|

|

市場調査レポート

商品コード

1822295

遠心分離機の世界市場:用途別、容量別、最終用途産業別、ロータータイプ別、スピード別、タイプ別、地域別 - 2030年までの予測Centrifuge Market by Type (Laboratory, Industrial), Rotor Type (Fixed-Angle, Swinging Bucket), Application (Fluid Clarification, Dewatering), End-use Industry (Pharmaceutical, Food & Beverage), Speed, Capacity, & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 遠心分離機の世界市場:用途別、容量別、最終用途産業別、ロータータイプ別、スピード別、タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月08日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

概要

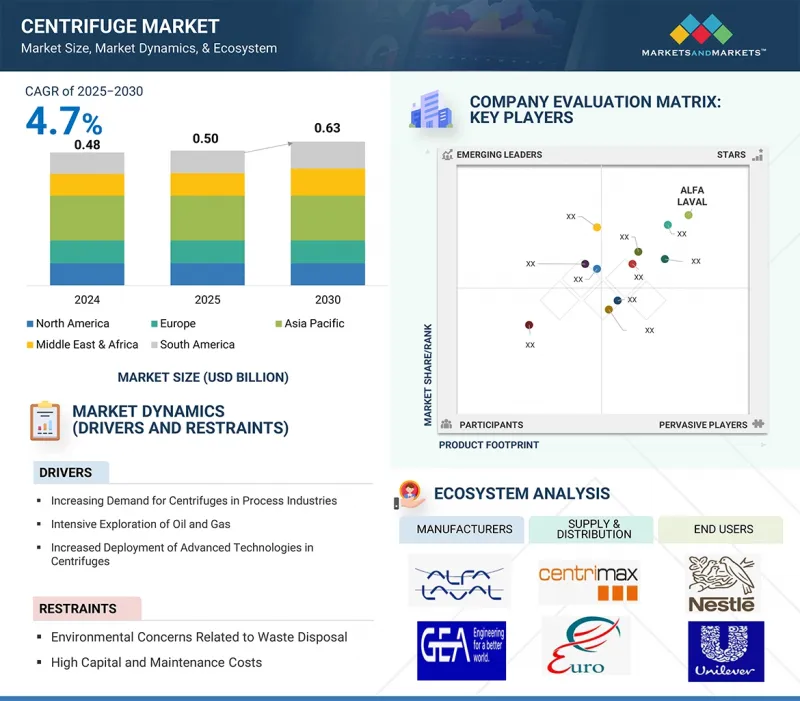

遠心分離機の市場規模は、4.7%のCAGRで拡大し、2025年の5億米ドルから2030年には6億3,000万米ドルに成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(100万米ドル/10億米ドル)および数量(台) |

| セグメント | 用途別、容量別、最終用途産業別、ロータータイプ別、スピード別、タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東&アフリカ、南米 |

遠心分離機市場は、製薬、バイオテクノロジー、食品・飲料、化学、鉱業、廃水処理などの産業における需要の高まりにより、着実な成長を遂げています。世界人口の増加、急速な都市化、環境規制の厳格化により、産業界は効率、品質、コンプライアンスを向上させるために高度な分離技術の導入を促しています。

医薬品とバイオテクノロジーでは、医薬品製造と診断における正確な分離の必要性が遠心分離機の利用を拡大しており、食品加工では、高品質で汚染物質のない製品の必要性が需要を後押ししています。鉱業分野では鉱物回収に遠心分離機が使用され、廃水処理プラントでは汚泥脱水と資源回収に遠心分離機が利用されています。自動化、エネルギー効率の高い設計、プロセス制御の強化など、技術の進歩が採用をさらに後押ししています。アジア太平洋は、産業拡大、都市インフラ開拓、ヘルスケア投資の増加により市場開拓をリードしており、北米と欧州は技術革新と規制遵守により需要が安定しています。設備コストの高騰やメンテナンスの必要性といった課題にもかかわらず、世界の遠心分離機市場は、産業の近代化と資源効率の追求に支えられて、持続的な拡大が見込まれています。この成長は、再生可能エネルギー、バイオテクノロジー研究、精密製造における新たな用途によってさらに強化されます。

産業用遠心分離機は、医薬品、食品・飲料、化学製造、石油・ガス、廃水処理などの大規模処理産業での広範な採用により、力強い成長を目の当たりにしています。これらの遠心分離機は、連続的な高スループット運転用に設計されており、工業規模で固体と液体、液体と液体の効率的な分離、粒子の清澄化を可能にします。需要の高まりの背景には、工業自動化の進展、品質基準の厳格化、生産施設における効率的な廃棄物管理の必要性があります。製薬部門では、工業用遠心分離機は医薬品有効成分(API)の製造に不可欠であり、食品業界では、牛乳の清澄化、ジュース抽出、食用油の精製などのプロセスに使用されています。廃水処理プラントもまた、汚泥脱水と廃水管理のために工業用遠心分離機に大きく依存しています。エネルギー効率の高いモーター、強化された安全システム、IoT対応モニタリングなど、設計の進歩が採用を後押ししています。新興国における製造拠点の拡大と、よりクリーンな工業プロセスへの規制強化が、市場の成長をさらに後押ししています。

処理能力が10m3/時未満のユニットと定義される小容量遠心分離機セグメントは、特殊で精密な用途に適しているため、遠心分離機市場で最も速い成長を遂げています。これらの遠心分離機は、高精度、制御されたサンプルハンドリング、コンパクト設計が重要な研究ラボ、臨床診断、パイロットスケール生産、ニッチ産業プロセスで広く使用されています。比較的設置面積が小さく、可搬性に優れ、既存設備への統合が容易なため、スペースや予算に制約のある研究室や小規模生産装置に最適です。さらに、特に製薬、バイオテクノロジー、食品加工、環境検査において、カスタマイズされた用途別遠心分離に対する需要の高まりが、採用をさらに加速しています。個別化医療の世界的な急増、研究開発活動の重点化、新興国における小規模製造の拡大も主要な成長促進要因です。さらに、小容量の遠心分離機は設備投資が少なくて済み、メンテナンス費用も削減できることが多いため、コストに敏感なエンドユーザーにとって魅力的です。改善されたローター設計、デジタル制御、エネルギー効率などの技術的進歩により、その能力は拡大し、より複雑な分離作業に適しています。

5,000~20,000 RPMで動作する中速遠心分離機セグメントは、その汎用性と幅広い応用範囲により、遠心分離機市場で最も速い成長を目の当たりにしています。これらの遠心分離機は、分離効率とサンプルの完全性の間で最適なバランスをとり、産業と研究所の両方の環境に適しています。バイオテクノロジーと医薬品では、中速遠心機は細胞採取、タンパク質精製、ワクチン製造に使用され、繊細な生物学的材料を損傷することなく正確に分離することが不可欠です。工業プロセスでは、廃水処理、食品・飲料の清澄化、化学処理において重要な役割を果たし、中速の遠心分離機は部品の摩耗を抑えながら効果的な分離を実現します。生物学的サンプルから工業用スラリーまで、多種多様なマテリアルハンドリングに対応できる適応性により、多様な分野での需要が拡大しています。さらに、中速遠心機は通常、超高速モデルよりも消費エネルギーが少なく、コスト削減と運転の持続可能性を提供します。ローターバランスの強化、自動制御、安全機構の改善などの技術革新により、効率と使いやすさがさらに向上しています。また、バイオ医薬品製造の拡大、研究投資の増加、拡張性がありながら効率的な分離ソリューションへのニーズも成長の原動力となっています。

固定角ローター遠心分離機セグメントは、その効率性、汎用性、産業および研究室での広範な採用により、遠心分離機市場のロータータイプカテゴリで最も速い成長を遂げています。固定角ローターは、回転軸に対して一定の角度(通常25~40度)でサンプルを保持し、チューブ壁に沿って粒子を迅速に沈降させることができます。この設計により、高い分離効率を実現しながら運転時間を最小限に抑えることができるため、細胞のペレット化、細胞内成分の分離、核酸の精製、工業的ワークフローにおける大量処理などのアプリケーションに最適です。バイオ医薬品製造では、固定角ローターは高収率の細胞培養採取とタンパク質分離に好まれています。その堅牢な設計は、スイングバケットローターと比較して、より高速で大きな遠心力をサポートし、幅広い粘度と密度に適しています。食品加工、化学製造、廃水処理などの産業分野では、その耐久性と費用対効果の高さから、この遠心分離機の採用が増えています。耐腐食性合金や軽量複合材などのローター材料の進歩により、性能が向上し、耐用年数が延長されました。さらに、自動制御と強化された安全機構を特徴とする最新の遠心分離機システムとの互換性が需要を牽引しています。

流体清澄化セグメントは、高純度の液体を必要とする業界全体で重要な役割を担っているため、遠心分離機市場で最も速い成長を目の当たりにしています。流体の清澄化には、液体から懸濁物質、不純物、その他の微粒子を効率的に除去し、下流工程で一貫した品質と性能を確保することが含まれます。この用途は、ジュース、ワイン、ビールの清澄化を行う食品・飲料業界、有効成分や注射液の精製を行う医薬品業界、貴重な生体分子から細胞の残骸を分離するバイオテクノロジー業界で特に重要です。また、化学・石油化学産業では、プロセス効率と製品の完全性を維持するために、流体の清澄化に依存しています。規制遵守、製品の安全性、品質基準が重視されるようになり、採用が進んでいます。さらに、高速、自動化、クリーン・イン・プレイス(CIP)システムなどの遠心分離機技術の進歩により、運転休止時間を短縮しながら清澄化効率が向上しています。特に都市部や工業環境における水処理イニシアチブの拡大は、流体浄化における遠心分離機の需要をさらに押し上げています。工業生産高が増加し、環境規制が厳しくなっている新興国は、この成長に大きく寄与しています。

産業界が効率性、持続可能性、精度をますます優先するようになるにつれて、遠心分離機を使用した流体の浄化は不可欠なものとなりつつあり、市場価値の面で最も急成長している応用セグメントとしての地位を確実なものにしています。

製薬業界は、人口増加、高齢化、慢性疾患や感染症の流行によって、医薬品、ワクチン、生物製剤に対する世界的な需要が増加しているため、遠心分離機市場で最も急成長している最終用途分野です。遠心分離機は、医薬品製造、特に原薬、血液成分、細胞培養、生物製剤の分離、精製、清澄化プロセスにおいて重要な役割を果たしています。バイオ医薬品と個別化医療の急速な成長は、遠心分離機、特に高速遠心分離機と超遠心分離機の採用をさらに加速しています。さらに、COVID-19パンデミックは、ワクチン生産と研究のための高度な遠心分離技術の必要性を浮き彫りにしました。医薬品における厳しい規制要件と連続製造へのシフトも、精度、無菌性、コンプライアンスを確保する高性能自動遠心分離機への投資を促進しています。

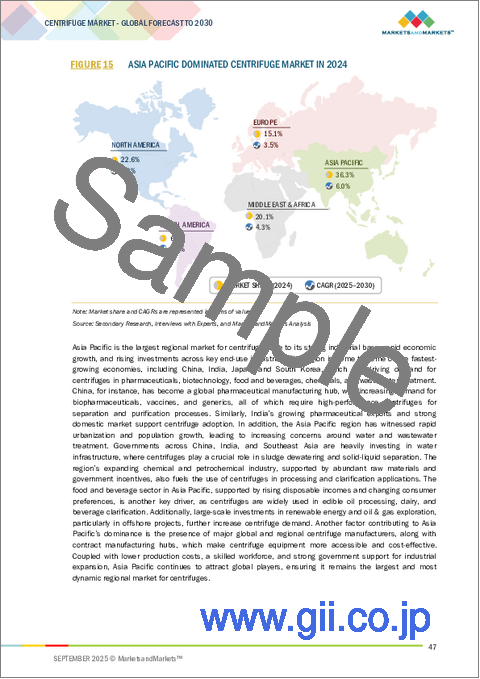

アジア太平洋は、急速な工業化、製造能力の拡大、インフラやプロセス産業への多額の投資により、遠心分離機市場で最も急成長している地域です。中国、インド、日本、韓国などの国々では、医薬品、バイオテクノロジー、食品・飲料、化学処理、廃水処理などの分野で力強い成長が見られますが、これらはすべて遠心分離機技術に大きく依存しています。人口の増加と可処分所得の増加によるヘルスケアニーズの高まりが、医薬品およびバイオプロセス用遠心分離機の需要を押し上げています。清潔な水、廃棄物管理、環境コンプライアンスに対する政府の取り組みは、自治体および産業廃水処理での採用を加速しています。さらに、アジア太平洋は製造と研究開発の拠点となりつつあり、グローバル企業が生産施設を設置することで、現地での稼働率を向上させ、コストを削減しています。競争力のある労働市場、有利な貿易政策、輸出の増加も市場拡大に寄与しています。この地域の力強い経済成長、都市開発、産業の多様化は、世界の遠心分離機産業の主要な成長エンジンとしての地位を確立しています。

当レポートでは、世界の遠心分離機市場について調査し、用途別、容量別、最終用途産業別、ロータータイプ別、スピード別、タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 生成AIが遠心分離機市場に与える影響

第6章 業界動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 2025年の米国関税が遠心分離機市場に与える影響

- 投資と資金調達のシナリオ

- 価格分析

- エコシステム分析

- 技術分析

- 特許分析

- 過去10年間の出版動向

- 法的地位

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

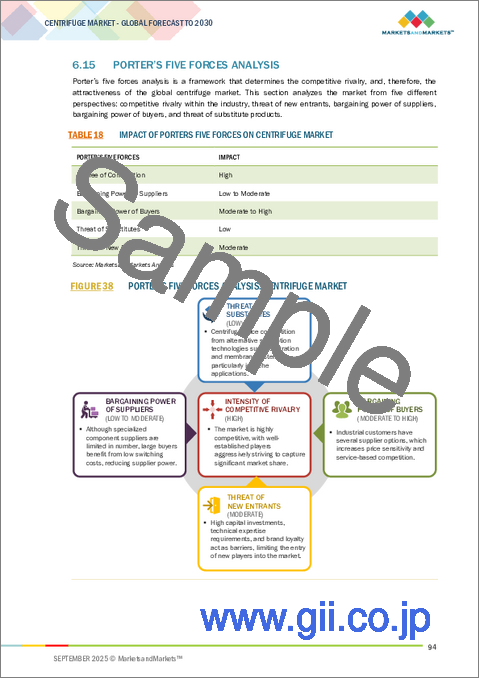

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- ケーススタディ分析

第7章 遠心分離機市場(用途別)

- イントロダクション

- 固体管理

- 泥洗浄

- 脱水

- 液体清澄化

- その他

第8章 遠心分離機市場(容量別)

- イントロダクション

- 小容量遠心分離機(10 m3/H未満)

- 中容量遠心分離機(10~50 m3/H)

- 大容量遠心分離機(50 m3/H超)

第9章 遠心分離機市場(最終用途産業別)

- イントロダクション

- 医薬品

- 食品・飲料

- 石油・ガス

- 化学薬品

- 水・廃水処理

- その他

第10章 遠心分離機市場(ロータータイプ別)

- イントロダクション

- 固定角ローター遠心分離機

- スイングバケット遠心分離機

- 縦型および横型遠心分離機

- その他

第11章 遠心分離機市場(スピード別)

- イントロダクション

- 低速(5,000 RPM以下)

- 中速(5,000 ~20,000 RPM)

- 高速(20,000 RPM以上)

第12章 遠心分離機市場(タイプ別)

- イントロダクション

- 実験室用遠心分離機

- 工業用遠心分離機

- デカンター遠心分離機

- 高速セパレーター

- その他

第13章 遠心分離機市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- アルゼンチン

- ブラジル

- その他

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年1月~2025年8月

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- ALFA LAVAL

- GEA GROUP AKTIENGESELLSCHAFT

- ANDRITZ

- FLSMIDTH A/S

- KUBOTA CORPORATION

- FLOTTWEG SE

- SPX FLOW, INC.

- MITSUBISHI KAKOKI KAISHA, LTD.

- FERRUM AG

- SIEBTECHNIK GMBH

- その他の企業

- SIGMA LABORZENTRIFUGEN GMBH

- BECKMAN COULTER, INC.

- EPPENDORF SE

- THERMO FISHER SCIENTIFIC INC.

- ANDREAS HETTICH GMBH

- PIERALISI MAIP SPA

- THOMAS BROADBENT & SONS LTD.

- ROUSSELET ROBATEL

- HEINKEL PROCESS TECHNOLOGY GMBH

- COLE-PARMER INSTRUMENT COMPANY, LLC

- HAUS CENTRIFUGE TECHNOLOGIES

- GTECH

- WESTERN STATES

- B&P LITTLEFORD

- ELGIN SEPARATION SOLUTIONS