|

|

市場調査レポート

商品コード

1355197

欠陥検出・分類 (FDC) の世界市場 (~2028年):提供タイプ (ソフトウェア・ハードウェア・サービス)・用途 (製造・パッケージング)・エンドユーザー (自動車・電子&半導体・金属&機械)・地域別Fault Detection and Classification (FDC) Market by offering type (Software, hardware, services), Application (Manufacturing, Packaging), end use (Automotive, Electronics & Semiconductor, Metal & Machinery) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 欠陥検出・分類 (FDC) の世界市場 (~2028年):提供タイプ (ソフトウェア・ハードウェア・サービス)・用途 (製造・パッケージング)・エンドユーザー (自動車・電子&半導体・金属&機械)・地域別 |

|

出版日: 2023年09月20日

発行: MarketsandMarkets

ページ情報: 英文 250 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の欠陥検出・分類 (FDC) の市場規模は、2022年の44億米ドルから、予測期間中は8.9%のCAGRで推移し、2028年には74億米ドルの規模に成長すると予測されています。

ASICへの高い需要とシステムの複雑化が同市場の成長を促進しています。一方で、製造工場における熟練の専門家の不足が市場のさらなる成長を抑制しています。

| 調査範囲 | |

|---|---|

| 調査対象年: | 2019-2028年 |

| 基準年: | 2022年 |

| 予測期間: | 2023-2028年 |

| 単位 | 米ドル |

| 区分 | 欠陥タイプ・技術・提供タイプ・用途・エンドユーザー・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

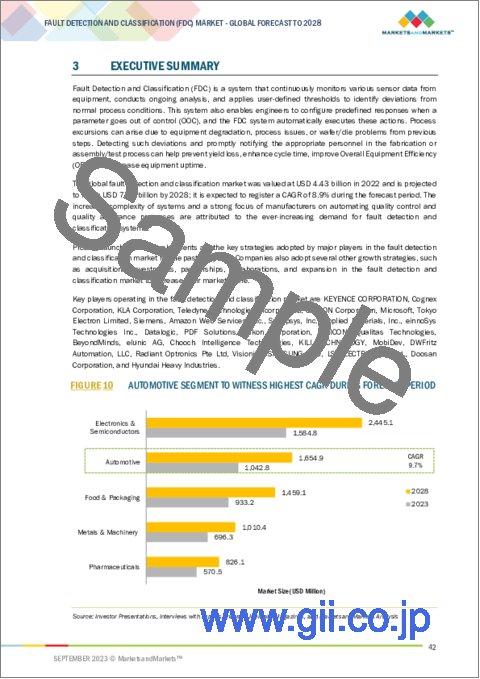

エンドユーザー別で見ると、自動車部門が予測期間中9.7%の最大のCAGRで成長すると予測されています。自動車産業では安全性がもっとも重要視されており、車両は厳格な安全規制を遵守する必要があります。FDCシステムは、製造プロセスの早い段階で潜在的な安全上重要な欠陥を特定し対処することで、これらの規格への準拠を確実にする上で極めて重要な役割を果たしています。また、電気自動車 (EV) や自動運転車の台頭も、FDCシステムの重要性を高めています。EVは複雑なバッテリーシステムに大きく依存しており、これらのシステムに不具合が生じると、安全性や性能に深刻な影響を及ぼしかねません。FDCシステムは、バッテリーの健全性を監視し、最適な充電と放電を保証し、潜在的な欠陥を特定して重大な事故を防ぐために不可欠です。

また、用途別では、製造部門が予測期間中に高いCAGRで成長すると予想されています。製造プロセスにおける欠陥は、設計の失敗、生産設備の欠陥、金属疲労、不利な作業条件、またはこれらの要因の相互作用に起因する可能性があります。組立ラインから排出されるさまざまな部品に、望ましくない穴、くぼみ、擦り傷、傷などの欠陥が生じることは避けられませんが、欠陥の原因が何であれ、欠陥のある部品は生産コストを押し上げ、製品品質を低下させ、製品寿命を縮め、顧客満足を妨げ、資源の浪費につながります。そのため、欠陥検出は、製造品質管理・保証プロセスの中核をなすものです。過去10年間で、欠陥検出は、AI、ディープラーニング、ビッグデータの進歩を基盤として、ますます技術主導型になってきました。スマートカメラと連携するAI対応システムの使用は、すでにメーカーがより短いサイクルで高品質の検査を提供し、待ち時間とコストを削減し、もっとも経験豊富な人間の検査員の能力をはるかに超える新たな基準を創出するのに役立っています。

当レポートでは、世界の欠陥検出・分類 (FDC) の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- ポーターのファイブフォース分析

- 顧客の事業に影響を与える動向・ディスラプション

- エコシステムマッピング

- 価格分析

- 主なステークホルダーと購入基準

- 特許分析

- 技術分析

- 貿易分析

- ケーススタディ分析

- 主要な会議とイベント

- 規制状況

- 料金分析

第6章 欠陥検出・分類 (FDC) システムで検出される欠陥のタイプ

- 寸法上の不良

- 表面欠陥

- 汚染による不良

- プロセスのばらつき

- その他

第7章 欠陥検出・分類 (FDC) の技術タイプ

- センサーデータ分析

- 統計的方法

- 機械学習アルゴリズム

- その他

第8章 欠陥検出・分類 (FDC) 市場:提供タイプ別

- ソフトウェア

- ハードウェア

- カメラ

- センサー

- フレームグラバー

- 光学系

- プロセッサー

- サービス

第9章 欠陥検出・分類 (FDC) 市場:用途別

- 製造

- アセンブリ検証

- 欠陥検出

- パッケージング

- グレーディング

- ラベル検証

- 容器包装検査

第10章 欠陥検出・分類 (FDC) 市場:産業別

- 自動車

- エレクトロニクスおよび半導体

- 金属・機械

- 食品・包装

- 医薬品

第11章 欠陥検出・分類 (FDC) 市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 概要

- 大手企業が採用した主な戦略

- 市場シェア分析

- 収益分析

- 主要企業の評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 企業のフットプリント

- 競争シナリオと動向

第13章 企業プロファイル

- 主要企業

- KEYENCE CORPORATION

- COGNEX CORPORATION

- OMRON CORPORATION

- TELEDYNE TECHNOLOGIES INCORPORATED

- KLA CORPORATION

- SIEMENS

- MICROSOFT

- AMAZON WEB SERVICES, INC.

- TOKYO ELECTRON LIMITED

- SYNOPSYS, INC.

- APPLIED MATERIALS, INC.

- その他の企業

- EINNOSYS TECHNOLOGIES INC.

- DATALOGIC S.P.A.

- PDF SOLUTIONS

- NIKON CORPORATION

- INFICON

- QUALITAS TECHNOLOGIES

- BEYONDMINDS

- ELUNIC AG

- CHOOCH INTELLIGENCE TECHNOLOGIES

- KILI TECHNOLOGY

- MOBIDEV

- DWFRITZ AUTOMATION, LLC

- RADIANT OPTRONICS PTE LTD

- VISIONIFY.AI

- 韓国:その他の企業

- SAMSUNG SDS

- LS ELECTRIC CO., LTD.

- DOOSAN CORPORATION (DOOSAN SKODA POWER)

- HYUNDAI HEAVY INDUSTRIES

第14章 付録

The global fault detection and classification market was valued at USD 4.4 billion in 2022 and is projected to reach USD 7.4 billion by 2028; it is expected to register a CAGR of 8.9% during the forecast period. High demand for application-specific integrated circuits (ASICs) and The increased complexity of systems are driving the growth of the fault detection and classification market. Whereaas,earth of skilled professionals in manufacturing factories are restraining the growth of fault detection and classification market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD(Billion) |

| Segments | Fault Types, Technology, Offering, Application, end use, Region |

| Regions covered | North America, Europe, APAC, RoW |

The software offering segment is expected to grow at the highest CAGR during the forecast period

The software offering segment is expected to grow at second highest CAGR of 12.9% in the near future. FDC software tends to be more cost-effective than hardware-based alternatives. FDC software typically involves lower initial costs, and ongoing expenses are mainly related to software updates and support. This cost advantage is particularly appealing to organizations aiming to optimize their budget while still benefiting from advanced fault detection capabilities. Also, factors such as flexibility, cost-efficiency, scalability, compatibility, advanced analytics capabilities, remote accessibility, and user-friendly data visualization are boosting the growth of software segment in the coming years.

Automotive end use segment to register growth at the highest CAGR during the forecast period

The automotive segment is expected to grow at a highest CAGR of 9.7% during the forecast period. Safety is paramount in the automotive industry, and vehicles must comply with strict safety regulations globally. FDC systems play a pivotal role in ensuring compliance with these standards by identifying and addressing potential safety-critical faults early in the manufacturing process. Also, the rise of electric vehicles (EVs) and autonomous vehicles has amplified the importance of FDC systems. EVs rely heavily on complex battery systems, and any fault in these systems can have serious safety and performance implications. FDC systems are essential in monitoring battery health, ensuring optimal charging and discharging, and identifying potential faults to prevent critical incidents.

The manufacuting application segment is likely to grow at a higher CAGR during the forecast period

The manufacuting segment is expected to grow at a higher CAGR during the forecast period. In manufacturing processes, faults may originate from design failures, faulty production equipment, metal fatigue, unfavorable working conditions, or any interplay between these factors. Faults like undesired holes, pits, abrasions, and scratches on various pieces that exit the assembly line are unavoidable. Regardless of the source of the defect, defected components spike production costs, degrade product quality, shorten product lifespan, hamper customer satisfaction, and result in an extensive waste of resources. Therefore, fault detection is a core part of any manufacturing quality control and assurance process. Earlier, faults were inspected manually by human inspectors, which is naturally prone to fatigue, inattentiveness, and biases. Later, manual inspection was augmented by rule-based machine vision technologies. Over the past decade, fault detection has become increasingly technology-driven, building on advancements in artificial intelligence, deep learning, and big data. The use of smart cameras and related AI-enabled systems is already helping manufacturers deliver high-quality inspection in shorter cycles, reduce latency and costs, and set new standards that are far beyond the capabilities of even the most experienced human inspectors.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation- C-level Executives - 40%, Sales Manager - 30%, Others - 30%

- By Region-North America - 20%, Europe - 20%, Asia Pacific - 40%, RoW - 10%

The fault detection and classification market is dominated by a few globally established players such as Keyence Corporation (Japan), Cognex Corporation (US), KLA Corporation (US), Teledyne Technologies (US), OMRON Corporation (Japan). The study includes an in-depth competitive analysis of these key players in the fault detection and classification market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the fault detection and classification market and forecasts its size by offering type, device type, deployment, application, end-user, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the fault detection and classification ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (The increased complexity of systems, Strong focus of manufacturers on automating quality control and quality assurance processes, Stringent health and safety measures imposed by governments and standards organizations on global manufacturing firms, High demand for application-specific integrated circuits (ASICs)). Restraint ( Dearth of skilled professionals in manufacturing factories). Opportunity (Increasing adoption of artificial intelligence (AI) technology, Rapid industrialization in emerging economies, along with government initiatives to facilitate adoption of automated tools in manufacturing plants), Challenges (Complexity in implementation of fault detection and classification solution and technologies)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the fault detection and classification market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the fault detection and classification market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the fault detection and classification market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Keyence Corporation (Japan), Cognex Corporation (US), KLA Corporation (US), Teledyne Technologies (US), OMRON Corporation (Japan), Microsoft (US), Tokyo Electron Limited (Japan), Siemens (Germany), Amazon Web Services, Inc. (US), Synopsys, Inc. (US) among others in the fault detection and classification market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 FAULT DETECTION AND CLASSIFICATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 FAULT DETECTION AND CLASSIFICATION MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Major primary participants

- 2.1.3.2 Primary interviews with experts

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key data from primary sources

- 2.1.3.5 Key industry insights

- 2.2 FACTOR ANALYSIS

- 2.2.1 SUPPLY-SIDE ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN SUPPLY-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to derive market size using top-down analysis (supply side)

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 GROWTH PROJECTION AND FORECAST-RELATED ASSUMPTIONS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 2 KEY ASSUMPTIONS: MACRO-AND MICRO-ECONOMIC ENVIRONMENT

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 3 RISK ASSESSMENT

- 2.7.1 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON FAULT DETECTION AND CLASSIFICATION MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 AUTOMOTIVE SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 SOFTWARE SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 12 CAMERA SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- 3.1 IMPACT OF RECESSION ON FAULT DETECTION AND CLASSIFICATION MARKET

- FIGURE 14 PRE- AND POST-RECESSION IMPACT ON FAULT DETECTION AND CLASSIFICATION MARKET, 2019-2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN FAULT DETECTION AND CLASSIFICATION MARKET

- FIGURE 15 HIGH DEMAND FOR APPLICATION-SPECIFIC INTEGRATED CIRCUITS TO DRIVE MARKET

- 4.2 FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION

- FIGURE 16 MANUFACTURING SEGMENT LEAD MARKET DURING FORECAST PERIOD

- 4.3 FAULT DETECTION AND CLASSIFICATION MARKET FOR MANUFACTURING, BY APPLICATION

- FIGURE 17 ASSEMBLY VERIFICATION SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- 4.4 FAULT DETECTION AND CLASSIFICATION MARKET FOR PACKAGING, BY APPLICATION

- FIGURE 18 LABEL VALIDATION SEGMENT TO CLAIM HIGHEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION

- FIGURE 19 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2028, BY VALUE

- 4.6 FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY

- FIGURE 20 CHINA TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 FAULT DETECTION AND CLASSIFICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Effective detection and management of complex systems in modern technological landscape

- 5.2.1.2 Improved plant-efficiency and reduced costs with quality control processes in manufacturing

- 5.2.1.3 Increasing focus on deployment of automated tools in manufacturing sector

- 5.2.1.4 High demand for application-specific integrated circuits

- FIGURE 22 FAULT DETECTION AND CLASSIFICATION MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of skilled professionals

- FIGURE 23 FAULT DETECTION AND CLASSIFICATION MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Improved production processes using AI-based fault detection and classification instruments

- 5.2.3.2 Government-led initiatives to boost adoption of automation and data acquisition systems

- FIGURE 24 FAULT DETECTION AND CLASSIFICATION MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing complexities in manufacturing processes attributed to technological innovations

- FIGURE 25 FAULT DETECTION AND CLASSIFICATION MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 26 FAULT DETECTION AND CLASSIFICATION MARKET: VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH & DEVELOPMENT ENGINEERS

- 5.3.2 RAW MATERIAL SUPPLIERS

- 5.3.3 MANUFACTURERS

- 5.3.4 SYSTEM INTEGRATORS

- 5.3.5 SUPPLIERS AND DISTRIBUTORS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 FAULT DETECTION AND CLASSIFICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 FAULT DETECTION AND CLASSIFICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN FAULT DETECTION AND CLASSIFICATION MARKET

- 5.6 ECOSYSTEM MAPPING

- FIGURE 29 FAULT DETECTION AND CLASSIFICATION MARKET: ECOSYSTEM MAPPING

- 5.7 PRICING ANALYSIS

- FIGURE 30 AVERAGE SELLING PRICE OF HARDWARE, 2019-2028

- 5.7.1 AVERAGE SELLING PRICE OF HARDWARE OFFERED BY KEY PLAYERS

- FIGURE 31 AVERAGE SELLING PRICE OF HARDWARE, BY KEY PLAYERS

- TABLE 5 AVERAGE SELLING PRICE OF HARDWARE OFFERED BY KEY PLAYERS

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VERTICALS

- 5.8.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.9 PATENT ANALYSIS

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS DURING LAST 10 YEARS

- FIGURE 35 REGIONAL ANALYSIS OF PATENTS GRANTED FOR FAULT DETECTION AND CLASSIFICATION DEVICES, 2022

- TABLE 8 FAULT DETECTION AND CLASSIFICATION MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021-2023

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 LIQUID LENS

- 5.10.2 ROBOTIC VISION

- 5.10.3 DEEP LEARNING

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- TABLE 9 IMPORT DATA FOR FAULT DETECTION AND CLASSIFICATION INSTRUMENTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11.2 EXPORT SCENARIO

- TABLE 10 EXPORT DATA FOR FAULT DETECTION AND CLASSIFICATION INSTRUMENTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 MICROSOFT PROVIDES END-TO-END FAULT DETECTION SYSTEM TO DETECT AND LOCALIZE FAULTS IN SOLAR PANELS BASED ON THEIR ELECTROLUMINESCENCE (EL) IMAGING

- 5.12.2 APPLIED MATERIALS, INC. OFFERS COST-EFFECTIVE APPROACH TO PROPAGATE FRONT-END FD PRACTICES INTO BACK-END ATP PROCESSES

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 11 FAULT DETECTION AND CLASSIFICATION MARKET: LIST OF CONFERENCES AND EVENTS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- 5.15 TARIFF ANALYSIS

- TABLE 16 TARIFF FOR HS CODE 903033-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- TABLE 17 TARIFF FOR HS CODE 903033-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2022

6 TYPES OF FAULTS DETECTED BY FAULT DETECTION AND CLASSIFICATION SYSTEMS

- 6.1 INTRODUCTION

- 6.2 DIMENSIONAL FAULT

- 6.2.1 INCREASING USE TO MINIMIZE DIMENSIONAL FAULTS LEADING TO HIGH COSTS AND DOWNTIME

- 6.3 SURFACE DEFECTS

- 6.3.1 IRREGULARITIES DUE TO ELECTRICAL SHORTS AND DEVICE FAILURES

- 6.4 CONTAMINATION FAULTS

- 6.4.1 INTERFERENCE IN PRECISE ETCHING AND DEPOSITION PROCESS DUE TO CONTAMINATION ISSUES

- 6.5 PROCESS VARIABILITY

- 6.5.1 FLUCTUATION IN CLEANROOM ENVIRONMENT IMPACTING PROCESS STABILITY

- 6.6 OTHER FAULT TYPES

7 TYPES OF TECHNOLOGY FOR FAULT DETECTION AND CLASSIFICATION

- 7.1 INTRODUCTION

- 7.2 SENSOR DATA ANALYSIS

- 7.2.1 GROWING NEED FOR ANALYSIS OF LARGE VOLUMES OF SENSOR DATA IN REAL-TIME TO DRIVE DEMAND

- 7.3 STATISTICAL METHODS

- 7.3.1 ABILITY TO TRANSFORM RAW DATA INTO ACTIONABLE INSIGHTS TO FOSTER SEGMENTAL GROWTH

- 7.4 MACHINE LEARNING ALGORITHMS

- 7.4.1 EARLY ISSUE DETECTION AND PREDICTIVE MAINTENANCE TO SPUR DEMAND

- 7.5 OTHER TECHNOLOGIES

8 FAULT DETECTION AND CLASSIFICATION MARKET, BY OFFERING

- 8.1 INTRODUCTION

- FIGURE 36 HARDWARE SEGMENT TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- TABLE 18 FAULT DETECTION AND CLASSIFICATION MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 19 FAULT DETECTION AND CLASSIFICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 8.2 SOFTWARE

- 8.2.1 RISING CRITICALITY OF INFRASTRUCTURE SYSTEMS TO FOSTER SEGMENTAL GROWTH

- 8.3 HARDWARE

- TABLE 20 HARDWARE: FAULT DETECTION AND CLASSIFICATION MARKET, 2019-2022 (USD MILLION)

- TABLE 21 HARDWARE: FAULT DETECTION AND CLASSIFICATION MARKET, 2023-2028 (USD MILLION)

- FIGURE 37 BY HARDWARE OFFERING, CAMERA SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 22 HARDWARE: FAULT DETECTION AND CLASSIFICATION MARKET, 2019-2022 (MILLION UNITS)

- TABLE 23 HARDWARE: FAULT DETECTION AND CLASSIFICATION MARKET, 2023-2028 (MILLION UNITS)

- 8.3.1 CAMERAS

- 8.3.1.1 Cameras, by format

- 8.3.1.1.1 Area scan cameras

- 8.3.1.1.1.1 Better flexibility than other cameras to drive demand

- 8.3.1.1.2 Line scan cameras

- 8.3.1.1.2.1 Cost advantage and high resolution to boost demand

- 8.3.1.1.1 Area scan cameras

- 8.3.1.2 Cameras, by frame rate

- 8.3.1.2.1 Ability to record smooth motion with less motion blur to foster segmental growth

- 8.3.1.1 Cameras, by format

- 8.3.2 SENSORS

- 8.3.2.1 CCD sensors

- 8.3.2.1.1 Less defective pixels due to simple structure to drive demand

- 8.3.2.2 CMOS sensors

- 8.3.2.2.1 Low power consumption and high-speed performance to drive demand

- 8.3.2.1 CCD sensors

- 8.3.3 FRAME GRABBERS

- 8.3.3.1 Ability to capture high-resolution digital still images to boost demand

- 8.3.4 OPTICS

- 8.3.4.1 Need to regulate flaws in raw materials, components, and finished products to boost demand

- 8.3.5 PROCESSORS

- 8.3.5.1 High-resolution and real-time video analytics in vision algorithms to propel market

- 8.4 SERVICES

- 8.4.1 GROWING ADOPTION OF AI AND DEEP LEARNING TECHNOLOGIES TO BOOST DEMAND

9 FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 38 MANUFACTURING SEGMENT TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- TABLE 24 FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 25 FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 MANUFACTURING

- TABLE 26 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 27 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- FIGURE 39 ASSEMBLY VERIFICATION SEGMENT TO CAPTURE LARGEST MARKET SHARE FOR MANUFACTURING APPLICATIONS THROUGHOUT FORECAST PERIOD

- TABLE 28 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 29 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 30 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 33 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 34 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 35 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 36 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 37 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 38 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 MANUFACTURING: FAULT DETECTION AND CLASSIFICATION MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.2.1 ASSEMBLY VERIFICATION

- 9.2.1.1 AI- and deep learning-based fault detection and classification systems to offer growth opportunities

- 9.2.2 FLAW DETECTION

- 9.2.2.1 Measurement

- 9.2.2.1.1 Semiconductor and electronics industries to generate significant demand

- 9.2.2.2 Surface anomalies

- 9.2.2.2.1 Implementation of technologically advanced products to detect real-time complex defects to drive market

- 9.2.2.3 Fabrication inspection

- 9.2.2.3.1 Welding inspection

- 9.2.2.3.1.1 Rising demand for light and efficient designs to foster segmental growth

- 9.2.2.3.2 Semiconductor device fabrication

- 9.2.2.3.2.1 Growing miniaturization of semiconductor devices to propel market growth

- 9.2.2.3.1 Welding inspection

- 9.2.2.1 Measurement

- 9.3 PACKAGING

- TABLE 40 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 41 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- FIGURE 40 LABEL VALIDATION SEGMENT TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- TABLE 42 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 43 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 44 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 47 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 48 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 49 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 50 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 51 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 52 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.3.1 GRADING

- 9.3.1.1 Introduction of application-specific products and solutions to boost market

- 9.3.2 LABEL VALIDATION

- 9.3.2.1 Product information

- 9.3.2.1.1 Assurance of defect-free product labeling with advanced fault detection and classification systems to drive market

- 9.3.2.2 Barcodes

- 9.3.2.2.1 Increasing concerns about quality standards to boost demand

- 9.3.2.1 Product information

- 9.3.3 CONTAINER/PACKAGING INSPECTION

- 9.3.3.1 Packaging integrity

- 9.3.3.1.1 Assurance of product sterility and reduced dependence on manual and expensive inspection processes to drive market

- 9.3.3.1 Packaging integrity

10 FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 41 ELECTRONICS & SEMICONDUCTORS TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- TABLE 54 FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 55 FAULT DETECTION AND CLASSIFICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 AUTOMOTIVE

- 10.2.1 RISING PRODUCTION OF HYBRID AND ELECTRIC VEHICLES TO BOOST MARKET

- TABLE 56 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 57 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- FIGURE 42 ASSEMBLY VERIFICATION TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- TABLE 58 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 59 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023-2028 (USD MILLION)

- TABLE 60 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 61 AUTOMOTIVE: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023-2028 (USD MILLION)

- 10.3 ELECTRONICS & SEMICONDUCTORS

- 10.3.1 ABILITY TO DETECT COMPLEX AND MACRO DEFECTS TO BOOST DEMAND

- TABLE 62 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 63 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- FIGURE 43 BY MANUFACTURING APPLICATION, FABRIC INSPECTION TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 64 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 65 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023-2028 (USD MILLION)

- TABLE 66 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 67 ELECTRONICS & SEMICONDUCTORS: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023-2028 (USD MILLION)

- 10.4 METALS & MACHINERY

- 10.4.1 DEPLOYMENT OF INDUSTRY 4.0 AND IIOT IN METALS & MACHINERY TO DRIVE MARKET

- TABLE 68 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 69 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- FIGURE 44 ASSEMBLY VERIFICATION SEGMENT TO EXHIBIT HIGHEST CAGR IN FAULT DETECTION AND CLASSIFICATION MARKET FOR MANUFACTURING APPLICATIONS DURING FORECAST PERIOD

- TABLE 70 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 71 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023-2028 (USD MILLION)

- TABLE 72 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 73 METALS & MACHINERY: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023-2028 (USD MILLION)

- 10.5 FOOD & PACKAGING

- 10.5.1 IMPLEMENTATION OF AI AND DEEP LEARNING SOFTWARE IN FOOD & PACKAGING TO DRIVE MARKET

- TABLE 74 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 75 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- FIGURE 45 ASSEMBLY VERIFICATION SEGMENT TO DISPLAY HIGHEST CAGR IN FAULT DETECTION AND CLASSIFICATION MARKET FOR MANUFACTURING APPLICATIONS THROUGHOUT FORECAST PERIOD

- TABLE 76 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 77 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023-2028 (USD MILLION)

- TABLE 78 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 79 FOOD & PACKAGING: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023-2028 (USD MILLION)

- 10.6 PHARMACEUTICALS

- 10.6.1 ABILITY TO INSPECT LARGE NUMBER OF TABLETS ACCURATELY TO BOOST DEMAND

- TABLE 80 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 81 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- FIGURE 46 ASSEMBLY VERIFICATION TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 82 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 83 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY MANUFACTURING APPLICATION, 2023-2028 (USD MILLION)

- TABLE 84 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2019-2022 (USD MILLION)

- TABLE 85 PHARMACEUTICALS: FAULT DETECTION AND CLASSIFICATION MARKET, BY PACKAGING APPLICATION, 2023-2028 (USD MILLION)

11 FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 47 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 86 FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 48 NORTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET SNAPSHOT

- TABLE 88 NORTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Presence of established players to foster market growth

- TABLE 90 US: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 91 US: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Thriving automotive and aerospace sectors to contribute to market growth

- TABLE 92 CANADA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 93 CANADA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Growing FDIs in manufacturing to boost market growth

- TABLE 94 MEXICO: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 95 MEXICO: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.4 NORTH AMERICA: RECESSION IMPACT

- 11.3 EUROPE

- FIGURE 49 EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET SNAPSHOT

- TABLE 96 EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Increasing demand for robots in automotive and electronics industries to foster market growth

- TABLE 98 GERMANY: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 99 GERMANY: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Pharmaceutical industry to create significant demand for fault detection and classification systems

- TABLE 100 UK: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 101 UK: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Rising automobile production to boost demand

- TABLE 102 FRANCE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 103 FRANCE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 REST OF EUROPE

- TABLE 104 REST OF EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5 EUROPE: RECESSION IMPACT

- 11.4 ASIA PACIFIC

- FIGURE 50 ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET SNAPSHOT

- TABLE 106 ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Established manufacturing hub for consumer electronics and automobiles to propel market growth

- TABLE 108 CHINA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 109 CHINA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.2 JAPAN

- 11.4.2.1 Healthy growth of consumer electronics industry to boost demand

- TABLE 110 JAPAN: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 111 JAPAN: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Expanding consumer electronics industry and manufacturing sector to boost market growth

- TABLE 112 SOUTH KOREA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 113 SOUTH KOREA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 INDIA

- 11.4.4.1 Government-led campaigns for boosting domestic manufacturing sector to drive market

- TABLE 114 INDIA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 115 INDIA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 REST OF ASIA PACIFIC

- TABLE 116 REST OF ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.6 ASIA PACIFIC: RECESSION IMPACT

- 11.5 ROW

- TABLE 118 ROW: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 119 ROW: FAULT DETECTION AND CLASSIFICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5.1 MIDDLE EAST & AFRICA

- 11.5.1.1 Booming energy & power industry to fuel demand

- TABLE 120 MEA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 MEA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Rising need for high-quality automated inspections to drive demand

- TABLE 122 SOUTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 SOUTH AMERICA: FAULT DETECTION AND CLASSIFICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.3 ROW: RECESSION IMPACT

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 124 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 12.2.1 PRODUCT PORTFOLIO

- 12.2.2 REGIONAL FOCUS

- 12.2.3 MANUFACTURING FOOTPRINT

- 12.2.4 ORGANIC/INORGANIC STRATEGIES

- 12.3 MARKET SHARE ANALYSIS, 2022

- TABLE 125 FAULT DETECTION AND CLASSIFICATION MARKET SHARE ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 51 FAULT DETECTION AND CLASSIFICATION SYSTEMS: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018-2022

- 12.5 EVALUATION MATRIX OF KEY COMPANIES, 2022

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 52 FAULT DETECTION AND CLASSIFICATION SYSTEMS: EVALUATION MATRIX OF KEY COMPANIES, 2022

- 12.6 EVALUATION MATRIX OF STARTUPS/SMES, 2022

- TABLE 126 FAULT DETECTION AND CLASSIFICATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 127 FAULT DETECTION AND CLASSIFICATION MARKET: STARTUPS/SMES COMPANY PROFILE

- TABLE 128 FAULT DETECTION AND CLASSIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (OFFERING)

- TABLE 129 FAULT DETECTION AND CLASSIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (VERTICAL FOOTPRINT)

- TABLE 130 FAULT DETECTION AND CLASSIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION FOOTPRINT)

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 53 FAULT DETECTION AND CLASSIFICATION MARKET: EVALUATION MATRIX OF STARTUPS/SME, 2022

- 12.7 COMPANY FOOTPRINT

- TABLE 131 FAULT DETECTION AND CLASSIFICATION MARKET: COMPANY FOOTPRINT

- TABLE 132 VERTICAL: COMPANY FOOTPRINT

- TABLE 133 OFFERING: COMPANY FOOTPRINT

- TABLE 134 REGION: COMPANY FOOTPRINT

- 12.8 COMPETITIVE SCENARIOS AND TRENDS

- 12.8.1 PRODUCT LAUNCHES

- TABLE 135 FAULT DETECTION AND CLASSIFICATION MARKET: PRODUCT LAUNCHES, 2019-2023

- 12.8.2 DEALS

- TABLE 136 FAULT DETECTION AND CLASSIFICATION MARKET: DEALS, 2019-2023

- 12.8.3 OTHERS

- TABLE 137 FAULT DETECTION AND CLASSIFICATION MARKET: OTHERS, 2019-2023

13 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS

- 13.1.1 KEYENCE CORPORATION

- TABLE 138 KEYENCE CORPORATION: COMPANY OVERVIEW

- FIGURE 54 KEYENCE CORPORATION: COMPANY SNAPSHOT

- TABLE 139 KEYENCE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 KEYENCE CORPORATION: PRODUCT LAUNCHES

- 13.1.2 COGNEX CORPORATION

- TABLE 141 COGNEX CORPORATION: COMPANY OVERVIEW

- FIGURE 55 COGNEX CORPORATION: COMPANY SNAPSHOT

- TABLE 142 COGNEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 COGNEX CORPORATION: PRODUCT LAUNCHES

- TABLE 144 COGNEX CORPORATION: DEALS

- 13.1.3 OMRON CORPORATION

- TABLE 145 OMRON CORPORATION: COMPANY OVERVIEW

- FIGURE 56 OMRON CORPORATION: COMPANY SNAPSHOT

- TABLE 146 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 148 OMRON CORPORATION: DEALS

- TABLE 149 OMRON CORPORATION: OTHERS

- 13.1.4 TELEDYNE TECHNOLOGIES INCORPORATED

- TABLE 150 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- FIGURE 57 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- TABLE 151 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 153 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- 13.1.5 KLA CORPORATION

- TABLE 154 KLA CORPORATION: COMPANY OVERVIEW

- FIGURE 58 KLA CORPORATION: COMPANY SNAPSHOT

- TABLE 155 KLA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 KLA CORPORATION: PRODUCT LAUNCHES

- TABLE 157 KLA CORPORATION: DEALS

- TABLE 158 KLA CORPORATION: OTHERS

- 13.1.6 SIEMENS

- TABLE 159 SIEMENS: COMPANY OVERVIEW

- FIGURE 59 SIEMENS: COMPANY SNAPSHOT

- TABLE 160 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 SIEMENS: DEALS

- 13.1.7 MICROSOFT

- TABLE 162 MICROSOFT: COMPANY OVERVIEW

- FIGURE 60 MICROSOFT: COMPANY SNAPSHOT

- TABLE 163 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 MICROSOFT: PRODUCT LAUNCHES

- TABLE 165 MICROSOFT: DEALS

- 13.1.8 AMAZON WEB SERVICES, INC.

- TABLE 166 AMAZON WEB SERVICES, INC.: COMPANY OVERVIEW

- FIGURE 61 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

- TABLE 167 AMAZON WEB SERVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 AMAZON WEB SERVICES, INC.: PRODUCT LAUNCHES

- TABLE 169 AMAZON WEB SERVICES, INC.: DEALS

- TABLE 170 AMAZON WEB SERVICES, INC.: OTHERS

- 13.1.9 TOKYO ELECTRON LIMITED

- TABLE 171 TOKYO ELECTRON LIMITED: COMPANY OVERVIEW

- FIGURE 62 TOKYO ELECTRON LIMITED: COMPANY SNAPSHOT

- TABLE 172 TOKYO ELECTRON LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.10 SYNOPSYS, INC.

- TABLE 173 SYNOPSYS, INC.: COMPANY OVERVIEW

- FIGURE 63 SYNOPSYS, INC.: COMPANY SNAPSHOT

- TABLE 174 SYNOPSYS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 SYNOPSYS, INC.: PRODUCT LAUNCHES

- TABLE 176 SYNOPSYS, INC.: DEALS

- 13.1.11 APPLIED MATERIALS, INC.

- TABLE 177 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

- FIGURE 64 APPLIED MATERIALS, INC.: COMPANY SNAPSHOT

- TABLE 178 APPLIED MATERIALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 APPLIED MATERIALS, INC.: PRODUCT LAUNCHES

- 13.2 OTHER PLAYERS

- 13.2.1 EINNOSYS TECHNOLOGIES INC.

- 13.2.2 DATALOGIC S.P.A.

- 13.2.3 PDF SOLUTIONS

- 13.2.4 NIKON CORPORATION

- 13.2.5 INFICON

- 13.2.6 QUALITAS TECHNOLOGIES

- 13.2.7 BEYONDMINDS

- 13.2.8 ELUNIC AG

- 13.2.9 CHOOCH INTELLIGENCE TECHNOLOGIES

- 13.2.10 KILI TECHNOLOGY

- 13.2.11 MOBIDEV

- 13.2.12 DWFRITZ AUTOMATION, LLC

- 13.2.13 RADIANT OPTRONICS PTE LTD

- 13.2.14 VISIONIFY.AI

- 13.3 SOUTH KOREA - OTHER PLAYERS

- 13.3.1 SAMSUNG SDS

- 13.3.2 LS ELECTRIC CO., LTD.

- 13.3.3 DOOSAN CORPORATION (DOOSAN SKODA POWER)

- 13.3.4 HYUNDAI HEAVY INDUSTRIES

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS