|

|

市場調査レポート

商品コード

1336039

溶射コーティングの世界市場:材料別(セラミックス、金属・合金)、プロセス別(燃焼炎、電気)、最終用途産業別(航空宇宙、自動車、ヘルスケア、農業、エネルギー・電力、エレクトロニクス)、地域別-2028年までの予測Thermal Spray Coatings Market by Materials (Ceramics and Metals & Alloys), Process (Combustion Flame and Electrical), End-Use Industry (Aerospace, Automotive, Healthcare, Agriculture, Energy & Power and Electronics) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 溶射コーティングの世界市場:材料別(セラミックス、金属・合金)、プロセス別(燃焼炎、電気)、最終用途産業別(航空宇宙、自動車、ヘルスケア、農業、エネルギー・電力、エレクトロニクス)、地域別-2028年までの予測 |

|

出版日: 2023年08月11日

発行: MarketsandMarkets

ページ情報: 英文 230 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

溶射コーティングの市場規模は、2023年の104億米ドルから2028年には143億米ドルに成長し、2023年から2028年までのCAGRは6.5%と予測されています。

航空宇宙産業は、溶射コーティング市場の重要な促進要因です。溶射コーティングは、航空機エンジン、タービンブレード、航空宇宙構造物、防衛装備品に広く使用され、性能の向上、軽量化、耐久性の強化に役立っています。

プロセス別では、燃焼炎セグメントが予測期間中最大セグメントになると推定されます。燃焼炎プロセスは、コーティングと基材間の優れた結合強度と接着を促進します。炎から発生する高温と粒子の速度は、強力な金属結合を促進し、耐久性と弾力性のあるコーティングをもたらします。これは、コーティングが高温や機械的ストレス、腐食環境に耐えなければならない用途では特に重要です。したがって、これらの要因が燃焼炎分野の市場成長を後押ししています。

材料別では、セラミックスが予測期間中最大のシェアを占めると推定されます。セラミックコーティングは優れた電気絶縁特性を有します。セラミックコーティングは、電気伝導性を最小限に抑える必要がある用途や絶縁が必要な用途で使用されます。例えば、電気部品、回路基板、高電圧絶縁体などです。

最終用途別では、航空宇宙が予測期間中最大のシェアを占めると推定されます。溶射コーティングは、宇宙船や再突入機の熱保護システム(TPS)に採用されています。アブレーション材料や絶縁材料などのTPSコーティングは、大気圏再突入時の極端な温度に耐え、熱による損傷から下部構造を保護するように設計されています。

北米は、2023年から2028年にかけて溶射コーティング市場で最大のシェアを記録すると予測されています。北米の自動車産業は、溶射コーティング市場のもう一つの主要促進要因です。コーティングは、エンジン部品、ピストンリング、トランスミッションシステムなどの自動車部品に塗布され、性能の向上、摩擦の低減、燃費の改善に役立っています。軽量素材とエンジン効率の改善に対する需要の増加に伴い、自動車分野での溶射コーティングの使用は拡大すると予想されます。

当レポートでは、世界の溶射コーティング市場について調査し、材料別、プロセス別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

第6章 業界の動向

- 技術分析

- ケーススタディ分析

- バリューチェーン分析

- 規制状況

- 主要な利害関係者と購入基準

- 顧客のビジネスに影響を与える動向/混乱

- 2023年の主要な会議とイベント

- 特許分析

- 溶射コーティングのエコシステム/市場マップ

第7章 溶射コーティング市場、プロセス別

- イントロダクション

- 燃焼炎

- 電気

第8章 溶射コーティング市場、材料別

- イントロダクション

- セラミックス

- 金属と合金

- その他

第9章 溶射コーティング市場、最終用途産業別

- イントロダクション

- 航空宇宙

- 自動車

- ヘルスケア

- エネルギー・電力

- エレクトロニクス

- 農業機械

- その他

第10章 地域分析

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要な市場プレーヤーが採用した戦略

- 市場シェア分析

- 企業のフットプリント

- 企業評価クアドラント(Tier 1)、2022年

- スタートアップ/中小企業の評価クアドラント、2022年

- 競合ベンチマーキング

- 競合シナリオ

第12章 企業プロファイル

- PRAXAIR S.T. TECHNOLOGY, INC.

- OERLIKON METCO

- BODYCOTE

- SURFACE TECHNOLOGY

- H.C. STARCK GMBH

- FLAME SPRAY TECHNOLOGIES B.V.

- THERMAL SPRAY TECHNOLOGIES ENGINEERED COATING SOLUTIONS

- A&A COATINGS

- GENERAL MAGNAPLATE CORPORATION

- PLASMA-TEC, INC.

- ASB INDUSTRIES INC.

- POLYMET CORPORATION

- PROGRESSIVE SURFACE

- BRYCOAT INC.

- METALLISATION LIMITED

- EXLINE INC.

- ARC-SPRAY(PTY)LTD.

- F.W. GARTNER THERMAL SPRAYING

- FLAME SPRAY SPA

- TOCALO CO., LTD.

- TREIBACHER INDUSTRIE AG

- GTC VERSCHLEISS-SCHUTZ

- SAINT-GOBAIN

- C & M TECHNOLOGIES GMBH

第13章 付録

The thermal spray coatings market is projected to grow from USD 10.4 billion in 2023 to USD 14.3 billion by 2028, at a CAGR of 6.5% from 2023 to 2028. The aerospace industry is a significant driver for the thermal spray coating market. Thermal spray coatings are widely used in aircraft engines, turbine blades, aerospace structures, and defense equipment to improve performance, reduce weight, and enhance durability.

"By process, the combustion flame segment is estimated to be the largest segment of the thermal spray coatings market from 2023 to 2028."

Based on the process, the combustion flame is estimated to be the largest segment during the forecast period. The combustion flame process facilitates excellent bond strength and adhesion between the coating and substrate. The high temperatures and velocity of the particles generated by the flame promote strong metallurgical bonding, resulting in a durable and resilient coating. This is particularly crucial for applications where the coating must withstand high temperatures, mechanical stress, or corrosive environments. Hence, these factors are propelling the market growth for the combustion flame segment.

"By material, ceramics is estimated to be the largest segment of the thermal spray coatings market from 2023 to 2028."

Based on material, ceramics is estimated to account for the largest share during the forecast period. Ceramic coatings possess excellent electrical insulation properties. They are used in applications where electrical conductivity needs to be minimized, or insulation is required. Examples include electrical components, circuit boards, and high-voltage insulators.

"By end-use, the aerospace is estimated to be the largest segment of the thermal spray coatings market from 2023 to 2028."

Based on end-use, aerospace is estimated to account for the largest share during the forecast period. Thermal spray coatings are employed in thermal protection systems (TPS) for spacecraft and re-entry vehicles. TPS coatings, such as ablation and insulating materials, are designed to withstand extreme temperatures during atmospheric re-entry and protect the underlying structures from heat damage.

"The thermal spray coatings market in the North America region is projected to witness the highest share during the forecast period."

North America is projected to register the greatest share in the thermal spray coatings market from 2023 to 2028. The automotive industry in North America is another key driver of the thermal spray coatings market. Coatings are applied to automotive components, such as engine parts, piston rings, and transmission systems, to enhance performance, reduce friction, and improve fuel efficiency. With the increasing demand for lightweight materials and improved engine efficiency, the use of thermal spray coatings in the automotive sector is expected to grow.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 40%, Tier 2 - 20%, and Tier 3 - 40%

- By Designation: C-level Executives - 20%, Directors - 50%, and Others - 30%

- By Region: North America - 25%, Europe -15%, Asia Pacific - 30%, and Latin America-20%, Middle East & Africa-10%

The thermal spray coatings report is dominated by players such as Praxair ST Technologies, Inc. (US), H.C Starck Gmbh (Germany), Bodycote (UK), and Oerlikon Metco (Switzerland), BryCoat Inc. (US), Thermal Spray Technologies Engineered Coatings Solution (US), F.W. Gartner Thermal Spraying (US), Arc Spray (Pty) Ltd. (South Africa), Metallisation Limited (UK), Plasma-Tec, Inc. (US), GTV Verschleiss-Schutz (Germany), and others.

Research Coverage:

The report defines, segments, and projects the thermal spray coatings market size based on process, material, end-use, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as expansions, agreements, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the thermal spray coatings market and its segments. This report is also expected to help stakeholder businesses and the market's competitive landscape better, gain insights to improve the position of their companies and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing demand from the healthcare industry, the reduced maintenance cost of thermally sprayed parts, thermal spray substituting electroplating processes, the boom in the aerospace industry), restraints (stringent regulations for thermal spray coatings), opportunities (adoption of new measures to conserve energy & harness renewable energy sources), and challenges (lack of technical skills, low investment in R&D activities by end-use industries) influencing the growth of the thermal spray coatings market.

- Market Development: Comprehensive information about lucrative markets - the report analyses

the thermal spray coatings market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped

geographies, recent developments, and investments in the thermal spray coatings market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service

offerings of leading players like Praxair ST Technologies, Inc. (US), H.C Starck Gmbh (Germany), Bodycote (UK), and Oerlikon Metco (Switzerland), Surface Technology (UK), among others in the thermal spray coatings market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 THERMAL SPRAY COATINGS MARKET, BY PROCESS: INCLUSIONS & EXCLUSIONS

- TABLE 2 THERMAL SPRAY COATINGS MARKET, BY MATERIAL: INCLUSIONS & EXCLUSIONS

- TABLE 3 THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

- TABLE 4 THERMAL SPRAY COATINGS MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 THERMAL SPRAY COATINGS MARKET SEGMENTATION

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 THERMAL SPRAY COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 BASE NUMBER CALCULATION

- FIGURE 3 BASE NUMBER CALCULATION APPROACH 1

- FIGURE 4 BASE NUMBER CALCULATION APPROACH 2

- 2.3 RECESSION IMPACT

- 2.4 FORECAST NUMBER CALCULATION

- 2.5 MARKET ENGINEERING PROCESS

- 2.5.1 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.5.2 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 THERMAL SPRAY COATINGS MARKET: DATA TRIANGULATION

- 2.7 ASSUMPTIONS

- 2.8 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 5 THERMAL SPRAY COATINGS MARKET SNAPSHOT

- FIGURE 8 CERAMICS TO BE MOST WIDELY CONSUMED MATERIAL IN THERMAL SPRAY COATINGS MARKET BETWEEN 2023 AND 2028

- FIGURE 9 AEROSPACE TO BE LARGEST END-USE INDUSTRY OF THERMAL SPRAY COATINGS

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THERMAL SPRAY COATINGS MARKET

- FIGURE 10 ASIA PACIFIC THERMAL SPRAY COATINGS MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.2 THERMAL SPRAY COATINGS MARKET, BY PROCESS

- FIGURE 11 COMBUSTION FLAME SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 THERMAL SPRAY COATINGS MARKET, BY REGION

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF THERMAL SPRAY COATINGS MARKET IN 2022

- 4.4 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL AND COUNTRY

- FIGURE 13 US ACCOUNTED FOR LARGER SHARE OF THERMAL SPRAY COATINGS MARKET IN NORTH AMERICA

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMAL SPRAY COATINGS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand from healthcare industry

- 5.2.1.2 Reduced maintenance cost of thermally sprayed parts

- 5.2.1.3 Thermal spray substituting electroplating processes

- 5.2.1.4 Boom in aerospace industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations for thermal spray coatings

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of new measures to conserve energy & harness renewable energy sources

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of technical skills

- 5.2.4.2 Low investment in R&D activities by end-use industries

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.1.1 Easy availability of raw materials

- 5.3.1.2 Presence of large number of suppliers

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.2.1 Presence of large number of buyers

- 5.3.2.2 Large volume purchases

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.3.1 Availability of substitutes

- 5.3.3.2 Cost of available substitutes

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.4.1 Presence of established players

- 5.3.4.2 Requirement for specific technical skills

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.5.1 Industry concentration

- 5.3.5.2 Exit barriers

6 INDUSTRY TRENDS

- 6.1 TECHNOLOGY ANALYSIS

- 6.2 CASE STUDY ANALYSIS

- 6.2.1 USE OF THERMAL SPRAY COATINGS FOR IMPROVED PERFORMANCE AND LIFESPAN IN AEROSPACE INDUSTRY

- 6.2.2 USE OF THERMAL SPRAY COATINGS FOR CORROSION PROTECTION IN OFFSHORE OIL & GAS INDUSTRY

- 6.2.3 THERMAL SPRAY COATINGS FOR WEAR PROTECTION IN MINING EQUIPMENT

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN ANALYSIS OF THERMAL SPRAY COATINGS MARKET

- 6.4 REGULATORY LANDSCAPE

- 6.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- 6.5.2 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 18 KEY BUYING CRITERIA

- TABLE 7 KEY BUYING CRITERIA, BY TOP THREE END-USE INDUSTRIES

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 19 REVENUE SHIFT & NEW REVENUE POCKETS FOR THERMAL SPRAY COATING MANUFACTURERS

- 6.7 KEY CONFERENCES AND EVENTS, 2023

- TABLE 8 THERMAL SPRAY COATINGS MARKET: KEY CONFERENCES AND EVENTS

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 PATENT PUBLICATION TRENDS

- FIGURE 20 NUMBER OF PATENTS, YEAR-WISE (2014-2022)

- 6.8.3 INSIGHT

- 6.8.4 JURISDICTION ANALYSIS

- FIGURE 21 CHINA ACCOUNTED FOR HIGHEST PATENT COUNT

- 6.8.5 TOP COMPANIES/APPLICANTS

- FIGURE 22 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- 6.8.6 MAJOR PATENTS

- 6.9 ECOSYSTEM/MARKET MAP OF THERMAL SPRAY COATINGS

- FIGURE 23 ECOSYSTEM/MARKET MAP OF THERMAL SPRAY COATINGS

- TABLE 9 THERMAL SPRAY COATINGS MARKET: ECOSYSTEM

7 THERMAL SPRAY COATINGS MARKET, BY PROCESS

- 7.1 INTRODUCTION

- FIGURE 24 COMBUSTION FLAME SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 10 THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 11 THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- 7.2 COMBUSTION FLAME

- 7.2.1 TYPES

- 7.2.1.1 Wire flame spraying

- 7.2.1.2 Powder flame spraying

- 7.2.1.3 Detonation gun spraying

- 7.2.1.4 Ceramic rod spraying

- 7.2.1.5 High Velocity Oxy Fuel (HVOF) process

- TABLE 12 COMBUSTION FLAME THERMAL SPRAY COATINGS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 13 COMBUSTION FLAME THERMAL SPRAY COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1 TYPES

- 7.3 ELECTRICAL

- 7.3.1 TYPES

- 7.3.1.1 Vacuum Plasma Spraying (VPS)

- 7.3.1.2 Atmospheric Plasma Spraying (APS)

- 7.3.1.3 Electric arc wire spraying

- 7.3.1.4 Plasma spraying

- 7.3.1.5 Arc spraying

- 7.3.1.6 Cold gas dynamic spray process

- 7.3.1.7 Radio Frequency (RF) plasma

- 7.3.1.8 Two-wire electric arc spraying

- TABLE 14 ELECTRICAL THERMAL SPRAY COATINGS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 15 ELECTRICAL THERMAL SPRAY COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.1 TYPES

8 THERMAL SPRAY COATINGS MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- FIGURE 25 CERAMICS MATERIAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 17 THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- 8.2 CERAMICS

- 8.2.1 ALUMINA

- 8.2.2 ZIRCONIA

- 8.2.3 YTTRIA

- TABLE 18 CERAMIC THERMAL SPRAY COATINGS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 19 CERAMIC THERMAL SPRAY COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 METALS & ALLOYS

- 8.3.1 NICKEL

- 8.3.2 MOLYBDENUM

- 8.3.3 ALUMINUM

- 8.3.4 COBALT

- 8.3.5 ZINC

- TABLE 20 METAL & ALLOY THERMAL SPRAY COATINGS MARKET, BY REGION, 2017-2022(USD MILLION) (PRE-COVID)

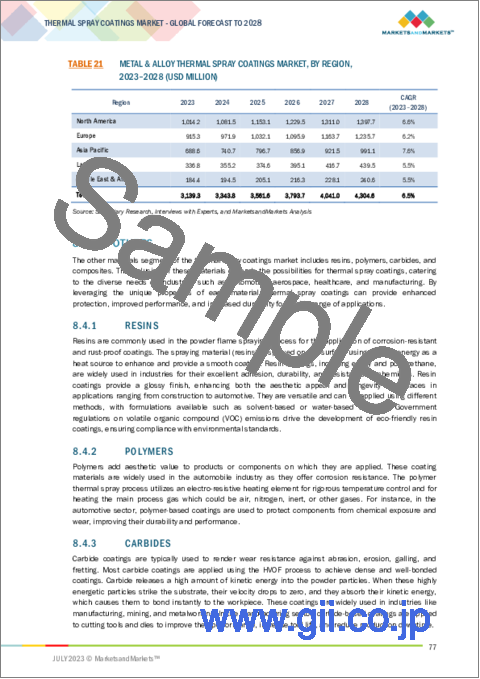

- TABLE 21 METAL & ALLOY THERMAL SPRAY COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 OTHERS

- 8.4.1 RESINS

- 8.4.2 POLYMERS

- 8.4.3 CARBIDES

- 8.4.4 COMPOSITES

- TABLE 22 OTHER MATERIALS THERMAL SPRAY COATINGS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 23 OTHER MATERIALS THERMAL SPRAY COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 26 ENERGY & POWER INDUSTRY TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 25 THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2 AEROSPACE

- 9.2.1 FLAME TUBES

- 9.2.2 TURBINE BLADES

- 9.2.3 LANDING GEAR

- TABLE 26 THERMAL SPRAY COATINGS MARKET IN AEROSPACE, BY REGION, 2017-2022 (USD MILLION)

- TABLE 27 THERMAL SPRAY COATINGS MARKET IN AEROSPACE, BY REGION, 2023-2028 (USD MILLION)

- 9.3 AUTOMOTIVE

- 9.3.1 SUSPENSION PARTS

- 9.3.2 PISTON RINGS

- 9.3.3 TURBOCHARGERS

- 9.3.4 ENGINE PARTS

- 9.3.5 CHASSIS

- 9.3.6 CYLINDER LINERS

- 9.3.7 EXHAUST PIPES

- TABLE 28 THERMAL SPRAY COATINGS MARKET IN AUTOMOTIVE, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 THERMAL SPRAY COATINGS MARKET IN AUTOMOTIVE, BY REGION, 2023-2028 (USD MILLION)

- 9.4 HEALTHCARE

- 9.4.1 ORTHOPEDICS

- 9.4.2 MEDICAL INSTRUMENTS

- 9.4.3 OVER-THE-COUNTER MEDICINES

- TABLE 30 THERMAL SPRAY COATINGS MARKET IN HEALTHCARE, BY REGION, 2017-2022 (USD MILLION)

- TABLE 31 THERMAL SPRAY COATINGS MARKET IN HEALTHCARE, BY REGION, 2023-2028 (USD MILLION)

- 9.5 ENERGY & POWER

- 9.5.1 BOILERS

- 9.5.2 SHAFTS

- 9.5.3 HYDRO TURBINES

- 9.5.4 POWER GENERATORS

- 9.5.5 COMPRESSOR BLADES

- TABLE 32 THERMAL SPRAY COATINGS MARKET IN ENERGY & POWER, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 THERMAL SPRAY COATINGS MARKET IN ENERGY & POWER, BY REGION, 2023-2028 (USD MILLION)

- 9.6 ELECTRONICS

- 9.6.1 ELECTRONIC ENCLOSURES

- 9.6.2 INSTRUMENT NUTS

- 9.6.3 MAGNETIC TAPES

- 9.6.4 DIELECTRIC COATINGS

- 9.6.5 SHIELDING

- TABLE 34 THERMAL SPRAY COATINGS MARKET IN ELECTRONICS, BY REGION, 2017-2022 (USD MILLION)

- TABLE 35 THERMAL SPRAY COATINGS MARKET IN ELECTRONICS, BY REGION, 2023-2028 (USD MILLION)

- 9.7 AGRICULTURAL MACHINERY

- 9.7.1 HARVESTER BLADES

- 9.7.2 BALERS

- 9.7.3 COMPRESSORS

- 9.7.4 THRESHING COMPONENTS

- 9.7.5 AGRICULTURAL PUMPS & WASTEWATER TREATMENT EQUIPMENT

- TABLE 36 THERMAL SPRAY COATINGS MARKET IN AGRICULTURAL MACHINERY, BY REGION, 2017-2022 (USD MILLION)

- TABLE 37 THERMAL SPRAY COATINGS MARKET IN AGRICULTURAL MACHINERY, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHERS

- 9.8.1 FOOD PROCESSING

- 9.8.2 DEFENSE

- 9.8.3 PRINTING

- TABLE 38 THERMAL SPRAY COATINGS MARKET IN OTHER INDUSTRIES, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 THERMAL SPRAY COATINGS MARKET IN OTHER INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

10 REGIONAL ANALYSIS

- 10.1 INTRODUCTION

- TABLE 40 THERMAL SPRAY COATINGS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 41 THERMAL SPRAY COATINGS MARKET, BY REGION 2023-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT

- FIGURE 27 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET SNAPSHOT

- TABLE 42 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 43 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 47 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.2 CHINA

- 10.2.2.1 Massive industrial growth to drive market

- TABLE 50 CHINA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 51 CHINA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 52 CHINA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 53 CHINA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 54 CHINA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 55 CHINA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.3 JAPAN

- 10.2.3.1 Increasing urbanization, capital investments, and technological advancements to drive market

- TABLE 56 JAPAN: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 57 JAPAN: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 58 JAPAN: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 59 JAPAN: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 60 JAPAN: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 61 JAPAN: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.4 INDIA

- 10.2.4.1 Increasing foreign investments to drive market

- TABLE 62 INDIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 63 INDIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 64 INDIA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 65 INDIA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 66 INDIA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 67 INDIA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Technological advancements in electronics to drive market

- TABLE 68 SOUTH KOREA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 69 SOUTH KOREA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 70 SOUTH KOREA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 71 SOUTH KOREA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 72 SOUTH KOREA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 73 SOUTH KOREA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.6 VIETNAM

- 10.2.6.1 Availability of raw materials to drive market

- TABLE 74 VIETNAM: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 75 VIETNAM: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 76 VIETNAM: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 77 VIETNAM: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 78 VIETNAM: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 79 VIETNAM: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2.7 REST OF ASIA PACIFIC

- TABLE 80 REST OF ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 85 REST OF ASIA PACIFIC: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT

- FIGURE 28 EUROPE: THERMAL SPRAY COATINGS MARKET SNAPSHOT

- TABLE 86 EUROPE: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 87 EUROPE: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 88 EUROPE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 89 EUROPE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 90 EUROPE: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022(USD MILLION)

- TABLE 91 EUROPE: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 92 EUROPE: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 93 EUROPE: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Growth of end-use industries to drive market

- TABLE 94 GERMANY: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 95 GERMANY: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 96 GERMANY: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 97 GERMANY: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 98 GERMANY: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 99 GERMANY: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Increased production of automobiles and government investments to fuel market

- TABLE 100 UK: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 101 UK: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 102 UK: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 103 UK: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 104 UK: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 105 UK: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.4 RUSSIA

- 10.3.4.1 Growth of automotive industry to drive market

- TABLE 106 RUSSIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 107 RUSSIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 108 RUSSIA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 109 RUSSIA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 110 RUSSIA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 111 RUSSIA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Increased investments in healthcare and automotive industries to fuel market

- TABLE 112 ITALY: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 113 ITALY: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 114 ITALY: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 115 ITALY: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 116 ITALY: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 117 ITALY: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.6 FRANCE

- 10.3.6.1 Growth of aerospace industry to drive consumption

- TABLE 118 FRANCE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 119 FRANCE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 120 FRANCE: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 121 FRANCE: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 122 FRANCE: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 123 FRANCE: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.7 BELGIUM

- 10.3.7.1 Growth of automotive & healthcare industries to drive market

- TABLE 124 BELGIUM: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 125 BELGIUM: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 126 BELGIUM: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 127 BELGIUM: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 128 BELGIUM: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 129 BELGIUM: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.3.8 REST OF EUROPE

- TABLE 130 REST OF EUROPE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 131 REST OF EUROPE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 132 REST OF EUROPE: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 133 REST OF EUROPE: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 135 REST OF EUROPE: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4 NORTH AMERICA

- 10.4.1 RECESSION IMPACT

- FIGURE 29 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET SNAPSHOT

- TABLE 136 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.2 US

- 10.4.2.1 US to lead North American thermal spray coatings market

- TABLE 144 US: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 145 US: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 146 US: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 147 US: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 148 US: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 149 US: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.4.3 CANADA

- 10.4.3.1 Increase in investments to drive growth

- TABLE 150 CANADA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 151 CANADA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 152 CANADA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 153 CANADA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 154 CANADA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 155 CANADA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 RECESSION IMPACT

- TABLE 156 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 157 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 159 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 161 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 163 LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.2 MEXICO

- 10.5.2.1 Increased investments in automotive industry to support growth

- TABLE 164 MEXICO: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 165 MEXICO: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 166 MEXICO: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 167 MEXICO: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 168 MEXICO: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 169 MEXICO: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.3 BRAZIL

- 10.5.3.1 Growth of automotive industry to drive market

- TABLE 170 BRAZIL: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 171 BRAZIL: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 172 BRAZIL: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 173 BRAZIL: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 174 BRAZIL: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 175 BRAZIL: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.4 COLOMBIA

- 10.5.4.1 Growing automotive and construction industries to drive market

- TABLE 176 COLOMBIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 177 COLOMBIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 178 COLOMBIA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 179 COLOMBIA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 180 COLOMBIA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 181 COLOMBIA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.5 ARGENTINA

- 10.5.5.1 End-use industries to witness growth

- TABLE 182 ARGENTINA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 183 ARGENTINA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 184 ARGENTINA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 185 ARGENTINA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 186 ARGENTINA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 187 ARGENTINA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.5.6 REST OF LATIN AMERICA

- TABLE 188 REST OF LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 189 REST OF LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 190 REST OF LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 193 REST OF LATIN AMERICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT

- TABLE 194 MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.2 SAUDI ARABIA

- 10.6.2.1 Growth of automotive industry to drive market

- TABLE 202 SAUDI ARABIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 203 SAUDI ARABIA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 204 SAUDI ARABIA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 205 SAUDI ARABIA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 206 SAUDI ARABIA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 207 SAUDI ARABIA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.3 SOUTH AFRICA

- 10.6.3.1 Investments in manufacturing sector to drive market

- TABLE 208 SOUTH AFRICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 209 SOUTH AFRICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 210 SOUTH AFRICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 211 SOUTH AFRICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 212 SOUTH AFRICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 213 SOUTH AFRICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.4 UAE

- 10.6.4.1 Rise in healthcare expenditure and growth of aviation sector to drive market

- TABLE 214 UAE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 215 UAE: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 216 UAE: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 217 UAE: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 218 UAE: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 219 UAE: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.5 EGYPT

- 10.6.5.1 Increased focus on harnessing renewable energy and growth of healthcare industry to drive market

- TABLE 220 EGYPT: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 221 EGYPT: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 222 EGYPT: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 223 EGYPT: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 224 EGYPT: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 225 EGYPT: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.6.6 REST OF MIDDLE EAST & AFRICA

- TABLE 226 REST OF MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2017-2022 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2017-2022 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: THERMAL SPRAY COATINGS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 232 STRATEGIES ADOPTED BY KEY THERMAL SPRAY COATINGS SERVICE PROVIDERS

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 30 RANKING OF TOP FIVE PLAYERS IN THERMAL SPRAY COATINGS MARKET, 2022

- 11.3.2 MARKET SHARE OF KEY PLAYERS

- TABLE 233 THERMAL SPRAY COATINGS MARKET: DEGREE OF COMPETITION

- FIGURE 31 PRAXAIR S.T. TECHNOLOGIES, INC. LED THERMAL SPRAY COATINGS MARKET IN 2022

- 11.3.3 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 32 TOP PLAYERS - REVENUE ANALYSIS (2018-2022)

- 11.4 COMPANY FOOTPRINT

- FIGURE 33 THERMAL SPRAY COATINGS MARKET: COMPANY OVERALL FOOTPRINT

- TABLE 234 THERMAL SPRAY COATINGS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 235 THERMAL SPRAY COATINGS MARKET: PROCESS FOOTPRINT

- TABLE 236 THERMAL SPRAY COATINGS MARKET: MATERIAL FOOTPRINT

- TABLE 237 THERMAL SPRAY COATINGS MARKET: REGION FOOTPRINT

- 11.5 COMPANY EVALUATION QUADRANT (TIER 1), 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 34 COMPANY EVALUATION QUADRANT (TIER 1), 2022

- 11.6 START-UPS/SMES EVALUATION QUADRANT, 2022

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 35 START-UPS/SMES EVALUATION QUADRANT, 2022

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 238 THERMAL SPRAY COATINGS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 239 THERMAL SPRAY COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.8 COMPETITIVE SCENARIO

- TABLE 240 THERMAL SPRAY COATINGS MARKET: PRODUCT LAUNCHES, 2018-2022

- TABLE 241 THERMAL SPRAY COATINGS MARKET: DEALS, 2018-2022

- TABLE 242 THERMAL SPRAY COATINGS MARKET: OTHERS, 2018-2022

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 PRAXAIR S.T. TECHNOLOGY, INC.

- TABLE 243 PRAXAIR SURFACE TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 36 PRAXAIR S.T. TECHNOLOGY, INC.: COMPANY SNAPSHOT

- 12.2 OERLIKON METCO

- TABLE 244 OERLIKON METCO: COMPANY OVERVIEW

- FIGURE 37 OERLIKON METCO: COMPANY SNAPSHOT

- 12.3 BODYCOTE

- TABLE 245 BODYCOTE: COMPANY OVERVIEW

- FIGURE 38 BODYCOTE: COMPANY SNAPSHOT

- 12.4 SURFACE TECHNOLOGY

- TABLE 246 SURFACE TECHNOLOGY: COMPANY OVERVIEW

- 12.5 H.C. STARCK GMBH

- TABLE 247 H.C. STARCK GMBH: COMPANY OVERVIEW

- 12.6 FLAME SPRAY TECHNOLOGIES B.V.

- TABLE 248 FLAME SPRAY TECHNOLOGIES B.V.: COMPANY OVERVIEW

- 12.7 THERMAL SPRAY TECHNOLOGIES ENGINEERED COATING SOLUTIONS

- TABLE 249 THERMAL SPRAY TECHNOLOGIES ENGINEERED COATING SOLUTION: COMPANY OVERVIEW

- 12.8 A&A COATINGS

- TABLE 250 A&A COATINGS: COMPANY OVERVIEW

- 12.9 GENERAL MAGNAPLATE CORPORATION

- TABLE 251 GENERAL MAGNAPLATE CORPORATION: COMPANY OVERVIEW

- 12.10 PLASMA-TEC, INC.

- TABLE 252 PLASMA-TEC, INC.: COMPANY OVERVIEW

- 12.11 ASB INDUSTRIES INC.

- TABLE 253 ASB INDUSTRIES, INC.: COMPANY OVERVIEW

- 12.12 POLYMET CORPORATION

- TABLE 254 POLYMET CORPORATION: COMPANY OVERVIEW

- 12.13 PROGRESSIVE SURFACE

- TABLE 255 PROGRESSIVE SURFACE: COMPANY OVERVIEW

- 12.14 BRYCOAT INC.

- TABLE 256 BRYCOAT INC.: COMPANY OVERVIEW

- 12.15 METALLISATION LIMITED

- TABLE 257 METALLISATION LIMITED: COMPANY OVERVIEW

- 12.16 EXLINE INC.

- TABLE 258 EXLINE, INC.: COMPANY OVERVIEW

- 12.17 ARC-SPRAY (PTY) LTD.

- TABLE 259 ARC-SPRAY (PTY) LTD.: COMPANY OVERVIEW

- 12.18 F.W. GARTNER THERMAL SPRAYING

- TABLE 260 F.W. GARTNER THERMAL SPRAYING: COMPANY OVERVIEW

- 12.19 FLAME SPRAY SPA

- TABLE 261 FLAME SPRAY SPA: COMPANY OVERVIEW

- 12.20 TOCALO CO., LTD.

- TABLE 262 TOCALO CO., LTD.: COMPANY OVERVIEW

- FIGURE 39 TOCALO CO., LTD.: COMPANY SNAPSHOT

- 12.21 TREIBACHER INDUSTRIE AG

- TABLE 263 TREIBACHER INDUSTRIE AG: COMPANY OVERVIEW

- 12.22 GTC VERSCHLEISS-SCHUTZ

- TABLE 264 GTC VERSCHLEISS-SCHUTZ: COMPANY OVERVIEW

- 12.23 SAINT-GOBAIN

- TABLE 265 SAINT-GOBAIN: COMPANY OVERVIEW

- FIGURE 40 SAINT-GOBAIN: COMPANY SNAPSHOT

- 12.24 C & M TECHNOLOGIES GMBH

- TABLE 266 C & M TECHNOLOGIES GMBH: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS