquisitions, and investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global biofuel market by fuel type, generation, end use, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the biofuel market.

Key Benefits of Buying the Report

- A transition toward the adoption of renewable energy sources and rising demand for cleaner fuels are a few of the key factors driving the biofuel market. Factors such as a high initial investment for setting up the biorefineries restrain the growth of the market. High rate depletion of fossil fuels and supportive government policies and programs to promote biofuels are expected to present lucrative opportunities for the players operating in the biofuel market. The variability and high cost of feedstocks pose a major challenge for the players, especially for emerging players operating in the biofuel market.

- Product Development/ Innovation: The biofuel market is witnessing significant product development and innovation, driven by the growing demand for biofuels in the transportation and aviation sectors. Companies are investing in developing advanced biofuel types using second-generation feedstocks such as used cooking oil, animal fats, and other agricultural residues.

- Market Development: Neste acquired Crimson Renewable Energy Holdings, LLC's used cooking oil (UCO) collecting and aggregation business and related assets. This acquisition strengthens Neste's global raw materials sourcing platform.

- Market Diversification: Chevron Renewable Energy Group launched its line of branded fuel solutions, EnDura Fuels, a line which produces many types of renewable fuel including InfinD, PuriD which is next-generation biodiesel, UltraClean, VelociD, and BeyonD. These products help aviation, marine, trucking, rail, and other industries reach sustainability targets by using cleaner-burning and lower-emission fuels.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include ADM (US), Chevron (US), Valero (US), Neste (Finland), and Cargill, Incorporated (US), among others in the biofuel market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 BIOFUEL MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 VOLUME UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BIOFUEL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 KEY DATA FROM PRIMARY SOURCES

- 2.1.2.1 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 8 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR BIOFUELS

- 2.3.3.1 Demand-side calculations

- 2.3.3.2 Demand-side assumptions

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 9 BIOFUEL MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side calculations

- 2.3.4.2 Supply-side assumptions

- 2.3.5 GROWTH FORECAST

- 2.3.6 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 1 BIOFUEL MARKET SNAPSHOT

- FIGURE 10 ETHANOL SEGMENT TO HOLD LARGEST SHARE OF BIOFUEL MARKET, BY FUEL TYPE, IN 2028

- FIGURE 11 TRANSPORTATION SEGMENT TO LEAD BIOFUEL MARKET, BY END USE, IN 2028

- FIGURE 12 FIRST-GENERATION BIOFUELS TO HOLD LARGEST SHARE OF BIOFUEL MARKET, BY GENERATION, IN 2028

- FIGURE 13 NORTH AMERICA DOMINATED BIOFUEL MARKET, BY REGION, IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIOFUEL MARKET

- FIGURE 14 INCREASING GLOBAL FOCUS ON GHG EMISSION REDUCTION AND ENERGY SUFFICIENCY TO DRIVE BIOFUEL MARKET

- 4.2 BIOFUEL MARKET IN NORTH AMERICA, BY FUEL TYPE AND COUNTRY

- FIGURE 15 ETHANOL AND US HELD LARGEST MARKET SHARES IN NORTH AMERICA IN 2022

- 4.3 BIOFUEL MARKET, BY REGION

- FIGURE 16 BIOFUEL MARKET IN EUROPE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 BIOFUEL MARKET, BY GENERATION

- FIGURE 17 FIRST-GENERATION BIOFUELS HELD LARGEST MARKET SHARE IN 2022

- 4.5 BIOFUEL MARKET, BY FUEL TYPE

- FIGURE 18 ETHANOL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.6 BIOFUEL MARKET, BY END USE

- FIGURE 19 TRANSPORTATION CAPTURED MAJOR MARKET SHARE IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 BIOFUEL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Favorable government policies promoting use of biofuels

- 5.2.1.2 Rising demand for cleaner fuels worldwide

- 5.2.1.3 Growing awareness of utilizing renewable sources to reduce greenhouse gas emissions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for high initial capital investment

- 5.2.2.2 Uncertain economic conditions globally

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High depletion rate of fossil fuels

- 5.2.4 CHALLENGES

- 5.2.4.1 High variable costs of feedstock

- 5.2.4.2 High cost of setting up biofuel plants

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR BIOFUEL PROVIDERS

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 22 BIOFUEL MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 2 BIOFUEL MARKET: SUPPLY CHAIN ANALYSIS

- 5.4.1 FEEDSTOCK PROVIDERS/TECHNOLOGY AND EPC PROVIDERS

- 5.4.2 BIOFUEL PRODUCERS/SUPPLIERS

- 5.4.3 END USERS

- 5.5 ECOSYSTEM/MARKET MAP

- FIGURE 23 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 TECHNOLOGY TRENDS IN BIOFUEL MARKET

- 5.6.2 IMPLEMENTATION OF MACHINE LEARNING IN BIOFUEL MANUFACTURING PROCESS

- 5.6.3 IOT-CONNECTED BIOFUEL PLANTS

- 5.7 PATENT ANALYSIS

- FIGURE 24 BIOFUEL MARKET: PATENT REGISTRATIONS, 2012-2022

- 5.7.1 LIST OF MAJOR PATENTS

- TABLE 3 BIOFUEL MARKET: INNOVATIONS AND PATENT REGISTRATIONS, MARCH 2019-SEPTEMBER 2023

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- TABLE 4 IMPORT DATA FOR HS CODE 3826, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 25 IMPORT DATA, BY TOP FIVE COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.8.2 EXPORT SCENARIO

- TABLE 5 EXPORT SCENARIO FOR HS CODE 3826, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 26 EXPORT DATA, BY TOP FIVE COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9 PRICING ANALYSIS

- 5.9.1 INDICATIVE PRICING ANALYSIS OF BIOFUELS, BY FUEL TYPE

- TABLE 6 INDICATIVE PRICING ANALYSIS OF BIOFUELS, BY FUEL TYPE, 2022

- 5.9.2 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 7 AVERAGE SELLING PRICE TREND, BY REGION, 2022

- 5.9.3 INDICATIVE PRICING ANALYSIS OF BIOFUELS, BY END USE

- TABLE 8 INDICATIVE PRICING ANALYSIS OF BIOFUELS, BY END USE, 2022

- 5.10 TARIFFS, CODES, AND REGULATORY BODIES

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 BIOFUEL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 BIOFUEL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF SUBSTITUTES

- 5.11.2 BARGAINING POWER OF SUPPLIERS

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 THREAT OF NEW ENTRANTS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 CASE STUDY ANALYSIS

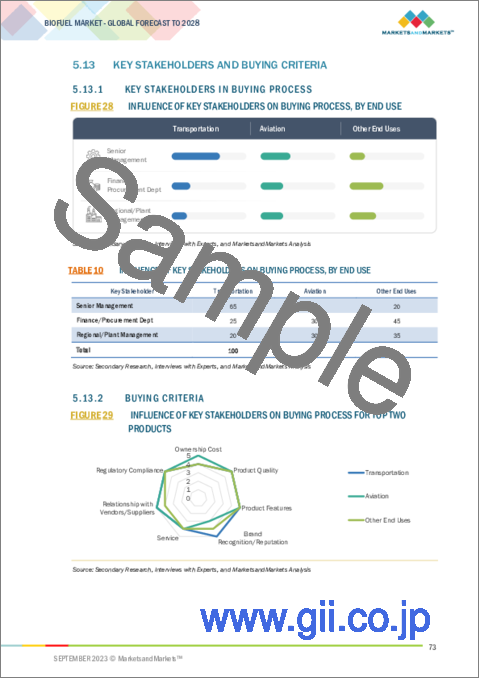

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USE

- TABLE 10 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USE

- 5.13.2 BUYING CRITERIA

- FIGURE 29 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO PRODUCTS

- TABLE 11 KEY BUYING CRITERIA FOR TOP TWO PRODUCTS

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 12 BIOFUEL MARKET: LIST OF CONFERENCES AND EVENTS

6 DIFFERENT FORMS OF BIOFUEL

- 6.1 INTRODUCTION

- 6.2 LIQUID

- 6.2.1 ETHANOL

- 6.2.2 BIODIESEL

- 6.2.3 RENEWABLE DIESEL

- 6.2.4 BIOJET

- 6.3 GASEOUS

- 6.3.1 BIOGAS

- 6.3.2 BIOMETHANE

- 6.3.3 BIOHYDROGEN

- 6.4 SOLID

7 BIOFUEL MARKET, BY FUEL TYPE

- 7.1 INTRODUCTION

- FIGURE 30 BIOFUEL MARKET, BY FUEL TYPE, 2022

- TABLE 13 BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD BILLION)

- TABLE 14 BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD BILLION)

- TABLE 15 BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (BILLION LITERS)

- TABLE 16 BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (BILLION LITERS)

- 7.2 ETHANOL

- 7.2.1 INCREASING CONCERNS OVER FOOD SECURITY TO ACCELERATE USE OF ETHANOL BLENDS

- TABLE 17 ETHANOL: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 18 ETHANOL: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 BIODIESEL

- 7.3.1 RISING USE OF BIODIESEL AS TRANSPORTATION FUEL TO DRIVE DEMAND

- TABLE 19 BIODIESEL: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 20 BIODIESEL: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 RENEWABLE DIESEL

- 7.4.1 GROWING FOCUS ON REDUCING CARBON EMISSIONS TO BOOST MARKET

- TABLE 21 RENEWABLE DIESEL: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 RENEWABLE DIESEL: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 BIOJET

- 7.5.1 SURGING REQUIREMENT TO REDUCE CO2 AND GHG EMISSIONS IN AVIATION SECTOR TO PROPEL SEGMENTAL GROWTH

- TABLE 23 BIOJET: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 24 BIOJET: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

8 BIOFUEL MARKET, BY END USE

- 8.1 INTRODUCTION

- FIGURE 31 TRANSPORTATION SEGMENT TO DOMINATE BIOFUEL MARKET IN 2028

- TABLE 25 BIOFUEL MARKET, BY END USE, 2019-2022 (USD BILLION)

- TABLE 26 BIOFUEL MARKET, BY END USE, 2023-2028 (USD BILLION)

- 8.2 TRANSPORTATION

- 8.2.1 BIOFUEL BLENDING MANDATES AND SUBSIDIES TO BOOST DEMAND FOR BIOFUELS

- TABLE 27 TRANSPORTATION: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 TRANSPORTATION: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 AVIATION

- 8.3.1 DROP-IN CAPABILITY OF BIOFUELS WITHOUT NEEDING TO REWORK AIRCRAFT INFRASTRUCTURE TO PROPEL MARKET

- TABLE 29 AVIATION: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 AVIATION: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 OTHER END USES

- TABLE 31 OTHER END USES: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 OTHER END USES: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

9 BIOFUEL MARKET, BY GENERATION

- 9.1 INTRODUCTION

- FIGURE 32 BIOFUEL MARKET, BY GENERATION, 2022

- TABLE 33 BIOFUEL MARKET, BY GENERATION, 2019-2022 (USD BILLION)

- TABLE 34 BIOFUEL MARKET, BY GENERATION, 2023-2028 (USD BILLION)

- 9.2 FIRST GENERATION

- 9.2.1 EASY AVAILABILITY OF FEEDSTOCK TO BOOST DEMAND

- TABLE 35 FIRST GENERATION: BIOFUEL MARKET, BY FEEDSTOCK, 2019-2022 (USD BILLION)

- TABLE 36 FIRST GENERATION: BIOFUEL MARKET, BY FEEDSTOCK, 2023-2028 (USD BILLION)

- TABLE 37 FIRST GENERATION: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 FIRST GENERATION: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 SECOND GENERATION

- 9.3.1 TRANSITION TOWARD CLEAN ENERGY ECONOMY TO SUPPORT MARKET GROWTH

- TABLE 39 SECOND GENERATION: BIOFUEL MARKET, BY FEEDSTOCK, 2019-2022 (USD BILLION)

- TABLE 40 SECOND GENERATION: BIOFUEL MARKET, BY FEEDSTOCK, 2023-2028 (USD BILLION)

- TABLE 41 SECOND GENERATION: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 SECOND GENERATION: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 THIRD GENERATION

- 9.4.1 RISE IN DEMAND FOR ALGAE-BASED BIOFUELS TO DRIVE MARKET

- TABLE 43 THIRD GENERATION: BIOFUEL MARKET, BY FEEDSTOCK, 2019-2022 (USD BILLION)

- TABLE 44 THIRD GENERATION: BIOFUEL MARKET, BY FEEDSTOCK, 2023-2028 (USD BILLION)

- TABLE 45 THIRD GENERATION: BIOFUEL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 THIRD GENERATION: BIOFUEL MARKET, BY REGION, 2023-2028 (USD MILLION)

10 BIOFUEL MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 33 EUROPE TO EXHIBIT FASTEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA DOMINATED BIOFUEL MARKET IN 2022

- TABLE 47 BIOFUEL MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 48 BIOFUEL MARKET, BY REGION, 2023-2028 (USD BILLION)

- 10.2 NORTH AMERICA

- 10.2.1 IMPACT OF RECESSION ON BIOFUEL MARKET IN NORTH AMERICA

- FIGURE 35 NORTH AMERICA: BIOFUEL MARKET SNAPSHOT

- TABLE 49 NORTH AMERICA: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: BIOFUEL MARKET, BY GENERATION, 2019-2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: BIOFUEL MARKET, BY GENERATION, 2023-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: BIOFUEL MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: BIOFUEL MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: BIOFUEL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: BIOFUEL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Government support, environmental concerns, and energy security to drive market

- TABLE 57 US: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 58 US: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Clean fuel regulations and stringent carbon reduction goals to boost demand for biofuels

- TABLE 59 CANADA: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 60 CANADA: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.2.4 MEXICO

- 10.2.4.1 Enforcement of policies liberalizing trade of biofuel products to drive market

- TABLE 61 MEXICO: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 62 MEXICO: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 IMPACT OF RECESSION ON BIOFUEL MARKET IN EUROPE

- FIGURE 36 EUROPE: BIOFUEL MARKET SNAPSHOT

- TABLE 63 EUROPE: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 64 EUROPE: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- TABLE 65 EUROPE: BIOFUEL MARKET, BY GENERATION, 2019-2022 (USD MILLION)

- TABLE 66 EUROPE: BIOFUEL MARKET, BY GENERATION, 2023-2028 (USD MILLION)

- TABLE 67 EUROPE: BIOFUEL MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 68 EUROPE: BIOFUEL MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 69 EUROPE: BIOFUEL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 70 EUROPE: BIOFUEL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.2 FRANCE

- 10.3.2.1 Development of sustainable biofuels from non-food feedstocks to foster market growth

- TABLE 71 FRANCE: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 72 FRANCE: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Rising fossil fuel prices and environmental concerns to accelerate demand for biofuels

- TABLE 73 UK: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 74 UK: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Biofuel blending mandates to support market growth

- TABLE 75 GERMANY: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 76 GERMANY: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.3.5 POLAND

- 10.3.5.1 Favorable policies to support development and use of biofuels to fuel market growth

- TABLE 77 POLAND: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 78 POLAND: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 79 REST OF EUROPE: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 80 REST OF EUROPE: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 IMPACT OF RECESSION ON BIOFUEL MARKET IN ASIA PACIFIC

- TABLE 81 ASIA PACIFIC: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: BIOFUEL MARKET, BY GENERATION, 2019-2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: BIOFUEL MARKET, BY GENERATION, 2023-2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: BIOFUEL MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: BIOFUEL MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: BIOFUEL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: BIOFUEL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Growing export of biodiesel to drive market

- TABLE 89 CHINA: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 90 CHINA: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Significant investments in ethanol production and R&D to contribute to market growth

- TABLE 91 INDIA: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 92 INDIA: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.4.4 INDONESIA

- 10.4.4.1 Rising adoption of biodiesel to accelerate market growth

- TABLE 93 INDONESIA: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 94 INDONESIA: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.4.5 THAILAND

- 10.4.5.1 Positive initiatives undertaken by government to support market growth

- TABLE 95 THAILAND: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 96 THAILAND: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 97 REST OF ASIA PACIFIC: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.5 ROW

- 10.5.1 IMPACT OF RECESSION ON BIOFUEL MARKET IN ROW

- TABLE 99 ROW: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 100 ROW: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- TABLE 101 ROW: BIOFUEL MARKET, BY GENERATION, 2019-2022 (USD MILLION)

- TABLE 102 ROW: BIOFUEL MARKET, BY GENERATION, 2023-2028 (USD MILLION)

- TABLE 103 ROW: BIOFUEL MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 104 ROW: BIOFUEL MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 105 ROW: BIOFUEL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 106 ROW: BIOFUEL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Significant investments in new biorefinery projects to drive market

- TABLE 107 BRAZIL: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 108 BRAZIL: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.5.3 ARGENTINA

- 10.5.3.1 Rising use of bioethanol in fuel blends to boost demand

- TABLE 109 ARGENTINA: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 110 ARGENTINA: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.5.4 COLOMBIA

- 10.5.4.1 High domestic production of ethanol to boost market

- TABLE 111 COLOMBIA: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 112 COLOMBIA: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

- 10.5.5 OTHER COUNTRIES

- TABLE 113 OTHER COUNTRIES: BIOFUEL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 114 OTHER COUNTRIES: BIOFUEL MARKET, BY FUEL TYPE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.1.1 KEY PLAYER STRATEGIES

- TABLE 115 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 MARKET SHARE ANALYSIS, 2022

- TABLE 116 BIOFUEL MARKET: DEGREE OF COMPETITION

- FIGURE 37 BIOFUEL MARKET: MARKET SHARE ANALYSIS, 2022

- 11.3 MARKET EVALUATION FRAMEWORK, 2019-2023

- TABLE 117 BIOFUEL MARKET: MARKET EVALUATION FRAMEWORK, 2019-2023

- 11.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 38 BIOFUEL MARKET: REVENUE ANALYSIS, 2018-2022

- 11.5 KEY COMPANY EVALUATION MATRIX, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 39 BIOFUEL MARKET: KEY COMPANY EVALUATION MATRIX, 2022

- 11.6 COMPANY FOOTPRINT

- TABLE 118 FUEL TYPE: COMPANY FOOTPRINT

- TABLE 119 GENERATION: COMPANY FOOTPRINT

- TABLE 120 END USE: COMPANY FOOTPRINT

- TABLE 121 REGION: COMPANY FOOTPRINT

- 11.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 40 BIOFUEL MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 11.8 COMPETITIVE BENCHMARKING

- TABLE 122 BIOFUEL MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 123 FUEL TYPE: STARTUPS/SMES FOOTPRINT

- TABLE 124 GENERATION: STARTUPS/SMES FOOTPRINT

- TABLE 125 END USE: KEY PLAYERS

- TABLE 126 REGION: STARTUPS/SMES FOOTPRINT

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 127 BIOFUEL MARKET: PRODUCT LAUNCHES, 2019-2023

- 11.9.2 DEALS

- TABLE 128 BIOFUEL MARKET: DEALS, 2018-2023

- 11.9.3 OTHERS

- TABLE 129 BIOFUEL MARKET: OTHERS, 2019-2023

12 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 ADM

- TABLE 130 ADM: COMPANY OVERVIEW

- FIGURE 41 ADM: COMPANY SNAPSHOT

- TABLE 131 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 132 ADM: DEALS

- TABLE 133 ADM: OTHERS

- 12.1.2 VALERO

- TABLE 134 VALERO: COMPANY OVERVIEW

- FIGURE 42 VALERO: COMPANY SNAPSHOT

- TABLE 135 VALERO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 136 VALERO: DEALS

- TABLE 137 VALERO: OTHERS

- 12.1.3 NESTE

- TABLE 138 NESTE: COMPANY OVERVIEW

- FIGURE 43 NESTE: COMPANY SNAPSHOT

- TABLE 139 NESTE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 140 NESTE: DEALS

- TABLE 141 NESTE: OTHERS

- 12.1.4 GREEN PLAINS INC.

- TABLE 142 GREEN PLAINS INC.: COMPANY OVERVIEW

- FIGURE 44 GREEN PLAINS INC.: COMPANY SNAPSHOT

- TABLE 143 GREEN PLAINS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 144 GREEN PLAINS INC.: DEALS

- TABLE 145 GREEN PLAINS INC.: OTHERS

- 12.1.5 POET, LLC.

- TABLE 146 POET, LLC: COMPANY OVERVIEW

- TABLE 147 POET, LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 148 POET, LLC: DEALS

- TABLE 149 POET, LLC: OTHERS

- 12.1.6 CHEVRON CORPORATION (CHEVRON RENEWABLE ENERGY GROUP)

- TABLE 150 CHEVRON CORPORATION: COMPANY OVERVIEW

- FIGURE 45 CHEVRON CORPORATION: COMPANY SNAPSHOT

- TABLE 151 CHEVRON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 152 CHEVRON CORPORATION: PRODUCT LAUNCHES

- TABLE 153 CHEVRON CORPORATION: DEALS

- TABLE 154 CHEVRON CORPORATION: OTHERS

- 12.1.7 CARGILL, INCORPORATED

- TABLE 155 CARGILL, INCORPORATED: COMPANY OVERVIEW

- FIGURE 46 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 156 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 157 CARGILL, INCORPORATED: DEALS

- TABLE 158 CARGILL, INCORPORATED: OTHERS

- 12.1.8 WILMAR INTERNATIONAL LTD

- TABLE 159 WILMAR INTERNATIONAL LTD: COMPANY OVERVIEW

- FIGURE 47 WILMAR INTERNATIONAL LTD: COMPANY SNAPSHOT

- TABLE 160 WILMAR INTERNATIONAL LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.9 THE ANDERSONS, INC.

- TABLE 161 THE ANDERSONS, INC.: COMPANY OVERVIEW

- FIGURE 48 THE ANDERSONS, INC.: COMPANY SNAPSHOT

- TABLE 162 THE ANDERSONS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 163 THE ANDERSONS, INC.: DEALS

- 12.1.10 VERBIO AG

- TABLE 164 VERBIO AG: COMPANY OVERVIEW

- FIGURE 49 VERBIO AG: COMPANY SNAPSHOT

- TABLE 165 VERBIO AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 166 VERBIO AG: DEALS

- TABLE 167 VERBIO AG: OTHERS

- 12.1.11 BORREGAARD AS

- TABLE 168 BORREGAARD AS: COMPANY OVERVIEW

- FIGURE 50 BORREGAARD AS: COMPANY SNAPSHOT

- TABLE 169 BORREGAARD AS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 BORREGAARD AS: OTHERS

- 12.1.12 AEMETIS, INC.

- TABLE 171 AEMETIS, INC.: COMPANY OVERVIEW

- FIGURE 51 AEMETIS, INC.: COMPANY SNAPSHOT

- TABLE 172 AEMETIS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 AEMETIS, INC.: DEALS

- TABLE 174 AEMETIS, INC.: OTHERS

- 12.1.13 RAIZEN

- TABLE 175 RAIZEN: COMPANY OVERVIEW

- FIGURE 52 RAIZEN: COMPANY SNAPSHOT

- TABLE 176 RAIZEN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 RAIZEN: DEALS

- TABLE 178 RAIZEN: OTHERS

- 12.1.14 FUTUREFUEL CORPORATION

- TABLE 179 FUTUREFUEL CORPORATION: COMPANY OVERVIEW

- FIGURE 53 FUTUREFUEL CORPORATION: COMPANY SNAPSHOT

- TABLE 180 FUTUREFUEL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 CROPENERGIES AG

- 12.2.2 BP P.L.C.

- 12.2.3 MUNZER BIOINDUSTRIE GMBH

- 12.2.4 ALGENOL

- 12.2.5 PANNONIA BIO ZRT.

- 12.2.6 BLUE BIOFUELS, INC.

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS