|

|

市場調査レポート

商品コード

1344199

セキュリティオートメーションの世界市場 (~2028年):提供区分 (ソリューション・サービス)・コードタイプ・技術 (AI&ML・予測分析)・用途 (ネットワークセキュリティ・IAM)・産業 (BFSI・製造・メディア&エンターテインメント)・地域別Security Automation Market by Offering (Solutions, Services), Code Type, Technology (AI & ML, Predictive Analytics), Application (Network Security, IAM), Vertical (BFSI, Manufacturing, Media & Entertainment) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| セキュリティオートメーションの世界市場 (~2028年):提供区分 (ソリューション・サービス)・コードタイプ・技術 (AI&ML・予測分析)・用途 (ネットワークセキュリティ・IAM)・産業 (BFSI・製造・メディア&エンターテインメント)・地域別 |

|

出版日: 2023年09月01日

発行: MarketsandMarkets

ページ情報: 英文 349 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のセキュリティオートメーションの市場規模は、2023年の89億米ドルから、予測期間中は13.4%のCAGRで推移し、2028年には167億米ドルの規模に成長すると予測されています。

サイバーセキュリティの脅威の増大と複雑化、セキュリティインシデントをリアルタイムで検知し対応する能力の向上により、市場の成長が見込まれています。

提供区分別では、ソリューションの部門が予測期間中に最大の市場規模を記録する見通しです。ソリューション部門には、SOAR、SIEM、XDRが含まれます。セキュリティオートメーション市場におけるソリューション部門の成長は、コネクテッドデバイスやデジタルサービスの急速な普及によってサイバー犯罪者の攻撃対象が拡大し、脅威の検出と緩和のためのプロアクティブで自動化されたアプローチが必要になっているなど、いくつかの重要な要因によって牽引されています。

産業別では、ヘルスケア&ライフサイエンスの部門が予測期間中に最速のCAGRを記録する見通しです。同業界は、過去10年間で飛躍的な進歩を遂げており、セキュリティオートメーション技術はこの進歩の推進において極めて重要な役割を果たしています。セキュリティオートメーション技術は医療保険の相互運用性と説明責任に関する法律 (HIPAA) などの規制へのコンプライアンスを合理化し、重要な研究活動の継続性を保証します。脆弱性評価、脅威検出、インシデント対応などのセキュリティプロセスを自動化することで、組織はセキュリティを犠牲にすることなく、質の高い患者ケアの提供と科学的発見の進展に集中することができます。

地域別では、北米地域が予測期間中に最大の規模を示す見通しです。同地域におけるセキュリティオートメーション市場の継続的な成長は、サイバー攻撃に対する企業や国による大規模な投資と、同地域全体における参入事業者の存在によるものです。

当レポートでは、世界のセキュリティオートメーションの市場を調査し、市場概要、市場成長への影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- 関税と規制状況

- エコシステム/市場マップ

- 特許分析

- サプライチェーン分析

- セキュリティオートメーション市場情勢の今後の方向性

- 価格分析

- セキュリティオートメーションの進化:経緯

- バイヤー/クライアントの事業に影響を与える動向・ディスラプション

- ポーターのファイブフォース分析

- 主な会議とイベント

- 主なステークホルダーと購入基準

- 技術分析

- ビジネスモデル分析

第6章 セキュリティオートメーション市場:提供区分別

- ソリューション

- SOAR

- SIEM

- XDR

- セキュリティオートメーションソリューション市場:展開モード別

- クラウド

- オンプレミス

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 セキュリティオートメーション市場:技術別

- AI・機械学習

- 予測分析

- RPA

- UEBA (ユーザとエンティティの行動分析)

- その他

第8章 セキュリティオートメーション市場:用途別

- ネットワークセキュリティ

- 侵入検知・防御システム (IDPS)

- ファイアウォール管理

- ネットワークアクセス制御

- ネットワークトラフィック分析

- その他

- エンドポイントセキュリティ

- 脅威検出・防止

- マルウェア検出・削除

- 構成管理

- フィッシング電子メールからの保護

- その他

- インシデント対応管理

- インシデントの分類・優先順位付け

- 証拠収集

- ワークフローオーケストレーション

- インシデントのトリアージ・エスカレーション

- その他

- 脆弱性管理

- 脆弱性スキャン・評価

- 優先順位付け

- 脆弱性の修復・発券

- パッチ管理・修復

- その他

- ID・アクセス管理 (IAM)

- ユーザーのプロビジョニング&プロビジョニング解除

- 多要素認証 (MFA)

- シングルサインオン (SSO)

- アクセスポリシーの施行

- その他

- コンプライアンス&ポリシー管理

- 自動コンプライアンス監査

- ポリシー施行の自動化

- 規制遵守レポート

- 監査証跡生成

- その他

- データ保護・暗号化

- 暗号化キー管理

- ファイル&データベース暗号化

- データ損失防止

- その他

- その他

- サイバー脅威インテリジェンス

- 脅威フィード統合

- イベントトリガーの自動化

第9章 セキュリティオートメーションソフトウェア市場:コードタイプ別

- ローコード

- ノーコード

- フルコード

第10章 セキュリティオートメーション市場:産業別

- 銀行・金融サービス・保険

- メディア・エンターテイメント

- 製造

- 政府・防衛

- エネルギー・ユーティリティ

- 小売・電子商取引

- ヘルスケア・ライフサイエンス

- IT・ITES

- その他

第11章 セキュリティオートメーション市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 主要企業の採用戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- セキュリティオートメーション市場におけるブランド/製品の比較分析

- 主要なセキュリティオートメーションベンダーの評価と財務指標

- 競合シナリオ・動向

第13章 企業プロファイル

- 主要企業

- PALO ALTO NETWORKS

- SPLUNK

- CYBERARK

- CHECK POINT

- CROWDSTRIKE

- RED HAT

- CISCO

- CARBON BLACK

- TRELLIX

- IBM

- SECUREWORKS

- TENABLE

- その他の企業

- MICROSOFT

- SWIMLANE

- TUFIN

- SUMO LOGIC

- LOGRHYTHM

- EXABEAM

- MANAGEENGINE

- FORTINET

- DEVO TECHNOLOGY

- D3 SECURITY

- LOGSIGN

- スタートアップ/SMEのプロファイル

- VULCAN CYBER

- CYWARE

- CYBERBIT

- SIRP

- TINES

- VERITI

- VANTA

- DRATA

- ANVILOGIC

- TORQ

第14章 隣接市場および関連市場

第15章 付録

The security automation market is projected to grow from USD 8.9 billion in 2023 to USD 16.7 billion by 2028, at a compound annual growth rate (CAGR) of 13.4% during the forecast period. The market is anticipated to grow due to the rising cybersecurity threats and complexity, growing ability to detect and respond to security incidents in real-time.

By offering solutions segment to register for largest market size during forecast period

The solution segment includes SOAR, SIEM, and XDR. The growth of the solutions segment in the security automation market is being driven by several key factors like the rapid proliferation of connected devices and digital services has expanded the attack surface for cybercriminals, necessitating a proactive and automated approach to threat detection and mitigation.

By vertical, healthcare & life sciences segment to register fastest growing CAGR during the forecast period

The healthcare & life sciences verticals have witnessed tremendous advancements over the past decade, and security automation technology have played a pivotal role in driving this progress. Security automation in the healthcare and life sciences sectors streamlines compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA) and ensures the continuity of critical research activities. By automating security processes such as vulnerability assessments, threat detection, and incident response, organizations can focus on delivering high-quality patient care and advancing scientific discoveries without compromising security.

North America to witness the largest market size during the forecast period

North America is experiencing significant technological growth in the security automation market, driven by various factors shaping the landscape of intelligent and connected devices. The continuous growth of the security automation market in the region is due to the heavy investment done by companies and countries against cyberattacks and the presence of market players across the region. The increase in the number of cyberattacks is giving a wake-up call to different organizations to safeguard their businesses by using new and innovative technologies, such as SOAR, to prevent attacks and to guard their organization's valuable and critical data.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the security automation market.

- By Company: Tier I: 38%, Tier II: 50%, and Tier III: 12%

- By Designation: C-Level Executives: 35%, D-Level Executives: 40%, and Managers: 25%

- By Region: North America: 40%, Europe: 30%, Asia Pacific: 20%, and Middle East and Africa- 5%, Latin America-5%

The report includes the study of key players offering security automation solutions. It profiles major vendors in the security automation market. The major players in the security automation market include Palo Alto Networks (US), Splunk (US), CyberArk (US), Check Point (Israel), CrowdStrike (US), Red Hat (US), Cisco (US), Carbon Black (US), Trellix (US), IBM (US), Secureworks (US), Tenable (US), Microsoft (US), Swimlane (US), Tufin (US), Sumo Logic (US), Google (US), LogRhythm (US), Exabeam (US), ManageEngine (India), Fortinet (US), Devo Technology (US), D3 Security (Canada), Logsign (Netherlands), Vulcan Cyber (Israel), Cyware (US), Cyberbit (US), SIRP (US), Tines (Ireland), Veriti (Israel), Vanta (US), Drata (US), Anvilogic (US), and Torq (US).

Research coverage

The security automation market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred security automation providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market's prospects.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall security automation market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising cybersecurity threats and complexity, Growing ability to detect and respond security incidents in real-time, Increasing incidents of phishing emails and ransomware, Need to ensure consistent adherence to security policies and facilitates audit trails), restraints (Concerns related to data privacy, Uncertainty in third-party applications), opportunities ( rise in advent of predictive analytics to anticipate potential threats, Advancements in quantum computing to mitigate quantum-based attacks), and challenges (shortage of modern IT infrastructure).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the security automation market

- Market Development: Comprehensive information about lucrative markets - the report analyses the security automation market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the security automation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like include Cisco (US), IBM (US), Palo Alto Networks (US), Splunk (US), CyberArk (US), Check Point (Israel), CrowdStrike (US) among others in the security automation market strategies. The report also helps stakeholders understand the pulse of the security automation market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SECURITY AUTOMATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 SECURITY AUTOMATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF SECURITY AUTOMATION MARKET

- FIGURE 5 APPROACH 2 (BOTTOM-UP, SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SECURITY AUTOMATION SOLUTION/SERVICE VENDORS

- FIGURE 6 APPROACH 3 (BOTTOM-UP, SUPPLY-SIDE): FLOWCHART OF ESTIMATION AND SOURCES

- FIGURE 7 APPROACH 4 (BOTTOM-UP, DEMAND-SIDE): SHARE OF SECURITY AUTOMATION THROUGH OVERALL SECURITY AUTOMATION SPENDING

- 2.4 MARKET FORECAST

- TABLE 1 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPLICATIONS OF RECESSION ON SECURITY AUTOMATION MARKET

- TABLE 2 IMPACT OF RECESSION ON GLOBAL SECURITY AUTOMATION MARKET

3 EXECUTIVE SUMMARY

- TABLE 3 SECURITY AUTOMATION MARKET SIZE AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y GROWTH)

- TABLE 4 SECURITY AUTOMATION MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y GROWTH)

- FIGURE 8 SECURITY AUTOMATION SOLUTIONS TO LEAD OVER SERVICES MARKET IN 2023

- FIGURE 9 SOAR SOLUTIONS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 10 THREAT INTELLIGENCE AUTOMATION TO LEAD SOAR SOLUTIONS MARKET IN 2023

- FIGURE 11 REAL-TIME ALERTING AUTOMATION TO LEAD SIEM SOLUTIONS MARKET IN 2023

- FIGURE 12 REAL-TIME RESPONSE AUTOMATION TO BE LARGEST XDR SOLUTIONS MARKET IN 2023

- FIGURE 13 PROFESSIONAL SERVICES SEGMENT TO LEAD OVER MANAGED SERVICES IN 2023

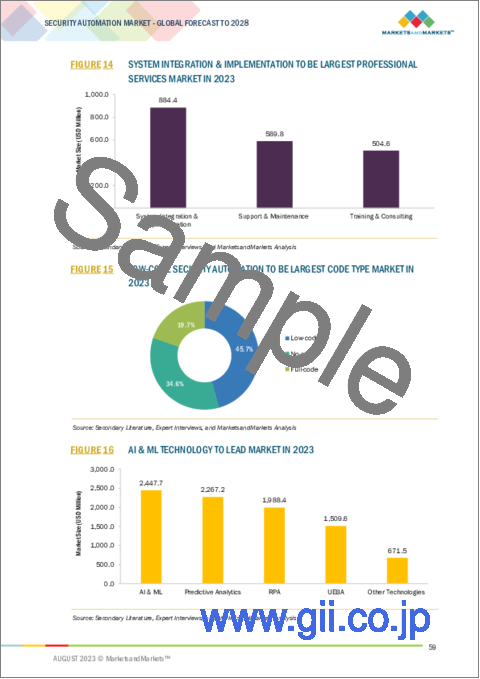

- FIGURE 14 SYSTEM INTEGRATION & IMPLEMENTATION TO BE LARGEST PROFESSIONAL SERVICES MARKET IN 2023

- FIGURE 15 LOW-CODE SECURITY AUTOMATION TO BE LARGEST CODE TYPE MARKET IN 2023

- FIGURE 16 AI & ML TECHNOLOGY TO LEAD MARKET IN 2023

- FIGURE 17 NETWORK SECURITY TO BE LARGEST APPLICATION MARKET IN 2023

- FIGURE 18 FIREWALL MANAGEMENT TO BE LARGEST NETWORK SECURITY APPLICATION MARKET IN 2023

- FIGURE 19 THREAT DETECTION & PREVENTION TO BE LARGEST ENDPOINT SECURITY APPLICATION MARKET IN 2023

- FIGURE 20 INCIDENT TRIAGE & ESCALATION TO BE LARGEST INCIDENT RESPONSE MANAGEMENT APPLICATION MARKET IN 2023

- FIGURE 21 VULNERABILITY SCANNING & ASSESSMENT TO BE LARGEST VULNERABILITY MANAGEMENT APPLICATION MARKET IN 2023

- FIGURE 22 USER PROVISIONING & DEPROVISIONING TO BE LARGEST IAM APPLICATION MARKET IN 2023

- FIGURE 23 AUTOMATED COMPLIANCE AUDITING TO BE LARGEST COMPLIANCE & POLICY MANAGEMENT APPLICATION MARKET IN 2023

- FIGURE 24 ENCRYPTION KEY MANAGEMENT TO LEAD LARGEST DATA PROTECTION & ENCRYPTION MANAGEMENT APPLICATION MARKET IN 2023

- FIGURE 25 CLOUD SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET IN 2023

- FIGURE 26 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR IN 2023

- FIGURE 27 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE; ASIA PACIFIC TO GROW AT HIGHEST CAGR

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR SECURITY AUTOMATION MARKET PLAYERS

- FIGURE 28 INCREASE IN PHISHING EMAILS AND RANSOMWARE INCIDENTS TO FACILITATE AUDIT TRAILS TO DRIVE MARKET GROWTH

- 4.2 OVERVIEW OF RECESSION IN GLOBAL SECURITY AUTOMATION MARKET

- FIGURE 29 SECURITY AUTOMATION MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- 4.3 SECURITY AUTOMATION MARKET: TOP THREE APPLICATIONS

- FIGURE 30 IDENTITY & ACCESS MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY OFFERING AND TOP THREE VERTICALS

- FIGURE 31 SOLUTION OFFERINGS AND BFSI VERTICAL TO ACCOUNT FOR LARGEST RESPECTIVE MARKET SHARES IN NORTH AMERICA IN 2023

- 4.5 SECURITY AUTOMATION MARKET, BY REGION

- FIGURE 32 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 33 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SECURITY AUTOMATION MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in cybersecurity threats and complexity

- 5.2.1.2 Increase in ability to detect and respond to security incidents in real time

- 5.2.1.3 Growth in incidents of phishing emails and ransomware

- 5.2.1.4 Need to ensure consistent adherence to security policies and facilitate audit trails

- 5.2.2 RESTRAINTS

- 5.2.2.1 Concerns related to data privacy

- 5.2.2.2 Uncertainty in third-party applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in advent of predictive analytics to anticipate potential threats

- 5.2.3.2 Advancements in quantum computing to mitigate quantum-based attacks

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of modern IT infrastructure

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 BFSI

- 5.3.1.1 Superior Credit Union relied on Taegis ManagedXDR for proactive security

- 5.3.1.2 R3's security team saved more than 220 hours/month with Tines

- 5.3.1.3 Tenable unified vulnerability management program of Global Payment AU NZ

- 5.3.1.4 eFinance strengthened digital payment security ecosystem in Egypt with LogRhythm SIEM

- 5.3.2 HEALTHCARE

- 5.3.2.1 Almac Group stepped up IoT Security

- 5.3.2.2 McKesson chose Tines for its refreshing approach to security automation

- 5.3.2.3 Geisinger expanded CrowdStrike usage to protect AWS Cloud Workloads

- 5.3.3 ENERGY & UTILITIES

- 5.3.3.1 Başkentgaz prevented potential DOS and XSS attacks by using Logsign SIEM

- 5.3.3.2 Botswana Power Corporation secured its infrastructure, its business, and its management's confidence with Check Point

- 5.3.4 IT & ITES

- 5.3.4.1 Upwork used Tines to improve its security posture and help its end-users get smarter

- 5.3.4.2 Auth0 used Tines to deliver faster and more efficient security alert response service

- 5.3.5 MEDIA & ENTERTAINMENT

- 5.3.5.1 Tines helped Canva to improve its security detection and response

- 5.3.5.2 The Kraft Group adopted Taegis ManagedXDR to transform its IT environment

- 5.3.6 RETAIL & ECOMMERCE

- 5.3.6.1 Busy Beaver took customer-first approach to IT Security

- 5.3.6.2 Global Retailer reduced risk with Secureworks Threat Detection And Response

- 5.3.7 TELECOM

- 5.3.7.1 Vodafone Idea Limited automated to improve IT infrastructure

- 5.3.8 MANUFACTURING

- 5.3.8.1 SMS Group maintained highest standards of security with Trellix solutions

- 5.3.9 GOVERNMENT & DEFENSE

- 5.3.9.1 Turkish Red Crescent used Logsign SIEM against possible cyber threats

- 5.3.10 EDUCATION

- 5.3.10.1 Istanbul Bilgi University observed network and system activities of users on all campuses using Logsign SIEM

- 5.3.11 AUTOMOTIVE & TRANSPORTATION

- 5.3.11.1 Tines enabled Turo's lean security team to do more with less

- 5.3.1 BFSI

- 5.4 TARIFF AND REGULATORY LANDSCAPE

- 5.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.2 NORTH AMERICA

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.3 EUROPE

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.4 ASIA PACIFIC

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.5 MIDDLE EAST & AFRICA

- TABLE 8 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.6 LATIN AMERICA

- TABLE 9 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5 ECOSYSTEM/MARKET MAP

- TABLE 10 SECURITY AUTOMATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 34 SECURITY AUTOMATION MARKET ECOSYSTEM

- 5.6 PATENT ANALYSIS

- 5.6.1 METHODOLOGY

- 5.6.2 PATENTS FILED, BY DOCUMENT TYPE

- TABLE 11 PATENTS FILED, 2013-2023

- 5.6.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 35 TOTAL NUMBER OF PATENTS GRANTED, 2013-2023

- 5.6.3.1 Top applicants

- FIGURE 36 TOP TEN PATENT APPLICANT COMPANIES, 2013-2023

- TABLE 12 TOP 20 PATENT OWNERS IN SECURITY AUTOMATION MARKET, 2013-2023

- TABLE 13 LIST OF PATENTS IN SECURITY AUTOMATION MARKET, 2023

- FIGURE 37 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SECURITY AUTOMATION MARKET, 2023

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 38 SECURITY AUTOMATION MARKET: SUPPLY CHAIN ANALYSIS

- 5.8 FUTURE DIRECTIONS OF SECURITY AUTOMATION MARKET LANDSCAPE

- 5.8.1 TECHNOLOGY ROADMAP FOR SECURITY AUTOMATION MARKET UNTIL 2030

- FIGURE 39 SECURITY AUTOMATION ROADMAP UNTIL 2030

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE OF KEY COMPANIES

- FIGURE 40 AVERAGE SELLING PRICE OF KEY COMPANIES

- 5.9.2 INDICATIVE PRICING ANALYSIS

- TABLE 14 AVERAGE SELLING PRICE ANALYSIS, BY OFFERING

- 5.10 BRIEF HISTORY OF SECURITY AUTOMATION/EVOLUTION

- FIGURE 41 SECURITY AUTOMATION MARKET EVOLUTION

- 5.11 TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS' BUSINESSES

- FIGURE 42 TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS' BUSINESSES

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 43 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY CONFERENCES AND EVENTS

- TABLE 15 DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 44 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.14.2 BUYING CRITERIA

- FIGURE 45 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGY

- 5.15.1.1 Artificial Intelligence and Machine Learning (AI and ML)

- 5.15.1.2 Biometric Authentication

- 5.15.1.3 Containerization and Microservices

- 5.15.1.4 Quantum Computing

- 5.15.1.5 User and Entity Behavior Analytics (UEBA)

- 5.15.1.6 Network Segmentation Technologies

- 5.15.1.7 Blockchain

- 5.15.2 ADJACENT TECHNOLOGY

- 5.15.2.1 IoT

- 5.15.2.2 5G

- 5.15.2.3 Cloud Computing

- 5.15.2.4 Edge Computing

- 5.15.2.5 Remote Work Technologies

- 5.15.1 KEY TECHNOLOGY

- 5.16 BUSINESS MODEL ANALYSIS

- 5.16.1 SUBSCRIPTION-BASED SERVICES

- 5.16.2 FREEMIUM MODELS

- 5.16.3 MANAGED SECURITY SERVICES

- 5.16.4 PLATFORM AS A SERVICE (PAAS)

- 5.16.5 ON-PREMISES LICENSING

- 5.16.6 USAGE-BASED MODELS

- 5.16.7 HYBRID CLOUD MODELS

6 SECURITY AUTOMATION MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: SECURITY AUTOMATION MARKET DRIVERS

- FIGURE 46 SECURITY AUTOMATION SERVICES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 18 SECURITY AUTOMATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 19 SECURITY AUTOMATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- FIGURE 47 XDR SOLUTIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 20 SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 21 SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2.1 SOAR

- FIGURE 48 THREAT INTELLIGENCE AUTOMATION TO GROW AT HIGHEST CAGR AMONG SOAR SOLUTIONS DURING FORECAST PERIOD

- TABLE 22 SOAR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 23 SOAR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 24 SOAR SOLUTIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 25 SOAR SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.1 Incident Response Automation

- 6.2.1.1.1 Growth evidenced by increasing number of technology providers specializing in this domain

- 6.2.1.1 Incident Response Automation

- TABLE 26 INCIDENT RESPONSE AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 27 INCIDENT RESPONSE AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.2 Case Management Automation

- 6.2.1.2.1 Solutions offered by vendors to cater to various industries, across organization sizes

- 6.2.1.2 Case Management Automation

- TABLE 28 CASE MANAGEMENT AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 CASE MANAGEMENT AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

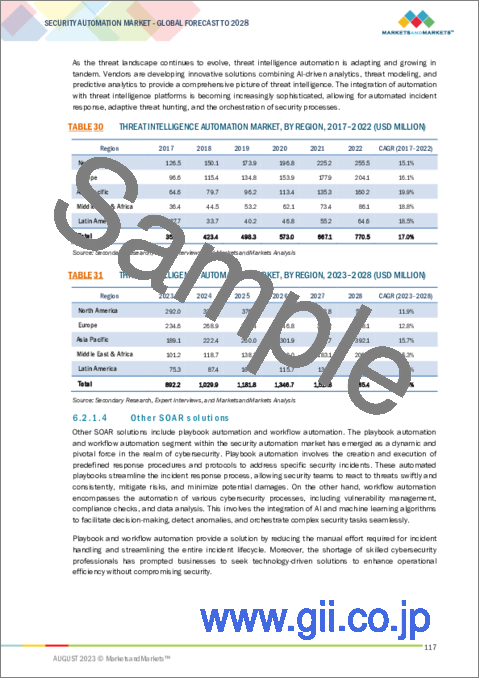

- 6.2.1.3 Threat Intelligence Automation

- 6.2.1.3.1 Demand for proactive approach to identifying potential threats, vulnerabilities, and emerging attack trends

- 6.2.1.3 Threat Intelligence Automation

- TABLE 30 THREAT INTELLIGENCE AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 31 THREAT INTELLIGENCE AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.4 Other SOAR solutions

- TABLE 32 OTHER SOAR SOLUTIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 OTHER SOAR SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 SIEM

- FIGURE 49 REAL-TIME ALERTING AUTOMATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 34 SIEM SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 35 SIEM SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 36 SIEM SOLUTIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 37 SIEM SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.1 Log Collection Automation

- 6.2.2.1.1 Unified approach to data aggregation, ensuring consistent monitoring across entire digital landscape

- 6.2.2.1 Log Collection Automation

- TABLE 38 LOG COLLECTION AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 LOG COLLECTION AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.2 Real-time Alerting Automation

- 6.2.2.2.1 Security teams allowed to focus on strategic decision-making and incident management

- 6.2.2.2 Real-time Alerting Automation

- TABLE 40 REAL-TIME ALERTING AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 41 REAL-TIME ALERTING AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.3 Incident Prioritization Automation

- 6.2.2.3.1 Convergence of cybersecurity and pioneering technologies

- 6.2.2.3 Incident Prioritization Automation

- TABLE 42 INCIDENT PRIORITIZATION AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 43 INCIDENT PRIORITIZATION AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.4 Automated Incident Escalation

- 6.2.2.4.1 Integration of AI & ML to empower continuous learning and adapting to new threat patterns

- 6.2.2.4 Automated Incident Escalation

- TABLE 44 AUTOMATED INCIDENT ESCALATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 45 AUTOMATED INCIDENT ESCALATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 XDR

- FIGURE 50 AUTOMATED THREAT HUNTING SOLUTIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 46 XDR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 47 XDR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 48 XDR SOLUTIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 49 XDR SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3.1 Real-time Response Automation

- 6.2.3.1.1 Demand for flexibility to adapt to changing environments and diverse threat scenarios

- 6.2.3.1 Real-time Response Automation

- TABLE 50 REAL-TIME RESPONSE AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 51 REAL-TIME RESPONSE AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3.2 Automated Threat Hunting

- 6.2.3.2.1 Automated threat hunting to rapidly evolve to address challenges posed by modern cyber threat landscape

- 6.2.3.2 Automated Threat Hunting

- TABLE 52 AUTOMATED THREAT HUNTING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 53 AUTOMATED THREAT HUNTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3.3 Automated Compliance Reporting

- 6.2.3.3.1 Advantages of comprehensive reports showcasing security posture, incident response capabilities, and proactive risk management strategies

- 6.2.3.3 Automated Compliance Reporting

- TABLE 54 AUTOMATED COMPLIANCE REPORTING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 55 AUTOMATED COMPLIANCE REPORTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3.4 Other XDR solutions

- TABLE 56 OTHER XDR SOLUTIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 57 OTHER XDR SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE

- FIGURE 51 CLOUD DEPLOYMENT OF SECURITY AUTOMATION SOLUTIONS TO GROW AT HIGHER CAGR THAN ON-PREMISE SOLUTIONS

- TABLE 58 SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 59 SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 6.3.1 CLOUD

- 6.3.1.1 Cloud solutions provide scalability, allowing organizations to easily expand or contract resources based on demand

- TABLE 60 CLOUD-BASED SECURITY AUTOMATION SOLUTIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 61 CLOUD-BASED SECURITY AUTOMATION SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 ON-PREMISES

- 6.3.2.1 On-premises solutions provide advantage of direct control over security configurations and data-handling practices

- TABLE 62 ON-PREMISE SECURITY AUTOMATION SOLUTIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 ON-PREMISE SECURITY AUTOMATION SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 SERVICES

- FIGURE 52 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 64 SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 65 SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.4.1 PROFESSIONAL SERVICES

- FIGURE 53 TRAINING & CONSULTING SERVICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 66 SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 67 SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 68 SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 69 SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1.1 Training & Consulting

- 6.4.1.1.1 Training and consulting services to empower organizations to harness full potential of automation technologies

- 6.4.1.1 Training & Consulting

- TABLE 70 SECURITY AUTOMATION TRAINING & CONSULTING SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 71 SECURITY AUTOMATION TRAINING & CONSULTING SERVICES, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1.2 System Integration & Implementation

- 6.4.1.2.1 Seamless integration of security automation solutions into organizations' IT environment

- 6.4.1.2 System Integration & Implementation

- TABLE 72 SECURITY AUTOMATION SYSTEM INTEGRATION & IMPLEMENTATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 73 SECURITY AUTOMATION SYSTEM INTEGRATION & IMPLEMENTATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1.3 Support & Maintenance

- 6.4.1.3.1 Need for businesses to stay ahead of cyber adversaries and maintain robust cybersecurity posture

- 6.4.1.3 Support & Maintenance

- TABLE 74 SECURITY AUTOMATION SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 75 SECURITY AUTOMATION SUPPORT & MAINTENANCE SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.2 MANAGED SERVICES

- TABLE 76 SECURITY AUTOMATION MANAGED SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 77 SECURITY AUTOMATION MANAGED SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

7 SECURITY AUTOMATION MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.1.1 TECHNOLOGY: SECURITY AUTOMATION MARKET DRIVERS

- FIGURE 54 PREDICTIVE ANALYTICS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 78 SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 79 SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2 AI & ML

- 7.2.1 GROWTH OF SECURITY AUTOMATION MARKET INTRICATELY TIED TO ADVANCEMENTS IN AI & ML TECHNOLOGIES

- TABLE 80 AI & ML IN SECURITY AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 81 AI & ML IN SECURITY AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PREDICTIVE ANALYTICS

- 7.3.1 PREDICTIVE ANALYTICS TO BE FORCE MULTIPLIER, ENHANCING EFFECTIVENESS OF SECURITY AUTOMATION SOLUTIONS

- TABLE 82 PREDICTIVE ANALYTICS IN SECURITY AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 83 PREDICTIVE ANALYTICS IN SECURITY AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 RPA

- 7.4.1 RPA TO EMPOWER SECURITY PROFESSIONALS TO FOCUS ON STRATEGIC INITIATIVES AND TACKLE COMPLEX CHALLENGES

- TABLE 84 RPA IN SECURITY AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 85 RPA IN SECURITY AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 USER BEHAVIOR & ENTITY BEHAVIOR ANALYTICS (UEBA)

- 7.5.1 UEBA TO HELP ORGANIZATIONS SIGNIFICANTLY REDUCE RESPONSE TIMES AND ENHANCE OVERALL CYBERSECURITY

- TABLE 86 UEBA IN SECURITY AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 87 UEBA IN SECURITY AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 OTHER TECHNOLOGIES

- TABLE 88 OTHER TECHNOLOGIES IN SECURITY AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 89 OTHER TECHNOLOGIES IN SECURITY AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 SECURITY AUTOMATION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: SECURITY AUTOMATION MARKET DRIVERS

- FIGURE 55 IDENTITY & ACCESS MANAGEMENT APPLICATION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 90 SECURITY AUTOMATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 91 SECURITY AUTOMATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 NETWORK SECURITY

- FIGURE 56 NETWORK ACCESS CONTROL APPLICATION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 92 NETWORK SECURITY APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD MILLION)

- TABLE 93 NETWORK SECURITY APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 94 NETWORK SECURITY APPLICATIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 95 NETWORK SECURITY APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1 INTRUSION DETECTION & PREVENTION SYSTEMS (IDPS)

- 8.2.1.1 IDPS to provide necessary monitoring and response mechanisms to meet industry standards

- 8.2.2 FIREWALL MANAGEMENT

- 8.2.2.1 Automation in firewall management aligned with rapid pace of modern cyber threats

- 8.2.3 NETWORK ACCESS CONTROL

- 8.2.3.1 Need to maintain regulatory compliance

- 8.2.4 NETWORK TRAFFIC ANALYSIS

- 8.2.4.1 Advanced and automated approach to threat detection within network environments

- 8.2.5 OTHER NETWORK SECURITY APPLICATIONS

- 8.3 ENDPOINT SECURITY

- FIGURE 57 MALWARE DETECTION & REMOVAL APPLICATION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 96 ENDPOINT SECURITY APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD MILLION)

- TABLE 97 ENDPOINT SECURITY APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 98 ENDPOINT SECURITY APPLICATIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 99 ENDPOINT SECURITY APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.1 THREAT DETECTION & PREVENTION

- 8.3.1.1 Strategic advantage against relentless cyber threats

- 8.3.2 MALWARE DETECTION & REMOVAL

- 8.3.2.1 Demand to bridge gap between rapid evolution of threats and capabilities of human-operated security systems

- 8.3.3 CONFIGURATION MANAGEMENT

- 8.3.3.1 Need to reduce risk of non-compliance penalties and data breaches resulting from misconfigurations

- 8.3.4 PHISHING & EMAIL PROTECTION

- 8.3.4.1 Facility of automated incident response workflows to be triggered to investigate and mitigate potential threats

- 8.3.5 OTHER ENDPOINT SECURITY APPLICATIONS

- 8.4 INCIDENT RESPONSE MANAGEMENT

- FIGURE 58 INCIDENT CATEGORIZATION & PRIORITIZATION APPLICATION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 100 INCIDENT RESPONSE MANAGEMENT APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD MILLION)

- TABLE 101 INCIDENT RESPONSE MANAGEMENT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 102 INCIDENT RESPONSE MANAGEMENT APPLICATIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 103 INCIDENT RESPONSE MANAGEMENT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.1 INCIDENT CATEGORIZATION & PRIORITIZATION

- 8.4.1.1 Need to contribute to improved decision-making within security operations

- 8.4.2 EVIDENCE GATHERING

- 8.4.2.1 Automation solutions to help sift through vast amounts of data, identifying pertinent evidence while minimizing false positives

- 8.4.3 WORKFLOW ORCHESTRATION

- 8.4.3.1 Demand for higher consistency and accuracy in security operations

- 8.4.4 INCIDENT TRIAGE & ESCALATION

- 8.4.4.1 Automation to enable swift escalation of incidents to relevant teams or individuals for further investigation and response

- 8.4.5 OTHER INCIDENT RESPONSE MANAGEMENT APPLICATIONS

- 8.5 VULNERABILITY MANAGEMENT

- FIGURE 59 PRIORITIZATION APPLICATION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 104 VULNERABILITY MANAGEMENT APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD MILLION)

- TABLE 105 VULNERABILITY MANAGEMENT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 106 VULNERABILITY MANAGEMENT APPLICATIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 107 VULNERABILITY MANAGEMENT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5.1 VULNERABILITY SCANNING & ASSESSMENT

- 8.5.1.1 Need for seamless integration into DevSecOps pipeline, identifying vulnerabilities throughout software development lifecycle

- 8.5.2 PRIORITIZATION

- 8.5.2.1 Prioritization to aid in meeting regulatory compliance requirements by ensuring prompt addressing of most serious threats

- 8.5.3 VULNERABILITY REMEDIATION & TICKETING

- 8.5.3.1 Vulnerability remediation to significantly reduce organizations' exposure to potential breaches, minimizing impact of cyber threats

- 8.5.4 PATCH MANAGEMENT & REMEDIATION

- 8.5.4.1 Packet management & remediation: An indispensable component of robust cybersecurity strategy

- 8.5.5 OTHER VULNERABILITY MANAGEMENT APPLICATIONS

- 8.6 IDENTITY & ACCESS MANAGEMENT (IAM)

- FIGURE 60 SINGLE SIGN-ON APPLICATION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 108 IDENTITY & ACCESS MANAGEMENT APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD MILLION)

- TABLE 109 IDENTITY & ACCESS MANAGEMENT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 110 IDENTITY & ACCESS MANAGEMENT APPLICATIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 111 IDENTITY & ACCESS MANAGEMENT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6.1 USER PROVISIONING & DEPROVISIONING

- 8.6.1.1 Organizations' need to stay compliant by providing auditable trail of access changes

- 8.6.2 MULTI-FACTOR AUTHENTICATION (MFA)

- 8.6.2.1 Need to strengthen organizations' defenses against various threats, including phishing attacks and credential theft

- 8.6.3 SINGLE SIGN-ON (SSO)

- 8.6.3.1 SSO to minimize potential attack surface and reduce likelihood of password-related security incidents

- 8.6.4 ACCESS POLICY ENFORCEMENT

- 8.6.4.1 Access policy enforcement to address escalating challenge of managing access rights in complex and dynamic IT environments

- 8.6.5 OTHER IDENTITY & ACCESS MANAGEMENT APPLICATIONS

- 8.7 COMPLIANCE & POLICY MANAGEMENT

- FIGURE 61 POLICY ENFORCEMENT AUTOMATION APPLICATION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 112 COMPLIANCE & POLICY MANAGEMENT APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD MILLION)

- TABLE 113 COMPLIANCE & POLICY MANAGEMENT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 114 COMPLIANCE & POLICY MANAGEMENT APPLICATIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 115 COMPLIANCE & POLICY MANAGEMENT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7.1 AUTOMATED COMPLIANCE AUDITING

- 8.7.1.1 Automated auditing to help organizations proactively identify and rectify compliance gaps before serious repercussions

- 8.7.2 POLICY ENFORCEMENT AUTOMATION

- 8.7.2.1 Policy enforcement automation to gain traction due to its ability to enhance both efficiency and effectiveness

- 8.7.3 REGULATORY COMPLIANCE REPORTING

- 8.7.3.1 Proactive monitoring and alerting to help organizations identify potential compliance breaches early on and take corrective actions

- 8.7.4 AUDIT TRAIL GENERATION

- 8.7.4.1 Automation to generate audit trails, ensuring accuracy, consistency, and timely reporting

- 8.7.5 OTHER COMPLIANCE & POLICY MANAGEMENT APPLICATIONS

- 8.8 DATA PROTECTION & ENCRYPTION

- FIGURE 62 FILE & DATABASE ENCRYPTION APPLICATION TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 116 DATA PROTECTION & ENCRYPTION APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD MILLION)

- TABLE 117 DATA PROTECTION & ENCRYPTION APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD MILLION)

- TABLE 118 DATA PROTECTION & ENCRYPTION APPLICATIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 119 DATA PROTECTION & ENCRYPTION APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8.1 ENCRYPTION KEY MANAGEMENT

- 8.8.1.1 Integration into broader security automation strategies to enhance data protection, reduce operational overhead, and ensure regulatory compliance

- 8.8.2 FILE & DATABASE ENCRYPTION

- 8.8.2.1 File and database encryption to enhance data security while maintaining operational efficiency

- 8.8.3 DATA LOSS PREVENTION

- 8.8.3.1 DLP solutions to aid in identify patterns, anomalies, and potential risks across these data flows in real time

- 8.8.4 OTHER DATA PROTECTION & ENCRYPTION APPLICATIONS

- 8.9 OTHER APPLICATIONS

- TABLE 120 OTHER APPLICATIONS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 121 OTHER APPLICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.9.1 CYBER THREAT INTELLIGENCE

- 8.9.1.1 Security automation to enable real-time threat hunting and incident response

- 8.9.2 THREAT FEED INTEGRATION

- 8.9.2.1 Threat feed integration to align with shift from reactive to proactive cybersecurity practices

- 8.9.3 EVENT-TRIGGERED AUTOMATION

- 8.9.3.1 Event-triggered automation to minimize impact of cyber incidents with optimizing resource allocation

9 SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE

- 9.1 INTRODUCTION

- 9.1.1 CODE TYPE: SECURITY AUTOMATION SOFTWARE MARKET DRIVERS

- FIGURE 63 LOW-CODE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 122 SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2017-2022 (USD MILLION)

- TABLE 123 SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2023-2028 (USD MILLION)

- 9.2 LOW-CODE

- 9.2.1 LOW-CODE PLATFORMS PROVIDE ORGANIZATIONS WITH AGILITY NEEDED TO COUNTER EVER-EVOLVING LANDSCAPE OF CYBER THREATS

- TABLE 124 LOW-CODE SECURITY AUTOMATION SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 125 LOW-CODE SECURITY AUTOMATION SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 NO-CODE

- 9.3.1 NO-CODE SOFTWARE OFFERS DEMOCRATIZED APPROACH TO BUILDING AND IMPLEMENTING SECURITY AUTOMATION SOLUTIONS

- TABLE 126 NO-CODE SECURITY AUTOMATION SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 127 NO-CODE SECURITY AUTOMATION SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 FULL-CODE

- 9.4.1 ABILITY TO MINIMIZE HUMAN ERROR, ACCELERATE DEVELOPMENT CYCLES, AND ENHANCE SECURITY MEASURES

- TABLE 128 FULL-CODE SECURITY AUTOMATION SOFTWARE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 129 FULL-CODE SECURITY AUTOMATION SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

10 SECURITY AUTOMATION MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: SECURITY AUTOMATION MARKET DRIVERS

- FIGURE 64 HEALTHCARE & LIFE SCIENCES VERTICAL TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 10.1.2 MAJOR USE CASES, BY VERTICAL

- TABLE 130 SECURITY AUTOMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 131 SECURITY AUTOMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- TABLE 132 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 133 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 MEDIA & ENTERTAINMENT

- TABLE 134 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 135 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 MANUFACTURING

- TABLE 136 MANUFACTURING VERTICAL MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 137 MANUFACTURING VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 GOVERNMENT & DEFENSE

- TABLE 138 GOVERNMENT & DEFENSE VERTICAL MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 139 GOVERNMENT & DEFENSE VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 ENERGY & UTILITIES

- TABLE 140 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 141 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 RETAIL & ECOMMERCE

- TABLE 142 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 143 RETAIL & ECOMMERCE VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8 HEALTHCARE & LIFE SCIENCES

- TABLE 144 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 145 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9 IT & ITES

- TABLE 146 IT & ITES VERTICAL MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 147 IT & ITES VERTICAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.10 OTHER VERTICALS

- TABLE 148 OTHER VERTICALS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 149 OTHER VERTICALS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 SECURITY AUTOMATION MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 65 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 66 INDIA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 150 SECURITY AUTOMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 151 SECURITY AUTOMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: SECURITY AUTOMATION MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 67 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 152 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 155 NORTH AMERICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 156 NORTH AMERICA: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 157 NORTH AMERICA: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 NORTH AMERICA: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 159 NORTH AMERICA: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 160 NORTH AMERICA: SOAR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 161 NORTH AMERICA: SOAR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 162 NORTH AMERICA: SIEM SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 163 NORTH AMERICA: SIEM SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 164 NORTH AMERICA: XDR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 165 NORTH AMERICA: XDR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 166 NORTH AMERICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 167 NORTH AMERICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 168 NORTH AMERICA: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2017-2022 (USD MILLION)

- TABLE 169 NORTH AMERICA: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2023-2028 (USD MILLION)

- TABLE 170 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 171 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 172 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 173 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 174 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 175 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 176 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 177 NORTH AMERICA: SECURITY AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Advanced technologies to increase security risks and threats to be addressed

- 11.2.4 CANADA

- 11.2.4.1 Private sector participation to play crucial role in advancement of security automation technology

- 11.3 EUROPE

- 11.3.1 EUROPE: SECURITY AUTOMATION MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 178 EUROPE: SECURITY AUTOMATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 179 EUROPE: SECURITY AUTOMATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 180 EUROPE: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 181 EUROPE: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 182 EUROPE: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 183 EUROPE: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 184 EUROPE: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 185 EUROPE: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 186 EUROPE: SOAR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 187 EUROPE: SOAR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 188 EUROPE: SIEM SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 189 EUROPE: SIEM SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 190 EUROPE: XDR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 191 EUROPE: XDR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 192 EUROPE: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 193 EUROPE: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 194 EUROPE: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2017-2022 (USD MILLION)

- TABLE 195 EUROPE: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2023-2028 (USD MILLION)

- TABLE 196 EUROPE: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 197 EUROPE: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 198 EUROPE: SECURITY AUTOMATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 199 EUROPE: SECURITY AUTOMATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 200 EUROPE: SECURITY AUTOMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 201 EUROPE: SECURITY AUTOMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 202 EUROPE: SECURITY AUTOMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 203 EUROPE: SECURITY AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Demand to strengthen cybersecurity posture by embracing automation and advanced technologies

- 11.3.4 GERMANY

- 11.3.4.1 German government emphasized regulatory frameworks and standards to encourage adoption of security automation technology

- 11.3.5 FRANCE

- 11.3.5.1 France leverages AI & ML to strengthen its cybersecurity defenses

- 11.3.6 SPAIN

- 11.3.6.1 Spanish organizations look to improve security posture and reduce risk of cyberattacks

- 11.3.7 ITALY

- 11.3.7.1 National cybersecurity strategy includes plans pertaining to R&D

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: SECURITY AUTOMATION MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 68 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 204 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 205 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 207 ASIA PACIFIC: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 209 ASIA PACIFIC: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 211 ASIA PACIFIC: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: SOAR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SOAR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: SIEM SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 215 ASIA PACIFIC: SIEM SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: XDR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 217 ASIA PACIFIC: XDR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2017-2022 (USD MILLION)

- TABLE 221 ASIA PACIFIC: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2023-2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 223 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 224 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 225 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 226 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 227 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 228 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY COUNTRY/REGION, 2017-2022 (USD MILLION)

- TABLE 229 ASIA PACIFIC: SECURITY AUTOMATION MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 China emerged proactive in leveraging AI and automation to bolster its cybersecurity capabilities

- 11.4.4 JAPAN

- 11.4.4.1 Integrating automation into its cybersecurity framework highlighted Japan's commitment to addressing evolving cyber threats

- 11.4.5 INDIA

- 11.4.5.1 India focuses on collaborations, innovation hubs, policy initiatives, and talent development

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Significant strides in AI research, development, and deployment and focus of companies on developing AI devices

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Australia & New Zealand actively embrace security automation as cornerstone of their cybersecurity strategies

- 11.4.8 ASEAN COUNTRIES

- 11.4.8.1 ASEAN countries' notable surge in adoption of security automation reflects region's commitment to enhancing cybersecurity and safeguarding digital assets

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 230 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: SOAR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: SOAR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: SIEM SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: SIEM SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: XDR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: XDR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2017-2022 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2023-2028 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: SECURITY AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Strategic deployment of AI and advanced technologies across various sectors

- 11.5.4 SAUDI ARABIA

- 11.5.4.1 Government's strong commitment toward advancing security automation initiatives

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Investment in advanced security automation solutions by several South African organizations to bolster incident response capabilities

- 11.5.6 ISRAEL

- 11.5.6.1 Surge in startups specializing in AI-driven threat detection, autonomous incident response, and predictive analytics

- 11.5.7 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: SECURITY AUTOMATION MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 256 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 257 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 258 LATIN AMERICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 259 LATIN AMERICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 260 LATIN AMERICA: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 261 LATIN AMERICA: SECURITY AUTOMATION SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 263 LATIN AMERICA: SECURITY AUTOMATION PROFESSIONAL SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 264 LATIN AMERICA: SOAR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 265 LATIN AMERICA: SOAR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 266 LATIN AMERICA: SIEM SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 267 LATIN AMERICA: SIEM SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: XDR SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 269 LATIN AMERICA: XDR SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 270 LATIN AMERICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 271 LATIN AMERICA: SECURITY AUTOMATION SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 272 LATIN AMERICA: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2017-2022 (USD MILLION)

- TABLE 273 LATIN AMERICA: SECURITY AUTOMATION SOFTWARE MARKET, BY CODE TYPE, 2023-2028 (USD MILLION)

- TABLE 274 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 275 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 276 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 277 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 278 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 279 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 280 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 281 LATIN AMERICA: SECURITY AUTOMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Proactive approach to adopting security automation technology

- 11.6.4 MEXICO

- 11.6.4.1 Investment in initiatives to foster R&D in AI-driven cybersecurity technologies

- 11.6.5 ARGENTINA

- 11.6.5.1 Argentina to witness high growth as organizations seek to improve threat detection, incident response, and overall security management

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 282 OVERVIEW OF STRATEGIES ADOPTED BY KEY SECURITY AUTOMATION VENDORS

- 12.3 REVENUE ANALYSIS

- 12.3.1 BUSINESS SEGMENT REVENUE ANALYSIS

- FIGURE 69 BUSINESS SEGMENT REVENUE ANALYSIS, 2020-2022 (USD BILLION)

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 70 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- TABLE 283 SECURITY AUTOMATION MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 71 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- 12.5.5 COMPANY PRODUCT FOOTPRINT

- TABLE 284 OVERALL PRODUCT FOOTPRINT ANALYSIS (KEY PLAYERS), 2022

- TABLE 285 OVERALL PRODUCT FOOTPRINT ANALYSIS (OTHER KEY PLAYERS), 2022

- 12.6 STARTUP/SME EVALUATION MATRIX

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 72 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2022

- 12.6.5 STARTUP/SME COMPETITIVE BENCHMARKING

- TABLE 286 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 287 PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/SMES, 2022

- 12.7 BRAND/PRODUCT COMPARATIVE ANALYSIS IN SECURITY AUTOMATION MARKET

- 12.7.1 COMPARATIVE ANALYSIS OF SECURITY AUTOMATION PRODUCTS

- TABLE 288 COMPARATIVE ANALYSIS OF TRENDING SECURITY AUTOMATION PRODUCTS

- TABLE 289 COMPARATIVE ANALYSIS OF OTHER SECURITY AUTOMATION PRODUCTS

- 12.8 VALUATION AND FINANCIAL METRICS OF KEY SECURITY AUTOMATION VENDORS

- FIGURE 73 FINANCIAL METRICS OF KEY SECURITY AUTOMATION VENDORS

- FIGURE 74 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY SECURITY AUTOMATION VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 290 NEW PRODUCT LAUNCHES AND ENHANCEMENTS, 2022-2023

- 12.9.2 DEALS

- TABLE 291 DEALS, 2021-2023

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)**

- 13.2.1 PALO ALTO NETWORKS

- TABLE 292 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- FIGURE 75 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- TABLE 293 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 PALO ALTO NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 295 PALO ALTO NETWORKS: DEALS

- 13.2.2 SPLUNK

- TABLE 296 SPLUNK: BUSINESS OVERVIEW

- FIGURE 76 SPLUNK: COMPANY SNAPSHOT

- TABLE 297 SPLUNK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 SPLUNK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 299 SPLUNK: DEALS

- 13.2.3 CYBERARK

- TABLE 300 CYBERARK: BUSINESS OVERVIEW

- FIGURE 77 CYBERARK: COMPANY SNAPSHOT

- TABLE 301 CYBERARK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 CYBERARK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 303 CYBERARK: DEALS

- 13.2.4 CHECK POINT

- TABLE 304 CHECK POINT: BUSINESS OVERVIEW

- FIGURE 78 CHECK POINT: COMPANY SNAPSHOT

- TABLE 305 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 CHECK POINT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 307 CHECK POINT: DEALS

- 13.2.5 CROWDSTRIKE

- TABLE 308 CROWDSTRIKE: BUSINESS OVERVIEW

- FIGURE 79 CROWDSTRIKE: COMPANY SNAPSHOT

- TABLE 309 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 CROWDSTRIKE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 311 CROWDSTRIKE: DEALS

- 13.2.6 RED HAT

- TABLE 312 RED HAT: BUSINESS OVERVIEW

- TABLE 313 RED HAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 RED HAT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 315 RED HAT: DEALS

- 13.2.7 CISCO

- TABLE 316 CISCO: BUSINESS OVERVIEW

- FIGURE 80 CISCO: COMPANY SNAPSHOT

- TABLE 317 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 319 CISCO: DEALS

- 13.2.8 CARBON BLACK

- TABLE 320 CARBON BLACK: BUSINESS OVERVIEW

- TABLE 321 CARBON BLACK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 CARBON BLACK: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.2.9 TRELLIX

- TABLE 323 TRELLIX: BUSINESS OVERVIEW

- TABLE 324 TRELLIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 TRELLIX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 326 TRELLIX: DEALS

- 13.2.10 IBM

- TABLE 327 IBM: BUSINESS OVERVIEW

- FIGURE 81 IBM: COMPANY SNAPSHOT

- TABLE 328 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 330 IBM: DEALS

- 13.2.11 SECUREWORKS

- TABLE 331 SECUREWORKS: BUSINESS OVERVIEW

- FIGURE 82 SECUREWORKS: COMPANY SNAPSHOT

- TABLE 332 SECUREWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 SECUREWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.2.12 TENABLE

- TABLE 334 TENABLE: BUSINESS OVERVIEW

- FIGURE 83 TENABLE: COMPANY SNAPSHOT

- TABLE 335 TENABLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 TENABLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 337 TENABLE: DEALS

- 13.3 OTHER KEY PLAYERS

- 13.3.1 MICROSOFT

- 13.3.2 SWIMLANE

- 13.3.3 TUFIN

- 13.3.4 SUMO LOGIC

- 13.3.5 GOOGLE

- 13.3.6 LOGRHYTHM

- 13.3.7 EXABEAM

- 13.3.8 MANAGEENGINE

- 13.3.9 FORTINET

- 13.3.10 DEVO TECHNOLOGY

- 13.3.11 D3 SECURITY

- 13.3.12 LOGSIGN

- 13.4 STARTUP/SME PROFILES

- 13.4.1 VULCAN CYBER

- 13.4.2 CYWARE

- 13.4.3 CYBERBIT

- 13.4.4 SIRP

- 13.4.5 TINES

- 13.4.6 VERITI

- 13.4.7 VANTA

- 13.4.8 DRATA

- 13.4.9 ANVILOGIC

- 13.4.10 TORQ

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 SECURITY ORCHESTRATION, AUTOMATION, AND RESPONSE (SOAR) MARKET - GLOBAL FORECAST TO 2027

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 SOAR market, by offering

- TABLE 338 SOAR MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 339 SOAR MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 14.2.2.2 SOAR market, by application

- TABLE 340 SOAR MARKET, BY DATA SOURCE, 2018-2021 (USD MILLION)

- TABLE 341 SOAR MARKET, BY DATA SOURCE, 2022-2027 (USD MILLION)

- 14.2.2.3 SOAR market, by organization size

- TABLE 342 SOAR MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 343 SOAR MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 14.2.2.4 SOAR market, by vertical

- TABLE 344 SOAR MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 345 SOAR MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 14.2.2.5 SOAR market, by region

- TABLE 346 SOAR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 347 SOAR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.3 SECURITY ANALYTICS MARKET - GLOBAL FORECAST TO 2026

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 Security analytics market, by application

- TABLE 348 SECURITY ANALYTICS MARKET SIZE, BY APPLICATION, 2015-2020 (USD MILLION)

- TABLE 349 SECURITY ANALYTICS MARKET SIZE, BY APPLICATION, 2021-2026 (USD MILLION)

- 14.3.2.2 Security analytics market, by component

- TABLE 350 SECURITY ANALYTICS MARKET SIZE, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 351 SECURITY ANALYTICS MARKET SIZE, BY COMPONENT, 2021-2026 (USD MILLION)

- 14.3.2.3 Security analytics market, by deployment mode

- TABLE 352 SECURITY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 353 SECURITY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 14.3.2.4 Security analytics market, by organization size

- TABLE 354 SECURITY ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015-2020 (USD MILLION)

- TABLE 355 SECURITY ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 14.3.2.5 Security analytics market, by industry vertical

- TABLE 356 SECURITY ANALYTICS MARKET SIZE, BY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 357 SECURITY ANALYTICS MARKET SIZE, BY VERTICAL, 2021-2026 (USD MILLION)

- 14.3.2.6 Security analytics market, by region

- TABLE 358 SECURITY ANALYTICS MARKET SIZE, BY REGION, 2015-2020 (USD MILLION)

- TABLE 359 SECURITY ANALYTICS MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS