|

|

市場調査レポート

商品コード

1337839

集成材用接着剤の世界市場 (~2028年):樹脂タイプ (MF・PRF・PU・EPI)・用途 (床梁・屋根梁・窓&かもい・トラス&支柱)・エンドユーザー (住宅・非住宅)・地域別Timber Laminating Adhesives Market by Resin type (MF, PRF, PU, EPI), Application (Floor Beams, Roof Beams, Window & Door Headers, Trusses & Supporting Columns), End - use (Residential, Nonresidential) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 集成材用接着剤の世界市場 (~2028年):樹脂タイプ (MF・PRF・PU・EPI)・用途 (床梁・屋根梁・窓&かもい・トラス&支柱)・エンドユーザー (住宅・非住宅)・地域別 |

|

出版日: 2023年08月17日

発行: MarketsandMarkets

ページ情報: 英文 285 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

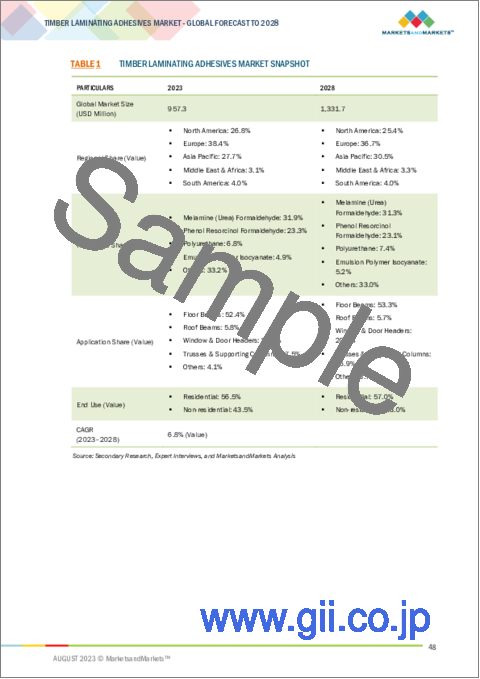

集成材用接着剤の市場規模は、2022年の9億5,700万米ドルから、CAGR 6.8%で推移し、2028年には13億3,100万米ドルの規模に成長すると予測されています。

2022年の市場では、欧州が最大のシェアを示すと推計されています。欧州は、住宅や商業ビルからインフラ開発に至るまで、幅広いプロジェクトを網羅する建設産業が確立され、活況を示しています。集成材用接着剤は、強度と汎用性を向上させた加工木材の製造を容易にするため、現代の建設業において重要な役割を果たしています。また、欧州では、持続可能性と環境責任を重視しており、再生可能な資源である木材は、こうした価値観に合致しています。集成材用接着剤は、木材利用を最適化し、建設プロジェクトの二酸化炭素排出量を削減する加工木材の使用を可能にすることで、持続可能な建設に貢献します。LEED (エネルギーと環境設計におけるリーダーシップ) などのグリーンビルディング認証の人気も、集成材用接着剤を含む持続可能な建設資材の需要を牽引しています。

用途別では、床梁の部門が最大の成長を示す見通しです。多くの場合、集成材用接着剤を使用して製造された加工木材の床梁は、優れた構造効率を提供します。これらの梁は、最小限の材料を使用しながら高い耐荷重能力を提供するように設計されており、コスト削減と環境への影響の低減をもたらします。

地域別では、米国が予測期間中、最大の市場になると予測されています。米国は、住宅、商業、工業、インフラプロジェクトを網羅する大規模で多様な建設産業を抱えています。木材積層接着剤は、住宅、商業ビル、橋梁など、さまざまな分野での用途を見出しています。米国では、革新的な建設ソリューションを必要とする大規模な近代化プロジェクトや改修プロジェクトが行われています。集成材用接着剤は、既存の構造物をアップグレードして再利用するための柔軟で効率的な方法を提供し、市場の需要に貢献しています。

当レポートでは、世界の集成材用接着剤の市場を調査し、市場概要、市場への影響因子および市場機会の分析、法規制環境、技術動向、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済指標

- 技術分析

- ケーススタディ

- 価格分析

- 貿易分析

- 市場の成長に影響を与える世界経済シナリオ

- サプライチェーン分析

- エコシステムとコネクテッド市場

- 規制・基準

- 関税・規制状況

- 主な会議とイベント

第6章 集成材用接着剤市場:樹脂タイプ別

- メラミン (尿素) ホルムアルデヒド

- フェノールレゾルシノールホルムアルデヒド

- ポリウレタン

- エマルジョンポリマーイソシアネート

- その他

- ポリ酢酸ビニル

- 尿素ホルムアルデヒド

- フェノールホルムアルデヒド

第7章 集成材用接着剤市場:用途別

- 床梁

- 屋根梁

- 窓・かもい

- トラス・支持柱

- その他

第8章 集成材用接着剤市場:エンドユーザー別

- 住宅

- 非住宅

第9章 集成材用接着剤市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 製品ポートフォリオの強み

- 市場シェア分析

- 市場ランキング分析

- 収益分析

- 競合シナリオ

- 戦略的開発

第11章 企業プロファイル

- 主要企業

- HENKEL AG & CO. KGAA

- SIKA AG

- ARKEMA (BOSTIK)

- 3M

- H.B. FULLER CO.

- DOW INC.

- AKZO NOBEL N.V.

- PIDILITE INDUSTRIES

- JOWAT SE

- ILLINOIS TOOL WORKS INC.

- その他の主要企業

- JUBILANT INDUSTRIES

- BEARDOW ADAMS

- BISON INTERNATIONAL BV

- BRITANNIA ADHESIVES

- CATTIE ADHESIVES

- DAP PRODUCTS INC.

- FOLLMANN GMBH & CO. KG

- FRANKLIN INTERNATIONAL

- IFS INDUSTRIES, INC.

- MAPEI SPA

- STAUF USA

- ASTRAL ADHESIVES

- PARKER HANNIFIN CORP (PARKER LORD)

- COLLANO AG

- BUHNEN ADHESIVE SYSTEMS

第12章 隣接/関連市場

第13章 付録

The timber laminating adhesives market size is projected to reach USD 1,331 million by 2028 at a CAGR of 6.8% from USD 957 million in 2022. Europe is estimated to account for the largest share in terms of value of the timber laminating adhesive market in 2022.

" Europe is likely to account for the largest share of timber laminating adhesive market in terms of volume."

Europe has a well-established and thriving construction industry that encompasses a wide range of projects, from residential and commercial buildings to infrastructure developments. Timber laminating adhesives play a significant role in modern construction practices, as they facilitate the creation of engineered wood products that offer enhanced strength and versatility. Europe places a strong emphasis on sustainability and environmental responsibility. Timber, as a renewable resource, aligns well with these values. Timber laminating adhesives contribute to sustainable construction by enabling the use of engineered wood products that optimize wood utilization and reduce the carbon footprint of construction projects. The popularity of green building certifications like LEED (Leadership in Energy and Environmental Design) has driven the demand for sustainable construction materials, including timber laminating adhesives.

" Floor beam is projected to be the fastest growing application segment of timber laminating adhesives market."

Engineered wood floor beams, often created using timber laminating adhesives, offer excellent structural efficiency. These beams are designed to provide high load-bearing capacities while using minimal material, resulting in cost savings and reduced environmental impact. This efficiency aligns with the increasing emphasis on sustainable construction practices and resource optimization.

Modern construction trends are leaning towards lightweight materials that simplify construction processes and reduce the overall weight of structures. Timber laminating adhesives enable the creation of engineered wood products that are significantly lighter than traditional solid wood beams, making them easier to transport, handle, and install.

"US, by country is forecasted to be the largest market of timber laminating adhesives during the forecast period."

US has a vast and diverse construction industry that encompasses residential, commercial, industrial, and infrastructure projects. Timber laminating adhesives find applications across various sectors, including residential housing, commercial buildings, bridges, and more. US has seen significant modernization and renovation projects that require innovative construction solutions. Timber laminating adhesives offer a flexible and efficient way to upgrade and repurpose existing structures, contributing to the demand in the market. US has stringent building codes and safety regulations. Timber laminating adhesives provide reliable bonding solutions that meet these regulations and enhance the structural performance of timber components.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 46%, Tier 2 - 27%, and Tier 3 - 27%

- By Designation: C Level - 36%, D Level - 18%, and Others - 46%

- By Region: North America - 36%, Asia Pacific - 19%, Europe - 36%, and South America & MEA - 9%

The key companies profiled in this report are H.B. Fuller (US), Henkel Ag (Germany), Arkema (France), Sika Ag(Switzerland), Dow Inc. (US), Ashland Inc. (US), Mapei SPA (Italy), Franklin International (US), 3M (US).

Research Coverage:

The timber laminating adhesive market has been segmented based on Resin Type (Melamine (Urea) Formaldehyde Adhesives- MF & MUF, Phenol Resorcinol Formaldehyde (PRF) Adhesives, Polyurethane, Emulsion Polymer Isocyanate (EPI) Adhesives, and Others), Application (Floor Beam, Roof Beam, Window & Door Header, Trusses & Supporting Column, and Others), End-use (Residential and Non Residential), and by Region (Asia Pacific, North America, Europe, South America, Middle East & Africa).

This report provides insights on the following pointers:

- Analysis of key drivers (Rising use in non-residential sector, Rising use in major emerging economies, Increasing urban population, Rising new construction activities, Renovations and remodeling) restraints (Volatility in raw material prices), opportunities (Demand for low-VOC adhesives, Rising demand in Europe and North America), and challenges (Stringent regulatory policies) influencing the growth of the timber laminating adhesives market.

- Product Development/Innovation: Detailed insight of upcoming technologies, research & development activities, and new product launch in the timber laminating adhesives market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the timber laminating adhesives market across varied regions.

- Market Diversification: Exclusive information about the new products & service untapped geographies, recent developments, and investments in timber laminating adhesives market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like H.B. Fuller (US), Henkel Ag (Germany), Arkema (France), Sika Ag(Switzerland), Dow Inc. (US), Ashland Inc. (US), Mapei SPA (Italy), Franklin International (US), 3M (US), among other in the timber laminating adhesive market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 TIMBER LAMINATING ADHESIVES MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 MARKET INCLUSIONS AND EXCLUSIONS

- 1.4.1 MARKET INCLUSIONS

- 1.4.2 MARKET EXCLUSIONS

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 UNITS CONSIDERED

- 1.8 LIMITATIONS

- 1.9 STAKEHOLDERS

- 1.10 SUMMARY OF CHANGES

- 1.11 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 TIMBER LAMINATING ADHESIVES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key sources of primary data

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 3 TIMBER LAMINATING ADHESIVES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 1

- FIGURE 4 TIMBER LAMINATING ADHESIVES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 2

- FIGURE 5 TIMBER LAMINATING ADHESIVES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 TIMBER LAMINATING ADHESIVES MARKET SIZE ESTIMATION, BY VOLUME

- FIGURE 7 TIMBER LAMINATING ADHESIVES MARKET, BY REGION

- FIGURE 8 TIMBER LAMINATING ADHESIVES MARKET, BY APPLICATION

- 2.3 MARKET GROWTH FORECAST

- 2.3.1 SUPPLY-SIDE ANALYSIS

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF TIMBER LAMINATING ADHESIVES MARKET

- 2.3.2 DEMAND-SIDE ANALYSIS

- FIGURE 10 TIMBER LAMINATING ADHESIVES MARKET: DEMAND-SIDE FORECAST

- 2.4 FACTOR ANALYSIS

- FIGURE 11 FACTOR ANALYSIS OF TIMBER LAMINATING ADHESIVES MARKET

- 2.5 DATA TRIANGULATION

- FIGURE 12 TIMBER LAMINATING ADHESIVES MARKET: DATA TRIANGULATION

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 RISK ANALYSIS

- 2.9 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.10 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 1 TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET BETWEEN 2023 AND 2028

- FIGURE 14 FLOOR BEAMS TO BE FASTEST-GROWING APPLICATION BETWEEN 2023 AND 2028

- FIGURE 15 RESIDENTIAL SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 MELAMINE RESIN TO BE LEADING SEGMENT BETWEEN 2023 AND 2028

- FIGURE 17 EUROPE ACCOUNTED FOR LARGEST SHARE OF TIMBER LAMINATING ADHESIVES MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN TIMBER LAMINATING ADHESIVES MARKET

- FIGURE 18 TIMBER LAMINATING ADHESIVES WITNESSING HIGH DEMAND FROM DEVELOPED ECONOMIES

- 4.2 TIMBER LAMINATING ADHESIVES MARKET, BY RESIN TYPE

- FIGURE 19 POLYURETHANE RESIN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 TIMBER LAMINATING ADHESIVES MARKET, BY APPLICATION

- FIGURE 20 FLOOR BEAMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 ASIA PACIFIC TIMBER LAMINATING ADHESIVES MARKET, BY APPLICATION AND COUNTRY, 2023

- FIGURE 21 CHINA DOMINATES TIMBER LAMINATING ADHESIVES MARKET IN ASIA PACIFIC

- 4.5 TIMBER LAMINATING ADHESIVES MARKET: DEVELOPED VS. EMERGING COUNTRIES

- FIGURE 22 EMERGING COUNTRIES TO GROW AT HIGHER CAGR

- 4.6 TIMBER LAMINATING ADHESIVES MARKET: BY MAJOR COUNTRIES

- FIGURE 23 INDIA TO EMERGE AS LUCRATIVE MARKET FOR TIMBER LAMINATING ADHESIVES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TIMBER LAMINATING ADHESIVES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use in non-residential sector

- 5.2.1.2 Growing demand in major emerging economies

- 5.2.1.3 Shift toward sustainable and eco-friendly construction

- 5.2.1.4 Increasing new construction activities

- 5.2.1.5 Rise in renovation and remodeling projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for low-VOC adhesives

- 5.2.3.2 Rising demand in Europe and North America

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory policies

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: TIMBER LAMINATING ADHESIVES MARKET

- TABLE 2 TIMBER LAMINATING ADHESIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 THREAT OF NEW ENTRANTS

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP END USES (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TIMBER LAMINATING ADHESIVES

- TABLE 4 KEY BUYING CRITERIA FOR TIMBER LAMINATING ADHESIVES

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 INTRODUCTION

- 5.5.2 GDP TRENDS AND FORECAST

- TABLE 5 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2020-2028

- 5.5.3 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- FIGURE 28 COUNTRY-WISE CONTRIBUTION TO GLOBAL CONSTRUCTION GROWTH, 2020-2030

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 CASE STUDY

- 5.8 PRICING ANALYSIS

- FIGURE 29 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY RESIN TYPE

- FIGURE 30 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY APPLICATION

- FIGURE 31 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY END USE

- FIGURE 32 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY REGION

- FIGURE 33 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY COMPANY

- 5.9 TRADE ANALYSIS

- TABLE 6 COUNTRY-WISE EXPORT DATA, 2020-2022 (USD THOUSAND)

- TABLE 7 COUNTRY-WISE IMPORT DATA, 2020-2022 (USD THOUSAND)

- 5.10 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 5.10.1 IMPACT OF SLOWDOWN

- 5.10.2 RUSSIA-UKRAINE WAR

- 5.10.3 EUROPE RECESSION

- 5.10.4 ENERGY CRISIS IN EUROPE

- 5.10.5 ASIA PACIFIC RECESSION IMPACT

- 5.11 SUPPLY CHAIN ANALYSIS

- FIGURE 34 TIMBER LAMINATING ADHESIVES MARKET: SUPPLY CHAIN ANALYSIS

- 5.12 TIMBER LAMINATING ADHESIVES ECOSYSTEM AND INTERCONNECTED MARKET

- TABLE 8 TIMBER LAMINATING ADHESIVES MARKET: STAKEHOLDERS IN SUPPLY CHAIN

- FIGURE 35 TIMBER LAMINATING ADHESIVES MARKET: ECOSYSTEM MAPPING

- 5.12.1 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 REVENUE SHIFT IN TIMBER LAMINATING ADHESIVES MARKET

- 5.13 PATENT ANALYSIS

- 5.13.1 METHODOLOGY

- 5.13.2 PATENT PUBLICATION TRENDS

- FIGURE 37 PATENT PUBLICATION TRENDS, 2018-2023

- 5.13.3 TOP APPLICANTS

- FIGURE 38 PATENTS PUBLISHED BY MAJOR PLAYERS, 2018-2023

- 5.13.4 JURISDICTION ANALYSIS

- FIGURE 39 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2018-2023

- TABLE 9 NUMBER OF PATENTS PUBLISHED, BY COMPANY

- TABLE 10 NUMBER OF PATENTS PUBLISHED, BY JURISDICTION

- 5.14 REGULATIONS AND STANDARDS

- 5.14.1 LEED STANDARDS

- TABLE 11 STANDARDS FOR ARCHITECTURAL APPLICATIONS

- TABLE 12 STANDARDS FOR SPECIALTY APPLICATIONS

- TABLE 13 STANDARDS FOR SUBSTRATE-SPECIFIC APPLICATIONS

- 5.14.2 STANDARDS FOR CROSS-LAMINATED TIMBER

- 5.14.3 STANDARDS FOR GLUE-LAMINATED TIMBER

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 KEY CONFERENCES AND EVENTS

- TABLE 17 ADHESIVES MARKET: KEY CONFERENCES AND EVENTS IN 2023

6 TIMBER LAMINATING ADHESIVES MARKET, BY RESIN TYPE

- 6.1 INTRODUCTION

- FIGURE 40 POLYURETHANE RESIN-BASED TIMBER LAMINATING ADHESIVES TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

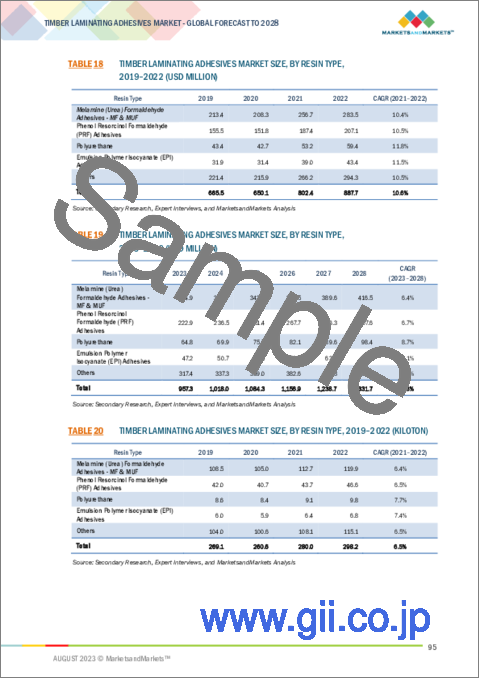

- TABLE 18 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 19 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 20 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 21 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 6.2 MELAMINE (UREA) FORMALDEHYDE

- TABLE 22 MELAMINE (UREA) FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 MELAMINE (UREA) FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 MELAMINE (UREA) FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (KILOTON)

- TABLE 25 MELAMINE (UREA) FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (KILOTON)

- 6.3 PHENOL RESORCINOL FORMALDEHYDE

- TABLE 26 PHENOL RESORCINOL FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 PHENOL RESORCINOL FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 28 PHENOL RESORCINOL FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (KILOTON)

- TABLE 29 PHENOL RESORCINOL FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (KILOTON)

- 6.4 POLYURETHANE

- TABLE 30 POLYURETHANE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 POLYURETHANE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 POLYURETHANE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (KILOTON)

- TABLE 33 POLYURETHANE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (KILOTON)

- 6.5 EMULSION POLYMER ISOCYANATE

- TABLE 34 EMULSION POLYMER ISOCYANATE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 35 EMULSION POLYMER ISOCYANATE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 EMULSION POLYMER ISOCYANATE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (KILOTON)

- TABLE 37 EMULSION POLYMER ISOCYANATE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (KILOTON)

- 6.6 OTHERS

- 6.6.1 POLYVINYL ACETATE

- 6.6.2 UREA-FORMALDEHYDE

- 6.6.3 PHENOL FORMALDEHYDE

- TABLE 38 OTHER TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 OTHER TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 40 OTHER TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (KILOTON)

- TABLE 41 OTHER TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (KILOTON)

7 TIMBER LAMINATING ADHESIVES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 41 FLOOR BEAMS TO ACCOUNT FOR LARGEST SHARE BETWEEN 2023 AND 2028

- TABLE 42 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 43 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 44 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 45 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- 7.2 FLOOR BEAMS

- 7.2.1 EUROPE TO ACCOUNT FOR LARGEST SHARE OF MARKET IN FLOOR BEAMS SEGMENT

- TABLE 46 TIMBER LAMINATING ADHESIVES MARKET SIZE IN FLOOR BEAMS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 TIMBER LAMINATING ADHESIVES MARKET SIZE IN FLOOR BEAMS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 48 TIMBER LAMINATING ADHESIVES MARKET SIZE IN FLOOR BEAMS, BY REGION, 2019-2022 (KILOTON)

- TABLE 49 TIMBER LAMINATING ADHESIVES MARKET SIZE IN FLOOR BEAMS, BY REGION, 2023-2028 (KILOTON)

- 7.3 ROOF BEAMS

- 7.3.1 RENOVATION AND REMODELING TO BE MAJOR DRIVERS IN ROOF BEAMS APPLICATION

- TABLE 50 TIMBER LAMINATING ADHESIVES MARKET SIZE IN ROOF BEAMS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 TIMBER LAMINATING ADHESIVES MARKET SIZE IN ROOF BEAMS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 52 TIMBER LAMINATING ADHESIVES MARKET SIZE IN ROOF BEAMS, BY REGION, 2019-2022 (KILOTON)

- TABLE 53 TIMBER LAMINATING ADHESIVES MARKET SIZE IN ROOF BEAMS, BY REGION, 2023-2028 (KILOTON)

- 7.4 WINDOW & DOOR HEADERS

- 7.4.1 EUROPE AND NORTH AMERICA DRIVING USE OF TIMBER LAMINATING ADHESIVES IN WINDOW & DOOR HEADERS

- TABLE 54 TIMBER LAMINATING ADHESIVES MARKET SIZE IN WINDOW & DOOR HEADERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 TIMBER LAMINATING ADHESIVES MARKET SIZE IN WINDOW & DOOR HEADERS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 TIMBER LAMINATING ADHESIVES MARKET SIZE IN WINDOW & DOOR HEADERS, BY REGION, 2019-2022 (KILOTON)

- TABLE 57 TIMBER LAMINATING ADHESIVES MARKET SIZE IN WINDOW & DOOR HEADERS, BY REGION, 2023-2028 (KILOTON)

- 7.5 TRUSSES & SUPPORTING COLUMNS

- 7.5.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 58 TIMBER LAMINATING ADHESIVES MARKET SIZE IN TRUSSES & SUPPORTING COLUMNS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 TIMBER LAMINATING ADHESIVES MARKET SIZE IN TRUSSES & SUPPORTING COLUMNS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 TIMBER LAMINATING ADHESIVES MARKET SIZE IN TRUSSES & SUPPORTING COLUMNS, BY REGION, 2019-2022 (KILOTON)

- TABLE 61 TIMBER LAMINATING ADHESIVES MARKET SIZE IN TRUSSES & SUPPORTING COLUMNS, BY REGION, 2023-2028 (KILOTON)

- 7.6 OTHERS

- 7.6.1 USE OF ARCHES INCREASING DUE TO DEMAND FOR TIMBER-EXPOSED ROOF LINES

- TABLE 62 TIMBER LAMINATING ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 TIMBER LAMINATING ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 TIMBER LAMINATING ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019-2022 (KILOTON)

- TABLE 65 TIMBER LAMINATING ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2023-2028 (KILOTON)

8 TIMBER LAMINATING ADHESIVES MARKET, BY END USE

- 8.1 INTRODUCTION

- FIGURE 42 RESIDENTIAL SEGMENT TO BE LARGER END USER OF TIMBER LAMINATING ADHESIVES BETWEEN 2023 AND 2028

- TABLE 66 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (USD MILLION)

- TABLE 67 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (USD MILLION)

- TABLE 68 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (KILOTON)

- TABLE 69 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (KILOTON)

- 8.2 RESIDENTIAL

- 8.2.1 EUROPE TO REMAIN LARGEST CONSUMER OF TIMBER LAMINATING ADHESIVES IN RESIDENTIAL SEGMENT

- TABLE 70 TIMBER LAMINATING ADHESIVES MARKET SIZE IN RESIDENTIAL, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 TIMBER LAMINATING ADHESIVES MARKET SIZE IN RESIDENTIAL, BY REGION, 2023-2028 (USD MILLION)

- TABLE 72 TIMBER LAMINATING ADHESIVES MARKET SIZE IN RESIDENTIAL, BY REGION, 2019-2022 (KILOTON)

- TABLE 73 TIMBER LAMINATING ADHESIVES MARKET SIZE IN RESIDENTIAL, BY REGION, 2023-2028 (KILOTON)

- 8.3 NON-RESIDENTIAL

- 8.3.1 CHANGES IN INTERNATIONAL BUILDING CODE (IBC) 2021 INCREASING CONSUMPTION IN NON-RESIDENTIAL SECTOR

- TABLE 74 TIMBER LAMINATING ADHESIVES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 TIMBER LAMINATING ADHESIVES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023-2028 (USD MILLION)

- TABLE 76 TIMBER LAMINATING ADHESIVES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2019-2022 (KILOTON)

- TABLE 77 TIMBER LAMINATING ADHESIVES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023-2028 (KILOTON)

9 TIMBER LAMINATING ADHESIVES MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 43 ASIA PACIFIC PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 78 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 80 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2022 (KILOTON)

- TABLE 81 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023-2028 (KILOTON)

- 9.2 NORTH AMERICA

- 9.2.1 IMPACT OF RECESSION ON NORTH AMERICA

- FIGURE 44 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- TABLE 82 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 85 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 86 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 89 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 90 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 93 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 94 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE 2019-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE 2023-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (KILOTON)

- TABLE 97 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (KILOTON)

- 9.2.2 US

- 9.2.2.1 Competition among local timber laminating adhesive manufacturers to propel market

- TABLE 98 US: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 99 US: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 100 US: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 101 US: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.2.3 CANADA

- 9.2.3.1 Polyurethane-based timber laminating adhesives to register highest growth during forecast period

- TABLE 102 CANADA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 103 CANADA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 104 CANADA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 105 CANADA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.2.4 MEXICO

- 9.2.4.1 Rising awareness to drive market during forecast period

- TABLE 106 MEXICO: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 107 MEXICO: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 108 MEXICO: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 109 MEXICO: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3 EUROPE

- 9.3.1 IMPACT OF RECESSION ON EUROPE

- FIGURE 45 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- TABLE 110 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 111 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 112 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 113 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 114 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 115 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 116 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 117 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 118 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 119 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 120 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 121 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 122 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (USD MILLION)

- TABLE 123 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (USD MILLION)

- TABLE 124 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (KILOTON)

- TABLE 125 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (KILOTON)

- 9.3.2 GERMANY

- 9.3.2.1 New developments and investments in technology to boost market

- TABLE 126 GERMANY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 127 GERMANY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 128 GERMANY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 129 GERMANY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.3 FRANCE

- 9.3.3.1 Development of affordable housing infrastructure to drive demand

- TABLE 130 FRANCE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 131 FRANCE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 132 FRANCE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 133 FRANCE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.4 UK

- 9.3.4.1 Government initiatives to boost construction sector to drive market growth

- TABLE 134 UK: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 135 UK: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 136 UK: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 137 UK: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.5 RUSSIA

- 9.3.5.1 Increasing awareness about laminated timber to support market growth

- TABLE 138 RUSSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 139 RUSSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 140 RUSSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 141 RUSSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.6 ITALY

- 9.3.6.1 Focus on modernization in woodworking industry to fuel demand

- TABLE 142 ITALY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 143 ITALY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 144 ITALY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 145 ITALY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.7 TURKEY

- 9.3.7.1 Rapid urbanization, rising middle-class population, and increasing purchasing power to drive demand

- TABLE 146 TURKEY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 147 TURKEY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 148 TURKEY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 149 TURKEY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.8 BALTIC COUNTRIES

- 9.3.8.1 Demand for sustainable and eco-friendly buildings to fuel market growth

- TABLE 150 BALTIC COUNTRIES: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 151 BALTIC COUNTRIES: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 152 BALTIC COUNTRIES: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 153 BALTIC COUNTRIES: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.9 AUSTRIA

- 9.3.9.1 Demand from residential segment to drive market

- TABLE 154 AUSTRIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 155 AUSTRIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 156 AUSTRIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 157 AUSTRIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.10 SCANDINAVIA

- 9.3.10.1 Demand for modern design in construction driving market

- TABLE 158 SCANDINAVIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 159 SCANDINAVIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 160 SCANDINAVIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 161 SCANDINAVIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.3.11 REST OF EUROPE

- TABLE 162 REST OF EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 163 REST OF EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 164 REST OF EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 165 REST OF EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.4 ASIA PACIFIC

- 9.4.1 IMPACT OF RECESSION ON ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- TABLE 166 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 169 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 170 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 173 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 174 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 177 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 178 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (KILOTON)

- TABLE 181 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (KILOTON)

- 9.4.2 CHINA

- 9.4.2.1 Foreign investment and growing infrastructure to drive market

- TABLE 182 CHINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 183 CHINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 184 CHINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 185 CHINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.4.3 INDIA

- 9.4.3.1 Growing real estate industry to fuel demand for timber laminating adhesives

- TABLE 186 INDIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 187 INDIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 188 INDIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 189 INDIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.4.4 JAPAN

- 9.4.4.1 Government reconstruction projects and growing tourism sector to boost market

- TABLE 190 JAPAN: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 191 JAPAN: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 192 JAPAN: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 193 JAPAN: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Growing population of homeowners to drive market

- TABLE 194 SOUTH KOREA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 195 SOUTH KOREA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 196 SOUTH KOREA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 197 SOUTH KOREA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.4.6 THAILAND

- 9.4.6.1 Increase in demand for home furniture to drive market

- TABLE 198 THAILAND: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 199 THAILAND: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 200 THAILAND: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 201 THAILAND: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.4.7 INDONESIA

- 9.4.7.1 Public and private investments to support market growth

- TABLE 202 INDONESIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 203 INDONESIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 204 INDONESIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 205 INDONESIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.4.8 MALAYSIA

- 9.4.8.1 Strong furniture export sector to boost demand for timber laminating adhesives

- TABLE 206 MALAYSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 207 MALAYSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 208 MALAYSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 209 MALAYSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.4.9 REST OF ASIA PACIFIC

- TABLE 210 REST OF ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 213 REST OF ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.5 SOUTH AMERICA

- 9.5.1 RECESSION IMPACT ON SOUTH AMERICA

- FIGURE 47 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- TABLE 214 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 215 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 216 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 217 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 218 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 219 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 220 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 221 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 222 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 223 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 224 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 225 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 226 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (USD MILLION)

- TABLE 227 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (USD MILLION)

- TABLE 228 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (KILOTON)

- TABLE 229 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (KILOTON)

- 9.5.2 BRAZIL

- 9.5.2.1 Fast-growing manufacturing hubs to offer opportunities for market growth

- TABLE 230 BRAZIL: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 231 BRAZIL: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 232 BRAZIL: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 233 BRAZIL: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.5.3 ARGENTINA

- 9.5.3.1 Timber laminating adhesives market in Argentina dependent on import

- TABLE 234 ARGENTINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 235 ARGENTINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 236 ARGENTINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 237 ARGENTINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.5.4 REST OF SOUTH AMERICA

- TABLE 238 REST OF SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 239 REST OF SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 240 REST OF SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 241 REST OF SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- FIGURE 48 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- TABLE 242 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 245 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 246 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 249 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 250 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 253 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 254 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2022 (KILOTON)

- TABLE 257 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023-2028 (KILOTON)

- 9.6.2 UAE

- 9.6.2.1 Urban development projects driving demand for timber laminating adhesives

- TABLE 258 UAE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 259 UAE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 260 UAE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 261 UAE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.6.3 SAUDI ARABIA

- 9.6.3.1 Development of real-estate sector and increasing demand for residential properties to spur market growth

- TABLE 262 SAUDI ARABIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 263 SAUDI ARABIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 264 SAUDI ARABIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 265 SAUDI ARABIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.6.4 AFRICA

- 9.6.4.1 Rising population and urbanization to boost market growth

- TABLE 266 AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 267 AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 268 AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 269 AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

- 9.6.5 REST OF MIDDLE EAST & AFRICA

- TABLE 270 REST OF MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 271 REST OF MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 272 REST OF MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 273 REST OF MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023-2028 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- TABLE 274 STRATEGIES ADOPTED BY KEY TIMBER LAMINATING ADHESIVES PLAYERS (2018-2023)

- 10.2 COMPANY EVALUATION MATRIX

- 10.2.1 STARS

- 10.2.2 PERVASIVE PLAYERS

- 10.2.3 EMERGING LEADERS

- 10.2.4 PARTICIPANTS

- 10.2.5 COMPANY FOOTPRINT

- TABLE 275 COMPANY REGION FOOTPRINT

- TABLE 276 COMPANY APPLICATION FOOTPRINT

- TABLE 277 COMPANY OVERALL FOOTPRINT

- FIGURE 49 TIMBER LAMINATING ADHESIVES MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.3 START-UPS/SMES EVALUATION MATRIX

- 10.3.1 PROGRESSIVE COMPANIES

- 10.3.2 STARTING BLOCKS

- 10.3.3 RESPONSIVE COMPANIES

- 10.3.4 DYNAMIC COMPANIES

- 10.3.5 COMPETITIVE BENCHMARKING

- TABLE 278 TIMBER LAMINATING ADHESIVES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 279 TIMBER LAMINATING ADHESIVES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- FIGURE 50 TIMBER LAMINATING ADHESIVES MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- 10.4 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 51 TIMBER LAMINATING ADHESIVES MARKET: PRODUCT PORTFOLIO ANALYSIS

- 10.5 MARKET SHARE ANALYSIS

- FIGURE 52 MARKET SHARE OF KEY PLAYERS, 2022

- TABLE 280 TIMBER LAMINATING ADHESIVES MARKET: DEGREE OF COMPETITION, 2022

- 10.6 MARKET RANKING ANALYSIS

- FIGURE 53 RANKING OF LEADING PLAYERS IN TIMBER LAMINATING ADHESIVES MARKET, 2022

- 10.7 REVENUE ANALYSIS

- FIGURE 54 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 MARKET EVALUATION FRAMEWORK

- TABLE 281 STRATEGIC DEVELOPMENTS, BY KEY COMPANIES

- TABLE 282 HIGHEST ADOPTED STRATEGIES

- TABLE 283 NUMBER OF GROWTH STRATEGIES ADOPTED, BY KEY COMPANIES

- 10.9 STRATEGIC DEVELOPMENTS

- TABLE 284 TIMBER LAMINATING ADHESIVES MARKET: DEALS, 2017-2023

- TABLE 285 TIMBER LAMINATING ADHESIVES MARKET: OTHERS, 2017-2023

11 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 11.1 KEY COMPANIES

- 11.1.1 HENKEL AG & CO. KGAA

- TABLE 286 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- FIGURE 55 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- TABLE 287 HENKEL AG & CO. KGAA: PRODUCT/SERVICES/SOLUTIONS OFFERED

- TABLE 288 HENKEL AG & CO. KGAA: OTHERS

- 11.1.2 SIKA AG

- TABLE 289 SIKA AG: COMPANY OVERVIEW

- FIGURE 56 SIKA AG: COMPANY SNAPSHOT

- TABLE 290 SIKA AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 291 SIKA AG: DEALS

- TABLE 292 SIKA AG: OTHERS

- 11.1.3 ARKEMA (BOSTIK)

- TABLE 293 ARKEMA (BOSTIK): COMPANY OVERVIEW

- FIGURE 57 ARKEMA (BOSTIK): COMPANY SNAPSHOT

- TABLE 294 ARKEMA (BOSTIK): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 295 ARKEMA (BOSTIK): DEALS

- TABLE 296 ARKEMA (BOSTIK): OTHERS

- 11.1.4 3M

- TABLE 297 3M: COMPANY OVERVIEW

- FIGURE 58 3M: COMPANY SNAPSHOT

- TABLE 298 3M COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.5 H.B. FULLER CO.

- TABLE 299 H.B. FULLER CO.: COMPANY OVERVIEW

- FIGURE 59 H.B. FULLER CO.: COMPANY SNAPSHOT

- TABLE 300 H.B. FULLER CO.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 301 H.B. FULLER: PRODUCT LAUNCHES

- TABLE 302 H.B. FULLER: DEALS

- TABLE 303 H.B. FULLER: OTHERS

- 11.1.6 DOW INC.

- TABLE 304 DOW INC.: COMPANY OVERVIEW

- FIGURE 60 DOW INC.: COMPANY SNAPSHOT

- TABLE 305 DOW INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 306 DOW INC.: OTHERS

- 11.1.7 AKZO NOBEL N.V.

- TABLE 307 AKZO NOBEL N.V.: COMPANY OVERVIEW

- FIGURE 61 AKZO NOBEL N.V.: COMPANY SNAPSHOT

- TABLE 308 AKZO NOBEL N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.8 PIDILITE INDUSTRIES

- TABLE 310 PIDILITE INDUSTRIES: COMPANY OVERVIEW

- FIGURE 62 PIDILITE INDUSTRIES: COMPANY SNAPSHOT

- TABLE 311 PIDILITE INDUSTRIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.9 JOWAT SE

- TABLE 312 JOWAT SE: COMPANY OVERVIEW

- TABLE 313 JOWAT SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.10 ILLINOIS TOOL WORKS INC.

- TABLE 314 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- FIGURE 63 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

- TABLE 315 ILLINOIS TOOL WORKS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2 OTHER KEY PLAYERS

- 11.2.1 JUBILANT INDUSTRIES

- TABLE 316 JUBILANT INDUSTRIES: COMPANY OVERVIEW

- TABLE 317 JUBILANT INDUSTRIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.2 BEARDOW ADAMS

- TABLE 318 BEARDOW ADAMS: COMPANY OVERVIEW

- TABLE 319 BEARDOW ADAMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.3 BISON INTERNATIONAL BV

- TABLE 320 BISON INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 321 BISON INTERNATIONAL BV: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.4 BRITANNIA ADHESIVES

- TABLE 322 BRITANNIA ADHESIVES: COMPANY OVERVIEW

- TABLE 323 BRITANNIA ADHESIVES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.5 CATTIE ADHESIVES

- TABLE 324 CATTIE ADHESIVES: COMPANY OVERVIEW

- TABLE 325 CATTIE ADHESIVES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.6 DAP PRODUCTS INC.

- TABLE 326 DAP PRODUCTS INC.: COMPANY OVERVIEW

- TABLE 327 DAP PRODUCTS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.7 FOLLMANN GMBH & CO. KG

- TABLE 328 FOLLMANN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 329 FOLLMANN GMBH & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.8 FRANKLIN INTERNATIONAL

- TABLE 330 FRANKLIN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 331 FRANKLIN INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.9 IFS INDUSTRIES, INC.

- TABLE 332 IFS INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 333 IFS INDUSTRIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.10 MAPEI SPA

- TABLE 334 MAPEI SPA: COMPANY OVERVIEW

- TABLE 335 MAPEI SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.11 STAUF USA

- TABLE 336 STAUF USA: COMPANY OVERVIEW

- TABLE 337 STAUF USA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.12 ASTRAL ADHESIVES

- TABLE 338 ASTRAL ADHESIVES: COMPANY OVERVIEW

- TABLE 339 ASTRAL ADHESIVES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.13 PARKER HANNIFIN CORP (PARKER LORD)

- TABLE 340 PARKER HANNIFIN CORP (PARKER LORD): COMPANY OVERVIEW

- TABLE 341 PARKER HANNIFIN CORP (PARKER LORD): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.14 COLLANO AG

- TABLE 342 COLLANO AG: COMPANY OVERVIEW

- TABLE 343 COLLANO AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.2.15 BUHNEN ADHESIVE SYSTEMS

- TABLE 344 BUHNEN ADHESIVE SYSTEMS: COMPANY OVERVIEW

- TABLE 345 BUHNEN ADHESIVE SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 ADHESIVES & SEALANT MARKET LIMITATIONS

- 12.3 ADHESIVES & SEALANTS

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 ADHESIVES & SEALANTS MARKET, BY ADHESIVES TECHNOLOGY

- TABLE 346 ADHESIVES & SEALANTS MARKET, BY ADHESIVE TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 347 ADHESIVES & SEALANTS MARKET, BY ADHESIVE TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 348 ADHESIVES & SEALANTS MARKET, BY ADHESIVE TECHNOLOGY, 2019-2022 (KILOTON)

- TABLE 349 ADHESIVES & SEALANTS MARKET, BY ADHESIVE TECHNOLOGY, 2023-2028 (KILOTON)

- 12.3.4 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION

- TABLE 350 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION, 2019-2022 (USD MILLION)

- TABLE 351 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION, 2023-2028 (USD MILLION)

- TABLE 352 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION, 2019-2022 (KILOTON)

- TABLE 353 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION, 2023-2028 (KILOTON)

- 12.3.5 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE

- TABLE 354 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE, 2019-2022 (USD MILLION)

- TABLE 355 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 356 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE, 2019-2022 (KILOTON)

- TABLE 357 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE, 2023-2028 (KILOTON)

- 12.3.6 ADHESIVES & SEALANTS MARKET, BY SEALANTS APPLICATION

- TABLE 358 SEALANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 359 SEALANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 360 SEALANTS MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 361 SEALANTS MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 12.3.7 ADHESIVES & SEALANTS MARKET, BY REGION

- TABLE 362 ADHESIVES & SEALANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 363 ADHESIVES & SEALANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 364 ADHESIVES & SEALANTS MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 365 ADHESIVES & SEALANTS MARKET, BY REGION, 2023-2028 (KILOTON)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS