|

|

市場調査レポート

商品コード

1345516

OEおよび交換用自動車タイヤの世界市場:リムサイズ別、アスペクト比別、断面幅別、シーズン別、車両タイプ別、リトレッド別 、地域別-2028年までの予測Automotive Tires Market for OE & Replacement By Rim, Aspect Ratio, Section Width, Season, Vehicle Type, Retreading & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| OEおよび交換用自動車タイヤの世界市場:リムサイズ別、アスペクト比別、断面幅別、シーズン別、車両タイプ別、リトレッド別 、地域別-2028年までの予測 |

|

出版日: 2023年09月04日

発行: MarketsandMarkets

ページ情報: 英文 340 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

タイヤアフターマーケットは、CAGR 2.0%で2023年の196億米ドルから2028年には216億米ドルに成長すると予測されています。

一人当たりの自動車保有台数の増加、顧客の低転がり抵抗タイヤへの需要のシフト、自動車の平均走行距離の増加が、アフターマーケットタイヤの成長を促進します。タイヤのアフターマーケット需要の増加は、乗用車市場の成長と、個人的な自動車利用の増加による中古車走行台数の増加によって予想されます。インターネット普及率の上昇と新たな技術進歩もタイヤアフターマーケットを牽引する要因です。

北米市場は、新車生産台数の増加と中古車市場の開拓によって牽引されています。小型商用車と大型商用車の保有台数が多いため、平均走行距離が比較的長く、より多くのタイヤ交換が必要となります。HCV用アフターマーケットタイヤの価格は230~250米ドルですが、同寸法のリトレッドタイヤは40%近く安くなります。

この地域でのリトレッド施設の拡大も、予測期間中にリトレッドタイヤの需要を増加させると思われます。さらに、リトレッドタイヤにはトレッド寿命の改善、コスト削減、燃費効率などの特典があります。リトレッドタイヤは製造時に使用するエネルギーや原材料が少ないため、新品タイヤよりも環境に優しいです。有利な政府規制とリトレッドタイヤの使用の増加は、このセクターに新たな成長の展望を開くと予測されています。しかし、使い古されたタイヤのケーシングは、インフラストラクチャーのコードに手を加えることなく、新しいゴム被覆が施されます。その結果、リトレッドタイヤの品質は常に新品タイヤよりも大幅に低下します。

ロープロファイルタイヤの人気が高まっており、その断面幅は断面高さよりも重要です。断面幅が広いと、車両の安定性が増し、重量が軽くなり、積載重量が増加しても対応できるようになり、燃費が向上します。プレミアム乗用車の断面幅は通常230mm以上です。北米では、GMグループのキャデラック、FCAダッジ課題、タタ・レンジローバースポーツ、BMW5シリーズ、アウディQ5などがその例です。タイヤの交換サイクルが最も多いセグメントは、プレミアムカーであると言われています。大型商用車のセクション幅は85%から90%です。

北米は、自動車の製造・販売において2番目に著名な場所です。この地域は、2023年の世界自動車生産に24%、世界自動車販売に26%貢献しています。この地域には、Goodyear Tire &Rubber Company(米国)、Cooper Tire &Rubber Company(米国)、Pirelli &C. S.p.A.(イタリア)、Michelin(フランス)、Bridgestone(日本)など、自動車タイヤOE市場の主要参入企業がいます。フォード(米国)、ゼネラル・モーターズ(米国)、フィアット・クライスラー(英国)の3大自動車メーカーを擁する米国は、プレミアム乗用車の産地として知られています。高級車やプレミアムセグメント車への高い需要が、北米の自動車用タイヤOE市場を牽引すると予想されます。さらに、北米は世界の自動車台数の約30%に寄与している(2022年)。

安定性と信頼性の向上、運転寿命の延長、高い耐パンク性能のために、超高性能車におけるプレミアム品質のタイヤに対する需要の高まりが、市場のニーズを押し上げると予想されます。これに加え、交通事故による死亡者数の増加により、 促進要因と同乗者の安全性を高めることが重視されるようになっていることも、同地域の市場にプラスの影響を与えています。さらに、雪や氷のような悪天候時に冬用タイヤの使用が増加することで、タイヤ市場が拡大する可能性が高いとみられています。さらに、制動力の向上、総合的な安全性の向上、ハンドリングの改善など、多くの利点があるため、荷物を時間通りに届けるための物流・輸送活動でプレミアムタイヤと車両が好まれる傾向が強まっており、この地域全体の市場に明るい見通しを生み出しています。

当レポートでは、世界のOEおよび交換用自動車タイヤ市場について調査し、リム別、アスペクト比別、断面幅別、シーズン別、車両タイプ別、リトレッド別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ケーススタディ

- 特許分析

- 貿易分析

- サプライチェーン分析

- 市場エコシステム

- 価格分析

- 市場に影響を与える動向/混乱

- 規制の枠組み

- 技術動向

- 2023年~2024年の主要な会議とイベント

- 主要な利害関係者と購入基準

第6章 市場別推奨事項

第7章 自動車用タイヤのアフターマーケット、断面幅別

- イントロダクション

- 200MM未満

- 200~230MM

- 230MM超

第8章 自動車用タイヤのアフターマーケット、アスペクト比別

- イントロダクション

- 60未満

- 60~70

- 70超

第9章 自動車用タイヤのアフターマーケット、リムサイズ別

- イントロダクション

- 13~15インチ

- 16~18インチ

- 19~21インチ

- >21インチ

第10章 自動車用タイヤのアフターマーケット、シーズン別

- イントロダクション

- 夏用タイヤ

- 冬用タイヤ

- オールシーズンタイヤ

第11章 自動車用タイヤのアフターマーケット、車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

第12章 自動車用タイヤのリトレッド市場、車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

第13章 自動車用タイヤのOE市場、車両タイプおよびリムサイズ別

- イントロダクション

- 乗用車

- 小型商用車

- バス

- トラック

第14章 自動車用タイヤのOE市場、タイヤタイプ別

- イントロダクション

- ラジアルタイヤ

- バイアスタイヤ

第15章 自動車用タイヤのOE市場、地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- ラテンアメリカ

- 中東・アフリカ

第16章 競合情勢

- 概要

- 主要企業の収益分析、2020~2022年

- 企業評価マトリックス:乗用車および小型商用車用タイヤメーカー

- 企業評価マトリックス:トラックおよびバス用タイヤメーカー

- 競合シナリオ

- お得情報

- その他の開発

- 主要企業が採用した戦略、2022~2023年

- 競合ベンチマーキング

第17章 企業プロファイル

- 主要参入企業

- BRIDGESTONE CORPORATION

- CONTINENTAL AG

- GOODYEAR TIRE & RUBBER COMPANY

- MICHELIN

- PIRELLI & C. S.P.A.

- SUMITOMO RUBBER INDUSTRIES LTD.

- HANKOOK TIRE & TECHNOLOGY

- YOKOHAMA RUBBER CO., LTD.

- COOPER TIRE & RUBBER COMPANY

- TOYO TIRE CORPORATION

- その他の企業

- ZHONGCE RUBBER GROUP CO., LTD.

- MAXXIS INTERNATIONAL

- DUNLOP

- KUMHO TIRE

- NOKIAN TYRES PLC

- APOLLO TYRES LTD.

- MRF LTD.

- JK TYRE & INDUSTRIES LTD.

- CEAT LTD.

- NEXEN TIRE CORPORATION

第18章 付録

The tire aftermarket is projected to grow from USD 19.6 billion in 2023 to USD 21.6 billion by 2028 at a CAGR of 2.0%. The growth in automobile ownership per capita, a shift in customers' demand to use low rolling resistance tires, and increase in average miles driven by the vehicles will fuel the growth of the aftermarket tires. An increase in tire aftermarket demand is anticipated due to the growth in the market for passenger vehicles and the rise in the number of used automobiles on the road due to greater personal vehicle use. Increasing internet penetration and emerging technical advancements are other factors driving the tire aftermarket.

"North America to be the largest market for retreading."

North American market is driven by increased production of new cars coupled with the development of used cars. The higher fleet of light and heavy commercial vehicles have relatively higher average miles, requiring more tire replacement. The cost of aftermarket tires for an HCV is USD 230-250, whereas a retreaded tire of similar dimensions can cost almost 40% less.

Expanding retreading facilities in this area will also increase demand for retreaded tires during the forecast period. In addition, retread tires come with benefits such as improved tread life quality, cost savings, and fuel efficiency. Retreaded tires are more environmentally friendly than new tires since they use less energy and raw materials during production. Favorable government regulations and a rise in the use of retreaded tires are predicted to open up new growth prospects in this sector. However, a worn-out tire's casing is given a fresh rubber coat without modifying the infrastructure's cords. As a result, the quality of the retreaded tires always stays a lot down than that of the new tire.

"Section width of >230 mm is the fastest-growing segment in the tires replacement market."."

Low-profile tires are becoming increasingly popular, and their section width is more significant than their section height. Full section width gives increased vehicle stability, lighter weight, ability to handle increased payload weight, and improved fuel economy. Premium passenger cars typically have section widths greater than 230 mm. In North America, examples of such vehicles are the GM Group Cadillac, FCA Dodge Challenger, Tata Range Rover Sport, BMW 5 series, Audi Q5, and others. The segment with the most tire replacement cycles is reportedly premium cars. The section width of heavy commercial vehicles ranges from 85% to 90%.

"North America is the second largest market by volume for automotive tire aftermarket."

North America is the second most prominent location for manufacturing and sales of vehicles. The region contributed 24% to global vehicle production and 26% to global vehicle sales in 2023. The region is home to key players in the automotive tire OE market, such as Goodyear Tire & Rubber Company (US), Cooper Tire & Rubber Company (US), Pirelli & C. S.p.A. (Italy), Michelin (France), and Bridgestone (Japan). The US, which is home to the big three vehicle manufacturers, including Ford (US), General Motors (US), and Fiat Chrysler (UK), is known for premium passenger cars. High demand for luxury and premium segment vehicles is expected to drive North America's automotive tire OE market. Furthermore, North America contributes to ~30% of the global vehicle parc (2022).

A rise in the demand for premium quality tires in ultra-high-performance vehicles for enhanced stability and reliability, longer operational life, and high puncture resistance is expected to boost the need for the market. Along with this, the growing emphasis on enhancing driver and passenger safety due to the rising incidence of deadly traffic accidents is influencing the market positively in the region. Additionally, the growing use of winter tires during severe weather events like snow and ice will likely increase the tire market. Furthermore, the growing preference for premium tires and vehicles for logistics and transportation activities to deliver packages on time due to their many benefits, including improved stopping power, increased overall safety, and better handling, creates a positive outlook for the market across the region.

The break-up of the profile of primary participants in the automotive tire market:

By Companies: Tier 1 - 80%, Tier 2 - 20%

By Designation: Directors- 10%, C-Level Executives - 60%, Manager level - 30%

By Region: North America - 10%, Europe - 0%, APAC - 90% and MEA - 0%

Global players dominate the automotive tire market and comprise several regional players. The key players in the automotive tire market are Bridgestone Corporation (Japan), Goodyear Tire & Rubber Company (United States), Continental AG (Germany), Michelin (France), and Sumitomo Rubber Industries (Japan).

Research Coverage:

This Research Report Categorizes The Tire Market By Automotive Tire Aftermarket,

By Section Width And Vehicle Type (<200 Mm, 200-230 Mm, and >230 Mm), Automotive Tire Aftermarket, By Aspect Ratio And Vehicle Type (<60, 60-70, and >70), Automotive Tire Aftermarket, By Rim Size And Vehicle Type (13-15", 16-18", 19-21", and > 21"), Automotive Tire Retreading Market, By Vehicle Type (Passenger Cars, Light, and Heavy Commercial Vehicles), Automotive Tire Oe Market, By Vehicle Type And Rim Size (Passenger Cars, Light Commercial Vehicles, Buses, and Trucks), Automotive Tire Aftermarket Market, By Season (Summer, Winter And All Season), Automotive Tire Aftermarket,

By Vehicle Type (Passenger Cars, Light, and Heavy Commercial Vehicles), by Automotive Tire OE Market, By Type (Radial And Bias), And By Region (Asia Pacific, Europe, North America, And Rest Of The World).

The report's scope covers detailed information regarding the major factors, such as influencing factors for the growth of the automotive tire market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, recession impact, and recent developments associated with the automotive tire market.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall automotive tire market and their subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing average life of vehicles and annual miles driven by light-duty vehicles, increase in demand for high-performance tires, and high demand for low rolling resistance tires), restraints (Volatility in raw material prices and increasing longevity of tires affecting aftermarket sales), opportunities (Demand for eco-friendly tires owing to stringent regulations, Increased use of bio-oils in the manufacturing process of tires, connected/ smart tires for autonomous cars), and challenges (Increasing number of mandatory tests to be performed before commercial use of tires and investing in R&D for effective and sustainable waste management solutions to incur additional cost) influencing the growth of the automotive tire market.

- Product Development/Innovation: Detailed insights on new products such as ADVAN V61 Tires by Yokohama Rubber Co., Ltd. in July 2023 and Procontrol launched by Cooper Tire & Rubber in May 2023.

- Market Development: The growing demand for passenger cars and rising demand for commercial is driving the market - the report analyses the automotive tire market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive tire market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Bridgestone Corporation (Japan), Goodyear Tire & Rubber Company (US), Continental AG (Germany), Michelin (France), and Sumitomo Rubber Industries (Japan). among others in the automotive tire market.

The report also helps stakeholders understand the pulse of the automotive tire market by providing information on recent trends and technologies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 AUTOMOTIVE TIRE MARKET OE & REPLACEMENT SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE TIRE MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for market sizing

- 2.1.1.2 Key secondary sources for vehicle production

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 Sampling techniques & data collection methods

- 2.1.2.2 Primary participants

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 AUTOMOTIVE TIRE OE MARKET (RIM SIZE AND REGIONAL/COUNTRY LEVEL)

- FIGURE 6 AUTOMOTIVE TIRE AFTERMARKET (BY VEHICLE TYPE AND REGION)

- FIGURE 7 AUTOMOTIVE TIRE RETREADING MARKET (BY REGION AND VEHICLE TYPE)

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE TIRE OE MARKET (TIRE TYPE)

- FIGURE 9 AUTOMOTIVE TIRE AFTERMARKET (BY SECTION WIDTH, ASPECT RATIO, RIM SIZE, AND SEASON)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 10 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS AND ASSOCIATED RISKS

- 2.5.1 AVERAGE NUMBER OF TIRES EMPLOYED, BY VEHICLE TYPE

- 2.5.2 AVERAGE NUMBER OF TIRES REPLACED IN SINGLE SERVICE CYCLE, BY VEHICLE TYPE

- 2.6 RESEARCH LIMITATIONS

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 11 AUTOMOTIVE TIRE MARKET OUTLOOK

- FIGURE 12 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 AUTOMOTIVE TIRE AFTERMARKET MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE TIRE MARKET

- FIGURE 14 INCREASING DEMAND FOR HIGH-PERFORMANCE TIRES TO DRIVE MARKET

- 4.2 AUTOMOTIVE TIRE AFTERMARKET, BY REGION

- FIGURE 15 NORTH AMERICA TO DOMINATE AUTOMOTIVE TIRE AFTERMARKET FROM 2023 TO 2028

- 4.3 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON

- FIGURE 16 WINTER TIRES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH

- FIGURE 17 >230 MM SEGMENT TO LEAD AUTOMOTIVE TIRE AFTERMARKET DURING FORECAST PERIOD

- 4.5 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO

- FIGURE 18 >70 SEGMENT TO LEAD AUTOMOTIVE TIRE AFTERMARKET DURING FORECAST PERIOD

- 4.6 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE

- FIGURE 19 19-21" SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.7 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE

- FIGURE 20 LIGHT COMMERCIAL VEHICLES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.8 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE

- FIGURE 21 HEAVY COMMERCIAL VEHICLES SEGMENT TO DOMINATE AUTOMOTIVE TIRE RETREADING MARKET FROM 2023 TO 2028

- 4.9 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE

- FIGURE 22 PASSENGER CARS SEGMENT TO LEAD AUTOMOTIVE TIRE MARKET DURING FORECAST PERIOD

- 4.10 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE

- FIGURE 23 RADIAL TIRES SEGMENT TO LEAD AUTOMOTIVE TIRE OE MARKET DURING FORECAST PERIOD

- 4.11 AUTOMOTIVE TIRE OE MARKET, BY REGION

- FIGURE 24 ASIA PACIFIC ESTIMATED TO DOMINATE AUTOMOTIVE TIRE OE MARKET IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 AUTOMOTIVE TIRE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing average life of vehicles and average annual miles driven by light-duty vehicles

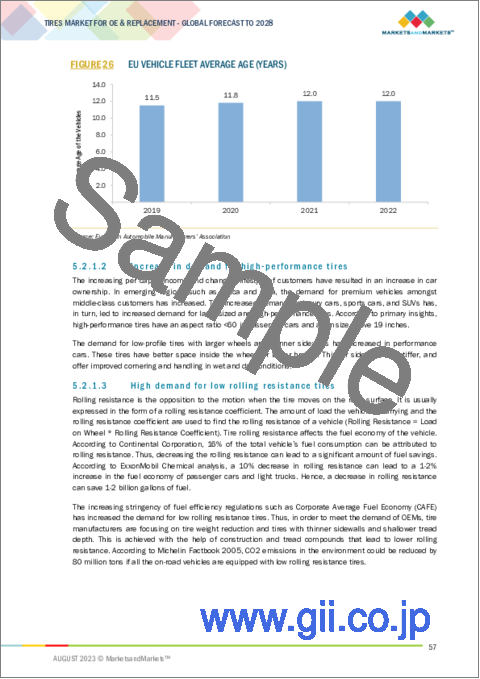

- FIGURE 26 EU VEHICLE FLEET AVERAGE AGE (YEARS)

- 5.2.1.2 Increase in demand for high-performance tires

- 5.2.1.3 High demand for low rolling resistance tires

- TABLE 2 TIRE EFFICIENCY CLASSIFICATION

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.2.2 Increasing longevity of tires affecting aftermarket sales

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising popularity of eco-friendly tires owing to stringent regulations

- TABLE 3 TIRE MANUFACTURERS FOCUS ON ECO-FRIENDLY MATERIALS

- 5.2.3.2 Increased use of bio-oil in tire manufacturing processes

- 5.2.3.3 Rising demand for connected/smart tires for autonomous cars

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing number of mandatory tests for tires before commercialization

- 5.2.4.2 Need for investment in R&D for effective and sustainable waste management solutions

- 5.3 CASE STUDY

- 5.3.1 MRF TYRES

- 5.3.2 JK TYRE & INDUSTRIES LTD.

- 5.4 PATENT ANALYSIS

- TABLE 4 PATENT ANALYSIS

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT DATA

- 5.5.1.1 US

- TABLE 5 US: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.1.2 Canada

- TABLE 6 CANADA: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.1.3 China

- TABLE 7 CHINA: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.1.4 Japan

- TABLE 8 JAPAN: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.1.5 India

- TABLE 9 INDIA: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.1.6 Germany

- TABLE 10 GERMANY: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.1.7 France

- TABLE 11 FRANCE: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.2 EXPORT DATA

- 5.5.2.1 US

- TABLE 12 US: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.2.2 Canada

- TABLE 13 CANADA: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.2.3 China

- TABLE 14 CHINA: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.2.4 Japan

- TABLE 15 JAPAN: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.2.5 India

- TABLE 16 INDIA: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.2.6 Germany

- TABLE 17 GERMANY: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.2.7 France

- TABLE 18 FRANCE: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- 5.5.1 IMPORT DATA

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 27 SUPPLY CHAIN ANALYSIS: AUTOMOTIVE TIRE MARKET

- 5.7 MARKET ECOSYSTEM

- FIGURE 28 AUTOMOTIVE TIRE MARKET ECOSYSTEM

- TABLE 19 ROLE OF COMPANIES IN AUTOMOTIVE TIRE MARKET ECOSYSTEM

- 5.8 PRICING ANALYSIS

- 5.8.1 BY REGION & RIM SIZE, 2022 (USD)

- TABLE 20 AVERAGE PRICE OF AUTOMOTIVE OE TIRES, BY REGION & RIM SIZE, 2022 (USD)

- 5.8.2 BY REGION & VEHICLE TYPE, 2022 (USD)

- TABLE 21 AVERAGE PRICE OF AUTOMOTIVE AFTERMARKET TIRES, BY REGION & VEHICLE TYPE, 2022 (USD)

- 5.8.3 BY RAW MATERIAL

- TABLE 22 AVERAGE PRICE OF AUTOMOTIVE TIRES, BY REGION & RAW MATERIAL, 2022 (USD)

- 5.9 TRENDS/DISRUPTIONS IMPACTING MARKET

- FIGURE 29 REVENUE SHIFT FOR AUTOMOTIVE TIRE MARKET

- 5.10 REGULATORY FRAMEWORK

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.1 North America

- TABLE 23 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.2 Europe

- TABLE 24 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.3 Asia Pacific

- TABLE 25 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 TECHNOLOGY TRENDS

- 5.11.1 SMART TIRES

- 5.11.2 3D-PRINTED TIRES

- 5.11.3 RUN-FLAT TIRES

- 5.11.4 INTELLIGENT TIRES

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR AUTOMOTIVE TIRES

- TABLE 26 KEY BUYING CRITERIA FOR AUTOMOTIVE TIRES

- 5.13.2 KEY STAKEHOLDERS IN BUYING PROCESS, BY VEHICLE TYPE

- TABLE 27 KEY STAKEHOLDERS IN BUYING PROCESS FOR VEHICLE TYPES

6 RECOMMENDATIONS BY MARKETSANDMARKETS

- 6.1 ASIA PACIFIC: KEY MARKET FOR AUTOMOTIVE TIRE MANUFACTURERS

- 6.2 COMPANIES TO ENHANCE FOCUS ON HIGH-PERFORMANCE AND GREEN TIRES

- 6.3 CONCLUSION

7 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH

- 7.1 INTRODUCTION

- 7.1.1 INDUSTRY INSIGHTS

- FIGURE 31 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2023 VS. 2028 (USD MILLION)

- TABLE 28 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2019-2022 (MILLION UNITS)

- TABLE 29 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2023-2028 (MILLION UNITS)

- TABLE 30 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2019-2022 (USD MILLION)

- TABLE 31 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2023-2028 (USD MILLION)

- 7.2 <200 MM

- 7.2.1 GROWING DEMAND FOR COMPACT AND SUBCOMPACT VEHICLES TO DRIVE MARKET

- TABLE 32 <200 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 33 <200 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 34 <200 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 35 <200 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

- 7.3 200-230 MM

- 7.3.1 RISING SALES OF LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

- TABLE 36 200-230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 37 200-230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 38 200-230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 39 200-230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

- 7.4 >230 MM

- 7.4.1 INCREASING SALES OF HEAVY COMMERCIAL VEHICLES TO DRIVE MARKET

- TABLE 40 >230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 41 >230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 42 >230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 43 >230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

8 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO

- 8.1 INTRODUCTION

- 8.1.1 INDUSTRY INSIGHTS

- FIGURE 32 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2023 VS. 2028 (USD MILLION)

- TABLE 44 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2019-2022 (MILLION UNITS)

- TABLE 45 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2023-2028 (MILLION UNITS)

- TABLE 46 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2019-2022 (USD MILLION)

- TABLE 47 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2023-2028 (USD MILLION)

- 8.2 <60

- 8.2.1 INCREASING DEMAND FOR PERFORMANCE CARS AND SEDANS TO DRIVE MARKET FOR <60 ASPECT RATIO TIRES

- TABLE 48 <60 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 49 <60 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 50 <60 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 51 <60 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

- 8.3 60-70

- 8.3.1 RISING SALES OF SUVS AND CROSSOVERS TO DRIVE MARKET

- TABLE 52 60-70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 53 60-70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 54 60-70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 55 60-70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

- 8.4 >70

- 8.4.1 GROWING E-COMMERCE INDUSTRY TO DRIVE MARKET

- TABLE 56 >70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 57 >70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 58 >70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 59 >70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

9 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE

- 9.1 INTRODUCTION

- 9.1.1 INDUSTRY INSIGHTS

- FIGURE 33 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2023 VS. 2028 (USD MILLION)

- TABLE 60 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2019-2022 (MILLION UNITS)

- TABLE 61 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2023-2028 (MILLION UNITS)

- TABLE 62 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2019-2022 (USD MILLION)

- TABLE 63 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2023-2028 (USD MILLION)

- 9.2 13-15"

- 9.2.1 GROWING DEMAND FOR AFFORDABLE CARS TO DRIVE MARKET

- TABLE 64 13-15" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 65 13-15" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 66 13-15" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 67 13-15" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

- 9.3 16-18"

- 9.3.1 GROWTH OF LOGISTICS INDUSTRY TO DRIVE MARKET

- TABLE 68 16-18" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 69 16-18" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 70 16-18" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 71 16-18" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

- 9.4 19-21"

- 9.4.1 RISING DEMAND FOR LUXURY AND SPORTS CARS TO DRIVE MARKET

- TABLE 72 19-21" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 73 19-21" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 74 19-21" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 75 19-21" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

- 9.5 >21"

- 9.5.1 INCREASING GLOBAL MEGA PROJECTS TO DRIVE MARKET

- TABLE 76 MEGAPROJECTS REQUIRING COMMERCIAL VEHICLES WITH >21" RIM-SIZED TIRES

- TABLE 77 >21" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (MILLION UNITS)

- TABLE 78 >21" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (MILLION UNITS)

- TABLE 79 >21" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019-2022 (USD MILLION)

- TABLE 80 >21" RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023-2028 (USD MILLION)

10 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON

- 10.1 INTRODUCTION

- 10.1.1 INDUSTRY INSIGHTS

- FIGURE 34 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2023 VS. 2028 (USD MILLION)

- TABLE 81 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2019-2022 (MILLION UNITS)

- TABLE 82 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2023-2028 (MILLION UNITS)

- TABLE 83 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2019-2022 (USD MILLION)

- TABLE 84 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2023-2028 (USD MILLION)

- 10.2 SUMMER TIRES

- 10.2.1 RISE IN PERFORMANCE VEHICLES EQUIPPED WITH SUMMER TIRES TO DRIVE MARKET

- TABLE 85 SUMMER TIRE LAUNCHES, 2022-2023

- TABLE 86 SUMMER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 87 SUMMER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 88 SUMMER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 SUMMER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 WINTER TIRES

- 10.3.1 GOVERNMENT REGULATIONS FOR USE OF WINTER TIRES IN CERTAIN COUNTRIES DURING WINTER MONTHS TO DRIVE MARKET

- TABLE 90 WINTER TIRE LAUNCHES, 2022-2023

- TABLE 91 WINTER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 92 WINTER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 93 WINTER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 94 WINTER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.2 STUDDED TIRES

- TABLE 95 STUDDED TIRE LAUNCHES, 2022-2023

- TABLE 96 STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 97 STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 98 STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 99 STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.3 NON-STUDDED TIRES

- TABLE 100 NON-STUDDED TIRE LAUNCHES, 2022-2023

- TABLE 101 NON-STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 102 NON-STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 103 NON-STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 104 NON-STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 ALL-SEASON TIRES

- 10.4.1 INCREASING SALES OF PASSENGER CARS AND SUVS TO DRIVE DEMAND FOR ALL-SEASON TIRES

- TABLE 105 ALL-SEASON TIRE LAUNCHES, 2022-2023

- TABLE 106 ALL-SEASON TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 107 ALL-SEASON TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 108 ALL-SEASON TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 109 ALL-SEASON TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (USD MILLION)

11 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.1.1 INDUSTRY INSIGHTS

- FIGURE 35 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 110 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 111 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 112 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 113 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.2 PASSENGER CARS

- 11.2.1 GROWING RENTAL CAR AND RIDE-SHARING BUSINESSES TO DRIVE MARKET

- TABLE 114 RIDE-SHARING, TAXI, AND RENTAL CAR SERVICES, 2022

- TABLE 115 PASSENGER CARS: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 116 PASSENGER CARS: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 117 PASSENGER CARS: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 118 PASSENGER CARS: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 LIGHT COMMERCIAL VEHICLES

- 11.3.1 GROWING FLEET AND DELIVERY SERVICES TO DRIVE MARKET

- TABLE 119 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 120 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 121 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 122 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 HEAVY COMMERCIAL VEHICLES

- 11.4.1 GROWING CONSTRUCTION AND MINING INDUSTRIES TO DRIVE MARKET

- TABLE 123 EUROPE AND US REGULATIONS AND STANDARDS FOR HCVS, 2022

- TABLE 124 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 125 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 126 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 127 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023-2028 (USD MILLION)

12 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE

- 12.1 INTRODUCTION

- 12.1.1 INDUSTRY INSIGHTS

- FIGURE 36 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 128 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 129 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 130 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 131 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 12.2 PASSENGER CARS

- 12.2.1 RISING DEMAND FOR USED CARS TO DRIVE MARKET

- TABLE 132 PASSENGER CARS TIRE RETREADING MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 133 PASSENGER CARS TIRE RETREADING MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 134 PASSENGER CARS TIRE RETREADING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 135 PASSENGER CARS TIRE RETREADING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 LIGHT COMMERCIAL VEHICLES

- 12.3.1 INCREASED MILES DRIVEN BY LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

- TABLE 136 LIGHT COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 137 LIGHT COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 138 LIGHT COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 139 LIGHT COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.4 HEAVY COMMERCIAL VEHICLES

- 12.4.1 HIGH COST OF NEW TIRES TO DRIVE DEMAND FOR RETREADED TIRES

- TABLE 140 HEAVY COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 141 HEAVY COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2023-2028 (MILLION UNITS

- TABLE 142 HEAVY COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 143 HEAVY COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2023-2028 (USD MILLION)

13 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE AND RIM SIZE

- 13.1 INTRODUCTION

- 13.1.1 INDUSTRY INSIGHTS

- FIGURE 37 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 144 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 145 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 146 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 147 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 13.2 PASSENGER CARS

- 13.2.1 DECREASING COST OF RIMS DUE TO INCREASED COMPETITION TO DRIVE MARKET

- TABLE 148 PASSENGER CAR TIRE OE MARKET, BY RIM SIZE, 2019-2022 (MILLION UNITS)

- TABLE 149 PASSENGER CAR TIRE OE MARKET, BY RIM SIZE, 2023-2028 (MILLION UNITS)

- TABLE 150 PASSENGER CAR TIRE OE MARKET, BY RIM SIZE, 2019-2022 (USD MILLION)

- TABLE 151 PASSENGER CAR TIRE OE MARKET, BY RIM SIZE, 2023-2028 (USD MILLION)

- 13.2.2 13-15"

- TABLE 152 13-15": PASSENGER CAR TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 153 13-15": PASSENGER CAR TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 154 13-15": PASSENGER CAR TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 155 13-15": PASSENGER CAR TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.2.3 16-18"

- TABLE 156 16-18": PASSENGER CAR TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 157 16-18": PASSENGER CAR TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 158 16-18": PASSENGER CAR TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 159 16-18": PASSENGER CAR TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.2.4 19-21"

- TABLE 160 19-21": PASSENGER CAR TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 161 19-21": PASSENGER CAR TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 162 19-21": PASSENGER CAR TIRE OE MARKET, BY REGION, 2019-2028 (USD MILLION)

- TABLE 163 19-21": PASSENGER CAR TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.2.5 >21"

- TABLE 164 >21": PASSENGER CAR TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 165 >21": PASSENGER CAR TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 166 >21": PASSENGER CAR TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 167 >21": PASSENGER CAR TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.3 LIGHT COMMERCIAL VEHICLES

- 13.3.1 USE OF LIGHTWEIGHT MATERIALS IN RIMS WITH IMPROVED TECHNOLOGY TO DRIVE MARKET

- TABLE 168 LIGHT COMMERCIAL VEHICLES TIRE OE MARKET, BY RIM SIZE, 2019-2022 (MILLION UNITS)

- TABLE 169 LIGHT COMMERCIAL VEHICLES TIRE OE MARKET, BY RIM SIZE, 2023-2028 (MILLION UNITS)

- TABLE 170 LIGHT COMMERCIAL VEHICLES TIRE OE MARKET, BY RIM SIZE, 2019-2022 (USD MILLION)

- TABLE 171 LIGHT COMMERCIAL VEHICLES TIRE OE MARKET, BY RIM SIZE, 2023-2028 (USD MILLION)

- 13.3.2 13-15"

- TABLE 172 13-15": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 173 13-15": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 174 13-15": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 175 13-15": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.3.3 16-18"

- TABLE 176 16-18": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 177 16-18": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 178 16-18": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 179 16-18": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.3.4 19-21"

- TABLE 180 19-21": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 181 19-21": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 182 19-21": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 183 19-21": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.3.5 >21"

- TABLE 184 >21": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 185 >21": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 186 >21": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 187 >21": LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.4 BUSES

- 13.4.1 RISING DEMAND FOR ELECTRIC BUSES WITH VARIOUS RIM SIZES TO DRIVE MARKET

- TABLE 188 BUSES: TIRE OE MARKET, BY RIM SIZE, 2019-2022 (MILLION UNITS)

- TABLE 189 BUSES TIRE OE MARKET, BY RIM SIZE, 2023-2028 (MILLION UNITS)

- TABLE 190 BUSES TIRE OE MARKET, BY RIM SIZE, 2019-2022 (USD MILLION)

- TABLE 191 BUSES TIRE OE MARKET, BY RIM SIZE, 2023-2028 (USD MILLION)

- 13.4.2 16-18"

- TABLE 192 16-18": BUS TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 193 16-18": BUS TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 194 16-18": BUS TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 195 16-18": BUS TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.4.3 19-21"

- TABLE 196 19-21": BUS TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 197 19-21": BUS TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 198 19-21": BUS TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 199 19-21": BUS TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.4.4 >21"

- TABLE 200 >21": BUS TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 201 >21": BUS TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 202 >21": BUS TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 203 >21": BUS TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.5 TRUCKS

- 13.5.1 INCREASE IN LAST-MILE DELIVERIES AND INFRASTRUCTURE DEVELOPMENT TO DRIVE MARKET

- TABLE 204 TRUCK TIRE OE MARKET, BY RIM SIZE, 2019-2022 (MILLION UNITS)

- TABLE 205 TRUCK TIRE OE MARKET, BY RIM SIZE, 2023-2028 (MILLION UNITS)

- TABLE 206 TRUCK TIRE OE MARKET, BY RIM SIZE, 2019-2022 (USD MILLION)

- TABLE 207 TRUCK TIRE OE MARKET, BY RIM SIZE, 2023-2028 (USD MILLION)

- 13.5.2 16-18"

- TABLE 208 16-18": TRUCK TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 209 16-18": TRUCK TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 210 16-18": TRUCK TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 211 16-18": TRUCK TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.5.3 19-21"

- TABLE 212 19-21": TRUCK TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 213 19-21": TRUCK TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 214 19-21": TRUCK TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 215 19-21": TRUCK TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.5.4 >21"

- TABLE 216 >21": TRUCK TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 217 >21": TRUCK TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 218 >21": TRUCK TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 219 >21": TRUCK TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

14 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE

- 14.1 INTRODUCTION

- 14.1.1 INDUSTRY INSIGHTS

- FIGURE 38 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 220 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 221 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 222 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2019-2022 (USD MILLION)

- TABLE 223 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2023-2028 (USD MILLION)

- TABLE 224 PROS AND CONS OF RADIAL AND BIAS TIRES

- 14.2 RADIAL TIRES

- 14.2.1 RISING SALES OF COMMERCIAL VEHICLES TO DRIVE DEMAND FOR RADIAL TIRES

- TABLE 225 RADIAL TIRES OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 226 RADIAL TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 227 RADIAL TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 228 RADIAL TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.2.2 TUBE TIRES

- TABLE 229 TUBE RADIAL TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 230 TUBE RADIAL TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 231 TUBE RADIAL TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 232 TUBE RADIAL TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.2.3 TUBELESS TIRES

- TABLE 233 TUBELESS RADIAL TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 234 TUBELESS RADIAL TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 235 TUBELESS RADIAL TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 236 TUBELESS RADIAL TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 14.3 BIAS TIRES

- 14.3.1 RISING SALES OF TRACTORS AND TRUCKS TO DRIVE DEMAND FOR BIAS TIRES

- TABLE 237 BIAS TIRES OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 238 BIAS TIRES OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 239 BIAS TIRES OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 240 BIAS TIRES OE MARKET, BY REGION, 2023-2028 (USD MILLION)

15 AUTOMOTIVE TIRE OE MARKET, BY REGION

- 15.1 INTRODUCTION

- FIGURE 39 AUTOMOTIVE TIRE MARKET: BY REGION, 2023-2028

- TABLE 241 AUTOMOTIVE TIRE OE MARKET, BY REGION, 2019-2022 (MILLION UNITS)

- TABLE 242 AUTOMOTIVE TIRE OE MARKET, BY REGION, 2023-2028 (MILLION UNITS)

- TABLE 243 AUTOMOTIVE TIRE OE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 244 AUTOMOTIVE TIRE OE MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 40 INDUSTRY INSIGHTS

- 15.2 ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET SNAPSHOT

- TABLE 245 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 246 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 247 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 248 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 15.2.1 ASIA PACIFIC: RECESSION IMPACT

- 15.2.2 CHINA

- 15.2.2.1 Increasing presence and investment by foreign tire manufacturers to drive market

- TABLE 249 CHINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 250 CHINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 251 CHINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 252 CHINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.2.3 INDIA

- 15.2.3.1 Increasing demand for premium vehicles to drive market

- TABLE 253 INDIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 254 INDIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 255 INDIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 256 INDIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.2.4 JAPAN

- 15.2.4.1 Increasing demand for fuel-efficient tires to drive market

- TABLE 257 JAPAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 258 JAPAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 259 JAPAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 260 JAPAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Heavy investment in R&D and manufacturing plant expansions to drive market

- TABLE 261 SOUTH KOREA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 262 SOUTH KOREA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 263 SOUTH KOREA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 264 SOUTH KOREA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.2.6 THAILAND

- 15.2.6.1 High production of pickup trucks to drive market

- TABLE 265 THAILAND: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 266 THAILAND: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 267 THAILAND: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 268 THAILAND: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.2.7 REST OF ASIA PACIFIC

- 15.3 NORTH AMERICA

- FIGURE 42 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET SNAPSHOTS

- TABLE 269 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 270 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 271 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 272 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 15.3.1 NORTH AMERICA: RECESSION IMPACT

- 15.3.2 CANADA

- 15.3.2.1 Decreased production of passenger cars to impact market

- TABLE 273 CANADA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 274 CANADA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 275 CANADA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 276 CANADA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.3.3 MEXICO

- 15.3.3.1 Increasing demand for pickup trucks and SUVs to drive market

- TABLE 277 MEXICO: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 278 MEXICO: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 279 MEXICO: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 280 MEXICO: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.3.4 US

- 15.3.4.1 Rising sales of pickup trucks to drive market

- TABLE 281 US: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 282 US: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 283 US: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 284 US: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.4 EUROPE

- TABLE 285 EUROPE: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 286 EUROPE: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 287 EUROPE: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 288 EUROPE: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 15.4.1 EUROPE: RECESSION IMPACT

- 15.4.2 GERMANY

- 15.4.2.1 Increasing sales of buses to drive demand for larger tires

- TABLE 289 GERMANY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 290 GERMANY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 291 GERMANY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 292 GERMANY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.4.3 FRANCE

- 15.4.3.1 Increasing demand for subcompact cars to drive market

- TABLE 293 FRANCE: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 294 FRANCE: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 295 FRANCE: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 296 FRANCE: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.4.4 UK

- 15.4.4.1 Implementation of Low Emission Zone (LEZ) to drive market

- TABLE 297 UK: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 298 UK: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 299 UK: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 300 UK: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.4.5 SPAIN

- 15.4.5.1 Rising popularity of small-sized SUVs and compact cars to drive market

- TABLE 301 SPAIN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 302 SPAIN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 303 SPAIN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 304 SPAIN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.4.6 RUSSIA

- 15.4.6.1 Rise of domestic automotive industry due to Russia-Ukraine war to drive market

- TABLE 305 RUSSIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 306 RUSSIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 307 RUSSIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 308 RUSSIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.4.7 ITALY

- 15.4.7.1 Shift in customer preference toward larger rim-sized vehicles to drive market

- TABLE 309 ITALY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 310 ITALY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 311 ITALY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 312 ITALY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.4.8 TURKEY

- 15.4.8.1 Growing use of trucks in mining industry to drive market

- TABLE 313 TURKEY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 314 TURKEY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 315 TURKEY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 316 TURKEY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.4.9 REST OF EUROPE

- 15.5 LATIN AMERICA

- TABLE 317 LATIN AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2028 (MILLION UNITS)

- TABLE 318 LATIN AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 319 LATIN AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

- TABLE 320 LATIN AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 15.5.1 LATIN AMERICA: RECESSION IMPACT

- 15.5.2 BRAZIL

- 15.5.2.1 Rising demand for pickup trucks and LCVs with larger rim-sized tires to drive market

- TABLE 321 BRAZIL: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 322 BRAZIL: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 323 BRAZIL: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 324 BRAZIL: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.5.3 ARGENTINA

- 15.5.3.1 Scrappage policy for old vehicles to drive market

- TABLE 325 ARGENTINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 326 ARGENTINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 327 ARGENTINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 328 ARGENTINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.5.4 REST OF LATIN AMERICA

- 15.6 MIDDLE EAST AND AFRICA

- TABLE 329 MIDDLE EAST AND AFRICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2022 (MILLION UNITS)

- TABLE 330 MIDDLE EAST AND AFRICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (MILLION UNITS)

- TABLE 331 MIDDLE EAST AND AFRICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 332 MIDDLE EAST AND AFRICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 15.6.1 MIDDLE EAST AND AFRICA: RECESSION IMPACT

- 15.6.2 SOUTH AFRICA

- 15.6.2.1 Increasing awareness about safety to drive demand for radial tires

- TABLE 333 SOUTH AFRICA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 334 SOUTH AFRICA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 335 SOUTH AFRICA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 336 SOUTH AFRICA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.6.3 IRAN

- 15.6.3.1 Government subsidies to reduce car shortage to drive market

- TABLE 337 IRAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION UNITS)

- TABLE 338 IRAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 339 IRAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 340 IRAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 15.6.4 REST OF MIDDLE EAST AND AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- FIGURE 43 MARKET SHARE ANALYSIS, 2022

- 16.2 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022

- FIGURE 44 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020-2022

- 16.3 COMPANY EVALUATION MATRIX: PASSENGER CAR AND LCV TIRE MANUFACTURERS

- 16.3.1 STARS

- 16.3.2 EMERGING LEADERS

- 16.3.3 PERVASIVE PLAYERS

- 16.3.4 PARTICIPANTS

- FIGURE 45 COMPANY EVALUATION MATRIX (PASSENGER CAR AND LCV TIRE MANUFACTURERS), 2022

- 16.4 COMPANY EVALUATION MATRIX: TRUCK AND BUS TIRE MANUFACTURERS

- 16.4.1 STARS

- 16.4.2 EMERGING LEADERS

- 16.4.3 PERVASIVE PLAYERS

- 16.4.4 PARTICIPANTS

- FIGURE 46 COMPANY EVALUATION MATRIX (TRUCK AND BUSE TIRE MANUFACTURERS), 2022

- TABLE 341 KEY STRATEGIES ADOPTED BY MARKET PLAYERS, 2022-2023

- 16.5 COMPETITIVE SCENARIO

- 16.5.1 PRODUCT DEVELOPMENTS

- TABLE 342 PRODUCT DEVELOPMENTS, 2022-2023

- 16.6 DEALS

- TABLE 343 DEALS, 2022-2023

- 16.7 OTHER DEVELOPMENTS

- TABLE 344 OTHERS, 2022-2023

- 16.8 STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2023

- TABLE 345 KEY GROWTH STRATEGIES, 2022-2023

- 16.9 COMPETITIVE BENCHMARKING

- TABLE 346 AUTOMOTIVE TIRE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

17 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 17.1 KEY PLAYERS

- 17.1.1 BRIDGESTONE CORPORATION

- TABLE 347 BRIDGESTONE CORPORATION: COMPANY OVERVIEW

- FIGURE 47 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

- TABLE 348 BRIDGESTONE CORPORATION: PRODUCTS OFFERED

- TABLE 349 BRIDGESTONE CORPORATION: PRODUCT LAUNCHES

- TABLE 350 BRIDGESTONE CORPORATION: DEALS

- TABLE 351 BRIDGESTONE CORPORATION: OTHERS

- 17.1.2 CONTINENTAL AG

- TABLE 352 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 48 CONTINENTAL AG: COMPANY SNAPSHOT

- TABLE 353 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 354 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 355 CONTINENTAL AG: DEALS

- TABLE 356 CONTINENTAL AG: OTHERS

- 17.1.3 GOODYEAR TIRE & RUBBER COMPANY

- TABLE 357 GOODYEAR TIRE & RUBBER COMPANY: COMPANY OVERVIEW

- FIGURE 49 GOODYEAR TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

- TABLE 358 GOODYEAR TIRE & RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 359 GOODYEAR TIRE & RUBBER COMPANY: PRODUCT LAUNCHES

- TABLE 360 GOODYEAR TIRE & RUBBER COMPANY: DEALS

- 17.1.4 MICHELIN

- TABLE 361 MICHELIN: COMPANY OVERVIEW

- FIGURE 50 MICHELIN: COMPANY SNAPSHOT

- TABLE 362 MICHELIN: PRODUCTS OFFERED

- TABLE 363 MICHELIN: PRODUCT LAUNCHES

- TABLE 364 MICHELIN: DEALS

- 17.1.5 PIRELLI & C. S.P.A.

- TABLE 365 PIRELLI & C. S.P.A.: COMPANY OVERVIEW

- FIGURE 51 PIRELLI & C. S.P.A.: COMPANY SNAPSHOT

- TABLE 366 PIRELLI & C. S.P.A.: PRODUCTS OFFERED

- TABLE 367 PIRELLI & C. S.P.A.: PRODUCT LAUNCHES

- TABLE 368 PIRELLI & C. S.P.A.: DEALS

- 17.1.6 SUMITOMO RUBBER INDUSTRIES LTD.

- TABLE 369 SUMITOMO RUBBER INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 52 SUMITOMO RUBBER INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 370 SUMITOMO RUBBER INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 371 SUMITOMO RUBBER INDUSTRIES LTD.: PRODUCT LAUNCHES

- 17.1.7 HANKOOK TIRE & TECHNOLOGY

- TABLE 372 HANKOOK TIRE & TECHNOLOGY: COMPANY OVERVIEW

- FIGURE 53 HANKOOK TIRE & TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 373 HANKOOK TIRE & TECHNOLOGY: PRODUCTS OFFERED

- TABLE 374 HANKOOK TIRE & TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 375 HANKOOK TIRE & TECHNOLOGY: DEALS

- TABLE 376 HANKOOK TIRE & TECHNOLOGY: OTHERS

- 17.1.8 YOKOHAMA RUBBER CO., LTD.

- TABLE 377 YOKOHAMA RUBBER CO., LTD.: COMPANY OVERVIEW

- FIGURE 54 YOKOHAMA RUBBER CO., LTD.: COMPANY SNAPSHOT

- TABLE 378 YOKOHAMA RUBBER CO., LTD.: PRODUCTS OFFERED

- TABLE 379 YOKOHAMA RUBBER CO., LTD.: PRODUCT LAUNCHES

- TABLE 380 YOKOHAMA RUBBER CO., LTD.: DEALS

- TABLE 381 YOKOHAMA RUBBER CO., LTD.: OTHERS

- 17.1.9 COOPER TIRE & RUBBER COMPANY

- TABLE 382 COOPER TIRE & RUBBER COMPANY: COMPANY OVERVIEW

- FIGURE 55 COOPER TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

- TABLE 383 COOPER TIRE & RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 384 COOPER TIRE & RUBBER COMPANY: PRODUCT LAUNCHES

- TABLE 385 COOPER TIRE & RUBBER COMPANY: DEALS

- TABLE 386 COOPER TIRE & RUBBER COMPANY: OTHERS

- 17.1.10 TOYO TIRE CORPORATION

- TABLE 387 TOYO TIRE CORPORATION: COMPANY OVERVIEW

- FIGURE 56 TOYO TIRE CORPORATION: COMPANY SNAPSHOT

- TABLE 388 TOYO TIRE CORPORATION: PRODUCTS OFFERED

- TABLE 389 TOYO TIRE CORPORATION: PRODUCT LAUNCHES

- TABLE 390 TOYO TIRE CORPORATION: DEALS

- TABLE 391 TOYO TIRE CORPORATION: OTHERS

- 17.2 OTHER PLAYERS

- 17.2.1 ZHONGCE RUBBER GROUP CO., LTD.

- TABLE 392 ZHONGCE RUBBER GROUP CO., LTD.: COMPANY OVERVIEW

- 17.2.2 MAXXIS INTERNATIONAL

- TABLE 393 MAXXIS INTERNATIONAL: COMPANY OVERVIEW

- 17.2.3 DUNLOP

- TABLE 394 DUNLOP: COMPANY OVERVIEW

- 17.2.4 KUMHO TIRE

- TABLE 395 KUMHO TIRE: COMPANY OVERVIEW

- 17.2.5 NOKIAN TYRES PLC

- TABLE 396 NOKIAN TYRES PLC: COMPANY OVERVIEW

- 17.2.6 APOLLO TYRES LTD.

- TABLE 397 APOLLO TYRES LTD.: COMPANY OVERVIEW

- 17.2.7 MRF LTD.

- TABLE 398 MRF LTD.: COMPANY OVERVIEW

- 17.2.8 JK TYRE & INDUSTRIES LTD.

- TABLE 399 JK TYRE & INDUSTRIES LTD.: COMPANY OVERVIEW

- 17.2.9 CEAT LTD.

- TABLE 400 CEAT LTD.: COMPANY OVERVIEW

- 17.2.10 NEXEN TIRE CORPORATION

- TABLE 401 NEXEN TIRE CORPORATION: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 PRODUCT DEVELOPMENTS

- TABLE 402 PRODUCT DEVELOPMENTS, 2022

- 18.4 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.5 CUSTOMIZATION OPTIONS

- 18.5.1 ADDITIONAL COMPANY PROFILES (BUSINESS OVERVIEW, RECENT DEVELOPMENT, AND MNM VIEW)

- 18.5.2 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE (COUNTRY LEVEL)

- 18.5.2.1 Passenger Cars

- 18.5.2.2 Light Commercial Vehicles

- 18.5.2.3 Heavy Commercial Vehicles

- 18.5.3 AUTOMOTIVE TIRE OE MARKET, BY SEASON

- 18.5.3.1 Summer Tires

- 18.5.3.2 Winter Tires

- 18.5.3.2.1 Studded

- 18.5.3.2.2 Non-studded

- 18.5.3.3 All-season Tires

- 18.5.4 AUTOMOTIVE TIRE OE MARKET, BY SECTION WIDTH

- 18.5.4.1 <200 MM

- 18.5.4.2 200-230 MM

- 18.5.4.3 >230 MM

- 18.5.5 AUTOMOTIVE TIRE OE MARKET, BY ASPECT RATIO

- 18.5.5.1 <60

- 18.5.5.2 60-70

- 18.5.5.3 >70

- 18.5.6 AUTOMOTIVE TIRE OE MARKET, BY MATERIAL

- 18.5.6.1 Polymers

- 18.5.6.2 Fillers

- 18.5.6.3 Softeners

- 18.5.6.4 Curatives

- 18.5.6.5 Others

- 18.5.7 AUTOMOTIVE TIRE RETREADING MARKET, BY RETREAD PROCESS (COMMERCIAL VEHICLE)

- 18.5.7.1 Mold Cure

- 18.5.7.2 Pre-cure

- 18.6 RELATED REPORTS

- 18.7 AUTHOR DETAILS