|

|

市場調査レポート

商品コード

1633534

自動車用鉛蓄電池の世界市場:製品別、タイプ別、顧客セグメント別、最終用途別、地域別 - 2032年までの予測Automotive Lead-Acid Battery Market by Product (SLI Batteries, Micro Hybrid, Auxiliary), Type (Flooded, VRLA), End Use (Passenger Cars, Light & Heavy Commercial Vehicles, Two Wheelers, Three Wheelers), and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用鉛蓄電池の世界市場:製品別、タイプ別、顧客セグメント別、最終用途別、地域別 - 2032年までの予測 |

|

出版日: 2025年01月08日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動車用鉛蓄電池の市場規模は、2024年の288億8,000万米ドルから2032年には367億2,000万米ドルに成長し、予測期間中のCAGRは3.0%と予測されています。

自動車産業は成長を続けており、特にインド、中国、東南アジアなどの新興国では、信頼性が高く費用対効果の高いバッテリーソリューションへのニーズが高まっています。鉛蓄電池は、その手頃な価格、実証済みの性能、従来の内燃機関(ICE)車との互換性により、ほとんどの自動車に採用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2022年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2032年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 製品別、タイプ別、顧客セグメント別、最終用途別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

マイクロハイブリッド電池は、自動車用鉛蓄電池市場において第2位のシェアを占めており、その背景には、スタート-ストップシステムとの互換性と低燃費車の需要増加があります。これらのバッテリーは、フルハイブリッドや電気自動車に比べてコスト効率が高く、最新の自動車技術で必要とされる頻繁な充放電サイクルに対応できるよう特別に設計されています。排ガス規制の強化と強化型フラッデッド・バッテリー(EFB)および吸収性ガラスマット(AGM)技術の進歩が、バッテリーの採用をさらに後押ししています。従来の電解液タイプ鉛蓄電池が市場を独占している一方で、マイクロハイブリッドバッテリーは、自動車業界がより環境に優しく効率的なソリューションにシフトしていることが後押しとなり、急速に普及しています。

電解液タイプ鉛蓄電池は、自動車用鉛蓄電池市場において、吸収ガラスマット(AGM)電池に次いでタイプ別シェア第2位を占めています。浸水型バッテリーは伝統的な設計であるにもかかわらず、標準的な自動車での費用対効果と信頼性の高い性能により、依然として広く使用されています。しかし、AGMと強化型フラッデッド・バッテリー(EFB)の進歩が、スタート・ストップ・システムなどの最新の自動車技術の要求をよりよく満たすようになったため、市場シェアはわずかに低下しています。とはいえ、浸水型バッテリーは、特にコストに敏感な消費者の市場が強い地域では、多くの従来型自動車で引き続き好まれています。

小型商用車は、自動車用鉛蓄電池市場の最終用途セグメントで第2位のシェアを占めています。この大きなシェアは、始動、照明、点火(SLI)機能用に信頼性と耐久性の高い電源を必要とする商用車の鉛蓄電池に対する安定した需要が牽引しています。これらの車両はしばしば厳しい条件下で運転され、手頃な価格で広く入手でき、信頼できる性能を提供できることから、鉛蓄電池に依存しています。乗用車が市場を独占している一方で、物流、建設、輸送産業の成長が商用車への鉛蓄電池の採用を強化し、市場における鉛蓄電池の優位性を維持しています。

当レポートでは、世界の自動車用鉛蓄電池市場について調査し、製品別、タイプ別、顧客セグメント別、最終用途別地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界の動向

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 世界マクロ経済見通し

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 関税と規制状況

- 2024年~2025年の主な会議とイベント

- 特許分析

- 技術分析

- 貿易分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 生成AI/AIが自動車用鉛蓄電池市場に与える影響

第7章 自動車用鉛蓄電池市場、製品別

- イントロダクション

- SLI電池

- マイクロハイブリッド電池

- 補助電池

第8章 自動車用鉛蓄電池市場、タイプ別

- イントロダクション

- 浸水型電池

- VRLA電池

第9章 自動車用鉛蓄電池市場、顧客セグメント別

- イントロダクション

- メーカー

- アフターマーケット

第10章 自動車用鉛蓄電池市場、最終用途別

- イントロダクション

- 乗用車

- 小型・大型商用車

- 二輪車

- 三輪車

第11章 自動車用鉛蓄電池市場、地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- イタリア

- フランス

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他

- 南米

- ブラジル

- チリ

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ENERSYS

- CLARIOS

- EXIDE INDUSTRIES LTD.

- GS YUASA INTERNATIONAL LTD.

- EAST PENN MANUFACTURING COMPANY

- C&D TECHNOLOGIES, INC.

- CAMEL GROUP CO., LTD

- TIANNENG RECHARGEABLE BATTERY MANUFACTURERS

- LEOCH INTERNATIONAL TECHNOLOGY LIMITED

- AMARA RAJA ENERGY & MOBILITY LIMITED

- THE FURUKAWA BATTERY CO., LTD.

- ROBERT BOSCH LLC

- REEM BATTERIES

- CENTURY BATTERIES INDONESIA

- STRYTEN ENERGY

- EXIDE TECHNOLOGIES

- CROWN BATTERY

- FIAMM ENERGY TECHNOLOGY S.P.A.

- CSB ENERGY TECHNOLOGY CO., LTD.

- MOURA ACCUMULATORS SA

- その他企業

- MEBCO

- KOYOSONIC POWER CO., LTD.

- RITAR INTERNATIONAL GROUP LIMITED

- JYC BATTERY MANUFACTURER CO., LTD.

- POWER SONIC CORPORATION

- XINFU TECHNOLOGY(CHINA)CO., LIMITED

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 AUTOMOTIVE LEAD-ACID BATTERY MARKET SNAPSHOT: 2024 VS. 2032

- TABLE 2 AUTOMOTIVE LEAD-ACID BATTERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE (%)

- TABLE 4 KEY BUYING CRITERIA, BY END USE

- TABLE 5 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2021-2023 (%)

- TABLE 6 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2021-2023 (%)

- TABLE 7 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2021-2023 (%)

- TABLE 8 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 VS. 2023 (USD BILLION)

- TABLE 9 ROLES OF COMPANIES IN AUTOMOTIVE LEAD-ACID BATTERY ECOSYSTEM

- TABLE 10 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE LEAD-ACID BATTERIES (12V, 34 AH), BY REGION, 2021-2023 (USD/UNIT)

- TABLE 11 INDICATIVE PRICING ANALYSIS OF AUTOMOTIVE LEAD-ACID BATTERIES (12V, 50 AH), BY TYPE, 2023 (USD/UNIT)

- TABLE 12 INDICATIVE PRICING ANALYSIS OF AUTOMOTIVE LEAD-ACID BATTERIES (12V, 34 AH) OFFERED BY KEY PLAYERS, 2023 (USD/UNIT)

- TABLE 13 AVERAGE RETAIL PRICE OF AUTOMOTIVE LEAD-ACID BATTERIES (40 AH) OFFERED BY KEY PLAYERS, 2024 (USD/UNIT)

- TABLE 14 AVERAGE RETAIL PRICE OF AUTOMOTIVE LEAD-ACID BATTERIES (50 AH) OFFERED BY KEY PLAYERS, 2024 (USD/UNIT)

- TABLE 15 AVERAGE RETAIL PRICE OF AUTOMOTIVE LEAD-ACID BATTERIES (60 AH) OFFERED BY KEY PLAYERS, 2024 (USD/UNIT)

- TABLE 16 TARIFF DATA RELATED TO HS CODE 850710-COMPLIANT PRODUCTS, 2023 (%)

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 AUTOMOTIVE LEAD-ACID BATTERY MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 21 AUTOMOTIVE LEAD-ACID BATTERY MARKET: LIST OF MAJOR PATENTS, 2013-2023

- TABLE 22 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2021-2023 (USD BILLION)

- TABLE 23 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2024-2032 (USD BILLION)

- TABLE 24 SLI BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 25 SLI BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 26 MICRO HYBRID BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 27 MICRO HYBRID BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 28 AUXILIARY BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 29 AUXILIARY BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 30 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2021-2023 (USD BILLION)

- TABLE 31 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2024-2032 (USD BILLION)

- TABLE 32 FLOODED BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 33 FLOODED BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 34 VRLA BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 35 VRLA BATTERIES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 36 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY CUSTOMER SEGMENT, 2021-2023 (USD BILLION)

- TABLE 37 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY CUSTOMER SEGMENT, 2024-2032 (USD BILLION)

- TABLE 38 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 39 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 40 PASSENGER CARS: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 41 PASSENGER CARS: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 42 LIGHT & HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 43 LIGHT & HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 44 TWO WHEELERS: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 45 TWO WHEELERS: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 46 THREE WHEELERS: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 47 THREE WHEELERS: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 48 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (USD BILLION)

- TABLE 49 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (USD BILLION)

- TABLE 50 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2021-2023 (MWH)

- TABLE 51 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024-2032 (MWH)

- TABLE 52 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2021-2023 (USD BILLION)

- TABLE 53 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2024-2032 (USD BILLION)

- TABLE 54 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 55 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 56 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2021-2023 (USD BILLION)

- TABLE 57 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2024-2032 (USD BILLION)

- TABLE 58 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2021-2023 (USD BILLION)

- TABLE 59 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2024-2032 (USD BILLION)

- TABLE 60 US: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 61 US: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 62 CANADA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 63 CANADA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 64 MEXICO: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 65 MEXICO: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 66 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2021-2023 (USD BILLION)

- TABLE 67 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2024-2032 (USD BILLION)

- TABLE 68 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 69 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 70 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2021-2023 (USD BILLION)

- TABLE 71 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2024-2032 (USD BILLION)

- TABLE 72 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2021-2023 (USD BILLION)

- TABLE 73 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2024-2032 (USD BILLION)

- TABLE 74 UK: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 75 UK: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 76 GERMANY: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 77 GERMANY: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 78 ITALY: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 79 ITALY: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 80 FRANCE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 81 FRANCE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 82 REST OF EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 83 REST OF EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 84 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2021-2023 (USD BILLION)

- TABLE 85 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2024-2032 (USD BILLION)

- TABLE 86 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 87 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 88 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2021-2023 (USD BILLION)

- TABLE 89 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2024-2032 (USD BILLION)

- TABLE 90 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2021-2023 (USD BILLION)

- TABLE 91 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2024-2032 (USD BILLION)

- TABLE 92 CHINA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 93 CHINA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 94 JAPAN: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 95 JAPAN: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 96 INDIA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 97 INDIA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 98 SOUTH KOREA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 99 SOUTH KOREA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 100 REST OF ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 101 REST OF ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 102 MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2021-2023 (USD BILLION)

- TABLE 103 MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2024-2032 (USD BILLION)

- TABLE 104 MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 105 MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 106 MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2021-2023 (USD BILLION)

- TABLE 107 MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2024-2032 (USD BILLION)

- TABLE 108 MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2021-2023 (USD BILLION)

- TABLE 109 MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2024-2032 (USD BILLION)

- TABLE 110 UAE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 111 UAE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 112 SAUDI ARABIA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 113 SAUDI ARABIA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 114 SOUTH AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 115 SOUTH AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 116 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 117 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 118 SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2021-2023 (USD BILLION)

- TABLE 119 SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY COUNTRY, 2024-2032 (USD BILLION)

- TABLE 120 SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 121 SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 122 SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2021-2023 (USD BILLION)

- TABLE 123 SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE, 2024-2032 (USD BILLION)

- TABLE 124 SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2021-2023 (USD BILLION)

- TABLE 125 SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT, 2024-2032 (USD BILLION)

- TABLE 126 BRAZIL: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 127 BRAZIL: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 128 CHILE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 129 CHILE: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 130 REST OF SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2021-2023 (USD BILLION)

- TABLE 131 REST OF SOUTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE, 2024-2032 (USD BILLION)

- TABLE 132 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 133 DEGREE OF COMPETITION: AUTOMOTIVE LEAD-ACID BATTERY MARKET

- TABLE 134 AUTOMOTIVE LEAD-ACID BATTERY MARKET: REGION FOOTPRINT

- TABLE 135 AUTOMOTIVE LEAD-ACID BATTERY MARKET: PRODUCT FOOTPRINT

- TABLE 136 AUTOMOTIVE LEAD-ACID BATTERY MARKET: TYPE FOOTPRINT

- TABLE 137 AUTOMOTIVE LEAD-ACID BATTERY MARKET: END-USE FOOTPRINT

- TABLE 138 AUTOMOTIVE LEAD-ACID BATTERY MARKET: CUSTOMER SEGMENT FOOTPRINT

- TABLE 139 AUTOMOTIVE LEAD-ACID BATTERY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 140 AUTOMOTIVE LEAD-ACID BATTERY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 141 AUTOMOTIVE LEAD-ACID BATTERY MARKET: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 142 AUTOMOTIVE LEAD-ACID BATTERY MARKET: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 143 AUTOMOTIVE LEAD-ACID BATTERY MARKET: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 144 ENERSYS: COMPANY OVERVIEW

- TABLE 145 ENERSYS: PRODUCTS OFFERED

- TABLE 146 ENERSYS: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 147 ENERSYS: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 148 CLARIOS: COMPANY OVERVIEW

- TABLE 149 CLARIOS: PRODUCTS OFFERED

- TABLE 150 CLARIOS: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 151 CLARIOS: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 152 CLARIOS: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 153 EXIDE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 154 EXIDE INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 155 EXIDE INDUSTRIES LTD.: PRODUCT LAUNCHES, JANUARY 2019-DECEMBER 2024

- TABLE 156 GS YUASA INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 157 GS YUASA INTERNATIONAL LTD.: PRODUCTS OFFERED

- TABLE 158 GS YUASA INTERNATIONAL LTD.: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 159 EAST PENN MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 160 EAST PENN MANUFACTURING COMPANY: PRODUCTS OFFERED

- TABLE 161 C&D TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 162 C&D TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 163 CAMEL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 164 CAMEL GROUP CO., LTD: PRODUCTS OFFERED

- TABLE 165 CAMEL GROUP CO., LTD.: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 166 TIANNENG RECHARGEABLE BATTERY MANUFACTURERS: COMPANY OVERVIEW

- TABLE 167 TIANNENG RECHARGEABLE BATTERY MANUFACTURERS: PRODUCTS OFFERED

- TABLE 168 TIANNENG RECHARGEABLE BATTERY MANUFACTURERS: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 169 LEOCH INTERNATIONAL TECHNOLOGY LIMITED: COMPANY OVERVIEW

- TABLE 170 LEOCH INTERNATIONAL TECHNOLOGY LIMITED: PRODUCTS OFFERED

- TABLE 171 LEOCH INTERNATIONAL TECHNOLOGY LIMITED: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 172 AMARA RAJA ENERGY & MOBILITY LIMITED: COMPANY OVERVIEW

- TABLE 173 AMARA RAJA ENERGY & MOBILITY LIMITED: PRODUCTS OFFERED

- TABLE 174 THE FURUKAWA BATTERY CO., LTD.: COMPANY OVERVIEW

- TABLE 175 THE FURUKAWA BATTERY CO., LTD.: PRODUCTS OFFERED

- TABLE 176 ROBERT BOSCH LLC: COMPANY OVERVIEW

- TABLE 177 ROBERT BOSCH LLC: PRODUCTS OFFERED

- TABLE 178 REEM BATTERIES: COMPANY OVERVIEW

- TABLE 179 REEM BATTERIES: PRODUCTS OFFERED

- TABLE 180 CENTURY BATTERIES INDONESIA: COMPANY OVERVIEW

- TABLE 181 CENTURY BATTERIES INDONESIA: PRODUCTS OFFERED

- TABLE 182 STRYTEN ENERGY: COMPANY OVERVIEW

- TABLE 183 STRYTEN ENERGY: PRODUCTS OFFERED

- TABLE 184 STRYTEN ENERGY: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 185 STRYTEN ENERGY: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 186 STRYTEN ENERGY: EXPANSIONS, JANUARY 2019-NOVEMBER 2024

- TABLE 187 EXIDE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 188 EXIDE TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 189 EXIDE TECHNOLOGIES: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 190 EXIDE TECHNOLOGIES: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 191 CROWN BATTERY: COMPANY OVERVIEW

- TABLE 192 CROWN BATTERY: PRODUCTS OFFERED

- TABLE 193 FIAMM ENERGY TECHNOLOGY S.P.A.: COMPANY OVERVIEW

- TABLE 194 FIAMM ENERGY TECHNOLOGY S.P.A.: PRODUCTS OFFERED

- TABLE 195 FIAMM ENERGY TECHNOLOGY S.P.A.: PRODUCT LAUNCHES, JANUARY 2019-NOVEMBER 2024

- TABLE 196 FIAMM ENERGY TECHNOLOGY S.P.A.: DEALS, JANUARY 2019-NOVEMBER 2024

- TABLE 197 CSB ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 198 CSB ENERGY TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 199 MOURA ACCUMULATORS SA: COMPANY OVERVIEW

- TABLE 200 MOURA ACCUMULATORS SA: PRODUCTS OFFERED

- TABLE 201 MEBCO: COMPANY OVERVIEW

- TABLE 202 KOYOSONIC POWER CO., LTD.: COMPANY OVERVIEW

- TABLE 203 RITAR INTERNATIONAL GROUP LIMITED: COMPANY OVERVIEW

- TABLE 204 JYC BATTERY MANUFACTURER CO., LTD.: COMPANY OVERVIEW

- TABLE 205 POWER SONIC CORPORATION: COMPANY OVERVIEW

- TABLE 206 XINFU TECHNOLOGY (CHINA) CO., LIMITED: COMPANY OVERVIEW

- TABLE 207 ADVANCED LEAD-ACID BATTERY MARKET, BY TYPE, 2017-2020 (USD BILLION)

- TABLE 208 ADVANCED LEAD-ACID BATTERY MARKET, BY TYPE, 2021-2027 (USD BILLION)

- TABLE 209 STATIONARY: ADVANCED LEAD-ACID BATTERY MARKET, BY REGION, 2017-2020 (USD BILLION)

- TABLE 210 STATIONARY: ADVANCED LEAD-ACID BATTERY MARKET, BY REGION, 2021-2027 (USD BILLION)

- TABLE 211 MOTIVE: ADVANCED LEAD-ACID BATTERY MARKET, BY REGION, 2017-2020 (USD BILLION)

- TABLE 212 MOTIVE: ADVANCED LEAD-ACID BATTERY MARKET, BY REGION, 2021-2027 (USD BILLION)

List of Figures

- FIGURE 1 AUTOMOTIVE LEAD-ACID BATTERY MARKET SEGMENTATION

- FIGURE 2 AUTOMOTIVE LEAD-ACID BATTERY MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR AUTOMOTIVE LEAD-ACID BATTERIES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF AUTOMOTIVE LEAD-ACID BATTERY MARKET (1/2)

- FIGURE 7 AUTOMOTIVE LEAD-ACID BATTERY MARKET: DATA TRIANGULATION

- FIGURE 8 AFTERMARKET SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 9 SLI BATTERIES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 10 VRLA BATTERIES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 PASSENGER CARS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 RISING DEMAND FOR LEAD-ACID BATTERIES IN AUTOMOTIVE INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 14 ASIA PACIFIC TO RECORD HIGHEST CAGR IN AUTOMOTIVE LEAD-ACID BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 15 CHINA TO GROW AT HIGHEST RATE IN AUTOMOTIVE LEAD-ACID BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 16 AUTOMOTIVE LEAD-ACID BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 GROWTH TRAJECTORY OF LEAD-ACID BATTERY MARKET, 2015-2030 (USD BILLION)

- FIGURE 18 AUTOMOTIVE LEAD-ACID BATTERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE

- FIGURE 20 KEY BUYING CRITERIA, BY END USE

- FIGURE 21 GLOBAL MOTOR VEHICLE PRODUCTION, 2020-2023 (UNITS)

- FIGURE 22 AUTOMOTIVE LEAD-ACID BATTERY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 PARTICIPANTS IN AUTOMOTIVE LEAD-ACID BATTERY ECOSYSTEM

- FIGURE 24 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE LEAD-ACID BATTERIES (12V, 34 AH), BY REGION, 2021-2023 (USD/UNIT)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE LEAD-ACID BATTERIES (12V, 50 AH), BY TYPE, 2023 (USD/UNIT)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE LEAD-ACID BATTERIES (12V, 34 AH) OFFERED BY KEY PLAYERS, BY TYPE, 2023 (USD/UNIT)

- FIGURE 27 MAJOR PATENTS RELATED TO AUTOMOTIVE LEAD-ACID BATTERIES, 2013-2023

- FIGURE 28 IMPORT DATA RELATED TO HS CODE 850720-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 29 EXPORT DATA RELATED TO HS CODE 850720-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 30 AUTOMOTIVE LEAD-ACID BATTERY MARKET: INVESTMENT AND FUNDING SCENARIO, 2018-2024 (USD MILLION)

- FIGURE 31 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 32 SLI BATTERIES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 33 FLOODED BATTERIES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 AFTERMARKET SEGMENT TO DOMINATE AUTOMOTIVE LEAD-ACID BATTERY MARKET IN 2032

- FIGURE 35 PASSENGER CARS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 36 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION, 2024 VS. 2032 (USD BILLION)

- FIGURE 37 NORTH AMERICA: AUTOMOTIVE LEAD-ACID BATTERY MARKET SNAPSHOT

- FIGURE 38 EUROPE: AUTOMOTIVE LEAD-ACID BATTERY MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: AUTOMOTIVE LEAD-ACID BATTERY MARKET SNAPSHOT

- FIGURE 40 AUTOMOTIVE LEAD-ACID BATTERY MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 41 AUTOMOTIVE LEAD-ACID BATTERY MARKET SHARE ANALYSIS, 2023

- FIGURE 42 BRAND/PRODUCT COMPARISON

- FIGURE 43 AUTOMOTIVE LEAD-ACID BATTERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 44 AUTOMOTIVE LEAD-ACID BATTERY MARKET: COMPANY FOOTPRINT

- FIGURE 45 AUTOMOTIVE LEAD-ACID BATTERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 46 AUTOMOTIVE LEAD-ACID BATTERY MARKET: EV/EBITDA OF COMPANIES

- FIGURE 47 AUTOMOTIVE LEAD-ACID BATTERY MARKET: COMPANY VALUATION

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 49 ENERSYS: COMPANY SNAPSHOT

- FIGURE 50 EXIDE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 51 GS YUASA INTERNATIONAL LTD.: COMPANY SNAPSHOT

- FIGURE 52 LEOCH INTERNATIONAL TECHNOLOGY LIMITED: COMPANY SNAPSHOT

- FIGURE 53 AMARA RAJA ENERGY & MOBILITY LIMITED: COMPANY SNAPSHOT

- FIGURE 54 THE FURUKAWA BATTERY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 55 ROBERT BOSCH LLC: COMPANY SNAPSHOT

The global automotive lead acid battery market is projected to grow from USD 28.88 billion in 2024 to USD 36.72 billion by 2032, at a CAGR of 3.0% during the forecast period. The automotive industry continues to grow, especially in emerging economies like India, China, and Southeast Asia, the need for reliable and cost-effective battery solutions intensifies. Lead-acid batteries are the preferred choice for most vehicles due to their affordability, proven performance, and compatibility with conventional internal combustion engine (ICE) vehicles.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2022 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Units Considered | Value (USD Million) |

| Segments | By Product, Type, End-Use, Customer Segment, and Region. |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Micro Hybrid Batteries segment, by product, is estimated to account for the second largest share during the forecast period."

Micro-hybrid batteries hold the second-largest share in the automotive lead-acid battery market, driven by their compatibility with start-stop systems and increasing demand for fuel-efficient vehicles. These batteries are cost-effective compared to full-hybrid or electric alternatives and are specifically designed to handle the frequent charge and discharge cycles required by modern vehicle technologies. Stricter emission regulations and advancements in Enhanced Flooded Batteries (EFB) and Absorbent Glass Mat (AGM) technologies have further boosted their adoption. While traditional flooded lead-acid batteries dominate the market, micro-hybrid batteries are rapidly gaining traction, fueled by the automotive industry's shift toward more eco-friendly and efficient solutions.

"By type, flooded batteries segment accounted for the second largest share during the forecast period."

Flooded batteries hold the second-largest share in the automotive lead-acid battery market by type, following Absorbent Glass Mat (AGM) batteries. Despite their traditional design, flooded batteries remain widely used due to their cost-effectiveness and reliable performance in standard vehicles. However, their market share has slightly declined as advancements in AGM and Enhanced Flooded Batteries (EFB) better meet the demands of modern automotive technologies, such as start-stop systems. Nevertheless, flooded batteries continue to be a preferred choice for many conventional vehicles, particularly in regions with a strong market for cost-sensitive consumers.

"By End-Use, light & heavy commercial vehicles segment accounted for the second largest share during the forecast period."

Light and heavy commercial vehicles hold the second-largest share in the end-use segment of the automotive lead-acid battery market. This significant share is driven by the consistent demand for lead-acid batteries in commercial vehicles, which require reliable and durable power sources for starting, lighting, and ignition (SLI) functions. These vehicles often operate in challenging conditions and rely on lead-acid batteries for their affordability, widespread availability, and ability to provide dependable performance. While passenger vehicles dominate the market, the growth of logistics, construction, and transportation industries has bolstered the adoption of lead-acid batteries in commercial vehicles, sustaining their prominent position in the market.

"By Customer Segment, OEM segment accounted for the second largest share during the forecast period."

The OEM (Original Equipment Manufacturer) segment holds the second-largest share in the customer segment of the automotive lead-acid battery market. This position is attributed to the steady demand for lead-acid batteries in new vehicle production, where manufacturers prioritize cost-effective and reliable battery solutions for starting, lighting, and ignition (SLI) applications. Although the aftermarket segment leads due to the frequent replacement cycles of batteries, the OEM segment benefits from the continuous production of conventional vehicles and the incorporation of advanced lead-acid battery technologies, such as AGM and EFB, in modern vehicles equipped with start-stop systems. This ensures the OEM segment remains a key contributor to the market's overall growth.

"North America region is estimated to account for the second largest share during the forecast period."

North America holds the second-largest share in the regional segment of the automotive lead-acid battery market. This is driven by the robust automotive industry in the region, which includes both the production of traditional vehicles and the increasing adoption of technologies like start-stop systems in newer models. The demand for lead-acid batteries in North America is bolstered by their widespread use in light vehicles, commercial vehicles, and replacement markets. Additionally, the region benefits from a well-established automotive manufacturing base and strong aftermarket demand, ensuring that lead-acid batteries continue to be a preferred power source due to their affordability and reliability.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 30%, Managers- 25%, and Others - 45%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, Middle East and Africa - 7%, and South America - 3%

EnerSys (US), Clarios (US), East Penn Manufacturing Company (US), GS Yuasa International Ltd. (Japan), and Exide Industries Ltd. (India) are some of the major players in the automotive lead acid battery market. These players have adopted acquisitions, expansions, product launches, and partnerships to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the automotive lead acid battery market based on product, type, end use, customer segment, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles automotive lead acid battery manufacturers. It comprehensively analyzes their market shares and core competencies and tracks and analyzes competitive developments, such as expansions, agreements, product launches, and acquisitions, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing the closest approximations of revenue numbers for the automotive lead acid battery market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Well-established technology & cost-effective energy solution and easily recyclable compared with lithium-ion batteries), restraints (risk of battery explosion due to overcharging), opportunities (technological advancements enhancing durability and reducing maintenance requirements), and challenges (limited usage capacity of lead acid batteries) influencing the growth of the automotive lead acid battery market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the automotive lead acid battery market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive lead acid battery market across varied regions.

- Market Diversification: Exhaustive information about various types, untapped geographies, new products, recent developments, and investments in the automotive lead acid battery market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players in the automotive lead acid battery market, such as EnerSys (US), Clarios (US), East Penn Manufacturing Company (US), GS Yuasa International Ltd. (Japan), Exide Industries Ltd. (India), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE LEAD-ACID BATTERY MARKET

- 4.2 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION

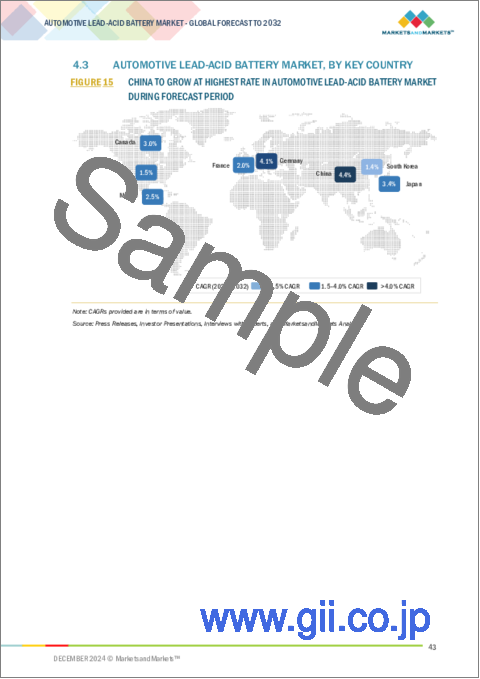

- 4.3 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High demand for cost-effective and reliable batteries in automotive industry and affordability

- 5.2.1.2 Easy recyclability compared with lithium-ion batteries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risk of battery explosion due to overcharging

- 5.2.2.2 Growing adoption of lithium-ion batteries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements to enhance durability of lead-acid batteries

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited capacity of lead-acid batteries

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 BARGAINING POWER OF BUYERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 GLOBAL MACROECONOMIC OUTLOOK

- 6.3.1 GDP

- 6.3.2 EXPANDING AUTOMOTIVE INDUSTRY

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2023

- 6.6.2 AVERAGE SELLING PRICE TREND, BY TYPE, 2023

- 6.6.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.6.4 AVERAGE RETAIL PRICE OF AUTOMOTIVE LEAD-ACID BATTERIES OFFERED BY KEY PLAYERS, BY CAPACITY RANGE, 2024

- 6.7 TARIFF AND REGULATORY LANDSCAPE

- 6.7.1 TARIFF ANALYSIS

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Absorbed glass mat (AGM)

- 6.10.2 COMPLEMENTARY TECHNOLOGIES

- 6.10.2.1 Enhanced flooded battery (EFB)

- 6.10.3 ADJACENT TECHNOLOGIES

- 6.10.3.1 Advanced lead-acid battery

- 6.10.1 KEY TECHNOLOGIES

- 6.11 TRADE ANALYSIS

- 6.11.1 IMPORT SCENARIO (HS CODE 850720)

- 6.11.2 EXPORT SCENARIO (HS CODE 850720)

- 6.12 INVESTMENT AND FUNDING SCENARIO

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 IMPACT OF GENERATIVE AI/AI ON AUTOMOTIVE LEAD-ACID BATTERY MARKET

- 6.14.1 INTRODUCTION

- 6.14.2 ENHANCEMENT OF BATTERY MANAGEMENT SYSTEMS (BMS)

- 6.14.3 OPTIMIZATION OF CHARGING PROFILES

- 6.14.4 PREDICTIVE MAINTENANCE AND FAILURE ANALYSIS

7 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 SLI BATTERIES

- 7.2.1 CONTINUOUS GROWTH OF AUTOMOTIVE INDUSTRY, ESPECIALLY IN DEVELOPING ECONOMIES, TO FUEL DEMAND

- 7.3 MICRO HYBRID BATTERIES

- 7.3.1 RISING DEMAND FOR SUSTAINABLE MOBILITY SOLUTIONS AND FUEL-EFFICIENT VEHICLES TO PROPEL DEMAND

- 7.4 AUXILIARY BATTERIES

- 7.4.1 INCREASING ELECTRIFICATION OF AUTOMOBILES TO BOOST DEMAND

8 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 FLOODED BATTERIES

- 8.2.1 TRADITIONAL FLOODED BATTERIES

- 8.2.1.1 Relatively low initial cost and reliable performance under challenging circumstances to fuel market growth

- 8.2.2 ENHANCED FLOODED BATTERIES

- 8.2.2.1 Improved performance tailored for modern vehicles with start-stop systems to drive market

- 8.2.1 TRADITIONAL FLOODED BATTERIES

- 8.3 VRLA BATTERIES

- 8.3.1 ABSORBED GLASS MAT BATTERIES

- 8.3.1.1 Superior performance and durability to fuel market growth

- 8.3.2 OTHER VRLA BATTERIES

- 8.3.1 ABSORBED GLASS MAT BATTERIES

9 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY CUSTOMER SEGMENT

- 9.1 INTRODUCTION

- 9.2 OEM

- 9.2.1 INCREASING VEHICLE PRODUCTION TO FUEL MARKET GROWTH

- 9.3 AFTERMARKET

- 9.3.1 RISING BATTERY REPLACEMENTS AND SYSTEM UPGRADES BY VEHICLE OWNERS TO DRIVE MARKET

10 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CARS

- 10.2.1 RISING DISPOSABLE INCOME AND URBANIZATION TO DRIVE MARKET

- 10.3 LIGHT & HEAVY COMMERCIAL VEHICLES

- 10.3.1 HIGH STARTING POWER AND ELECTRICAL SUPPORT TO DRIVE MARKET

- 10.4 TWO WHEELERS

- 10.4.1 COST-EFFECTIVENESS TO SUPPORT MARKET GROWTH

- 10.5 THREE WHEELERS

- 10.5.1 AFFORDABILITY AND WIDESPREAD AVAILABILITY TO PROPEL MARKET

11 AUTOMOTIVE LEAD-ACID BATTERY MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Growing consumer demand for vehicles to drive market

- 11.2.2 CANADA

- 11.2.2.1 Rise in commercial motor vehicle production to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Increasing investments in automotive sector to fuel demand for advanced lead-acid batteries

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 UK

- 11.3.1.1 Increased production of commercial vehicles to drive market

- 11.3.2 GERMANY

- 11.3.2.1 Growth of transportation sector to drive market

- 11.3.3 ITALY

- 11.3.3.1 Rising demand for cars and commercial vehicles to propel market

- 11.3.4 FRANCE

- 11.3.4.1 Growing number of cars with start-stop systems to boost demand

- 11.3.5 REST OF EUROPE

- 11.3.1 UK

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Rising population and increasing demand for cars to propel market

- 11.4.2 JAPAN

- 11.4.2.1 Presence of leading automotive manufacturers to fuel market growth

- 11.4.3 INDIA

- 11.4.3.1 Increasing requirements for passenger cars and government initiatives to boost market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Increasing production of commercial vehicles with internal combustion engines to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 UAE

- 11.5.1.1 Growth of automotive aftermarket to drive market

- 11.5.2 SAUDI ARABIA

- 11.5.2.1 Government policies to boost market growth

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Government initiatives to support market growth

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 UAE

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Increased production of flexible-fuel vehicles to drive market

- 11.6.2 CHILE

- 11.6.2.1 Shift toward affordable, recyclable, and dependable energy storage options to drive adoption

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARISON

- 12.5.1 ENERSYS

- 12.5.2 CLARIOS

- 12.5.3 EXIDE INDUSTRIES LTD.

- 12.5.4 GS YUASA INTERNATIONAL LTD.

- 12.5.5 EAST PENN MANUFACTURING COMPANY

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Product footprint

- 12.6.5.4 Type footprint

- 12.6.5.5 End-use footprint

- 12.6.5.6 Customer segment footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ENERSYS

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 CLARIOS

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 EXIDE INDUSTRIES LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 GS YUASA INTERNATIONAL LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 EAST PENN MANUFACTURING COMPANY

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 C&D TECHNOLOGIES, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 CAMEL GROUP CO., LTD

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.8 TIANNENG RECHARGEABLE BATTERY MANUFACTURERS

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.9 LEOCH INTERNATIONAL TECHNOLOGY LIMITED

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Expansions

- 13.1.10 AMARA RAJA ENERGY & MOBILITY LIMITED

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 THE FURUKAWA BATTERY CO., LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 ROBERT BOSCH LLC

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 REEM BATTERIES

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 CENTURY BATTERIES INDONESIA

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 STRYTEN ENERGY

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Deals

- 13.1.15.3.3 Expansions

- 13.1.16 EXIDE TECHNOLOGIES

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches

- 13.1.16.3.2 Deals

- 13.1.17 CROWN BATTERY

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.18 FIAMM ENERGY TECHNOLOGY S.P.A.

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Product launches

- 13.1.18.3.2 Deals

- 13.1.19 CSB ENERGY TECHNOLOGY CO., LTD.

- 13.1.19.1 Business overview

- 13.1.19.2 Products offered

- 13.1.20 MOURA ACCUMULATORS SA

- 13.1.20.1 Business overview

- 13.1.20.2 Products offered

- 13.1.1 ENERSYS

- 13.2 OTHER PLAYERS

- 13.2.1 MEBCO

- 13.2.2 KOYOSONIC POWER CO., LTD.

- 13.2.3 RITAR INTERNATIONAL GROUP LIMITED

- 13.2.4 JYC BATTERY MANUFACTURER CO., LTD.

- 13.2.5 POWER SONIC CORPORATION

- 13.2.6 XINFU TECHNOLOGY (CHINA) CO., LIMITED

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 INTERCONNECTED MARKETS

- 14.4 ADVANCED LEAD-ACID BATTERY MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 ADVANCED LEAD-ACID BATTERY MARKET, BY TYPE

- 14.4.3.1 Stationary

- 14.4.3.1.1 Use in commercial & residential and utility sectors to drive demand

- 14.4.3.2 Motive

- 14.4.3.2.1 Increased applications in transportation sector to boost market

- 14.4.3.1 Stationary

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS