|

|

市場調査レポート

商品コード

1700510

栄養補助食品包装の世界市場:製品形態別、製品タイプ別、包装タイプ別、素材別、成分別、地域別 - 2030年までの予測Nutraceutical Packaging Market by Packaging Type (Blisters & Strips; Bottles), Product Type (Dietary Supplements; Functional Foods), Product Form (Tablets & Capsules; Powder & Granules), Material, Ingredient & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 栄養補助食品包装の世界市場:製品形態別、製品タイプ別、包装タイプ別、素材別、成分別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月07日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

栄養補助食品包装の市場規模は、4.9%のCAGRで拡大し、2025年の36億7,000万米ドルから2030年には46億6,000万米ドルに達すると予測されています。

持続可能で保護的な包装に対する需要の高まりが、栄養補助食品包装市場の成長を促進しています。消費者は環境に優しい包装に移行しており、栄養補助食品包装に生分解性、リサイクル可能、再利用可能な材料を使用する必要性が生じています。ハイバリアラミネート、改ざん防止デザインなど、製品を保護する包装材は、製品の安全性、完全性、効能を維持し、保存期間を延長します。eコマースの台頭により、包装は安全な配送のために耐久性があり軽量である必要があります。これらの要求は、環境的に責任のある慣行、技術革新、持続可能なパッケージングソリューションの成長分野に対処するために融合しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | キロトン、金額(100万米ドル) |

| セグメント | 製品形態別、製品タイプ別、包装タイプ別、素材別、成分別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

ビタミンは、健康意識と予防ヘルスケア傾向の成長により、栄養補助食品包装の最大の成分です。消費者は免疫力を高め、総合的な健康を確保し、欠乏症をなくすことを目的として、より多くのビタミンサプリメントを求め続けています。高齢者人口の増加やパンデミックによる健康への関心の高まりが、引き続き需要を後押ししています。環境に優しい製品、小児用安全キャップ、スマートなラベリングなど、パッケージングにおける継続的な革新と開発が、製品の魅力と安全性を高めています。人々がより多くのビタミンを消費するにつれて、高品質で保護的かつ持続可能なパッケージング・ソリューションは増加傾向にあり、市場価値の大幅な成長を促進しています。

ブリスターとストリップは、利便性、製品保護、保存性により、栄養補助食品包装市場で最も急成長しているタイプです。これらの包装タイプは優れたバリア特性を有しており、ビタミン、サプリメント、その他の栄養補助食品の湿気、光、汚染からの安全性を保証します。消費者への直接販売やeコマースにより、1回分ずつで、開封が確認でき、便利な包装への需要が高まっています。エコ・ブリスター包装、特にリサイクル可能で生分解可能なブリスター包装も拡大しています。安全で旅行しやすく持続可能な栄養補助食品包装に対する消費者の需要の変化に伴い、ブリスターとストリップは力強く成長し、市場価値を高める可能性が高いです。

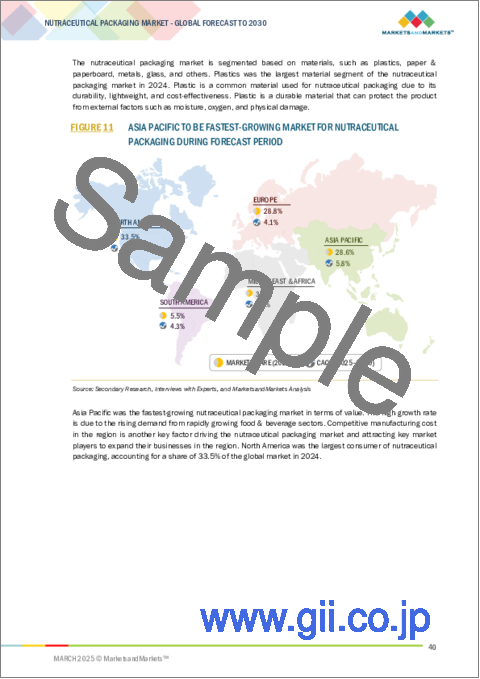

地域別では、北米が最大のシェアを占め、アジア太平洋は金額ベースで栄養補助食品包装の急成長地域です。

当レポートでは、世界の栄養補助食品包装市場について調査し、製品形態別、製品タイプ別、包装タイプ別、素材別、成分別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- 関税と規制状況

- 価格分析

- 技術分析

- 原材料分析

- 貿易分析

- エコシステム/市場マップ

- 顧客ビジネスに影響を与える動向/混乱

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 特許分析

第6章 栄養補助食品包装市場、製品形態別

- イントロダクション

- 錠剤・カプセル

- 粉末・顆粒

- 液体

- 固形・ソフトジェル

第7章 栄養補助食品包装市場、製品タイプ別

- イントロダクション

- 栄養補助食品

- 機能性食品

- 機能性飲料

- その他

第8章 栄養補助食品包装市場、包装タイプ別

- イントロダクション

- ブリスター・ストリップ

- ボトル

- 瓶・キャニスター

- バッグ・パウチ

- スティックパック

- 箱・カートン

- キャップとクロージャー

- その他

第9章 栄養補助食品包装市場、素材別

- イントロダクション

- プラスチック

- 紙・板紙

- 金属

- ガラス

- その他

第10章 栄養補助食品包装市場、成分別

- イントロダクション

- ビタミン

- ミネラル

- プロバイオティクスとプレバイオティクス

- アミノ酸

- オメガ3脂肪酸

- その他

第11章 栄養補助食品包装市場、地域別

- イントロダクション

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 景気後退の影響

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 景気後退の影響

- 中国

- 日本

- 韓国

- インド

- その他

- 南米

- 景気後退の影響

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- 景気後退の影響

- サウジアラビア

- 南アフリカ

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/有力企業

- 収益分析

- 主要参入企業ランキング

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- BERRY GLOBAL, INC.

- AMCOR PLC

- WESTROCK COMPANY

- MONDI

- SONOCO PRODUCTS COMPANY

- HUHTAMAKI

- APTAR CSP TECHNOLOGIES

- COMAR PACKAGING SOLUTIONS

- AMGRAPH PACKAGING, INC

- GLENROY, INC.

- その他の企業

- DORAN & WARD PACKAGING

- DRUG PLASTICS & GLASS COMPANY, INC.

- ELIS PACKAGING SOLUTIONS, INC.

- WESTERN PACKAGING DISTRIBUTION

- MRP SOLUTIONS

- SONIC PACKAGING INDUSTRIES, INC.

- STOELZLE OBERGLAS GMBH

- TIRUMALA ROTO LAM(TRL)PRIVATE LIMITED

- PRETIUM PACKAGING LLC

- ASSEMBLIES UNLIMITED, INC

- SGH HEALTHCARING

- ASCEND PACKAGING SYSTEMS

- SCHOLLE IPN PACKAGING, INC.

- SAFEPACK INDUSTRIES

- AMERICAN FLEXPACK

第14章 付録

List of Tables

- TABLE 1 NUTRACEUTICAL PACKAGING MARKET: STAKEHOLDERS IN VALUE CHAIN

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES ON NUTRACEUTICAL PACKAGING MARKET

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 4 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2019-2023 (%)

- TABLE 5 GDP ANNUAL PERCENTAGE CHANGE AND PROJECTIONS, BY KEY COUNTRY, 2024-2029

- TABLE 6 HEALTH EXPENDITURE AS PERCENTAGE OF GDP, 2019-2022

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 AVERAGE SELLING PRICE TREND OF NUTRACEUTICAL PACKAGING, BY MATERIAL, 2023-2030 (USD/KG)

- TABLE 9 IMPORT DATA FOR HS CODE 3923-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 3923-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 NUTRACEUTICAL PACKAGING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 13 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT FORM, 2021-2024 (USD MILLION)

- TABLE 14 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT FORM, 2025-2030 (USD MILLION)

- TABLE 15 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 16 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 17 NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 18 NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 19 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 20 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 21 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 22 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 23 NUTRACEUTICAL PACKAGING MARKET, BY INGREDIENT, 2021-2024 (USD MILLION)

- TABLE 24 NUTRACEUTICAL PACKAGING MARKET, BY INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 25 NUTRACEUTICAL PACKAGING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 NUTRACEUTICAL PACKAGING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 28 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 30 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 ((USD MILLION)

- TABLE 31 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 32 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 34 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 35 US: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 36 US: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 ((USD MILLION)

- TABLE 37 CANADA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 38 CANADA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 ((USD MILLION)

- TABLE 39 MEXICO: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 40 MEXICO: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 ((USD MILLION)

- TABLE 41 EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 44 EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 45 EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 46 EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 47 EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 48 EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 49 GERMANY: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 50 GERMANY: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 51 UK: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 52 UK: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 53 FRANCE: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 54 FRANCE: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 55 ITALY: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 56 ITALY: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 57 SPAIN: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 58 SPAIN: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 59 REST OF EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 60 REST OF EUROPE: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 68 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 69 CHINA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 70 CHINA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 71 JAPAN: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 72 JAPAN: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 73 SOUTH KOREA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 75 INDIA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 76 INDIA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 79 SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 82 SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 83 SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 84 SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 85 SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 86 SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 87 BRAZIL: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 88 BRAZIL: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 89 ARGENTINA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 90 ARGENTINA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 91 REST OF SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 92 REST OF SOUTH AMERICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 100 MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 101 SAUDI ARABIA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 102 SAUDI ARABIA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 103 SOUTH AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 104 SOUTH AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 105 REST OF MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2024 (USD MILLION)

- TABLE 106 REST OF MIDDLE EAST & AFRICA: NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2025-2030 (USD MILLION)

- TABLE 107 COMPANIES ADOPTED ACQUISITION/PARTNERSHIP/AGREEMENT AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2024

- TABLE 108 NUTRACEUTICAL PACKAGING MARKET: DEGREE OF COMPETITION

- TABLE 109 NUTRACEUTICAL PACKAGING MARKET: PACKAGING TYPE FOOTPRINT

- TABLE 110 NUTRACEUTICAL PACKAGING MARKET: MATERIAL FOOTPRINT

- TABLE 111 NUTRACEUTICAL PACKAGING MARKET: REGION FOOTPRINT

- TABLE 112 NUTRACEUTICAL PACKAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 113 NUTRACEUTICAL PACKAGING MARKET: PRODUCT LAUNCHES, JANUARY 2018-MARCH 2025

- TABLE 114 NUTRACEUTICAL PACKAGING MARKET: DEALS, JANUARY 2018-MARCH 2025

- TABLE 115 NUTRACEUTICAL PACKAGING MARKET: EXPANSIONS, JANUARY 2018-MARCH 2025

- TABLE 116 BERRY GLOBAL, INC.: COMPANY OVERVIEW

- TABLE 117 BERRY GLOBAL, INC.: PRODUCTS OFFERED

- TABLE 118 BERRY GLOBAL, INC.: PRODUCT LAUNCHES

- TABLE 119 BERRY GLOBAL, INC.: DEALS

- TABLE 120 BERRY GLOBAL, INC.: EXPANSIONS

- TABLE 121 AMCOR PLC: COMPANY OVERVIEW

- TABLE 122 AMCOR PLC: PRODUCTS OFFERED

- TABLE 123 AMCOR PLC: DEALS

- TABLE 124 AMCOR PLC: EXPANSIONS

- TABLE 125 WESTROCK COMPANY: COMPANY OVERVIEW

- TABLE 126 WESTROCK COMPANY: PRODUCTS OFFERED

- TABLE 127 WESTROCK COMPANY: DEALS

- TABLE 128 MONDI: COMPANY OVERVIEW

- TABLE 129 MONDI: PRODUCTS OFFERED

- TABLE 130 SONOCO PRODUCTS COMPANY: COMPANY OVERVIEW

- TABLE 131 SONOCO PRODUCTS COMPANY: PRODUCTS OFFERED

- TABLE 132 SONOCO PRODUCTS COMPANY PLC: DEALS

- TABLE 133 HUHTAMAKI: COMPANY OVERVIEW

- TABLE 134 HUHTAMAKI: PRODUCTS OFFERED

- TABLE 135 APTAR CSP TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 136 APTAR CSP TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 137 APTAR CSP TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 138 COMAR PACKAGING SOLUTIONS: COMPANY OVERVIEW

- TABLE 139 COMAR PACKAGING SOLUTIONS: PRODUCTS OFFERED

- TABLE 140 COMAR PACKAGING SOLUTIONS: DEALS

- TABLE 141 COMAR PACKAGING SOLUTIONS: EXPANSIONS

- TABLE 142 AMGRAPH PACKAGING, INC: COMPANY OVERVIEW

- TABLE 143 AMGRAPH PACKAGING, INC: PRODUCTS OFFERED

- TABLE 144 GLENROY, INC.: COMPANY OVERVIEW

- TABLE 145 GLENROY, INC.: PRODUCTS OFFERED

- TABLE 146 GLENROY, INC.: PRODUCT LAUNCHES

- TABLE 147 GLENROY, INC.: DEALS

- TABLE 148 DORAN & WARD PACKAGING: COMPANY OVERVIEW

- TABLE 149 DRUG PLASTICS & GLASS COMPANY, INC.: COMPANY OVERVIEW

- TABLE 150 ELIS PACKAGING SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 151 WESTERN PACKAGING DISTRIBUTION: COMPANY OVERVIEW

- TABLE 152 MRP SOLUTIONS: COMPANY OVERVIEW

- TABLE 153 SONIC PACKAGING INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 154 STOELZLE OBERGLAS GMBH: COMPANY OVERVIEW

- TABLE 155 TIRUMALA ROTO LAM (TRL) PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 156 PRETIUM PACKAGING LLC: COMPANY OVERVIEW

- TABLE 157 ASSEMBLIES UNLIMITED, INC: COMPANY OVERVIEW

- TABLE 158 SGH HEALTHCARING: COMPANY OVERVIEW

- TABLE 159 ASCEND PACKAGING SYSTEMS: COMPANY OVERVIEW

- TABLE 160 SCHOLLE IPN PACKAGING, INC.: COMPANY OVERVIEW

- TABLE 161 SAFEPACK INDUSTRIES: COMPANY OVERVIEW

- TABLE 162 AMERICAN FLEXPACK: COMPANY OVERVIEW

List of Figures

- FIGURE 1 NUTRACEUTICAL PACKAGING MARKET SEGMENTATION

- FIGURE 2 NUTRACEUTICAL PACKAGING MARKET: RESEARCH DESIGN

- FIGURE 3 DEMAND-SIDE MARKET SIZE ESTIMATION

- FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 NUTRACEUTICAL PACKAGING MARKET: DATA TRIANGULATION

- FIGURE 8 NUTRACEUTICAL PACKAGING MARKET: FACTOR ANALYSIS

- FIGURE 9 BOTTLES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF NUTRACEUTICAL PACKAGING MARKET IN 2030

- FIGURE 10 PLASTICS TO BE FASTEST-GROWING MATERIAL SEGMENT OF NUTRACEUTICAL PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR NUTRACEUTICAL PACKAGING DURING FORECAST PERIOD

- FIGURE 12 GROWING DEMAND FOR NUTRACEUTICAL PRODUCTS IN EMERGING ECONOMIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 BOTTLES SEGMENT TO EXHIBIT HIGHEST CAGR IN NUTRACEUTICAL PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 14 DIETARY SUPPLEMENTS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 TABLETS & CAPSULES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 PLASTICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 VITAMINS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN NUTRACEUTICAL PACKAGING MARKET FROM 2025 TO 2030

- FIGURE 19 NUTRACEUTICAL PACKAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 OVERVIEW OF VALUE CHAIN OF NUTRACEUTICAL PACKAGING MARKET

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS OF NUTRACEUTICAL PACKAGING MARKET

- FIGURE 22 SUPPLIER SELECTION CRITERION

- FIGURE 23 AVERAGE SELLING PRICE TREND OF NUTRACEUTICAL PACKAGING, BY REGION, 2023-2030 (USD/KG)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF NUTRACEUTICAL PACKAGING OFFERED BY KEY PLAYERS, BY PACKAGING TYPE, 2023 (USD/KG)

- FIGURE 25 IMPORT DATA RELATED TO HS CODE 3923-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 26 EXPORT DATA RELATED TO HS CODE 3923-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 27 NUTRACEUTICALS PACKAGING MARKET: ECOSYSTEM

- FIGURE 28 SUSTAINABLE PACKAGING TO DRIVE GROWTH

- FIGURE 29 PATENTS REGISTERED, 2014-2024

- FIGURE 30 NUMBER OF PATENTS IN LAST 10 YEARS, 2014-2024

- FIGURE 31 TOP JURISDICTIONS, 2014-2024

- FIGURE 32 TOP APPLICANTS, 2014-2024

- FIGURE 33 TABLETS & CAPSULES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 34 DIETARY SUPPLEMENTS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 35 BOTTLES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 36 PLASTICS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 37 VITAMINS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 38 NUTRACEUTICAL PACKAGING MARKET IN CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: NUTRACEUTICAL PACKAGING MARKET SNAPSHOT

- FIGURE 40 BOTTLES SEGMENT TO BE LARGEST PACKAGING TYPE IN EUROPE IN 2024

- FIGURE 41 ASIA PACIFIC: NUTRACEUTICAL PACKAGING MARKET SNAPSHOT

- FIGURE 42 NUTRACEUTICAL PACKAGING MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2022-2024 (USD BILLION)

- FIGURE 43 RANKING OF TOP FIVE PLAYERS IN NUTRACEUTICAL PACKAGING MARKET

- FIGURE 44 NUTRACEUTICAL PACKAGING MARKET SHARE ANALYSIS, 2024

- FIGURE 45 NUTRACEUTICAL PACKAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 NUTRACEUTICAL PACKAGING MARKET: COMPANY FOOTPRINT

- FIGURE 47 NUTRACEUTICAL PACKAGING MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS AND SMES, 2022

- FIGURE 48 BERRY GLOBAL, INC.: COMPANY SNAPSHOT

- FIGURE 49 AMCOR PLC: COMPANY SNAPSHOT

- FIGURE 50 WESTROCK COMPANY: COMPANY SNAPSHOT

- FIGURE 51 MONDI: COMPANY SNAPSHOT

- FIGURE 52 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

- FIGURE 53 HUHTAMAKI: COMPANY SNAPSHOT

- FIGURE 54 APTAR CSP TECHNOLOGIES: COMPANY SNAPSHOT

The nutraceutical packaging market is projected to reach USD 4.66 billion by 2030 from USD 3.67 billion in 2025, at a CAGR of 4.9%. The rising demand for sustainable and protective packaging is driving growth in the nutraceutical packaging market. Consumers are moving towards eco-friendly packaging creating need of using, biodegradable, recyclable, and reusable materials in nutraceutical packaging. Packaging materials that provide protection the product, such as high-barrier laminated and tamper-proof designs, maintain the safety, integrity, and potency of the product, and prolong the shelf life. With the rise of e-commerce packaging needs to be durable and lightweight for safe delivery. These demands are melding together to address the growing area of environmentally responsible practices, innovation and sustainable packaging solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Kilotons; Value (USD Million) |

| Segments | Packaging Type, Product Type, Product Form, Material, and Ingredient |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Based on ingredient, vitamins is the largest ingredient in nutraceutical packaging market during the forecast period, in terms of value."

Vitamins are the largest ingredient in nutraceutical packaging due to growth of health awareness and preventive healthcare tendencies. Consumers continue to demand more vitamin supplements as they aim to increase immunity, ensure overall health, and eliminate deficiencies. Increased populations of aged persons and the pandemic-induced renewed interest in health continue to propel demand. Ongoing innovations and developments in packaging through eco-friendly products, child safety caps, and smart labeling raise the appeal and safety of products. As people consume more vitamins, high-quality protective and sustainable packaging solutions have been on the rise, fostering substantial growth in market value.

"Based on packaging type, blisters and strips are the fastest growing type in nutraceutical packaging market during the forecast period, in terms of value."

listers and strips are the fastest growing type in nutraceutical packaging market due to convenience, product protection, and shelf life. These packaging types possess superior barrier properties which guarantee safety from moisture, light, and contamination for vitamins, supplements, and other nutraceuticals. Direct to consumers sales and e-commerce have raised demand for single-dose, tamper-evident, and convenient packaging. Eco-blister packaging, especially recyclable and biodegradable blister formats, is also expanding. With changing consumer demand towards safe, travel-friendly, and sustainable nutraceutical packaging, blisters and strips are likely to grow strongly and add market value.

"Based on region, North America accounts the largest share and Asia pacific is the fastest growing region in nutraceutical packaging, in terms of value."

The largest share of the nutraceutical packaging market is held by North America, aided by high demand for dietary supplements from consumers, regulatory standards in place, as well as innovation in packaging. The region's e-commerce base drives demand for durable and tamper-proof packaging even further. Asia-Pacific is the fastest-growing region in the nutraceutical packaging market due to growing concerns towards of health, increasing disposable income, and growing nutraceutical markets in countries like China and India. Driven towards sustainable packaging fueled by government incentives for using green materials have also helped in expanding the market. Although these factors boost the market, North America is still the largest market; however, Asia-Pacific is projected to be the leading par region growing forward. In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors- 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

The key players in this market are Berry Global Inc. (US), Amcor PLC (Australia), WestRock Company (US), Mondi (UK), Sonoco Products Company (US), Huhtamaki (Finland), Aptar CSP Technologies (Alabama), Comar Packaging Solutions (US), Amgraph Packaging, Inc. (US) and Glenroy, Inc. (US)

Research Coverage

This report segments the nutraceutical packaging market based on packaging type, product type, product form, material and ingredient and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the nutraceutical packaging market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the nutraceutical packaging market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for nutraceutical products , Increasing demand from personal care and food & beverage end-use industries, High demand for sustainable packaging) , restraints (Regulatory compliance and stringent standards, Higher costs compared to conventional packaging ), opportunities (Child-resistant packaging innovations, Increasing acceptance of eco-friendly packaging solutions in nutraceutical industry, Innovations in smart packaging) and challenges (Shelf life and product stability, Supply chain disruptions ).

- Market Penetration: Comprehensive information on the nutraceutical packaging market offered by top players in the global nutraceutical packaging market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the nutraceutical packaging market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for nutraceutical packaging market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global nutraceutical packaging market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the nutraceutical packaging market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.3 LIST OF PRIMARY RESPONDENTS

- 2.1.3.1 Demand and supply side primary respondents

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6.1 SUPPLY SIDE

- 2.6.2 DEMAND SIDE

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NUTRACEUTICAL PACKAGING MARKET

- 4.2 NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE

- 4.3 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT TYPE

- 4.4 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT FORM

- 4.5 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL

- 4.6 NUTRACEUTICAL PACKAGING MARKET, BY INGREDIENT

- 4.7 NUTRACEUTICAL PACKAGING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for nutraceutical products

- 5.2.1.2 Increasing demand in personal care and food & beverage end-use industries

- 5.2.1.3 High demand for sustainable packaging

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory compliance and stringent standards

- 5.2.2.2 Higher costs compared to conventional packaging

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising emphasis on child-resistant packaging

- 5.2.3.2 Growing acceptance of eco-friendly packaging solutions in nutraceutical industry

- 5.2.3.3 Innovations in smart packaging

- 5.2.4 CHALLENGES

- 5.2.4.1 Need to meet specific shelf life requirements and product stability

- 5.2.4.2 Supply chain disruptions

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 RESEARCH & DEVELOPMENT

- 5.3.3 MANUFACTURERS

- 5.3.4 DISTRIBUTORS

- 5.3.5 END USERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.5.2 BUYING CRITERIA

- 5.5.2.1 QUALITY

- 5.5.2.2 SERVICE

- 5.6 MACROECONOMIC INDICATORS

- 5.6.1 GLOBAL GDP TRENDS

- 5.7 TARIFF AND REGULATORY LANDSCAPE

- 5.7.1 REGULATIONS

- 5.7.1.1 Europe

- 5.7.1.2 US

- 5.7.1.3 Others

- 5.7.2 STANDARDS

- 5.7.2.1 ISO 9001

- 5.7.2.2 ISO 22000

- 5.7.2.3 ASTM D3475

- 5.7.2.4 USP (United States Pharmacopeia) Standards

- 5.7.2.5 Child-Resistant Packaging Standards

- 5.7.2.6 Re-operationalization of FSS (Nutra) Regulations, 2022

- 5.7.2.7 Draft Food Safety and Standards (Labelling & Display) Amendment Regulations, 2022

- 5.7.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 REGULATIONS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2030

- 5.8.2 AVERAGE SELLING PRICE TREND, BY MATERIAL, 2023-2030

- 5.8.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PACKAGING TYPE, 2023

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Smart packaging

- 5.9.1.2 Active packaging

- 5.9.1.3 Modified atmosphere packaging (MAP)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Sustainable material science

- 5.9.2.2 3D printing

- 5.9.2.3 Nanotechnology

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 QR codes and NFC technology

- 5.9.1 KEY TECHNOLOGIES

- 5.10 RAW MATERIAL ANALYSIS

- 5.10.1 PLASTICS

- 5.10.2 GLASS

- 5.10.3 METAL

- 5.10.4 PAPER

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 3923)

- 5.11.2 EXPORT SCENARIO (HS CODE 3923)

- 5.12 ECOSYSTEM/MARKET MAP

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 ECOPACK SOLUTIONS: SUSTAINABLE NUTRACEUTICAL PACKAGING

- 5.15.2 SECURESEAL: CHILD-RESISTANT NUTRACEUTICAL PACKAGING

- 5.15.3 AMCOR PLC - SUSTAINABLE PACKAGING FOR NUTRACEUTICAL PRODUCTS

- 5.15.4 BERRY GLOBAL - LIGHTWEIGHT AND FUNCTIONAL PACKAGING FOR NUTRACEUTICALS

- 5.16 PATENT ANALYSIS

- 5.16.1 INTRODUCTION

- 5.16.2 METHODOLOGY

- 5.16.3 DOCUMENT TYPE

- 5.16.4 PUBLICATION TRENDS

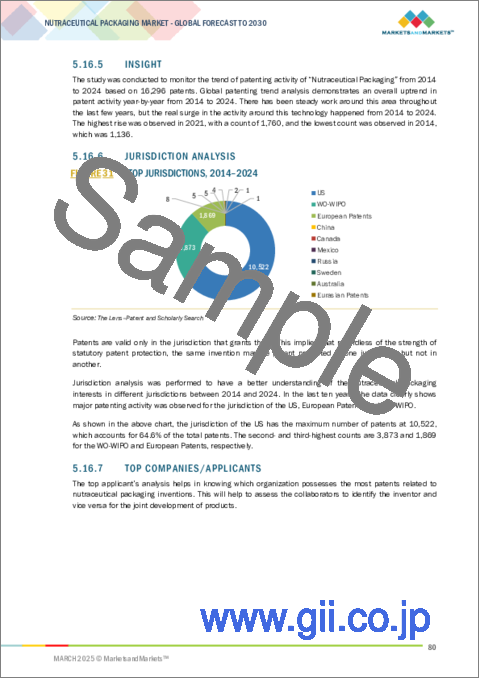

- 5.16.5 INSIGHT

- 5.16.6 JURISDICTION ANALYSIS

- 5.16.7 TOP COMPANIES/APPLICANTS

6 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT FORM

- 6.1 INTRODUCTION

- 6.2 TABLETS & CAPSULES

- 6.2.1 ACCURATE DELIVERY OF NUTRIENTS OR ACTIVE COMPOUNDS TO DRIVE MARKET

- 6.3 POWDER & GRANULES

- 6.3.1 CONVENIENCE AND VERSATILITY TO LEAD TO HIGH UTILIZATION

- 6.4 LIQUID

- 6.4.1 EASE OF CONSUMPTION, DOSING FLEXIBILITY, AND RAPID ABSORPTION TO BOOST DEMAND

- 6.5 SOLID & SOFT GEL

- 6.5.1 PORTABILITY TO BOOST DEMAND FROM BUSY INDIVIDUALS/ TRAVELERS

7 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 DIETARY SUPPLEMENTS

- 7.2.1 BRIDGING OF NUTRITIONAL GAP AND ADDRESSING OF HEALTH CONCERNS TO DRIVE MARKET

- 7.3 FUNCTIONAL FOODS

- 7.3.1 CONVENIENCE AND ACCESSIBILITY TO NUTRIENTS AND BIOACTIVE COMPOUNDS TO DRIVE MARKET

- 7.4 FUNCTIONAL BEVERAGES

- 7.4.1 ALTERNATIVE TO SUGARY BEVERAGES TO INCREASE DEMAND

- 7.5 OTHERS

8 NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE

- 8.1 INTRODUCTION

- 8.2 BLISTERS & STRIPS

- 8.2.1 EXCELLENT PROTECTION FROM MOISTURE, LIGHT, AND AIR TO DRIVE MARKET

- 8.3 BOTTLES

- 8.3.1 EASY OPERABILITY, SHATTER RESISTANCE, AND LIGHTWEIGHT PROPERTIES TO DRIVE DEMAND

- 8.4 JARS & CANISTERS

- 8.4.1 EFFECTIVE BARRIER PROPERTIES TO PROPEL DEMAND

- 8.5 BAGS & POUCHES

- 8.5.1 VERSATILE AND EFFECTIVE PACKAGING TO DRIVE MARKET

- 8.6 STICK PACKS

- 8.6.1 FRESHNESS AND ENHANCED SHELF LIFE OF NUTRACEUTICAL PRODUCTS TO DRIVE MARKET

- 8.7 BOXES & CARTONS

- 8.7.1 LOW RISK OF DAMAGE OR CONTAMINATION OF NUTRACEUTICAL PRODUCTS TO BOOST DEMAND

- 8.8 CAPS & CLOSURES

- 8.8.1 DEMAND FOR TAMPER-EVIDENT PACKAGING TO PROPEL MARKET

- 8.9 OTHERS

9 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 PLASTICS

- 9.2.1 EXCELLENT SHATTER RESISTANCE BOOSTS USE IN PRIMARY PACKAGING

- 9.2.2 HIGH-DENSITY POLYETHYLENE (HDPE)

- 9.2.3 POLYESTER

- 9.2.4 POLYPROPYLENE

- 9.2.5 LOW-DENSITY POLYETHYLENE

- 9.2.6 POLYVINYL CHLORIDE

- 9.2.7 CYCLIC OLEFIN COPOLYMER (COC)

- 9.2.8 POLYETHYLENE TEREPHTHALATE (PET)

- 9.3 PAPER & PAPERBOARD

- 9.3.1 INNOVATIONS IN SECONDARY PACKAGING TO PROPEL USE OF PAPER & PAPERBOARD

- 9.4 METALS

- 9.4.1 INCREASING USE OF ALUMINUM FOR BLISTER PACKAGING TO BOOST MARKET

- 9.5 GLASS

- 9.5.1 EXCELLENT CHEMICAL RESISTANCE TO BOOST USE IN PRIMARY PACKAGING

- 9.6 OTHERS

10 NUTRACEUTICAL PACKAGING MARKET, BY INGREDIENT

- 10.1 INTRODUCTION

- 10.2 VITAMINS

- 10.2.1 HEALTH BENEFITS BEYOND BASIC NUTRITION TO INCREASE DEMAND

- 10.3 MINERALS

- 10.3.1 BRIDGING OF GAP BETWEEN PHARMACEUTICALS AND DIETARY SUPPLEMENTS TO DRIVE MARKET

- 10.4 PROBIOTICS & PREBIOTICS

- 10.4.1 NEED FOR MAINTENANCE OF GUT HEALTH DURING ANTIBIOTIC USE TO DRIVE DEMAND

- 10.5 AMINO ACIDS

- 10.5.1 SUPPORTING OF MUSCLE RECOVERY AND ENHANCING IMMUNE FUNCTION TO DRIVE MARKET

- 10.6 OMEGA-3 FATTY ACIDS

- 10.6.1 IMPROVING BLOOD LIPID PROFILES AND CARDIOVASCULAR HEALTH BENEFITS TO INCREASE DEMAND

- 10.7 OTHERS

11 NUTRACEUTICAL PACKAGING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT

- 11.2.2 US

- 11.2.2.1 Improved quality of nutraceutical products amid increased consumer demand to drive market

- 11.2.3 CANADA

- 11.2.3.1 Competitive business environment to boost market

- 11.2.4 MEXICO

- 11.2.4.1 Government initiatives in healthcare sector to fuel high demand

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT

- 11.3.2 GERMANY

- 11.3.2.1 Increase in aging population and non-communicable diseases to drive market

- 11.3.3 UK

- 11.3.3.1 High demand for products with added vitamins, minerals, and other wellness ingredients to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Active promotions for development of products infused with nutraceutical ingredients to drive market

- 11.3.5 ITALY

- 11.3.5.1 Growing imports of nutraceuticals to boost market

- 11.3.6 SPAIN

- 11.3.6.1 Government initiatives in healthcare sector to boost demand

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 RECESSION IMPACT

- 11.4.2 CHINA

- 11.4.2.1 Changing lifestyles of consumers and preference for fortified food & beverages to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Sizeable aging population to drive demand for nutraceuticals

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Historical usage of herbal medicines and increasing consumption of functional foods to increase demand

- 11.4.5 INDIA

- 11.4.5.1 Changing lifestyles & dietary patterns and growing awareness about nutrition to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 SOUTH AMERICA

- 11.5.1 RECESSION IMPACT

- 11.5.2 BRAZIL

- 11.5.2.1 Rising health consciousness and rapid urbanization to drive market

- 11.5.3 ARGENTINA

- 11.5.3.1 Growing awareness of healthy foods and affinity for functional beverages to drive market

- 11.5.4 REST OF SOUTH AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 RECESSION IMPACT

- 11.6.2 SAUDI ARABIA

- 11.6.2.1 Wider access to healthcare services to increase demand for nutraceuticals

- 11.6.3 SOUTH AFRICA

- 11.6.3.1 Increasing health awareness to fuel market

- 11.6.4 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 RANKING OF KEY PLAYERS

- 12.4.1 BERRY GLOBAL, INC.

- 12.4.2 AMCOR PLC

- 12.4.3 WESTROCK COMPANY

- 12.4.4 MONDI

- 12.4.5 SONOCO PRODUCTS COMPANY

- 12.5 MARKET SHARE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 PERVASIVE PLAYERS

- 12.6.3 EMERGING LEADERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Packaging type footprint

- 12.6.5.3 Material footprint

- 12.6.5.4 Region footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 STARTING BLOCKS

- 12.7.4 DYNAMIC COMPANIES

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- 12.8.2 DEALS

- 12.8.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 BERRY GLOBAL, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 AMCOR PLC

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 WESTROCK COMPANY

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 MONDI

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 SONOCO PRODUCTS COMPANY

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic Choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 HUHTAMAKI

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Key strengths

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses/Competitive threats

- 13.1.7 APTAR CSP TECHNOLOGIES

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.4 MnM view

- 13.1.8 COMAR PACKAGING SOLUTIONS

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strengths

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses/Competitive threats

- 13.1.9 AMGRAPH PACKAGING, INC

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 MnM view

- 13.1.10 GLENROY, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Key strengths

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses/Competitive threats

- 13.1.1 BERRY GLOBAL, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 DORAN & WARD PACKAGING

- 13.2.2 DRUG PLASTICS & GLASS COMPANY, INC.

- 13.2.3 ELIS PACKAGING SOLUTIONS, INC.

- 13.2.4 WESTERN PACKAGING DISTRIBUTION

- 13.2.5 MRP SOLUTIONS

- 13.2.6 SONIC PACKAGING INDUSTRIES, INC.

- 13.2.7 STOELZLE OBERGLAS GMBH

- 13.2.8 TIRUMALA ROTO LAM (TRL) PRIVATE LIMITED

- 13.2.9 PRETIUM PACKAGING LLC

- 13.2.10 ASSEMBLIES UNLIMITED, INC

- 13.2.11 SGH HEALTHCARING

- 13.2.12 ASCEND PACKAGING SYSTEMS

- 13.2.13 SCHOLLE IPN PACKAGING, INC.

- 13.2.14 SAFEPACK INDUSTRIES

- 13.2.15 AMERICAN FLEXPACK

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS