|

|

市場調査レポート

商品コード

1638722

冷却ファブリックの世界市場 (~2030年):タイプ (天然・合成)・テキスタイルタイプ (織布・不織布・編布)・用途 (スポーツアパレル・ライフスタイル・防護服)・地域別Cooling Fabrics Market by Type (Natural, Synthetic), Textile Type (Woven, Nonwoven, Knitted), Application (Sports Apparel, Lifestyle, Protective Wearing), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 冷却ファブリックの世界市場 (~2030年):タイプ (天然・合成)・テキスタイルタイプ (織布・不織布・編布)・用途 (スポーツアパレル・ライフスタイル・防護服)・地域別 |

|

出版日: 2025年01月17日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の冷却ファブリックの市場規模は、2024年の27億米ドルから、予測期間中は7.1%のCAGRで推移し、2030年には40億8,000万米ドルの規模に成長すると予測されています。

世界の冷却ファブリック市場は、スポーツウェア、ヘルスケア、産業用途など様々な部門で革新的なテキスタイルに対する需要が高まっていることから、成長が見込まれています。成長要因としては、スポーツやフィットネス活動の人気の結果、パフォーマンスアパレルを着用する人が増え続けていることや、高い水分管理と快適性を備えた冷却ファブリックに対する要求が高まっていることなどが挙げられます。相変化材料 (PCM) やマイクロカプセル化を含む最新のテキスタイル技術の進歩も、冷却ファブリックの効率化とコスト削減に貢献しています。さらに、ヘルスケア用途では市場の視野を広げています。冷却ファブリックは、特に熱関連の疾患に苦しむ患者の体温調節に使用される医療用テキスタイル製品で主要な役割を果たしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017-2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2030年 |

| 単位 | 金額 (米ドル)・数量 (平米) |

| 部門 | タイプ・テキスタイルタイプ・用途・地域 |

| 対象地域 | 欧州・アジア太平洋・北米・南米・中東&アフリカ |

"タイプ別では、天然素材の部門が2023年に金額ベースで第2位のシェアを示す"

天然素材は主に綿、絹、麻で構成されています。これらの生地は通常、湿気を吸収する能力があり、自然な通気性と高い快適性のために好まれています。これらの素材は体温を調節することができるため、スポーツウェア、カジュアルウェア、ヘルスケア部門のテキスタイルなど、さまざまな用途で使用されています。エンドユーザーが天然素材の冷却ファブリックを採用する理由は、これらの素材が示す快適性と独自性だけでなく、環境に配慮した製品に対する消費者の意識の高まりに沿った、エコフレンドリーさと持続可能性にもあります。これらの生地は性能と快適性を兼ね備えており、温度調節が優先される高温多湿の地域に非常に適しています。また、機能性と環境の両面で持続可能なニーズへの高い要求に応え、天然素材の冷却ファブリックの重要性も着実に高まっています。

"テキスタイルタイプ別では、織布の部門が2023年に金額ベースで第2位のシェアを示す"

織布は耐久性、通気性、湿度管理性に優れているため人気があり、多くの用途に使用できます。また、PCMやマイクロカプセル化などの高度な冷却技術を組み込むことができる優れた構造的完全性を持っているため、パフォーマンス中の効率と快適性を高めることができます。

織布の部門は、アスレチックアパレル、カジュアルウェア、その他の長持ちする高機能素材を必要とする産業で使用されます。スポーツやフィットネスにおけるパフォーマンスアパレルの動向の高まりと、高度な冷却オプションに関する消費者の知識が、織布による冷却ファブリック市場をさらに活性化しています。さらに、ユーザーごとの温度と快適性の制御性から、医療用テキスタイル製品に組み込まれることで、ヘルスケア市場にも進出しています。

"用途別では、ライフスタイルの部門が2023年に金額ベースで第2位のシェアを示す"

消費者が日常の衣服やアクセサリーに快適性と性能を求めることから、2023年に金額ベースで2番目に大きなシェアを占めたのはライフスタイル用途でした。これには、カジュアルウェアからスリープウェア、インナーウェアなど、温度調節や湿度管理機能が強く求められる衣料品全般が含まれます。湿度が高く、気温が高い地域では特に顕著です。都市化や、機能的でハイテクなテキスタイル製品に対する消費者の嗜好の変化も、ライフスタイル製品における冷却ファブリックへの関心を高めています。

当レポートでは、世界の冷却ファブリックの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- バリューチェーン分析

- エコシステムマッピング

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 顧客の事業に影響を与える動向/ディスラプション

- ケーススタディ分析

- 特許分析

- 規制状況

- 技術分析

- 貿易分析

- 主な会議とイベント

- 価格分析

- AI/生成AIの影響

- 世界マクロ経済見通し

- 投資と資金調達のシナリオ

第7章 冷却ファブリック市場:タイプ別

- 合成

- 自然

第8章 冷却ファブリック市場:テキスタイルタイプ別

- 織布

- 不織布

- 編布

第9章 冷却ファブリック市場:技術別

- アクティブ冷却ファブリック

- 空冷式

- 液冷式

- パッシブ冷却ファブリック

- 相変化冷却

- 蒸発冷却

第10章 冷却ファブリック市場:用途別

- スポーツアパレル

- ライフスタイルアパレル

- 防護服

- その他

第11章 冷却ファブリック市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- イタリア

- フランス

- スペイン

- ポルトガル

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

第12章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業の戦略/強み

- 企業評価マトリックス:スタートアップ/中小企業

- 企業価値評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- COOLCORE

- NAN YA PLASTICS CORPORATION

- AHLSTROM

- NILIT

- POLARTEC

- TEXRAY INDUSTRIAL CO., LTD.

- FORMOSA TAFFETA CO., LTD.

- ASAHI KASEI CORPORATION

- EVEREST TEXTILE CO., LTD.

- NANOTEX

- BURLINGTON

- LIBOLON

- COLUMBIA SPORTSWEAR COMPANY

- LIEBAERT

- HEIQ MATERIALS AG

- PATAGONIA

- VIRUS

- その他の企業

- TEHRANI INDUSTRIAL GROUP

- HONG LI TEXTILE CO., LTD.

- SUN DREAM ENTERPRISE CO., LTD.

- TECHNICAL ABSORBENTS LIMITED

- BALAVIGNA MILLS PVT. LTD.

- THE NORTH FACE

- PARAMO LTD.

- TOYOBO CO., LTD.

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 COOLING FABRICS MARKET: INCLUSIONS AND EXCLUSIONS OF STUDY

- TABLE 2 COOLING FABRICS MARKET SNAPSHOT: 2024 VS. 2030

- TABLE 3 COOLING FABRICS MARKET: ECOSYSTEM

- TABLE 4 COOLING FABRICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 7 COOLING FABRICS MARKET: LIST OF MAJOR PATENTS, JANUARY 2014-SEPTEMBER 2024

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 IMPORT DATA FOR HS CODE 61-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 61-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 15 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 AVERAGE SELLING PRICE OF COOLING FABRICS, BY TYPE, 2019-2023 (USD/SQUARE METER)

- TABLE 17 AVERAGE SELLING PRICE OF NATURAL COOLING FABRICS, BY APPLICATION, 2019-2023 (USD/SQUARE METER)

- TABLE 18 AVERAGE SELLING PRICE OF COOLING FABRICS, BY KEY PLAYER, 2023

- TABLE 19 AVERAGE SELLING PRICE OF COOLING FABRICS, BY REGION, 2019-2023 (USD/SQUARE METER)

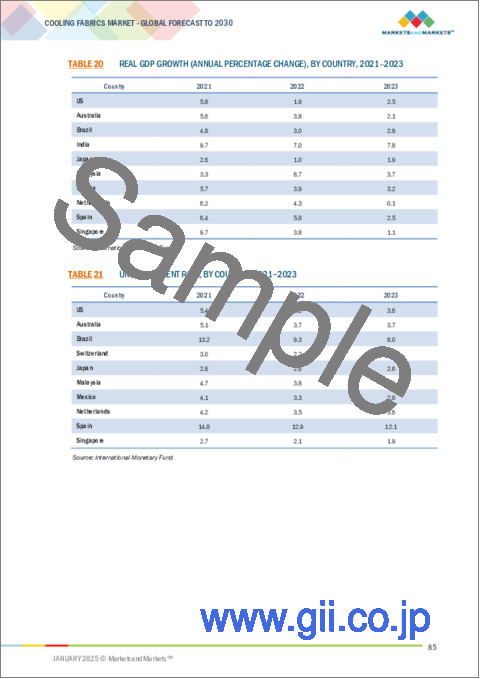

- TABLE 20 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY COUNTRY, 2021-2023

- TABLE 21 UNEMPLOYMENT RATE, BY COUNTRY, 2021-2023

- TABLE 22 INFLATION RATE (AVERAGE CONSUMER PRICES), BY COUNTRY, 2021-2023

- TABLE 23 FOREIGN DIRECT INVESTMENT, 2022-2023

- TABLE 24 COOLING FABRICS MARKET, BY TYPE, 2017-2023 (USD MILLION)

- TABLE 25 COOLING FABRICS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 26 COOLING FABRICS MARKET, BY TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 27 COOLING FABRICS MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 28 SYNTHETIC COOLING FABRICS MARKET, BY REGION, 2017-2023 (USD MILLION)

- TABLE 29 SYNTHETIC COOLING FABRICS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 30 SYNTHETIC COOLING FABRICS MARKET, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 31 SYNTHETIC COOLING FABRICS MARKET, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 32 NATURAL COOLING FABRICS MARKET, BY REGION, 2017-2023 (USD MILLION)

- TABLE 33 NATURAL COOLING FABRICS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 34 NATURAL COOLING FABRICS MARKET, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 35 NATURAL COOLING FABRICS MARKET, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 36 COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (USD MILLION)

- TABLE 37 COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (USD MILLION)

- TABLE 38 COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 39 COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 40 WOVEN COOLING FABRICS MARKET, BY REGION, 2017-2023 (USD MILLION)

- TABLE 41 WOVEN COOLING FABRICS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 42 WOVEN COOLING FABRICS MARKET, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 43 WOVEN COOLING FABRICS MARKET, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 44 NONWOVEN COOLING FABRICS MARKET, BY REGION, 2017-2023 (USD MILLION)

- TABLE 45 NONWOVEN COOLING FABRICS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 46 NONWOVEN COOLING FABRICS MARKET, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 47 NONWOVEN COOLING FABRICS MARKET, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 48 KNITTED COOLING FABRICS MARKET, BY REGION, 2017-2023 (USD MILLION)

- TABLE 49 KNITTED COOLING FABRICS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 50 KNITTED COOLING FABRICS MARKET, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 51 KNITTED COOLING FABRICS MARKET, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 52 COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 53 COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 54 COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 55 COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 56 COOLING FABRICS MARKET FOR SPORTS APPAREL, BY REGION, 2017-2023 (USD MILLION)

- TABLE 57 COOLING FABRICS MARKET FOR SPORTS APPAREL, BY REGION, 2024-2030 (USD MILLION)

- TABLE 58 COOLING FABRICS MARKET FOR SPORTS APPAREL, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 59 COOLING FABRICS MARKET FOR SPORTS APPAREL, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 60 COOLING FABRICS MARKET FOR LIFESTYLE APPAREL, BY REGION, 2017-2023 (USD MILLION)

- TABLE 61 COOLING FABRICS MARKET FOR LIFESTYLE APPAREL, BY REGION, 2024-2030 (USD MILLION)

- TABLE 62 COOLING FABRICS MARKET FOR LIFESTYLE APPAREL, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 63 COOLING FABRICS MARKET FOR LIFESTYLE APPAREL, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 64 COOLING FABRICS MARKET FOR PROTECTIVE CLOTHING, BY REGION, 2017-2023 (USD MILLION)

- TABLE 65 COOLING FABRICS MARKET FOR PROTECTIVE CLOTHING, BY REGION, 2024-2030 (USD MILLION)

- TABLE 66 COOLING FABRICS MARKET FOR PROTECTIVE CLOTHING, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 67 COOLING FABRICS MARKET FOR PROTECTIVE CLOTHING, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 68 COOLING FABRICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2017-2023 (USD MILLION)

- TABLE 69 COOLING FABRICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 70 COOLING FABRICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 71 COOLING FABRICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 72 COOLING FABRICS MARKET, BY REGION, 2017-2023 (USD MILLION)

- TABLE 73 COOLING FABRICS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 74 COOLING FABRICS MARKET, BY REGION, 2017-2023 (MILLION SQUARE METER)

- TABLE 75 COOLING FABRICS MARKET, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 76 NORTH AMERICA: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (MILLION SQUARE METER)

- TABLE 79 NORTH AMERICA: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 80 NORTH AMERICA: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 83 NORTH AMERICA: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 84 NORTH AMERICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 87 NORTH AMERICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 88 NORTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 91 NORTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 92 US: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 93 US: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 94 US: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 95 US: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 96 CANADA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 97 CANADA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 98 CANADA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 99 CANADA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 100 MEXICO: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 101 MEXICO: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 102 MEXICO: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 103 MEXICO: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 104 EUROPE: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (USD MILLION)

- TABLE 105 EUROPE: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 106 EUROPE: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (MILLION SQUARE METER)

- TABLE 107 EUROPE: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 108 EUROPE: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (USD MILLION)

- TABLE 109 EUROPE: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 110 EUROPE: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 111 EUROPE: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 112 EUROPE: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (USD MILLION)

- TABLE 113 EUROPE: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (USD MILLION)

- TABLE 114 EUROPE: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 115 EUROPE: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 116 EUROPE: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 117 EUROPE: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 118 EUROPE: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 119 EUROPE: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 120 UK: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 121 UK: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 122 UK: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 123 UK: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 124 GERMANY: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 125 GERMANY: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 126 GERMANY: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 127 GERMANY: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 128 ITALY: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 129 ITALY: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 130 ITALY: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 131 ITALY: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 132 FRANCE: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 133 FRANCE: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 134 FRANCE: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 135 FRANCE: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 136 SPAIN: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 137 SPAIN: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 138 SPAIN: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 139 SPAIN: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 140 PORTUGAL: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 141 PORTUGAL: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 142 PORTUGAL: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 143 PORTUGAL: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 144 REST OF EUROPE: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 145 REST OF EUROPE: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 147 REST OF EUROPE: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 148 ASIA PACIFIC: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (USD MILLION)

- TABLE 149 ASIA PACIFIC: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (MILLION SQUARE METER)

- TABLE 151 ASIA PACIFIC: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 152 ASIA PACIFIC: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (USD MILLION)

- TABLE 153 ASIA PACIFIC: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 155 ASIA PACIFIC: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 156 ASIA PACIFIC: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (USD MILLION)

- TABLE 157 ASIA PACIFIC: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 159 ASIA PACIFIC: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 160 ASIA PACIFIC: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 161 ASIA PACIFIC: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 163 ASIA PACIFIC: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 164 CHINA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 165 CHINA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 166 CHINA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 167 CHINA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 168 JAPAN: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 169 JAPAN: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 170 JAPAN: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 171 JAPAN: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 172 INDIA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 173 INDIA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 174 INDIA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 175 INDIA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 176 SOUTH KOREA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 177 SOUTH KOREA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 178 SOUTH KOREA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 179 SOUTH KOREA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 180 REST OF ASIA PACIFIC: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 183 REST OF ASIA PACIFIC: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 184 SOUTH AMERICA: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (USD MILLION)

- TABLE 185 SOUTH AMERICA: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 186 SOUTH AMERICA: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (MILLION SQUARE METER)

- TABLE 187 SOUTH AMERICA: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 188 SOUTH AMERICA: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (USD MILLION)

- TABLE 189 SOUTH AMERICA: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 190 SOUTH AMERICA: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 191 SOUTH AMERICA: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 192 SOUTH AMERICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (USD MILLION)

- TABLE 193 SOUTH AMERICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 195 SOUTH AMERICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 196 SOUTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 197 SOUTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 198 SOUTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 199 SOUTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 200 BRAZIL: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 201 BRAZIL: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 202 BRAZIL: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 203 BRAZIL: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 204 ARGENTINA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 205 ARGENTINA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 206 ARGENTINA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 207 ARGENTINA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 208 REST OF SOUTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 209 REST OF SOUTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 210 REST OF SOUTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 211 REST OF SOUTH AMERICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 212 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY COUNTRY, 2017-2023 (MILLION SQUARE METER)

- TABLE 215 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 216 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 219 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 220 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2017-2023 (MILLION SQUARE METER)

- TABLE 223 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 224 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 227 MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 228 UAE: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 229 UAE: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 230 UAE: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 231 UAE: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 232 SAUDI ARABIA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 233 SAUDI ARABIA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 234 SAUDI ARABIA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 235 SAUDI ARABIA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 236 REST OF GCC COUNTRIES: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 237 REST OF GCC COUNTRIES: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 238 REST OF GCC COUNTRIES: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 239 REST OF GCC COUNTRIES: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 240 SOUTH AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 241 SOUTH AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 242 SOUTH AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 243 SOUTH AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 244 REST OF MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2017-2023 (MILLION SQUARE METER)

- TABLE 247 REST OF MIDDLE EAST & AFRICA: COOLING FABRICS MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 248 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN COOLING FABRICS MARKET

- TABLE 249 COOLING FABRICS MARKET: DEGREE OF COMPETITION

- TABLE 250 COOLING FABRICS MARKET: TYPE FOOTPRINT

- TABLE 251 COOLING FABRICS MARKET: TEXTILE TYPE FOOTPRINT

- TABLE 252 COOLING FABRICS MARKET: APPLICATION FOOTPRINT

- TABLE 253 COOLING FABRICS MARKET: REGION FOOTPRINT

- TABLE 254 COOLING FABRICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 255 COOLING FABRICS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 256 COOLING FABRICS MARKET: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 257 COOLING FABRICS MARKET: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 258 COOLCORE: COMPANY OVERVIEW

- TABLE 259 COOLCORE: PRODUCTS OFFERED

- TABLE 260 COOLCORE: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 261 NAN YA PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 262 NAN YA PLASTICS CORPORATION: PRODUCTS OFFERED

- TABLE 263 AHLSTROM: COMPANY OVERVIEW

- TABLE 264 AHLSTROM: PRODUCTS OFFERED

- TABLE 265 NILIT: COMPANY OVERVIEW

- TABLE 266 NILIT: PRODUCTS OFFERED

- TABLE 267 NILIT: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 268 POLARTEC: COMPANY OVERVIEW

- TABLE 269 POLARTEC: PRODUCTS OFFERED

- TABLE 270 POLARTEC: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 271 POLARTEC: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 272 TEXRAY INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 273 TEXRAY INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 274 FORMOSA TAFFETA CO., LTD.: COMPANY OVERVIEW

- TABLE 275 FORMOSA TAFFETA CO., LTD.: PRODUCTS OFFERED

- TABLE 276 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 277 ASAHI KASEI CORPORATION: PRODUCTS OFFERED

- TABLE 278 EVEREST TEXTILE CO., LTD.: COMPANY OVERVIEW

- TABLE 279 EVEREST TEXTILE CO., LTD.: PRODUCTS OFFERED

- TABLE 280 NANOTEX: COMPANY OVERVIEW

- TABLE 281 NANOTEX: PRODUCTS OFFERED

- TABLE 282 BURLINGTON: COMPANY OVERVIEW

- TABLE 283 BURLINGTON: PRODUCTS OFFERED

- TABLE 284 BURLINGTON: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 285 LIBOLON: COMPANY OVERVIEW

- TABLE 286 LIBOLON: PRODUCTS OFFERED

- TABLE 287 COLUMBIA SPORTSWEAR COMPANY: COMPANY OVERVIEW

- TABLE 288 COLUMBIA SPORTSWEAR COMPANY: PRODUCTS OFFERED

- TABLE 289 COLUMBIA SPORTSWEAR COMPANY: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 290 LIEBAERT: COMPANY OVERVIEW

- TABLE 291 LIEBAERT: PRODUCTS OFFERED

- TABLE 292 LIEBAERT: OTHER DEVELOPMENTS, JANUARY 2019-NOVEMBER 2024

- TABLE 293 HEIQ MATERIALS AG: COMPANY OVERVIEW

- TABLE 294 HEIQ MATERIALS AG: PRODUCTS OFFERED

- TABLE 295 HEIQ MATERIALS AG: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 296 HEIQ MATERIALS AG: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 297 PATAGONIA: COMPANY OVERVIEW

- TABLE 298 PATAGONIA: PRODUCTS OFFERED

- TABLE 299 VIRUS: COMPANY OVERVIEW

- TABLE 300 VIRUS: PRODUCTS OFFERED

- TABLE 301 TEHRANI INDUSTRIAL GROUP: COMPANY OVERVIEW

- TABLE 302 HONG LI TEXTILE CO., LTD.: COMPANY OVERVIEW

- TABLE 303 SUN DREAM ENTERPRISE CO., LTD.: COMPANY OVERVIEW

- TABLE 304 TECHNICAL ABSORBENTS LIMITED: COMPANY OVERVIEW

- TABLE 305 BALAVIGNA MILLS PVT. LTD.: COMPANY OVERVIEW

- TABLE 306 THE NORTH FACE: COMPANY OVERVIEW

- TABLE 307 PARAMO LTD.: COMPANY OVERVIEW

- TABLE 308 TOYOBO CO., LTD.: COMPANY OVERVIEW

- TABLE 309 COATED FABRICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 310 COATED FABRICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 311 COATED FABRICS MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 312 COATED FABRICS MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 313 CONDUCTIVE TEXTILES MARKET, BY TYPE, 2014-2021 (USD MILLION)

List of Figures

- FIGURE 1 COOLING FABRICS MARKET SEGMENTATION

- FIGURE 2 COOLING FABRICS MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX FOR ASSESSING DEMAND FOR COOLING FABRICS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 COOLING FABRICS MARKET: DATA TRIANGULATION

- FIGURE 7 SYNTHETIC SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 8 KNITTED SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 9 SPORTS APPAREL SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 11 INCREASING DEMAND FOR COMFORTABLE CLOTHING TO DRIVE MARKET

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 SYNTHETIC COOLING FABRICS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 14 NONWOVEN SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 SPORTS APPAREL AND LIFESTYLE APPAREL SEGMENTS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 INDIA TO OFFER LUCRATIVE GROWTH OPPORTUNITIES DURING FORECAST PERIOD

- FIGURE 17 COOLING FABRICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 NUMBER OF PEOPLE LIVING IN URBAN AND RURAL AREAS WORLDWIDE, 1960-2022 (BILLION)

- FIGURE 19 COOLING FABRICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 COOLING FABRICS MARKET: ECOSYSTEM MAP

- FIGURE 21 COOLING FABRICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 MAJOR PATENTS RELATED TO COOLING FABRICS, JANUARY 2014-SEPTEMBER 2024

- FIGURE 26 IMPORT DATA FOR HS CODE 61-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 27 EXPORT DATA FOR HS CODE 61-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 28 AVERAGE SELLING PRICE OF COOLING FABRICS, BY TYPE, 2019-2023 (USD/SQUARE METER)

- FIGURE 29 AVERAGE SELLING PRICE OF NATURAL COOLING FABRICS, BY APPLICATION, 2019-2023 (USD/SQUARE METER)

- FIGURE 30 AVERAGE SELLING PRICE OF COOLING FABRICS, BY KEY PLAYER, 2023

- FIGURE 31 AVERAGE SELLING PRICE OF NATURAL COOLING FABRICS, BY REGION, 2019-2023 (USD/SQUARE METER)

- FIGURE 32 COOLING FABRICS MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2024 (USD MILLION)

- FIGURE 33 SYNTHETIC COOLING FABRICS TO ACCOUNT FOR LARGEST MARKET IN 2024

- FIGURE 34 KNITTED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 SPORTS APPAREL SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 36 COOLING FABRICS MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 37 NORTH AMERICA: COOLING FABRICS MARKET SNAPSHOT

- FIGURE 38 EUROPE: COOLING FABRICS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: COOLING FABRICS MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN COOLING FABRICS MARKET, 2019-2023 (USD BILLION)

- FIGURE 41 RANKING OF TOP FIVE PLAYERS IN COOLING FABRICS MARKET, 2023

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS IN COOLING FABRICS MARKET (2023)

- FIGURE 43 COOLING FABRICS MARKET: PRODUCT ANALYSIS FOR COOLING FABRICS

- FIGURE 44 COOLING FABRICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 45 COOLING FABRICS MARKET: COMPANY FOOTPRINT

- FIGURE 46 COOLING FABRICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 47 COMPANY VALUATION OF KEY PLAYERS IN COOLING FABRICS MARKET (USD BILLION)

- FIGURE 48 EV/EBITDA OF KEY VENDORS IN COOLING FABRICS MARKET

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 50 NAN YA PLASTICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 FORMOSA TAFFETA CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 COLUMBIA SPORTSWEAR COMPANY: COMPANY SNAPSHOT

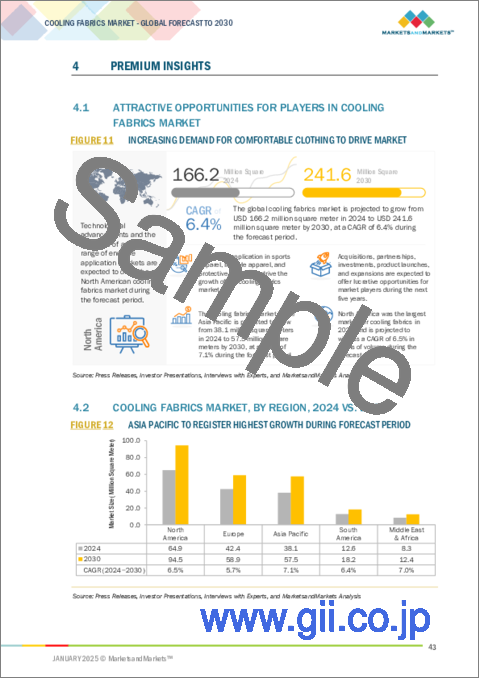

The cooling fabrics market is projected to grow from USD 2.70 billion in 2024 to USD 4.08 billion by 2030, at a CAGR of 7.1%. The global cooling fabrics market is expected to grow due to rising demand for innovative textiles in various sectors, including sportswear, healthcare, and industrial applications. Increased growth factors include the continual increase in the number of people wearing performance apparel as a result of the popularity of sports and fitness activities, as well as increased requirements for cooling fabrics with high moisture management and comfort properties. Increasing advances in modern textile technology, including phase-change materials (PCMs) and microencapsulation, have also contributed to the efficiency and reduced cost of cooling textiles. In addition, healthcare applications are broadening horizons in the market, as cooling fabrics play a major role in medical textiles where they are used for temperature regulation, especially for patients suffering from heat-related illnesses.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion) & Volume (Million Square Meters) |

| Segments | Type, Textile Type, Application, and Region |

| Regions covered | Europe, Asia Pacific, North America, South America, and Middle East & Africa |

"By type, natural segment accounted for the second-largest share by value in cooling fabrics market in 2023."

Among the options available in the cooling fabrics market, the natural cooling fabrics segment held the second-largest value share in 2023. This mostly consists of cotton, silk, and linen. These fabrics are usually preferred for their natural breathability and phenomenal comfort in addition to their ability to absorb moisture. They can care for the temperature of the body, so be it among the different applications in which they are found; for instance, sportswear, casual wear, or textiles in healthcare, they always make it on being a choice. End-users adopt natural cooling fabrics, not only because of the comfort and uniqueness that these fabrics exhibit but also their eco-friendliness and sustainability, which align with the increasing awareness among consumers of products that pay concern towards the environment. Performance and comfort combine in these fabrics, making them very suitable for hot and humid regions where temperature regulation is a priority. Also, natural cooling fabrics are steadily growing in importance, responding to the high demand for sustainable needs in both functionality and the environment.

"By textile type, the woven segment accounted for the second-largest share in cooling fabrics market in 2023 by value."

According to textile type, the woven segment constituted the second largest part of the cooling fabrics market in 2023 by value. Woven fabrics are popular because of their durability, breathability, and moisture management; hence, they can be used in many applications. They have superior structural integrity to allow for the incorporation of advanced cooling technologies such as PCM and microencapsulation to augment their efficiency and comfort during performance.

The woven segment is then used in athletic apparel, casual wear, and other industries that require long-lasting, high-performance fabrics. The increasing trend for performance apparel in sports and fitness and knowledge among consumers regarding advanced cooling options have further energized the market for woven cooling fabrics. Additionally, woven fabrics are making inroads into healthcare markets through their incorporation into medical textiles for user-specified temperature and comfort control. While most of these technologies continue to improve the application and affordability of woven cooling fabrics, this segment is expected to continue its steady course in the cooling fabrics market.

"By application, the lifestyle segment accounted for the second-largest share in cooling batteries in 2023 by value."

The second-largest share was lifestyle applications in 2023, by value, in cooling fabrics, on account of demanding comfort and performance in everyday clothing and accessories by consumers. This would include everything from casual wear to sleepwear and innerwear and other types of clothing for which temperature regulation and moisture management features are highly desired. Increasingly, consumers are making decisions about fabrics that offer better comfort - this is particularly noticeable with high humidity and hot temperature regions. Urbanization and changing consumer preferences toward functional and high-tech textiles also fueled the interest in cooling fabrics in lifestyle products.

In this way, a growing trend regarding the use of environmentally and ecologically sustainable materials is driving the market for recyclable or bio-based cooling textiles. Such had also been customer usage needs in environmentally responsible solutions. Innovations such as phase-change materials (PCMs) and novel superior blends are adding more performance to cooling textiles, making them ready to meet personal needs. As health, wellness, and thermal comfort gain greater recognition and entry into everyone's lives, this lifestyle segment will remain the largest market segment for cooling fabrics through the forecast period.

"The cooling fabrics market in Europe accounted for the second-largest share in 2023 by value."

In 2023, Europe was the second-largest market by value for cooling fabrics due to the increasing demand for advanced textile solutions for applications in various fields, such as sportswear, health care, and industrial sectors. Advances in competitive performances through apparel, especially in sports and fitness, have been a hallmark of the increasing adoption of cooling fabrics that give moisture management, breathability, and comfort. On the other hand, new technologies adopted in textiles such as phase-change materials (PCMs) and microencapsulation contributed significantly to the improvement of the functionality and efficiency of the cooling fabrics, thus facilitating further growth of the market.

Increased sustainability and environmental accountability are driving more demand toward eco-friendly cooling options from recyclable and bio-based materials. This change, however, goes with the extremely strict carbon emissions and textile waste regulations present in the area. Other points that may also contribute to the growth are healthcare applications since increasingly temperature-regulating fabrics should be useful for patients suffering from heat-related conditions in medical applications. Developed economies, innovative capabilities, and technological prowess have placed Europe as one of the most important players in the cooling fabrics market among the rest of the global players. These factors usually contribute to the overall market growth significantly.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 40%, Tier 2 -20%, and Tier 3 - 40%

- By Designation: Directors- 70%, C- Level Executives - 10%, and Others - 20%

- By Region: North America -20%, Europe -20%, Asia Pacific - 45%, Middle East & Africa-5%, South America -10%

The cooling fabrics report is dominated by players, such as Coolcore (US), Nan Ya Plastics Corporation (Taiwan), Ahlstrom (Finland), Nilit (Israel), Polartec (US), Texray Industrial Co., Ltd. (Taiwan), Formosa Taffeta Co., Ltd. (Taiwan), Asahi Kasei Corporation (Japan), Everest Textile Co., Ltd. (Taiwan), Nanotex (US), Burlington (US), Libolon (Taiwan), Columbia Sportswear Company (US) and others.

Research Coverage:

The report defines, segments, and projects the size of the cooling fabrics market based on type, textile type, application, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as joint ventures, collaborations, partnerships, new product launches, acquisitions, agreements, investments, and expansions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the cooling fabrics market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing demand for comfortable clothing), restraints (high cost of cooling fabrics compared to regular fabrics), opportunities (increasing usage in medical and healthcare sector), and challenges (low market penetration) influencing the growth of the cooling fabrics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the cooling fabrics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the cooling fabrics market across varied regions.

- Market Diversification: Exhaustive information about new products, various textile types, untapped geographies, recent developments, and investments in the cooling fabrics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as Coolcore (US), Nan Ya Plastics Corporation (Taiwan), Ahlstrom (Finland), NILIT (Israel), and Polartec (US), among others in the cooling fabrics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE MATRIX

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 METHODOLOGY FOR SUPPLY-SIDE SIZING

- 2.5 ANALYSIS OF SUPPLY-SIDE SIZING

- 2.5.1 CALCULATIONS BASED ON SUPPLY-SIDE ANALYSIS

- 2.5.2 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.7.1 RESEARCH LIMITATIONS

- 2.7.2 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COOLING FABRICS MARKET

- 4.2 COOLING FABRICS MARKET, BY REGION, 2024 VS. 2030

- 4.3 COOLING FABRICS MARKET SHARE, BY TYPE

- 4.4 COOLING FABRICS MARKET, BY TEXTILE TYPE, 2024 VS. 2030

- 4.5 COOLING FABRICS MARKET SHARE, BY APPLICATION

- 4.6 COOLING FABRICS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for comfortable clothing

- 5.2.1.2 Rapid urbanization and improved standard of living

- 5.2.1.3 Rising awareness about heat stress and health

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost compared to regular fabrics

- 5.2.2.2 Limited awareness in developing regions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use in medical and healthcare sectors

- 5.2.3.2 Development of sustainable and recyclable cooling fabrics

- 5.2.4 CHALLENGES

- 5.2.4.1 Low market penetration

- 5.2.4.2 Competition from alternative technologies

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN ANALYSIS

- 6.2 ECOSYSTEM MAPPING

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- 6.3.1 BARGAINING POWER OF SUPPLIERS

- 6.3.2 THREAT OF NEW ENTRANTS

- 6.3.3 THREAT OF SUBSTITUTES

- 6.3.4 BARGAINING POWER OF BUYERS

- 6.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.4.2 BUYING CRITERIA

- 6.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 REVOLUTIONIZING PERSONAL THERMAL MANAGEMENT

- 6.6.2 DESIGNING AFFORDABLE COOLING SPORTSWEAR FOR ENDURANCE ATHLETES IN TROPICAL REGIONS

- 6.6.3 AFFORDABLE COOLING SPORTSWEAR FOR ENDURANCE CYCLISTS IN TROPICAL REGIONS

- 6.7 PATENT ANALYSIS

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 KEY REGULATIONS

- 6.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 Advanced moisture-wicking fabrics

- 6.9.1.2 Nanotechnology

- 6.9.2 COMPLEMENTARY TECHNOLOGIES

- 6.9.2.1 Hybrid cooling systems in cooling fabrics

- 6.9.2.2 Smart textiles

- 6.9.3 ADJACENT TECHNOLOGIES

- 6.9.3.1 Foam material technology in cooling fabrics

- 6.9.3.2 Evaporative cooling technology

- 6.9.1 KEY TECHNOLOGIES

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT DATA (HS CODE 61)

- 6.10.2 EXPORT DATA (HS CODE 61)

- 6.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.12 PRICING ANALYSIS

- 6.12.1 AVERAGE SELLING PRICE OF COOLING FABRICS, BY TYPE, 2019-2023

- 6.12.2 AVERAGE SELLING PRICE OF NATURAL COOLING FABRICS, BY APPLICATION, 2019-2023

- 6.12.3 AVERAGE SELLING PRICE OF COOLING FABRICS, BY KEY PLAYER, 2023

- 6.12.4 AVERAGE SELLING PRICE OF NATURAL COOLING FABRICS, BY REGION, 2019-2023

- 6.13 IMPACT OF AI/GEN AI

- 6.14 GLOBAL MACROECONOMIC OUTLOOK

- 6.14.1 GDP

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 COOLING FABRICS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SYNTHETIC

- 7.2.1 HIGH STRENGTH AND SMOOTH TEXTURE TO DRIVE MARKET

- 7.3 NATURAL

- 7.3.1 COMFORT AND BIODEGRADABILITY TO DRIVE ADOPTION

8 COOLING FABRICS MARKET, BY TEXTILE TYPE

- 8.1 INTRODUCTION

- 8.2 WOVEN

- 8.2.1 STRENGTH AND DURABILITY TO BOOST DEMAND

- 8.3 NONWOVEN

- 8.3.1 INCREASING DEMAND FOR LIGHTWEIGHT TEXTILES TO SUPPORT MARKET GROWTH

- 8.4 KNITTED

- 8.4.1 OPTIMAL COOLING AND FLEXIBILITY TO DRIVE ADOPTION

9 COOLING FABRICS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 ACTIVE COOLING FABRICS

- 9.2.1 AIR-COOLED

- 9.2.2 LIQUID-COOLED

- 9.3 PASSIVE COOLING FABRICS

- 9.3.1 PHASE-CHANGE COOLING

- 9.3.2 EVAPORATIVE COOLING

10 COOLING FABRICS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 SPORTS APPAREL

- 10.2.1 RISING DEMAND FOR SELF-COOLING FABRICS TO BOOST MARKET

- 10.3 LIFESTYLE APPAREL

- 10.3.1 RISING ENGAGEMENT IN SPORTS & OUTDOOR ACTIVITIES TO FUEL DEMAND

- 10.4 PROTECTIVE CLOTHING

- 10.4.1 USE OF COOLING FABRICS IN COMBAT UNIFORMS AND BODY ARMOR TO DRIVE MARKET

- 10.5 OTHER APPLICATIONS

11 COOLING FABRICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Presence of established manufacturers to boost market

- 11.2.2 CANADA

- 11.2.2.1 Duty-free trade agreements to support market growth

- 11.2.3 MEXICO

- 11.2.3.1 Infrastructural development and construction activities to fuel demand for protective gear

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Increasing use of cooling fabrics in military to drive market

- 11.3.2 GERMANY

- 11.3.2.1 Growing demand for sports apparel and protective wear to drive market

- 11.3.3 ITALY

- 11.3.3.1 Rising consumer awareness to fuel demand for natural fabrics

- 11.3.4 FRANCE

- 11.3.4.1 High demand for comfortable sports apparel to boost market

- 11.3.5 SPAIN

- 11.3.5.1 Increased participation in outdoor activities to boost use of cooling fabrics in sports apparel

- 11.3.6 PORTUGAL

- 11.3.6.1 Government initiatives promoting sustainability to drive market

- 11.3.7 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Advanced textile manufacturing technologies to drive market

- 11.4.2 JAPAN

- 11.4.2.1 Rise in environmental temperature to fuel demand for natural fabrics

- 11.4.3 INDIA

- 11.4.3.1 Growing population and rising income levels to fuel demand for cooling fabrics

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Technological advancements and government initiatives to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Increasing use of nonwoven products to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Change in weather conditions to fuel demand for cooling fabrics

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 UAE

- 11.6.1.1.1 High demand for protective wear to drive market

- 11.6.1.2 Saudi Arabia

- 11.6.1.2.1 Increasing demand from oil & gas industry to drive market

- 11.6.1.3 Rest of GCC Countries

- 11.6.1.1 UAE

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Rising awareness of heat-related health concerns to boost demand for comfortable clothing

- 11.6.3 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN COOLING FABRICS MARKET

- 12.3 REVENUE ANALYSIS, 2021-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.4.1 RANKING OF KEY MARKET PLAYERS, 2023

- 12.4.2 MARKET SHARE OF KEY PLAYERS

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company footprint

- 12.6.5.2 Type footprint

- 12.6.5.3 Textile type footprint

- 12.6.5.4 Application footprint

- 12.6.5.5 Region footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8.1 COMPANY VALUATION

- 12.8.2 FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 COOLCORE

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 NAN YA PLASTICS CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 AHLSTROM

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 NILIT

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 POLARTEC

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 TEXRAY INDUSTRIAL CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 FORMOSA TAFFETA CO., LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 ASAHI KASEI CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 EVEREST TEXTILE CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 NANOTEX

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 BURLINGTON

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.12 LIBOLON

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 COLUMBIA SPORTSWEAR COMPANY

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Expansions

- 13.1.14 LIEBAERT

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Other developments

- 13.1.15 HEIQ MATERIALS AG

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Deals

- 13.1.16 PATAGONIA

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.17 VIRUS

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.1 COOLCORE

- 13.2 OTHER PLAYERS

- 13.2.1 TEHRANI INDUSTRIAL GROUP

- 13.2.2 HONG LI TEXTILE CO., LTD.

- 13.2.3 SUN DREAM ENTERPRISE CO., LTD.

- 13.2.4 TECHNICAL ABSORBENTS LIMITED

- 13.2.5 BALAVIGNA MILLS PVT. LTD.

- 13.2.6 THE NORTH FACE

- 13.2.7 PARAMO LTD.

- 13.2.8 TOYOBO CO., LTD.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 INTERCONNECTED MARKETS

- 14.3.1 COATED FABRICS MARKET

- 14.3.1.1 Market definition

- 14.3.1.2 Market overview

- 14.3.1.3 Coated fabrics market, by application

- 14.3.1.3.1 Transportation

- 14.3.1.3.2 Protective clothing

- 14.3.1.3.3 Industrial

- 14.3.1.3.4 Roofing, awnings, & canopies

- 14.3.1.3.5 Furniture and seating

- 14.3.1.3.6 Other applications

- 14.3.2 CONDUCTIVE TEXTILES MARKET

- 14.3.2.1 Market definition

- 14.3.2.2 Market overview

- 14.3.2.3 Conductive textiles market, by type

- 14.3.2.3.1 Woven conductive textiles

- 14.3.2.3.2 Nonwoven conductive textiles

- 14.3.2.3.3 Knitted conductive textiles

- 14.3.1 COATED FABRICS MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS