|

|

市場調査レポート

商品コード

1345513

アクリル酸市場:誘導体別、用途別、地域別-2028年までの予測Acrylic Acid Market by Derivative (Methyl, Ethyl, Butyl, 2-EH, SAP, Water Treatment), Acrylic Ester/Polymer Application (Surface coating, Adhesive & Sealant, Plastic additive, Textile, Detergent Diaper & Training Pad), & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| アクリル酸市場:誘導体別、用途別、地域別-2028年までの予測 |

|

出版日: 2023年09月01日

発行: MarketsandMarkets

ページ情報: 英文 248 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

アクリル酸の市場規模は、予測期間中に3.3%のCAGRで拡大し、2023年の117億米ドルから2028年には138億米ドルに成長すると予測されています。

塗料やコーティング剤、接着剤、繊維製品、衛生用品の高吸水性ポリマーなどの分野からのアクリル酸の需要は、市場を促進するいくつかの要因の一つです。化学合成における用途の増加、環境に優しい製品への移行、経済の拡大、新興市場における需要の高まりが、市場を拡大しています。

アクリルポリマーは、その汎用性の高い特性と幅広い用途により、アクリル酸市場で2番目に高い市場シェアを確保すると予想されています。これらのポリマーは優れた接着性、耐久性、耐候性を示すため、水処理、ベビー用おむつ、パーソナルケアなど、さまざまな産業で非常に好まれています。アクリルポリマーの様々な処方への適応性と様々な基材への適合性が、市場での大きな存在感を示しており、多くの最終用途に好まれる選択肢となっています。

より優れた塗料やコーティング処方を生み出すのに役立つその適応性の高い特質により、表面コーティングはアクリル酸エステルの主要な用途分野として浮上しています。優れた密着性、強靭性、耐候性により、アクリル酸エステルは消費者向け製品、建築、自動車産業の表面コーティングに頻繁に利用されています。アクリル酸エステルは、光沢、色持ち、防食性を付与する性質があり、他の様々な化学物質とよく混ざり合うことから、表面塗料に広く使用されており、アクリル酸の用途分野での優位性を確固たるものにしています。

大人用失禁・その他パーソナルケア製品分野は、人口動態の変化、人口の増加、個人衛生に対する意識の高まりにより、アクリル酸ポリマー市場内で急成長を遂げています。ヘルスケアとウェルビーイングが注目されるにつれ、大人用失禁用品では高性能で吸収性の高い素材への需要が高まっています。アクリル酸ポリマーは優れた吸収性と快適性を提供するため、大人用紙おむつ、生理用ナプキン、その他のパーソナルケア用品の用途に最適です。

アジア太平洋のアクリル酸市場は、要因によって推進される成長を示しています。急速な工業化、都市化、人口増加により、塗料、コーティング剤、接着剤、繊維製品、衛生用品に使用される高吸水性ポリマーなどの製品に対する需要が急増しています。アジア太平洋には、強力な製造能力を持つ主要経済国がいくつかあり、さまざまな産業の製造拠点となっています。生産施設に近接しているため、輸送コストが削減され、効率的なサプライチェーン管理が可能になります。主要な製造拠点が存在すること、様々な産業への投資が増加していること、経済発展を支援する政府の政策が好意的であることが、この地域の優位性に寄与しています。さらに、パーソナルケアや衛生用品に対する消費者の意識の高まりが高吸水性ポリマーの需要をさらに押し上げ、アジア太平洋地域全体の市場成長を促進しています。

当レポートでは、世界のアクリル酸市場について調査し、誘導体別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 関税と規制状況

- 規制機関、政府機関、その他の組織

- 技術分析

- アクリル酸市場のエコシステム

- 2023年~2024年の主な会議とイベント

- 貿易分析(輸出入)

- 特許分析

- ケーススタディ分析

- 価格分析

- マクロ経済の概要

- 主要な利害関係者と購入基準

第6章 アクリル酸市場、誘導体別

- イントロダクション

- アクリル酸エステル

- アクリルポリマー

- その他の誘導体

第7章 アクリル酸市場、用途別

- イントロダクション

- アクリル酸エステル市場、用途別

- 表面コーティング

- 接着剤・シーラント

- プラスチック添加剤

- 洗剤

- テキスタイル

- その他

- 用途別アクリルポリマーおよびその他の誘導体市場

- おむつ・トレーニングパンツ

- 成人用失禁・その他のパーソナルケア製品

- 水処理(分散剤、スケール防止剤、増粘剤)

- その他

第8章 アクリル酸市場、地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第9章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の収益分析

- 企業評価マトリックス

- 企業のフットプリント

- 中小企業評価マトリックス、2022年

- 競合ベンチマーキング

- 競合シナリオ

第10章 企業プロファイル

- 主要参入企業

- BASF SE

- ARKEMA

- NIPPON SHOKUBAI CO., LTD.

- LG CHEM

- DOW CHEMICAL COMPANY

- MITSUBISHI CHEMICAL CORPORATION

- SASOL LTD.

- EVONIK INDUSTRIES AG

- MERCK KGAA

- SUMITOMO CORPORATION

- その他の参入企業

- SATELLITE CHEMICAL CO., LTD.

- SYNTHOMER PLC

- SHANGHAI HUAYI ACRYLIC ACID CO., LTD.

- SIBUR HOLDING PJSC

- WANHUA CHEMICAL GROUP CO., LTD.

- TOAGOSEI CO., LTD.

- SINOCHEM GROUP CO., LTD.

- LUBRIZOL CORPORATION

- POLYSCIENCES, INC.

- JURONG GROUP

- MOMENTIVE PERFORMANCE MATERIALS

- SOLVAY

- ROHM GMBH

- KAMSONS CHEMICALS PVT. LTD.

- GELLNER INDUSTRIAL LLC

第11章 隣接市場および関連市場

第12章 付録

The Acrylic acid market is projected to grow from USD 11.7 billion in 2023 to USD 13.8 billion by 2028, at a CAGR of 3.3% during the forecast period. The demand for acrylic acid from sectors like paints and coatings, adhesives, textiles, and superabsorbent polymers for hygiene products is one of several drivers driving the market. The market is expanding as a result of rising applications in chemical synthesis, a move towards environmentally friendly products, expanding economies, and rising demand in emerging markets.

"By derivative, acrylic polymers to have the second highest market share in 2022."

Acrylic polymers are anticipated to secure the second-highest market share in the acrylic acid market due to their versatile properties and wide-ranging applications. These polymers exhibit exceptional adhesion, durability, and weather resistance, making them highly desirable for various industries, including water treatment, baby diapers, personal care etc. The adaptability of acrylic polymers to different formulations and their compatibility with various substrates contribute to their significant market presence, positioning them as a preferred choice for numerous end-use applications.

"By acrylic ester application, surface coatings accounted for the maximum share in 2022."

Due to their adaptable qualities that help create better paint and coating formulas, surface coatings have emerged as the major application segment for acrylic acid esters. Because of their superior adherence, toughness, and weather resistance, acrylic acid esters are frequently utilized in making surface coatings in consumer products, construction, and automotive industries. Because of their propensity to impart gloss, color retention, and corrosion protection, as well as the fact that they mix well with a variety of other chemicals, acrylic acid esters are widely used in surface coatings, cementing their dominance in the field of applications for acrylic acid.

"By acrylic polymer application, Adult Incontinence & Other Personal Care Products to have the highest CAGR during the forecast period."

The Adult Incontinence & Other Personal Care Products segment is experiencing rapid growth within the acrylic acid polymers market due to shifting demographics, increasing population, and growing awareness about personal hygiene. As healthcare and well-being gain prominence, the demand for high-performance and absorbent materials in adult incontinence products is escalating. Acrylic acid polymers offer superior absorbency and comfort, making them ideal for applications in adult diapers, sanitary napkins, and other personal care items.

"Asia Pacific accounted for the highest market share in the Acrylic acid market in 2022."

The Asia Pacific Acrylic acid market is witnessing growth propelled by factors. Rapid industrialization, urbanization, and population growth have spurred demand for products such as paints, coatings, adhesives, textiles, and superabsorbent polymers used in hygiene products. Asia Pacific is home to several major economies with robust manufacturing capabilities, making it a manufacturing hub for various industries. This proximity to production facilities reduces shipping costs and enables efficient supply chain management. The presence of major manufacturing hubs, increasing investments in various industries, and favorable government policies supporting economic development contribute to the region's dominance. Additionally, rising consumer awareness about personal care and hygiene products further propels the demand for superabsorbent polymers, enhancing the overall market growth in Asia Pacific.

By Company: Tier1: 40%, Tier 2: 25%, Tier3: 4: 35%

By Designation: C-Level: 35%, Director Level: 30%, Others: 35%

By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, South America: 5%, and Middle East & Africa: 5%.

Companies Covered: BASF SE (Germany), Arkema (France), Nippon Shokubai Co., Ltd. (Japan), LG Chem (South Korea), and The Dow Chemical Company (Midland, Michigan), and others are covered in the acrylic acid market.

Research Coverage

The market study covers the acrylic acid market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on derivative, application, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the acrylic acid market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall acrylic acid market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rapid expansion of superabsorbent polymers sector, increasing application in chemical synthesis), restraints (Environmental concerns and health hazards), opportunities (Increasing demand in emerging economies) and challenges (Improper waste disposal of end products, Fluctuations in raw material prices) influencing the growth of the acrylic acid market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the acrylic acid market

- Market Development: Comprehensive information about lucrative markets - the report analyses the acrylic acid market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the acrylic acid market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like BASF SE (Germany), Arkema (France), Nippon Shokubai Co., Ltd. (Japan), LG Chem (South Korea), and The Dow Chemical Company (Midland, Michigan), and among others in the acrylic acid market. The report also helps stakeholders understand the pulse of the acrylic acid market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 ACRYLIC ACID MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 INCLUSIONS AND EXCLUSIONS

- TABLE 1 ACRYLIC ACID MARKET: INCLUSIONS AND EXCLUSIONS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ACRYLIC ACID MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 5 ACRYLIC ACID MARKET: DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 GROWTH RATE ASSUMPTION

- 2.7 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 6 ACRYLIC ESTERS TO LEAD OVERALL ACRYLIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 7 DIAPERS & TRAINING PANTS TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 8 SURFACE COATINGS APPLICATION TO DOMINATE ACRYLIC ESTERS MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ACRYLIC ACID MARKET

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGH GROWTH DURING FORECAST PERIOD

- 4.2 ASIA PACIFIC: ACRYLIC ACID MARKET, BY DERIVATIVE AND COUNTRY (2022)

- FIGURE 11 CHINA DOMINATES ACRYLIC ACID MARKET IN ASIA PACIFIC

- 4.3 ACRYLIC ACID MARKET, BY COUNTRY

- FIGURE 12 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 ACRYLIC ACID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in demand from paints & coatings sector

- 5.2.1.2 Increasing demand for superabsorbent polymers

- 5.2.1.3 Expanding application in chemical synthesis

- 5.2.1.4 Shift from solvent-based coatings to acrylic emulsions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental concerns and health hazards

- 5.2.2.1.1 Clean Air Act 1990

- 5.2.2.1.2 Acute toxicity and air exposure limits

- 5.2.2.1.3 Health hazards

- 5.2.2.1.4 Pulmonary edema

- 5.2.2.1 Environmental concerns and health hazards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Commercial production of bio-based acrylic acid

- 5.2.3.2 Increasing demand in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Improper waste disposal of end products

- FIGURE 14 WASTE DISPOSABLE DIAPER MANAGEMENT (1970-2018)

- 5.2.4.2 Strong competition among market players

- 5.2.4.3 Fluctuations in raw material prices, high transportation costs, and reactivity hazards

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 15 ACRYLIC ACID MARKET: VALUE CHAIN ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 16 SUPPLY CHAIN OF ACRYLIC ACID MARKET

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 ACRYLIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS: ACRYLIC ACID MARKET

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ACRYLIC ACID MANUFACTURERS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 AMERICAN INDUSTRIAL HYGIENE ASSOCIATION EMERGENCY RESPONSE PLANNING GUIDELINES (ERPG) 2010: ACRYLIC ACID DOSE-EFFECT RELATIONSHIP

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 NEW CATALYST TECHNOLOGY TURNS CORN INTO ACRYLIC ACID

- 5.8.2 NEW TECHNOLOGIES - ACRYLIC RESINS

- 5.9 ACRYLIC ACID MARKET ECOSYSTEM

- FIGURE 19 ACRYLIC ACID MARKET: ECOSYSTEM MAPPING

- FIGURE 20 ACRYLIC ACID MARKET: KEY STAKEHOLDERS

- 5.10 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 5 ACRYLIC ACID MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.11 TRADE ANALYSIS (IMPORT AND EXPORT)

- 5.11.1 IMPORT SCENARIO

- TABLE 6 IMPORT SCENARIO FOR HS CODE 291611, BY COUNTRY, 2017-2021 (USD THOUSAND)

- 5.11.2 EXPORT SCENARIO

- TABLE 7 EXPORT SCENARIO FOR HS CODE: 291611, BY COUNTRY, 2017-2021 (USD THOUSAND)

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPE

- FIGURE 21 GRANTED PATENTS ACCOUNTED FOR 8% OF ALL PATENTS IN LAST FIVE YEARS

- FIGURE 22 PATENT PUBLICATION TRENDS (2018-2022)

- FIGURE 23 JURISDICTION ANALYSIS

- FIGURE 24 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- 5.13 CASE STUDY ANALYSIS

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 25 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- 5.14.2 AVERAGE SELLING PRICE, BY ACRYLIC ACID DERIVATIVE

- TABLE 8 AVERAGE SELLING PRICE, BY ACRYLIC ACID DERIVATIVE TYPE (USD/KG)

- 5.15 MACROECONOMIC OVERVIEW

- 5.15.1 INTRODUCTION

- 5.15.2 TRENDS AND FORECAST OF GDP

- TABLE 9 WORLD GDP GROWTH, 2021-2028 (USD TRILLION)

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ACRYLIC ACID AND ITS DERIVATIVES

- 5.16.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA IN ACRYLIC ACID MARKET

- TABLE 11 KEY BUYING CRITERIA IN ACRYLIC ACID MARKET

6 ACRYLIC ACID MARKET, BY DERIVATIVE

- 6.1 INTRODUCTION

- FIGURE 28 ACRYLIC ESTERS ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- TABLE 12 ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (USD MILLION)

- TABLE 13 ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (KILOTON)

- TABLE 14 ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 15 ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- 6.1.1 ACRYLIC ESTERS

- TABLE 16 ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 17 ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY TYPE, 2021-2028 (KILOTON)

- 6.1.1.1 Methyl acrylate

- 6.1.1.2 Ethyl acrylate

- 6.1.1.3 Butyl acrylate

- 6.1.1.4 2-Ethylhexyl acrylate

- 6.1.1.5 Other acrylic esters

- 6.1.1.5.1 Specialty acrylate

- 6.1.1.5.2 Benzyl acrylate

- 6.1.1.5.3 Hydroxypropyl acrylate

- 6.1.2 ACRYLIC POLYMERS

- TABLE 18 ACRYLIC ACID MARKET IN ACRYLIC POLYMERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 19 ACRYLIC ACID MARKET IN ACRYLIC POLYMERS, BY TYPE, 2021-2028 (KILOTON)

- 6.1.2.1 Acrylic elastomers

- 6.1.2.2 Superabsorbent polymers

- 6.1.2.3 Water treatment polymers

- 6.1.3 OTHER DERIVATIVES

- 6.1.3.1 Ammonium polyacrylate

- 6.1.3.2 Polycyanoacrylate

- TABLE 20 ACRYLIC ACID MARKET IN OTHER DERIVATIVES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 21 ACRYLIC ACID MARKET IN OTHER DERIVATIVES, BY TYPE, 2021-2028 (KILOTON)

7 ACRYLIC ACID MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 29 OVERVIEW OF APPLICATIONS OF ACRYLIC ACID

- 7.2 ACRYLIC ESTERS MARKET, BY APPLICATION

- FIGURE 30 SURFACE COATINGS TO BE LARGEST APPLICATION OF ACRYLIC ESTERS BETWEEN 2023 AND 2028

- TABLE 22 ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 23 ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- 7.2.1 SURFACE COATINGS

- 7.2.2 ADHESIVES & SEALANTS

- 7.2.3 PLASTIC ADDITIVES

- 7.2.4 DETERGENTS

- 7.2.5 TEXTILES

- 7.2.6 OTHER APPLICATIONS

- 7.3 ACRYLIC POLYMERS AND OTHER DERIVATIVES MARKET, BY APPLICATION

- FIGURE 31 DIAPERS & TRAINING PANTS TO DOMINATE MARKET FOR ACRYLIC POLYMERS

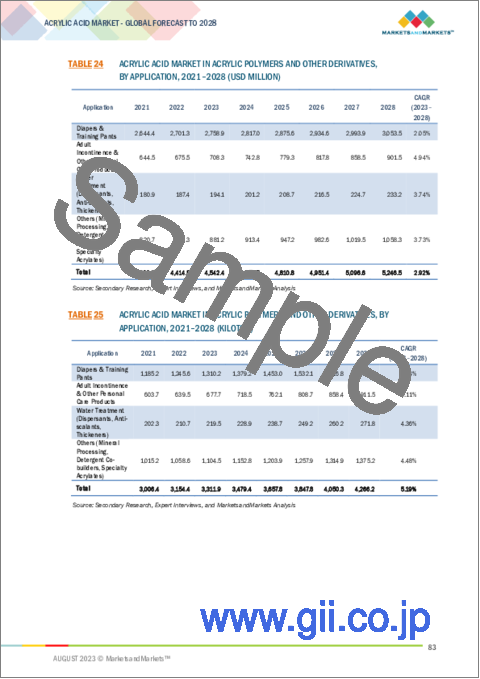

- TABLE 24 ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 25 ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 7.3.1 DIAPERS & TRAINING PANTS

- 7.3.2 ADULT INCONTINENCE & OTHER PERSONAL CARE PRODUCTS

- 7.3.3 WATER TREATMENT (DISPERSANTS, ANTI-SCALANTS, AND THICKENERS)

- 7.3.4 OTHER APPLICATIONS

8 ACRYLIC ACID MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 32 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- TABLE 26 ACRYLIC ACID MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 27 ACRYLIC ACID MARKET, BY REGION, 2021-2028 (KILOTON)

- 8.2 ASIA PACIFIC

- 8.2.1 RECESSION IMPACT

- FIGURE 34 ASIA PACIFIC: ACRYLIC ACID MARKET SNAPSHOT

- TABLE 28 ASIA PACIFIC: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 30 ASIA PACIFIC: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (USD MILLION)

- TABLE 31 ASIA PACIFIC: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (KILOTON)

- TABLE 32 ASIA PACIFIC: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 34 ASIA PACIFIC: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.2.2 CHINA

- 8.2.2.1 Surface coatings application to be largest consumer of acrylic esters

- TABLE 38 CHINA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 39 CHINA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 40 CHINA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 41 CHINA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 42 CHINA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 43 CHINA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.2.3 JAPAN

- 8.2.3.1 Increasing demand for adult diaper and incontinence products to drive market

- TABLE 44 JAPAN: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 45 JAPAN: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 46 JAPAN: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 47 JAPAN: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 48 JAPAN: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 49 JAPAN: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.2.4 INDIA

- 8.2.4.1 India to register highest CAGR in acrylic acid market during forecast period

- TABLE 50 INDIA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 51 INDIA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 52 INDIA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 53 INDIA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 54 INDIA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 55 INDIA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.2.5 SOUTH KOREA

- 8.2.5.1 Increasing demand from diaper and textile sectors to support market growth

- TABLE 56 SOUTH KOREA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 57 SOUTH KOREA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 58 SOUTH KOREA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 59 SOUTH KOREA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 60 SOUTH KOREA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 61 SOUTH KOREA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.2.6 REST OF ASIA PACIFIC

- TABLE 62 REST OF ASIA PACIFIC: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 64 REST OF ASIA PACIFIC: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 66 REST OF ASIA PACIFIC: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.3 NORTH AMERICA

- 8.3.1 RECESSION IMPACT

- FIGURE 35 NORTH AMERICA: ACRYLIC ACID MARKET SNAPSHOT

- TABLE 68 NORTH AMERICA: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 70 NORTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (USD MILLION)

- TABLE 71 NORTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (KILOTON)

- TABLE 72 NORTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 74 NORTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 76 NORTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.3.2 US

- 8.3.2.1 Expanding residential sector to fuel market growth

- TABLE 78 US: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 79 US: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 80 US: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 81 US: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 82 US: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 83 US: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.3.3 CANADA

- 8.3.3.1 Government initiatives in construction sector to support acrylic acid market growth

- TABLE 84 CANADA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 85 CANADA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 86 CANADA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 87 CANADA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 88 CANADA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 89 CANADA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.3.4 MEXICO

- 8.3.4.1 Acrylic esters to account for major share of overall market during forecast period

- TABLE 90 MEXICO: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 91 MEXICO: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 92 MEXICO: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 93 MEXICO: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 94 MEXICO: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 95 MEXICO: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.4 EUROPE

- 8.4.1 RECESSION IMPACT

- TABLE 96 EUROPE: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 97 EUROPE: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 98 EUROPE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (USD MILLION)

- TABLE 99 EUROPE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (KILOTON)

- TABLE 100 EUROPE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 101 EUROPE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 102 EUROPE: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 103 EUROPE: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 104 EUROPE: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 105 EUROPE: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.4.2 GERMANY

- 8.4.2.1 Presence of highly developed chemical industry to support market growth

- TABLE 106 GERMANY: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 107 GERMANY: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 108 GERMANY: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 109 GERMANY: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 110 GERMANY: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 111 GERMANY: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.4.3 FRANCE

- 8.4.3.1 Growing investment in plastic industry to drive demand

- TABLE 112 FRANCE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 113 FRANCE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 114 FRANCE: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 115 FRANCE: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 116 FRANCE: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 117 FRANCE: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.4.4 NETHERLANDS

- 8.4.4.1 Strategic location in European chemical industry to support market

- TABLE 118 NETHERLANDS: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 119 NETHERLANDS: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 120 NETHERLANDS: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 121 NETHERLANDS: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 122 NETHERLANDS: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 123 NETHERLANDS: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.4.5 BELGIUM

- 8.4.5.1 Increasing exports to support market growth

- TABLE 124 BELGIUM: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 125 BELGIUM: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 126 BELGIUM: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 127 BELGIUM: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 128 BELGIUM: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 129 BELGIUM: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.4.6 REST OF EUROPE

- TABLE 130 REST OF EUROPE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 131 REST OF EUROPE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 132 REST OF EUROPE: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 133 REST OF EUROPE: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 134 REST OF EUROPE: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 135 REST OF EUROPE: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 RECESSION IMPACT

- 8.5.2 SOUTH AFRICA

- 8.5.2.1 Increasing demand for surface coatings to boost market growth

- TABLE 136 SOUTH AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 137 SOUTH AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 138 SOUTH AFRICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 139 SOUTH AFRICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 140 SOUTH AFRICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 141 SOUTH AFRICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.5.3 SAUDI ARABIA

- 8.5.3.1 Acrylic esters segment to dominate overall market during forecast period

- TABLE 142 SAUDI ARABIA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 143 SAUDI ARABIA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 144 SAUDI ARABIA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 145 SAUDI ARABIA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 146 SAUDI ARABIA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 147 SAUDI ARABIA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.5.4 EGYPT

- 8.5.4.1 Increasing exports of chemicals to boost market for acrylic acid

- TABLE 148 EGYPT: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 149 EGYPT: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 150 EGYPT: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 151 EGYPT: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 152 EGYPT: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 153 EGYPT: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 154 REST OF MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 158 REST OF MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 162 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (KILOTON)

- TABLE 164 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 166 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 168 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.6 SOUTH AMERICA

- 8.6.1 RECESSION IMPACT

- TABLE 170 SOUTH AMERICA: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 171 SOUTH AMERICA: ACRYLIC ACID MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 172 SOUTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (USD MILLION)

- TABLE 173 SOUTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2017-2020 (KILOTON)

- TABLE 174 SOUTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 175 SOUTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 176 SOUTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 177 SOUTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 178 SOUTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 179 SOUTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.6.2 BRAZIL

- 8.6.2.1 Brazil to be dominant market for acrylic acid in South America

- TABLE 180 BRAZIL: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 181 BRAZIL: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 182 BRAZIL: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 183 BRAZIL: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 184 BRAZIL: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 185 BRAZIL: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.6.3 ARGENTINA

- 8.6.3.1 Unfavorable economic conditions likely to cause sluggish market growth

- TABLE 186 ARGENTINA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 187 ARGENTINA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 188 ARGENTINA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 189 ARGENTINA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 190 ARGENTINA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 191 ARGENTINA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

- 8.6.4 REST OF SOUTH AMERICA

- TABLE 192 REST OF SOUTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (USD MILLION)

- TABLE 193 REST OF SOUTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021-2028 (KILOTON)

- TABLE 194 REST OF SOUTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 195 REST OF SOUTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 196 REST OF SOUTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 197 REST OF SOUTH AMERICA: ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021-2028 (KILOTON)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 198 COMPANIES ADOPTED EXPANSIONS AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2023

- 9.2 MARKET SHARE ANALYSIS

- FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 9.3 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 37 FIVE-YEAR REVENUE ANALYSIS OF KEY COMPANIES

- 9.4 COMPANY EVALUATION MATRIX

- 9.4.1 STARS

- 9.4.2 EMERGING LEADERS

- 9.4.3 PARTICIPANTS

- 9.4.4 PERVASIVE PLAYERS

- FIGURE 38 COMPANY EVALUATION MATRIX: ACRYLIC ACID MARKET, 2022

- 9.5 COMPANY FOOTPRINT

- TABLE 199 ACRYLIC ACID MARKET: COMPANY FOOTPRINT

- 9.6 SME EVALUATION MATRIX, 2022

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- FIGURE 39 SME EVALUATION MATRIX: ACRYLIC ACID MARKET, 2022

- 9.7 COMPETITIVE BENCHMARKING

- TABLE 200 ACRYLIC ACID MARKET: LIST OF KEY PLAYERS

- 9.8 COMPETITIVE SCENARIO

- 9.8.1 DEALS

- TABLE 201 DEALS, 2018-2023

- 9.8.2 PRODUCT LAUNCHES

- TABLE 202 PRODUCT LAUNCHES, 2018-2023

- 9.8.3 OTHER DEVELOPMENTS

- TABLE 203 OTHER DEVELOPMENTS, 2018-2023

10 COMPANY PROFILE

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 10.1 KEY PLAYERS

- 10.1.1 BASF SE

- TABLE 204 BASF SE: COMPANY OVERVIEW

- FIGURE 40 BASF SE: COMPANY SNAPSHOT

- TABLE 205 BASF SE: DEALS

- TABLE 206 BASF SE: OTHERS

- 10.1.2 ARKEMA

- TABLE 207 ARKEMA: COMPANY OVERVIEW

- FIGURE 41 ARKEMA: COMPANY SNAPSHOT

- TABLE 208 ARKEMA: PRODUCT LAUNCHES

- TABLE 209 ARKEMA: DEALS

- TABLE 210 ARKEMA: OTHERS

- 10.1.3 NIPPON SHOKUBAI CO., LTD.

- TABLE 211 NIPPON SHOKUBAI CO., LTD.: COMPANY OVERVIEW

- FIGURE 42 NIPPON SHOKUBAI CO., LTD.: COMPANY SNAPSHOT

- TABLE 212 NIPPON SHOKUBAI CO., LTD.: OTHERS

- 10.1.4 LG CHEM

- TABLE 213 LG CHEM: COMPANY OVERVIEW

- FIGURE 43 LG CHEM: COMPANY SNAPSHOT

- TABLE 214 LG CHEM: DEALS

- TABLE 215 LG CHEM: OTHERS

- 10.1.5 DOW CHEMICAL COMPANY

- TABLE 216 DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 44 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 217 DOW CHEMICAL COMPANY: OTHERS

- 10.1.6 MITSUBISHI CHEMICAL CORPORATION

- TABLE 218 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- FIGURE 45 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

- TABLE 219 MITSUBISHI CHEMICAL CORPORATION: DEALS

- TABLE 220 MITSUBISHI CHEMICAL CORPORATION: OTHERS

- 10.1.7 SASOL LTD.

- TABLE 221 SASOL LTD.: COMPANY OVERVIEW

- FIGURE 46 SASOL LTD.: COMPANY SNAPSHOT

- 10.1.8 EVONIK INDUSTRIES AG

- TABLE 222 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 47 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 223 EVONIK INDUSTRIES AG: DEALS

- TABLE 224 EVONIK INDUSTRIES AG: PRODUCT LAUNCHES

- TABLE 225 EVONIK INDUSTRIES AG: OTHERS

- 10.1.9 MERCK KGAA

- TABLE 226 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 48 MERCK KGAA: COMPANY SNAPSHOT

- 10.1.10 SUMITOMO CORPORATION

- TABLE 227 SUMITOMO CORPORATION: COMPANY OVERVIEW

- FIGURE 49 SUMITOMO CORPORATION: COMPANY SNAPSHOT

- TABLE 228 SUMITOMO CORPORATION: OTHERS

- 10.2 ADDITIONAL PLAYERS

- 10.2.1 SATELLITE CHEMICAL CO., LTD.

- TABLE 229 SATELLITE CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 10.2.2 SYNTHOMER PLC

- TABLE 230 SYNTHOMER PLC: COMPANY OVERVIEW

- 10.2.3 SHANGHAI HUAYI ACRYLIC ACID CO., LTD.

- TABLE 231 SHANGHAI HUAYI ACRYLIC ACID CO., LTD.: COMPANY OVERVIEW

- 10.2.4 SIBUR HOLDING PJSC

- TABLE 232 SIBUR HOLDING PJSC: COMPANY OVERVIEW

- 10.2.5 WANHUA CHEMICAL GROUP CO., LTD.

- TABLE 233 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- 10.2.6 TOAGOSEI CO., LTD.

- TABLE 234 TOAGOSEI CO., LTD.: COMPANY OVERVIEW

- 10.2.7 SINOCHEM GROUP CO., LTD.

- TABLE 235 SINOCHEM GROUP CO., LTD.: COMPANY OVERVIEW

- 10.2.8 LUBRIZOL CORPORATION

- TABLE 236 LUBRIZOL CORPORATION: COMPANY OVERVIEW

- 10.2.9 POLYSCIENCES, INC.

- TABLE 237 POLYSCIENCES, INC.: COMPANY OVERVIEW

- 10.2.10 JURONG GROUP

- TABLE 238 JURONG GROUP: COMPANY OVERVIEW

- 10.2.11 MOMENTIVE PERFORMANCE MATERIALS

- TABLE 239 MOMENTIVE PERFORMANCE MATERIALS: COMPANY OVERVIEW

- 10.2.12 SOLVAY

- TABLE 240 SOLVAY: COMPANY OVERVIEW

- 10.2.13 ROHM GMBH

- TABLE 241 ROHM GMBH: COMPANY OVERVIEW

- 10.2.14 KAMSONS CHEMICALS PVT. LTD.

- TABLE 242 KAMSONS CHEMICALS PVT. LTD. COMPANY OVERVIEW

- 10.2.15 GELLNER INDUSTRIAL LLC

- TABLE 243 GELLNER INDUSTRIAL LLC: COMPANY OVERVIEW

11 ADJACENT & RELATED MARKET

- 11.1 INTRODUCTION

- 11.2 LIMITATIONS

- 11.3 BIO-ACRYLIC ACID MARKET

- 11.3.1 MARKET DEFINITION

- 11.3.2 MARKET OVERVIEW

- 11.4 BIO-ACRYLIC ACID MARKET, BY TYPE

- TABLE 244 BIO-ACRYLIC ACID MARKET, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 245 BIO-ACRYLIC ACID MARKET, BY TYPE, 2021-2027 (TON)

- 11.5 BIO-ACRYLIC ACID MARKET, BY APPLICATION

- TABLE 246 BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 247 BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021-2027 (TON)

- 11.6 BIO-ACRYLIC ACID MARKET, BY REGION

- TABLE 248 BIO-ACRYLIC ACID MARKET, BY REGION, 2021-2027 (TON)

- TABLE 249 BIO-ACRYLIC ACID MARKET, BY REGION, 2021-2027 (USD MILLION)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 CUSTOMIZATION OPTIONS

- 12.3 RELATED REPORTS

- 12.4 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.5 AUTHOR DETAILS