|

|

市場調査レポート

商品コード

1340760

光衛星通信の世界市場 (~2028年):タイプ (衛星間通信・地上対衛星通信)・コンポーネント (送信機・受信機・アンプ・トランスポンダー・アンテナ・コンバーター)・用途・レーザータイプ・地域別Optical Satellite Communication Market by Type (Satellite-to-Satellite, Ground-to-Satellite Communication), Component (Transmitter, Receivers, Amplifiers, Transponders, Antenna, Converter), Application, Laser Type and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 光衛星通信の世界市場 (~2028年):タイプ (衛星間通信・地上対衛星通信)・コンポーネント (送信機・受信機・アンプ・トランスポンダー・アンテナ・コンバーター)・用途・レーザータイプ・地域別 |

|

出版日: 2023年08月16日

発行: MarketsandMarkets

ページ情報: 英文 218 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

光衛星通信の市場規模は、2023年の2億8,200万米ドルから、予測期間中は32.1%のCAGRで推移し、2028年には11億3,400万米ドルに達すると予測されています。 過去数十年にわたり、光衛星通信業界は使用事例の拡大、コスト効率の向上、世界のデジタルデバイド解消への影響拡大など、進化を続けてきました。

高精細ビデオストリーミング、バーチャルリアリティ、IoTデバイスなどのデータ集約型用途の台頭により、効率的で大容量の通信チャネルが求められています。光通信は膨大なデータ量を管理できるため、有力な選択肢となっています。衛星間通信では、軌道上の衛星間でより高速なデータ転送を可能にする光通信が研究されています。これは、宇宙探査、地球観測、科学研究などのミッションに不可欠です。レーザー技術、光学部品、変調技術のすべてが向上しており、光衛星通信をより現実的でコスト効率の高いものにしています。こうした進歩が参入の障壁を下げ、市場拡大を後押ししています。

用途別で見ると、通信・セルラーバックホールの部門が予測期間中に最大の規模を示すと予測されています。より大容量の光ファイバーやマイクロ波ラインを含むバックホール技術の進歩は、より効率的なデータ転送と低遅延を可能にし、光衛星通信にとって重要なコンポーネントとなっています。2020年のCOVID-19の流行により、リモートワークやオンラインコラボレーションソリューションの導入が加速しています。その結果、堅牢で高速な接続に対するニーズが高まり、通信ネットワークはバックホール容量の拡大を迫られています。2021年以降は、5Gネットワークの実装が順調に進んでおり、約束された高速データレートと最小の遅延を提供するため、より小さなセルからなる高密度ネットワークが必要とされていることから、光衛星通信は重要な役割を果たしています。

レーザータイプ別では、ガリウムヒ素 (GaAs) レーザーの部門が市場をリードしています。そのユニークな特徴から、GaAsレーザーは、光衛星通信の特定の用途でリードを示しています。GaAsは化合物半導体材料であり、ダイオードレーザーや垂直共振器面発光レーザー (VCSEL) などのレーザーの構築に使用されてきました。GaAsレーザーは、光通信用途に適した近赤外領域の発光が可能であることが基本的な利点です。また、また、温度安定性が高く、かなりの高温でも性能劣化を起こすことなく動作させることができます。これらの特性により、GaAsレーザーは温度変化のある宇宙環境での使用に適しています。

また、地域別では、北米市場が予測期間中に最大のシェアを示す見通しです。北米では、通信、テレビ、気象モニタリング、危機管理などが衛星通信に広く依存しています。これらの産業での信頼できる高速通信へにニーズが光衛星通信技術の利用を後押ししていると考えられます。北米では、大学、研究機関、営利企業が技術を推進するために頻繁に連携しています。このような協力的な環境は、光衛星通信などの革新的な技術の開発と受け入れを加速させる可能性を秘めています。

当レポートでは、世界の光衛星通信の市場を調査し、市場概要、市場への影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術・特許の動向、ケーススタディ、法規制環境、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客の事業に影響を与える動向/ディスラプション

- エコシステム

- 価格分析

- ポーターのファイブフォース分析

- 市場規模の分析:・予測:タイプ別

- 規制状況

- 主なステークホルダーと購入基準

- 光衛星通信技術の進化

- 貿易分析

- 主な会議とイベント

第6章 産業動向

- 技術動向

- 衛星ネットワークと5Gネットワークの融合

- 高スループット衛星 (HTS)

- 衛星の小型化

- 宇宙・空・地上統合ネットワーク (SAGIN)

- インテリジェント光衛星通信

- ATP技術

- 有人宇宙活動

- 観測衛星からのデータ送信

- 技術分析

- RFおよび光空間通信システム

- RFおよび光通信システムの車載要件の比較

- 使用事例の分析

- メガトレンドの影響

- イノベーションと特許登録

第7章 光衛星通信市場:タイプ別

- 衛星間通信ペイロード

- 小型衛星

- 中型衛星

- 大型衛星

- 地上対衛星通信端末

- 固定端末

- モバイル端末

第8章 光衛星通信市場:レーザータイプ別

- GaAsベースのレーザー

- INPベースのレーザー

- YAGレーザー

- 固体レーザー

- CO2レーザー

- その他のレーザー

第9章 光衛星通信市場:コンポーネント別

- 送信機

- 受信機

- アンプ

- トランスポンダー

- アンテナ

- コンバーター

- その他

第10章 光衛星通信市場:用途別

- 通信・セルラーバックホール

- 事業・企業

- 地球観測・リモートセンシング

- 科学研究・探査

- 輸送・物流

- 政府・防衛

- その他

第11章 光衛星通信市場:地域分析

- 景気後退の影響分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 企業概要

- 市場ランキング分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- BALL CORPORATION

- MYNARIC AG

- BRIDGECOMM INC.

- SPACE MICRO INC.

- TESAT-SPACECOM GMBH & CO. KG

- LIGHTPATH TECHNOLOGIES

- SPACEX

- ATLAS SPACE OPERATIONS, INC.

- HONEYWELL INTERNATIONAL INC.

- MITSUBISHI ELECTRIC CORPORATION

- SONY SPACE COMMUNICATIONS CORPORATION

- AAC CLYDE SPACE

- NEC CORPORATION

- SKYLOOM

- GENERAL ATOMICS

- その他の企業

- WARPSPACE

- HISDESAT

- SITAEL SPA

- LASER TECHNOLOGY, INC.

- TRANSCELESTIAL TECHNOLOGIES

- OXFORD SPACE SYSTEMS LTD.

- ASTROGATE

- HENSOLDT

- ARCHANGEL LIGHTWORKS LTD.

- XONA SPACE SYSTEMS

第14章 付録

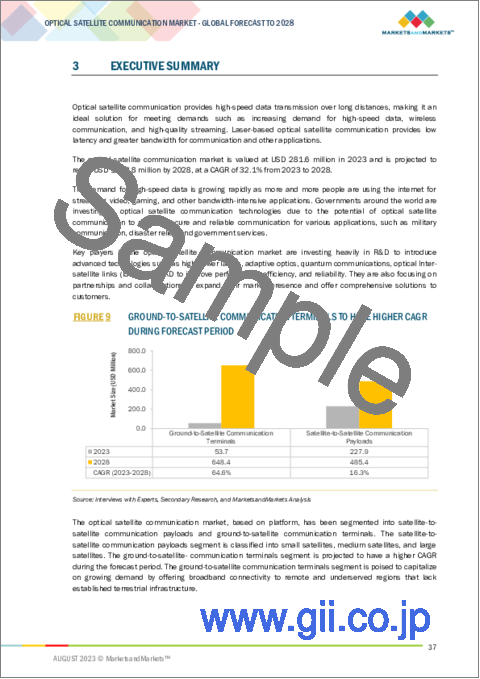

The optical satellite communication market is valued at USD 282 million in 2023 and is projected to reach USD 1134 million by 2028, at a CAGR of 32.1% from 2023 to 2028. Over the last few decades, the optical satellite communication industry has continued to evolve with expanding use cases, better cost efficiencies, and a more significant impact on bridging the digital divide worldwide. With the rise of data-intensive applications such as high-definition video streaming, virtual reality, and Internet of Things (IoT) devices, efficient and high-capacity communication channels are required. The ability of optical communication to manage enormous data volumes makes it a favored alternative. For inter-satellite communication, optical communication is being investigated, which would allow for faster data transfer between satellites in orbit. This is critical for missions such as space exploration, Earth observation, and scientific study. Laser technology, optical components, and modulation techniques are all improving, making optical satellite communication more realistic and cost-effective. These advances are lowering entry barriers and propelling market expansion.

Private enterprises and startups are realizing the value of optical satellite communication for a variety of applications ranging from commercial satellite services to space tourism. This has increased investment and innovation & is helping to propel the sector forward.

Optical satellite communication is increasingly being integrated with terrestrial optical networks. This integration has the potential to improve overall communication infrastructure by enabling smooth data flow between satellites and terrestrial networks. FSO, or free-space optical communication, is a method that employs light to transfer data through free space (air or vacuum). This technology is being researched for the purpose of building high-speed communication linkages between satellites, satellite-to-ground stations, and even aircraft and satellites.

Based on application, the telecommunication & cellular backhaul segment is projected to register the highest during the forecast period 2023-2028.

Backhaul technology advancements, including higher-capacity fiber optics and microwave lines, enable more efficient data transfer and lower latency, making them critical components for optical satellite communication. The epidemic of COVID-19 in 2020 has hastened the adoption of remote work and online collaboration solutions. As a result, the need for robust and high-speed connections increased, putting pressure on communications networks to expand their backhaul capacity. In 2021, 5G network implementation is well underway, requiring a denser network of smaller cells to provide the promised fast data rates and minimal latency, optical satellite communication is certainly going to play a key role in the implementation of such services.

Based on laser type, the GaAs laser segment is to lead the market during the forecast period 2023-2028

Due to its unique features, gallium arsenide (GaAs) lasers dominate this category for certain applications in optical satellite communication. GaAs is a compound semiconductor material that has been used in the construction of lasers such as diode lasers and vertical-cavity surface-emitting lasers (VCSELs). The ability of GaAs lasers to emit light in the near-infrared spectrum, which is well-suited for optical communication applications, is a fundamental advantage. They are also temperature stable and can run at reasonably high temperatures without substantial performance deterioration. These characteristics make GaAs lasers appropriate for use in space conditions with temperature changes.

The North American market is projected to contribute the most significant share from 2023 to 2028 in the Optical satellite communication market.

Telecommunications, television, weather monitoring, crisis management, and other businesses rely extensively on satellite communication in North America. The need for dependable and fast communication in these industries may have pushed the use of optical satellite communication technologies. In North America, universities, research organizations, and commercial enterprises frequently combine to promote technology. This collaborative environment has the potential to speed the development and acceptance of innovative technologies such as optical satellite communication. North America has a thriving aerospace and defense industry, with a particular emphasis on satellite technology. Established firms, research organizations, and government agencies have all contributed to the development and deployment of advanced satellite communication technologies, including optical communication.

The break-up of the profile of primary participants in the Optical satellite communication market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, Middle East & Africa - 5%, Latin America - 5%

Major companies profiled in the report include Ball Corporation (US), Minaric AG (Switzerland), Atlas space operations, INC (US), SpaceMicro (US), and Tesat Spacecom GMBH (Germany), among others.

Research Coverage:

This market study covers the Optical satellite communication market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on type, components, application, laser type, and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall optical satellite communication market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The growth of the market can be attributed to the increasing launch of low earth orbit (LEO) satellites and constellations of satellites for communications applications, increasing usage of laser-based satellite connection, and Increasing demand for Quantum Key Distribution, Inter-Satellite Links (ISLs). The report provides insights on the following pointers:

- Market Drivers: Market Drivers such as the Increasing demand for Quantum Key Distribution, the need for secure communication, and other drivers covered in the report.

- Market Penetration: Comprehensive information on optical satellite communication offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the optical satellite communication market

- Market Development: Comprehensive information about lucrative markets - the report analyses the optical satellite communication market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the optical satellite communication market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the optical satellite communication market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 OPTICAL SATELLITE COMMUNICATION MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 OPTICAL SATELLITE COMMUNICATION MARKET SEGMENTATION

- 1.4.2 YEARS CONSIDERED

- 1.4.3 REGIONAL SCOPE

- 1.5 LIMITATIONS

- 1.6 CURRENCY CONSIDERED

- 1.7 USD EXCHANGE RATES

- 1.8 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 OPTICAL SATELLITE COMMUNICATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 MARKET SIZE APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- TABLE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- FIGURE 8 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 9 GROUND-TO-SATELLITE COMMUNICATION TERMINALS TO HAVE HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 10 TRANSPONDERS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 GOVERNMENT AND DEFENSE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 GAAS-BASED LASERS TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF OPTICAL SATELLITE COMMUNICATION MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN OPTICAL SATELLITE COMMUNICATION MARKET

- FIGURE 14 INCREASING USE OF OPTICAL SATELLITES FOR SECURED COMMUNICATION TO DRIVE MARKET

- 4.2 OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE

- FIGURE 15 SATELLITE-TO-SATELLITE COMMUNICATION PAYLOADS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 SMALL SATELLITES TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION

- FIGURE 17 EARTH OBSERVATION AND REMOTE SENSING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT

- FIGURE 18 TRANSPONDERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE

- FIGURE 19 GAAS-BASED LASERS TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 OPTICAL SATELLITE COMMUNICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Advantages over conventional RF technologies

- 5.2.1.2 Growing need for secured communication

- 5.2.1.3 Increasing use in space exploration and scientific research

- 5.2.1.4 Advancements in optics and signal processing technology

- 5.2.1.5 Accelerating demand for high-speed free space optics

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation cost of free space optics

- 5.2.2.2 Stringent government regulations and policies

- 5.2.2.3 Technical limitations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of Li-Fi

- 5.2.3.2 Increasing use of cloud-based services

- 5.2.3.3 Increasing use in healthcare and emergency response

- 5.2.4 CHALLENGES

- 5.2.4.1 Electromagnetic compatibility challenges

- 5.2.4.2 Atmospheric interference

- 5.2.4.3 Beam dispersion and signal loss

- 5.2.4.4 Precise pointing and tracking

- 5.3 VALUE CHAIN ANALYSIS OF OPTICAL SATELLITE COMMUNICATION MARKET

- FIGURE 21 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR OPTICAL SATELLITE COMMUNICATION COMPONENT MANUFACTURERS

- 5.5 OPTICAL SATELLITE COMMUNICATION MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- FIGURE 22 OPTICAL SATELLITE COMMUNICATION MARKET ECOSYSTEM

- TABLE 3 OPTICAL SATELLITE COMMUNICATION ECOSYSTEM

- TABLE 4 OPTICAL SATELLITE COMMUNICATION DEVELOPMENT PHASE

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY TYPE

- TABLE 5 AVERAGE SELLING PRICE TRENDS OF OPTICAL SATELLITE COMMUNICATION, BY TYPE, 2022

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 OPTICAL SATELLITE COMMUNICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 OPTICAL SATELLITE COMMUNICATION: PORTER'S FIVE FORCE ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 VOLUME ANALYSIS OF OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2028

- 5.9 REGULATORY LANDSCAPE

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING OPTICAL SATELLITE COMMUNICATION, BY TYPE

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING OPTICAL SATELLITE COMMUNICATION, BY VERTICAL (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR OPTICAL SATELLITE COMMUNICATION, BY TYPE

- TABLE 12 KEY BUYING CRITERIA FOR OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE

- 5.11 EVOLUTION OF OPTICAL SATELLITE COMMUNICATION TECHNOLOGY

- 5.12 TRADE ANALYSIS

- TABLE 13 COUNTRY-WISE IMPORTS, 2019-2021 (USD THOUSAND)

- TABLE 14 COUNTRY-WISE EXPORTS, 2019-2021 (USD THOUSAND)

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 KEY CONFERENCES AND EVENTS, 2023-2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 FUSION OF SATELLITE AND 5G NETWORKS

- 6.2.2 HIGH THROUGHPUT SATELLITES (HTS)

- 6.2.3 MINIATURIZATION OF SATELLITES

- 6.2.4 SPACE-AIR-GROUND INTEGRATED NETWORK (SAGIN)

- 6.2.5 INTELLIGENT OPTICAL SATELLITE COMMUNICATION

- 6.2.6 ATP TECHNOLOGY

- 6.2.7 MANNED SPACE ACTIVITY

- 6.2.8 DATA TRANSMISSION FROM OBSERVATION SATELLITES

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 RF AND OPTICAL SPACE COMMUNICATIONS SYSTEMS

- 6.3.1.1 Antenna diameter

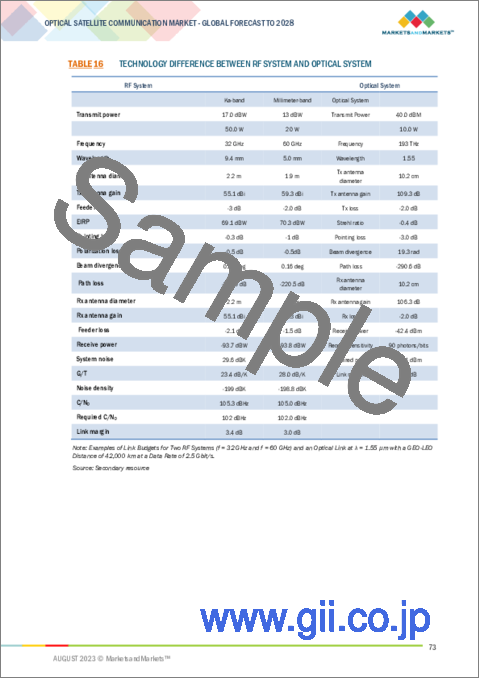

- TABLE 16 TECHNOLOGY DIFFERENCE BETWEEN RF SYSTEM AND OPTICAL SYSTEM

- 6.3.1.2 Antenna coverage and tracking accuracy

- 6.3.1.3 Acquisition sequence

- 6.3.1.4 Communications system

- 6.3.2 COMPARISON OF ONBOARD REQUIREMENTS OF RF AND OPTICAL COMMUNICATION SYSTEMS

- TABLE 17 COMPARISON OF ONBOARD REQUIREMENTS

- 6.3.1 RF AND OPTICAL SPACE COMMUNICATIONS SYSTEMS

- 6.4 USE CASE ANALYSIS

- 6.4.1 OPTICAL INTER-SATELLITE COMMUNICATION TECHNOLOGY

- 6.4.2 OPTICAL SATELLITE TRACKING FOR SPACE WARFARE

- 6.4.3 FACTORIZED POWER ARCHITECTURE

- 6.5 IMPACT OF MEGATRENDS

- 6.5.1 GROWTH OF INTERNET OF THINGS (IOT)

- 6.5.2 INCREASING DEMAND FOR GLOBAL CONNECTIVITY

- 6.5.3 DEVELOPMENT OF NEW SPACE TECHNOLOGIES

- 6.6 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 18 INNOVATIONS AND PATENT REGISTRATIONS, MAY 2017-APRIL 2023

7 OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 26 GROUND-TO-SATELLITE COMMUNICATION TERMINALS TO HOLD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 19 OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 20 OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 7.2 SATELLITE-TO-SATELLITE COMMUNICATION PAYLOADS

- TABLE 21 SATELLITE-TO-SATELLITE COMMUNICATION PAYLOADS: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 22 SATELLITE-TO-SATELLITE COMMUNICATION PAYLOADS: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.1 SMALL SATELLITES

- 7.2.1.1 Rapid data exchange and collaboration among satellites to drive market

- 7.2.2 MEDIUM SATELLITES

- 7.2.2.1 Vital role in expanding inter-satellite communication to drive market

- 7.2.3 LARGE SATELLITES

- 7.2.3.1 Higher payload capacity to drive market

- 7.3 GROUND-TO-SATELLITE COMMUNICATION TERMINALS

- 7.3.1 FIXED TERMINALS

- 7.3.1.1 Need for robust and reliable infrastructure to drive market

- 7.3.2 MOBILE TERMINALS

- 7.3.2.1 Use in disaster management and remote exploration to drive market

- 7.3.1 FIXED TERMINALS

8 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE

- 8.1 INTRODUCTION

- FIGURE 27 GAAS-BASED LASERS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 23 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE, 2020-2022 (USD MILLION)

- TABLE 24 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE, 2023-2028 (USD MILLION)

- 8.2 GAAS-BASED LASERS

- 8.2.1 ESCALATING DEMAND FOR HIGH-SPEED DATA TRANSMISSION TO DRIVE MARKET

- 8.3 INP-BASED LASERS

- 8.3.1 HIGH SPEED AND AFFORDABILITY TO DRIVE MARKET

- 8.4 YAG LASERS

- 8.4.1 STABLE COMMUNICATION LINKS AND SPECTRAL EFFICIENCY TO DRIVE MARKET

- 8.5 SOLID STATE-BASED LASERS

- 8.5.1 DATA TRANSMISSION AT WIDER SPECTRUM TO DRIVE MARKET

- 8.6 CO2 LASERS

- 8.6.1 DATA TRANSMISSION OVER LONG DISTANCES WITH HIGH BANDWIDTH TO DRIVE MARKET

- 8.7 OTHER LASER TYPES

- 8.7.1 DEMAND FOR COMPACT AND LIGHTWEIGHT LASERS TO DRIVE MARKET

9 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- FIGURE 28 TRANSPONDERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 25 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 26 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 9.2 TRANSMITTERS

- 9.2.1 PRECISION AND MODULATION CAPABILITIES TO DRIVE MARKET

- 9.3 RECEIVERS

- 9.3.1 INCREASING USE IN EARTH OBSERVATION APPLICATIONS TO DRIVE MARKET

- 9.4 AMPLIFIERS

- 9.4.1 ABILITY TO REDUCE RISK OF SIGNAL LOSS TO DRIVE MARKET

- 9.5 TRANSPONDERS

- 9.5.1 UTILIZATION IN GROUND AND SPACE COMMUNICATION TO DRIVE MARKET

- 9.6 ANTENNAS

- 9.6.1 INCREASING NEED FOR MORE SECURED COMMUNICATION TO DRIVE MARKET

- 9.7 CONVERTERS

- 9.7.1 DEMAND FOR EFFICIENT SIGNAL EXCHANGE TO DRIVE MARKET

- 9.8 OTHER COMPONENTS

- 9.8.1 TARGET TRACKING AND MULTI-SATELLITE COMMUNICATION TO DRIVE MARKET

10 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 29 GOVERNMENT AND DEFENSE SEGMENT TO LEAD OPTICAL SATELLITE COMMUNICATION MARKET DURING FORECAST PERIOD

- TABLE 27 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 28 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2 TELECOMMUNICATION AND CELLULAR BACKHAUL

- 10.2.1 INCREASING NEED FOR MOBILE BROADBAND COVERAGE TO DRIVE MARKET

- 10.3 BUSINESSES AND ENTERPRISES

- 10.3.1 USE OF OPTICAL SATELLITE COMMUNICATION FOR HIGH-SPEED INTERNET IN RURAL AND REMOTE AREAS TO DRIVE MARKET

- 10.4 EARTH OBSERVATION AND REMOTE SENSING

- 10.4.1 INCREASING DEMAND FOR ENVIRONMENT MONITORING AND DISASTER TRACKING TO DRIVE MARKET

- 10.5 SCIENTIFIC RESEARCH AND EXPLORATION

- 10.5.1 USE OF SATELLITES FOR COMMERCIALIZATION AND DATA TRANSFERABILITY TO DRIVE MARKET

- 10.6 TRANSPORTATION AND LOGISTICS

- 10.6.1 TECHNOLOGICAL ADVANCEMENTS IN OPTICAL EQUIPMENT TO DRIVE MARKET

- 10.7 GOVERNMENT AND DEFENSE

- 10.7.1 INCREASING NEED FOR SURVEILLANCE TO DRIVE MARKET

- 10.8 OTHER APPLICATIONS

- 10.8.1 INCREASED DATA TRANSMISSION FROM DRONES AND SURVEILLANCE PLATFORMS TO DRIVE MARKET

11 OPTICAL SATELLITE COMMUNICATION MARKET, REGIONAL ANALYSIS

- 11.1 INTRODUCTION

- FIGURE 30 NORTH AMERICA TO LEAD OPTICAL SATELLITE COMMUNICATION MARKET FROM 2023 TO 2028

- TABLE 29 OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 30 OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 RECESSION IMPACT ANALYSIS

- TABLE 31 REGIONAL RECESSION IMPACT ANALYSIS

- 11.3 NORTH AMERICA

- 11.3.1 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 31 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET SNAPSHOT

- TABLE 32 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.2 US

- 11.3.2.1 Increased spending by government organizations and private players to drive market

- TABLE 40 US: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 41 US: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 42 US: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 43 US: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.3.3 CANADA

- 11.3.3.1 Deployment of optical constellations to drive market

- TABLE 44 CANADA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 45 CANADA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 46 CANADA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 47 CANADA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 EUROPE: PESTLE ANALYSIS

- FIGURE 32 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET SNAPSHOT

- TABLE 48 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 49 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 50 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 51 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 52 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 53 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 54 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 55 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.2 UK

- 11.4.2.1 Initiatives to strengthen network infrastructure to drive market

- TABLE 56 UK: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 57 UK: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 58 UK: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 59 UK: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.4.3 GERMANY

- 11.4.3.1 Emergence of secured connections in telecommunication to drive market

- TABLE 60 GERMANY: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 61 GERMANY: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 62 GERMANY: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 63 GERMANY: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.4.4 ITALY

- 11.4.4.1 Demand for high-speed data transmission to drive market

- TABLE 64 ITALY: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 65 ITALY: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 66 ITALY: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 67 ITALY: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.4.5 FRANCE

- 11.4.5.1 Technological advancements to drive market

- TABLE 68 FRANCE: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 69 FRANCE: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 70 FRANCE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 71 FRANCE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.4.6 SPAIN

- 11.4.6.1 R&D investments by government and corporate entities to drive market

- TABLE 72 SPAIN: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 73 SPAIN: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 74 SPAIN: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 75 SPAIN: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.5 ASIA PACIFIC

- 11.5.1 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 33 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET SNAPSHOT

- TABLE 76 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 77 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 79 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.2 CHINA

- 11.5.2.1 Government support and expanding population to drive market

- TABLE 84 CHINA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 85 CHINA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 86 CHINA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 87 CHINA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.5.3 INDIA

- 11.5.3.1 Technological advancements and robust telecommunication sector to drive market

- TABLE 88 INDIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 89 INDIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 90 INDIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 91 INDIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.5.4 JAPAN

- 11.5.4.1 Increasing use of satellites for enhanced emergency services to drive market

- TABLE 92 JAPAN: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 93 JAPAN: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 94 JAPAN: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 95 JAPAN: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.5.5 AUSTRALIA

- 11.5.5.1 New technologies to drive market

- TABLE 96 AUSTRALIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 97 AUSTRALIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 98 AUSTRALIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 99 AUSTRALIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.6 REST OF THE WORLD

- 11.6.1 REST OF THE WORLD: PESTLE ANALYSIS

- TABLE 100 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 101 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2024-2028 (USD MILLION)

- TABLE 102 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 103 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 104 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 105 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6.2 MIDDLE EAST & AFRICA

- 11.6.2.1 Technological advancements and innovations to drive market

- TABLE 106 MIDDLE EAST & AFRICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 11.6.3 LATIN AMERICA

- 11.6.3.1 Heightened security needs of governments and businesses to drive market

- TABLE 110 LATIN AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 111 LATIN AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 113 LATIN AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 COMPANY OVERVIEW

- TABLE 114 KEY DEVELOPMENTS OF LEADING PLAYERS IN OPTICAL SATELLITE COMMUNICATION, 2020-2022

- 12.3 MARKET RANKING ANALYSIS, 2022

- FIGURE 34 RANKING OF KEY PLAYERS IN OPTICAL SATELLITE COMMUNICATION MARKET, 2022

- 12.4 COMPANY EVALUATION MATRIX

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 35 COMPANY EVALUATION MATRIX, 2023

- 12.5 STARTUP/SME EVALUATION MATRIX

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- FIGURE 36 STARTUP/SME EVALUATION MATRIX, 2023

- 12.5.5 COMPETITIVE BENCHMARKING

- TABLE 115 OPTICAL SATELLITE COMMUNICATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 116 OPTICAL SATELLITE COMMUNICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 117 OPTICAL SATELLITE COMMUNICATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 12.6 COMPETITIVE SCENARIO

- 12.6.1 MARKET EVALUATION FRAMEWORK

- 12.6.2 PRODUCT LAUNCHES

- TABLE 118 PRODUCT LAUNCHES, MAY 2023

- 12.6.3 DEALS

- TABLE 119 DEALS, FEBRUARY 2020-JUNE 2023

- 12.6.4 OTHERS

- TABLE 120 OTHERS, JANUARY 2022-JUNE 2023

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 13.2.1 BALL CORPORATION

- TABLE 121 BALL CORPORATION: BUSINESS OVERVIEW

- FIGURE 37 BALL CORPORATION: COMPANY SNAPSHOT

- TABLE 122 BALL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 123 BALL CORPORATION: DEALS

- 13.2.2 MYNARIC AG

- TABLE 124 MYNARIC AG: BUSINESS OVERVIEW

- FIGURE 38 MYNARIC AG: COMPANY SNAPSHOT

- TABLE 125 MYNARIC AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 126 MYNARIC AG: DEALS

- 13.2.3 BRIDGECOMM INC.

- TABLE 127 BRIDGECOMM INC.: BUSINESS OVERVIEW

- TABLE 128 BRIDGECOMM INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 129 BRIDGECOMM INC.: DEALS

- 13.2.4 SPACE MICRO INC.

- TABLE 130 SPACE MICRO INC.: BUSINESS OVERVIEW

- TABLE 131 SPACE MICRO INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 132 SPACE MICRO INC.: DEALS

- 13.2.5 TESAT-SPACECOM GMBH & CO. KG

- TABLE 133 TESAT-SPACECOM GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 134 TESAT-SPACECOM GMBH & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 135 TESAT-SPACECOM GMBH & CO. KG: DEALS

- 13.2.6 LIGHTPATH TECHNOLOGIES

- TABLE 136 LIGHTPATH TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 39 LIGHTPATH TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 137 LIGHTPATH TECHNOLOGIES: PRODUCTS/ SERVICES/SOLUTIONS OFFERED

- 13.2.7 SPACEX

- TABLE 138 SPACEX: BUSINESS OVERVIEW

- TABLE 139 SPACEX: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 140 SPACEX: DEALS

- 13.2.8 ATLAS SPACE OPERATIONS, INC.

- TABLE 141 ATLAS SPACE OPERATIONS, INC.: BUSINESS OVERVIEW

- TABLE 142 ATLAS SPACE OPERATIONS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 143 ATLAS SPACE OPERATIONS, INC.: DEALS

- 13.2.9 HONEYWELL INTERNATIONAL INC.

- TABLE 144 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 40 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 145 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 146 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 147 HONEYWELL INTERNATIONAL INC: DEALS

- 13.2.10 MITSUBISHI ELECTRIC CORPORATION

- TABLE 148 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

- FIGURE 41 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 149 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 150 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- 13.2.11 SONY SPACE COMMUNICATIONS CORPORATION

- TABLE 151 SONY SPACE COMMUNICATIONS CORPORATION: BUSINESS OVERVIEW

- TABLE 152 SONY SPACE COMMUNICATIONS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 153 SONY SPACE COMMUNICATIONS CORPORATION: OTHERS

- 13.2.12 AAC CLYDE SPACE

- TABLE 154 AAC CLYDE SPACE: BUSINESS OVERVIEW

- FIGURE 42 AAC CLYDE SPACE: COMPANY SNAPSHOT

- TABLE 155 AAC CLYDE SPACE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 AAC CLYDE SPACE: OTHERS

- 13.2.13 NEC CORPORATION

- TABLE 157 NEC CORPORATION: BUSINESS OVERVIEW

- FIGURE 43 NEC CORPORATION: COMPANY SNAPSHOT

- TABLE 158 NEC CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 NEC CORPORATION: DEALS

- TABLE 160 NEC CORPORATION: OTHERS

- 13.2.14 SKYLOOM

- TABLE 161 SKYLOOM: BUSINESS OVERVIEW

- TABLE 162 SKYLOOM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 163 SKYLOOM: DEALS

- 13.2.15 GENERAL ATOMICS

- TABLE 164 GENERAL ATOMICS: BUSINESS OVERVIEW

- TABLE 165 GENERAL ATOMICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 166 GENERAL ATOMICS: DEALS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 WARPSPACE

- TABLE 167 WARPSPACE: COMPANY OVERVIEW

- 13.3.2 HISDESAT

- TABLE 168 HISDESAT: COMPANY OVERVIEW

- 13.3.3 SITAEL SPA

- TABLE 169 SITAEL SPA: COMPANY OVERVIEW

- 13.3.4 LASER TECHNOLOGY, INC.

- TABLE 170 LASER TECHNOLOGY, INC.: COMPANY OVERVIEW

- 13.3.5 TRANSCELESTIAL TECHNOLOGIES

- TABLE 171 TRANSCELESTIAL TECHNOLOGIES: COMPANY OVERVIEW

- 13.3.6 OXFORD SPACE SYSTEMS LTD.

- TABLE 172 OXFORD SPACE SYSTEMS LTD.: COMPANY OVERVIEW

- 13.3.7 ASTROGATE

- TABLE 173 ASTROGATE: COMPANY OVERVIEW

- 13.3.8 HENSOLDT

- TABLE 174 HENSOLDT: COMPANY OVERVIEW

- 13.3.9 ARCHANGEL LIGHTWORKS LTD.

- TABLE 175 ARCHANGEL LIGHTWORKS LTD.: COMPANY OVERVIEW

- 13.3.10 XONA SPACE SYSTEMS

- TABLE 176 XONA SPACE SYSTEMS: COMPANY OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS