|

|

市場調査レポート

商品コード

1554603

タイミングデバイスの世界市場:発振器別、水晶別、セラミック別、原子時計別、クロックジェネレータ別、クロックバッファ別、ジッタ減衰器別 - 予測 (~2030年)Timing Devices Market by Oscillators- MEMS (SPMO, TCMO, VCMO, FSMO, DCMO, SSMO), Crystal (SPXO, TCXO, VCXO, FCXO, OCXO, SSXO, HiFlex, MCXO), Ceramic; Atomic Clocks; Clock Generators; Clock Buffers; and Jitter Attenuators - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| タイミングデバイスの世界市場:発振器別、水晶別、セラミック別、原子時計別、クロックジェネレータ別、クロックバッファ別、ジッタ減衰器別 - 予測 (~2030年) |

|

出版日: 2024年09月09日

発行: MarketsandMarkets

ページ情報: 英文 229 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

タイミングデバイスの市場規模は、2024年の52億4,000万米ドルから、予測期間中はCAGR 6.4%で推移し、2030年には75億9,000万米ドルの規模に成長すると予測されています。

スマートフォンやタブレット、ウェアラブル、その他のデバイスの増加により、シームレスな通信と各種機能の効率的な動作のために正確な計時が必要とされています。スマートフォンの内部時計は、異なるタイムゾーンやネットワークプロバイダー間を移動する場合でも、デバイスが正確な時刻を維持できるように、タイミングデバイスによってネットワーク時刻ソースと同期されます。タイミングデバイスは、データ転送や音声通話が中断されることなく行われるように、セルラーやワイヤレス通信プロトコルに正確なタイミング同期があることを確認します。GPSなどのGNSSとともにタイミングデバイスを使用することで、正確な測位と、ナビゲーションや位置追跡のようなロケーションベースの機能が保証されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 検討単位 | 金額(米ドル) |

| セグメント | タイプ・材料・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

"発振器の部門が予測期間中に最大のシェアを占める"

低消費電力、安定した消費電力、低位相ジッタ、費用対効果へのニーズの高まりにより、発振器の部門が最大のシェアを示しています。周波数設定、オーディオアプリケーション、クロック信号生成などは、発振器が使用される分野の一部です。また、カスタム出力仕様に対応したプログラマブル発振器への需要の高まりや、より高品質な低ノイズ信号を生成する安定した出力の水晶発振器への需要の高まりも同部門の成長を後押ししています。

"シリコン部門が予測期間中にもっとも高い成長率を記録する"

シリコンは現在のCE製品に利用されている集積回路の大半の基礎を形成している物質です。シリコンの採用は、規模の経済性、安価で入手しやすい高品質材料、機能を統合する能力によって後押しされています。さらに、シリコンはその物理的特性から多くの利点があります。安定性、精度、半導体製造プロセスとの互換性といった特性は、発振器や共振器を含む幅広いタイミングデバイスの使用に理想的です。

"アジア太平洋地域が予測期間中に最大の規模を維持すると予想される"

アジア太平洋地域は、高速データ転送と低遅延要件の加速により、予測期間中に最大の規模を維持すると予想されており、中国の通信業界ではタイミングデバイスのニーズが高まっています。光ファイバーネットワーク、データセンター、トランスミッションなどの通信インフラの信頼性と同期性を高めるためには高精度のタイミングデバイスが必要です。産業オートメーションの主要分野のひとつに、オートメーションの応用を伴う製造、電力、ユーティリティシステムがあります。タイミングの精度は、情報収集だけでなく、製造オペレーション制御システムの同期においても重要です。さらに、新しいオートメーション技術により、タイミングデバイスに対する要求も高まっています。

当レポートでは、世界のタイミングデバイスの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客の事業に影響を与える動向/ディスラプション

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント

- 規制状況

- 価格分析

- タイミングデバイス市場における生成AI/AIの影響

第6章 タイミングデバイス市場:タイプ別

- 発振器

- MEMS発振器

- 水晶発振器

- セラミック発振器

- 原子時計

- 共振器

- クロックジェネレータ

- クロックバッファ

- ジッタ減衰器

第7章 タイミングデバイス市場:材料別

- 水晶

- セラミック

- シリコン

第8章 タイミングデバイス市場:産業別

- CE製品

- エンタープライズエレクトロニクス

- 通信およびネットワーク

- 自動車

- BFSI

- 軍事・航空宇宙

- 工業

- 医療・ヘルスケア

第9章 タイミングデバイス市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 概要

- 主要企業の採用戦略

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業フットプリント

- 企業評価マトリックス:スタートアップ/中小企業

- 競合ベンチマーキング:スタートアップ/中小企業

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- SEIKO EPSON CORPORATION

- NIHON DEMPA KOGYO CO., LTD.

- TXC CORPORATION

- KYOCERA CORPORATION

- RAKON LIMITED

- RENESAS ELECTRONICS CORPORATION

- INFINEON TECHNOLOGIES AG

- MICROCHIP TECHNOLOGY INC.

- TEXAS INSTRUMENTS INCORPORATED

- ABRACON

- その他の企業

- IQD FREQUENCY PRODUCTS LTD.

- VISHAY INTERTECHNOLOGY, INC.

- STMICROELECTRONICS

- SITIME CORP.

- MTRONPTI

- CTS CORPORATION

- DIODES INCORPORATED

- ON SEMICONDUCTOR CORPORATION

- CRYSTEK CORPORATION

- GREENRAY INDUSTRIES, INC.

- FREQUENCY ELECTRONICS, INC.

- OSCILLOQUARTZ

- ACCUBEAT LTD.

- CONNOR-WINFIELD CORPORATION

- MERCURY INC.

第12章 付録

List of Tables

- TABLE 1 TIMING DEVICES MARKET: RISK ASSESSMENT

- TABLE 2 TIMING DEVICES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 TIMING DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 6 TIMING DEVICES MARKET: LIST OF MAJOR PATENTS, 2023

- TABLE 7 TIMING DEVICES MARKET: CONFERENCES & EVENTS, 2024-2025

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PRICE OF OSCILLATORS, BY COMPANY

- TABLE 13 PRICE OF CLOCK GENERATORS, BY COMPANY

- TABLE 14 PRICE OF CLOCK BUFFERS, BY COMPANY

- TABLE 15 PRICE OF JITTER ATTENUATORS, BY COMPANY

- TABLE 16 PRICE OF RESONATORS, BY COMPANY

- TABLE 17 PRICE OF ATOMIC CLOCKS, BY COMPANY

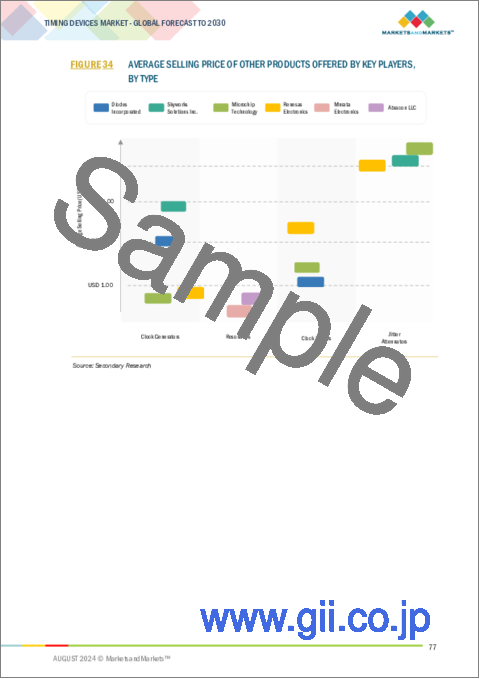

- TABLE 18 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, BY TYPE

- TABLE 19 TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 20 TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 21 TIMING DEVICES MARKET, BY TYPE, 2020-2023 (MILLION UNITS)

- TABLE 22 TIMING DEVICES MARKET, BY TYPE, 2024-2030 (MILLION UNITS)

- TABLE 23 OSCILLATORS: TIMING DEVICES MARKET, BY OSCILLATOR TYPE, 2020-2023 (USD MILLION)

- TABLE 24 OSCILLATORS: TIMING DEVICES MARKET, BY OSCILLATOR TYPE, 2024-2030 (USD MILLION)

- TABLE 25 OSCILLATORS: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 26 OSCILLATORS: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 27 MEMS OSCILLATORS: TIMING DEVICES MARKET, BY CIRCUITRY TYPE, 2020-2023 (USD MILLION)

- TABLE 28 MEMS OSCILLATORS: TIMING DEVICES MARKET, BY CIRCUITRY TYPE, 2024-2030 (USD MILLION)

- TABLE 29 CRYSTAL OSCILLATORS: TIMING DEVICES MARKET, BY CIRCUITRY TYPE, 2020-2023 (USD MILLION)

- TABLE 30 CRYSTAL OSCILLATORS: TIMING DEVICES MARKET, BY CIRCUITRY TYPE, 2024-2030 (USD MILLION)

- TABLE 31 ATOMIC CLOCKS: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 32 ATOMIC CLOCKS: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 33 RESONATORS: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 34 RESONATORS: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 35 CLOCK GENERATORS: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 36 CLOCK GENERATORS: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 37 CLOCK BUFFERS: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 38 CLOCK BUFFERS: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 39 JITTER ATTENUATORS: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 40 JITTER ATTENUATORS: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 41 TIMING DEVICES MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 42 TIMING DEVICES MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- TABLE 43 TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 44 TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 45 CONSUMER ELECTRONICS: TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 46 CONSUMER ELECTRONICS: TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 47 CONSUMER ELECTRONICS: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 CONSUMER ELECTRONICS: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 49 ENTERPRISE ELECTRONICS: TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 50 ENTERPRISE ELECTRONICS: TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 51 ENTERPRISE ELECTRONICS: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 52 ENTERPRISE ELECTRONICS: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 53 TELECOMMUNICATIONS & NETWORKING: TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 54 TELECOMMUNICATIONS & NETWORKING: TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 55 TELECOMMUNICATIONS & NETWORKING: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 TELECOMMUNICATIONS & NETWORKING: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 AUTOMOTIVE: TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 58 AUTOMOTIVE: TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 59 AUTOMOTIVE: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 AUTOMOTIVE: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 61 BFSI: TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 62 BFSI: TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 63 BFSI: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 BFSI: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 MILITARY & AEROSPACE: TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 66 MILITARY & AEROSPACE: TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 67 MILITARY & AEROSPACE: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 MILITARY & AEROSPACE: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 69 INDUSTRIAL: TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 70 INDUSTRIAL: TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 71 INDUSTRIAL: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 INDUSTRIAL: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 73 MEDICAL & HEALTHCARE: TIMING DEVICES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 74 MEDICAL & HEALTHCARE: TIMING DEVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 75 MEDICAL & HEALTHCARE: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 MEDICAL & HEALTHCARE: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 77 TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 78 TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: TIMING DEVICES MARKET: BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: TIMING DEVICES MARKET: BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: TIMING DEVICES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: TIMING DEVICES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 83 EUROPE: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 84 EUROPE: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 85 EUROPE: TIMING DEVICES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 86 EUROPE: TIMING DEVICES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: TIMING DEVICES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: TIMING DEVICES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 91 ROW: TIMING DEVICES MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 92 ROW: TIMING DEVICES MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 93 ROW: TIMING DEVICES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 94 ROW: TIMING DEVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 95 TIMING DEVICES MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 96 TIMING DEVICES MARKET SHARE ANALYSIS FOR TOP FIVE PLAYERS, 2023

- TABLE 97 TIMING DEVICES MARKET: TYPE FOOTPRINT

- TABLE 98 TIMING DEVICES MARKET: VERTICAL FOOTPRINT

- TABLE 99 TIMING DEVICES MARKET: REGION FOOTPRINT

- TABLE 100 TIMING DEVICES MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 101 TIMING DEVICES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 102 TIMING DEVICES MARKET: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2024

- TABLE 103 TIMING DEVICES MARKET: DEALS, JANUARY 2022-APRIL 2024

- TABLE 104 TIMING DEVICES MARKET: EXPANSIONS, JANUARY 2022-APRIL 2024

- TABLE 105 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 106 SEIKO EPSON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 107 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 108 NIHON DEMPA KOGYO CO., LTD.: COMPANY OVERVIEW

- TABLE 109 NIHON DEMPA KOGYO CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 NIHON DEMPA KOGYO CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 111 TXC CORPORATION: COMPANY OVERVIEW

- TABLE 112 TXC CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 113 TXC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 114 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 115 KYOCERA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 116 KYOCERA CORPORATION: EXPANSIONS

- TABLE 117 RAKON LIMITED: COMPANY OVERVIEW

- TABLE 118 RAKON LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 119 RAKON LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 120 RAKON LIMITED: EXPANSIONS

- TABLE 121 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 122 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 123 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 124 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 125 INFINEON TECHNOLOGIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 126 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 127 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 128 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 129 MICROCHIP TECHNOLOGY INC.: DEALS

- TABLE 130 MICROCHIP TECHNOLOGY INC.: OTHER DEVELOPMENTS

- TABLE 131 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 132 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 133 TEXAS INSTRUMENTS INCORPORATED: EXPANSIONS

- TABLE 134 ABRACON: COMPANY OVERVIEW

- TABLE 135 ABRACON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 136 ABRACON: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 137 ABRACON: DEALS

- TABLE 138 IQD FREQUENCY PRODUCTS LTD.: COMPANY OVERVIEW

- TABLE 139 VISHAY INTERTECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 140 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 141 SITIME CORP.: COMPANY OVERVIEW

- TABLE 142 MTRONPTI: COMPANY OVERVIEW

- TABLE 143 CTS CORPORATION: COMPANY OVERVIEW

- TABLE 144 DIODES INCORPORATED: COMPANY OVERVIEW

- TABLE 145 ON SEMICONDUCTOR CORPORATION: COMPANY OVERVIEW

- TABLE 146 CRYSTEK CORPORATION: COMPANY OVERVIEW

- TABLE 147 GREENRAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 148 FREQUENCY ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 149 OSCILLOQUARTZ: COMPANY OVERVIEW

- TABLE 150 ACCUBEAT LTD.: COMPANY OVERVIEW

- TABLE 151 CONNOR-WINFIELD CORPORATION: COMPANY OVERVIEW

- TABLE 152 MERCURY INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 TIMING DEVICES MARKET SEGMENTATION

- FIGURE 2 TIMING DEVICES MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 TIMING DEVICES MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): REVENUE GENERATED BY TIMING DEVICE MANUFACTURERS

- FIGURE 6 TIMING DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 7 TIMING DEVICES MARKET: DATA TRIANGULATION

- FIGURE 8 ATOMIC CLOCKS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 SILICON TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

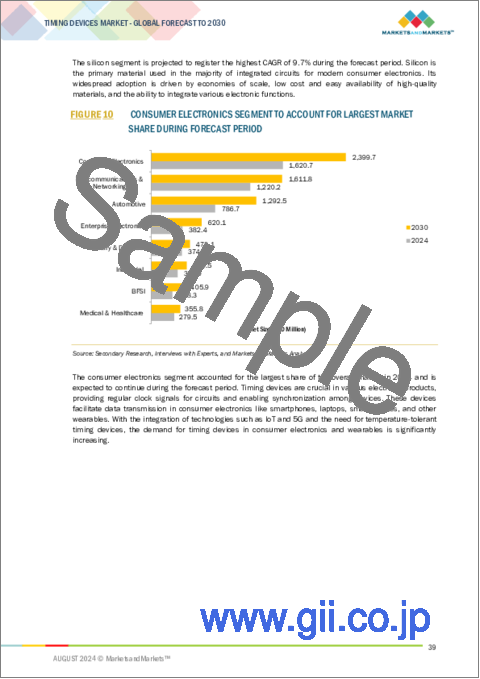

- FIGURE 10 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC DOMINATED GLOBAL TIMING DEVICES MARKET IN 2023

- FIGURE 12 GROWING ADOPTION OF TIMING DEVICES IN CONSUMER ELECTRONICS TO FUEL MARKET GROWTH

- FIGURE 13 OSCILLATORS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 CRYSTAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 15 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 TIMING DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 GLOBAL VEHICLE PRODUCTION, 2017-2022 (MILLION UNITS)

- FIGURE 19 IMPACT OF DRIVERS ON TIMING DEVICES MARKET

- FIGURE 20 IMPACT OF RESTRAINTS ON TIMING DEVICES MARKET

- FIGURE 21 IMPACT OF OPPORTUNITIES ON TIMING DEVICES MARKET

- FIGURE 22 IMPACT OF CHALLENGES ON TIMING DEVICES MARKET

- FIGURE 23 TIMING DEVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 TIMING DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 FUNDS RAISED BY AVICENATECH CORP. (STARTUP) IN TIMING DEVICES MARKET

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS: TIMING DEVICES MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 30 IMPORT DATA FOR HS CODE 854160, BY COUNTRY, 2019-2023

- FIGURE 31 EXPORT DATA FOR HS CODE 854160, BY COUNTRY, 2019-2023

- FIGURE 32 NUMBER OF PATENTS GRANTED AND APPLIED, 2013-2023

- FIGURE 33 AVERAGE SELLING PRICE OF OSCILLATORS OFFERED BY KEY PLAYERS, BY OSCILLATOR TYPE

- FIGURE 34 AVERAGE SELLING PRICE OF OTHER PRODUCTS OFFERED BY KEY PLAYERS, BY TYPE

- FIGURE 35 AVERAGE SELLING PRICE TREND OF RESONATORS, BY REGION, 2020-2023 (USD)

- FIGURE 36 IMPACT OF AI ON TIMING DEVICES

- FIGURE 37 OSCILLATORS TO DOMINATE TIMING DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 38 CRYSTAL OSCILLATORS TO LEAD TIMING DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 39 TELECOMMUNICATIONS & NETWORKING TO LEAD DEMAND FOR RESONATORS DURING FORECAST PERIOD

- FIGURE 40 CRYSTALS TO LEAD TIMING DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 41 CONSUMER ELECTRONICS TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 42 ASIA PACIFIC TO DOMINATE TIMING DEVICES MARKET IN CONSUMER ELECTRONICS SEGMENT

- FIGURE 43 OSCILLATORS TO DOMINATE TIMING DEVICES MARKET IN AUTOMOTIVE SECTOR

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: TIMING DEVICES MARKET SNAPSHOT

- FIGURE 46 US TO LEAD NORTH AMERICAN TIMING DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 47 EUROPE: TIMING DEVICES MARKET SNAPSHOT

- FIGURE 48 GERMANY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC: TIMING DEVICES MARKET SNAPSHOT

- FIGURE 50 CHINA TO DOMINATE TIMING DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 51 SOUTH AMERICA TO BE DOMINANT MARKET DURING FORECAST PERIOD

- FIGURE 52 TIMING DEVICES MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023

- FIGURE 53 TIMING DEVICES: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 54 COMPANY VALUATION (USD BILLION), 2024

- FIGURE 55 FINANCIAL METRICS (ENTERPRISE VALUE/EBITDA), 2023

- FIGURE 56 TIMING DEVICES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 57 TIMING DEVICES MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 58 TIMING DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 59 TIMING DEVICES MARKET: STARTUPS/SMES EVALUATION MATRIX, 2023

- FIGURE 60 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 NIHON DEMPA KOGYO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 TXC CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 RAKON LIMITED: COMPANY SNAPSHOT

- FIGURE 65 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 67 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 68 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

The timing devices market is projected to grow from USD 5.24 billion in 2024 and is expected to reach USD 7.59 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. The increase in the number of smartphones, tablets, wearables and other devices makes accurate timekeeping necessary for seamless communication and efficient functioning of different features and functionalities. The internal clock of a smartphone is synchronized with the network time sources by timing devices to make sure the device keeps accurate time even when moving between different time zones or network providers. Timing devices make sure that precise timing synchronization is there in cellular and wireless communication protocols so that data transfer and voice calls can be made without interruption. The use of timing devices together with global navigation satellite systems (GNSS) like GPS ensures accurate positioning and location-based functions such as navigation and location tracking.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Material, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The oscillators segment in the timing devices market to hold the largest market share during the forecast period."

Oscillators segment to hold the largest maket share due to the growing need for low and stable power consumption, low phase jitter and cost effectiveness. The frequency setting, audio applications and clock signal generation are some of the areas in which oscillators can be used. More so, the growth of this segment is fueled by the increasing demand for crystal oscillators with stable output that produce low noise signals for better quality in addition to a rise in demand for programmable oscillators that meet custom output specifications.

"Market for silicon in the timing devices market to witness highest growth rate during the forecast period."

Silicon is the substance that forms the basis of majority of integrated circuits utilized in present day consumer electronics. Adoption of silicon is encouraged by its economies of scale, cheapness of high-quality materials easy to obtain and capability of merging functions. Furthermore, using silicon has a number of benefits because of its physical characteristics. Its properties, such as stability, precision, and compatibility with semiconductor manufacturing processes, make it ideal for use in a wide range of timing devices, including oscillators and resonators.

"Asia Pacific is expected to hold the largest market size in the timing devices market during the forecast period."

Asia Pacific is expected to hold the largest market size in the timing devices market during the forecast period due to the escalation of fast data transfer and low latency requirements, there is an increasing need for timing devices in the China telecommunication industry. In order for communication infrastructure, such as improved or enlarged fiber optic networks, data centers and transmission equipment, to be reliable and synchronized, they need high precision timekeeping devices. One major area of industrial automation is manufacturing, power and utility systems that involve the application of automation. Timing precision is important in synchronizing manufacturing operations control systems as well as gathering information. Moreover, new automation techniques have created greater demands for timing equipment.

- By Company Type: Tier 1 - 20%, Tier 2 - 35%, and Tier 3 - 45%

- By Designation: C-level Executives - 20%, Directors -30%, and Others - 50%

- By Region: North America -40%, Europe - 20%, Asia Pacific- 30%, and RoW - 10%

Prominent players profiled in this report include TXC Corporation (Taiwan), Seiko Epson Corporation (Japan), KYOCERA Corporation (Japan), NIHON DEMPA KOGYO CO., LTD., (Japan), Renesas Electronics Corporation (Japan), Rakon Limited (New Zealand), Infineon Technologies AG (Germany), Texas Instruments Incorporated (US), and Abracon (US). Microchip Technology Inc. (US), IQD Frequency Products Ltd. (UK), Vishay Intertechnology, Inc. (US), STMicroelectronics (Switzerland), SiTime Corp. (US), MtronPTI (US), CTS Corporation (US), Diodes Incorporated (US), ON Semiconductor Corporation (US), Greenray Industries, Inc. (US), Crystek Corporation (US), Frequency Electronics, Inc. (US), Oscilloquartz (Switzerland), AccuBeat Ltd. (Israel), Connor-Winfield Corporation (US), and Mercury Inc. (Taiwan) are among a few other key companies in the timing devices market.

Report Coverage

The report defines, describes, and forecasts the timing devices market based on type, material, vertical, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the timing devices market. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall timing devices market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (Increasing adoption of advanced automotive electronics) restraints (High development costs of timing devices)

opportunities (Growing need for high-precision timing and frequency stability due to network densification), and challenges (Difficulties in designing timing devices for customized applications requiring small form factors) of the timing devices market.

- Product development /Innovation: Detailed insights on upcoming technologies, new product launches, and research & development activities in the timing devices market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the timing devices market across various regions.

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the timing devices market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players like NIHON DEMPA KOGYO CO., LTD., (Japan), KYOCERA Corporation (Japan), Seiko Epson Corporation (Japan), TXC Corporation (Taiwan), and Rakon Limited (New Zealand) among others in the timing devices market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size by bottom-up analysis (supply side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market share by top-down analysis (demand side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TIMING DEVICES MARKET

- 4.2 TIMING DEVICES MARKET, BY TYPE

- 4.3 TIMING DEVICES MARKET, BY MATERIAL

- 4.4 TIMING DEVICES MARKET IN ASIA PACIFIC, BY VERTICAL AND COUNTRY

- 4.5 TIMING DEVICES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of advanced automotive electronics

- 5.2.1.2 Surge in demand for healthcare and medical equipment

- 5.2.1.3 Advancements in telecommunications industry

- 5.2.1.4 Rising adoption of timing devices in smartphones and smart wearables

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development costs of timing devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing need for high-precision timing and frequency stability due to network densification

- 5.2.3.2 Rising demand for miniature electronic devices with improved performance and advanced features

- 5.2.3.3 Increasing global demand for networking applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulties in designing timing devices for customized applications requiring small form factors

- 5.2.4.2 Compatibility and integration issues associated with timing devices

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Green crystal technology

- 5.6.1.2 Bulk acoustic wave (BAW) resonators and surface acoustic wave (SAW) resonators

- 5.6.1.3 Chip-scale atomic clock (CSAC)

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Phase-locked loops (PLLs)

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Quantum-secure timing systems

- 5.6.3.2 Integration with IoT and Edge computing

- 5.6.1 KEY TECHNOLOGIES

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 TIMING DEVICES FOR TELECOMMUNICATIONS APPLICATIONS

- 5.10.2 TIMING DEVICES FOR INDUSTRIAL APPLICATIONS

- 5.10.3 TIMING DEVICES FOR AUTOMOTIVE APPLICATIONS

- 5.10.4 TIMING DEVICES FOR MILITARY APPLICATIONS

- 5.10.5 TIMING DEVICES FOR TEST & MEASUREMENT APPLICATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 854160)

- 5.11.2 EXPORT SCENARIO (HS CODE 854160)

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES & EVENTS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY STANDARDS

- 5.14.2.1 CEN/ISO

- 5.14.2.2 ISO/IEC JTC 1

- 5.14.2.2.1 ISO/IEC JTC 1/SC 3 1

- 5.14.2.2.2 ISO/IEC JTC 1/SC 27

- 5.14.2.2.3 IEC 62595-2-3

- 5.14.3 GOVERNMENT REGULATIONS

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE OF OSCILLATORS, BY TYPE

- 5.15.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.16 IMPACT OF GEN AI/AI ON TIMING DEVICES MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF AI ON VARIOUS END-USE INDUSTRIES OF TIMING DEVICES

6 TIMING DEVICES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 OSCILLATORS

- 6.2.1 MEMS OSCILLATORS

- 6.2.1.1 Demand in consumer electronics and automotive applications to drive market

- 6.2.2 CRYSTAL OSCILLATORS

- 6.2.2.1 Simple packaged crystal oscillators

- 6.2.2.1.1 Significant demand from automotive applications to contribute to market growth

- 6.2.2.2 Temperature-compensated crystal oscillators

- 6.2.2.2.1 Increasing adoption in mobile phones, wireless equipment, and satellite communication systems to fuel market growth

- 6.2.2.3 Voltage-controlled crystal oscillators

- 6.2.2.3.1 Rising deployment in wireless equipment, synthesizers, and FPGAs to contribute to market growth

- 6.2.2.4 Frequency-controlled crystal oscillators

- 6.2.2.4.1 Growing use in automotive and radar systems to drive market

- 6.2.2.5 Oven-controlled crystal oscillators

- 6.2.2.5.1 High demand from satellite and telecommunications applications to support market growth

- 6.2.2.6 Others

- 6.2.2.1 Simple packaged crystal oscillators

- 6.2.3 CERAMIC OSCILLATORS

- 6.2.3.1 Offers small size and low-cost benefits

- 6.2.1 MEMS OSCILLATORS

- 6.3 ATOMIC CLOCKS

- 6.3.1 LARGE-SCALE DEPLOYMENT IN SCIENTIFIC RESEARCH TO PROPEL MARKET

- 6.4 RESONATORS

- 6.4.1 INCREASING ADOPTION IN TELECOMMUNICATIONS & NETWORKING TO FUEL DEMAND

- 6.5 CLOCK GENERATORS

- 6.5.1 RAPID ADOPTION IN TELECOMMUNICATIONS SYSTEMS, DIGITAL SWITCHING SYSTEMS, AND MECHANICAL DEVICES TO DRIVE MARKET

- 6.6 CLOCK BUFFERS

- 6.6.1 USE OF CLOCK BUFFERS IN HIGH-SPEED SERIAL COMMUNICATION SYSTEMS TO FUEL MARKET GROWTH

- 6.7 JITTER ATTENUATORS

- 6.7.1 INCREASING DEMAND IN HIGH-SPEED APPLICATIONS TO SUPPORT MARKET GROWTH

7 TIMING DEVICES MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 CRYSTAL

- 7.2.1 PIEZOELECTRIC PROPERTY OF CRYSTALS TO DRIVE DEMAND IN TIMING DEVICES

- 7.3 CERAMIC

- 7.3.1 GOOD CHEMICAL AND THERMAL STABILITY OF CERAMIC TO BOOST ADOPTION IN TIMING DEVICES

- 7.4 SILICON

- 7.4.1 READY AVAILABILITY AND AFFORDABILITY TO INCREASE DEMAND IN TIMING DEVICES

8 TIMING DEVICES MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.2 CONSUMER ELECTRONICS

- 8.2.1 RISING INTEGRATION OF TIMING DEVICES INTO CONSUMER ELECTRONICS TO DRIVE MARKET

- 8.3 ENTERPRISE ELECTRONICS

- 8.3.1 HIGHER ADOPTION OF TIMEKEEPING AND ATTENDANCE TRACKING SYSTEMS TO SUPPORT MARKET GROWTH

- 8.4 TELECOMMUNICATIONS & NETWORKING

- 8.4.1 DEPLOYMENT OF 5G NETWORK TO DRIVE DEMAND FOR TIMING DEVICES

- 8.5 AUTOMOTIVE

- 8.5.1 TECHNOLOGICAL ADVANCEMENTS IN AUTOMOTIVE SECTOR TO FUEL MARKET GROWTH

- 8.6 BFSI

- 8.6.1 ACCURATE TIMEKEEPING REQUIREMENTS FROM BFSI VERTICAL TO PROPEL MARKET

- 8.7 MILITARY & AEROSPACE

- 8.7.1 ONGOING DEVELOPMENT OF SOPHISTICATED MISSILES AND WEAPONS TO DRIVE MARKET

- 8.8 INDUSTRIAL

- 8.8.1 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 8.9 MEDICAL & HEALTHCARE

- 8.9.1 ADVANCEMENTS IN MEDICAL TECHNOLOGY TO SUPPORT ADOPTION OF TIMING DEVICES

9 TIMING DEVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Ongoing automation in various industries to drive demand

- 9.2.3 CANADA

- 9.2.3.1 Surging investments in advanced technologies to contribute to market growth

- 9.2.4 MEXICO

- 9.2.4.1 Increasing manufacturing investments and political stability to drive market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK

- 9.3.2 GERMANY

- 9.3.2.1 Flourishing automotive industry to contribute to market growth

- 9.3.3 UK

- 9.3.3.1 Advancements in electronics and networking to drive demand for crystal oscillators

- 9.3.4 FRANCE

- 9.3.4.1 Surging demand for electric vehicles to fuel market growth

- 9.3.5 ITALY

- 9.3.5.1 Ongoing technological advancements in healthcare sector to foster market growth

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Rapid industrial development to fuel market growth

- 9.4.3 JAPAN

- 9.4.3.1 Rising adoption of precision automation and robotics to contribute to market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Growing demand from automotive and consumer electronics industries to propel market

- 9.4.5 INDIA

- 9.4.5.1 Government initiatives to support development of automotive industry to fuel demand

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- 9.5.1 MACROECONOMIC OUTLOOK

- 9.5.2 GCC COUNTRIES

- 9.5.2.1 Increasing investment in smart technologies and digital ecosystems to accelerate market growth

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.3.1 Growing consumer electronics industry to support market growth

- 9.5.4 SOUTH AMERICA

- 9.5.4.1 Growing investments in manufacturing sector to fuel demand

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY MAJOR PLAYERS

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.8 COMPANY FOOTPRINT

- 10.8.1 TYPE FOOTPRINT

- 10.8.2 VERTICAL FOOTPRINT

- 10.8.3 REGION FOOTPRINT

- 10.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- 10.10 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.11 COMPETITIVE SCENARIO AND TRENDS

- 10.11.1 PRODUCT LAUNCHES

- 10.11.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 SEIKO EPSON CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Services/Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches/developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 NIHON DEMPA KOGYO CO., LTD.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Services/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches/developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 TXC CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Services/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches/developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 KYOCERA CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Services/Solutions offered

- 11.1.4.2.1 Expansions

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 RAKON LIMITED

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Services/Solutions offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches/developments

- 11.1.5.3.2 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 RENESAS ELECTRONICS CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Services/Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches/developments

- 11.1.7 INFINEON TECHNOLOGIES AG

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Services/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 MICROCHIP TECHNOLOGY INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Services/Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Other developments

- 11.1.9 TEXAS INSTRUMENTS INCORPORATED

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Services/Solutions offered

- 11.1.9.3 Expansions

- 11.1.10 ABRACON

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Services/Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches/developments

- 11.1.10.3.2 Deals

- 11.1.1 SEIKO EPSON CORPORATION

- 11.2 OTHER COMPANIES

- 11.2.1 IQD FREQUENCY PRODUCTS LTD.

- 11.2.2 VISHAY INTERTECHNOLOGY, INC.

- 11.2.3 STMICROELECTRONICS

- 11.2.4 SITIME CORP.

- 11.2.5 MTRONPTI

- 11.2.6 CTS CORPORATION

- 11.2.7 DIODES INCORPORATED

- 11.2.8 ON SEMICONDUCTOR CORPORATION

- 11.2.9 CRYSTEK CORPORATION

- 11.2.10 GREENRAY INDUSTRIES, INC.

- 11.2.11 FREQUENCY ELECTRONICS, INC.

- 11.2.12 OSCILLOQUARTZ

- 11.2.13 ACCUBEAT LTD.

- 11.2.14 CONNOR-WINFIELD CORPORATION

- 11.2.15 MERCURY INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS