|

|

市場調査レポート

商品コード

1348057

農業用界面活性剤の世界市場:タイプ別、用途別、基質別、作物タイプ別、地域別-2028年までの予測Agricultural Surfactants Market by Type (Non-Ionic, Anionic, Cationic, Amphoteric), Application (Herbicides, Fungicides), Substrate Type, Crop Type (Cereals & Grains, Pulses & Oilseeds, Fruits & Vegetables) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 農業用界面活性剤の世界市場:タイプ別、用途別、基質別、作物タイプ別、地域別-2028年までの予測 |

|

出版日: 2023年09月08日

発行: MarketsandMarkets

ページ情報: 英文 324 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の農業用界面活性剤の市場規模は、2023年には17億米ドルになるとみられ、2028年には23億米ドルに達し、金額ベースでCAGR 6.2%を達成すると予測されています。

世界の農業用界面活性剤市場は、精密農業の普及によって推進されています。精密農業では、的を絞った効率的な農薬散布が重視されており、界面活性剤がもたらすメリットと完全に合致しています。これらの化合物は農薬の被覆性と吸収性を高め、作物表面での最適な性能を保証します。精密農業技術が現代農業に不可欠になるにつれ、正確で一貫性のある農薬散布を促進する界面活性剤への需要が高まっています。界面活性剤は、農薬の効能を最大化し、無駄を最小化することで、精密農業システムの生産性と持続可能性を高める上で極めて重要な役割を果たすため、その統合が進み、農業用界面活性剤市場の成長を牽引しています。

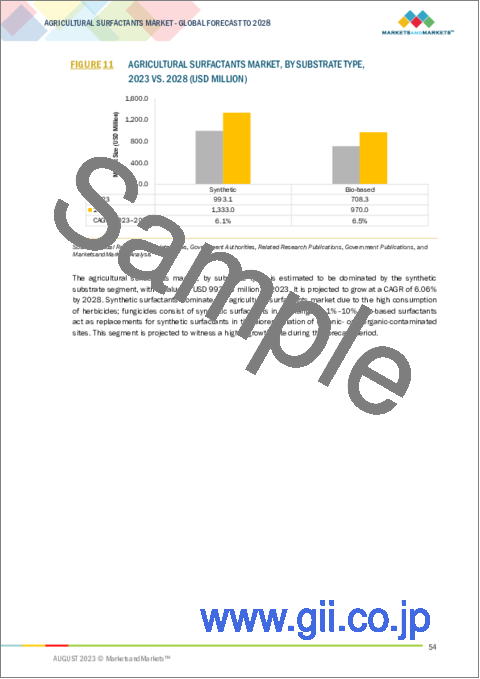

合成農業用界面活性剤は、その安定した性能、汎用性、オーダーメイドの特性により、最も頻繁に採用されています。その正確な化学組成は、様々な農薬処方に対して信頼性が高く予測可能な効果をもたらし、多様な農業の状況において一貫した結果を保証します。これらの界面活性剤は、拡散性、湿潤性、付着性など、さまざまな作物表面における農薬の被覆を最適化するために重要な特定の特性を持つように設計することができます。さらに、生産におけるスケーラビリティにより、費用対効果の高い製造が可能となり、経済的に広く普及させることができます。

非イオン農業用界面活性剤市場は、その汎用性、適合性、環境安全性により成長しています。非イオン界面活性剤は、除草剤、殺虫剤、殺菌剤など幅広い用途に使用できます。また、さまざまな水質やpHレベルに適合するため、農家にとって信頼できる選択肢となっています。さらに、非イオン界面活性剤は環境に対して比較的安全で、植物毒性や植物へのダメージを引き起こす可能性が低いです。農薬に対する規制が厳しくなり、持続可能な農業への需要が高まるにつれ、非イオン界面活性剤の重要性はますます高まっています。

農業用界面活性剤は、除草剤の効果を最適化する上で極めて重要な役割を果たすため、除草剤において最も広範な用途を見出しています。除草剤は、作物への害を最小限に抑えながら特定の雑草を標的にするように設計されているため、正確な散布が必要となります。界面活性剤は、除草剤の植物表面への被覆性、拡散性、付着性を向上させ、標的とする雑草との十分な接触と吸収を可能にします。これにより、より高度な雑草防除と全体的な農薬効率が保証されます。さまざまな雑草種、環境条件、作物の種類が複雑に絡み合っているため、適応性の高いソリューションが必要とされますが、界面活性剤は多様なシナリオで除草剤の性能を向上させることにより、このようなソリューションを提供します。さらに、作物の収量を最大化し、資源との競合を最小化するために効果的な雑草管理が必要であることから、除草剤製剤における界面活性剤の重要性が強調され、農業における最新の雑草防除戦略に不可欠な要素となっています。

北米が農業用界面活性剤市場で最も高いシェアを占めるのは、いくつかの要因によるものです。この地域の先進的な農法は、作物の収量を最適化することへの強い焦点と相まって、農薬効率を高める界面活性剤への大きな需要を牽引しています。北米の農家は精密農法を採用するようになっており、正確で効果的な薬剤散布が必要とされていますが、界面活性剤はこれを促進します。さらに、同地域には著名な農薬会社やバイオテクノロジー企業が存在するため、研究開発への取り組みが活発化し、革新的な界面活性剤製剤が生み出されています。厳しい環境規制も、化学物質の浪費と環境への影響を減らすために界面活性剤の使用を後押ししています。持続可能な農法への取り組みと実質的な農業生産高を背景に、北米は依然として農業用界面活性剤採用の最前線にあり、そのため市場シェアは最高となっています。

当レポートでは、世界の農業用界面活性剤市場について調査し、タイプ別、用途別、基質別、作物タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

第6章 業界の動向

- イントロダクション

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- 関税と規制状況

- 特許分析

- 貿易分析

- 価格分析

- エコシステム分析

- 技術分析

- ケーススタディ

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 主要な会議とイベント

第7章 農業用界面活性剤市場、タイプ別

- イントロダクション

- 非イオン性

- 陰イオン性

- 両性

- カチオン性

第8章 農業用界面活性剤市場、用途別

- イントロダクション

- 除草剤

- 殺菌剤

- 殺虫剤

- その他

第9章 農業用界面活性剤市場、作物タイプ別

- イントロダクション

- シリアルと穀物

- 油糧種子と豆類

- 果物と野菜

- その他

第10章 農業用界面活性剤市場、基質別

- イントロダクション

- 合成

- バイオベース

第11章 農業用界面活性剤市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 主要企業の過去の収益分析

- 主要企業の市場シェア分析

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業向けの企業評価マトリクス

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- CORTEVA AGRISCIENCE

- BASF SE

- EVONIK INDUSTRIES

- SOLVAY

- CLARIANT

- CHS INC.

- NUFARM

- CRODA INTERNATIONAL PLC

- STEPAN COMPANY

- HELENA AGRI-ENTERPRISES, LLC

- WINFIELD UNITED

- KALO

- WILBUR-ELLIS COMPANY LLC

- BRANDT, INC.

- NOURYON

- スタートアップ/中小企業

- PRECISION LABORATORIES, LLC

- GARRCO PRODUCTS, INC.

- INNVICTIS

- LANKEM LTD.

- INDOFIL INDUSTRIES LIMITED

第14章 隣接市場および関連市場

第15章 付録

The global agricultural surfactants market size is projected to reach USD 1.7 billion in 2023 and USD 2.3 billion by 2028, recording a CAGR of 6.2% in terms of value. The global agricultural surfactants market is being propelled by the widespread adoption of precision farming practices. Precision farming's emphasis on targeted and efficient agrochemical application aligns perfectly with the benefits surfactants offer. These compounds enhance pesticide coverage and absorption, ensuring optimal performance on crop surfaces. As precision farming technologies become integral to modern agriculture, the demand for surfactants that facilitate precise and consistent chemical delivery is escalating. By maximizing the efficacy of agrochemicals and minimizing waste, surfactants play a pivotal role in enhancing the productivity and sustainability of precision farming systems, thus driving their increased integration and the growth of the agricultural surfactants market.

"Synthetic is the most frequently employed substrate type of agricultural surfactants."

Synthetic agricultural surfactants are the most frequently employed due to their consistent performance, versatility, and tailor-made properties. Their precise chemical compositions offer reliable and predictable effects on various agrochemical formulations, ensuring consistent results in diverse agricultural contexts. These surfactants can be engineered to possess specific characteristics, such as spreading, wetting, and adhesion capabilities, which are crucial for optimizing pesticide coverage on different crop surfaces. Moreover, their scalability in production allows for cost-effective manufacturing, making them economically viable for widespread adoption.

"Non ionic type of agricultural surfactants is anticipated to hold the largest share in 2028."

The non-ionic agricultural surfactants market is growing due to their versatility, compatibility, and environmental safety. Nonionic surfactants can be used in a wide range of applications, including herbicides, insecticides, and fungicides. They are also compatible with a variety of water qualities and pH levels, making them a reliable choice for farmers. Additionally, nonionic surfactants are relatively safe for the environment and less likely to cause phytotoxicity or plant damage. As regulations on agricultural chemicals become stricter and the demand for sustainable agriculture practices grows, nonionic surfactants are becoming increasingly important.

"Herbicides in the application segment of the agricultural surfactants market are projected to grow and have the largest market share for the forecasted year."

Agricultural surfactants find their most extensive use in herbicides due to their pivotal role in optimizing herbicide effectiveness. Herbicides are designed to target specific weeds while minimizing harm to crops, necessitating precise application. Surfactants enhance herbicide coverage, spreading, and adhesion on plant surfaces, enabling thorough contact and absorption by targeted weeds. This ensures a higher degree of weed control and overall agrochemical efficiency. The complexities of various weed species, environmental conditions, and crop types require adaptable solutions, which surfactants provide by improving herbicide performance across diverse scenarios. Moreover, the need for effective weed management to maximize crop yields and minimize resource competition underscores the critical importance of surfactants in herbicide formulations, making them an indispensable component of modern weed control strategies in agriculture.

"North America is anticipated to have the highest share in the agricultural surfactants market, valued at 37.2% during the forecast period."

North America accounts for the highest share of the agricultural surfactants market due to several factors. The region's advanced agricultural practices, coupled with a strong focus on optimizing crop yields, have driven substantial demand for surfactants that enhance pesticide efficiency. North American farmers are increasingly adopting precision agriculture methods, necessitating precise and effective chemical application, which surfactants facilitate. Furthermore, the presence of prominent agrochemical and biotechnology companies in the region fuels research and development efforts, leading to innovative surfactant formulations. Stringent environmental regulations have also pushed for the use of surfactants to reduce chemical wastage and environmental impact. With a commitment to sustainable farming practices, coupled with substantial agricultural output, North America remains at the forefront of agricultural surfactant adoption, thus holding the highest market share.

The break-up of the profile of primary participants in the agricultural surfactants market:

By Company: Tier 1- 60%, Tier 2- 25%, Tier 3 - 15%

By Designation: Director Level - 35%, C- Level- 45%, and Others- 20%

By Region: North America -20%, Europe - 25%, Asia Pacific -45%, South America - 5%, and RoW - 5%

Prominent companies include CHS Inc. (US), BASF SE (Germany), Solvay (Belgium), Corteva Agriscience (US), Evonik (Germany), Croda International Plc (UK), Nufarm (Australia), CLARIANT (Switzerland), and Stepan Company (US).

Research Coverage:

In this report, the agricultural surfactants market has been categorized by type (non-ionic, anionic, cationic, amphoteric), application (herbicides, fungicides), substrate type (synthetic, bio-based), crop type (cereals & grains, pulses & oilseeds, fruits & vegetables), and region. The report's coverage includes specific information on the key elements-such as drivers, restraints, challenges, and opportunities-influencing the market for lactic acid. A comprehensive evaluation of the top industry players has been conducted to provide insights into their business overview, products, and services, important strategies, contracts, partnerships, agreements, the introduction of new products and services, acquisitions and mergers, and current trends affecting the agricultural surfactants market. This research covers competitive analysis of future startups in the agricultural surfactants market environment.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall agricultural surfactants market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (High demand for agricultural surfactants and agricultural surfactants applications), restraints (Fluctuations in raw material prices), opportunities (Government regulations and frameworks to encourage the use of bioplastics), and challenges (High initial investment costs involved for small & medium enterprises) influencing the growth of the agricultural surfactants market.

- Product Development/Innovation: Detailed insights on research & development activities and new product & service launches in the agricultural surfactants market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the agricultural surfactants market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the agricultural surfactants market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Corbion (Netherlands), Cargill, Incorporated (US), Galactic (Belgium), and Unitika Ltd (Japan), among others in the agricultural surfactants market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2022

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key participants and opinion leaders

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM-UP APPROACH (BASED ON AGRICULTURAL SURFACTANTS MARKET, BY REGION)

- 2.2.2 APPROACH TWO: TOP-DOWN APPROACH (BASED ON GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.5.1 MAJOR RECESSION INDICATORS

- FIGURE 4 MAJOR RECESSION INDICATORS

- FIGURE 5 GLOBAL INFLATION RATE, 2011-2021

- FIGURE 6 GLOBAL GROSS DOMESTIC PRODUCT, 2011-2021 (USD TRILLION)

- FIGURE 7 RECESSION INDICATORS AND THEIR IMPACT ON AGRICULTURAL SURFACTANTS MARKET

- FIGURE 8 GLOBAL AGRICULTURAL SURFACTANTS MARKET: CURRENT FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 AGRICULTURAL SURFACTANTS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 9 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 AGRICULTURAL SURFACTANTS MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURAL SURFACTANTS MARKET

- FIGURE 14 NEED FOR ADOPTING HIGH-QUALITY PESTICIDES IN AGRICULTURE SECTOR TO DRIVE MARKET

- 4.2 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 15 NON-IONIC SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.3 AGRICULTURAL SURFACTANTS MARKET: REGIONAL SUBMARKETS

- FIGURE 16 US TO ACCOUNT FOR LARGEST SHARE IN 2023

- 4.4 AGRICULTURAL SURFACTANTS MARKET, BY TYPE

- FIGURE 17 NON-IONIC SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- 4.5 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE

- FIGURE 18 SYNTHETIC SEGMENT TO DOMINATE MARKET IN 2023

- 4.6 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION

- FIGURE 19 HERBICIDES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- 4.7 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE

- FIGURE 20 CEREALS & GRAINS SEGMENT TO LEAD MARKET IN 2023

- 4.8 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION AND REGION

- FIGURE 21 HERBICIDES SEGMENT TO DOMINATE NORTH AMERICAN AGRICULTURAL SURFACTANTS MARKET BY 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 POPULATION GROWTH AND DECREASE IN ARABLE LAND

- FIGURE 22 POPULATION GROWTH, 1950-2025 (BILLION)

- FIGURE 23 PER CAPITA ARABLE LAND, 1960-2025 (HA PER CAPITA)

- 5.2.2 INCREASE IN FARM EXPENDITURE

- FIGURE 24 SHARE OF TOTAL ON-FARM PRODUCTION EXPENDITURE

- 5.3 MARKET DYNAMICS

- FIGURE 25 AGRICULTURAL SURFACTANTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Adoption of precision farming and protected agriculture

- 5.3.1.2 Increase in demand for green solutions

- 5.3.2 RESTRAINTS

- 5.3.2.1 Strict regulations regarding use of synthetic surfactants

- 5.3.2.2 Rising use of genetically modified seeds

- TABLE 3 GM CROPS & BIOPESTICIDES: SUBSTITUTION POTENTIAL OF SYNTHETIC PESTICIDES FOR VARIOUS CROPS

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Production of sustainable bio-based surfactant products

- 5.3.3.2 Development of cost-effective production techniques

- 5.3.4 CHALLENGES

- 5.3.4.1 Rising environmental concerns

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 PRODUCTION AND PROCESSING

- 6.2.4 PACKAGING

- 6.2.5 DISTRIBUTION

- 6.2.6 MARKETING AND SALES

- 6.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 REVENUE SHIFT FOR AGRICULTURAL SURFACTANTS MARKET

- 6.4 TARIFF AND REGULATORY LANDSCAPE

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.4.1 NORTH AMERICA

- 6.4.1.1 US

- 6.4.1.2 Canada

- 6.4.2 EUROPE

- 6.4.2.1 UK

- 6.4.2.2 Germany

- 6.4.3 ASIA PACIFIC

- 6.4.3.1 Australia

- 6.4.4 REST OF THE WORLD

- 6.4.4.1 South Africa

- 6.5 PATENT ANALYSIS

- FIGURE 28 TOTAL PATENTS GRANTED, 2013-2022

- FIGURE 29 TOTAL PATENTS GRANTED, BY KEY REGION

- TABLE 9 LIST OF MAJOR PATENTS PERTAINING TO AGRICULTURAL SURFACTANTS MARKET, 2016-2023

- 6.6 TRADE ANALYSIS

- TABLE 10 IMPORT VALUE OF AGRICULTURAL SURFACTANTS, BY KEY COUNTRY, 2022 (USD THOUSAND)

- TABLE 11 EXPORT VALUE OF AGRICULTURAL SURFACTANTS, BY KEY COUNTRY, 2022 (USD THOUSAND)

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE TRENDS

- TABLE 12 GLOBAL AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2020-2022 (USD MILLION PER KT)

- TABLE 13 GLOBAL AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2020-2022 (USD MILLION PER KT)

- TABLE 14 OATS: GLOBAL AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2020-2022 (USD MILLION PER KT)

- 6.8 ECOSYSTEM ANALYSIS

- 6.8.1 DEMAND SIDE

- 6.8.2 SUPPLY SIDE

- FIGURE 30 ECOSYSTEM MAP

- TABLE 15 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 MICROBIAL BIOSURFACTANTS

- 6.9.2 BIOSURFACTANT MICROEMULSION SYSTEMS

- 6.10 CASE STUDIES

- 6.10.1 EVONIK DEVELOPED SUSTAINABLE SURFACTANTS TO ENCOURAGE ENVIRONMENTALLY FRIENDLY CROP PROTECTION

- 6.10.2 WILBUR-ELLIS DEVELOPED NON-IONIC SURFACTANTS TO IMPROVE DEPOSITION QUALITY OF ORGANIC PRODUCTS

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 IMPACT OF PORTER'S FIVE FORCES ON AGRICULTURAL SURFACTANTS MARKET

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 BARGAINING POWER OF SUPPLIERS

- 6.11.3 BARGAINING POWER OF BUYERS

- 6.11.4 THREAT OF SUBSTITUTES

- 6.11.5 THREAT OF NEW ENTRANTS

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SUBSTRATE TYPES

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SUBSTRATE TYPES

- 6.12.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR KEY SUBSTRATE TYPES

- TABLE 18 KEY BUYING CRITERIA FOR SUBSTRATE TYPES

- 6.13 KEY CONFERENCES & EVENTS

- TABLE 19 KEY CONFERENCES & EVENTS, 2023-2024

7 AGRICULTURAL SURFACTANTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 33 NON-IONIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 20 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 21 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 22 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 23 AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- 7.2 NON-IONIC

- 7.2.1 RISING DEMAND FOR EXPERTLY FORMULATED ADJUVANT FORMULATIONS TO DRIVE GROWTH

- TABLE 24 NON-ICONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 NON-ICONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 26 NON-ICONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 27 NON-ICONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 7.3 ANIONIC

- 7.3.1 RISING ADOPTION OF ANIONIC AGRICULTURAL SURFACTANTS TO IMPROVE ADHESION IN PESTICIDE FORMULATIONS TO BOOST GROWTH

- TABLE 28 ANIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 ANIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 ANIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 31 ANIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 7.4 AMPHOTERIC

- 7.4.1 RISING NEED TO IMPROVE EFFICACY OF PESTICIDES, HERBICIDES, AND FERTILIZERS TO PROPEL MARKET EXPANSION

- TABLE 32 AMPHOTERIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 AMPHOTERIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 34 AMPHOTERIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 35 AMPHOTERIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 7.5 CATIONIC

- 7.5.1 POPULARITY OF CATIONIC SURFACTANTS DUE TO THEIR PH-SENSITIVE NATURE TO FACILITATE MARKET GROWTH

- TABLE 36 CATIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 CATIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 38 CATIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 39 CATIONIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

8 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 34 HERBICIDES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 40 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 41 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 42 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 43 AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- 8.2 HERBICIDES

- 8.2.1 DEMAND FOR INCREASED EFFICIENCY OF LEAF CUTICLES TO DRIVE USE OF SURFACTANTS IN HERBICIDES

- TABLE 44 HERBICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 HERBICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 HERBICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 47 HERBICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 8.3 FUNGICIDES

- 8.3.1 FOCUS ON STRENGTHENING PERFORMANCE OF FUNGICIDES TO DRIVE MARKET

- TABLE 48 FUNGICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 FUNGICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 50 FUNGICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 51 FUNGICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 8.4 INSECTICIDES

- 8.4.1 RISING DEMAND FOR LIMITING USE OF CHEMICALS IN INSECTICIDES TO ENCOURAGE ADOPTION OF SURFACTANTS

- TABLE 52 INSECTICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 INSECTICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 54 INSECTICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 55 INSECTICIDES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 8.5 OTHER APPLICATIONS

- TABLE 56 OTHER APPLICATIONS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 OTHER APPLICATIONS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 58 OTHER APPLICATIONS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 59 OTHER APPLICATIONS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

9 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE

- 9.1 INTRODUCTION

- FIGURE 35 CEREALS & GRAINS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 60 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (USD MILLION)

- TABLE 61 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 62 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (KT)

- TABLE 63 AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (KT)

- 9.2 CEREALS & GRAINS

- 9.2.1 GROWING EMPHASIS ON CROP PROTECTION AND ENHANCEMENT TO DRIVE USE OF SURFACTANTS IN CEREALS AND GRAINS

- TABLE 64 CEREALS & GRAINS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 CEREALS & GRAINS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 66 CEREALS & GRAINS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 67 CEREALS & GRAINS: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 9.2.2 CORN

- 9.2.3 WHEAT

- 9.2.4 OTHER CEREALS & GRAINS

- 9.3 OILSEEDS & PULSES

- 9.3.1 RISING DEMAND FOR EDIBLE OILS AND PROTEIN-RICH PULSES TO BOOST MARKET

- TABLE 68 OILSEEDS & PULSES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 OILSEEDS & PULSES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 70 OILSEEDS & PULSES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 71 OILSEEDS & PULSES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 9.4 FRUITS & VEGETABLES

- 9.4.1 INCREASING GLOBAL CONSUMPTION OF FRUITS AND VEGETABLES TO ENCOURAGE MARKET GROWTH

- TABLE 72 FRUITS & VEGETABLES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 FRUITS & VEGETABLES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 74 FRUITS & VEGETABLES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 75 FRUITS & VEGETABLES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 9.5 OTHER CROP TYPES

- TABLE 76 OTHER CROP TYPES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 OTHER CROP TYPES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 78 OTHER CROP TYPES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 79 OTHER CROP TYPES: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

10 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE

- 10.1 INTRODUCTION

- FIGURE 36 SYNTHETIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 80 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 81 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 82 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 83 AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 10.2 SYNTHETIC

- 10.2.1 INCREASING ADOPTION OF SYNTHETIC SURFACTANTS AS EMULSIFYING AGENTS IN PESTICIDES TO BOOST MARKET

- TABLE 84 SYNTHETIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 SYNTHETIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 86 SYNTHETIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 87 SYNTHETIC: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 10.3 BIO-BASED

- 10.3.1 DEMAND FOR RENEWABLE BIOLOGICAL SUBSTRATES DUE TO RISING HEALTH CONCERNS TO PROPEL MARKET

- TABLE 88 BIO-BASED: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 BIO-BASED: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 90 BIO-BASED: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 91 BIO-BASED: AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

11 AGRICULTURAL SURFACTANTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 37 REGIONS EMERGING AS NEW HOTSPOTS IN AGRICULTURAL SURFACTANTS MARKET

- TABLE 92 AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 93 AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 94 AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 95 AGRICULTURAL SURFACTANTS MARKET, BY REGION, 2023-2028 (KT)

- 11.2 NORTH AMERICA

- FIGURE 38 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET SNAPSHOT

- TABLE 96 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 99 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 100 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 103 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 104 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (KT)

- TABLE 107 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (KT)

- TABLE 108 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 111 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 112 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 115 NORTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.2.1 US

- 11.2.1.1 Adoption of precision farming techniques to boost demand for agricultural surfactants

- TABLE 116 US: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 117 US: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 118 US: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 119 US: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 120 US: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 US: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 122 US: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 123 US: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 124 US: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 125 US: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 126 US: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 127 US: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.2.2 CANADA

- 11.2.2.1 Focus on organic farming to spur adoption of agricultural surfactants

- TABLE 128 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 129 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 130 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 131 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 132 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 133 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 134 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 135 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 136 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 137 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 138 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 139 CANADA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.2.3 MEXICO

- 11.2.3.1 Demand for sustainable farming solutions to drive market

- TABLE 140 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 141 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 142 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 143 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 144 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 145 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 146 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 147 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 148 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 149 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 150 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 151 MEXICO: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.3 EUROPE

- TABLE 152 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 153 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 154 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 155 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 156 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 157 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 159 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 160 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (USD MILLION)

- TABLE 161 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 162 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (KT)

- TABLE 163 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (KT)

- TABLE 164 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 165 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 166 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 167 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 168 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 169 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 170 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 171 EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.3.1 GERMANY

- 11.3.1.1 Demand for solutions that amplify pesticide efficacy to drive market

- TABLE 172 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 173 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 174 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 175 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 176 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 177 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 178 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 179 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 180 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 181 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 182 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 183 GERMANY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.3.2 FRANCE

- 11.3.2.1 Growing focus on crop protection to boost market

- TABLE 184 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 185 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 186 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 187 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 188 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 189 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 190 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 191 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 192 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 193 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 194 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 195 FRANCE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.3.3 UK

- 11.3.3.1 Demand for sustainable agricultural solutions to boost popularity of agricultural surfactants

- TABLE 196 UK: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 197 UK: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 198 UK: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 199 UK: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 200 UK: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 201 UK: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 202 UK: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 203 UK: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 204 UK: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 205 UK: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 206 UK: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 207 UK: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.3.4 ITALY

- 11.3.4.1 Rising adoption of integrated pest management solutions to fuel market

- TABLE 208 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 209 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 210 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 211 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 212 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 213 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 214 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 215 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 216 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 217 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 218 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 219 ITALY: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.3.5 SPAIN

- 11.3.5.1 Popularity of sustainable farming practices to amplify demand for agricultural surfactants

- TABLE 220 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 221 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 222 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 223 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 224 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 225 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 226 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 227 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 228 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 229 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 230 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 231 SPAIN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.3.6 REST OF EUROPE

- TABLE 232 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 233 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 234 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 235 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 236 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 237 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 238 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 239 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 240 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 241 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 242 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 243 REST OF EUROPE: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.4 ASIA PACIFIC

- TABLE 244 KEY CROPS CULTIVATED, BY COUNTRY

- TABLE 245 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 246 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 247 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 248 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 249 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 250 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 251 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 252 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 253 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (USD MILLION)

- TABLE 254 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 255 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (KT)

- TABLE 256 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (KT)

- TABLE 257 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 258 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 259 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 260 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 261 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 262 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 263 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 264 ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.4.1 CHINA

- 11.4.1.1 Rapid modernization of agriculture to drive market expansion

- TABLE 265 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 266 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 267 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 268 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 269 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 270 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 271 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 272 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 273 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 274 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 275 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 276 CHINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.4.2 INDIA

- 11.4.2.1 Focus on large-scale farming practices to boost market growth

- TABLE 277 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 278 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 279 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 280 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 281 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 282 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 283 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 284 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 285 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 286 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 287 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 288 INDIA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.4.3 JAPAN

- 11.4.3.1 Technological innovations in agriculture to fuel adoption of agricultural surfactants

- TABLE 289 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 290 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 291 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 292 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 293 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 294 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 295 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 296 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 297 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 298 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 299 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 300 JAPAN: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Demand for agrochemical efficacy to encourage market growth

- TABLE 301 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 302 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 303 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 304 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 305 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 306 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 307 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 308 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 309 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 310 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 311 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 312 AUSTRALIA & NEW ZEALAND: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.4.5 REST OF ASIA PACIFIC

- TABLE 313 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 314 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 315 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 316 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 317 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 318 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 319 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 320 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 321 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 322 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 323 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 324 REST OF ASIA PACIFIC: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.5 SOUTH AMERICA

- TABLE 325 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 326 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 327 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 328 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 329 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 330 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 331 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 332 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 333 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (USD MILLION)

- TABLE 334 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 335 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (KT)

- TABLE 336 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (KT)

- TABLE 337 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 338 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 339 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 340 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 341 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 342 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 343 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 344 SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.5.1 BRAZIL

- 11.5.1.1 Strong commercial appeal for crop benefits to propel market growth

- TABLE 345 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 346 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 347 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 348 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 349 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 350 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 351 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 352 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 353 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 354 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 355 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 356 BRAZIL: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.5.2 ARGENTINA

- 11.5.2.1 Rising need to optimize pesticide efficacy to boost growth

- TABLE 357 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 358 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 359 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 360 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 361 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 362 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 363 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 364 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 365 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 366 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 367 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 368 ARGENTINA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.5.3 REST OF SOUTH AMERICA

- TABLE 369 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 370 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 371 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 372 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 373 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 374 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 375 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 376 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 377 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 378 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 379 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 380 REST OF SOUTH AMERICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.6 REST OF THE WORLD

- TABLE 381 ROW: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 382 ROW: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 383 ROW: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 384 ROW: AGRICULTURAL SURFACTANTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 385 ROW: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 386 ROW: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 387 ROW: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 388 ROW: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 389 ROW: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (USD MILLION)

- TABLE 390 ROW: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- TABLE 391 ROW: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2019-2022 (KT)

- TABLE 392 ROW: AGRICULTURAL SURFACTANTS MARKET, BY CROP TYPE, 2023-2028 (KT)

- TABLE 393 ROW: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 394 ROW: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 395 ROW: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 396 ROW: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 397 ROW: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 398 ROW: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 399 ROW: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 400 ROW: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.6.1 AFRICA

- 11.6.1.1 Focus on food security to accelerate demand for agricultural surfactants

- TABLE 401 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 402 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 403 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 404 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 405 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 406 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 407 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 408 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 409 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 410 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 411 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 412 AFRICA: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Growing emphasis on desert agricultural practices to amplify demand for agricultural surfactants

- TABLE 413 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 414 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 415 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 416 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 417 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 418 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 419 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2019-2022 (KT)

- TABLE 420 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY APPLICATION, 2023-2028 (KT)

- TABLE 421 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (USD MILLION)

- TABLE 422 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (USD MILLION)

- TABLE 423 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2019-2022 (KT)

- TABLE 424 MIDDLE EAST: AGRICULTURAL SURFACTANTS MARKET, BY SUBSTRATE TYPE, 2023-2028 (KT)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 425 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 39 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020-2022 (USD BILLION)

- 12.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- TABLE 426 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- 12.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PARTICIPANTS

- 12.5.4 PERVASIVE PLAYERS

- FIGURE 40 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 12.5.5 COMPETITIVE BENCHMARKING

- TABLE 427 COMPANY FOOTPRINT, BY TYPE

- TABLE 428 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 429 COMPANY FOOTPRINT, BY REGION

- 12.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 41 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 12.6.5 COMPETITIVE BENCHMARKING

- TABLE 430 LIST OF KEY STARTUPS/SMES

- TABLE 431 COMPETITIVE BENCHMARKING (BY TYPE, APPLICATION, AND REGION)

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 432 AGRICULTURAL SURFACTANTS MARKET: PRODUCT LAUNCHES, 2021-2022

- TABLE 433 AGRICULTURAL SURFACTANTS MARKET: DEALS, 2021

13 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 CORTEVA AGRISCIENCE

- TABLE 434 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

- FIGURE 42 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- TABLE 435 CORTEVA AGRISCIENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.2 BASF SE

- TABLE 436 BASF SE: BUSINESS OVERVIEW

- FIGURE 43 BASF SE: COMPANY SNAPSHOT

- TABLE 437 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.3 EVONIK INDUSTRIES

- TABLE 438 EVONIK INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 44 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- TABLE 439 EVONIK INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.4 SOLVAY

- TABLE 440 SOLVAY: BUSINESS OVERVIEW

- FIGURE 45 SOLVAY: COMPANY SNAPSHOT

- TABLE 441 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 442 SOLVAY: DEALS

- 13.1.5 CLARIANT

- TABLE 443 CLARIANT: BUSINESS OVERVIEW

- FIGURE 46 CLARIANT: COMPANY SNAPSHOT

- TABLE 444 CLARIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 445 CLARIANT: PRODUCT LAUNCHES

- 13.1.6 CHS INC.

- TABLE 446 CHS INC.: BUSINESS OVERVIEW

- FIGURE 47 CHS INC.: COMPANY SNAPSHOT

- TABLE 447 CHS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 448 CHS INC.: PRODUCT LAUNCHES

- 13.1.7 NUFARM

- TABLE 449 NUFARM: BUSINESS OVERVIEW

- FIGURE 48 NUFARM: COMPANY SNAPSHOT

- TABLE 450 NUFARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.8 CRODA INTERNATIONAL PLC

- TABLE 451 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

- FIGURE 49 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

- TABLE 452 CRODA INTERNATIONAL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 STEPAN COMPANY

- TABLE 453 STEPAN COMPANY: BUSINESS OVERVIEW

- FIGURE 50 STEPAN COMPANY: COMPANY SNAPSHOT

- TABLE 454 STEPAN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.10 HELENA AGRI-ENTERPRISES, LLC

- TABLE 455 HELENA AGRI-ENTERPRISES, LLC: BUSINESS OVERVIEW

- TABLE 456 HELENA AGRI-ENTERPRISES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 WINFIELD UNITED

- TABLE 457 WINFIELD UNITED: BUSINESS OVERVIEW

- TABLE 458 WINFIELD UNITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.12 KALO

- TABLE 459 KALO: BUSINESS OVERVIEW

- TABLE 460 KALO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 WILBUR-ELLIS COMPANY LLC

- TABLE 461 WILBUR-ELLIS COMPANY: BUSINESS OVERVIEW

- TABLE 462 WILBUR-ELLIS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 463 WILBUR-ELLIS COMPANY: PRODUCT LAUNCHES

- 13.1.14 BRANDT, INC.

- TABLE 464 BRANDT, INC.: BUSINESS OVERVIEW

- TABLE 465 BRANDT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.15 NOURYON

- TABLE 466 NOURYON: BUSINESS OVERVIEW

- TABLE 467 NOURYON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 STARTUPS/SMES

- 13.2.1 PRECISION LABORATORIES, LLC

- 13.2.2 GARRCO PRODUCTS, INC.

- 13.2.3 INNVICTIS

- 13.2.4 LANKEM LTD.

- 13.2.5 INDOFIL INDUSTRIES LIMITED

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 468 MARKETS ADJACENT TO AGRICULTURAL SURFACTANTS MARKET

- 14.2 LIMITATIONS

- 14.3 AGRICULTURAL ADJUVANTS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 469 AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2019-2022 (USD MILLION)

- TABLE 470 AGRICULTURAL ADJUVANTS MARKET, BY ADOPTION STAGE, 2023-2028 (USD MILLION)

- 14.4 CROP PROTECTION MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 471 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2016-2019 (USD MILLION)

- TABLE 472 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2020-2025 (USD MILLION)

- TABLE 473 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2016-2019 (KT)

- TABLE 474 CROP PROTECTION CHEMICALS MARKET, BY TYPE, 2020-2025 (KT)

15 APPENDIX

- 15.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.2 CUSTOMIZATION OPTIONS

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS