|

|

市場調査レポート

商品コード

1681524

ロケット・ミサイルの世界市場:製品別、速度別、推進タイプ別、発射方式別、誘導機構別、地域別 - 予測(~2029年)Rocket and Missile Market by Product (Missiles, Rocket Artilleries, Torpedoes), Speed (Subsonic, Supersonic, Hypersonic), Propulsion Type (Solid, Liquid, Hybrid, Ramjet, Turbojet), Launch Mode, Guidance Mechanism and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ロケット・ミサイルの世界市場:製品別、速度別、推進タイプ別、発射方式別、誘導機構別、地域別 - 予測(~2029年) |

|

出版日: 2025年03月01日

発行: MarketsandMarkets

ページ情報: 英文 360 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のロケット・ミサイルの市場規模は、2024年の625億米ドルから2029年までに852億2,000万米ドルに達すると予測され、CAGRで6.4%の成長が見込まれます。

市場の主な促進要因は、脅威に対抗するための米国の防衛計画、進行中の紛争による需要の急増、世界の防衛支出などです。ミサイル防衛システムの開発と戦争の性質は、市場の成長をさらに促進します。しかし、市場は武器移転に関する規制、メンテナンスを必要とする運用の複雑性、ミサイルシステムの開発コストなどの課題に直面しており、このことが拡大の妨げとなる可能性があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 速度、製品、誘導機構、発射プラットフォーム、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「推進タイプ別では、固体セグメントが予測期間に市場で最大のシェアを獲得すると推定されます。」

固体セグメントは、その信頼性と保管の容易さからロケット・ミサイル市場をリードしています。固体推進ロケットは推力に固体推進剤を使用しており、戦術ロケットや砲撃ロケットを含む軍事用ミサイルに利用されます。モジュール設計はメンテナンスとアップグレードを可能にし、固体推進剤の化学的改良は安定性と性能を向上させます。コンパクトな設計は保管効率を高め、長い貯蔵寿命は特別なメンテナンスなしで弾薬が使用可能であることを意味します。

「速度別では、極超音速セグメントが予測期間に最高のCAGRで成長する見込みです。」

極超音速セグメントは、ロケット・ミサイル市場の中でもっとも急速に発展しています。極超音速ロケット・ミサイルは、マッハ5、つまり時速6,174km超で飛行することが意図されており、従来のミサイルよりも大幅に速くターゲットにミサイルを送り込むことができます。これにより、精度の向上と既存のミサイル防衛システムの回避が可能になります。その上、政府と防衛企業は極超音速の達成と維持の課題克服に投資しています。スクラムジェットエンジン、耐熱材料、照準システム自体の進歩が実現されています。計算モデリングとシミュレーションのさらなる改良も、極超音速システムの設計と性能を向上させています。これらの技術が進歩し、安価になるにつれて、極超音速ロケット・ミサイルの需要は伸び続け、その結果、この市場セグメントは市場でもっとも高い成長率を維持し続けることになります。

「北米が予測期間に最大の市場になると推定されます。」

北米のロケット・ミサイル市場が2024年にリードすると予測されます。米国は北米における最大のロケット・ミサイル市場です。軍事費の増加、防衛契約、先進のロケット・ミサイル計画により、この地域が市場をリードしています。この地域には多くの主要企業が存在し、先進のロケット・ミサイル技術に取り組んでいます。

当レポートでは、世界のロケット・ミサイル市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ロケット・ミサイル市場の企業にとって魅力的な機会

- ロケット・ミサイル市場:製品別

- ロケット・ミサイル市場:速度別

- ロケット・ミサイル市場:推進別

- ロケット・ミサイル市場:誘導機構別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 運用データ

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- 著名な企業

- 民間企業と中小企業

- エンドユーザー

- バリューチェーン分析

- 価格分析

- 参考価格分析:製品別

- 参考価格分析:地域別

- ケーススタディ分析

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 主な会議とイベント(2024年~2025年)

- 関税と規制情勢

- 関税データ

- 規制機関、政府機関、その他の組織

- 主なステークホルダーと購入基準

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 投資と資金調達のシナリオ

- ビジネスモデル

- 政府への直接販売

- 外国軍隊販売

- 官民パートナーシップ

- 総所有コスト

- 部品表

- マクロ経済の見通し

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

- ロケット・ミサイル市場に対する戦争の影響

- ロシア・ウクライナ戦争の影響の分析

- イスラエル・ハマス戦争の影響の分析

第6章 産業の動向

- イントロダクション

- 技術動向

- 次世代迎撃ミサイルプログラム

- 自律型、AI駆動型システム

- 先進のセンサー、イメージングシステム

- 精密攻撃ミサイル

- メガトレンドの影響

- AIと機械学習

- 先進材料と製造

- 技術ロードマップ

- AIの影響

- イントロダクション

- 防衛部門におけるAIの影響

- 軍隊におけるAIの採用:主要国別

- ロケット・ミサイル市場に対するAIの影響

- サプライチェーン分析

- 特許分析

第7章 ロケット・ミサイルの市場:製品別

- イントロダクション

- ミサイル

- 巡航ミサイル

- 弾道ミサイル

- 迎撃ミサイル

- ロケット砲

- 魚雷

第8章 ロケット・ミサイルの市場:速度別

- イントロダクション

- 亜音速

- 超音速

- 極超音速

第9章 ロケット・ミサイル市場:推進別

- イントロダクション

- 固体

- 液体

- ハイブリッド

- ラムジェット

- スクラムジェット

- ターボジェット

第10章 ロケット・ミサイルの市場:発射方式別

- イントロダクション

- 地対地

- 地対空

- 空対空

- 空対地

- 水中対地

第11章 ロケット・ミサイルの市場:誘導機構別

- イントロダクション

- 誘導あり

- 誘導なし

第12章 ロケット・ミサイル市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 防衛プログラム

- 米国

- カナダ

- 欧州

- PESTLE分析

- 防衛プログラム

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- PESTLE分析

- 防衛プログラム

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他のアジア太平洋

- 中東

- PESTLE分析

- 防衛プログラム

- GCC

- イスラエル

- トルコ

- その他の中東

- その他の地域

- PESTLE分析

- 防衛プログラム

- ラテンアメリカ

- アフリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年~2024年)

- 収益分析(2020年~2023年)

- 市場シェア分析(2023年)

- ブランド/製品の比較

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- LOCKHEED MARTIN CORPORATION

- RTX

- BAE SYSTEMS

- NORTHROP GRUMMAN

- BOEING

- GENERAL DYNAMICS CORPORATION

- ISRAEL AEROSPACE INDUSTRIES

- THALES

- LIG NEX1

- BHARAT DYNAMICS LIMITED

- MBDA

- KONGSBERG

- SAAB AB

- DIEHL STIFTUNG & CO. KG

- HANWHA AEROSPACE

- FINCANTIERI S.P.A.

- L3HARRIS TECHNOLOGIES, INC.

- TELEDYNE TECHNOLOGIES INCORPORATED

- ELBIT SYSTEMS LTD.

- RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- その他の企業

- DENEL DYNAMICS

- FRONTIER ELECTRONIC SYSTEMS CORP.

- ARIANEGROUP

- GENERAL ATOMICS

- ALMAZ-ANTEY

- ROKETSAN

- BRAHMOS AEROSPACE

第15章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 US: ROCKET AND MISSILE PROCUREMENT, 2019-2023

- TABLE 4 ARMS TRANSFER REGULATIONS, BY COUNTRY

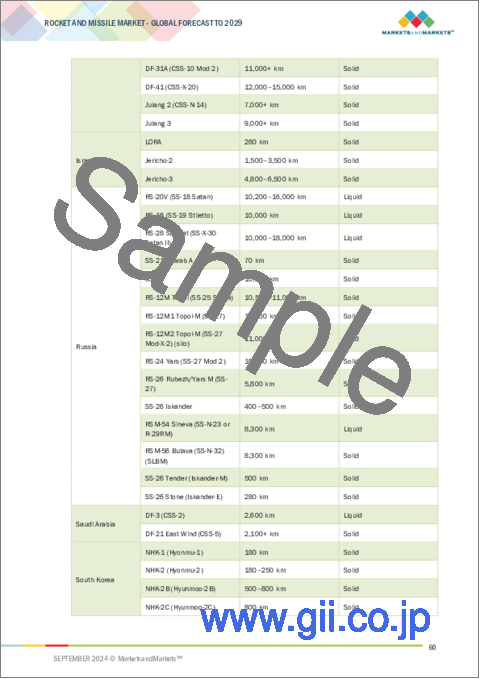

- TABLE 5 BALLISTIC MISSILE INVENTORY, BY COUNTRY, 2023

- TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 INDICATIVE PRICING ANALYSIS, BY PRODUCT (USD MILLION)

- TABLE 8 INDICATIVE PRICING ANALYSIS OF KEY PRODUCTS, BY REGION (USD MILLION)

- TABLE 9 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 10 TARIFFS FOR BOMBS, GRENADES, TORPEDOES, MINES, MISSILES, OTHER AMMUNITION AND PROJECTILES, AND PARTS (HS CODE: 930690)

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT (%)

- TABLE 17 KEY BUYING CRITERIA, BY PRODUCT

- TABLE 18 COMPARISON BETWEEN PROPULSION SYSTEMS

- TABLE 19 TOTAL COST OF OWNERSHIP OF ROCKETS AND MISSILES

- TABLE 20 PATENT ANALYSIS

- TABLE 21 ROCKET AND MISSILE VOLUME, BY PRODUCT, 2020-2023 (UNITS)

- TABLE 22 ROCKET AND MISSILE VOLUME, BY PRODUCT, 2024-2029 (UNITS)

- TABLE 23 ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 24 ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 25 MISSILES: ROCKET AND MISSILE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 26 MISSILES: ROCKET AND MISSILE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 27 CRUISE MISSILES: ROCKET AND MISSILE MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 28 CRUISE MISSILES: ROCKET AND MISSILE MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 29 SCALP AG: SPECIFICATIONS

- TABLE 30 BRAHMOS (PJ-10): SPECIFICATIONS

- TABLE 31 BGM-109 TOMAHAWK: SPECIFICATIONS

- TABLE 32 BALLISTIC MISSILES: ROCKET AND MISSILE MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 33 BALLISTIC MISSILES: ROCKET AND MISSILE MARKET, BY RANGE, 2024-2029 (USD MILLION)

- TABLE 34 AGNI-I: SPECIFICATIONS

- TABLE 35 AGNI-II: SPECIFICATIONS

- TABLE 36 DF-25: SPECIFICATIONS

- TABLE 37 TRIDENT D5: SPECIFICATIONS

- TABLE 38 PATRIOT MSE INTERCEPTOR: SPECIFICATIONS

- TABLE 39 TAMIR INTERCEPTOR: SPECIFICATIONS

- TABLE 40 M142 HIMARS: SPECIFICATIONS

- TABLE 41 M270 MULTIPLE LAUNCH ROCKET SYSTEM: SPECIFICATIONS

- TABLE 42 MK 48 MOD 7 TORPEDO: SPECIFICATIONS

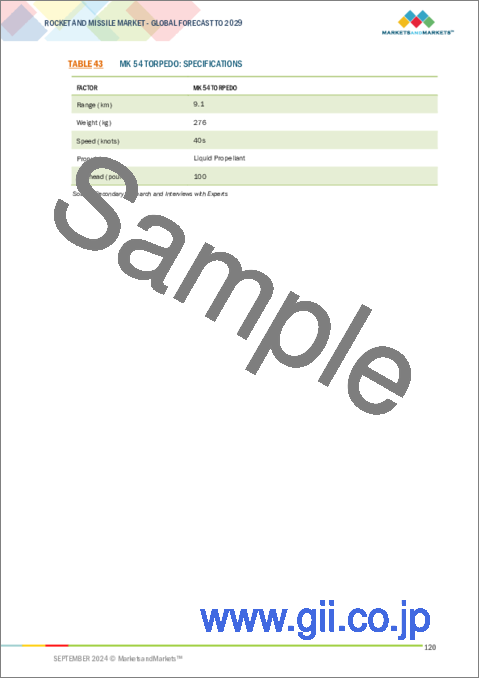

- TABLE 43 MK 54 TORPEDO: SPECIFICATIONS

- TABLE 44 ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 45 ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 46 ROCKET AND MISSILE MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 47 ROCKET AND MISSILE MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 48 ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 49 ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 50 ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2020-2023 (USD MILLION)

- TABLE 51 ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2024-2029 (USD MILLION)

- TABLE 52 ROCKET AND MISSILE VOLUME, BY REGION, 2020-2023 (UNITS)

- TABLE 53 ROCKET AND MISSILE VOLUME, BY REGION, 2024-2029 (UNITS)

- TABLE 54 ROCKET AND MISSILE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 ROCKET AND MISSILE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 57 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 58 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 59 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 61 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 63 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 64 NORTH AMERICA: MISSILE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 65 NORTH AMERICA: MISSILE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2020-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2024-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 70 US: SUPPLIER ANALYSIS OF ROCKET AND MISSILE MARKET

- TABLE 71 US: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 72 US: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 73 US: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 74 US: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 75 US: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 76 US: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 77 CANADA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 78 CANADA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 79 CANADA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 80 CANADA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 81 CANADA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 82 CANADA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 83 EUROPE: ROCKET AND MISSILE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 84 EUROPE: ROCKET AND MISSILE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 85 EUROPE: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 86 EUROPE: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 87 EUROPE: ROCKET AND MISSILE MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: ROCKET AND MISSILE MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 89 EUROPE: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 90 EUROPE: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 91 EUROPE: MISSILE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 92 EUROPE: MISSILE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 93 EUROPE: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2020-2023 (USD MILLION)

- TABLE 94 EUROPE: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2024-2029 (USD MILLION)

- TABLE 95 EUROPE: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 96 EUROPE: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 97 UK: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 98 UK: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 99 UK: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 100 UK: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 101 UK: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 102 UK: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 103 GERMANY: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 104 GERMANY: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 105 GERMANY: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 106 GERMANY: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 107 GERMANY: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 108 GERMANY: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 109 FRANCE: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 110 FRANCE: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 111 FRANCE: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 112 FRANCE: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 113 FRANCE: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 114 FRANCE: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 115 ITALY: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 116 ITALY: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 117 ITALY: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 118 ITALY: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 119 ITALY: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 120 ITALY: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 121 RUSSIA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 122 RUSSIA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 123 RUSSIA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 124 RUSSIA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 125 RUSSIA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 126 RUSSIA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 127 REST OF EUROPE: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 128 REST OF EUROPE: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 129 REST OF EUROPE: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 130 REST OF EUROPE: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 131 REST OF EUROPE: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 132 REST OF EUROPE: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 135 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 136 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 137 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 138 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 139 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MISSILE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MISSILE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 143 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2020-2023 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2024-2029 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 147 CHINA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 148 CHINA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 149 CHINA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 150 CHINA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 151 CHINA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 152 CHINA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 153 INDIA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 154 INDIA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 155 INDIA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 156 INDIA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 157 INDIA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 158 INDIA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 159 JAPAN: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 160 JAPAN: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 161 JAPAN: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 162 JAPAN: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 163 JAPAN: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 164 JAPAN: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 165 AUSTRALIA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 166 AUSTRALIA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 167 AUSTRALIA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 168 AUSTRALIA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 169 AUSTRALIA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 170 AUSTRALIA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 171 SOUTH KOREA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 172 SOUTH KOREA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 173 SOUTH KOREA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 174 SOUTH KOREA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 175 SOUTH KOREA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 176 SOUTH KOREA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 183 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 184 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 185 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 186 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 187 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 188 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 189 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 190 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 191 MIDDLE EAST: MISSILE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 192 MIDDLE EAST: MISSILE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 193 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2020-2023 (USD MILLION)

- TABLE 194 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2024-2029 (USD MILLION)

- TABLE 195 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 196 MIDDLE EAST: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 197 SAUDI ARABIA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 198 SAUDI ARABIA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 199 SAUDI ARABIA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 200 SAUDI ARABIA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 201 SAUDI ARABIA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 202 SAUDI ARABIA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 203 KUWAIT: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 204 KUWAIT: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 205 KUWAIT: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 206 KUWAIT: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 207 KUWAIT: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 208 KUWAIT: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 209 ISRAEL: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 210 ISRAEL: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 211 ISRAEL: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 212 ISRAEL: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 213 ISRAEL: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 214 ISRAEL: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 215 TURKEY: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 216 TURKEY: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 217 TURKEY: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 218 TURKEY: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 219 TURKEY: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 220 TURKEY: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 221 REST OF MIDDLE EAST: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 222 REST OF MIDDLE EAST: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 223 REST OF MIDDLE EAST: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 224 REST OF MIDDLE EAST: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 225 REST OF MIDDLE EAST: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 226 REST OF MIDDLE EAST: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 227 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 228 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 229 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 230 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 231 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY PROPULSION, 2020-2023 (USD MILLION)

- TABLE 232 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- TABLE 233 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 234 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 235 REST OF THE WORLD: MISSILE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 236 REST OF THE WORLD: MISSILE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 237 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2020-2023 (USD MILLION)

- TABLE 238 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2024-2029 (USD MILLION)

- TABLE 239 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 240 REST OF THE WORLD: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 241 LATIN AMERICA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 242 LATIN AMERICA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 243 LATIN AMERICA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 244 LATIN AMERICA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 245 LATIN AMERICA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 246 LATIN AMERICA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 247 AFRICA: ROCKET AND MISSILE MARKET, BY SPEED, 2020-2023 (USD MILLION)

- TABLE 248 AFRICA: ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- TABLE 249 AFRICA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 250 AFRICA: ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 251 AFRICA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2020-2023 (USD MILLION)

- TABLE 252 AFRICA: ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- TABLE 253 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 254 ROCKET AND MISSILE MARKET: DEGREE OF COMPETITION

- TABLE 255 PRODUCT FOOTPRINT

- TABLE 256 LAUNCH MODE FOOTPRINT

- TABLE 257 GUIDANCE MECHANISM FOOTPRINT

- TABLE 258 REGION FOOTPRINT

- TABLE 259 LIST OF START-UPS/SMES

- TABLE 260 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 261 ROCKET AND MISSILE MARKET: PRODUCT LAUNCHES, 2020-2024

- TABLE 262 ROCKET AND MISSILE MARKET: DEALS, 2020-2025

- TABLE 263 ROCKET AND MISSILE MARKET: OTHERS, 2020-2025

- TABLE 264 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 265 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 266 LOCKHEED MARTIN CORPORATION: OTHERS

- TABLE 267 RTX: COMPANY OVERVIEW

- TABLE 268 RTX: PRODUCTS OFFERED

- TABLE 269 RTX: OTHERS

- TABLE 270 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 271 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 272 BAE SYSTEMS: OTHERS

- TABLE 273 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 274 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 275 NORTHROP GRUMMAN: DEALS

- TABLE 276 NORTHROP GRUMMAN: OTHERS

- TABLE 277 BOEING: COMPANY OVERVIEW

- TABLE 278 BOEING: PRODUCTS OFFERED

- TABLE 279 BOEING: OTHERS

- TABLE 280 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 281 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 282 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 283 GENERAL DYNAMICS CORPORATION: OTHERS

- TABLE 284 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 285 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS OFFERED

- TABLE 286 ISRAEL AEROSPACE INDUSTRIES: PRODUCT LAUNCHES

- TABLE 287 ISRAEL AEROSPACE INDUSTRIES: DEALS

- TABLE 288 ISRAEL AEROSPACE INDUSTRIES: OTHERS

- TABLE 289 THALES: COMPANY OVERVIEW

- TABLE 290 THALES: PRODUCTS OFFERED

- TABLE 291 THALES: DEALS

- TABLE 292 THALES: OTHERS

- TABLE 293 LIG NEX1: COMPANY OVERVIEW

- TABLE 294 LIG NEX1: PRODUCTS OFFERED

- TABLE 295 LIG NEX1: OTHERS

- TABLE 296 BHARAT DYNAMICS LIMITED: COMPANY OVERVIEW

- TABLE 297 BHARAT DYNAMICS LIMITED: PRODUCTS OFFERED

- TABLE 298 BHARAT DYNAMICS LIMITED: OTHERS

- TABLE 299 MBDA: COMPANY OVERVIEW

- TABLE 300 MBDA: PRODUCTS OFFERED

- TABLE 301 MBDA: DEALS

- TABLE 302 MBDA: OTHERS

- TABLE 303 KONGSBERG: COMPANY OVERVIEW

- TABLE 304 KONGSBERG: PRODUCTS OFFERED

- TABLE 305 KONGSBERG: OTHERS

- TABLE 306 SAAB AB: COMPANY OVERVIEW

- TABLE 307 SAAB AB: PRODUCTS OFFERED

- TABLE 308 SAAB AB: OTHERS

- TABLE 309 DIEHL STIFTUNG & CO. KG: COMPANY OVERVIEW

- TABLE 310 DIEHL STIFTUNG & CO. KG: PRODUCTS OFFERED

- TABLE 311 DIEHL STIFTUNG & CO. KG: DEALS

- TABLE 312 DIEHL STIFTUNG & CO. KG: OTHERS

- TABLE 313 HANWHA AEROSPACE: COMPANY OVERVIEW

- TABLE 314 HANWHA AEROSPACE: PRODUCTS OFFERED

- TABLE 315 HANWHA AEROSPACE: DEALS

- TABLE 316 HANWHA AEROSPACE: OTHERS

- TABLE 317 FINCANTIERI S.P.A.: COMPANY OVERVIEW

- TABLE 318 FINCANTIERI S.P.A.: PRODUCTS OFFERED

- TABLE 319 FINCANTIERI S.P.A.: DEALS

- TABLE 320 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 321 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 322 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 323 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 324 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 325 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 326 TELEDYNE TECHNOLOGIES INCORPORATED: OTHERS

- TABLE 327 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 328 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 329 ELBIT SYSTEMS LTD.: OTHERS

- TABLE 330 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 331 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 332 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: OTHERS

- TABLE 333 DENEL DYNAMICS: COMPANY OVERVIEW

- TABLE 334 FRONTIER ELECTRONIC SYSTEMS CORP.: COMPANY OVERVIEW

- TABLE 335 ARIANEGROUP: COMPANY OVERVIEW

- TABLE 336 GENERAL ATOMICS: COMPANY OVERVIEW

- TABLE 337 ALMAZ-ANTEY: COMPANY OVERVIEW

- TABLE 338 ROKETSAN: COMPANY OVERVIEW

- TABLE 339 BRAHMOS AEROSPACE: COMPANY OVERVIEW

- TABLE 340 LAUNDRY LIST OF COMPANIES

List of Figures

- FIGURE 1 ROCKET AND MISSILE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 MISSILES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 8 HYPERSONIC TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 9 SURFACE-TO-SURFACE SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 10 SOLID SEGMENT TO BE PREVALENT DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO BE LARGEST MARKET FOR ROCKETS AND MISSILES DURING FORECAST PERIOD

- FIGURE 12 INCREASING INVESTMENTS IN HYPERSONIC MISSILES TO DRIVE MARKET

- FIGURE 13 MISSILES SEGMENT TO ACQUIRE MAXIMUM SHARE IN 2024

- FIGURE 14 SUPERSONIC SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 15 SOLID TO SURPASS OTHER PROPULSION SEGMENTS DURING FORECAST PERIOD

- FIGURE 16 GUIDED SEGMENT TO BE LARGER THAN UNGUIDED SEGMENT DURING FORECAST PERIOD

- FIGURE 17 ROCKET AND MISSILE MARKET DYNAMICS

- FIGURE 18 MILITARY EXPENDITURE OF KEY COUNTRIES, 2019-2023 (USD BILLION)

- FIGURE 19 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 20 ECOSYSTEM ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 IMPORT DATA OF HS CODE 930690, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 23 EXPORT DATA OF HS CODE 930690, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

- FIGURE 25 KEY BUYING CRITERIA, BY PRODUCT

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD BILLION)

- FIGURE 27 BUSINESS MODELS IN ROCKET AND MISSILE MARKET

- FIGURE 28 BREAKDOWN OF TOTAL COST OF OWNERSHIP OF ROCKET AND MISSILES THROUGHOUT LIFECYCLE

- FIGURE 29 BILL OF MATERIALS OF ROCKETS AND MISSILES

- FIGURE 30 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 31 MACROECONOMIC OUTLOOK FOR REST OF THE WORLD

- FIGURE 32 IMPACT OF RUSSIA-UKRAINE WAR

- FIGURE 33 IMPACT OF ISRAEL-HAMAS WAR

- FIGURE 34 TECHNOLOGY TRENDS IN ROCKET AND MISSILE MARKET

- FIGURE 35 EVOLUTION OF ROCKET AND MISSILE TECHNOLOGIES

- FIGURE 36 TECHNOLOGY ROADMAP OF ROCKET AND MISSILES

- FIGURE 37 EMERGING TRENDS IN ROCKET AND MISSILE MARKET

- FIGURE 38 IMPACT OF AI ON DEFENSE SECTOR

- FIGURE 39 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

- FIGURE 40 IMPACT OF AI ON ROCKET AND MISSILE MARKET

- FIGURE 41 SUPPLY CHAIN ANALYSIS

- FIGURE 42 PATENT ANALYSIS

- FIGURE 43 ROCKET AND MISSILE MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- FIGURE 44 ROCKET AND MISSILE MARKET, BY SPEED, 2024-2029 (USD MILLION)

- FIGURE 45 ROCKET AND MISSILE MARKET, BY PROPULSION, 2024-2029 (USD MILLION)

- FIGURE 46 ROCKET AND MISSILE MARKET, BY LAUNCH MODE, 2024-2029 (USD MILLION)

- FIGURE 47 ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM, 2024-2029 (USD MILLION)

- FIGURE 48 ROCKET AND MISSILE MARKET, BY REGION, 2024-2029

- FIGURE 49 NORTH AMERICA: ROCKET AND MISSILE MARKET SNAPSHOT

- FIGURE 50 EUROPE: ROCKET AND MISSILE MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: ROCKET AND MISSILE MARKET SNAPSHOT

- FIGURE 52 MIDDLE EAST: ROCKET AND MISSILE MARKET SNAPSHOT

- FIGURE 53 REST OF THE WORLD: ROCKET AND MISSILE MARKET SNAPSHOT

- FIGURE 54 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023

- FIGURE 55 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 56 BRAND/PRODUCT COMPARISON

- FIGURE 57 FINANCIAL METRICS OF PROMINENT PLAYERS

- FIGURE 58 VALUATION OF PROMINENT PLAYERS

- FIGURE 59 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 60 COMPANY FOOTPRINT

- FIGURE 61 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 62 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 RTX: COMPANY SNAPSHOT

- FIGURE 64 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 65 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 66 BOEING: COMPANY SNAPSHOT

- FIGURE 67 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 69 THALES: COMPANY SNAPSHOT

- FIGURE 70 LIG NEX1: COMPANY SNAPSHOT

- FIGURE 71 BHARAT DYNAMICS LIMITED: COMPANY SNAPSHOT

- FIGURE 72 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 73 SAAB AB: COMPANY SNAPSHOT

- FIGURE 74 DIEHL STIFTUNG & CO. KG: COMPANY SNAPSHOT

- FIGURE 75 HANWHA AEROSPACE: COMPANY SNAPSHOT

- FIGURE 76 FINCANTIERI S.P.A.: COMPANY SNAPSHOT

- FIGURE 77 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 78 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 79 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

The rocket and missile market is projected to reach USD 85.22 billion by 2029, from USD 62.50 billion in 2024, at a CAGR of 6.4%. The market is driven by key factors, including US defense programs to counter threats, a surge in demand due to ongoing conflicts, and global defense expenditure. The development of missile defense systems and the nature of warfare further fuel market growth. However, the market faces challenges from regulations on arms transfers, operational complexities requiring maintenance, and the development costs of missile systems, which can hinder expansion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Speed, By Product, By Propulsion Type, By Guidance Mechanism, By Launch Platform and By Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Based on propulsion type, solid segment is estimated to capture the largest share in the market during the forecast period"

The solid segment leads the rocket and missile market due to its reliability and ease of storage. Solid propulsion rockets apply solid propellants for thrust and apply to military missiles, including tactical as well as artillery rockets. Modular designs allow for maintenance and upgradability, while improvements in solid propellant chemistry increase stability and performance. Compact designs enhance storage efficiency and long shelf life means that munitions remain viable without special maintenance.

"Based on speed, the hypersonic segment forecasted to grow at highest CAGR during forecast period "

The hypersonic segment is developing as the fastest-growing within the rocket and missile market. Hypersonic rockets and missiles are intended to fly over Mach 5, meaning 6,174 km/h, which gives them the ability to deliver missiles onto the target significantly faster than traditional missiles. This enables improved precision and evasion of existing missile defense systems. Besides, governments and defense companies are investing in overcoming the challenges of achieving and maintaining hypersonic speeds. Advances are realized in the scramjet engine, heat-resistant materials and targeting systems themselves. Further improvements in computational modeling and simulation are also improving the design and performance of hypersonic systems. As these technologies advance and become cheaper, the demand for hypersonic rockets and missiles will continue to grow thus ensuring this market segment continues to have the highest growth rate within the markets.

" The North America region is estimated to be the largest market during the forecast period"

The rocket and missile market in North America is expected to lead in 2024. The US is the largest market for rockets and missiles in North America. With increased military expenditure, defense contracts, and advanced rocket and missile programs, the region is leading the market. Many key players are present in this region, working on advanced rocket and missile technologies.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the rocket and missile marketplace.

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America- 35%, Europe - 20%, Asia Pacific- 30%, Middle East - 10% and Rest of the World - 5%

include Lockheed Martin Corporation (US), RTX (US), BAE Systems (UK), Northrop Grumman (US), Boeing (US) Israel Aerospace Industries (Israel), Thales (France), LIG Nex1 (South Korea), Saab AB (Norway), MBDA (France), KONGSBERG (Norway), Hanwha Aerospace (South Korea), Elbit Systems Ltd. (Israel), RAFAEL Advanced Defense Systems Ltd. (Israel), General Atomics (US) and Denel Dynamics (South Africa) are some of the leading players operating in the rocket and missile market.

Research Coverage

This research report categorizes the rocket and missile market by Product (Missiles, Rocket Artilleries, and Torpedoes) by Speed (Subsonic, Supersonic, and Hypersonic) by Launch Mode (Surface-to-Surface, Surface-to-Air, Air-to-Air, Air-to-Surface, and Subsea-to-Surface) by Propulsion Type (Solid, Liquid, Hybrid, Ramjet, Scramjet, and Turbojet) by Guidance Mechanism (Guided, and Unguided), and by Region (North America, Europe, Asia Pacific, Middle East, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the rocket and missile market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; Contracts, partnerships, agreements, new product launches, and recent developments associated with the rocket and missile market. Competitive analysis of upcoming startups in the rocket and missile market ecosystem is covered in this report.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall rocket and missile market and its subsegments. The report covers the entire ecosystem of the rocket and missile market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key Drivers (Increasing defense programs in US for security against threats, Surge in demand for missiles and rockets due to ongoing conflicts, Rising global defense expenditure, Indigenous development of missile defense systems, and Evolving nature of warfare), restrains (Stringent regulations for arms transfer, Operational complexity and need for periodic maintenance, and High development cost of missile systems), opportunities (Miniaturization of missile systems and components, Rapid AI integration in military operations, Development of new-generation air and missile defense systems, and Advent of hybrid rockets and missiles) and challenges (Complex integration of large rockets and missiles) influencing the growth of the market.

- Product Development/Innovation: Detailed Insights on upcoming technologies, R&D activities, and new products/solutions launched in the market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the rocket and missile market across varied regions

- Market Diversification: Exhaustive information about new solutions, recent developments, and investments in the rocket and missile market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including Lockheed Martin Corporation (US), RTX (US), BAE Systems (UK), Northrop Grumman (US), and Boeing (US) among others in the rocket and missile market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ROCKET AND MISSILE MARKET

- 4.2 ROCKET AND MISSILE MARKET, BY PRODUCT

- 4.3 ROCKET AND MISSILE MARKET, BY SPEED

- 4.4 ROCKET AND MISSILE MARKET, BY PROPULSION

- 4.5 ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing defense programs in US for security against threats

- 5.2.1.2 Surge in demand for missiles and rockets due to ongoing conflicts

- 5.2.1.3 Rising global defense expenditure

- 5.2.1.4 Indigenous development of missile defense systems

- 5.2.1.5 Evolving nature of warfare

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations for arms transfer

- 5.2.2.2 Operational complexity and need for periodic maintenance

- 5.2.2.3 High development cost of missile systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Miniaturization of missile systems and components

- 5.2.3.2 Rapid AI integration in military operations

- 5.2.3.3 Development of new-generation air and missile defense systems

- 5.2.3.4 Advent of hybrid rockets and missiles

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex integration of large rockets and missiles

- 5.2.1 DRIVERS

- 5.3 OPERATIONAL DATA

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING ANALYSIS, BY PRODUCT

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 IAF TESTS SMALLER BRAHMOS MISSILE VARIANT TO ENHANCE OPERATIONAL CAPABILITY

- 5.8.2 US MODERNIZES HYPERSONIC WEAPONS TO MAINTAIN COMPETITIVE EDGE

- 5.8.3 US EXPANDS GROUND-BASED MISSILE CAPABILITIES TO COUNTER CHINA IN INDO-PACIFIC

- 5.8.4 INDIA ADVANCES HYPERSONIC MISSILE DEVELOPMENT WITH SCRAMJET TEST

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFF DATA

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Propulsion systems

- 5.13.1.2 Next-generation missile seekers

- 5.13.1.3 Hypersonic technology

- 5.13.1.4 Guidance systems

- 5.13.1.5 Warheads

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Electronics and sensors for precision warfare

- 5.13.2.2 Launch platforms and silos

- 5.13.3 ADJACENT TECHNOLOGIES

- 5.13.3.1 Smart weapons

- 5.13.3.2 Ammunition

- 5.13.3.3 Weapon carriage and release systems

- 5.13.1 KEY TECHNOLOGIES

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 BUSINESS MODELS

- 5.15.1 DIRECT SALES TO GOVERNMENTS

- 5.15.2 FOREIGN MILITARY SALES

- 5.15.3 PUBLIC-PRIVATE PARTNERSHIPS

- 5.16 TOTAL COST OF OWNERSHIP

- 5.17 BILL OF MATERIALS

- 5.18 MACROECONOMIC OUTLOOK

- 5.18.1 INTRODUCTION

- 5.18.2 NORTH AMERICA

- 5.18.3 EUROPE

- 5.18.4 ASIA PACIFIC

- 5.18.5 MIDDLE EAST

- 5.18.6 REST OF THE WORLD

- 5.19 IMPACT OF WAR ON ROCKET AND MISSILE MARKET

- 5.19.1 RUSSIA-UKRAINE WAR IMPACT ANALYSIS

- 5.19.2 ISRAEL-HAMAS WAR IMPACT ANALYSIS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 NEXT-GENERATION INTERCEPTOR PROGRAM

- 6.2.2 AUTONOMOUS AND AI-DRIVEN SYSTEMS

- 6.2.3 ADVANCED SENSORS AND IMAGING SYSTEMS

- 6.2.4 PRECISION-STRIKE MISSILES

- 6.3 IMPACT OF MEGA TRENDS

- 6.3.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.3.2 ADVANCED MATERIALS AND MANUFACTURING

- 6.4 TECHNOLOGY ROADMAP

- 6.5 IMPACT OF AI

- 6.5.1 INTRODUCTION

- 6.5.2 IMPACT OF AI ON DEFENSE SECTOR

- 6.5.3 ADOPTION OF AI IN MILITARY BY TOP COUNTRIES

- 6.5.4 IMPACT OF AI ON ROCKET AND MISSILE MARKET

- 6.6 SUPPLY CHAIN ANALYSIS

- 6.7 PATENT ANALYSIS

7 ROCKET AND MISSILE MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 MISSILES

- 7.2.1 CRUISE MISSILES

- 7.2.1.1 Short-range cruise missiles

- 7.2.1.1.1 Need for precision in modern military operations to drive market

- 7.2.1.2 Medium-range cruise missiles

- 7.2.1.2.1 Advancements in guidance and navigation technologies to drive market

- 7.2.1.3 Long-range cruise missiles

- 7.2.1.3.1 Surge in global defense budgets to drive market

- 7.2.1.1 Short-range cruise missiles

- 7.2.2 BALLISTIC MISSILES

- 7.2.2.1 Short-range ballistic missiles

- 7.2.2.1.1 Low production and maintenance costs to drive market

- 7.2.2.2 Medium-range ballistic missiles

- 7.2.2.2.1 High deterrence capabilities to drive market

- 7.2.2.3 Intermediate-range ballistic missiles

- 7.2.2.3.1 Increasing military modernization to drive market

- 7.2.2.4 Intercontinental ballistic missiles

- 7.2.2.4.1 Security alliances to ensure regional stability to drive market

- 7.2.2.1 Short-range ballistic missiles

- 7.2.3 INTERCEPTOR MISSILES

- 7.2.3.1 Technological advancements aimed at enhancing detection tracking capabilities to drive market

- 7.2.1 CRUISE MISSILES

- 7.3 ROCKET ARTILLERIES

- 7.3.1 GROWING INTEROPERABILITY REQUIREMENTS TO DRIVE MARKET

- 7.4 TORPEDOES

- 7.4.1 ENHANCED TARGETING FEATURES TO DRIVE MARKET

8 ROCKET AND MISSILE MARKET, BY SPEED

- 8.1 INTRODUCTION

- 8.2 SUBSONIC

- 8.2.1 EXTENSIVE USE IN TACTICAL APPLICATIONS TO DRIVE MARKET

- 8.3 SUPERSONIC

- 8.3.1 HEIGHTENED DEMAND FOR ADVANCED WEAPONS TO DRIVE MARKET

- 8.4 HYPERSONIC

- 8.4.1 GOVERNMENT INVESTMENTS IN RESEARCH AND DEVELOPMENT TO DRIVE MARKET

9 ROCKET AND MISSILE MARKET, BY PROPULSION

- 9.1 INTRODUCTION

- 9.2 SOLID

- 9.2.1 INNOVATIONS IN SOLID PROPELLANT CHEMISTRY TO DRIVE MARKET

- 9.3 LIQUID

- 9.3.1 DEVELOPMENT OF REUSABLE ROCKET ARTILLERIES TO DRIVE MARKET

- 9.4 HYBRID

- 9.4.1 RISING PREFERENCE FOR ADAPTABLE PROPULSION SOLUTIONS TO DRIVE MARKET

- 9.5 RAMJET

- 9.5.1 SURGING DEMAND FOR EXTENDED RANGE CAPABILITIES TO DRIVE MARKET

- 9.6 SCRAMJET

- 9.6.1 SHIFT TOWARD HYPERSONIC TECHNOLOGIES TO DRIVE MARKET

- 9.7 TURBOJET

- 9.7.1 INCREASING DEFENSE BUDGETS TO DRIVE MARKET

10 ROCKET AND MISSILE MARKET, BY LAUNCH MODE

- 10.1 INTRODUCTION

- 10.2 SURFACE-TO-SURFACE

- 10.2.1 SUBSTANTIAL COST ADVANTAGES TO DRIVE MARKET

- 10.3 SURFACE-TO-AIR

- 10.3.1 STRATEGIC INVESTMENTS IN AERIAL SECURITY TO DRIVE MARKET

- 10.4 AIR-TO-AIR

- 10.4.1 SEAMLESS INTEGRATION WITH ADVANCED PLATFORMS TO DRIVE MARKET

- 10.5 AIR-TO-SURFACE

- 10.5.1 MINIMIZED COLLATERAL DAMAGE WITH ADVANCEMENTS IN GUIDANCE SYSTEMS TO DRIVE MARKET

- 10.6 SUBSEA-TO-SURFACE

- 10.6.1 EVOLVING MARITIME THREATS TO DRIVE MARKET

11 ROCKET AND MISSILE MARKET, BY GUIDANCE MECHANISM

- 11.1 INTRODUCTION

- 11.2 GUIDED

- 11.2.1 ADVANCES IN TARGETING TECHNOLOGIES TO DRIVE MARKET

- 11.3 UNGUIDED

- 11.3.1 NEED FOR PRECISION AND COST-EFFECTIVE SOLUTIONS TO DRIVE MARKET

12 ROCKET AND MISSILE MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 PESTLE ANALYSIS

- 12.2.2 DEFENSE PROGRAMS

- 12.2.3 US

- 12.2.3.1 Increasing military expenditure and contracts with defense manufacturers to drive market

- 12.2.4 CANADA

- 12.2.4.1 Ongoing defense modernization efforts to drive market

- 12.3 EUROPE

- 12.3.1 PESTLE ANALYSIS

- 12.3.2 DEFENSE PROGRAMS

- 12.3.3 UK

- 12.3.3.1 Inclination toward hypersonic and long-range missile development to drive market

- 12.3.4 GERMANY

- 12.3.4.1 Strategic partnerships to improve defense capabilities to drive market

- 12.3.5 FRANCE

- 12.3.5.1 Rapid advancements in missile technology to combat geopolitical threats to drive market

- 12.3.6 ITALY

- 12.3.6.1 Rising investments in missile systems to enhance regional security to drive market

- 12.3.7 RUSSIA

- 12.3.7.1 Increasing missile production capacity to drive market

- 12.3.8 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 PESTLE ANALYSIS

- 12.4.2 DEFENSE PROGRAMS

- 12.4.3 CHINA

- 12.4.3.1 Focus on enhancing defense infrastructure to drive market

- 12.4.4 INDIA

- 12.4.4.1 Indigenous development of defense systems to drive market

- 12.4.5 JAPAN

- 12.4.5.1 Shift toward hypersonic missile technologies to drive market

- 12.4.6 AUSTRALIA

- 12.4.6.1 Expansion of domestic missile production capabilities to drive market

- 12.4.7 SOUTH KOREA

- 12.4.7.1 Growing missile threats from neighboring countries to drive market

- 12.4.8 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST

- 12.5.1 PESTLE ANALYSIS

- 12.5.2 DEFENSE PROGRAMS

- 12.5.3 GCC

- 12.5.3.1 Saudi Arabia

- 12.5.3.1.1 Emphasis on enhancing air defense capabilities to drive market

- 12.5.3.2 Kuwait

- 12.5.3.2.1 Modernization of missile systems through foreign military sales to drive market

- 12.5.3.1 Saudi Arabia

- 12.5.4 ISRAEL

- 12.5.4.1 Increasing regional conflicts to drive market

- 12.5.5 TURKEY

- 12.5.5.1 Ongoing advancements in missile capabilities to drive market

- 12.5.6 REST OF MIDDLE EAST

- 12.6 REST OF THE WORLD

- 12.6.1 PESTLE ANALYSIS

- 12.6.2 DEFENSE PROGRAMS

- 12.6.3 LATIN AMERICA

- 12.6.3.1 Focus on strengthening national defense capabilities to drive market

- 12.6.4 AFRICA

- 12.6.4.1 Surge in demand for enhanced defense systems to mitigate security threats to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 REVENUE ANALYSIS, 2020-2023

- 13.4 MARKET SHARE ANALYSIS, 2023

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT

- 13.7.5.1 Company footprint

- 13.7.5.2 Product footprint

- 13.7.5.3 Launch mode footprint

- 13.7.5.4 Guidance mechanism footprint

- 13.7.5.5 Region footprint

- 13.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 List of start-ups/SMEs

- 13.8.5.2 Competitive benchmarking of start-ups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 OTHERS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 LOCKHEED MARTIN CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 RTX

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Others

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 BAE SYSTEMS

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Others

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 NORTHROP GRUMMAN

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Others

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 BOEING

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Others

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 GENERAL DYNAMICS CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Others

- 14.1.7 ISRAEL AEROSPACE INDUSTRIES

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Others

- 14.1.8 THALES

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Others

- 14.1.9 LIG NEX1

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Others

- 14.1.10 BHARAT DYNAMICS LIMITED

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Others

- 14.1.11 MBDA

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Others

- 14.1.12 KONGSBERG

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Others

- 14.1.13 SAAB AB

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Others

- 14.1.14 DIEHL STIFTUNG & CO. KG

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.14.3.2 Others

- 14.1.15 HANWHA AEROSPACE

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.15.3.2 Others

- 14.1.16 FINCANTIERI S.P.A.

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.17 L3HARRIS TECHNOLOGIES, INC.

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Deals

- 14.1.17.3.2 Others

- 14.1.18 TELEDYNE TECHNOLOGIES INCORPORATED

- 14.1.18.1 Business overview

- 14.1.18.2 Products offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Others

- 14.1.19 ELBIT SYSTEMS LTD.

- 14.1.19.1 Business overview

- 14.1.19.2 Products offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Others

- 14.1.20 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- 14.1.20.1 Business overview

- 14.1.20.2 Products offered

- 14.1.20.3 Recent developments

- 14.1.20.3.1 Others

- 14.1.1 LOCKHEED MARTIN CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 DENEL DYNAMICS

- 14.2.2 FRONTIER ELECTRONIC SYSTEMS CORP.

- 14.2.3 ARIANEGROUP

- 14.2.4 GENERAL ATOMICS

- 14.2.5 ALMAZ-ANTEY

- 14.2.6 ROKETSAN

- 14.2.7 BRAHMOS AEROSPACE

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 ANNEXURE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS