|

|

市場調査レポート

商品コード

1355382

プロセスアナライザーの世界市場 (~2028年):液体アナライザー・ガスアナライザー・産業・地域別Process Analyzer Market by Liquid Analyzer (MLSS, Total Organic Carbon, pH, Liquid Density, Conductivity, Dissolved Oxygen), Gas Analyzer (Oxygen, Carbon Dioxide, Moisture, Toxic Gas, Hydrogen Sulfide), Industry and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| プロセスアナライザーの世界市場 (~2028年):液体アナライザー・ガスアナライザー・産業・地域別 |

|

出版日: 2023年09月21日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のプロセスアナライザーの市場規模は、2023年の78億米ドルから、予測期間中は3.6%のCAGRで推移し、2028年には93億米ドルの規模に成長すると予測されています。

同市場は、石油、医薬品、水処理などの産業でリアルタイムモニタリングと精密技術への需要が高まり、急速に成長しています。

液体アナライザー別で見ると、MLSSアナライザーの部門がもっとも高いCAGRで成長する見通しです。MLSSアナライザー市場の成長は主に、効果的な廃水処理の必要性の高まりと、環境保全の重視によるものです。MLSSアナライザーは、廃水中の懸濁物質のモニタリングと管理、処理プロセスの最適化に不可欠です。さらに、分析技術の進歩と水質維持への関心の高まりも、MLSSアナライザーの市場導入と拡大を後押しする要因となっています。

ガスアナライザー別では、酸素アナライザーの部門が2022年に最大のシェアを示しています。酸素アナライザーの利用は、複数の産業におけるその重要な有用性のおかげで急増しています。センサーや自動化などの技術の進歩から、医療、環境、工業の各領域において、その精度、生産性、使用量が高まっています。ヘルスケア、環境順守、産業セキュリティにおける酸素監視に対する要求の高まりも市場成長を刺激しています。リアルタイムのデータ収集と遠隔監視機能の強化も酸素濃度計の普及を大きく後押しし、幅広い用途で最適な酸素濃度が確保されています。

地域別では、産業オートメーションの増加、人件費の上昇、技術の進歩、強力な製造部門、政府の支援などから、アジア太平洋地域が大幅な成長を遂げています。ロボティクスとコンピュータービジョンを組み合わせたこの技術は、中国、日本、韓国、インドなどの国々の、さまざまな産業分野で広く採用されています。

当レポートでは、世界のプロセスアナライザーの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステム分析

- 価格分析

- 顧客の事業に影響を与える動向/ディスラプション

- 技術分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント

- 規制・基準

- 規格

第6章 さまざまなタイプの分析におけるプロセスアナライザーの使用

- オンライン分析

- インライン分析

- アットライン分析

第7章 プロセスアナライザー市場:液体アナライザー別

- PH/ORPアナライザー

- 導電率アナライザー

- 濁度アナライザー

- 溶存酸素アナライザー

- 液体密度アナライザー

- MLSSアナライザー

- TOCアナライザー

第8章 プロセスアナライザー市場:ガスアナライザー別

- 酸素アナライザー

- 二酸化炭素アナライザー

- 水分アナライザー

- 有毒ガスアナライザー

- 硫化水素アナライザー

第9章 プロセスアナライザー市場:産業別

- 医薬品

- 石油化学

- 医薬品

- 水・廃水

- 電力

- 食品・飲料

- 製紙パルプ

- 金属・鉱業

- セメント・ガラス

- その他

第10章 プロセスアナライザー市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 収益分析

- 市場シェア分析

- 主要企業の評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- ABB

- EMERSON ELECTRIC CO.

- SIEMENS

- ENDRESS+HAUSER GROUP SERVICES AG

- YOKOGAWA ELECTRIC CORPORATION

- METTLER TOLEDO

- SUEZ

- THERMO FISHER SCIENTIFIC INC.

- AMETEK, INC.

- ANTON PAAR GMBH

- その他の企業

- HACH

- SHIMADZU CORPORATION

- JUMO GMBH & CO. KG

- APPLIED ANALYTICS, INC.

- OMEGA ENGINEERING, INC.

- VEGA GRIESHABER KG

- SARTORIUS AG

- SCHMIDT+HAENSCH

- METROHM AG

- HORIBA

- BERTHOLD TECHNOLOGIES GMBH & CO. KG

- KYOTO ELECTRONICS MANUFACTURING CO., LTD.

- MICHELL INSTRUMENTS

- SINAR TECHNOLOGY

- GOW-MAC INSTRUMENT COMPANY

- スタートアップ/SME企業

- SKALAR ANALYTICAL B.V.

- UIC, INC.

- COMET ANALYTICS, INC.

- TOC SYSTEMS

- SENSOTECH

- BOPP & REUTHER MESSTECHNIK GMBH

- ROTOTHERM GROUP

- INTEGRATED SENSING SYSTEMS

- LIQUID ANALYTICAL RESOURCE, LLC

- ELTRA GMBH

第13章 隣接市場および関連市場

第14章 付録

The global Process Analyzer market is expected to grow from USD 7.8 billion in 2023 to USD 9.3 billion by 2028, registering a CAGR of 3.6%. The process analyzer market is rapidly growing due to increased demand for real-time monitoring and precise technology in industries like oil, pharmaceuticals, and water treatment, ensuring improved efficiency and product quality.

"MLSS Analyzer segment to grow at highest CAGR in Liquid analyzer market."

The MLSS Analyzer segment is experiencing robust growth in the market. The market for MLSS analyzers is on the rise. This growth is primarily due to a greater need for effective wastewater treatment and a strong emphasis on environmental preservation. MLSS analyzers are critical in monitoring and managing suspended solids in wastewater and optimizing treatment processes. Moreover, advancements in analytical technologies and an increased focus on maintaining water quality are contributing factors propelling the adoption and expansion of MLSS analyzers in the market.

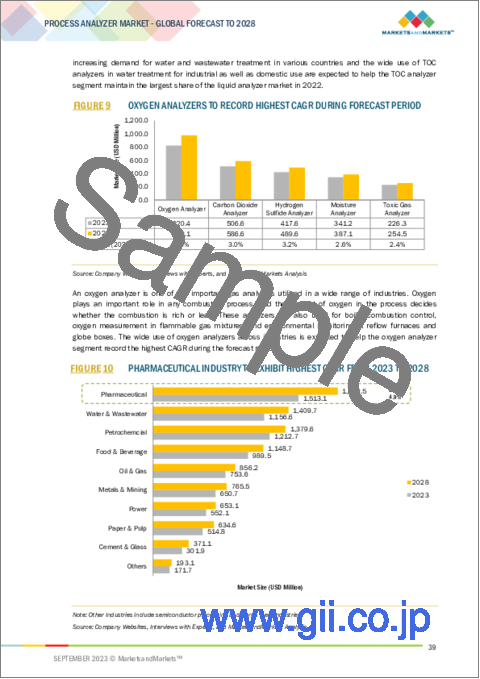

"Oxygen Analyzer segment accounted for the largest share of the Process Analyzer market in 2022."

The utilization of oxygen analyzers has surged owing to their vital significance in multiple industries. Technological progress in sensors and automation has amplified their precision, productivity, and usage across medical, environmental, and industrial domains. Escalating requirements for oxygen supervision in healthcare, environmental adherence, and industrial security have stimulated market growth. Enhanced real-time data collection and remote monitoring features have significantly driven the uptake of oxygen analyzers, ensuring optimal oxygen levels in a wide array of applications.

"Pharmaceuticals Industry to account for the largest market size in 2022"

The pharmaceutical industry has witnessed a notable surge in the utilization of process analyzers. These instruments play a pivotal role in guaranteeing product quality, adhering to regulatory standards, and optimizing operations. The integration of real-time monitoring, automation, and cutting-edge analytical technologies has spurred their widespread embrace. In essence, process analyzers contribute significantly to enhancing productivity, reducing operational expenses, and expediting decision-making processes. Their precision and commitment to regulatory compliance make them indispensable, upholding elevated standards and fulfilling the rigorous requirements of pharmaceutical manufacturing.

"Asia Pacific to account for the largest market size in 2022"

The Process Analyzer market in the Asia Pacific region is experiencing substantial growth, driven by increasing industrial automation, rising labor costs, technological advancements, a strong manufacturing sector, and government support. This technology, which combines robotics and computer vision, is being widely adopted in countries like China, Japan, South Korea, and India across various industries. Process Analyzer enables robots to perform complex tasks based on visual perception and interpretation, enhancing productivity and efficiency. As the region continues to embrace automation and robotics, the demand for Process Analyzer systems is expected to rise further.

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 35%, Tier 2 - 30%, and Tier 3 - 35%

- By Designation - C-level Executives - 45%, Directors - 30%, and Others - 20%

- By Region - North America - 35%, Asia Pacific - 30%, Europe - 25%, RoW- 10%

The major players in the market are Emerson Electric Co. (US), Yokogawa Electric Corporation (Japan), ABB (Switzerland), Ametek, Inc. (US), and Thermo Fisher Scientific, Inc. (US)

Research Coverage:

The Process Analyzer market has been segmented into Liquid Analyzer, Gas Analyzer, Industry, and region. The Process Analyzer market was studied in North America, Europe, Asia Pacific, and the Rest of the World (RoW). The report describes the major drivers, restraints, challenges, and opportunities of the Process Analyzer market and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the Process Analyzer ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the Process Analyzer market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- Analysis of Key Drivers (Rising demand for water and wastewater treatment, Increasing use of process analyzers in drug safety, Global expansion of chemical and petrochemical industries), restraints (Lack of skilled professionals, High infrastructure cost), Opportunities (Growing Demand from Emerging Market such as China & India, Growing demand for environmental monitoring), Challenges (Need for continuous support and maintenance of installed analyzer, Complexity of installation and operation).

- Product Development/Innovation: Detailed insights on research & development activities and new product launches in the Process Analyzer market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Process Analyzer market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Process Analyzer market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like ABB (Switzerland), Emerson Electric Co. (US), Siemens (Germany), Endress+Hauser Group Services AG (Switzerland), Yokogawa Electric Corporation (Japan), Mettler Toledo (US), Suez (US), Thermo Fisher Scientific, Inc. (US), Ametek. Inc.(US), Anton Paar GmbH (Austria) among others in the Process Analyzer market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 PROCESS ANALYZER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- FIGURE 2 PROCESS ANALYZER MARKET: SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 4 PROCESS ANALYZER MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- FIGURE 5 PROCESS ANALYZER MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 7 ASSUMPTIONS OF RESEARCH STUDY

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON PROCESS ANALYZER MARKET

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 TOC ANALYZER SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 9 OXYGEN ANALYZERS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 PHARMACEUTICAL INDUSTRY TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 11 PROCESS ANALYZER MARKET IN EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN PROCESS ANALYZER MARKET

- FIGURE 12 BOOMING PHARMACEUTICAL INDUSTRY IN ASIA PACIFIC TO CREATE LUCRATIVE OPPORTUNITIES FOR PROCESS ANALYZER MARKET

- 4.2 PROCESS ANALYZER MARKET, BY LIQUID ANALYZER

- FIGURE 13 MLSS ANALYZER SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 PROCESS ANALYZER MARKET, BY GAS ANALYZER

- FIGURE 14 OXYGEN ANALYZER SEGMENT TO SECURE LARGEST MARKET SHARE IN 2028

- 4.4 PROCESS ANALYZER MARKET, BY INDUSTRY

- FIGURE 15 PHARMACEUTICAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 PROCESS ANALYZER MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

- 4.6 PROCESS ANALYZER MARKET, BY COUNTRY

- FIGURE 17 JAPAN ACCOUNTED FOR LARGEST SHARE OF GLOBAL MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for efficient and effective water and wastewater treatment

- 5.2.1.2 Increasing adoption of process analyzers by pharma companies to ensure drug safety

- 5.2.1.3 Booming chemicals and petrochemical industries worldwide

- FIGURE 19 PROCESS ANALYZER MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of skilled professionals

- 5.2.2.2 High infrastructure setup cost

- FIGURE 20 PROCESS ANALYZER MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for process analyzers from emerging markets such as China & India

- 5.2.3.2 Growing focus on environmental monitoring

- FIGURE 21 PROCESS ANALYZER MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.4 CHALLENGES

- 5.2.4.1 Need for continuous support and maintenance of installed analyzers

- 5.2.4.2 Complexities associated with installation and operation

- FIGURE 22 PROCESS ANALYZER MARKET CHALLENGES: IMPACT ANALYSIS

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 23 SUPPLY CHAIN ANALYSIS MODEL

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 24 GLOBAL PROCESS ANALYZER ECOSYSTEM

- TABLE 1 ROLE OF CRITICAL PARTICIPANTS IN ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF PROCESS ANALYZERS PROVIDED BY KEY PLAYERS, BY TYPE

- FIGURE 25 AVERAGE SELLING PRICE OF DIFFERENT TYPES OF PROCESS ANALYZERS OFFERED BY KEY PLAYERS

- TABLE 2 AVERAGE SELLING PRICE OF PROCESS ANALYZERS OFFERED BY KEY PLAYERS, BY TYPE (USD)

- TABLE 3 AVERAGE SELLING PRICE OF PROCESS ANALYZER BY REGION (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ARTIFICIAL INTELLIGENCE

- 5.7.2 INTERNET OF THINGS (IOT)

- 5.7.3 CYBERSECURITY

- 5.7.4 MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS)

- 5.8 PORTER'S FIVE FORCE ANALYSIS

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS WITH THEIR IMPACT (2022)

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA OF TOP 3 INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA OF TOP 3 INDUSTRIES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CASE STUDY 1: USE OF PROCESS ANALYZERS TO MEASURE H2S IN CRUDE OIL TO ENSURE SAFETY DURING TRANSPORTATION

- 5.10.2 CASE STUDY 2: DEPLOYMENT OF IN-SITU GAS ANALYZER FOR TROUBLE-FREE OXYGEN MEASUREMENT

- 5.11 TRADE ANALYSIS

- FIGURE 29 IMPORT DATA FOR HS CODE 902710, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 852580, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 31 TOP 10 COMPANIES WITH SIGNIFICANT SHARE OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 PATENT ANALYSIS RELATED TO PROCESS ANALYZER MARKET

- TABLE 7 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- 5.12.1 LIST OF MAJOR PATENTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 8 PROCESS ANALYZER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 REGULATIONS AND STANDARDS

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 STANDARDS

- 5.15.1 ISO (INTERNATIONAL ORGANIZATION FOR STANDARDIZATION)

- 5.15.1.1 ISO 21501

- 5.15.1.2 ISO 14911

- 5.15.2 IEC (INTERNATIONAL ELECTROTECHNICAL COMMISSION)

- 5.15.2.1 IEC 60079 series

- 5.15.3 ISA (INTERNATIONAL SOCIETY OF AUTOMATION)

- 5.15.3.1 ISA-88

- 5.15.3.2 ISA-84

- 5.15.1 ISO (INTERNATIONAL ORGANIZATION FOR STANDARDIZATION)

6 USE OF PROCESS ANALYZERS IN DIFFERENT TYPES ANALYSES

- 6.1 INTRODUCTION

- FIGURE 33 PROCESS ANALYZER MARKET, BY ANALYSIS TYPE

- 6.2 ON-LINE ANALYSIS

- 6.3 IN-LINE ANALYSIS

- 6.4 AT-LINE ANALYSIS

7 PROCESS ANALYZER MARKET, BY LIQUID ANALYZER

- 7.1 INTRODUCTION

- FIGURE 34 PROCESS ANALYZER MARKET, BY LIQUID ANALYZER

- FIGURE 35 MLSS ANALYZERS TO DEPICT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 13 PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

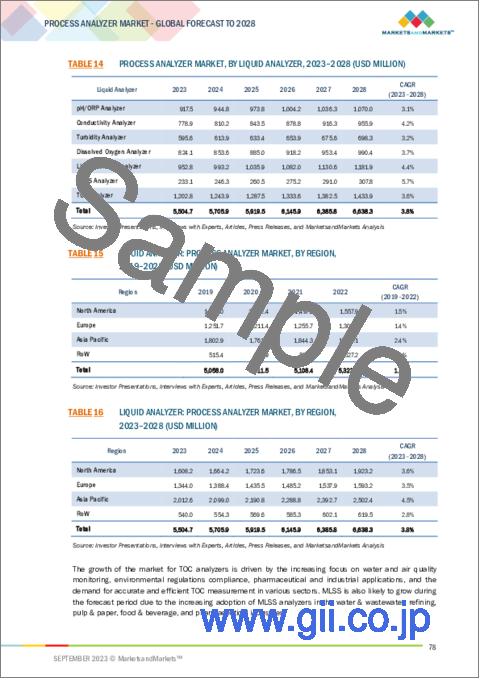

- TABLE 14 PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 15 LIQUID ANALYZER: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 16 LIQUID ANALYZER: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2 PH/ORP ANALYZER

- 7.2.1 USE OF PH/ORP ANALYZERS IN REVERSE OSMOSIS AND COOLING PROCESSES TO FUEL SEGMENTAL GROWTH

- TABLE 17 PH/ORP ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 18 PH/ORP ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 7.3 CONDUCTIVITY ANALYZER

- 7.3.1 RELIANCE ON CONDUCTIVITY ANALYZERS TO IMPROVE INDUSTRIAL PROCESS EFFICIENCY TO PROPEL MARKET

- TABLE 19 CONDUCTIVITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 20 CONDUCTIVITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 7.4 TURBIDITY ANALYZER

- 7.4.1 NEED FOR ACCURATE TURBIDITY MEASUREMENT IN WASTEWATER TREATMENT FACILITIES TO ACCELERATE SEGMENTAL GROWTH

- TABLE 21 TURBIDITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 22 TURBIDITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 7.5 DISSOLVED OXYGEN ANALYZER

- 7.5.1 INSTALLATION OF DISSOLVED OXYGEN ANALYZERS IN WATER MONITORING APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

- TABLE 23 DISSOLVED OXYGEN ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 24 DISSOLVED OXYGEN ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 7.6 LIQUID DENSITY ANALYZER

- 7.6.1 DEPLOYMENT OF IOT TECHNOLOGY IN LIQUID DENSITY ANALYZERS TO PROPEL SEGMENTAL GROWTH

- TABLE 25 LIQUID DENSITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 26 LIQUID DENSITY ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 7.7 MLSS ANALYZER

- 7.7.1 UTILIZATION OF MLSS ANALYZERS TO OPTIMIZE WASTEWATER TREATMENT TO DRIVE MARKET

- TABLE 27 MLSS ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 28 MLSS ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 7.8 TOC ANALYZER

- 7.8.1 ADOPTION OF TOC ANALYZERS TO ENSURE COMPLIANCE WITH PHARMACEUTICAL MANUFACTURING STANDARDS TO BOOST SEGMENTAL GROWTH

- TABLE 29 TOC ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 30 TOC ANALYZER: LIQUID ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

8 PROCESS ANALYZER MARKET, BY GAS ANALYZER

- 8.1 INTRODUCTION

- FIGURE 36 PROCESS ANALYZER MARKET, BY GAS ANALYZER

- FIGURE 37 OXYGEN ANALYZERS TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- TABLE 31 PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 32 PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 33 GAS ANALYZER: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 GAS ANALYZER: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2 OXYGEN ANALYZER

- 8.2.1 ADVANCEMENTS IN SENSOR TECHNOLOGY TO FUEL MARKET GROWTH

- TABLE 35 OXYGEN ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 36 OXYGEN ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 8.3 CARBON DIOXIDE ANALYZER

- 8.3.1 NEED FOR ACCURATE MONITORING OF CO2 LEVELS TO DRIVE MARKET

- TABLE 37 CARBON DIOXIDE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 38 CARBON DIOXIDE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 8.4 MOISTURE ANALYZER

- 8.4.1 GROWING IMPORTANCE OF MOISTURE CONTROL IN INDUSTRIES TO FOSTER SEGMENTAL GROWTH

- TABLE 39 MOISTURE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 40 MOISTURE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 8.5 TOXIC GAS ANALYZER

- 8.5.1 ADVANCED SENSOR TECHNOLOGY AND INTEGRATION OF IOT TO CREATE LUCRATIVE GROWTH OPPORTUNITIES

- TABLE 41 TOXIC GAS ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 42 TOXIC GAS ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 8.6 HYDROGEN SULFIDE ANALYZER

- 8.6.1 INCREASING FOCUS ON REDUCING ENVIRONMENTAL IMPACT TO BOOST SEGMENTAL GROWTH

- TABLE 43 HYDROGEN SULFIDE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 44 HYDROGEN SULFIDE ANALYZER: GAS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

9 PROCESS ANALYZER MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 38 PROCESS ANALYZER MARKET, BY INDUSTRY

- FIGURE 39 PHARMACEUTICAL INDUSTRY TO COMMAND PROCESS ANALYZER MARKET DURING FORECAST PERIOD

- TABLE 45 PROCESS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 46 PROCESS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.2 PHARMACEUTICAL

- 9.2.1 REDUCED RELIANCE ON MANUAL TESTING TO BOOST DEMAND FOR PROCESS ANALYZERS

- TABLE 47 OIL & GAS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 48 OIL & GAS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 49 OIL & GAS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 50 OIL & GAS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 51 OIL & GAS: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 OIL & GAS: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 PETROCHEMICAL

- 9.3.1 RISING LPG/LNG PRODUCTION TO BOOST DEMAND

- TABLE 53 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 54 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 55 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 56 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 57 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 PETROCHEMICAL: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 PHARMACEUTICAL

- 9.4.1 STRONG FOCUS ON DRUG SAFETY TO FUEL MARKET GROWTH

- TABLE 59 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 60 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 61 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 62 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 63 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 PHARMACEUTICAL: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 WATER & WASTEWATER

- 9.5.1 INTEGRATION OF SENSORS AND ANALYZERS INTO CENTRALIZED CONTROL SYSTEMS TO DRIVE MARKET

- TABLE 65 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 66 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 67 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 68 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 69 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 70 WATER & WASTEWATER: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 POWER

- 9.6.1 GROWING DEMAND FOR SUSTAINABLE ENERGY TO FUEL MARKET GROWTH

- TABLE 71 POWER: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 72 POWER: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 73 POWER: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 74 POWER: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 75 POWER: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 POWER: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 FOOD & BEVERAGE

- 9.7.1 RISING FOCUS ON ENHANCING FOOD PRODUCTION QUALITY, SAFETY, AND COST-EFFICIENCY TO BOOST DEMAND FOR PROCESS ANALYZERS

- TABLE 77 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 78 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 79 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 80 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 81 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 82 FOOD & BEVERAGE: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 PAPER & PULP

- 9.8.1 ABILITY TO DETECT CONTAMINANTS AND VERIFY PULP PROPERTIES TO BOOST DEMAND

- TABLE 83 PAPER & PULP: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 84 PAPER & PULP: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 85 PAPER & PULP: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 86 PAPER & PULP: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 87 PAPER & PULP: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 PAPER & PULP: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9 METALS & MINING

- 9.9.1 GROWING DEMAND FOR METALS AND MINERALS TO INCREASE ADOPTION OF PROCESS ANALYZERS

- TABLE 89 METALS & MINING: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 90 METAL & MINING: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 91 METALS & MINING: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 92 METALS & MINING: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 93 METALS & MINING: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 94 METALS & MINING: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10 CEMENT & GLASS

- 9.10.1 INCREASED INVESTMENTS IN CONSTRUCTION OF RESIDENTIAL AND COMMERCIAL BUILDINGS TO FUEL MARKET GROWTH

- TABLE 95 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 96 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 97 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 98 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 99 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 100 CEMENT & GLASS: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.11 OTHERS

- TABLE 101 OTHERS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2019-2022 (USD MILLION)

- TABLE 102 OTHERS: PROCESS ANALYZER MARKET, BY LIQUID ANALYZER, 2023-2028 (USD MILLION)

- TABLE 103 OTHERS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2019-2022 (USD MILLION)

- TABLE 104 OTHERS: PROCESS ANALYZER MARKET, BY GAS ANALYZER, 2023-2028 (USD MILLION)

- TABLE 105 OTHERS: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 106 OTHERS: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

10 PROCESS ANALYZER MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 40 PROCESS ANALYZER MARKET, BY REGION

- FIGURE 41 PROCESS ANALYZER MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 107 PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 108 PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- FIGURE 42 NORTH AMERICA: PROCESS ANALYZER MARKET SNAPSHOT

- TABLE 109 NORTH AMERICA: PROCESS ANALYZER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: PROCESS ANALYZER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: PROCESS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: PROCESS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Increasing use of predictive and preventive maintenance techniques to fuel market growth

- 10.2.3 CANADA

- 10.2.3.1 Advent of Industry 4.0 and IIoT to drive market

- 10.2.4 MEXICO

- 10.2.4.1 Growing demand for minerals to create growth opportunities

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- FIGURE 43 EUROPE: PROCESS ANALYZER MARKET SNAPSHOT

- TABLE 113 EUROPE: PROCESS ANALYZER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 114 EUROPE: PROCESS ANALYZER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 115 EUROPE: PROCESS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 116 EUROPE: PROCESS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Rising focus on workplace safety and energy conservation to boost demand

- 10.3.3 GERMANY

- 10.3.3.1 Increasing adoption of automation to fuel market growth

- 10.3.4 FRANCE

- 10.3.4.1 Stringent regulatory policies to drive demand from oil & gas and pharmaceutical companies

- 10.3.5 REST OF EUROPE (ROE)

- 10.4 ASIA PACIFIC

- 10.4.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- FIGURE 44 ASIA PACIFIC: PROCESS ANALYZER MARKET SNAPSHOT

- TABLE 117 ASIA PACIFIC: PROCESS ANALYZER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: PROCESS ANALYZER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: PROCESS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: PROCESS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Rapid adoption of Industry 4.0 to accelerate market growth

- 10.4.3 JAPAN

- 10.4.3.1 Thriving pharmaceutical industry to drive market

- 10.4.4 INDIA

- 10.4.4.1 Government-led initiatives to boost production in chemical and pharmaceutical industries to contribute to market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 RECESSION IMPACT ON MARKET IN ROW

- FIGURE 45 SOUTH AMERICA TO DOMINATE MARKET IN ROW THROUGHOUT FORECAST PERIOD

- TABLE 121 ROW: PROCESS ANALYZER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 122 ROW: PROCESS ANALYZER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 123 ROW: PROCESS ANALYZER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 124 ROW: PROCESS ANALYZER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Increasing investments in infrastructure development to drive market

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Expanding industrial sector and stringent environmental regulations to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 125 PROCESS ANALYZER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 REVENUE ANALYSIS, 2018-2022

- FIGURE 46 REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018-2022

- 11.3 MARKET SHARE ANALYSIS, 2022

- TABLE 126 PROCESS ANALYZER MARKET SHARE ANALYSIS, 2022

- FIGURE 47 PROCESS ANALYZER MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 11.4 EVALUATION MATRIX OF KEY COMPANIES, 2022

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 48 PROCESS ANALYZER MARKET: EVALUATION MATRIX OF KEY COMPANIES, 2022

- 11.4.5 COMPANY FOOTPRINT

- TABLE 127 LIQUID ANALYZER: COMPANY FOOTPRINT

- TABLE 128 GAS ANALYZER: COMPANY FOOTPRINT

- TABLE 129 INDUSTRY: COMPANY FOOTPRINT

- TABLE 130 REGION: COMPANY FOOTPRINT

- TABLE 131 OVERALL COMPANY FOOTPRINT

- 11.5 EVALUATION MATRIX OF STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 49 PROCESS ANALYZER MARKET: EVALUATION MATRIX OF STARTUPS/SMES, 2022

- 11.5.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 132 PROCESS ANALYZER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 133 PROCESS ANALYZER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.6 COMPETITIVE SCENARIO AND TRENDS

- 11.6.1 PRODUCT LAUNCHES

- TABLE 134 PROCESS ANALYZER MARKET: PRODUCT LAUNCHES, 2021-2023

- 11.6.2 DEALS

- TABLE 135 PROCESS ANALYZER MARKET: DEALS, 2021-2023

- 11.6.3 OTHER DEVELOPMENTS

- TABLE 136 PROCESS ANALYZER MARKET: OTHER DEVELOPMENTS, 2021-2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 12.1.1 ABB

- TABLE 137 ABB: COMPANY OVERVIEW

- FIGURE 50 ABB: COMPANY SNAPSHOT

- TABLE 138 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 ABB: PRODUCT LAUNCHES

- TABLE 140 ABB: DEALS

- 12.1.2 EMERSON ELECTRIC CO.

- TABLE 141 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 51 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 142 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 OTHERS: HONEYWELL INTERNATIONAL INC

- 12.1.3 SIEMENS

- TABLE 144 SIEMENS: COMPANY OVERVIEW

- FIGURE 52 SIEMENS: COMPANY SNAPSHOT

- TABLE 145 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.4 ENDRESS+HAUSER GROUP SERVICES AG

- TABLE 146 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- FIGURE 53 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

- TABLE 147 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCT LAUNCHES

- TABLE 149 ENDRESS+HAUSER GROUP SERVICES AG: DEALS

- 12.1.5 YOKOGAWA ELECTRIC CORPORATION

- TABLE 150 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 54 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 151 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERINGS

- TABLE 152 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- 12.1.6 METTLER TOLEDO

- TABLE 153 METTLER TOLEDO: COMPANY OVERVIEW

- FIGURE 55 METTLER TOLEDO: COMPANY SNAPSHOT

- TABLE 154 METTLER TOLEDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 METTLER TOLEDO: PRODUCT LAUNCHES

- 12.1.7 SUEZ

- TABLE 156 SUEZ: COMPANY OVERVIEW

- FIGURE 56 SUEZ: COMPANY SNAPSHOT

- TABLE 157 SUEZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 SUEZ: PRODUCT LAUNCHES

- 12.1.8 THERMO FISHER SCIENTIFIC INC.

- TABLE 159 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 57 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- TABLE 160 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES

- TABLE 162 THERMO FISHER SCIENTIFIC INC.: DEALS

- 12.1.9 AMETEK, INC.

- TABLE 163 AMETEK, INC.: COMPANY OVERVIEW

- FIGURE 58 AMETEK, INC.: COMPANY SNAPSHOT

- TABLE 164 AMETEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 AMETEK, INC.: PRODUCT LAUNCHES

- TABLE 166 AMETEK, INC.: OTHERS

- 12.1.10 ANTON PAAR GMBH

- TABLE 167 ANTON PAAR GMBH: BUSINESS OVERVIEW

- TABLE 168 ANTON PAAR GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 MITSUBISHI ELECTRIC CORPORATION: DEALS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 12.2 OTHER KEY PLAYERS

- 12.2.1 HACH

- 12.2.2 SHIMADZU CORPORATION

- 12.2.3 JUMO GMBH & CO. KG

- 12.2.4 APPLIED ANALYTICS, INC.

- 12.2.5 OMEGA ENGINEERING, INC.

- 12.2.6 VEGA GRIESHABER KG

- 12.2.7 SARTORIUS AG

- 12.2.8 SCHMIDT + HAENSCH

- 12.2.9 METROHM AG

- 12.2.10 HORIBA

- 12.2.11 BERTHOLD TECHNOLOGIES GMBH & CO. KG

- 12.2.12 KYOTO ELECTRONICS MANUFACTURING CO., LTD.

- 12.2.13 MICHELL INSTRUMENTS

- 12.2.14 SINAR TECHNOLOGY

- 12.2.15 GOW-MAC INSTRUMENT COMPANY

- 12.3 STARTUP/SME PLAYERS

- 12.3.1 SKALAR ANALYTICAL B.V.

- 12.3.2 UIC, INC.

- 12.3.3 COMET ANALYTICS, INC.

- 12.3.4 TOC SYSTEMS

- 12.3.5 SENSOTECH

- 12.3.6 BOPP & REUTHER MESSTECHNIK GMBH

- 12.3.7 ROTOTHERM GROUP

- 12.3.8 INTEGRATED SENSING SYSTEMS

- 12.3.9 LIQUID ANALYTICAL RESOURCE, LLC

- 12.3.10 ELTRA GMBH

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 STUDY LIMITATIONS

- 13.3 GAS SENSORS MARKET, BY PRODUCT

- FIGURE 59 GAS SENSORS MARKET, BY PRODUCT

- TABLE 170 GAS SENSORS MARKET, BY PRODUCT, 2018-2021 (USD MILLION)

- TABLE 171 GAS SENSORS MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 13.4 GAS ANALYZERS & MONITORS

- 13.4.1 PRESSING NEED FOR WORKPLACE SAFETY TO BOOST DEMAND

- 13.5 GAS DETECTORS

- 13.5.1 BOOMING AUTOMOTIVE SECTOR TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 13.6 AIR QUALITY MONITORS

- 13.6.1 ONGOING CAMPAIGNS AND PROGRAMS TO INCREASE AWARENESS ABOUTH AIR POLLUTION CONTROL TO BOOST DEMAND

- 13.7 AIR PURIFIERS/AIR CLEANERS

- 13.7.1 GROWING DEPLOYMENT IN COMMERCIAL AND RESIDENTIAL BUILDINGS TO DRIVE MARKET

- 13.8 HVAC SYSTEMS

- 13.8.1 RISING NEED TO REGULATE ENVIRONMENTAL CONDITIONS TO DRIVE MARKET

- 13.9 MEDICAL EQUIPMENT

- 13.9.1 INCREASING DEMAND FOR VENTILATORS AND INCUBATORS TO DRIVE MARKET

- 13.10 CONSUMER DEVICES

- 13.10.1 SURGING ADOPTION OF WEARABLE DEVICES TO DRIVE MARKET

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS