|

|

市場調査レポート

商品コード

1347846

ナノろ過膜の世界市場:タイプ別、モジュール別、用途別、地域別 - 予測(~2028年)Nanofiltration Membrane Market by Type (Polymeric, Ceramic, Hybrid), Module (Spiral Wound, Tubular, Hollow Fiber, Flat Sheet), Application (Municipal, Industrial), And Region (North America, Europe, Apac, South America, MEA) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ナノろ過膜の世界市場:タイプ別、モジュール別、用途別、地域別 - 予測(~2028年) |

|

出版日: 2023年09月11日

発行: MarketsandMarkets

ページ情報: 英文 235 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

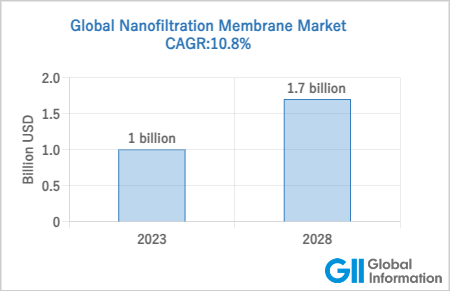

世界のナノろ過膜の市場規模は、2023年に10億米ドル、2028年までに17億米ドルに達し、予測期間中にCAGRで10.8%の成長が予測されています。

ナノろ過膜の需要は、清潔で安全な飲料水の必要性によって増加しています。ナノろ過膜は、廃水処理、食品・飲料加工、乳業などのさまざまな産業用途で使用されています。ナノろ過膜の需要は、これらの用途での有効性により増加しています。

"チューブラーが2022年に市場で2番目に大きい規模のモジュールである"

"地方自治体が2022年に市場で2番目に大きい規模の用途である"

ナノろ過膜は汚染物質を除去し水質を改善する効果があるため、地方自治体の廃水処理でますます使用されるようになっています。

"欧州は2022年に市場で3番目に大きい地域である"

欧州は2022年の市場において、金額ベースで3番目に大きい地域です。欧州は、深刻な水不足による社会的、経済的、環境的影響から安全です。しかし、需要が増加するにつれて、欧州の一部の地域では水ストレスの影響を受けやすくなっています。このような状況の原因は、過剰取水と少ない降水または干ばつの長期化です。欧州の水資源管理は、貯水池、流域間移動、地表水と地下水の両方の取水の増加などを組み合わせて、定期的に水を供給することに重点を置いています。これらすべての要因が、この地域の市場を牽引すると予測されています。

当レポートでは、世界のナノろ過膜市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ナノろ過膜市場の企業にとって魅力的な機会

- ナノろ過膜市場:タイプ別

- ナノろ過膜市場:モジュール別

- ナノろ過膜市場:用途別

- ナノろ過膜市場:主要国別

第5章 市場の概要

- イントロダクション

- 景気後退の影響の分析

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 原材料のサプライヤー

- メーカー

- 販売業者

- エンドユーザー

- ポーターのファイブフォース分析

- マクロ経済指標

- 規制情勢

- 規則

- 北米

- アジア太平洋

- 欧州

- 規制機関、政府機関、その他の組織

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 顧客のビジネスに影響を与える動向と混乱

- ケーススタディ分析

- 技術分析

- エコシステムマッピング

- 主な会議とイベント(2023年~2024年)

- 主なステークホルダーと購入基準

- 特許分析

第6章 ナノろ過膜市場:タイプ別

- イントロダクション

- ポリマー

- セラミック

- ハイブリッド

- その他のタイプ

第7章 ナノろ過膜市場:モジュール別

- イントロダクション

- 渦巻形

- チューブラー

- 中空糸

- フラットシート

- その他のモジュール

第8章 ナノろ過膜市場:用途別

- イントロダクション

- 地方自治体の処理

- 産業処理

第9章 ナノろ過膜市場:地域別

- イントロダクション

- アジア太平洋

- アジア太平洋に対する景気後退の影響

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 欧州

- 欧州に対する景気後退の影響

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- その他の欧州

- 北米

- 北米に対する景気後退の影響

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- 中東・アフリカに対する景気後退の影響

- サウジアラビア

- アラブ首長国連邦

- カタール

- オマーン

- その他の中東・アフリカ

- 南米

- ブラジル

- チリ

- その他の南米

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益分析

- 主要企業のランキング

- 市場シェア分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合ベンチマーキング

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- DUPONT

- TORAY INDUSTRIES, INC.

- VEOLIA

- ALFA LAVAL

- GEA GROUP

- HYDRANAUTICS

- NX FILTRATION BV

- PALL CORPORATION

- VONTRON TECHNOLOGY CO., LTD.

- PENTAIR

- KOCH MEMBRANE SYSTEMS

- INOPOR

- その他の企業

- SYNDER FILTRATION, INC.

- SOLSEP BV

- RISINGSUN MEMBRANE TECHNOLOGY (BEIJING) CO., LTD.

- UNISOL MEMBRANE TECHNOLOGY

- MEMBRANIUM

- KEENSEN TECHNOLOGY CO., LTD.

- JOZZON MEMBRANE TECHNOLOGY CO., LTD.

- WAVE CYBER(SHANGHAI)CO., LTD.

- MANN+HUMMEL

- APPLIED MEMBRANES, INC.

- SPX FLOW

- ORIGINWATER

- NOVASEP

第12章 付録

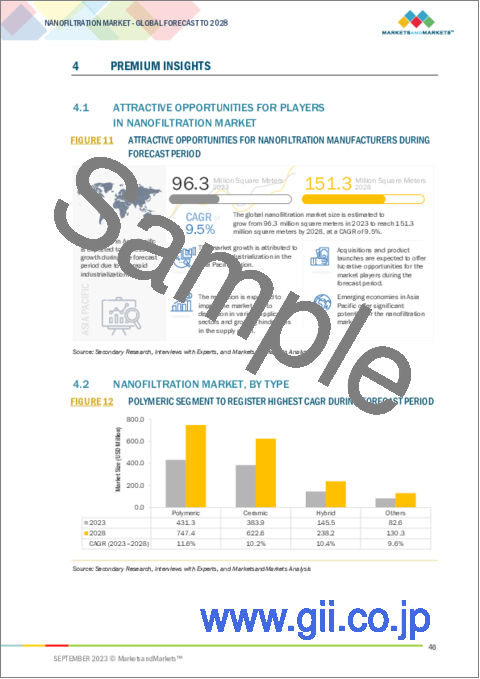

The global nanofiltration membrane market size is projected to reach USD 1.7 billion by 2028 from USD 1.0 billion in 2023, at a CAGR of 10.8% during the forecast period. The demand for nanofiltration membranes is increasing due to the need for clean and safe drinking water. Nanofiltration is an effective water treatment solution that can remove contaminants and impurities from water. Nanofiltration membranes are used in various industrial applications, including wastewater treatment, food and beverage processing, and the dairy industry. The demand for nanofiltration membranes is increasing due to their effectiveness in these applications.

"Tubular is the second largest in terms of value amongst other modules in the nanofiltration membranes market in 2022."

Tubular nanofiltration membrane modules are tube-like structures with porous walls that operate via tangential crossflow. The module is made of stainless steel and has a robust design that allows it to be used in systems designed for operation at up to 80 bars at 80°C, depending on the type of membrane fitted. Tubular nanofiltration membrane modules are used in various applications, including wastewater treatment, food & beverage processing, and the pharmaceutical industry. They are ideal for high solids/oily applications and can manage high concentrations of suspended solids.

"Municipal is the second largest in terms of value amongst other applications in the nanofiltration membranes market in 2022."

Nanofiltration membranes are increasingly being used in municipal wastewater treatment due to their effectiveness in removing contaminants and improving water quality. Nanofiltration membranes are employed in the treatment of municipal wastewater. They can effectively remove ions, organic substances, and other contaminants from the wastewater, improving its quality before discharge or reuse. Nanofiltration membranes offer advantages over conventional clarification and disinfection processes in municipal treatment. They have a smaller physical footprint, require less chemical addition, and provide consistent removal of particles and microbes.

"Europe is the third largest in the nanofiltration membranes market in 2022."

Europe is the third largest region amongst others in the nanofiltration membranes market in 2022 in terms of value. Europe has been secure from the social, economic, and environmental impacts of severe water shortages. However, as demand increases, some parts of Europe have become susceptible to water stress. The reason for this situation is the over-extraction and prolonged periods of low rainfall or drought. European water resources management focuses on a regular supply of water using a combination of reservoirs, inter-basin transfers, and increasing abstraction of both surface water and groundwater. All these factors are projected to drive the nanofiltration membranes market in the region.

The breakdown of primary interviews has been given below.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives - 20%, Director Level - 10%, Others - 70%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 30%, Middle East & Africa - 10%, South America-10%.

The key players in the nanofiltration membranes market DuPont Water Solutions (US), Toray Industries, Inc. (Japan), Veolia Environnement S.A. (France), Alfa Laval AB (Sweden), GEA Group AG (Germany), Hydranautics (US), NX Filtration (Netherlands), Pall Corporation (US), Vontron Technology Co., Ltd. (China), and Pentair (US) among others. The nanofiltration membranes market report analyzes the key growth strategies, such as new product launches, investments & expansions, agreements, partnerships, and mergers & acquisitions to strengthen their market positions.

Research Coverage

This report provides a detailed segmentation of the nanofiltration membranes market and forecasts its market size until 2028. The market has been segmented based on type (polymeric, ceramic, hybrid), module (spiral wound, tubular, hollow fiber, flat sheet), application (municipal, industrial), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisitions associated with the market for the nanofiltration membranes market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the nanofiltration membranes market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising industrialization and urbanization, Declining freshwater resources, Low energy consumption in nanofiltration), restraints (Fouling in nanofiltration membrane), opportunities (Rising advancements in nanofiltration membrane, Growing food & beverage industry), and challenges (Lack of awareness about advantages of membrane filtration) influencing the growth of the nanofiltration membranes market.

- Market Penetration: Comprehensive information on the nanofiltration membranes offered by top players in the global nanofiltration membranes market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the nanofiltration membranes market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for nanofiltration membranes market across regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the nanofiltration membranes market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 NANOFILTRATION MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 NANOFILTRATION MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 NANOFILTRATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 NANOFILTRATION MARKET: MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 NANOFILTRATION MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 NANOFILTRATION MARKET: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 NANOFILTRATION MARKET: DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 GROWTH FORECAST

- 2.5.1 SUPPLY-SIDE APPROACH

- 2.5.2 DEMAND-SIDE APPROACH

- 2.6 RISK ASSESSMENT

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 7 POLYMERIC SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 SPIRAL WOUND SEGMENT TO REGISTER HIGHEST GROWTH IN 2028

- FIGURE 9 INDUSTRIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NANOFILTRATION MARKET

- FIGURE 11 ATTRACTIVE OPPORTUNITIES FOR NANOFILTRATION MANUFACTURERS DURING FORECAST PERIOD

- 4.2 NANOFILTRATION MARKET, BY TYPE

- FIGURE 12 POLYMERIC SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NANOFILTRATION MARKET, BY MODULE

- FIGURE 13 SPIRAL WOUND SEGMENT TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- 4.4 NANOFILTRATION MARKET, BY APPLICATION

- FIGURE 14 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- 4.5 NANOFILTRATION MARKET, BY KEY COUNTRY

- FIGURE 15 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 RECESSION IMPACT ANALYSIS

- 5.3 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN NANOFILTRATION MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Rapid industrialization and urbanization

- 5.3.1.2 Declining freshwater resources

- 5.3.1.3 Low energy consumption

- 5.3.2 RESTRAINTS

- 5.3.2.1 Fouling in nanofiltration membranes

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological advancements in nanofiltration

- 5.3.3.2 Expansion into emerging markets

- 5.3.4 CHALLENGES

- 5.3.4.1 Low performance at high temperatures

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 17 NANOFILTRATION MARKET: VALUE CHAIN

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 MANUFACTURERS

- 5.4.3 DISTRIBUTORS

- 5.4.4 END USERS

- TABLE 2 NANOFILTRATION MARKET: VALUE CHAIN STAKEHOLDERS

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 NANOFILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 NANOFILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6 MACROECONOMIC INDICATORS

- 5.6.1 GLOBAL GDP TRENDS

- TABLE 4 PER CAPITA GDP TRENDS (USD), 2020-2022

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2023-2027

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATIONS

- 5.7.2 NORTH AMERICA

- 5.7.2.1 Clean Water Act

- 5.7.2.2 Safe Drinking Water Act

- 5.7.3 ASIA PACIFIC

- 5.7.3.1 Environmental Protection Law

- 5.7.3.2 Water Resources Law

- 5.7.3.3 Water Pollution Prevention and Control Law

- 5.7.3.4 Water Prevention and Control of Pollution Act

- 5.7.4 EUROPE

- 5.7.4.1 Urban Wastewater Treatment Directive

- 5.7.4.2 Drinking Water Directive

- 5.7.4.3 Water Framework Directive

- 5.7.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- TABLE 9 REGION-WISE IMPORT TRADE DATA (USD THOUSAND)

- FIGURE 19 REGION-WISE IMPORT TRADE DATA (USD THOUSAND)

- 5.8.2 EXPORT SCENARIO

- TABLE 10 REGION-WISE EXPORT TRADE DATA (USD THOUSAND)

- FIGURE 20 REGION-WISE EXPORT TRADE (USD THOUSAND)

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 REVENUE SHIFT AND NEW REVENUE POCKETS IN NANOFILTRATION MARKET

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 TORAY INDUSTRIES, INC.: NANOFILTRATION MEMBRANES FOR WATER TREATMENT

- 5.10.2 KOCH SEPARATION SOLUTIONS: NANOFILTRATION MEMBRANES FOR DAIRY INDUSTRY

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 ECOSYSTEM MAPPING

- FIGURE 22 NANOFILTRATION MARKET ECOSYSTEM

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 11 NANOFILTRATION MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 QUALITY

- 5.14.2 SERVICE

- FIGURE 23 SUPPLIER SELECTION CRITERION

- 5.15 PATENT ANALYSIS

- 5.15.1 INTRODUCTION

- 5.15.2 DOCUMENT TYPES

- FIGURE 24 PATENTS REGISTERED (2012-2022)

- 5.15.3 PUBLICATION TRENDS IN LAST 10 YEARS

- FIGURE 25 NUMBER OF PATENTS IN LAST 10 YEARS

- 5.15.4 INSIGHTS

- 5.15.5 JURISDICTION ANALYSIS

- FIGURE 26 TOP JURISDICTIONS

- 5.15.6 TOP APPLICANTS

- FIGURE 27 TOP APPLICANTS' ANALYSIS

- TABLE 12 PATENTS BY EVONIK OPERATIONS GMBH

- TABLE 13 PATENTS BY ECOLAB INC.

- TABLE 14 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 NANOFILTRATION MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 28 POLYMERIC MEMBRANES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 15 NANOFILTRATION MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 16 NANOFILTRATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 17 NANOFILTRATION MARKET, BY TYPE, 2019-2022 (MILLION SQUARE METER)

- TABLE 18 NANOFILTRATION MARKET, BY TYPE, 2023-2028 (MILLION SQUARE METER)

- 6.2 POLYMERIC

- 6.2.1 POROSITY AND PERMEABILITY OF POLYMERIC MEMBRANES TO DRIVE MARKET

- 6.2.2 POLYAMIDE

- 6.2.3 POLYSULFONE AND POLYETHERSULFONE

- 6.2.4 OTHERS

- 6.3 CERAMIC

- 6.3.1 RESISTANCE TO CONCENTRATED ACIDS AND CAUSTIC SOLUTIONS TO FUEL MARKET

- 6.3.2 ZIRCONIA

- 6.3.3 ALUMINA

- 6.3.4 TITANIA

- 6.3.5 OTHERS

- 6.4 HYBRID

- 6.4.1 HYDROPHILICITY AND CHEMICAL STABILITY TO DRIVE MARKET

- 6.5 OTHER TYPES

7 NANOFILTRATION MARKET, BY MODULE

- 7.1 INTRODUCTION

- FIGURE 29 SPIRAL WOUND SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 19 NANOFILTRATION MARKET, BY MODULE, 2019-2022 (USD MILLION)

- TABLE 20 NANOFILTRATION MARKET, BY MODULE, 2023-2028 (USD MILLION)

- TABLE 21 NANOFILTRATION MARKET, BY MODULE, 2019-2022 (MILLION SQUARE METER)

- TABLE 22 NANOFILTRATION MARKET, BY MODULE, 2023-2028 (MILLION SQUARE METER)

- 7.2 SPIRAL WOUND

- 7.2.1 OPTIMAL PERFORMANCE AND COST-EFFECTIVENESS TO DRIVE MARKET

- 7.3 TUBULAR

- 7.3.1 EFFICIENT SEPARATION OF PARTICLES AND SOLUTES TO DRIVE MARKET

- 7.4 HOLLOW FIBER

- 7.4.1 HIGH SURFACE AREA AND EFFECTIVE REMOVAL OF CONTAMINANTS TO FUEL MARKET

- 7.5 FLAT SHEET

- 7.5.1 INCREASING FILTRATION REQUIREMENTS FROM VARIOUS INDUSTRIES TO DRIVE MARKET

- 7.6 OTHER MODULES

8 NANOFILTRATION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 30 INDUSTRIAL TREATMENT TO GROW FASTER DURING FORECAST PERIOD

- TABLE 23 NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 24 NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 25 NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 26 NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 8.2 MUNICIPAL TREATMENT

- 8.2.1 NEED FOR WATER TREATMENT AND REUSE TO DRIVE MARKET

- 8.2.2 DESALINATION

- 8.2.3 UTILITY WATER TREATMENT

- 8.2.4 WASTEWATER REUSE

- 8.3 INDUSTRIAL TREATMENT

- 8.3.1 SELECTIVE SEPARATION OF IONS AND MOLECULES TO DRIVE MARKET

- 8.3.2 FOOD & BEVERAGE

- 8.3.2.1 Dairy processing

- 8.3.2.2 Food processing

- 8.3.2.3 Beverage processing

- 8.3.3 CHEMICAL & PETROCHEMICAL

- 8.3.4 PHARMACEUTICAL & MEDICAL

- 8.3.5 OTHERS

9 NANOFILTRATION MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 31 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 27 NANOFILTRATION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 NANOFILTRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 29 NANOFILTRATION MARKET, BY REGION, 2019-2022 (MILLION SQUARE METER)

- TABLE 30 NANOFILTRATION MARKET, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 9.2 ASIA PACIFIC

- 9.2.1 RECESSION IMPACT ON ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: NANOFILTRATION MARKET SNAPSHOT

- TABLE 31 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 32 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE METER)

- TABLE 34 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- TABLE 35 ASIA PACIFIC: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 36 ASIA PACIFIC: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (MILLION SQUARE METER)

- TABLE 38 ASIA PACIFIC: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (MILLION SQUARE METER)

- TABLE 39 ASIA PACIFIC: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (USD MILLION)

- TABLE 40 ASIA PACIFIC: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (MILLION SQUARE METER)

- TABLE 42 ASIA PACIFIC: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (MILLION SQUARE METER)

- TABLE 43 ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 44 ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 46 ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.2.2 CHINA

- 9.2.2.1 Implementing clean-up strategies and water pollution prevention laws to drive market

- TABLE 47 CHINA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 48 CHINA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 49 CHINA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 50 CHINA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.2.3 JAPAN

- 9.2.3.1 Development of advanced technologies and industrial sector to fuel market

- TABLE 51 JAPAN: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 52 JAPAN: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 53 JAPAN: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 54 JAPAN: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.2.4 INDIA

- 9.2.4.1 Growing demand from end-use industries to drive market

- TABLE 55 INDIA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 56 INDIA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 57 INDIA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 58 INDIA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.2.5 SOUTH KOREA

- 9.2.5.1 Rising demand from food & beverage industry to boost market

- TABLE 59 SOUTH KOREA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 60 SOUTH KOREA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 61 SOUTH KOREA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 62 SOUTH KOREA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.2.6 REST OF ASIA PACIFIC

- TABLE 63 REST OF ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 66 REST OF ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT ON EUROPE

- FIGURE 33 SPIRAL WOUND TYPE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 67 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 68 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 69 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE METER)

- TABLE 70 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- TABLE 71 EUROPE: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 72 EUROPE: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 73 EUROPE: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (MILLION SQUARE METER)

- TABLE 74 EUROPE: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (MILLION SQUARE METER)

- TABLE 75 EUROPE: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (USD MILLION)

- TABLE 76 EUROPE: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (USD MILLION)

- TABLE 77 EUROPE: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (MILLION SQUARE METER)

- TABLE 78 EUROPE: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (MILLION SQUARE METER)

- TABLE 79 EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 80 EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 81 EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 82 EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.3.2 GERMANY

- 9.3.2.1 Highest EU standards for wastewater treatment to drive growth

- TABLE 83 GERMANY: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 84 GERMANY: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 85 GERMANY: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 86 GERMANY: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.3.3 UK

- 9.3.3.1 Rapid urbanization and industrialization to drive market

- TABLE 87 UK: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 88 UK: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 89 UK: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 90 UK: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.3.4 FRANCE

- 9.3.4.1 Advancements in water treatment infrastructure to boost market

- TABLE 91 FRANCE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 92 FRANCE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 93 FRANCE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 94 FRANCE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.3.5 ITALY

- 9.3.5.1 Rising demand from pharmaceutical sector to drive market

- TABLE 95 ITALY: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 96 ITALY: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 97 ITALY: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 98 ITALY: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.3.6 SPAIN

- 9.3.6.1 High production of desalinated water to fuel demand for nanofiltration membranes

- TABLE 99 SPAIN: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 100 SPAIN: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 101 SPAIN: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 102 SPAIN: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.3.7 NETHERLANDS

- 9.3.7.1 Well-organized water supply system and sewage facilities to drive growth

- TABLE 103 NETHERLANDS: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 104 NETHERLANDS: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 105 NETHERLANDS: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 106 NETHERLANDS: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.3.8 REST OF EUROPE

- TABLE 107 REST OF EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 110 REST OF EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.4 NORTH AMERICA

- 9.4.1 RECESSION IMPACT ON NORTH AMERICA

- FIGURE 34 NORTH AMERICA: NANOFILTRATION MARKET SNAPSHOT

- TABLE 111 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE METER)

- TABLE 114 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- TABLE 115 NORTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (MILLION SQUARE METER)

- TABLE 118 NORTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (MILLION SQUARE METER)

- TABLE 119 NORTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (MILLION SQUARE METER)

- TABLE 122 NORTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (MILLION SQUARE METER)

- TABLE 123 NORTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 124 NORTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 126 NORTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.4.2 US

- 9.4.2.1 Various government initiatives for wastewater treatment to drive market

- TABLE 127 US: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 128 US: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 129 US: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 130 US: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.4.3 CANADA

- 9.4.3.1 State- and national-level municipal regulations to drive growth

- TABLE 131 CANADA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 132 CANADA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 133 CANADA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 134 CANADA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.4.4 MEXICO

- 9.4.4.1 High demand from manufacturing and agriculture sector to fuel market

- TABLE 135 MEXICO: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 136 MEXICO: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 137 MEXICO: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 138 MEXICO: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- TABLE 139 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE METER)

- TABLE 142 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- TABLE 143 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (MILLION SQUARE METER)

- TABLE 146 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (MILLION SQUARE METER)

- TABLE 147 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (MILLION SQUARE METER)

- TABLE 150 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (MILLION SQUARE METER)

- TABLE 151 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 154 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.5.2 SAUDI ARABIA

- 9.5.2.1 Growth of tourism and chemical industry to drive market

- TABLE 155 SAUDI ARABIA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 156 SAUDI ARABIA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 157 SAUDI ARABIA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 158 SAUDI ARABIA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.5.3 UAE

- 9.5.3.1 New water treatment infrastructure and sustainable practices to drive market

- TABLE 159 UAE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 160 UAE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 161 UAE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 162 UAE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.5.4 QATAR

- 9.5.4.1 Reuse of treated wastewater for industrial and irrigation purposes to drive market

- TABLE 163 QATAR: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 164 QATAR: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 165 QATAR: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 166 QATAR: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.5.5 OMAN

- 9.5.5.1 Increasing domestic and industrial water requirements to fuel market

- TABLE 167 OMAN: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 168 OMAN: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 169 OMAN: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 170 OMAN: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 171 REST OF MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.6 SOUTH AMERICA

- TABLE 175 SOUTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 176 SOUTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 177 SOUTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE METER)

- TABLE 178 SOUTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- TABLE 179 SOUTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 180 SOUTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2019-2022 (MILLION SQUARE METER)

- TABLE 182 SOUTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2023-2028 (MILLION SQUARE METER)

- TABLE 183 SOUTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (USD MILLION)

- TABLE 184 SOUTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2019-2022 (MILLION SQUARE METER)

- TABLE 186 SOUTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2023-2028 (MILLION SQUARE METER)

- TABLE 187 SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 189 SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 190 SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.6.1 BRAZIL

- 9.6.1.1 Smart water management techniques and foreign investments to drive growth

- TABLE 191 BRAZIL: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 192 BRAZIL: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 193 BRAZIL: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 194 BRAZIL: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.6.2 CHILE

- 9.6.2.1 Well-developed water supply channels and use of sustainable resources to drive market

- TABLE 195 CHILE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 196 CHILE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 197 CHILE: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 198 CHILE: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 9.6.3 REST OF SOUTH AMERICA

- TABLE 199 REST OF SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE METER)

- TABLE 202 REST OF SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 203 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2023

- 10.3 REVENUE ANALYSIS

- TABLE 204 REVENUE ANALYSIS OF KEY COMPANIES, 2020-2022

- 10.4 RANKING OF KEY PLAYERS

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN NANOFILTRATION MARKET

- 10.5 MARKET SHARE ANALYSIS

- FIGURE 36 NANOFILTRATION MARKET SHARE, BY COMPANY (2022)

- TABLE 205 NANOFILTRATION MARKET: DEGREE OF COMPETITION

- 10.6 COMPANY EVALUATION MATRIX

- 10.6.1 STARS

- 10.6.2 PERVASIVE PLAYERS

- 10.6.3 EMERGING LEADERS

- 10.6.4 PARTICIPANTS

- FIGURE 37 NANOFILTRATION MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.7 STARTUP/SME EVALUATION MATRIX

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 STARTING BLOCKS

- 10.7.4 DYNAMIC COMPANIES

- FIGURE 38 NANOFILTRATION MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 10.8 COMPETITIVE BENCHMARKING

- TABLE 206 COMPANIES IN NANOFILTRATION MARKET

- TABLE 207 NANOFILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY TYPE

- TABLE 208 NANOFILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY MODULE

- TABLE 209 NANOFILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY APPLICATION

- TABLE 210 NANOFILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- TABLE 211 NANOFILTRATION: PRODUCT LAUNCHES/DEVELOPMENTS, 2018-2023

- 10.9.2 DEALS

- TABLE 212 NANOFILTRATION: DEALS, 2018-2023

- 10.9.3 OTHERS

- TABLE 213 NANOFILTRATION: OTHERS, 2018-2023

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1 KEY PLAYERS

- 11.1.1 DUPONT

- TABLE 214 DUPONT: COMPANY OVERVIEW

- FIGURE 39 DUPONT: COMPANY SNAPSHOT

- TABLE 215 DUPONT: PRODUCTS OFFERED

- TABLE 216 DUPONT: DEALS

- TABLE 217 DUPONT: OTHER DEVELOPMENTS

- 11.1.2 TORAY INDUSTRIES, INC.

- TABLE 218 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 40 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 219 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 220 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 221 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- 11.1.3 VEOLIA

- TABLE 222 VEOLIA: COMPANY OVERVIEW

- FIGURE 41 VEOLIA: COMPANY SNAPSHOT

- TABLE 223 VEOLIA: PRODUCTS OFFERED

- TABLE 224 VEOLIA: DEALS

- TABLE 225 VEOLIA: PRODUCT LAUNCHES

- TABLE 226 VEOLIA: OTHER DEVELOPMENTS

- 11.1.4 ALFA LAVAL

- TABLE 227 ALFA LAVAL: COMPANY OVERVIEW

- FIGURE 42 ALFA LAVAL: COMPANY SNAPSHOT

- TABLE 228 ALFA LAVAL: PRODUCTS OFFERED

- TABLE 229 ALFA LAVAL: DEALS

- 11.1.5 GEA GROUP

- TABLE 230 GEA GROUP: COMPANY OVERVIEW

- FIGURE 43 GEA GROUP: COMPANY SNAPSHOT

- TABLE 231 GEA GROUP: PRODUCTS OFFERED

- TABLE 232 GEA GROUP: PRODUCT LAUNCHES

- 11.1.6 HYDRANAUTICS

- TABLE 233 HYDRANAUTICS: COMPANY OVERVIEW

- TABLE 234 HYDRANAUTICS: PRODUCTS OFFERED

- TABLE 235 HYDRANAUTICS: PRODUCT LAUNCHES

- 11.1.7 NX FILTRATION BV

- TABLE 236 NX FILTRATION BV: COMPANY OVERVIEW

- FIGURE 44 NX FILTRATION BV: COMPANY SNAPSHOT

- TABLE 237 NX FILTRATION BV: PRODUCTS OFFERED

- TABLE 238 NX FILTRATION BV: OTHER DEVELOPMENTS

- 11.1.8 PALL CORPORATION

- TABLE 239 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 240 PALL CORPORATION: PRODUCTS OFFERED

- TABLE 241 PALL CORPORATION: OTHER DEVELOPMENTS

- 11.1.9 VONTRON TECHNOLOGY CO., LTD.

- TABLE 242 VONTRON TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 243 VONTRON TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 11.1.10 PENTAIR

- TABLE 244 PENTAIR: COMPANY OVERVIEW

- FIGURE 45 PENTAIR: COMPANY SNAPSHOT

- TABLE 245 PENTAIR: PRODUCTS OFFERED

- TABLE 246 PENTAIR: DEALS

- 11.1.11 KOCH MEMBRANE SYSTEMS

- TABLE 247 KOCH MEMBRANE SYSTEMS: COMPANY OVERVIEW

- TABLE 248 KOCH MEMBRANE SYSTEMS: PRODUCTS OFFERED

- TABLE 249 KOCH MEMBRANE SYSTEMS: DEALS

- TABLE 250 KOCH MEMBRANE SYSTEMS: PRODUCT LAUNCHES

- TABLE 251 KOCH MEMBRANE SYSTEMS: OTHER DEVELOPMENTS

- 11.1.12 INOPOR

- TABLE 252 INOPOR: COMPANY OVERVIEW

- TABLE 253 INOPOR: PRODUCTS OFFERED

- 11.2 OTHER PLAYERS

- 11.2.1 SYNDER FILTRATION, INC.

- 11.2.2 SOLSEP BV

- 11.2.3 RISINGSUN MEMBRANE TECHNOLOGY (BEIJING) CO., LTD.

- 11.2.4 UNISOL MEMBRANE TECHNOLOGY

- 11.2.5 MEMBRANIUM

- 11.2.6 KEENSEN TECHNOLOGY CO., LTD.

- 11.2.7 JOZZON MEMBRANE TECHNOLOGY CO., LTD.

- 11.2.8 WAVE CYBER(SHANGHAI)CO., LTD.

- 11.2.9 MANN+HUMMEL

- 11.2.10 APPLIED MEMBRANES, INC.

- 11.2.11 SPX FLOW

- 11.2.12 ORIGINWATER

- 11.2.13 NOVASEP

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS