|

|

市場調査レポート

商品コード

1303033

デカンタ型遠心分離機の世界市場:種類別 (二相式遠心分離機、三相式遠心分離機)・用途別 (化学、石油・ガス、エネルギー、石油化学、製薬、廃水処理、食品・飲料)・設計の種類別・地域別の将来予測 (2028年まで)Decanters Centrifuges Market by Type (Two-Phase Centrifuge, Three-Phase Centrifuge), Application (Chemical, Oil & Gas, Energy, Petrochemical, Pharmaceutical, Wastewater Treatment, Food & Beverage), Design Type, & Region - Global Forecast 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| デカンタ型遠心分離機の世界市場:種類別 (二相式遠心分離機、三相式遠心分離機)・用途別 (化学、石油・ガス、エネルギー、石油化学、製薬、廃水処理、食品・飲料)・設計の種類別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月29日

発行: MarketsandMarkets

ページ情報: 英文 221 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のデカンタ型遠心分離機の市場規模は、2023年の19億米ドルから、2028年には23億米ドルに成長し、2023年から2028年までのCAGRは4.8%に達すると予測されています。

固液分離の需要増加、水処理施設の拡大、高品質オリーブ油の需要、食品・飲料産業の拡大、医薬品の分離需要の増加、再生可能エネルギー源の拡大、自動化・デジタル化の進展、上下水道処理の需要拡大といった要因が、デカンタ型遠心分離機市場に成長機会がもたらされます。

"種類別では、三相式デカンタ型遠心分離機のセグメントが2023年から2028年にかけて最も急成長する"

種類別に見ると、三相式デカンタ型遠心分離機が最大の種類の1つとみなされています。三相式遠心分離機は、工業プロセスのための時間とコストの節約を提供します。効率的に単一操作で固体・液体・オイルを分けることによって、それらは多数の分離ステップおよび装置のための必要性を除去します。その結果、プロセスの複雑さが軽減され、エネルギー消費量が減少し、必要な労働力が減少します。これらの要因により、三相遠心分離機市場が最も急速に成長しています。

"用途別では、石油・ガスが2023年から2028年にかけて最も急成長する"

用途別では、成熟した貯留層からさらに石油を抽出するために導入されている (冠水や化学注入などの) 石油増進回収 (EOR) 技術により、予測期間中、石油・ガス分野が最も大きく成長すると予測されています。デカンタ型遠心分離機は、生産された流体の処理・分離に役立ち、石油の効果的な回収・EORプロセスのための水や他の流体の再注入を可能にします。EOR用途におけるデカンタ型遠心分離機の需要は、市場成長の原動力となっています。

"アジア太平洋地域のデカンタ型遠心分離機市場は、予測期間中に最も高いCAGRで成長する"

アジア太平洋地域は、2023年から2028年にかけてデカンタ型遠心分離機市場で最高のCAGRを記録すると予測されています。アジア太平洋地域は、化学処理、食品・飲料、医薬品、鉱業、廃水処理、石油・ガスなどのさまざまな産業が急成長しており、そのため、デカンタ型遠心分離機の主要市場の1つとなっています。アジア太平洋地域は近年、力強い経済成長を遂げ、工業化とインフラ整備が加速しています。この地域には、急速に拡大している都市部を含め、多くの人々が暮らしています。産業活動が活発化し、効果的な分離・ろ過技術が求められるようになった結果、デカンタ型遠心分離機の需要が増加しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- マクロ経済指標

- 関税・規制状況

- 貿易分析

- 特許分析

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム/市場マップ

- 技術分析

- 主要な利害関係者と購入基準

- ケーススタディ

第7章 デカンタ型遠心分離機市場:設計の種類別

- イントロダクション

- 横型デカンタ

- 縦型デカンタ

第8章 デカンタ型遠心分離機市場:種類別

- イントロダクション

- 二相式デカンタ型

- 三相式デカンタ型

第9章 デカンタ型遠心分離機市場:用途別

- イントロダクション

- 化学

- 石油・ガス

- エネルギー (鉱業・鉱石)

- 石油化学

- 製薬

- 廃水処理

- 食品・飲料

- その他

- 製紙・パルプ産業

第10章 デカンタ型遠心分離機市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- ベトナム

- その他のアジア太平洋

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- ロシア

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- 概要

- 市場シェア分析

- 主要企業のランキング

- 主要企業の市場シェア

- 企業フットプリント分析

- 企業評価マトリックス

- 競合ベンチマーキング

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- GEA GROUP AKTIENGECOMSELLSCHAFT

- FLOTTWEG SE

- PIERALISI MAIP SPA

- ALFA LAVAL

- ANDRITZ

- SLB

- IHI ROTATING MACHINERY ENGINEERING CO., LTD.

- MITSUBISHI KAKOKI KAISHA, LTD.

- TOMOE ENGINEERING CO. LTD.

- FLSMIDTH

- その他の企業

- THE WEIR GROUP PLC

- ELGIN POWER AND SEPARATION SOLUTIONS

- SIEBTECHNIK TEMA GMBH

- POLAT MAKINA SAN A.S.

- JIANGSU HUADA CENTRIFUGE CO., LTD.

- HILLER SEPARATION & PROCESS

- THOMAS BROADBENT & SONS LTD.

- CENTRISYS

- ROUSSELET ROBATEL

- NOXON AB

- GN SOLIDS CONTROL

- ZK SEPARATION

- PENNWALT LTD.

- HUADING SEPARATOR

- VITONE ECO S.R.L

第13章 付録

The Decanters Centrifuges market is projected to grow from USD 1.9 billion in 2023 to USD 2.3 billion by 2028, at a CAGR of 4.8% from 2023 to 2028. Considering these factors, such as Increasing Demand for Solid-Liquid Separation, Expansion of Water Treatment Facilities, Demand for High-Quality Olive Oil, Expansion of the Food and Beverage Industry, Increasing Demand for Pharmaceutical Separation, and Expansion of Renewable Energy Sources, Advancements in Automation and Digitalization, Growing Demand for Water and Wastewater Treatment, provides growth opportunities Decanters Centrifuges market.

"By type, the Three-phase Decanters Centrifuges segment is estimated to be the fastest-growing segment of the Decanters Centrifuges market from 2023 to 2028."

Based on the type, the Decanters Centrifuges market made of three-phase Decanters Centrifuges centrifuge is regarded as one of the greatest types. Three-phase centrifuges offer time and cost savings for industrial processes. By efficiently separating solids, liquids, and oils in a single operation, they eliminate the need for multiple separation steps and equipment. This results in reduced process complexity, lower energy consumption, and decreased labor requirements. These factors contribute to the fastest-growing market for three-phase centrifuges in the Decanters Centrifuges centrifuge market.

"By application, Oil & Gas estimated to be the fastest-growing segment of Decanters Centrifuges market from 2023 to 2028."

Based on application, the oil & gas segment is expected to be the most significant in the Decanters Centrifuges market during the forecast period due to the enhanced Oil Recovery techniques, such as water flooding and chemical injection, that are being employed to extract additional oil from mature reservoirs. Decanters Centrifuges are instrumental in treating and separating the produced fluids, allowing for the effective recovery of oil and reinjection of water or other fluids for EOR processes. The demand for Decanters Centrifuges in EOR applications is driving the market growth.

"The Decanters Centrifuges market in Asia Pacific region is projected to witness the highest CAGR during the forecast period."

Asia Pacific region is projected to register the highest CAGR in the Decanters Centrifuges market from 2023 to 2028. Asia Pacific is one of the key markets of Decanters Centrifuges considering these factors, such as the region has experienced rapid industrial growth in various sectors such as chemical processing, food and beverage, pharmaceuticals, mining, wastewater treatment, and oil and gas. The Asia-Pacific area has recently undergone strong economic expansion, which has sped up industrialization and infrastructural growth. There are many people living in the area, including many urban centers that are expanding quickly. The demand for decanter centrifuges has increased as a result of increased industrial activity and the requirement for effective separation and filtration techniques.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 40%, Asia Pacific - 30% Europe -20%, Middle East & Africa-5%, and South America-5%

The Decanters Centrifuges market report is dominated by players, such as GEA (Germany), Flottweg SE (Germany), Pieralisi (Italy), Alfa Laval (Sweden), ANDRITZ (Austria), SLB (US), 1.1.7 IHI ROTATING MACHINERY ENGINEERING CO LTD (Japan), Mitsubishi Kakoki Kaisha, Ltd (Japan), Tomoe Engineering Co Ltd (Japan), Flsmidth (Denmark), and others.

Research Coverage:

The report defines, segments, and projects the size of the Decanters Centrifuges based on type, design type, application, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product launches, agreements, contracts, partnerships, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the Decanters Centrifuges and their segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Increasing Demand for Solid-Liquid Separation, Expansion of Water Treatment Facilities, Demand for High-Quality Olive Oil.), restraints (High Initial Investment, Alternative Separation Technologies, Size, and Footprint Constraints.), opportunities (Expansion of Renewable Energy Sources, Advancements in Automation and Digitalization, Growing Demand for Water.), and challenges (Maintenance and Spare Parts Availability, International Trade Barriers.) influencing the growth of the Decanters Centrifuges market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research &

development activities in the Decanters Centrifuges.

- Market Development: Comprehensive information about Decanters Centrifuges - the report analyses

the Decanters Centrifuges across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped

geographies, recent developments, and investments in the Decanters Centrifuges market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service

offerings of leading players like GEA (Germany), Flottweg SE (Germany), Pieralisi (Italy), Alfa Laval (Sweden), ANDRITZ (Austria). among others in the Decanters Centrifuges market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DECANTER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION: DECANTER MARKET

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION BASED ON DEMAND SIDE

- FIGURE 7 METRICS CONSIDERED FOR ASSESSING DEMAND FOR DECANTERS

- 2.3.3.1 Research assumptions

- 2.3.4 MARKET FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 DECANTER MARKET: SNAPSHOT

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 TWO-PHASE DECANTER SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 10 CHEMICAL APPLICATION SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 11 HORIZONTAL DESIGN SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DECANTER MARKET

- FIGURE 12 INCREASING AWARENESS REGARDING SUSTAINABLE TECHNOLOGY TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 DECANTER MARKET: REGIONAL ANALYSIS

- FIGURE 13 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 DECANTER MARKET, BY TYPE

- FIGURE 14 TWO-PHASE DECANTER SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2028

- 4.4 DECANTER MARKET, BY APPLICATION

- FIGURE 15 CHEMICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- 4.5 DECANTER MARKET, BY DESIGN TYPE

- FIGURE 16 HORIZONTAL SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2028

- 4.6 ASIA PACIFIC DECANTER MARKET, BY APPLICATION AND COUNTRY

- FIGURE 17 CHINA ACCOUNTS FOR LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DECANTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for solid-liquid separation

- 5.2.1.2 Growing demand for high-quality olive oil

- 5.2.1.3 Growth of food & beverage industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investments

- 5.2.2.2 Alternative separation technologies

- 5.2.2.3 Requirement for significant floor space

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth of renewable energy sources

- 5.2.3.2 Advancements in automation and digitalization

- 5.2.3.3 Rising demand for water & wastewater treatment

- 5.2.4 CHALLENGES

- 5.2.4.1 Use of decanter centrifuge for barite recovery in oil & gas industry

- 5.2.4.2 Minimizing waste generation and maximizing resource recovery

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 DECANTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS: DECANTER MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN OF DECANTER MARKET

- 6.2.1 RAW MATERIAL SUPPLIERS

- 6.2.2 DECANTER MANUFACTURERS

- 6.2.3 DISTRIBUTORS

- 6.2.4 END USER

- 6.3 MACROECONOMIC INDICATORS

- 6.3.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 6.4 TARIFF AND REGULATORY LANDSCAPE

- 6.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO

- TABLE 5 EXPORTS OF DECANTER CENTRIFUGES, BY COUNTRY, 2020-2022 (USD MILLION)

- 6.5.2 IMPORT SCENARIO

- TABLE 6 IMPORT OF DECANTER CENTRIFUGES, BY COUNTRY, 2020-2022 (USD MILLION)

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- 6.6.2.1 Document type

- TABLE 7 GRANTED PATENTS ACCOUNT FOR 36.5% OF TOTAL COUNT IN LAST 10 YEARS

- 6.6.2.2 Patent publication trends

- FIGURE 21 NUMBER OF PATENTS GRANTED FROM 2013 TO 2023

- 6.6.3 INSIGHTS

- 6.6.4 LEGAL STATUS OF PATENTS

- 6.6.5 JURISDICTION ANALYSIS

- FIGURE 22 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DECANTERS, 2023

- 6.6.6 TOP COMPANIES/APPLICANTS

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- TABLE 8 LIST OF MAJOR PATENTS FOR DECANTER CENTRIFUGES

- 6.6.7 LIST OF MAJOR PATENTS

- TABLE 9 MAJOR PATENTS FOR DECANTER CENTRIFUGES

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.7.1 REVENUE SHIFTS & REVENUE POCKETS FOR DECANTER MARKET

- FIGURE 24 REVENUE SHIFTS FOR DECANTER PROVIDERS

- 6.8 ECOSYSTEM/MARKET MAP

- TABLE 10 DECANTER MARKET: ECOSYSTEM

- FIGURE 25 DECANTER MARKET: ECOSYSTEM MAPPING

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 VFD TECHNOLOGY

- TABLE 11 ADVANTAGES OF VFD TECHNOLOGY

- 6.9.2 ADVANCED CONTROL TECHNOLOGY

- TABLE 12 ADVANTAGES OF ADVANCED CONTROL TECHNOLOGY

- 6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP SEVEN APPLICATIONS

- TABLE 13 INFLUENCE OF BUYERS IN BUYING PROCESS FOR TOP SEVEN APPLICATIONS

- 6.10.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR END USERS

- TABLE 14 KEY BUYING CRITERIA FOR END USERS

- 6.11 CASE STUDY

- 6.11.1 MUNICIPALITY UPGRADES TO DECANTER CENTRIFUGE WITH GREASED BEARINGS

7 DECANTER MARKET, BY DESIGN TYPE

- 7.1 INTRODUCTION

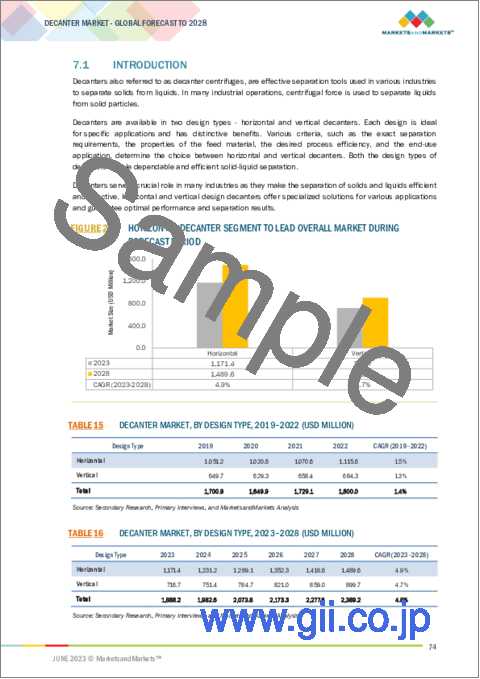

- FIGURE 28 HORIZONTAL DECANTER SEGMENT TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- TABLE 15 DECANTER MARKET, BY DESIGN TYPE, 2019-2022 (USD MILLION)

- TABLE 16 DECANTER MARKET, BY DESIGN TYPE, 2023-2028 (USD MILLION)

- 7.2 HORIZONTAL DECANTER

- 7.2.1 HORIZONTAL DECANTERS WIDELY USED DUE TO THEIR HIGH CAPACITY AND VERSATILITY

- 7.3 VERTICAL DECANTER

- 7.3.1 VERTICAL DECANTERS MOSTLY USED FOR SPECIALISED APPLICATIONS

8 DECANTER MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 29 TWO-PHASE DECANTERS TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- TABLE 17 DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 18 DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2 TWO-PHASE DECANTER

- 8.2.1 TWO-PHASE SEGMENT TO ACCOUNT FOR DOMINANT SHARE IN OVERALL MARKET

- 8.3 THREE-PHASE DECANTER

- 8.3.1 ENABLES RECOVERY OF VALUABLE MATERIALS FROM COMPLICATED MIXES, OFFERS HIGH PROCESSING CAPACITY

9 DECANTER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 30 CHEMICAL APPLICATION TO LEAD OVERALL DECANTER MARKET DURING FORECAST PERIOD

- TABLE 19 DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 20 DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 CHEMICAL

- 9.2.1 CHEMICAL APPLICATION TO BE LARGEST END USER OF DECANTERS

- 9.3 OIL & GAS

- 9.3.1 DECANTERS WIDELY USED IN DRILLING OPERATIONS IN OIL & GAS SECTOR

- 9.4 ENERGY (MINING & MINERALS)

- 9.4.1 DECANTERS USED FOR COMPLEX SOLID-LIQUID SEPARATION PROCESSES IN MINING

- 9.5 PETROCHEMICAL

- 9.5.1 DECANTERS USED IN PETROCHEMICAL SECTOR TO MAXIMIZE RESOURCE RECOVERY AND REDUCE WASTE GENERATION

- 9.6 PHARMACEUTICAL

- 9.6.1 NEED FOR EFFICIENT SEPARATION, CLARIFYING, AND PURIFICATION PROCEDURES TO DRIVE DEMAND

- 9.7 WASTEWATER TREATMENT

- 9.7.1 DECANTER CENTRIFUGES WIDELY USED IN WASTEWATER TREATMENT FOR OIL-WATER SEPARATION

- 9.8 FOOD & BEVERAGE

- 9.8.1 DEMAND FOR HIGH-QUALITY PROCESSING OF FOOD & BEVERAGE TO DRIVE MARKET

- 9.9 OTHERS

- 9.9.1 PULP & PAPER INDUSTRY

- 9.9.1.1 Decanters used for effective sludge dewatering in pulp & paper industry

- 9.9.1.2 Automotive

- 9.9.1.2.1 Recovery and recycling of used motor oil to drive demand

- 9.9.1 PULP & PAPER INDUSTRY

10 DECANTER MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 21 DECANTER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 DECANTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- FIGURE 31 ASIA PACIFIC: DECANTER MARKET SNAPSHOT

- 10.3 RECESSION IMPACT

- TABLE 23 ASIA PACIFIC: DECANTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 24 ASIA PACIFIC: DECANTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 26 ASIA PACIFIC: DECANTER MARKET BY TYPE, 2023-2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: DECANTER MARKET BY APPLICATION 2019-2022 (USD MILLION)

- TABLE 28 ASIA PACIFIC: DECANTER MARKET, BY APPLICATION 2023-2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: DECANTER MARKET, BY DESIGN TYPE, 2019-2022 (USD MILLION)

- TABLE 30 ASIA PACIFIC: DECANTER MARKET, BY DESIGN TYPE, 2023-2028 (USD MILLION)

- 10.3.1 CHINA

- 10.3.1.1 Large population to fuel demand for wastewater treatment

- TABLE 31 CHINA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 32 CHINA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 33 CHINA: DECANTER MARKET, BY APPLICATION 2019-2022 (USD MILLION)

- TABLE 34 CHINA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.2 JAPAN

- 10.3.2.1 Demand for high-quality products to support market

- TABLE 35 JAPAN: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 36 JAPAN: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 37 JAPAN: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 38 JAPAN: DECANTER MARKET, BY APPLICATION 2023-2028 (USD MILLION)

- 10.3.3 INDIA

- 10.3.3.1 Chemical application to be largest end user of decanter centrifuges

- TABLE 39 INDIA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 40 INDIA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 41 INDIA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 42 INDIA: DECANTER MARKET, BY APPLICATION 2023-2028 (USD MILLION)

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Growing demand from various end-use industries to drive market

- TABLE 43 SOUTH KOREA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 44 SOUTH KOREA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 45 SOUTH KOREA: DECANTER MARKET, BY APPLICATION, 2019-2022(USD MILLION)

- TABLE 46 SOUTH KOREA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.5 VIETNAM

- 10.3.5.1 Growing food and aquaculture industry to drive market

- TABLE 47 VIETNAM: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 48 VIETNAM: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 49 VIETNAM: DECANTER MARKET, BY APPLICATION 2019-2022 (USD MILLION)

- TABLE 50 VIETNAM: DECANTER MARKET, BY APPLICATION 2023-2028 (USD MILLION)

- 10.3.6 REST OF ASIA PACIFIC

- TABLE 51 REST OF ASIA PACIFIC: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 52 REST OF ASIA PACIFIC: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 53 REST OF ASIA PACIFIC: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 54 REST OF ASIA PACIFIC: DECANTER, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4 EUROPE

- FIGURE 32 EUROPE: DECANTERS MARKET SNAPSHOT

- 10.5 RECESSION IMPACT

- TABLE 55 EUROPE: DECANTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 56 EUROPE: DECANTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 57 EUROPE: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 58 EUROPE: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 59 EUROPE: DECANTER MARKET, BY APPLICATION 2019-2022 (USD MILLION)

- TABLE 60 EUROPE: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 61 EUROPE: DECANTER MARKET, BY DESIGN TYPE, 2019-2022 (USD MILLION)

- TABLE 62 EUROPE: DECANTER MARKET, BY DESIGN TYPE, 2023-2028 (USD MILLION)

- 10.5.1 GERMANY

- 10.5.1.1 Decanter centrifuges widely used to promote sustainable practices

- TABLE 63 GERMANY: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 64 GERMANY: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 65 GERMANY: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 66 GERMANY: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.2 ITALY

- 10.5.2.1 Production of olive oil to fuel demand for decanter centrifuges

- TABLE 67 ITALY: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 68 ITALY: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 69 ITALY: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 70 ITALY: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.3 FRANCE

- 10.5.3.1 Strong commitment to environmental sustainability to create favorable market

- TABLE 71 FRANCE: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 72 FRANCE: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 73 FRANCE: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 74 FRANCE: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.4 UK

- 10.5.4.1 Rise in demand for renewable energy to create opportunities

- TABLE 75 UK: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 76 UK: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 77 UK: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 78 UK: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.5 SPAIN

- 10.5.5.1 Thriving oil and food industries to support market growth

- TABLE 79 SPAIN: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 80 SPAIN: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 81 SPAIN: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 82 SPAIN: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.6 RUSSIA

- 10.5.6.1 Oil & gas sector to drive market

- TABLE 83 RUSSIA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 84 RUSSIA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 85 RUSSIA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 86 RUSSIA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.7 REST OF EUROPE

- TABLE 87 REST OF EUROPE: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 88 REST OF EUROPE: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6 NORTH AMERICA

- 10.6.1 RECESSION IMPACT

- FIGURE 33 NORTH AMERICA: DECANTER MARKET SNAPSHOT

- TABLE 91 NORTH AMERICA: DECANTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: DECANTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: DECANTER MARKET, BY DESIGN TYPE, 2019-2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: DECANTER MARKET, BY DESIGN TYPE, 2023-2028 (USD MILLION)

- 10.6.2 US

- 10.6.2.1 US to dominate market in North America

- TABLE 99 US: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 100 US: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 US: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 102 US: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.3 CANADA

- 10.6.3.1 Developments in chemical and pharmaceutical sectors to drive market

- TABLE 103 CANADA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 104 CANADA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 105 CANADA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 106 CANADA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Growing awareness of sustainability to drive demand

- TABLE 107 MEXICO: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 108 MEXICO: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 109 MEXICO: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 110 MEXICO: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.7 MIDDLE EAST & AFRICA

- 10.7.1 RECESSION IMPACT

- FIGURE 34 MIDDLE EAST & AFRICA: DECANTER MARKET SNAPSHOT

- TABLE 111 MIDDLE EAST & AFRICA: DECANTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: DECANTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: DECANTER MARKET, BY DESIGN TYPE, 2019-2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: DECANTER MARKET, BY DESIGN TYPE, 2023-2028 (USD MILLION)

- 10.7.2 SAUDI ARABIA

- 10.7.2.1 Saudi Arabia to account for largest market share in Middle East & Africa

- TABLE 119 SAUDI ARABIA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 120 SAUDI ARABIA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 121 SAUDI ARABIA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 122 SAUDI ARABIA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.7.3 SOUTH AFRICA

- 10.7.3.1 Two-phase decanter to be larger and faster-growing segment

- TABLE 123 SOUTH AFRICA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 124 SOUTH AFRICA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 125 SOUTH AFRICA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 126 SOUTH AFRICA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.7.4 REST OF MIDDLE EAST & AFRICA

- TABLE 127 REST OF MIDDLE EAST & AFRICA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 128 REST OF MIDDLE EAST & AFRICA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.8 SOUTH AMERICA

- 10.8.1 RECESSION IMPACT

- FIGURE 35 SOUTH AMERICA: DECANTER MARKET SNAPSHOT

- TABLE 131 SOUTH AMERICA: DECANTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 132 SOUTH AMERICA: DECANTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 133 SOUTH AMERICA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 134 SOUTH AMERICA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 135 SOUTH AMERICA: DECANTER MARKET, BY DESIGN TYPE, 2019-2022 (USD MILLION)

- TABLE 136 SOUTH AMERICA: DECANTER MARKET, BY DESIGN TYPE, 2023-2028 (USD MILLION)

- TABLE 137 SOUTH AMERICA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 138 SOUTH AMERICA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.8.2 BRAZIL

- 10.8.2.1 Rising investment in oil production and energy industry to drive demand

- TABLE 139 BRAZIL: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 140 BRAZIL: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 141 BRAZIL: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 142 BRAZIL: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.8.3 ARGENTINA

- 10.8.3.1 Rising awareness to drive market

- TABLE 143 ARGENTINA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 144 ARGENTINA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 145 ARGENTINA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 146 ARGENTINA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.8.4 REST OF SOUTH AMERICA

- TABLE 147 REST OF SOUTH AMERICA: DECANTER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 148 REST OF SOUTH AMERICA: DECANTER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 149 REST OF SOUTH AMERICA: DECANTER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 150 REST OF SOUTH AMERICA: DECANTER MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 151 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- 11.2 MARKET SHARE ANALYSIS

- 11.2.1 RANKING OF KEY MARKET PLAYERS

- FIGURE 36 RANKING OF TOP FIVE PLAYERS IN DECANTER MARKET, 2022

- 11.2.2 MARKET SHARE OF KEY PLAYERS

- TABLE 152 DECANTER MARKET: DEGREE OF COMPETITION

- FIGURE 37 DEGREE OF COMPETITION IN DECANTER MARKET

- 11.2.2.1 Gea Group Aktiengesellschaft

- 11.2.2.2 Flottweg SE

- 11.2.2.3 Alfa Laval

- 11.2.2.4 Andritz

- 11.2.2.5 Mitsubishi Kakoki Kaisha, Ltd.

- 11.3 COMPANY FOOTPRINT ANALYSIS

- TABLE 153 DECANTER MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 154 DECANTER MARKET: COMPANY TYPE FOOTPRINT

- TABLE 155 DECANTER MARKET: COMPANY DESIGN TYPE FOOTPRINT

- TABLE 156 DECANTER MARKET: COMPANY REGION FOOTPRINT

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 38 COMPANY EVALUATION MATRIX, 2022

- 11.5 COMPETITIVE BENCHMARKING

- TABLE 157 DECANTER MARKET: KEY STARTUPS/SMES

- TABLE 158 DECANTER MARKET: SMES/STARTUPS APPLICATION FOOTPRINT

- TABLE 159 DECANTER MARKET: SMES/STARTUPS TYPE FOOTPRINT

- TABLE 160 DECANTER MARKET: SMES/STARTUPS DESIGN TYPE FOOTPRINT

- TABLE 161 DECANTER MARKET: SMES/STARTUPS REGION FOOTPRINT

- 11.6 STARTUP/SME EVALUATION MATRIX

- 11.6.1 RESPONSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 PROGRESSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 39 STARTUPS/SMES EVALUATION MATRIX, 2022

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 162 DECANTER MARKET: PRODUCT LAUNCHES (2019-2022)

- 11.7.2 DEALS

- TABLE 163 DECANTER MARKET: DEALS (2019-2023)

- 11.7.3 OTHER DEVELOPMENTS

- TABLE 164 DECANTER MARKET: OTHER DEVELOPMENTS (2019-2023)

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 GEA GROUP AKTIENGECOMSELLSCHAFT

- TABLE 165 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- FIGURE 40 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 166 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 168 GEA GROUP AKTIENGESELLSCHAFT: DEALS

- TABLE 169 GEA GROUP AKTIENGESELLSCHAFT: OTHER DEVELOPMENTS

- 12.1.2 FLOTTWEG SE

- TABLE 170 FLOTTWEG SE: COMPANY OVERVIEW

- TABLE 171 FLOTTWEG SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 172 FLOTTWEG SE: PRODUCT LAUNCHES

- TABLE 173 FLOTTWEG SE: DEALS

- TABLE 174 FLOTTWEG SE: OTHER DEVELOPMENTS

- 12.1.3 PIERALISI MAIP SPA

- TABLE 175 PIERALISI MAIP SPA: COMPANY OVERVIEW

- TABLE 176 PIERALISI MAIP SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 PIERALISI MAIP SPA: DEALS

- 12.1.4 ALFA LAVAL

- TABLE 178 ALFA LAVAL: COMPANY OVERVIEW

- FIGURE 41 ALFA LAVAL: COMPANY SNAPSHOT

- TABLE 179 ALFA LAVAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 180 ALFA LAVAL: PRODUCT LAUNCHES

- TABLE 181 ALFA LAVAL: DEALS

- TABLE 182 ALFA LAVAL: OTHER DEVELOPMENTS

- 12.1.5 ANDRITZ

- TABLE 183 ANDRITZ: COMPANY OVERVIEW

- FIGURE 42 ANDRITZ: COMPANY SNAPSHOT

- TABLE 184 ANDRITZ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 185 ANDRITZ: PRODUCT LAUNCHES

- 12.1.6 SLB

- TABLE 186 SLB: COMPANY OVERVIEW

- FIGURE 43 SLB: COMPANY SNAPSHOT

- TABLE 187 SLB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 SLB: OTHER DEVELOPMENTS

- 12.1.7 IHI ROTATING MACHINERY ENGINEERING CO., LTD.

- TABLE 189 IHI ROTATING MACHINERY ENGINEERING CO., LTD.: COMPANY OVERVIEW

- FIGURE 44 IHI ROTATING MACHINERY ENGINEERING CO., LTD.: COMPANY SNAPSHOT

- TABLE 190 IHI ROTATING MACHINERY ENGINEERING CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.8 MITSUBISHI KAKOKI KAISHA, LTD.

- TABLE 191 MITSUBISHI KAKOKI KAISHA, LTD.: COMPANY OVERVIEW

- FIGURE 45 MITSUBISHI KAKOKI KAISHA, LTD.: COMPANY SNAPSHOT

- TABLE 192 MITSUBISHI KAKOKI KAISHA, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 193 MITSUBISHI KAKOKI KAISHA, LTD.: OTHER DEVELOPMENTS

- 12.1.9 TOMOE ENGINEERING CO. LTD.

- TABLE 194 TOMOE ENGINEERING CO., LTD.: COMPANY OVERVIEW

- FIGURE 46 TOMOE ENGINEERING CO., LTD.: COMPANY SNAPSHOT

- 12.1.9.2 Products/services/solutions offered

- TABLE 195 TOMOE ENGINEERING CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 196 TOMOE ENGINEERING CO., LTD.: DEALS

- 12.1.10 FLSMIDTH

- TABLE 197 FLSMIDTH: COMPANY OVERVIEW

- FIGURE 47 FLSMIDTH: COMPANY SNAPSHOT

- TABLE 198 FLSMIDTH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 199 FLSMIDTH: OTHER DEVELOPMENTS

- TABLE 200 FLSMIDTH: DEALS

- 12.2 OTHER PLAYERS

- 12.2.1 THE WEIR GROUP PLC

- TABLE 201 THE WEIR GROUP PLC: COMPANY OVERVIEW

- 12.2.2 ELGIN POWER AND SEPARATION SOLUTIONS

- TABLE 202 ELGIN POWER AND SEPARATION SOLUTIONS: COMPANY OVERVIEW

- 12.2.3 SIEBTECHNIK TEMA GMBH

- TABLE 203 SIEBTECHNIK TEMA GMBH: COMPANY OVERVIEW

- 12.2.4 POLAT MAKINA SAN A.S.

- TABLE 204 POLAT MAKINA SAN A.S.: COMPANY OVERVIEW

- 12.2.5 JIANGSU HUADA CENTRIFUGE CO., LTD.

- TABLE 205 JIANGSU HUADA CENTRIFUGE CO., LTD.: COMPANY OVERVIEW

- 12.2.6 HILLER SEPARATION & PROCESS

- TABLE 206 HILLER SEPARATION & PROCESS: COMPANY OVERVIEW

- 12.2.7 THOMAS BROADBENT & SONS LTD.

- TABLE 207 THOMAS BROADBENT & SONS LTD.: COMPANY OVERVIEW

- 12.2.8 CENTRISYS

- TABLE 208 CENTRISYS: COMPANY OVERVIEW

- 12.2.9 ROUSSELET ROBATEL

- TABLE 209 ROUSSELET ROBATEL: COMPANY OVERVIEW

- 12.2.10 NOXON AB

- TABLE 210 NOXON AB: COMPANY OVERVIEW

- 12.2.11 GN SOLIDS CONTROL

- TABLE 211 GN SOLIDS CONTROL: COMPANY OVERVIEW

- 12.2.12 ZK SEPARATION

- TABLE 212 ZK SEPARATION: COMPANY OVERVIEW

- 12.2.13 PENNWALT LTD.

- TABLE 213 PENNWALT LTD.: COMPANY OVERVIEW

- 12.2.14 HUADING SEPARATOR

- TABLE 214 HUADING SEPARATOR: COMPANY OVERVIEW

- 12.2.15 VITONE ECO S.R.L

- TABLE 215 VITONE ECO S.R.L: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS