|

|

市場調査レポート

商品コード

1583645

ポストコンシューマーリサイクルプラスチックの世界市場:ポリマータイプ別、由来別、最終用途別、処理タイプ別、地域別 - 2029年までの予測Post-Consumer Recycled Plastics Market by Source (Bottles, Non-bottle Rigid), Polymer Type, Processing Type (Mechanical, Chemical, Biological), End-use (Packaging, Building & Construction, Automotive, Electronics), and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ポストコンシューマーリサイクルプラスチックの世界市場:ポリマータイプ別、由来別、最終用途別、処理タイプ別、地域別 - 2029年までの予測 |

|

出版日: 2024年10月29日

発行: MarketsandMarkets

ページ情報: 英文 365 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ポストコンシューマーリサイクルプラスチックの市場規模は、2024年の714億4,000万米ドルから2029年には1,069億7,000万米ドルに成長し、CAGRは8.4%と予測されています。

ポストコンシューマー再生(PCR)プラスチックは、様々な要因から大きな成長が予測されています。環境保護への関心の高まりは、消費者や産業界に循環型経済を取り入れ、プラスチック廃棄物を根絶するよう大きな圧力をかけています。世界中の各国政府は、プラスチックによる環境汚染を抑制することを目的とした、より厳しい規制と政策を実施しており、これが包装や製造におけるリサイクル材料の使用をさらに促しています。また、大手ブランドや組織は、製品や容器におけるPCRプラスチックの使用比率を高めることで、持続可能性の目標を楽観視しています。リサイクル技術における現在の技術革新も、PCRプラスチックの品質と供給の向上に役立っています。様々な最終用途産業におけるリサイクルプラスチックのニーズの高まりは、持続可能な製品を求める消費者の嗜好によってさらに後押しされています。これらすべての要因が相まって、ポストコンシューマーリサイクルプラスチックの採用が環境に配慮しているだけでなく、経済的にも有益であるという楽観的な雰囲気が生まれ、市場は急速な拡大を遂げるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント別 | ポリマータイプ別、由来別、最終用途別、処理タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

非ボトル硬質プラスチックは、ボトル以外の用途でも重要な役割を果たしているため、産業リサイクルプラスチックの主要な供給源となっています。非ボトル硬質プラスチック、例えば容器、キャップ、クロージャー、包装トレイ、自動車に使用される部品などは、廃棄されたボトル以外の硬質プラスチックの蓄積につながります。これらの材料は、様々な種類のポリマーから構成されていることが多く、その化合物の複雑な構造のためにリサイクルが困難です。しかし、選別とリサイクル技術への新しいアプローチは、非ボトル硬質プラスチックの分離とリサイクルを容易にし、廃棄物を最小限に抑え、これらの非常に有用な製品を使用する様々な産業における持続可能な慣行を促しています。

ポリプロピレンは、ポストコンシューマーリサイクルプラスチック市場において最も高い成長率を示している主要なポリマーの一種です。その理由は、幅広い用途、消費者の環境に対する関心の高まり、リサイクル施設の改善です。このような需要の高まりは、包装、自動車、消費者製品などさまざまな分野で再生PPを使用する可能性に産業界が気づいているためです。加えて、PP廃棄物のリサイクルにおいて遭遇していた困難が、リサイクル技術の発展により解決され、PPをリサイクルして製造工程に戻すことがより現実的になったため、ポストコンシューマーリサイクルプラスチックの成長が加速しています。

機械的リサイクルは、プラスチックのリサイクルにおいて、特にエネルギー効率、環境への影響、ポリマー特性の保持という点で特有の利点があります。また、メカニカルリサイクルは、材料を回収するために選別、洗浄、再処理を行うため、エネルギー消費の点でもケミカルリサイクルより効率的です。さらに、この手法では新たな化学物質を導入せず、ポリマー本来の特性を維持することができます。そのため、リサイクルプラスチックは本来の特性を失うことなく、本来の品質と性能を維持し、さらにさまざまな用途に使用することができ、省資源と適切な廃棄物管理の実践に貢献します。

建築・建設製品におけるリサイクルプラスチックの使用は、持続可能性、資源効率、プラスチック廃棄物削減への関心の高まりから徐々に拡大しています。建築材料にポストコンシューマーリサイクルプラスチックを使用することで、バージン材料への依存を減らし、埋立処分のレベルを下げ、プラスチック製品の生産時のエネルギーを節約できる可能性があるなどの利点があります。断熱材、屋根材、構造部材などの用途で環境に優しい解決策を模索する業界では、リサイクルプラスチックの需要が高まっており、持続可能な建築慣行と整合し、従来の建築材料に関連する環境問題に対処しています。

当レポートでは、世界のポストコンシューマーリサイクルプラスチック市場について調査し、ポリマータイプ別、由来別、最終用途別、処理タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界の動向

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 生成AIがポストコンシューマーリサイクルプラスチック市場に与える影響

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- マクロ経済分析

- 投資と資金調達のシナリオ

第7章 ポストコンシューマーリサイクルプラスチック市場、ポリマータイプ別

- イントロダクション

- ポリプロピレン(PP)

- 低密度ポリエチレン(LDPE)

- 高密度ポリエチレン(HDPE)

- ポリ塩化ビニル(PVC)

- ポリウレタン(PUR)

- ポリスチレン(PS)

- ポリエチレンテレフタレート(PET)

- その他

第8章 ポストコンシューマーリサイクルプラスチック市場、由来別

- イントロダクション

- ボトル

- 非ボトル硬質

- その他

第9章 ポストコンシューマーリサイクルプラスチック市場、最終用途別

- イントロダクション

- 包装

- 建築・建設

- 自動車

- エレクトロニクス

- その他

第10章 ポストコンシューマーリサイクルプラスチック市場、処理タイプ別

- イントロダクション

- 化学プロセス

- 機械的プロセス

- 生物学的プロセス

第11章 ポストコンシューマーリサイクルプラスチック市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- ランキング分析

- 収益分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- VEOLIA

- SUEZ SA

- REMONDIS SE & CO. KG

- WM INTELLECTUAL PROPERTY HOLDINGS, L.L.C.

- REPUBLIC SERVICES

- WASTE CONNECTIONS

- BIFFA

- CLEAN HARBORS, INC.

- STERICYCLE, INC.

- DS SMITH

- その他の企業

- REVITAL POLYMERS, INC.

- B&B PLASTICS, INC.

- FRESH PAK CORPORATION

- B. SCHOENBERG & CO., INC.

- CUSTOM POLYMERS, INC.

- VAN WERVEN RECYCLING BV

- DALMIA POLYPRO INDUSTRIES PVT. LTD.

- MERLIN PLASTICS

- PLASTREC

- LUCRO PLASTECYCLE PRIVATE LIMITED

- ENVISION PLASTICS INDUSTRIES LLC

- JAYPLAS

- PLASTIPAK HOLDINGS, INC.

- KW PLASTICS

- MBA POLYMERS

- BANYAN NATION

- DEPOLY

- UBQ

- REPEAT PLASTICS AUSTRALIA PTY LTD

- NOVOLOOP

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 RECENT LAWS AND REGULATIONS RELATED TO ENVIRONMENTAL SAFETY

- TABLE 2 GLOBAL RURAL AND URBAN POPULATION GROWTH, BY REGION, 2021 VS. 2050 (MILLION)

- TABLE 3 GLOBAL POPULATION GROWTH, BY REGION, 2022 VS. 2030 VS. 2050 (MILLION)

- TABLE 4 ASIA PACIFIC URBANIZATION TREND, 1990-2050

- TABLE 5 TOP 10 COUNTRIES PRODUCING MOST PLASTIC WASTE, 2023 (MILLION TONS)

- TABLE 6 TOP 10 COUNTRIES WITH MISMANAGED PLASTIC WASTE, 2019 (KG/PERSON)

- TABLE 7 AVERAGE SELLING PRICE TREND OF POST-CONSUMER RECYCLED PLASTICS OFFERED BY KEY PLAYERS, BY APPLICATIONS, 2023 (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE TREND OF POST-CONSUMER RECYCLED PLASTICS, BY REGION, 2021-2029 (USD/KG)

- TABLE 9 ROLES OF COMPANIES IN POST-CONSUMER RECYCLED PLASTICS ECOSYSTEM

- TABLE 10 POST-CONSUMER RECYCLED PLASTICS MARKET: LIST OF MAJOR PATENTS, 2022-2023

- TABLE 11 POST-CONSUMER RECYCLED PLASTICS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 12 POST-CONSUMER RECYCLED PLASTICS MARKET: TARIFF DATA, BY COUNTRY, 2023

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 POST-CONSUMER RECYCLED PLASTICS MARKET: PORTER'S FIVE FORCE ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE APPLICATION

- TABLE 18 KEY BUYING CRITERIA, BY END-USE APPLICATION

- TABLE 19 GLOBAL GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 20 CONSTRUCTION INDUSTRY AS PERCENTAGE OF GDP, BY KEY COUNTRY, 2021 (USD BILLION)

- TABLE 21 GLOBAL AUTOMOBILE PRODUCTION (UNIT) AND GROWTH, BY COUNTRY, 2021 VS. 2022

- TABLE 22 POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 23 POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 24 POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 25 POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 26 POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (USD MILLION)

- TABLE 27 POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (USD MILLION)

- TABLE 28 POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (KILOTON)

- TABLE 29 POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (KILOTON)

- TABLE 30 POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 31 POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 32 POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 33 POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

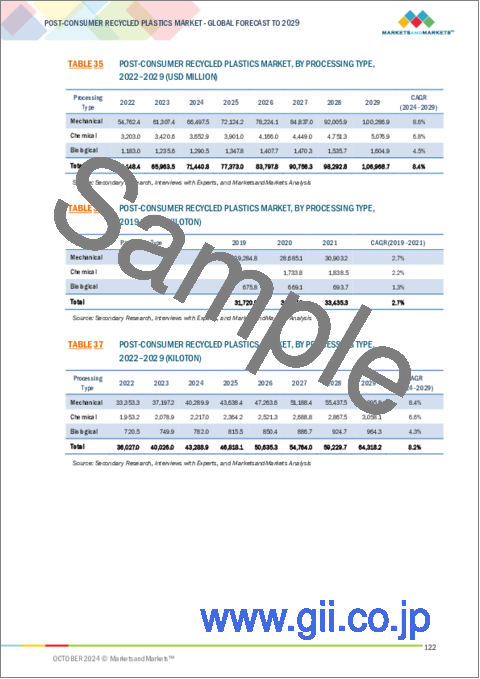

- TABLE 34 POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (USD MILLION)

- TABLE 35 POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (USD MILLION)

- TABLE 36 POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (KILOTON)

- TABLE 37 POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (KILOTON)

- TABLE 38 POST-CONSUMER RECYCLED PLASTIC, BY REGION, 2019-2021 (USD MILLION)

- TABLE 39 POST-CONSUMER RECYCLED PLASTIC, BY REGION, 2022-2029 (USD MILLION)

- TABLE 40 POST-CONSUMER RECYCLED PLASTIC, BY REGION, 2019-2021 (KILOTON)

- TABLE 41 POST-CONSUMER RECYCLED PLASTICS, BY REGION, 2022-2029 (KILOTON)

- TABLE 42 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 43 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 44 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 45 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 46 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 47 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 48 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 49 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 50 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (USD MILLION)

- TABLE 51 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (KILOTON)

- TABLE 53 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (KILOTON)

- TABLE 54 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (USD MILLION)

- TABLE 55 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (KILOTON)

- TABLE 57 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (KILOTON)

- TABLE 58 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 59 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 61 NORTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 62 US: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 63 US: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 64 US: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 65 US: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 66 US: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 67 US: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 68 US: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 69 US: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 70 US: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 71 CANADA: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 72 CANADA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 73 CANADA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 74 CANADA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 75 CANADA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 76 CANADA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 77 CANADA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 78 CANADA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 79 CANADA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 80 MEXICO: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 81 MEXICO: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 82 MEXICO: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 83 MEXICO: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 84 MEXICO: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 85 MEXICO: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 86 MEXICO: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 87 MEXICO: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 88 MEXICO: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 89 EUROPE: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 90 EUROPE: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 91 EUROPE: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 92 EUROPE: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 93 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 94 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 95 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 96 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 97 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (USD MILLION)

- TABLE 98 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (USD MILLION)

- TABLE 99 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (KILOTON)

- TABLE 100 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (KILOTON)

- TABLE 101 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (USD MILLION)

- TABLE 102 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (USD MILLION)

- TABLE 103 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (KILOTON)

- TABLE 104 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (KILOTON)

- TABLE 105 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 106 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 107 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 108 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 109 GERMANY: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 110 GERMANY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 111 GERMANY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 112 GERMANY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 113 GERMANY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 114 GERMANY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 115 GERMANY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 116 GERMANY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 117 GERMANY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 118 UK: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 119 UK: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 120 UK: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 121 UK: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 122 UK: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 123 UK: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 124 UK: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 125 UK: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 126 UK: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 127 FRANCE: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 128 FRANCE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 129 FRANCE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 130 FRANCE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 131 FRANCE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 132 FRANCE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 133 FRANCE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 134 FRANCE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 135 FRANCE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 136 ITALY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 137 ITALY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 138 ITALY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 139 ITALY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 140 ITALY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 141 ITALY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 142 ITALY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 143 ITALY: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 144 RUSSIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 145 RUSSIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 146 RUSSIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 147 RUSSIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 148 RUSSIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 149 RUSSIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 150 RUSSIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 151 RUSSIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 152 REST OF EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 153 REST OF EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 154 REST OF EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 155 REST OF EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 156 REST OF EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 157 REST OF EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 158 REST OF EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 159 REST OF EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 160 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 161 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 162 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 163 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 164 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 165 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 166 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 167 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 168 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (USD MILLION)

- TABLE 169 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (KILOTON)

- TABLE 171 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (KILOTON)

- TABLE 172 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (USD MILLION)

- TABLE 173 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (USD MILLION)

- TABLE 174 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (KILOTON)

- TABLE 175 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (KILOTON)

- TABLE 176 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 177 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 178 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 179 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 180 CHINA: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 181 CHINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 182 CHINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 183 CHINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 184 CHINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 185 CHINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 186 CHINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 187 CHINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 188 CHINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 189 JAPAN: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 190 JAPAN: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 191 JAPAN: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 192 JAPAN: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 193 JAPAN: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 194 JAPAN: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 195 JAPAN: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 196 JAPAN: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 197 JAPAN: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 198 INDIA: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 199 INDIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 200 INDIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 201 INDIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 202 INDIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 203 INDIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 204 INDIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 205 INDIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 206 INDIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 207 SOUTH KOREA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 208 SOUTH KOREA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 209 SOUTH KOREA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 210 SOUTH KOREA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 211 SOUTH KOREA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 212 SOUTH KOREA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 213 SOUTH KOREA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 214 SOUTH KOREA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 215 VIETNAM: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 216 VIETNAM: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 217 VIETNAM: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 218 VIETNAM: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 219 VIETNAM: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 220 VIETNAM: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 221 VIETNAM: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 222 VIETNAM: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 223 REST OF ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 226 REST OF ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 227 REST OF ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 230 REST OF ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 231 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 234 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 235 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 238 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 239 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (KILOTON)

- TABLE 242 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (KILOTON)

- TABLE 243 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (KILOTON)

- TABLE 246 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (KILOTON)

- TABLE 247 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 250 MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 251 GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 252 GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 253 GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 254 GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 255 GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 256 GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 257 GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 258 GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 259 SAUDI ARABIA: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 260 SAUDI ARABIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 261 SAUDI ARABIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 262 SAUDI ARABIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 263 SAUDI ARABIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 264 SAUDI ARABIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 265 SAUDI ARABIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 266 SAUDI ARABIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 267 SAUDI ARABIA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 268 REST OF GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 269 REST OF GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 270 REST OF GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 271 REST OF GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 272 REST OF GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 273 REST OF GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 274 REST OF GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 275 REST OF GCC COUNTRIES: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 276 SOUTH AFRICA: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 277 SOUTH AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 278 SOUTH AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 279 SOUTH AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 280 SOUTH AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 281 SOUTH AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 282 SOUTH AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 283 SOUTH AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 284 SOUTH AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 285 EGYPT: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 286 EGYPT: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 287 EGYPT: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 288 EGYPT: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 289 EGYPT: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 290 EGYPT: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 291 EGYPT: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 292 EGYPT: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 293 EGYPT: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 296 REST OF MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 297 REST OF MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 298 REST OF MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 299 REST OF MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 300 REST OF MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 301 REST OF MIDDLE EAST & AFRICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 302 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 303 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 304 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2019-2021 (KILOTON)

- TABLE 305 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTIC, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 306 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 307 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 308 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 309 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 310 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (USD MILLION)

- TABLE 311 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (USD MILLION)

- TABLE 312 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2019-2021 (KILOTON)

- TABLE 313 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE, 2022-2029 (KILOTON)

- TABLE 314 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (USD MILLION)

- TABLE 315 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (USD MILLION)

- TABLE 316 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2019-2021 (KILOTON)

- TABLE 317 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE, 2022-2029 (KILOTON)

- TABLE 318 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 319 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 320 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 321 SOUTH AMERICA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 322 BRAZIL: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 323 BRAZIL: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 324 BRAZIL: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 325 BRAZIL: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 326 BRAZIL: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 327 BRAZIL: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 328 BRAZIL: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 329 BRAZIL: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 330 BRAZIL: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 331 ARGENTINA: LAWS AND REGULATIONS RELATED TO WASTE MANAGEMENT

- TABLE 332 ARGENTINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 333 ARGENTINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 334 ARGENTINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 335 ARGENTINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 336 ARGENTINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 337 ARGENTINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 338 ARGENTINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 339 ARGENTINA: POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 340 REST OF SOUTH AMERICA POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (USD MILLION)

- TABLE 341 REST OF SOUTH AMERICA POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (USD MILLION)

- TABLE 342 REST OF SOUTH AMERICA POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2019-2021 (KILOTON)

- TABLE 343 REST OF SOUTH AMERICA POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE, 2022-2029 (KILOTON)

- TABLE 344 REST OF SOUTH AMERICA POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (USD MILLION)

- TABLE 345 REST OF SOUTH AMERICA POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (USD MILLION)

- TABLE 346 REST OF SOUTH AMERICA POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2019-2021 (KILOTON)

- TABLE 347 REST OF SOUTH AMERICA POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION, 2022-2029 (KILOTON)

- TABLE 348 POST-CONSUMER RECYCLED PLASTICS MARKET: OVERVIEW OF KEY STRATEGIES DEPLOYED BY MAJOR PLAYERS, 2019-2024

- TABLE 349 POST-CONSUMER RECYCLED PLASTICS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 350 POST-CONSUMER RECYCLED PLASTICS MARKET: SOURCE FOOTPRINT

- TABLE 351 POST-CONSUMER RECYCLED PLASTICS MARKET: POLYMER TYPE FOOTPRINT

- TABLE 352 POST-CONSUMER RECYCLED PLASTICS MARKET: END-USE APPLICATION FOOTPRINT

- TABLE 353 POST-CONSUMER RECYCLED PLASTICS MARKET: REGION FOOTPRINT

- TABLE 354 POST-CONSUMER RECYCLED PLASTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 355 POST-CONSUMER RECYCLED PLASTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 356 POST-CONSUMER RECYCLED PLASTICS MARKET: PRODUCT LAUNCHES, JANUARY 2019-OCTOBER 2024

- TABLE 357 POST-CONSUMER RECYCLED PLASTICS MARKET: DEALS, JANUARY 2019-OCTOBER 2024

- TABLE 358 POST-CONSUMER RECYCLED PLASTICS MARKET: EXPANSIONS, JANUARY 2019-OCTOBER 2024

- TABLE 359 POST-CONSUMER RECYCLED PLASTICS MARKET: OTHERS, JANUARY 2019-OCTOBER 2024

- TABLE 360 VEOLIA: COMPANY OVERVIEW

- TABLE 361 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 362 VEOLIA: PRODUCT LAUNCHES

- TABLE 363 VEOLIA: DEALS

- TABLE 364 VEOLIA: OTHERS

- TABLE 365 SUEZ SA: COMPANY OVERVIEW

- TABLE 366 SUEZ SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 SUEZ SA: DEALS

- TABLE 368 SUEZ SA: EXPANSIONS

- TABLE 369 REMONDIS SE & CO. KG: COMPANY OVERVIEW

- TABLE 370 REMONDIS SE & CO. KG: PRODUCTS/SOLUTIONS/SERVICE OFFERED

- TABLE 371 REMONDIS SE & CO. KG: DEALS

- TABLE 372 REMONDIS SE & CO. KG: EXPANSIONS

- TABLE 373 WM INTELLECTUAL PROPERTY HOLDINGS, L.L.C.: COMPANY OVERVIEW

- TABLE 374 WM INTELLECTUAL PROPERTY HOLDINGS, L.L.C.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 375 WM INTELLECTUAL PROPERTY HOLDINGS, L.L.C.: DEALS

- TABLE 376 WM INTELLECTUAL PROPERTY HOLDINGS, L.L.C.: EXPANSIONS

- TABLE 377 REPUBLIC SERVICES: COMPANY OVERVIEW

- TABLE 378 REPUBLIC SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 REPUBLIC SERVICES: DEALS

- TABLE 380 REPUBLIC SERVICES: EXPANSIONS

- TABLE 381 WASTE CONNECTIONS: COMPANY OVERVIEW

- TABLE 382 WASTE CONNECTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 383 WASTE CONNECTIONS: DEALS

- TABLE 384 BIFFA: COMPANY OVERVIEW

- TABLE 385 BIFFA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 386 BIFFA: DEALS

- TABLE 387 BIFFA.: EXPANSIONS

- TABLE 388 CLEAN HARBORS, INC.: COMPANY OVERVIEW

- TABLE 389 CLEAN HARBORS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 390 CLEAN HARBORS, INC.: DEALS

- TABLE 391 STERICYCLE, INC.: COMPANY OVERVIEW

- TABLE 392 STERICYCLE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 393 STERICYCLE, INC.: PRODUCT LAUNCHES

- TABLE 394 DS SMITH: COMPANY OVERVIEW

- TABLE 395 DS SMITH: PRODUCTS/SOLUTIONS/SERVICE OFFERED

- TABLE 396 REVITAL POLYMERS, INC.: COMPANY OVERVIEW

- TABLE 397 B&B PLASTICS, INC.: COMPANY OVERVIEW

- TABLE 398 FRESH PAK CORPORATION: COMPANY OVERVIEW

- TABLE 399 B. SCHOENBERG & CO., INC.: COMPANY OVERVIEW

- TABLE 400 CUSTOM POLYMERS, INC.: COMPANY OVERVIEW

- TABLE 401 VAN WERVEN RECYCLING BV: COMPANY OVERVIEW

- TABLE 402 DALMIA POLYPRO INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 403 MERLIN PLASTICS: COMPANY OVERVIEW

- TABLE 404 PLASTREC: COMPANY OVERVIEW

- TABLE 405 LUCRO PLASTECYCLE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 406 ENVISION PLASTICS INDUSTRIES LLC: COMPANY OVERVIEW

- TABLE 407 JAYPLAS: COMPANY OVERVIEW

- TABLE 408 GUANGDONG HUIYUN TITANIUM CO., LTD.: COMPANY OVERVIEW

- TABLE 409 KW PLASTICS: COMPANY OVERVIEW

- TABLE 410 MBA POLYMERS: COMPANY OVERVIEW

- TABLE 411 BANYAN NATION: COMPANY OVERVIEW

- TABLE 412 DEPOLY: COMPANY OVERVIEW

- TABLE 413 UBQ: COMPANY OVERVIEW

- TABLE 414 REPEAT PLASTICS AUSTRALIA PTY LTD: COMPANY OVERVIEW

- TABLE 415 NOVOLOOP: COMPANY OVERVIEW

- TABLE 416 RECYCLED PLASTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 417 RECYCLED PLASTICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 418 RECYCLED PLASTICS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 419 RECYCLED PLASTICS MARKET, BY REGION, 2023-2030 (KILOTON)

List of Figures

- FIGURE 1 POST-CONSUMER RECYCLED PLASTICS MARKET: RESEARCH DESIGN

- FIGURE 2 POST-CONSUMER RECYCLED PLASTICS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 POST-CONSUMER RECYCLED PLASTICS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 APPROACH 1: POST-CONSUMER PLASTIC WASTE GENERATION, BY COUNTRY

- FIGURE 5 APPROACH 2: COUNTRY-LEVEL MARKET SIZE

- FIGURE 6 POST-CONSUMER RECYCLED PLASTICS MARKET: DATA TRIANGULATION

- FIGURE 7 BOTTLE SEGMENT TO LEAD POST-CONSUMER RECYCLED PLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 8 POLYETHYLENE TEREPHTHALATE (PET) TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 9 MECHANICAL PROCESS SEGMENT TO HOLD LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 10 PACKAGING SEGMENT TO HOLD MAXIMUM MARKET SHARE IN 2029

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 12 INCREASED AWARENESS REGARDING SUSTAINABLE PACKAGING SOLUTIONS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 AUTOMOTIVE SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC POST-CONSUMER RECYCLED PLASTICS MARKET IN 2023

- FIGURE 14 BOTTLE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 15 POLYETHYLENE TEREPHTHALATE (PET) SEGMENT TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 16 MECHANICAL PROCESS SEGMENT TO LEAD MARKET IN 2029

- FIGURE 17 PACKAGING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 US TO BE FASTEST-GROWING MARKET FOR POST-CONSUMER RECYCLED PLASTICS DURING FORECAST PERIOD

- FIGURE 19 POST-CONSUMER RECYCLED PLASTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 RETAIL SALES GROWTH IN US, 2018-2022

- FIGURE 21 MIXED AND SEPARATE POST-CONSUMER PLASTIC WASTE COLLECTION, 2022

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF POST-CONSUMER RECYCLED PLASTICS OFFERED BY KEY PLAYERS, BY APPLICATION, 2023 (USD/KG)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF POST-CONSUMER RECYCLED PLASTICS, BY REGION, 2021-2029 (USD/KG)

- FIGURE 25 POST-CONSUMER RECYCLED PLASTICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 POST-CONSUMER RECYCLED PLASTICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 MAJOR PATENTS RELATED TO POST-CONSUMER RECYCLED PLASTICS, 2014-2023

- FIGURE 28 EXPORT DATA RELATED TO HS CODE 3915-COMPLIANT PRODUCTS, BY COUNTRY, 2014-2023 (USD MILLION)

- FIGURE 29 IMPORT DATA RELATED TO HS CODE 3915-COMPLIANT PRODUCTS, BY COUNTRY, 2014-2023 (USD MILLION)

- FIGURE 30 POST-CONSUMER RECYCLED PLASTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE APPLICATION

- FIGURE 32 KEY BUYING CRITERIA, BY END-USE APPLICATION

- FIGURE 33 INVESTOR DEAL AND FUNDING TREND IN PLASTIC RECYCLING INDUSTRY, 2020-2024 (USD MILLION)

- FIGURE 34 POLYETHYLENE TEREPHTHALATE (PET) SEGMENT TO HOLD LARGEST SHARE OF POST-CONSUMER RECYCLED PLASTICS MARKET IN 2024

- FIGURE 35 BOTTLE SEGMENT TO HOLD LARGEST SHARE OF POST-CONSUMER RECYCLED PLASTICS MARKET IN 2024

- FIGURE 36 PACKAGING SEGMENT TO HOLD LARGEST SHARE OF POST-CONSUMER RECYCLED PLASTICS MARKET IN 2024

- FIGURE 37 MECHANICAL PROCESS SEGMENT TO HOLD LARGEST SHARE OF POST-CONSUMER RECYCLED PLASTICS MARKET IN 2024

- FIGURE 38 US TO REGISTER HIGHEST CAGR IN POST-CONSUMER RECYCLED PLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 39 EUROPE: POST-CONSUMER RECYCLED PLASTICS MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: POST-CONSUMER RECYCLED PLASTICS MARKET SNAPSHOT

- FIGURE 41 POST-CONSUMER RECYCLED PLASTICS MARKET SHARE ANALYSIS, 2023

- FIGURE 42 POST-CONSUMER RECYCLED PLASTICS MARKET: RANKING OF KEY PLAYERS, 2023

- FIGURE 43 POST-CONSUMER RECYCLED PLASTICS MARKET: REVENUE ANALYSIS FOR KEY COMPANIES, 2019-2023 (USD BILLION)

- FIGURE 44 POST-CONSUMER RECYCLED PLASTICS MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 45 POST-CONSUMER RECYCLED PLASTICS MARKET: EV/EBITDA RATIO, 2024

- FIGURE 46 POST-CONSUMER RECYCLED PLASTICS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 POST-CONSUMER RECYCLED PLASTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 48 POST-CONSUMER RECYCLED PLASTICS MARKET: COMPANY FOOTPRINT

- FIGURE 49 POST-CONSUMER RECYCLED PLASTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 50 VEOLIA: COMPANY SNAPSHOT

- FIGURE 51 WM INTELLECTUAL PROPERTY HOLDINGS, L.L.C.: COMPANY SNAPSHOT

- FIGURE 52 REPUBLIC SERVICES: COMPANY SNAPSHOT

- FIGURE 53 WASTE CONNECTIONS: COMPANY SNAPSHOT

- FIGURE 54 CLEAN HARBORS, INC.: COMPANY SNAPSHOT

- FIGURE 55 STERICYCLE, INC.: COMPANY SNAPSHOT

- FIGURE 56 DS SMITH: COMPANY SNAPSHOT

The post-consumer recycled plastics market size is projected to grow from USD 71.44 billion in 2024 to USD 106.97 billion by 2029, at a CAGR of 8.4%. Post consumer recycled (PCR) plastics have been projected for significant growth due to various factors. Rising concern for environmental conservation is putting a lot of pressure on consumers and industries to embrace circular economy and eradicate plastic waste. National governments across the globe are implementing stricter regulations and policies aimed to curb plastics from polluting the environment which further encourages the use of recycled materials in packaging and manufacturing. Also, leading brands and organizations are optimistic about their sustainability targets mainly in the use of a higher proportion of PCR plastics in their products and containers. Current innovations in recycling technology are also helping in enhancing the quality and supply of PCR plastics, hence making them more applicable in broader range of applications. This growing need for recycled plastics by various end-use industries is further propelled by consumer preferences for sustainable products. All these factors combinely will create an optimistic atmosphere where the adoption of post-consumers recycled plastics is not only environmentally responsible but also economically beneficial, positioning the market for rapid expansion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Type, Product Type, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

"Non-bottle Rigid to be the second fastest growing source during the forecast period."

Non-bottle rigid plastics serve as a major source of post-industrial recycled plastics because of their importance in applications other than bottles. Non-bottle rigid plastics for instance containers, caps, closures, packaging trays, and parts used in automobiles lead to the build-up of discarded non-bottle rigid plastics. These materials, which often consist of various polymer types, are difficult to recycle because of the complex structure of their compounds. However, new approaches to sorting and recycling technologies are facilitating the separation and recycling of non-bottle rigid plastics thus minimizing waste, and encouraging sustainable practices among various industries that use these highly useful products.

"The Polypropylene (PP) to be the fastest growing polymer type in the post-consumer recycled plastics market."

Polypropylene is among the key polymer types in the post-consumer recycled plastics market which is experiencing the highest growth rate because of its wide applicability, growing consumer concerns for environment, and improvements in recycling facilities. This rising demand is because industries are now realizing the possibility of using recycled PP in different areas such as packaging, automotive and consumer products. In addition to this, the difficulties encountered in the recycling of PP waste have been solved by the developments in recycling technologies, making it more feasible to recycle PP for reintegration back into the manufacturing process and this has accelerated its growth of post-consumer recycled plastics.

"The mechanical processing holds the largest market share in the post-consumer recycled plastics market."

Mechanical recycling has specific advantages in the recycling of plastics especially in terms of energy efficiency, environmental impact, and retaining polymer properties. Mechanical recycling is also more efficient in terms of energy consumption than chemical recycling as it involves sorting, cleaning, and reprocessing to recover the material. Furthermore, this approach does not introduce new chemicals and preserves the inherent properties of the polymer; thus, recycled plastics do not lose their original properties and retain their original quality and performance and can further be used in different applications, thus contributing to resource conservation and proper waste management practices.

"The building & construction application holds the second largest market share in post-consumer recycled plastics market."

The use of recycled plastics in building and construction products is gradually growing because of the sector's growing concern with sustainability, resources efficiency, and plastics waste reduction. The use of post-consumer recycled plastics in construction materials have benefits like, reduced dependence on virgin materials, lower levels of landfill disposal and potential energy savings during production of plastics products. Demand for recycled plastics grows as the industry seeks eco-friendly solution for applications such as insulation, roofing and structural elements, aligning with sustainable building practices and addressing environmental concerns associated with traditional construction materials.

"Europe is the second biggest market in post-consumer recycled plastics market."

Currently, the post-consumer recycled plastics market is rapidly developing, especially in Europe, mainly due to the strong regulatory framework and commitment to environmental sustainability. Newer laws like EU's goals towards controlling the plastic waste and recycling are forcing industries to opt for environment friendly solutions like recycling of plastics. Such a regulatory pressure coupled with increased concern for the detrimental effect of plastic wastage to the environment is driving the shift towards the circular economy. Customers in Europe are now pressing for sustainable goods and services, and this has led to an increased adoption of post-consumer plastics in various industries such as packaging, automotive, and electronics. Consequently, the availability of recycled plastics is rising, aligning with both regulatory requirements and consumer preferences for more sustainable alternatives. This market demand and convergence of policy is driving the post-consumer recycled plastics market in the region.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments and the information gathered through secondary research.

The break-up of primary interviews is given below:

- By Company Type: Tier 1: 45%, Tier 2: 37%, and Tier 3: 18%

- By Designation: C-level Executives: 54%, Directors: 28%, and Others: 18%

- By Region: North America: 44%, Europe: 31%, Asia Pacific: 25%,

- Notes: Others include sales, marketing, and product managers.

- Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered Veolia (France), Suez SA (France), WM Intellectual Property Holdings, L.L.C. (US), Republic Services (US), Waste Connections (Canada), Biffa (UK), Clean Harbors, Inc. (US), Stericycle, Inc. (US), Remondis SE & Co. KG (Germany), DS Smith plc (UK) are covered in the post-consumer recycled plastics market.

The study includes an in-depth competitive analysis of these key players in the post-consumer recycled plastics market, with their company profiles, recent developments, and key market strategies

Research Coverage

This research report categorizes the post-consumer recycled plastics market by source, (Bottle, Non-bottle rigid, and Others), by processing type, (mechanical, chemical and biological), by application (packaging, building & construction, automotive, electronics and other end-use applications), polymer type (polyethylene terephthalate (PET), high-density polyethylene (HDPE), low-density polyethylene (LDPE), polypropylene (PP), polyurethane (PUR), polyvinyl chloride (PVC), polystyrene (PS), and other polymers) and by region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the post-consumer recycled plastics market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the post-consumer recycled plastics market. Competitive analysis of upcoming startups in the post-consumer recycled plastics market ecosystem is covered in this report.

Reasons to buy the report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall post-consumer recycled plastics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Implementation of stringent regulations related to environmental safety, Increasing number of awareness programs for sustainable waste management, Growing urban population, Rising consumer preference for sustainable products), restraints (Non-compliance with plastic waste management in residential sector, Absence of framework for plastic waste collection and segregation, Lack of adequate recycling facilities), opportunities (Growing demand for plastic waste management in emerging economies, Increased R&D investments in plastic recycling technologies, Rise in public-private partnerships (PPPs) for plastic waste management) and challenges (High recycling cost, and Challenges associated with supply chain management).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the post-consumer recycled plastics market

- Market Development: Comprehensive information about profitable markets - the report analyses the post-consumer recycled plastics market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the post-consumer recycled plastics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Veolia (France), Suez SA (France), WM Intellectual Property Holdings, L.L.C. (US), Republic Services (US), Waste Connections, Inc. (Canada), Biffa (UK), Clean Harbors, Inc. (US), Stericycle, Inc. (US), Remondis SE & Co. KG (Germany), and DS Smith plc (UK), and among others in the post-consumer recycled plastics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: MARKET SIZE ESTIMATION, BY VOLUME

- 2.2.2 APPROACH 2: MARKET SIZE ESTIMATION, BY VALUE

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POST-CONSUMER RECYCLED PLASTICS MARKET

- 4.2 ASIA PACIFIC POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION AND COUNTRY

- 4.3 POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE

- 4.4 POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE

- 4.5 POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE

- 4.6 POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION

- 4.7 POST-CONSUMER RECYCLED PLASTICS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Implementation of stringent regulations related to environmental safety

- 5.2.1.2 Increasing number of awareness programs for sustainable waste management

- 5.2.1.3 Growing urban population

- 5.2.1.4 Rising consumer preference for sustainable products

- 5.2.2 RESTRAINTS

- 5.2.2.1 Non-compliance with plastic waste management in residential sector

- 5.2.2.2 Absence of framework for plastic waste collection and segregation

- 5.2.2.3 Lack of adequate recycling facilities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for plastic waste management in emerging economies

- 5.2.3.2 Increased research and development (R&D) investments in plastic recycling technologies

- 5.2.3.3 Rise in public-private partnerships (PPPs) for plastic waste management

- 5.2.4 CHALLENGES

- 5.2.4.1 High recycling cost

- 5.2.4.2 Challenges associated with supply chain management

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 IMPACT OF GEN AI ON POST-CONSUMER RECYCLED PLASTICS MARKET

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Mechanical recycling

- 6.6.1.2 Chemical recycling

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Advanced sorting and separation technologies

- 6.6.2.2 Plastic-to-fuel (energy recovery)

- 6.6.2.3 Blockchain for traceability and transparency

- 6.6.1 KEY TECHNOLOGIES

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 METHODOLOGY

- 6.7.3 PATENT ANALYSIS

- 6.8 TRADE ANALYSIS

- 6.8.1 EXPORT DATA (HS CODE 3915)

- 6.8.2 IMPORT SCENARIO (HS CODE 3915)

- 6.9 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 TARIFF ANALYSIS (HS CODE 3915)

- 6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.3 STANDARDS AND REGULATIONS RELATED TO POST-CONSUMER RECYCLED PLASTICS INDUSTRY

- 6.10.3.1 Ban & Restriction - To Reduce Impact of Certain Plastic Products on Environment

- 6.10.3.2 Economic Instruments Have Impacted Plastic Usage and Behavior Patterns

- 6.10.3.3 Standardization - Criteria and Guidelines for Quality, Safety, and Acceptability of Products

- 6.10.3.4 Guidance for Industry - Use of Recycled Plastics in Food Packaging

- 6.10.3.5 Resource Conservation and Recovery Act (RCRA)

- 6.10.3.6 ISO 15270

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 HP AND SLS COLLABORATED TO ACHIEVE CIRCULAR ECONOMY BY LOWERING ENVIRONMENTAL IMPACTS AND FACILITATING RESOURCE RECOVERY AND REUSE

- 6.13.2 GERMANY ACHIEVED PLASTIC PACKAGING RECYCLING RATE OF 63% IN 2022

- 6.13.3 FLIGHT GROUP SET UP FIRST PET-WASH PLANT IN NEW ZEALAND

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECASTS

- 6.14.3 CONSTRUCTION INDUSTRY AS PERCENTAGE OF GDP

- 6.14.4 GLOBAL AUTOMOBILE PRODUCTION AND GROWTH

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 POST-CONSUMER RECYCLED PLASTICS MARKET, BY POLYMER TYPE

- 7.1 INTRODUCTION

- 7.2 POLYPROPYLENE (PP)

- 7.2.1 HEAT RESISTANCE PROPERTY TO DRIVE DEMAND

- 7.3 LOW-DENSITY POLYETHYLENE (LDPE)

- 7.3.1 HIGH FLEXIBILITY AND ELASTICITY TO FUEL DEMAND

- 7.4 HIGH-DENSITY POLYETHYLENE (HDPE)

- 7.4.1 HIGH TENSILE STRENGTH AND EXCELLENT CHEMICAL PROPERTIES TO DRIVE DEMAND

- 7.5 POLYVINYL CHLORIDE (PVC)

- 7.5.1 LOW MOISTURE ABSORPTION FEATURE TO PROPEL DEMAND

- 7.6 POLYURETHANE (PUR)

- 7.6.1 EXCELLENT ELECTRICAL INSULATING PROPERTIES TO DRIVE DEMAND

- 7.7 POLYSTYRENE (PS)

- 7.7.1 EASE OF PROCESSING TO FUEL DEMAND

- 7.8 POLYETHYLENE TEREPHTHALATE (PET)

- 7.8.1 HIGH STRENGTH-TO-WEIGHT RATIO TO BOOST DEMAND

- 7.9 OTHER POLYMER TYPES

8 POST-CONSUMER RECYCLED PLASTICS MARKET, BY SOURCE

- 8.1 INTRODUCTION

- 8.2 BOTTLES

- 8.2.1 PRESENCE OF ROBUST RECYCLING INFRASTRUCTURE TO DRIVE MARKET

- 8.3 NON-BOTTLE RIGID

- 8.3.1 ADVANCEMENTS IN SORTING AND PROCESSING TECHNIQUES TO DRIVE MARKET

- 8.4 OTHER SOURCES

9 POST-CONSUMER RECYCLED PLASTICS MARKET, BY END-USE APPLICATION

- 9.1 INTRODUCTION

- 9.2 PACKAGING

- 9.2.1 STRINGENT REGULATIONS REGARDING REUSE OF PLASTIC PACKAGING TO DRIVE MARKET

- 9.3 BUILDING & CONSTRUCTION

- 9.3.1 USE OF ECO-FRIENDLY CONSTRUCTION MATERIALS TO FUEL MARKET GROWTH

- 9.4 AUTOMOTIVE

- 9.4.1 ADOPTION OF RECYCLED PLASTICS IN AUTOMOBILE MANUFACTURING TO DRIVE MARKET

- 9.5 ELECTRONICS

- 9.5.1 IMPLEMENTATION OF RECYCLED PLASTICS IN ELECTRONICS TO DRIVE MARKET

- 9.6 OTHER END-USE APPLICATIONS

10 POST-CONSUMER RECYCLED PLASTICS MARKET, BY PROCESSING TYPE

- 10.1 INTRODUCTION

- 10.2 CHEMICAL PROCESS

- 10.2.1 RISING ADOPTION OF CHEMICAL RECYCLING TO DRIVE MARKET

- 10.2.1.1 Chemolysis

- 10.2.1.2 Pyrolysis

- 10.2.1.3 Hydrogen technologies

- 10.2.1.4 Gasification

- 10.2.1 RISING ADOPTION OF CHEMICAL RECYCLING TO DRIVE MARKET

- 10.3 MECHANICAL PROCESS

- 10.3.1 USE IN COMMERCIAL AND INDUSTRIAL SECTORS TO DRIVE MARKET

- 10.4 BIOLOGICAL PROCESS

- 10.4.1 INCREASING DEMAND FOR ENVIRONMENTALLY FRIENDLY PRODUCTS TO FUEL MARKET GROWTH

11 POST-CONSUMER RECYCLED PLASTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 High demand for plastic products and packaging to drive market

- 11.2.2 CANADA

- 11.2.2.1 Government-led efforts toward plastic recycling to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Increasing demand for convenience food & beverages to fuel market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Rising adoption of advanced plastic recycling technologies to drive market

- 11.3.2 UK

- 11.3.2.1 Growing awareness regarding sustainability to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Presence of prominent plastic recycling companies to fuel market growth

- 11.3.4 ITALY

- 11.3.4.1 Expanding plastic packaging industry to drive market

- 11.3.5 RUSSIA

- 11.3.5.1 Improved recycling capabilities to drive market

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Rapid industrialization and urbanization to drive market

- 11.4.2 JAPAN

- 11.4.2.1 Rising emphasis on plastic waste management to fuel market growth

- 11.4.3 INDIA

- 11.4.3.1 Growing adoption of sustainable practices to propel market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Favorable government policies for plastic recycling to drive market

- 11.4.5 VIETNAM

- 11.4.5.1 Rising focus on curbing plastic pollution and untapped market potential to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Government-led initiatives to mitigate environmental degradation to drive market

- 11.5.1.2 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Expanding middle-class population to drive market

- 11.5.3 EGYPT

- 11.5.3.1 Improved waste management practices to boost market growth

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Rapid development of plastic packaging industry to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Booming food & beverage industry to fuel market growth

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.4 RANKING ANALYSIS

- 12.5 REVENUE ANALYSIS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.8.5.1 Company footprint

- 12.8.5.2 Source footprint

- 12.8.5.3 Polymer type footprint

- 12.8.5.4 End-use application footprint

- 12.8.5.5 Region footprint

- 12.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.9.5.1 Detailed list of key startups/SMEs

- 12.9.5.2 Competitive benchmarking of key startups/SMEs

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- 12.10.2 DEALS

- 12.10.3 EXPANSIONS

- 12.10.4 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 VEOLIA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Others

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 SUEZ SA

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 REMONDIS SE & CO. KG

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 WM INTELLECTUAL PROPERTY HOLDINGS, L.L.C.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 REPUBLIC SERVICES

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 WASTE CONNECTIONS

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.6.4.1 Key strengths/Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses/Competitive threats

- 13.1.7 BIFFA

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Expansions

- 13.1.7.4 MnM view

- 13.1.7.4.1 Key strengths/Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses/Competitive threats

- 13.1.8 CLEAN HARBORS, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strengths/Right to win

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses/Competitive threats

- 13.1.9 STERICYCLE, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.4 MnM view

- 13.1.10 DS SMITH

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.1 VEOLIA

- 13.2 OTHER PLAYERS

- 13.2.1 REVITAL POLYMERS, INC.

- 13.2.2 B&B PLASTICS, INC.

- 13.2.3 FRESH PAK CORPORATION

- 13.2.4 B. SCHOENBERG & CO., INC.

- 13.2.5 CUSTOM POLYMERS, INC.

- 13.2.6 VAN WERVEN RECYCLING BV

- 13.2.7 DALMIA POLYPRO INDUSTRIES PVT. LTD.

- 13.2.8 MERLIN PLASTICS

- 13.2.9 PLASTREC

- 13.2.10 LUCRO PLASTECYCLE PRIVATE LIMITED

- 13.2.11 ENVISION PLASTICS INDUSTRIES LLC

- 13.2.12 JAYPLAS

- 13.2.13 PLASTIPAK HOLDINGS, INC.

- 13.2.14 KW PLASTICS

- 13.2.15 MBA POLYMERS

- 13.2.16 BANYAN NATION

- 13.2.17 DEPOLY

- 13.2.18 UBQ

- 13.2.19 REPEAT PLASTICS AUSTRALIA PTY LTD

- 13.2.20 NOVOLOOP

14 ADJACENT AND RELATED MARKET

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 RECYCLED PLASTICS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS